0000750686DEF 14AFALSE00007506862023-01-012023-12-31iso4217:USDiso4217:USDxbrli:shares00007506862022-01-012022-12-3100007506862021-01-012021-12-3100007506862020-01-012020-12-310000750686cac:ChangeInPensionValueMemberecd:PeoMember2023-01-012023-12-310000750686cac:EquityAwardAdjustmentsMemberecd:PeoMember2023-01-012023-12-310000750686cac:PensionAdjustmentsServiceCostMemberecd:PeoMember2023-01-012023-12-310000750686cac:EquityAwardsReportedValueMemberecd:PeoMember2023-01-012023-12-310000750686cac:EquityAwardsValueOfDividendsPaidAdjustmentMemberecd:PeoMember2023-01-012023-12-310000750686cac:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2023-01-012023-12-310000750686cac:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2023-01-012023-12-310000750686cac:EquityAwardsForfeitedDuringTheYearMemberecd:PeoMember2023-01-012023-12-310000750686cac:ChangeInPensionValueMemberecd:PeoMember2022-01-012022-12-310000750686cac:EquityAwardAdjustmentsMemberecd:PeoMember2022-01-012022-12-310000750686cac:PensionAdjustmentsServiceCostMemberecd:PeoMember2022-01-012022-12-310000750686cac:EquityAwardsReportedValueMemberecd:PeoMember2022-01-012022-12-310000750686cac:EquityAwardsValueOfDividendsPaidAdjustmentMemberecd:PeoMember2022-01-012022-12-310000750686cac:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2022-01-012022-12-310000750686cac:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2022-01-012022-12-310000750686cac:EquityAwardsForfeitedDuringTheYearMemberecd:PeoMember2022-01-012022-12-310000750686cac:ChangeInPensionValueMemberecd:PeoMember2021-01-012021-12-310000750686cac:EquityAwardAdjustmentsMemberecd:PeoMember2021-01-012021-12-310000750686cac:PensionAdjustmentsServiceCostMemberecd:PeoMember2021-01-012021-12-310000750686cac:EquityAwardsReportedValueMemberecd:PeoMember2021-01-012021-12-310000750686cac:EquityAwardsValueOfDividendsPaidAdjustmentMemberecd:PeoMember2021-01-012021-12-310000750686cac:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2021-01-012021-12-310000750686cac:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-01-012021-12-310000750686cac:EquityAwardsForfeitedDuringTheYearMemberecd:PeoMember2021-01-012021-12-310000750686cac:ChangeInPensionValueMemberecd:PeoMember2020-01-012020-12-310000750686cac:EquityAwardAdjustmentsMemberecd:PeoMember2020-01-012020-12-310000750686cac:PensionAdjustmentsServiceCostMemberecd:PeoMember2020-01-012020-12-310000750686cac:EquityAwardsReportedValueMemberecd:PeoMember2020-01-012020-12-310000750686cac:EquityAwardsValueOfDividendsPaidAdjustmentMemberecd:PeoMember2020-01-012020-12-310000750686cac:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2020-01-012020-12-310000750686cac:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2020-01-012020-12-310000750686cac:EquityAwardsForfeitedDuringTheYearMemberecd:PeoMember2020-01-012020-12-310000750686ecd:NonPeoNeoMembercac:ChangeInPensionValueMember2023-01-012023-12-310000750686cac:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310000750686cac:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310000750686cac:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2023-01-012023-12-310000750686ecd:NonPeoNeoMembercac:EquityAwardsValueOfDividendsPaidAdjustmentMember2023-01-012023-12-310000750686cac:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000750686cac:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000750686cac:EquityAwardsForfeitedDuringTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000750686ecd:NonPeoNeoMembercac:ChangeInPensionValueMember2022-01-012022-12-310000750686cac:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000750686cac:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310000750686cac:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2022-01-012022-12-310000750686ecd:NonPeoNeoMembercac:EquityAwardsValueOfDividendsPaidAdjustmentMember2022-01-012022-12-310000750686cac:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000750686cac:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000750686cac:EquityAwardsForfeitedDuringTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000750686ecd:NonPeoNeoMembercac:ChangeInPensionValueMember2021-01-012021-12-310000750686cac:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000750686cac:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310000750686cac:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2021-01-012021-12-310000750686ecd:NonPeoNeoMembercac:EquityAwardsValueOfDividendsPaidAdjustmentMember2021-01-012021-12-310000750686cac:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000750686cac:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000750686cac:EquityAwardsForfeitedDuringTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000750686ecd:NonPeoNeoMembercac:ChangeInPensionValueMember2020-01-012020-12-310000750686cac:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000750686cac:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310000750686cac:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2020-01-012020-12-310000750686ecd:NonPeoNeoMembercac:EquityAwardsValueOfDividendsPaidAdjustmentMember2020-01-012020-12-310000750686cac:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000750686cac:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000750686cac:EquityAwardsForfeitedDuringTheYearMemberecd:NonPeoNeoMember2020-01-012020-12-31000075068612023-01-012023-12-31000075068622023-01-012023-12-31000075068632023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | | | | | | | |

| Filed by a Party other than the Registrant | o |

Check the appropriate box:

| | | | | | | | |

| o | Preliminary Proxy Statement |

| | | | | | | | |

| o | Confidential, For Use of the Commission Only |

| | | | | | | | |

| ý | Definitive Proxy Statement |

| | | | | | | | |

| o | Definitive Additional Materials |

| | | | | | | | |

| o | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

CAMDEN NATIONAL CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Dear Shareholders:

You are cordially invited to attend the 2024 Annual Meeting of Shareholders of Camden National Corporation, which will be held on Tuesday, May 21, 2024, at 9:00 a.m., Eastern Daylight Time (together with any adjournments or postponements thereof, the “Annual Meeting”). We will be holding the Annual Meeting virtually via a live audio webcast at www.virtualshareholdermeeting.com/CAC2024 and in person at Camden National Corporation’s Hanley Center, Fox Ridge Office Park, 245 Commercial Street, Rockport, Maine 04856. You may attend the Annual Meeting virtually or in person. We encourage you to attend the Annual Meeting.

The accompanying Notice of Annual Meeting of Shareholders describes matters to be acted upon at the Annual Meeting. Please give these materials your prompt attention. Whether or not you are able to attend the Annual Meeting, please follow the instructions to vote online, by telephone, or by mail. Submitting your vote by proxy will not limit your right to attend the Annual Meeting. If you attend the Annual Meeting virtually or in person, you may vote if you wish to do so, which will supersede your proxy. Your vote is extremely important, so please act at your earliest convenience.

We appreciate your continued interest in Camden National Corporation.

Sincerely,

Lawrence J. Sterrs

Chair of the Board

Simon R. Griffiths

President and Chief Executive Officer

April 5, 2024

| | |

Notice of Annual Meeting of Shareholders to be held May 21, 2024 |

MEETING DETAILS

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

Date Tuesday, May 21, 2024 | | Time 9:00 a.m., Eastern Daylight Time | | Location 245 Commercial Street, Rockport, Maine 04856 | | Virtual Live Audio Webcast at www.virtualshareholdermeeting.com/CAC2024 |

| | | | | | |

TO THE SHAREHOLDERS OF CAMDEN NATIONAL CORPORATION:

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of Shareholders of Camden National Corporation, a Maine corporation (the “Company”), will be held on Tuesday, May 21, 2024, at 9:00 a.m., Eastern Daylight Time, at Camden National Corporation's Hanley Center, Fox Ridge Office Park, 245 Commercial Street, Rockport, Maine 04856 and virtually via live audio webcast at www.virtualshareholdermeeting.com/CAC2024 (together with any adjournments or postponements thereof, the “Annual Meeting”) for the purpose of considering and voting upon the following matters:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | | | 2 | | | 3 | | | 4 | |

| | | |

| Election of Directors. | Shareholder “Say-on-Pay." | Ratification of Appointment of Independent Registered Public Accounting Firm. | Other Business. |

| | | |

| | | |

To elect seven persons to the Company’s Board of Directors, each for a term that expires in 2025. | To approve, by a non-binding advisory vote, the compensation of the Company’s named executive officers (“Say-on-Pay”). | To ratify the appointment of RSM US LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024. | To consider and act upon such other business, matters or proposals as may properly come before the Annual Meeting. |

| | | |

The Company's Board of Directors has fixed the close of business on March 25, 2024 as the record date (the “Record Date”) for determining the shareholders of the Company entitled to receive notice of, and to vote at, the Annual Meeting. Only shareholders of record of the Company’s common stock at the close of business on the Record Date are entitled to receive notice of, and to vote at, the Annual Meeting.

ATTENDING AND VOTING AT THE ANNUAL MEETING

Attending by virtual means: You will be able to attend the Annual Meeting virtually by visiting www.virtualshareholdermeeting.com/CAC2024. To vote your shares or submit questions at the Annual Meeting, you must enter the control number found on your proxy card, voting instruction form or notice you previously received. If you do not have access to your control number, please contact Broadridge, no earlier than 30 minutes prior to the start of the Annual Meeting, at (844) 976-0738 (domestic) or (303) 562-9301 (international). If you hold your shares in a brokerage account and do not have access to your control number, neither the Company nor Broadridge will be able to provide your control number and you will need to contact your broker. If you do not enter your control number at the log-in page, you will be able to join the live audio webcast of the meeting as a guest, but you will not be able vote your shares or submit questions at the Annual Meeting.

If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting log-in page. Technical support will be available starting 15 minutes prior to the start of the Annual Meeting.

Voting by virtual means: You will be able to vote your eligible shares while attending the virtual annual meeting by following the instructions on the Annual Meeting website at www.virtualshareholdermeeting.com/CAC2024.

Voting in person: If you want to vote in person at the Annual Meeting and you are a holder of record, you must register with the Inspector of Election at the Annual Meeting (“Inspector of Election”), and produce valid, government-issued photo identification, such as a driver’s license or passport. If you want to vote in person at the Annual Meeting and you hold your shares in street name, you must obtain an additional proxy from your bank, broker or other holder of record authorizing you to vote. You must bring such proxy to the Annual Meeting, present it to the Inspector of Election, and produce valid, government-issued photo identification, such as a driver’s license or passport.

