UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04087

Manning & Napier Fund, Inc.

(Exact name of registrant as specified in charter)

290 Woodcliff Drive, Fairport, NY 14450

(Address of principal executive offices)(Zip Code)

Paul J. Battaglia 290 Woodcliff Drive, Fairport, NY 14450

(Name and address of agent for service)

Registrant’s telephone number, including area code: 585-325-6880

Date of fiscal year end: October 31

Date of reporting period: November 1, 2018 through October 31, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1: REPORTS TO STOCKHOLDERS.

www.manning-napier.com

| Manning & Napier Fund, Inc.

|

| Equity Series |

Beginning on June 25, 2021, as permitted by Securities and Exchange Commission regulations, paper copies of the Series’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary or, if you are a direct investor, by visiting www.manning-napier.com or calling 1-800-466-3863.

You may elect to receive all future annual and semi-annual reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by visiting www.manning-napier.com or calling 1-800-466-3863. Your election to receive reports in paper will apply to all funds held with your financial intermediary if you invest through a financial intermediary or all series of the Fund if you invest directly with the Fund.

|

Independent Perspective | Real-World Solutions |

A Note from Our CEO

Dear Shareholder,

Corporate Headquarters | 290 Woodcliff Drive | Fairport, NY 14450 | (585) 325-6880 phone | (800) 551-0224 toll free | www.manning-napier.com

1

Equity Series

Fund Commentary

(unaudited)

Investment Objective

To provide long-term growth of capital by investing primarily in common stocks. The Series may invest in large-, mid- and small-size companies within the US.

Performance Commentary

US equity markets posted positive returns for the twelve-month period ending October 31, 2019 and have experienced the second strongest year-to-date start in two decades. Over the one year period, large-cap stocks outperformed small- and mid-cap stocks, while growth stocks outperformed their value counterparts.

The Equity Series Class S delivered positive returns during the year and outperformed the Russell 3000® Index, returning 16.9% and 13.5%, respectively.

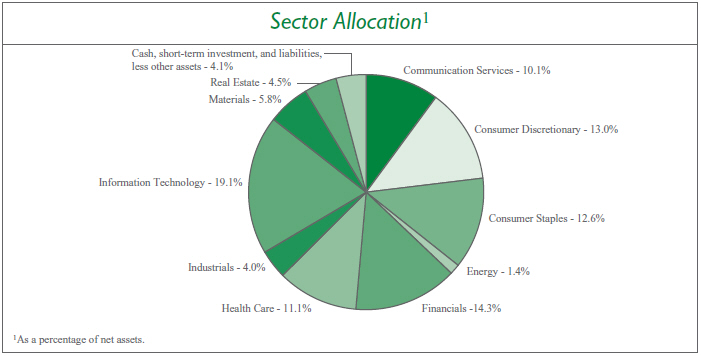

Outperformance was primarily driven by stock selection, led by decisions in Information Technology, Consumer Discretionary, Real Estate, and Materials. Sector positioning was also positive, though to a lesser degree. Specifically, an underweight to Energy benefitted relative returns (i.e., returns compared to the benchmark); however, selection within the sector was a detractor.

We believe the global economy is showing signs of moving into the later stages of the economic cycle. When this occurs, it is common to see strong stock market gains. While these rallies may give investors the feeling of missing out, it is exactly in these moments that risk management can be most valuable.

Given our outlook, the portfolio is focused on higher quality businesses and reasonably priced growth companies. We prefer businesses with strong management and solid balance sheets who have historically provided some degree of downside protection in adverse markets.

This view has led to meaningful positions in areas such as Consumer Staples and Health Care. In contrast, the portfolio is less exposed to sectors highly dependent on strong and above average economic growth such as Industrials and Energy.

Please see the next page for additional performance information as of October 31, 2019.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than that quoted; investors can obtain the most recent month-end performance at www.manning-napier.com or by calling (800) 466-3863.

Commentary prepared using data provided by FactSet. Analysis Manning & Napier. Commentary presented is relative to the Russell 3000® Index. Additional information and associated disclosures can be found on the Performance Update page of this report.

All investments involve risks, including possible loss of principal. As with any stock fund, the value of your investment will fluctuate in response to stock market movements. Investing in the Series will also involve a number of other risks, including issuer-specific risk, small-cap/mid-cap risk, and interest rate risk.

2

Equity Series

Performance Update as of October 31, 2019

(unaudited)

|

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2019 | ||||||

| ONE YEAR1 |

FIVE YEAR |

TEN YEAR | ||||

| Equity Series - Class S2 |

16.88% | 10.06% | 11.81% | |||

| Equity Series - Class W2,3 |

17.64% | 10.20% | 11.88% | |||

| Russell 3000® Index4 |

13.49% | 10.31% | 13.62% | |||

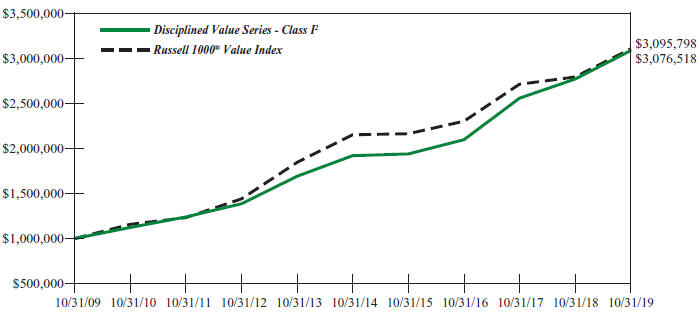

The following graph compares the value of a $10,000 investment in the Equity Series - Class S for the ten years ended October 31, 2019 to the Russell 3000® Index.

1The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

2The Series’ performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. The Series’ performance is historical and may not be indicative of future results. The performance returns shown are inclusive of the net expense ratio of the Series. For the year ended October 31, 2019, the net expense ratio was 1.05% for Class S and 0.05% for Class W. The gross expense ratio, which does not account for any voluntary or contractual waivers currently in effect, was 1.29% for Class S and 1.05% for Class W for the year ended October 31, 2019.

3For periods through March 1, 2019 (the inception date of the Class W shares), performance for the Class W shares is based on the historical performance of the Class S shares. Because the Class W shares invest in the same portfolio of securities as the Class S shares, performance will be different only to the extent that the Class S shares have a higher expense ratio.

4The Russell 3000® Index is an unmanaged index that consists of 3,000 of the largest U.S. companies based on total market capitalization. The Index returns are based on a market capitalization-weighted average of relative price changes of the component stocks plus dividends whose reinvestments are compounded daily. The Index returns do not reflect any fees or expenses. Index returns provided by Bloomberg.

3

Equity Series

Shareholder Expense Example

(unaudited)

| BEGINNING ACCOUNT VALUE 5/1/19 |

ENDING ACCOUNT VALUE 10/31/19 |

EXPENSES PAID DURING PERIOD 5/1/19-10/31/191 |

ANNUALIZED RATIO | |||||

| Class S |

||||||||

| Actual |

$1,000.00 | $1,049.10 | $5.42 | 1.05% | ||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,019.91 | $5.35 | 1.05% | ||||

| Class W |

||||||||

| Actual |

$1,000.00 | $1,054.30 | $0.26 | 0.05% | ||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,024.95 | $0.26 | 0.05% | ||||

1Expenses are equal to the Series’ annualized expense ratio (for the six-month period), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses are based on the most recent fiscal half year; therefore, the expense ratios stated above may differ from the expense ratios stated in the financial highlights, which are based on one-year data. The Class’ total return would have been lower had certain expenses not been waived during the period.

4

Equity Series

Portfolio Composition as of October 31, 2019

(unaudited)

