UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☑ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material under Rule 14a-12 |

QNB Corp.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☑ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

(5) |

Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

(3) |

Filing Party: |

|

|

(4) |

Date Filed: |

|

|

Proxy Statement April 12, 2022 |

|

|

P.O. Box 9005 Quakertown, PA 18951-9005 TEL (215)538-5600 FAX (215)538-5765 |

April 12, 2022

Dear Fellow Shareholder:

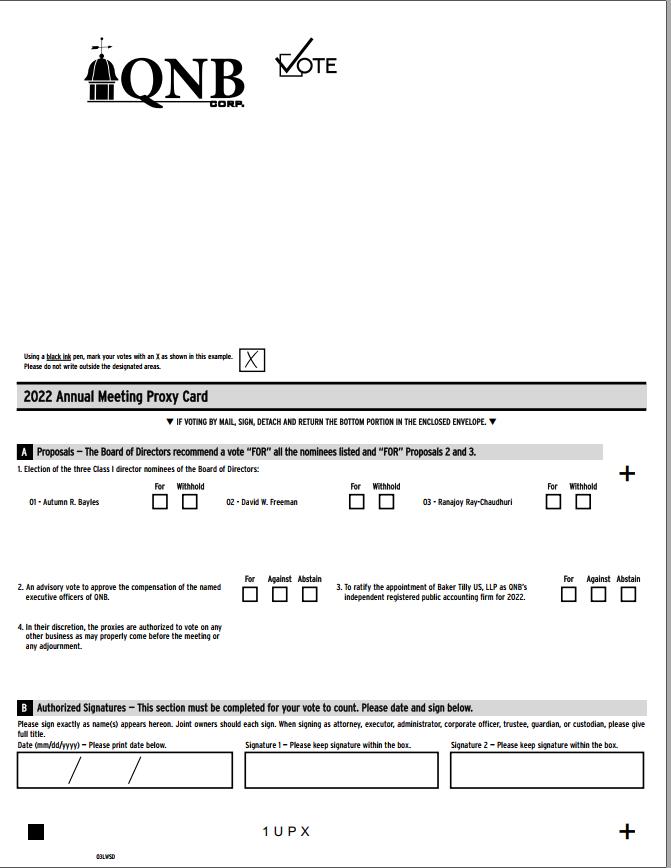

You are invited to attend QNB Corp.’s 2022 Annual Meeting of Shareholders on Tuesday, May 24, 2022. The meeting will be held in a virtual meeting format only at 11:00 a.m., Eastern time. To be admitted to the Annual Meeting at meetnow.global/MQLURHW, you must enter the control number found on your proxy card. Enclosed are the notice of the annual meeting, proxy statement and proxy card for the annual meeting. Our 2021 Annual Report on Form 10-K accompanies these enclosures.

At this year’s annual meeting, you are being asked to elect the three Class I director nominees of the Board of Directors and to ratify the Audit Committee’s appointment of Baker Tilly US, LLP as QNB Corp.’s independent registered public accounting firm for 2022. At the meeting, we will also consider an advisory vote to approve the compensation of our named executive officers. These proposals are fully described in the accompanying proxy statement, which you are urged to read carefully.

YOUR BOARD OF DIRECTORS HAS UNANIMOUSLY ENDORSED THE NOMINEES FOR ELECTION. WE RECOMMEND THAT YOU VOTE “FOR” ALL THREE NOMINEES, “FOR” THE ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION, AND “FOR” THE RATIFICATION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2022.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend, you can ensure that your shares are represented at the meeting by promptly voting and submitting your proxy by completing, signing, dating and returning your proxy card in the enclosed envelope or by voting on-line per instructions on your proxy card.

If you have any questions regarding the annual meeting, please contact Suzanne Weisberg at (215) 538-5600, extension 5677.

Thank you for your cooperation and continuing support.

Sincerely,

David W. Freeman

Chief Executive Officer

The Annual Meeting on May 24, 2022 at 11:00 a.m. Eastern time is available at meetnow.global/MQLURHW. To access the virtual meeting, you must have the information that is printed in the shaded bar on your proxy card. The password for this meeting is — QNBC2022. The proxy statement and Annual Report are available on our website at www.qnbbank.com. Additionally, you may access our proxy materials at meetnow.global/MQLURHW .

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

QNB CORP.

TO BE HELD ON MAY 24, 2022

TO OUR SHAREHOLDERS:

The 2022 Annual Meeting of the Shareholders of QNB Corp. will be a virtual meeting on Tuesday, May 24, 2022, beginning at 11:00 a.m., Eastern time, for the purpose of considering and acting upon the following matters:

|

|

(1) |

election of the three Class I director nominees of the Board of Directors; |

|

|

(2) |

an advisory vote to approve the compensation of our named executive officers; |

|

|

(3) |

ratification of the appointment of Baker Tilly US, LLP as QNB’s independent registered public accounting firm for 2022; and |

|

|

(4) |

such other business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors fixed the close of business on March 22, 2022 as the record date for the purpose of determining those shareholders entitled to notice of, and to vote at, the annual meeting, either in person or by proxy.

All shareholders are cordially invited to attend the annual meeting. Whether or not you plan to attend the annual meeting, you are requested to complete, date and sign the proxy card, and return it promptly in the enclosed envelope provided or vote one-line. At any time prior to the proxy being voted, it is revocable by written notice to QNB Corp. in accordance with the instructions set forth in the enclosed proxy statement, including by voting at the meeting in person.

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 24, 2022: Under Securities and Exchange Commission rules, you are receiving this notice that the proxy materials for the 2022 Annual Meeting of Shareholders are available on the Internet. The proxy statement, the proxy card and the 2021 Annual Report to Shareholders on Form 10-K are available at www.qnbbank.com under the “Investor Relations” link.

If you plan to attend the annual meeting, please login on meetnow.global/MQLURHW and you must enter the control number found on your proxy card.

By Order of the Board of Directors,

Suzanne B. Weisberg

Secretary

Quakertown, Pennsylvania

April 12, 2022

The Annual Meeting on May 24, 2022 at 11:00 a.m. Eastern time is available at meetnow.global/MQLURHW. To access the virtual meeting, you must have the information that is printed in the shaded bar on your proxy card. The password for this meeting is — QNBC2022. The proxy statement and Annual Report are available on our website at www.qnbbank.com. Additionally, you may access our proxy materials at meetnow.global/MQLURHW.

QNB Corp.

15 North Third Street

P.O. Box 9005

Quakertown, Pennsylvania 18951

(215) 538-5600

PROXY STATEMENT

2022 Annual Meeting of Shareholders – MAY 24, 2022

This proxy statement is being furnished to holders of the common stock, par value $0.625 per share, of QNB Corp. (herein referred to as QNB or the Corporation) in connection with the solicitation of proxies by the Board of Directors for use at the 2022 Annual Meeting of Shareholders.

As of the date of this proxy statement, the Board of Directors knows of no business that will be presented for consideration at the annual meeting other than that referred to in the accompanying Notice of Annual Meeting and described in this proxy statement. As to other business, if any, properly presented at the annual meeting, executed proxies will be voted in accordance with the judgment of the person or persons voting the proxy upon the recommendation of the Board of Directors.

The cost of solicitation of proxies will be paid by QNB. QNB will reimburse brokerage firms and other custodians, nominees, and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of QNB’s common stock. In addition to solicitations by mail, directors, officers, and employees of QNB and QNB Bank (herein referred to as the Bank) may solicit proxies personally, by telephone or other electronic means without additional compensation.

These proxy materials are first being mailed to shareholders on or about April 12, 2022.

Date, Time and Place of Meeting

QNB’s annual shareholders’ meeting will be held in a virtual format on Tuesday, May 24, 2022, beginning at 11:00 a.m., Eastern time. To be admitted to the Annual Meeting at meetnow.global/MQLURHW, you must enter the control number found on your proxy card, voting instruction form or notice that you received previously.