During the Annual Meeting, we will answer questions that are submitted online and in person by shareholders as time permits. However, we reserve the right to exclude questions that are not pertinent to meeting matters or that are otherwise inappropriate. If we receive substantially similar questions, we may group such questions together and provide a single response to avoid repetition.

| | | | | |

| |

| ü | YOUR VOTE IS IMPORTANT. SHAREHOLDERS ARE URGED TO VOTE AS PROMPTLY AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING. TO VOTE YOUR SHARES, PLEASE FOLLOW THE INSTRUCTIONS IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS OR THE PROXY CARD YOU RECEIVED IN THE MAIL. IF YOU VOTE ONLINE OR BY TELEPHONE, YOU DO NOT NEED TO RETURN A PROXY CARD. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE IN PERSON IF YOU WISH TO DO SO, WHICH WILL SUPERSEDE YOUR PROXY. IF YOU HOLD SHARES THROUGH A BROKER, CHECK THE VOTING INSTRUCTIONS PROVIDED TO YOU BY THAT BROKER. |

| |

| | |

| By Order of the Board of Directors, |

|

Brandon Y. Boey General Counsel & Corporate Secretary |

| April 5, 2024 |

| | |

Proxy Statement Table of Contents |

| | | | | | | | | | | |

| ANNUAL MEETING AND VOTING PROCEDURES | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| PROPOSALS TO BE VOTED UPON AT ANNUAL MEETING | | |

| | | |

| | | |

| | | |

| | | |

| COMMITMENT TO CORPORATE SOCIAL RESPONSIBILITY | | |

| BOARD OF DIRECTOR AND CORPORATE GOVERNANCE INFORMATION | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | | | | | |

| EXECUTIVE OFFICER INFORMATION | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| CEO Transition Arrangements | | |

| | | | | | | | | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| STOCK OWNERSHIP AND OTHER MATTERS | | |

| | | |

| | | |

| APPENDIX | | |

| | | |

| | |

Proxy Statement

Annual Meeting of Shareholders to be held May 21, 2024 |

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Camden National Corporation, a Maine corporation (the “Company”), for use at the 2024 Annual Meeting of Shareholders of the Company to be held on Tuesday, May 21, 2024, at 9:00 a.m. Eastern Daylight Time, at Camden National Corporation's Hanley Center, Fox Ridge Office Park, 245 Commercial Street, Rockport, Maine 04856 (together with any adjournments or postponements thereof, the “Annual Meeting” or the “Meeting”). This Proxy Statement and the Proxy Card were provided to the Company’s shareholders on April 5, 2024.

The Annual Meeting will be held at 9:00 a.m. Eastern Daylight Time on Tuesday, May 21, 2024, at the Company’s Hanley Center, Fox Ridge Office Park, 245 Commercial Street, Rockport, Maine 04856. Shareholders can attend the Annual Meeting in person or via live audio webcast at www.virtualshareholdermeeting.com/CAC2024. To vote your shares or submit questions virtually at the Annual Meeting, you must enter the control number found on your proxy card, voting instruction form or notice you previously received. If you do not log in with your control number, you will be able to attend the Annual Meeting virtually as a guest, but you will not be able to vote your shares or submit questions during the Annual Meeting.

Only shareholders of record as of March 25, 2024 (the “Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting. Each share is entitled to cast one vote for each of the seven candidates to the Company’s Board of Directors and to cast one vote on each of the other matters to be voted on at the Annual Meeting. Cumulative voting is not permitted. As of the Record Date, 14,629,325 shares of the Company’s common stock, no par value (“Common Stock”), were outstanding and entitled to vote at the Annual Meeting.

| | | | | |

| Camden National Corporation 2023 Proxy Statement | 1 |

WAYS TO VOTE

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | |

Mail Shareholders who wish to vote by mail may do so by requesting printed copies of the proxy materials and completing, signing, dating and mailing the enclosed proxy card in the enclosed postage-paid envelope. | | Phone If you choose to vote by telephone, you may do so by calling toll-free 1-800-690-6903 (domestic and international) and following the instructions. | | Internet If you choose to vote by internet in advance of the meeting, you may do so by visiting www.proxy.com and following the instructions. |

| | | | | | |

| | | | | | |

| | | | | | |

| | |

Vote Virtually at the Annual Meeting If you choose to vote virtually at the Annual Meeting, you must enter the control number found on your proxy card, voting instruction form or notice you previously received. | | Vote In-Person at the Annual Meeting If you choose to vote in person at the Annual Meeting you must register with the Inspector of Election at the Annual Meeting, and produce valid, government-issued photo identification, such as a driver’s license or passport. If you hold your shares in street name, you must also provide a proxy from your bank, broker or other holder of record authorizing you to vote. |

| | | | | | |

ELECTRONIC DELIVERY OF PROXY MATERIALS

In connection with our Annual Meeting, the Notice of Annual Meeting of Shareholders (the “Notice of Annual Meeting”), Proxy Statement, Proxy Card and 2023 Annual Report were provided to the Company’s shareholders on April 5, 2024. On or about April 5, 2024, we mailed to our shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access these materials online. The Notice of Internet Availability of Proxy Materials is not a proxy card and cannot be used to vote your shares. If you received such notice, you will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the notice or on the website referred to in the notice.

QUORUM AND VOTE REQUIRED

The holders of one-third of the total number of outstanding shares of Common Stock entitled to vote, present in person or by proxy, are required for a quorum at the Annual Meeting.

If a quorum is present at the Annual Meeting, an affirmative vote of a majority of the votes cast “for” or “against” a nominee at the Annual Meeting is required to elect each of the seven director nominees. Similarly, an affirmative vote of a majority of the votes cast “for” or “against” a proposal at the Annual Meeting is required for Proposals 2 and 3.

You may vote “FOR”, “AGAINST”, or “ABSTAIN” on each of proposals 1, 2 and 3. The Board of Directors recommends a vote “FOR” the election of all seven of its nominees for director; “FOR” approval of the compensation of the Company’s named executive officers; and “FOR” the ratification of the appointment of RSM US LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024.

Effect of Abstentions and Broker Non-Votes.

If you hold your shares in street name and do not provide voting instructions, your broker, bank, trust or other nominee has discretionary authority to vote your shares on the ratification of the selection of RSM US LLP as our independent auditor. However, in the absence of your specific instructions as to how to vote, your broker, bank, trust or other nominee does not have discretionary authority to vote on any other proposal. Such a situation results in a "broker non-vote." It is important, therefore,

| | | | | |

2 | Camden National Corporation 2024 Proxy Statement |

that you provide instructions to your broker, bank, trust or other nominee so that your vote with respect to the other proposals is counted.

Abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present at the Annual Meeting. The effect of abstentions and broker non-votes on each proposal to be considered at the Annual Meeting is described below.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Proposal | | Board Recommendation | Effect of Abstentions and Broker Non-Votes | Page Reference | |

| | | | | | |

| 1 | Election of Directors. Under the Company’s Bylaws, in uncontested elections, the affirmative vote of a majority of the votes cast at the Annual Meeting is required to elect each director. | FOR

each nominee | No effect | | |

| 2 | Shareholder “Say-on-Pay.” Under the Company’s Bylaws, the affirmative vote of a majority of votes cast at the Annual Meeting is necessary to approve, on an advisory basis, the compensation paid to the Company’s named executive officers. | FOR | No effect | | |

| 3 | Ratification of Appointment of Independent Registered Public Accounting Firm. Under the Company’s Bylaws, the affirmative vote of a majority of votes cast at the Annual Meeting is necessary to ratify the appointment of the Company’s independent registered public accounting firm. Abstentions will not count as votes cast and will have no effect on this proposal. Brokers will have discretionary authority to vote for the ratification of the appointment of the Company’s independent registered public accounting firm if they do not receive voting instructions from the beneficial owner of the shares, and there will not be any broker non-votes with respect to this proposal. | FOR | No effect | | |

VOTING

You are encouraged to submit your proxy with voting instructions promptly. To vote your shares, please follow the instructions in the Notice of Internet Availability of Proxy Materials or the proxy card you received in the mail.

Voting by Mail. Shareholders who wish to vote by mail may do so by requesting printed copies of the proxy materials and completing, signing, dating and mailing the enclosed proxy card in the enclosed postage-paid envelope. Your vote must be received by 11:59 p.m., Eastern Daylight Time, on May 20, 2024 to be counted. If you properly complete your proxy card and send it to us in time to vote, your “proxy” (one of the individuals named on your proxy card) will vote your shares as you have directed. If you sign the proxy card but do not direct a vote for each proposal, your proxy will vote your shares “FOR” each of proposals 1, 2 and 3, as set forth in the Notice of Annual Meeting, for which you do not make a selection.

The proxy also confers discretionary authority with respect to any other business which may come before the Annual Meeting, including rules for the conduct of the meeting. The Board knows of no other matter to be presented at the meeting. It is the intention of the persons named as proxies to vote the shares to which the proxies relate according to their best judgment if any matters not included in this proxy statement come before the meeting.

Voting by Telephone or the Internet. If you choose to vote by telephone, you may do so by calling toll-free 1-800-690-6903 (domestic and international) and following the instructions. If you choose to vote by internet in advance of the meeting, you may do so by visiting www.proxy.com and following the instructions. Instructions to vote by phone or Internet can also be found on the Notice of Internet Availability of Proxy Materials mailed to you on or about April 5, 2024. To vote by phone or Internet, you will need the control number found on your proxy card, voting instruction form or notice you previously received. If you vote by

| | | | | |

| Camden National Corporation 2023 Proxy Statement | 3 |

telephone or via the Internet, you need not return a proxy card, but your vote must be received by 11:59 p.m., Eastern Daylight Time, on May 20, 2024.

Voting at the Annual Meeting. If you choose to vote virtually at the Annual Meeting, you must enter the control number found on your proxy card, voting instruction form or notice you previously received. If you choose to vote in person at the Annual Meeting, you must register with the Inspector of Election at the Annual Meeting, and produce valid, government-issued photo identification, such as a driver’s license or passport. If you hold your shares in street name, you must also provide a proxy from your bank, broker or other holder of record authorizing you to vote.

If your shares are held by a bank, broker or other nominee, please follow the instructions provided with your proxy materials supplied by your bank or broker.

Even if you currently plan to attend the Annual Meeting, we recommend that you submit your proxy as described above so that your vote will be counted if you later decide not to attend the Annual Meeting.

REVOCABILITY OF PROXIES

A proxy may be revoked at any time before it is voted at the Annual Meeting by:

•Filing a written revocation of the proxy with the Secretary of the Company, Brandon Y. Boey, Two Elm Street, Camden, Maine 04843;

•Submitting a new signed proxy card bearing a later date or voting again by telephone or the internet (any earlier proxies will be revoked automatically); or

•Attending and voting virtually or in person at the Annual Meeting, provided that you are the holder of record of your shares.