5

Equity Series

Investment Portfolio - October 31, 2019

| SHARES

|

VALUE

|

|||||||

| COMMON STOCKS - 95.9% |

| |||||||

| Communication Services - 10.1% |

| |||||||

| Entertainment - 3.5% |

||||||||

| Activision Blizzard, Inc. |

14,400 | $ | 806,832 | |||||

| Electronic Arts, Inc.* |

14,525 | 1,400,210 | ||||||

|

|

|

|||||||

| 2,207,042 | ||||||||

|

|

|

|||||||

| Interactive Media & Services - 6.6% |

||||||||

| Alphabet, Inc. - Class A* |

810 | 1,019,628 | ||||||

| Alphabet, Inc. - Class C* |

810 | 1,020,689 | ||||||

| Facebook, Inc. - Class A* |

8,135 | 1,559,073 | ||||||

| IAC - InterActiveCorp.* |

2,790 | 634,028 | ||||||

|

|

|

|||||||

| 4,233,418 | ||||||||

|

|

|

|||||||

| Total Communication Services |

|

6,440,460 | ||||||

|

|

|

|||||||

| Consumer Discretionary - 13.0% |

||||||||

| Internet & Direct Marketing Retail - 3.4% |

||||||||

| Amazon.com, Inc.* |

860 | 1,527,928 | ||||||

| Booking Holdings, Inc.* |

330 | 676,094 | ||||||

|

|

|

|||||||

| 2,204,022 | ||||||||

|

|

|

|||||||

| Multiline Retail - 4.3% |

||||||||

| Dollar General Corp. |

8,380 | 1,343,649 | ||||||

| Dollar Tree, Inc.* |

12,755 | 1,408,152 | ||||||

|

|

|

|||||||

| 2,751,801 | ||||||||

|

|

|

|||||||

| Specialty Retail - 3.3% |

||||||||

| Advance Auto Parts, Inc. |

4,995 | 811,588 | ||||||

| AutoZone, Inc.* |

705 | 806,788 | ||||||

| The TJX Cos., Inc. |

8,915 | 513,950 | ||||||

|

|

|

|||||||

| 2,132,326 | ||||||||

|

|

|

|||||||

| Textiles, Apparel & Luxury Goods - 2.0% |

||||||||

| NIKE, Inc. - Class B |

13,975 | 1,251,461 | ||||||

|

|

|

|||||||

| Total Consumer Discretionary |

|

8,339,610 | ||||||

|

|

|

|||||||

| Consumer Staples - 12.6% |

||||||||

| Beverages - 6.2% |

||||||||

| The Coca-Cola Co. |

41,995 | 2,285,788 | ||||||

| PepsiCo, Inc. |

12,255 | 1,681,018 | ||||||

|

|

|

|||||||

| 3,966,806 | ||||||||

|

|

|

|||||||

| Food Products - 3.2% |

||||||||

| Mondelez International, Inc. - |

||||||||

| Class A |

38,595 | 2,024,308 | ||||||

|

|

|

|||||||

| Household Products - 1.0% |

||||||||

| Colgate-Palmolive Co. |

9,685 | 664,391 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

6

Equity Series

Investment Portfolio - October 31, 2019

| SHARES

|

VALUE

|

|||||||

| COMMON STOCKS (continued) |

||||||||

| Consumer Staples (continued) |

||||||||

| Tobacco - 2.2% |

||||||||

| Altria Group, Inc. |

11,860 | $ | 531,209 | |||||

| Philip Morris International, Inc. |

11,230 | 914,571 | ||||||

|

|

|

|||||||

| 1,445,780 | ||||||||

|

|

|

|||||||

| Total Consumer Staples |

8,101,285 | |||||||

|

|

|

|||||||

| Energy - 1.4% |

||||||||

| Energy Equipment & Services - 1.4% |

||||||||

| Diamond Offshore Drilling, Inc.* |

31,200 | 165,048 | ||||||

| Halliburton Co. |

20,845 | 401,266 | ||||||

| Transocean Ltd.* |

67,475 | 320,506 | ||||||

|

|

|

|||||||

| Total Energy |

886,820 | |||||||

|

|

|

|||||||

| Financials - 14.3% |

||||||||

| Capital Markets - 11.0% |

||||||||

| BlackRock, Inc. |

3,305 | 1,525,919 | ||||||

| Cboe Global Markets, Inc. |

9,310 | 1,072,047 | ||||||

| CME Group, Inc. |

5,270 | 1,084,303 | ||||||

| Intercontinental Exchange, Inc. |

11,925 | 1,124,766 | ||||||

| Moody’s Corp. |

5,055 | 1,115,588 | ||||||

| S&P Global, Inc. |

4,310 | 1,111,937 | ||||||

|

|

|

|||||||

| 7,034,560 | ||||||||

|

|

|

|||||||

| Diversified Financial Services - 3.3% |

||||||||

| Berkshire Hathaway, Inc. - Class B* |

9,995 | 2,124,737 | ||||||

|

|

|

|||||||

| Total Financials |

9,159,297 | |||||||

|

|

|

|||||||

| Health Care - 11.1% |

||||||||

| Biotechnology - 2.6% |

||||||||

| BioMarin Pharmaceutical, Inc.* |

8,890 | 650,837 | ||||||

| Incyte Corp.* |

3,845 | 322,672 | ||||||

| Seattle Genetics, Inc.* |

3,205 | 344,217 | ||||||

| Vertex Pharmaceuticals, Inc.* |

1,750 | 342,090 | ||||||

|

|

|

|||||||

| 1,659,816 | ||||||||

|

|

|

|||||||

| Health Care Equipment & Supplies - 1.7% |

||||||||

| Boston Scientific Corp.* |

17,800 | 742,260 | ||||||

| Intuitive Surgical, Inc.* |

645 | 356,653 | ||||||

|

|

|

|||||||

| 1,098,913 | ||||||||

|

|

|

|||||||

| Health Care Providers & Services - 1.2% |

||||||||

| UnitedHealth Group, Inc. |

2,995 | 756,836 | ||||||

|

|

|

|||||||

| Life Sciences Tools & Services - 1.4% |

||||||||

| Thermo Fisher Scientific, Inc. |

2,930 | 884,801 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

7

Equity Series

Investment Portfolio - October 31, 2019

| SHARES

|

VALUE (NOTE 2)

|

|||||||

| COMMON STOCKS (continued) |

||||||||

| Health Care (continued) |

||||||||

| Pharmaceuticals - 4.2% |

||||||||

| Johnson & Johnson |

18,125 | $ | 2,393,225 | |||||

| Merck & Co., Inc. |

3,710 | 321,509 | ||||||

|

|

|

|||||||

| 2,714,734 | ||||||||

|

|

|

|||||||

| Total Health Care |

7,115,100 | |||||||

|

|

|

|||||||

| Industrials - 4.0% |

||||||||

| Commercial Services & Supplies - 2.6% |

||||||||

| Stericycle, Inc.* |

12,305 | 708,768 | ||||||

| Waste Management, Inc. |

8,245 | 925,171 | ||||||

|

|

|

|||||||

| 1,633,939 | ||||||||

|

|

|

|||||||

| Road & Rail - 1.4% |

||||||||

| JB Hunt Transport Services, Inc. |

7,880 | 926,373 | ||||||

|

|

|

|||||||

| Total Industrials |

2,560,312 | |||||||

|

|

|

|||||||

| Information Technology - 19.1% |

||||||||

| Electronic Equipment, Instruments & Components - 1.5% |

||||||||

| Cognex Corp. |

18,335 | 944,069 | ||||||

|

|

|

|||||||

| IT Services - 7.9% |

||||||||

| EPAM Systems, Inc.* |

1,665 | 292,973 | ||||||

| Mastercard, Inc. - Class A |

7,110 | 1,968,119 | ||||||

| Verra Mobility Corp.* |

95,765 | 1,374,228 | ||||||

| Visa, Inc. - Class A |

8,160 | 1,459,498 | ||||||

|

|

|

|||||||

| 5,094,818 | ||||||||

|

|

|

|||||||

| Semiconductors & Semiconductor Equipment - 3.9% |

||||||||

| Micron Technology, Inc.* |

34,790 | 1,654,264 | ||||||

| NVIDIA Corp. |

4,055 | 815,136 | ||||||

|

|

|

|||||||

| 2,469,400 | ||||||||

|

|

|

|||||||

| Software - 5.8% |

||||||||

| Microsoft Corp. |

13,990 | 2,005,746 | ||||||

| ServiceNow, Inc.* |

6,905 | 1,707,330 | ||||||

|

|

|

|||||||

| 3,713,076 | ||||||||

|

|

|

|||||||

| Total Information Technology |

12,221,363 | |||||||

|

|

|

|||||||

| Materials - 5.8% |

||||||||

| Chemicals - 3.8% |

||||||||

| Axalta Coating Systems Ltd.* |

31,815 | 938,224 | ||||||

| CF Industries Holdings, Inc. |

19,260 | 873,441 | ||||||

| Corteva, Inc. |

24,940 | 657,917 | ||||||

|

|

|

|||||||

| 2,469,582 | ||||||||

|

|

|

|||||||

| Containers & Packaging - 1.1% |

||||||||

| Crown Holdings, Inc.* |

9,285 | 676,319 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

8

Equity Series

Investment Portfolio - October 31, 2019

| SHARES

|

VALUE (NOTE 2)

|

|||||||

| COMMON STOCKS (continued) |

||||||||

| Materials (continued) |

||||||||

| Metals & Mining - 0.9% |

||||||||

| Freeport-McMoRan, Inc. |

25,430 | $ | 249,723 | |||||

| Southern Copper Corp. (Peru) |

8,370 | 297,805 | ||||||

|

|

|

|||||||

| 547,528 | ||||||||

|

|

|

|||||||

| Total Materials |

3,693,429 | |||||||

|

|

|

|||||||

| Real Estate - 4.5% |

||||||||

| Equity Real Estate Investment Trusts (REITS) - 4.5% |

||||||||

| American Tower Corp. |

4,660 | 1,016,253 | ||||||

| Equinix, Inc. |

1,445 | 818,997 | ||||||

| SBA Communications Corp. |

4,365 | 1,050,437 | ||||||

|

|

|

|||||||

| Total Real Estate |

2,885,687 | |||||||

|

|

|

|||||||

| TOTAL COMMON STOCKS |

61,403,363 | |||||||

|

|

|

|||||||

| SHORT-TERM INVESTMENT - 4.3% |

||||||||

| Dreyfus Government Cash Management, Institutional Shares, 1.73%1 |

||||||||

| (Identified Cost $2,770,713) |

2,770,713 | 2,770,713 | ||||||

|

|

|

|||||||

| TOTAL INVESTMENTS - 100.2% |

64,174,076 | |||||||

| LIABILITIES, LESS OTHER ASSETS - (0.2%) |

(104,410 | ) | ||||||

|

|

|

|||||||

| NET ASSETS - 100% |

$ | 64,069,666 | ||||||

|

|

|

|||||||

*Non-income producing security.

