Exhibit 99.1

News Release

Contact: | |||

Investors | Media | ||

Ankur Vyas | Hugh Suhr | ||

(404) 827-6714 | (404) 827-6813 | ||

For Immediate Release

April 20, 2015

SunTrust Reports First Quarter 2015 Results

Continued Efficiency Progress and Asset Quality Improvements Drive Solid Earnings Growth

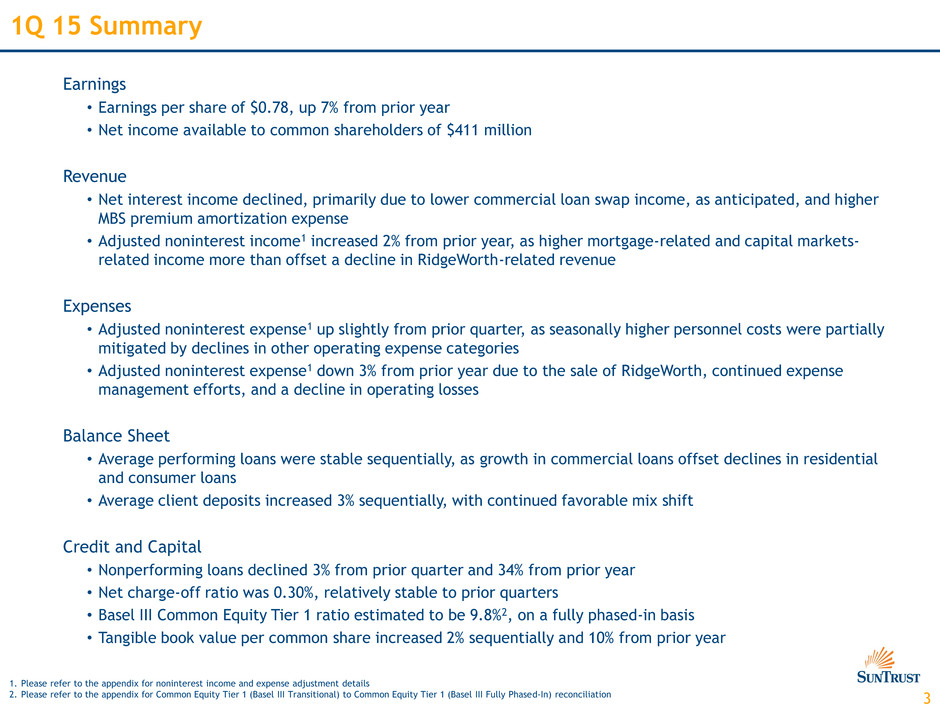

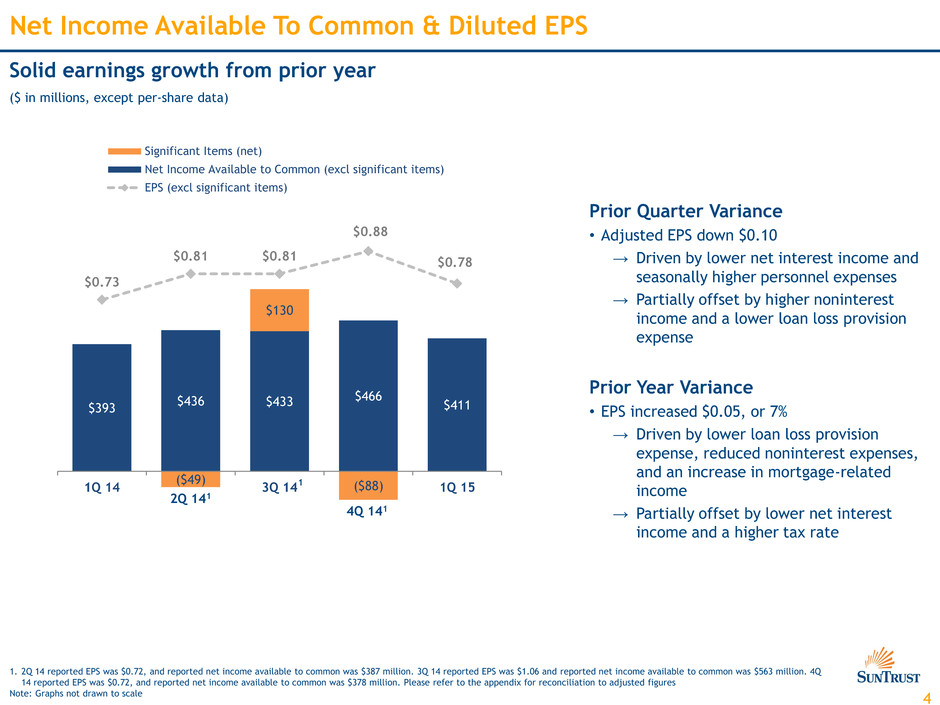

ATLANTA -- SunTrust Banks, Inc. (NYSE: STI) today reported net income available to common shareholders of $411 million, or $0.78 per average common diluted share, representing a 7% per share increase compared to the first quarter of 2014.

Earnings in the prior quarter were $378 million, or $0.72 per average common diluted share, and included a $145 million legal provision expense related to legacy mortgage matters. Excluding the impact of this expense, adjusted earnings per share for the prior quarter were $0.88.

“Continued expense discipline and strong asset quality performance, coupled with growth in noninterest income, contributed to solid performance in the first quarter and helped to mitigate the impact of the persistent low rate environment,” said William H. Rogers, Jr., chairman and CEO of SunTrust Banks, Inc. “As we look forward, we remain focused on deepening client relationships and executing our strategic priorities, particularly improving returns and efficiency, to further enhance shareholder value.”

1

First quarter 2015 Financial Highlights

Income Statement

• | Net income available to common shareholders was $411 million, or $0.78 per average common diluted share, a 7% increase, per share, over the first quarter of 2014. |

• | Total revenues declined 2% compared to the prior quarter and the first quarter of 2014 due to a decline in net interest income. |

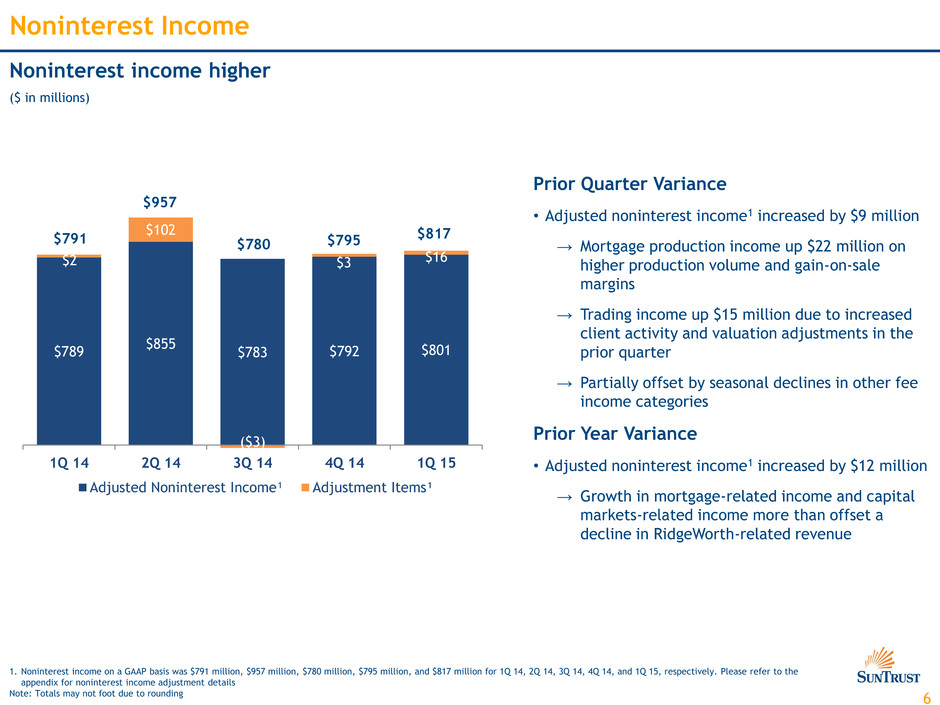

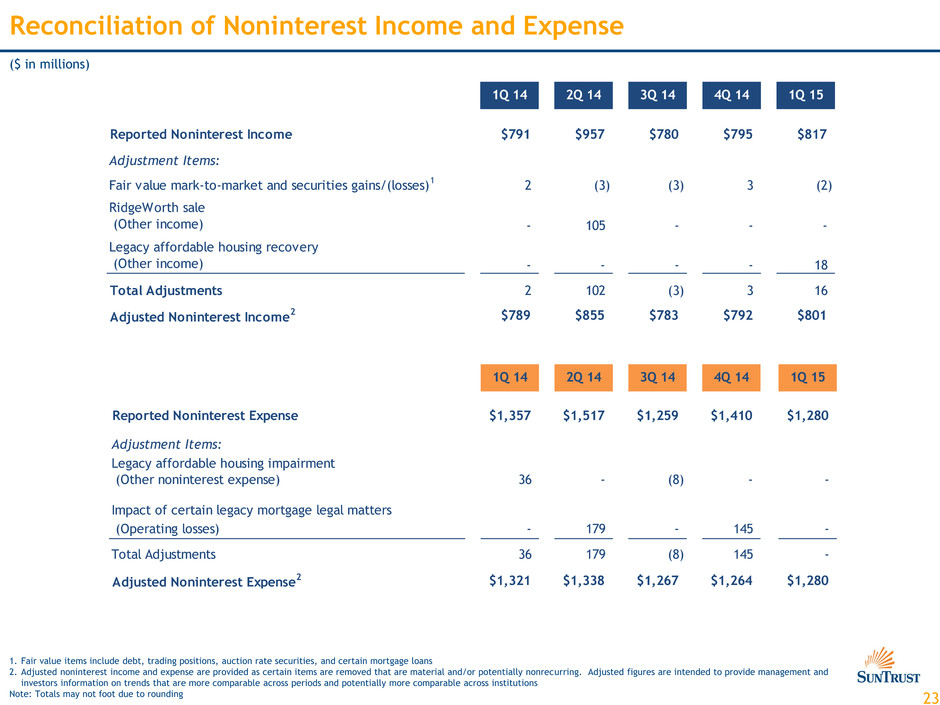

• | Noninterest income increased 3%, both sequentially and compared to the first quarter of 2014, based largely on higher mortgage production-related income, as well as a gain realized upon the sale of legacy affordable housing properties during the current quarter. |

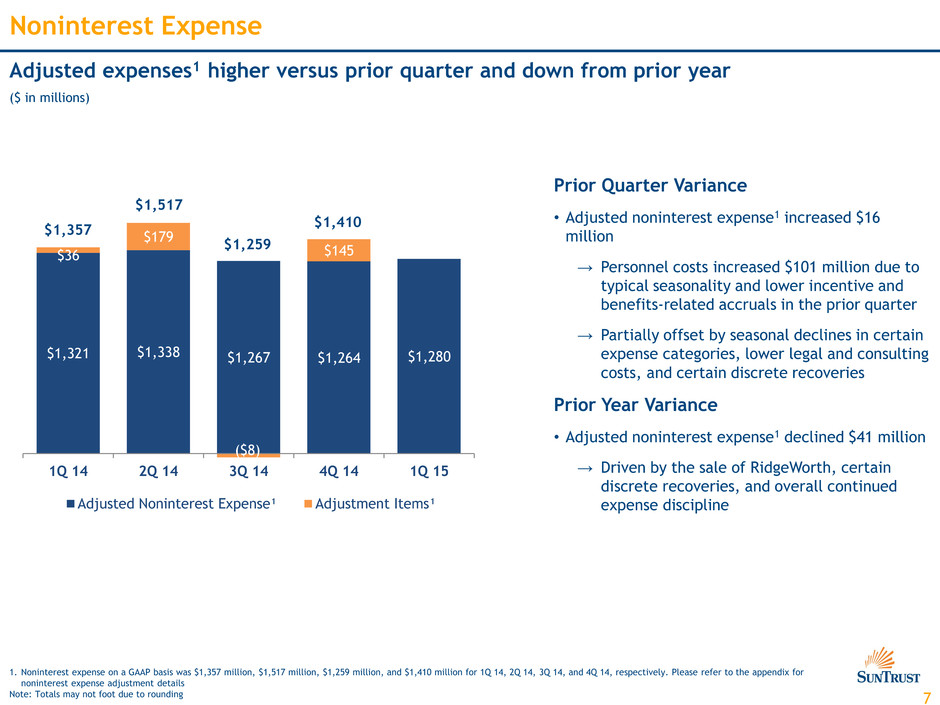

• | Noninterest expense decreased $130 million compared to the prior quarter, primarily driven by the impact of the $145 million legal provision expense related to legacy mortgage matters in the prior quarter. Excluding this impact, noninterest expense increased $15 million, as seasonally higher compensation and benefits expenses were partially offset by declines in other expense categories. |

◦ | Noninterest expense declined 6% compared to the first quarter of 2014 due to declines in most expense categories and the sale of RidgeWorth Capital Management in the second quarter of 2014. |

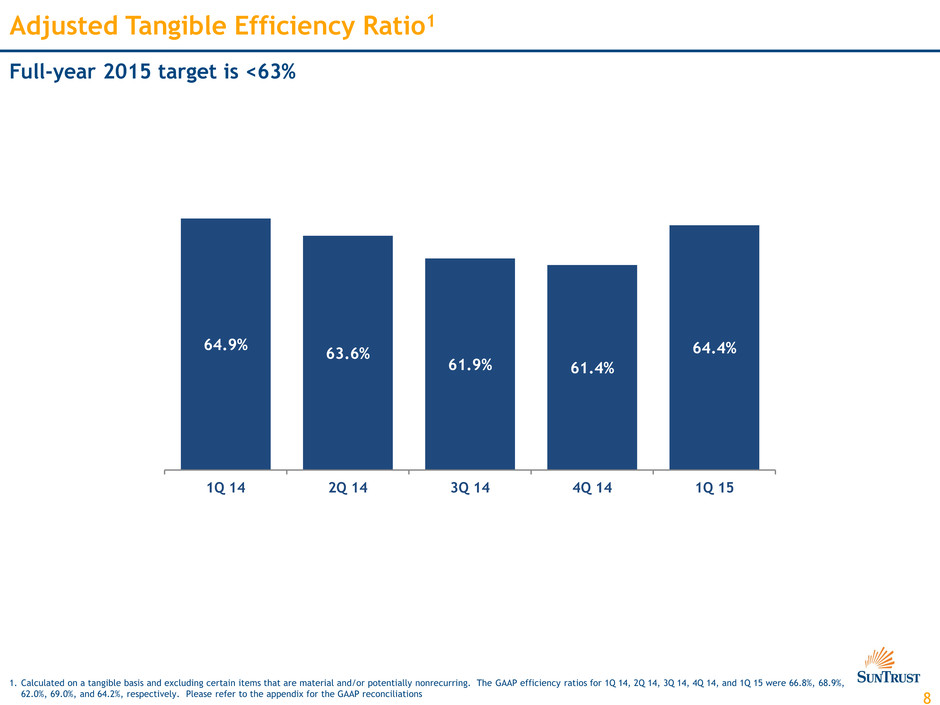

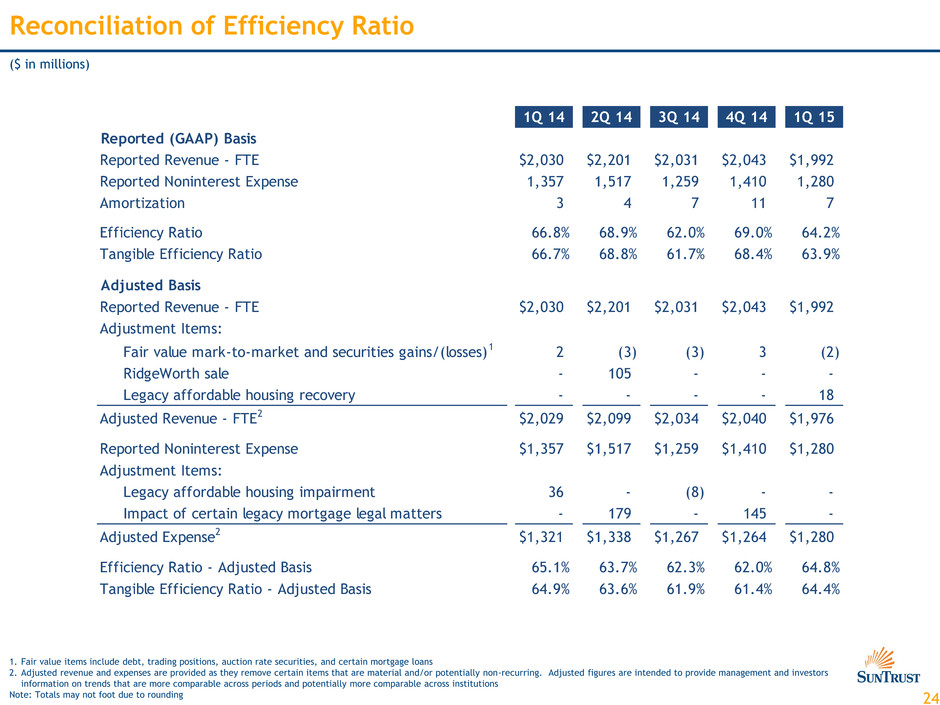

• | The efficiency and tangible efficiency ratios in the current quarter were 64.2% and 63.9%, respectively. |

