UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04087

Manning & Napier Fund, Inc.

(Exact name of registrant as specified in charter)

290 Woodcliff Drive, Fairport, NY 14450

(Address of principal executive offices)(Zip Code)

B. Reuben Auspitz 290 Woodcliff Drive, Fairport, NY 14450

(Name and address of agent for service)

Registrant’s telephone number, including area code: 585-325-6880

Date of fiscal year end: December 31, 2010

Date of reporting period: January 1, 2010 through December 31, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS |

Management Discussion and Analysis (unaudited)

Dear Shareholders:

Over the course of 2010, the markets experienced several ups and downs driven by well-defined swings in investor sentiment. Optimism fueled strong market returns early in the year, as upbeat economic releases led investors to believe in the potential for a robust U.S. recovery. However, sentiment shifted drastically in May and June as more negative economic news and issues related to Europe’s government debt problems led to notable stock market losses. In another swing, the markets rebounded in the fall amid better economic developments and prospects that the Federal Reserve would enact another round of quantitative easing. That rally generally continued through the end of the year as the markets reacted positively to the U.S. tax compromise, which extended the Bush-era tax cuts for all income brackets.

With equities posting double-digit gains in the third and fourth quarters, the choppy year ended on a strong note, and broad equity indices have now produced back-to-back years of positive results. For the twelve months ending December 31, 2010, the S&P 500 Index returned 15.07%, while the S&P 500 Health Care Index earned only 2.9%, as Health Care was the lowest performing market sector in 2010.

The Life Sciences Series had a 14.80% return during 2010, noticeably outpacing the S&P 500 Health Care Index yet slightly lagging the broader stock market. More importantly, the Series continues to have a strong track record relative to the broad market and the sector-specific benchmark over the current market cycle, which includes both a bull and a bear market. Over this current cycle, the Life Sciences Series has earned an annualized return of 9.90%, compared to the 7.52% return of the S&P 500 Index and the 4.49% return of the S&P 500 Health Care Index.

In the volatile markets of 2010, Manning & Napier maintained a selective investment approach and focused on companies that we believe can grow market share. We continued to emphasize quality, targeting best-in-class companies expected to generate sales growth despite a muted economic backdrop, as well as “away game winners” expected to successfully compete in faster-growing markets overseas.

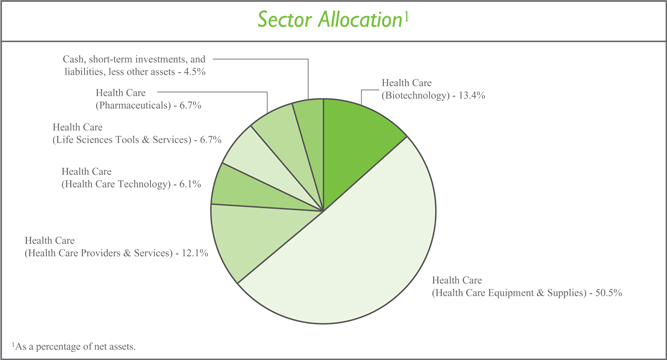

In the current health care environment, Manning & Napier is targeting companies that can lower costs and enhance quality. With this particular focus, over the past year the Series had a substantial weighting to diagnostics companies, which are part of the health care equipment and supplies industry. By emphasizing prevention and early detection, we believe diagnostics companies can improve health care treatment and help avoid expensive, unexpected hospital visits. The Series started 2010 with a significantly higher allocation to the health care equipment and supplies industry than the benchmark, and this exposure increased during the year. By the end of the year, about half of the portfolio consisted of companies within this industry.

The Advisor also sees opportunities in health care information technology companies. Over the last twelve months, the Series maintained an overweight to the health care technology industry relative to the benchmark, although this weighting is much smaller than that of the health care equipment and supplies industry. Additionally, the Series reduced exposure to health care providers and services over the past year, and the Series continued to have a noteworthy underweight to pharmaceuticals versus the benchmark, which aided relative returns.

Stock selection decisions were the primary drivers of outperformance for the Life Sciences Series in 2010. In particular, the Series’ relative results benefited from specific holdings in the health care equipment and supplies industry as well as the life sciences tools and services industry.

While economic developments turned more optimistic toward the end of 2010, the U.S. economy still faces significant headwinds, including a struggling housing market, a stagnant job market, a difficult consumer rebalancing act, and high government debt burdens. Given these long-term structural issues, the slow growth environment in the U.S. will likely remain a reality. As the markets fluctuated around this slow growth trend in 2010, Manning & Napier earned solid returns

1

Management Discussion and Analysis (unaudited)

by staying focused on the fundamentals and maintaining our selective investment process. This investment approach has proved beneficial for the past 40 years, and we believe these qualities will remain important as the market environment unfolds in 2011.

As always, we appreciate your business.

Sincerely,

Manning & Napier Advisors, Inc.

| 2 |

Performance Update as of December 31, 2010 (unaudited)

|

Average Annual Total Returns |

||||||||||||||||||

| One Year |

Five Year |

Ten Year |

Since Inception 1 |

|||||||||||||||

| Manning & Napier Fund, Inc. - Life Sciences Series2 |

14.80 | % | 5.84% | 6.36% | 12.58% | |||||||||||||

| S&P 500 Total Return Index3 |

15.07 | % | 2.30% | 1.42% | 1.05% | |||||||||||||

| S&P 500 Health Care Index3 |

2.90 | % | 1.89% | -0.23% | 1.67% | |||||||||||||

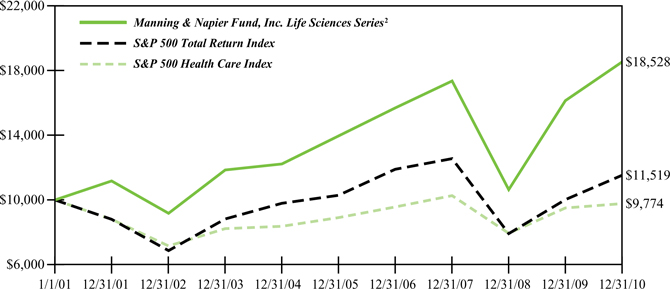

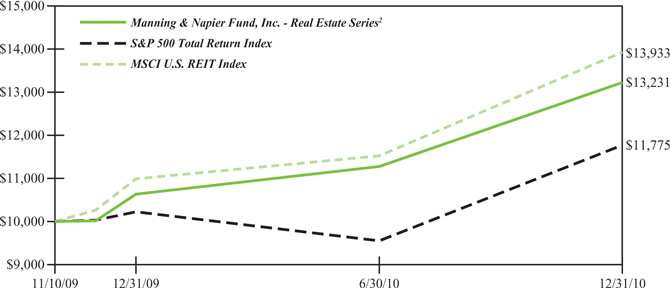

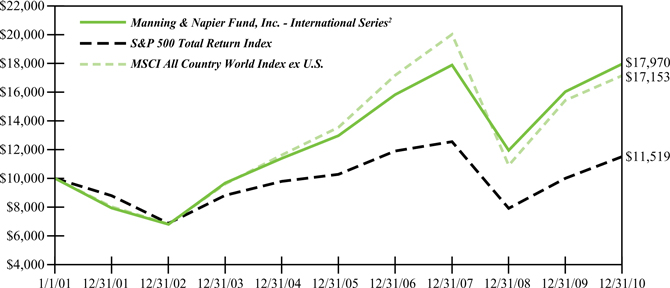

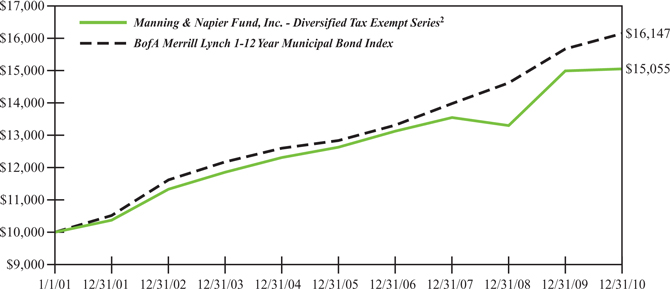

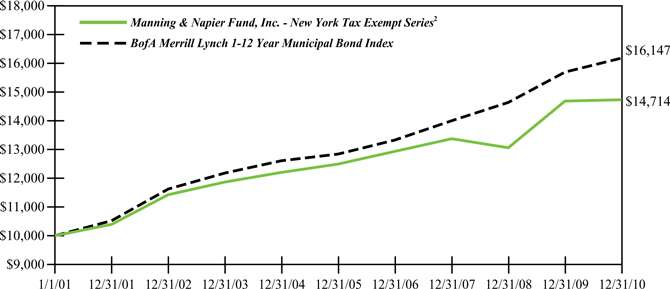

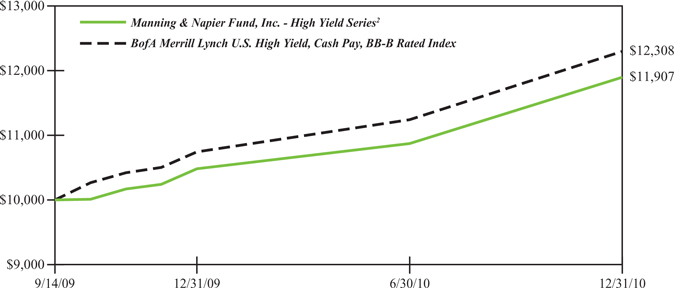

The following graph compares the value of a $10,000 investment in the Manning & Napier Fund, Inc. - Life Sciences Series for the ten years ended December 31, 2010 to the S&P 500 Total Return Index and the S&P 500 Health Care Index.