1Rate shown is the current yield as of October 31, 2019.

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor’s, a division of S&P Global Inc. (S&P), and is licensed for use by Manning & Napier when referencing GICS sectors. Neither MSCI, S&P, nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification, nor shall any such party have any liability therefrom.

The accompanying notes are an integral part of the financial statements.

9

Equity Series

Statement of Assets and Liabilities

October 31, 2019

| ASSETS: |

||||

| Investments, at value (identified cost $51,603,659) (Note 2) |

$ | 64,174,076 | ||

| Dividends receivable |

10,462 | |||

| Receivable for fund shares sold |

2,509 | |||

| Prepaid expenses |

15,662 | |||

|

|

|

|||

| TOTAL ASSETS |

64,202,709 | |||

|

|

|

|||

| LIABILITIES: |

||||

| Accrued management fees (Note 3) |

25,373 | |||

| Accrued fund accounting and administration fees (Note 3) |

13,618 | |||

| Accrued shareholder services fees (Class S) (Note 3) |

13,438 | |||

| Accrued transfer agent fees (Note 3) |

5,498 | |||

| Accrued Chief Compliance Officer service fees (Note 3) |

687 | |||

| Accrued sub-transfer agent fees (Note 3) |

42 | |||

| Payable for fund shares repurchased |

40,471 | |||

| Audit fees payable |

20,634 | |||

| Printing fees payable |

10,844 | |||

| Other payables and accrued expenses |

2,438 | |||

|

|

|

|||

| TOTAL LIABILITIES |

133,043 | |||

|

|

|

|||

| TOTAL NET ASSETS |

$ | 64,069,666 | ||

|

|

|

|||

| NET ASSETS CONSIST OF: |

||||

| Capital stock |

$ | 46,117 | ||

| Additional paid-in-capital |

45,433,569 | |||

| Total distributable earnings (loss) |

18,589,980 | |||

|

|

|

|||

| TOTAL NET ASSETS |

$ | 64,069,666 | ||

|

|

|

|||

| NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - Class

S |

$ | 13.89 | ||

|

|

|

|||

| NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - Class

W |

$ | 13.98 | ||

|

|

|

|||

The accompanying notes are an integral part of the financial statements.

10

Equity Series

Statement of Operations

For the Year Ended October 31, 2019

| INVESTMENT INCOME: |

||||

| Dividends |

$ | 767,458 | ||

|

|

|

|||

| EXPENSES: |

||||

| Management fees (Note 3) |

491,938 | |||

| Shareholder services fees (Class S) (Note 3) |

163,367 | |||

| Fund accounting and administration fees (Note 3) |

52,732 | |||

| Directors’ fees (Note 3) |

6,103 | |||

| Chief Compliance Officer service fees (Note 3) |

3,455 | |||

| Sub-transfer agent fees (Note 3) |

42 | |||

| Custodian fees |

4,309 | |||

| Miscellaneous |

121,114 | |||

|

|

|

|||

| Total Expenses |

843,060 | |||

| Less reduction of expenses (Note 3) |

(156,798 | ) | ||

|

|

|

|||

| Net Expenses |

686,262 | |||

|

|

|

|||

| NET INVESTMENT INCOME |

81,196 | |||

|

|

|

|||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: |

||||

| Net realized gain (loss) on investments |

6,764,451 | |||

| Net change in unrealized appreciation (depreciation) on investments |

3,236,054 | |||

|

|

|

|||

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS |

10,000,505 | |||

|

|

|

|||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 10,081,701 | ||

|

|

|

|||

The accompanying notes are an integral part of the financial statements.

11

Equity Series

Statements of Changes in Net Assets

| FOR THE

|

FOR THE

|

|||||||

| INCREASE (DECREASE) IN NET ASSETS: |

||||||||

| OPERATIONS: |

||||||||

| Net investment income (loss) |

$ | 81,196 | $ | (132,735 | ) | |||

| Net realized gain (loss) on investments |

6,764,451 | 11,047,143 | ||||||

| Net change in unrealized appreciation (depreciation) on investments |

3,236,054 | (4,124,586 | ) | |||||

|

|

|

|

|

|||||

| Net increase from operations |

10,081,701 | 6,789,822 | ||||||

|

|

|

|

|

|||||

| DISTRIBUTIONS TO SHAREHOLDERS (Note 9): |

||||||||

| Class S |

(10,873,259 | ) | (5,983,527 | ) | ||||

|

|

|

|

|

|||||

| CAPITAL STOCK ISSUED AND REPURCHASED: |

||||||||

| Net increase (decrease) from capital share transactions (Note 5) |

(4,700,431 | ) | (14,599,547 | ) | ||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets |

(5,491,989 | ) | (13,793,252 | ) | ||||

| NET ASSETS: |

||||||||

| Beginning of year |

69,561,655 | 83,354,907 | ||||||

|

|

|

|

|

|||||

| End of year |

$ | 64,069,666 | $ | 69,561,655 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of the financial statements.

12

Equity Series

Financial Highlights - Class S*

|

FOR THE YEAR ENDED |

||||||||||||||||||||

| 10/31/19 | 10/31/18 | 10/31/17 | 10/31/16 | 10/31/15 | ||||||||||||||||

| Per share data (for a share outstanding throughout each year): |

||||||||||||||||||||

| Net asset value - Beginning of year |

$14.28 | $14.27 | $12.20 | $16.62 | $21.15 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||

| Net investment income (loss)1 |

0.02 | (0.02 | ) | 0.01 | (0.07 | ) | 0.01 | |||||||||||||

| Net realized and unrealized gain (loss) on investments |

1.86 | 1.07 | 2.63 | 0.64 | (0.42 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

1.88 | 1.05 | 2.64 | 0.57 | (0.41 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less distributions to shareholders: |

||||||||||||||||||||

| From net investment income |

(0.01 | ) | — | — | (0.00 | )2 | (0.00 | )2 | ||||||||||||

| From net realized gain on investments |

(2.26 | ) | (1.04 | ) | (0.57 | ) | (4.99 | ) | (4.12 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions to shareholders |

(2.27 | ) | (1.04 | ) | (0.57 | ) | (4.99 | ) | (4.12 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value - End of year |

$13.89 | $14.28 | $14.27 | $12.20 | $16.62 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net assets - End of year (000’s omitted) |

$63,701 | $69,562 | $83,355 | $98,470 | $500,946 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total return3 |

16.88% | 7.67% | 22.68% | 4 | 6.16% | (1.46% | ) | |||||||||||||

| Ratios (to average net assets)/Supplemental Data: |

||||||||||||||||||||

| Expenses** |

1.05% | 1.05% | 1.05% | 1.05% | 1.05% | |||||||||||||||

| Net investment income (loss) |

0.12% | (0.17% | ) | 0.10% | (0.55% | ) | 0.04% | |||||||||||||

| Series portfolio turnover |

48% | 45% | 71% | 40% | 62% | |||||||||||||||

| *Effective March 1, 2017, Class A shares of the Series have been designated as Class S shares. |

|

|||||||||||||||||||

| **The investment advisor did not impose all or a portion of its management and/or other fees, and in some years may have paid a portion of the Series’ expenses. If these expenses had been incurred by the Class, the expense ratio (to average net assets) would have increased by the following amounts: |

| |||||||||||||||||||

| 0.24% | 0.17% | 0.15% | 0.09% | 0.03% | ||||||||||||||||

1Calculated based on average shares outstanding during the years.

2Less than $(0.01).

3Represents aggregate total return for the years indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived or reimbursed.

4Includes litigation proceeds. Excluding this amount, the Series’ total return is 21.48%.

The accompanying notes are an integral part of the financial statements.