Balance Sheet

• | Average total loans for the current quarter increased 4% compared to the first quarter of 2014, while loan sales and transfers of loans to held-for-sale during the latter part of the prior quarter resulted in stable average loans on a sequential quarter basis. |

• | Average client deposits increased 3% sequentially and 9% compared to the first quarter of 2014. |

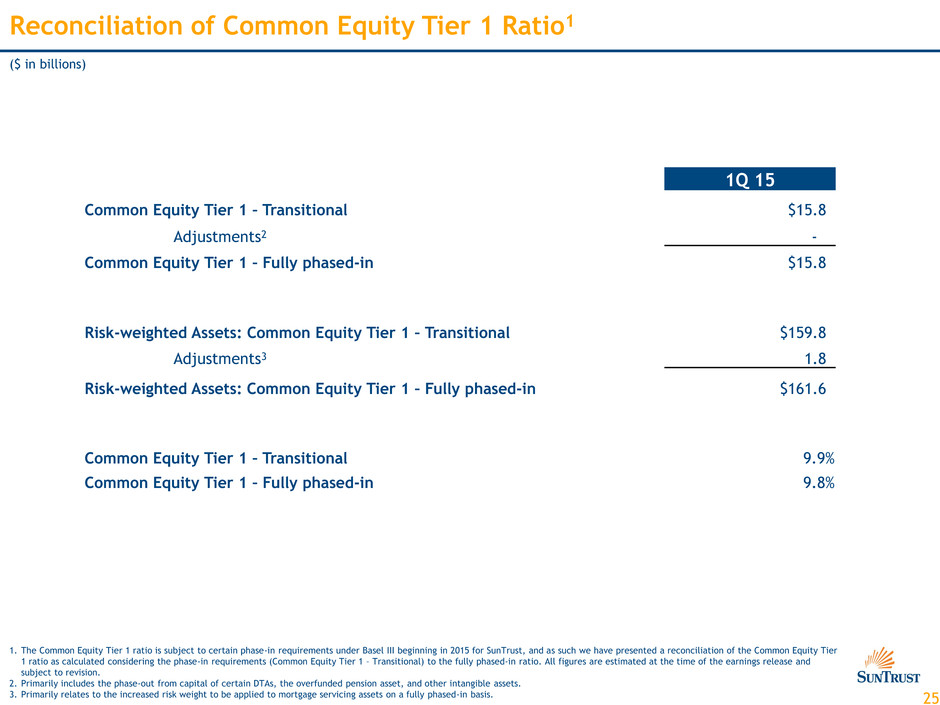

Capital

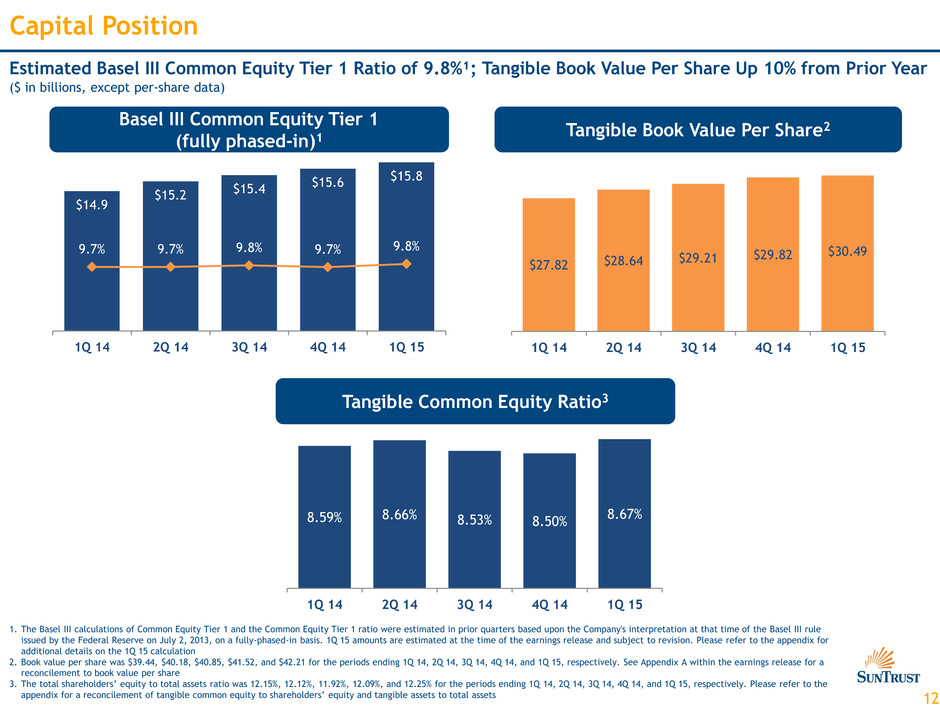

• | Estimated capital ratios continued to be well above regulatory requirements. The Basel III Common Equity Tier 1 ratio and Tier 1 Capital ratios were estimated to be 9.8% and 10.8%, respectively, as of March 31, 2015, on a fully phased-in basis. |

• | During the quarter, the Company: |

◦ | Repurchased $115 million of common shares. |

◦ | Announced its capital plan, which includes: |

▪ | The purchase of up to $875 million of its common shares between the second quarter of 2015 and the second quarter of 2016. |

▪ | A 20% increase in the quarterly common stock dividend from $0.20 per share to $0.24 per share, beginning in the second quarter of 2015, subject to approval by the Company's Board of Directors. |

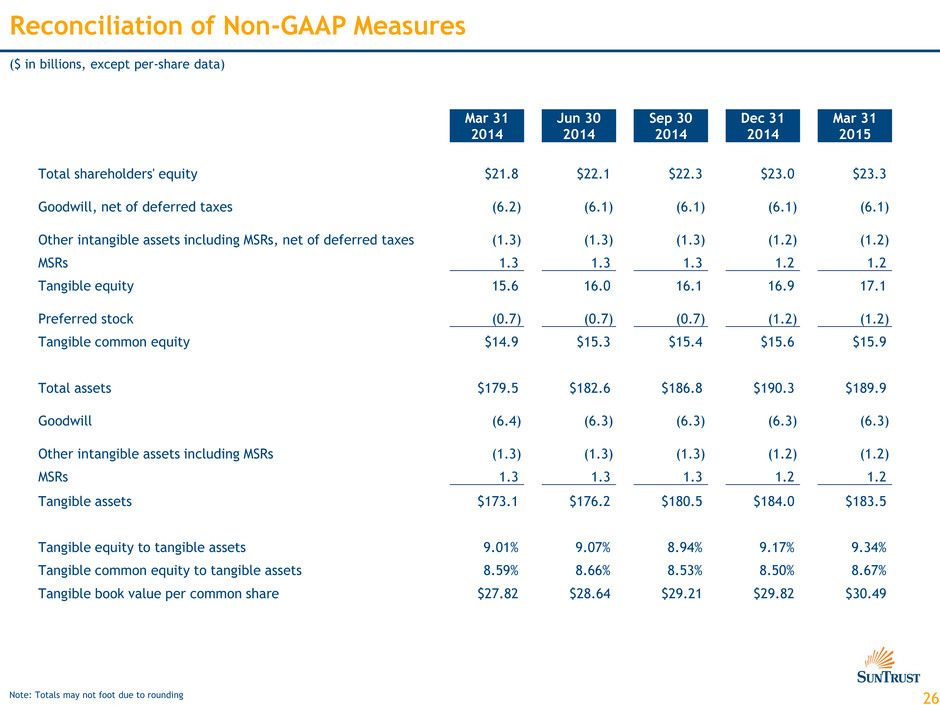

• | Book value per share was $42.21, and tangible book value per share was $30.49, both up 2% sequentially. The increase was primarily due to growth in retained earnings. |

Asset Quality

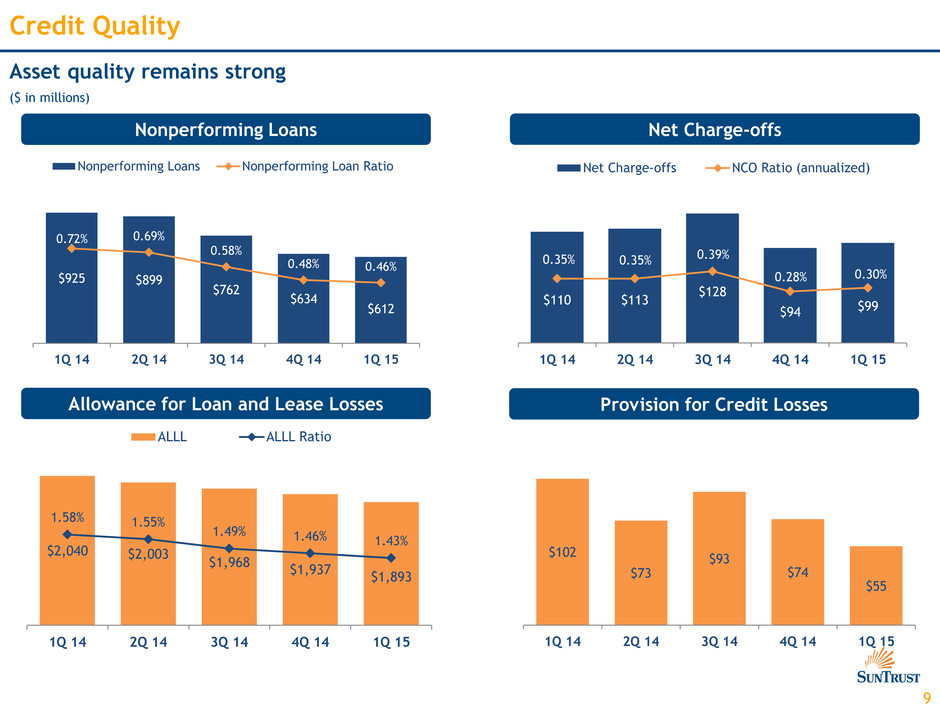

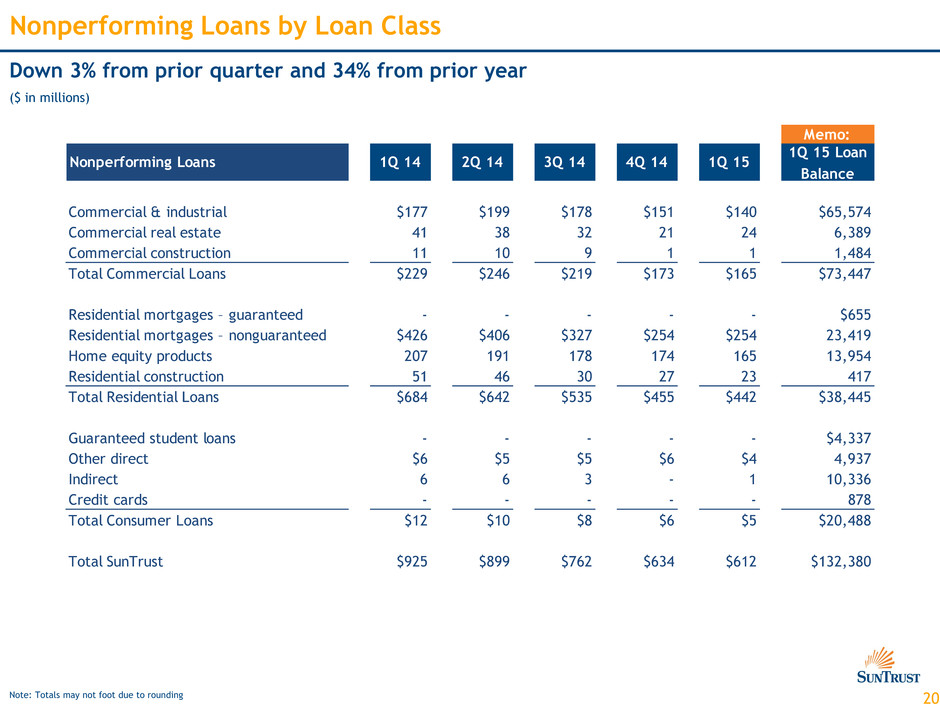

• | Asset quality continued to improve, as nonperforming loans declined 3% from the prior quarter and totaled 0.46% of total loans at March 31, 2015. |

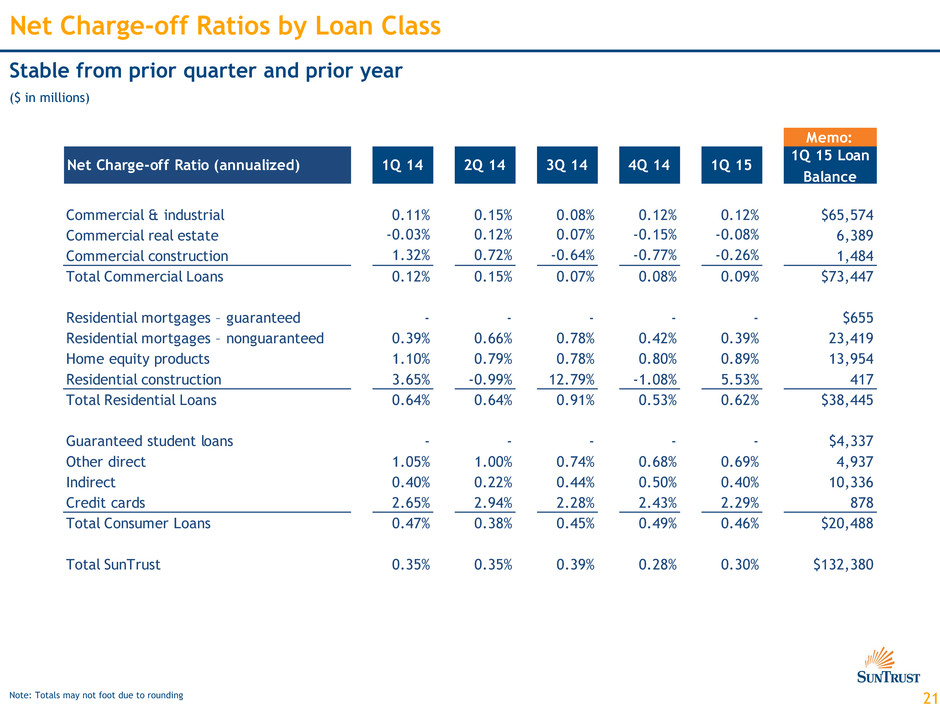

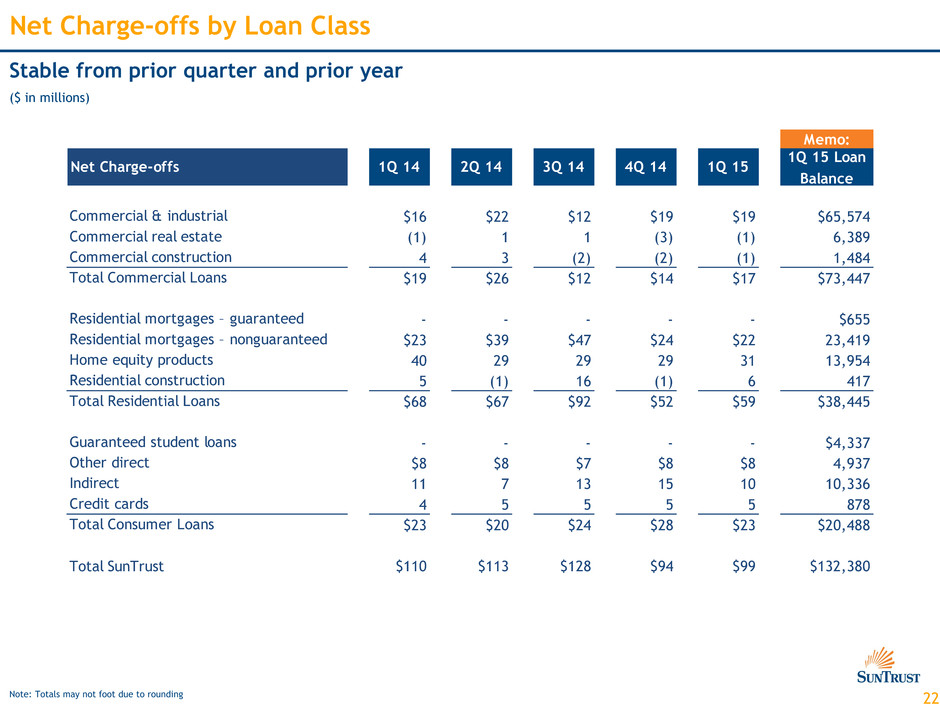

• | Net charge-offs for the current quarter were $99 million, representing 0.30% of average loans on an annualized basis, relatively stable to the prior quarter and the first quarter of 2014. |

• | The provision for credit losses decreased $19 million and $47 million compared to the prior quarter and the first quarter of 2014, respectively, driven by the continued improvement in asset quality, combined with lower loan growth in the current quarter. |