Outstanding Securities; Quorum; Voting Rights; and Record Date

The close of business on March 22, 2022 was fixed as the record date for the purpose of determining those shareholders entitled to notice of, and to vote at, the annual meeting and any adjournments or postponements of the meeting. As of the close of business on the record date, QNB had 3,551,629 shares of common stock issued and outstanding.

Shareholders are entitled to one vote for each share of common stock held of record on the record date with respect to each matter to be voted on at the annual meeting. Shareholders do not have cumulative voting rights in elections of directors.

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of the common stock on the record date is necessary to constitute a quorum at the annual meeting. We intend to count as present: (i) shares present in person but not voting; (ii) shares for which we have received proxies but for which the holders of such shares have withheld votes or abstained; and (iii) shares represented by proxies returned by a broker holding shares for a beneficial owner in nominee or street name even if the shares are not entitled to be voted on a particular proposal because the nominee does not have discretionary voting authority with respect to that proposal and has not received instructions from the beneficial owner (commonly referred to as “broker non-votes”).

QNB’s Bylaws and Pennsylvania law govern the vote needed to elect directors and approve the other matters to be considered at the annual meeting. In the case of the election of the Class I directors, assuming the presence of a quorum, the three candidates receiving the highest number of votes will be elected to the Board of Directors. Assuming the presence of a quorum, a majority of the votes cast at the meeting is required to approve the advisory vote on compensation of QNB’s

1

named executive officers and to ratify the appointment of Baker Tilly US, LLP as QNB’s independent registered public accounting firm for 2022. Because they are not considered votes cast, abstentions and broker non-votes have no effect on the matters to be considered at the annual meeting.

You may not vote your shares held by a broker in nominee or “street” name at the annual meeting unless you obtain a legal proxy from your broker or holder of record.

Solicitation of Proxies

The Board of Directors is soliciting proxies for use at QNB’s 2022 Annual Meeting of Shareholders.

Voting and Revocability of Proxies

Shares of common stock represented by properly executed proxies will, unless the proxies have previously been revoked, be voted in accordance with the instructions indicated on the proxies. If no instructions are indicated on the proxies, the shares will be voted FOR the election of QNB’s nominees to the Board of Directors, FOR the advisory vote to approve the compensation of QNB’s named executive officers, and FOR ratification of the appointment of Baker Tilly US, LLP as QNB’s independent registered public accounting firm for 2022. The Board of Directors does not anticipate that any matters will be presented at the annual meeting other than as set forth in the accompanying Notice of Annual Meeting. In the event that any other matters are properly presented at the annual meeting, proxies will be voted at the discretion of the proxy holders as to such matters upon the recommendation of the Board of Directors.

A shareholder of record who executes and returns a proxy has the power to revoke it at any time before it is voted by delivering to Suzanne B. Weisberg, Secretary of QNB, at the offices of QNB, at 320 West Broad Street, P.O. Box 9005 Quakertown, Pennsylvania 18951, either a written notice of the revocation or a duly executed later-dated proxy, or by attending the annual meeting and voting on-line after giving notice of the revocation.

2

PROPOSAL 1

ELECTION OF THE THREE CLASS I DIRECTOR NOMINEES

The Board of Directors

QNB’s Articles of Incorporation and Bylaws provide that the Board of Directors consists of no less than seven or no more than fifteen members divided into three classes, Class I, Class II, and Class III, as nearly equal in number as possible. The directors constituting Class I have been nominated for re-election at the annual meeting. The Directors in Class II will hold office until the 2023 annual meeting and the Directors in Class III will hold office until the 2024 annual meeting.

The Class I Director Nominees of the Board of Directors

At the annual meeting, three Class I directors will be elected. Each director so elected will hold office until the 2025 Annual Meeting of Shareholders and until his or her successor in office is duly qualified and elected.

To the extent given discretion, the persons named in the accompanying proxy intend to vote FOR each of the nominees listed below. Each nominee has consented to being nominated as a director and, as far as the Board of Directors and management of QNB are aware, will serve as a director if elected. In the event that any nominee should decline to serve or be unable to serve, the persons named in the accompanying proxy may vote for the election of such person or persons as the Board of Directors recommends.

Set forth on the following pages, we include the following information with respect to each director and director nominee:

|

|

• |

their names and ages; |

|

|

• |

the years they first became directors of QNB and the Bank; |

|

|

• |

their principal occupations and other directorships over the past five years; and |

|

|

• |

a brief discussion of the specific experience, qualifications, attributes or skills that led to our Board’s conclusion that the person should serve as a director. |

Voting Requirements

The three director candidates are required to be elected by a plurality of the total votes cast. Thus, the three persons receiving the highest number of votes will be elected. Votes may be cast in favor or withheld for any or all of the nominees.

RECOMMENDATION

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT EACH OF THESE NOMINEES BE ELECTED AS A CLASS I DIRECTOR.

3

Current Class I Directors and Nominees for Three Year Term Expiring in 2025 (Class I Directors)

Autumn R. Bayles

Director of QNB and the Bank since December 2012

Age 51

Ms. Bayles is Senior Vice President of Global Supply Chain for Aramark Corp., a global food and facilities company (August 2018 to present). Prior to that, Ms. Bayles served as Aramark Corp’s Vice President of Global Operational Excellence (March 2013 to August 2018) and Vice President of Strategic Development (October 2011 to March 2013). Before joining Aramark Corp., Ms. Bayles was Senior Vice President of Strategic Operations from 2006 to 2011, and Chief Information Officer from 2003 to 2006 for Tasty Baking Company, a consumer-packaged goods company. Ms. Bayles’ educational background includes a Bachelor of Science degree in industrial engineering from Lehigh University and a Master of Business Administration from University of Pennsylvania’s Wharton School. Ms. Bayles’ career has focused on operational improvements and innovative growth opportunities leveraging technology and process changes. The Board believes that Ms. Bayles’ expertise in the areas of business strategy, operations and technology and her experience with a public company give her the qualifications and skills to serve as a QNB director.

David W. Freeman

Director of QNB since December 2012

Director of the Bank since 2010

Age 65

Mr. Freeman has been the Chief Executive Officer of QNB and the Bank from January 2013 to present. Mr. Freeman served as the President of QNB and the Bank from September 2010 to present. Mr. Freeman also served as Chief Operating Officer of QNB and the Bank from September 2010 to December 2012. Prior to joining QNB, Mr. Freeman was the Division President of the Drovers Bank Division of Fulton Bank from March 2002 to March 2010. Mr. Freeman serves on several local boards including St. Luke’s Hospital, Upper Bucks YMCA and Minsi Trails Council of the Boy Scouts of America. Mr. Freeman’s educational background includes a Bachelor of Science degree in business management from Franklin University, a Master of Business Administration from The Ohio State University and he is a graduate of ABA Stonier Graduate School of Banking. The Board believes Mr. Freeman’s career in banking, including his position as President and Chief Executive Officer of QNB and the Bank, gives him the qualifications and skills to serve as a QNB director.

Ranajoy Ray-Chaudhuri

Director of QNB and the Bank since 2022

Age 46

Dr. Ray-Chaudhuri is Associate Professor of Economics and Finance at Muhlenberg College from August 2021 to present. Dr. Ray-Chaudhuri served as Assistant Professor of Economics and Finance at Muhlenberg College from August 2015 to July 2021. His educational background includes a masters and a doctorate in Economics from The Ohio State University. His teaching interests include Money and Banking, Macroeconomics and Development Economics, and his research focuses on the history of financial regulations, regulatory changes in the financial sector, central bank anatomy and the conduct of monetary policy, and the impact of financial development on economic growth. The Board believes that Dr. Ray-Chaudhuri’s knowledge and perspective of financial regulations, central banking and economic development give him the qualifications and skills to serve as a QNB director.

