[SunTrust Letterhead]

January 9, 2008

VIA EDGAR

Securities and Exchange Commission

Division of Corporation Finance

Mail Stop 4561

100 F Street, N.E.

Washington, D.C. 20549

| Attention: Sharon |

Blume |

Reviewing Accountant

| Re: |

SunTrust Banks, Inc. (file no. 1-08918) |

Form 10-K for the year ended December 31, 2006

Form 10-Q for the quarter ended March 31, 2007

Form 10-Q for the quarter ended June 30, 2007

Form 10-Q for the quarter ended September 30, 2007

Dear Ms. Blume:

We have set forth below our responses to the comments of the Securities and Exchange Commission (the “Commission”) staff (the “Staff”) in the letter from the Staff dated December 20, 2007, concerning the SunTrust Banks, Inc. (the “Company”) Form 10-K for the year ended December 31, 2006, Form 10-Q for the quarter ended March 31, 2007, Form 10-Q for the quarter ended June 30, 2007, and Form 10-Q for the quarter ended September 30, 2007. Our responses to each of the Staff’s specific comments follow the Executive Summary. For your convenience, we have listed the responses in the same order as the Staff’s comments were presented and have repeated each comment in bold face type prior to our response. We welcome the opportunity to further explain the rationale behind our adoption, as well as gain insight into potential additional disclosures the Staff may feel would add additional transparency.

Executive Summary

Prior to providing you with our responses to each comment, we have provided in this Executive Summary a comprehensive explanation of the circumstances and thought process surrounding our decision to early adopt SFAS 157 and SFAS 159, as well as the financial instruments we elected to record at fair value pursuant to SFAS 159.

Business Environment

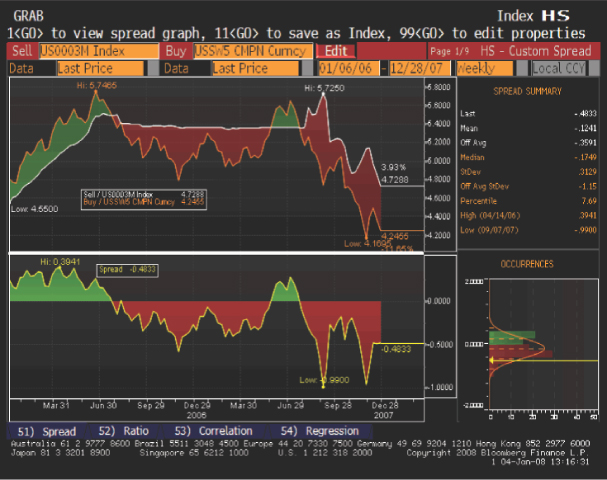

We discussed in “Adoption of Fair Value Accounting Standards” within Management’s Discussion and Analysis of our March 31, 2007 Form 10-Q the challenging business and economic environment that was impacting the Company in 2006 and early 2007. The persistent flat to inverted yield curve and difficulty growing customer deposits caused us to begin taking moderate balance sheet management related actions

SunTrust Banks, Inc.

January 9, 2008

Page 2

in 2006 to limit the growth of the balance sheet. These actions helped slow margin compression and improve liquidity, but as the challenging economic environment unexpectedly persisted into the first quarter of 2007 and the yield curve trended toward further inversion in mid-February, we recognized the need to take additional measures to improve our financial performance. See the Appendix for a summary of key economic and balance sheet performance metrics that depicts this challenging operating environment.

Comprehensive Review of Balance Sheet Management Strategies

During the second half of 2006, we had taken some measures to moderate the size of the balance sheet in response to the challenging business and economic environment. During the first quarter of 2007, we intensified our efforts by initiating a comprehensive review of our asset/liability management strategies. The overall premise of this review was to improve net interest margin, more efficiently deploy our capital, reduce credit exposure, and increase liquidity. We analyzed a variety of possible tactical asset/liability management actions to address this difficult operating environment and developed a plan of integrated actions that would strengthen our business and overall financial performance. One of the strategies that we began analyzing late in the first quarter in conjunction with our evaluation of SFAS 159 was reducing the size of our available for sale securities and mortgage loan portfolios and increasing the size of our trading assets, as a means to better align the duration of our assets and liabilities, improve liquidity, reduce interest rate and credit risk, and more efficiently utilize capital as a result of trading assets consuming less capital.

Inter-relationship of Asset Liability Management Strategies with Early Adoption Decision

The timing of the issuance of SFAS 159 coincided with the comprehensive review of our asset/liability management strategies in the first quarter of 2007. The objective of SFAS 159 of expanding the use of fair value was consistent with the balance sheet management strategies we were considering. Consequently, after the issuance of SFAS 159 on February 15, 2007, we began evaluating the specific provisions of the standard and the implications of early adopting SFAS 157 and SFAS 159. While our review of our asset/liability management strategies focused, in part, on reducing the available for sale securities and mortgage loan portfolios, our evaluation of the potential SFAS 159 adoption impacts also included all fixed rate debt and mortgage loans that were hedged under SFAS 133. Given the complexity of SFAS 157 and SFAS 159, our evaluation of the implications of these fair value standards to all facets of our business, especially in combination with the various balance sheet management initiatives we were evaluating, extended into late March 2007.

Preparation Leading to Decision to Early Adopt

Extensive analysis needed to be performed related to the asset/liability management strategies that we were evaluating. In addition, we had to gather additional information regarding how to interpret and apply the provisions of SFAS 157 and SFAS 159, including peer bank data, all of which required a significant amount of dedicated time. By mid-March, we had begun to hone our balance sheet management strategies. Our analysis concluded that, based on current market conditions, we needed to take incremental actions to reduce the size of the balance sheet and more effectively align the duration of our assets and liabilities in a capital efficient manner. With those objectives in mind, we determined that there was a strong business purpose to reduce the sizes of the available for sale securities and mortgage loan portfolios.

SunTrust Banks, Inc.

January 9, 2008

Page 3

In addition by mid to late March, we completed our initial review of the provisions of SFAS 157 and SFAS 159. Our analysis of the provisions of SFAS 157 and SFAS 159, coupled with discussions with our external auditors and peers, concluded that while the interpretations of how to apply these principles-based standards were likely to evolve over time, the objectives of SFAS 157 and SFAS 159 aligned with our recent balance sheet management strategies.

Broad and Consistent Use of Fair Value Option

In late March 2007, our Board approved early adoption of SFAS 157 and SFAS 159. We elected to apply the fair value option provisions of SFAS 159 to certain available for sale securities and mortgage portfolio loans, as well as to all of the fixed rate debt that was designated in qualifying fair value hedges pursuant to the provisions of SFAS 133. We opted to delay the fair value election to newly-originated mortgage loans held for sale that were also hedged under SFAS 133 until we had more time to address certain operational matters, which demonstrates the fluid nature of the decisioning process related to our SFAS 159 adoption efforts late into the first quarter of 2007. In the second quarter of 2007, we resolved those operational issues and began electing fair value on approximately 80% of newly-originated mortgage loans held for sale.

Subsequent to our adoption of SFAS 159, we have elected to record at fair value newly-issued fixed rate debt that we otherwise intended to hedge under SFAS 133. In addition, we have also continued to maintain a large and active trading assets portfolio. We believe that our election of the fair value option to multiple financial assets and financial liabilities, both at the time of early adoption and continuing throughout 2007, demonstrates our support of the standard’s objective and represented a meaningful change in the manner in which we manage the balance sheet.

Specific Rationale Related to Available for Sale Securities Election

With respect to the specific actions related to the available for sale securities, we elected to reclassify $15.4 billion of available for sale securities to trading as of January 1, 2007. In addition, we elected to reclassify to trading assets $600 million of similar securities that were purchased during the first quarter. We sold substantially all of these securities in the second quarter of 2007, and used the proceeds from the sales to (i) purchase approximately $7 billion of trading securities (i.e., Treasury bills) that satisfied our liquidity and customer collateral needs, (ii) purchase approximately $5 billion of available for sale securities, (i.e., 30-year fixed-rate mortgage backed securities) that were similar to the pre-existing securities that remained in available for sale, in order to extend the duration and improve the yield of the investment portfolio, and (iii) repay wholesale debt with the residual proceeds of approximately $4 billion. We also entered into interest rate derivatives with a notional of $13.5 billion to mitigate the fair value volatility of the securities we elected to reclassify to trading.

