| UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 SCHEDULE 14A |

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant ý | |||

Filed by a Party other than the Registrant o |

|||

Check the appropriate box: |

|||

o |

Preliminary Proxy Statement |

||

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

||

ý |

Definitive Proxy Statement |

||

o |

Definitive Additional Materials |

||

o |

Soliciting Material under Rule 14a-12 |

||

SCIENTIFIC GAMES CORPORATION |

||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

||||

April 26, 2012

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Scientific Games Corporation to be held at 10:30 a.m. on Tuesday, June 5, 2012, at our executive offices located at 750 Lexington Avenue, 19th Floor, New York, New York.

At the annual meeting, you will be asked to elect directors and to ratify the appointment of the independent auditor. These matters are described in detail in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

Whether you plan to attend in person or not, we encourage you to vote your shares so that they are represented at the annual meeting.

We look forward to seeing you at the annual meeting.

|

Sincerely, | |

|

A. Lorne Weil Chairman and Chief Executive Officer |

SCIENTIFIC GAMES CORPORATION

750 Lexington Avenue, 25th Floor

New York, New York 10022

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

Notice is hereby given that the annual meeting of stockholders of Scientific Games Corporation (the "Company") will be held at 10:30 a.m. on Tuesday, June 5, 2012, at the executive offices of the Company, 750 Lexington Avenue, 19th Floor, New York, New York, for the following purposes:

- 1.

- To

elect 11 members of the Board of Directors to serve for the ensuing year and until their respective successors are duly elected and qualified.

- 2.

- To

ratify the appointment of Deloitte & Touche LLP as independent auditor for the fiscal year ending December 31, 2012.

- 3.

- To consider and act upon any other matter that may properly come before the meeting or any adjournment thereof.

Only stockholders of record at the close of business on April 10, 2012 are entitled to receive notice of and to vote at the meeting and any adjournment thereof. A list of the holders will be open to the examination of stockholders for ten days prior to the date of the meeting, between the hours of 9:00 a.m. and 5:00 p.m., at the office of the Secretary of the Company at 750 Lexington Avenue, 25th Floor, New York, New York, and will be available for inspection at the meeting itself.

To obtain directions to attend the meeting and vote in person, please telephone the Company at (212) 754-2233.

Whether you plan to be personally present at the meeting or not, we encourage you to submit your vote by proxy as soon as possible.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be Held on June 5, 2012:

The Proxy Statement and 2011 Annual Report will be available

on or about April 26, 2012 through the Investor Information link on our website at

www.scientificgames.com or through www.proxyvote.com

By

Order of the Board of Directors

Grier C. Raclin

Senior Vice President, General Counsel

and Corporate Secretary

Dated: April 26, 2012

TABLE OF CONTENTS

i

SCIENTIFIC GAMES CORPORATION

750 Lexington Avenue, 25th Floor

New York, New York 10022

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the "Board") of Scientific Games Corporation ("Scientific Games," the "Company," "we" or "us") of proxies to be voted at the annual meeting of stockholders to be held at 10:30 a.m. on Tuesday, June 5, 2012, at our executive offices, 750 Lexington Avenue, 19th Floor, New York, New York, and any adjournment or postponement of the meeting, for the purposes set forth in the Notice of Annual Meeting of Stockholders.

Notice and Access to Proxy Materials

We expect our proxy materials, including this Proxy Statement and our 2011 Annual Report, to be made available to stockholders on or about April 26, 2012 through the Investor Information link on our website at www.scientificgames.com or through www.proxyvote.com. In accordance with the rules of the Securities and Exchange Commission ("SEC"), most stockholders will not receive printed copies of these proxy materials unless they request them. Instead, most stockholders will receive by mail a "Notice Regarding the Availability of Proxy Materials" that contains instructions as to how they can view our materials online, request copies be sent to them by mail or electronically by email and as to how they can vote online (the "Notice").

Stockholders Entitled to Vote

All stockholders of record at the close of business on April 10, 2012 are entitled to vote at the meeting. At the close of business on April 10, 2012, 92,764,626 shares of common stock were outstanding. Each share is entitled to one vote on all matters that properly come before the meeting.

Voting Procedures

You can vote your shares by proxy without attending the meeting. You may vote your shares by proxy over the Internet by following the instructions provided in the Notice, or, if you receive printed proxy materials, you can also vote by mail or telephone pursuant to instructions provided on the proxy card. If you are voting over the Internet or by telephone, you will need to provide the control number that is printed on the Notice or proxy card that you receive.

If you are the record holder of your shares, you may also vote your shares in person at the meeting. If you are not the record holder of your shares (i.e., they are held in "street" name by a broker, bank or other nominee), you must first obtain a proxy issued in your name from the record holder giving you the right to vote the shares at the meeting.

Voting of Proxies

All valid proxies received prior to the meeting will be voted in accordance with the instructions specified by the stockholder. If a proxy card is returned without instructions, the persons named as proxy holders on your proxy card will vote in accordance with the recommendations of the Board, which are as follows:

- •

- FOR election of the nominated directors (Proposal 1); and

- •

- FOR ratification of the appointment of the independent auditor (Proposal 2).

1

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

Changing Your Vote

A stockholder may revoke a proxy at any time prior to its being voted by delivering written notice to the Secretary of the Company, by delivering a properly executed later-dated proxy (including over the Internet or by telephone), or by voting in person at the meeting.

Quorum

The presence, in person or by proxy, of the holders of a majority of the shares entitled to vote at the meeting constitutes a quorum for the transaction of business.

Vote Required

Assuming a quorum is present, directors will be elected by a plurality of the votes cast in person or by proxy at the meeting.

The proposal to ratify the appointment of the independent auditor requires the affirmative vote of a majority of the shares entitled to vote represented at the meeting.

Effect of Withheld Votes or Abstentions

If you vote "WITHHOLD" in the election of directors or vote "ABSTAIN" (rather than vote "FOR" or "AGAINST") with respect to the proposal to ratify the appointment of the independent auditor, your shares will count as present for purposes of determining whether a quorum is present. A "WITHHOLD" vote will have no effect on the outcome of the election of directors (Proposal 1) and an "ABSTAIN" vote will have the effect of a negative vote on the proposal to ratify the appointment of the independent auditor (Proposal 2).

Effect of Broker Non-Votes

If any broker "non-votes" occur at the meeting with respect to your shares, the broker "non-votes" will count for purposes of determining whether a quorum is present but will not have an effect on any proposals presented for your vote. A broker "non-vote" occurs when a broker or nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker or nominee does not have discretionary voting power on that item and has not received instructions from the owner. We believe that brokers and other nominees will have discretionary voting power to vote without instructions from the beneficial owner on the ratification of the appointment of the independent auditor (Proposal 2) and, accordingly, your shares may be voted by your broker or nominee on Proposal 2 without your instructions. We believe that a broker or other nominee holding shares for a beneficial owner may not vote these shares with respect to the election of directors (Proposal 1) without specific instructions from the beneficial owner as to how to vote with respect to such proposal.

2

PROPOSAL 1

ELECTION OF DIRECTORS

The Board has nominated for election to the Board the 11 persons named below to serve for a one-year term and until their successors have been duly elected and qualified or until their earlier death, resignation or removal. Four of the nominees, Messrs. Perelman, Schwartz and Meister and Ms. Townsend, were designated for election to the Board by MacAndrews & Forbes Holdings Inc., our largest stockholder, pursuant to its rights under a stockholders' agreement with us (discussed more fully below). Additionally, David L. Kennedy is an officer of MacAndrews & Forbes Holdings Inc. All of the nominees are presently directors of the Company.