Continuing Directors Serving Until 2023 (Class II Directors)

Laurie A. Bergman

Director of QNB and the Bank since 2020

Age 44

Ms. Bergman is currently Chief Financial Officer of Liquid Environmental Solutions (June 2021 to present). Prior to that, Ms. Bergman served as Vice President, Chief Accounting Officer and Corporate Controller of UGI Corporation (February 2019 to June 2021). She previously served as the Chief Accounting Officer and Corporate Controller of AmeriGas Propane,

4

Inc. (2016 to 2019) and as its Group Director – Financial Planning and Operations (2014 to 2016). Ms. Bergman joined AmeriGas Propane, Inc. in 2006 as Manager – Disbursements and served in various roles for AmeriGas Propane, Inc., including Assistant Controller (2011 to 2012), Director of Financial Analysis and Planning (2012 to 2013), and Group Director of Financial Planning and Revenue Management (2013 to 2014). Prior to that, she held positions of increasing responsibility at AmeriGas Propane, Inc. Previously, Ms. Bergman served as a Financial Analysis Specialist and a Disbursement Operations Manager at CIGNA Corporation from 2001 to 2005. Ms. Bergman’s educational background includes a Bachelor of Business Administration degree in Finance from Temple University and a Master of Business Administration from Temple University. Ms. Bergman’s leadership of corporate accounting functions in large publicly traded organizations give her the qualifications and skills to serve as a director of QNB.

Randy S. Bimes

Director of QNB and the Bank since 2020

Age 60

Dr. Bimes is President and managing partner of Quakertown Veterinary Clinic – (August 1996 to present). From December 2016 to October 2020 served as Vice President of Operations at MAVANA, a national aggregation of veterinary practices. Chair of the Medical Advisory Board of Community Veterinary Partners (July 2016 to present). Dr. Bimes’ educational background includes Doctor of Veterinary Medicine degree from University of Illinois College of Veterinary Medicine. His experience in small business operations and development, strategic planning and work in small business aggregation, as well as his role in the community give Dr. Bimes the qualifications and skills to serve as a director of QNB.

Kenneth F. Brown, Jr.

Director of QNB and the Bank since 1993

Age 66

Mr. Brown is the President of McAdoo & Allen, Inc., a manufacturer of pigment dispersions and high-performance coatings (September 1989 to present). Mr. Brown also serves or has served as a Director and Trustee for various local nonprofit organizations including the Upper Bucks YMCA and St. Luke’s Quakertown Hospital. The Board believes that Mr. Brown’s success in building and managing McAdoo and Allen, Inc. along with his prominent role in the community and years of service as a director of QNB give Mr. Brown the qualifications and skills to serve as a director of QNB.

Director of QNB and the Bank since 2014

Age 67

Mr. Stauffer retired from Stauffer Glove and Safety as of December 31, 2021. Mr. Stauffer was Chairman/Chief Operating Officer of Stauffer Glove & Safety (July 2017 to December 2021), a national distributor of gloves and safety equipment. He has been employed at Stauffer Manufacturing since 1976, holding various positions and is part of the fourth generation in the family business. He served as President of Stauffer Manufacturing from January 2005 to June 2017. Mr. Stauffer is the managing member of Stauffer Realty Trust, LLC (March 2005 to present), a commercial real estate partnership. Mr. Stauffer is also the managing member of WR and JR Realty, LLC (1987 to present), a residential real estate partnership. Mr. Stauffer’s educational background includes a Bachelor of Science degree in Business Administration from Elizabethtown College. The Board believes that Mr. Stauffer’s business experience and long-term involvement with many non-profit organizations in the Upper Perkiomen Valley give him the qualifications to serve as a director of QNB.

Continuing Directors Serving Until 2024 (Class III Directors)

Thomas J. Bisko

Director of QNB since 1986

Director of the Bank since 1985

Age 74

Mr. Bisko served as the Chief Executive Officer of QNB and the Bank from March 1988 to December 2012. Mr. Bisko served as the President of QNB from May 1986 to September 2010 and the President of the Bank from September 1985 to

5

September 2010. Mr. Bisko has also held the position of Treasurer of QNB from February 1986 to December 2012. Prior to joining QNB, Mr. Bisko was an examiner for the Office of the Comptroller of the Currency and a consultant with a firm specializing in the banking industry. Mr. Bisko served on many local boards including St. Luke’s Quakertown Hospital and the Upper Bucks YMCA. Mr. Bisko’s educational background includes a Bachelor of Science degree in business administration from King’s College. The Board believes that Mr. Bisko’s career in banking gives him the qualifications and skills to serve as a QNB director.

Dennis Helf

Chairman of the Board since 2002

Director of QNB since 1997

Director of the Bank since 1996

Age 75

Mr. Helf has been a Registered Investment Advisor since 1995 and has over 30 years of experience investing in community bank stocks. Prior to 1995, Mr. Helf was the managing partner in a law firm and spent 22 years representing five financial institutions in all facets of the law affecting financial institutions with a concentration in commercial lending and workouts. Mr. Helf served on the Board of Sellersville Savings & Loan and has long-term involvement with many nonprofit organizations in QNB’s market area. Mr. Helf’s educational background includes a Bachelor of Arts degree from Muhlenberg College, a Juris Doctorate from Villanova School of Law and a Masters in Tax Law from Temple University Law School. The Board believes that Mr. Helf’s extensive legal and business experience in the financial services industry gives him the qualifications and skills to serve as a QNB director.

Jennifer L. Mann

Director of QNB and the Bank since 2015

Age 52

Ms. Mann is the founder and President of JL Mann Consulting, LLC, a firm that provides customized business solutions to a wide array of companies (2012 to present). Elected to serve Allentown, Ms. Mann was a state representative from 1998 to 2012. As a member of the national Democratic Leadership Council (DLC) Leadership Team, Ms. Mann served as chairwoman of the DLC’s State Legislative Advisory Board. Prior to serving in the House, Ms. Mann launched and managed a successful wireless telecommunications business in Allentown. Ms. Mann also serves on several community and nonprofit boards including the board of the Lehigh Valley Community Foundation, the board of governors of St. Luke’s Hospital Allentown Campus and the executive board of the Minsi Trails Council of the Boy Scouts of America. Ms. Mann earned degrees in government and economics from Lehigh University. The Board believes that Ms. Mann’s business experience, combined with her legislative background and her legislative focus on business-friendly economic policies, give her a unique understanding of the challenges and opportunities associated with entrepreneurship and business leadership, provide the qualifications and skills to serve as a QNB director.

Scott R. Stevenson

Director of QNB and the Bank since 2015

Age 61

Mr. Stevenson was appointed President/CEO of Phoebe Ministries in June 2008 and also served as the organization’s Chief Financial Officer, from 2006 to 2017. In addition, he serves as President of the organization’s Reciprocal Risk Retention Group. Prior to his appointment with Phoebe Ministries, Mr. Stevenson was the Chief Financial Officer of Graduate Hospital, Philadelphia, Pennsylvania, and prior to that served as Vice President of Financial Operations for Diakon Lutheran Social Ministries. He holds a Bachelor’s Degree in Accounting and a Master of Business Administration in Healthcare Systems Management. Mr. Stevenson serves or served on several boards including: CHHSM (Council for Health and Human Service Ministries), Highmark Blue Shield Regional Advisory Board, QNB Regional Advisory Board, New Life Bible Fellowship Elder Board, and Leading Age PA as Board Trustee. The Board believes that Mr. Stevenson’s extensive senior managerial experience including his financial accounting background and experience provide the qualifications and skills for him to serve as a QNB director.

6

EXECUTIVE OFFICERS OF QNB AND/OR THE BANK

The following list sets forth the names of the executive officers of QNB, and other significant employees of the Bank, their respective ages, positions held, recent business experience with QNB and the Bank, and the period they have served in their respective capacities.