We believe that an entity is not in a substantially different economic position whether they decide to sell trading securities shortly after the reclassification of the available for sale securities or retain those securities in trading and hedge their positions. Regardless of the strategy followed, we believe that the underlying principle in SFAS 159 of expanding the use of fair value should be adhered to when addressing whether a transaction was a substantive use of the fair value option.

SunTrust Banks, Inc.

January 9, 2008

Page 4

As illustrated in the table below, we have significantly expanded our use of trading assets in connection with, and subsequent to, our adoption of SFAS 159. The following table references the significant quarterly activity in the total available for sale and trading portfolios:

| (in billions) Date/Activity |

AFS |

Trading Assets | ||||||||

| 1/1/07 |

$23.0 | $2.8 | ||||||||

| Purchases |

3.8 | 1.7 | ||||||||

| Transfer to fair value |

(16.0) | 15.8 | ||||||||

| Other activity, net |

- | 1.2 | ||||||||

| 3/31/07 |

$10.8 | $21.5 | ||||||||

| Purchases |

1.8 | 9.7 | ||||||||

| Sold, called, matured, repaid |

(0.2) | (17.8) | ||||||||

| Other activity, net |

0.3 | (0.4) | ||||||||

| 6/30/07 |

$12.7 | $13.0 | ||||||||

| Purchases |

0.4 | 1.0 | ||||||||

| Sold, called, matured, repaid |

(0.1) | (4.3) | ||||||||

| Other activity, net |

(0.1) | (0.1) | ||||||||

| 9/30/07 |

$12.9 | $9.6 | ||||||||

| Purchases |

0.6 | 2.6 | ||||||||

| Sold, called, matured, repaid |

(0.6) | (0.6) | ||||||||

| Other activity, net |

0.6 | (1.1) | ||||||||

| 12/31/07 |

$13.5 | $10.5 |

In addition to expanding the size of our trading assets, we also significantly altered the mix of our available for sale and trading securities portfolios. Specifically, we substantially reduced our exposure to commercial and residential mortgage backed securities and increased our holdings of U.S. government securities. We believe our adoption of SFAS 159 demonstrates substantive business purpose and meets the objectives of SFAS 159.

Other Than Temporary Impairment

We had the ability and intent to hold all available for sale securities to recovery as of March 1, 2007 and prior, including those ultimately transferred to trading in connection with our adoption of SFAS 159. Due to the timing of the issuance of SFAS 159 and the significant amount of analysis that needed to be done to determine if we could early adopt SFAS 157 and SFAS 159, it was very conceivable that we would decide not to early adopt SFAS 157 and SFAS 159.

The provisions of SFAS 159 permitted us to record selected financial assets and financial liabilities at fair value and recognize changes in fair value through earnings, allowing for more active hedging and/or trading of those assets and liabilities. This provision helped alleviate the accounting uncertainty surrounding what constituted other than temporary impairment or qualified as a “rare” transfer into trading.

The economic and business environment in the first quarter of 2007 was an unexpected continuation of the difficult conditions that were present in 2006. This caused us to take incremental actions to manage

SunTrust Banks, Inc.

January 9, 2008

Page 5

the balance sheet. The provisions of SFAS 159 aligned with our balance sheet management strategies by permitting the reclassification of available for sale securities to trading. Until we decided in late March to early adopt SFAS 159, we were unable to execute certain asset/liability management strategies related to the available for sale securities portfolio without potentially calling into question the available for sale classification of existing and possibly future acquisitions of available for sale securities. Prior to our evaluation of SFAS 157 and SFAS 159 and their inter-relationship with the balance sheet management strategies we were considering, we definitively had the intent and ability to hold these securities to recovery as we did not believe sales of available for sale securities in an unrealized loss position were a viable option. The issuance of SFAS 159 on February 15, 2007 provided the impetus to allow us to execute the repositioning strategies; however, a complete analysis around the details of a potential repositioning transaction did not occur until mid March.

Form 10-Q for the Fiscal Quarter Ended March 31, 2007

Item 1. Financial Statements

Notes to Consolidated Financial Statements

Note 12 – Fair Value page 24

| 1. |

We noted you elected to early adopt SFAS 159 effective January 1, 2007 for $15.4 billion of available for sale investment securities and transferred those securities to trading. Your disclosure further states that, subsequent to March 31, 2007, you sold substantially all of those securities and used the proceeds to purchase approximately $5.3 billion of new securities classified as trading. Please provide us with the following information regarding your election to early adopt SFAS 159 for your available for sale securities. |

| Comment A: |

The purpose of adopting SFAS 159 and electing the fair value option, specifically addressing reasons other than avoiding recognition of unrealized losses in income. |

Response

We elected to early adopt SFAS 159 in order to more accurately portray through earnings the changes in fair value of the available for sale securities that the Company determined to actively hedge and/or trade as part of its newly-formulated balance sheet management strategies. This presentation provided a more relevant and meaningful representation of those securities carried at fair value as it reflected through earnings how management was evaluating and measuring these financial instruments.

The persistent challenging economic environment, exacerbated by an uncertain outlook for meaningful improvement, intensified in early 2007, resulting in specific actions by the Company to actively manage its balance sheet. Namely, the prolonged and unprecedented inversion in the yield curve and continued shift in deposit preferences by customers to higher cost products resulted in further compression in net interest margin, increased the loan to deposit ratio, and increased our usage of wholesale funding. These factors accelerated our desire to alter the size and construct of the balance sheet (i.e., smaller loan and securities portfolios and larger trading assets). The decision to reduce the size of the available for sale securities portfolio and to increase the size of the trading portfolio occurred in March 2007, after completing a comprehensive analysis of our asset/liability management strategies based on business and economic conditions present at that time.

SunTrust Banks, Inc.

January 9, 2008

Page 6

Our adoption of SFAS 159 was driven by substantive business reasons that aligned with the objectives of SFAS 159. The classification in retained earnings of the after-tax unrealized loss related to the available for sale securities that were reclassified to trading assets was not a factor in our decision to early adopt SFAS 159 and to record the available for sale securities as trading assets. Our evaluation of the balance sheet initiatives to deploy specifically focused on the impact to run rate earnings, regulatory capital, risk-weighted assets, and return on equity. In addition, we evaluated the credit exposure related to these securities, ways to more efficiently maintain customer collateral, the improvement to liquidity by reducing the level of wholesale funding, the increase to net interest margin, and the increased usage of derivatives to manage duration and interest rate risk. Our focus was on assessing the long-term financial impact of the various balance sheet management strategies.

We also support the FASB’s decision to require transparent disclosures of the transition adjustment in the financial statements so that an investor could choose to make adjustments to an entity’s reported results. We believe our disclosures around our adoption and subsequent fair value related activities enabled investors to evaluate the financial impact at a more granular level.

In summary, the purpose of adopting SFAS 159 and electing to reclassify certain available for sale securities to trading assets was to reflect the recently developed business-driven strategy to significantly change the size and construct of the investment portfolio. Further, the use of the fair value option on other financial instruments demonstrates the extent of change that occurred at the end of the first quarter of 2007 to our asset/liability management approach. The criteria used to evaluate all of these strategies were based on financial analyses that centered on the long-term impact to SunTrust’s shareholders.

| Comment B: |

Tell us how your adoption of SFAS 159 is consistent with the objective of the standard as described in paragraph 1 in view of the restructuring transactions. |

Response

Based on our evaluation of SFAS 159 and the related commentaries, we interpreted an objective of SFAS 159 was to expand the use of fair value in a manner that more accurately portrays the economic or cash equivalent value of certain financial instruments that an entity is actively hedging or trading. Further, we believe an objective of the standard is to provide comprehensive and transparent disclosures. As discussed below, we believe our application of SFAS 159 was substantive and consistent with these objectives.

Expand Use of Fair Value Measurement

We have generally maintained the size of the available for sale securities portfolio subsequent to the completion of the repositioning transactions and have maintained a large and active trading securities portfolio. We recognize the attention received by some companies that sold securities at the beginning of the second quarter in which the fair value option was elected. A key and troubling

SunTrust Banks, Inc.

January 9, 2008

Page 7

aspect of some companies’ sales strategies was that the economic profile of the entity remained generally consistent after the completion of the sales strategy, as the proceeds from the sale were used to purchase similar securities that were not recorded at fair value through earnings, but were classified as available for sale. Such strategies appeared to be designed to achieve the accounting result of avoiding loss recognition through earnings, while at the same time not meeting the objective of SFAS 159 of expanding the use of fair value. We were cognizant of these issues and believe that our repositioning transactions differ significantly from those transactions. We generally identified entire classes of available for sale securities to reclassify to trading assets, which resulted in the size of our available for sale securities portfolio shrinking by approximately $12 billion, or 50%, the mix of available for sale securities being altered significantly, and the average size of our trading assets increasing and remaining at 4 to 5 times the 2006 average. In addition, we acquired additional trading securities throughout 2007, including approximately $2.6 billion of trading assets during the fourth quarter of 2007. Any security purchases during 2007 of securities similar to those reclassified to trading assets as part of our transition adjustment were classified as trading assets. Similarly, any security purchases of securities similar to those that we elected to keep in available for sale were classified as available for sale.