13

Equity Series

Financial Highlights - Class W

| FOR THE PERIOD 3/1/191 TO 10/31/19 | |||||

| Per share data (for a share outstanding throughout each period): |

|||||

| Net asset value - Beginning of period |

$12.53 | ||||

|

|

|

||||

| Income from investment operations: |

|||||

| Net investment income2 |

0.09 | ||||

| Net realized and unrealized gain (loss) on investments |

1.36 | ||||

|

|

|

||||

| Total from investment operations |

1.45 | ||||

|

|

|

||||

| Net asset value - End of period |

$13.98 | ||||

|

|

|

||||

| Net assets - End of period (000’s omitted) |

$369 | ||||

|

|

|

||||

| Total return3 |

11.57% | ||||

| Ratios (to average net assets)/Supplemental Data: |

|||||

| Expenses*4 |

0.05% | ||||

| Net investment income4 |

1.04% | ||||

| Series portfolio turnover |

48% | ||||

| *The investment advisor did not impose all or a portion of its management and/or other fees during the period, and may have paid a portion of the Series’ expenses. If these expenses had been incurred by the Class, the expense ratio (to average net assets) would have increased by the following amount4: |

| ||||

| 1.00% | |||||

1Commencement of operations.

2Calculated based on average shares outstanding during the period.

3Represents aggregate total return for the period indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived or reimbursed during the period. Periods less than one year are not annualized.

4Annualized.

The accompanying notes are an integral part of the financial statements.

14

Equity Series

Notes to Financial Statements

| 1. | Organization |

Equity Series (the “Series”) is a no-load diversified series of Manning & Napier Fund, Inc. (the “Fund”). The Fund is organized in Maryland and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The Series’ investment objective is to provide long-term growth of capital.

The Series is authorized to issue two classes of shares (Class S and Class W). Class W shares of the Series were issued on March 1, 2019. Each class of shares is substantially the same, except that Class S shares bear shareholder servicing fees.

The Fund’s Advisor is Manning & Napier Advisors, LLC (the “Advisor”). Shares of the Series are offered to investors, clients and employees of the Advisor and its affiliates. The total authorized capital stock of the Fund consists of 15 billion shares of common stock each having a par value of $0.01. As of October 31, 2019, 10 billion shares have been designated in total among 34 series, of which 200 million have been designated as Equity Series Class S common stock and 100 million have been designated as Equity Series Class W common stock.

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Series. The Series is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 - Investment Companies, which is part of accounting principles generally accepted in the United States of America (“GAAP”).

Security Valuation

Portfolio securities, including domestic equities, listed on an exchange other than the NASDAQ Stock Market are valued at the latest quoted sales price of the exchange on which the security is primarily traded. Securities not traded on valuation date or securities not listed on an exchange are valued at the latest quoted bid price provided by the Fund’s pricing service. Securities listed on the NASDAQ Stock Market are valued in accordance with the NASDAQ Official Closing Price.

Short-term investments that mature in sixty days or less may be valued at amortized cost, which approximates fair value. Investments in open-end investment companies are valued at their net asset value per share on valuation date.

Volume and level of activity in established markets for an asset or liability are evaluated to determine whether recent transactions and quoted prices are determinative of fair value. Where there have been significant decreases in volume and level of activity, further analysis and adjustment may be necessary to estimate fair value. The Series measures fair value in these instances by the use of inputs and valuation techniques which may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry and/or expectation of future cash flows. As a result of trading in relatively thin markets and/or markets that experience significant volatility, the prices used by the Series to value these securities may differ from the value that would be realized if these securities were sold, and the differences could be material.

Securities for which representative valuations or prices are not available from the Series’ pricing service may be valued at fair value as determined in good faith by the Advisor under procedures approved by and under the general supervision and responsibility of the Fund’s Board of Directors (the “Board”). Due to the inherent uncertainty of valuations of such securities, the fair value may differ significantly from the values that would have been used had a ready market for such securities existed. If trading or events occurring after the close of the principal market in which securities are traded are expected to materially affect the value of those securities, then they may be valued at their fair value, taking this trading or these events into account.

Various inputs are used in determining the value of the Series’ assets or liabilities carried at fair value. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical assets and liabilities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Level 3 includes significant unobservable inputs (including the Series’ own assumptions in determining the fair value of investments). A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both

15

Equity Series

Notes to Financial Statements (continued)

| 2. | Significant Accounting Policies (continued) |

Security Valuation (continued)

individually and in aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the valuation levels used for major security types as of October 31, 2019 in valuing the Series’ assets or liabilities carried at fair value:

| DESCRIPTION | TOTAL | LEVEL 1 | LEVEL 2 | LEVEL 3 | ||||||||||||

| Assets: |

||||||||||||||||

| Equity Securities: |

||||||||||||||||

| Communication Services |

$ | 6,440,460 | $ | 6,440,460 | $ | — | $ | — | ||||||||

| Consumer Discretionary |

8,339,610 | 8,339,610 | — | — | ||||||||||||

| Consumer Staples |

8,101,285 | 8,101,285 | — | — | ||||||||||||

| Energy |

886,820 | 886,820 | — | — | ||||||||||||

| Financials |

9,159,297 | 9,159,297 | — | — | ||||||||||||

| Health Care |

7,115,100 | 7,115,100 | — | — | ||||||||||||

| Industrials |

2,560,312 | 2,560,312 | — | — | ||||||||||||

| Information Technology |

12,221,363 | 12,221,363 | — | — | ||||||||||||

| Materials |

3,693,429 | 3,693,429 | — | — | ||||||||||||

| Real Estate |

2,885,687 | 2,885,687 | — | — | ||||||||||||

| Short-Term Investment |

2,770,713 | 2,770,713 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets |

$ | 64,174,076 | $ | 64,174,076 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

There were no Level 2 or Level 3 securities held by the Series as of October 31, 2018 or October 31, 2019.

Security Transactions, Investment Income and Expenses

Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date, except that if the ex-dividend date has passed, certain dividends from foreign securities are recorded as soon as the Series is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair value of the securities received. Interest income, including amortization of premium and accretion of discounts using the effective interest method, is earned from settlement date and accrued daily.

Expenses are recorded on an accrual basis. Most expenses of the Fund can be attributed to a specific series. Expenses which cannot be directly attributed are apportioned among the series in the Fund in such a manner as deemed equitable by the Fund’s Board, taking into consideration, among other things, the nature and type of expense.

The Series uses the identified cost method for determining realized gain or loss on investments for both financial statement and federal income tax reporting purposes.

Federal Taxes

The Series’ policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. The Series is not subject to federal income tax or excise tax to the extent that the Series distributes to shareholders each year its taxable income, including any net realized gains on investments, in accordance with requirements of the Internal Revenue Code. Accordingly, no provision for federal income tax or excise tax has been made in the financial statements.

Management evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. At October 31, 2019, the Series has recorded no liability for net unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken in future tax returns.

16

Equity Series

Notes to Financial Statements (continued)

| 2. | Significant Accounting Policies (continued) |

Federal Taxes (continued)

The Series files income tax returns in the U.S. federal jurisdiction, various states and foreign jurisdictions, as required. No income tax returns are currently under investigation. The statute of limitations on the Series’ tax returns remains open for the years ended October 31, 2016 through October 31, 2019. The Series is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Foreign Taxes

Based on the Series’ understanding of the tax rules and rates related to income, gains and currency purchase/repatriation transactions for foreign jurisdictions in which it invests, the Series will provide for foreign taxes, and where appropriate, deferred foreign tax.

Distributions of Income and Gains

Distributions to shareholders of net investment income and net realized gains are made annually. An additional distribution may be necessary to avoid taxation of the Series. Distributions are recorded on the ex-dividend date.

Indemnifications

The Fund’s organizational documents provide former and current directors and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Other

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

| 3. | Transactions with Affiliates |

The Fund has an Investment Advisory Agreement (the “Agreement”) with the Advisor, for which the Series pays a fee, computed daily and payable monthly, at an annual rate of 0.75% of the Series’ average daily net assets.

Under the Agreement, personnel of the Advisor provide the Series with advice and assistance in the choice of investments and the execution of securities transactions, and otherwise maintain the Series’ organization. The Advisor also provides the Fund with necessary office space and fund administration and support services. The salaries of all officers of the Fund (except a percentage of the Fund’s Chief Compliance Officer’s salary, which is paid by the Fund), and of all Directors who are “affiliated persons” of the Fund, or of the Advisor, and all personnel of the Fund, or of the Advisor, performing services relating to research, statistical and investment activities, are paid by the Advisor. Each “non-affiliated” Director receives an annual stipend, which is allocated among all the active series of the Fund. In addition, these Directors also receive a fee per Board meeting attended plus a fee for each committee meeting attended and are reimbursed for travel and other out-of-pocket expenses incurred by them in connection with attending such meetings. The Fund also has an Audit Committee Chair, Governance & Nominating Committee Chair and Lead Independent Director who each receive an additional annual stipend for these roles.

The Class S shares of the Series are subject to a shareholder services fee in accordance with a shareholder services plan adopted by the Board. The shareholder services fee is intended to compensate financial intermediaries, including affiliates of the Fund, in connection with the provision of direct client service, personal services, maintenance of shareholder accounts and reporting services. For these services, Class S of the Series pay a fee, computed daily and payable monthly, at an annual rate of 0.25% of the average daily net assets of Class S shares. The Fund has a Shareholder Services Agreement with the Advisor, for which the Advisor receives the shareholder services fee as stated above.

