UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-4084

Hawaiian Tax-Free Trust

(Exact name of Registrant as specified in charter)

120 West 45th Street, Suite 3600

New York, New York 10036

(Address of principal executive offices) (Zip code)

Joseph P. DiMaggio

120 West 45th Street, Suite 3600

New York, New York 10036

(Name and address of agent for service)

Registrant's telephone number, including area code:

(212) 697-6666

Date of fiscal year end: 3/31/23

Date of reporting period: 3/31/23

FORM N-CSR

ITEM 1. REPORTS TO STOCKHOLDERS

|

Annual Report March 31, 2023

| ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

|

Hawaiian Tax-Free Trust Navigating Changing

Serving Hawaii investors since 1985 |

|

May, 2023

Dear Fellow Shareholder:

The financial markets have a way of reminding us that it isn’t always smooth sailing. As history has demonstrated, investments can be influenced to varying degrees by changing market conditions. That’s why charting a course for your financial future, and being prepared for inevitable twists and turns, may be important to help one navigate times of volatility and uncertainty. And while the municipal bond market has shown some signs of improvement following a particularly challenging period in 2022, some investors remain leery, wondering what lies ahead. What is the future direction of interest rates? Will inflation continue, or might the economy be headed for a recession? These and other market drivers remain to be seen, which is why we believe it’s important to maintain perspective, as well as a long-term focus.

What’s Driving Fixed Income Markets

The Federal Reserve (the “Fed”) remains front and center when to comes to factors that influence fixed income markets, including the municipal bonds in which your Trust invests. The Fed has continued with a “tight” monetary policy in its quest to manage the U.S. economy. The primary tool employed by the Fed has been to increase interest rates, specifically the Federal Funds rate (the rate that banks charge one another to borrow or lend excess reserves overnight). To date, the Federal Reserve has implemented 10 rate hikes since March of 2022, bringing the Fed Funds rate to a 16-year high, and representing the first time that the Fed’s target rate has been above 5% since 2007. This has had a significant impact on fixed income securities, including municipal bonds, and continues to work its way through the economy.

As a result, interest rates rose fairly dramatically over the past year. And as interest rates rise (along with the resulting yields on fixed income securities), prices of bonds generally fall commensurately. When rising rates and declining prices occur at a relatively rapid pace, this normally creates a shift in market dynamics, and in the overall tenor among investors.

The Federal Reserve has also engaged in efforts to reduce its balance sheet, as it attempts to combat inflation, while also trying to avoid the possibility of an economic recession. The state of the U.S. economy continues to be another key driver of fixed income markets. Although certain economic indicators suggest a resilient economy, the future direction of the economy remains a question mark. As the Fed attempts to perform

NOT A PART OF THE ANNUAL REPORT

a delicate balancing act, market participants are left wondering if the Fed can successfully achieve a so-called “soft landing,” or if the economy may slip into a recession.

Additional factors also contribute to market movements. One such example is recent turmoil in the banking industry which resulted in several high-profile bank failures and subsequent takeovers beginning in March. While the bank failures triggered some concern and uncertainty, they did not necessarily appear to have changed the Fed’s outlook on the economy. With continued elevated inflation data, the Fed went ahead with yet another rate increase on May 3, 2023. Comments by Fed Chair Jerome Powell at a subsequent news conference did, however, indicate to many market observers that the Fed may push pause on further rate hikes. The markets, of course, will be paying close attention as we approach the Fed’s June meeting date, and beyond.

The Effect on Municipal Bonds

The municipal bond market is currently being supported by strong credit fundamentals. Generally speaking, municipalities around the country have recorded high levels of tax receipts and added liquidity. Credit conditions appear to be solid even in the face of interest rate volatility. Moreover, credit rating upgrades continued to significantly outpace downgrades through year-end 2022, based on data from Standard & Poor’s.

Bond issuance has remained relatively low on a year-over-year basis. The combination of robust tax receipts and federal aid programs have left many municipalities with excess budgets. Additionally, bond issuers remain wary given interest rate changes and overall volatility swings. Issuance is generally expected to pick up as the year progresses, although many believe it is likely to remain rather muted.

Maintain a Long-Term Focus

At Aquila Group of Funds, we remain optimistic in the long term for the municipal bond market. Municipal bonds are vital to financing the infrastructure of our local communities and states. Moreover, they may play an important role for investors’ asset allocation. We, therefore, believe it’s important to keep in mind the key benefits that municipal bond funds offer, particularly during periods of market change and uncertainty.

Your Trust has been specifically designed bearing in mind the fact that most people are more sensitive to potential investment losses than they are eager for outsized gains. Important characteristics of your Fund therefore include:

| · | High-quality municipal bonds – Invests in investment-grade bonds; those in the four highest rating categories, or determined to be of comparable credit quality |

| · | Intermediate bond portfolio – Seeks to minimize share price volatility or interest rate risk |

| · | Broad portfolio diversification – Supports a wide range of projects in communities of all sizes throughout your state, not only reducing risk but also improving the quality of life throughout the state |

| · | Local portfolio management – Provides an up-close perspective and valuable insights on the issuers and economy in the state |

NOT A PART OF THE ANNUAL REPORT

Rest assured that your dedicated team of investment professionals continually draws upon their many years of experience in analyzing securities, observing market and economic cycles, and recognizing risks and opportunities. Our goal is to achieve your Trust’s investment objective of delivering the highest level of income exempt from regular federal and state income taxes, as is consistent with preservation of capital.

As always, we encourage you to consult with a trusted financial professional who can help ensure that your investment portfolio remains aligned with your individual needs to meet your long-term financial goals. It’s prudent to focus on your goals, your time frame for achieving them, and your tolerance for risk.

Thank you for your investment and continued confidence in Aquila Group of Funds.

| Sincerely, | ||

|

||

|

||

| Diana P. Herrmann, Vice Chair and President |

Any information in this Shareholder Letter regarding market or economic trends or the factors influencing the Trust’s historical or future performance are statements of opinion as of the date of this report. These statements should not be relied upon for any other purposes. Past performance is no guarantee of future results, and there is no guarantee that any market forecasts discussed will be realized.

NOT A PART OF THE ANNUAL REPORT

|

Hawaiian Tax-Free Trust ANNUAL

REPORT

Serving Hawaii investors since 1985 |

|

Economic Overview

Over the last year, fixed income market volatility reached historic highs and the yield curve inverted steeply as the Federal Reserve (the “Fed”) aggressively increased short-term interest rates (specifically, the Federal Funds (“Fed Funds”) rate, the rate at which commercial banks borrow and lend their excess reserves to one another overnight). The shift in interest rates has, to some extent, slowed economic growth and eased inflationary pressures. Although inflation has moved lower, it still remains elevated well above the Federal Reserve’s 2% target. Employment metrics remain strong as the economy is exhibiting underlying strength with steady job gains. However, the rapid increase in rates over the past year has created stress cracks in the banking system. To date, several regional banks have failed but depositors were rescued by the FDIC and regulators. The Federal Reserve opened up additional sources of liquidity for other struggling banks and worries that a systemic banking crisis had erupted generally subsided. Despite these events, the Federal Reserve has remained resolute in its efforts to contain inflation, raising the Fed Funds rate by a total of 50 basis points (“bps” -- a basis point is one hundredth of one percent) in the first quarter. This included a 25 bps increase after two U.S. banks failed in March. Despite banking system strains, the Fed appears intent on holding rates higher for longer than markets are anticipating. The market, as reflected in the yield curve and Fed Funds futures, has priced in a decline in the Fed Funds rate by the end of 2023. In March, the Fed’s commentary indicated to market observers that the Fed projected that it would hold rates steady at just over 5% through the end of the year. Given the likely persistence of elevated inflation, especially in the dominant services segment of the economy, our outlook for rates is aligned with the Fed’s projections. (Following the March 31st year end for Hawaiian Tax-Free Trust (your “Trust”), a third bank failed on May 1st and, on May 3rd, the Fed raised rates an additional 25 bps and market observers generally interpreted Fed Chair Jerome Powell’s comments at a news conference to indicate that the Fed may push pause on further increases.)

Municipal Bond Market Overview

In the most recent quarter ended March 31, 2023, the municipal market exhibited a rally as yields fell lower in sympathy with easing inflation and vastly improved supply chain conditions. The bond market rebounded in the beginning of 2023 after a punishing 2022. The Bloomberg Municipal Index* (a benchmark for the entire U.S. municipal bond market) and the Bloomberg Hawaii Index increased 2.1% and 2.2%, respectively, during the first quarter. Lower interest rates and limited supply of newly issued bonds bolstered returns. According to Bloomberg, the national municipal 10 year maturity “AAA” yield decreased from 2.6% as of December 31, 2022 to 2.3% at quarter end. Meanwhile, the Hawaiian 10 year maturity fell from 2.8% to 2.4% during the same period. Market issuers

1 | Hawaiian Tax-Free Trust

MANAGEMENT DISCUSSION (continued)

pulled back from bringing new debt to market, reducing supply. Most issuers remained flush with funds and were resistant to issuing debt while given elevated interest rates. For the one year period ended March 31, 2023, the supply of national new bond issuance (as recorded in The Bond Buyer) fell by 27% nationally and by 92% in Hawaii. All in all, we believe it was a satisfying quarter for municipal bonds following the volatile prior year.

As Hawaiian Tax-Free Trust’s Adviser, we diligently seek to locate Hawaiian bonds from numerous mainland securities brokers and investment managers from very early in the morning until market close. We have over 40 different counterparties who we regularly put in competition as we seek to execute bond purchases with what we deem to be the most advantageous terms for your Trust. Our objective with bond purchases from our mainland peers in the secondary market is to opportunistically “bring Hawaii bonds home.” . In addition, being located in Hawaii helps with our understanding of local credit trends and issuers. For the primary market (new bond issues), we maintain strong relationships with all of the island issuers. This relationship is two way as we stay close to the Hawaii municipal bond market and frequently participate in new bond issuances throughout the State. We remain determined in our pursuit of your Trust’s investment objective to bring as high a level of income exempt from State and Federal taxation as is consistent with preservation of capital.