1Performance numbers for the Series and Indices are calculated from November 5, 1999, the Series’ current activation date.

2The Series’ performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. The Series’ performance is historical and may not be indicative of future results. The performance returns shown are inclusive of the net expense ratio of the Series. For the year ended December 31, 2010, this net expense ratio was 1.09%. The gross expense ratio, which does not account for any voluntary or contractual waivers currently in effect, was 1.09% for the year ended December 31, 2010.

3The S&P 500 Total Return Index is an unmanaged capitalization-weighted measure of 500 widely held common stocks listed on the New York Stock Exchange, American Stock Exchange and the Over-the-Counter market. The S&P 500 Health Care Index, a sub-index of the S&P 500 Total Return Index, includes the stocks of companies involved in the business of health care related products and services. Both Indices’ returns assume daily reinvestment of dividends and, unlike Series returns, do not reflect any fees or expenses.

| 3 |

Shareholder Expense Example (unaudited)

| Beginning Account Value 7/1/10 |

Ending Account Value 12/31/10 |

Expenses Paid During Period* 7/1/10-12/31/10 | ||||||||

| Actual |

$1,000.00 | $1,178.00 | $6.04 | |||||||

| Hypothetical |

$1,000.00 | $1,019.66 | $5.60 |

*Expenses are equal to the Series’ annualized expense ratio (for the six-month period) of 1.10%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses are based on the most recent fiscal half year; therefore, the expense ratio stated above may differ from the expense ratio stated in the financial highlights, which is based on one-year data. The Series’ total return would have been lower had certain expenses not been waived during the period.

| 4 |

Portfolio Composition as of December 31, 2010 (unaudited)

|

Top Ten Stock Holdings2 |

| |||||||||||

| Alere, Inc. |

5.8 | % | Cerner Corp. | 4.0 | % | |||||||

| Gen-Probe, Inc. |

5.8 | % | Sequenom, Inc. | 3.5 | % | |||||||

| Zoll Medical Corp. |

5.3 | % | Insulet Corp. | 3.4 | % | |||||||

| Cochlear Ltd. (Australia) |

4.7 | % | Amgen, Inc. | 3.2 | % | |||||||

| DexCom, Inc. |

4.5 | % | UCB S.A. (Belgium) | 3.2 | % | |||||||

| 2As a percentage of total investments.

|

||||||||||||

| 5 |

Investment Portfolio - December 31, 2010

| Shares |

Value (Note 2) |

|||||||

| COMMON STOCKS - 95.4% |

||||||||

| Financials - 0.0% |

||||||||

| Insurance - 0.0% |

||||||||

| Avalon HealthCare Holdings, Inc.*1,2,3,4 |

38,359 | $ | — | |||||

| Health Care - 95.4% |

||||||||

| Biotechnology - 13.4% |

||||||||

| Amgen, Inc.* |

145,770 | 8,002,773 | ||||||

| Basilea Pharmaceutica AG (Switzerland)*6 |

77,000 | 5,354,529 | ||||||

| Cepheid, Inc.* |

155,000 | 3,526,250 | ||||||

| Momenta Pharmaceuticals, Inc.* |

312,230 | 4,674,083 | ||||||

| Swedish Orphan Biovitrum AB (Sweden)*6 |

740,501 | 4,455,306 | ||||||

| United Therapeutics Corp.* |

114,500 | 7,238,690 | ||||||

| 33,251,631 | ||||||||

| Health Care Equipment & Supplies - 50.5% |

||||||||

| Abaxis, Inc.* |

232,500 | 6,242,625 | ||||||

| Alere, Inc.* |

273,000 | 9,991,800 | ||||||

| Alere, Inc.*3,5 |

122,000 | 4,465,200 | ||||||

| Becton, Dickinson and Co. |

57,000 | 4,817,640 | ||||||

| Cochlear Ltd. (Australia)6 |

141,230 | 11,625,969 | ||||||

| Conceptus, Inc.* |

405,000 | 5,589,000 | ||||||

| Covidien plc (Ireland) |

148,601 | 6,785,122 | ||||||

| DexCom, Inc.* |

815,000 | 11,124,750 | ||||||

| Gen-Probe, Inc.*2 |

246,000 | 14,354,100 | ||||||

| Hogy Medical Co. Ltd. (Japan)6 |

99,000 | 4,811,432 | ||||||

| Hologic, Inc.* |

310,000 | 5,834,200 | ||||||

| Insulet Corp.* |

550,970 | 8,540,035 | ||||||

| Quidel Corp.* |

325,000 | 4,696,250 | ||||||

| Sirona Dental Systems, Inc.* |

128,100 | 5,352,018 | ||||||

| Straumann Holding AG (Switzerland)6 |

32,717 | 7,492,365 | ||||||

| Zoll Medical Corp.*2 |

355,000 | 13,216,650 | ||||||

| 124,939,156 | ||||||||

| Health Care Providers & Services - 12.1% |

||||||||

| Bio-Reference Laboratories, Inc.* |

280,000 | 6,210,400 | ||||||

| China Cord Blood Corp. (Hong Kong)* |

894,000 | 3,584,940 | ||||||

| Cross Country Healthcare, Inc.* |

640,300 | 5,423,341 | ||||||

| Diagnosticos da America S.A. (Brazil) |

542,000 | 7,346,385 | ||||||

| Sonic Healthcare Ltd. (Australia)6 |

614,000 | 7,298,923 | ||||||

| 29,863,989 | ||||||||

| Health Care Technology - 6.1% |

||||||||

| Allscripts Healthcare Solutions, Inc.* |

277,000 | 5,337,790 | ||||||

| Cerner Corp.* |

104,000 | 9,852,960 | ||||||

| 15,190,750 | ||||||||

| 6 | The accompanying notes are an integral part of the financial statements. |

Investment Portfolio - December 31, 2010

| Shares |

Value (Note 2) |

|||||||

| COMMON STOCKS (continued) |

||||||||

| Health Care (continued) |

||||||||

| Life Sciences Tools & Services - 6.6% |

||||||||

| Caliper Life Sciences, Inc.* |

1,037,452 | $ | 6,577,446 | |||||

| Sequenom, Inc.* |

1,085,000 | 8,701,700 | ||||||

| WuXi PharmaTech (Cayman), Inc. - ADR (Cayman Islands)* |

70,000 | 1,129,800 | ||||||

| 16,408,946 | ||||||||

| Pharmaceuticals - 6.7% |

||||||||

| Green Cross Corp. (South Korea)6 |

43,000 | 5,260,298 | ||||||

| Teva Pharmaceutical Industries Ltd. - ADR (Israel) |

66,500 | 3,466,645 | ||||||

| UCB S.A. (Belgium)6 |

228,939 | 7,861,333 | ||||||

| 16,588,276 | ||||||||

| Total Health Care |

236,242,748 | |||||||

| TOTAL COMMON STOCKS |

236,242,748 | |||||||

| PREFERRED STOCKS - 0.0% |

||||||||

| Financials - 0.0% |

||||||||

| Insurance - 0.0% |

||||||||

| Avalon HealthCare Holdings, Inc. - Series D*2,3,4,7 |

925,000 | — | ||||||

| WARRANTS - 0.1% |

||||||||

| Financials - 0.0% |

||||||||

| Insurance - 0.0% |

||||||||

| Avalon HealthCare Holdings, Inc., 2/27/20142,3,4,8 |

38,359 | — | ||||||

| Health Care - 0.1% |

||||||||

| Life Sciences Tools & Services - 0.1% |

||||||||

| Caliper Life Sciences, Inc., 8/10/2011 |

401,109 | 248,687 | ||||||

| TOTAL WARRANTS |

248,687 | |||||||

| SHORT-TERM INVESTMENTS - 4.7% |

||||||||

| Dreyfus Cash Management, Inc. - Institutional Shares9, 0.14%, |

11,668,542 | 11,668,542 | ||||||

| The accompanying notes are an integral part of the financial statements. | 7 |

Investment Portfolio - December 31, 2010

|

Value (Note 2) |

||||

| TOTAL INVESTMENTS - 100.2% |

$ | 248,159,977 | ||

| LIABILITIES, LESS OTHER ASSETS - (0.2%) |

(596,067 | ) | ||

| NET ASSETS - 100% |

$ | 247,563,910 | ||

ADR - American Depository Receipt

*Non-income producing security

| 1 | This security was acquired on February 27, 2009 at a cost of $76,718 ($2.00 per share) and has been determined to be illiquid under guidelines established by the Board of Directors (see Note 2 to the financial statements). |