Our expanded use of fair value also extended to other financial instruments besides investment securities. During 2007, we elected to record at fair value (i) certain newly-issued fixed rate debt that we intended to otherwise hedge under SFAS 133 and (ii) approximately 80% to 85% of our newly-originated mortgage loans held for sale. Although, we sold substantially all of the $15.4 billion of available for sale securities that we elected to record at fair value, we continued to maintain an extensive level of financial instruments, including investment securities, at fair value, while significantly altering the size, construct, and economic profile of our balance sheet.

Comprehensive and Transparent Disclosures

The information disclosed in our Form 10-Q for each of the fiscal quarters of 2007 provides clear and transparent information about our rationale for adopting SFAS 159. We described the reasons for electing to record certain financial instruments at fair value, as well as the financial implications of this accounting treatment. We understand that given the elective nature of SFAS 159, transparent disclosures are a key component to allow investors to understand the impacts of the initial adoption and subsequent elections, as well as to enable better comparability.

In summary, we believe that our adoption efforts, in light of our restructuring activities, are consistent with the objective of expanding the use of fair value as described in paragraph 1 of SFAS 159. While we sold securities formerly designated as available for sale that were reclassified to trading in connection with our adoption, we generally used the proceeds to purchase either additional trading securities or additional available for sale securities that were consistent with those that were not reclassified under SFAS 159. In addition, as we have discussed in our quarterly filings during 2007 and elsewhere in this letter, our application of SFAS 159 has extended beyond our available for sale securities portfolio.

SunTrust Banks, Inc.

January 9, 2008

Page 8

| Comment C: |

Tell us how you determined which investment securities to account for under SFAS 159 and sell subsequent to March 31, 2007. |

Response

Two key factors were negatively impacting our ability to grow net interest income in 2006 and 2007. These factors were (i) a flat to inverted yield curve that persisted for an unprecedented length of time and continued into the first quarter of 2007 and (ii) our inability to grow customer deposits, particularly lower cost demand deposits. These factors manifested themselves in several ways. The 2006 earning asset growth of 8.0% was funded by a 4.1% growth in customer deposits with the remaining 3.9% funded entirely by higher cost wholesale deposits. As a result, our net interest margin declined 17 basis points during 2006. In response to this, we initiated in 2006 a series of systematic balance sheet management strategies designed to reduce reliance on wholesale deposits, including: securitizations and whole loan sales of student loan assets previously held on the balance sheet; secondary market sales of mortgage loans that would normally have been held in portfolio; and increased use of receive-fixed swaps in lieu of securities to manage our duration position without increasing the size of the balance sheet.

While the yield curve steepened some in December 2006 and January 2007, the yield curve was again strongly inverted by the end of February 2007. In response to this, we intensified our focus on balance sheet efficiency in terms of controlling both the absolute size of the balance sheet, as well as the risk weighting of assets for Tier 1 capital purposes. This evaluation resulted in additional incremental actions that included a structured asset sale of approximately $2 billion of corporate loans and $1.1 billion notional of receive-fixed interest rate swaps on floating rate commercial loans. More significantly, we conducted a comprehensive review and analysis of the securities and loan portfolios in light of the potential for early adoption of SFAS 159. This analysis identified several key opportunities to: 1) reduce balance sheet utilization and related wholesale funding, 2) reduce risk weighted assets for Tier 1 capital purposes, 3) reduce interest rate risk, 4) significantly reduce credit risk, 5) minimize redundancy between the securities portfolio and the mortgage loan portfolio, 6) increase the overall portfolio yield, and 7) maintain overall balance sheet duration.

The available for sale securities that we elected to reclassify to trading assets were generally entire classes of securities, whether in an unrealized gain or loss position. We elected to reclassify securities that we intended to actively trade or hedge based on our recently formulated asset/liability management strategies. The criteria used to select which types of individual securities to elect to transfer to trading securities was based on the yield, duration, and credit characteristics of the securities. Generally, we elected to reclassify available for sale securities that were lower yielding, shorter maturity, and that had greater credit risk. The securities that remained classified in available for sale are described further in our response to Comment D. By being able to reclassify certain available for sale securities to trading assets, we were able to take the following actions.

SunTrust Banks, Inc.

January 9, 2008

Page 9

Securities Held as Collateral for Deposits

Historically, SunTrust has used investment securities in the available for sale portfolio as collateral for public fund deposits and other accounts that require collateral. The comprehensive review of the securities portfolio that was performed in the first quarter of 2007 identified that this created a significant maturity mismatch between the deposits, which are shorter-term in nature, and longer-term maturity securities. In addition, this practice created significant interest rate risk from using fixed coupon longer-term securities to collateralize shorter-term deposits. Finally, risk weighted assets for Tier 1 capital purposes were unnecessarily increased by not using U.S. Government or U.S. agency securities as collateral for these deposits.

The fair value election allowed us to reclassify available for sale securities that were used for collateral to trading securities. We subsequently sold substantially all of these trading securities to reduce both the maturity mismatch and the interest rate risk relative to the deposits and purchased Treasury bills, which have a zero risk weighting and are most efficient from a regulatory capital perspective.

Reduction of Credit Risk

Through the end of the first quarter of 2007, we experienced a significant narrowing in the credit spread for corporate bonds. We recognized that continued spread tightening was unlikely and that credit spread widening was more likely. As a result, we designated generally all corporate bonds, CMBS, and CMO securities as trading and sold them, replacing them with Treasury bills and thereby changing the duration and credit profile of the investment portfolio. In doing so, we correctly anticipated and avoided much of the credit deterioration in our investment portfolio that has dominated the fixed income markets in the second half of 2007.

Eliminated Redundancy between Securities Portfolio and Mortgage Loan Portfolio

We recognized that there was a significant overlap between our mortgage loan portfolio and securities portfolio regarding 3-year, 5-year, and 7-year adjustable rate mortgages (“ARMS”). We determined that, because those products were naturally originated by our mortgage subsidiary, they were most appropriately held in the mortgage loan portfolio instead of the investment portfolio. In contrast, we determined that 10-year ARMS and 30-year mortgage backed securities were most appropriately held in the available for sale securities portfolio. As such, we designated generally all mortgage securities other than 10/1 ARMS and 30-year agency mortgage backed securities as trading assets and subsequently sold them and replaced them with Treasury bills. We then increased our 30-year U.S. agency mortgage backed securities classified as available for sale securities to replace the portfolio duration that had been eliminated by the movement of securities to trading assets and to increase the overall yield on the available for sale securities portfolio.

Use of Receive-Fixed Swaps for Duration Management Purposes

Historically, we have principally managed the overall duration of the balance sheet by increasing the securities in the available for sale securities portfolio. Subsequent to moving securities to trading assets, we have increased the use of receive-fixed swaps for duration management purposes in lieu of adding securities and avoided increases in both the absolute size of the balance sheet and the risk weighted assets of the balance sheet.

SunTrust Banks, Inc.

January 9, 2008

Page 10

In summary, SFAS 159 enabled us to engage in a fundamental bifurcation and reconstruction of the investment portfolio that: a) appropriately used trading securities as collateral for shorter-term deposits, b) reduced the credit risk, risk weighting, and overall size of the available for sale securities portfolio, c) reduced the reliance on wholesale funding in an inverted yield curve environment, d) maintained a similar balance sheet duration, and e) increased the yield on the available for sale securities portfolio. The specific information included in our responses to Comments D, E, F, and G illustrates, by security type, specific characteristics of the securities that were reclassified from available for sale under SFAS 159 and sold and those that remained in available for sale.

| Comment D: |

Quantify by type or class the number and percentage of securities sold subsequent to March 31, 2007 to the total outstanding portfolio at December 31, 2006 and March 31, 2007. |

Response

We have provided the information requested in “Attachment to Comment D.” We wish to clarify that we provided the “book value” of securities by type in addition to the number of securities, which was the Staff’s specific request. We believe book value, which we have defined as the amortized cost, is a meaningful measure of the relative size of our holdings.

