0000751365DEF 14AFALSE00007513652023-02-012024-01-31iso4217:USD00007513652022-02-012023-01-3100007513652021-02-012022-01-310000751365ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-02-012022-01-310000751365ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-02-012023-01-310000751365ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-02-012024-01-310000751365ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-02-012022-01-310000751365ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-02-012023-01-310000751365ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-02-012024-01-310000751365ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-02-012022-01-310000751365ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-02-012023-01-310000751365ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-02-012024-01-310000751365ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-02-012022-01-310000751365ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-02-012023-01-310000751365ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-02-012024-01-310000751365ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2021-02-012022-01-310000751365ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2022-02-012023-01-310000751365ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-02-012024-01-310000751365ecd:PeoMemberecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMember2021-02-012022-01-310000751365ecd:PeoMemberecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMember2022-02-012023-01-310000751365ecd:PeoMemberecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMember2023-02-012024-01-310000751365ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2021-02-012022-01-310000751365ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2022-02-012023-01-310000751365ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2023-02-012024-01-310000751365ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2021-02-012022-01-310000751365ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2022-02-012023-01-310000751365ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-02-012024-01-310000751365ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-02-012022-01-310000751365ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-02-012023-01-310000751365ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-02-012024-01-310000751365ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2021-02-012022-01-310000751365ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2022-02-012023-01-310000751365ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-02-012024-01-310000751365ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-02-012022-01-310000751365ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-02-012023-01-310000751365ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-02-012024-01-310000751365ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-02-012022-01-310000751365ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-02-012023-01-310000751365ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-02-012024-01-310000751365ecd:NonPeoNeoMemberecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMember2021-02-012022-01-310000751365ecd:NonPeoNeoMemberecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMember2022-02-012023-01-310000751365ecd:NonPeoNeoMemberecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMember2023-02-012024-01-310000751365ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2021-02-012022-01-310000751365ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2022-02-012023-01-310000751365ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2023-02-012024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under Rule 14a-12

VIRCO MFG. CORPORATION

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| | | | | | | | |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | | | | | | | |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

Virco Mfg. Corporation

2027 Harpers Way

Torrance, California 90501

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 18, 2024

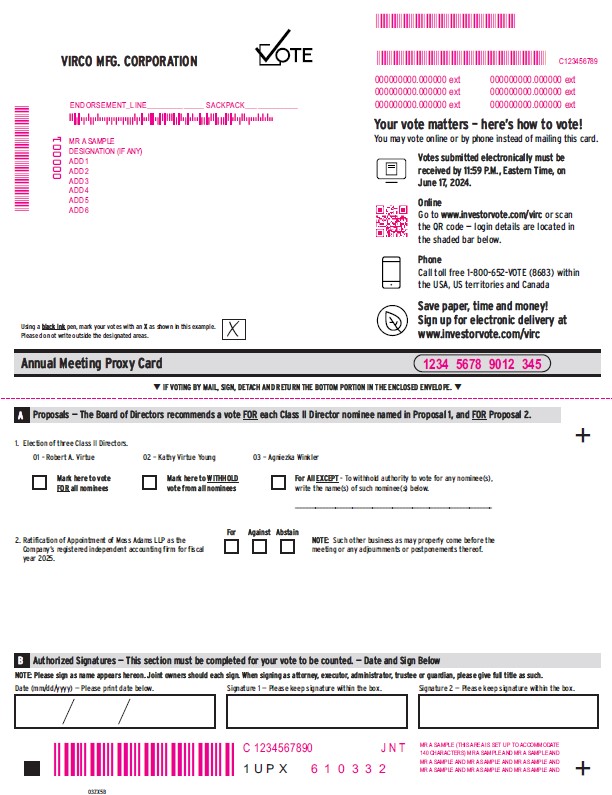

The 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Virco Mfg. Corporation, a Delaware corporation (the “Company”), will be held on Tuesday, June 18, 2024, at 10:00 a.m. Pacific Time for the following purposes:

| | | | | |

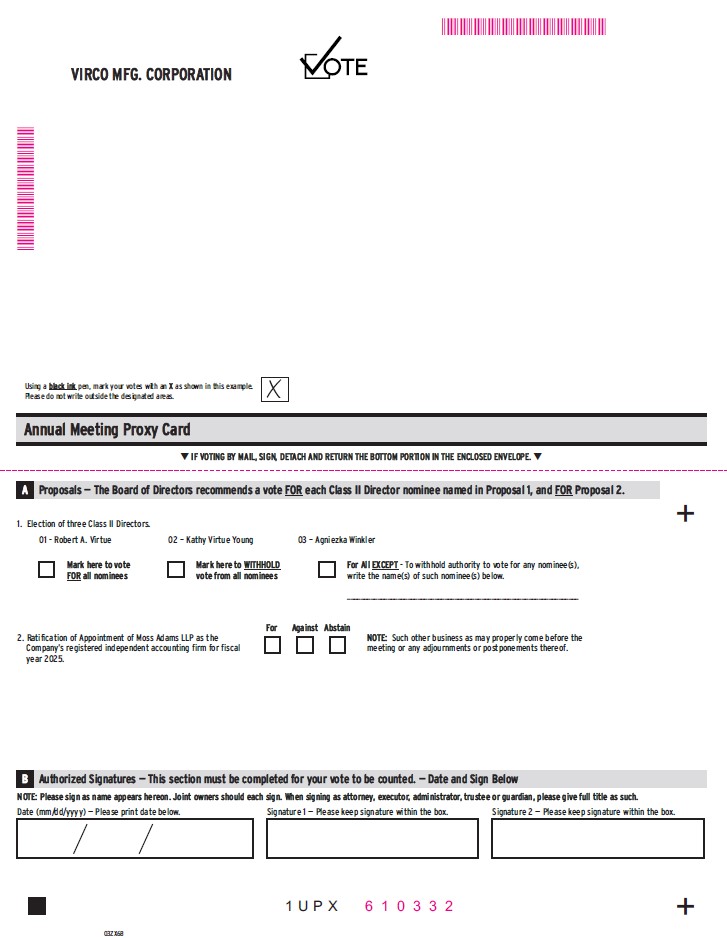

| 1. | Election of three Class II directors to the Company’s Board of Directors. |

| |

| 2. | Ratification of the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the 2025 fiscal year. |

| |

| 3. | Transact such other business as may properly come before the Annual Meeting. |

The Board of Directors recommends a vote FOR each of proposals 1 and 2. These items are more fully described in the attached Proxy Statement, which is made part of this notice.

Please note that the 2024 Annual Meeting of Stockholders will be held at our corporate headquarters located at 2027 Harpers Way, Torrance, CA 90501.

The Board of Directors has fixed the close of business on April 23, 2024 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any adjournments and postponements thereof. To ensure that your vote is recorded promptly, please vote as soon as possible. Most stockholders have three options for submitting their vote: (1) via the Internet, (2) by phone or (3) by mail, using the enclosed proxy card. For further details, see your proxy card. If you have Internet access, we encourage you to record your vote on the Internet. It is convenient for you, and it also saves the Company significant postage and processing costs.

Based on New York Stock Exchange rules, without instructions from the beneficial owner, brokers are only permitted to vote on proposal 2 (ratification of accounting firm), as discussed in more detail in the Proxy Statement. Therefore, if your shares are held through a brokerage firm, bank or other nominee, they will not be voted on the election of directors, unless you provide voting instructions to your brokerage firm, bank or other nominee.

By Order of the Board of Directors

Robert E. Dose, Secretary

Torrance, California

May 7, 2024

Important Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on June 18, 2024. The Proxy Statement and our Annual Report for fiscal year ended January 31, 2024 are available at: www.edocumentview.com/VIRC

TABLE OF CONTENTS

Virco Mfg. Corporation

2027 Harpers Way

Torrance, California 90501

PROXY STATEMENT

FOR 2024 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION

This Proxy Statement is being delivered to stockholders of Virco Mfg. Corporation, a Delaware corporation (the “Company,” “we,” “our” or “us”), on or about May 7, 2024, in connection with the solicitation by the Board of Directors (the “Board”) of proxies to be used at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of the Company to be held on Tuesday, June 18, 2024, at 10:00 a.m. Pacific Time, and at any and all adjournments and postponements thereof.

Please note that the 2024 Annual Meeting of Stockholders will be held at our corporate headquarter located at 2027 Harpers Way, Torrance, CA 90501.