| 2 | Affiliated company as defined by the Investment Company Act of 1940 (see Note 2 to the financial statements). |

| 3 | Restricted securities - Investment in securities that are restricted as to public resale under the Securities Act of 1933, as amended. These securities amount to $4,465,200, or 1.8% of the Series’ net assets as of December 31, 2010 (see Note 2 to the financial statements). |

| 4 | Security has been valued at fair value (see Note 2 to the financial statements). |

| 5 | This security was acquired on February 3, 2006 at a cost of $2,978,020 ($24.41 per share) and has been determined to be liquid under guidelines established by the Board of Directors (see Note 2 to the financial statements). |

| 6 | International Fair Value factor from pricing service was applied. |

| 7 | This security was acquired on June 22, 2007 at a cost of $2,312,500 ($2.50 per share) and has been determined to be illiquid under guidelines established by the Board of Directors (see Note 2 to the financial statements). |

| 8 | This security was acquired on February 27, 2009 at a cost of $19,180 ($0.50 per warrant) and has been determined to be illiquid under guidelines established by the Board of Directors (see Note 2 to the financial statements). |

| 9 | Rate shown is the current yield as of December 31, 2010. |

| 8 | The accompanying notes are an integral part of the financial statements. |

Statement of Assets and Liabilities

December 31, 2010

| ASSETS: |

||||

| Investments, at value (identified cost $199,460,933) (Note 2) |

$ | 248,159,977 | ||

| Receivable for fund shares sold |

157,402 | |||

| Foreign tax reclaims receivable |

131,557 | |||

| Dividends receivable |

75,196 | |||

| TOTAL ASSETS |

248,524,132 | |||

| LIABILITIES: |

||||

| Accrued management fees (Note 3) |

204,807 | |||

| Accrued fund accounting and administration fees (Note 3) |

7,788 | |||

| Accrued transfer agent fees (Note 3) |

2,594 | |||

| Accrued Chief Compliance Officer service fees (Note 3) |

245 | |||

| Payable for fund shares repurchased |

355,159 | |||

| Payable for securities purchased |

326,716 | |||

| Other payables and accrued expenses |

62,913 | |||

| TOTAL LIABILITIES |

960,222 | |||

| TOTAL NET ASSETS |

$ | 247,563,910 | ||

| NET ASSETS CONSIST OF: |

||||

| Capital stock |

$ | 203,302 | ||

| Additional paid-in-capital |

219,578,943 | |||

| Undistributed net investment loss |

(20,942 | ) | ||

| Accumulated net realized loss on investments, foreign currency and translation of other assets and liabilities |

(20,912,749 | ) | ||

| Net unrealized appreciation on investments, foreign currency and translation of other assets and liabilities |

48,715,356 | |||

| TOTAL NET ASSETS |

$ | 247,563,910 | ||

| NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - CLASS A |

$ | 12.18 | ||

| The accompanying notes are an integral part of the financial statements. | 9 |

Statement of Operations

For the Year Ended December 31, 2010

| INVESTMENT INCOME: |

||||

| Dividends (net of foreign taxes withheld, $154,466) |

$ | 1,804,817 | ||

| Interest |

1,681 | |||

| Total Investment Income |

1,806,498 | |||

| EXPENSES: |

||||

| Management fees (Note 3) |

2,650,046 | |||

| Fund accounting and administration fees (Note 3) |

61,888 | |||

| Transfer agent fees (Note 3) |

15,672 | |||

| Directors’ fees (Note 3) |

10,566 | |||

| Chief Compliance Officer service fees (Note 3) |

2,631 | |||

| Custodian fees |

52,878 | |||

| Miscellaneous |

102,561 | |||

| Total Expenses |

2,896,242 | |||

| Less reduction of expenses (Note 3) |

(758 | ) | ||

| Net Expenses |

2,895,484 | |||

| NET INVESTMENT LOSS |

(1,088,986 | ) | ||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: |

||||

| Net realized gain (loss) on- |

||||

| Investments |

18,309,383 | |||

| Foreign currency and translation of other assets and liabilities |

(75,704 | ) | ||

| 18,233,679 | ||||

| Net change in unrealized appreciation appreciation on- |

||||

| Investments |

17,281,571 | |||

| Foreign currency and translation of other assets and liabilities |

12,605 | |||

| 17,294,176 | ||||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCY |

35,527,855 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 34,438,869 | ||

| 10 | The accompanying notes are an integral part of the financial statements. |

Statements of Changes in Net Assets

| For the Year Ended 12/31/10 |

For the Year Ended 12/31/09 |

|||||||

| INCREASE (DECREASE) IN NET ASSETS: |

||||||||

| OPERATIONS: |

||||||||

| Net investment loss |

$ | (1,088,986 | ) | $ | (1,203,760 | ) | ||

| Net realized gain (loss) on investments, foreign currency and written options |

18,233,679 | (3,756,944 | ) | |||||

| Net change in unrealized appreciation on investments and foreign currency |

17,294,176 | 99,105,593 | ||||||

| Net increase from operations |

34,438,869 | 94,144,889 | ||||||

| CAPITAL STOCK ISSUED AND REPURCHASED: |

||||||||

| Net decrease from capital share transactions (Note 5) |

(59,818,922 | ) | (3,905,204 | ) | ||||

| Net increase (decrease) in net assets |

(25,380,053 | ) | 90,239,685 | |||||

| NET ASSETS: |

||||||||

| Beginning of year |

272,943,963 | 182,704,278 | ||||||

| End of year (including undistributed net investment income (loss) of $(20,942) and $0, respectively) |

$ | 247,563,910 | $ | 272,943,963 | ||||

| The accompanying notes are an integral part of the financial statements. | 11 |

Financial Highlights

| For the Years Ended | ||||||||||||||||||||||||

| 12/31/10 | 12/31/09 | 12/31/08 | 12/31/07 | 12/31/06 | ||||||||||||||||||||

| Per share data (for a share outstanding throughout each year): |

||||||||||||||||||||||||

| Net asset value - Beginning of year |

$ | 10.61 | $ | 6.99 | $ | 11.54 | $ | 11.41 | $ | 12.10 | ||||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment loss |

(0.04 | )1 | (0.05 | )1 | (0.06 | ) | (0.08 | ) | (0.05 | ) | ||||||||||||||

| Net realized and unrealized gain (loss) on investments |

1.61 | 3.67 | (4.38 | ) | 1.25 | 1.56 | ||||||||||||||||||

| Total from investment operations |

1.57 | 3.62 | (4.44 | ) | 1.17 | 1.51 | ||||||||||||||||||

| Less distributions to shareholders: |

||||||||||||||||||||||||

| From net realized gain on investments |

— | — | (0.11 | ) | (1.04 | ) | (2.20 | ) | ||||||||||||||||

| Net asset value - End of year |

$ | 12.18 | $ | 10.61 | $ | 6.99 | $ | 11.54 | $ | 11.41 | ||||||||||||||

| Net assets - End of year |

||||||||||||||||||||||||

| (000’s omitted) |

$ | 247,564 | $ | 272,944 | $ | 182,704 | $ | 299,669 | $ | 233,072 | ||||||||||||||

| Total return2 |

14.80% | 51.79% | (38.77%) | 10.62% | 12.52% | |||||||||||||||||||

| Ratios (to average net assets)/ |

||||||||||||||||||||||||

| Supplemental Data: |

||||||||||||||||||||||||

| Expenses* |

1.09% | 1.11% | 1.12% | 1.12% | 1.14% | |||||||||||||||||||

| Net investment loss |

(0.41% | ) | (0.55% | ) | (0.65% | ) | (0.75% | ) | (0.51% | ) | ||||||||||||||

| Portfolio turnover |

67% | 95% | 94% | 95% | 93% | |||||||||||||||||||

| *The investment advisor did not impose all or a portion of its management fees, CCO fees, fund accounting and transfer agent fees, and other fees in some years and in some years paid a portion of the Series’ expenses. If these expenses had been incurred by the Series, the expense ratio (to average net assets) would have been increased by the following amounts: |

||||||||||||||||||||||||

| 0.00%3 | 0.01% | N/A | N/A | N/A | ||||||||||||||||||||

1Calculated based on average shares outstanding during the year.