With respect to the total portfolio as of December 31, 2006, we have defined that to be the total available for sale securities portfolio, excluding our ownership in common stock of The Coca-Cola Company (“Coke”). With respect to the total portfolio as of March 31, 2007, we have defined that to be the combination of the available for sale securities portfolio, excluding our Coke stock, plus the trading assets in which fair value was elected. We believe that these available for sale and trading securities need to be combined in order to appropriately address the Staff’s comment because it provides the applicable population of securities from which fair value option could have been elected. You will note in the Attachment to Comment D that we have provided comments as to why securities within similar classes were not sold. In general, the securities that remained in available for sale were securities with minimal credit or interest rate risk which we did not intend to actively trade or hedge due to various legal or business restrictions associated with these securities.

| Comment E: |

Quantify by type or class the unrealized losses of securities sold subsequent to March 31, 2007 to total unrealized losses in the outstanding portfolio as of December 31, 2006 and March 31, 2007. |

Response

We have provided the information requested in “Attachment to Comment E.” We have also defined the December 31, 2006 and March 31, 2007 securities portfolios consistently with our response to Comment D. We have defined the unrealized gains or losses as the difference between the securities’ amortized cost and fair value, regardless of whether the security is classified as available for sale or trading.

SunTrust Banks, Inc.

January 9, 2008

Page 11

| Comment F: |

Describe the type, maturity and credit characteristics of those securities sold subsequent to March 31, 2007 for which you elected to account for on a fair value basis upon the adoption of SFAS 159. |

Response

We have provided the information requested in “Attachment to Comment F.” In addition to the information the Staff requested, we provided the book value and unrealized gains and losses of these securities in order to illustrate the relative size of our holdings by security type. All of the information is based on information as of December 31, 2006. There are multiple ways to describe the credit characteristics of a securities portfolio. We believe information related to the portfolio’s yield, regulatory capital risk weighting, collateral, and credit rating provide an accurate description of the securities’ credit characteristics. With respect to the Staff’s request for this information based on “securities sold”, we provided the information based on all securities in which fair value was elected. As we noted in our Form 10-Q filings, substantially all of the $15.4 billion in securities in which fair value was elected were subsequently sold; however, there were a small number of securities that were not sold. We were not able to readily separate the information provided in our response based on sold versus not sold. We believe it relevant and responsive to the Staff’s comment to provide the information on a fair value elected versus not fair value elected basis, especially in light of Comment G, which specifically asks about securities in which fair value was not elected.

| Comment G: |

Describe the type, maturity and credit characteristics of those securities for which you did not elect to account for on a fair value basis upon the adoption of SFAS 159. |

Response

We have provided the information requested in “Attachment to Comment G.” In addition to the information the Staff requested, we have also included the book value and unrealized gains and losses of these securities in order to illustrate the relative size of our holdings by security type. All of the information is based on information as of December 31, 2006. There are multiple ways to describe the credit characteristics of a securities portfolio. We believe information related to the portfolio’s yield, regulatory capital risk weighting, collateral, and credit rating provide an accurate description of the securities’ credit characteristics.

You will note in comparing the attached information related to Comment F and Comment G that generally entire classes of securities were transferred to trading assets. As discussed further in our response to Comment D, the similar securities that remained classified as available for sale were generally retained due to business or legal restrictions associated with these securities. In addition, the yield and duration on certain securities retained in available for sale were attractive relative to current market conditions, and we believed that retaining these securities in available for sale was consistent with our asset/liability management objectives.

SunTrust Banks, Inc.

January 9, 2008

Page 12

| Comment H: |

Tell us whether the securities purchased with proceeds from the sale of the above referenced securities are the same or have similar characteristics (i.e., similar instruments or similar risk characteristics) to those previously sold. |

Response

The securities purchased and classified as either available for sale securities or trading assets were different from the securities sold in connection with our restructuring transaction in terms of type, maturity, yield, and risk characteristics. The type and characteristics of the securities sold are described more fully in Comment F. Generally, these securities represented highly-rated commercial and residential mortgage backed securities and corporate bonds with an average yield of approximately 4.6%. Approximately 45% of these securities were floating rate. The risk weighting of these securities for Tier 1 capital purposes was primarily 20%.

The securities sold were replaced with approximately $7 billion of Treasury bills (classified as trading assets) and approximately $5 billion of 30-year fixed rate mortgage backed securities (classified as available for sale securities). The remaining proceeds, approximately $4 billion, were used to repay wholesale funding. The Treasury bills have an average yield of approximately 5.0% and a 0.2 weighted average life. The risk weighting of these securities for Tier 1 capital purposes is less than 1%. The 30-year fixed rate mortgage backed securities have an average yield of approximately 5.6% and a risk weighting for Tier 1 capital purposes of 20%.

The trading portfolio has been used primarily for shorter-duration, lower yielding, high quality assets that are used to secure public fund deposits and customer-driven repurchase agreements. Since these customer liabilities have short durations and re-price frequently, shorter-duration trading assets are an effective asset/liability match. The available for sale securities met our ALCO objectives of improving yield, extending duration, and enhancing the credit quality of the available for sale securities portfolio.

Subsequent to our adoption of SFAS 159, we continue to classify purchases of securities as either available for sale or as trading assets consistent with the criteria employed upon adoption, which is consistent with our recent ALCO objectives. Additionally, we have significantly increased our trading assets from an average of $2.1 billion in 2006 to an average of $13.2 billion in 2007, and we significantly reduced our available for sale securities from an average of $24.4 billion in 2006 to an average of $11.3 billion in 2007.

In summary, we fundamentally changed the construct of our available for sale and trading securities portfolios as evidenced by the characteristics (i.e., yield, maturity, collateral, credit exposure, etc.) of those portfolios, upon and subsequent to adoption of SFAS 159. This fundamental change resulted in the economic profile of our available for sale and trading portfolios more closely aligning with our current ALCO strategies.

SunTrust Banks, Inc.

January 9, 2008

Page 13

| Comment I(1): |

Provide us a timeline of the facts and circumstances related to your decision to sell the above referenced securities. Include all important meetings and explain the actions taken during the decision making process. |

Response I(1)

While the Staff’s comment focuses on the timeline and facts and circumstances related to our decision to sell specific securities, we believe that it is important to also describe the timeline and facts and circumstances around our decision to early adopt SFAS 157 and SFAS 159, as that decision was inextricably linked to the decision to sell the specific securities. Upon the issuance of SFAS 157 in September 2006, we began evaluating its provisions with the goal of evaluating the pertinent SAB 74 disclosures to be included in the December 31, 2006 Form 10-K. However, at this time, we had not performed any focused evaluations of the draft provisions of SFAS 159. Given the timing of the release of SFAS 159, our early adoption evaluation efforts around both fair value standards began in earnest in mid-February and continued through late March.

| · |

December 2006 through April 2007 – Monthly ALCO Meetings |

The Asset/Liability Management Committee (“ALCO”) is comprised of members from senior management and is chaired by our CFO. Meeting materials are primarily prepared by the Treasury department. During the December through April meetings, ALCO reviewed a variety of information related to general economic conditions and the performance of our balance sheet. Specific topics included net interest income and margin, duration gap, duration of equity (“DOE”), liquidity, investment and trading portfolio statistics, and capital. The December through March meetings made no mention of the portfolio repositioning transactions that we executed in connection with our adoption of SFAS 159. The materials from these meetings referenced maintaining the target size of the available for sale securities portfolio within a 3% band of $23 billion, while re-investing cash flows in longer duration securities to increase yield and DOE. The anticipated impact of the portfolio repositioning strategy was reviewed at the April ALCO meeting.

| · |

Early February – Commenced Discussions around SFAS 157 and SFAS 159 with Ernst & Young |

Given the issuance of SFAS 157 and the impending issuance of SFAS 159, we began to discuss various implementation considerations with Ernst & Young, including their National Office experts to gain a better understanding of the expectations for the final standard, emerging guidance, and interpretations. These discussions continued throughout the first quarter as our analysis focused on more specific matters.

SunTrust Banks, Inc.