• | At March 31, 2015, the allowance for loan losses to period-end loans ratio was 1.43%. |

2

(Dollars in millions, except per-share data) | |||||||||||

Income Statement (presented on a fully taxable-equivalent basis) | 1Q 2014 | 4Q 2014 | 1Q 2015 | ||||||||

Net income available to common shareholders | $393 | $378 | $411 | ||||||||

Earnings per average common diluted share | 0.73 | 0.72 | 0.78 | ||||||||

Adjusted earnings per average common diluted share (1) | 0.73 | 0.88 | 0.78 | ||||||||

Total revenue | 2,030 | 2,043 | 1,992 | ||||||||

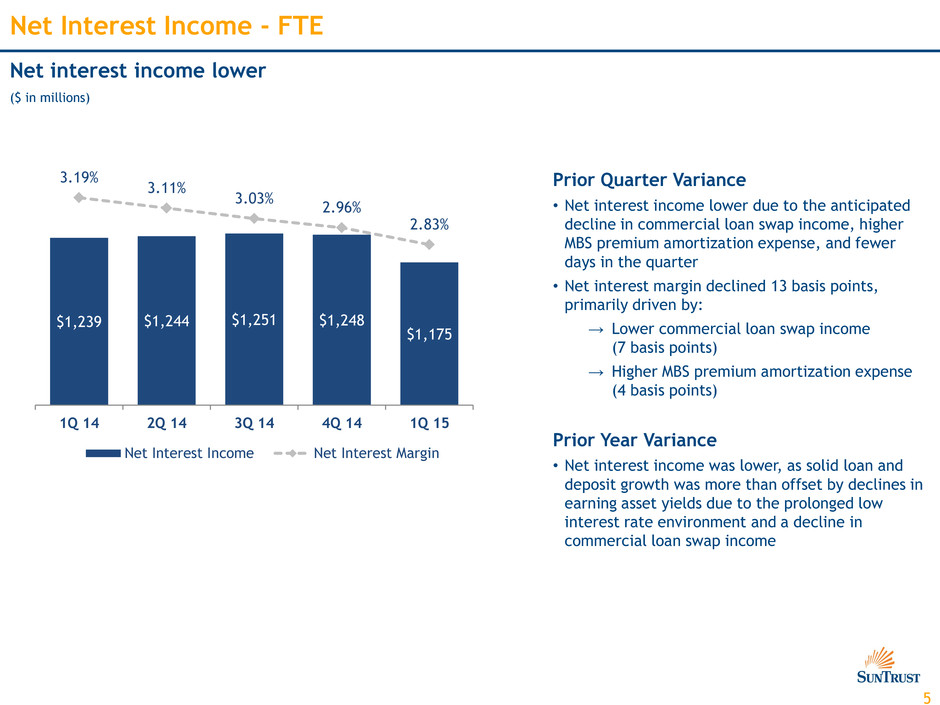

Net interest income | 1,239 | 1,248 | 1,175 | ||||||||

Provision for credit losses | 102 | 74 | 55 | ||||||||

Noninterest income | 791 | 795 | 817 | ||||||||

Noninterest expense | 1,357 | 1,410 | 1,280 | ||||||||

Net interest margin | 3.19 | % | 2.96 | % | 2.83 | % | |||||

Balance Sheet | |||||||||||

(Dollars in billions) | |||||||||||

Average loans | $128.5 | $133.4 | $133.3 | ||||||||

Average consumer and commercial deposits | 128.4 | 136.9 | 140.5 | ||||||||

Capital | |||||||||||

Basel III capital ratios at period end (2) : | |||||||||||

Tier 1 capital (transitional) | N/A | N/A | 10.75 | % | |||||||

Common Equity Tier 1 ("CET1") (transitional) | N/A | N/A | 9.90 | % | |||||||

Common Equity Tier 1 ("CET1") (fully phased-in) | N/A | N/A | 9.80 | % | |||||||

Total average shareholders’ equity to total average assets | 12.28 | % | 12.08 | % | 12.24 | % | |||||

Asset Quality | |||||||||||

Net charge-offs to average loans (annualized) | 0.35 | % | 0.28 | % | 0.30 | % | |||||

Allowance for loan and lease losses to period-end loans | 1.58 | % | 1.46 | % | 1.43 | % | |||||

Nonperforming loans to total loans | 0.72 | % | 0.48 | % | 0.46 | % | |||||

(1) See page 22 for non-U.S. GAAP reconciliation

(2) Current period Tier 1 capital and CET1 ratios are estimated as of the date of this news release. Basel III Final Rules became effective for the Company on January 1, 2015; thus, Basel III capital ratios are not applicable ("N/A") in periods ending prior to January 1, 2015.

Consolidated Financial Performance Details

(Presented on a fully taxable-equivalent basis unless otherwise noted)

Revenue

Total revenue was $2.0 billion for the current quarter, a decrease of $51 million compared to the prior quarter. The decline was primarily driven by lower net interest income, partially offset by an increase in noninterest income, which benefited from higher mortgage production-related income. Compared to the first quarter of 2014, total revenue declined $38 million, driven largely by a decrease in net interest income and foregone RidgeWorth revenue, partially offset by higher mortgage production-related and capital markets-related income.

Net Interest Income

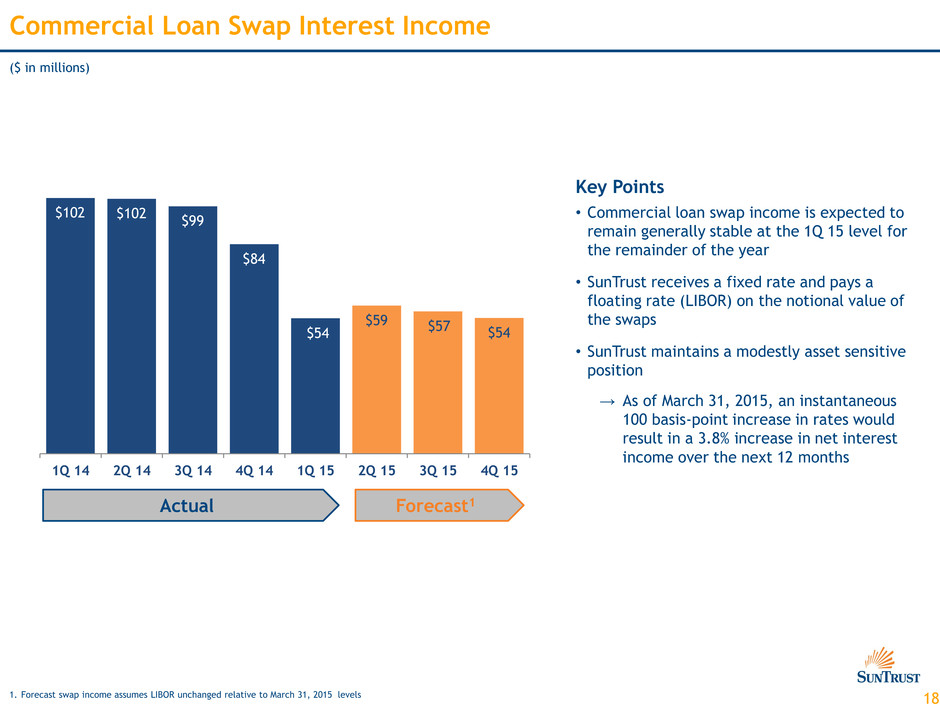

Net interest income was $1.2 billion for the current quarter, a decline of $73 million compared to the prior quarter. The decrease was primarily due to the expected decline in commercial loan swap income, higher mortgage-backed securities (MBS) premium amortization, and two fewer days in the current quarter. Compared to the first quarter of 2014, the $64 million decline in net interest income was driven by lower commercial loan swap income, higher MBS premium amortization expense, and lower loan yields, partially offset by growth in average earning assets.

3

Net interest margin for the current quarter was 2.83% compared to 2.96% in the prior quarter and 3.19% in the first quarter of 2014. The 13 basis point decline compared to the prior quarter was driven primarily by lower commercial loan swap income and higher MBS premium amortization expense. The 36 basis point decline in net interest margin compared to the first quarter of 2014 was due primarily to 32 and 53 basis point declines in loan and investment securities yields, respectively, due to the aforementioned factors, combined with the impact of the prolonged low interest rate environment on asset yields.

Noninterest Income

Noninterest income was $817 million for the current quarter, compared to $795 million for the prior quarter and $791 million for the first quarter of 2014. The $22 million increase from the prior quarter was due largely to increased mortgage-related and trading revenue, as well an $18 million gain on the sale of legacy affordable housing investments, partially offset by declines in other fee income categories. Compared to the first quarter of 2014, noninterest income increased $26 million, driven primarily by higher mortgage-related and capital markets-related income, as well as the gain on the sale of legacy affordable housing investments, partially offset by foregone RidgeWorth revenue.

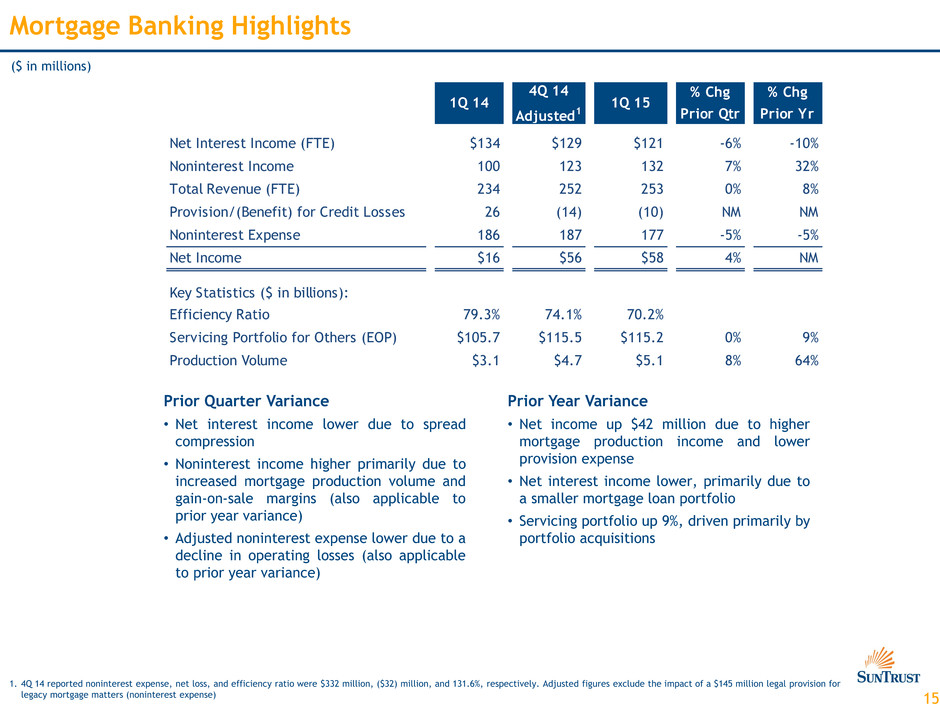

Mortgage production-related income for the current quarter was $83 million compared to $61 million for the prior quarter and $43 million for the first quarter of 2014. The increase compared to both prior periods was due to higher mortgage production volume and improved gain-on-sale margins. Mortgage production volume increased 8% sequentially and 64% compared to the first quarter of 2014.

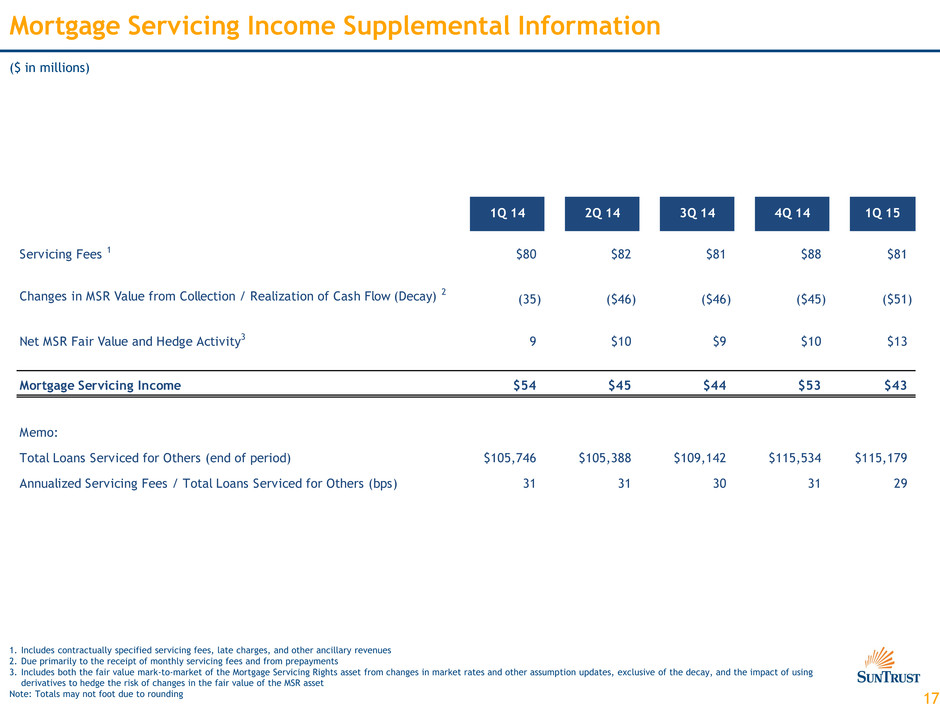

Mortgage servicing-related income was $43 million in the current quarter, compared to $53 million in the prior quarter and $54 million in the first quarter of 2014. The decline compared to the prior quarter was driven in large part by higher servicing asset decay expense arising from increased prepayment volume, combined with elevated servicing fees in the prior quarter that reflected seasonal activity. Compared to the first quarter of 2014, the $11 million decline was due to higher decay, partially offset by higher servicing fees from a larger servicing portfolio. The servicing portfolio was $142 billion at March 31, 2015, compared to $142 billion at December 31, 2014 and $135 billion at March 31, 2014.

Investment banking income was $97 million for the current quarter, compared to $109 million in the prior quarter and $88 million in the first quarter of 2014. The sequential quarter decline was due primarily to a decline in syndicated finance activity, partially offset by higher equity origination and debt capital markets fees. Compared to the first quarter of 2014, the increase was due to higher equity origination fees. Trading income was $55 million for the current quarter, compared to $40 million for the prior quarter and $49 million in the first quarter of 2014. The sequential quarter increase was driven by an increase in fixed income-related trading revenue. Compared to the first quarter of 2014, the increase was driven largely by a decline in mark-to-market valuation losses on the Company's debt carried at fair value.

Trust and investment management income was $84 million in both the current and prior quarter and $130 million in the first quarter of 2014. The $46 million decline compared to the first quarter of 2014 was due entirely to foregone revenue resulting from the sale of RidgeWorth in the second quarter of 2014.

Other noninterest income was $63 million for the current quarter, compared to $42 million for the prior quarter and $38 million for the first quarter of 2014. The increase compared to both periods was primarily due to the aforementioned $18 million gain from the sale of legacy affordable housing investments in the current quarter.

4

Noninterest Expense

Noninterest expense for the current quarter was $1.3 billion, compared to $1.4 billion in both the prior quarter and the first quarter of 2014. The prior quarter included a $145 million legal provision for legacy mortgage matters. Excluding this expense, noninterest expense was increased slightly sequentially and declined $77 million, or 6%, compared to the first quarter of 2014. Compared to prior quarter, seasonally higher employee compensation was partially offset by declines in most expense categories. Compared to the first quarter of 2014, the decline was due to lower employee compensation and benefits expense in the current quarter, primarily driven by a reduction in expenses related to the RidgeWorth sale, as well as reductions in other expense categories resulting from the Company's efficiency efforts, together with the recognition of a $36 million impairment of certain legacy affordable housing investments during the first quarter of 2014.

Employee compensation and benefits expense was $771 million in the current quarter, compared to $670 million in the prior quarter and $800 million in the first quarter of 2014. The sequential increase of $101 million was due to the seasonal increase in employee benefits and FICA taxes, as well as normalized levels of incentive compensation and medical expenses. The $29 million decrease from the first quarter of 2014 was largely a result of the sale of RidgeWorth.

Operating losses were $14 million in the current quarter, compared to $174 million in the prior quarter, which included the $145 million legal provision related to legacy mortgage matters, and $21 million in the first quarter of 2014. Compared to both prior periods, excluding the $145 million legal provision in the prior quarter, the declines were primarily due to recoveries of previously recorded mortgage-related losses.

Outside processing and software expense was $189 million in the current quarter, compared to $206 million in the prior quarter and $170 million in the first quarter of 2014. The $17 million sequential decline was primarily due to elevated costs in the prior quarter, as a result of timing of rendering certain services in addition to the replacement cost of specific software. The $19 million increase compared to first quarter of 2014 was due to higher utilization of certain third-party services, higher mortgage production volume, and higher software-related expenses tied to technology investments.

Marketing and customer development expense was $27 million in the current quarter, compared to $43 million in the prior quarter and $25 million in the first quarter of 2014. Compared to the prior quarter, the $16 million decrease was driven largely by a seasonal decline in advertising expenses.