17

Equity Series

Notes to Financial Statements (continued)

| 3. | Transactions with Affiliates (continued) |

Effective, March 1, 2019, the Advisor has contractually agreed to waive the management fee for the Class W shares. In addition, pursuant to a separate expense limitation agreement, the Advisor has contractually agreed to limit its fees and reimburse expenses to the extent necessary so that the total direct annual fund operating expenses, exclusive of the shareholder services fee and waived Class W management fees (collectively, “excluded expenses”), to 0.80% of the average daily net assets of the Class S shares and 0.05% of the average daily net assets of the Class W shares. These contractual waivers are expected to continue indefinitely, and may not be amended or terminated by the Advisor without the approval of the Series’ Board of Directors. The Advisor may receive from a Class the difference between the Class’s total direct annual fund operating expenses, not including excluded expenses, and the Class’s contractual expense limit to recoup all or a portion of its prior fee waivers (other than Class W management fee waivers) or expense reimbursements made during the rolling three-year period preceding the recoupment if at any point the total direct annual fund operating expenses, not including excluded expenses, are below the contractual expense limit (a) at the time of the fee waiver and/or expense reimbursement and (b) at the time of the recoupment.

Pursuant to the advisory fee waiver, the Advisor waived $1,839 in management fees for Class W shares for the year ended October 31, 2019. In addition, pursuant to the separate expense limitation agreement, the Advisor waived or reimbursed expenses of $154,347 and $612 for Class S and Class W shares, respectively, for the year ended October 31, 2019. These amounts are included as a reduction of expenses on the Statement of Operations. At October 31, 2019, the Advisor is eligible to recoup $109,525. For the year ended October 31, 2019, the Advisor did not recoup any expenses that have been previously waived or reimbursed.

Manning & Napier Investor Services, Inc., a registered broker-dealer affiliate of the Advisor, acts as distributor for the Fund’s shares. The services of Manning & Napier Investor Services, Inc. are provided at no additional cost to the Series.

Pursuant to a master services agreement dated March 1, 2017, the Fund pays the Advisor an annual fee related to fund accounting and administration of 0.0085% on the first $25 billion of average daily net assets (excluding Target Series and Income Series); 0.0075% on the next $15 billion of average daily net assets (excluding Target Series and Income Series); and 0.0065% of average daily net assets in excess of $40 billion (excluding Target Series and Income Series); plus a base fee of $30,400 per series. Additionally, certain transaction and out-of-pocket expenses, including charges for reporting relating to the Fund’s compliance program, are charged. The Advisor has agreements with BNY Mellon Investment Servicing (U.S.) Inc. (“BNY”) under which BNY serves as sub-accountant services agent.

| 4. | Purchases and Sales of Securities |

For the year ended October 31, 2019, purchases and sales of securities, other than U.S. Government securities and short-term securities, were $30,596,597 and $45,954,201, respectively. There were no purchases or sales of U.S. Government securities.

18

Equity Series

Notes to Financial Statements (continued)

| 5. | Capital Stock Transactions |

Transactions in Class S and Class W shares of Equity Series were:

| CLASS S | FOR THE YEAR ENDED 10/31/19 |

FOR THE YEAR ENDED 10/31/18 |

||||||||||||||

| SHARES | AMOUNT | SHARES | AMOUNT | |||||||||||||

| Sold |

269,984 | $ | 3,457,862 | 282,300 | $ | 4,076,767 | ||||||||||

| Reinvested |

943,883 | 10,628,123 | 426,205 | 5,860,318 | ||||||||||||

| Repurchased |

(1,499,648 | ) | (19,117,104 | ) | (1,680,674 | ) | (24,536,632 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

(285,781 | ) | $ | (5,031,119 | ) | (972,169 | ) | $ | (14,599,547 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| CLASS W | FOR THE PERIOD 3/1/19 (COMMENCEMENT OF OPERATIONS) TO 10/31/19 |

|||||||||||||||

| SHARES | AMOUNT | |||||||||||||||

| Sold |

28,317 | $ | 356,802 | |||||||||||||

| Reinvested |

— | — | ||||||||||||||

| Repurchased |

(1,924 | ) | (26,114 | ) | ||||||||||||

|

|

|

|

|

|||||||||||||

| Total |

26,393 | $ | 330,688 | |||||||||||||

|

|

|

|

|

|||||||||||||

At October 31, 2019, the Advisor and its affiliates owned 11.1% of the Series.

| 6. | Line of Credit |

The Fund has entered into a 364-day, $25 million credit agreement (the “line of credit”) with Bank of New York Mellon. Each series of the Fund may borrow under the line of credit for temporary or emergency purposes, including funding shareholder redemptions and other short-term liquidity purposes. The Fund pays an annual fee on the unused commitment amount, payable quarterly, and is allocated among all the series of the Fund and included in miscellaneous expenses in the Statement of Operations for each series. The line of credit expires in August 2020 unless extended or renewed. During the year ended October 31, 2019, the Series did not borrow under the line of credit.

| 7. | Financial Instruments |

The Series may trade in instruments including written and purchased options, forward foreign currency exchange contracts and futures contracts and other derivatives in the normal course of investing activities to assist in managing exposure to various market risks. The Series may be subject to various elements of risk, which may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. These risks include: the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate or index; counterparty credit risk related to over the counter derivative counterparties’ failure to perform under contract terms; liquidity risk related to the lack of a liquid market for these contracts allowing the fund to close out its position(s); and documentation risk relating to disagreement over contract terms. No such investments were held by the Series as of October 31, 2019.

| 8. | Foreign Securities |

Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in securities of domestic companies and the U.S. Government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of comparable domestic companies and the U.S. Government.

19

Equity Series

Notes to Financial Statements (continued)

| 9. | Federal Income Tax Information |

The amount and characterization of certain income and capital gains to be distributed are determined in accordance with federal income tax regulations, which may differ from GAAP. These differences are primarily due to differing book and tax treatments in the timing of the recognition of net investment income or gains and losses, including losses deferred due to wash sales, the use of equalization and investments in real estate investment trusts. The Series may periodically make reclassifications among its capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations, without impacting the Series’ net asset value. For the year ended October 31, 2019, amounts were reclassified within the capital accounts to increase Additional Paid in Capital by $469,409 and decrease Total Distributable Earnings (Loss) by $469,409. Any such reclassifications are not reflected in the financial highlights.

The tax character of distributions paid were as follows:

| FOR THE YEAR ENDED 10/31/19 |

FOR THE YEAR ENDED 10/31/18 |

||||||||||||||

| Ordinary income |

$ | 3,116,908 | $ | 3,065,404 | |||||||||||

| Long-term capital gains |

7,756,351 | 2,918,123 | |||||||||||||

At October 31, 2019, the tax basis of components of distributable earnings and the net unrealized appreciation based on the identified cost of investments for federal income tax purposes were as follows:

| Cost for federal income tax purposes |

$ | 51,775,918 | ||||||

| Unrealized appreciation |

14,008,852 | |||||||

| Unrealized depreciation |

(1,610,694 | ) | ||||||

|

|

|

|||||||

| Net unrealized appreciation |

$ | 12,398,158 | ||||||

|

|

|

|||||||

| Undistributed ordinary income |

$ | 875,642 | ||||||

| Undistributed long-term capital gains |

$ | 5,316,181 | ||||||

20

Equity Series

Report of Independent Registered Public Accounting Firm

To the Board of Directors of Manning & Napier Fund, Inc. and Shareholders of Equity Series

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the investment portfolio, of Equity Series (one of the series constituting Manning & Napier Fund, Inc., referred to hereafter as the “Fund”) as of October 31, 2019, the related statement of operations for the year ended October 31, 2019, the statement of changes in net assets for each of the two years in the period ended October 31, 2019, including the related notes, and the financial highlights for each of the periods indicated therein (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended October 31, 2019 and the financial highlights for each of the periods indicated therein in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of October 31, 2019 by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

New York, New York

December 16, 2019

We have served as the auditor of one or more investment companies in Manning & Napier Mutual Funds since 1992.

21

Equity Series

Supplemental Tax Information

(unaudited)

All reportings are based on financial information available as of the date of this annual report and, accordingly, are subject to change.

For federal income tax purposes, the Series reports for the current fiscal year $676,482 or, if different, the maximum amount allowable under the tax law, as qualified dividend income.

For corporate shareholders, the percentage of investment income (dividend income plus short-term gains, if any) that qualifies for the dividends received deduction for the current fiscal year is 21.05%.

The Series designates $6,005,383 as Long-Term Capital Gain dividends pursuant to Section 852(b) of the Code for the fiscal year ended October 31, 2019.

22

Equity Series

Directors’ and Officers’ Information

(unaudited)

The Statement of Additional Information provides additional information about the Fund’s directors and officers and can be obtained without charge by calling 1-800-466-3863, at www.manning-napier.com, or on the EDGAR Database on the SEC Internet web site (http://www.sec.gov). The following chart shows certain information about the Fund’s directors and officers, including their principal occupations during the last five years. Unless specific dates are provided, the individuals have held the listed positions for longer than five years.