The cost of preparing, assembling and mailing the Notice of the Annual Meeting, Proxy Statement and form of proxy and the solicitation of proxies will be paid by the Company. Proxies may be solicited by mail, telephone, e-mail or other electronic means by personnel of the Company who will not receive any additional compensation for such solicitation. The Company will reimburse brokers or other persons holding stock in their names or the names of their nominees for the expenses of forwarding soliciting material to their principals.

Pursuant to rules adopted by the Securities and Exchange Commission (“SEC”), we have elected to provide access to our proxy materials electronically over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials to our stockholders. Stockholders have the ability to access our proxy materials on the website referred to in the Notice of Internet Availability of Proxy Materials (www.edocumentview.com/VIRC) or request to receive a printed set of our proxy materials. Instructions on how to access our proxy materials over the Internet or request a printed copy of our proxy materials may be found in the Notice of Internet Availability of Proxy Materials. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

RECORD DATE AND VOTING

The close of business on April 23, 2024, has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting. On that date there were 16,347,314 shares of the Company’s common stock, par value $.01 per share (“common stock”), outstanding. All voting rights are vested exclusively in the holders of the Company’s common stock.

Stockholders of Record: Shares Registered in Your Name. If on the record date, your shares were registered directly in your name with the Company’s transfer agent, Computershare, then you are a stockholder of record and you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to vote to ensure that your vote is counted.

Beneficial Holder: Owner of Shares Held in Street Name: If, on the record date, your shares were held in an account at a broker, bank, or other financial institution (collectively referred to as “broker”), then you are the beneficial holder of shares held in “street name” and these proxy materials are being forwarded to you by that broker. The broker holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial holder, you have the right to direct your broker on how to vote the shares in your account. As a beneficial holder, you are invited to attend the Annual Meeting. However, since you are not a stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker giving you the legal right to vote the shares at the Annual Meeting.

Our bylaws require that a quorum – that is, the holders of a majority of the voting power of the issued and outstanding shares of our capital stock entitled to vote at the Annual Meeting – be present, in person or by proxy, before any business may be

transacted at the Annual Meeting (other than adjourning the Annual Meeting to a later date to allow time to obtain additional proxies to satisfy the quorum requirement).

Each share of common stock is entitled to one vote on any matter that may be presented for consideration and action by the stockholders, except that as to the election of directors, stockholders may cumulate their votes. Because three directors are to be elected at the Annual Meeting, cumulative voting means that each stockholder may cast a number of votes equal to three times the number of shares actually owned. That number of votes may be cast for one nominee, divided equally among each of the nominees or divided among the nominees in any other manner. Stockholders wishing to cumulate their votes should make an explicit statement of their intent by so indicating in writing on the proxy card or when voting by telephone or Internet. Stockholders holding shares beneficially in street name who wish to cumulate votes should contact their broker, trustee or nominee.

Below is a summary of the vote required for adoption of each proposal and the respective effect of abstentions and broker non-votes. For more detailed information see the discussion of the respective proposal below.

| | | | | | | | | | | | | | | | | | | | |

|

| Proposal | | Vote Required for Approval of Proposal | | Effect of Abstentions | | Effect of Broker Non-Votes |

| | | | | | | |

| 1. Election of directors | | Plurality of shares voted | | No effect | | No effect (1) |

| | | | | | |

| 2. Ratification of Moss Adams LLP | | Majority of shares voted | | No effect | | Brokers have discretion to vote |

(1) While “Withhold” votes and broker non-votes will have no effect on the outcome of the vote, we have adopted a Director Resignation Policy pursuant to which nominees for election as director at the Annual Meeting are required to submit an offer of resignation for consideration by the Corporate Governance and Nominating Committee if such nominee receives a greater number of “Withhold” votes than votes “For” such election. See “Director Resignation Policy” below.

Proxies marked as abstentions or withheld votes will be counted as shares that are present and entitled to vote for purposes of determining whether a quorum is present. If a broker indicates on its proxy that it does not have discretionary voting authority to vote shares on one or more proposals at the Annual Meeting (a “broker non-vote”), such shares will still be counted in determining whether a quorum is present. Brokers or other nominees who hold shares in “street name” for the beneficial owner of those shares typically have the authority to vote in their discretion on “routine” proposals when they have not received instructions from the beneficial owner. However, brokers are not allowed to exercise their voting discretion with respect to the election of directors or other “non-routine” proposals without specific instructions from the beneficial owner. Of the matters on the agenda for the Annual Meeting, only the ratification of the selection of our auditors is considered to be a “routine” proposal for the purposes of brokers exercising their voting discretion.

If no direction is made on your proxy and it is otherwise properly executed, your proxy will be voted FOR the election of all director nominees, and FOR ratification of Moss Adams LLP. Where a stockholder has appropriately directed how the proxy is to be voted, it will be voted according to the stockholder’s direction.

Any stockholder has the power to revoke its proxy at any time before it is voted at the 2024 Annual Meeting by submitting written notice of revocation to the Secretary of the Company at the Company’s principal executive offices located at 2027 Harpers Way, Torrance, California 90501, by participating and attending the 2024 Annual Meeting or by filing a duly executed proxy bearing a later date via the Internet, by telephone, or by mail. Please consult the instructions included with your proxy card for how to vote your shares.

CORPORATE GOVERNANCE

Meetings and Independence

Each incumbent director of the Company serving during our latest fiscal year ended January 31, 2024 (referred to as “fiscal 2024”) attended at least 75% of the total number of meetings of the Board of Directors and committees on which he or she served. The Board of Directors held eight meetings in fiscal 2024. In addition, the independent directors hold regularly scheduled executive session meetings each fiscal year outside of the presence of management, as well as additional meetings as are necessary. Directors are expected to attend our annual meetings of stockholders when practical to do so, although we have no formal policy with respect to such attendance. All of the directors then in office attended our 2023 Annual Meeting of Stockholders.

The Board of Directors has determined that the following directors, who, as of the Annual Meeting, will constitute a majority of the Board of Directors, are “independent directors” as defined by the NASDAQ Stock Market listing standards: Craig L. Levra, Robert R. Lind, Bradley Richardson and Agnieszka Winkler.

Leadership Structure

Currently, Mr. Robert Virtue serves as Chairman and Chief Executive Officer (“CEO”) of the Company. Because the Board also believes that strong, independent Board leadership is a critical component of effective corporate governance, the Board has established the position of lead independent director. The lead independent director position rotates among the independent directors periodically. Currently, Robert R. Lind serves as the lead independent director of the Board. The lead independent director’s responsibilities and authority include providing input to the Chairman and CEO on preparation of agendas for Board and committee meetings and communicating to the Chairman and CEO the substance of the discussions and consensus reached at the meetings of independent directors. In addition, the Company has strong governance structures and processes in place to review and confirm the independence of the Board, eliminate conflicts of interest, and prevent dominance of the Board by management. For example, all directors, with the exception of Robert Virtue, Douglas Virtue and Kathy Virtue Young, are independent as defined by the listing standards of the NASDAQ Stock Market, and the three standing committees of the Board discussed below are made up entirely of independent directors.

Audit Committee

The Board of Directors has a standing Audit Committee which is composed of Messrs. Richardson (Chair), Levra, Lind, and Ms. Winkler. The Audit Committee held six meetings during fiscal 2024. The Audit Committee acts pursuant to a written charter adopted by the Board of Directors. Among other things, the Audit Committee is directly responsible for the following: the appointment, compensation, retention and oversight of the independent registered public accounting firm; reviewing the independent registered public accounting firm’s qualifications and independence; reviewing the plans and results of the audit engagement with the independent registered public accounting firm; reviewing the financial statements of the Company; reviewing the scope of the annual audit by the Company’s independent registered public accounting firm; reviewing the audit reports rendered by such independent registered public accounting firm; approving professional services provided by the independent registered public accounting firm and approving financial reporting principles and policies; considering the range of audit and non-audit fees; reviewing the adequacy of the Company’s internal accounting controls; and working to ensure the integrity of financial information supplied to stockholders. The Audit Committee also has the other responsibilities enumerated in its charter. The Audit Committee’s charter is available on the Company’s website at www.virco.com in the Investor Relations section of the “Discover Virco” webpage. Each of the Audit Committee members is an “independent director” as that term is defined for audit committee members by the listing standards of the NASDAQ Stock Market. The Board of Directors has determined that each of Messrs. Richardson and Lind qualifies as an “audit committee financial expert,” as that term is defined in Item 407(d)(5) of Regulation S-K of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board reevaluates the composition of the Audit Committee on at least an annual basis to ensure that its composition remains in the best interests of the Company and its stockholders.