If you hold your shares in the name of a bank, broker, or other nominee, you will need to contact your nominee in order to revoke your proxy. If you hold your shares in “street name” through a broker or bank, you may only change your vote virtually if you have access to your control number or in person if you have a legal proxy in your name from Broadridge Financial Solutions or your bank or broker.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on May 23, 2023:

| | | | | | | | |

| | |

| The Company’s Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2023 are available free of charge at www.cacannualmeeting.com.

In addition, the Company will provide, without charge and upon the written request of any shareholder, a copy of the Company’s Annual Report on Form 10-K, including the financial statements and the financial statement schedules, required to be filed with the United States Securities and Exchange Commission (“SEC”) for the fiscal year ended December 31, 2023. Requests should be directed to Camden National Corporation, Attn: Investor Relations, P.O. Box 310, Camden, Maine 04843.

Shareholders of record as of the Record Date are cordially invited to attend the Annual Meeting virtually or in person. Directions to attend the Annual Meeting where you may vote in person can be found on our website: www.cacannualmeeting.com. | |

| | |

| | | | | |

4 | Camden National Corporation 2024 Proxy Statement |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | Proposals to be Voted On at the Annual Meeting | | | |

| | | | | | |

| | 1 | | PROPOSAL ONE Election of Directors | | | |

| | | | | | | |

| | 2 | | PROPOSAL TWO Non-binding Advisory Vote on Compensation of the Company's Named Executive Officers | | | |

| | | | | | | |

| | 3 | | PROPOSAL THREE Ratification of the Appointment of Independent Registered Public Accounting Firm | | | |

| | | | | | | |

| | | | | | | |

| | |

Proposal One Election of Directors |

The Board currently consists of eleven members. Prior to the 2023 annual meeting of shareholders, the Board was divided into three classes, with one class of directors standing for election each year. At the 2023 annual meeting of shareholders, the Company’s shareholders voted to approve an amendment to the Company’s Articles of Incorporation (the “Articles”) to declassify the Board. Under the Articles, as amended, beginning with the Company’s 2023 annual meeting of shareholders, directors are elected to one-year terms, provided that the three-year terms of directors elected at the Company’s 2021 and 2022 annual meetings of shareholders will not be shortened. Accordingly, directors who were elected at the Company’s 2023 annual meeting of shareholders as well as those who were elected at the Company’s 2021 annual meeting of shareholders will stand for election to a one-year term at the Annual Meeting. Directors who were elected at the Company’s 2022 annual meeting of shareholders, for terms to expire at the 2025 annual meeting of shareholders, will stand for election to a one-year term at the Company’s 2025 annual meeting of shareholders. Beginning with the Company’s 2025 annual meeting of shareholders, the Board will be declassified fully and all directors will stand for election on annual basis at the 2025 annual meeting of shareholders and at each annual meeting thereafter.

At the Annual Meeting, seven directors will be elected. The Board has nominated for election as directors Simon R. Griffiths, Rebecca K. Hatfield, S. Catherine Longley, Robert D. Merrill, Robin A. Sawyer, CPA, Carl J. Soderberg and Lawrence J. Sterrs. For more information about our nomination procedures, please see “Corporate Governance and Risk Committee” on page 29. If shareholders vote to elect the seven nominees proposed by the Board, each such director will be elected to serve for a term of one year and until each such director’s successor is duly elected and qualified.

All of the Company’s nominees for director for the Annual Meeting are currently serving on the Board. For more information about the background of each of the Board's seven nominees for director, please see “Current Board Members” on page 18. The Company’s Bylaws require that, in uncontested elections, each director be elected by the affirmative vote of a majority of votes cast with respect to such director. In a contested election, where the number of nominees exceeds the number of directors to be elected, the standard for election of directors would be a plurality of the shares represented in person or by proxy at any such meeting and entitled to vote on the election of directors. We expect this year’s election to be an uncontested election, and that the majority vote standard will apply.

Under our Bylaws, each director annually submits an advance, contingent, irrevocable resignation that the Board may accept if the director fails to be elected through a majority vote. In that situation, the Corporate Governance and Risk Committee would make a recommendation to the Board, within 30 days from the date the election results are certified, about whether to accept or reject the resignation, or whether to take other action, and the Board would act on the Corporate Governance and Risk Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date the election results are certified.

| | | | | |

ü | THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” ALL SEVEN OF ITS NOMINEES FOR DIRECTOR. |

| | | | | |

6 | Camden National Corporation 2024 Proxy Statement |

| | |

Proposal Two Non-Binding Advisory Vote on Compensation of the Company's Named Executive Officers |

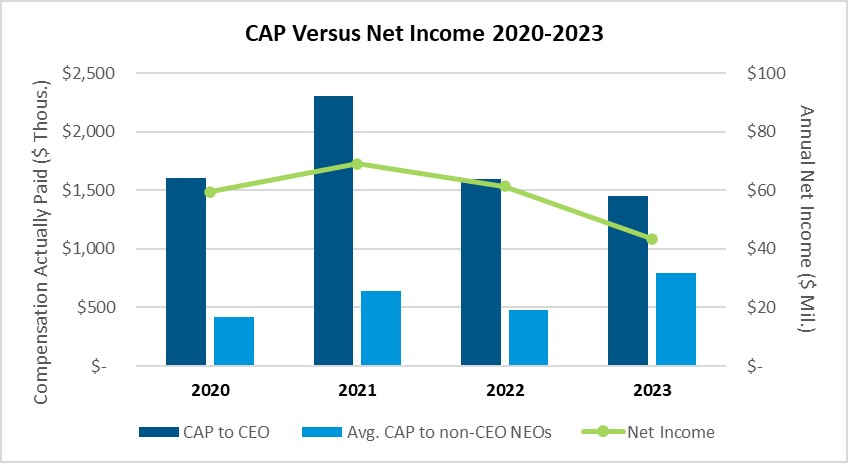

As required by Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Board is submitting for shareholder approval, on an advisory basis, the compensation paid to the Company’s named executive officers as described in this Proxy Statement pursuant to Item 402 of Regulation S-K promulgated under the Exchange Act.

The resolution that is the subject of this proposal is a non-binding advisory resolution. Accordingly, the resolution will not have any binding legal effect regardless of whether or not it is approved and may not be construed as overruling a decision by the Company or the Board or to create or imply any change to the fiduciary duties of the Board. Furthermore, because this non-binding advisory resolution primarily relates to compensation of the named executive officers that has already been paid or contractually committed, there is generally no opportunity for us to revisit those decisions. However, the Compensation Committee intends to take the results of the vote on this proposal into account in its future decisions regarding the compensation of our named executive officers.

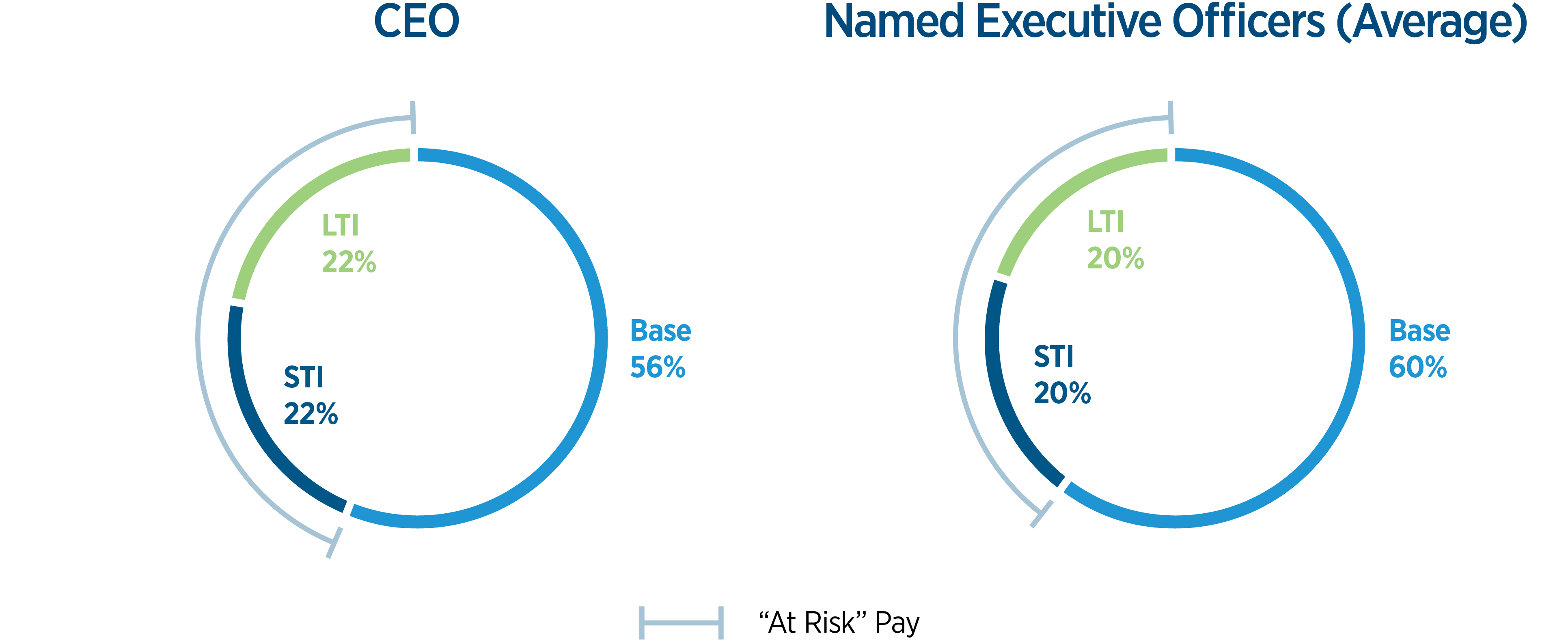

The Company has five named executive officers for 2023: Gregory A. Dufour, Michael R. Archer, Simon R. Griffiths, William H. Martel and Patricia A. Rose. The Company’s compensation program is designed to attract, motivate and retain its named executive officers, who are critical to the Company’s success, by offering a combination of base salary and annual and long-term incentives that are closely aligned to the annual and long-term performance objectives of the Company. Please see “Compensation Discussion and Analysis” beginning on page 38 for additional information about the Company’s executive compensation programs. For these reasons, the Board recommends that shareholders vote in favor of the following resolution:

RESOLVED, that the shareholders of Camden National Corporation hereby approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, the compensation tables and narrative discussion.

| | | | | |

ü | THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” PROPOSAL 2. |

| | | | | |

| Camden National Corporation 2024 Proxy Statement | 7 |

| | |

Proposal Three Ratification of the Appointment of Independent Registered Public Accounting Firm |

The Board has appointed RSM US LLP (“RSM”) as the Company’s independent registered public accounting firm for the Company's 2024 fiscal year. Representatives of RSM are expected to attend the Annual Meeting. The representatives are expected to be available to respond to questions and will have an opportunity to make a statement, if they desire to do so.