January 9, 2008

Page 14

| · |

February 13, 2007 – Launch of Project to Analyze SFAS 157 and SFAS 159 |

A communication was distributed to a broad working team in finance, as well as certain of our lines of business to request their assistance in evaluating more thoroughly the implications of SFAS 157 and SFAS 159 so that we would be able to make a decision on whether to early adopt the standards by late March. While the final SFAS 159 had not been issued, we were aware of the significant implications that both standards would have on operations, systems, and disclosures; therefore, it was appropriate for this team to begin evaluating a variety of financial scenarios, as well as perform a readiness assessment of early adoption. Based on our initial understanding of SFAS 157 and SFAS 159, a significant amount of work (i.e., scope, analysis, education, operational, etc.) needed to be performed in order to be in a position to evaluate our readiness to early adopt SFAS 157 and SFAS 159.

| · |

February 15, 2007 – Issuance of SFAS 159 |

With the release of the final standard, internal meetings continued over the following several weeks with various constituents within the Company to further evaluate the specific requirements of SFAS 159 and evaluate our desire and readiness to early adopt SFAS 157 and SFAS 159.

| · |

March 1, 2007 – Filing of our Form 10-K |

We disclosed in the “Securities Available for Sale” section of Management’s Discussion and Analysis that we “managed the portfolio in 2006 with the goal of continuing to improve yield while reducing the size to partially fund loan growth and reduce the Company’s use of wholesale funding. Consistent with this goal, the Company restructured a portion of the investment portfolio during the latter half of 2006”. We further disclosed that we continue “to monitor economic and Company specific performance in order to determine if incremental balance sheet management tactics are appropriate”. We indicated in this section of the 10-K that we review “all securities with unrealized losses for impairment at least quarterly. As of December 31, 2006, the Company has the ability and intent to hold the remaining securities with unrealized losses to recovery”.

In Note 1 “Accounting Policies” of the Notes to the Consolidated Financial Statements, we disclosed that we are “currently evaluating the impact of SFAS 159 and determining if early adoption of both SFAS 157 and SFAS 159 is appropriate”. At March 1, we were not in a position to provide more specific disclosures regarding the possible impacts of early adopting SFAS 157 and SFAS 159. At this point in the process, we were clearly not able to decide whether we would early adopt SFAS 159 as our detailed analysis of the standard and its implications was still in its early stages.

| · |

March 2007 – Review of Potential Balance Sheet Management Strategies |

The challenging economic environment unexpectedly continued into the first quarter of 2007. The Company evaluated a variety of measures to help manage the balance sheet, including the potential repositioning of the investment portfolio. The analysis was at an exploratory level in early March and became more specific later in March.

SunTrust Banks, Inc.

January 9, 2008

Page 15

| · |

March 21, 2007 – Meeting with Audit Committee Chair and Ernst & Young |

The purpose of the meeting was to inform our Audit Committee Chair of the balance sheet management strategies that we had been reviewing and describe how SFAS 159 complimented those strategies. We discussed the purpose of the balance sheet evaluation that the Company was performing and explained how the current economic environment was creating a need for the Company to take greater action to restructure the balance sheet. We emphasized that the objective of any restructuring of the balance sheet was to provide lasting and sustainable value to SunTrust’s shareholders. We provided background information regarding SFAS 159 and explained how the objectives of this standard aligned with our balance sheet management strategy. We provided some financial analysis regarding the impact of the balance sheet restructuring initiatives; however, no attention was given to how the transition adjustment upon adoption would be recorded in the financial statements other than to indicate that it would be reported in retained earnings. In addition, the financial analysis included references to a variety of financial measures, including EPS but in the context of run rate earnings as a result of the restructuring actions. We also discussed the various risks to the balance sheet management strategies, including the accounting risk from early adopting such a complex standard. No decisions were reached at the meeting.

| · |

March 22 and 23, 2007 – Spring COBAR Peer Bank Meeting |

Representatives from the COBAR institutions discussed various interpretations related to SFAS 157 and SFAS 159, as well as whether any of these institutions were intending to early adopt these standards. While the fiscal quarter-end was about a week away, the early adoption deadline was not until April 30, 2007; therefore, there was much discussion that indicated that the final decision around early adoption had not yet been made. There was no discussion from the meeting that caused us to derail our evaluation of early adopting the standards.

| · |

March 27, 2007 – Memo to the SunTrust Board of Directors Explaining the Purpose of the March 28, 2007 Board Meeting |

| · |

March 28, 2007 – SunTrust Board Meeting |

Similar to the March 21, 2007 meeting with the Audit Committee Chair, the purpose of this meeting was to explain the evaluation that had been done regarding various balance sheet management strategies and discuss the reasons for early adopting SFAS 157 and SFAS 159. At the conclusion of the meeting, the Board approved the decision to early adopt SFAS 157 and SFAS 159 and was supportive of the balance sheet management strategies.

| · |

March 28, 2007 – ALCO Approval of Securities Strategy |

Subsequent to the SunTrust Board meeting, Mark Chancy, CFO and Chairman of ALCO, approved the execution of the securities repositioning strategy. This approval included entering into $13.5 billion in notional amount of interest rate swaps intended to hedge a portion of prospective changes in fair value of the trading securities, along with the purchase of $7.0 billion of Treasury bills to be classified as trading securities and $5.0 billion of 30-year fixed rate mortgage-backed securities to be classified as available for sale. It also included authorization to sell securities beginning in the second quarter. Prior to this date, no sales or hedging activities had occurred related to the potential restructuring of the available for sale securities portfolio.

SunTrust Banks, Inc.

January 9, 2008

Page 16

| · |

April 16, 2007 – Quarterly Audit Committee Meeting, including the Review of First Quarter Earnings Release |

In addition to reviewing the results of the first quarter, we discussed the recent events related to certain institutions rescinding their decisions to early adopt SFAS 159. We discussed the specifics of our balance sheet management strategy and described how our actions differed from those institutions that had rescinded their early adoption decision. Ernst & Young was in attendance at this meeting.

| · |

April 17, 2007 – First Quarter Earnings Release |

Our disclosures in the earnings release included extensive detail regarding our adoption of SFAS 159 and the financial impact. Furthermore, given the heightened scrutiny in the marketplace of certain applications of SFAS 159, we increased our disclosures to emphasize the strong business purpose of our balance sheet management strategy. Specifically, Mark Chancy addressed the public perception regarding certain early adoption strategies by stating, “I want to make one last comment on the recent press and speculation related to some of the potential applications of these fair value standards. SunTrust’s use of the fair value standards has a substantive business purpose, and results in a real sea change in our balance sheet management strategies. The construct and economic position of our balance sheet is much different today than prior to our adoption of these standards, and we believe this type of use of fair value fits squarely within the standards’ objectives. Furthermore, we have been very transparent in our discussions today, and will be even more so in our 10-Q filing in May regarding the one-time, as well as longer term impact from our use of fair value”.

| · |

April 17, 2007 – Release of CAQ White Paper regarding SFAS 159 |

The CAQ issued Alert 2007-14, which was meant to provide additional clarification related to the early adoption of SFAS 159, specifically focusing on whether a company’s adoption of SFAS 159 is contrary to the objectives and principles of the standard. While this Alert was not supposed to provide new U.S. GAAP, it does conclude that a strategy where an entity elects to fair value certain underwater available for sale securities, subsequently sell those securities and not elect to fair value newly-purchased securities is a situation where the adoption was not substantive. It also acknowledged that the accounting related to other strategies could be less clear. In those cases, it outlined several considerations for management and their external auditors to assess in evaluating whether an entity’s application of SFAS 159 was consistent with the standard’s objectives, such as whether (i) the entity’s reasons for early adoption are consistent with the objectives of SFAS 159, including furthering the use of fair value in periods subsequent to adoption and (ii) sales of securities subsequent to adoption call into question prior intent and ability assertions. While we did not know in advance that this Alert was being issued, we were aware of discussions between the Commission and the public accounting firms. We had a reviewed publications that were circulating which provided accounting interpretations on the topic of adoption efforts related to available for sale securities. We had closely considered all of these factors and confirmed that our previous conclusions regarding our application of SFAS 159 were consistent with the standard’s objectives.

SunTrust Banks, Inc.

January 9, 2008

Page 17

| · |

May 4 and 7, 2007 – Form 10-Q Review by Disclosure Committee and Audit Committee |

On May 4, 2007, the Disclosure Committee met to discuss the disclosures included in the Form 10-Q. A similar meeting was held on May 7, 2007 with the SunTrust Audit Committee. At both meetings, the disclosures pertaining to early adoption of SFAS 157 and SFAS 159 were discussed. We described the extensive detail and transparent disclosures provided in the Form 10-Q that enable an investor to understand the rationale and financial impact of our early adoption and subsequent application of SFAS 159. Ernst & Young was in attendance at the May 7, 2007 Audit Committee meeting.