2Represents aggregate total return for the years indicated, and assumes reinvestment of all distributions. Total returns would have been lower had certain expenses not been waived or reimbursed during certain years.

3Less than 0.01%.

| 12 | The accompanying notes are an integral part of the financial statements. |

Notes to Financial Statements

| 1. | ORGANIZATION |

Life Sciences Series (the “Series”) is a no-load diversified series of Manning & Napier Fund, Inc. (the “Fund”). The Fund is organized in Maryland and is registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as an open-end management investment company.

The Series’ investment objective is to provide long-term growth by investing principally in the common stocks of companies in the life sciences industry.

The Fund’s Advisor is Manning & Napier Advisors, Inc. (the “Advisor”). On November 5, 1999, the Series resumed sales of shares to advisory clients and employees of the Advisor and its affiliates. On May 1, 2001, the Series began offering shares directly to investors. Previously, the Series was available from time to time to advisory clients and employees of the Advisor. The total authorized capital stock of the Fund consists of 10.0 billion shares of common stock each having a par value of $0.01. As of December 31, 2010, 6.2 billion shares have been designated in total among 29 series, of which 100 million have been designated as Life Sciences Series Class A common stock.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

Security Valuation

Portfolio securities, including domestic equities, foreign equities, warrants and options, listed on an exchange other than the NASDAQ National Market System are valued at the latest quoted sales price of the exchange on which the security is primarily traded. Securities not traded on valuation date or securities not listed on an exchange are valued at the latest quoted bid price provided by the Fund’s pricing service. Securities listed on the NASDAQ National Market System are valued in accordance with the NASDAQ Official Closing Price.

Short-term investments that mature in sixty days or less are valued at amortized cost, which approximates market value. Investments in open-end investment companies are valued at their net asset value per share on valuation date.

Volume and level of activity in established markets for an asset or liability are evaluated to determine whether recent transactions and quoted prices are determinative of fair value. Where there have been significant decreases in volume and level of activity, further analysis and adjustment may be necessary to estimate fair value. The Series measures fair value in these instances by the use of inputs and valuation techniques which may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry and/or expectation of future cash flows. As a result of trading in relatively thin markets and/or markets that experience significant volatility, the prices used by the Series to value these securities may differ from the value that would be realized if these securities were sold, and the differences could be material.

Securities for which representative valuations or prices are not available from the Fund’s pricing service may be valued at fair value. Due to the inherent uncertainty of valuations of such securities, the fair value may differ significantly from the values that would have been used had a ready market for such securities existed. If trading or events occurring after the close of the principal market in which securities are traded are expected to materially affect the value of those securities, then they may be valued at their fair value, taking this trading or these events into account. Fair value is determined in good faith by the Advisor under procedures approved by and under the general supervision and responsibility of the Fund’s Board of Directors (the “Board”). In accordance with the procedures approved by the Board, the Series applies fair value pricing on a daily basis except for North American, Central American, South American and Caribbean equity securities. Fair valuing of securities is determined with the assistance of a pricing service using calculations or factors based on indices of domestic securities and other appropriate indicators, such as prices of relevant American Depository Receipts and futures contracts, to adjust local market prices for subsequent movements through the time the Series calculates its net asset value. The value of securities used for the net asset value calculation under the procedures may differ from published prices for the same securities. It is the Fund’s

| 13 |

Notes to Financial Statements

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

Security Valuation (continued)

policy to classify each foreign equity security, except for those in the regions noted above, as Level 2 securities due to the fact the pricing service evaluated what factor was applied to the calculated end of day market price.

Various inputs are used in determining the value of the Series’ assets or liabilities carried at market value. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical assets and liabilities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Level 3 includes significant unobservable inputs (including the Series’ own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the valuation levels used for major security types as of December 31, 2010 in valuing the Series’ assets or liabilities carried at market value:

| Description | Total | Level 1 | Level 2 | Level 3 | ||||||||||||

| Assets: |

||||||||||||||||

| Equity securities* |

$ | 236,491,435 | $ | 182,331,280 | $ | 54,160,155 | $ | — | **** | |||||||

| Preferred securities |

— | — | — | — | ||||||||||||

| Debt securities |

— | — | — | — | ||||||||||||

| Mutual funds |

11,668,542 | 11,668,542 | — | — | ||||||||||||

| Other financial |

— | — | — | — | ||||||||||||

| Total assets: |

248,159,977 | 193,999,822 | 54,160,155 | — | ||||||||||||

| Liabilities: |

||||||||||||||||

| Other financial |

— | — | — | — | ||||||||||||

| Total liabilities: |

— | — | — | — | ||||||||||||

| Total |

$ | 248,159,977 | $ | 193,999,822 | $ | 54,160,155 | $ | — | ||||||||

The following table is a reconciliation of Level 3 investments for which significant unobservable inputs were used to determine fair value:

| Level 3 reconciliation | Equity Securities |

Preferred Securities |

||||||||

| Balance as of December 31, 2009 (market value) |

$ | 37,739 | $ | 231,250 | ||||||

| Realized gain (loss) |

(365,484 | ) | — | |||||||

| Change in unrealized appreciation (depreciation)*** |

327,745 | (231,250 | ) | |||||||

| Net purchases (sales) |

— | — | ||||||||

| Transfers in and/or out of Level 3 |

— | — | ||||||||

| Balance as of December 31, 2010 (market value) |

$ | — | $ | — | ||||||

*Includes common stock, warrants and rights. Please see the Investment Portfolio for industry classification and for securities where an International Fair Value factor from the pricing service was applied to value the security. Such securities are included in Level 2 in the table above.

**Other financial instruments are derivative instruments not reflected in the Investment Portfolio, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation/depreciation on the instrument. As of December 31, 2010, the Series did not hold any derivative instruments.

| 14 |

Notes to Financial Statements

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

Security Valuation (continued)

***The change in unrealized appreciation (depreciation) on securities still held at December 31, 2010 was $(241,223), which is included in the related net change in unrealized appreciation/depreciation on the Statement of Operations.

****Avalon Healthcare Holdings, Inc., Avalon Healthcare Holdings, Inc.- Series D, and Avalon Healthcare Holdings, Inc. 2/27/2014 are Level 3 as of December 31, 2010. However, there is no market value for these securities reported in the financial statements.

The Fund’s policy is to recognize transfers in and transfers out of the valuation levels as of the beginning of the reporting period. During the year ended December 31, 2010, the Fund had three foreign equity securities transfer from Level 1 to Level 2 due to the implementation of new international fair value pricing procedures. The following is a summary of the foreign equity securities that transferred from Level 1 to Level 2:

| Total # Securities Level 1 at beginning and Level 2 at end of period |

Total

Market Value Beginning of period |

Total Market End of period |

Change

in Market Value |

|||||||||||

| 3 | $ | 30,576,707 | $ | 26,417,257 | $ | (4,159,450 | ) | |||||||

Additional disclosure surrounding the activity in Level 3 fair value measurement will be effective for fiscal years beginning after December 15, 2010. Management has concluded that this will not have a material impact on the Series’ financial statements.

Security Transactions, Investment Income and Expenses

Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date, except that if the ex-dividend date has passed, certain dividends from foreign securities are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Interest income, including amortization of premium and accretion of discounts using the effective interest method, is earned from settlement date and accrued daily.

Expenses are recorded on an accrual basis. Most expenses of the Fund can be attributed to a specific series. Expenses which cannot be directly attributed are apportioned among the series in the Fund in such a manner as deemed equitable by the Fund’s Board, taking into consideration, among other things, the nature and type of expense.

The Series uses the identified cost method for determining realized gain or loss on investments for both financial statement and federal income tax reporting purposes.

Foreign Currency Translation

The books and records of the Series are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities are translated into U.S. dollars at the current exchange rates. Purchases and sales of investment securities and income and expenses are translated on the respective dates of such transactions. The Series does not isolate realized and unrealized gains and losses attributable to changes in the exchange rates from gains and losses that arise from changes in the market value of investments. Such fluctuations are included with net realized and unrealized gain or loss on investments. Net realized foreign currency gains and losses represent foreign currency gains and losses between trade date and settlement date on securities transactions, gains and losses on disposition of foreign currencies and the difference between the amount of income and foreign withholding taxes recorded on the books of the Series and the amounts actually received or paid.

| 15 |

Notes to Financial Statements

Restricted securities

Restricted securities are purchased in private placement transactions, are not registered under the Securities Act of 1933, as amended, and may have contractual restrictions on resale. Information regarding restricted securities is included at the end of the Series’ Investment Portfolio.