David W. Freeman

Age 65; Chief Executive Officer of QNB and the Bank from January 2013 to present; President of QNB and the Bank from September 2010 to present; Chief Operating Officer of QNB and the Bank from September 2010 to December 2012; Division President of the Drovers Bank Division of Fulton Bank from March 2002 to March 2010.

Christopher T. Cattie

Age 49; Executive Vice President, Chief Information Technology Officer of the Bank from February 2016 to present; Group Vice President of Information Technology for Bryn Mawr Trust Company from January 2015 to February 2016; Senior Vice President, Information Technology Director for Continental Bank, Plymouth Meeting, PA from March 2005 to December 2014.

Janice S. McCracken Erkes

Age 57; Chief Financial Officer of QNB from September 2014 to present; Executive Vice President, Chief Financial Officer of the Bank from September 2014 to present; Chief Risk Management Officer of the Bank from January 2017 to present; Chief Financial Officer of Noah Bank, Elkins Park, PA from May 2014 to September 2014; Chief Accounting Officer of Noah Bank, from December 2010 to April 2014; Chief Financial Officer of National Penn Bank, Boyertown, PA from February 2010 to September 2010; Executive Vice President and Director of Finance and Management Accounting of National Penn Bank from January 2007 to January 2010.

Scott G. Orzehoski

Age 56; Executive Vice President, Chief Lending Officer of the Bank from July 2011 to present; Senior Vice President, Chief Lending Officer of the Bank from February 2008 to June 2011; Senior Vice President, Commercial Lending Officer of the Bank from January 2002 to July 2011; Vice President, Commercial Lending Officer of the Bank from August 1997 to December 2001; Assistant Vice President, Commercial Lending Officer of the Bank from February 1996 to July 1997.

Dale A. Westwood

Age 66; Executive Vice President, Chief Retail Officer of the Bank from January 2015 to present; Senior Vice President, Chief Retail Officer of the Bank from October 2008 to December 2014; Vice President, Fairmont Quality Service & Sales Development, Frederick, PA from March 1999 to September 2008.

7

BENEFICIAL OWNERSHIP OF DIRECTORS AND OFFICERS

The following table sets forth, as of March 22, 2022, the number of shares of common stock, par value $0.625 per share, beneficially owned by each current director and nominee for director, by each executive officer, and by all directors, nominees and executive officers of QNB and the Bank, as a group. Unless otherwise indicated, shares are held individually and not pledged as security. The address for each person is 320 West Broad Street, P.O. Box 9005, Quakertown, Pennsylvania 18951.

|

Name of Beneficial Owner |

|

Amount and Nature of Beneficial Ownership (1) |

|

Percentage of Class (2) |

|

||||

|

Autumn R. Bayles |

|

|

1,083 |

|

|

|

* |

|

|

|

Laurie Bergman |

|

|

800 |

|

|

|

* |

|

|

|

Randy S. Bimes |

|

|

108,448 |

|

(3) |

|

3.05% |

|

|

|

Thomas J. Bisko |

|

|

25,647 |

|

(4) |

|

* |

|

|

|

Kenneth F. Brown, Jr. |

|

|

150,100 |

|

(5) |

|

4.23% |

|

|

|

Christopher T. Cattie |

|

|

1,210 |

|

(6) |

|

* |

|

|

|

David W. Freeman |

|

|

20,556 |

|

(7) |

|

* |

|

|

|

Dennis Helf |

|

|

35,061 |

|

(8) |

|

* |

|

|

|

Jennifer L. Mann |

|

|

4,046 |

|

|

|

* |

|

|

|

Janice McCracken Erkes |

|

|

4,455 |

|

(9) |

|

* |

|

|

|

Scott G. Orzehoski |

|

|

15,667 |

|

(10) |

|

* |

|

|

|

Ranajoy Ray-Chaudhuri |

|

|

— |

|

(11) |

|

* |

|

|

|

W. Randall Stauffer |

|

|

38,508 |

|

(12) |

|

1.08% |

|

|

|

Scott R. Stevenson |

|

|

897 |

|

|

|

* |

|

|

|

Dale A. Westwood |

|

|

6,950 |

|

(13) |

|

* |

|

|

|

Current Directors, Nominees & Executive Officers as a Group (15 persons) |

|

|

413,428 |

|

(14) |

|

11.64% |

|

|

|

* Less than 1.00% |

|

|

|

|

|

|

|

|

|

|

(1) |

The securities “beneficially owned” by an individual are determined in accordance with the definitions of “beneficial ownership” set forth in the rules of the SEC and may include securities owned by or for the individual's spouse and minor children and any other relative who has the same home, as well as securities as to which the individual has, or shares, voting or investment power or has the right to acquire beneficial ownership within 60 days after March 22, 2022. Beneficial ownership may be disclaimed as to certain of the securities. |

|

(2) |

Numbers are rounded to the nearest one-hundredth percent. |

|

(3) |

Includes 95,357 shares owned jointly by Dr. Bimes with his wife. |

|

(4) |

Includes 20,329 shares owned jointly by Mr. Bisko with his wife and 325 shares held in her individual capacity. |

|

(5) |

Includes 148,336 shares owned jointly by Mr. Brown with his wife. |

|

(6) |

Includes -0- options |

|

(7) |

Includes -0- options. |

|

(8) |

Includes 22,043 shares owned jointly by Mr. Helf with his wife. |

|

(9) |

Includes 500 shares owned jointly by Ms. McCracken Erkes with her husband and -0- options. |

|

(10) |

Includes -0- options. |

|

(11) |

Dr. Ray-Chaudhuri has one year from his appointment to obtain 800 shares. |

|

(12) |

Includes 30,583 shares owned by Mr. Stauffer’s wife. |

|

(13) |

Includes -0- options. |

|

(14) |

Includes -0- options, in the aggregate which are exercisable within 60 days of the record date; the percentage ownership calculation is based upon an aggregate of 3,551,629 shares outstanding. |

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS.

The following table sets forth the names of each person who, directly or indirectly, are known to QNB’s management to be the beneficial owners of at least 5% of QNB's outstanding common stock as of March 22, 2022.

|

Name and Address of Beneficial Owner |

|

Number of Shares Owned (1) |

|

Percentage of Class (2) |

|

|||

|

Mark T, Lynch 2900 Wayland Road Berwyn, PA 19312 |

|

|

294,811 |

|

|

|

8.30% |

|

|

(1) |

Information derived from Schedule 13G filed with the SEC on January 6, 2022. |

|

(2) |

Numbers are rounded to the nearest one-hundredth percent. |

9

GOVERNANCE OF THE CORPORATION

Our Board of Directors believes that the purpose of corporate governance is to promote maximizing shareholder value in a manner consistent with legal requirements and the highest standards of integrity. The Board has adopted and adheres to corporate governance practices which the Board and senior management believe promote this purpose, are sound and represent best practices. We continually review these governance practices, Pennsylvania law (the state in which we are incorporated), the rules and listing standards of the Nasdaq Stock Market and SEC regulations, as well as best practices suggested by recognized governance authorities.

The structure of the Corporation’s Board leadership consists of an independent non-employee Chairman, Mr. Helf, a non-independent Principal Executive Officer, David W. Freeman, and a majority of independent non-employee directors. The independent directors of the Board meet separately at least twice a year without management present. Additionally, the Corporation has an active committee structure in which members of the Board of Directors attend and actively participate in the following Committees: Investment/Asset & Liability Management Committee, Audit Committee, Compensation Committee, Executive Committee, Loan Committee, Nominating and Governance Committee, Strategic Planning Committee and Wealth Management Committee. The active participation in these Committees in addition to the monthly Board of Directors’ meetings provides the independent members of the Board the necessary insight into the daily operations of the Corporation. The Board believes that this Board leadership structure most effectively represents the best interests of the Corporation and its shareholders.