Compensation Committee

The Board of Directors has a standing Compensation Committee which is composed of Ms. Winkler (Chair), and Messrs. Levra, Lind, and Richardson. The Compensation Committee held three meetings in fiscal 2024. The function of the Compensation Committee is, among other things, to: set the Company’s compensation policy and administer the Company’s compensation plans; make decisions on the compensation of key Company executives (including the review and approval of merit/other compensation budgets and payouts under the Company’s incentive plans); review and approve compensation and employment agreements of the Company’s executive officers; and recommend pay levels for members of the Board of Directors for consideration and approval by

the full Board of Directors. The Compensation Committee oversees the design and implementation of the incentives and risks associated with the Company’s compensation policies and practices. The Compensation Committee may consult with the Chief Executive Officer and other members of senior management as it deems necessary and engage the assistance of outside consultants to assist in determining and establishing the Company’s compensation policies. The Compensation Committee acts pursuant to a written charter adopted by the Board of Directors, a copy of which is available on the Company’s website at www.virco.com in the Investor Relations section of the “Discover Virco” webpage.

Corporate Governance and Nominating Committee

The Board of Directors has a standing Corporate Governance and Nominating Committee which is composed of Messrs. Levra (Chair), Lind and Richardson, and Ms. Winkler. All members of the Corporate Governance and Nominating Committee are “independent directors” as defined in the listing standards of the NASDAQ Stock Market. During fiscal 2024, the Corporate Governance and Nominating Committee held three meetings. The Corporate Governance and Nominating Committee acts pursuant to a written charter adopted by the Board of Directors, a copy of which is available on the Company’s website at www.virco.com in the Investor Relations section of the “Discover Virco” webpage. The Corporate Governance and Nominating Committee recommended to the Board of Directors each nominee the Board selected.

The Corporate Governance and Nominating Committee’s functions are to identify and recommend to the Board of Directors from time to time candidates for nomination for election as directors of the Company at the Annual Meeting, recommend the composition of the Board of Directors and its committees, monitor a process to assess Board effectiveness and develop and implement Company corporate governance guidelines. Candidates may come to the attention of the Corporate Governance and Nominating Committee through members of the Board of Directors, stockholders or other persons. Consideration of new Board nominee candidates typically involves a series of internal discussions, review of information concerning candidates and interviews with selected candidates. Candidates may be evaluated at regular or special meetings and may be considered at any point during the year, depending on the Company’s needs. In evaluating nominations, the Corporate Governance and Nominating Committee considers a variety of criteria, including business experience and skills, independence, judgment, integrity, the ability to commit sufficient time and attention to Board of Directors activities and the absence of potential conflicts with the Company’s interests. Such criteria are published in the Company’s Corporate Governance Guidelines available on the Company’s website at www.virco.com in the Investor Relations section of the “Discover Virco” webpage. To recommend a prospective nominee for the Corporate Governance and Nominating Committee’s consideration, stockholders should submit a candidate’s name and qualifications to the Company’s Corporate Secretary at 2027 Harpers Way, Torrance, California 90501, Attention: Robert E. Dose, Secretary.

Communications with the Board of Directors

Any stockholder interested in communicating with individual members of the Board of Directors, the Board of Directors as a whole, any of the committees of the Board or the independent directors as a group may send written communications to the Board of Directors, any committee of the Board of Directors or any director or directors of the Company at 2027 Harpers Way, Torrance, California 90501, Attention: Robert E. Dose, Secretary. Communications received in writing are forwarded to the Board of Directors, or the committee or individual director or directors to whom the communication is directed, unless, at his discretion, the Secretary determines that the communication is of a commercial or frivolous nature, is unduly hostile, threatening, illegal, does not reasonably relate to the Company or its business, or is otherwise inappropriate for the Board of Directors’ consideration. In such cases, such correspondence may be forwarded elsewhere in the Company for review and possible response. The Secretary has the authority to discard or disregard any inappropriate communications or to take other appropriate actions with respect to any such inappropriate communications.

Code of Ethics

The Company has adopted a Code of Conduct and Ethics for Directors, Officers and Employees (the “Code”). The Code applies to all Company directors, employees and officers, including the Company’s Chief Executive Officer and senior financial officers, including the principal financial and accounting officers. The Code is available on the Company’s website at www.virco.com in the Investor Relations section of the “Discover Virco” webpage. The Company intends to post any amendments to or waivers under the Code that apply to its Chief Executive Officer, principal financial officer and principal accounting officer on its website. Upon written request, the Company will provide a copy of the Code free of charge. Requests should be directed to Virco Mfg. Corporation, 2027 Harpers Way, Torrance, California 90501, Attention: Robert E. Dose, Secretary.

Board’s Role in Risk Oversight

Our Board of Directors believes that open communication between management and the Board is essential for effective risk management and oversight. The Board of Directors meets with our Chief Executive Officer and other members of senior management at Board meetings where, among other topics, they discuss strategy and risks in the context of reports from the management team and evaluate the risks inherent in significant transactions. While our Board of Directors is ultimately responsible for risk oversight, our Board committees assist the Board of Directors in fulfilling its oversight responsibilities in certain areas of risk. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk management in the areas of major financial risk exposures, internal control over financial reporting, disclosure controls and procedures, and legal and regulatory compliance. The Compensation Committee assists the Board in assessing risks created by the incentives inherent in our compensation policies. The Corporate Governance and Nominating Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of corporate, legal and regulatory risk. In the area of cybersecurity risk,the Board oversees the execution of our cybersecurity strategy and the assessment of cybersecurity risks, along with actions that we may take to mitigate and address cybersecurity risks. The Board delegates primary oversight of cybersecurity risks to the executive team and lead independent director.

Anti-Hedging Policy and Insider Trading Restrictions

The Company’s Insider Trading Compliance Policy restricts certain transactions in our securities and prohibits our directors, officers and employees (and their respective family and household members) from purchasing or selling any type of security while in possession of material non-public information relating to the security or the issuer of such security, whether the issuer of such security is the Company or any other company, or from providing such material non-public information to any person outside of the Company, except in accordance with the Company’s disclosure policies. Trading by our executive officers and directors, as well as other designated covered persons, is restricted to certain quarterly trading windows. In addition, our Insider Trading Compliance Policy also prohibits directors, officers and employees from engaging in short sales, pledging and margining of the Company’s securities, and from hedging the economic risk of stock ownership in the Company’s securities. The Company’s Insider Trading Compliance Policy is available on the Company’s website at www.virco.com in the Investor Relations section of the “Discover Virco” webpage.

Director Resignation Policy

We have adopted a Director Resignation Policy pursuant to which any nominee for election as director is required to submit an offer of resignation for consideration by the Corporate Governance and Nominating Committee if such nominee for director (in an uncontested election) receives a greater number of “Withhold” votes from his or her election than votes “For” such election. In such case, the Corporate Governance and Nominating Committee will then consider the relevant facts and circumstances and recommend to the Board the action to be taken with respect to such offer of resignation. The Board will then act on the Committee’s recommendation. Promptly following the Board’s decision, we would disclose that decision and an explanation of such decision in a Current Report on Form 8-K filed with the SEC. A copy of the Director Resignation Policy is included in our Corporate Governance Guidelines, which is available on our website at www.virco.com in the Investor Relations section of the “Discover Virco” webpage.

PROPOSAL 1

ELECTION OF DIRECTORS

The Certificate of Incorporation of the Company provides for the division of the Board of Directors into three classes as nearly equal in number as possible, with the term of one class expiring each year. The Company currently has seven members on its Board of Directors, with two members in Class I, three members in Class II, and two members in Class III.

At the Annual Meeting, the stockholders will be asked to elect three Class II directors, with terms expiring at the 2027 Annual Meeting of Stockholders.

It is intended that the proxies solicited by this Proxy Statement will be voted in favor of the election of all nominees to the Board of Directors, unless authority to do so is withheld. Should any of such nominees be unable to serve as a director or should any additional vacancy occur before the election (which events are not anticipated), proxies may be voted for a substitute nominee selected by the Board of Directors.

The following table sets forth certain information with respect to each of the three nominees and our continuing directors. The Board of Directors recommends that you vote “FOR” the election of each of the nominees.