Illiquid Securities

A security may be considered illiquid if so deemed in good faith by the Advisor under procedures approved by and under the general supervision and responsibility of the Fund’s Board. Securities that are illiquid are marked with the applicable footnote on the Investment Portfolio. As of December 31, 2010, the aggregate value of securities deemed illiquid was $0 representing 0% of the Series’ net assets.

Affiliated Companies

The 1940 Act defines “affiliated companies” to include securities in which a series owns 5% or more of the outstanding voting securities of the issuer. The following transactions were effected for the year ended December 31, 2010:

| Name of Issuer | Value

at 12/31/09 |

Purchase Cost |

Sales Proceeds |

Value

at 12/31/10 |

Shares Held

at 12/31/10 |

Dividend Income 12/31/09 through 12/31/10 |

Net Realized Gain (Loss) 12/31/09 through 12/31/10 | |||||||

| Avalon |

||||||||||||||

| HealthCare |

||||||||||||||

| Holdings, Inc. - |

||||||||||||||

| Series D |

$231,250 | $— | $— | $— | 925,000 | $— | $— | |||||||

| Avalon |

||||||||||||||

| HealthCare |

||||||||||||||

| Holdings, Inc. |

9,590 | — | — | — | 38,359 | — | — | |||||||

| Avalon |

||||||||||||||

| HealthCare |

||||||||||||||

| Holdings, Inc. - |

||||||||||||||

| Warrants |

||||||||||||||

| 2/27/2014 |

383 | — | — | — | 38,359 | — | — | |||||||

| $241,223 | $— | $— | $— | 1,001,718 | $— | $— | ||||||||

Federal Taxes

The Series’ policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. The Series is not subject to federal income tax or excise tax to the extent that the Series distributes to shareholders each year its taxable income, including any net realized gains on investments, in accordance with requirements of the Internal Revenue Code. Accordingly, no provision for federal income tax or excise tax has been made in the financial statements.

Management evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. At December 31, 2010, the Series has recorded no liability for net unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken in future tax returns.

The Series files income tax returns in the U.S. federal jurisdiction, various states and foreign jurisdictions, as required. No income tax returns are currently under investigation. The statute of limitations on the Series’ tax returns remains open for the years ended December 31, 2007 through December 31, 2010. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

| 16 |

Notes to Financial Statements

Additionally, based on the Fund’s understanding of the tax rules and rates related to income, gains and transactions for foreign jurisdictions in which it invests, the Series will provide for foreign taxes, and where appropriate, deferred foreign tax.

Distributions of Income and Gains

Distributions to shareholders of net investment income and net realized gains are made annually. An additional distribution may be necessary to avoid taxation of the Series. Distributions are recorded on the ex-dividend date.

Indemnifications

The Fund’s organizational documents provide former and current directors and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Other

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

| 3. | TRANSACTIONS WITH AFFILIATES |

The Fund has an Investment Advisory Agreement (the “Agreement”) with the Advisor, for which the Series pays a fee, computed daily and payable monthly, at an annual rate of 1.00% of the Series’ average daily net assets. Under the Agreement, personnel of the Advisor provide the Series with advice and assistance in the choice of investments and the execution of securities transactions, and otherwise maintain the Series’ organization. The Advisor also provides the Fund with necessary office space and fund administration and support services. The salaries of all officers of the Fund (except a percentage of the Fund’s Chief Compliance Officer’s salary, which is paid by the Fund), and of all Directors who are “affiliated persons” of the Fund, or of the Advisor, and all personnel of the Fund, or of the Advisor, performing services relating to research, statistical and investment activities, are paid by the Advisor. Each “non-affiliated” Director receives an annual stipend, which is allocated among all the active series of the Fund. In addition, these Directors also receive a fee per Board meeting attended plus a fee for each committee meeting attended.

Manning & Napier Investor Services, Inc., a registered broker-dealer affiliate of the Advisor, acts as distributor for the Fund’s shares. The services of Manning & Napier Investor Services, Inc. are provided at no additional cost to the Series.

For the year ended December 31, 2010, the Advisor voluntarily waived fees of $758, which is included as a reduction of expenses on the Statement of Operations. The Advisor is not eligible to recoup any expenses that have been waived or reimbursed in prior years.

The Advisor has agreements with PNC Global Investment Servicing (U.S.) Inc. (“PNCGIS”) under which PNCGIS serves as sub-accountant services agent and sub-transfer agent. The Fund pays the Advisor an annual fee related to fund accounting and administration of 0.0175% on the first $3 billion of average daily net assets (excluding Target Series); 0.015% on the next $3 billion of average daily net assets (excluding Target Series); and 0.01% of the average daily net assets in excess of $6 billion (excluding Target Series); plus a base fee of $25,500 per Series.

| 17 |

Notes to Financial Statements

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

Transfer Agent fees are charged to the Fund on a per account basis. Additionally, certain transaction- and cusip-based fees and out-of-pocket expenses, including charges for reporting relating to the Fund’s compliance program, are charged.

Effective July 1, 2010, PNCGIS, was sold to The Bank of New York Mellon Corporation, the Series’ custodian. At the close of the sale, PNCGIS changed its name to BNY Mellon Investment Servicing (U.S.) Inc. (“BNY”).

Expenses not directly attributable to a Series are allocated based on each Series’ relative net assets or number of accounts, depending on the expense.

| 4. | PURCHASES AND SALES OF SECURITIES |

For the year ended December 31, 2010, purchases and sales of securities, other than U.S. Government securities and short-term securities, were $166,102,061 and $233,048,440, respectively. There were no purchases or sales of U.S. Government securities.

| 5. | CAPITAL STOCK TRANSACTIONS |

Transactions in shares of Life Sciences Series were:

| For the Year Ended 12/31/10 |

For the Year Ended 12/31/09 |

|||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Sold |

2,426,114 | $ | 26,545,889 | 3,589,547 | $ | 27,786,051 | ||||||||||

| Reinvested |

— | — | — | — | ||||||||||||

| Repurchased |

(7,813,236 | ) | (86,364,811 | ) | (4,015,779 | ) | (31,691,255 | ) | ||||||||

| Total |

(5,387,122 | ) | $ | (59,818,922 | ) | (426,232 | ) | $ | (3,905,204 | ) | ||||||

Substantially all of the Series’ shares represent investments by fiduciary accounts over which the Advisor has sole investment discretion.

| 6. | FINANCIAL INSTRUMENTS |

The Series may trade in instruments including written and purchased options, forward foreign currency exchange contracts and futures contracts and other derivatives in the normal course of investing activities to assist in managing exposure to various market risks. Investments in these instruments may subject the Series to various elements of risk, which may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. These risks include: the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate or index, counterparty credit risk related to over the counter derivatives counterparties’ failure to perform under contract terms, liquidity risk related to the lack of a liquid market for these contracts allowing the fund to close out its position(s) and documentation risk relating to disagreement over contract terms. No such investments were held by the Series during the year ended December 31, 2010.

| 7. | FOREIGN SECURITIES |

Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in securities of domestic companies and the U.S. Government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of comparable domestic companies and the U.S. Government.

| 18 |

Notes to Financial Statements

| 8. | LIFE SCIENCES SECURITIES |

The Series may focus its investments in certain related life sciences industries; hence, the Series may subject itself to a greater degree of risk than a series that is more diversified.

| 9. | FEDERAL INCOME TAX INFORMATION |

The amount and characterization of certain income and capital gains to be distributed are determined in accordance with federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America. These differences are primarily due to differing book and tax treatments in the timing of the recognition of net investment income or gains and losses, including net operating losses, foreign currency gains and losses, losses deferred due to wash sales and post-October losses. The Series may periodically make reclassifications among its capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations without impacting the Series’ net asset value. Any such reclassifications are not reflected in the financial highlights.

There were no distributions to shareholders for the years ended December 31, 2010 or December 31, 2009. For the year ended December 31, 2010, the Series elected to defer $20,942 of currency losses, attributable to post-October losses.

