UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04085

Fidelity Income Fund

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

|

Date of fiscal year end: |

August 31 |

|

|

|

|

Date of reporting period: |

February 28, 2023 |

Item 1.

Reports to Stockholders

Contents

|

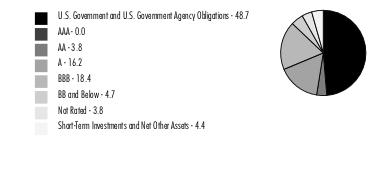

Quality Diversification (% of Fund's net assets)

|

|

|

Percentages shown as 0.0% may reflect amounts less than 0.05%.

|

|

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

|

|

Asset Allocation (% of Fund's net assets)

|

|

|

Foreign investments - 19.3%

|

|

Futures - 12.1%

|

|

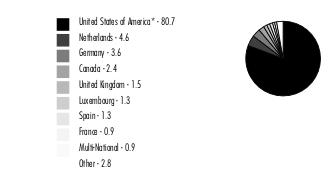

Geographic Diversification (% of Fund's net assets)

|

|

|

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of derivatives, if applicable.

|

|

Nonconvertible Bonds - 40.1%

|

|||

|

Principal

Amount (a)

|

Value ($)

|

||

|

COMMUNICATION SERVICES - 2.0%

|

|||

|

Diversified Telecommunication Services - 1.8%

|

|||

|

NTT Finance Corp. 4.372% 7/27/27 (b)

|

100,000

|

97,668

|

|

|

TELUS Corp. 3.4% 5/13/32

|

200,000

|

170,491

|

|

|

Verizon Communications, Inc. 3.875% 2/8/29

|

300,000

|

279,208

|

|

|

547,367

|

|||

|

Media - 0.2%

|

|||

|

Comcast Corp. 4.65% 2/15/33

|

50,000

|

48,291

|

|

|

TOTAL COMMUNICATION SERVICES

|

595,658

|

||

|

CONSUMER DISCRETIONARY - 2.1%

|

|||

|

Auto Components - 0.3%

|

|||

|

ZF Finance GmbH 2% 5/6/27 (Reg. S)

|

EUR

|

100,000

|

90,862

|

|

Automobiles - 1.2%

|

|||

|

Ford Motor Co. 3.25% 2/12/32

|

200,000

|

151,158

|

|

|

General Motors Co. 5.4% 10/15/29

|

200,000

|

192,050

|

|

|

343,208

|

|||

|

Household Durables - 0.3%

|

|||

|

The Berkeley Group PLC 2.5% 8/11/31 (Reg. S)

|

GBP

|

100,000

|

85,064

|

|

Textiles, Apparel & Luxury Goods - 0.3%

|

|||

|

AXA Logistics Europe Master SCA 0.375% 11/15/26 (Reg. S)

|

EUR

|

100,000

|

88,284

|

|

TOTAL CONSUMER DISCRETIONARY

|

607,418

|

||

|

CONSUMER STAPLES - 2.4%

|

|||

|

Beverages - 0.4%

|

|||

|

PepsiCo, Inc. 3.9% 7/18/32

|

100,000

|

94,047

|

|

|

Food & Staples Retailing - 0.8%

|

|||

|

Walmart, Inc. 1.8% 9/22/31

|

300,000

|

242,130

|

|

|

Food Products - 1.2%

|

|||

|

General Mills, Inc. 2.25% 10/14/31

|

450,000

|

360,821

|

|

|

TOTAL CONSUMER STAPLES

|

696,998

|

||

|

FINANCIALS - 13.9%

|

|||

|

Banks - 6.7%

|

|||

|

ABN AMRO Bank NV 2.47% 12/13/29 (b)(c)

|

200,000

|

166,689

|

|

|

AIB Group PLC 2.875% 5/30/31 (Reg. S) (c)

|

EUR

|

125,000

|

119,690

|

|

Bank of America Corp. 6.204% 11/10/28 (c)

|

140,000

|

143,945

|

|

|

Bank of Ireland Group PLC 0.375% 5/10/27 (Reg. S) (c)

|

EUR

|

155,000

|

143,377

|

|

Bank of Nova Scotia 0.65% 7/31/24

|

250,000

|

233,829

|

|

|

BNP Paribas SA 0.5% 5/30/28 (Reg. S) (c)

|

EUR

|

100,000

|

89,849

|

|

BPCE SA 0.5% 1/14/28 (Reg. S) (c)

|

EUR

|

100,000

|

90,339

|

|

CaixaBank SA 1.25% 6/18/31 (Reg. S) (c)

|

EUR

|

100,000

|

92,035

|

|

Canadian Imperial Bank of Commerce 0.95% 10/23/25

|

325,000

|

291,272

|

|

|

Fifth Third Bancorp 1.707% 11/1/27 (c)

|

200,000

|

177,465

|

|

|

ING Groep NV:

|

|||

|

0.875% 6/9/32 (Reg. S) (c)

|

EUR

|

100,000

|

89,273

|

|

2.125% 5/23/26 (Reg. S) (c)

|

EUR

|

100,000

|

100,796

|

|

PNC Financial Services Group, Inc. 4.758% 1/26/27 (c)

|

100,000

|

98,501

|

|

|

Santander Holdings U.S.A., Inc. 5.807% 9/9/26 (c)

|

43,000

|

42,992

|

|

|

Wells Fargo & Co. 4.54% 8/15/26 (c)

|

100,000

|

97,578

|

|

|

1,977,630

|

|||

|

Capital Markets - 1.8%

|

|||

|

Deutsche Bank AG 3.25% 5/24/28 (Reg. S) (c)

|

EUR

|

100,000

|

98,244

|

|

S&P Global, Inc. 2.7% 3/1/29 (b)

|

400,000

|

351,282

|

|

|

State Street Corp. 5.751% 11/4/26 (c)

|

100,000

|

101,385

|

|

|

550,911

|

|||

|

Diversified Financial Services - 2.2%

|

|||

|

Acciona Energia Financiacion Filiales SA 0.375% 10/7/27 (Reg. S)

|

EUR

|

100,000

|

91,290

|

|

ACEF Holding SCA 1.25% 4/26/30 (Reg. S)

|

EUR

|

100,000

|

77,631

|

|

CBRE Global Investors Pan European Core Fund 0.9% 10/12/29 (Reg. S)

|

EUR

|

100,000

|

76,263

|

|

Rexford Industrial Realty LP 2.15% 9/1/31

|

314,000

|

242,924

|

|

|

VMED O2 UK Financing I PLC 4.75% 7/15/31 (b)

|

200,000

|

165,640

|

|

|

653,748

|

|||

|

Insurance - 3.2%

|

|||

|

Metropolitan Life Global Funding I 0.95% 7/2/25 (b)

|

250,000

|

226,774

|

|

|

Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen 5.875% 5/23/42 (b)(c)

|

200,000

|

201,000

|

|

|

Pacific Life Global Funding II 1.375% 4/14/26 (b)

|

250,000

|

222,219

|

|

|

Prudential Financial, Inc. 1.5% 3/10/26

|

325,000

|

292,920

|

|

|

942,913

|

|||

|

TOTAL FINANCIALS

|

4,125,202

|

||

|

HEALTH CARE - 1.0%

|

|||

|

Health Care Providers & Services - 0.1%

|

|||

|

Kaiser Foundation Hospitals 3.15% 5/1/27

|

50,000

|

46,905

|

|

|

Pharmaceuticals - 0.9%

|

|||

|

Merck & Co., Inc. 1.9% 12/10/28

|

300,000

|

257,233

|

|

|

TOTAL HEALTH CARE

|

304,138

|

||

|

INDUSTRIALS - 0.3%

|

|||

|

Transportation Infrastructure - 0.3%

|

|||

|

Holding d'Infrastructures et des Metiers de l'Environnement 0.125% 9/16/25 (Reg. S)