Interested Director and Officer

| Name: | Paul Battaglia* | |

| Address: | 290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: | 41 | |

| Current Position(s) Held with Fund: | Principal Executive Officer, President, Chairman & Director | |

| Term of Office & Length of Time Served: | Indefinite – Chairman and Director since November 20181 | |

| Principal Occupation(s) During Past 5 Years: | Chief Financial Officer (2018 – Present); Vice President of Finance (2016 – 2018); Director of Finance (2011 – 2016); Financial Analyst/Internal Auditor (2004-2006) – Manning & Napier Advisors, LLC and affiliates Holds one or more of the following titles for various affiliates: Chief Financial Officer | |

| Number of Portfolios Overseen within Fund Complex: | 32 | |

| Other Directorships Held Outside Fund Complex During | N/A | |

| Past 5 Years:

|

||

| Independent Directors | ||

| Name: | Stephen B. Ashley | |

| Address: | 290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: | 79 | |

| Current Position(s) Held with Fund: | Director, Audit Committee Member, Governance & Nominating Committee Member | |

| Term of Office & Length of Time Served: | Indefinite – Since 1996 | |

| Principal Occupation(s) During Past 5 Years: | Chairman, Director & Chief Executive Officer (1997 to present) - The Ashley Group (property management and investment). Director (1995-2008) and Chairman (non-executive) (2004-2008) - Fannie Mae (mortgage) | |

| Number of Portfolios Overseen within Fund Complex: | 32 | |

| Other Directorships Held Outside Fund Complex During | Fannie Mae (1995-2008) | |

| Past 5 Years: | The Ashley Group (1995-2008) | |

| Genesee Corporation (1987-2007)

| ||

| Name: | Paul A. Brooke | |

| Address: | 290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: | 73 | |

| Current Position(s) Held with Fund: | Lead Independent Director, Audit Committee Member, Governance & Nominating Committee Chairman | |

| Term of Office & Length of Time Served: | Indefinite – Director, Audit Committee Member, Governance & Nominating Committee Member since 2007; Governance & Nominating Committee Chairman since 2016; Lead Independent Director since 2017 | |

| Principal Occupation(s) During Past 5 Years: | Chairman & CEO (2005-2009) - Ithaka Acquisition Corporation (investments); Chairman (2007-2009) - Alsius Corporation (investments); Managing Member (1991-present) - PMSV Holdings LLC (investments); Managing Member (2010-2016) - Venbio (investments). | |

| Number of Portfolios Overseen within Fund Complex: | 32 | |

| Other Directorships Held Outside Fund Complex During | Incyte Corp. (biotech)(2000-present); ViroPharma, Inc. (speciality | |

| Past 5 Years: | pharmaceuticals)(2000-2014); HLTH (WebMD)(information)(2000-2010); Cheyne Capital International (investment)(2000-2017); GMP Companies (investment)(2000-2011); Cytos Biotechnology Ltd (biotechnology)(2012-2014); Cerus (biomedical)(2016-present); PureEarth(non-profit)(2012-present); Caelum BioSciences (biomedical)(2018-present)

| |

23

Equity Series

Directors’ and Officers’ Information

(unaudited)

Independent Directors (continued)

| Name: | Peter L. Faber | |

| Address: | 290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: | 81 | |

| Current Position(s) Held with Fund: | Director, Governance & Nominating Committee Member | |

| Term of Office & Length of Time Served: | Indefinite – Since 1987 | |

| Principal Occupation(s) During Past 5 Years: | Senior Counsel (2006-2012), Partner (1995-2006 & 2013-present) - | |

| McDermott, Will & Emery LLP (law firm) | ||

| Number of Portfolios Overseen within Fund Complex: | 32 | |

| Other Directorships Held Outside Fund Complex During Past 5 Years: | Boston Early Music Festival (non-profit)(2007-present); Amherst Early Music, Inc. (non-profit)(2009-present); Gotham Early Music Scene, Inc. (non-profit)(2009-present); Partnership for New York City, Inc. (non-profit)(1989-2010); New York Collegium (non-profit)(2004-2011); S’Cool Sounds, Inc. (non-profit)(2017-present)

| |

| Name: | Harris H. Rusitzky | |

| Address: | 290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: | 84 | |

| Current Position(s) Held with Fund: | Director, Audit Committee Member, Governance & Nominating Committee Member | |

| Term of Office & Length of Time Served: | Indefinite – Since 1985 | |

| Principal Occupation(s) During Past 5 Years: | President (1994- present) - The Greening Group (business consultants); | |

| Partner (2006-present) - The Restaurant Group (restaurants) | ||

| Number of Portfolios Overseen within Fund Complex: | 32 | |

| Other Directorships Held Outside Fund Complex During Past 5 Years: | Rochester Institute of Technology (university)(1972-present); Culinary Institute of America (non-profit college)(1985-present); George Eastman House (museum)(1988-present); National Restaurant Association (restaurant trade organization)(1978-present)

| |

| Name: | Chester N. Watson | |

| Address: | 290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: | 69 | |

| Current Position(s) Held with Fund: | Director, Audit Committee Chairman, Governance & Nominating Committee Member | |

| Term of Office & Length of Time Served: | Indefinite – Director, Audit Committee Member, Governance & Nominating Committee Member Since 2012; Audit Committee Chairman since 2013 | |

| Principal Occupation(s) During Past 5 Years: | General Auditor (2003-2011) - General Motors Company (auto manufacturer) | |

| Number of Portfolios Overseen within Fund Complex: | 32 | |

| Other Directorships Held Outside Fund Complex During Past 5 Years: | Rochester Institute of Technology (university)(2005-present); Town of Greenburgh, NY Planning Board (municipal government) (2015-2018)

| |

| Officers: | ||

| Name: | Elizabeth Craig | |

| Address: | 290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: | 32 | |

| Current Position(s) Held with Fund: | Corporate Secretary | |

| Term of Office1 & Length of Time Served: | Since 2016 | |

| Principal Occupation(s) During Past 5 Years: | Fund Regulatory Administration Manager since 2018; Fund Administration Manager (2015-2018); Mutual Fund Compliance Specialist (2009-2015) - Manning & Napier Advisors, LLC; Assistant Corporate Secretary (2011-2016) - Manning & Napier Fund, Inc.

| |

24

Equity Series

Directors’ and Officers’ Information

(unaudited)

Officers: (continued)

| Name: | Christine Glavin | |

| Address: | 290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: | 53 | |

| Current Position(s) Held with Fund: | Principal Financial Officer, Chief Financial Officer | |

| Term of Office1 & Length of Time Served: | Principal Financial Officer since 2002; Chief Financial Officer since 2001 | |

| Principal Occupation(s) During Past 5 Years: | Director of Fund Reporting since 2011; Fund Reporting Manager (1997-2011) - Manning & Napier Advisors, LLC; Assistant Treasurer since 2008 - Exeter Trust Company; Chief Financial Officer (2017-2018) - Rainier Investment Management Mutual Funds, Inc.

| |

| Name: | Samantha Larew | |

| Address: | 290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: | 39 | |

| Current Position(s) Held with Fund: | Chief Compliance Officer and Anti-Money Laundering Compliance Officer | |

| Term of Office1 & Length of Time Served: | Chief Compliance Officer since 2019; Anti-Money Laundering Compliance Officer since 2018 | |

| Principal Occupation(s) During Past 5 Years: | Co-Director of Compliance (since 2018); Compliance Communications Supervisor (2014-2018); Compliance Supervisor (2011-2014); Broker-Dealer Compliance Analyst (2010-2014) - Manning & Napier Advisors, LLC and affiliates; Broker-Dealer Chief Compliance Officer (since 2013) – Manning & Napier Investor Services, Inc.; Compliance Analyst (2007-2009) – Wall Street Financial Group; Compliance Specialist (2003-2007) – Manning & Napier Advisors, LLC and affiliates Holds one or more of the following titles for various affiliates: Assistant Corporate Secretary, Chief Compliance Officer

| |

| Name: | Scott Morabito | |

| Address: | 290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: | 31 | |

| Current Position(s) Held with Fund: | Vice President | |

| Term of Office1 & Length of Time Served: | Vice President since 2019; Assistant Vice President (2017-2019) | |

| Principal Occupation(s) During Past 5 Years: | Managing Director of Operations since 2019 and Director of Funds Group from 2017 - 2019; Fund Product and Strategy Manager (2014-2017); Senior Product and Strategy Analyst (2013-2014); Product and Strategy Analyst (2011-2013) - Manning & Napier Advisors, LLC; President, Director – Manning & Napier Investor Services, Inc. since 2018

| |

| Name: | Sarah Turner | |

| Address: | 290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: | 37 | |

| Current Position(s) Held with Fund: | Chief Legal Officer; Assistant Corporate Secretary | |

| Term of Office1 & Length of Time Served: | Since 2018 | |

| Principal Occupation(s) During Past 5 Years: | General Counsel since 2018 - Manning & Napier Advisors, LLC and affiliates; Counsel (2017-2018) – Harter Secrest and Emery LLP; Legal Counsel (2010-2017) – Manning & Napier Advisors, LLC and affiliates Holds one or more of the following titles for various affiliates: Corporate Secretary, General Counsel | |

*Interested Director, within the meaning of the 1940 Act by reason of his positions with the Fund’s Advisor, Manning & Napier Advisors, LLC, and Distributor, Manning & Napier Investor Services, Inc.