The Company is asking shareholders to ratify the selection of RSM as its independent registered public accounting firm because it believes it is a matter of good corporate practice. If shareholders do not ratify the selection, the Audit Committee will reconsider whether to retain RSM, but may still retain them. Even if the selection is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interests of the Company and shareholders.

Services Rendered by and Fees Paid to Independent Registered Public Accounting Firm. The following table describes the services rendered by RSM and fees paid for such services by the Company for the years ended December 31, 2023 and 2022.

| | | | | | | | | | | |

| | | |

| For the Year Ended December 31, | |

| | | |

| | | |

| Type of Fee | 2023 ($) | 2022

($) | |

| | | |

Audit Fees(1) | 546,276 | | 480,997 | | |

Audit-Related Fees(2) | — | | 15,750 | | |

Tax Fees(3) | — | | — | | |

All Other Fees(4) | — | | — | | |

1.The aggregate fees for professional services rendered for the audit of the Company’s annual financial statements in compliance with the Sarbanes-Oxley Act of 2002 (“SOX”), internal control reporting under Section 404 of SOX, review of financial statements included in the Company’s Form 10-Qs, consent procedures, and audit requirements for the U.S. Department of Housing and Urban Development for supervised mortgagees and the audit of the Company's Uniform Single Attestation Program for Mortgage Bankers.

2.The aggregate fees for assurance and related services rendered related to the performance of the audit or review of the Company’s financial statements.

3.The aggregate fees for professional services rendered for tax compliance, tax audit assistance, tax advice and tax planning. There were no such tax services rendered for the years ended December 31, 2023 and 2022.

4.There were no other services rendered for the years ended December 31, 2023 and 2022.

The Audit Committee of the Board pre-approved all services provided by the principal accountant during the years ended December 31, 2023 and 2022. Each service to be provided by the principal accountant is presented for pre-approval at the Audit Committee’s regular meeting.

| | | | | |

ü | THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” PROPOSAL 3. |

| | | | | |

8 | Camden National Corporation 2024 Proxy Statement |

The proxy also confers discretionary authority with respect to any other business which may come before the Annual Meeting, including rules for the conduct of the Meeting. The Board knows of no other matter to be presented at the Meeting. It is the intention of the persons named as proxies to vote the shares to which the proxies relate according to their best judgment if any matters not included in this proxy statement come before the Meeting.

| | | | | |

| Camden National Corporation 2024 Proxy Statement | 9 |

| | |

| Commitment to Corporate Social Responsibility |

We prioritize corporate social responsibility and strive to be transparent, consistent, and thoughtful in our approach. Our annual Corporate Responsibility Report, which outlines our evolving and expanding strategy, is available on our website at www.CamdenNational.bank/corporate-responsibility. Our corporate responsibility strategy guides how we conduct business and work towards driving positive change for our communities, customers, employees, and shareholders. Our Corporate Responsibility Report is provided to shareholders for informational purposes only and is not part of, or incorporated by reference into, this Proxy Statement.

We are dedicated to integrating our values across the Company, leveraging all parts of our organization to create value for our employees, customers, communities, and shareholders.

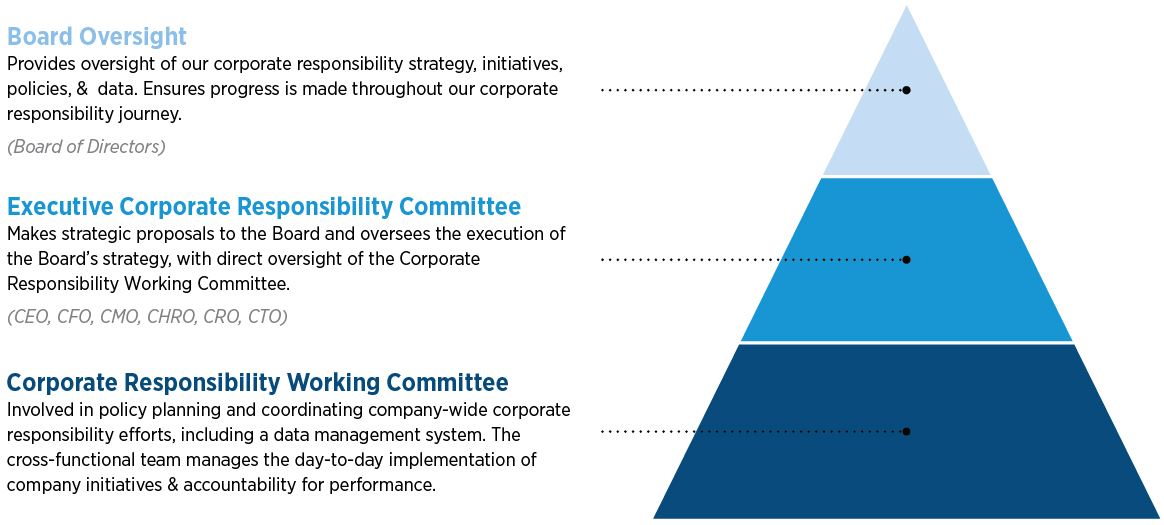

OUR APPROACH TO SUSTAINABILITY

| | | | | | | | |

| | |

| Our commitment to sustainability is integrated across our Company. Our Board and executive management understand the critical importance of corporate responsibility matters to our future success and the success of our constituents. | |

| | |

| | | | | |

10 | Camden National Corporation 2024 Proxy Statement |

| | | | | |

| Commitment to Corporate Social Responsibility | |

OUR APPROACH TO DIVERSITY, EQUITY AND INCLUSION (“DEI”)

| | | | | | | | |

| | |

| Our commitment to DEI starts at the top of our organization: The Board and our President and CEO oversee our DEI initiatives and our President and CEO sponsors our DEI Council. The DEI Council is self-governed by employees and represents the diversity of our employee population, including employees who identify as racially diverse and LGBTQ+. Building a diverse, equitable and inclusive workforce equips us to thrive now and in the future. Our efforts to foster DEI throughout the Company are evolving. | |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

of our workforce identifies as female | | of our executive team identifies as female | | of our Board of Directors identifies as female | | of our Board of Directors identifies as racially diverse | | of our Board of Directors identifies as LGBTQ+ |

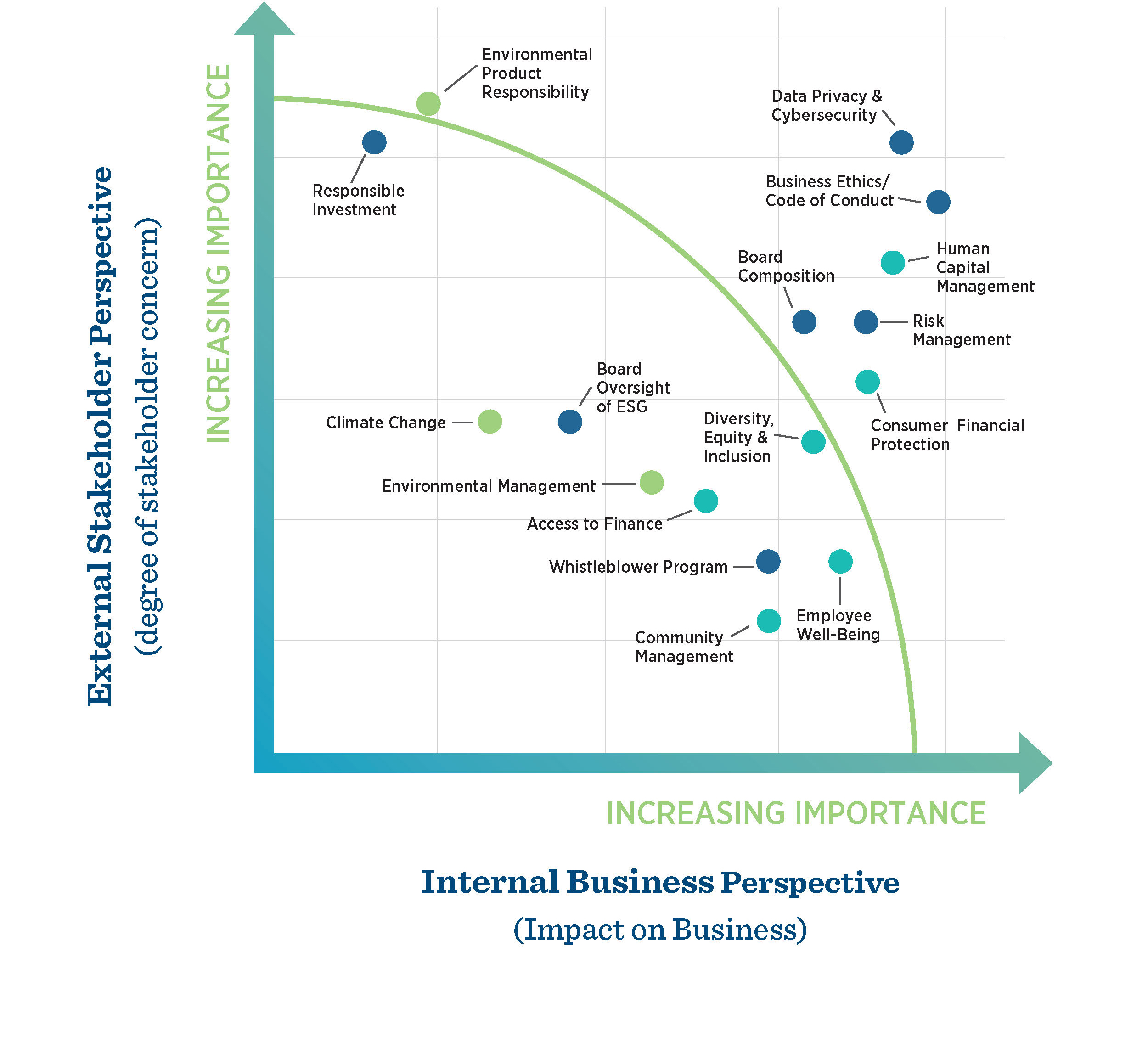

CORPORATE RESPONSIBILITY MATERIALITY MATRIX

| | | | | |

In 2022, our third-party corporate responsibility consultant supported us in conducting a materiality assessment to identify the issues most important to our employees and to leverage insights from investors, ratings agencies and corporate responsibility frameworks. From the assessment, we identified the following topics as our priorities: •Data Privacy & Cybersecurity •Business Ethics/Code of Conduct •Human Capital Management •Risk Management •Board Composition •Consumer Financial Protection •Environmental Product Responsibility | |

| | | | | |

| Camden National Corporation 2024 Proxy Statement | 11 |

| | | | | |

| Commitment to Corporate Social Responsibility |

We recognize that we all have a role to play in environmental sustainability and combating climate change. We foster sustainability by:

•Financing clean energy and energy efficiency projects.