|

EUR

|

100,000

|

94,601

|

|

INFORMATION TECHNOLOGY - 3.4%

|

|||

|

Semiconductors & Semiconductor Equipment - 2.6%

|

|||

|

Analog Devices, Inc. 1.7% 10/1/28

|

300,000

|

252,788

|

|

|

ASML Holding NV 2.25% 5/17/32 (Reg. S)

|

EUR

|

100,000

|

95,999

|

|

Micron Technology, Inc. 2.703% 4/15/32

|

200,000

|

151,750

|

|

|

NXP BV/NXP Funding LLC/NXP U.S.A., Inc.:

|

|||

|

2.5% 5/11/31

|

100,000

|

78,465

|

|

|

5% 1/15/33

|

200,000

|

186,788

|

|

|

765,790

|

|||

|

Software - 0.8%

|

|||

|

Autodesk, Inc. 2.4% 12/15/31

|

300,000

|

239,973

|

|

|

TOTAL INFORMATION TECHNOLOGY

|

1,005,763

|

||

|

MATERIALS - 0.6%

|

|||

|

Chemicals - 0.6%

|

|||

|

Air Products & Chemicals, Inc. 4.8% 3/3/33

|

100,000

|

99,619

|

|

|

Evonik Industries AG 1.375% 9/2/81 (Reg. S) (c)

|

EUR

|

100,000

|

89,376

|

|

188,995

|

|||

|

REAL ESTATE - 2.8%

|

|||

|

Equity Real Estate Investment Trusts (REITs) - 1.9%

|

|||

|

Boston Properties, Inc. 6.75% 12/1/27

|

22,000

|

22,834

|

|

|

Hudson Pacific Properties LP 5.95% 2/15/28

|

151,000

|

140,372

|

|

|

UDR, Inc. 1.9% 3/15/33

|

375,000

|

271,682

|

|

|

WP Carey, Inc. 2.45% 2/1/32

|

150,000

|

118,529

|

|

|

553,417

|

|||

|

Real Estate Management & Development - 0.9%

|

|||

|

Blackstone Property Partners Europe LP 1.625% 4/20/30 (Reg. S)

|

EUR

|

100,000

|

74,174

|

|

CTP BV 0.5% 6/21/25 (Reg. S)

|

EUR

|

100,000

|

94,248

|

|

Lend Lease Finance Ltd. 3.4% 10/27/27 (Reg. S)

|

AUD

|

30,000

|

17,912

|

|

P3 Group SARL 0.875% 1/26/26 (Reg. S)

|

EUR

|

100,000

|

93,251

|

|

279,585

|

|||

|

TOTAL REAL ESTATE

|

833,002

|

||

|

UTILITIES - 11.6%

|

|||

|

Electric Utilities - 8.6%

|

|||

|

Clearway Energy Operating LLC 3.75% 1/15/32 (b)

|

100,000

|

79,250

|

|

|

EnBW Energie Baden-Wuerttemberg AG 1.875% 6/29/80 (Reg. S) (c)

|

EUR

|

100,000

|

93,474

|

|

ENEL Finance International NV 1.375% 7/12/26 (b)

|

600,000

|

520,674

|

|

|

Energias de Portugal SA 1.7% 7/20/80 (Reg. S) (c)

|

EUR

|

100,000

|

95,193

|

|

Northern States Power Co. 2.25% 4/1/31

|

500,000

|

412,760

|

|

|

NSTAR Electric Co. 4.95% 9/15/52

|

400,000

|

382,003

|

|

|

Oncor Electric Delivery Co. LLC 4.15% 6/1/32

|

100,000

|

93,964

|

|

|

Public Service Co. of Colorado:

|

|||

|

2.7% 1/15/51

|

300,000

|

195,140

|

|

|

3.7% 6/15/28

|

325,000

|

306,879

|

|

|

Wisconsin Electric Power Co. 4.75% 9/30/32

|

400,000

|

390,938

|

|

|

2,570,275

|

|||

|

Independent Power and Renewable Electricity Producers - 2.0%

|

|||

|

Atlantica Sustainable Infrastructure PLC 4.125% 6/15/28 (b)

|

200,000

|

176,517

|

|

|

RWE AG 2.125% 5/24/26 (Reg. S)

|

EUR

|

100,000

|

99,962

|

|

The AES Corp. 2.45% 1/15/31

|

400,000

|

317,734

|

|

|

594,213

|

|||

|

Multi-Utilities - 1.0%

|

|||

|

Consolidated Edison Co. of New York, Inc. 3.35% 4/1/30

|

325,000

|

290,468

|

|

|

TOTAL UTILITIES

|

3,454,956

|

||

|

TOTAL NONCONVERTIBLE BONDS

(Cost $13,394,881)

|

11,906,731

|

||

|

U.S. Government and Government Agency Obligations - 34.8%

|

|||

|

Principal

Amount (a)

|

Value ($)

|

||

|

U.S. Government Agency Obligations - 0.5%

|

|||

|

Tennessee Valley Authority 1.5% 9/15/31

|

200,000

|

158,679

|

|

|

U.S. Treasury Obligations - 34.3%

|

|||

|

U.S. Treasury Bonds:

|

|||

|

1.875% 11/15/51

|

750,000

|

487,793

|

|

|

2% 11/15/41 (d)

|

2,820,000

|

2,038,221

|

|

|

2.25% 2/15/52

|

170,000

|

121,211

|

|

|

2.875% 5/15/52

|

1,360,000

|

1,113,659

|

|

|

3% 8/15/52

|

385,000

|

323,641

|

|

|

U.S. Treasury Notes:

|

|||

|

0.25% 6/15/24 (d)

|

150,000

|

140,965

|

|

|

2.75% 8/15/32

|

850,000

|

772,438

|

|

|

2.875% 5/15/32

|

80,000

|

73,575

|

|

|

3% 7/15/25

|

1,375,000

|

1,323,921

|

|

|

3.25% 6/30/27

|

2,320,000

|

2,226,019

|

|

|

3.5% 1/31/28

|

120,000

|

116,353

|

|

|

3.5% 2/15/33

|

200,000

|

193,406

|

|

|

4.125% 10/31/27

|

690,000

|

686,550

|

|

|

4.125% 11/15/32

|

200,000

|

203,188

|

|

|

4.375% 10/31/24

|

375,000

|

371,484

|

|

|

TOTAL U.S. TREASURY OBLIGATIONS

|

10,192,424

|

||

|

TOTAL U.S. GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS

(Cost $11,719,064)

|

10,351,103

|

||

|

U.S. Government Agency - Mortgage Securities - 12.3%

|

|||

|

Principal

Amount (a)

|

Value ($)

|

||

|

Fannie Mae - 4.7%

|

|||

|

2% 6/1/36 to 11/1/41

|

389,054

|

335,142

|

|

|

3% 1/1/52

|

979,610

|

863,208

|

|

|

4.5% 12/1/52

|

200,000

|

192,892

|

|

|

TOTAL FANNIE MAE

|

1,391,242

|

||

|

Freddie Mac - 7.3%

|

|||

|

2% 4/1/51 to 1/1/52

|

557,231

|

454,472

|

|

|

2.5% 2/1/52 to 3/1/52

|

1,354,828

|

1,148,454

|

|

|

3.5% 6/1/52

|

99,584

|

90,795

|

|

|

4% 12/1/52

|

199,494

|

187,436

|

|

|

1.5% 12/1/31

|

300,557

|

269,965

|

|

|

TOTAL FREDDIE MAC

|

2,151,122

|

||

|

Uniform Mortgage Backed Securities - 0.3%

|

|||

|

5% 3/1/53 (e)