Currently, our Board of Directors has 11 members. Under the rules adopted by the Securities and Exchange Commission and Nasdaq Stock Market for independence, Autumn R. Bayles, Laurie Bergman, Randy S. Bimes, Thomas J. Bisko, Kenneth F. Brown, Jr., Dennis Helf, Jennifer L. Mann, Ranajoy Ray-Chaudhuri, W. Randall Stauffer and Scott R. Stevenson meet the standards for independence. These directors represent more than a majority of our Board of Directors.

Our Board of Directors determined that the following director was not independent within the meaning of the rules and listing standards of the Nasdaq Stock Market: David W. Freeman, President and Chief Executive Officer of QNB and the Bank.

Our Board of Directors has determined that a lending relationship resulting from a loan made by the Bank to a director would not affect the determination of independence if the loan complies with Regulation O under the federal banking laws. Our Board of Directors also determined that maintaining with the Bank a deposit, savings or similar account by a director or any of the director’s affiliates would not affect the determination of independence if the account is maintained on the same terms and conditions as those available to similarly situated customers. Additional categories or types of transactions or relationships considered by our Board of Directors regarding director independence include, but are not limited to, vendor or contractual relationships with directors or their affiliates.

Risk Management

The management of risk is fundamental to the business of banking and integral to the daily operations of the Corporation. The Board of Directors oversees the Risk Management functions of the Corporation through policies which are reviewed at least on an annual basis and by representation on Loan Committee, and the joint Investment/Asset & Liability Committee. The minutes from these Committees are reported to the full Board of Directors. Janice McCracken Erkes is the Chief Risk Management Officer of the Bank. Currently, the Corporation does not have an Enterprise Risk Management Committee.

Code of Ethics

We have adopted a Code of Ethics for Directors, officers and employees of QNB and the Bank. It is intended to promote honest and ethical conduct, full and accurate reporting and compliance with laws as well as other matters. A copy of the Code of Ethics is posted on our website at www.qnbbank.com under “Governance Documents”.

Restrictions on Hedging and Pledging QNB Securities

QNB believes that stock ownership can effectively align the interests of directors, officers, and employees with the long-term interests of shareholders. Certain transactions in QNB securities, however, may be considered short-term or speculative in nature, or create the appearance that incentives are not properly aligned with the long-term interests of shareholders. It is QNB’s policy that directors, officers, and employees not purchase financial investments (including equity

10

swaps, collars and similar derivative securities) or otherwise engage in transactions that hedge or offset, or are designed to hedge or offset, any potential decrease in the market value of QNB securities. As a result, under QNB’s policies and procedures governing trading in securities, directors, officers, and employees may not engage in hedging or monetization transactions in QNB securities, including through the use of financial instruments such as exchange funds, puts, calls and other derivative instruments or through the establishment of short positions. In addition, such persons may not hold QNB securities in a margin account or pledge QNB securities as collateral for a loan. An exception to the policy prohibiting pledges of QNB securities as collateral for a loan (not including margin debt) may be made where the covered person clearly demonstrates the capacity to repay the loan without resort to the pledged securities.

11

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS OF QNB AND THE BANK

Set forth below is a list of each of our current Board members and our current Board committee members. The respective chairperson of each of the Board committees is also noted below. Each current director of QNB is also a current member of the Bank’s Board of Directors.

|

Board Member |

|

Board |

|

Audit |

|

Compensation |

|

Executive |

|

Nominating |

|

Autumn R. Bayles |

|

X |

|

X |

|

C |

|

|

|

X |

|

Laurie Bergman |

|

X |

|

X |

|

|

|

|

|

|

|

Randy S. Bimes |

|

X |

|

|

|

|

|

|

|

X |

|

Thomas J. Bisko |

|

X |

|

X |

|

|

|

X |

|

|

|

Kenneth F. Brown, Jr. |

|

X |

|

|

|

X |

|

X |

|

C |

|

David W. Freeman |

|

X |

|

|

|

|

|

X |

|

|

|

Dennis Helf |

|

C |

|

|

|

|

|

C |

|

|

|

Jennifer L. Mann |

|

X |

|

|

|

X |

|

|

|

|

|

Ranajoy Ray-Chauduri |

|

X |

|

X |

|

|

|

|

|

|

|

W. Randall Stauffer |

|

X |

|

|

|

X |

|

X |

|

|

|

Scott R. Stevenson |

|

X |

|

C |

|

|

|

|

|

|

|

Meetings Held in 2021 |

|

12 |

|

5 |

|

1 |

|

2 |

|

1 |

C – Chairperson

Our Board of Directors held twelve meetings during 2021. All current directors attended at least 75% of the aggregate of the total number of meetings of the Board of Directors (held for the period for which he or she has been a director) and the total number of meetings held by all committees of the Board of Directors on which he or she served (during the periods that he or she served).

QNB has no specific policy requiring directors to attend the Annual Meeting of Shareholders; however, director attendance is strongly encouraged. All members of the Board of Directors at May 25, 2021 were present at the 2021 Annual Meeting of Shareholders. It is anticipated that all members of the Board of Directors will attend the 2022 Annual Meeting of Shareholders.

QNB’s Board of Directors established and maintains the following committees, among others:

Audit Committee. The Audit Committee recommends the engagement and dismissal of the independent registered public accounting firm, reviews their annual audit plan and the results of their auditing activities, and considers the range of audit and non-audit fees. It also reviews the general audit plan, scope and results of QNB's procedures for internal auditing. The reports of examination of QNB and its subsidiary by bank regulatory examiners are also reviewed by the Audit Committee. The Audit Committee also reviews all SEC filings and earnings press releases. The Audit Committee meets with management and the auditors prior to the filing of officers’ certifications with the SEC to receive information concerning, among other things, the adequacy of the design and operation of internal controls, including significant deficiencies identified, if any. The Audit Committee held five meetings in 2021.

All members of the Audit Committee are independent directors pursuant to the rules adopted by the SEC and the corporate governance standards promulgated by the Nasdaq Stock Market. In determining whether a director is independent for purposes of each of the above stated guidelines, the Board of Directors must affirmatively determine that the directors on the Audit Committee do not, among other things, accept any consulting, advisory, or other compensatory fee from QNB. Applying these standards, the Board of Directors has determined that all the directors on the Audit Committee are independent. The current members of QNB’s Audit Committee are Directors Bayles, Bergman, Bisko, Ray-Chaudhuri and Stevenson.

Director Stevenson served as the Audit Committee Chair and Audit Committee financial expert since March 1, 2020. The Board of Directors determined that Director Stevenson met the requirements adopted by the SEC and Nasdaq Stock Market for qualification as an Audit Committee financial expert. Mr. Stevenson has employment experience as a President, Chief Executive Officer and Chief Financial Officer providing him with diverse and progressive financial management experience, as well as expertise in internal controls and U.S. accounting. An Audit Committee financial expert is defined as a person who has the following attributes: (i) an understanding of generally accepted accounting principles and financial statements; (ii) the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves; (iii) experience preparing, auditing, analyzing or evaluating financial statements that

12

present a breadth and level of complexity or accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the registrant’s financial statements, or experience actively supervising one or more persons engaged in such activities; (iv) an understanding of internal controls and procedures for financial reporting; and (v) an understanding of audit committee functions.

The identification of a person as an audit committee financial expert does not impose on such person any duties, obligations or liability that are greater than those that are imposed on such person as a member of the Audit Committee and the Board of Directors in the absence of such identification. Moreover, the identification of a person as an audit committee financial expert for purposes of the regulations of the SEC does not affect the duties, obligations or liability of any other member of the Audit Committee or the Board of Directors.

The Audit Committee operates under a formal charter that governs its duties and conduct. The Audit Committee Charter is available on our website at www.qnbbank.com under “Governance Documents”.