Hawaii Municipal Bond Market and Economy

The Hawaiian economy is pushing mightily forward according to State of Hawaii statistics. Tourism is doing fine even with a lag in the return of visitors from Japan. In the fourth quarter of 2022, the total number of visitors increased by 16%. The fourth quarter of 2022 ended well with the State’s general fund tax revenue up 3.1% compared with the fourth quarter 2021. An increase in State Transient accommodations tax (“TAT”) collections and state excise tax collections more than offset the decline in net individual income tax revenues.

Despite a constructive economic backdrop, the counties of Maui and Honolulu were each downgraded once notch by Moody’s Investors Service, Inc. (“Moody’s”) from Aa1 to Aa2 in November 2022 and February 2023, respectively. While maintaining solid mid-Aa ratings and stable outlooks, Moody’s cited concerns associated with the State’s reliance on tourism, moderately higher debt levels and improving, but still challenging pension funding. Positively, Moody’s commented on both counties’ strong cash positions, experienced managements, unusually favorable financial flexibility and diversified economic support from military base investment.

Separately, the Honolulu Board of Water supply notched its second “AAA” from Fitch Ratings, Inc. in March. S&P Global Ratings had upgraded the credit to “AAA” in February of 2022.

Performance

Hawaiian Tax-Free Trust’s Class Y shares returned 0.01% for the twelve-month period ended March 31, 2023. This compares to 2.04% for the Trust’s prospectus benchmark, the Bloomberg Municipal Bond Quality Intermediate Total Return Unhedged USD (the

2 | Hawaiian Tax-Free Trust

MANAGEMENT DISCUSSION (continued)

“Index”). During the same period, the Bloomberg Hawaii Index returned 0.76%. The Trust’s underperformance when compared to the prospectus benchmark was primarily due to its exclusive focus on Hawaii bonds which tend to be of a higher credit quality and of longer duration. (It should be noted that the Index does not include any operating expenses nor sales charges, and being nationally oriented, does not reflect state-specific bond market performance.)

Trust Outlook and Strategy

Looking forward, we believe the Federal Reserve is nearing the conclusion of its interest rate hikes. We expect the economy will slow in coming quarters and inflationary pressures will continue to ease. The unknown is whether the Fed’s goal of lower inflation can be achieved without precipitating a recession. For now, the outlook points towards a generally constructive environment for the performance of investment grade municipal bonds. We have sought to opportunistically extended the Trust’s average maturity to lock in elevated interest rates. This should bode well for the forward return potential of your Trust and its continued generation of double tax-exempt income distributions for your benefit.

| * | Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information therein, nor does Bloomberg make any warranty, express or implied, as to results to be obtained therefrom, and, to the maximum extent allowed by the law, Bloomberg shall not have any liability or responsibility for any injury or damages arising in connection therewith. |

Mutual fund investing involves risk and loss of principal is possible.

The market prices of the Trust’s securities may rise or decline in value due to general market conditions, such as real or perceived adverse economic, political or regulatory conditions, recessions, inflation, changes in interest rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict including Russia’s military invasion of Ukraine, sanctions against Russia, other nations or individuals or companies and possible countermeasures, market disruptions caused by tariffs, trade disputes or other factors, or adverse investor sentiment. When market prices fall, the value of your investment may go down. In the past several years, financial markets have experienced increased volatility, depressed valuations, decreased liquidity and heightened uncertainty. These conditions may continue, recur, worsen or spread. Recently, inflation and interest rates have increased and may rise further. These circumstances could adversely affect the value and liquidity of the Trust’s investments, impair the Trust’s ability to satisfy redemption requests, and negatively impact the Fund’s performance. Raising the ceiling on U.S. government debt has become increasingly politicized. Any failure to increase the ceiling on U.S. government debt could lead to a default on U.S. government obligations, with unpredictable consequences for economies and markets.

The global pandemic of the novel coronavirus respiratory disease designated COVID-19 has resulted in major disruption to economies and markets around the world, including the United States. Global financial markets have experienced extreme volatility and severe losses, and trading in many instruments has been disrupted. Liquidity for many instruments has been greatly reduced for periods of time. Some sectors of the economy and individual issuers have experienced particularly large losses. These circumstances may continue to affect adversely the value and liquidity of the Trust’s investments. Following Russia’s invasion of Ukraine, Russian securities have lost all, or nearly all, their market value. Other securities or markets could be similarly affected by past or future geopolitical or other events or conditions.

Governments and central banks, including the U.S. Federal Reserve, have taken extraordinary and unprecedented actions to support local and global economies and the financial markets. These actions have resulted in significant expansion of public debt, including in the U.S. The consequences of high public debt, including its future impact on the economy and securities markets, may not be known for some time.

3 | Hawaiian Tax-Free Trust

MANAGEMENT DISCUSSION (continued)

The U.S. and other countries are periodically involved in disputes over trade and other matters, which may result in tariffs, investment restrictions and adverse impacts on affected companies and securities. For example, the U.S. has imposed tariffs and other trade barriers on Chinese exports, has restricted sales of certain categories of goods to China, and has established barriers to investments in China. Trade disputes may adversely affect the economies of the U.S. and its trading partners, as well as companies directly or indirectly affected and financial markets generally. If the political climate between the U.S. and China does not improve or continues to deteriorate, if China were to attempt unification of Taiwan by force, or if other geopolitical conflicts develop or get worse, economies, markets and individual securities may be severely affected both regionally and globally, and the value of the Trust’s assets may go down.

The value of your investment will generally go down when interest rates rise. A rise in interest rates tends to have a greater impact on the prices of longer term or longer duration securities. In recent years, interest rates and credit spreads in the U.S. have been at historic lows. The U.S. Federal Reserve has raised certain interest rates, and interest rates may continue to go up. A general rise in interest rates may cause investors to move out of fixed income securities on a large scale and could also result in increased redemptions from the Trust.

Investments in the Trust are subject to possible loss due to the financial failure of the issuers of underlying securities and their inability to meet their debt obligations.

The value of municipal securities can be adversely affected by changes in the financial condition of one or more individual municipal issuers or insurers of municipal issuers, regulatory developments, legislative actions, and by uncertainties and public perceptions concerning these and other factors. The Trust may be affected significantly by adverse economic, political or other events affecting state and other municipal issuers in which it invests, and may be more volatile than a more geographically diverse fund. The municipal bond market can be susceptible to unusual volatility, particularly for lower-rated and unrated securities. Liquidity can be reduced unpredictably in response to overall economic conditions or credit tightening. Municipal issuers may be adversely affected by rising health care costs, increasing unfunded pension liabilities, and by the phasing out of federal programs providing financial support. Unfavorable conditions and developments relating to projects financed with municipal securities can result in lower revenues to issuers of municipal securities, potentially resulting in defaults. Municipal securities may be more susceptible to downgrades or defaults during a recession or similar periods of economic stress. Financial difficulties of municipal issuers may continue or get worse, particularly in the event of political, economic or market turmoil or a recession.

A portion of income may be subject to local, state, Federal and/or alternative minimum tax. Capital gains, if any, are subject to capital gains tax.

These risks may result in share price volatility.

Any information in this Annual Report regarding market or economic trends or the factors influencing the Trust’s historical or future performance are statements of opinion as of the date of this report. These statements should not be relied upon for any other purposes. Past performance is no guarantee of future results, and there is no guarantee that any market forecasts discussed will be realized.