The Board recommends that you vote in favor of the election of each of the nominees named below as directors of the Company for the ensuing year, and the persons named as proxies in the enclosed proxy will vote the proxies received by them for the election of each of the nominees unless otherwise specified on those proxies. All of the nominees have indicated a willingness to serve as directors; however, if any nominee becomes unavailable to serve before the election, proxies may be voted for a substitute nominee selected by the Board.

The name, age, business experience and certain other information regarding each of the nominees for director are set forth below.

Name

|

Age | Position with the Company | Director Since |

||||||

|---|---|---|---|---|---|---|---|---|---|

A. Lorne Weil |

66 | Director (Chairman and Chief Executive Officer) | 1989 | ||||||

Michael R. Chambrello |

54 | Director (Chief Executive Officer—Asia-Pacific Region) | 2009 | ||||||

Peter A. Cohen |

65 | Director (Vice Chairman of the Board) | 2000 | ||||||

Gerald J. Ford |

67 | Director | 2005 | ||||||

David L. Kennedy |

65 | Director (Vice Chairman of the Board) | 2009 | ||||||

Paul M. Meister |

59 | Director | 2012 | ||||||

Ronald O. Perelman |

69 | Director | 2003 | ||||||

Michael J. Regan |

70 | Director | 2006 | ||||||

Barry F. Schwartz |

63 | Director | 2003 | ||||||

Frances F. Townsend |

50 | Director | 2010 | ||||||

Eric M. Turner |

56 | Director | 2002 | ||||||

A. Lorne Weil has been Chairman of the Board since October 1991. Mr. Weil became Chief Executive Officer in November 2010, a position he previously held from 1992 to 2008. Mr. Weil also served as the President of the Company from August 1997 to June 2005. Mr. Weil was President of Lorne Weil, Inc., a firm providing strategic planning and corporate development services to high technology industries, from 1979 to November 1992. Previously, Mr. Weil was Vice President of Corporate Development at General Instrument Corporation, working with wagering and cable systems. Mr. Weil is a director of Andina Acquisition Corporation, Avantair, Inc. and Sportech Plc.

Michael R. Chambrello became Chief Executive Officer—Asia-Pacific Region in November 2010 after serving as Chief Executive Officer since January 2010. From July 2005 to December 2009, Mr. Chambrello was President and Chief Operating Officer. From November 2000 to June 2005, Mr. Chambrello was President and Chief Executive Officer of Environmental Systems Products Holdings Inc. ("ESP"), which provides vehicle emissions testing systems and services to government agencies. Prior to ESP, he was Chief Executive Officer of Transmedia Asia Pacific, Inc. and Transmedia Europe Inc., which provide membership-based consumer and business services. Mr. Chambrello has over 20 years of lottery industry experience, having served as President of GTECH Corporation and Executive Vice President of GTECH Holdings Corporation.

3

Peter A. Cohen has served as Vice Chairman of the Board since September 2004. Mr. Cohen serves as Chief Executive Officer and Chairman of the Board of Cowen Group, Inc., a diversified financial services company. Mr. Cohen was a founding partner and principal of Ramius LLC, a private investment management firm formed in 1994 that was combined with Cowen in late 2009. From November 1992 to May 1994, Mr. Cohen was Vice Chairman and a director of Republic New York Corporation ("Republic"), as well as a member of its executive management committee. Mr. Cohen was also Chairman of Republic's subsidiary, Republic New York Securities Corporation. Mr. Cohen was Chairman of the Board and Chief Executive Officer of Shearson Lehman Brothers from 1983 to 1990. During the past five years, Mr. Cohen has also served as a director of L-3 Communications Holdings, Inc.

Gerald J. Ford has been a financial institutions entrepreneur and private investor involved in numerous mergers and acquisitions of private and public sector financial institutions over the past 30 years. Mr. Ford served as Chairman of the Board and Chief Executive Officer of Golden State Bancorp Inc. from September 1998 until its merger with Citigroup Inc. in November 2002. Mr. Ford is Chairman of Hilltop Holdings, Inc. and Pacific Capital Bancorp. Mr. Ford serves as a director of Freeport-McMoRan Copper & Gold Inc., McMoRan Exploration Company and SWS Group, Inc. During the past five years, Mr. Ford has also served as Chairman of the Board of First Acceptance Corporation and a director of Triad Financial SM LLC.

David L. Kennedy has served as Vice Chairman of the Board since joining it in October 2009. Mr. Kennedy served as an executive of the Company from November 2010 until March 2012, including as Chief Administrative Officer from April 2011 until March 2012. Mr. Kennedy serves as Senior Executive Vice President of MacAndrews & Forbes Holdings Inc. and Vice Chairman of Revlon, Inc. Mr. Kennedy served as President and Chief Executive Officer of Revlon from September 2006 through May 2009 and has held various senior management and senior financial positions with Revlon and The Coca-Cola Company and affiliates during his 40-year business career. Mr. Kennedy is a director of Revlon, Inc. and Revlon Consumer Products Corporation.

Paul M. Meister is Chairman and Chief Executive Officer of inVentiv Health, Inc. a provider of commercial, consulting and clinical research services to the pharmaceutical and biotech industries. He also is co-founder and Chief Executive Officer of Liberty Lane Partners, LLC, a private investment company with diverse investments in healthcare and distribution-related industries. Mr. Meister served as Chairman of Thermo Fisher Scientific Inc., a scientific instruments, equipment and supplies company, from November 2006 until April 2007. He previously served as Vice Chairman of Fisher Scientific International, Inc., a predecessor to Thermo Fisher, from March 2001 to November 2006, and as Vice Chairman and Chief Financial Officer of Fisher Scientific from March 1991 to March 2001. Prior to Fisher Scientific, Mr. Meister held executive positions with the Henley Group, Wheelabrator Technologies and Abex, Inc.

Ronald O. Perelman has been Chairman of the Board and Chief Executive Officer of MacAndrews & Forbes Holdings Inc., a diversified holding company, and various affiliates since 1980. Mr. Perelman is also Chairman of the Board of Revlon Consumer Products Corporation and Revlon, Inc. During the past five years, Mr. Perelman served as Chairman of the Board of M & F Worldwide Corp., Co-Chairman of the Board of Panavision, Inc. and a member of the boards of managers of Allied Security Holdings LLC and REV Holdings LLC.

Michael J. Regan is a former Vice Chairman and Chief Administrative Officer of KPMG LLP and was the lead audit partner for many Fortune 500 companies during his 40-year tenure with KPMG. Mr. Regan serves as a director of DynaVox Inc. During the past five years, Mr. Regan also served as a member of the board of managers of Allied Security Holdings LLC and a director of Citadel Broadcasting Corporation.

Barry F. Schwartz has been Executive Vice Chairman and Chief Administrative Officer of MacAndrews & Forbes Holdings Inc. and various affiliates since October 2007. Prior to that, he was Executive Vice President and General Counsel of MacAndrews & Forbes and various affiliates since 1993 and was Senior Vice President of MacAndrews & Forbes and various affiliates from 1989 to 1993.

4

Mr. Schwartz is a director of Harland Clarke Holdings Corp., Revlon Consumer Products Corporation and Revlon, Inc. During the past five years, Mr. Schwartz also served as a director of M & F Worldwide Corp. and as a member of the board of managers of REV Holdings LLC.

Frances F. Townsend has served as the Senior Vice President of Worldwide Government, Legal and Business Affairs of MacAndrews & Forbes Holdings Inc. since October 2010. Ms. Townsend was a corporate partner at the law firm of Baker Botts L.L.P. from April 2009 to October 2010. Prior to that, she served as Assistant to President George W. Bush for Homeland Security and Counterterrorism and chaired the Homeland Security Council from May 2004 until January 2008. Prior to serving the President, Ms. Townsend served as the first Assistant Commandant for Intelligence for the U.S. Coast Guard and spent 13 years at the U.S. Department of Justice in various senior positions. She also serves on numerous government advisory and nonprofit boards, chairs the Board of the Intelligence and National Security Alliance, and is a member of the Council on Foreign Relations and the Trilateral Commission. Ms. Townsend is a director of SIGA Technologies, Inc.