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Age | | Biographical Information, Skills and Qualifications | | Director

Since | | Class of Director (term expires) |

| | | | | | | |

| Nominees for Class II Directors Whose New Terms Will Expire in 2027: |

| | | | | | | |

| Robert A. Virtue | 91 | | Mr. Virtue has served as Chairman of the Board and Chief Executive Officer of the Company since 1990, and President of the Company from August 1982 to November 2014. Mr. Virtue brings to the Board over 60 years of experience and knowledge of the Company’s business, operations, and culture. Mr. Virtue is the father of Douglas A. Virtue and Kathy Virtue Young. | | 1956 | | II (2024) |

| | | | | | | |

| Kathy Virtue Young | 60 | | Ms. Virtue Young has been employed by the Company in various sales positions since 1986, most recently as a Vice President of Sales. She brings to the Board over 30 years of experience and knowledge of the Company’s business, operations, and culture. Ms. Virtue Young is the daughter of Robert A. Virtue and sister of Douglas Virtue. | | 2018 | | II (2024) |

| | | | | | | |

| Agnieszka Winkler | 78 | | Ms. Winkler is the founder and former Chairperson of The Winkler Group, a San Francisco based management consultancy specializing in branding and marketing efficiency and effectiveness. She is also the founder and former Chairperson and Chief Executive Officer of Winkler Advertising, founded in 1984, and Team Toolz Inc., founded in 1999, both of which were acquired. Ms. Winkler has also served on the Boards of Directors of the following public and private companies: The Cheesecake Factory Inc., Inter-Tel Inc., Reno Air, Inc., SuperCuts, Inc., Ascension Health Care Network and Iplocks. Ms. Winkler currently serves on the Board of Trustees of Santa Clara University, as Chair of the Board of Directors of the Jesuit School of Theology, on the Board of Directors of African Diaspora Network. and on the Executive Committee of the Advisory Board for the Miller Center for Social Entrepreneurship. Ms. Winkler is the author of the book, “Warp Speed Branding” published by Wiley in the United States, China, and Turkey and editor of “Emigrant: Fight For Freedom 1939 to 2000.” Ms. Winkler brings to the Board extensive experience in leadership, management and marketing. | | 2018 | | II (2024) |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Age | | Biographical Information, Skills and Qualifications | | Director

Since | | Class of Director (term expires) |

| | | | | | | |

| Continuing Class I Directors Whose Terms Expire in 2026: |

| | | | | | | |

| Robert R. Lind | 75 | | Mr. Lind has been Managing Partner of Berkshire Bridge Capital, LLC, a consulting firm and formerly an investment banking firm, since October 2005. Mr. Lind also served as Managing Partner of Berkshire Bridge Partners, LLC, a licensed investment advisor, and Nevada Growth Capital Fund from October 2012 to March 2014, and as a Director of Nevada Capital Investment Corporation, a statutory public benefit corporation formed by the State of Nevada to provide venture funding for Nevada businesses, from July 2011 to April 2012. From 2016- 2023 Mr. Lind served as a member of the Advisory Board of Longenecker & Associates which provides highly specialized, fast-response technical and management support to the nuclear and environmental industries. Mr. Lind previously was a Managing Director and a board member of SAIC’s Venture Capital Corporation, served as Head of Corporate Development at Rockwell International, was a Managing Director at Lehman Brothers Holdings, Inc. and served as a board member on the Yosemite Conservancy Board of Trustees until December 31, 2014; Currently he is a Council Member for the Yosemite Conservancy. Mr. Lind brings many years of investment banking, venture capital investing, corporate management and commercial banking experience and qualifies as an “audit committee financial expert.” | | 2014 | | I (2026) |

| | | | | | | |

| Craig L. Levra | 65 | | Mr. Levra is a seasoned executive with deep expertise in operations, technology and ecommerce. He is a Founding Member of GoodwillFinds.com, a recently launched social enterprise comprising a re-commerce technology platform and second-hand marketplace. He also serves as Executive Vice President - Chief Operating Officer for Goodwill Southern California, the nation’s largest Goodwill entity operating 120 stores and donation centers, five distribution centers and multiple ecommerce sites generating significant operating earnings to support Goodwill’s mission of transforming lives through the power of work. In 2018, Mr. Levra served as President of Gear Coop, Inc, an outdoor specialty online retailer and a leading supplier of over one hundred fifty technical brands providing comprehensive brand management on Amazon.com. Mr. Levra led Sport Chalet, Inc., formerly a publicly traded specialty sports retailer, from 1997 until May 2015, and served as Chairman and CEO from 2001 until the sale to a private equity firm in 2014. He serves on the Board and as a strategic advisor of several privately held retail and sports companies, including Open 4 Sale Technologies and Gameday in the USA. Mr. Levra also serves on the Board of Directors – Executive Committee of the Los Angeles Sports and Entertainment Commission. Early in his career, he was a client of the Company when he headed furniture merchandising for office specialty retailer HQ Office Supplies Warehouse. Mr. Levra received a bachelor’s and MBA degree from the University of Kansas, and a Certificate in Public Company Governance from the University of California, Irvine. Mr. Levra brings to the Board extensive experience in leadership, management, operations and marketing. | | 2016 | | I (2026) |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Age | | Biographical Information, Skills and Qualifications | | Director

Since | | Class of Director (term expires) |

| | | | | | | |

| Continuing Class III Directors Whose Terms Expire in 2025: |

| | | | | | | |

| Bradley Richardson | 65 | | Mr. Richardson has served as a director of Brady Corporation since 2007 and became Chairman of the Board in May 2021. He also serves as Chair of the Audit Committee of Brady Corporation and is a member of its Corporate Governance, Finance and Management Development Committees and Compensation Committee. Mr. Richardson served as EVP and CFO of Avient Corporation from 2013 to 2020. He previously served as EVP and CFO of Diebold, Inc. and EVP Corporate Strategy and CFO of Modine Manufacturing. Prior to Modine, he spent 21 years with BP Amoco, serving in various financial and operational roles. Mr. Richardson has served on the Boards of Modine Manufacturing and Tronox, Inc. Mr. Richardson received a bachelor’s degree in finance and economics from Miami University, and an MBA degree in accounting and finance from Indiana University. Mr. Richardson brings to the Company extensive knowledge and global experience in the areas of operations, strategy, accounting, tax accounting and finance, which are areas of critical importance and focus of the Company. | | 2023 | | III (2025) |

| | | | | | | | |

| Douglas A. Virtue | 65 | | Mr. Virtue has served as President of the Company since November 2014, and Executive Vice President of the Company from December 1997 to November 2014. Prior to that, he was General Manager of the Torrance Division of the Company. Mr. Virtue brings to the Board 30 years of experience and knowledge of the Company’s business, operations and culture. Mr. Virtue is Robert A. Virtue’s son and Kathy Virtue Young’s brother. | | 1992 | | III (2025) |

| | | | | | | |

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board selected Moss Adams LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending January 31, 2025, and recommends that the stockholders vote for ratification of that appointment. Notwithstanding this selection or the ratification vote, the Audit Committee, at its discretion, may direct the appointment of new auditors at any time during the fiscal year if the Audit Committee determines that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of a majority of the votes cast is required to ratify the Audit Committee’s selection. The Company is not required to submit the selection of the independent registered public accounting firm to the stockholders for approval, but is doing so as a matter of good corporate governance. If the stockholders reject the selection, the Board of Directors will reconsider its selection.

Representatives of Moss Adams LLP are expected to attend the Annual Meeting and will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from shareholders.