4 | Hawaiian Tax-Free Trust

PERFORMANCE REPORT

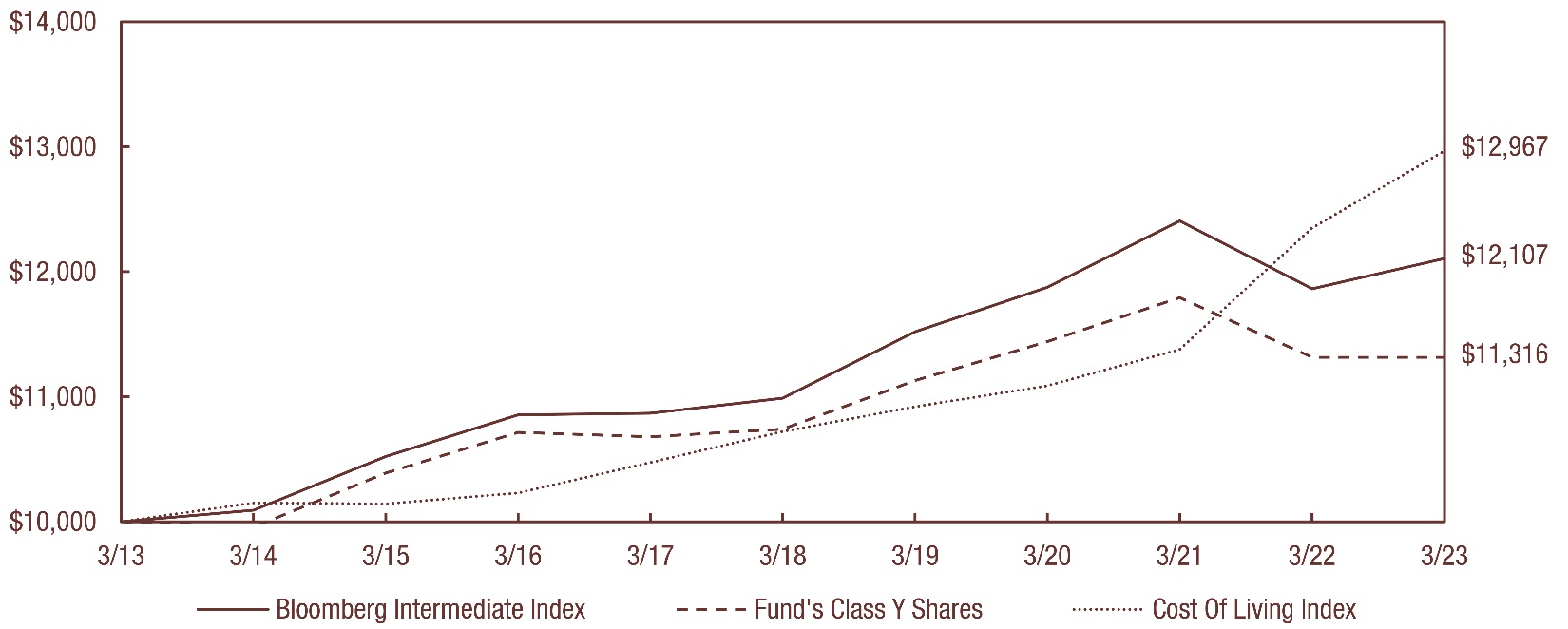

The following graph illustrates the value of $10,000 invested in the Class Y shares of Hawaiian Tax-Free Trust (the “Trust”) for the 10-year period ended March 31, 2023 as compared with the Bloomberg Municipal Bond: Quality Intermediate TR Unhedged Index*** (the “Bloomberg Intermediate Index”) and the Consumer Price Index (a cost of living index). The performance of each of the other classes is not shown in the graph but is included in the table below. It should be noted that the Bloomberg Intermediate Index does not include any operating expenses nor sales charges, and being nationally oriented, does not reflect state-specific bond market performance.

|

Average Annual Total Return for periods ended March 31, 2023 |

|||||||||

| Class and Inception Date | 1 Year | 5 Years | 10 Years | Since Inception |

|||||

| Class A since 2/20/85 | |||||||||

| With Maximum Sales Charge | (3.15)% | 0.03% | 0.63% | 4.54% | |||||

| Without Sales Charge | (0.19) | 0.85 | 1.04 | 4.66 | |||||

| Class C since 4/01/96 | |||||||||

| With CDSC** | (1.97) | 0.06 | 0.24 | 2.35 | |||||

| Without CDSC | (0.99) | 0.06 | 0.24 | 2.35 | |||||

| Class F since 11/30/18 | |||||||||

| No Sales Charge | 0.05 | N/A | N/A | 1.10 | |||||

| Class Y since 4/01/96 | |||||||||

| No Sales Charge | 0.01 | 1.05 | 1.24 | 3.46 | |||||

| Bloomberg Intermediate Index | 2.04 | 1.96 | 1.93 | 4.71* | (Class A) | ||||

| 3.92 | (Class C & Y) | ||||||||

| 1.98 | (Class F) | ||||||||

Total return figures shown for the Trust reflect any change in price and assume all distributions, including capital gains, within the period were invested in additional shares. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Trust Shares. The rates of return will vary and the principal value of an investment will fluctuate with market conditions. Shares, if redeemed, may be worth more or less than their original cost. A portion of each class’s income may be subject to Federal and state income taxes and/or the Federal Alternative Minimum Tax (“AMT”). Past performance is not predictive of future investment results.

* From commencement of the Bloomberg Barclays Quality Index on 1/1/87.

** CDSC = 1% contingent deferred sales charge imposed on redemptions made within the first 12 months after purchase.

5 | Hawaiian Tax-Free Trust

PERFORMANCE REPORT (continued)

| *** | Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information therein, nor does Bloomberg make any warranty, express or implied, as to results to be obtained therefrom, and, to the maximum extent allowed by the law, Bloomberg shall not have any liability or responsibility for any injury or damages arising in connection therewith. |

6 | Hawaiian Tax-Free Trust

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees and the Shareholders of

Hawaiian Tax-Free Trust:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Hawaiian Tax-Free Trust (the “Trust”), including the schedule of investments, as of March 31, 2023, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Trust as of March 31, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and its financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on the Trust’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the auditor for the Trust since 2005.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of March 31, 2023 by correspondence with the custodian and brokers. We believe that our audit provides a reasonable basis for our opinion.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

May 30, 2023

7 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST SCHEDULE OF INVESTMENTS MARCH 31, 2023 |

| Principal Amount |

General Obligation Bonds (39.3%) | Ratings Moody’s, S&P and Fitch (unaudited) |

Value | |||

| City & County (11.7%) | ||||||

| City and County of Honolulu, Hawaii | ||||||

| $ 1,000,000 | 5.000%, 10/01/23 Series A | Aa2/NR/AA+ | $ 1,011,940 | |||

| 1,000,000 | 5.000%, 10/01/25 Series A | Aa2/NR/AA+ | 1,062,860 | |||

| 5,055,000 | 5.000%, 10/01/26 Series A | Aa2/NR/AA+ | 5,380,340 | |||

| 1,735,000 | 5.000%, 10/01/29 Series A | Aa2/NR/AA+ | 1,841,043 | |||

| 1,300,000 | 5.000%, 10/01/35 Series A | Aa2/NR/AA+ | 1,365,286 | |||

| 1,000,000 | 5.000%, 10/01/36 Series A | Aa2/NR/AA+ | 1,047,030 | |||

| 2,040,000 | 5.000%, 10/01/26 Series B | Aa2/NR/AA+ | 2,171,294 | |||

| 2,860,000 | 5.000%, 10/01/23 Series C | Aa2/NR/AA+ | 2,894,148 | |||

| 2,095,000 | 5.000%, 10/01/27 Series C | Aa2/NR/AA+ | 2,226,168 | |||

| 4,510,000 | 5.000%, 10/01/28 Series C | Aa2/NR/AA+ | 4,787,861 | |||

| 575,000 | 5.000%, 10/01/29 Series C | Aa2/NR/AA+ | 610,144 | |||

| 1,820,000 | 5.000%, 09/01/29 Series 2017E | Aa2/NR/AA+ | 2,023,749 | |||

| 1,130,000 | 5.000%, 09/01/32 Series 2018A | Aa2/NR/AA+ | 1,271,905 | |||

| 5,000,000 | 5.000%, 09/01/24 Series 2018B | Aa2/NR/AA+ | 5,170,650 | |||

| 1,500,000 | 5.000%, 09/01/25 Series 2019A | Aa2/NR/AA+ | 1,590,720 | |||

| 1,060,000 | 5.000%, 09/01/26 Series 2019A | Aa2/NR/AA+ | 1,153,746 | |||

| 1,175,000 | 3.000%, 09/01/25 Series 2019B | Aa2/NR/AA+ | 1,190,017 | |||

| 1,075,000 | 4.000%, 08/01/26 Series 2019C | Aa2/NR/AA+ | 1,133,469 | |||

| 3,000,000 | 4.000%, 08/01/36 Series 2019C | Aa2/NR/AA+ | 3,121,170 | |||

| 1,565,000 | 4.000%, 08/01/43 Series 2019C | Aa2/NR/AA+ | 1,572,637 | |||

| 500,000 | 4.000%, 09/01/36 Series 2020A | Aa2/NR/AA+ | 521,535 | |||

| 640,000 | 4.000%, 09/01/39 Series 2020A | Aa2/NR/AA+ | 652,928 | |||

| 500,000 | 4.000%, 09/01/40 Series 2020A | Aa2/NR/AA+ | 507,635 | |||

| 2,000,000 | 4.000%, 07/01/36 Series 2020C | Aa2/NR/AA+ | 2,092,540 | |||

| 1,000,000 | 3.000%, 07/01/37 Series 2020C | Aa2/NR/AA+ | 930,490 | |||

| 1,000,000 | 4.000%, 07/01/39 Series 2020C | Aa2/NR/AA+ | 1,021,030 | |||

| 930,000 | 5.000%, 07/01/43 Series 2020C | Aa2/NR/AA+ | 1,024,051 | |||

| 175,000 | 5.000%, 07/01/33 Series 2020F | Aa2/NR/AA+ | 204,213 | |||

| 1,250,000 | 5.000%, 07/01/35 Series 2020F | Aa2/NR/AA+ | 1,438,763 | |||

| 3,920,000 | 5.250%, 07/01/46 Series 2022B | Aa2/NR/AA+ | 4,454,649 | |||

| 5,155,000 | 5.000%, 07/01/47 Series 2022B | Aa2/NR/AA+ | 5,749,475 | |||

| Total City & County | 61,223,486 |

8 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST SCHEDULE OF INVESTMENTS (continued) MARCH 31, 2023 |

| Principal Amount |

General Obligation Bonds (continued) | Ratings Moody’s, S&P and Fitch (unaudited) |