FDIC premium and regulatory costs were $37 million in the current quarter, compared to $32 million in the prior quarter, and $40 million in the first quarter of 2014. The sequential increase reflected growth in average deposits during 2014, resulting in higher FDIC insurance premiums. Compared to the first quarter of 2014, the decline was driven by lower FDIC insurance premiums arising from improvements in the Company's risk profile.

Other noninterest expense was $111 million in the current quarter, compared to $146 million in the prior quarter and $168 million in the first quarter of 2014. The $35 million sequential decrease was primarily driven by a decline in legal and consulting fees alongside $17 million in recoveries of previously recognized losses related to the financial crisis. The $57 million decrease compared to the first quarter of 2014 was driven primarily by the recognition of a $36 million impairment of legacy affordable housing assets during the first quarter of 2014 and the current quarter recoveries of previously recognized losses related to the financial crisis.

Income Taxes

For the current quarter, the Company recorded an income tax provision of $191 million, compared to $128 million for the prior quarter and $125 million for the first quarter of 2014. The effective tax rate for the current quarter was approximately 31%, compared to approximately 28% in the prior quarter, which excludes the tax impact ($57 million) of the $145 million legal provision expense, and 23% in the first quarter of 2014. The effective tax rate in the first quarter of 2014 was favorably impacted by certain discrete items.

5

Balance Sheet

At March 31, 2015, the Company had total assets of $189.9 billion and shareholders’ equity of $23.3 billion, representing 12% of total assets. Book value per share was $42.21, and tangible book value per share was $30.49, both up 2% compared to December 31, 2014, driven by growth in retained earnings.

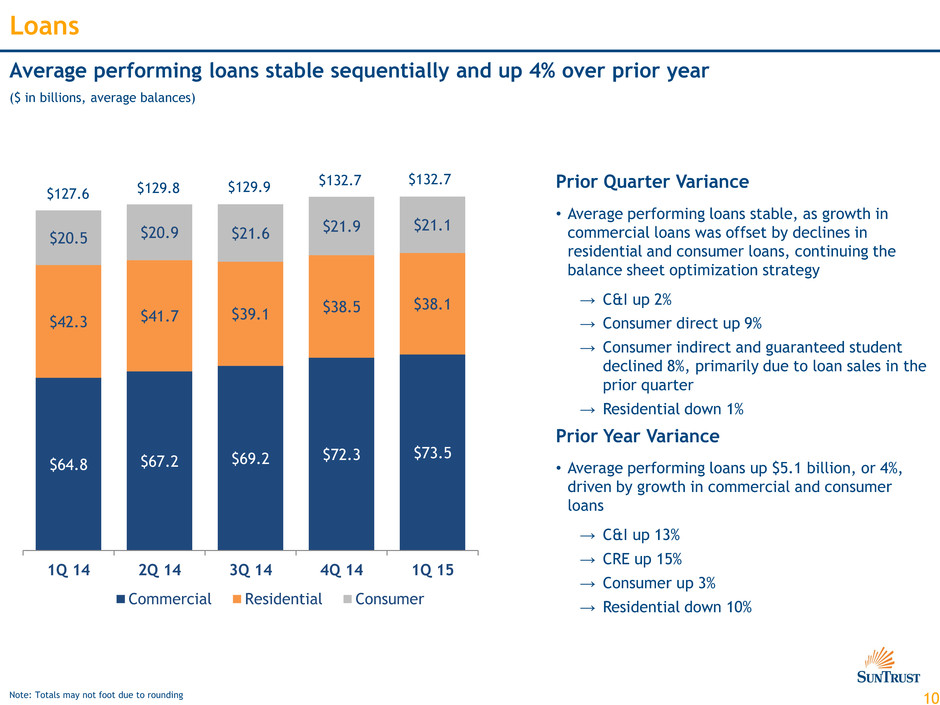

Loans

Average performing loans were $132.7 billion for the current quarter, unchanged compared to the prior quarter, and up 4% over the first quarter of 2014. Sequentially, average C&I loans and average consumer direct loans increased $1.2 billion and $402 million, respectively. Average consumer indirect loans and average guaranteed student loans declined $880 million and $403 million, respectively, reflecting the impact of loan sales and transfers to held for sale during the latter part of the prior quarter. Compared to the first quarter of 2014, average performing loans increased $5.1 billion, or 4%, with growth across most portfolios other than residential, guaranteed student, and consumer indirect loans.

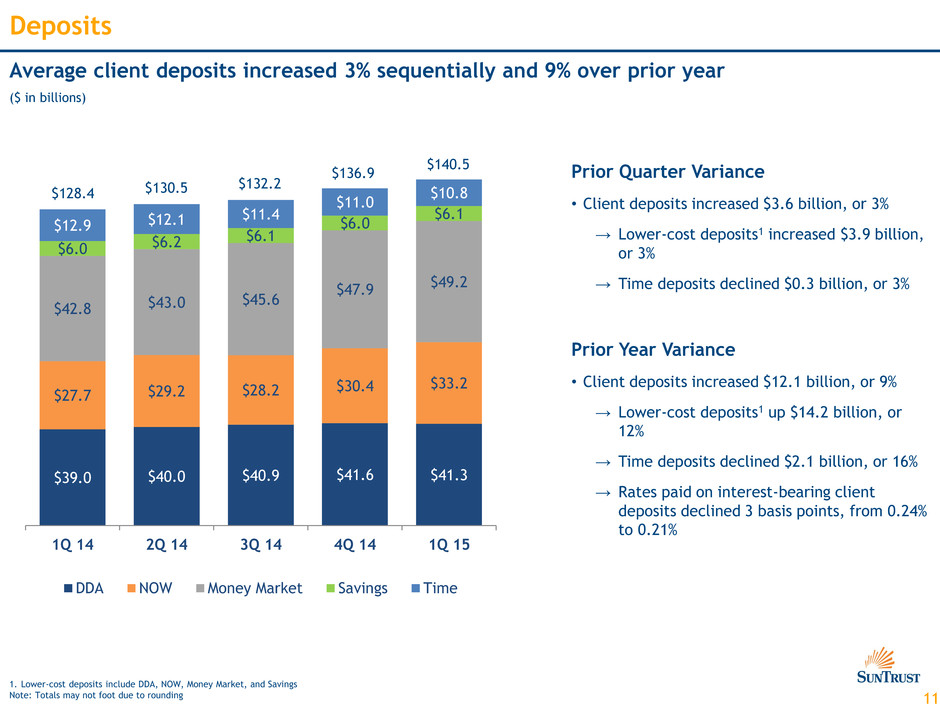

Deposits

Average client deposits for the current quarter were $140.5 billion, compared to $136.9 billion in the prior quarter and $128.4 billion in the first quarter of 2014. Sequentially, average client deposits increased 3% due to a $2.8 billion, or 9%, increase in NOW account balances and a $1.3 billion, or 3%, increase in money market account balances. Partially offsetting this growth in lower-cost deposits was a $0.3 billion, or 3%, decline in time deposits. Compared to the first quarter of 2014, average client deposits increased 9%, driven by increases in lower-cost deposits, partially offset by a $2.1 billion, or 16%, decrease in time deposits.

Capital and Liquidity

The Company’s estimated capital ratios are well above current regulatory requirements with Basel III Common Equity Tier 1 and Basel III Tier 1 capital ratios at an estimated 9.8% and 10.8%, respectively, at March 31, 2015, on a fully phased-in basis. The ratios of total average equity to total average assets and tangible equity to tangible assets were 12.24% and 9.34%, respectively, at March 31, 2015. The Company continues to have substantial available liquidity in the form of its client deposit base, cash, high-quality government-backed securities, and other available funding sources.

During the first quarter, the Company declared a common stock dividend of $0.20 per common share, consistent with the prior quarter and up $0.10 per share from the first quarter of 2014. Additionally, during the current quarter, the Company repurchased $115 million of its outstanding common stock, which completed the authorized share repurchases in conjunction with the 2014 capital plan.

In March, the Company announced that the Federal Reserve had no objections to the repurchase of up to $875 million of the Company's outstanding common stock to be completed between the second quarter of 2015 and the second quarter of 2016, as part of the Company's capital plan submitted in connection with the 2015 CCAR. Additionally, subject to Board approval, the Company intends to increase its quarterly common stock dividend 20% to $0.24 per common share beginning in the second quarter of 2015 and maintain the current level of dividend payments on its preferred stock.

6

Asset Quality

Total nonperforming assets were $696 million at March 31, 2015, down 11% compared to the prior quarter and 36% compared to the first quarter of 2014. At March 31, 2015, the percentage of nonperforming loans to total loans was 0.46% compared to 0.48% at December 31, 2014. Other real estate owned totaled $79 million, a 20% decrease from the prior quarter and a 48% decrease from the first quarter of 2014.

The provision for credit losses was $55 million, a decline of $19 million from the prior quarter and $47 million from the first quarter of 2014, driven by the continued improvement in asset quality and lower loan growth in the current quarter. Net charge-offs were $99 million during the current quarter, relatively stable to the prior quarter and the prior year. The ratio of annualized net charge-offs to total average loans was 0.30% during the current quarter, compared to 0.28% during the prior quarter and 0.35% during the first quarter of 2014.

At March 31, 2015, the allowance for loan and lease losses was $1.9 billion, which represented 1.43% of total loans, a $44 million and 3 basis point decline from December 31, 2014. The decline was primarily due to the continued improvement in asset quality during the quarter.

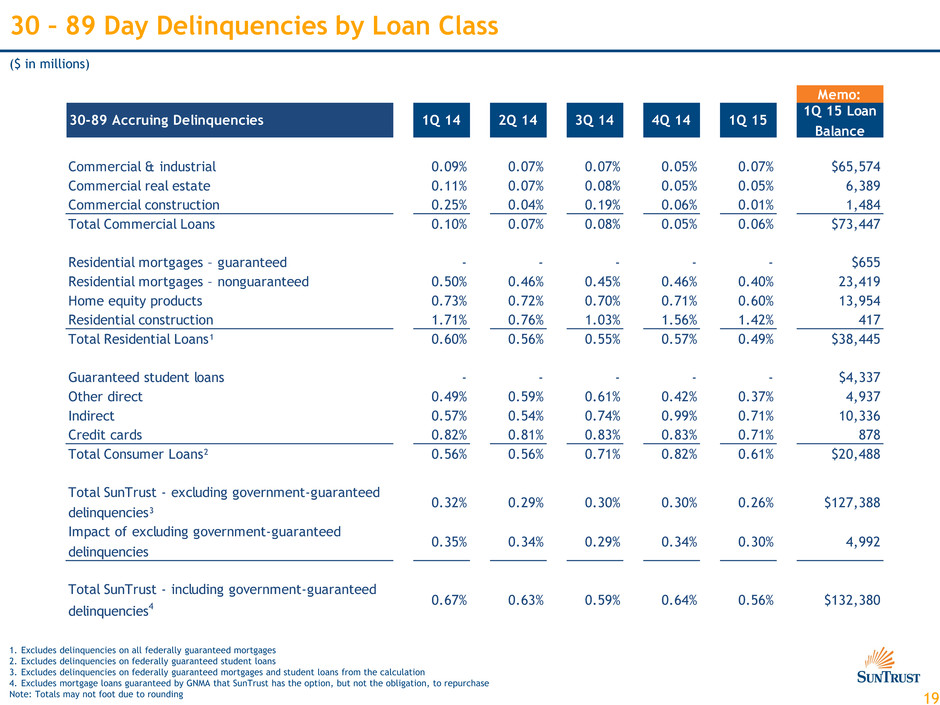

Early stage delinquencies declined 8 basis points from the prior quarter to 0.56% at March 31, 2015. Excluding government-guaranteed loans, early stage delinquencies were 0.26%, down 4 basis points from the prior quarter.

Accruing restructured loans totaled $2.6 billion and nonaccruing restructured loans totaled $255 million at March 31, 2015, of which $2.6 billion were residential loans, $126 million were consumer loans, and $109 million were commercial loans.

7

OTHER INFORMATION

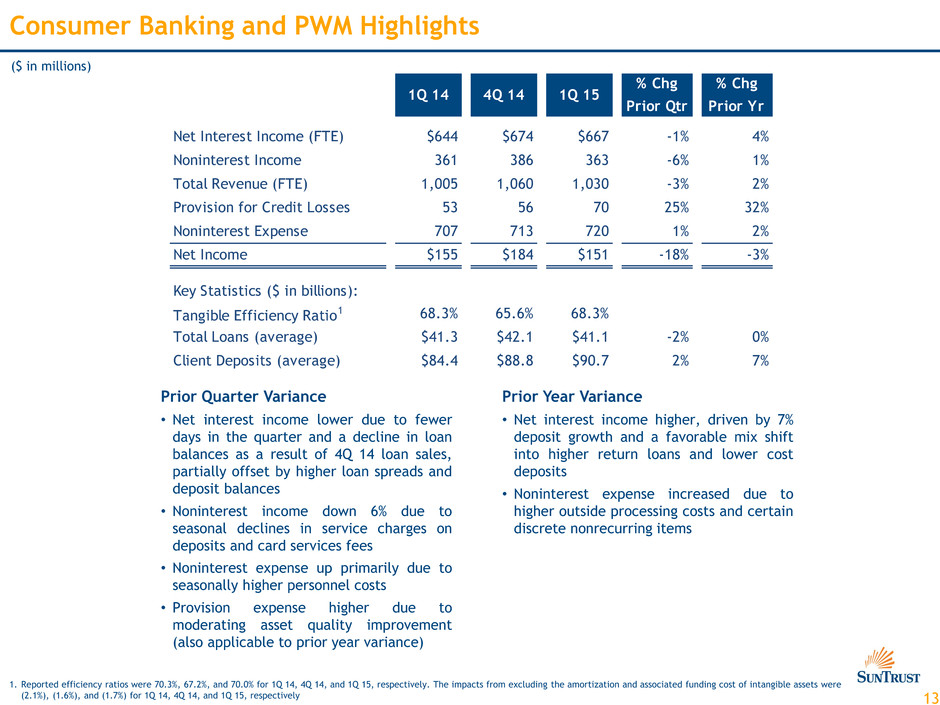

Business Segment Results

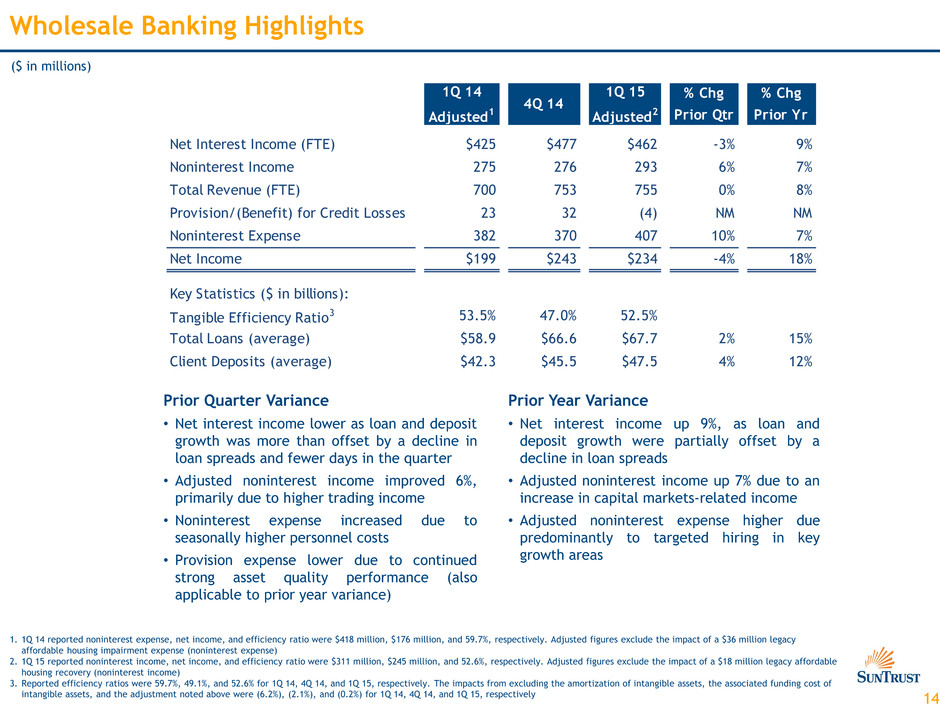

The Company has included business segment financial tables as part of this release. The Company’s business segments include: Consumer Banking and Private Wealth Management, Wholesale Banking, and Mortgage Banking. All revenue in the business segment tables is reported on a fully taxable-equivalent basis. For the business segments, results include net interest income, which is computed using matched-maturity funds transfer pricing. Further, provision for credit losses represents net charge-offs by segment combined with an allocation to the segments of the provision attributable to quarterly changes in the allowance for loan and lease losses and unfunded commitment reserve balances. SunTrust also reports results for Corporate Other, which includes the Treasury department as well as the residual expense associated with operational and support expense allocations. The Corporate Other segment also includes differences created between internal management accounting practices and U.S. Generally Accepted Accounting Principles ("U.S. GAAP") and certain matched-maturity funds transfer pricing credits and charges. A detailed discussion of the business segment results will be included in the Company’s forthcoming Form 10-Q.