The Audit Committee has also adopted a Whistleblower Policy to enable confidential and anonymous reporting of questionable accounting or auditing matters, fraudulent activities, or misconduct to the Audit Committee. The policy also is available on our website at www.qnbbank.com under “Governance Documents”.

Compensation Committee. The Compensation Committee's primary functions are to review and approve key executive salaries and salary policy, determine the salary of the Chief Executive Officer and to administer equity compensation plans. In formulating its recommendations for the other executive officers, the Compensation Committee will consider information provided by the Chief Executive Officer related to subordinate executives. In addition, the Committee reviews the general guidelines on compensation for all employees. The Board of Directors has determined that all the directors serving on the Compensation Committee are independent for the purposes of the rules adopted by the SEC and the corporate governance standards promulgated by the Nasdaq Stock Market. The Compensation Committee has a formal charter which is available on our website at www.qnbbank.com under “Governance Documents”. The current members of the Compensation Committee are Directors Bayles, Brown, Mann and Stauffer. The Compensation Committee held one meeting during 2021.

Executive Committee. The Executive Committee is authorized to exercise all the authority of the Board of Directors in the management of QNB between Board meetings, unless otherwise provided in QNB’s Bylaws. The current members of the Executive Committee are Directors Bisko, Brown, Freeman, Helf and Stauffer. The Executive Committee held two meetings during 2021.

Nominating Committee. The Board of Directors has determined that all the directors serving on the Nominating Committee are independent for the purposes of the rules adopted by the SEC and the corporate governance standards promulgated by the Nasdaq Stock Market. The principal duties of the Nominating Committee include developing and recommending to the Board criteria for selecting qualified director candidates, identifying individuals qualified to become Board members, evaluating and selecting, or recommending to the Board, director nominees for each election of directors, considering committee member qualifications, appointment and removal, recommending codes of conduct and codes of ethics applicable to the Corporation and providing oversight in the evaluation of the Board and each committee. The Nominating Committee has no formal process for considering director candidates recommended by shareholders, but the Nominating Committee will consider such candidates and its policy is to give due consideration to all candidates. If a shareholder wishes to recommend a director candidate as a possible nominee for the 2023 annual meeting of shareholders, the shareholder should mail the name, background and contact information for the candidate to the Nominating Committee at the Corporation's offices at P.O. Box 9005, Quakertown, PA 18951 no later than February 25, 2023. The Nominating Committee has a formal charter which is available on our website at www.qnbbank.com under “Governance Documents”. Members of the Nominating Committee include Directors Bayles, Bimes and Brown. The Nominating Committee met one time during 2021.

In considering individual director candidates, the Nominating Committee considers individuals who, in the judgment of the Committee, would be best qualified to serve on the Board. The Nominating Committee will seek to balance the existing skill sets of current Board members with the need for other diverse skills, backgrounds and qualities that will complement the Corporation’s strategic vision and also consider diversity of gender and ethnicity in fulfilling its responsibilities to select qualified and appropriate director candidates. All director candidates are evaluated based on general characteristics and specific talents and skills needed to increase the Board’s effectiveness. Additionally, all candidates must possess an unquestionable commitment to high ethical standards and have a demonstrated reputation for integrity.

13

AUDIT COMMITTEE REPORT

Pursuant to rules adopted by the SEC designed to improve disclosures related to the functioning of corporate audit committees and to enhance the reliability and credibility of financial statements of public companies, QNB’s Audit Committee submits the following report:

Audit Committee Report to Board of Directors

The Board of Directors has formally adopted an Audit Committee Charter setting forth the Committee's duties. The Charter delegates to the Committee responsibility for overseeing QNB's financial reporting process. In that connection, the Committee has discussed and reviewed the Corporation's audited consolidated financial statements for 2021 with management and Baker Tilly US, LLP, QNB's independent registered public accounting firm.

Management has the primary responsibility for the consolidated financial statements and the reporting process, including the systems of internal control. Baker Tilly US, LLP is responsible for expressing opinions on the conformity of QNB's audited consolidated financial statements with generally accepted accounting principles and evaluation of effectiveness of QNB’s internal control over financial reporting.

In discharging its responsibilities, the Committee's review of the Corporation's financial statements for 2021 included discussion of the quality, not just the acceptability, of the accounting principles used, the reasonableness of significant judgments made, and the clarity, consistency and completeness of disclosures in such financial statements with management and Baker Tilly US, LLP, as required by Public Company Accounting Oversight Board (PCAOB) Auditing Standard No. 16, Communication with Audit Committees (as modified or supplemented).

The Audit Committee has considered the compatibility of non-audit services provided by Baker Tilly US, LLP with the maintenance of QNB's registered public accounting firm's independence. Baker Tilly US, LLP has provided written disclosures and a letter required by the applicable requirements of the PCAOB regarding its firm's communications with the Audit Committee concerning independence. These disclosures have been reviewed by the Audit Committee and discussed with management and Baker Tilly US, LLP.

The Committee discussed with QNB's internal auditors and Baker Tilly US, LLP the overall scope and plans for their respective audits, and met with both firms, with and without management present, to discuss the results of their examinations, their evaluations of QNB's internal controls and the overall quality of QNB's financial reporting process.

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors (and the Board has approved) that the audited consolidated financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2021, for filing with the SEC.

Respectfully submitted,

THE AUDIT COMMITTEE

Scott R. Stevenson

Autumn R. Bayles

Laurie Bergman

Thomas J. Bisko

Ranajoy Ray-Chaudhuri

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of the Independent Registered Public Accounting Firm

The Audit Committee has a policy for the pre-approval of services provided by the independent registered public accounting firm. The policy requires the Audit Committee to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit related services, tax services, and other services. Under the policy, pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is subject to a specific budget. In addition, the Audit Committee may also pre-approve particular services on a case-by-case basis. The Audit Committee has delegated to the Chairperson of the Audit Committee authority to pre-approve services not prohibited by law to be performed by our independent registered public accounting firm and associated fees up to a maximum for any one service of $5,000. All of the services related to the Audit Related Fees, Tax Fees, and All Other Fees described below were approved by the Audit Committee pursuant to the pre-approval provisions set forth in applicable rules issued by the SEC and the Audit Committee’s pre-approval policy.

14

Audit Fees, Audit Related Fees, Tax Fees, and All Other Fees

Baker Tilly US, LLP was QNB’s independent registered public accounting firm for 2021 and 2020.

The following table shows the fees paid by the Corporation in 2021 and 2020 for the audit and other services provided by Baker Tilly US, LLP for those years:

|

|

|

2021 |

|

|

2020 |

|

||

|

Audit fees |

|

$ |

222,860 |

|

|

$ |

217,450 |

|

|

Audit related fees |

|

|

15,517 |

|

|

|

11,292 |

|

|

Audit and audit related fees |

|

|

238,377 |

|

|

|

228,742 |

|

|

Tax fees |

|

|

— |

|

|

|

— |

|

|

All other fees |

|

|

— |

|

|

|

— |

|

|

Total fees |

|

$ |

238,377 |

|

|

$ |

228,742 |

|

Audit Fees include professional services rendered for the audit of QNB’s annual consolidated financial statements and internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, comfort letters, consents, quarterly reviews and consultations concerning financial accounting and reporting standards arising during the audits and statutory and regulatory audits (i.e., attest services required by FDICIA or Section 404 of the Sarbanes-Oxley Act), including out-of-pocket expenses.

Audit Related Fees include assurance and related services related to the performance of the audit of the employee benefit plan and to the dividend reinvestment and stock purchase plan.

Tax Fees include fees billed for the preparation of state and federal tax returns and assistance with calculating estimated tax payments.

All Other Fees would include fees billed for products and services other than the services reported under the Audit Fees, Audit Related Fees, or Tax Fees sections of the table above.