Value | |||

| County (10.5%) | ||||||

| County of Hawaii | ||||||

| $ 1,000,000 | 5.000%, 09/01/30 Series 2016A | Aa2/AA/NR | $ 1,071,460 | |||

| 1,095,000 | 4.000%, 09/01/35 Series 2016 A | Aa2/AA/NR | 1,124,401 | |||

| 2,365,000 | 5.000%, 09/01/27 Series 2017A | Aa2/NR/AA+ | 2,600,034 | |||

| 1,970,000 | 5.000%, 09/01/28 Series 2017A | Aa2/NR/AA+ | 2,168,103 | |||

| 4,175,000 | 5.000%, 09/01/29 Series 2017A | Aa2/NR/AA+ | 4,594,838 | |||

| 2,445,000 | 4.000%, 09/01/28 Series 2017D | Aa2/NR/AA+ | 2,591,529 | |||

| 1,000,000 | 4.000%, 09/01/31 Series 2017D | Aa2/NR/AA+ | 1,055,660 | |||

| 1,050,000 | 5.000%, 09/01/25 Series 2020A | Aa2/AA/AA+ | 1,113,504 | |||

| 2,000,000 | 5.000%, 09/01/29 Series 2020A | Aa2/AA/AA+ | 2,320,800 | |||

| 2,250,000 | 5.000%, 09/01/31 Series 2020A | Aa2/AA/AA+ | 2,657,497 | |||

| 1,000,000 | 5.000%, 09/01/37 Series 2020A | Aa2/AA/AA+ | 1,130,350 | |||

| County of Hawaii BAN | ||||||

| 3,000,000 | 4.030%, 07/19/23 | Aa2/AA/NR | 2,994,000 | |||

| County of Kauai, Hawaii | ||||||

| 300,000 | 3.000%, 08/01/24 Series 2017 | Aa2/NR/AA | 301,185 | |||

| 295,000 | 5.000%, 08/01/25 Series 2017 | Aa2/NR/AA | 312,007 | |||

| 235,000 | 5.000%, 08/01/26 Series 2017 | Aa2/NR/AA | 254,869 | |||

| 285,000 | 5.000%, 08/01/28 Series 2017 | Aa2/NR/AA | 316,185 | |||

| 825,000 | 2.500%, 08/01/29 Series 2017 | Aa2/NR/AA | 828,630 | |||

| 385,000 | 5.000%, 08/01/30 Series 2017 | Aa2/NR/AA | 425,456 | |||

| 200,000 | 4.000%, 08/01/32 Series 2017 | Aa2/NR/AA | 212,276 | |||

| 200,000 | 5.000%, 08/01/37 Series 2017 | Aa2/NR/AA | 217,160 | |||

| 1,000,000 | 5.000%, 08/01/23 Series 2021A | Aa2/NR/AA | 1,007,760 | |||

| County of Maui, Hawaii | ||||||

| 4,500,000 | 5.000%, 09/01/30 Series 2018 | Aa2/AA+/AA+ | 5,099,715 | |||

| 1,000,000 | 5.000%, 03/01/33 Series 2020 | Aa2/AA+/AA+ | 1,166,690 | |||

| 1,275,000 | 5.000%, 03/01/34 Series 2020 | Aa2/AA+/AA+ | 1,482,302 | |||

| 1,200,000 | 5.000%, 03/01/40 Series 2020 | Aa2/AA+/AA+ | 1,329,240 | |||

| 1,000,000 | 5.000%, 03/01/33 Series 2022 | Aa2/AA+/AA+ | 1,200,320 | |||

| 925,000 | 5.000%, 03/01/34 Series 2022 | Aa2/AA+/AA+ | 1,105,468 | |||

| 1,650,000 | 5.000%, 03/01/38 Series 2022 | Aa2/AA+/AA+ | 1,884,548 | |||

| 3,885,000 | 5.000%, 03/01/39 Series 2022 | Aa2/AA+/AA+ | 4,411,612 | |||

| 4,075,000 | 5.000%, 03/01/40 Series 2022 | Aa2/AA+/AA+ | 4,600,227 | |||

| 1,350,000 | 5.000%, 03/01/41 Series 2022 | Aa2/AA+/AA+ | 1,516,739 | |||

| 1,575,000 | 5.000%, 03/01/42 Series 2022 | Aa2/AA+/AA+ | 1,766,032 | |||

| Total County | 54,860,597 |

9 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST SCHEDULE OF INVESTMENTS (continued) MARCH 31, 2023 |

| Principal Amount |

General Obligation Bonds (continued) | Ratings Moody’s, S&P and Fitch (unaudited) |

Value | |||

| State (17.1%) | ||||||

| State of Hawaii | ||||||

| $ 2,045,000 | 5.000%, 08/01/23 Series EL | Aa2/AA+/AA | $ 2,060,665 | |||

| 3,410,000 | 5.000%, 08/01/27 Series EO | NR/AA+/AA | 3,516,460 | |||

| 1,735,000 | 5.000%, 08/01/28 Series EO | NR/AA+/AA | 1,789,167 | |||

| 1,475,000 | 5.000%, 08/01/29 Series EO | NR/AA+/AA | 1,521,049 | |||

| 3,195,000 | 5.000%, 08/01/30 Series EO | Aa2/AA+/AA | 3,294,748 | |||

| 5,075,000 | 5.000%, 08/01/23 Series EP | Aa2/AA+/AA | 5,113,874 | |||

| 5,000,000 | 5.000%, 08/01/24 Series EP | Aa2/AA+/AA | 5,157,450 | |||

| 2,085,000 | 5.000%, 10/01/26 Series EZ | Aa2/AA+/AA | 2,219,191 | |||

| 6,225,000 | 5.000%, 04/01/27 Series FB | Aa2/AA+/AA | 6,697,726 | |||

| 2,255,000 | 4.000%, 04/01/29 Series FB | Aa2/AA+/AA | 2,354,288 | |||

| 1,265,000 | 5.000%, 10/01/28 Series FG | Aa2/AA+/AA | 1,376,143 | |||

| 825,000 | 5.000%, 10/01/25 Series FH | Aa2/AA+/AA | 875,828 | |||

| 4,055,000 | 5.000%, 10/01/28 Series FH | Aa2/AA+/AA | 4,414,151 | |||

| 6,460,000 | 4.000%, 10/01/30 Series FH | Aa2/AA+/AA | 6,735,648 | |||

| 2,515,000 | 5.000%, 10/01/29 Series FN | Aa2/AA+/AA | 2,794,995 | |||

| 1,215,000 | 5.000%, 10/01/31 Series FN | Aa2/AA+/AA | 1,346,985 | |||

| 10,100,000 | 5.000%, 01/01/29 Series FT | Aa2/AA+/AA | 11,281,195 | |||

| 1,680,000 | 5.000%, 01/01/30 Series FT | Aa2/AA+/AA | 1,874,477 | |||

| 4,100,000 | 5.000%, 01/01/33 Series FT | Aa2/AA+/AA | 4,552,804 | |||

| 1,095,000 | 5.000%, 01/01/38 Series FT | Aa2/AA+/AA | 1,186,213 | |||

| 3,000,000 | 5.000%, 01/01/24 Series FW | Aa2/AA+/AA | 3,052,410 | |||

| 4,000,000 | 4.000%, 01/01/25 Series FW | Aa2/AA+/AA | 4,099,960 | |||

| 2,000,000 | 4.000%, 01/01/34 Series FW | Aa2/AA+/AA | 2,119,260 | |||

| 3,000,000 | 5.000%, 01/01/37 Series FW | Aa2/AA+/AA | 3,324,270 | |||

| 6,000,000 | 5.000%, 01/01/38 Series FW | Aa2/AA+/AA | 6,612,840 | |||

| 400,000 | 5.000%, 01/01/39 Series FW | Aa2/AA+/AA | 439,100 | |||

| Total State | 89,810,897 | |||||

| Total General Obligation Bonds | 205,894,980 | |||||

10 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST SCHEDULE OF INVESTMENTS (continued) MARCH 31, 2023 |

| Principal Amount |

Revenue Bonds (51.9%) | Ratings Moody’s, S&P and Fitch (unaudited) |

Value | |||

| Airport (4.7%) | ||||||

| State of Hawaii Airport System Revenue | ||||||

| $ 2,000,000 | 5.000%, 07/01/41 Series 2015A AMT | A1/AA-/A+ | $ 2,028,960 | |||

| 3,000,000 | 5.000%, 07/01/45 Series 2015A AMT | A1/AA-/A+ | 3,034,830 | |||

| 2,465,000 | 5.000%, 07/01/48 Series 2018A AMT | A1/AA-/A+ | 2,538,999 | |||

| 300,000 | 5.000%, 07/01/34 Series 2020D | A1/AA-/A+ | 342,672 | |||

| 12,000,000 | 5.000%, 07/01/51 Series 2022A AMT | A1/AA-/A+ | 12,621,120 | |||

| State of Hawaii Department of Transportation Airports Division Lease Revenue COP AMT | ||||||

| 360,000 | 5.000%, 08/01/23 Series 2013 | A2/A+/A | 361,854 | |||

| 3,435,000 | 5.250%, 08/01/25 Series 2013 | A2/A+/A | 3,455,507 | |||

| Total Airport | 24,383,942 | |||||

| Education (5.2%) | ||||||

| Hawaii State Department of Budget and Finance, Special Purpose Revenue (Mid-Pacific Institute) | ||||||

| 340,000 | 4.000%, 01/01/28 Series 2020 | NR/BBB+/NR | 345,005 | |||

| 360,000 | 4.000%, 01/01/29 Series 2020 | NR/BBB+/NR | 365,404 | |||

| 540,000 | 4.000%, 01/01/32 Series 2020 | NR/BBB+/NR | 545,638 | |||

| 540,000 | 4.000%, 01/01/33 Series 2020 | NR/BBB+/NR | 543,980 | |||

| 435,000 | 3.000%, 01/01/34 Series 2020 | NR/BBB+/NR | 389,225 | |||

| 300,000 | 3.000%, 01/01/35 Series 2020 | NR/BBB+/NR | 264,705 | |||

| 280,000 | 3.000%, 01/01/36 Series 2020 | NR/BBB+/NR | 241,567 | |||

| University of Hawaii | ||||||

| 1,055,000 | 4.000%, 10/01/23 Series 2015B | Aa3/NR/AA | 1,062,269 | |||

| 1,250,000 | 4.000%, 10/01/24 Series 2015B | Aa3/NR/AA | 1,274,550 | |||

| 1,125,000 | 5.000%, 10/01/25 Series 2015B | Aa3/NR/AA | 1,192,916 | |||

| 1,065,000 | 5.000%, 10/01/26 Series 2015B | Aa3/NR/AA | 1,129,028 | |||

| 4,635,000 | 5.000%, 10/01/29 Series 2015E | Aa3/NR/AA | 5,000,238 | |||

| 3,825,000 | 5.000%, 10/01/31 Series 2015E | Aa3/NR/AA | 4,105,258 | |||

| 1,595,000 | 5.000%, 10/01/25 Series 2017F | Aa3/NR/AA | 1,691,290 | |||

| 1,335,000 | 5.000%, 10/01/29 Series 2017F | Aa3/NR/AA | 1,481,009 | |||

| 2,080,000 | 5.000%, 10/01/30 Series 2017F | Aa3/NR/AA | 2,304,224 |

11 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST SCHEDULE OF INVESTMENTS (continued) MARCH 31, 2023 |