1The term of office of all officers shall be one year and until their respective successors are chosen and qualified, or his or her earlier resignation or removal as provided in the Fund’s By-Laws.

25

Equity Series

Literature Requests

(unaudited)

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available, without charge, upon request:

| By phone |

1-800-466-3863 | |

| On the Securities and Exchange |

||

| Commission’s (SEC) web site |

http://www.sec.gov |

Proxy Voting Record

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available, without charge, upon request:

| By phone |

1-800-466-3863 | |

| On the SEC’s web site |

http://www.sec.gov |

Quarterly Portfolio Holdings

The Series’ complete schedule of portfolio holdings for the 1st and 3rd quarters of each fiscal year are provided on Form N-PORT, and are available, without charge, upon request:

| By phone |

1-800-466-3863 | |

| On the SEC’s web site |

http://www.sec.gov |

Prospectus and Statement of Additional Information (SAI)

For more information about any of the Manning & Napier Fund, Inc. Series, you may obtain a prospectus and SAI at www.manning-napier.com or by calling (800) 466-3863. Before investing, carefully consider the objectives, risks, charges and expenses of the investment and read the prospectus carefully as it contains this and other information about the investment company. In addition, this information can be found on the SEC’s web site, http://www.sec.gov.

Additional information available at www.manning-napier.com

1. Fund Holdings - Month-End

2. Fund Holdings - Quarter-End

3. Shareholder Report - Annual

4. Shareholder Report - Semi-Annual

The Fund also offers electronic notification or “e-delivery” when certain documents are available on-line to be downloaded or reviewed. Direct shareholders can elect to receive electronic notification when shareholder reports, prospectus updates, and/or statements are available. If you do not currently have on-line access to your account, you can establish access by going to www.manning-napier.com, click on “Login” in the top corner of the page, and follow the prompts to self-enroll. Once enrolled, you can set your electronic notification preferences by clicking on the Account Options tab located within the green toolbar and then select E-Delivery Option. Should you have any questions on either how to establish on-line access or how to update your account settings, please contact Investor Services at 1-800-466-3863.

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

MNEQY-10/19-AR

www.manning-napier.com

| Manning & Napier Fund, Inc.

|

| Blended Asset Conservative Series |

| Blended Asset Moderate Series |

| Blended Asset Extended Series |

| Blended Asset Maximum Series |

Beginning on June 25, 2021, as permitted by Securities and Exchange Commission regulations, paper copies of the Series’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary or, if you are a direct investor, by visiting www.manning-napier.com or calling 1-800-466-3863.

You may elect to receive all future annual and semi-annual reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by visiting www.manning-napier.com or calling

1-800-466-3863. Your election to receive reports in paper will apply to all funds held with your financial intermediary if you invest through a financial intermediary or all series of the Fund if you invest directly with the Fund.

|

Independent Perspective | Real-World Solutions |

A Note from Our CEO

Dear Shareholder,

Corporate Headquarters | 290 Woodcliff Drive | Fairport, NY 14450 | (585) 325-6880 phone | (800) 551-0224 toll free | www.manning-napier.com

1

Fund Commentary

(unaudited)

Investment Objective

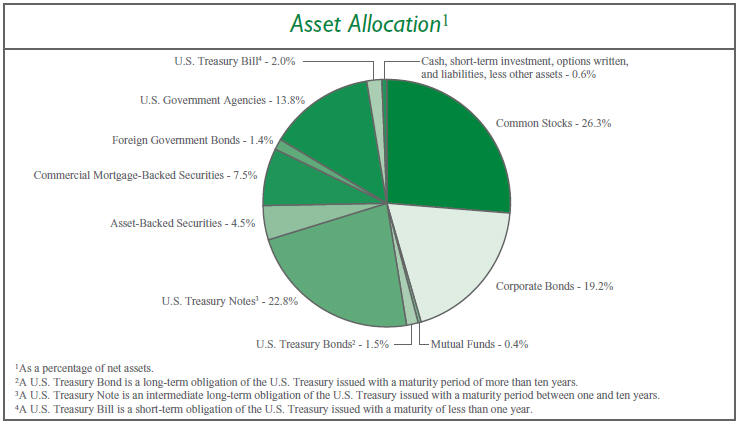

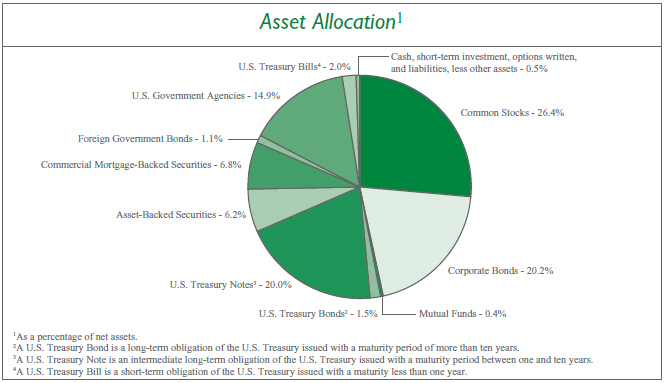

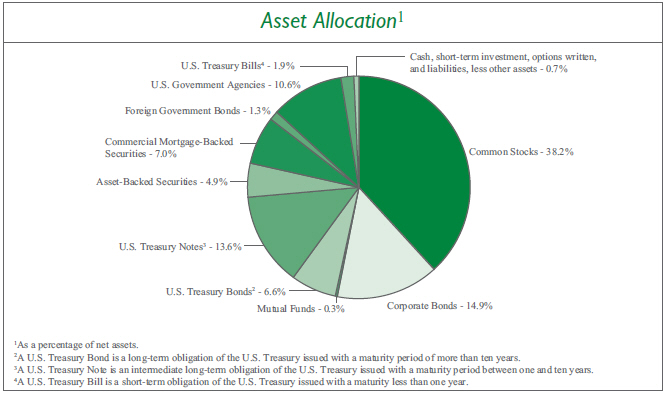

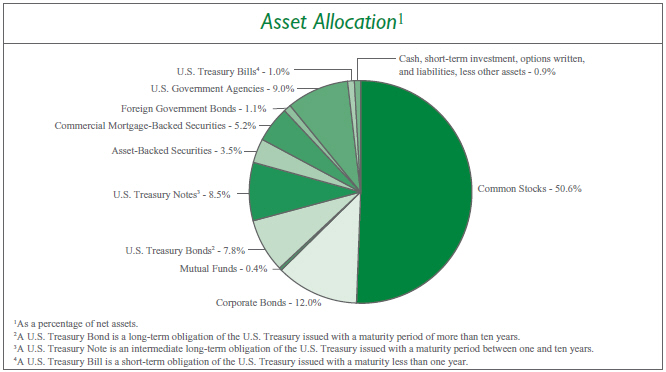

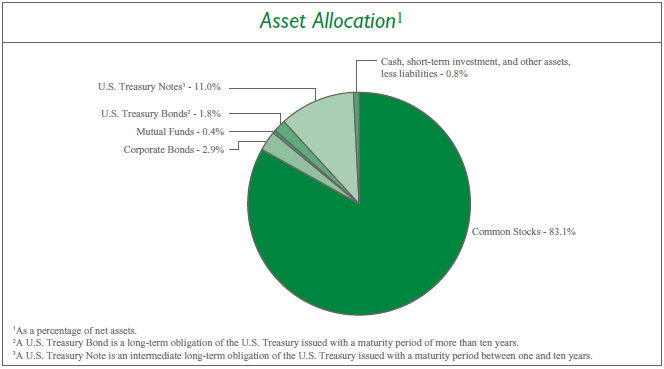

The Blended Asset Series are strategically allocated across stocks, bonds, and cash to balance growth, capital preservation, and income to fit a range of investor risk management priorities.