Eric M. Turner has been an independent management consultant and private investor since 2003. Mr. Turner serves as a director of Tri-State Bank of Memphis. Mr. Turner served as Senior Vice President of State Street Corporation, a financial services company, from 1996 to 2003. Mr. Turner was the Executive Director of the Massachusetts State Lottery Commission from 1992 to 1995. During his time at the Lottery Commission, Mr. Turner was elected to positions of Treasurer and Secretary of the North American Association of State and Provincial Lotteries, a professional association of North American lotteries. In 1991, Mr. Turner served as Deputy Treasurer of the Commonwealth of Massachusetts. Prior to that, he was employed with Drexel Burnham Lambert for approximately six years, last serving as a Vice President in Municipal Finance from 1989 to 1990.

Designees of MacAndrews & Forbes Holdings Inc.

Messrs. Perelman, Schwartz and Meister and Ms. Townsend were designated for election to the Board by MacAndrews & Forbes Holdings Inc. pursuant to its rights under a stockholders' agreement with us dated September 6, 2000, as supplemented by an agreement dated June 26, 2002, a letter agreement dated October 10, 2003 and a letter agreement dated February 15, 2007. The stockholders' agreement was originally entered into with holders of our Series A Convertible Preferred Stock in connection with the initial issuance of such preferred stock and provides for, among other things, the right of the holders to designate up to four members of our Board based on their ownership of preferred stock or the common stock issued upon conversion thereof. All of the preferred stock was converted into common stock in August 2004. MacAndrews & Forbes Holdings Inc., which owned approximately 92% of the preferred stock prior to conversion and currently owns approximately 34% of our outstanding common stock, has the right to designate up to four directors based on its level of share ownership. The percentages that must be maintained in order to designate directors are as follows: (a) 20% to designate four directors; (b) 16% to designate three directors; (c) 9% to designate two directors; and (d) 4.6% to designate one director. Such percentages, in each case, are to be determined based on our fully diluted common stock subject to certain exclusions of common stock or other securities that may be issued in the future.

Qualifications of Directors

The Nominating and Corporate Governance Committee is responsible for evaluating and making recommendations to the Board concerning the appropriate size and needs of the Board with the objective of maintaining the necessary experience, skills and independence on the Board. The Nominating and Corporate Governance Committee and the Board believe that experience as a leader of a business or institution, sound judgment, effective interpersonal and communication skills, strong character and integrity, and expertise in areas relevant to the Company's business are important attributes in maintaining the effectiveness of the Board. As a matter of practice, the Nominating and Corporate Governance Committee and the Board consider the diversity of the backgrounds and experience of prospective directors as well as their personal characteristics (e.g., gender, ethnicity, age) in evaluating, and making

5

decisions regarding, Board composition, in order to facilitate Board deliberations that reflect a broad range of perspectives. The Nominating and Corporate Governance Committee and the Board believe that the Board is comprised of a diverse group of individuals.

The Nominating and Corporate Governance Committee and the Board believe that each nominee has valuable individual skills and experiences that, taken together, provide the variety and depth of knowledge, judgment and vision necessary for the effective oversight of the Company. As indicated in the foregoing biographies, the nominees have extensive experience in a variety of fields, including lottery and gaming (Messrs. Weil, Chambrello, Kennedy and Turner), technology (Messrs. Weil, Chambrello and Kennedy), consumer products and marketing (Messrs. Kennedy, Perelman and Schwartz), government (Ms. Townsend and Mr. Turner), investment and financial services (Messrs. Cohen, Ford, Kennedy, Meister, Perelman, Schwartz and Turner), law (Ms. Townsend and Mr. Schwartz) and public accounting (Mr. Regan), each of which the Board believes provides valuable knowledge about important elements of our business. Most of our nominees have leadership experience at major companies or firms with operations inside and outside the United States and/or experience on other companies' boards, which provides an understanding of ways other companies address various business matters, strategies, corporate governance and other issues. As indicated in the foregoing biographies, the nominees have each demonstrated significant leadership skills, including as a chief executive officer (Messrs. Weil, Chambrello, Cohen, Ford, Kennedy, Meister, Perelman and Schwartz), as an executive director of a leading lottery (Mr. Turner), as a chief administrative officer of a major accounting firm (Mr. Regan) and as chair of the Homeland Security Council and an officer in the U.S. Coast Guard (Ms. Townsend). Two of the nominees have extensive public policy, government or regulatory experience, including Executive Office, Congressional and Cabinet service (Ms. Townsend and Mr. Turner), which can provide valuable insight into issues faced by companies in regulated industries such as the Company. Three of the nominees (Messrs. Weil, Chambrello and Kennedy) have either served or are currently serving as a senior executive of the Company, which service has given them a deep knowledge of the Company and its businesses and directly relevant management experience. The Nominating and Corporate Governance Committee and the Board believe that these skills and experiences qualify each nominee to serve as a director of the Company.

THE BOARD RECOMMENDS A VOTE "FOR" EACH OF THE 11 NOMINEES

Information about the Board of Directors and Committees

Director Independence. The Board has adopted Director Independence Guidelines as a basis for determining that individual directors are independent under the standards of the Nasdaq Stock Market. This determination, which is made annually, helps assure the quality of the Board's oversight of management and reduces the possibility of damaging conflicts of interest. Under these standards, a director will not qualify as independent if:

- (1)

- the

director has been employed by the Company (or any subsidiary) at any time within the past three years;

- (2)

- the

director has an immediate family member who has been employed as an executive officer of the Company (or any subsidiary) at any time within the past

three years;

- (3)

- the

director or an immediate family member of the director has accepted any compensation from the Company (or any subsidiary) in excess of $120,000 during

any period of 12 consecutive months within the past three years other than (a) for Board or Board committee service, (b) in the case of the family member, as compensation for employment

other than as an executive officer or (c) benefits under a tax-qualified retirement plan, or non-discretionary compensation;

- (4)

- the director or an immediate family member of the director is a partner, controlling shareholder or executive officer of an organization that made payments to, or received payments from, the Company for property or services in the current or in any of the past three years that exceed the greater of 5% of the recipient's consolidated gross revenues or $200,000, other than (a) payments

6

- (5)

- the

director or an immediate family member of the director is employed as an executive officer of another entity where at any time during the past three

years any of the executive officers of the Company served on the compensation committee of such other entity; or

- (6)

- the director or an immediate family member of the director is a current partner of the Company's outside auditor, or was a partner or employee of the Company's outside auditor who worked on the Company's audit at any time during any of the past three years.

arising solely from investments in the Company's securities or (b) payments under non-discretionary charitable contribution matching programs;

In applying these standards, the Board determined that each of Messrs. Cohen, Ford, Meister, Perelman, Regan, Schwartz, Townsend and Turner qualify as independent directors and none has a business or other relationship that would interfere with the director's exercise of independent judgment. Mr. Kennedy did not qualify as an independent director in light of his service as an executive officer of the Company from November 2010 until March 2012.

The full text of the Board's Director Independence Guidelines can be accessed through the Corporate Governance link on our website at www.scientificgames.com.

Corporate Governance Guidelines. The Board has adopted Corporate Governance Guidelines that outline the structure, role and functioning of the Board and address various governance matters including director independence, the Board selection process, length of Board service, Board meetings and executive sessions of independent directors, Board and committee performance evaluations and management succession planning. The full text of the Guidelines can be accessed through the Corporate Governance link on our website at www.scientificgames.com.