Corresponding Financial Tables and Information

Investors are encouraged to review the foregoing summary and discussion of SunTrust’s earnings and financial condition in conjunction with the detailed financial tables and information which SunTrust has also published today and SunTrust’s forthcoming Form 10-Q. Detailed financial tables and other information are also available at investors.suntrust.com. This information is also included in a current report on Form 8-K furnished with the SEC today.

Conference Call

SunTrust management will host a conference call on April 20, 2015, at 8:00 a.m. (Eastern Time) to discuss the earnings results and business trends. Individuals may call in beginning at 7:45 a.m. (Eastern Time) by dialing 1-888-972-7805 (Passcode: 1Q15). Individuals calling from outside the United States should dial 1-517-308-9091 (Passcode: 1Q15). A replay of the call will be available approximately one hour after the call ends on April 20, 2015, and will remain available until May 20, 2015, by dialing 1-800-568-6276 (domestic) or 1-402-344-6819 (international). Alternatively, individuals may listen to the live webcast of the presentation by visiting the SunTrust investor relations website at investors.suntrust.com. Beginning the afternoon of April 20, 2015, listeners may access an archived version of the webcast in the “Events & Presentations” section of the investor relations website. This webcast will be archived and available for one year.

SunTrust Banks, Inc., headquartered in Atlanta, is one of the nation’s largest banking organizations, serving a broad range of consumer, commercial, corporate and institutional clients. The Company operates an extensive branch and ATM network throughout the Southeast and Mid-Atlantic States and a full array of technology-based, 24-hour delivery channels. The Company also serves clients in selected markets nationally. Its primary businesses include deposit, credit, and trust and investment management services. Through various subsidiaries, the Company provides mortgage banking, insurance, brokerage, equipment leasing, and capital markets services. SunTrust’s Internet address is www.suntrust.com.

Important Cautionary Statement About Forward-Looking Statements

This news release includes non-GAAP financial measures to describe SunTrust’s performance. The reconciliations of those measures to GAAP measures are provided within or in the appendix to this news release. In this news release, the Company presents net interest income and net interest margin on a fully taxable-equivalent (“FTE”) basis, and ratios on an annualized basis. The FTE basis adjusts for the tax-favored status of income from certain loans and investments. The Company believes this measure to be the preferred industry measurement of net interest income and provides relevant comparison between taxable and non-taxable amounts.

This news release contains forward-looking statements. Statements regarding potential future share repurchases, and future expected dividends are forward-looking statements. Also, any statement that does not describe historical

8

or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “forecast,” “goals,” “targets,” “initiatives,” “focus,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements are based upon the current beliefs and expectations of management and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events.

Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward looking statements. Future dividends, and the amount of any such dividend, must be declared by our board of directors in the future in their discretion. Also, future share repurchases and the timing of any such repurchase are subject to market conditions and management's discretion. Additional factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Part I, “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2014 and in other periodic reports that we file with the SEC.

9

SunTrust Banks, Inc. and Subsidiaries

FINANCIAL HIGHLIGHTS

(Dollars in millions and shares in thousands, except per share data) (Unaudited)

Three Months Ended March 31 | % | |||||||||

2015 | 2014 | Change | ||||||||

EARNINGS & DIVIDENDS | ||||||||||

Net income | $429 | $405 | 6 | % | ||||||

Net income available to common shareholders | 411 | 393 | 5 | |||||||

Total revenue - FTE 1, 2 | 1,992 | 2,030 | (2 | ) | ||||||

Net income per average common share: | ||||||||||

Diluted | 0.78 | 0.73 | 7 | |||||||

Basic | 0.79 | 0.74 | 7 | |||||||

Dividends paid per common share | 0.20 | 0.10 | 100 | |||||||

CONDENSED BALANCE SHEETS | ||||||||||

Selected Average Balances: | ||||||||||

Total assets | $189,265 | $176,971 | 7 | % | ||||||

Earning assets | 168,179 | 157,343 | 7 | |||||||

Loans | 133,338 | 128,525 | 4 | |||||||

Intangible assets including MSRs | 7,502 | 7,666 | (2 | ) | ||||||

MSRs | 1,152 | 1,265 | (9 | ) | ||||||

Consumer and commercial deposits | 140,476 | 128,396 | 9 | |||||||

Brokered time and foreign deposits | 1,250 | 2,013 | (38 | ) | ||||||

Total shareholders’ equity | 23,172 | 21,727 | 7 | |||||||

Preferred stock | 1,225 | 725 | 69 | |||||||

Period End Balances: | ||||||||||

Total assets | 189,881 | 179,542 | 6 | |||||||

Earning assets | 168,269 | 158,487 | 6 | |||||||

Loans | 132,380 | 129,196 | 2 | |||||||

Allowance for loan and lease losses ("ALLL") | 1,893 | 2,040 | (7 | ) | ||||||

Consumer and commercial deposits | 143,239 | 130,933 | 9 | |||||||

Brokered time and foreign deposits | 1,184 | 2,023 | (41 | ) | ||||||

Total shareholders’ equity | 23,260 | 21,817 | 7 | |||||||

FINANCIAL RATIOS & OTHER DATA | ||||||||||

Return on average total assets | 0.92 | % | 0.93 | % | (1 | )% | ||||

Return on average common shareholders’ equity | 7.59 | 7.59 | — | |||||||

Return on average tangible common shareholders' equity 1 | 10.53 | 10.78 | (2 | ) | ||||||

Net interest margin 2 | 2.83 | 3.19 | (11 | ) | ||||||

Efficiency ratio 2 | 64.23 | 66.83 | (4 | ) | ||||||

Tangible efficiency ratio 1, 2 | 63.91 | 66.65 | (4 | ) | ||||||

Effective tax rate | 31 | 23 | 35 | |||||||

Basel III capital ratios at period end (transitional) 3: | ||||||||||

CET1 | 9.90 | % | N/A | |||||||

Tier 1 capital | 10.75 | N/A | ||||||||

Total capital | 12.70 | N/A | ||||||||

Leverage | 9.40 | N/A | ||||||||

Basel III fully phased-in CET1 ratio 3 | 9.80 | N/A | ||||||||

Basel I capital ratios at period end 3: | ||||||||||

Tier 1 common | N/A | 9.90 | % | |||||||

Tier 1 capital | N/A | 10.88 | ||||||||

Total capital | N/A | 12.81 | ||||||||

Tier 1 leverage | N/A | 9.57 | ||||||||

Total average shareholders’ equity to total average assets | 12.24 | 12.28 | — | |||||||

Tangible equity to tangible assets 1 | 9.34 | 9.01 | 4 | |||||||

Book value per common share | $42.21 | $39.44 | 7 | |||||||

Tangible book value per common share 1 | 30.49 | 27.82 | 10 | |||||||

Market capitalization | 21,450 | 21,279 | 1 | |||||||

Average common shares outstanding: | ||||||||||

Diluted | 526,837 | 536,992 | (2 | ) | ||||||

Basic | 521,020 | 531,162 | (2 | ) | ||||||

Full-time equivalent employees | 24,466 | 25,925 | (6 | ) | ||||||

Number of ATMs | 2,176 | 2,243 | (3 | ) | ||||||

Full service banking offices | 1,444 | 1,501 | (4 | ) | ||||||

1 | See Appendix A for reconcilements of non-U.S. GAAP performance measures. |

2 | Total revenue, net interest margin, and efficiency ratios are presented on a fully taxable-equivalent (“FTE”) basis. The FTE basis adjusts for the tax-favored status of net interest income from certain loans and investments. The Company believes this measure to be the preferred industry measurement of net interest income and it enhances comparability of net interest income arising from taxable and tax-exempt sources. Total revenue - FTE equals net interest income on a FTE basis plus noninterest income. |

3 Current period capital ratios are estimated as of the earnings release date. Basel III Final Rules became effective for the Company on January 1, 2015; thus, Basel III capital ratios are not applicable ("N/A") in periods ending prior to January 1, 2015 and Basel I capital ratios are N/A in periods ending subsequent to January 1, 2015.

10

SunTrust Banks, Inc. and Subsidiaries

FIVE QUARTER FINANCIAL HIGHLIGHTS

(Dollars in millions and shares in thousands, except per share data) (Unaudited)

Three Months Ended | |||||||||||||||||||

March 31 | December 31 | September 30 | June 30 | March 31 | |||||||||||||||

2015 | 2014 | 2014 | 2014 | 2014 | |||||||||||||||

EARNINGS & DIVIDENDS | |||||||||||||||||||

Net income | $429 | $394 | $576 | $399 | $405 | ||||||||||||||

Net income available to common shareholders | 411 | 378 | 563 | 387 | 393 | ||||||||||||||

Adjusted net income available to common shareholders 1 | 411 | 466 | 433 | 436 | 393 | ||||||||||||||

Total revenue - FTE 1, 2 | 1,992 | 2,043 | 2,031 | 2,201 | 2,030 | ||||||||||||||

Total revenue - FTE, excluding gain on sale of asset management subsidiary 1, 2 | 1,992 | 2,043 | 2,031 | 2,096 | 2,030 | ||||||||||||||

Net income per average common share: | |||||||||||||||||||

Diluted | 0.78 | 0.72 | 1.06 | 0.72 | 0.73 | ||||||||||||||

Adjusted diluted 1 | 0.78 | 0.88 | 0.81 | 0.81 | 0.73 | ||||||||||||||

Basic | 0.79 | 0.72 | 1.07 | 0.73 | 0.74 | ||||||||||||||

Dividends paid per common share | 0.20 | 0.20 | 0.20 | 0.20 | 0.10 | ||||||||||||||

CONDENSED BALANCE SHEETS | |||||||||||||||||||

Selected Average Balances: | |||||||||||||||||||

Total assets | $189,265 | $188,341 | $183,433 | $179,820 | $176,971 | ||||||||||||||

Earning assets | 168,179 | 167,227 | 163,688 | 160,373 | 157,343 | ||||||||||||||

Loans | 133,338 | 133,438 | 130,747 | 130,734 | 128,525 | ||||||||||||||

Intangible assets including MSRs | 7,502 | 7,623 | 7,615 | 7,614 | 7,666 | ||||||||||||||

MSRs | 1,152 | 1,272 | 1,262 | 1,220 | 1,265 | ||||||||||||||

Consumer and commercial deposits | 140,476 | 136,892 | 132,195 | 130,472 | 128,396 | ||||||||||||||

Brokered time and foreign deposits | 1,250 | 1,399 | 1,624 | 1,893 | 2,013 | ||||||||||||||

Total shareholders’ equity | 23,172 | 22,754 | 22,191 | 21,994 | 21,727 | ||||||||||||||

Preferred stock | 1,225 | 1,024 | 725 | 725 | 725 | ||||||||||||||

Period End Balances: | |||||||||||||||||||

Total assets | 189,881 | 190,328 | 186,818 | 182,559 | 179,542 | ||||||||||||||

Earning assets | 168,269 | 168,678 | 165,434 | 162,422 | 158,487 | ||||||||||||||

Loans | 132,380 | 133,112 | 132,151 | 129,744 | 129,196 | ||||||||||||||

ALLL | 1,893 | 1,937 | 1,968 | 2,003 | 2,040 | ||||||||||||||

Consumer and commercial deposits | 143,239 | 139,234 | 135,077 | 131,792 | 130,933 | ||||||||||||||

Brokered time and foreign deposits | 1,184 | 1,333 | 1,430 | 1,493 | 2,023 | ||||||||||||||

Total shareholders’ equity | 23,260 | 23,005 | 22,269 | 22,131 | 21,817 | ||||||||||||||

FINANCIAL RATIOS & OTHER DATA | |||||||||||||||||||

Return on average total assets | 0.92 | % | 0.83 | % | 1.25 | % | 0.89 | % | 0.93 | % | |||||||||

Return on average common shareholders’ equity | 7.59 | 6.91 | 10.41 | 7.29 | 7.59 | ||||||||||||||

Return on average tangible common shareholders' equity 1 | 10.53 | 9.62 | 14.59 | 10.29 | 10.78 | ||||||||||||||

Net interest margin 2 | 2.83 | 2.96 | 3.03 | 3.11 | 3.19 | ||||||||||||||

Efficiency ratio 2 | 64.23 | 69.00 | 62.03 | 68.93 | 66.83 | ||||||||||||||

Tangible efficiency ratio 1, 2 | 63.91 | 68.44 | 61.69 | 68.77 | 66.65 | ||||||||||||||

Effective tax rate | 31 | 25 | 10 | 30 | 23 | ||||||||||||||

Basel III capital ratios at period end (transitional) 3: | |||||||||||||||||||

CET1 | 9.90 | % | N/A | N/A | N/A | N/A | |||||||||||||

Tier 1 capital | 10.75 | N/A | N/A | N/A | N/A | ||||||||||||||

Total capital | 12.70 | N/A | N/A | N/A | N/A | ||||||||||||||

Leverage | 9.40 | N/A | N/A | N/A | N/A | ||||||||||||||

Basel III fully phased-in CET1 ratio 3 | 9.80 | N/A | N/A | N/A | N/A | ||||||||||||||

Basel I capital ratios at period end 3: | |||||||||||||||||||

Tier 1 common | N/A | 9.60 | % | 9.63 | % | 9.72 | % | 9.90 | % | ||||||||||

Tier 1 capital | N/A | 10.80 | 10.54 | 10.66 | 10.88 | ||||||||||||||

Total capital | N/A | 12.51 | 12.32 | 12.53 | 12.81 | ||||||||||||||

Tier 1 leverage | N/A | 9.64 | 9.51 | 9.56 | 9.57 | ||||||||||||||

Total average shareholders’ equity to total average assets | 12.24 | 12.08 | 12.10 | 12.23 | 12.28 | ||||||||||||||

Tangible equity to tangible assets 1 | 9.34 | 9.17 | 8.94 | 9.07 | 9.01 | ||||||||||||||

Book value per common share | $42.21 | $41.52 | $40.85 | $40.18 | $39.44 | ||||||||||||||

Tangible book value per common share 1 | 30.49 | 29.82 | 29.21 | 28.64 | 27.82 | ||||||||||||||

Market capitalization | 21,450 | 21,978 | 20,055 | 21,344 | 21,279 | ||||||||||||||

Average common shares outstanding: | |||||||||||||||||||

Diluted | 526,837 | 527,959 | 533,230 | 535,486 | 536,992 | ||||||||||||||

Basic | 521,020 | 521,775 | 527,402 | 529,764 | 531,162 | ||||||||||||||

Full-time equivalent employees | 24,466 | 24,638 | 25,074 | 25,841 | 25,925 | ||||||||||||||

Number of ATMs | 2,176 | 2,187 | 2,192 | 2,212 | 2,243 | ||||||||||||||

Full service banking offices | 1,444 | 1,445 | 1,454 | 1,473 | 1,501 | ||||||||||||||

1 | See Appendix A for reconcilements of non-U.S. GAAP performance measures. |

2 | Total revenue, net interest margin, and efficiency ratios are presented on a fully taxable-equivalent (“FTE”) basis. The FTE basis adjusts for the tax-favored status of net interest income from certain loans and investments. The Company believes this measure to be the preferred industry measurement of net interest income and it enhances comparability of net interest income arising from taxable and tax-exempt sources. Total revenue - FTE equals net interest income on a FTE basis plus noninterest income. |

3 Current period capital ratios are estimated as of the earnings release date. Basel III Final Rules became effective for the Company on January 1, 2015; thus, Basel III capital ratios are not applicable ("N/A") in periods ending prior to January 1, 2015 and Basel I capital ratios are N/A in periods ending subsequent to January 1, 2015.