| Principal Amount |

Revenue Bonds (continued) | Ratings Moody’s, S&P and Fitch (unaudited) |

Value | |||

| Education (continued) | ||||||

| University of Hawaii (continued) | ||||||

| $ 2,690,000 | 5.000%, 10/01/31 Series 2017F | Aa3/NR/AA | $ 2,975,705 | |||

| 230,000 | 5.000%, 10/01/23 Series 2020B | Aa3/NR/AA | 232,700 | |||

| 2,000,000 | 4.000%, 10/01/33 Series 2020D | Aa3/NR/AA | 2,153,520 | |||

| Total Education | 27,298,231 | |||||

| Housing (0.3%) | ||||||

| State of Hawaii Housing Finance and Development Corp., Iwilei Apartments | ||||||

| 1,825,000 | 3.750%, 01/01/31 Series 2012A FHLMC Insured Liquidity Agreement | NR/AA+/NR | 1,825,876 | |||

| Medical (6.5%) | ||||||

| Hawaii State Department of Budget and Finance, Special Purpose Revenue (Hawaii Pacific Health) | ||||||

| 1,000,000 | 5.000%, 07/01/24 Series 2013A | A1/NR/AA- | 1,005,210 | |||

| 685,000 | 5.000%, 07/01/25 Series 2013A | A1/NR/AA- | 687,952 | |||

| 1,355,000 | 5.000%, 07/01/27 Series 2013A | A1/NR/AA- | 1,359,851 | |||

| 280,000 | 5.000%, 07/01/28 Series 2013A | A1/NR/AA- | 280,868 | |||

| 3,895,000 | 6.000%, 07/01/33 Series 2013A | A1/NR/AA- | 3,925,381 | |||

| 20,000 | 5.500%, 07/01/43 Series 2013A | A1/NR/AA- | 20,075 | |||

| 225,000 | 5.000%, 07/01/30 Series 2013B | A1/NR/AA- | 225,587 | |||

| 590,000 | 5.125%, 07/01/31 Series 2013B | A1/NR/AA- | 592,531 | |||

| Hawaii State Department of Budget and Finance, Special Purpose Revenue (Queens Health System) | ||||||

| 1,105,000 | 5.000%, 07/01/23 Series 2015A | NR/AA-/AA | 1,110,823 | |||

| 3,120,000 | 5.000%, 07/01/25 Series 2015A | NR/AA-/AA | 3,273,098 | |||

| 1,715,000 | 5.000%, 07/01/26 Series 2015A | NR/AA-/AA | 1,802,293 | |||

| 2,400,000 | 5.000%, 07/01/27 Series 2015A | NR/AA-/AA | 2,523,120 | |||

| 850,000 | 5.000%, 07/01/28 Series 2015A | NR/AA-/AA | 893,520 | |||

| 15,520,000 | 5.000%, 07/01/35 Series 2015A | NR/AA-/AA | 16,146,077 | |||

| Total Medical | 33,846,386 | |||||

12 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST SCHEDULE OF INVESTMENTS (continued) MARCH 31, 2023 |

| Principal Amount |

Revenue Bonds (continued) | Ratings Moody’s, S&P and Fitch (unaudited) |

Value | |||

| Transportation (9.1%) | ||||||

| State of Hawaii Harbor System | ||||||

| $ 1,000,000 | 4.000%, 07/01/33 Series 2020A AMT | Aa3/NR/AA- | $ 1,035,670 | |||

| 495,000 | 4.000%, 07/01/35 Series 2020A AMT | Aa3/NR/AA- | 504,593 | |||

| 10,000,000 | 4.000%, 07/01/36 Series 2020A AMT | Aa3/NR/AA- | 10,105,700 | |||

| 9,000,000 | 4.000%, 07/01/37 Series 2020A AMT | Aa3/NR/AA- | 9,029,700 | |||

| 430,000 | 5.000%, 07/01/29 Series 2020C | Aa3/NR/AA- | 494,431 | |||

| 200,000 | 4.000%, 07/01/34 Series 2020C | Aa3/NR/AA- | 211,296 | |||

| 560,000 | 4.000%, 07/01/37 Series 2020C | Aa3/NR/AA- | 574,991 | |||

| 875,000 | 4.000%, 07/01/38 Series 2020C | Aa3/NR/AA- | 894,163 | |||

| State of Hawaii Highway Revenue | ||||||

| 1,500,000 | 5.000%, 01/01/27 Series 2016A | Aa2/AA+/AA | 1,620,165 | |||

| 5,000,000 | 5.000%, 01/01/30 Series 2016A | Aa2/AA+/AA | 5,403,800 | |||

| 4,750,000 | 4.000%, 01/01/31 Series 2016A | Aa2/AA+/AA | 4,947,077 | |||

| 1,000,000 | 5.000%, 01/01/32 Series 2019A | Aa2/AA+/NR | 1,136,800 | |||

| 1,010,000 | 5.000%, 01/01/35 Series 2021 | Aa2/AA+/NR | 1,173,166 | |||

| 2,800,000 | 5.000%, 01/01/37 Series 2021 | Aa2/AA+/NR | 3,190,516 | |||

| 3,000,000 | 5.000%, 01/01/39 Series 2021 | Aa2/AA+/NR | 3,377,190 | |||

| 3,580,000 | 5.000%, 01/01/41 Series 2021 | Aa2/AA+/NR | 3,992,058 | |||

| Total Transportation | 47,691,316 | |||||

| Utility (4.9%) | ||||||

| Hawaii State Department of Budget and Finance, Special Purpose Revenue (Hawaiian Electric Co.) | ||||||

| 500,000 | 3.250%, 01/01/25 Series 2015 AMT | Baa1/NR/A- | 495,865 | |||

| 10,360,000 | 3.100%, 05/01/26 Series 2017A AMT | Baa1/NR/A- | 10,153,525 | |||

| 4,000,000 | 4.000%, 03/01/37 Series 2017B AMT | Baa1/NR/A- | 3,862,800 | |||

| 6,300,000 | 3.200%, 07/01/39 Series 2019 | Baa1/NR/A- | 5,365,773 | |||

| 7,000,000 | 3.500%, 10/01/49 Series 2019 AMT | Baa1/NR/A- | 5,607,980 | |||

| Total Utility | 25,485,943 | |||||

13 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST SCHEDULE OF INVESTMENTS (continued) MARCH 31, 2023 |

| Principal Amount |

Revenue Bonds (continued) | Ratings Moody’s, S&P and Fitch (unaudited) |

Value | |||

| Water & Sewer (20.1%) | ||||||

| City and County of Honolulu, Hawaii, Board of Water Supply Water System | ||||||

| $ 1,000,000 | 5.000%, 07/01/23 Series 2014A | Aa2/NR/AAA | $ 1,005,800 | |||

| 1,030,000 | 5.000%, 07/01/24 Series 2014A | Aa2/NR/AAA | 1,060,055 | |||

| 500,000 | 5.000%, 07/01/27 Series 2020A | NR/AAA/AAA | 554,105 | |||

| 1,565,000 | 5.000%, 07/01/33 Series 2020A | NR/AAA/AAA | 1,829,642 | |||

| 2,105,000 | 4.000%, 07/01/36 Series 2020A | NR/AAA/AAA | 2,215,681 | |||

| 1,890,000 | 4.000%, 07/01/37 Series 2020A | NR/AAA/AAA | 1,968,794 | |||

| 2,060,000 | 4.000%, 07/01/39 Series 2020A | NR/AAA/AAA | 2,101,365 | |||

| 500,000 | 5.000%, 07/01/32 Series 2021A | NR/AAA/AAA | 596,810 | |||

| 525,000 | 5.000%, 07/01/33 Series 2021A | NR/AAA/AAA | 624,860 | |||

| 35,000 | 4.000%, 07/01/39 Series 2021A | NR/AAA/AAA | 35,824 | |||

| 2,565,000 | 4.000%, 07/01/46 Series 2021A | NR/AAA/AAA | 2,568,719 | |||

| 10,000,000 | 4.000%, 07/01/47 Series 2022A | NR/AAA/AAA | 9,913,300 | |||

| 760,000 | 5.000%, 07/01/40 Series 2023 | NR/AAA/AAA | 871,712 | |||

| 800,000 | 5.000%, 07/01/41 Series 2023 | NR/AAA/AAA | 916,424 | |||

| 885,000 | 5.000%, 07/01/43 Series 2023 | NR/AAA/AAA | 1,005,626 | |||

| 5,150,000 | 5.000%, 07/01/52 Series 2023 | NR/AAA/AAA | 5,740,396 | |||

| City and County of Honolulu, Hawaii, Wastewater System (First Bond Resolution) | ||||||