At December 31, 2010, the tax basis of distributable earnings and the net unrealized appreciation based on the identified cost for federal income tax purposes were as follows:

| Cost for federal income tax purposes |

$ | 199,954,537 | ||||

| Unrealized appreciation |

$ | 54,788,657 | ||||

| Unrealized depreciation |

(6,583,217 | ) | ||||

| Net unrealized appreciation |

$ | 48,205,440 | ||||

| Capital loss carryover |

20,419,145 |

At December 31, 2010, the capital loss carryover, disclosed above, available to the extent allowed by tax law to offset future net capital gain, if any, will expire as follows:

| Loss Carryover | Expiration Date | |||

| $15,858,502 |

December 31, 2016 | |||

| $ 4,560,643 |

December 31, 2017 |

The capital loss carryover utilized in the current year was $17,300,198.

| 19 |

Report of Independent Registered Public Accounting Firm

To the Board of Directors of Manning & Napier Fund, Inc. and Shareholders of Life Sciences Series:

In our opinion, the accompanying statement of assets and liabilities, including the investment portfolio, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the Life Sciences Series (a series of Manning & Napier Fund, Inc., hereafter referred to as the “Series”) at December 31, 2010, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Series’ management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2010 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

New York, New York

February 22, 2011

| 20 |

Renewal of Investment Advisory Agreement (unaudited)

At the Manning & Napier Fund, Inc. (the “Fund”) Board of Directors’ (the “Board”) meeting, held on November 17, 2010, the Investment Advisory Agreement (the “Agreement”) between the Fund and Manning & Napier Advisors, Inc. (the “Advisor”) was reviewed by the Board for renewal. In connection with the decision whether to renew the Agreement, a variety of material was prepared for and reviewed by the Board.

Representatives of the Advisor attended the meeting and presented additional oral and written information to the Board to assist the Board in its considerations. The discussion immediately below outlines the materials and information presented to the Board in connection with the Board’s 2010 Annual Review of the Agreement and the conclusions made by the Directors when determining to continue the Agreement.

| • | The Board considered the services provided by the Advisor under the Agreement including, among others: deciding what securities to purchase and sell for each Series; arranging for the purchase and sale of such securities by placing orders with broker-dealers; administering the affairs of the Fund (including the books and records of the Fund not maintained by third party service providers such as the custodian or sub-transfer agent); arranging for the insurance coverage for the Fund; and supervising the preparation of tax returns, SEC filings (including registration statements) and reports to shareholders for the Fund. The Board also considered the nature and quality of such services provided under the Agreement in light of the Advisor’s services provided to the Fund for 24 years. The Board discussed the quality of these services with representatives from the Advisor and concluded that the Advisor was performing its services to the Fund required under the Agreement in a reasonable manner. |

| • | The Board considered the investment performance of the various Series of the Fund. The investment performance for each Series was reviewed on a cumulative basis since inception and on a one year basis. In addition, annualized performance for the following time periods was considered: inception, three year, five year, ten year, and current market cycle. A market cycle includes periods of both rising and falling markets. Returns for established benchmark indices for each Series were provided for each time period. The Board noted that the various Series were competitive against their respective benchmarks and/or peer groups over various time periods, but in particular over the full market cycle period relevant for the Series. In addition, the Board considered at the meeting (and considers on a quarterly basis) a peer group performance analysis consisting of Morningstar universes of mutual funds with similar investment objectives. The Board discussed the performance with representatives from the Advisor and concluded that the investment performance of each of the Fund’s Series was reasonable based on the Fund’s actual performance and comparative performance, especially performance over the current market cycle. |

| • | The Board considered the costs of the Advisor’s services and the profits of the Advisor as they relate to the Advisor’s services to the Fund under the Agreement. In reviewing the Advisor’s costs and profits, the Board discussed the Advisor’s revenues generated from the Fund (on both an actual and adjusted basis) and its expenses associated with providing the services under the Agreement. In addition, the Board reviewed the Advisor’s expenses associated with Fund activities outside of the Agreement (such as expense reimbursements pursuant to expense caps and payments made by the Advisor to third party platforms on which shares of the Fund are available for purchase). It was noted by representatives of the Advisor that 11 of the 27 active Series of the Fund are currently experiencing expenses above the capped expense ratios. After discussing the above costs and profits, the Board concluded that the Advisor’s profitability relating to its services provided under the Agreement was reasonable. |

| • | The Board considered the fees and expenses of the various Series of the Fund. The Advisor presented the advisory fees and total expenses for each Series, including the advisory fee adjusted for any expense waivers or reimbursements (either contractual or voluntary) paid by the Advisor. The advisory fees and expense ratios of each Series were compared to an average (on both a mean and median basis) of similar funds as disclosed on the Morningstar database. Representatives of the Advisor discussed with the Board the levels of its advisory |

| 21 |

Renewal of Investment Advisory Agreement (unaudited)

fee for each Series of the Fund and as compared to the median and mean advisory fees for similar funds as listed on Morningstar. Expense ratios for every Series, except the Pro-Blend’s Class R and Class C, and Target Class R and Class C, are currently below the median and mean for similar funds as listed on Morningstar. Based on their review of the information provided, the Board concluded that the fees and expenses of each Series of the Fund were reasonable on a comparative basis.

| • | The Board also considered the other benefits the Advisor derives from its relationship with the Fund. Such other benefits include certain research products provided by soft dollars. Given the level of soft dollar transactions involving the Fund, the Board concluded that these additional benefits to the Advisor were reasonable. |

| • | In addition to the factors described above, the Board considered the Advisor’s personnel, investment strategies, policies and procedures relating to compliance with personal securities transactions, and reputation, expertise and resources in domestic and foreign financial markets. The Board concluded that these factors support the conclusion that the Advisor performs its services in a reasonable manner. |

| • | The Board did not consider economies of scale at this time because of the multiple uses of the Fund (for the Advisor’s discretionary investment account clients in addition to direct investors), the current profitability of the Advisor’s services to the Fund under the Agreement, and the overall size of the Fund complex. |

Based on the Board’s deliberations and their evaluation of the information described above, the Board, including a majority of Directors that are not “interested persons” as defined in the Investment Company Act of 1940, concluded that the compensation under the Agreement was fair and reasonable in light of the services and expenses and such other matters as the Directors considered to be relevant in the exercise of their reasonable judgment. Accordingly, the Board approved the renewal of the Agreement. In the course of their deliberations, the Directors did not identify any particular information that was all important or controlling.

| 22 |

Directors’ and Officers’ Information (unaudited)

The Statement of Additional Information provides additional information about the Fund’s directors and officers and can be obtained without charge by calling 1-800-466-3863, at www.manningnapieradvisors.com, or on the EDGAR Database on the SEC Internet web site (http:// www.sec.gov). The following chart shows certain information about the Fund’s officers and directors, including their principal occupations during the last five years. Unless specific dates are provided, the individuals have held the listed positions for longer than five years.

| INTERESTED DIRECTOR/OFFICER

|

||

| Name: |

B. Reuben Auspitz* | |

| Address: |

290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: |

63 | |

| Current Position(s) Held with Fund: |

Principal Executive Officer, President, Chairman & Director | |

| Term of Office1 & Length of Time Served: |

Indefinite - Director since 1984; Vice President 1984 - 2003; President since 2004; Principal Executive Officer since 2002 | |

| Principal Occupation(s) During Past 5 Years: |

Executive Vice President; Executive Group Member**; Chief Compliance Officer since 2004; Vice Chairman since June 2010; Co-Executive Director from 2003-2010 - Manning & Napier Advisors, Inc. President; | |

| Director - Manning & Napier Investor Services, Inc. | ||

| Holds or has held one or more of the following titles for various subsidiaries and affiliates: President, Vice President, Director, Chairman, Treasurer, Chief Compliance Officer or Member. | ||

| Number of Portfolios Overseen within Fund Complex: |

29 | |

| Other Directorships Held Outside Fund Complex: |

N/A | |

|

INDEPENDENT DIRECTORS

|

||

| Name: |

Paul A. Brooke | |

| Address: |

290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: |

65 | |

| Current Position(s) Held with Fund: |

Director, Audit Committee Member, Governance & Nominating Committee Member | |

| Term of Office & Length of Time Served: |

Indefinite - Since 2007 | |

| Principal Occupation(s) During Past 5 Years: |

Chairman & CEO, Alsius Corp. (investments); Managing Member, PMSV Holdings LLC (investments) | |

| Number of Portfolios Overseen within Fund Complex: |

29 | |

| Other Directorships Held Outside Fund Complex: |

Incyte Corp. (2000-present) | |

| ViroPharma, Inc. (2000-present) | ||

| HLTH Corp. (2000-present) | ||

| Cheyne Capital International (2000-present) | ||

| MPM Bio-equities (2000-present) | ||

| GMP Companies (2000-present) | ||

| HoustonPharma (2000-present) | ||

|

Name: |

Richard M. Hurwitz | |

| Address: |

290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: |

47 | |

| Current Position(s) Held with Fund: |

Director, Audit Committee Member, Governance & Nominating Committee Member | |

| Term of Office & Length of Time Served: |

Indefinite - Since 2009 | |

| Principal Occupation(s) During Past 5 Years: |

Chief Executive Officer, Pictometry International Corp. since August 2010 (provider of georeferenced, aerial image libraries and related software) Managing Partner (2006-July 2010) - Aegis Investment Partners, LLC (investments); Founder and Managing Partner (2004-2005) - Village Markets, LLC (groceries) | |