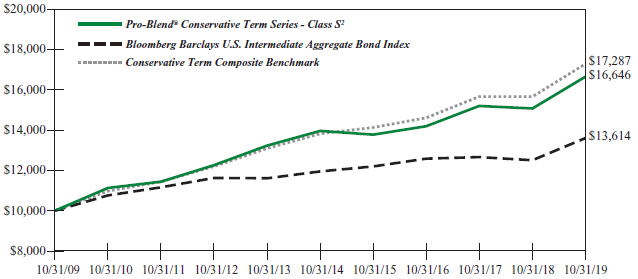

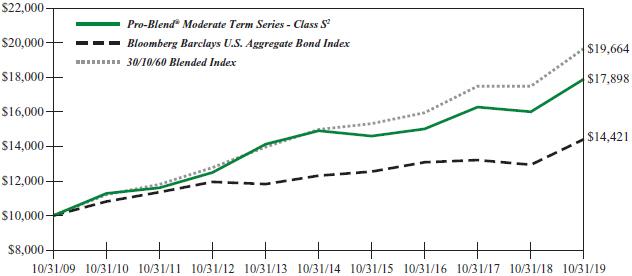

Performance Commentary

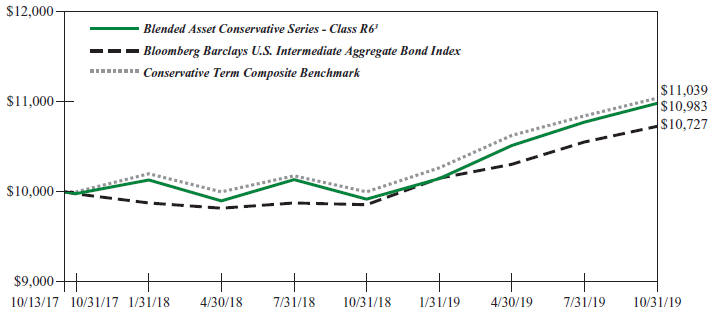

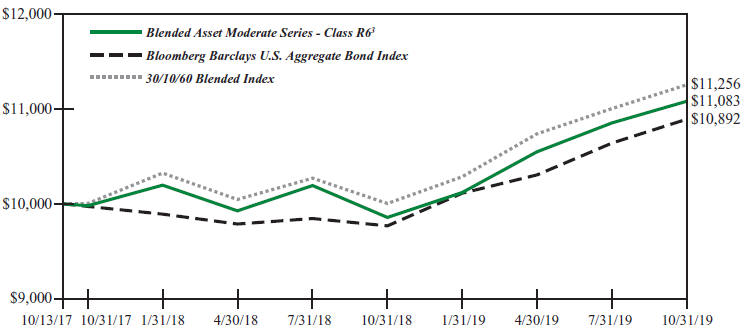

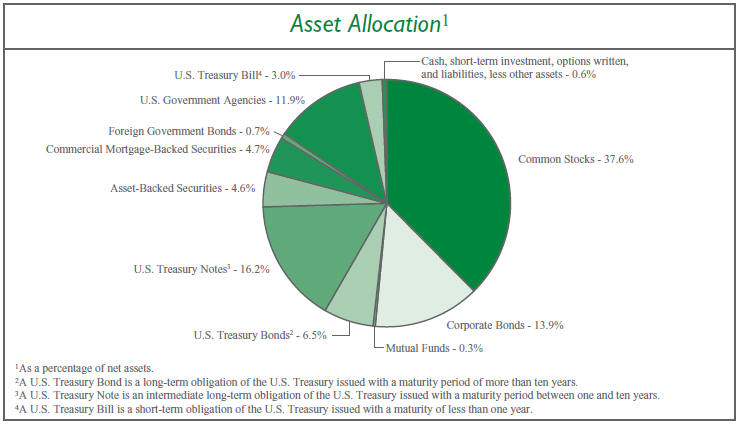

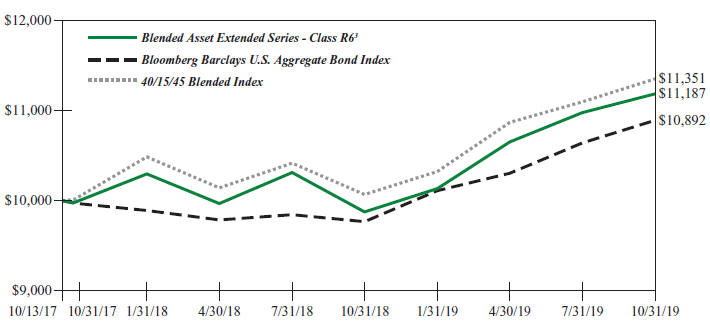

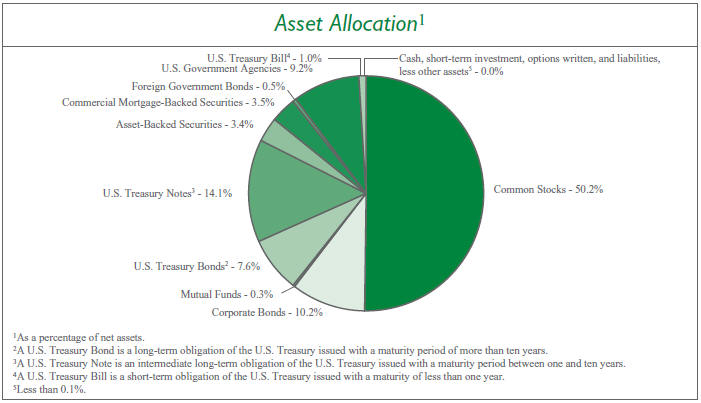

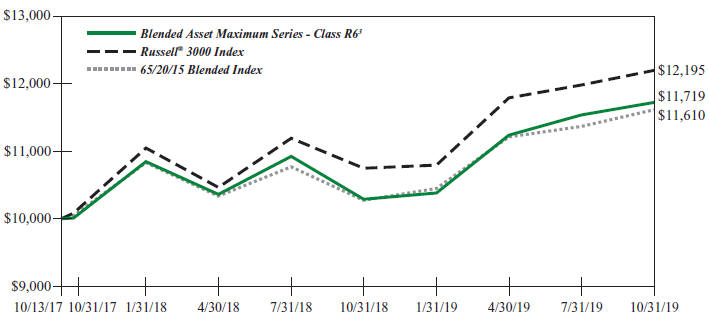

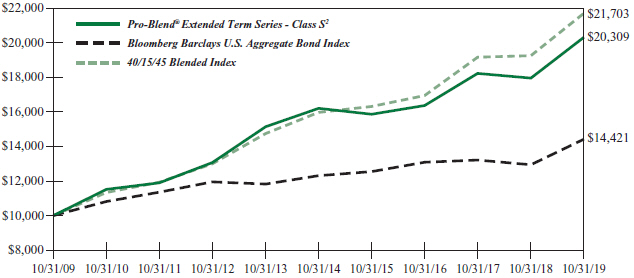

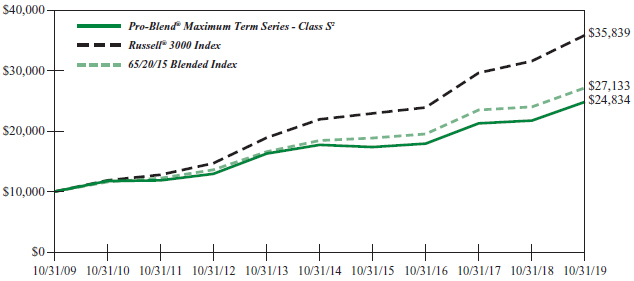

Global equity and fixed income markets posted strong positive returns for the twelve-month period ending October 31, 2019. Over the one year period, equities outperformed fixed income markets, and within stocks, US equities outperformed international markets. With respect to equities, large-cap stocks outperformed small-and mid-cap stocks, while growth stocks outperformed their value counterparts. On the fixed income side, corporate bonds experienced the highest returns from a sector perspective, while longer dated bonds were the highest returning segment of the market from a maturity perspective as a result of falling interest rates.

Each of the Blended Asset Series delivered positive returns over the period, and, with the exception of Moderate Series, outperformed their respective blended benchmarks.

Among the largest contributors to relative returns (i.e., returns compared to the benchmark) was stock selection in Materials, Health Care, Consumer Staples, Information Technology, and Real Estate, as well as from an overweight to Real Estate and underweight to Energy. Additionally, selection within Consumer Discretionary was a large contributor to outperformance for the Maximum Series. Underperformance for the Moderate Series was largely attributable to positioning within the fixed income portion of the portfolio when compared to the benchmark. Specifically, a shorter duration in a period where interest rates generally fell.

We believe the global economy is showing signs of moving into the later stages of the economic cycle. When this occurs, it is common to see strong stock market gains. While these rallies may give investors the feeling of missing out, it is exactly in these moments that risk management can be most valuable.

Given our outlook, the portfolios are focused on higher quality businesses and reasonably priced growth companies. We prefer businesses with strong management and solid balance sheets who have historically provided some degree of downside protection in adverse markets.

This view has led to meaningful positions in areas such as Consumer Staples and Health Care. In contrast, the portfolios are less exposed to sectors that are highly dependent on strong and above average economic growth such as Industrials and Energy. On the fixed income side, we are seeing opportunities in select corporate bonds and shorter duration, higher-quality securitized credit.

Please see the next page for additional performance information as of October 31, 2019.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than that quoted; investors can obtain the most recent month-end performance at www.manning-napier.com or by calling (800) 466-3863.

Commentary prepared using data provided by FactSet. Analysis Manning & Napier. Commentary presented is relative to each Series’ respective blended benchmark. Additional information and associated disclosures can be found on the Performance Update pages contained in this report.