Board Leadership Structure. The Board is comprised of a substantial majority of independent directors and the Audit, Compensation, Compliance and Nominating and Corporate Governance Committees are comprised entirely of independent directors. The Board has designated Mr. Cohen, who serves as Vice Chairman of the Board and as Chairman of the Executive and Finance Committee of the Board, as the lead director to preside over regularly held executive sessions of independent directors. The responsibilities of the lead director include facilitating communication between the independent directors and the Chairman and Chief Executive Officer and coordinating the activities of the independent directors. Mr. Cohen also provides assistance to the Board and the committees of the Board in their evaluations of management's performance and he carries out other duties that the Board assigns to him from time to time in areas of governance and oversight.

The Executive and Finance Committee, which includes two independent directors (Messrs. Cohen and Perelman) as well as Messrs. Weil and Kennedy, meets regularly to support the Board in the performance of its duties between regularly scheduled Board meetings, to implement the policy decisions of the Board and to provide strategic guidance and oversight to the Company. In his capacity as Vice Chairman of the Board and a member of the Executive and Finance Committee, Mr. Kennedy regularly consults with senior management regarding the affairs of the Company and also facilitates communication between the independent directors and senior management.

The Board has the flexibility to select the leadership structure that is most appropriate for the Company and its stockholders and has determined that the Company and its stockholders are best served by not having a formal policy regarding whether the same individual should serve as both Chairman of the Board and Chief Executive Officer. This approach allows the Board to elect the most qualified director as Chairman of the Board, while maintaining the ability to separate the Chairman of the Board and Chief Executive Officer roles when deemed appropriate (as was the case during most of 2010 prior to Mr. Weil becoming Chief Executive Officer in November 2010).

Mr. Weil currently serves both as Chairman of the Board and Chief Executive Officer. The Board believes that Mr. Weil continuing to serve as Chairman (as he has since 1991) is optimal because it provides the Board with strong and consistent leadership, while the Vice Chairmen (including the lead

7

director) positions and the Executive and Finance Committee allow for multiple additional perspectives, including the perspectives of independent directors, in the provision of overall strategic guidance and oversight to the Company. Taken together, the Board believes that this leadership structure provides an appropriate balance of experienced leadership, independent oversight and management input.

Board's Role in Risk Oversight. The Board is responsible for overseeing management in the execution of its responsibilities and for assessing the Company's approach to risk management. The Board exercises these responsibilities on an ongoing basis as part of its meetings and through the Board's committees, each of which examines various components of enterprise risk as part of its responsibilities. An overall review of risk is inherent in the Board's consideration of the Company's strategies and other matters presented to the Board, including financial matters, capital expenditures, acquisitions and divestitures. The Board's role in risk oversight is consistent with the Company's leadership structure, with the Chief Executive Officer and other members of senior management having responsibility for managing the Company's risk exposure, and the Board and its committees providing oversight of those efforts.

The Company has implemented internal processes and controls to identify and manage risks and to communicate with the Board regarding risk management. These include an enterprise risk management program, regular internal management meetings that identify risks and discuss risk management, a Code of Business Conduct, a strong ethics and compliance function that includes suitability reviews of customers, partners, vendors and other persons/entities with which the Company does business, an internal and external audit process, internal approval processes and legal department review of contracts. In connection with these processes and controls, management regularly communicates with the Board, Board committees and individual directors regarding identified risks and the management of these risks. Individual directors often communicate directly with senior management on matters relating to risk management. In particular, the chairmen of the Board committees regularly communicate with members of senior management to discuss potential risks in connection with accounting and audit matters, compensation matters, compliance matters and finance-related matters.

The Board committees, which meet regularly and report to the full Board, play significant roles in carrying out the Board's risk oversight function. In particular, the Audit Committee oversees risks related to the Company's financial statements, the financial reporting process, accounting and certain legal matters. The Audit Committee also oversees the internal audit function and regularly meets separately with the Vice President of Internal Audit (who reports functionally to the Chief Financial Officer and has a direct reporting line to the Audit Committee) and representatives of the Company's independent auditing firm. The Compensation Committee evaluates the risks associated with the Company's compensation programs and discusses with management procedures to identify and mitigate such risks. See "Executive Compensation—Compensation Discussion and Analysis—Compensation Program as it Relates to Risk" below. The Compliance Committee is active in overseeing the Company's program with respect to compliance with the laws applicable to the Company's business, including gaming laws, as well as compliance with our Code of Business Conduct and related policies by employees, officers, directors and other representatives of the Company. In addition, the Compliance Committee oversees a compliance review process, which is designed to ensure that the vendors, consultants, customers and business partners of the Company are "suitable" or "qualified" as those terms are used by applicable gaming authorities, and regularly meets separately with the Vice President and Chief Compliance Officer (who reports functionally to the General Counsel and has a direct reporting line to the Compliance Committee).

Board Meetings. The Board held a total of seven meetings during 2011 including four executive sessions at which no members of management were present. During 2011, all directors attended at least 75% of the total number of meetings of the Board and committees of the Board on which they served during the period in which they served.

Board Committees. The Board has five committees: the Audit Committee; the Compensation Committee; the Compliance Committee; the Executive and Finance Committee; and the Nominating and Corporate Governance Committee. All committees are comprised solely of independent directors with the

8

exception of the Executive and Finance Committee, which is comprised of two independent directors as well as the Chairman and Chief Executive Officer and the Vice Chairman (who recently served as Chief Administrative Officer). The Board has approved charters for every Board committee, which can be accessed through the Corporate Governance link on our website at www.scientificgames.com. The current membership of each committee is as follows:

| Audit Committee(1) |

Compensation Committee(1) |

Compliance Committee |

Executive and Finance Committee |

Nominating and Corporate Governance Committee(1) |

||||

|---|---|---|---|---|---|---|---|---|

| Michael J. Regan (Chair) | Peter A. Cohen (Chair) | Barry F. Schwartz (Chair) | Peter A. Cohen (Chair) | Gerald J. Ford (Chair) | ||||

| Paul M. Meister | Paul M. Meister | Gerald J. Ford | David L. Kennedy | Michael J. Regan | ||||

| Barry F. Schwartz | Barry F. Schwartz | Eric M. Turner | Ronald O. Perelman | Frances F. Townsend | ||||

| Eric M. Turner | Frances F. Townsend | A. Lorne Weil |

- (1)

- Mr. Meister joined the Audit and Compensation Committees in March 2012. J. Robert Kerrey served on the Compensation and Nominating and Corporate Governance Committees until his resignation from the Board in March 2012.

Audit Committee. The Audit Committee is responsible for hiring the Company's independent auditor and for overseeing the accounting, auditing and financial reporting processes of the Company. In the course of performing its functions, the Audit Committee reviews, with management and the independent auditor, the Company's internal accounting controls, the annual financial statements, the report and recommendations of the independent auditor, the scope of the audit, and the qualifications and independence of the auditor. The Board has determined that each member of the Audit Committee is independent under the listing standards of the Nasdaq Stock Market and that Mr. Regan qualifies as an "audit committee financial expert" under the rules of the SEC. The Audit Committee held five meetings during 2011.

Compensation Committee. The Compensation Committee sets the compensation of the Chief Executive Officer and other senior executives of the Company, administers the equity incentive plans and executive compensation programs of the Company, determines eligibility for, and awards under, such plans and programs, and makes recommendations to the Board with regard to the adoption of new employee benefit plans and equity incentive plans and with respect to the compensation program for non-employee directors. The Board has determined that each member of the Compensation Committee is independent under the listing standards of the Nasdaq Stock Market. The Compensation Committee held nine meetings during 2011, including one joint meeting with the Nominating and Corporate Governance Committee.