•Embracing digital tools to reduce paper usage and reliance on paper-intensive processes.

•Reducing waste and energy, and resource usage in our facilities.

We believe that all members of our communities should have the opportunity to enjoy prosperous and fulfilling lives and that our success should enrich all constituents. We support our clients, employees and communities through:

Human Capital Management: Attracting, engaging, and developing a diverse, highly skilled workforce where employees feel included, respected, and valued is key to our ability to deliver our Vision. We create a dynamic and rewarding workplace by:

•Building a diverse and inclusive workplace where all backgrounds, experiences, interests, and skills are respected, appreciated, and encouraged.

•Providing employees with opportunities to grow, learn and develop in their careers through internal and external education and development programs.

•Delivering competitive compensation and comprehensive benefits that focus on supporting the total well-being of our employees to provide a fulfilling work environment.

Consumer Financial Protection: Making financial products and services accessible and affordable by:

•Striving to act in the best interest of consumers by providing reasonably priced products, defining clear terms and disclosures, and offering fair and consistent service.

•Recognizing small businesses’ role in supporting economic deployment and job creation, and providing advice, guidance and education to meet their needs.

Community Engagement: Supporting area nonprofit organizations to build healthier, more resilient and more inclusive communities throughout our footprint by:

•Providing significant grant funding and encouraging employee volunteerism to provide financial expertise to nonprofit organizations.

We believe in strong governance and a culture of ethics and integrity in all that we do. Effective and ethical corporate governance is essential to our long-term viability and the success of each of our business objectives. We follow these principles by:

•Maintaining a robust control environment that is embedded at all levels of the company.

•Adhering to a Code of Business Conduct and Ethics that sets expectations aligned with our core values.

•Protecting our customer’s personal and financial information through strong data privacy, cybersecurity, and third-party oversight.

| | | | | |

12 | Camden National Corporation 2024 Proxy Statement |

| | | | | |

| Commitment to Corporate Social Responsibility | |

| | | | | |

| Camden National Corporation 2024 Proxy Statement | 13 |

| | |

Board of Director and Corporate Governance Information |

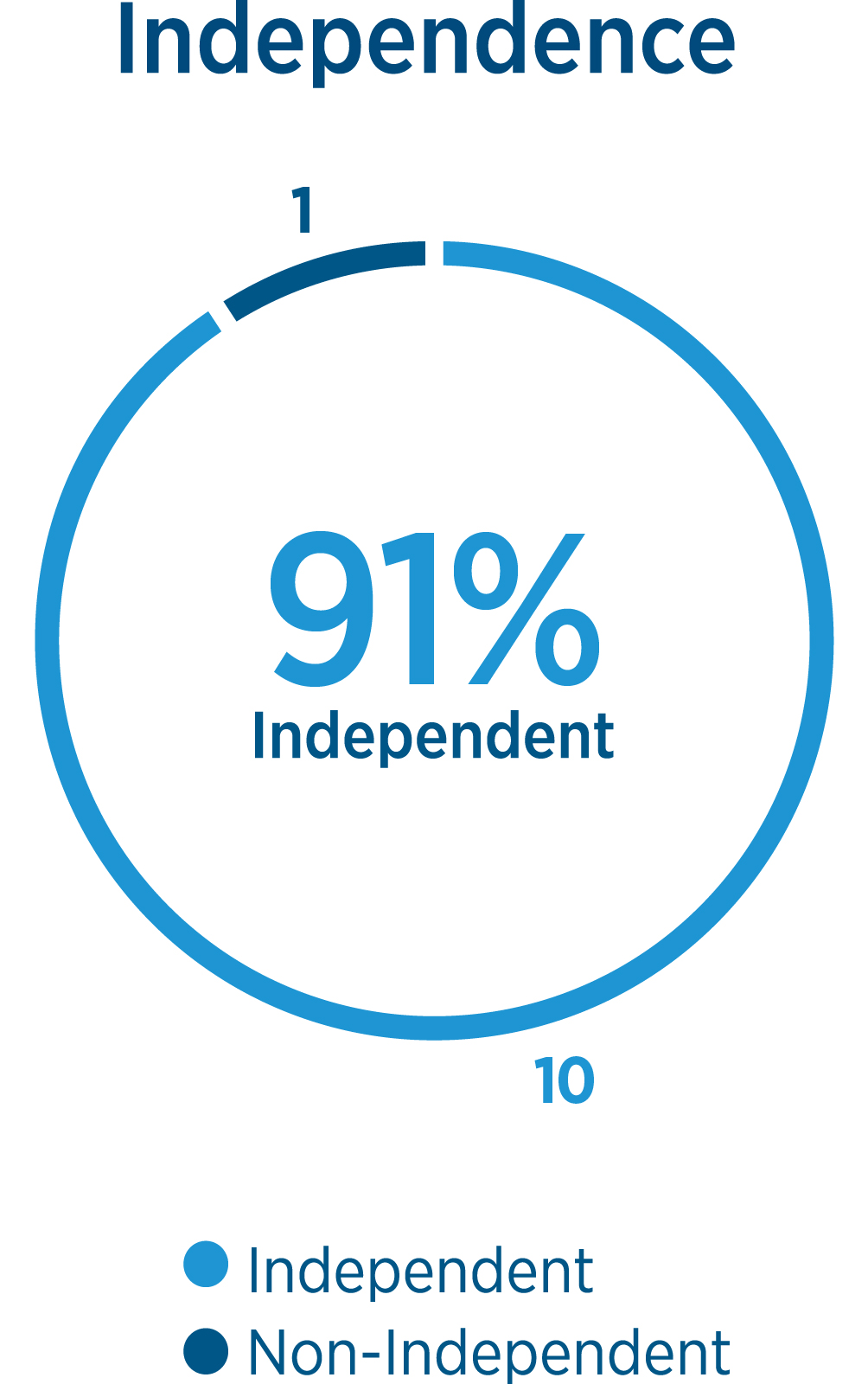

BOARD DIVERSITY

CURRENT BOARD MEMBERS

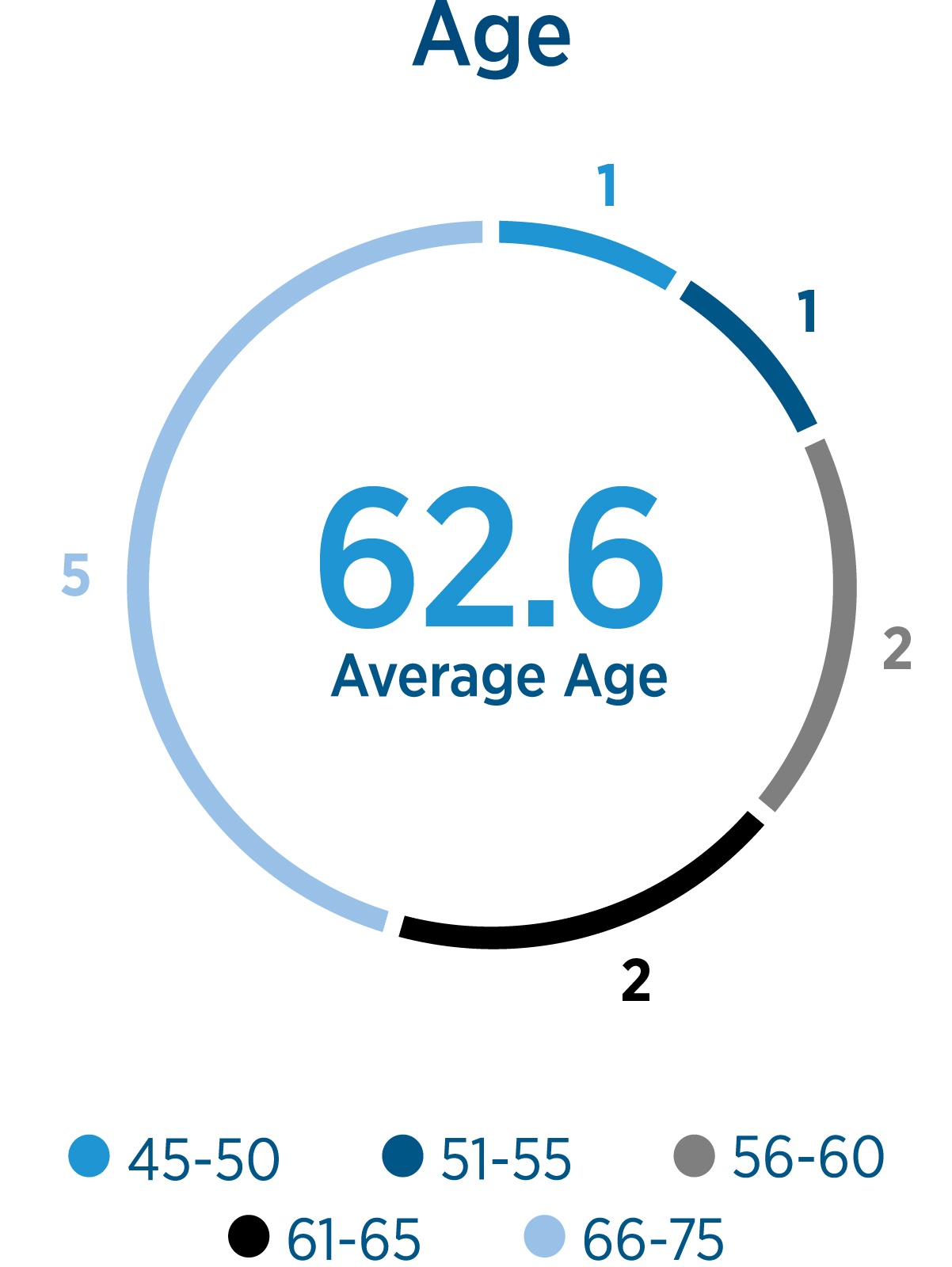

Information regarding the nominees and the directors continuing in office is provided below. Unless otherwise stated, each individual has held their current occupation for at least the last five years. The ages of the board nominees and continuing directors have been presented as of December 31, 2023. Camden National Bank (the “Bank”) is a wholly owned subsidiary of the Company.

| | | | | | | | | | | | | | |

| | First Year Elected or Appointed as Director of the: | |

Name | Age | Company | Bank | Term Expires |

Simon R. Griffiths(1) | 50 | 2024 | 2024 | 2024 |

| Rebecca K. Hatfield | 46 | 2022 | 2022 | 2024 |

| S. Catherine Longley | 69 | 2014 | 2022 | 2024 |

| Robert D. Merrill | 69 | 2022 | 2011 | 2024 |

Robin A. Sawyer, CPA(2) | 56 | 2018 | 2018 | 2024 |

| Carl J. Soderberg | 62 | 2015 | 2015 | 2024 |

| Lawrence J. Sterrs | 70 | 2015 | 2016 | 2024 |

| Craig N. Denekas | 59 | 2017 | 2022 | 2025 |

| David C. Flanagan | 69 | 2005 | 1998 | 2025 |

| Marie J. McCarthy | 55 | 2018 | 2018 | 2025 |

| James H. Page, Ph.D. | 71 | 2008 | 2022 | 2025 |

1.Mr. Griffiths joined the Company and the Bank in November 2023 and was appointed as President, Chief Executive Officer (“CEO”) and director of the Company and the Bank, effective January 1, 2024.