In summary, our decision to sell the securities reclassified to trading assets was linked to our decision to early adopt SFAS 159. Due to the February 15, 2007 issuance of SFAS 159, we had limited time to evaluate the implications of early adopting. Our adoption efforts were primarily focused on whether we could appropriately adopt the provisions of SFAS 157 and SFAS 159. An appropriate adoption included not only properly interpreting and applying the provisions of the standards, but also ensuring that all documentation, operational and control-related procedures could be completed. As such, our decision to early adopt and to hedge and sell securities was not made until March 28, 2007.

| Comment I(2): |

Tell us, in detail, how you considered whether you were required to record an other than temporary impairment charge related to available for sale securities in an unrealized loss position as of December 31, 2006 and March 31, 2007. Specifically tell us the basis for your conclusions that you had the intent and ability to hold these securities to the earlier of recovery of losses or maturity. |

Response I(2)

Determining whether an impairment of an available for sale security is other than temporarily impaired is highly judgmental, particularly for securities that have not experienced a significant decline due to deterioration in creditworthiness and the limited accounting guidance in this area. However, we considered the guidance in FSP FAS 115-1 and SAB 59 as the primary bases for our other than temporary impairment evaluation procedures. FSP FAS 115-1 and SAB 59 highlight that any number of factors may be used to evaluate whether a security is other than temporarily impaired, but SAB 59 identifies the following three factors as considerations for other than temporary impairment charges: (a) the length of the time and the extent to which the market value has been less than cost, (b) the financial condition and near–term prospects of the issuer, and (c) the intent and ability of the holder to retain its investment in the issuer for a period of time sufficient to allow for an anticipated recovery in market value. Our quarterly evaluation of other than temporary impairment is based on an individual security level review of our available for sale securities in order to identify those securities with (i) unrealized losses greater than $5 million, regardless of the time horizon over which the loss has accumulated, or (ii) unrealized losses for at least twelve months of greater than $1 million and 5% of its initial carrying value. We perform our detailed other than temporary impairment analysis one month in advance of each quarter end and update the evaluation as of quarter end for new purchases and significant changes in fair value.

SunTrust Banks, Inc.

January 9, 2008

Page 18

The other than temporary impairment analysis as of November 30, 2006 was performed on December 19, 2007. As of November 30, 2006, the available for sale debt securities that were in an unrealized loss position was comprised of approximately 1,110 securities, with a fair value of $16.1 billion and an unrealized loss of approximately $300 million. The unrealized losses in the available for sale securities portfolio as of November 30, 2006 had recovered from a twelve-month low in June 2006 of over $800 million, primarily due to a decrease in swap rates from over 5.5% in June to under 5% in November. No securities in the portfolio as of November 30, 2006 had unrealized losses of greater than $5 million. Of the positions with greater than $1 million in unrealized losses, only five had carried these losses for greater than twelve months, but none had a loss greater than 4%. We updated our analysis as of December 31, 2006 noting that no positions had unrealized losses greater than $1 million for greater than twelve months and for more than 5% of its initial carrying value. In addition, the credit quality of the securities was considered. None of the securities had been downgraded. We concluded that all of the securities were still highly rated by Moody’s and/or S&P and that the unrealized losses were due to interest rates that were forecasted to recover and were not credit issues.

The fair value of the available for sale securities portfolio that was in a loss position as of February 28, 2007 was $15.7 billion, with unrealized losses of approximately $250 million. Of the approximately 1,100 positions in this population, none of the positions had an unrealized loss greater than $5 million. Of the positions that carried an unrealized loss of greater than $1 million, none of these losses were in excess of 5% and only four of these securities had losses in excess of 4%. On March 28, 2007, we formally decided to adopt the provisions of SFAS 159. As we have discussed elsewhere in this letter, we reclassified $15.4 billion of securities, as of January 1, to trading assets. The Company updated its other than temporary impairment analysis as of March 31, 2007 noting that none of the securities remaining in the available for sale securities portfolio met our criteria for further review. Based on our review of the securities, we concluded that the securities were not other than temporarily impaired. The available for sale securities in an unrealized loss position as of March 31, 2007 recovered in value in April 2007.

The Company had the ability and intent to hold all impaired available for sale securities to recovery. There were no factors, such as contractual constraints, liquidity needs, or capital requirements that would impair our ability to hold these securities until recovery. Regarding our intent to hold these available for sale securities to recovery, ALCO is the governing body for determining if a change in intent has occurred. In 2005, we established guidelines pertaining to the type of events that could result in a change in intent to hold a security to recovery. These events relate to changes in the balance sheet, market, or general economic conditions. The occurrence of any of these events is not a de facto change in our intent; however, these events coupled with ALCO’s discretion, represent a potential change in intent.

ALCO continually reviews various repositioning and balance sheet management strategies, which is customary given the volatility in capital markets and the changing interest rate environment. The consideration of alternative balance sheet management tactics does not result in a change in intent to hold to recovery and thereby trigger an other than temporary impairment charge. SFAS 159 permits the reclassification of available for sale securities to trading assets in order to help achieve the FASB’s objective of expanded use of fair value. Without the ability to transfer securities out of available for sale, the objective of SFAS 159 would have been hindered by the provisions and interpretations of SFAS 115. SFAS 159 helped clarify the accounting interpretations related to transferring a security to trading. The issuance of SFAS 159 on February 15, 2007 allowed us to execute the repositioning transactions; however, a complete analysis around the details of a potential repositioning transaction, particularly at the individual security level as required by SFAS 115, was not completed until mid to late March.

SunTrust Banks, Inc.

January 9, 2008

Page 19

We are aware of the recent comments by the Staff related to other than temporary impairment. Specifically, that management should consider all factors that may impact an entity’s intent and ability to hold available for sale securities to recovery. We believe that our evaluations at December 31, 2006, which extended through the filing of our Form 10-K on March 1, 2007, and as of March 31, 2007 considered all relevant factors. We recognize that a change in intent does not always coincide with the decision to sell securities. The decision to sell specific securities did not occur until March 28, 2007, upon approval by the SunTrust Board. The change in intent was linked to the evaluation of SFAS 159, and the formulation of specific balance sheet management strategies. Neither of these reviews was completed until mid-March at the earliest, given the complex nature of SFAS 159 and its issuance on February 15, 2007, as well as the various balance sheet repositioning strategies that were under review. The early adoption transition provisions of SFAS 159 were unique in that SFAS 159 was not issued until February 15, 2007 but calendar year end companies had the ability to evaluate its provisions and not make a decision on early adoption, which was retroactive to January 1, 2007, until April 30, 2007. Our intent to hold securities to recovery changed upon management finalizing its evaluation of the available for sale securities portfolio and the Board approval to early adopt SFAS 159 on March 28, 2007. The early adoption transition provisions of SFAS 159 superseded any other than temporary impairment charges because, without the ability to transfer available for sale securities to trading, we would not have sold the securities out of available for sale.

In summary, our available for sale securities in an unrealized loss position were not other than temporarily impaired at December 31, 2006 and March 31, 2007. We considered relevant economic factors specific to each security, along with our overall intent and ability to hold these securities to recovery and determined that an other than temporary impairment charge was not warranted.

In connection with our response, the Company acknowledges that:

| · |

the Company is responsible for the adequacy and accuracy of the disclosure in the filings; |

| · |

Staff comments or changes to disclosure on response to Staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| · |

the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Please feel free to call the undersigned at (404) 813-1281 or Tom Panther at (404) 588-8585 with any questions concerning our responses to the Staff’s comments.