|

100,000

|

98,266

|

|

|

TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES

(Cost $4,013,594)

|

3,640,630

|

||

|

Asset-Backed Securities - 2.4%

|

|||

|

Principal

Amount (a)

|

Value ($)

|

||

|

GoodLeap Sustainable Home Solutions Trust Series 2021-5CS Class A, 2.31% 10/20/48 (b)

|

340,150

|

268,920

|

|

|

Hertz Vehicle Financing III LLC Series 2023-1A Class A, 5.49% 6/25/27 (b)

|

100,000

|

99,770

|

|

|

Sunnova Helios Viii Issuer LLC Series 2022-A Class A, 2.79% 2/22/49 (b)

|

233,382

|

198,631

|

|

|

Sunrun Callisto Issuer, LLC Series 2021-2A Class A, 2.27% 1/30/57 (b)

|

187,786

|

147,572

|

|

|

TOTAL ASSET-BACKED SECURITIES

(Cost $858,124)

|

714,893

|

||

|

Commercial Mortgage Securities - 1.6%

|

|||

|

Principal

Amount (a)

|

Value ($)

|

||

|

Freddie Mac sequential payer:

|

|||

|

Series 2020-KG03 Class A2, 1.297% 6/25/30

|

160,000

|

128,182

|

|

|

Series 2022-KG07 Class A2, 3.123% 8/25/32

|

200,000

|

178,832

|

|

|

Series 2022-KSG4 Class A2, 3.4% 8/25/32 (c)

|

200,000

|

182,915

|

|

|

TOTAL COMMERCIAL MORTGAGE SECURITIES

(Cost $541,641)

|

489,929

|

||

|

Foreign Government and Government Agency Obligations - 1.8%

|

|||

|

Principal

Amount (a)

|

Value ($)

|

||

|

German Federal Republic 0% 8/15/31(Reg. S) (d)

|

EUR

|

486,000

|

414,566

|

|

Uruguay Republic 5.75% 10/28/34

|

100,000

|

107,500

|

|

|

TOTAL FOREIGN GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS

(Cost $528,482)

|

522,066

|

||

|

Preferred Securities - 2.6%

|

|||

|

Principal

Amount (a)

|

Value ($)

|

||

|

COMMUNICATION SERVICES - 0.3%

|

|||

|

Diversified Telecommunication Services - 0.3%

|

|||

|

Telefonica Europe BV 2.502% (Reg. S) (c)(f)

|

EUR

|

100,000

|

92,767

|

|

FINANCIALS - 0.7%

|

|||

|

Banks - 0.7%

|

|||

|

Banco Bilbao Vizcaya Argentaria SA 6% (Reg. S) (c)(f)

|

EUR

|

200,000

|

204,280

|

|

REAL ESTATE - 0.2%

|

|||

|

Real Estate Management & Development - 0.2%

|

|||

|

Citycon Oyj 4.496% (Reg. S) (c)(f)

|

EUR

|

100,000

|

64,704

|

|

UTILITIES - 1.4%

|

|||

|

Electric Utilities - 1.4%

|

|||

|

Iberdrola International BV 3.25% (Reg. S) (c)(f)

|

EUR

|

100,000

|

102,027

|

|

ORSTED A/S 2.25% (Reg. S) (c)(f)

|

EUR

|

100,000

|

100,624

|

|

TenneT Holding BV 2.995% (Reg. S) (c)(f)

|

EUR

|

125,000

|

132,365

|

|

Terna - Rete Elettrica Nazionale 2.375% (Reg. S) (c)(f)

|

EUR

|

100,000

|

88,185

|

|

423,201

|

|||

|

TOTAL PREFERRED SECURITIES

(Cost $1,026,260)

|

784,952

|

||

|

Money Market Funds - 6.2%

|

|||

|

Shares

|

Value ($)

|

||

|

Fidelity Cash Central Fund 4.63% (g)

(Cost $1,852,794)

|

1,852,423

|

1,852,794

|

|

|

TOTAL INVESTMENT IN SECURITIES - 101.8%

(Cost $33,934,840)

|

30,263,098

|

|

NET OTHER ASSETS (LIABILITIES) - (1.8)%

|

(546,313)

|

|

NET ASSETS - 100.0%

|

29,716,785

|

|

Futures Contracts

|

|||||

|

Number

of contracts

|

Expiration

Date

|

Notional

Amount ($)

|

Value ($)

|

Unrealized

Appreciation/

(Depreciation) ($)

|

|

|

Purchased

|

|||||

|

Treasury Contracts

|

|||||

|

CBOT 5-Year U.S. Treasury Note Contracts (United States)

|

3

|

Jun 2023

|

321,164

|

(404)

|

(404)

|

|

Sold

|

|||||

|

Bond Index Contracts

|

|||||

|

Eurex Euro-Bobl Contracts (Germany)

|

12

|

Mar 2023

|

1,461,911

|

56,548

|

56,548

|

|

Eurex Euro-Bund Contracts (Germany)

|

3

|

Mar 2023

|

421,737

|

27,735

|

27,735

|

|

Eurex Euro-Schatz Contracts (Germany)

|

13

|

Mar 2023

|

1,443,486

|

22,867

|

22,867

|

|

TOTAL BOND INDEX CONTRACTS

|

107,150

|

||||

|

Treasury Contracts

|

|||||

|

CBOT Ultra 10-Year U.S. Treasury Note Contracts (United States)

|

5

|

Jun 2023

|

585,938

|

(1,730)

|

(1,730)

|

|

TOTAL SOLD

|

105,420

|

||||

|

TOTAL FUTURES CONTRACTS

|

105,016

|

||||

|

The notional amount of futures purchased as a percentage of Net Assets is 1.1%

|

|||||

|

The notional amount of futures sold as a percentage of Net Assets is 13.2%

|

|||||

|

Forward Foreign Currency Contracts

|

||||||

|

Currency

Purchased

|

Currency

Sold

|

Counterparty

|

Settlement

Date

|

Unrealized

Appreciation/

(Depreciation) ($)

|

||

|

EUR

|

52,000

|

USD

|

55,053

|

State Street Bank and Trust Co

|

3/01/23

|

(53)

|

|

EUR

|

4,000

|

USD

|

4,245

|

JPMorgan Chase Bank, N.A.

|

3/02/23

|

(15)

|

|

AUD

|

17,000

|

USD

|

12,073

|

Brown Brothers Harriman & Co

|

4/20/23

|

(613)

|

|

EUR

|

3,000

|

USD

|

3,187

|

BNP Paribas S.A.

|

4/20/23

|

(5)

|

|

EUR

|

86,000

|

USD

|

93,952

|

Bank of America, N.A.

|

4/20/23

|

(2,720)

|

|

EUR

|

10,000

|

USD

|

10,722

|

Bank of America, N.A.

|

4/20/23

|

(113)

|

|

EUR

|

4,000

|

USD

|

4,321

|

Bank of America, N.A.

|

4/20/23

|

(78)

|

|

EUR

|

36,000

|

USD

|

38,570

|

Bank of America, N.A.

|

4/20/23

|

(380)

|

|

EUR

|

4,000

|

USD

|

4,284

|

Bank of America, N.A.

|

4/20/23

|

(41)

|

|

EUR

|

78,000

|

USD

|

82,535

|

Bank of America, N.A.