11

SunTrust Banks, Inc. and Subsidiaries

CONSOLIDATED STATEMENTS OF INCOME

(Dollars in millions and shares in thousands, except per share data) (Unaudited)

Three Months Ended | (Decrease)/Increase | |||||||||||||

March 31 | ||||||||||||||

2015 | 2014 | Amount | % 2 | |||||||||||

Interest income | $1,272 | $1,336 | ($64 | ) | (5 | )% | ||||||||

Interest expense | 132 | 132 | — | — | ||||||||||

NET INTEREST INCOME | 1,140 | 1,204 | (64 | ) | (5 | ) | ||||||||

Provision for credit losses | 55 | 102 | (47 | ) | (46 | ) | ||||||||

NET INTEREST INCOME AFTER PROVISION FOR CREDIT LOSSES | 1,085 | 1,102 | (17 | ) | (2 | ) | ||||||||

NONINTEREST INCOME | ||||||||||||||

Service charges on deposit accounts | 151 | 155 | (4 | ) | (3 | ) | ||||||||

Other charges and fees | 89 | 88 | 1 | 1 | ||||||||||

Card fees | 80 | 76 | 4 | 5 | ||||||||||

Investment banking income | 97 | 88 | 9 | 10 | ||||||||||

Trading income | 55 | 49 | 6 | 12 | ||||||||||

Trust and investment management income | 84 | 130 | (46 | ) | (35 | ) | ||||||||

Retail investment services | 72 | 71 | 1 | 1 | ||||||||||

Mortgage production related income | 83 | 43 | 40 | 93 | ||||||||||

Mortgage servicing related income | 43 | 54 | (11 | ) | (20 | ) | ||||||||

Net securities losses | — | (1 | ) | (1 | ) | (100 | ) | |||||||

Other noninterest income | 63 | 38 | 25 | 66 | ||||||||||

Total noninterest income | 817 | 791 | 26 | 3 | ||||||||||

NONINTEREST EXPENSE | ||||||||||||||

Employee compensation and benefits | 771 | 800 | (29 | ) | (4 | ) | ||||||||

Outside processing and software | 189 | 170 | 19 | 11 | ||||||||||

Net occupancy expense | 84 | 86 | (2 | ) | (2 | ) | ||||||||

Equipment expense | 40 | 44 | (4 | ) | (9 | ) | ||||||||

FDIC premium/regulatory exams | 37 | 40 | (3 | ) | (8 | ) | ||||||||

Marketing and customer development | 27 | 25 | 2 | 8 | ||||||||||

Operating losses | 14 | 21 | (7 | ) | (33 | ) | ||||||||

Amortization | 7 | 3 | 4 | NM | ||||||||||

Other noninterest expense | 111 | 168 | (57 | ) | (34 | ) | ||||||||

Total noninterest expense | 1,280 | 1,357 | (77 | ) | (6 | ) | ||||||||

INCOME BEFORE PROVISION FOR INCOME TAXES | 622 | 536 | 86 | 16 | ||||||||||

Provision for income taxes | 191 | 125 | 66 | 53 | ||||||||||

NET INCOME INCLUDING INCOME ATTRIBUTABLE TO NONCONTROLLING INTEREST | 431 | 411 | 20 | 5 | ||||||||||

Net income attributable to noncontrolling interest | 2 | 6 | (4 | ) | (67 | ) | ||||||||

NET INCOME | $429 | $405 | $24 | 6 | % | |||||||||

NET INCOME AVAILABLE TO COMMON SHAREHOLDERS | $411 | $393 | $18 | 5 | % | |||||||||

Net interest income - FTE 1 | 1,175 | 1,239 | (64 | ) | (5 | ) | ||||||||

Net income per average common share: | ||||||||||||||

Diluted | 0.78 | 0.73 | 0.05 | 7 | ||||||||||

Basic | 0.79 | 0.74 | 0.05 | 7 | ||||||||||

Cash dividends paid per common share | 0.20 | 0.10 | 0.10 | 100 | ||||||||||

Average common shares outstanding: | ||||||||||||||

Diluted | 526,837 | 536,992 | (10,155 | ) | (2 | ) | ||||||||

Basic | 521,020 | 531,162 | (10,142 | ) | (2 | ) | ||||||||

1 Net interest income includes the effects of FTE adjustments using a federal tax rate of 35% and state income taxes where applicable to increase tax-exempt interest income to a taxable-equivalent basis. See Appendix A for a reconcilement of this non-U.S. GAAP measure to the related U.S.GAAP measure.

2 “NM” - Not meaningful. Those changes over 100 percent were not considered to be meaningful.

12

SunTrust Banks, Inc. and Subsidiaries

FIVE QUARTER CONSOLIDATED STATEMENTS OF INCOME

(Dollars in millions and shares in thousands, except per share data) (Unaudited)

Three Months Ended | Three Months Ended | |||||||||||||||||||||||||

March 31 | December 31 | (Decrease)/Increase | September 30 | June 30 | March 31 | |||||||||||||||||||||

2015 | 2014 | Amount | % 2 | 2014 | 2014 | 2014 | ||||||||||||||||||||

Interest income | $1,272 | $1,349 | ($77 | ) | (6 | )% | $1,353 | $1,346 | $1,336 | |||||||||||||||||

Interest expense | 132 | 138 | (6 | ) | (4 | ) | 138 | 137 | 132 | |||||||||||||||||

NET INTEREST INCOME | 1,140 | 1,211 | (71 | ) | (6 | ) | 1,215 | 1,209 | 1,204 | |||||||||||||||||

Provision for credit losses | 55 | 74 | (19 | ) | (26 | ) | 93 | 73 | 102 | |||||||||||||||||

NET INTEREST INCOME AFTER PROVISION FOR CREDIT LOSSES | 1,085 | 1,137 | (52 | ) | (5 | ) | 1,122 | 1,136 | 1,102 | |||||||||||||||||

NONINTEREST INCOME | ||||||||||||||||||||||||||

Service charges on deposit accounts | 151 | 162 | (11 | ) | (7 | ) | 169 | 160 | 155 | |||||||||||||||||

Other charges and fees | 89 | 94 | (5 | ) | (5 | ) | 95 | 91 | 88 | |||||||||||||||||

Card fees | 80 | 82 | (2 | ) | (2 | ) | 81 | 82 | 76 | |||||||||||||||||

Investment banking income | 97 | 109 | (12 | ) | (11 | ) | 88 | 119 | 88 | |||||||||||||||||

Trading income | 55 | 40 | 15 | 38 | 46 | 47 | 49 | |||||||||||||||||||

Trust and investment management income | 84 | 84 | — | — | 93 | 116 | 130 | |||||||||||||||||||

Retail investment services | 72 | 73 | (1 | ) | (1 | ) | 76 | 76 | 71 | |||||||||||||||||

Mortgage production related income | 83 | 61 | 22 | 36 | 45 | 52 | 43 | |||||||||||||||||||

Mortgage servicing related income | 43 | 53 | (10 | ) | (19 | ) | 44 | 45 | 54 | |||||||||||||||||

Net securities losses | — | (5 | ) | (5 | ) | (100 | ) | (9 | ) | (1 | ) | (1 | ) | |||||||||||||

Other noninterest income | 63 | 42 | 21 | 50 | 52 | 170 | 38 | |||||||||||||||||||

Total noninterest income | 817 | 795 | 22 | 3 | 780 | 957 | 791 | |||||||||||||||||||

NONINTEREST EXPENSE | ||||||||||||||||||||||||||

Employee compensation and benefits | 771 | 670 | 101 | 15 | 730 | 763 | 800 | |||||||||||||||||||

Outside processing and software | 189 | 206 | (17 | ) | (8 | ) | 184 | 181 | 170 | |||||||||||||||||

Net occupancy expense | 84 | 86 | (2 | ) | (2 | ) | 84 | 83 | 86 | |||||||||||||||||

Equipment expense | 40 | 42 | (2 | ) | (5 | ) | 41 | 42 | 44 | |||||||||||||||||

FDIC premium/regulatory exams | 37 | 32 | 5 | 16 | 29 | 40 | 40 | |||||||||||||||||||

Marketing and customer development | 27 | 43 | (16 | ) | (37 | ) | 35 | 30 | 25 | |||||||||||||||||

Operating losses | 14 | 174 | (160 | ) | (92 | ) | 29 | 218 | 21 | |||||||||||||||||

Amortization | 7 | 11 | (4 | ) | (36 | ) | 7 | 4 | 3 | |||||||||||||||||

Other noninterest expense | 111 | 146 | (35 | ) | (24 | ) | 120 | 156 | 168 | |||||||||||||||||

Total noninterest expense | 1,280 | 1,410 | (130 | ) | (9 | ) | 1,259 | 1,517 | 1,357 | |||||||||||||||||

INCOME BEFORE PROVISION FOR INCOME TAXES | 622 | 522 | 100 | 19 | 643 | 576 | 536 | |||||||||||||||||||

Provision for income taxes | 191 | 128 | 63 | 49 | 67 | 173 | 125 | |||||||||||||||||||

NET INCOME INCLUDING INCOME ATTRIBUTABLE TO NONCONTROLLING INTEREST | 431 | 394 | 37 | 9 | 576 | 403 | 411 | |||||||||||||||||||

Net income attributable to noncontrolling interest | 2 | — | 2 | NM | — | 4 | 6 | |||||||||||||||||||

NET INCOME | $429 | $394 | $35 | 9 | % | $576 | $399 | $405 | ||||||||||||||||||

NET INCOME AVAILABLE TO COMMON SHAREHOLDERS | $411 | $378 | $33 | 9 | % | $563 | $387 | $393 | ||||||||||||||||||

Net interest income - FTE 1 | 1,175 | 1,248 | (73 | ) | (6 | ) | 1,251 | 1,244 | 1,239 | |||||||||||||||||

Net income per average common share: | ||||||||||||||||||||||||||

Diluted | 0.78 | 0.72 | 0.06 | 8 | 1.06 | 0.72 | 0.73 | |||||||||||||||||||

Basic | 0.79 | 0.72 | 0.07 | 10 | 1.07 | 0.73 | 0.74 | |||||||||||||||||||

Cash dividends paid per common share | 0.20 | 0.20 | — | — | 0.20 | 0.20 | 0.10 | |||||||||||||||||||

Average common shares outstanding: | ||||||||||||||||||||||||||

Diluted | 526,837 | 527,959 | (1,122 | ) | — | 533,230 | 535,486 | 536,992 | ||||||||||||||||||

Basic | 521,020 | 521,775 | (755 | ) | — | 527,402 | 529,764 | 531,162 | ||||||||||||||||||

1 Net interest income includes the effects of FTE adjustments using a federal tax rate of 35% and state income taxes where applicable to increase tax-exempt interest income to a taxable-equivalent basis. See Appendix A for a reconcilement of this non-U.S. GAAP measure to the related U.S. GAAP measure.

2 “NM” - Not meaningful. Those changes over 100 percent were not considered to be meaningful.

13

SunTrust Banks, Inc. and Subsidiaries

CONSOLIDATED BALANCE SHEETS

(Dollars in millions and shares in thousands, except per share data) (Unaudited)

March 31 | (Decrease)/Increase | |||||||||||||

2015 | 2014 | Amount | % 2 | |||||||||||

ASSETS | ||||||||||||||

Cash and due from banks | $6,483 | $6,978 | ($495 | ) | (7 | )% | ||||||||

Federal funds sold and securities borrowed or purchased under agreements to resell | 1,233 | 907 | 326 | 36 | ||||||||||

Interest-bearing deposits in other banks | 22 | 22 | — | — | ||||||||||

Trading assets and derivatives | 6,595 | 4,848 | 1,747 | 36 | ||||||||||

Securities available for sale | 26,761 | 23,302 | 3,459 | 15 | ||||||||||

Loans held for sale ("LHFS") | 3,404 | 1,488 | 1,916 | NM | ||||||||||

Loans held for investment: | ||||||||||||||

Commercial and industrial ("C&I") | 65,574 | 58,828 | 6,746 | 11 | ||||||||||

Commercial real estate ("CRE") | 6,389 | 5,961 | 428 | 7 | ||||||||||

Commercial construction | 1,484 | 920 | 564 | 61 | ||||||||||

Residential mortgages - guaranteed | 655 | 3,295 | (2,640 | ) | (80 | ) | ||||||||

Residential mortgages - nonguaranteed | 23,419 | 24,331 | (912 | ) | (4 | ) | ||||||||

Residential home equity products | 13,954 | 14,637 | (683 | ) | (5 | ) | ||||||||

Residential construction | 417 | 532 | (115 | ) | (22 | ) | ||||||||

Consumer student loans - guaranteed | 4,337 | 5,533 | (1,196 | ) | (22 | ) | ||||||||

Consumer other direct | 4,937 | 3,109 | 1,828 | 59 | ||||||||||

Consumer indirect | 10,336 | 11,339 | (1,003 | ) | (9 | ) | ||||||||

Consumer credit cards | 878 | 711 | 167 | 23 | ||||||||||

Total loans held for investment | 132,380 | 129,196 | 3,184 | 2 | ||||||||||

Allowance for loan and lease losses ("ALLL") | (1,893 | ) | (2,040 | ) | (147 | ) | (7 | ) | ||||||

Net loans held for investment | 130,487 | 127,156 | 3,331 | 3 | ||||||||||

Goodwill | 6,337 | 6,377 | (40 | ) | (1 | ) | ||||||||

Other intangible assets | 1,193 | 1,282 | (89 | ) | (7 | ) | ||||||||

Other real estate owned ("OREO") | 79 | 151 | (72 | ) | (48 | ) | ||||||||

Other assets | 7,287 | 7,031 | 256 | 4 | ||||||||||

Total assets 1 | $189,881 | $179,542 | $10,339 | 6 | % | |||||||||

LIABILITIES | ||||||||||||||

Deposits: | ||||||||||||||

Noninterest-bearing consumer and commercial deposits | $42,376 | $39,792 | $2,584 | 6 | % | |||||||||

Interest-bearing consumer and commercial deposits: | ||||||||||||||

NOW accounts | 34,574 | 29,151 | 5,423 | 19 | ||||||||||

Money market accounts | 49,430 | 43,196 | 6,234 | 14 | ||||||||||

Savings | 6,304 | 6,217 | 87 | 1 | ||||||||||

Consumer time | 6,670 | 8,102 | (1,432 | ) | (18 | ) | ||||||||

Other time | 3,885 | 4,475 | (590 | ) | (13 | ) | ||||||||

Total consumer and commercial deposits | 143,239 | 130,933 | 12,306 | 9 | ||||||||||

Brokered time deposits | 884 | 2,023 | (1,139 | ) | (56 | ) | ||||||||

Foreign deposits | 300 | — | 300 | NM | ||||||||||

Total deposits | 144,423 | 132,956 | 11,467 | 9 | ||||||||||

Funds purchased | 1,299 | 1,269 | 30 | 2 | ||||||||||

Securities sold under agreements to repurchase | 1,845 | 2,133 | (288 | ) | (14 | ) | ||||||||

Other short-term borrowings | 1,438 | 5,277 | (3,839 | ) | (73 | ) | ||||||||

Long-term debt | 13,012 | 11,565 | 1,447 | 13 | ||||||||||

Trading liabilities and derivatives | 1,459 | 1,041 | 418 | 40 | ||||||||||

Other liabilities | 3,145 | 3,484 | (339 | ) | (10 | ) | ||||||||

Total liabilities | 166,621 | 157,725 | 8,896 | 6 | ||||||||||

SHAREHOLDERS' EQUITY | ||||||||||||||

Preferred stock, no par value | 1,225 | 725 | 500 | 69 | ||||||||||

Common stock, $1.00 par value | 550 | 550 | — | — | ||||||||||

Additional paid in capital | 9,074 | 9,107 | (33 | ) | — | |||||||||

Retained earnings | 13,600 | 12,278 | 1,322 | 11 | ||||||||||

Treasury stock, at cost, and other | (1,124 | ) | (643 | ) | 481 | 75 | ||||||||

Accumulated other comprehensive loss | (65 | ) | (200 | ) | (135 | ) | (68 | ) | ||||||

Total shareholders' equity | 23,260 | 21,817 | 1,443 | 7 | ||||||||||

Total liabilities and shareholders' equity | $189,881 | $179,542 | $10,339 | 6 | % | |||||||||

Common shares outstanding | 522,031 | 534,780 | (12,749 | ) | (2 | )% | ||||||||

Common shares authorized | 750,000 | 750,000 | — | — | ||||||||||

Preferred shares outstanding | 12 | 7 | 5 | 71 | ||||||||||

Preferred shares authorized | 50,000 | 50,000 | — | — | ||||||||||

Treasury shares of common stock | 27,890 | 15,141 | 12,749 | 84 | ||||||||||

1 Includes earning assets of $168,269 and $158,487 at March 31, 2015 and 2014, respectively.

2 “NM” - Not meaningful. Those changes over 100 percent were not considered to be meaningful.