Compliance Committee. The Compliance Committee is responsible for providing oversight of the Company's program with respect to compliance with laws and regulations applicable to the business of the Company, including gaming and anticorruption laws, and with respect to compliance with the Code of Business Conduct by employees, officers, directors and other representatives of the Company. The Board has determined that each member of the Compliance Committee is independent under the listing standards of the Nasdaq Stock Market. The Compliance Committee held seven meetings during 2011.

Executive and Finance Committee. The Executive and Finance Committee has broad authority to act on behalf of the Board in the management of the business and affairs of the Company between regular meetings of the Board and assists the Board in implementing Board policy decisions. The Executive and Finance Committee held 11 meetings during 2011.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for identifying individuals who are qualified to become directors, recommending nominees for membership on the Board and on committees of the Board, reviewing and recommending corporate governance principles, procedures and practices and overseeing the annual self-assessment of the Board and its committees. The Board has determined that each member of the Nominating and Corporate Governance Committee is independent under the listing standards of the Nasdaq Stock Market.

9

The Nominating and Corporate Governance Committee held four meetings during 2011, including one joint meeting with the Compensation Committee.

The Nominating and Corporate Governance Committee does not have a set of minimum, specific qualifications that must be met by a candidate for director and will consider individuals suggested as candidates by stockholders. A stockholder wishing to propose a nominee for director should submit a recommendation in writing to the Company's Secretary at least 120 days before the mailing date of the proxy materials applicable to the annual meeting for which such nomination is proposed for submission, indicating the nominee's qualifications and other relevant biographical information and providing confirmation of the nominee's consent to serve as a director. The Nominating and Corporate Governance Committee will review the candidate's background, experience and abilities, and the contributions the candidate can be expected to make to the collective functioning of the Board and the needs of the Board at the time. In prior years, candidates have been identified through recommendations made by directors, the Chief Executive Officer and other third parties. The Nominating and Corporate Governance Committee anticipates that it would use these sources as well as stockholder recommendations to identify candidates in the future.

Stockholder Communications with Directors. Stockholders may communicate with the Board or an individual director by sending a letter to the Board or to a director's attention care of the Corporate Secretary of the Company at Scientific Games Corporation, 750 Lexington Avenue, 25th Floor, New York, New York, 10022. The Corporate Secretary will open, log and deliver all such correspondence (other than advertisements, solicitations or communications that contain offensive or abusive content) to directors on a periodic basis, generally in advance of each Board meeting.

Attendance at Stockholders' Meetings. The Company encourages directors to attend the annual stockholders' meeting. Last year, ten of the 11 directors then serving attended the annual meeting.

Code of Ethics. The Board has adopted a Code of Business Conduct that applies to all of our officers, directors and employees. The Code sets forth fundamental principles of integrity and business ethics and is intended to ensure ethical decision making in the conduct of professional responsibilities. Among the areas addressed by the Code are standards concerning conflicts of interest, confidential information and compliance with laws, regulations and policies. The full text of the Code can be accessed through the Corporate Governance link on our website at www.scientificgames.com.

The compensation program for non-employee directors consists of cash retainers, meeting fees and equity awards. Directors receive an annual retainer of $50,000 and meeting fees of $2,000 for each Board and committee meeting attended (except for meetings of the Executive and Finance Committee). In addition, directors who chair a committee receive additional annual retainers in the amount of $10,000 (except that the Audit Committee Chairman receives an additional annual retainer of $20,000) and Messrs. Cohen and Kennedy each receive $250,000 for their service as Vice Chairmen of the Board. Mr. Cohen does not receive an additional retainer for his service as Chairman of the Executive and Finance Committee or Chairman of the Compensation Committee.

Each non-employee director is eligible to receive an award of restricted stock units ("RSUs") each year having a grant date value of $110,000 and a four-year vesting schedule, provided such director satisfied the Board's attendance requirements for the prior year, as discussed below. New directors receive stock options for 10,000 shares (with a four-year vesting schedule) upon joining the Board. Awards of stock options and RSUs are subject to forfeiture if a director leaves the Board prior to the scheduled vesting date except that the vesting of such awards would accelerate in full upon a director's death or disability. Directors who are employed by the Company do not receive any additional compensation for their services as directors.

10

The annual RSU awards to eligible directors scheduled for January 2011 were deferred in light of the limited availability of shares under the Company's equity incentive plans. Such awards were made in September 2011 following completion of the option exchange program described below, which resulted in additional shares becoming available under the Company's equity incentive plans. In addition, in light of the limited availability of shares under the Company's equity incentive plans, the Compensation Committee and the Board determined to use the then average stock price over the previous two years ($11.70), rather than the then current stock price ($8.00), to determine the number of RSUs to be awarded to non-employee directors for 2011. Accordingly, the number of RSUs awarded in 2011 was determined by dividing the normal grant date value of $110,000 by such average stock price. As a result, approximately 32% fewer RSUs were granted in 2011 than would have been granted pursuant to our normal award guidelines. This reduction in RSUs granted in 2011 decreased the grant date value of each RSU award to directors from $110,000 to $75,216. Finally, the Compensation Committee and the Board determined, based on the advice of the Committee's external compensation consultant, to make annual RSU awards to eligible directors beginning in 2012 on the date of the annual meeting of stockholders (which in recent years has been in early June), rather than in January as was the case in prior years.

The Board imposes a minimum meeting attendance requirement in connection with the annual awards of RSUs such that only directors who have attended at least 75% of the total number of meetings held by the Board and committees on which they served in the prior year are eligible to receive an award, except that a new director with less than six months of service in the prior year is not subject to such threshold with respect to the first grant made after becoming a director. All directors then serving satisfied the attendance requirements applicable for the 2011 awards.

Directors can elect to defer their cash compensation into a non-qualified deferred compensation plan throughout their tenure on the Board or for certain specified deferral periods. The amounts deferred under the plan are measured by investment options that the participants may select from a variety of mutual funds in various investment categories offered under the plan. The plan for director deferrals is operated in conjunction with the deferred compensation plan for executives discussed below. The Company does not guarantee any minimum return on investments and participants receive their deferrals and any related earnings following the end of the specified deferral period or earlier if they leave the Board.

In 2011, our stockholders authorized, and the Company completed, a "value-for-value" stock option exchange program. Under the terms of the program, eligible employees and directors could surrender outstanding stock options with exercise prices substantially above the then-current market price of our common stock in exchange for a new award of RSUs. In order to promote retention, new RSUs granted in the exchange were not vested on the date of grant regardless of whether the surrendered option was fully vested. Instead, the new RSUs are scheduled to vest on the later of the first anniversary of their grant date and the date on which the corresponding option would have vested. Members of the Board (including Messrs. Weil, Kennedy and Chambrello) were eligible to participate in the option exchange program, but at exchange ratios that discounted the value of their eligible options by 50%. The Board and the Compensation Committee considered the option exchange program to be a valuable means to retain and motivate eligible employees and directors, reduce potential future dilution and return a substantial number of shares to the pool of available shares under our primary equity incentive plan, thereby facilitating the continued operation of the Company's equity compensation programs in the near-term. See "Compensation Discussion and Analysis—Long-Term Incentive Compensation—Option Exchange Program" for additional information regarding the option exchange program.

11

The table below shows the compensation earned by non-employee directors for 2011. Mr. Meister, who joined the Board in March 2012, did not receive any compensation for 2011.