| Number of Portfolios Overseen within Fund Complex: |

29 | |

| Other Directorships Held Outside Fund Complex: |

Pictometry International Corp. (2000-2010) | |

| Pioneering Technologies (2006-2009) | ||

| Vensearch Capital Corp. (2003-2007)

|

| 23 |

Directors’ and Officers’ Information (unaudited)

| INDEPENDENT DIRECTORS (continued) | ||

| Name: |

Stephen B. Ashley | |

| Address: |

290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: |

70 | |

| Current Position(s) Held with Fund: |

Director, Audit Committee Member, Governance & Nominating Committee Member | |

| Term of Office & Length of Time Served: |

Indefinite - Since 1996 | |

| Principal Occupation(s) During Past 5 Years: |

Chairman, Director, President & Chief Executive Officer, The Ashley Group (property management and investment). Chairman (non-executive) 2004-2008; Director 1995-2008 - Fannie Mae (mortgage) | |

| Number of Portfolios Overseen within Fund Complex: |

29 | |

| Other Directorships Held Outside Fund Complex: |

The Ashley Group (1995-2008) | |

| Genesee Corporation (1987-2007) | ||

|

Name: |

Peter L. Faber | |

| Address: |

290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: |

72 | |

| Current Position(s) Held with Fund: |

Director, Governance & Nominating Committee Member | |

| Term of Office & Length of Time Served: |

Indefinite - Since 1987 | |

| Principal Occupation(s) During Past 5 Years: |

Senior Counsel since 2006, Partner (1995 - 2006) - McDermott, Will & Emery LLP (law firm) | |

| Number of Portfolios Overseen within Fund Complex: |

29 | |

| Other Directorships Held Outside Fund Complex: |

Partnership for New York City, Inc. (non-profit) | |

| New York Collegium (non-profit) | ||

| Boston Early Music Festival (non-profit) | ||

|

Name: |

Harris H. Rusitzky | |

| Address: |

290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: |

76 | |

| Current Position(s) Held with Fund: |

Director, Audit Committee Member, Governance & Nominating Committee Member | |

| Term of Office & Length of Time Served: |

Indefinite - Since 1985 | |

| Principal Occupation(s) During Past 5 Years: |

President, The Greening Group (business consultants) since 1994; Partner, The Restaurant Group (restaurants) since 2006 | |

| Number of Portfolios Overseen within Fund Complex: |

29 | |

| Other Directorships Held Outside Fund Complex: |

N/A | |

|

OFFICERS |

||

| Name: |

Jeffrey S. Coons, Ph.D., CFA | |

| Address: |

290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: |

47 | |

| Current Position(s) Held with Fund: |

Vice President | |

| Term of Office1 & Length of Time Served: |

Since 2004 | |

| Principal Occupation(s) During Past 5 Years: |

President since 2010, Co-Director of Research since 2002, Executive Group Member** since 2003, - Manning & Napier Advisors, Inc. Holds one or more of the following titles for various subsidiaries and affiliates: President, Director, Treasurer or Senior Trust Officer. | |

| Number of Portfolios Overseen within Fund Complex: |

29 | |

| Other Directorships Held Outside Fund Complex:

|

N/A

| |

| 24 |

Directors’ and Officers’ Information (unaudited)

| OFFICERS (continued) |

||

|

Name: |

Beth Galusha | |

| Address: |

290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: |

49 | |

| Current Position(s) Held with Fund: |

Assistant Chief Financial Officer | |

| Term of Office1 & Length of Time Served: |

Assistant Chief Financial Officer since 2010 | |

| Principal Occupation(s) During Past 5 Years: |

Chief Financial Officer and Treasurer, Manning & Napier Advisors, Inc. | |

| Holds one or more of the following titles for various affiliates: Chief Financial Officer, Director, or Treasurer | ||

| Number of Portfolios Overseen within Fund Complex: |

29 | |

| Other Directorships Held Outside Fund Complex: |

N/A | |

|

Name: |

Christine Glavin | |

| Address: |

290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: |

44 | |

| Current Position(s) Held with Fund: |

Principal Financial Officer, Chief Financial Officer | |

| Term of Office1 & Length of Time Served: |

Principal Financial Officer since 2002; Chief Financial Officer since 2001 | |

| Principal Occupation(s) During Past 5 Years: |

Fund Reporting Manager, Manning & Napier Advisors, Inc. since 1997 | |

| Number of Portfolios Overseen within Fund Complex: |

29 | |

| Other Directorships Held Outside Fund Complex: |

N/A | |

|

Name: |

Jodi L. Hedberg | |

| Address: |

290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: |

43 | |

| Current Position(s) Held with Fund: |

Corporate Secretary, Chief Compliance Officer, Anti-Money Laundering Compliance Officer | |

| Term of Office1 & Length of Time Served: |

Corporate Secretary since 1997; Chief Compliance Officer since 2004 | |

| Principal Occupation(s) During Past 5 Years: |

Director of Compliance, Manning & Napier Advisors, Inc. and affiliates since 1990 (title change in 2005 from Compliance Manager to Director of Compliance); Corporate Secretary, Manning & Napier Investor Services, Inc. since 2006 | |

| Number of Portfolios Overseen within Fund Complex: |

29 | |

| Other Directorships Held Outside Fund Complex: |

N/A | |

|

Name: |

Richard Yates | |

| Address: |

290 Woodcliff Drive | |

| Fairport, NY 14450 | ||

| Age: |

45 | |

| Current Position(s) Held with Fund: |

Chief Legal Officer | |

| Term of Office1 & Length of Time Served: |

Chief Legal Officer since 2004 | |

| Principal Occupation(s) During Past 5 Years: |

Counsel - Manning & Napier Advisors, Inc. & affiliates since 2000; Holds one or more of the following titles for various affiliates; Director or Corporate Secretary | |

| Number of Portfolios Overseen within Fund Complex: |

29 | |

| Other Directorships Held Outside Fund Complex: |

N/A |

*Interested Director, within the meaning of the Investment Company Act of 1940 by reason of his position with the Fund’s investment advisor and distributor. Mr. Auspitz serves as the Executive Vice President and Director, Manning & Napier Advisors, Inc. and President and Director, Manning & Napier Investor Services, Inc., the Fund’s distributor.

**Prior to June 2010, the Executive Group, consisting of senior executive employee-owners, performed the duties of the Office of the Chief Executive of the Advisor. Effective June 2010, the Executive Group serves as an advisory board to the Chief Executive Officer.

1The term of office for President, Vice President, Chief Financial Officer, Assistant Chief Financial Officer, Chief Legal Officer and Corporate Secretary is one year and until their respective successors are chosen and qualified. All other officers’ terms are indefinite.

| 25 |

Literature Requests (unaudited)

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available, without charge, upon request:

| By phone |

1-800-466-3863 | |||

| On the Securities and Exchange |

http://www.sec.gov | |||

Proxy Voting Record

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available, without charge, upon request:

| By phone |

1-800-466-3863 | |||

| On the SEC’s web site |

http://www.sec.gov | |||

Quarterly Portfolio Holdings

The Series’ complete schedule of portfolio holdings for the 1st and 3rd quarters of each fiscal year are provided on Form N-Q, and are available, without charge, upon request:

| By phone |

1-800-466-3863 | |||

| On the SEC’s web site |

http://www.sec.gov | |||

The Series’ Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Prospectus and Statement of Additional Information (SAI)

The prospectus and SAI provide additional information about each Series, including charges, expenses and risks. These documents are available, without charge, upon request:

| By phone |

1-800-466-3863 | |||

| On the SEC’s web site |

http://www.sec.gov | |||

| On the Advisor’s web site |

http://www.manning-napier.com | |||

Additional information available at www.manning-napier.com

1. Fund Holdings - Month-End

2. Fund Holdings - Quarter-End

3. Shareholder Report - Annual

4. Shareholder Report - Semi-Annual

MNLFS-12/10-AR

Management Discussion and Analysis (unaudited)

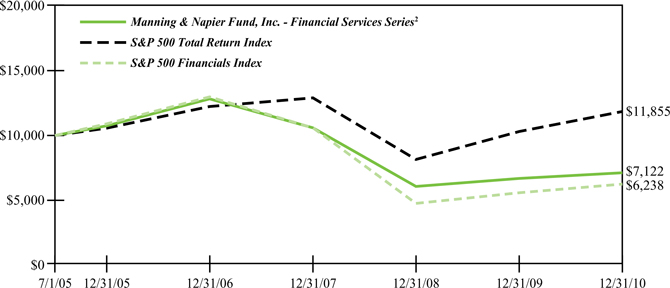

Dear Shareholders:

Over the course of 2010, the markets experienced several ups and downs driven by well-defined swings in investor sentiment. Optimism fueled strong market returns early in the year, as upbeat economic releases led investors to believe in the potential for a robust U.S. recovery. However, sentiment shifted drastically in May and June as more negative economic news and issues related to Europe’s government debt problems led to notable stock market losses. In another swing, the markets rebounded in the fall amid better economic developments and prospects that the Federal Reserve would enact another round of quantitative easing. That rally generally continued through the end of the year as the markets reacted positively to the U.S. tax compromise, which extended the Bush-era tax cuts for all income brackets.