| Very truly yours, |

| /s/ Mark A. Chancy |

| Mark A. Chancy |

| Corporate Executive Vice President and Chief Financial Officer |

cc: Mr. M. Doug Ivester

Audit Committee Chairman

Mr. James M. Wells III

President and Chief Executive Officer

Mr. Raymond D. Fortin

Corporate Executive Vice President and

General Counsel

Mr. Thomas E. Panther

Controller and Chief Accounting Officer

Mr. David W. Leeds

Ernst & Young LLP, Coordinating Partner

Mr. Denis J. Duncan

PricewaterhouseCoopers LLP, Engagement Partner

Attachment to Comment D

| Analyzed Based on Book Value of Securities |

| December 31, 2006 | March 31, 2007 | |||||||||||||||||

| ($ in millions) | Book Value of KO |

Book Value of Sold |

Percent Sold |

Book Value of KO |

Book Value of Sold |

Percent Sold |

Comments regarding Securities in Similar Classes Which Were Not Reclassified to Trading Upon Adoption of FAS 159 | |||||||||||

| US Government Securities | $1,623.0 | $1,318.6 | 81% | $3,434.0 | $1,479.6 | 43% | The percent of securities sold decreased as a percent of the total portfolio from December 31 to March 31 due to purchase of $1.7 billion of Treasury Bills on March 26-28, 2007. US Government Securities which were not reclassified to trading include securities which were sold or matured during Q1 2007, which provide Community Reinvestment Act investment credit, or which were restricted for business purposes (i.e. RABBI Trust and SunTrust Life Insurance Accounts). | |||||||||||

| Municipal Bonds | 1,032.2 | - | 0% | 1,050.7 | - | 0% | Municipal bonds were not reclassified to trading upon adoption of FAS 159 as they are longer dated securities with irreplaceable fully tax equivalent yields and due to the number and size of securities were impractical to sell. | |||||||||||

| Mortgage Backed Security Passthroughs | 12,707.6 | 8,480.8 | 67% | 16,066.5 | 8,421.3 | 52% | The percent of securities sold decreased as a percent of the total portfolio from December 31 to March 31 due to purchase of $3.2 billion of 30 year fixed rate MBS Passthrough securities on March 28-30, 2007. Securities which were not reclassified to trading include securities that were sold, matured or factored down to less than $1 million during Q1 2007; FNMA Delegated Underwriter/Servicer (DUS) bonds that provide Community Reinvestment Act investment credit; bonds retained from SunTrust securitizations whose marketability is limited; 30 year fixed rate MBS; Adjustable Rate Mortgages with greater than 84 months to coupon reset; and securities which were restricted for business purposes (i.e. RABBI Trust, SunTrust Life Insurance, REIT and National Commerce Bank Service Inc. Accounts). | |||||||||||

| Collateralized Mortgage Obligations | 2,433.6 | 2,297.2 | 94% | 2,379.7 | 2,223.8 | 93% | Collateralized mortgage obligations which were not reclassified to trading include securities which were sold, matured or factored down to less than $1 million during Q1 2007; securities retained from SunTrust securitizations whose marketability is limited; and securities which were restricted for business purposes (i.e. RABBI Trust, SunTrust Life Insurance, REIT and National Commerce Bank Service, Inc. Accounts). | |||||||||||

| Commercial Mortgage Backed Securities & Multi-family Mortgage Backed Securities | 2,225.4 | 2,088.1 | 94% | 2,497.3 | 2,199.9 | 88% | Commercial Mortgage Backed Securities which were not reclassified to trading include GNMA multi-family mortgage backed securities that provide Community Reinvestment Act investment credit. | |||||||||||

| Asset Backed Securities | 1,128.0 | 805.9 | 71% | 1,122.5 | 811.7 | 72% | Asset Backed Securities which were not reclassified to trading include securities with irreplaceable floating rate ABS spreads and those securities which were restricted for business purposes (i.e. RABBI Trust and REIT Accounts). | |||||||||||

| Corporate Securities | 464.1 | 343.9 | 74% | 379.3 | 341.2 | 90% | Corporate Securities which were not reclassified to trading include securities which were sold or matured during the Q1 2007 or which were restricted for business purposes (i.e. RABBI Trust, SunTrust Life Insurance Accounts, STI Investment Management (Collateral) Inc. and Corcoran Holdings Accounts). | |||||||||||

| Other | 1,384.2 | - | 0% | 1,096.9 | - | 0% | Other equity securities (primarily Federal Reserve Bank stock, FNMA stock and FHLB stock); foreign debt securities and investments in mutual funds were not reclassified to trading. | |||||||||||

| Total Respective Securities Portfolio, ex. KO | $22,998.3 | $15,334.4 | 67% | $28,026.9 | $15,477.5 | 55% | ||||||||||||

Attachment to Comment D (continued)

| Analyzed Based on Number of Securities | ||||||||||||||||||

| December 31, 2006 | March 31, 2007 | |||||||||||||||||

| Number of Total KO |

Number of Securities Sold |

Percent Sold |

Number of AFS & Trading Securities, ex. KO |

Number of Securities Sold |

Percent Sold |

|||||||||||||

|

US Government Securities |

128 | 41 | 32% | 139 | 41 | 29% |

Note: The percent of the number of securities sold is lower than the book value of securities sold due to the retention of a significant number of small-dollar securities, as explained above. | |||||||||||

|

Municipal Bonds |

1,734 | - | 0% | 1,731 | - | 0% | ||||||||||||

|

Mortgage Backed Security Passthroughs |

1,320 | 353 | 27% | 1,291 | 353 | 27% | ||||||||||||

|

Collateralized Mortgage Obligations |

195 | 129 | 66% | 194 | 129 | 66% | ||||||||||||

| Commercial Mortgage Backed Securities & Multi-family Mortgage Backed Securities | 90 | 77 | 86% | 103 | 77 | 75% | ||||||||||||

| Asset Backed Securities | 71 | 34 | 48% | 64 | 34 | 53% | ||||||||||||

| Corporate Securities | 133 | 57 | 43% | 82 | 57 | 70% | ||||||||||||

| Other | 44 | - | 0% | 44 | - | 0% | ||||||||||||

| Total Respective Securities Portfolio , ex. KO | 3,715 | 691 | 19% | 3,648 | 691 | 19% | ||||||||||||

Attachment to Comment E

| December 31, 2006 | March 31, 2007 | |||||||||||||

| ($ in millions)

|

Total Net Unrealized

|

Net Unrealized Gains/(Losses) of

|

Total Net Unrealized

|

Net Unrealized

|

||||||||||

| US Government Securities |

($7.6 | ) | ($4.7 | ) | ($0.7 | ) | $0.3 | |||||||

| Municipal Bonds |

8.9 | - | 8.6 | - | ||||||||||

| Mortgage Backed Security Passthroughs |

(157.4 | ) | (161.6 | ) | (109.2 | ) | (117.7 | ) | ||||||

| Collateralized Mortgage Obligations |

(43.7 | ) | (39.4 | ) | (27.5 | ) | (25.0 | ) | ||||||

| Commercial Mortgage Backed Securities & Multi-family Mortgage Backed Securities | (5.2 | ) | (4.8 | ) | 1.1 | 0.3 | ||||||||

| Asset Backed Securities |

(15.7 | ) | (17.2 | ) | (14.7 | ) | (15.8 | ) | ||||||

| Corporate Securities |

(5.5 | ) | (4.5 | ) | (3.8 | ) | (4.0 | ) | ||||||

| Other |

4.9 | - | 0.7 | - | ||||||||||

| Total Respective Portfolio, ex. KO |

($221.3 | ) | ($232.2 | ) | ($145.5 | ) | ($161.9 | ) | ||||||

Attachment to Comment F

| Coupon | Credit | ||||||||||||||||||||||||||||

| Available For Sale Portfolio as of 12/31/2006 Fair Value Elected |

Book Value ($MM) |

Unrealized Gains/ (Losses) ($MM) |

Yield (%) | Average Tier 1 Capital (%) |

Weighted Average Life(1)/ Maturity(2) /Coupon Reset(3) (Years) |

Fixed | Floating | Corporate | Structured | US Government/ Agency |

Average Rating | ||||||||||||||||||

| US Government: | |||||||||||||||||||||||||||||

| Treasury Bills |

- | - | - | ||||||||||||||||||||||||||

| Treasury Notes |

$125.5 | $1.4 | 4.94 | % | 0% | 4.0 | (1 | ) | x | x | AAA | ||||||||||||||||||

| Agency Discount Notes |

- | - | - | ||||||||||||||||||||||||||

| Agency Debentures |

1,234.0 | (6.1 | ) | 4.57 | % | 20% | 3.8 | (1 | ) | x | x | AAA | |||||||||||||||||

| Total |

1,359.5 | (4.7 | ) | 4.60 | % | ||||||||||||||||||||||||

| Municipal Bonds | - | ||||||||||||||||||||||||||||

| Mortgage Backed Security Passthroughs: | |||||||||||||||||||||||||||||

| 1/1, 3/1, 5/1,7/1 Adjustable Rate Mortgage |

6,769.5 | (122.8 | ) | 4.41 | % | 20% | 7.0 | (3 | ) | x | x | x | AAA | ||||||||||||||||

| 10/1 Adjustable Rate Mortgage |

- | - | - | ||||||||||||||||||||||||||

| 15 Year Fixed Rate |

1,711.3 | (38.8 | ) | 4.59 | % | 20% | 15.0 | (2 | ) | x | x | x | AAA | ||||||||||||||||