The Board of Directors recommends a vote “FOR” the ratification of the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the fiscal year ending January 31, 2025.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Shares Owned by Directors, Management and Principal Stockholders

The following table sets forth information as of April 23, 2024 (unless otherwise indicated) about the beneficial ownership of the Company’s common stock by (i) each person known by the Company to own beneficially more than 5% of the outstanding shares of common stock of the Company, (ii) each director and director-nominee of the Company, (iii) each executive officer of the Company for whom compensation is disclosed in the tables below (“Named Executive Officers” or “NEOs”) and (iv) all executive officers and directors of the Company as a group. Unless otherwise indicated, the mailing address of each of the persons named is c/o Virco Mfg. Corporation, 2027 Harpers Way, Torrance, California 90501.

| | | | | | | | | | | |

|

| | | |

| Name of Beneficial Owner * | Amount and Nature of Beneficial Ownership

(*) | | Percent of Class

(%) |

| Minerva Advisors LLC and related parties (1) | 1,103,513 | | 6.75 |

| | | | |

| Robert A. Virtue (2) (3) | 479,842 | | 2.94 |

| Chairman of the Board of Directors and Chief Executive Officer | | | |

| | | | |

| Craig L. Levra | 106,503 | | ** |

| Director | | | |

| | | | |

| Robert R. Lind | 110,043 | | ** |

| Director | | | |

| | | |

| Bradley Richardson | 28,000 | | ** |

| Director | | | |

| | | |

| Douglas A. Virtue (3) | 889,934 | | 5.44 |

| Director and President | | | |

| | | |

| Agnieszka Winkler | 76,931 | | ** |

| Director | | | |

| | | |

| Kathy Virtue Young | 704,842 | | 4.31 |

| Director | | | |

| | | |

| Robert E. Dose | 129,891 | | ** |

| Sr. Vice President Finance, Secretary, Treasurer | | | |

| | | |

| All executive officers and directors as a group (11 persons) | 2,856,107 | | 17.47 |

____________________________

(*) Except as indicated in the footnotes to this table and pursuant to applicable community property laws, to the knowledge of the Company, the persons named in this table have sole voting and investment power with respect to all shares beneficially owned by them. For purposes of this table, a person is deemed to be the “beneficial owner” of any security if the person has the right to acquire beneficial ownership of such security within 60 days of April 23, 2024 including but not limited to, any right to acquire through the exercise of any option, warrant or right or through the conversion of a security. Amounts for Messrs. Robert Virtue, Douglas Virtue, Robert Dose, and all executive officers and directors as a group, include 4,000, 4,000, 4,000 and 93,600 shares issuable upon exercise of options or as restricted stock grants, respectively, and 21,604, 61,009, 18,079 and 281,100 shares held under the Company’s 401(k) Plan as of April 23, 2024 respectively.

** Less than 1%.

(1) Reflects information as of December 31, 2023, as reported in a Schedule 13G/A filing on February 9, 2024 by Minerva Advisors LLC (“Minerva LLC”), Minerva Group, LP (“Minerva Group”), Minerva GP, LP (“Minerva GP”), Minerva GP, Inc. (“Minerva Inc.”) and David P. Cohen. The address for each of the reporting persons is 50 Monument Road, Suite 201, Bala Cynwyd, PA 19004. Minerva LLC has sole power to vote and sole power to dispose of 812,186 shares, and shared power to vote and to dispose of 285,153 shares; each of Minerva Group, Minerva GP, and Minerva Inc. has sole power to vote and sole power to dispose of 812,186

shares and shared power to vote and dispose of 285,153 shares, and Mr. Cohen has sole power to vote and dispose of 818,360 shares and shared power to vote and dispose of 285,153 shares.

(2) Excludes 1,985,094 shares owned beneficially by Mr. Robert Virtue’s adult children, including Mr. Douglas Virtue and Ms. Kathy Virtue Young, as to which Mr. Robert Virtue disclaims beneficial ownership.

(3) Douglas A. Virtue is Robert A. Virtue’s son, and Kathy Virtue Young is Robert A. Virtue’s daughter. The total number of shares beneficially owned by Robert A. Virtue, his brother Richard J. Virtue, his sister, Nancy Virtue-Cutshall and their children (including Douglas A. Virtue and Kathy Virtue Young), grandchildren, and great grandchildren aggregate 4,742,997 shares or 29.01% of the total shares of common stock outstanding. Robert A. Virtue, Richard J. Virtue, Nancy Virtue-Cutshall and certain of their respective spouses and children (including Douglas A. Virtue and Kathy Virtue Young) (collectively, the “Virtue Stockholders”) and the Company have entered into an agreement with respect to certain shares of the Company’s common stock received by the Virtue Stockholders as gifts from the founder, Julian A. Virtue, including shares received in subsequent stock dividends in respect of such shares. Under the agreement, each Virtue Stockholder who proposes to sell any of such shares is required to provide the remaining Virtue Stockholders notice of the terms of such proposed sale. Each of the remaining Virtue Stockholders is entitled to purchase any or all of such shares on the terms set forth in the notice. The Company may purchase any shares not purchased by such remaining Virtue Stockholders on such terms. The agreement also provides for a similar right of first refusal in the event of the death or bankruptcy of a Virtue Stockholder, except that the purchase price for the shares is to be based upon the then prevailing sales price of the Company’s common stock on the NASDAQ Stock Market.

EXECUTIVE COMPENSATION

Objectives and Structure of the Executive Compensation Program

The objectives of the Company’s executive compensation program are to: 1) attract, motivate and retain highly qualified executives; 2) link total compensation to stockholder returns; 3) reflect individual contributions to the performance of the Company; 4) achieve appropriate balance between long-term value creation and short-term performance by including equity as part of total compensation; and 5) maintain internal fairness and morale.

In keeping with the entrepreneurial spirit of Virco founder Julian Virtue (1908-1991), Virco’s executive compensation package is designed to be simple, frugal, inclusive of all salaried employees and contain substantial components, which are tied directly to shareholder returns.

All salaried Virco employees, including Named Executive Officers and top-, mid-, and entry-level managers, are participants in the Company’s Entrepreneurial Salaried Bonus Plan (“ESBP”). There is no separate compensation plan exclusively for executives. The ESBP was used in establishing eligibility for bonuses during the fiscal year ended January 31, 2024.

The ESBP contains three basic elements:

1) Each salaried employee’s annual Base Salary;

2) An annual Bonus Incentive denoted as a percentage of the base salary, and;

3) For the top 26 Officers and Internal ‘Directors’ (collectively the Company’s top managers), an award of Restricted Stock Units (RSUs) reflecting the respective manager’s duties and responsibilities. Although the Company has not made new awards of RSUs since 2019, prior awards have continued to vest through fiscal 2024.

Each year, the Company’s Board of Directors evaluates the Company's prior year’s performance and its prospects for the coming year. The Compensation Committee, which consists entirely of Independent Directors, then establishes a minimum operating income threshold. For fiscal 2024 the target operating income was $4,000,000. Until this target operating income is met, no participants in the ESBP are eligible for any bonus. The Compensation Committee then recommends the ESBP targets to the full Board for approval as a component of the Company’s Annual Operating and Bonus Plan.

Once the minimum operating income threshold is achieved, one-third of any additional earnings by the Company in excess of the minimum target are available for distribution to the Salaried Employees. In addition, bonus payouts to NEOs are capped at 50% of their base salary.

The Compensation Committee believes that the ESBP has several important entrepreneurial benefits:

1) It ensures that NEOs and managers will only receive a cash bonus if the Company is profitable.

2) It provides a simple ratio of distribution that rewards shareholders on a 2:1 ratio compared to management, once the shareholder minimum profit target has been achieved;

3) It links all salaried managers into a single incentive plan, appropriate for a vertically-integrated business model in which all managers and all operating units must cooperate to achieve success.

As of January 31, 2024, the Company had 140 salaried employees participating in this plan. This included all salaried members of operations, distribution, administration and selected sales and marketing. The majority of salaried sales employees have a separate incentive plan tied directly to the sales volume generated in their own territory, and do not participate in the Entrepreneurial Salaried Bonus Plan.

During fiscal 2024, Named Executive Officers received in the aggregate:

1) $1,030,975 in base salary;

2) $514,225 in ESBP cash payments; and

3) Vested in 12,000 RSUs.

The ESBP reaches deep into the Company’s ranks. Its structure has the effect of rewarding salaried personnel as the Company’s performance improves, and is designed to engage all participants in the risks and rewards of entrepreneurship.

Because of the entrepreneurial nature of this compensation plan and the difficult business conditions at various times, no salaried employees received a bonus during the fiscal years 2010-2015, 2019, or 2021-2022. During recent years salaried employees generally received minimal raises or Cost-of-Living adjustments, other than for promotions, and several executives took voluntary salary decreases.

Management and the Board believe the simple, transparent compensation program of the ESBP rewards shareholders while also incentivizing the teamwork essential in a vertically-integrated manufacturing, sales and service business. The program structure has remained essentially unchanged since the early 1990s. Because employees and shareholders were “all in it together,” Management further believes the inclusive nature of this plan contributed to the Company’s high morale while navigating the challenges related to COVID-19 in recent years.

The Company typically makes equity based awards on the date of the Annual Meeting of Stockholders. The Company has not typically made grants of stock options in the past, but if it did so in the future, the Board of Directors or Compensation Committee would likely take into account material nonpublic information in determining the timing and terms of such an award. The Company has not timed the disclosure of material nonpublic information for the purpose of affecting the value of executive compensation.