|

4/20/23

|

210

|

|

EUR

|

6,000

|

USD

|

6,496

|

Brown Brothers Harriman & Co

|

4/20/23

|

(131)

|

|

EUR

|

4,000

|

USD

|

4,356

|

Brown Brothers Harriman & Co

|

4/20/23

|

(113)

|

|

EUR

|

12,000

|

USD

|

13,114

|

Brown Brothers Harriman & Co

|

4/20/23

|

(384)

|

|

EUR

|

851,000

|

USD

|

931,694

|

Brown Brothers Harriman & Co

|

4/20/23

|

(28,922)

|

|

EUR

|

14,000

|

USD

|

14,954

|

Brown Brothers Harriman & Co

|

4/20/23

|

(102)

|

|

EUR

|

75,000

|

USD

|

81,827

|

JPMorgan Chase Bank, N.A.

|

4/20/23

|

(2,264)

|

|

EUR

|

5,000

|

USD

|

5,394

|

JPMorgan Chase Bank, N.A.

|

4/20/23

|

(90)

|

|

EUR

|

11,000

|

USD

|

11,837

|

JPMorgan Chase Bank, N.A.

|

4/20/23

|

(168)

|

|

EUR

|

3,000

|

USD

|

3,203

|

JPMorgan Chase Bank, N.A.

|

4/20/23

|

(21)

|

|

GBP

|

2,000

|

USD

|

2,407

|

Bank of America, N.A.

|

4/20/23

|

1

|

|

GBP

|

87,000

|

USD

|

107,596

|

Brown Brothers Harriman & Co

|

4/20/23

|

(2,851)

|

|

USD

|

30,669

|

AUD

|

44,000

|

HSBC Bank

|

4/20/23

|

1,009

|

|

USD

|

4,484,074

|

EUR

|

4,141,000

|

BNP Paribas S.A.

|

4/20/23

|

91,150

|

|

USD

|

18,526

|

EUR

|

17,000

|

BNP Paribas S.A.

|

4/20/23

|

491

|

|

USD

|

2,181

|

EUR

|

2,000

|

Brown Brothers Harriman & Co

|

4/20/23

|

60

|

|

USD

|

7,638

|

EUR

|

7,000

|

Brown Brothers Harriman & Co

|

4/20/23

|

212

|

|

USD

|

38,421

|

EUR

|

35,000

|

Brown Brothers Harriman & Co

|

4/20/23

|

1,292

|

|

USD

|

7,563

|

EUR

|

7,000

|

Citibank, N. A.

|

4/20/23

|

137

|

|

USD

|

30,467

|

EUR

|

28,000

|

JPMorgan Chase Bank, N.A.

|

4/20/23

|

763

|

|

USD

|

18,450

|

EUR

|

17,000

|

JPMorgan Chase Bank, N.A.

|

4/20/23

|

416

|

|

USD

|

2,194

|

EUR

|

2,000

|

JPMorgan Chase Bank, N.A.

|

4/20/23

|

72

|

|

USD

|

4,397

|

EUR

|

4,000

|

JPMorgan Chase Bank, N.A.

|

4/20/23

|

154

|

|

USD

|

14,148

|

EUR

|

13,000

|

State Street Bank and Trust Co

|

4/20/23

|

357

|

|

USD

|

45,659

|

EUR

|

43,000

|

State Street Bank and Trust Co

|

4/20/23

|

43

|

|

USD

|

208,969

|

GBP

|

171,000

|

Bank of America, N.A.

|

4/20/23

|

3,090

|

|

USD

|

3,714

|

GBP

|

3,000

|

Bank of America, N.A.

|

4/20/23

|

102

|

|

USD

|

3,673

|

GBP

|

3,000

|

JPMorgan Chase Bank, N.A.

|

4/20/23

|

61

|

|

USD

|

2,455

|

GBP

|

2,000

|

JPMorgan Chase Bank, N.A.

|

4/20/23

|

47

|

|

TOTAL FORWARD FOREIGN CURRENCY CONTRACTS

|

60,603

|

|||||

|

Unrealized Appreciation

|

99,667

|

|||||

|

Unrealized Depreciation

|

(39,064)

|

|||||

|

AUD

|

-

|

Australian dollar

|

|

EUR

|

-

|

European Monetary Unit

|

|

GBP

|

-

|

British pound sterling

|

|

USD

|

-

|

U.S. dollar

|

|

(a)

|

Amount is stated in United States dollars unless otherwise noted.

|

|

(b)

|

Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $2,922,606 or 9.8% of net assets.

|

|

(c)

|

Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

|

|

(d)

|

Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $129,817.

|

|

(e)

|

Security or a portion of the security purchased on a delayed delivery or when-issued basis.

|

|

(f)

|

Security is perpetual in nature with no stated maturity date.

|

|

(g)

|

Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

|

|

Affiliate

|

Value,

beginning

of period ($)

|

Purchases ($)

|

Sales

Proceeds ($)

|

Dividend

Income ($)

|

Realized

Gain (loss) ($)

|

Change in

Unrealized

appreciation

(depreciation) ($)

|

Value,

end

of period ($)

|

% ownership,

end

of period

|

|

Fidelity Cash Central Fund 4.63%

|

1,783,992

|

6,822,963

|

6,754,161

|

26,066

|

-

|

-

|

1,852,794

|

0.0%

|

|

Total

|

1,783,992

|

6,822,963

|

6,754,161

|

26,066

|

-

|

-

|

1,852,794

|

|

|

Valuation Inputs at Reporting Date:

|

||||

|

Description

|

Total ($)

|

Level 1 ($)

|

Level 2 ($)

|

Level 3 ($)

|

|

Investments in Securities:

|

||||

|

Corporate Bonds

|

11,906,731

|

-

|

11,906,731

|

-

|

|

U.S. Government and Government Agency Obligations

|

10,351,103

|

-

|

10,351,103

|

-

|

|

U.S. Government Agency - Mortgage Securities

|

3,640,630

|

-

|

3,640,630

|

-

|

|

Asset-Backed Securities

|

714,893

|

-

|

714,893

|

-

|

|

Commercial Mortgage Securities

|

489,929

|

-

|

489,929

|

-

|

|

Foreign Government and Government Agency Obligations

|

522,066

|

-

|

522,066

|

-

|

|

Preferred Securities

|

784,952

|

-

|

784,952

|

-

|

|

Money Market Funds

|

1,852,794

|

1,852,794

|

-

|

-

|

|

Total Investments in Securities:

|

30,263,098

|

1,852,794

|

28,410,304

|

-

|

|

Derivative Instruments:

|

||||

|

Assets

|

||||

|

Futures Contracts

|

107,150

|

107,150

|

-

|

-

|

|

Forward Foreign Currency Contracts

|

99,667

|

-

|

99,667

|

-

|

|

Total Assets

|

206,817

|

107,150

|

99,667

|

-

|

|

Liabilities

|

||||

|

Futures Contracts

|

(2,134)

|

(2,134)

|

-

|

-

|

|

Forward Foreign Currency Contracts

|

(39,064)

|

-

|

(39,064)

|

-

|

|

Total Liabilities

|

(41,198)

|

(2,134)

|

(39,064)

|

-

|

|

Total Derivative Instruments:

|

165,619

|

105,016

|

60,603

|

-

|

|

Primary Risk Exposure / Derivative Type

|

Value

|

|

|

Asset ($)

|

Liability ($)

|

|

|

Foreign Exchange Risk

|

||

|

Forward Foreign Currency Contracts

(a)

|

99,667

|

(39,064)

|

|

Total Foreign Exchange Risk

|

99,667

|

(39,064)

|

|

Interest Rate Risk

|

||

|

Futures Contracts

(b)

|

107,150

|

(2,134)