14

SunTrust Banks, Inc. and Subsidiaries

FIVE QUARTER CONSOLIDATED BALANCE SHEETS

(Dollars in millions and shares in thousands, except per share data) (Unaudited)

March 31 | December 31 | (Decrease)/Increase | September 30 | June 30 | March 31 | |||||||||||||||||||||

2015 | 2014 | Amount | % | 2014 | 2014 | 2014 | ||||||||||||||||||||

ASSETS | ||||||||||||||||||||||||||

Cash and due from banks | $6,483 | $7,047 | ($564 | ) | (8 | )% | $7,178 | $5,681 | $6,978 | |||||||||||||||||

Federal funds sold and securities borrowed or purchased under agreements to resell | 1,233 | 1,160 | 73 | 6 | 1,125 | 1,156 | 907 | |||||||||||||||||||

Interest-bearing deposits in other banks | 22 | 22 | — | — | 22 | 22 | 22 | |||||||||||||||||||

Trading assets and derivatives | 6,595 | 6,202 | 393 | 6 | 5,782 | 5,141 | 4,848 | |||||||||||||||||||

Securities available for sale | 26,761 | 26,770 | (9 | ) | — | 26,162 | 24,015 | 23,302 | ||||||||||||||||||

LHFS | 3,404 | 3,232 | 172 | 5 | 1,739 | 4,046 | 1,488 | |||||||||||||||||||

Loans held for investment: | ||||||||||||||||||||||||||

C&I | 65,574 | 65,440 | 134 | — | 63,140 | 61,337 | 58,828 | |||||||||||||||||||

CRE | 6,389 | 6,741 | (352 | ) | (5 | ) | 6,704 | 6,105 | 5,961 | |||||||||||||||||

Commercial construction | 1,484 | 1,211 | 273 | 23 | 1,250 | 1,096 | 920 | |||||||||||||||||||

Residential mortgages - guaranteed | 655 | 632 | 23 | 4 | 651 | 661 | 3,295 | |||||||||||||||||||

Residential mortgages - nonguaranteed | 23,419 | 23,443 | (24 | ) | — | 23,718 | 24,173 | 24,331 | ||||||||||||||||||

Residential home equity products | 13,954 | 14,264 | (310 | ) | (2 | ) | 14,389 | 14,519 | 14,637 | |||||||||||||||||

Residential construction | 417 | 436 | (19 | ) | (4 | ) | 464 | 508 | 532 | |||||||||||||||||

Consumer student loans - guaranteed | 4,337 | 4,827 | (490 | ) | (10 | ) | 5,314 | 5,420 | 5,533 | |||||||||||||||||

Consumer other direct | 4,937 | 4,573 | 364 | 8 | 4,110 | 3,675 | 3,109 | |||||||||||||||||||

Consumer indirect | 10,336 | 10,644 | (308 | ) | (3 | ) | 11,594 | 11,501 | 11,339 | |||||||||||||||||

Consumer credit cards | 878 | 901 | (23 | ) | (3 | ) | 817 | 749 | 711 | |||||||||||||||||

Total loans held for investment | 132,380 | 133,112 | (732 | ) | (1 | ) | 132,151 | 129,744 | 129,196 | |||||||||||||||||

ALLL | (1,893 | ) | (1,937 | ) | (44 | ) | (2 | ) | (1,968 | ) | (2,003 | ) | (2,040 | ) | ||||||||||||

Net loans held for investment | 130,487 | 131,175 | (688 | ) | (1 | ) | 130,183 | 127,741 | 127,156 | |||||||||||||||||

Goodwill | 6,337 | 6,337 | — | — | 6,337 | 6,337 | 6,377 | |||||||||||||||||||

Other intangible assets | 1,193 | 1,219 | (26 | ) | (2 | ) | 1,320 | 1,277 | 1,282 | |||||||||||||||||

OREO | 79 | 99 | (20 | ) | (20 | ) | 112 | 136 | 151 | |||||||||||||||||

Other assets | 7,287 | 7,065 | 222 | 3 | 6,858 | 7,007 | 7,031 | |||||||||||||||||||

Total assets 1 | $189,881 | $190,328 | ($447 | ) | — | % | $186,818 | $182,559 | $179,542 | |||||||||||||||||

LIABILITIES | ||||||||||||||||||||||||||

Deposits: | ||||||||||||||||||||||||||

Noninterest-bearing consumer and commercial deposits | $42,376 | $41,096 | $1,280 | 3 | % | $42,542 | $40,891 | $39,792 | ||||||||||||||||||

Interest-bearing consumer and commercial deposits: | ||||||||||||||||||||||||||

NOW accounts | 34,574 | 33,326 | 1,248 | 4 | 28,414 | 29,243 | 29,151 | |||||||||||||||||||

Money market accounts | 49,430 | 48,013 | 1,417 | 3 | 46,892 | 43,942 | 43,196 | |||||||||||||||||||

Savings | 6,304 | 5,925 | 379 | 6 | 6,046 | 6,133 | 6,217 | |||||||||||||||||||

Consumer time | 6,670 | 6,881 | (211 | ) | (3 | ) | 7,068 | 7,334 | 8,102 | |||||||||||||||||

Other time | 3,885 | 3,993 | (108 | ) | (3 | ) | 4,115 | 4,249 | 4,475 | |||||||||||||||||

Total consumer and commercial deposits | 143,239 | 139,234 | 4,005 | 3 | 135,077 | 131,792 | 130,933 | |||||||||||||||||||

Brokered time deposits | 884 | 958 | (74 | ) | (8 | ) | 1,180 | 1,483 | 2,023 | |||||||||||||||||

Foreign deposits | 300 | 375 | (75 | ) | (20 | ) | 250 | 10 | — | |||||||||||||||||

Total deposits | 144,423 | 140,567 | 3,856 | 3 | 136,507 | 133,285 | 132,956 | |||||||||||||||||||

Funds purchased | 1,299 | 1,276 | 23 | 2 | 1,000 | 1,053 | 1,269 | |||||||||||||||||||

Securities sold under agreements to repurchase | 1,845 | 2,276 | (431 | ) | (19 | ) | 2,089 | 2,192 | 2,133 | |||||||||||||||||

Other short-term borrowings | 1,438 | 5,634 | (4,196 | ) | (74 | ) | 7,283 | 5,870 | 5,277 | |||||||||||||||||

Long-term debt | 13,012 | 13,022 | (10 | ) | — | 12,942 | 13,155 | 11,565 | ||||||||||||||||||

Trading liabilities and derivatives | 1,459 | 1,227 | 232 | 19 | 1,231 | 1,190 | 1,041 | |||||||||||||||||||

Other liabilities | 3,145 | 3,321 | (176 | ) | (5 | ) | 3,497 | 3,683 | 3,484 | |||||||||||||||||

Total liabilities | 166,621 | 167,323 | (702 | ) | — | 164,549 | 160,428 | 157,725 | ||||||||||||||||||

SHAREHOLDERS’ EQUITY | ||||||||||||||||||||||||||

Preferred stock, no par value | 1,225 | 1,225 | — | — | 725 | 725 | 725 | |||||||||||||||||||

Common stock, $1.00 par value | 550 | 550 | — | — | 550 | 550 | 550 | |||||||||||||||||||

Additional paid in capital | 9,074 | 9,089 | (15 | ) | — | 9,090 | 9,085 | 9,107 | ||||||||||||||||||

Retained earnings | 13,600 | 13,295 | 305 | 2 | 13,020 | 12,560 | 12,278 | |||||||||||||||||||

Treasury stock, at cost, and other | (1,124 | ) | (1,032 | ) | 92 | 9 | (939 | ) | (730 | ) | (643 | ) | ||||||||||||||

Accumulated other comprehensive loss | (65 | ) | (122 | ) | (57 | ) | (47 | ) | (177 | ) | (59 | ) | (200 | ) | ||||||||||||

Total shareholders’ equity | 23,260 | 23,005 | 255 | 1 | 22,269 | 22,131 | 21,817 | |||||||||||||||||||

Total liabilities and shareholders’ equity | $189,881 | $190,328 | ($447 | ) | — | % | $186,818 | $182,559 | $179,542 | |||||||||||||||||

Common shares outstanding | 522,031 | 524,540 | (2,509 | ) | — | % | 527,358 | 532,800 | 534,780 | |||||||||||||||||

Common shares authorized | 750,000 | 750,000 | — | — | 750,000 | 750,000 | 750,000 | |||||||||||||||||||

Preferred shares outstanding | 12 | 12 | — | — | 7 | 7 | 7 | |||||||||||||||||||

Preferred shares authorized | 50,000 | 50,000 | — | — | 50,000 | 50,000 | 50,000 | |||||||||||||||||||

Treasury shares of common stock | 27,890 | 25,381 | 2,509 | 10 | 22,563 | 17,121 | 15,141 | |||||||||||||||||||

1 Includes earning assets of $168,269, $168,678, $165,434, $162,422, and $158,487 at March 31, 2015, December 31, 2014, September 30, 2014, June 30, 2014, and March 31, 2014, respectively.

15

SunTrust Banks, Inc. and Subsidiaries CONSOLIDATED DAILY AVERAGE BALANCES, AVERAGE YIELDS EARNED AND RATES PAID (Dollars in millions; yields on taxable-equivalent basis) (Unaudited) | |||||||||||||||||||||||||||||||||||

Three Months Ended | Increase/(Decrease) From | ||||||||||||||||||||||||||||||||||

March 31, 2015 | December 31, 2014 | Sequential Quarter | Prior Year Quarter | ||||||||||||||||||||||||||||||||

Average Balances | Interest Income/ Expense | Yields/ Rates | Average Balances | Interest Income/ Expense | Yields/ Rates | Average Balances | Yields/ Rates | Average Balances | Yields/ Rates | ||||||||||||||||||||||||||

ASSETS | |||||||||||||||||||||||||||||||||||

Loans: | |||||||||||||||||||||||||||||||||||

Commercial and industrial ("C&I") - FTE 1 | $65,725 | $511 | 3.15 | % | $64,523 | $554 | 3.41 | % | $1,202 | (0.26 | ) | $7,438 | (0.59 | ) | |||||||||||||||||||||

Commercial real estate ("CRE") | 6,475 | 44 | 2.77 | 6,535 | 47 | 2.83 | (60 | ) | (0.06 | ) | 859 | (0.16 | ) | ||||||||||||||||||||||

Commercial construction | 1,342 | 10 | 3.17 | 1,245 | 10 | 3.23 | 97 | (0.06 | ) | 448 | (0.14 | ) | |||||||||||||||||||||||

Residential mortgages - guaranteed | 638 | 6 | 3.58 | 624 | 6 | 4.08 | 14 | (0.50 | ) | (2,713 | ) | (0.04 | ) | ||||||||||||||||||||||

Residential mortgages - nonguaranteed | 23,104 | 222 | 3.84 | 23,266 | 227 | 3.91 | (162 | ) | (0.07 | ) | (829 | ) | (0.21 | ) | |||||||||||||||||||||

Residential home equity products | 13,953 | 125 | 3.63 | 14,151 | 126 | 3.54 | (198 | ) | 0.09 | (563 | ) | 0.04 | |||||||||||||||||||||||

Residential construction | 398 | 5 | 5.21 | 424 | 5 | 4.57 | (26 | ) | 0.64 | (87 | ) | 0.81 | |||||||||||||||||||||||

Consumer student loans - guaranteed | 4,755 | 43 | 3.70 | 5,158 | 47 | 3.65 | (403 | ) | 0.05 | (768 | ) | — | |||||||||||||||||||||||

Consumer other direct | 4,747 | 50 | 4.24 | 4,345 | 46 | 4.20 | 402 | 0.04 | 1,788 | (0.01 | ) | ||||||||||||||||||||||||

Consumer indirect | 10,708 | 83 | 3.13 | 11,588 | 93 | 3.19 | (880 | ) | (0.06 | ) | (591 | ) | (0.12 | ) | |||||||||||||||||||||

Consumer credit cards | 880 | 22 | 9.84 | 850 | 21 | 9.66 | 30 | 0.18 | 164 | 0.28 | |||||||||||||||||||||||||

Nonaccrual | 613 | 4 | 2.90 | 729 | 7 | 3.60 | (116 | ) | (0.70 | ) | (333 | ) | 0.92 | ||||||||||||||||||||||

Total loans | 133,338 | 1,125 | 3.42 | 133,438 | 1,189 | 3.54 | (100 | ) | (0.12 | ) | 4,813 | (0.32 | ) | ||||||||||||||||||||||

Securities available for sale: | |||||||||||||||||||||||||||||||||||

Taxable | 25,676 | 139 | 2.17 | 25,659 | 155 | 2.41 | 17 | (0.24 | ) | 3,254 | (0.51 | ) | |||||||||||||||||||||||

Tax-exempt - FTE 1 | 192 | 2 | 5.19 | 219 | 3 | 5.26 | (27 | ) | (0.07 | ) | (72 | ) | (0.06 | ) | |||||||||||||||||||||

Total securities available for sale | 25,868 | 141 | 2.18 | 25,878 | 158 | 2.44 | (10 | ) | (0.26 | ) | 3,182 | (0.53 | ) | ||||||||||||||||||||||

Federal funds sold and securities borrowed or purchased under agreements to resell | 1,141 | — | — | 1,205 | — | — | (64 | ) | — | 163 | — | ||||||||||||||||||||||||

Loans held for sale ("LHFS") | 2,630 | 22 | 3.33 | 1,826 | 17 | 3.70 | 804 | (0.37 | ) | 1,180 | (0.72 | ) | |||||||||||||||||||||||

Interest-bearing deposits | 23 | — | 0.12 | 22 | — | 0.04 | 1 | 0.08 | 1 | (0.01 | ) | ||||||||||||||||||||||||

Interest earning trading assets | 5,179 | 19 | 1.49 | 4,858 | 22 | 1.78 | 321 | (0.29 | ) | 1,497 | (0.38 | ) | |||||||||||||||||||||||

Total earning assets | 168,179 | 1,307 | 3.15 | 167,227 | 1,386 | 3.29 | 952 | (0.14 | ) | 10,836 | (0.38 | ) | |||||||||||||||||||||||

Allowance for loan and lease losses ("ALLL") | (1,910 | ) | (1,931 | ) | 21 | 127 | |||||||||||||||||||||||||||||

Cash and due from banks | 6,567 | 6,661 | (94 | ) | 1,131 | ||||||||||||||||||||||||||||||

Other assets | 14,417 | 14,574 | (157 | ) | (410 | ) | |||||||||||||||||||||||||||||

Noninterest earning trading assets and derivatives | 1,402 | 1,357 | 45 | 103 | |||||||||||||||||||||||||||||||

Unrealized gains on securities available for sale, net | 610 | 453 | 157 | 507 | |||||||||||||||||||||||||||||||

Total assets | $189,265 | $188,341 | $924 | $12,294 | |||||||||||||||||||||||||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||||||||||||||||||||||||||

Interest-bearing deposits: | |||||||||||||||||||||||||||||||||||

NOW accounts | $33,159 | $7 | 0.09 | % | $30,367 | $6 | 0.08 | % | $2,792 | 0.01 | $5,452 | 0.02 | |||||||||||||||||||||||

Money market accounts | 49,193 | 21 | 0.18 | 47,910 | 20 | 0.16 | 1,283 | 0.02 | 6,438 | 0.06 | |||||||||||||||||||||||||

Savings | 6,082 | 1 | 0.04 | 5,987 | 1 | 0.03 | 95 | 0.01 | 47 | — | |||||||||||||||||||||||||

Consumer time | 6,793 | 13 | 0.77 | 6,970 | 13 | 0.76 | (177 | ) | 0.01 | (1,525 | ) | (0.31 | ) | ||||||||||||||||||||||

Other time | 3,957 | 10 | 1.00 | 4,067 | 10 | 0.99 | (110 | ) | 0.01 | (576 | ) | (0.19 | ) | ||||||||||||||||||||||

Total interest-bearing consumer and commercial deposits | 99,184 | 52 | 0.21 | 95,301 | 50 | 0.21 | 3,883 | — | 9,836 | (0.03 | ) | ||||||||||||||||||||||||

Brokered time deposits | 916 | 4 | 1.50 | 1,055 | 5 | 1.66 | (139 | ) | (0.16 | ) | (1,096 | ) | (0.81 | ) | |||||||||||||||||||||

Foreign deposits | 334 | — | 0.13 | 344 | — | 0.12 | (10 | ) | 0.01 | 333 | (0.47 | ) | |||||||||||||||||||||||

Total interest-bearing deposits | 100,434 | 56 | 0.22 | 96,700 | 55 | 0.22 | 3,734 | — | 9,073 | (0.07 | ) | ||||||||||||||||||||||||

Funds purchased | 1,040 | — | 0.10 | 973 | — | 0.11 | 67 | (0.01 | ) | 51 | 0.02 | ||||||||||||||||||||||||

Securities sold under agreements to repurchase | 1,922 | 1 | 0.19 | 2,279 | 1 | 0.19 | (357 | ) | — | (280 | ) | 0.09 | |||||||||||||||||||||||

Interest-bearing trading liabilities | 882 | 5 | 2.37 | 961 | 6 | 2.38 | (79 | ) | (0.01 | ) | 183 | (0.37 | ) | ||||||||||||||||||||||

Other short-term borrowings | 3,698 | 2 | 0.19 | 6,581 | 3 | 0.20 | (2,883 | ) | (0.01 | ) | (1,890 | ) | (0.05 | ) | |||||||||||||||||||||

Long-term debt | 13,018 | 68 | 2.13 | 12,967 | 73 | 2.23 | 51 | (0.10 | ) | 1,651 | 0.08 | ||||||||||||||||||||||||

Total interest-bearing liabilities | 120,994 | 132 | 0.44 | 120,461 | 138 | 0.45 | 533 | (0.01 | ) | 8,788 | (0.04 | ) | |||||||||||||||||||||||

Noninterest-bearing deposits | 41,292 | 41,591 | (299 | ) | 2,244 | ||||||||||||||||||||||||||||||

Other liabilities | 3,279 | 3,143 | 136 | (245 | ) | ||||||||||||||||||||||||||||||

Noninterest-bearing trading liabilities and derivatives | 528 | 392 | 136 | 62 | |||||||||||||||||||||||||||||||

Shareholders’ equity | 23,172 | 22,754 | 418 | 1,445 | |||||||||||||||||||||||||||||||

Total liabilities and shareholders’ equity | $189,265 | $188,341 | $924 | $12,294 | |||||||||||||||||||||||||||||||

Interest Rate Spread | 2.71 | % | 2.84 | % | (0.13 | ) | (0.34 | ) | |||||||||||||||||||||||||||

Net Interest Income - FTE 1 | $1,175 | $1,248 | |||||||||||||||||||||||||||||||||

Net Interest Margin 2 | 2.83 | % | 2.96 | % | (0.13 | ) | (0.36 | ) | |||||||||||||||||||||||||||

1 The fully taxable-equivalent (“FTE”) basis adjusts for the tax-favored status of net interest income from certain loans and investments. The Company believes this measure to be the preferred industry measurement of net interest income and it enhances comparability of net interest income arising from taxable and tax-exempt sources.