Name

|

Fees Earned or Paid in Cash ($)(1) |

Stock Awards ($)(2) |

Option Awards ($) |

All Other Compensation ($) |

Total ($) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Peter A. Cohen |

332,000 | 85,636 | — | — | 417,636 | |||||||||||

Gerald J. Ford |

88,000 | 85,091 | — | — | 173,091 | |||||||||||

J. Robert Kerrey(3) |

80,000 | 97,324 | — | — | 177,324 | |||||||||||

Ronald O. Perelman |

62,000 | 99,471 | — | — | 161,471 | |||||||||||

Michael J. Regan |

102,000 | 86,945 | — | — | 188,945 | |||||||||||

Barry F. Schwartz |

114,000 | 99,471 | — | — | 213,471 | |||||||||||

Frances F. Townsend |

86,000 | 92,533 | — | — | 178,533 | |||||||||||

Eric M. Turner |

88,000 | 75,216 | — | — | 163,216 | |||||||||||

- (1)

- Reflects

cash retainers and meeting fees earned by directors for services provided during 2011.

- (2)

- Reflects

the aggregate grant date fair value of RSUs awarded during 2011, computed in accordance with Financial Accounting Standards Board Accounting

Standards Codification Topic 718, Compensation—Stock Compensation ("FASB ASC Topic 718"). For a discussion of valuation assumptions, see Note 12 to our consolidated financial

statements included in our annual report on Form 10-K for the year ended December 31, 2011.

- The

amounts include the grant date fair value of the annual RSU award made to each of the non-employee directors of $75,216 plus the

grant date fair value of RSUs awarded in exchange for surrendered options under the stock option exchange program described above, as follows: Mr. Cohen ($10,420); Mr. Ford ($9,875);

Mr. Kerrey ($22,108); Mr. Perelman ($24,255); Mr. Regan ($11,729); Mr. Schwartz ($24,255); and Ms. Townsend ($17,317).

- (3)

- Mr. Kerrey ceased serving on the Board in March 2012.

The table below shows the aggregate number of stock options and RSUs held by non-employee directors as of December 31, 2011.

Name

|

Stock Options (in shares) |

5-Year Vesting RSUs(1) |

4-Year Vesting RSUs(2) |

RSUs Granted in Option Exchange(3) |

Total RSUs |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Peter A. Cohen |

— | 11,789 | 9,402 | 1,242 | 22,433 | |||||||||||

Gerald J. Ford |

— | 11,789 | 9,402 | 1,177 | 22,368 | |||||||||||

J. Robert Kerrey(4) |

— | 11,066 | 9,402 | 2,635 | 23,103 | |||||||||||

Ronald O. Perelman |

— | 11,789 | 9,402 | 2,891 | 24,082 | |||||||||||

Michael J. Regan |

— | 11,789 | 9,402 | 1,398 | 22,589 | |||||||||||

Barry F. Schwartz |

— | 11,789 | 9,402 | 2,891 | 24,082 | |||||||||||

Frances F. Townsend |

— | — | 9,402 | 2,064 | 11,466 | |||||||||||

Eric M. Turner |

— | 11,789 | 9,402 | — | 21,191 | |||||||||||

- (1)

- Reflects

RSUs that have a five-year vesting schedule, with one-fifth scheduled to vest on each of the first five anniversaries of

the date of the grant.

- (2)

- Reflects

RSUs granted on September 7, 2011 that have a four-year vesting schedule, with one-fourth scheduled to vest on

January 3 of each of 2012, 2013, 2014 and 2015.

- (3)

- Reflects

RSUs granted in exchange for stock options tendered in the 2011 stock option exchange program, with a scheduled vesting period that ends on the

later of one year from the date of grant (August 16, 2011) and the original stated vesting date of the corresponding exchanged options.

- (4)

- Mr. Kerry ceased serving on the Board in March 2012.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), requires our officers and directors, and persons who beneficially own more than ten percent of our common stock, to file initial reports of ownership and reports of changes in their ownership with the SEC. Based on a review of the copies of the reports that our directors, officers and ten percent holders filed with the SEC and on the representations made by such persons, we believe all applicable filing requirements were met during 2011.

12

The following table sets forth certain information as to the security ownership of each person known to us to be the beneficial owner of more than five percent of the outstanding shares of our common stock, each of our directors, each of our named executive officers, and all of our directors and executive officers as a group. The number of shares beneficially owned is as of April 15, 2012 unless otherwise indicated; in all cases the percentage of beneficial ownership of the outstanding shares of our common stock is calculated as of April 15, 2012. Except as otherwise indicated, the stockholders listed in the table below have sole voting and investment power with respect to the shares indicated.

| |

Shares of Common Stock | ||||

|---|---|---|---|---|---|

| |

Number(1) | Percent(1) | |||

MacAndrews & Forbes Holdings Inc. |

31,700,737 | (2) | 34.17% | ||

Fine Capital Partners, L.P |

6,896,402 |

(3) |

7.43% |

||

A. Lorne Weil |

2,169,012 |

(4) |

2.33% |

||

Michael R. Chambrello |

180,442 |

* |

|||

Peter A. Cohen |

1,046,828 |

(5) |

1.13% |

||

Gerald J. Ford |

319,357 |

* |

|||

David L. Kennedy |

114,832 |

* |

|||

Paul M. Meister(6) |

0 |

* |

|||

Ronald O. Perelman |

31,723,126 |

(7) |

34.20% |

||

Michael J. Regan |

18,354 |

* |

|||

Barry F. Schwartz |

52,389 |

* |

|||

Frances F. Townsend |

3,990 |

* |

|||

Eric M. Turner |

183 |

* |

|||

Jeffrey S. Lipkin |

46,507 |

* |

|||

William J. Huntley |

63,504 |

* |

|||

Ira H. Raphaelson(8) |

160,346 |

* |

|||

All directors and executive officers as a group (consisting of 21 persons)(9) |

36,004,373 |

38.59% |

|||

- *

- Represents

less than 1% of the outstanding shares of common stock.

- (1)

- In

accordance with SEC rules, this column includes shares that a person has a right to acquire within 60 days of April 15, 2012 through the

exercise or conversion of stock options, RSUs or other securities. Such securities are deemed to be outstanding for the purpose of calculating the percentage of outstanding securities owned by such

person but are not deemed to be outstanding for the purpose of calculating the percentage owned by any other person. The securities reported for the directors and named executive officers listed in

the table above include shares subject to the following awards as to which the equivalent number of underlying shares may be acquired through exercise or conversion within 60 days of

April 15, 2012:

- Mr. Weil,

369,000 stock options; Mr. Chambrello, 9,600 RSUs; Mr. Kennedy, 28,367 stock options; Mr. Lipkin, 8,432

stock options; and Mr. Huntley, 59,997 stock options.

- (2)

- Based on an amendment to Schedule 13D filed with the SEC on June 16, 2011 by MacAndrews & Forbes Holdings Inc., SGMS Acquisition Corporation and SGMS Acquisition Two Corporation. SGMS Acquisition Corporation and SGMS Acquisition Two Corporation are holding companies owned by MacAndrews & Forbes Holdings Inc., whose chairman, chief executive officer and sole stockholder is Mr. Perelman. The Schedule 13D states that (a) MacAndrews & Forbes Holdings Inc. has sole voting

13

and investment power with respect to 31,700,737 shares, (b) SGMS Acquisition Corporation has sole voting and investment power with respect to 26,315,090 shares and (c) SGMS Acquisition Two Corporation has sole voting and investment power with respect to 5,315,000 shares. The shares so owned are, or may from time to time be, pledged to secure obligations of MacAndrews & Forbes Holdings Inc. or its affiliates.

- (3)

- Based

on a Schedule 13G filed with the SEC on January 11, 2012 jointly by Fine Capital Partners, L.P., Fine Capital

Advisors, LLC and Ms. Debra Fine, reporting beneficial ownership as of January 11, 2012. The Schedule 13G states that each such person has shared voting power and shared

investment power with respect to 6,896,402 shares.