2.Ms. Sawyer served as a director of the Company from 2004 until her resignation in 2017. She was reappointed as a Director in 2018.

| | | | | |

14 | Camden National Corporation 2024 Proxy Statement |

| | | | | |

| Board of Director and Corporate Governance Information | |

There are no arrangements or understandings between any director or any other persons pursuant to which any of the above directors has been selected as a director or nominee for director. There are no “family relationships” between any director, executive officer, or person nominated or chosen by the Company to become a director or executive officer, as the SEC defines that term.

BOARD NOMINEES

| | | | | | | | | | | |

| Simon R. Griffiths |

| | | |

Experience and Qualifications: Simon R. Griffiths joined the Company in November 2023 as Executive Vice President (“EVP”) and Chief Operating Officer, and was announced as the successor to the president and CEO. Mr. Griffiths became president and CEO of the Company and the Bank on January 1, 2024, and was also appointed to the boards of directors of the Company and the Bank. Prior to joining the Company, Mr. Griffiths most recently served as executive vice president - head of core banking at Citizens Bank, where he managed the retail, business banking, contact center, deposit, and core banking digital delivery channels, including nearly 1,100 branches, commercial real estate, deposit and checking business, and new market expansion. He joined Citizens Bank in 2015 from Santander Bank, where he served as executive vice president, managing director of the retail network. | | Age: 50 |

| Director Since: 2024 |

| Camden National Corporation Committees: Capital Planning Committee and Technology Committee |

| Other Directorships: •Camden National Bank |

| Career Highlights: •President and CEO, Camden National Corporation and Camden National Bank •Executive Vice President, Head of Core Banking, Citizens Bank •Executive Vice President, Managing Director Retail Network, Santander Bank |

| | | | | |

| Camden National Corporation 2024 Proxy Statement | 15 |

| | | | | |

| Board of Director and Corporate Governance Information |

| | | | | | | | | | | |

| Rebecca K. Hatfield |

| | | |

Experience and Qualifications: Ms. Hatfield is the President and CEO at Avesta Housing, a nonprofit affordable housing provider, a role she has held since September 2022. Ms. Hatfield has been with Avesta Housing since 2015. Prior to becoming President and CEO at Avesta Housing, Ms. Hatfield was Avesta Housing's Senior Vice President of Real Estate. Through her roles at Avesta Housing, Ms. Hatfield brings to the Company's Board of Directors both her significant leadership experience and a deep understanding of Maine's housing and economic development challenges and the needs of Maine's low- and moderate-income population. Before joining Avesta, she was a senior vice president at Citigroup, working within the private, commercial and corporate banks. In addition to her nonprofit leadership, real estate development and property management experience, she has over 15 years of experience in finance, with a focus on deal structuring, underwriting, risk analysis, portfolio management, and relationship management. Ms. Hatfield’s finance and risk management experience will support her contributions as a member of the Capital Committee, as well as her role on the Asset Liability Committee of Camden National Bank. Ms. Hatfield’s previous employment also includes five years as a software and network engineer, serving as project manager and lead developer. Ms. Hatfield was named a 2021 Mainebiz Women to Watch and is actively involved in the community beyond her role at Avesta. She serves as the board vice chair and loan committee chair for Genesis Community Loan fund and serves on the boards of the Gulf of Maine Research Institute and the John T. Gorman Foundation. Previously she served on the board of the Maine Council on Aging and the Maine Real Estate Development Association (MEREDA). | | Age: 46 |

| Director Since: 2022 |

| Camden National Corporation Committees: Capital Planning Committee |

| Other Directorships: •Camden National Bank |

| Career Highlights: •President and CEO, Avesta Housing •Senior Vice President, Citigroup |

| |

| | | | | |

16 | Camden National Corporation 2024 Proxy Statement |

| | | | | |

| Board of Director and Corporate Governance Information | |

| | | | | | | | | | | |

| S. Catherine Longley |

| | | |

Experience and Qualifications: Ms. Longley was the Executive Vice President and Chief Operating Officer of The Jackson Laboratory, in Bar Harbor, Maine, from July 2018 until her retirement in March 2024. She previously served as Vice President and Chief Financial Officer of The Jackson Laboratory for two years. Prior to joining The Jackson Laboratory, Ms. Longley served for fourteen years as Senior Vice President for Finance and Administration and Treasurer at Bowdoin College in Brunswick, Maine. She also served as the commissioner of the Maine Department of Professional and Financial Regulation in the cabinet of former Governor Angus S. King, Jr. from 1995 - 2002. Ms. Longley started her career practicing law at the firm of Verrill LLP located in Portland, Maine where she became a partner in its corporate law department. Ms. Longley’s extensive background in law, banking regulation, as well as direct oversight and active engagement in financial oversight roles makes her an asset to the Board and is the Company’s designated “Financial Expert” under the NASDAQ rules. Her career experience has resulted in Ms. Longley’s expertise in understanding financial statements and accounting methodologies which is essential to her service as the Audit Committee Chair and the Audit Committee “Financial Expert,” and in her role as a member of the Capital Committee. Ms. Longley’s strong knowledge of the Maine market and broader global experience lends support to the Company from a strategic and competitive perspective. | | Age: 69 |

| Director Since: 2014 |

| Camden National Corporation Committees: Audit Committee (Chair) and Capital Planning Committee |

| Other Directorships: •Camden National Bank |

| Career Highlights: •Retired Chief Operating Officer of The Jackson Laboratory •Chief Financial Officer, The Jackson Laboratory •Senior Vice President, Bowdoin College |

| |

| | | | | |

| Camden National Corporation 2024 Proxy Statement | 17 |

| | | | | |

| Board of Director and Corporate Governance Information |

| | | | | | | | | | | |

| Robert D. Merrill |

| | | |

Experience and Qualifications: Mr. Merrill currently serves as President of Merrill Furniture in Ellsworth, Maine, a position he has held since 1998. Mr. Merrill also serves as a director of Merrill Blueberry Farms. Mr. Merrill brings to the Company's Board of Directors his significant understanding of Camden National Bank and its business, gained over his more than a decade of experience as a director of Camden National Bank. Mr. Merrill also brings his experience in running an independently owned business and its need for technology and easy access to banking services to his role on the Technology Committee. Mr. Merrill brings a strong business acumen and understanding of commodity market strategies and financial analysis that contributes to his success in his role as Chair of the Bank’s Directors Asset Liability Committee and Trust Committee. As a small business owner, Mr. Merrill has a depth of experience in strategic decision-making, business operations and business growth and development that lend to his overall contribution to the Company and Bank Boards. Mr. Merrill is well known in the Down East Maine business community in the Ellsworth Area having been recognized as the Chamber of Commerce 2010 Citizen of the Year. Mr. Merrill formerly served on the Ellsworth Business Development Committee for three years. Mr. Merrill formerly sat on the board of Maine Coast Memorial Hospital, for which he served as treasurer, vice chair and chair. He was also chair of the Maine Coast Memorial Hospital Emergency Department Capital Campaign. Mr. Merrill is currently serving on the Northern Light Maine Coast capital campaign for the new birthing center. | | Age: 69 |

| Director Since: 2022 |

| Camden National Corporation Committees: Technology Committee |

| Other Directorships: •Camden National Bank |

| Career Highlights: •President, Merrill Furniture |

| |

| | | | | |

18 | Camden National Corporation 2024 Proxy Statement |

| | | | | |

| Board of Director and Corporate Governance Information | |

| | | | | | | | | | | |

| Robin A. Sawyer, CPA |

| | | |

Experience and Qualifications: Ms. Sawyer served for five years as Vice President of Corporate Finance and Corporate Controller at WEX Inc., prior to her retirement in 2018. Before joining WEX Inc., Ms. Sawyer spent more than ten years as Vice President and Corporate Controller at Fairchild Semiconductor International, Inc. She is the former Director of Financial Planning and Reporting at Cornerstone Brands, Inc., and she formerly worked at Baker, Newman & Noyes, LLC and its predecessor firm of Ernst & Young. Ms. Sawyer’s experience in public accounting and finance roles uniquely positions her to add value in her Board role. Her overall strong business acumen, executive and management skills, experience in managing business growth, and organizational management supports her contributions to the Board in the areas of corporate strategy, merger and acquisitions, compensation and all financial related matters. Her prior experience as Corporate Controller at both WEX, Inc. and Fairchild Semiconductor International, Inc. supports her role as Chair of the Capital Committee with a broad understanding of capital management. Ms. Sawyer’s direct experience with publicly traded companies and their shareholders provides deep knowledge and direct understanding of the regulatory environment within which the company operates; she also has a strong understanding of the Maine economic and business climate all of which contribute to her being a strong board member. She also brings her business experience and knowledge of public company governance and disclosure requirements to her roles on the Compensation Committee and the Governance and Risk Committee. Until June 2021, she served on the board of directors of the Gulf of Maine Research Institute, where she was Treasurer, Chair of the Finance Committee, and a member of the Executive Committee, and on the board of its subsidiary, Gulf of Maine Properties, Inc. | | Age: 56 |

| Director Since: 2018(1) |

| Camden National Corporation Committees: Capital Planning Committee (Chair), Compensation Committee, and Corporate Governance and Risk Committee |

| Other Directorships: •Camden National Bank |

| Career Highlights: •Retired Corporate Controller of WEX, Inc. |

| |

1.Ms. Sawyer served as a director of the Company from 2004 until her resignation in 2017. She was reappointed as a Director in 2018.