| 1,500,000 | 5.000%, 07/01/24 Senior Series 2015B | Aa2/NR/AA | 1,545,255 | |||

| 2,095,000 | 5.000%, 07/01/25 Senior Series 2015B | Aa2/NR/AA | 2,207,166 | |||

| 2,085,000 | 5.000%, 07/01/34 Senior Series 2016A | Aa2/NR/AA | 2,233,827 | |||

| 635,000 | 5.000%, 07/01/35 Senior Series 2016B | Aa2/NR/AA | 677,272 | |||

| 6,000,000 | 5.000%, 07/01/36 Senior Series 2018A | Aa2/NR/AA | 6,588,660 | |||

| 3,000,000 | 4.000%, 07/01/30 Senior Series 2019A | Aa2/NR/AA | 3,257,130 | |||

| 770,000 | 5.000%, 07/01/44 Senior Series 2019A | Aa2/NR/AA | 834,472 | |||

| 1,000,000 | 4.000%, 07/01/34 Senior Series 2019B | Aa2/NR/AA | 1,049,260 | |||

| 2,700,000 | 4.000%, 07/01/38 Senior Series 2019B | Aa2/NR/AA | 2,760,534 |

14 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST SCHEDULE OF INVESTMENTS (continued) MARCH 31, 2023 |

| Principal Amount |

Revenue Bonds (continued) | Ratings Moody’s, S&P and Fitch (unaudited) |

Value | |||

| Water & Sewer (continued) | ||||||

| City and County of Honolulu, Hawaii, Wastewater System (First Bond Resolution) Green Bond | ||||||

| $ 4,000,000 | 5.000%, 07/01/47 Senior Series 2022A | Aa2/NR/AA | $ 4,441,320 | |||

| 17,500,000 | 5.250%, 07/01/51 Senior Series 2022A | Aa2/NR/AA | 19,731,425 | |||

| 19,360,000 | 5.000%, 07/01/51 Senior Series 2022A | Aa2/NR/AA | 21,419,130 | |||

| City and County of Honolulu, Hawaii, Wastewater System (Second Bond Resolution) Junior Series 2015A | ||||||

| 4,000,000 | 5.000%, 07/01/25 Junior Series 2015A | Aa3/NR/AA- | 4,214,160 | |||

| 1,375,000 | 3.000%, 07/01/26 Junior Series 2019A | Aa3/NR/AA- | 1,399,406 | |||

| Total Water & Sewer | 105,368,130 | |||||

| Other (1.1%) | ||||||

| Hawaii State Department of Hawaiian Home Lands | ||||||

| 600,000 | 5.000%, 04/01/23 Series 2017 | A1/NR/NR | 600,000 | |||

| 500,000 | 5.000%, 04/01/24 Series 2017 | A1/NR/NR | 511,080 | |||

| 945,000 | 5.000%, 04/01/26 Series 2017 | A1/NR/NR | 1,013,938 | |||

| 905,000 | 5.000%, 04/01/29 Series 2017 | A1/NR/NR | 983,590 | |||

| 840,000 | 5.000%, 04/01/30 Series 2017 | A1/NR/NR | 909,636 | |||

| Hawaii State Department of Hawaiian Home Lands, COP (Kapolei Office Facility) | ||||||

| 330,000 | 5.000%, 11/01/24 Series 2017A | Aa3/NR/NR | 341,831 | |||

| 145,000 | 5.000%, 11/01/25 Series 2017A | Aa3/NR/NR | 153,899 | |||

| 1,115,000 | 5.000%, 11/01/27 Series 2017A | Aa3/NR/NR | 1,239,835 | |||

| Total Other | 5,753,809 | |||||

| Total Revenue Bonds | 271,653,633 | |||||

15 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST SCHEDULE OF INVESTMENTS (continued) MARCH 31, 2023 |

| Principal Amount |

Pre-Refunded Bonds (6.5%)†† | Ratings Moody’s, S&P and Fitch (unaudited) |

Value | |||

| Pre-Refunded General Obligation Bonds (4.4%) | ||||||

| State (4.4%) | ||||||

| State of Hawaii | ||||||

| $ 4,375,000 | 5.000%, 08/01/25 Series EH | Aa2/AA+/AA | $ 4,409,388 | |||

| 1,800,000 | 5.000%, 08/01/27 Series EH | Aa2/AA+/NR | 1,814,148 | |||

| 2,000,000 | 5.000%, 08/01/30 Series EH | NR/NR/NR* | 2,015,380 | |||

| 5,000 | 5.000%, 08/01/30 Series EH | NR/NR/NR* | 5,038 | |||

| 590,000 | 5.000%, 08/01/27 Series EO | NR/NR/NR* | 608,184 | |||

| 265,000 | 5.000%, 08/01/28 Series EO | NR/NR/NR* | 273,167 | |||

| 570,000 | 5.000%, 08/01/29 Series EO | NR/NR/NR* | 587,567 | |||

| 5,280,000 | 5.000%, 08/01/25 Series EP | Aa2/AA+/AA | 5,449,752 | |||

| 5,300,000 | 5.000%, 08/01/26 Series EP | Aa2/AA+/AA | 5,470,395 | |||

| 2,070,000 | 5.000%, 10/01/30 Series ET | Aa2/AA+/AA | 2,201,155 | |||

| Total Pre-Refunded General Obligation Bonds | 22,834,174 | |||||

| Pre-Refunded Revenue Bonds (2.1%) | ||||||

| Water & Sewer (2.1%) | ||||||

| City and County of Honolulu, Hawaii, Board of Water Supply Water System | ||||||

| 1,795,000 | 5.000%, 07/01/26 Series 2014A | Aa2/NR/AAA | 1,848,940 | |||

| 875,000 | 5.000%, 07/01/27 Series 2014A | Aa2/NR/AAA | 901,294 | |||

| 1,750,000 | 5.000%, 07/01/28 Series 2014A | Aa2/NR/AAA | 1,802,588 | |||

| 360,000 | 5.000%, 07/01/29 Series 2014A | Aa2/NR/AAA | 370,818 | |||

| City and County of Honolulu, Hawaii, Wastewater System (First Bond Resolution) |

||||||

| 200,000 | 5.000%, 07/01/40 Senior Series 2015A | Aa2/NR/AA | 210,574 | |||

| 2,150,000 | 5.000%, 07/01/30 Senior Series 2015B | Aa2/NR/AA | 2,263,671 | |||

| 3,700,000 | 5.000%, 07/01/31 Senior Series 2015B | Aa2/NR/AA | 3,895,619 | |||

| Total Water & Sewer | 11,293,504 | |||||

| Total Pre-Refunded Revenue Bonds | 11,293,504 | |||||

| Total Pre-Refunded Bonds | 34,127,678 | |||||

| Total Municipal Bonds (cost $525,666,834) |

511,676,291 |

16 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST SCHEDULE OF INVESTMENTS (continued) MARCH 31, 2023 |

| Shares | Short-Term Investment (1.2%) | Ratings Moody’s, S&P and Fitch (unaudited) |

Value | |||

| 6,112,205 | Dreyfus Government Cash Management, Institutional Shares, 4.71%** (cost $6,112,205) |

Aaa-mf/AAAm/NR | $ 6,112,205 | |||

| Total Investments (cost $531,779,039 - note 4) |

98.9% | 517,788,496 | ||||

| Other assets less liabilities | 1.1 | 5,957,185 | ||||

| Net Assets | 100.0% | $ 523,745,681 |

| Portfolio Distribution By Quality Rating (unaudited) | Percentage of Investments† | |

| Aaa-mf of Moody's or AAA of S&P or Fitch and AAAm of S&P | 7.6% | |

| Pre-Refunded Bonds†† | 6.6 | |

| Aa of Moody's or AA of S&P or Fitch | 78.9 | |

| A of Moody's or S&P or Fitch | 6.4 | |

| Baa of Moody’s or BBB of S&P | 0.5 | |

| 100.0% |

| PORTFOLIO ABBREVIATIONS |

|

AMT - Alternative Minimum Tax BAN – Bond Anticipation Note COP - Certificates of Participation FHLMC - Federal Home Loan Mortgage Corp. NR - Not Rated |

| * | Any security not rated (“NR”) by any of the Nationally Recognized Statistical Rating Organizations (“NRSRO”) has been determined by the Investment Adviser to have sufficient quality to be ranked in the top four credit ratings if a credit rating were to be assigned by a NRSRO. |

| ** | The rate is an annualized seven-day yield at period end. |

| † | Where applicable, calculated using the highest rating of the three NRSRO. |

| †† | Pre-refunded bonds are bonds for which U.S. Government Obligations usually have been placed in escrow to retire the bonds at their earliest call date. |

See accompanying notes to financial statements.

17 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST STATEMENT OF ASSETS AND LIABILITIES MARCH 31, 2023 |

| ASSETS | |||

| Investments at value (cost $531,779,039) | $ | 517,788,496 | |

| Interest receivable | 6,217,589 | ||

| Receivable for investment securities sold | 742,973 | ||

| Receivable for Trust Shares sold | 140,906 | ||

| Other assets | 77,642 | ||

| Total assets | 524,967,606 | ||

| LIABILITIES | |||

| Payables: | |||

| Fund shares redeemed | 356,861 | ||

| Advisory and Administrative fees | 198,708 | ||

| Dividends | 168,297 | ||

| Investment securities purchased | 150,499 | ||

| Transfer and shareholder servicing fees | 147,855 | ||

| Legal fees | 65,963 | ||

| Distribution and service fees payable | 1,055 | ||

| Accrued other expenses | 132,687 | ||

| Total liabilities | 1,221,925 | ||

| NET ASSETS | $ | 523,745,681 | |

| Net Assets consist of: | |||

| Capital Stock – Authorized an unlimited number of shares, par value $0.01 per share | $ | 492,972 | |

| Additional paid-in capital | 540,441,905 | ||

| Total distributable earnings (losses) | (17,189,196) | ||

| $ | 523,745,681 | ||

| CLASS A | |||

| Net Assets | $ | 456,130,451 | |

| Capital shares outstanding | 42,941,326 | ||

| Net asset value and redemption price per share | $ | 10.62 | |

| Maximum offering price per share (100/97 of $10.62) | $ | 10.95 | |

| CLASS C | |||

| Net Assets | $ | 9,778,517 | |

| Capital shares outstanding | 921,136 | ||

| Net asset value and offering price per share | $ | 10.62 | |

| CLASS F | |||

| Net Assets | $ | 427,936 | |

| Capital shares outstanding | 40,235 | ||

| Net asset value, offering and redemption price per share | $ | 10.64 | |

| CLASS Y | |||

| Net Assets | $ | 57,408,777 | |

| Capital shares outstanding | 5,394,542 | ||

| Net asset value, offering and redemption price per share | $ | 10.64 |

See accompanying notes to financial statements.