Summary Compensation Table

The table below sets forth the compensation awarded to, earned by or paid to, each of the Named Executive Officers for the fiscal years ended January 31, 2024 and 2023. The Company has no written employment agreements with any of its executives. While employed, executives are entitled to base salary, participation in the executive compensation programs identified in the tables below and other benefits common to all employees.

The amounts shown in the following table are based on the same assumptions used in the preparation of the Company’s 2024 financial statements, which are described in the Company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2024 under the section “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and in Note 4 to the consolidated financial statements included therein. The Pension Plans that the Named Executive Officers participate in were frozen in 2003 and the Named Executive Officers did not accrue any additional benefits under the Pension Plans during 2024 or 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | |

Name and | | | Salary | | Bonus | | Stock Awards | | Non-Equity Incentive Plan Compensation | | Change in Pension | | All Other Compensation | | Total |

| Position | Year | | ($) | | ($) | | ($)(1) | | ($) | | ($)(2) | | ($)(3) | | ($) |

| | | | | | | | | | | | | | | | |

| Robert A. Virtue | 2024 | | 364,252 | | — | | — | | 181,275 | | — | | 11,500 | | 557,027 | |

| Chairman & CEO | 2023 | | 352,148 | | — | | — | | 155,302 | | — | | 15,000 | | 522,450 | |

| | | | | | | | | | | | | | | | |

| Douglas A. Virtue | 2024 | | 334,373 | | — | | — | | 167,625 | | — | | 10,602 | | 512,600 | |

| President | 2023 | | 324,953 | | — | | — | | 143,608 | | — | | 9,103 | | 477,664 | |

| | | | | | | | | | | | | | | | |

| Robert E. Dose | 2024 | | 332,352 | | — | | — | | 165,325 | | — | | 17,500 | | 515,177 | |

| Sr. Vice President | 2023 | | 321,642 | | — | | — | | 141,637 | | — | | 15,000 | | 478,279 | |

| Finance | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| (1) The amounts shown in this column are the aggregate grant date fair value of stock awards granted during the applicable fiscal year, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“FASB 718”). The assumptions used to calculate these figures are described in Note 5 of the Company’s Form 10-K for the applicable fiscal year. |

|

| (2) The aggregate change in the actuarial present value of the executive’s accumulated benefits under the Employee Plan and VIP Plan was negative during the current year and for Robert Virtue and Doug Virtue in the prior year. The aggregate change in the prior year for Robert Dose was attributable to changes in discount rate and passage of time. NEO’s did not earn any additional pension benefits. |

|

| (3) The amounts in this column include automobile allowances and the value of personal use of a Company provided vehicle. |

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth outstanding equity awards held by the Named Executive Officers as of January 31, 2024:

| | | | | | | | | | | |

|

| | | |

| | | Stock Awards | |

| Name and Title | Year of Award | Shares or Units of Stock that have not Vested (#)(1) | Market Value of Shares or Units of Stock that have not Vested ($)(2) |

| | | | |

| Robert A. Virtue | 2020 | 4,000 | 47,920 |

| Chairman and CEO | | | |

| | | | |

| Douglas A. Virtue | 2020 | 4,000 | 47,920 |

| President | | | |

| | | | |

| Robert E. Dose | 2020 | 4,000 | 47,920 |

| Sr. Vice President | | | |

| Finance | | | |

| | | |

| (1) All RSUs vest at 20% per year for five years from the grant date. For the 4,000 RSUs remaining from the June 21, 2019 RSU award there is one remaining vesting on June 21, 2024. |

| |

| (2) All year-end dollar values were computed based on the fiscal year-end closing price of $11.98 per share of common stock less the $0.01 par value of the share of Common Stock that is paid by the Named Executive Officer. |

Retirement Benefits

The Company maintains two defined benefit pension plans in which the Named Executive Officers participate, the Virco Employees Retirement Plan (“Employee Plan”) and the Virco Important Performers Retirement Plan (“VIP Plan”). The Company and its subsidiaries cover all employees under the Employee Plan, which is a qualified noncontributory defined benefit retirement plan. Benefits under the Employee Plan are based on years of service and career average earnings. The Company also provides a supplementary retirement plan for certain key employees, the VIP Plan. The VIP Plan provides a benefit up to 50% of average compensation for the last five years in the VIP Plan, offset by benefits earned under the Employee Plan. Effective December 31, 2003, the Company froze all future benefit accruals under the plans. All NEOs are fully vested under both Plans.

Potential Payments upon Termination or Change-in-Control

The Company does not have written employment agreements with any of the Named Executive Officers. Retirement, death, disability and change-in-control events do not trigger the payment of compensation to the Named Executive Officers that is not available to all salaried employees (including the amounts included in the “Retirement Benefits” discussion above). Named Executive Officers do not have a contractual right to receive severance benefits.

The Company’s 2019 Omnibus Equity Incentive Plan provides that awards under such Plan may be subject to acceleration upon a “Change of Control” (as defined in the Plan).

Executive Officers of the Registrant

As of April 1, 2024, the executive officers of the Company, who are elected by and serve at the discretion of the Company’s Board of Directors, were as follows:

| | | | | | | | | | | | | | |

| Name | Office | Age at

January 31, 2024 | Held Office Since |

| | | |

| Robert A. Virtue (1) | Chairman of the Board and Chief Executive Officer | 91 | 1990 |

| | | |

| Douglas A. Virtue (2) | President | 65 | 2014 |

| | | |

| J. Scott Bell (3) | Senior Vice President - Chief Operating Officer | 67 | 2004 |

| | | |

| Robert E. Dose (4) | Senior Vice President - Chief Financial Officer, Secretary and Treasurer | 67 | 1995 |

| | | |

| Patricia Quinones (5) | Senior Vice President - Chief Administrative Officer | 60 | 2004 |

| | | |

| Bassey Yau (6) | Vice President - Corporate Controller, Assistant Secretary and Assistant Treasurer | 65 | 2004 |

|

| (1) | Appointed Chairman in 1990; has been employed by the Company for 67 years and served as the President from 1982 until 2014 and Chief Executive Officer since 1988. |

| (2) | Appointed President in 2014; has been employed by the Company for 38 years and has served in Production Control, as Contract Administrator, as Manager of Marketing Services, as General Manager of the Torrance Division, as Corporate Executive Vice President and currently as President. |

| (3) | Appointed in 2004; has been employed by the Company for 35 years and has served in a variety of manufacturing, safety, and environmental positions, Vice President - General Manager, Conway Division, and currently as Chief Operating Officer. |

| (4) | Appointed in 1995; has been employed by the Company for 33 years and has served as the Corporate Controller, and currently as Senior Vice President of Finance, Secretary and Treasurer. |

| (5) | Appointed in 2004; has been employed by the Company for 32 years in a variety customer and marketing service positions, Vice President of Logistics, Marketing Services and Information Technology and currently as Chief Administrative Officer. |

| (6) | Appointed in 2004; has been employed by the Company for 27 years and has served as Corporate Controller, and currently as Vice President Accounting, Corporate Controller, Assistant Secretary and Assistant Treasurer. |

Securities Authorized for Issuance Under Equity Compensation Plans

| | | | | | | | | | | | | | | | | |

|

| | | | | |

| | Equity Compensation Plan Information |

| Plan category | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

(#) | | Weighted-average

exercise price of

outstanding

options, warrants

and rights

($) | | Number of

securities remaining

available for future

issuance under

equity compensation

plans - excluding

securities reflected

in column

(#) |

| | | | | | |

| Equity compensation plans approved by security holders | 164,110 | | $4.18 | | 537,925 (1) |

| | | | | | |

(1) Represents the number of shares available for issuance as of January 31, 2024 under the Company’s 2019 Omnibus Equity Stock Incentive Plan.

Pay Versus Performance

As required by Section 953(a) of the Dodd-Frank Act and Item 402(v) of Regulation S-K, we are providing the following disclosure about the relationship between “compensation actually paid” for our principal executive officer, or PEO, and non-PEO named executive officers, or Non-PEO NEOs, and certain financial performance of the Company. As a smaller reporting company we are permitted and have elected to provide scaled pay versus performance disclosure. For further information regarding our compensation philosophy and how we seek to align executive compensation with the Company’s performance, please see above in this “Executive Compensation” section.