2 The net interest margin is calculated by dividing annualized net interest income - FTE by average total earning assets.

16

SunTrust Banks, Inc. and Subsidiaries CONSOLIDATED DAILY AVERAGE BALANCES, AVERAGE YIELDS EARNED AND RATES PAID, continued (Dollars in millions; yields on taxable-equivalent basis) (Unaudited) | ||||||||||||||||||||||||||||||||

Three Months Ended | ||||||||||||||||||||||||||||||||

September 30, 2014 | June 30, 2014 | March 31, 2014 | ||||||||||||||||||||||||||||||

Average Balances | Interest Income/ Expense | Yields/ Rates | Average Balances | Interest Income/ Expense | Yields/ Rates | Average Balances | Interest Income/ Expense | Yields/ Rates | ||||||||||||||||||||||||

ASSETS | ||||||||||||||||||||||||||||||||

Loans: | ||||||||||||||||||||||||||||||||

C&I - FTE 1 | $61,700 | $548 | 3.53 | % | $60,141 | $545 | 3.63 | % | $58,287 | $538 | 3.74 | % | ||||||||||||||||||||

CRE | 6,386 | 46 | 2.86 | 6,052 | 44 | 2.92 | 5,616 | 41 | 2.93 | |||||||||||||||||||||||

Commercial construction | 1,162 | 9 | 3.21 | 1,006 | 9 | 3.41 | 894 | 7 | 3.31 | |||||||||||||||||||||||

Residential mortgages - guaranteed | 635 | 6 | 3.64 | 2,994 | 27 | 3.62 | 3,351 | 30 | 3.62 | |||||||||||||||||||||||

Residential mortgages - nonguaranteed | 23,722 | 236 | 3.99 | 23,849 | 237 | 3.98 | 23,933 | 242 | 4.05 | |||||||||||||||||||||||

Residential home equity products | 14,260 | 129 | 3.58 | 14,394 | 128 | 3.58 | 14,516 | 129 | 3.59 | |||||||||||||||||||||||

Residential construction | 445 | 6 | 5.27 | 474 | 5 | 4.34 | 485 | 5 | 4.40 | |||||||||||||||||||||||

Consumer student loans - guaranteed | 5,360 | 49 | 3.66 | 5,463 | 50 | 3.64 | 5,523 | 50 | 3.70 | |||||||||||||||||||||||

Consumer other direct | 3,876 | 41 | 4.20 | 3,342 | 35 | 4.23 | 2,959 | 31 | 4.25 | |||||||||||||||||||||||

Consumer indirect | 11,556 | 92 | 3.15 | 11,388 | 91 | 3.19 | 11,299 | 91 | 3.25 | |||||||||||||||||||||||

Consumer credit cards | 788 | 19 | 9.74 | 732 | 18 | 9.63 | 716 | 17 | 9.56 | |||||||||||||||||||||||

Nonaccrual | 857 | 5 | 2.16 | 899 | 6 | 2.81 | 946 | 5 | 1.98 | |||||||||||||||||||||||

Total loans | 130,747 | 1,186 | 3.60 | 130,734 | 1,195 | 3.67 | 128,525 | 1,186 | 3.74 | |||||||||||||||||||||||

Securities available for sale: | ||||||||||||||||||||||||||||||||

Taxable | 24,195 | 151 | 2.49 | 22,799 | 147 | 2.58 | 22,422 | 150 | 2.68 | |||||||||||||||||||||||

Tax-exempt - FTE 1 | 235 | 3 | 5.24 | 263 | 3 | 5.26 | 264 | 3 | 5.25 | |||||||||||||||||||||||

Total securities available for sale | 24,430 | 154 | 2.52 | 23,062 | 150 | 2.61 | 22,686 | 153 | 2.71 | |||||||||||||||||||||||

Federal funds sold and securities borrowed or purchased under agreements to resell | 1,036 | — | — | 1,047 | — | — | 978 | — | — | |||||||||||||||||||||||

LHFS | 3,367 | 30 | 3.53 | 1,678 | 17 | 4.03 | 1,450 | 15 | 4.05 | |||||||||||||||||||||||

Interest-bearing deposits | 53 | — | 0.05 | 25 | — | 0.16 | 22 | — | 0.13 | |||||||||||||||||||||||

Interest earning trading assets | 4,055 | 19 | 1.85 | 3,827 | 19 | 1.98 | 3,682 | 17 | 1.87 | |||||||||||||||||||||||

Total earning assets | 163,688 | 1,389 | 3.37 | 160,373 | 1,381 | 3.45 | 157,343 | 1,371 | 3.53 | |||||||||||||||||||||||

ALLL | (1,988 | ) | (2,023 | ) | (2,037 | ) | ||||||||||||||||||||||||||

Cash and due from banks | 5,573 | 5,412 | 5,436 | |||||||||||||||||||||||||||||

Other assets | 14,613 | 14,675 | 14,827 | |||||||||||||||||||||||||||||

Noninterest earning trading assets and derivatives | 1,215 | 1,155 | 1,299 | |||||||||||||||||||||||||||||

Unrealized gains on securities available for sale, net | 332 | 228 | 103 | |||||||||||||||||||||||||||||

Total assets | $183,433 | $179,820 | $176,971 | |||||||||||||||||||||||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||||||||||||||||||||||

Interest-bearing deposits: | ||||||||||||||||||||||||||||||||

NOW accounts | $28,224 | $5 | 0.07 | % | $29,198 | $6 | 0.08 | % | $27,707 | $5 | 0.07 | % | ||||||||||||||||||||

Money market accounts | 45,562 | 17 | 0.15 | 42,963 | 15 | 0.14 | 42,755 | 13 | 0.12 | |||||||||||||||||||||||

Savings | 6,098 | 1 | 0.03 | 6,182 | 1 | 0.04 | 6,035 | — | 0.04 | |||||||||||||||||||||||

Consumer time | 7,186 | 14 | 0.75 | 7,701 | 17 | 0.89 | 8,318 | 22 | 1.08 | |||||||||||||||||||||||

Other time | 4,182 | 10 | 0.99 | 4,398 | 12 | 1.07 | 4,533 | 13 | 1.19 | |||||||||||||||||||||||

Total interest-bearing consumer and commercial deposits | 91,252 | 47 | 0.20 | 90,442 | 51 | 0.22 | 89,348 | 53 | 0.24 | |||||||||||||||||||||||

Brokered time deposits | 1,392 | 7 | 1.91 | 1,890 | 10 | 2.19 | 2,012 | 12 | 2.31 | |||||||||||||||||||||||

Foreign deposits | 232 | — | 0.11 | 3 | — | — | 1 | — | 0.60 | |||||||||||||||||||||||

Total interest-bearing deposits | 92,876 | 54 | 0.23 | 92,335 | 61 | 0.27 | 91,361 | 65 | 0.29 | |||||||||||||||||||||||

Funds purchased | 937 | — | 0.10 | 825 | — | 0.09 | 989 | — | 0.08 | |||||||||||||||||||||||

Securities sold under agreements to repurchase | 2,177 | 1 | 0.13 | 2,148 | 1 | 0.12 | 2,202 | 1 | 0.10 | |||||||||||||||||||||||

Interest-bearing trading liabilities | 778 | 5 | 2.72 | 783 | 6 | 2.83 | 699 | 5 | 2.74 | |||||||||||||||||||||||

Other short-term borrowings | 6,559 | 4 | 0.23 | 5,796 | 3 | 0.23 | 5,588 | 3 | 0.24 | |||||||||||||||||||||||

Long-term debt | 13,064 | 74 | 2.24 | 12,014 | 66 | 2.21 | 11,367 | 58 | 2.05 | |||||||||||||||||||||||

Total interest-bearing liabilities | 116,391 | 138 | 0.47 | 113,901 | 137 | 0.48 | 112,206 | 132 | 0.48 | |||||||||||||||||||||||

Noninterest-bearing deposits | 40,943 | 40,030 | 39,048 | |||||||||||||||||||||||||||||

Other liabilities | 3,620 | 3,599 | 3,524 | |||||||||||||||||||||||||||||

Noninterest-bearing trading liabilities and derivatives | 288 | 296 | 466 | |||||||||||||||||||||||||||||

Shareholders’ equity | 22,191 | 21,994 | 21,727 | |||||||||||||||||||||||||||||

Total liabilities and shareholders’ equity | $183,433 | $179,820 | $176,971 | |||||||||||||||||||||||||||||

Interest Rate Spread | 2.90 | % | 2.97 | % | 3.05 | % | ||||||||||||||||||||||||||

Net Interest Income - FTE 1 | $1,251 | $1,244 | $1,239 | |||||||||||||||||||||||||||||

Net Interest Margin 2 | 3.03 | % | 3.11 | % | 3.19 | % | ||||||||||||||||||||||||||

1 | The fully taxable-equivalent (“FTE”) basis adjusts for the tax-favored status of net interest income from certain loans and investments. The Company believes this measure to be the preferred industry measurement of net interest income and it enhances comparability of net interest income arising from taxable and tax-exempt sources. |

2 | The net interest margin is calculated by dividing annualized net interest income - FTE by average total earning assets. |

17

SunTrust Banks, Inc. and Subsidiaries OTHER FINANCIAL DATA (Dollars in millions) (Unaudited) | ||||||||||||||

Three Months Ended | ||||||||||||||

March 31 | (Decrease)/Increase | |||||||||||||

2015 | 2014 | Amount | % 4 | |||||||||||

CREDIT DATA | ||||||||||||||

Allowance for credit losses - beginning | $1,991 | $2,094 | ($103 | ) | (5 | )% | ||||||||

Provision/(benefit) for unfunded commitments | — | (4 | ) | 4 | (100 | ) | ||||||||

Provision for loan losses: | ||||||||||||||

Commercial | 7 | 39 | (32 | ) | (82 | ) | ||||||||

Residential | 25 | 48 | (23 | ) | (48 | ) | ||||||||

Consumer | 23 | 19 | 4 | 21 | ||||||||||

Total provision for loan losses | 55 | 106 | (51 | ) | (48 | ) | ||||||||

Charge-offs: | ||||||||||||||

Commercial | (28 | ) | (33 | ) | (5 | ) | (15 | ) | ||||||

Residential | (68 | ) | (85 | ) | (17 | ) | (20 | ) | ||||||

Consumer | (34 | ) | (33 | ) | 1 | 3 | ||||||||

Total charge-offs | (130 | ) | (151 | ) | (21 | ) | (14 | ) | ||||||

Recoveries: | ||||||||||||||

Commercial | 11 | 14 | (3 | ) | (21 | ) | ||||||||

Residential | 9 | 17 | (8 | ) | (47 | ) | ||||||||

Consumer | 11 | 10 | 1 | 10 | ||||||||||

Total recoveries | 31 | 41 | (10 | ) | (24 | ) | ||||||||

Net charge-offs | (99 | ) | (110 | ) | (11 | ) | (10 | ) | ||||||

Allowance for credit losses - ending | $1,947 | $2,086 | ($139 | ) | (7 | )% | ||||||||

Components: | ||||||||||||||

Allowance for loan and lease losses ("ALLL") | $1,893 | $2,040 | ($147 | ) | (7 | )% | ||||||||

Unfunded commitments reserve | 54 | 46 | 8 | 17 | ||||||||||

Allowance for credit losses | $1,947 | $2,086 | ($139 | ) | (7 | )% | ||||||||

Net charge-offs to average loans (annualized): | ||||||||||||||

Commercial | 0.09 | % | 0.12 | % | (0.03 | ) | (25 | )% | ||||||

Residential | 0.62 | 0.64 | (0.02 | ) | (3 | ) | ||||||||

Consumer | 0.46 | 0.47 | (0.01 | ) | (2 | ) | ||||||||

Total net charge-offs to total average loans | 0.30 | 0.35 | (0.05 | ) | (14 | ) | ||||||||

Period Ended | ||||||||||||||

Nonaccrual/nonperforming loans ("NPLs"): | ||||||||||||||

Commercial | $165 | $229 | ($64 | ) | (28 | )% | ||||||||

Residential | 442 | 684 | (242 | ) | (35 | ) | ||||||||

Consumer | 5 | 12 | (7 | ) | (58 | ) | ||||||||

Total nonaccrual/nonperforming loans ("NPLs") | 612 | 925 | (313 | ) | (34 | ) | ||||||||

Other real estate owned (“OREO”) | 79 | 151 | (72 | ) | (48 | ) | ||||||||

Other repossessed assets | 5 | 7 | (2 | ) | (29 | ) | ||||||||

Nonperforming loans held for sale ("LHFS") | — | 12 | (12 | ) | (100 | ) | ||||||||

Total nonperforming assets ("NPAs") | $696 | $1,095 | ($399 | ) | (36 | )% | ||||||||

Accruing restructured loans | $2,589 | $2,783 | ($194 | ) | (7 | )% | ||||||||

Nonaccruing restructured loans | 255 | 358 | (103 | ) | (29 | ) | ||||||||

Accruing loans past due > 90 days (guaranteed) | 937 | 1,095 | (158 | ) | (14 | ) | ||||||||

Accruing loans past due > 90 days (non-guaranteed) | 43 | 42 | 1 | 2 | ||||||||||

Accruing LHFS past due > 90 days | 12 | 1 | 11 | NM | ||||||||||

NPLs to total loans | 0.46 | % | 0.72 | % | (0.26 | ) | (36 | )% | ||||||

NPAs to total loans plus OREO, other repossessed assets, and nonperforming LHFS | 0.53 | 0.85 | (0.32 | ) | (38 | ) | ||||||||

ALLL to period-end loans 1, 2 | 1.43 | 1.58 | (0.15 | ) | (9 | ) | ||||||||

ALLL to period-end loans, excluding government guaranteed loans 1, 2, 3 | 1.49 | 1.70 | (0.21 | ) | (12 | ) | ||||||||

ALLL to NPLs 1, 2 | 310x | 223x | 87x | 39 | ||||||||||

ALLL to annualized net charge-offs 1 | 4.69x | 4.56x | 0.13x | 3 | ||||||||||

1 This ratio is computed using the allowance for loan and lease losses.

2 Loans carried at fair value were excluded from the calculation.

3 See Appendix A for reconciliation of non-U.S. GAAP performance measures.

4 "NM" - Not meaningful. Those changes over 100 percent were not considered to be meaningful.

18

SunTrust Banks, Inc. and Subsidiaries FIVE QUARTER OTHER FINANCIAL DATA (Dollars in millions) (Unaudited) | ||||||||||||||||||||||||||

Three Months Ended | Three Months Ended | |||||||||||||||||||||||||

March 31 | December 31 | (Decrease)/Increase | September 30 | June 30 | March 31 | |||||||||||||||||||||

2015 | 2014 | Amount | % 4 | 2014 | 2014 | 2014 | ||||||||||||||||||||

CREDIT DATA | ||||||||||||||||||||||||||

Allowance for credit losses - beginning | $1,991 | $2,011 | ($20 | ) | (1 | )% | $2,046 | $2,086 | $2,094 | |||||||||||||||||

Provision/(benefit) for unfunded commitments | — | 11 | (11 | ) | (100 | ) | — | (3 | ) | (4 | ) | |||||||||||||||

Provision for loan losses: | ||||||||||||||||||||||||||

Commercial | 7 | 29 | (22 | ) | (76 | ) | 25 | 18 | 39 | |||||||||||||||||

Residential | 25 | 12 | 13 | NM | 34 | 32 | 48 | |||||||||||||||||||

Consumer | 23 | 22 | 1 | 5 | 34 | 26 | 19 | |||||||||||||||||||

Total provision for loan losses | 55 | 63 | (8 | ) | (13 | ) | 93 | 76 | 106 | |||||||||||||||||

Charge-offs: | ||||||||||||||||||||||||||

Commercial | (28 | ) | (31 | ) | (3 | ) | (10 | ) | (26 | ) | (38 | ) | (33 | ) | ||||||||||||

Residential | (68 | ) | (65 | ) | 3 | 5 | (104 | ) | (90 | ) | (85 | ) | ||||||||||||||

Consumer | (34 | ) | (38 | ) | (4 | ) | (11 | ) | (34 | ) | (30 | ) | (33 | ) | ||||||||||||

Total charge-offs | (130 | ) | (134 | ) | (4 | ) | (3 | ) | (164 | ) | (158 | ) | (151 | ) | ||||||||||||

Recoveries: | ||||||||||||||||||||||||||

Commercial | 11 | 17 | (6 | ) | (35 | ) | 14 | 12 | 14 | |||||||||||||||||