18 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST STATEMENT OF OPERATIONS YEAR ENDED MARCH 31, 2023 |

| Investment Income | ||||||

| Interest income | $ | 13,498,274 | ||||

| Expenses | ||||||

| Investment Adviser fee (note 3) | $ | 1,244,891 | ||||

| Administrator/Business Manager fee (note 3) | 1,190,765 | |||||

| Distribution and service fee (note 3) | 1,053,154 | |||||

| Transfer and shareholder servicing agent fees | 367,137 | |||||

| Trustees’ fees and expenses (note 7) | 206,182 | |||||

| Legal fees | 182,301 | |||||

| Fund accounting fees | 155,413 | |||||

| Registration fees and dues | 58,605 | |||||

| Auditing and tax fees | 33,700 | |||||

| Shareholders’ reports and proxy statements | 31,370 | |||||

| Insurance | 29,116 | |||||

| Custodian fees | 20,388 | |||||

| Credit facility fees (note 10) | 15,235 | |||||

| Compliance services (note 3) | 9,824 | |||||

| Miscellaneous | 22,419 | |||||

| Total expenses | 4,620,500 | |||||

| Net investment income | 8,877,774 | |||||

| Realized and Unrealized Gain (Loss) on Investments: | ||||||

| Net realized gain (loss) from securities transactions | (2,262,391) | |||||

| Change in unrealized appreciation (depreciation) on investments | (8,910,550) | |||||

| Net realized and unrealized gain (loss) on investments | (11,172,941) | |||||

| Net change in net assets resulting from operations | $ | (2,295,167) |

See accompanying notes to financial statements.

19 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST STATEMENT OF CHANGES IN NET ASSETS |

| Year Ended March 31, 2023 |

Year Ended March 31, 2022 | |||||

| OPERATIONS: | ||||||

| Net investment income | $ | 8,877,774 | $ | 9,318,289 | ||

| Realized gain (loss) from securities transactions | (2,262,391) | (764,500) | ||||

| Change in unrealized appreciation (depreciation) on investments | (8,910,550) | (34,199,938) | ||||

| Change in net assets resulting from operations | (2,295,167) | (25,646,149) | ||||

| DISTRIBUTIONS TO SHAREHOLDERS (note 9): | ||||||

| Class A Shares | (7,761,146) | (8,457,671) | ||||

| Class C Shares | (105,568) | (135,638) | ||||

| Class F Shares | (5,174) | (4,217) | ||||

| Class Y Shares | (1,178,990) | (1,376,806) | ||||

| Change in net assets from distributions | (9,050,878) | (9,974,332) | ||||

| CAPITAL SHARE TRANSACTIONS (note 6): | ||||||

| Proceeds from shares sold | 32,952,870 | 42,954,914 | ||||

| Reinvested dividends and distributions | 7,101,764 | 7,791,464 | ||||

| Cost of shares redeemed | (91,261,992) | (74,417,054) | ||||

| Change in net assets from capital share transactions | (51,207,358) | (23,670,676) | ||||

| Change in net assets | (62,553,403) | (59,291,157) | ||||

| NET ASSETS: | ||||||

| Beginning of period | 586,299,084 | 645,590,241 | ||||

| End of period | $ | 523,745,681 | $ | 586,299,084 | ||

See accompanying notes to financial statements.

20 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST NOTES TO FINANCIAL STATEMENTS MARCH 31, 2023 |

1. Organization

Hawaiian Tax-Free Trust (the “Trust”), a non-diversified, open-end investment company, was organized on May 7, 1984, as a Massachusetts business trust and commenced operations on February 20, 1985. The Trust is authorized to issue an unlimited number of shares. Class A Shares are sold at net asset value plus a sales charge of varying size (depending upon a variety of factors) paid at the time of purchase and bear a distribution fee. Class C Shares are sold at net asset value with no sales charge payable at the time of purchase but with a level charge for service and distribution fees for six years thereafter. Class C Shares automatically convert to Class A Shares after six years. Class F Shares and Class Y Shares are sold only through authorized financial institutions acting for investors in a fiduciary, advisory, agency, custodial or similar capacity, and are not offered directly to retail customers. Class F Shares and Class Y Shares are sold at net asset value with no sales charge, no redemption fee, no contingent deferred sales charge (“CDSC”) and no distribution fee. All classes of shares represent interests in the same portfolio of investments and are identical as to rights and privileges but differ with respect to the effect of sales charges, the distribution and/or service fees borne by each class, expenses specific to each class, voting rights on matters affecting a single class and the exchange privileges of each class.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Trust in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America for investment companies.

| a) | Portfolio valuation: Municipal securities are valued each business day based upon information provided by a nationally prominent independent pricing service and periodically verified through other pricing services. In the case of securities for which market quotations are readily available, securities are valued by the pricing service at the mean of bid and ask quotations. If a market quotation or a valuation from the pricing service is not readily available, the security is valued using other fair value methods. Rule 2a-5 under the 1940 Act provides that in the event that market quotations are not readily available, such securities must be valued at their fair value as determined in good faith by each Fund’s Board of Trustees. Rule 2a-5 further provides that the Board may choose to designate a “valuation designee” to perform the fair value determination. The Aquila Municipal Trust Board has designated Aquila Investment Management LLC as the valuation designee (the “Valuation Designee”) to determine the fair value of Fund securities in good faith. Aquila Investment Management LLC as Valuation Designee, selects an appropriate methodology or methodologies for determining and calculating the fair value of Fund investments and applies such methodology or methodologies in a consistent manner, including specifying the key inputs and assumptions specific to each asset class or portfolio holding. |

| b) | Fair value measurements: The Trust follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Trust’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Trust’s investments and are summarized in the following fair value hierarchy: |

21 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST NOTES TO FINANCIAL STATEMENTS (continued) MARCH 31, 2023 |

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Trust has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Trust’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, based on the best information available.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the valuation inputs, representing 100% of the Trust’s investments, used to value the Trust’s net assets as of March 31, 2023:

| Valuation Inputs* | Investments in Securities | |||

| Level 1 – Quoted Prices – Short-Term Investment | $ | 6,112,205 | ||

| Level 2 – Other Significant Observable Inputs – Municipal Bonds* | 511,676,291 | |||

| Level 3 – Significant Unobservable Inputs | — | |||

| Total | $ | 517,788,496 | ||

| * See schedule of investments for a detailed listing of securities. | ||||

| c) | Subsequent events: In preparing these financial statements, the Trust has evaluated events and transactions for potential recognition or disclosure through the date these financial statements were issued. |

| d) | Securities transactions and related investment income: Securities transactions are recorded on the trade date. Realized gains and losses from securities transactions are reported on the identified cost basis. Interest income is recorded daily on the accrual basis and is adjusted for amortization of premium and accretion of original issue discount and market discount. |

| e) | Federal income taxes: It is the policy of the Trust to continue to qualify as a regulated investment company by complying with the provisions of the Internal Revenue Code applicable to certain investment companies. The Trust intends to make distributions of income and securities profits sufficient to relieve it from all, or substantially all, Federal income and excise taxes. |

Management has reviewed the tax positions for each of the open tax years (2020 – 2022) or expected to be taken in the Trust’s 2023 tax returns and has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements.

22 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST NOTES TO FINANCIAL STATEMENTS (continued) MARCH 31, 2023 |

| f) | Multiple class allocations: All income, expenses (other than class-specific expenses), and realized and unrealized gains or losses are allocated daily to each class of shares based on the relative net assets of each class. Class-specific expenses, which include distribution and service fees and any other items that are specifically attributed to a particular class, are also charged directly to such class on a daily basis. |

| g) | Use of estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. |

| h) | Reclassification of capital accounts: Accounting principles generally accepted in the United States of America require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications had no effect on net assets or net asset value per share. For the year ended March 31, 2023, there were no items identified that have been reclassified among components of net assets. |

| i) | The Trust is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services-Investment Companies”. |

3. Fees and Related Party Transactions

| a) | Management Arrangements: |

The Asset Management Group of Bank of Hawaii (the “Adviser”), serves as Investment Adviser to the Trust. In this role, under an Investment Advisory Agreement, the Adviser supervises the Trust’s investments. Aquila Investment Management LLC (the “Administrator/Business Manager”), a wholly-owned subsidiary of Aquila Management Corporation, the Trust’s founder and sponsor, serves as the Administrator/Business Manager for the Trust under an Administration and Business Management Agreement with the Trust. The Administrator/Business Manager provides all administrative services to the Trust other than those relating to its investment portfolio. These include providing the office of the Trust and all related services as well as overseeing the activities of all the various support organizations to the Trust such as the transfer and shareholder servicing agent, fund accounting agent, custodian, legal counsel, auditors and distributor.

The Trust pays the Adviser a fee which is payable monthly and computed on the net assets of the Trust as of the close of business each day at the annual rate of 0.23% of the Trust’s net assets up to and including $875 million; 0.17% of the Trust’s net assets between $875 million and $1.5 billion; and 0.155% of the Trust’s net assets over $1.5 billion. For its services, the Administrator/Business Manager is entitled to receive a fee which is payable monthly and computed as of the close of business each day at the annual rate of 0.22% of the Trust’s net assets.