| | | | | |

| Camden National Corporation 2024 Proxy Statement | 19 |

| | | | | |

| Board of Director and Corporate Governance Information |

| | | | | | | | | | | |

| Carl J. Soderberg |

| | | |

Experience and Qualifications: Mr. Soderberg is currently the President of Soderberg Company, Inc., a construction firm that has been in business for over 50 years and which he has led since 1992. Soderberg Company, Inc. is a family-owned business serving all of Maine, completing highway and airport construction as well as heavy civil construction work. Mr. Soderberg also continues to develop commercial real estate throughout Maine through Nordic Properties and CSS Development, Inc. Mr. Soderberg brings his understanding of Maine, his small business experience, which includes skills in leadership, decision making, business operations, employee relations and real estate expertise, to his role as a director and as Chair of the Bank’s Director Credit Committee. Mr. Soderberg’s prior board experience contributes to his strong understanding of regulatory, investor and governance requirements which contribute to his impact on the Governance and Risk Committee. Mr. Soderberg is currently on the Board of Directors for Cary Medical Center, serving on the Strategic planning committee and as Chair of the Finance committee. He also serves as a Director for the Bigrock Mountain ski area and Northern Skiers Club. | | Age: 62 |

| Director Since: 2015 |

| Camden National Corporation Committees: Corporate Governance & Risk Committee |

| Other Directorships: •Camden National Bank |

| Career Highlights: •President, Soderberg Company, Inc. |

| |

| | | | | |

20 | Camden National Corporation 2024 Proxy Statement |

| | | | | |

| Board of Director and Corporate Governance Information | |

| | | | | | | | | | | |

| Lawrence J. Sterrs |

| | | |

Experience and Qualifications: Mr. Sterrs currently serves as the Chairman of the Board of Camden National Corporation and joined the Board in 2015. Mr. Sterrs currently is the Chairman and CEO of the Unity Foundation, a public charity that invests in building the capacity of nonprofits that serve both local Maine communities and statewide needs. As of September 2022, Mr. Sterrs became the Executive Chairman of the Star of Hope Foundation. In this capacity, he will lead the Star of Hope Foundation through board development, strategic planning, asset management and program development. Mr. Sterrs previously served as the chair of the board of directors of UniTek, Inc. and its telecom subsidiary, UniTel, Inc. from 1994 until 2022. Mr. Sterrs formerly served as the Chief Executive Officer of UniTek, Inc. and UniTel, Inc. until 2003, and as Vice President of both companies from 2003 until his retirement in early 2022. Mr. Sterrs began his 49-year telecom career working with ConTel Corporation across the Northeast where he held executive leadership positions in network design and planning, legislative and regulatory strategy, and project and operations management. After leaving ConTel Corporation as Assistant Vice President, Mr. Sterrs worked at the accounting and consulting firm of BerryDunn as manager of telecommunications consulting where he specialized in telecom mergers, acquisitions and regulatory and legislative strategy development. Mr. Sterrs brings to the Company's Board of Directors his extensive director and business experience of nearly 50 years in the telecommunications industry, both as a direct leader and in consulting roles. His extensive experience in the areas of regulatory oversight, governance, management, leadership and technology support his membership on the Compensation and Technology Committees. Through Mr. Sterrs work at the Unity Foundation, he has significant knowledge of the economic and community development needs of Maine and has a deep understanding of the Maine business and nonprofit community. Mr. Sterrs has been appointed by several Maine Governors to various task forces and steering committees, and has served as the vice-chair of the Maine Telecommunications Infrastructure Steering Committee Mr. Sterrs currently serves on boards in both the for-profit and non-profit areas. | | Age: 70 |

| Director Since: 2015 |

| Camden National Corporation Committees: Governance and Risk Committee (Chair), Compensation Committee, and Technology Committee |

| Other Directorships: •Camden National Bank |

| Career Highlights: •Chairman and CEO of the Unity Foundation •Executive Chairman of the Star of Hope Foundation •Former CEO and Board Chair of UniTek, Inc. and its subsidiary UniTel, Inc. |

| |

CONTINUING DIRECTORS

Craig N. Denekas serves as Trustee, Chairman and Chief Executive Officer of the Libra Foundation in Portland, Maine. This is a private grant-making charitable foundation with a mission of maintaining a balance and diversity of giving throughout the state of Maine and across all populations. In addition to traditional grant-making, the Foundation takes an innovative approach to program-related investing by establishing Maine-based enterprises such as the Pineland Farms group of national specialty food companies to create sustainable businesses and employment opportunities for Maine citizens. Prior to joining the Libra Foundation in 2001, where he served in multiple leadership positions before his appointment as Chief Executive Officer, Mr. Denekas was a director and shareholder at the law firm of Perkins, Thompson in Portland, Maine, with over a decade of practice focused primarily on corporate acquisitions, business law, real estate and commercial lending matters. Mr. Denekas has served as a Trustee and on various boards of directors, including the Barbara Bush Foundation for Family Literacy based in Florida and the Fisher Charitable Foundation of Maine, and was past Chairman of the Board of Trustees of Maine Public Broadcasting.

| | | | | |

| Camden National Corporation 2024 Proxy Statement | 21 |

| | | | | |

| Board of Director and Corporate Governance Information |

David C. Flanagan is currently President of Viking Lumber, Inc., a family-owned lumber and building supply business operating for over 70 years. Viking Lumber currently employs more than 200 people through its ten locations throughout the Mid-Coast, Down East, and Central Maine regions. Mr. Flanagan currently serves on the Board of Directors and is the Treasurer of Coastal Healthcare Alliance, a subsidiary of Maine Health.

Marie J. McCarthy is currently Chief Operations Officer at L.L.Bean, and has been with L.L. Bean since 1993. Working primarily in human resources throughout her career, Ms. McCarthy’s role with L.L. Bean has evolved in recent years to include current oversight of Operations, including Fulfillment, Returns, Manufacturing, Customer Satisfaction, and Corporate Facilities and Real Estate. Ms. McCarthy is a member of L.L. Bean’s Investment Committee and Benefits Committee, Retail Real Estate Committee (that governs store selection/construction), and Corporate Real Estate Committee (that oversees all corporate holdings). She has also been a Sponsor of L.L. Bean’s Diversity, Equity, and Inclusion efforts. In her leadership role at L.L. Bean, Ms. McCarthy supports over 3,500 employees and is well versed in all of the challenges that organizations face in hiring, developing and retaining talent in today’s competitive work environment. She is also responsible for managing extensive operations that serve L.L. Bean’s customers worldwide. Ms. McCarthy currently serves on the Board of Directors of Maine Health, and the Board of Directors of the Olympia Snowe Women’s Leadership Institute, and has shared her talents with a number of other nonprofit organizations over the years.

James H. Page, Ph.D. is Chancellor Emeritus of the University of Maine System. As Chancellor, he had executive responsibilities for the governance and administration of Maine's public universities, including more than 5,000 employees, seven campuses, law school and associated programs and facilities. Dr. Page was previously principal and CEO of James W. Sewall Company, which provides consulting services in forestry, engineering and geographic information management. Dr. Page currently consults on higher education matters nationwide. Dr. Page is recognized as a leader throughout Maine, and has received many awards for his professional and civic activity over the years.

| | | | | |

22 | Camden National Corporation 2024 Proxy Statement |

| | | | | |

| Board of Director and Corporate Governance Information | |

DIRECTOR QUALIFICATIONS AND EXPERIENCE

The following table identifies the specific experience, qualifications, attributes, and skills that led to the conclusion by the Board that each director nominee should serve as a director of the Company. The table identifies the specific experience, qualifications, attributes, and skills that the Board would expect to consider if it were making a conclusion currently as to whether such person should serve as a director. Other than directors nominated for election at the Annual Meeting, the Corporate Governance and Risk Committee and the Board did not currently evaluate whether these individuals should serve as directors, as the terms for which they have previously been elected continue beyond the Annual Meeting. This information supplements the biographical information previously provided. In addition to the information presented regarding each person’s specific experience, qualifications, attributes, and skills that led the Board to the conclusion that they should serve as a director, we also believe all of our directors have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to the Company and its shareholders.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Denekas | Flanagan | Griffiths(1) | Hatfield | Longley | McCarthy | Merrill | Page | Sawyer | Soderberg | Sterrs | Total |

| Business Experience | | | | | | | | | | | | |

| General Business Acumen | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 11 |

| Financial Services Industry Knowledge | | ü | ü | ü | ü | | | | ü | ü | ü | 7 |

| Experience in Managing Growth | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 11 |

| Experience in Organization Development | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 11 |

| Executive Experience & Knowledge | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 11 |

| Financial Service Experience | | | ü | ü | ü | | | | ü | ü | | 5 |

| Audit, Compensation or Corporate Governance Experience | ü | ü | ü | ü | ü | ü | | ü | ü | ü | ü | 10 |

| Regulatory Experience | | | ü | ü | ü | | | | ü | ü | ü | 6 |

| Large Shareholder Relationship Experience | | | ü | | ü | | | | ü | | | 3 |

| Well Connected to the Community | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 11 |

| Professional Experience | ü | ü | ü | ü | ü | ü | | ü | ü | ü | ü | 10 |

| Collegiality | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 11 |

| Industry Experience | | | | | | | | | | | | |

| Accounting | | | ü | | ü | | | | ü | ü | ü | 5 |

| Merchandising | | ü | | | | ü | ü | | | ü | | 4 |

| Insurance | ü | | | | ü | | | | | | | 2 |

| Technology & Cybersecurity | | | ü | ü | | ü | | ü | ü | | ü | 6 |

| Asset Management | ü | | ü | ü | ü | | | | ü | | ü | 6 |

| Community Relations | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 11 |

| Law | ü | | | | ü | | | | | | | 2 |

| Management | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 11 |

1.Mr. Griffiths joined the Company and the Bank in November 2023 and was appointed as President, Chief Executive Officer (“CEO”) and director of the Company and the Bank, effective January 1, 2024.

| | | | | |

| Camden National Corporation 2024 Proxy Statement | 23 |

| | | | | |

| Board of Director and Corporate Governance Information |

BOARD STATEMENT ON DIVERSITY, EQUITY AND INCLUSION

The Company and its Board are committed to creating an environment of diversity, equity and inclusion (“DEI”) throughout the organization. The Governance and Risk Committee has been appointed by the Board to oversee the Company’s response to DEI-related social matters.