|

|

Total Interest Rate Risk

|

107,150

|

(2,134)

|

|

Total Value of Derivatives

|

206,817

|

(41,198)

|

|

Statement of Assets and Liabilities

|

||||

|

February 28, 2023

(Unaudited)

|

||||

|

Assets

|

||||

|

Investment in securities, at value - See accompanying schedule:

|

||||

|

Unaffiliated issuers (cost $32,082,046)

|

$

|

28,410,304

|

||

|

Fidelity Central Funds (cost $1,852,794)

|

1,852,794

|

|||

|

Total Investment in Securities (cost $33,934,840)

|

$

|

30,263,098

|

||

|

Cash

|

11,287

|

|||

|

Foreign currency held at value (cost $36,145)

|

35,610

|

|||

|

Unrealized appreciation on forward foreign currency contracts

|

99,667

|

|||

|

Receivable for fund shares sold

|

7,158

|

|||

|

Interest receivable

|

197,330

|

|||

|

Distributions receivable from Fidelity Central Funds

|

5,281

|

|||

|

Receivable for daily variation margin on futures contracts

|

7,620

|

|||

|

Receivable from investment adviser for expense reductions

|

914

|

|||

|

Total assets

|

30,627,965

|

|||

|

Liabilities

|

||||

|

Payable for investments purchased

|

||||

|

Regular delivery

|

$

|

688,245

|

||

|

Delayed delivery

|

99,840

|

|||

|

Unrealized depreciation on forward foreign currency contracts

|

39,064

|

|||

|

Payable for fund shares redeemed

|

38,657

|

|||

|

Distributions payable

|

33,829

|

|||

|

Accrued management fee

|

8,729

|

|||

|

Distribution and service plan fees payable

|

944

|

|||

|

Other affiliated payables

|

1,872

|

|||

|

Total Liabilities

|

911,180

|

|||

|

Net Assets

|

$

|

29,716,785

|

||

|

Net Assets consist of:

|

||||

|

Paid in capital

|

$

|

42,242,357

|

||

|

Total accumulated earnings (loss)

|

(12,525,572)

|

|||

|

Net Assets

|

$

|

29,716,785

|

||

|

Net Asset Value and Maximum Offering Price

|

||||

|

Class A :

|

||||

|

Net Asset Value

and redemption price per share ($974,646 ÷ 116,457 shares)

(a)

|

$

|

8.37

|

||

|

Maximum offering price per share (100/96.00 of $8.37)

|

$

|

8.72

|

||

|

Class M :

|

||||

|

Net Asset Value

and redemption price per share ($725,343 ÷ 86,670 shares)

(a)

|

$

|

8.37

|

||

|

Maximum offering price per share (100/96.00 of $8.37)

|

$

|

8.72

|

||

|

Class C :

|

||||

|

Net Asset Value

and offering price per share ($730,042 ÷ 87,315 shares)

(a)

|

$

|

8.36

|

||

|

Fidelity Environmental Bond Fund :

|

||||

|

Net Asset Value

, offering price and redemption price per share ($10,945,368 ÷ 1,307,830 shares)

|

$

|

8.37

|

||

|

Class I :

|

||||

|

Net Asset Value

, offering price and redemption price per share ($649,353 ÷ 77,654 shares)

|

$

|

8.36

|

||

|

Class Z :

|

||||

|

Net Asset Value

, offering price and redemption price per share ($15,692,033 ÷ 1,875,068 shares)

|

$

|

8.37

|

||

|

(a)Redemption price per

share

is equal to net asset value less any applicable contingent deferred sales charge.

|

||||

|

Statement of Operations

|

||||

|

Six months ended

February 28, 2023

(Unaudited)

|

||||

|

Investment Income

|

||||

|

Dividends

|

$

|

19,296

|

||

|

Interest

|

428,512

|

|||

|

Income from Fidelity Central Funds

|

26,066

|

|||

|

Total Income

|

473,874

|

|||

|

Expenses

|

||||

|

Management fee

|

$

|

51,686

|

||

|

Transfer agent fees

|

11,180

|

|||

|

Distribution and service plan fees

|

5,505

|

|||

|

Independent trustees' fees and expenses

|

63

|

|||

|

Total expenses before reductions

|

68,434

|

|||

|

Expense reductions

|

(3,672)

|

|||

|

Total expenses after reductions

|

64,762

|

|||

|

Net Investment income (loss)

|

409,112

|

|||

|

Realized and Unrealized Gain (Loss)

|

||||

|

Net realized gain (loss) on:

|

||||

|

Investment Securities:

|

||||

|

Unaffiliated issuers

|

(620,429)

|

|||

|

Forward foreign currency contracts

|

(161,071)

|

|||

|

Foreign currency transactions

|

(2,052)

|

|||

|

Futures contracts

|

110,141

|

|||

|

Total net realized gain (loss)

|

(673,411)

|

|||

|

Change in net unrealized appreciation (depreciation) on:

|

||||

|

Investment Securities:

|

||||

|

Unaffiliated issuers

|

(254,331)

|

|||

|

Forward foreign currency contracts

|

(25,212)

|

|||

|

Assets and liabilities in foreign currencies

|

2,416

|

|||

|

Futures contracts

|

62,493

|

|||

|

Total change in net unrealized appreciation (depreciation)

|

(214,634)

|

|||

|

Net gain (loss)

|

(888,045)

|

|||

|

Net increase (decrease) in net assets resulting from operations

|

$

|

(478,933)

|

||

|

Statement of Changes in Net Assets

|

||||

|

Six months ended

February 28, 2023

(Unaudited)

|

Year ended

August 31, 2022

|

|||

|

Increase (Decrease) in Net Assets

|

||||

|

Operations

|

||||

|

Net investment income (loss)

|

$

|

409,112

|

$

|

869,461

|

|

Net realized gain (loss)

|

(673,411)

|

(8,069,400)

|

||

|

Change in net unrealized appreciation (depreciation)

|

(214,634)

|

(3,326,964)

|

||

|

Net increase (decrease) in net assets resulting from operations

|

(478,933)

|

(10,526,903)

|

||

|

Distributions to shareholders

|

(738,357)

|

(874,786)

|

||

|

Share transactions - net increase (decrease)

|

556,593

|

30,072,001

|

||

|

Total increase (decrease) in net assets

|

(660,697)

|

18,670,312

|

||

|

Net Assets

|

||||

|

Beginning of period

|

30,377,482

|

11,707,170

|

||

|

End of period

|

$

|

29,716,785

|

$

|

30,377,482

|

|

Fidelity Advisor® Environmental Bond Fund Class A

|

|

Six months ended

(Unaudited) February 28, 2023

|

Years ended August 31, 2022

|

2021

A

|

||||

|

Selected Per-Share Data

|

||||||

|

Net asset value, beginning of period

|

$

|

8.71

|

$

|

10.10

|

$

|

10.00

|

|

Income from Investment Operations

|

||||||

|

Net investment income (loss)

B,C

|

.105

|

.101

|

.010

|

|||

|

Net realized and unrealized gain (loss)

|

(.245)

|

(1.386)

|

.101

|

|||

|

Total from investment operations

|

(.140)

|

(1.285)

|

.111

|

|||

|

Distributions from net investment income

|

(.200)

|

(.100)

D

|

(.011)

|

|||

|

Distributions from net realized gain

|

-

|

(.005)