| 30 Year Fixed Rate |

- | - | - | ||||||||||||||||||||||||||

| Total |

8,480.8 | (161.6 | ) | 4.45 | % | ||||||||||||||||||||||||

| Collateralized Mortgage Obligations: | |||||||||||||||||||||||||||||

| Fixed Rate |

2,288.8 | (39.5 | ) | 4.44 | % | 20% | 3.7 | (1 | ) | x | x | x | AAA | ||||||||||||||||

| Floating Rate |

8.4 | 0.1 | 6.00 | % | 20% | 4.7 | (1 | ) | x | x | x | AAA | |||||||||||||||||

| Total |

2,297.2 | (39.4 | ) | 4.45 | % | ||||||||||||||||||||||||

| Commercial Mortgage Backed Securities & Multi-family Mortgage Backed Securities: | |||||||||||||||||||||||||||||

| Fixed Rate |

2,088.1 | (4.8 | ) | 5.09 | % | 20% | 4.3 | (1 | ) | x | x | AAA | |||||||||||||||||

| Floating Rate |

- | - | - | ||||||||||||||||||||||||||

| Total |

2,088.1 | (4.8 | ) | 5.09 | % | ||||||||||||||||||||||||

| Asset Backed Securities: | |||||||||||||||||||||||||||||

| Fixed Rate |

805.9 | (17.2 | ) | 4.53 | % | 20% | 3.4 | (1 | ) | x | x | AAA | |||||||||||||||||

| Floating Rate |

- | - | - | ||||||||||||||||||||||||||

| Total |

805.9 | (17.2 | ) | 4.53 | % | ||||||||||||||||||||||||

| Corporate Securities: | |||||||||||||||||||||||||||||

| Fixed Rate |

343.9 | (4.5 | ) | 5.28 | % | 100% | 2.6 | (1 | ) | x | x | A | |||||||||||||||||

| Floating Rate |

- | - | - | ||||||||||||||||||||||||||

| Total |

343.9 | (4.5 | ) | 5.28 | % | ||||||||||||||||||||||||

| Total, excluding KO |

$15,375.3 | $(232.2 | ) | 4.57 | % | ||||||||||||||||||||||||

Attachment to Comment G

| Coupon | Credit | ||||||||||||||||||||||||||||

| Available For Sale Portfolio as of 12/31/2006 Not Fair Value Elected |

Book Value ($MM) |

Unrealized Gains/ (Losses) ($MM) |

Yield (%) | Average Tier 1 (%) |

Weighted Average Life(1)/ Maturity(2) /Coupon Reset(3) (Years) |

Fixed | Floating | Corporate | Structured | US Government/ Agency |

Average Rating | ||||||||||||||||||

| US Government: | |||||||||||||||||||||||||||||

| Treasury Bills |

- | - | - | ||||||||||||||||||||||||||

| Treasury Notes |

$33.3 | $(0.1 | ) | 4.37 | % | 0% | 1.6 | (1 | ) | x | x | AAA | |||||||||||||||||

| Agency Discount Notes |

- | - | - | ||||||||||||||||||||||||||

| Agency Debentures |

230.3 | (2.8 | ) | 4.95 | % | 20% | 4.9 | (1 | ) | x | x | AAA | |||||||||||||||||

| Total |

263.6 | (2.9 | ) | 4.88 | % | ||||||||||||||||||||||||

| Municipal Bonds | 1,032.2 | 8.9 | 4.29 | % | 26% | 5.2 | (1 | ) | x | x | AA | ||||||||||||||||||

| Mortgage Backed Security Passthroughs: | |||||||||||||||||||||||||||||

| 1/1, 3/1, 5/1,7/1 Adjustable Rate Mortgage |

452.2 | (2.6 | ) | 4.73 | % | 20% | 7.0 | (3 | ) | x | x | x | AAA | ||||||||||||||||

| 10/1 Adjustable Rate Mortgage |

1,546.9 | (7.4 | ) | 5.41 | % | 20% | 10.0 | (3 | ) | x | x | x | AAA | ||||||||||||||||

| 15 Year Fixed Rate |

32.9 | 0.8 | 8.04 | % | 20% | 15.0 | (2 | ) | x | x | x | AAA | |||||||||||||||||

| 30 Year Fixed Rate |

2,194.8 | 13.4 | 5.58 | % | 20% | 30.0 | (2 | ) | x | x | x | AAA | |||||||||||||||||

| Total |

4,226.8 | 4.2 | 5.44 | % | |||||||||||||||||||||||||

| Collateralized Mortgage Obligations: | |||||||||||||||||||||||||||||

| Fixed Rate |

41.4 | (1.6 | ) | 4.44 | % | 133% | 3.2 | (1 | ) | x | x | x | AA | ||||||||||||||||

| Floating Rate |

95.0 | (2.7 | ) | 7.11 | % | 41% | 1.3 | (1 | ) | x | x | x | AA | ||||||||||||||||

| Total |

136.4 | (4.4 | ) | 6.30 | % | ||||||||||||||||||||||||

| Commercial Mortgage Backed Securities & Multi-family Mortgage Backed Securities: | |||||||||||||||||||||||||||||

| Fixed Rate |

137.3 | (0.4 | ) | 5.41 | % | 20% | 8.1 | (1 | ) | x | x | AAA | |||||||||||||||||

| Floating Rate |

- | - | - | ||||||||||||||||||||||||||

| Total |

137.3 | (0.4 | ) | 5.41 | % | ||||||||||||||||||||||||

| Asset Backed Securities: | |||||||||||||||||||||||||||||

| Fixed Rate |

6.5 | (0.0 | ) | 5.77 | % | 20% | 2.7 | (1 | ) | x | x | AAA | |||||||||||||||||

| Floating Rate |

315.6 | 1.5 | 6.49 | % | 36% | 1.6 | (1 | ) | x | x | AA | ||||||||||||||||||

| Total |

322.2 | 1.5 | 6.48 | % | |||||||||||||||||||||||||

| Corporate Securities: | |||||||||||||||||||||||||||||

| Fixed Rate |

110.4 | (1.0 | ) | 5.49 | % | 100% | 1.6 | (1 | ) | x | x | BBB | |||||||||||||||||

| Floating Rate |

9.9 | 0.0 | 6.29 | % | 100% | 20.5 | (1 | ) | x | x | A | ||||||||||||||||||

| Total |

120.2 | (1.0 | ) | 5.55 | % | ||||||||||||||||||||||||

| Other |

1,384.2 | 4.9 | 5.94 | % | |||||||||||||||||||||||||

| Total, excluding KO |

$7,623.0 | $10.9 | 5.33 | % | |||||||||||||||||||||||||

Appendix to SEC Response Letter

Key Business and Economic Trends

| Balance Sheet Averages During Months | ||||||||||||||||||||

| ($ in millions) | March | June | Sept. | Dec. | March | March over March | ||||||||||||||

| 2006 | 2006 | 2006 | 2006 | 2007 | Change | Percent | ||||||||||||||

| Lower Cost Deposits: |

||||||||||||||||||||

| Noninterest-bearing deposits |

$ | 23,853 | $ | 23,644 | $ | 22,713 | $ | 22,653 | $ | 22,034 | $ | (1,820) | (7.6%) | |||||||

| Money market regular |

25,894 | 24,727 | 23,995 | 22,570 | 22,048 | (3,846) | (14.9%) | |||||||||||||

| Savings |

5,299 | 5,365 | 5,617 | 5,267 | 5,029 | (271) | (5.1%) | |||||||||||||

| Higher Cost Deposits: |

||||||||||||||||||||

| NOW / money market |

16,883 | 16,574 | 16,815 | 19,629 | 20,053 | 3,170 | 18.8% | |||||||||||||

| CDs under $100M |

14,223 | 16,025 | 16,529 | 16,779 | 16,896 | 2,673 | 18.8% | |||||||||||||

| CDs $100M and over |

9,866 | 11,218 | 12,114 | 12,322 | 12,077 | 2,211 | 22.4% | |||||||||||||

| Total Customer Deposits |

$ | 96,019 | $ | 97,553 | $ | 97,782 | $ | 99,219 | $ | 98,136 | $ | 2,117 | 2.2% | |||||||

| Total Loans |

$ | 117,683 | $ | 121,340 | $ | 121,088 | $ | 121,417 | $ | 120,820 | $ | 3,137 | 2.7% | |||||||

| Loan to Customer Deposit Ratio |

122.6% | 124.4% | 123.8% | 122.4% | 123.1% | |||||||||||||||

| Non-Core Funding Dependency Ratio |