The following table presents the pay versus performance information for our Named Executive Officers. The amounts set forth below have been calculated in accordance with Item 402(v) of Regulation S-K. Use of the term “compensation actually paid” is required by the SEC’s rules and, as a result of the calculation methodology required by the SEC. Such amounts differ from compensation actually received by the individuals.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fiscal Year | | Summary Compensation Table Total for PEO ($)(1) | | Compensation Actually Paid to PEO ($)(2) | | Average Summary Compensation Table Total for Non-PEO NEOs ($)(3) | | Average Compensation Actually Paid to Non-PEO NEOs ($)(4) | | Year-End Value of $100 Investment Based On Total Stockholder Return ($)(5) | | Net Income (Loss) (thousand $)(6) |

(a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) |

| 2024 | | 557,027 | | | 581,827 | | | 513,889 | | | 538,689 | | | 436 | | 21,910 | |

| 2023 | | 522,450 | | | 544,650 | | | 477,971 | | | 500,171 | | | 178 | | 16,547 | |

| 2022 | | 341,139 | | | 351,099 | | | 340,091 | | | 319,568 | | | 108 | | (15,136) | |

| | | | | |

(1) | The dollar amounts reported in column (b) are the amounts of total compensation reported for Robert A. Virtue (our Chief Executive Officer, or PEO) for each corresponding year in the “Total” column of the Summary Compensation Table. Refer to “Executive Compensation—Summary Compensation Table.” |

(2) | The dollar amounts reported in column (c) represent the amount of “compensation actually paid” to Mr. Virtue, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to Mr. Virtue during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the adjustments in the table below were made to Mr. Virtue’s Summary Compensation Table Total compensation for each year to determine the compensation actually paid. The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | PEO |

| | | 2022 | | 2023 | | 2024 |

| | | | | | | |

| Summary Compensation Table Total | | $ | 341,139 | | | $ | 522,450 | | | $ | 557,027 | |

Less: | Stock Award Values Reported in Summary Compensation Table for the Covered Year | | $0 | | $0 | | $0 |

Plus: | Fair value of Equity Awards Granted During Covered Year | | $0 | | $0 | | $0 |

| Change in Fair Value of Outstanding Unvested Stock Awards from Prior Years | | $ | 3,520 | | | $ | 15,440 | | | $ | 28,320 | |

| Change in Fair Value of Stock Awards from Prior Years that Vested in the Covered Year | | $ | 6,440 | | | $ | 6,760 | | | $ | (3,520) | |

Less: | Fair Value of Equity Awards Forfeited During Covered Year | | $0 | | $0 | | $0 |

Less: | Change in Pension Value Reported in Summary Compensation Table | | $0 | | $0 | | $0 |

Plus: | Pension Value Service Cost | | $0 | | $0 | | $0 |

| Compensation Actually Paid | | $ | 351,099 | | | $ | 544,650 | | | $ | 581,827 | |

| | | | | |

(3) | The dollar amounts reported in column (d) represent the average of the amounts reported for the NEOs as a group (excluding our PEO) in the “Total” column of the Summary Compensation Table in each applicable year. The Non-PEO NEOs included for purposes of calculating the average amounts in each applicable year are Douglas A. Virtue and Robert E. Dose. |

(4) | The dollar amounts reported in column (e) represent the average amount of “compensation actually paid” to the Non-PEO NEOs as a group, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual average amount of compensation earned by or paid to the NEOs as a group (excluding our PEO) during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the adjustments in the table below were made to average total compensation for the Non-PEO NEOs as a group for each year to determine the compensation actually paid, using the same methodology described above in Note (2). |

| | | | | | | | | | | | | | | | | | | | |

| | Average of Non-PEO NEOs |

| | 2022 | | 2023 | | 2024 |

| | | | | | |

| Summary Compensation Table Total | $ | 340,091 | | | $ | 477,971 | | | $ | 513,889 | |

Less: | Stock Award Values Reported in Summary Compensation Table for the Covered Year | $0 | | $0 | | $0 |

Plus: | Fair value of Equity Awards Granted During Covered Year | $0 | | $0 | | $0 |

| Change in Fair Value of Outstanding Unvested Stock Awards from Prior Years | $ | 3,520 | | | $ | 15,440 | | | $ | 28,320 | |

| Change in Fair Value of Stock Awards from Prior Years that Vested in the Covered Year | $ | 6,440 | | | $ | 6,760 | | | $ | (3,520) | |

Less: | Fair Value of Equity Awards Forfeited During Covered Year | $0 | | $0 | | $0 |

Less: | Change in Pension Value Reported in Summary Compensation Table | $ | (30,483) | | | $0 | | $0 |

Plus: | Pension Value Service Cost | $0 | | $0 | | $0 |

| Compensation Actually Paid | $ | 319,568 | | | $ | 500,171 | | | $ | 538,689 | |

| | | | | |

(5) | Cumulative TSR is calculated by dividing the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between the Company’s share price at the end and the beginning of the measurement period by the Company’s share price at the beginning of the measurement period. |

| | | | | |

(6) | The dollar amounts reported represent the amount of net income (loss) reflected in the Company’s audited financial statements for the applicable fiscal year. |

Analysis of the Information Presented in the Pay Versus Performance Table

In accordance with Item 402(v) of Regulation S-K, we are providing the following descriptions of the relationships between information presented in the Pay Versus Performance table above.

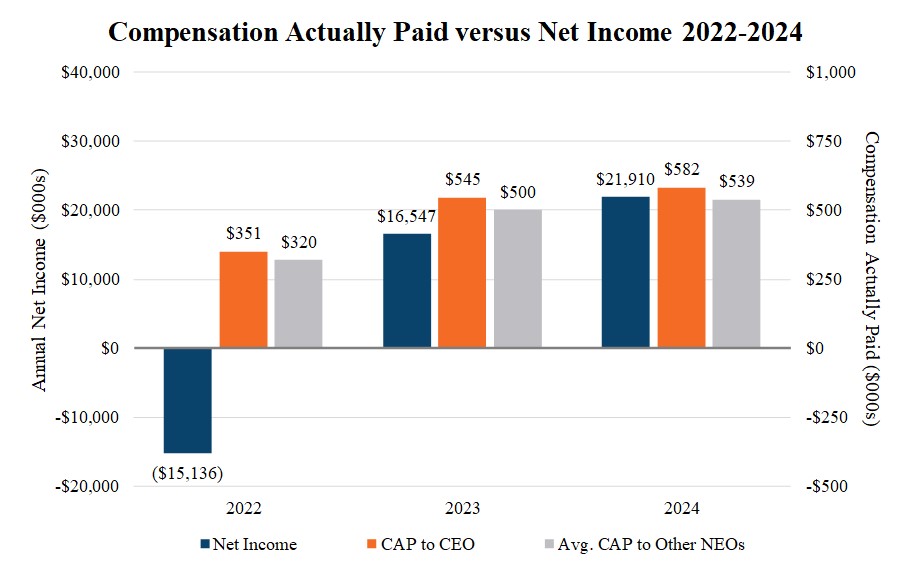

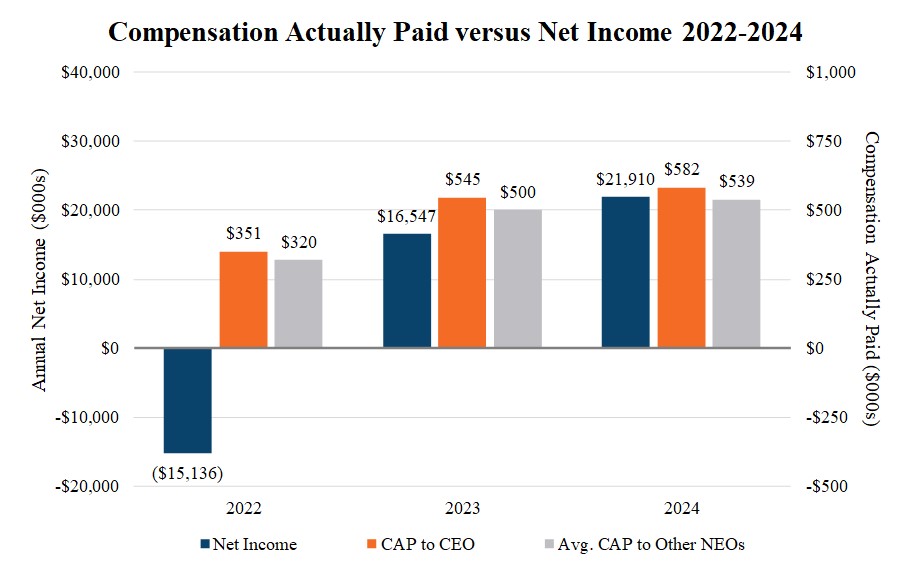

Compensation Actually Paid and Net Income

The chart below shows the relationship between the compensation actually paid to our PEO and the average compensation actually paid to our Non-PEO NEOs to the Company’s net income over the three fiscal years presented in the table.