- (4)

- Includes

1,800,012 shares subject to a pledge agreement. Mr. Weil's reported holdings do not include 557,299 shares held in family trusts for which

Mr. Weil does not serve as trustee and disclaims beneficial ownership.

- (5)

- Includes

5,900 shares held by members of Mr. Cohen's immediate family, 15,000 shares held by trusts for members of his immediate family for which

Mr. Cohen serves as co-trustee, 750,000 shares held by an entity of which Ramius Advisors, LLC acts as an investment advisor and 39,500 shares held by third party accounts

managed by Ramius Securities, LLC. Mr. Cohen is one of four managing members of C4S & Co., LLC, which is the managing member of RCG Holdings LLC. RCG

Holdings LLC is a significant shareholder of Cowen Group, Inc., which is the sole member of Ramius LLC ("Ramius"). Ramius is the sole managing member of Ramius

Advisors, LLC. Mr. Cohen disclaims beneficial ownership of the securities held by affiliates of Ramius LLC and the third party accounts except to the extent of his pecuniary

interest therein. On September 15, 2008, 750,000 of the shares held by the entity of which Ramius Advisors, LLC acts as an investment advisor (the "Frozen Shares") were frozen in such

entity's prime brokerage account as a result of Lehman Brothers International (Europe) ("LBIE") being placed in administration. LBIE, through certain of its affiliates, was a prime broker for such

Ramius entity. The current status of the Frozen Shares under LBIE's administration proceedings has not been determined. The Ramius entity claims beneficial ownership over the Frozen Shares until such

time a final determination concerning the Frozen Shares is made.

- (6)

- Mr. Meister

joined the Board in March 2012.

- (7)

- Includes

the 31,700,737 shares reported in footnote 2 above, which may be deemed to be beneficially owned by Mr. Perelman, the Chairman, Chief

Executive Officer and sole stockholder of MacAndrews & Forbes Holdings Inc. Mr. Perelman's address is 35 East 62nd Street, New York, NY 10065.

- (8)

- Mr. Raphaelson

was among the "named executive officers" for 2011 but is no longer an employee.

- (9)

- Includes 521,745 shares issuable upon exercise of stock options and 13,600 shares issuable upon vesting of RSUs. Excludes the 160,346 shares held by Mr. Raphaelson, who is no longer an employee.

14

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Oversight of Executive Compensation Program

The Company's executive compensation program is administered by the Compensation Committee of the Board, which is referred to in this section as the "Committee." The Committee is responsible for determining the compensation of the Company's Chief Executive Officer and other executive officers of the Company and for overseeing the Company's executive compensation and benefits programs. The six individuals identified in the Summary Compensation Table below are collectively referred to in this Proxy Statement as the "named executive officers."

Executive Summary

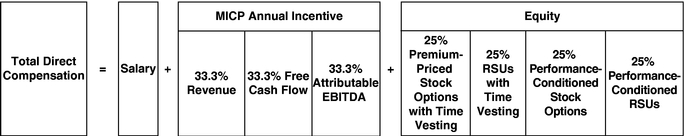

In late 2010, the Board appointed A. Lorne Weil, its then-Chairman, as the Company's Chief Executive Officer to lead the Company as it seeks to identify and capitalize on growth opportunities in the evolving lottery and gaming industries. In early 2011, the Committee made significant changes to the Company's management incentive compensation program ("MICP") intended to incentivize Mr. Weil and other members of management to meet growth objectives while managing incentive compensation costs and share availability under the Company's equity incentive plans. As discussed in more detail below, these changes included the addition of revenue and attributable EBITDA (in lieu of adjusted EBIT) as performance metrics under the MICP and the adoption of a revised payout structure under which the Company had to achieve significant above-budget results in order for executives to achieve their cash bonus target opportunities.

The Company's financial performance in 2011 exceeded both budget and prior-year results on all MICP financial metrics, as shown below.

| |

|

2011 Results | Percentage Increase | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2011 Budget | Reported | MICP(1) | 2011 MICP Results vs. 2010 MICP Results |

2011 MICP Results vs. 2011 Budget |

|||||||||||

Revenue |

$ | 837.1 | $ | 878.7 | $ | 862.9 | 8.0 | % | 3.1 | % | ||||||

Attributable EBITDA |

$ | 298.4 | $ | 327.5 | $ | 315.3 | 3.7 | % | 5.7 | % | ||||||

Free Cash Flow |

$ | 181.0 | $ | 235.6 | (2) | $ | 209.2 | 8.1 | % | 15.6 | % | |||||

- (1)

- As

indicated above, the 2011 revenue and attributable EBITDA amounts calculated for MICP purposes are less than the revenue and attributable EBITDA amounts

reported in our earnings release dated February 28, 2012. See page 22 for additional detail as to how 2011 results were calculated for MICP purposes.

- (2)

- Free cash flow for MICP purposes (generally, attributable EBITDA less total capital expenditures) is defined differently than the free cash flow metric we report in our earnings releases (net cash provided by operating activities less total capital expenditures). The 2011 reported free cash flow indicated above reflects reported attributable EBITDA less reported total capital expenditures.

Under the more challenging MICP payout structure adopted for 2011, in order for the named executive officers with Company-wide responsibilities (Messrs. Weil, Lipkin and Kennedy) to receive at least 100% of their target bonus opportunities, revenue, attributable EBITDA and free cash flow needed to be, on average, 7.1% above budget. The foregoing results translated into a payout of approximately 104% of the target bonus opportunity of each of these named executive officers. However, the Committee determined to reduce such payout to 101% based on its view that 2011 financial results, although generally solid, warranted a payout that was essentially equal to these named executive officers' target bonus opportunities.

15

CEO Compensation

2011 Compensation Program for Mr. Weil

- •

- A substantial portion of Mr. Weil's compensation opportunity consists of premium-priced stock options subject to

four-year time vesting, performance-conditioned stock options, RSUs subject to four-year time vesting and performance-conditioned RSUs, which were awarded in late 2010 in

connection with Mr. Weil returning as Chief Executive Officer. The performance-conditioned stock options and RSUs are scheduled to vest at a rate of 20% per year, but only to the extent that

the Company achieves challenging multi-year performance targets (subject to certain "carryover" vesting provisions described below). No performance-conditioned stock options or RSUs have

vested as the applicable target for 2011 was not met.

- •

- Mr. Weil's cash bonus for 2011 reflects a target bonus opportunity equal to his base salary and the Company's

above-budget performance with respect to each of the relevant financial metrics.

- •

- Mr. Weil participated in the stock option exchange program described below at exchange ratios that valued his eligible options at 50% of the value ascribed to identical eligible options held by non-director employees.

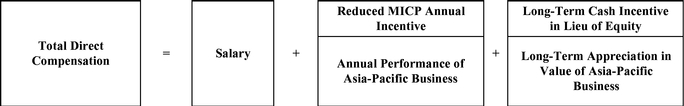

CEO—Asia-Pacific Region Compensation

2011 Compensation Program for Mr. Chambrello

- •

- A substantial portion of Mr. Chambrello's compensation opportunity consists of his participation in the

Asia-Pacific business incentive compensation program described below, which provides him with a long-term cash incentive opportunity directly tied to the growth of the

Company's Asia-Pacific business during the four-year period ending December 31, 2014 (subject to a cap). This long-term incentive opportunity is provided in lieu of

annual grants of equity awards and a portion of the annual cash bonus opportunity that Mr. Chambrello would otherwise be eligible to receive.

- •

- As the Chief Executive Officer—Asia-Pacific Region, Mr. Chambrello earned an annual cash

bonus for 2011 that reflected the strong performance of the Company's Asia-Pacific business during 2011, as China Sports Lottery instant ticket retail sales reached a record

level.

- •

- Like Mr. Weil, Mr. Chambrello participated in the stock option exchange program at exchange ratios that valued his eligible options at 50% of the value ascribed to identical eligible options held by non-director employees.