With equities posting double-digit gains in the third and fourth quarters, the choppy year ended on a strong note, and broad equity indices have now produced back-to-back years of positive results. During 2010, the Russell 2000 Index earned 26.85%, outpacing indexes such as the Russell 1000 and S&P 500, which are composed of larger cap stocks. Similar to the Russell 2000 Index, the Small Cap Series had a return of 25.71%, slightly trailing the index for the year.

In the volatile market environment of 2010, Manning & Napier maintained a selective investment approach and focused on companies that we believe can grow market share. We continued to emphasize quality, targeting best-in-class companies expected to generate sales growth despite a muted economic backdrop, as well as “away game winners” expected to successfully compete in faster-growing markets overseas. Using our active stock selection strategies, our analysts also identified opportunities in certain cyclical industries that have experienced supply cutbacks. Specifically, we have looked for well-positioned companies that can take market share and benefit from tight supply and demand dynamics in certain industries. Overall, the Small Cap Series continues to have a bias toward larger, more stable small cap companies.

During 2010, the Series had a heavy weighting to Energy and Industrials versus the benchmark, which benefited the Series’ relative performance. Additionally, the Series had a relatively high allocation to the Consumer Discretionary and Staples sectors. Meanwhile, noticeably lower exposure to Financials than the benchmark helped relative performance over the past year, yet an underweight to Information Technology detracted from relative returns.

Stock selection decisions modestly aided relative results over the past twelve months. In particular, security selections in the Energy, Industrials, and Information Technology sectors contributed to positive relative performance. Several key Technology and Industrials holdings were either acquired or the subject of takeover speculation in the second half of the year, which helped drive outperformance. In contrast, specific investments in the Consumer Staples, Materials, and Utilities sectors hurt relative returns in 2010.

While economic developments turned more optimistic toward the end of 2010, the U.S. economy still faces significant headwinds, including a struggling housing market, a stagnant job market, a difficult consumer rebalancing act, and high government debt burdens. Given these long-term structural issues, the slow growth environment in the U.S. will likely remain a reality. As the markets fluctuated around this slow growth trend in 2010, Manning & Napier earned solid returns by staying focused on the fundamentals and maintaining our selective investment process. This investment approach has proved beneficial for the past 40 years, and we believe these qualities will remain important as the market environment unfolds in 2011.

As always, we appreciate your business.

Sincerely,

Manning & Napier Advisors, Inc.

| 1 |

Performance Update as of December 31, 2010 (unaudited)

| Average

Annual Total Returns As of December 31, 2010 |

||||||||||

| One Year |

Five Year |

Ten Year |

Since Inception1 | |||||||

| Manning & Napier Fund, Inc. - Small Cap Series2 |

25.71 | % | -0.30% | 6.50% | 7.67% | |||||

| S&P 500 Total Return Index3 |

15.07 | % | 2.30% | 1.42% | 8.25% | |||||

| Russell 2000® Index3 |

26.85 | % | 4.47% | 6.33% | 9.20% | |||||

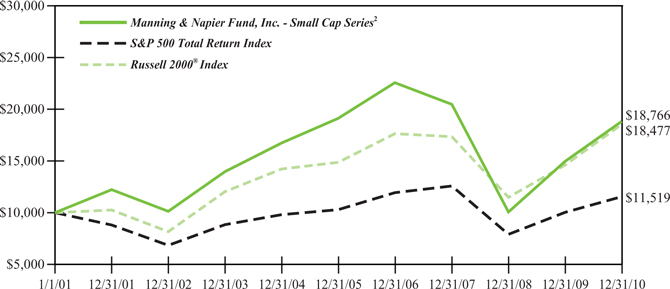

The following graph compares the value of a $10,000 investment in the Manning & Napier Fund, Inc. - Small Cap Series for the ten years ended December 31, 2010 to the S&P 500 Total Return Index and the Russell 2000® Index.

1Performance numbers for the Series and Indices are calculated from April 30, 1992, the Series’ current activation date.

2The Series’ performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. The Series’ performance is historical and may not be indicative of future results. The performance returns shown are inclusive of the net expense ratio of the Series. For the year ended December 31, 2010, this net expense ratio was 1.12%. The gross expense ratio, which does not account for any voluntary or contractual waivers currently in effect, was 1.12% for the year ended December 31, 2010.

3The S&P 500 Total Return Index is an unmanaged capitalization-weighted measure of 500 widely held common stocks listed on the New York Stock Exchange, American Stock Exchange and the Over-the-Counter market. The Index returns assume daily reinvestment of dividends. The Russell 2000® Index is an unmanaged index that consists of 2,000 U.S. small-capitalization stocks. The Index returns are based on a market capitalization-weighted average of relative price changes of the component stocks plus dividends whose reinvestments are compounded daily. Both Indices’ returns, unlike Series returns, do not reflect any fees or expenses.

| 2 |

Shareholder Expense Example (unaudited)

| Beginning Account Value 7/1/10 |

Ending Account Value 12/31/10 |

Expenses Paid During Period* 7/1/10-12/31/10 | ||||

| Actual |

$1,000.00 | $1,358.20 | $6.60 | |||

| Hypothetical |

$1,000.00 | $1,019.61 | $5.65 |

*Expenses are equal to the Series’ annualized expense ratio (for the six-month period) of 1.11%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses are based on the most recent fiscal half year; therefore, the expense ratio stated above may differ from the expense ratio stated in the financial highlights, which is based on one-year data. The Series’ total return would have been lower had certain expenses not been waived during the period.

| 3 |

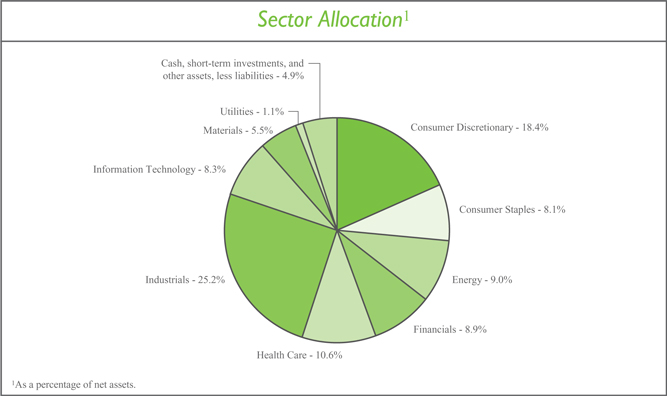

Portfolio Composition as of December 31, 2010 (unaudited)

| Market Capitalization | TopTen Stock Holdings2 | |||||||||||

| Average |

$2,143 Million | Tomra Systems ASA (Norway) |

3.1 | % | ||||||||

| Median |

1,595 Million | Zoll Medical Corp. |

2.9 | % | ||||||||

| Weighted Average |

1,963 Million | Imax Corp. (Canada) |

2.9 | % | ||||||||

| First Commonwealth Financial Corp. |

2.5 | % | ||||||||||

| Paladin Energy Ltd. (Australia) |

2.5 | % | ||||||||||

| RailAmerica, Inc. |

2.3 | % | ||||||||||

| Alere, Inc. |

2.3 | % | ||||||||||

| Infinera Corp. |

2.3 | % | ||||||||||

| Calfrac Well Services Ltd. (Canada) |

2.2 | % | ||||||||||

| Eagle Materials, Inc. |

2.2 | % | ||||||||||

|

2As a percentage of total investments. |

||||||||||||

| 4 |

Investment Portfolio - December 31, 2010

| Shares |

Value (Note 2) |

|||||||||||

| COMMON STOCKS - 95.1% |

||||||||||||

| Consumer Discretionary - 18.4% |

||||||||||||

| Auto Components - 1.5% |

||||||||||||

| Cooper Tire & Rubber Co. |

131,190 | $ | 3,093,460 | |||||||||

| Distributors - 1.9% |

||||||||||||

| Inchcape plc (United Kingdom)*1 |

714,271 | 3,983,905 | ||||||||||

| Hotels, Restaurants & Leisure - 2.7% |

||||||||||||

| Choice Hotels International, Inc. |

52,060 | 1,992,336 | ||||||||||