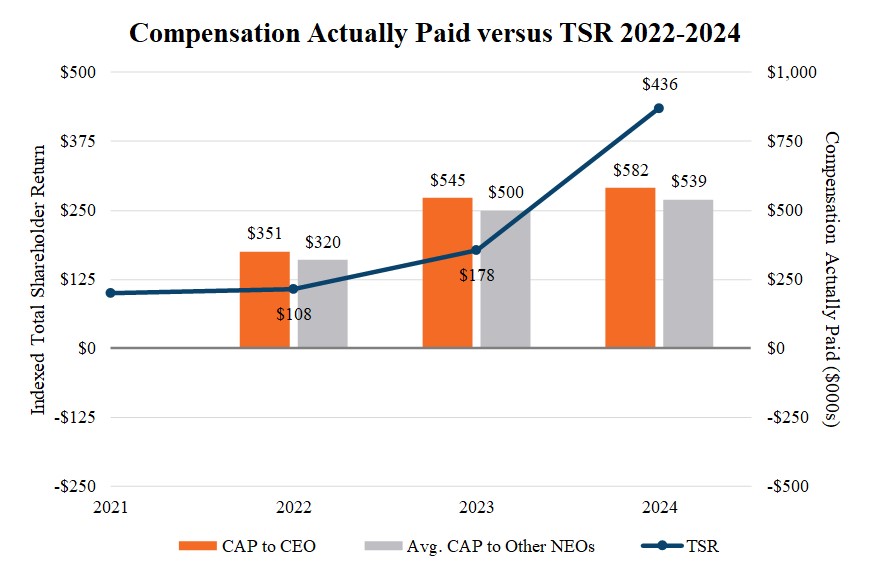

Compensation Actually Paid and Cumulative TSR

The chart below shows the relationship between the compensation actually paid to our PEO and the average compensation actually paid to our Non-PEO NEOs to the Company’s cumulative total stockholder return, or TSR, over the three fiscal years presented in the table.

All information provided above under the “Pay Versus Performance” heading will not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing, except to the extent the Company specifically incorporates such information by reference.

DIRECTOR COMPENSATION

Directors who are also employees of the Company receive no additional compensation for their services as directors. Non-employee directors receive an annual retainer of $150,000 comprised of (i) $75,000 in monthly cash payments and (ii) $75,000 in shares of restricted common stock granted on the date of the Annual Meeting of Stockholders based on the closing trading price of the common stock on such date, although directors may elect to receive all or a portion of this amount in cash if they have achieved the Company’s minimum stock ownership guidelines for directors. The Directors are reimbursed for travel and related expenses incurred to attend meetings. The Company’s guidelines with regard to common stock ownership by directors are for each director to own common stock with a market value of at least four times the amount of the annual cash retainer.

The following table sets forth the compensation paid to each individual, other than the Named Executive Officers, who served as a director of the Company during our fiscal year ended January 31, 2024:

| | | | | | | | | | | | | | |

| Fees Earned | | | |

| or Paid | Stock | All Other | |

| in Cash | Awards | Compensation | Total |

| Name | ($) | ($) | ($) | ($) |

| Alexander Cappello (former director) (1) | 68,750 | — | — | 68,750 |

| | | | | |

| Craig Levra | 106,250 | 75,000 | — | 181,250 |

| | | | |

| Robert Lind | 120,833 | 50,000 | — | 170,833 |

| | | | |

| Bradley Richardson (2) | 43,750 | 75,000 | — | 118,750 |

| | | | | |

| Agnieszka Winkler | 106,250 | 75,000 | — | 181,250 |

| | | | |

| Kathy Virtue Young | — | — | 313,149 (3) | 313,149 |

| | | | |

| | | | |

| (1) Departed the Board on June 20, 2023. | | | |

| (2) Joined the Board on June 20, 2023. | | | |

| (3) Reflects compensation for service as a Vice President of Sales, including base salary, incentive sales programs, and personal use of a Company car. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Jerald Farrell, who is the brother of Patricia Quinones, our Senior Vice President and Chief Administrative Officer, has been employed by the Company in various positions since March 1997, and most recently as Vice President of Technical Operations and Information Technology. During fiscal 2023 and 2024, the total compensation (which includes base salary, the value of stock-based awards and personal use of a Company car) paid by the Company to Mr. Farrell was approximately $263,717 and $288,692, respectively. Debra Bell, who is the spouse of J. Scott Bell, our Senior Vice President of Operations, has been employed by the Company since September 2018, most recently as PlanScape Project Manager. During fiscal 2023 and 2024, the total compensation (which includes base salary) paid by the Company to Ms. Bell was approximately $130,937 and $137,906. Kathy Virtue Young, a member of the Board of Directors of the Company and the daughter of Robert A. Virtue and sister of Douglas A. Virtue, has been employed by the Company in various sales positions since October 1986, most recently as a Vice President of Sales. During fiscal 2023 and 2024, the total compensation (which includes base salary, incentive sales programs, and personal use of a Company car) paid by the Company to Ms. Young was approximately $287,024 and $313,149, respectively. Andrew Virtue, the son of Robert A. Virtue, worked as a consultant for the Company. During fiscal 2023 and 2024, Andrew Virtue received compensation of $177,025 and $192,369, respectively.

In keeping with the Company’s policy on Related-Party Transactions, the Board and the Audit Committee (or Audit Committee Chair) have reviewed and ratified the terms and circumstances of the transactions at the time such transactions were initiated.

REPORT OF THE AUDIT COMMITTEE

The Board of Directors has adopted a written charter for the Audit Committee, which is available on the Company’s website at www.virco.com in the Investor Relations section of the “Discover Virco” webpage. The Audit Committee reviews the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process. The Company’s independent registered public accounting firm is responsible for expressing an opinion on the conformity of the Company’s audited financial statements with accounting principles generally accepted in the United States.

In this context, the Audit Committee has reviewed and discussed the audited financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2024, with management and the independent registered public accounting firm, including their judgment of the quality and appropriateness of accounting principles, the reasonableness of significant judgments and the clarity of the disclosures in the financial statements. In addition, the Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Public Company Accounting Oversight Board standards, SEC rules, and other applicable standards. In addition, the Audit Committee has received from the independent registered public accounting firm the written disclosures and letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communication with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the independent registered public accounting firm’s independence. The Audit Committee has also considered whether the independent registered public accounting firm’s provision of non-audit services to the Company is compatible with the auditors’ independence. The Audit Committee also reviewed and discussed with management its report on internal control over financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2024, for filing with the Securities and Exchange Commission.

| | |

| THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS |

| |

| Bradley Richardson, Chair |

| Craig L. Levra |

| Robert R. Lind |

| Agnieszka Winkler |

The report of the Audit Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

RELATIONSHIP WITH INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Moss Adams LLP audited the Company’s financial statements for the fiscal years ended January 31, 2024 and 2023. The Audit Committee is directly responsible for the engagement of the Company’s independent registered public accounting firm. In making its determination, the Audit Committee reviewed both the audit scope and estimated audit fees of Moss Adams LLP for the coming year, among other things.

The Audit Committee has adopted policies and procedures for pre-approving all audit services, audit-related services, tax services and non-audit services performed by the Company’s independent registered public accounting firm. With respect to Moss Adams LLP, the Audit Committee previously pre-approved the use of Moss Adams LLP for detailed, specific types of services within the following categories: annual audits, quarterly reviews and statutory audits, regulatory implementation and compliance and risk assessment guidance. In each case, the Audit Committee has also set specific annual ranges or limits on the amount of each category of services which the Company would obtain from Moss Adams LLP, which limits and amounts are established periodically by the Audit Committee. Any proposed services exceeding these levels or amounts would require specific pre-approval by the Audit Committee. The Audit Committee monitors the performance of all services provided by the independent registered public accounting firm to determine whether such services are in compliance with the Company’s pre-approval policies and procedures.

Fees Paid to Moss Adams LLP