D

|

-

|

|||

|

Total distributions

|

(.200)

|

(.105)

|

(.011)

|

|||

|

Net asset value, end of period

|

$

|

8.37

|

$

|

8.71

|

$

|

10.10

|

|

Total Return

E,F,G

|

(1.60)%

|

(12.79)%

|

1.11%

|

|||

|

Ratios to Average Net Assets

C,H,I

|

||||||

|

Expenses before reductions

|

.71%

J

|

.67%

|

.65%

J

|

|||

|

Expenses net of fee waivers, if any

|

.71%

J

|

.67%

|

.65%

J

|

|||

|

Expenses net of all reductions

|

.71%

J

|

.67%

|

.65%

J

|

|||

|

Net investment income (loss)

|

2.52%

J

|

1.07%

|

.50%

J

|

|||

|

Supplemental Data

|

||||||

|

Net assets, end of period (000 omitted)

|

$

|

975

|

$

|

778

|

$

|

809

|

|

Portfolio turnover rate

K

|

49%

J

|

198%

|

12%

L

|

|

Fidelity Advisor® Environmental Bond Fund Class M

|

|

Six months ended

(Unaudited) February 28, 2023

|

Years ended August 31, 2022

|

2021

A

|

||||

|

Selected Per-Share Data

|

||||||

|

Net asset value, beginning of period

|

$

|

8.71

|

$

|

10.10

|

$

|

10.00

|

|

Income from Investment Operations

|

||||||

|

Net investment income (loss)

B,C

|

.107

|

.101

|

.010

|

|||

|

Net realized and unrealized gain (loss)

|

(.246)

|

(1.386)

|

.101

|

|||

|

Total from investment operations

|

(.139)

|

(1.285)

|

.111

|

|||

|

Distributions from net investment income

|

(.201)

|

(.100)

D

|

(.011)

|

|||

|

Distributions from net realized gain

|

-

|

(.005)

D

|

-

|

|||

|

Total distributions

|

(.201)

|

(.105)

|

(.011)

|

|||

|

Net asset value, end of period

|

$

|

8.37

|

$

|

8.71

|

$

|

10.10

|

|

Total Return

E,F,G

|

(1.59)%

|

(12.78)%

|

1.11%

|

|||

|

Ratios to Average Net Assets

C,H,I

|

||||||

|

Expenses before reductions

|

.69%

J

|

.67%

|

.65%

J

|

|||

|

Expenses net of fee waivers, if any

|

.69%

J

|

.67%

|

.65%

J

|

|||

|

Expenses net of all reductions

|

.69%

J

|

.66%

|

.65%

J

|

|||

|

Net investment income (loss)

|

2.55%

J

|

1.07%

|

.50%

J

|

|||

|

Supplemental Data

|

||||||

|

Net assets, end of period (000 omitted)

|

$

|

725

|

$

|

736

|

$

|

809

|

|

Portfolio turnover rate

K

|

49%

J

|

198%

|

12%

L

|

|

Fidelity Advisor® Environmental Bond Fund Class C

|

|

Six months ended

(Unaudited) February 28, 2023

|

Years ended August 31, 2022

|

2021

A

|

||||

|

Selected Per-Share Data

|

||||||

|

Net asset value, beginning of period

|

$

|

8.70

|

$

|

10.09

|

$

|

10.00

|

|

Income from Investment Operations

|

||||||

|

Net investment income (loss)

B,C

|

.075

|

.030

|

(.005)

|

|||

|

Net realized and unrealized gain (loss)

|

(.246)

|

(1.382)

|

.095

|

|||

|

Total from investment operations

|

(.171)

|

(1.352)

|

.090

|

|||

|

Distributions from net investment income

|

(.169)

|

(.033)

D

|

-

E

|

|||

|

Distributions from net realized gain

|

-

|

(.005)

D

|

-

|

|||

|

Total distributions

|

(.169)

|

(.038)

|

-

E

|

|||

|

Net asset value, end of period

|

$

|

8.36

|

$

|

8.70

|

$

|

10.09

|

|

Total Return

F,G,H

|

(1.96)%

|

(13.42)%

|

.90%

|

|||

|

Ratios to Average Net Assets

C,I,J

|

||||||

|

Expenses before reductions

|

1.45%

K

|

1.42%

|

1.39%

K

|

|||

|

Expenses net of fee waivers, if any

|

1.45%

K

|

1.42%

|

1.39%

K

|

|||

|

Expenses net of all reductions

|

1.44%

K

|

1.42%

|

1.39%

K

|

|||

|

Net investment income (loss)

|

1.79%

K

|

.32%

|

(.25)%

K

|

|||

|

Supplemental Data

|

||||||

|

Net assets, end of period (000 omitted)

|

$

|

730

|

$

|

741

|

$

|

808

|

|

Portfolio turnover rate

L

|

49%

K

|

198%

|

12%

M

|

|

Fidelity® Environmental Bond Fund

|

|

Six months ended

(Unaudited) February 28, 2023

|

Years ended August 31, 2022

|

2021

A

|

||||

|

Selected Per-Share Data

|

||||||

|

Net asset value, beginning of period

|

$

|

8.71

|

$

|

10.10

|

$

|

10.00

|

|

Income from Investment Operations

|

||||||

|

Net investment income (loss)

B,C

|

.116

|

.120

|

.015

|

|||

|

Net realized and unrealized gain (loss)

|

(.245)

|

(1.385)

|

.101

|

|||

|

Total from investment operations

|

(.129)

|

(1.265)

|

.116

|

|||

|

Distributions from net investment income

|

(.211)

|

(.120)

D

|

(.016)

|

|||

|

Distributions from net realized gain

|

-

|

(.005)

D

|

-

|

|||

|

Total distributions

|

(.211)

|

(.125)

|

(.016)

|

|||

|

Net asset value, end of period

|

$

|

8.37

|

$

|

8.71

|

$

|

10.10

|

|

Total Return

E,F

|

(1.47)%

|

(12.60)%

|

1.16%

|

|||

|

Ratios to Average Net Assets

C,G,H

|

||||||

|

Expenses before reductions

|

.45%

I

|

.45%

|

.45%

I

|

|||

|

Expenses net of fee waivers, if any

|

.45%

I

|

.45%

|

.45%

I

|

|||

|

Expenses net of all reductions

|

.45%

I

|

.45%

|

.45%

I

|

|||

|

Net investment income (loss)

|

2.78%

I

|

1.29%

|

.70%

I

|

|||

|

Supplemental Data

|

||||||

|

Net assets, end of period (000 omitted)

|

$

|

10,945

|

$

|

10,796

|

$

|

7,663

|

|

Portfolio turnover rate

J

|

49%

I

|

198%

|

12%

K

|

|

Fidelity Advisor® Environmental Bond Fund Class I

|

|

Six months ended

(Unaudited) February 28, 2023

|

Years ended August 31, 2022

|

2021

A

|

||||

|

Selected Per-Share Data

|

||||||

|

Net asset value, beginning of period

|

$

|

8.70

|

$

|

10.10

|

$

|

10.00

|

|

Income from Investment Operations

|

||||||

|

Net investment income (loss)

B,C

|

.112

|

.109

|

.016

|

|||

|

Net realized and unrealized gain (loss)

|

(.247)

|

(1.372)

|

.100

|

|||

|

Total from investment operations

|

(.135)

|

(1.263)

|

.116

|

|||

|

Distributions from net investment income

|

(.205)

|

(.132)

D

|

(.016)

|

|||

|

Distributions from net realized gain

|

-

|

(.005)