23 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST NOTES TO FINANCIAL STATEMENTS (continued) MARCH 31, 2023 |

Under a Compliance Agreement with the Administrator/Business Manager, the Administrator/Business Manager is additionally compensated by the Trust for compliance related services provided to enable the Trust to comply with Rule 38a-1 of the Investment Company Act of 1940, as amended (the “1940 Act”).

Specific details as to the nature and extent of the services provided by the Adviser and the Administrator/Business Manager are more fully defined in the Trust’s Prospectus and Statement of Additional Information.

| b) | Distribution and Service Fees: |

The Trust has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 (the “Rule”) under the 1940 Act. Under one part of the Plan, with respect to Class A Shares, the Trust is authorized to make distribution fee payments to broker-dealers or others (“Qualified Recipients”) selected by Aquila Distributors LLC (the “Distributor”), including, but not limited to, any principal underwriter of the Trust, with which the Distributor has entered into written agreements contemplated by the Rule and which have rendered assistance in the distribution and/or retention of the Trust’s shares or servicing of shareholder accounts. The Trust makes payment of this distribution fee at the annual rate of 0.20% of the Trust’s average net assets represented by Class A Shares. For the year ended March 31, 2023, distribution fees on Class A Shares amounted to $929,400 of which the Distributor retained $64,959.

Under another part of the Plan, the Trust is authorized to make payments with respect to Class C Shares to Qualified Recipients which have rendered assistance in the distribution and/or retention of the Trust’s Class C shares or servicing of shareholder accounts. These payments are made at the annual rate of 0.75% of the Trust’s average net assets represented by Class C Shares and for the year ended March 31, 2023, amounted to $92,815. In addition, under a Shareholder Services Plan, the Trust is authorized to make service fee payments with respect to Class C Shares to Qualified Recipients for providing personal services and/or maintenance of shareholder accounts. These payments are made at the annual rate of 0.25% of the Trust’s average net assets represented by Class C Shares and for the year ended March 31, 2023, amounted to $30,939. The total of these payments made with respect to Class C Shares amounted to $123,754 of which the Distributor retained $30,835.

Specific details about the Plans are more fully defined in the Trust’s Prospectus and Statement of Additional Information.

Under a Distribution Agreement, the Distributor serves as the exclusive distributor of the Trust’s shares. Through agreements between the Distributor and various brokerage and advisory firms (“financial intermediaries”), the Trust’s shares are sold primarily through the facilities of these financial intermediaries having offices within Hawaii, with the bulk of any sales commissions inuring to such financial intermediaries. For the year ended March 31, 2023, total commissions on sales of Class A Shares amounted to $46,553, of which the Distributor received $20,925.

24 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST NOTES TO FINANCIAL STATEMENTS (continued) MARCH 31, 2023 |

| c) | Transfer and shareholder servicing fees: |

The Trust occasionally compensates financial intermediaries in connection with the sub-transfer agency related services provided by such entities in connection with their respective Fund shareholders so long as the fees are deemed by the Board of Trustees to be reasonable in relation to (i) the value of the services and the benefits received by the Fund and certain shareholders; and (ii) the payments that the Fund would make to another entity to perform similar ongoing services to existing shareholders.

4. Purchases and Sales of Securities

During the year ended March 31, 2023, purchases of securities and proceeds from the sales of securities aggregated $112,011,085 and $156,002,207, respectively.

At March 31, 2023, the aggregate tax cost for all securities was $531,779,039. At March 31, 2023, the aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost amounted to $1,477,081 and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over value amounted to $15,467,624 for a net unrealized depreciation of $13,990,543.

5. Portfolio Orientation

Since the Trust invests principally and may invest entirely in double tax-free municipal obligations of issuers within Hawaii, it is subject to possible risks associated with economic, political, or legal developments or industrial or regional matters specifically affecting Hawaii and whatever effects these may have upon Hawaii issuers’ ability to meet their obligations. At March 31, 2023, the Trust had all of its long-term portfolio holdings invested in the securities of Hawaii issuers.

25 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST NOTES TO FINANCIAL STATEMENTS (continued) MARCH 31, 2023 |

6. Capital Share Transactions

Transactions in Capital Shares of the Trust were as follows:

| Year Ended March 31, 2023 |

Year Ended March 31, 2022 | |||||||||

| Shares | Amount | Shares | Amount | |||||||

| Class A Shares: | ||||||||||

| Proceeds from shares sold | 2,038,359 | $ | 21,455,585 | 2,350,219 | $ | 26,788,662 | ||||

| Reinvested dividends and distributions | 581,015 | 6,110,935 | 586,723 | 6,672,496 | ||||||

| Cost of shares redeemed | (5,732,124) | (60,417,058) | (4,730,899) | (53,871,076) | ||||||

| Net change | (3,112,750) | (32,850,538) | (1,793,957) | (20,409,918) | ||||||

| Class C Shares: | ||||||||||

| Proceeds from shares sold | 74,606 | 790,826 | 157,430 | 1,809,708 | ||||||

| Reinvested dividends and distributions | 8,606 | 90,441 | 10,007 | 113,873 | ||||||

| Cost of shares redeemed | (570,140) | (6,017,240) | (491,380) | (5,622,480) | ||||||

| Net change | (486,928) | (5,135,973) | (323,943) | (3,698,899) | ||||||

| Class F Shares: | ||||||||||

| Proceeds from shares sold | 25,612 | 269,953 | 8,814 | 100,801 | ||||||

| Reinvested dividends and distributions | 491 | 5,175 | 370 | 4,217 | ||||||

| Cost of shares redeemed | (3,987) | (42,185) | (16,744) | (190,913) | ||||||

| Net change | 22,116 | 232,943 | (7,560) | (85,895) | ||||||

| Class Y Shares: | ||||||||||

| Proceeds from shares sold | 986,246 | 10,436,506 | 1,244,775 | 14,255,743 | ||||||

| Reinvested dividends and distributions | 84,951 | 895,213 | 87,875 | 1,000,878 | ||||||

| Cost of shares redeemed | (2,348,774) | (24,785,509) | (1,294,417) | (14,732,585) | ||||||

| Net change | (1,277,577) | (13,453,790) | 38,233 | 524,036 | ||||||

| Total transactions in Trust shares | (4,855,139) | $ | (51,207,358) | (2,087,227) | $ | (23,670,676) | ||||

7. Trustees’ Fees and Expenses

At March 31, 2023, there were 4 Trustees, one of whom is affiliated with the Administrator/Business Manager and is not paid any fees. The total amount of Trustees’ service fees (for carrying out their responsibilities) and attendance fees paid during the year ended March 31, 2023 was $193,889. Attendance fees are paid to those in attendance at regularly scheduled quarterly Board Meetings and meetings of the Independent Trustees held prior to each quarterly Board Meeting, as well as additional

26 | Hawaiian Tax-Free Trust

|

HAWAIIAN TAX-FREE TRUST NOTES TO FINANCIAL STATEMENTS (continued) MARCH 31, 2023 |

meetings (such as Audit, Nominating, Shareholder and special meetings). Trustees are reimbursed for their expenses such as travel, accommodations and meals incurred in connection with attendance at Board Meetings and the Annual and Outreach Meetings of Shareholders. For the year ended March 31, 2023, due to the COVID-19 pandemic, such meeting-related expenses were reduced and amounted to $12,293.

8. Securities Traded on a When-Issued Basis

The Trust may purchase or sell securities on a when-issued basis. When-issued transactions arise when securities are purchased or sold by the Trust with payment and delivery taking place in the future in order to secure what is considered to be an advantageous price and yield to the Trust at the time of entering into the transaction. These transactions are subject to market fluctuations and their current value is determined in the same manner as for other securities.

9. Income Tax Information and Distributions

The Trust declares dividends daily from net investment income and makes payments monthly. Net realized capital gains, if any, are distributed annually and are taxable. These distributions are paid in additional shares at the net asset value per share or in cash at the shareholder’s option. The Trust intends to maintain, to the maximum extent possible, the tax-exempt status of interest payments received from portfolio municipal securities in order to allow dividends paid to shareholders from net investment income to be exempt from regular Federal and State of Hawaii income taxes. Due to differences between financial statement reporting and Federal income tax reporting requirements, distributions made by the Trust may not be the same as the Trust’s net investment income, and/or net realized securities gains. Further, a portion of the dividends and distributions may, under some circumstances, be subject to taxes at ordinary income and/or capital gain rates. For certain shareholders, some dividend income may, under some circumstances, be subject to the Alternative Minimum Tax. As a result of the passage of the Regulated Investment Company Act of 2010 (the “Act”), losses incurred in this fiscal year and beyond retain their character as short-term or long-term, have no expiration date and are utilized before capital losses incurred prior to the enactment of the Act. At March 31, 2023, the Trust had capital loss carry forwards of $2,179,380 where the $1,435,345 retains it character of short-term and $744,035 retains its character of long-term; both have no expiration. This carryover is available to offset future net realized gains on securities transactions to the extent provided for in the Internal Revenue Code. As of March 31, 2023, the Fund had post-October losses of $1,021,472, which is deferred until fiscal 2023 for tax purposes.

The tax character of distributions was as follows:

| Year Ended March 31, 2023 |

Year Ended March 31, 2022 | ||||||

| Net tax-exempt income | $ | 8,632,836 | $ | 9,312,098 | |||

| Ordinary Income | 244,518 | 6,182 | |||||

| Capital gains | 173,524 | 656,052 | |||||

| $ | 9,050,878 | $ | 9,974,332 | ||||