A representative of Baker Tilly US, LLP is expected to be available at the Annual Meeting. The representative will have an opportunity to make a statement and be available to respond to appropriate questions.

15

EXECUTIVE AND DIRECTOR COMPENSATION

Compensation Discussion and Analysis

QNB’s executive compensation program includes compensation and benefit components typical of programs among comparable banking and financial service companies in our local and regional marketplace.

Objectives

QNB’s success is dependent upon its ability to attract and retain highly qualified and motivated executives. QNB endorses the philosophy that executive compensation should reflect QNB’s performance and the contribution of such officers to that performance. Our executive compensation program is designed to support QNB’s core values, strategic objectives and financial goals as established by the Board. Moreover, our compensation philosophy is intended to align the interests of management with those of our shareholders through equity-based plans.

Program Management

The Compensation Committee of the Board of Directors has primary responsibility for the design and administration of the executive compensation program for directors and executive officers of QNB, including the Chief Executive Officer. It reviews the executive compensation program throughout the year considering changing organization needs and operating conditions and changing trends in industry practice. In addition, the Committee, in consultation with the Chief Executive Officer, considers and reports to the Board regarding employee or executive succession matters.

The Compensation Committee is responsible for recommending compensation-related decisions to the Board of Directors for final approval. The performance of Mr. Freeman, the Chief Executive Officer, is reviewed semi-annually by the full Board. The results of these appraisals are used by the Compensation Committee in its recommendation of annual pay adjustments and other elements of compensation for Mr. Freeman to the Board of Directors for its consideration.

Role of Executive Officers in Executive Compensation

In formulating its recommendations for the named executive officers other than Mr. Freeman, the Compensation Committee will consider information provided by Mr. Freeman related to subordinate executives.

Elements of Executive Compensation

Factors the Compensation Committee considered in analyzing compensation include:

|

|

• |

Total compensation; |

|

|

• |

Internal pay equity; and |

|

|

• |

The competitive environment for recruiting executive officers, and what the relevant competitors pay. |

We compensate our executive management through a mix of base salary, bonus and equity compensation designed to be competitive with comparable employers and to align management's incentives with the long-term interests of our shareholders. At the senior-most levels, we design the incentive compensation to reward company-wide performance through tying awards primarily to earnings per share growth.

The key components of QNB’s executive compensation consist of:

|

|

• |

Base salary; |

|

|

• |

Cash incentive compensation; and |

|

|

• |

Equity compensation awards under the 2015 Stock Option Plan. |

16

|

|

Base Salary

The Compensation Committee offers competitive salaries in comparison to the market for currently employed executives in comparable positions in financial services institutions with similar asset size and operations. In determining base salaries, the Compensation Committee reviews a salary survey prepared by an independent third party who specializes in financial service institution compensation. The Compensation Committee also considers the executive's qualifications and experience, scope of responsibilities and future potential, the goals and objectives established for the executive, the executive's past performance, and internal pay equity.

Base salaries are adjusted annually and are in effect for the period January 1 through December 31. The Compensation Committee determines annual salary adjustments by evaluating the performance of QNB and of each named executive officer relative to both corporate and individual goals determined during a previous review.

The Compensation Committee met in October 2021 to review the performance of the named executive officers with the Chief Executive Officer to determine increases in base salary compensation for 2022. The Committee then met in executive session without the Chief Executive Officer to discuss his base salary for 2022. Base salaries for those executives that report directly to the Chief Executive Officer are subject to approval by the Chief Executive Officer and the Committee. The Chief Executive Officer’s salary is subject to approval by the Compensation Committee and the Board. The table below outlines the increases in base salary compensation for 2022 approved by the Compensation Committee:

|

Executive |

|

2022 Base Salary |

|

|

2021 Base Salary |

|

|

% Increase |

|

|||

|

Christopher T. Cattie |

|

$ |

223,650 |

|

|

$ |

213,000 |

|

|

|

5.00 |

% |

|

David W. Freeman |

|

|

551,565 |

|

|

|

525,300 |

|

|

|

5.00 |

% |

|

Janice McCracken Erkes |

|

|

312,900 |

|

|

|

298,000 |

|

|

|

5.00 |

% |

|

Scott G. Orzehoski |

|

|

284,550 |

|

|

|

271,000 |

|

|

|

5.00 |

% |

|

Dale A. Westwood |

|

|

190,050 |

|

|

|

181,000 |

|

|

|

5.00 |

% |

The increase for named executive officers was determined based on merit, as well as internal pay equity and compensation levels of similar positions at financial institutions with similar operations and asset size.

Cash Incentive Compensation

In 2015, the Compensation Committee, with Board approval, established a cash incentive plan to reward QNB employees for achieving annual financial objectives. The cash incentive plan is paid for meeting annual goals established by the Board for earnings per share (EPS) growth, and three-year average performance of return on average equity (ROAE) and return on average assets (ROAA), with the average calculation being built over the last three years. Finally, QNB’s five-year average performance of ROAE and ROAA, with the average calculation being built over five years commencing in 2015, was compared to peer group ROAE and ROAA. For 2021, QNB’s ROAE and ROAA was compared to peers’ for the nine months ended September 30, 2021. The 2021 peer group includes Mid-Atlantic publicly traded financial institutions with assets sizes between $1.0 billion and $2.0 billion. The 2020 and 2019 peer groups include Mid-Atlantic publicly traded financial institutions with assets sizes between $750 million and $1.5 billion. These pools included institutions headquartered in Pennsylvania, New Jersey, New York, and Maryland of fifty-four institutions in 2019, forty-six in 2020 and forty-three institutions in 2021.

17

The following table details the members of the peer groups for 2020 and 2021:

|

2020 Peer Group Institutions (Mid-Atlantic) |

|

2021 Peer Group Institutions (Mid-Atlantic) |

|

1st Constitution Bancorp |

|

1st Constitution Bancorp |

|

1st Summit Bncp Johnstown Inc. |

|

1st Summit Bncp Johnstown Inc. |

|

|

|

ACNB Corp. |

|

AmeriServ Financial Inc. |

|

AmeriServ Financial Inc. |

|

Bank of Utica |

|

Bank of Utica |

|

Berkshire Bancorp Inc. |

|

|

|

Capital Bancorp Inc. |

|

Capital Bancorp Inc. |

|

CB Financial Services Inc. |

|

CB Financial Services Inc. |

|

|

|

Chemung Financial Corp. |

|

Citizens & Northern Corp. |

|

Citizens & Northern Corp. |

|

Citizens Financial Services |

|

Citizens Financial Services |

|

|

|

Codorus Valley Bancorp Inc. |

|

Embassy Bancorp Inc. |

|

Embassy Bancorp Inc. |

|

Emclaire Financial Corp |

|

|

|

Empire Bancorp Inc |

|

|

|

ENB Financial Corp |

|

ENB Financial Corp |

|

|

|

ESSA Bancorp Inc. |

|

Evans Bancorp Inc. |

|

Evans Bancorp Inc. |

|

Fidelity D & D Bancorp Inc. |

|

Fidelity D & D Bancorp Inc. |

|

First Commerce Bank |

|

First Commerce Bank |

|

First Keystone Corp. |

|

First Keystone Corp. |

|

First United Corp. |

|

First United Corp. |

|

FNB Bancorp Inc. |

|

|

|

FNCB Bancorp Inc. |

|

FNCB Bancorp Inc. |

|

Franklin Financial Services |

|

Franklin Financial Services |

|

Greene County Bncp Inc. (MHC) |

|

Greene County Bncp Inc. (MHC) |

|

Harleysville Financial Corp. |

|

|

|

Kish Bancorp Inc. |

|

|

|

Lyons Bancorp Inc |

|

Lyons Bancorp Inc |

|

Malvern Bancorp Inc |

|

Malvern Bancorp Inc |

|

Marlin Bus. Services Corp. |

|

Marlin Bus. Services Corp. |

|

Meridian Corp. |

|

Meridian Corp. |

|

NorthEast Community Bncp (MHC) |

|

|

|

Norwood Financial Corp. |

|

Norwood Financial Corp. |

|

Orange County Bancorp Inc. |

|

Orange County Bancorp Inc. |

|

Parke Bancorp Inc. |

|

Parke Bancorp Inc. |

|

|

|

Partners Bancorp |

|

Pathfinder Bancorp Inc. |

|

Pathfinder Bancorp Inc. |

|

PCSB Financial Corp. |

|

PCSB Financial Corp. |

|

PDL Community Bancorp |

|

PDL Community Bancorp |

|

|

|

Penns Woods Bancorp Inc. |

|

Pioneer Bancorp (MHC) |

|

Pioneer Bancorp (MHC) |

|

Prudential Bancorp Inc. |

|

Prudential Bancorp Inc. |

|

Rhinebeck Bancorp Inc (MHC) |

|

|

|

Riverview Financial Corp. |

|

Riverview Financial Corp. |

|

Severn Bancorp Inc. |

|

|

|

Shore Bancshares Inc. |

|

Shore Bancshares Inc. |

|

Solvay Bank Corp. |

|

|

|

Somerset Trust Holding Company |

|

Somerset Trust Holding Company |

|

Standard AVB Financial Corp. |

|

|

|

The Adirondack Trust Company |

|

The Adirondack Trust Company |

|

The Bank of Princeton |

|

The Bank of Princeton |

|

|

|

The Community Financial Corp. |

|

|

|

Unity Bancorp Inc. |

18

The plan provides for a cash incentive for named executive officers of up to 24% of their base salaries. The cash incentive payout is calculated annually, and payout occurs within two months following fiscal year-end. The purpose of the plan is to motivate named executives to achieve financial goals that have a positive impact on QNB’s stock price and therefore increase shareholder value.

QNB’s financial targets and incentive payouts under the cash incentive plan set by the Compensation Committee are as follows:

|

|

|

|

|

Threshold |

|

Moderate |

|

Excellent |

|

Optimum |

|

Part 1 |

|

One-year earnings per share (EPS) growth |

|

|

|

|

|

|

|

|

|

|

|

Goal |

|

5% |

|

6% |

|

7% |

|

8% |

|

|

|

Potential bonus payout |

|

2.00% |

|

4.00% |

|

6.00% |

|

8.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 2 |

|

Three-year return on average equity (ROAE) performance |

|

|

|

|

|

|

|

|

|

|

|

Goal |

|

9% |

|

10% |

|

11% |

|

12% |

|

|

|

Potential bonus payout |

|

1.00% |

|

2.00% |

|

3.00% |

|

4.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three-year return on average assets (ROAA) performance |

|

|

|

|

|

|

|

|

|

|

|

Goal |

|

0.84% |

|

0.92% |

|

1.00% |

|

1.08% |

|

|

|

Potential bonus payout |

|

1.00% |

|

2.00% |

|

3.00% |

|

4.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 3 |

|

Five-year peer group ROAE |

|

|

|

|

|

|

|

|

|

|

|

Goal |

|

95%-105% of peers |

|

|

|

|

|

>105% of peers |

|

|

|

Potential bonus payout |

|

2.00% |

|

|

|

|

|

4.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Five-year peer group ROAA |

|

|

|

|

|

|

|

|

|

|

|

Goal |

|

95%-105% of peers |

|

|

|

|

|

>105% of peers |

|

|

|

Potential bonus payout |

|

2.00% |

|

|

|

|

|

4.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Bonus Payout Potential |

|

8.00% |

|

12.00% |

|

16.00% |

|

24.00% |

At its January 2022 meeting, the Board of Directors approved the calculation of 2021’s cash incentive compensation program measures. QNB met the optimum level in Part 1 in the table above, with a one-year earnings per share growth at 35.67%. QNB met Part 2 three-year average ROAA at 0.99% and three-year ROAE at 10.84% at the Moderate level payout. QNB’s average ROAE and ROAA for the nine months ended September 30, 2021, and twelve months in 2020, 2019, 2018, and 2017 were 10.66% and 0.97%, respectively. QNB’s average ROAE was 105.50% of the peer group average ROAE and average ROAA was 118.49% of the peer group average ROAA, both meeting the Optimum level as detailed in Part 3 of the table above. As a result, an aggregate cash incentive paid to the named executive officers was equivalent to 20.00% of their base salary.

The amounts paid under the cash incentive plan for 2021 are reflected in the Summary Compensation Table.

Long-Term Incentive Compensation

The named executive officers are eligible to participate in a long-term incentive award plan established to focus executive efforts on the strategic directions and goals of QNB and to reward them for their successes in these areas. The 2015 Stock Incentive Plan (the Plan) was approved by the shareholders at the 2015 Annual Meeting of Shareholders. The purpose of the Plan is also to provide ownership incentive to the executive officers and align their interests with the interests of shareholders. In establishing award levels, equity ownership levels of the recipients or prior awards that are fully vested are not considered.

19

The Plan is administered by the Compensation Committee. The Plan provides for the granting of either (i) nonqualified stock options or (ii) incentive stock options. The exercise price of an option, as defined by the Plan, is the fair market value of QNB’s common stock on the date of grant.

The Compensation Committee determines the type of grant, the number of shares of common stock subject to a particular grant and the vesting period for such grants. To date, options granted under the Plan have a three-year vesting feature. The Compensation Committee determines the number of options granted in total and to Mr. Freeman, individually. Mr. Freeman determines the allocation of the remaining grants among eligible employees. Ms. Westwood is expected to retire prior to the vesting of the 2022 grants. Excluding, Ms. Westwood, the fair value of the stock options granted represented between 2.0% and 4.9% of named executive officers’ base salaries in 2022.

Post-Retirement Plans

QNB provides a qualified retirement plan to all employees, including the named executive officers. The QNB Bank Retirement Savings Plan provides for elective employee contributions up to the maximum allowed by the IRS and a matching company contribution limited to three percent of total compensation. In addition, the plan provides for safe harbor non-elective contributions of five percent of total compensation by QNB. To be eligible to participate, employees must have completed six months of service.

During 2001, QNB purchased Bank Owned Life Insurance (BOLI) for officers of the Corporation. A split-dollar agreement provides the employee’s beneficiary a portion of the death proceeds under the BOLI equal to two times their current base salary. Under this plan vesting occurs when the employee reaches age 55 and has a combined age and years of service of 70. When vested, the insurance would become portable to the participant after they are no longer in service with the Bank either through termination or retirement thereby creating the post-retirement benefit. Mr. Orzehoski is the only named executive officer that is insured through BOLI.

Health and Welfare Benefits

The named executive officers participate in the Corporation’s qualified health and welfare benefits program on the same terms and conditions as all other salaried employees.

Perquisites and Other Benefits; Agreements

Perquisites received by the named executive officers are reviewed annually. The primary perquisite received by Mr. Freeman is the reimbursement of country club dues. Certain executive officers are encouraged to belong to a golf or social club to provide the appropriate entertainment forum for customers and appropriate interaction with the communities served by QNB.

Certain members of senior management are parties to change in control agreements with the Corporation. Executive management and other employees have built QNB into a successful enterprise, and the Board believes that it is important to protect them in the event of a change in control. Further, it is our belief that the interests of shareholders will be best served if the interests of our executive management are aligned with them, and providing change in control benefits should eliminate, or at least reduce, the reluctance of executive management to pursue potential change in control transactions that may be in the best interests of shareholders.

Future Compensation Determination

The committee will continue to reassess QNB’s executive compensation program to ensure that it promotes the long-term objectives of QNB, encourages growth in shareholder value and attracts and retains top-level executives.

Tax Considerations