D

|

-

|

|||

|

Total distributions

|

(.205)

|

(.137)

|

(.016)

|

|||

|

Net asset value, end of period

|

$

|

8.36

|

$

|

8.70

|

$

|

10.10

|

|

Total Return

E,F

|

(1.53)%

|

(12.58)%

|

1.16%

|

|||

|

Ratios to Average Net Assets

C,G,H

|

||||||

|

Expenses before reductions

|

.57%

I

|

.60%

|

.40%

I

|

|||

|

Expenses net of fee waivers, if any

|

.57%

I

|

.60%

|

.40%

I

|

|||

|

Expenses net of all reductions

|

.57%

I

|

.59%

|

.40%

I

|

|||

|

Net investment income (loss)

|

2.66%

I

|

1.14%

|

.74%

I

|

|||

|

Supplemental Data

|

||||||

|

Net assets, end of period (000 omitted)

|

$

|

649

|

$

|

996

|

$

|

809

|

|

Portfolio turnover rate

J

|

49%

I

|

198%

|

12%

K

|

|

Fidelity Advisor® Environmental Bond Fund Class Z

|

|

Six months ended

(Unaudited) February 28, 2023

|

Years ended August 31, 2022

|

2021

A

|

||||

|

Selected Per-Share Data

|

||||||

|

Net asset value, beginning of period

|

$

|

8.71

|

$

|

10.10

|

$

|

10.00

|

|

Income from Investment Operations

|

||||||

|

Net investment income (loss)

B,C

|

.120

|

.130

|

.017

|

|||

|

Net realized and unrealized gain (loss)

|

(.245)

|

(1.386)

|

.101

|

|||

|

Total from investment operations

|

(.125)

|

(1.256)

|

.118

|

|||

|

Distributions from net investment income

|

(.215)

|

(.129)

D

|

(.018)

|

|||

|

Distributions from net realized gain

|

-

|

(.005)

D

|

-

|

|||

|

Total distributions

|

(.215)

|

(.134)

|

(.018)

|

|||

|

Net asset value, end of period

|

$

|

8.37

|

$

|

8.71

|

$

|

10.10

|

|

Total Return

E,F

|

(1.42)%

|

(12.52)%

|

1.18%

|

|||

|

Ratios to Average Net Assets

C,G,H

|

||||||

|

Expenses before reductions

|

.40%

I

|

.40%

|

.40%

I

|

|||

|

Expenses net of fee waivers, if any

|

.36%

I

|

.36%

|

.36%

I

|

|||

|

Expenses net of all reductions

|

.36%

I

|

.36%

|

.36%

I

|

|||

|

Net investment income (loss)

|

2.88%

I

|

1.38%

|

.78%

I

|

|||

|

Supplemental Data

|

||||||

|

Net assets, end of period (000 omitted)

|

$

|

15,692

|

$

|

16,331

|

$

|

809

|

|

Portfolio turnover rate

J

|

49%

I

|

198%

|

12%

K

|

|

Fidelity Central Fund

|

Investment Manager

|

Investment Objective

|

Investment Practices

|

Expense Ratio

A

|

|

Fidelity Money Market Central Funds

|

Fidelity Management & Research Company LLC (FMR)

|

Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity.

|

Short-term Investments

|

Less than .005%

|

|

Gross unrealized appreciation

|

$232,156

|

|

Gross unrealized depreciation

|

(3,968,545)

|

|

Net unrealized appreciation (depreciation)

|

$(3,736,389)

|

|

Tax cost

|

$34,165,106

|

|

Short-term

|

$(8,304,797)

|

|

Long-term

|

(97,177)

|

|

Total capital loss carryforward

|

$(8,401,974)

|

|

|

|

|

Foreign Exchange Risk

|

Foreign exchange rate risk relates to fluctuations in the value of an asset or liability due to changes in currency exchange rates.

|

|

Interest Rate Risk

|

Interest rate risk relates to the fluctuations in the value of interest-bearing securities due to changes in the prevailing levels of market interest rates.

|

|

Primary Risk Exposure / Derivative Type

|

Net Realized Gain (Loss)

|

Change in Net Unrealized Appreciation (Depreciation)

|

|

Fidelity Environmental Bond Fund

|

|

|

|

Foreign Exchange Risk

|

|

|

|

Forward Foreign Currency Contracts

|

$(161,071)

|

$(25,212)

|

|

Total Foreign Exchange Risk

|

(161,071)

|

(25,212)

|

|

Interest Rate Risk

|

|

|

|

Futures Contracts

|

110,141

|

62,493

|

|

Total Interest Rate Risk

|

110,141

|

62,493

|

|

Totals

|

$(50,930)

|

$37,281

|

|

|

Purchases ($)

|

Sales ($)

|

|

Fidelity Environmental Bond Fund

|

3,592,854

|

3,436,034

|

|

|

Distribution Fee

|

Service Fee

|

Total Fees

|

Retained by FDC

|

|

Class A

|

- %

|

.25%

|

$989

|

$851

|

|

Class M

|

- %

|

.25%

|

900

|

862

|

|

Class C

|

.75%

|

.25%

|

3,616

|

3,498

|

|

|

|

|

$5,505

|

$5,211

|

|

|

Retained by FDC

|

|

Class A

|

$13

|

|

Class M

|

2

|

|

|

$15

|

|

|

Amount

|

% of Class-Level Average Net Assets

A

|

|

Class A

|

$420

|

.11

|

|

Class M

|

302

|

.08

|

|

Class C

|

300

|

.08

|

|

Fidelity Environmental Bond Fund

|

5,390

|

.10

|

|

Class I

|

825

|

.22

|

|

Class Z

|

3,943

|

.05

|

|

|

$11,180

|

|

|

|

Expense Limitations

|

Reimbursement

|

|

Class Z

|

.36%

|

$3,390

|

|

|

Six months ended

February 28, 2023

|

Year ended

August 31, 2022

|

|

Fidelity Environmental Bond Fund

|

|

|

|

Distributions to shareholders

|

|

|

|

Class A

|

$18,682

|

$9,091

|

|

Class M

|

17,110

|

8,571

|

|

Class C

|

14,474

|

3,199

|

|

Fidelity Environmental Bond Fund

|

269,801

|

137,201

|

|

Class I

|

17,904

|

186,400

|

|

Class Z

|

400,386

|

530,324

|

|

Total

|

$738,357

|

$874,786

|

|

|

Shares

|

Shares

|

Dollars

|

Dollars

|

|

|

Six months ended

February 28, 2023

|

Year ended

August 31, 2022

|

Six months ended

February 28, 2023

|

Year ended

August 31, 2022

|

|

Fidelity Environmental Bond Fund

|

|

|

|

|

|

Class A

|

|

|

|

|

|

Shares sold

|

25,090

|

8,862

|

$210,141

|

$86,250

|

|

Reinvestment of distributions

|

2,225

|

975

|

18,682

|

9,091

|

|

Shares redeemed

|

(146)

|

(635)

|

(1,238)

|

(5,913)

|

|

Net increase (decrease)

|

27,169

|

9,202

|

$227,585

|

$89,428

|

|

Class M

|

|

|

|

|

|

Shares sold

|

120

|

3,509

|

$1,015

|

$31,738

|

|

Reinvestment of distributions

|

2,038

|

919

|

17,110

|

8,571

|

|

Shares redeemed

|

(2)

|

-

|

(15)

|

-

|

|

Net increase (decrease)

|

2,156

|

4,428

|

$18,110

|

$40,309

|

|

Class C

|

|

|

|

|

|

Shares sold

|

676

|

4,759

|

$5,749

|

$45,195

|

|

Reinvestment of distributions

|

1,724

|

347

|

14,474

|

3,199

|

|

Shares redeemed

|

(192)

|

-

|

(1,599)

|

(4)

|

|

Net increase (decrease)

|

2,208

|

5,106

|

$18,624

|

$48,390

|

|

Fidelity Environmental Bond Fund

|

|

|

|

|

|

Shares sold

|

125,149

|

633,009

|

$1,057,606

|

$6,136,270

|

|

Reinvestment of distributions

|

28,320

|

13,467

|

237,714

|

125,175

|

|

Shares redeemed

|

(85,100)