16

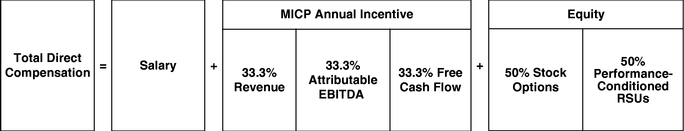

Compensation of Other Named Executive Officers

2011 Compensation Program for Other Named Executive Officers

- •

- An average of approximately 66% of the targeted compensation of the other named executive officers is composed of variable

incentive compensation, including a performance-based annual cash incentive, stock options and performance-conditioned RSUs.

- •

- In light of limited availability of shares under our equity incentive plans and our stock price at the time of grant, the

Committee reduced the value of 2011 annual equity awards to our eligible named executive officers by more than 30% relative to "target" levels.

- •

- We made special awards of performance-conditioned RSUs to certain key executives (including Mr. Lipkin) in February 2012. These performance-conditioned RSUs are scheduled to vest at a rate of 25% per year, but only to the extent that the Company achieves the same challenging, multi-year performance targets applicable to Mr. Weil's sign-on performance-conditioned awards (subject to the same "carryover" vesting provisions).

Other Highlights of Our Compensation Program

- •

- For named executive officers with Company-wide responsibilities, potential payouts (based solely on financial performance) as a percentage of their target cash bonus opportunities have varied with the Company's financial performance over the past five years as follows:

| 2007 | 2008 | 2009 | 2010 | 2011 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 105% | 42% | 23% | 42% | 101% | (1) | |||||||||

- (1)

- Although actual results translated into a 104% payout, the Committee reduced such payout to 101%.

- •

- The Committee eliminated most perquisites, including travel and company car allowances, in 2006.

- •

- We do not pay tax gross-ups on excise taxes associated with change in control benefits.

Response to 2011 Say on Pay Vote

The Committee believes that the Company's executive compensation program reflects a strong pay-for-performance philosophy and is well aligned with stockholders' long-term interests. Our "say on pay" proposal at the 2011 annual meeting was approved by more than 67% of the votes cast. As part of its on-going review of our executive compensation program, the Committee considered the outcome of last year's "say on pay" proposal and has responded, and intends to continue to respond, to questions or concerns regarding our executive compensation program that are raised from time to time by our stockholders.

The Committee has taken a number of recent actions that it believes address concerns expressed by certain proxy advisory firms and stockholders and that should be positively received by our stockholders generally. As discussed in more detail below, the Committee implemented a more challenging MICP

17

payout structure for 2011 bonuses that included an additional performance metric. The Committee exercised negative discretion to reduce the payouts that were otherwise earned under this more challenging structure. The Committee did not award any discretionary cash bonuses to any named executive officer for 2011. In light of the Company's stock price and the limited availability of shares under the Company's equity incentive plans, the Committee, as it did in 2011, determined to reduce the value of the 2012 annual equity awards by more than 30% relative to "target" levels. In addition, we have sought to enhance our disclosure regarding our compensation decisions, including by disclosing more information regarding our 2011 performance results for purposes of the MICP.

Compensation Program as it Relates to Risk

The Company's management and the Committee, with the assistance of the Committee's independent compensation consultant, periodically review the Company's compensation policies and practices, focusing particular attention on incentive programs, so as to ensure that they do not encourage excessive risk taking by the Company's employees. Specifically, this review includes the cash and equity components of the MICP (in which executives generally participate) and the Company's local cash bonus and commission plans (in which other employees participate). As discussed below, the cash bonus programs are generally designed to reward achievement of annual results when measured against performance metrics, whereas the equity incentive program is designed to link a portion of compensation to long-term Company performance. Management and the Committee do not believe that the Company's compensation programs create risks that are reasonably likely to have a material adverse impact on the Company for the following reasons:

- •

- our incentive programs generally balance short- and long-term incentives, with a significant percentage of

total compensation for the senior executive team provided in the form of incentive compensation focused on long-term performance;

- •

- the MICP and many of our local bonus plans (which often "mirror" the MICP) use multiple financial performance metrics that

encourage executives and other employees to focus on the overall health of the business rather than on a single financial measure;

- •

- a qualitative assessment of individual performance is generally a key component of individual compensation payments;

- •

- cash bonuses under the MICP, local bonus plans and the Asia-Pacific business incentive compensation program

are generally capped;

- •

- incentive compensation paid to Messrs. Weil, Chambrello and certain other senior executives (including compensation

paid under the Asia-Pacific business incentive compensation program) is subject to recovery under any "clawback" policy that may be adopted by the Company;

- •

- executive officers and certain other key employees must obtain permission from the Company's General Counsel to sell any

shares, even during an open trading period;

- •

- Board and management processes are in place to oversee risk associated with the MICP and local bonus plans, including

periodic business performance reviews by management and regular bonus accrual updates to the Committee; and

- •

- the Company's risk management processes—including the Company's enterprise risk management program, Code of Business Conduct, strong ethics and compliance function that includes suitability reviews of customers and other persons and entities with which the Company does business, internal approval processes and legal department review of contracts—mitigate undue risk-taking.

18

Objectives and Components of Compensation Program

The objectives of the executive compensation program are to attract and retain executive talent, foster excellent performance by executives whose contributions drive the success of the Company and create value for our stockholders. The program is structured to provide compensation packages that are competitive with the marketplace and is designed to offer rewards to executives based on Company and individual performance, encourage long-term service and align the interests of management and stockholders through incentives that encourage annual and long-term results.

The principal components of the Company's compensation program consist of base salaries, annual performance-based incentive compensation, long-term incentive compensation and employment agreements that include severance and change of control arrangements. The following is a description of the Company's compensation elements and the objectives they are designed to support:

| Element of Compensation | Rationale | Linkage to Compensation Objective | ||

|---|---|---|---|---|

| Base Salary | Provides fixed level of compensation | Attract and retain executive talent | ||

Annual Incentive Compensation (cash bonuses) |

Combined with salary, target level of annual incentive compensation provides a market-competitive total cash opportunity Actual annual incentive compensation payout depends on Company and individual performance |

Foster excellent business performance Align executive and stockholder interests by linking a portion of compensation to the annual performance of the Company Attract and retain executive talent |

||

Long-Term Incentive Compensation (stock options, performance-conditioned RSUs and long-term cash incentive) |

Target level of long-term incentive compensation provides a market-competitive equity opportunity Conditioning the vesting of RSUs (and performance-conditioned stock options granted to the CEO) upon Company achievement of financial performance targets aligns executive pay with stockholder interests Long-term cash incentive opportunity granted to the Chief Executive Officer—Asia-Pacific Region is directly linked to the appreciation in value of the Asia-Pacific Business over a four-year period |

Align executive and stockholder interests by linking a portion of compensation to long-term Company performance Foster excellent business performance that creates value for stockholders Attract and retain executive talent Encourage long-term service |

||

Employment Agreements with Severance and Change in Control Provisions |

Severance provisions under employment agreements provide benefits to ease an employee's transition due to an unexpected employment termination by the Company due to changes in the Company's employment needs Change in control provisions under employment agreements and equity incentive plans encourage employees to remain focused on the best interests of the Company in the event of rumored or actual fundamental corporate changes |

Attract and retain executive talent Encourage long-term service |

The Committee believes that a substantial portion of executive officer compensation should vary from year to year based on Company and individual performance.

The Company's compensation policies are generally consistent with respect to the named executive officers, although there are differences in the executive officers' base salary levels, bonus opportunities and equity award opportunities based on the relative responsibilities of the positions, the executive officers' relative importance to the success of the Company and, to some extent, the terms of the executive officers'

19