Camden National Corporation Board Diversity Statement

| | |

The Company values the benefits that diversity can bring to its Board of Directors. A diverse board reflects a variety of important perspectives in the boardroom, ultimately resulting in more informed decision making. Accordingly, in identifying potential nominees, the Governance and Risk Committee also considers whether a particular candidate adds to the overall diversity of the Board. The Committee seeks nominees with a broad diversity of experience, areas of expertise, professions and perspectives including, but not limited to, diversity with respect to age, race, ethnicity, gender, gender expression, and sexual orientation. The Committee will ensure that it will employ a variety of strategies to help develop a diverse candidate pool from which director nominees are selected. |

Please refer to the “Corporate Governance and Risk Committee” section beginning on page 28 for a description of how the Corporate Governance and Risk Committee considers diversity when assessing potential director nominees. As of December 31, 2023, the Company continues to meet NASDAQ’s board diversity objectives.

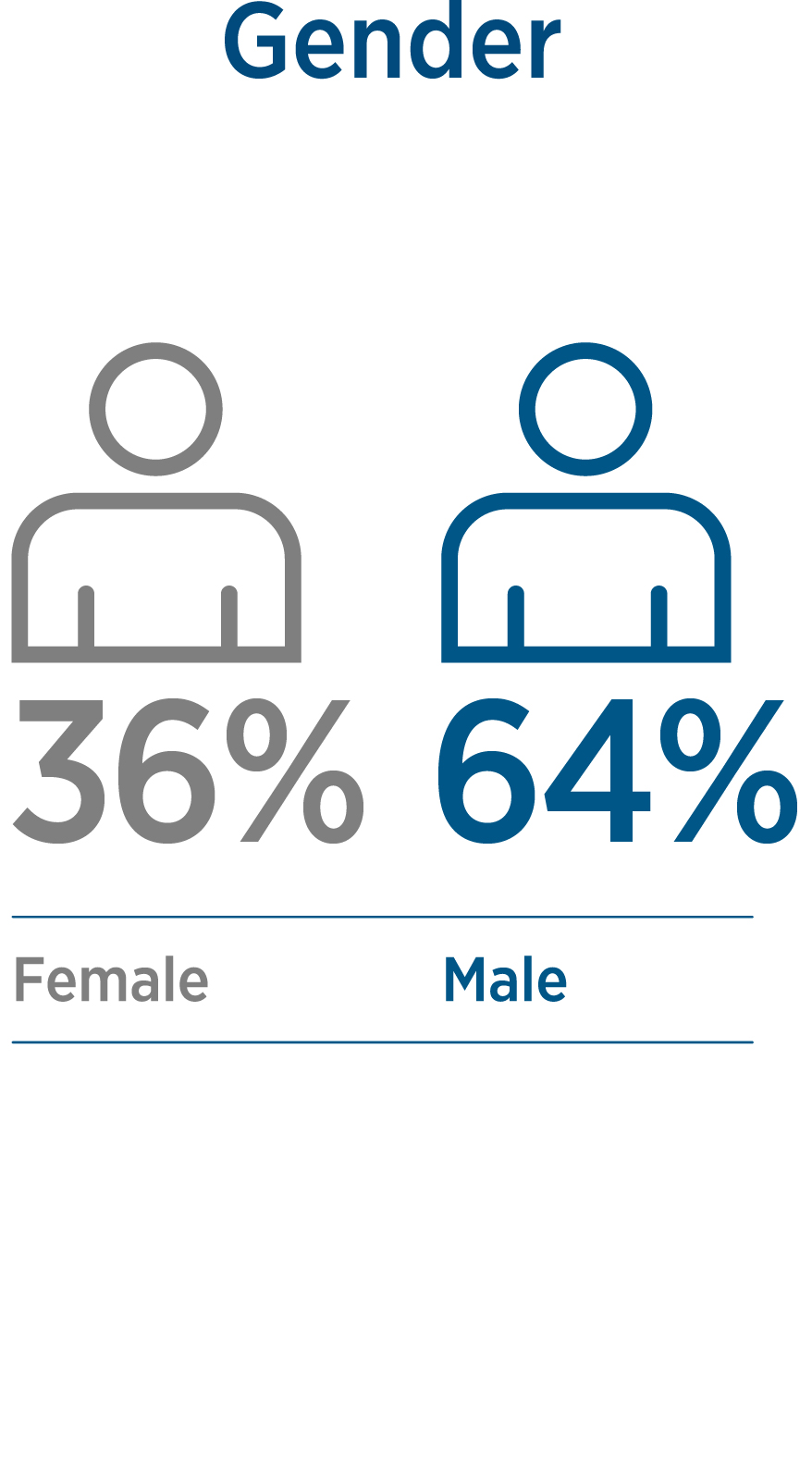

| | | | | | | | | | | | | | |

Board Diversity Matrix as of December 31, 2023 |

Total Number of Directors: 11 (including Mr. Dufour, who retired, effective as of the close of business on December 31, 2023, and not including Mr. Griffiths, who was appointed as a director on January 1, 2024) |

| Female | Male | Non-Binary | Did Not Disclosure Gender |

| Part I: Gender Identity |

| Directors | 4 | 7 | ─ | ─ |

| Part II: Demographic Background |

| African American or Black | 1 | ─ | ─ | ─ |

| Alaskan Native or Native American | ─ | ─ | ─ | ─ |

| Asian | ─ | ─ | ─ | ─ |

| Hispanic or Latinx | ─ | ─ | ─ | ─ |

| Native Hawaiian or Pacific Islander | ─ | ─ | ─ | ─ |

| White | 3 | 7 | ─ | ─ |

| Two or More Races or Ethnicities | ─ | ─ | ─ | ─ |

| LGBTQ+ | 1 |

| Did Not Disclose Demographic Background | | ─ | |

| | | | | |

24 | Camden National Corporation 2024 Proxy Statement |

| | | | | |

| Board of Director and Corporate Governance Information | |

Corporate Governance Information

We operate within a comprehensive plan of corporate governance for the purpose of defining director independence; assigning Board responsibilities; setting high standards of professional and personal conduct for directors, officers, and employees; and monitoring compliance with such responsibilities and standards. We regularly monitor developments in the area of corporate governance. The Board has adopted a set of Corporate Governance Guidelines that provides additional information on board governance-related matters. The Board has also adopted a Code of Business Conduct and Ethics (the “Code of Conduct”) that applies to our directors, employees and officers. The Code of Conduct covers compliance with law; fair and honest dealings with the Company, with competitors and with others; fair and honest disclosure to the public; and procedures for compliance with the Code of Conduct. In addition, the Company has adopted a Code of Ethics for Financial Officers, which applies to our Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”), Corporate Controller, Treasurer, and all other officers of the Company in Finance and Audit. You can review our Corporate Governance Guidelines, Code of Business Conduct, and Ethics and Financial Code of Ethics for Financial Officers on our website located under the “About — Investor Relations” tab at www.CamdenNational.bank. Any material amendments to either of these documents, or waivers of the Code (to the extent applicable to any of our directors or executive officers), will be disclosed promptly under the “About — Investor Relations” tab at www.CamdenNational.bank.

The Board and its Committees Oversee:

•Management’s development of the Company’s multi-year strategic plan and the annual financial operating plan, and monitor the implementation and progress of these plans.

•Our Company’s practice of high ethical standards and management’s implementation of effective policies and practices to protect the reputation and assets of the Company.

•Our audit functions and SOX program, our independent registered public accounting firm, and the integrity of our financial statements.

•Our Company’s creation and administration of appropriately designed compensation programs and plans.

•Management’s identification, measurement, monitoring and control of the Company’s material risks, including: Capital; Compliance and Legal; Interest Rate; Liquidity; Market; Operational; People and Compensation; Reputation; Strategic Alignment; Technology, including cybersecurity; and Vendor and Third Party.

Other Responsibilities of the Board and its Committees Include:

•Overseeing succession planning for our Board, CEO and other key executive management.

•Completing an annual formal Board evaluation, including self and peer-evaluations for nominees of our Board.

•Identifying and evaluating director candidates and nominating qualified individuals to serve on our Board that reflect a diversity of experience, areas of expertise, perspectives, and characteristics.

•Overseeing the Company’s engagement with, and disclosure to, shareholders and other parties regarding corporate responsibility matters.

•Reviewing our CEO’s performance and approving the total annual compensation of our CEO and other executive officers.

| | | | | |

| Camden National Corporation 2024 Proxy Statement | 25 |

| | | | | |

| Board of Director and Corporate Governance Information |

LEADERSHIP STRUCTURE AND SUCCESSION PLANNING

The leadership structure of the Company is determined by the Corporate Governance and Risk Committee. The Corporate Governance and Risk Committee proposes director nominees to the Board for election by the shareholders, including any management directors. Except for the CEO of the Company, all directors of the Company are “independent” directors. The Chair of the Board is an independent director and, in accordance with the charter of the Corporate Governance and Risk Committee, serves as the Chair of the Corporate Governance and Risk Committee. The current policy of the Board is that the offices of the Chair of the Board and CEO should be separate and the Chair of the Board should be selected from among the independent directors. Management directors do not serve as Chairs of any of the Board’s Committees nor do they participate in the Corporate Governance and Risk Committee or Compensation Committee meetings unless by invitation of the committee chair. Upon our CEO's retirement, our CEO is required to offer to tender to the Board their resignation as a member of the Board effective immediately concurrent with the retirement. The Corporate Governance and Risk Committee is required to evaluate the appropriateness of the former CEO’s continued service on the Board in light of the new circumstances, including any impact to the independence of the Board as a whole, and then recommend to the Board whether the Board should accept the resignation. The Corporate Governance and Risk Committee nominates the Chair and, if appropriate, Vice Chair roles for election by the entire Board. The independent directors meet in executive session periodically to help ensure that there is adequate oversight of management and that there is ample time to assess the Company’s activities separate from management.

Search and Transition Committee

In 2022, the Board formed a temporary committee of the Board to identify a successor for Mr. Dufour as President and CEO of the Company and the Bank and support the successful onboarding of the new President and CEO (the “Search and Transition Committee”). The Search and Transition Committee is chaired by Mr. Sterrs, Chair of the Board, and Messrs. Flanagan and Soderberg and Mses. McCarthy and Sawyer serve as members of the Search and Transition Committee.

The Search and Transition Committee, with input from the Board, identified the backgrounds, experiences and other characteristics desired for our incoming CEO. The Search and Transition Committee worked closely with the Corporate Governance and Risk Committee and the Compensation Committee throughout the process that led to Mr. Griffiths being identified and recommended to the Board as Mr. Dufour’s successor as the Company’s and the Bank’s next President and CEO.