|

(165,841)

|

(717,647)

|

(1,556,252)

|

|

Net increase (decrease)

|

68,369

|

480,635

|

$577,673

|

$4,705,193

|

|

Class I

|

|

|

|

|

|

Shares sold

|

17,695

|

3,876,416

|

$148,507

|

$38,185,205

|

|

Reinvestment of distributions

|

2,028

|

18,854

|

17,009

|

179,111

|

|

Shares redeemed

|

(56,564)

|

(3,860,903)

|

(471,187)

|

(35,321,990)

|

|

Net increase (decrease)

|

(36,841)

|

34,367

|

$(305,671)

|

$3,042,326

|

|

Class Z

|

|

|

|

|

|

Shares sold

|

137,254

|

7,890,789

|

$1,157,700

|

$77,233,768

|

|

Reinvestment of distributions

|

3,022

|

38,714

|

25,324

|

366,403

|

|

Shares redeemed

|

(140,183)

|

(6,134,667)

|

(1,162,752)

|

(55,453,816)

|

|

Net increase (decrease)

|

93

|

1,794,836

|

$20,272

|

$22,146,355

|

|

Fund

|

Affiliated %

|

|

Fidelity Environmental Bond Fund

|

23%

|

|

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2022 to February 28, 2023).

|

|

Annualized Expense Ratio-

A

|

Beginning Account Value September 1, 2022

|

Ending Account Value February 28, 2023

|

Expenses Paid During Period-

C

September 1, 2022 to February 28, 2023

|

|||||||

|

Fidelity® Environmental Bond Fund

|

||||||||||

|

Class A

|

.71%

|

|||||||||

|

Actual

|

$ 1,000

|

$ 984.00

|

$ 3.49

|

|||||||

|

Hypothetical-

B

|

$ 1,000

|

$ 1,021.27

|

$ 3.56

|

|||||||

|

Class M

|

.69%

|

|||||||||

|

Actual

|

$ 1,000

|

$ 984.10

|

$ 3.39

|

|||||||

|

Hypothetical-

B

|

$ 1,000

|

$ 1,021.37

|

$ 3.46

|

|||||||

|

Class C

|

1.45%

|

|||||||||

|

Actual

|

$ 1,000

|

$ 980.40

|

$ 7.12

|

|||||||

|

Hypothetical-

B

|

$ 1,000

|

$ 1,017.60

|

$ 7.25

|

|||||||

|

Fidelity® Environmental Bond Fund

|

.45%

|

|||||||||

|

Actual

|

$ 1,000

|

$ 985.30

|

$ 2.22

|

|||||||

|

Hypothetical-

B

|

$ 1,000

|

$ 1,022.56

|

$ 2.26

|

|||||||

|

Class I

|

.57%

|

|||||||||

|

Actual

|

$ 1,000

|

$ 984.70

|

$ 2.80

|

|||||||

|

Hypothetical-

B

|

$ 1,000

|

$ 1,021.97

|

$ 2.86

|

|||||||

|

Class Z

|

.36%

|

|||||||||

|

Actual

|

$ 1,000

|

$ 985.80

|

$ 1.77

|

|||||||

|

Hypothetical-

B

|

$ 1,000

|

$ 1,023.01

|

$ 1.81

|

|||||||

- Highly liquid investments - cash or convertible to cash within three business days or less

- Moderately liquid investments - convertible to cash in three to seven calendar days

- Less liquid investments - can be sold or disposed of, but not settled, within seven calendar days

- Illiquid investments - cannot be sold or disposed of within seven calendar days

|

Contents

|

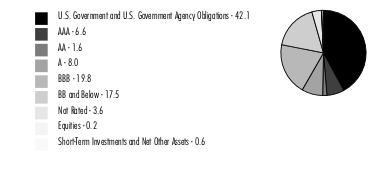

Quality Diversification (% of Fund's net assets)

|

|

|

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

|

|

Asset Allocation (% of Fund's net assets)

|

|

|

Futures and Swaps - 0.6%

|

|

Percentages in the above tables are adjusted for the effect of TBA Sale Commitments.

|

|

Geographic Diversification (% of Fund's net assets)

|

|

|

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of derivatives, if applicable.

|

|

Corporate Bonds - 35.8%

|

|||

|

Principal

Amount (a)

|

Value ($)

|

||

|

Convertible Bonds - 0.2%

|

|||

|

COMMUNICATION SERVICES - 0.1%

|

|||

|

Media - 0.1%

|

|||

|

DISH Network Corp.:

|

|||

|

2.375% 3/15/24

|

16,044,000

|

14,736,166

|

|

|

3.375% 8/15/26

|

22,712,000

|

14,514,788

|

|

|

29,250,954

|

|||

|

ENERGY - 0.1%

|

|||

|

Oil, Gas & Consumable Fuels - 0.1%

|

|||

|

Mesquite Energy, Inc. 15% 7/15/23 (b)(c)

|

894,620

|

5,477,579

|

|

|

Mesquite Energy, Inc. 15% 7/15/23 (b)(c)

|

1,544,200

|

9,454,828

|

|

|

14,932,407

|

|||

|

TOTAL CONVERTIBLE BONDS

|

44,183,361

|

||

|

Nonconvertible Bonds - 35.6%

|

|||

|

COMMUNICATION SERVICES - 3.4%

|

|||

|

Diversified Telecommunication Services - 0.7%

|

|||

|

Altice France SA:

|

|||

|

5.125% 1/15/29(d)

|

8,750,000

|

6,716,965

|

|

|

5.125% 7/15/29(d)

|

5,125,000

|

3,954,558

|

|

|

5.5% 1/15/28(d)

|

4,280,000

|

3,525,308

|

|

|

5.5% 10/15/29(d)

|

35,000

|

27,289

|

|

|

AT&T, Inc. 4.3% 2/15/30

|

10,373,000

|

9,730,655

|

|

|

C&W Senior Financing Designated Activity Co. 6.875% 9/15/27 (d)

|

27,602,000

|

24,869,402

|

|

|

Cablevision Lightpath LLC:

|

|||

|

3.875% 9/15/27(d)

|

1,135,000

|

925,207

|

|

|

5.625% 9/15/28(d)

|

895,000

|

666,775

|

|

|

Colombia Telecomunicaciones SA 4.95% 7/17/30 (d)

|

560,000

|

430,080

|

|

|

Consolidated Communications, Inc. 5% 10/1/28 (d)

|

1,385,000

|

921,150

|

|

|

Frontier Communications Holdings LLC:

|

|||

|

5% 5/1/28(d)

|

6,390,000

|

5,607,225

|

|

|

5.875% 10/15/27(d)

|

2,511,000

|

2,332,970

|

|

|

5.875% 11/1/29

|

3,395,000

|

2,718,512

|

|

|

8.75% 5/15/30(d)

|

2,730,000

|

2,760,713

|

|

|

IHS Holding Ltd. 5.625% 11/29/26 (d)

|

1,070,000

|

907,694

|

|

|

Iliad SA 1.875% 2/11/28 (Reg. S)

|

EUR

|

1,800,000

|

1,561,496

|

|

Level 3 Financing, Inc.:

|

|||

|

3.625% 1/15/29(d)

|

840,000

|

539,011

|

|

|

4.25% 7/1/28(d)

|

8,820,000

|

6,019,650

|

|

|

Liquid Telecommunications Financing PLC 5.5% 9/4/26 (d)

|

1,630,000

|

1,132,850

|

|

|