lnw-20240331000075000412/312024Q1FALSEhttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrentxbrli:sharesiso4217:USDiso4217:USDxbrli:shareslnw:Segmentxbrli:pureiso4217:COP00007500042024-01-012024-03-3100007500042024-05-030000750004us-gaap:ServiceMember2024-01-012024-03-310000750004us-gaap:ServiceMember2023-01-012023-03-310000750004us-gaap:ProductMember2024-01-012024-03-310000750004us-gaap:ProductMember2023-01-012023-03-3100007500042023-01-012023-03-310000750004us-gaap:RetainedEarningsMember2024-01-012024-03-3100007500042024-03-3100007500042023-12-3100007500042022-12-3100007500042023-03-310000750004lnw:GamingOperationsMemberlnw:GamingGroupMember2024-01-012024-03-310000750004lnw:GamingOperationsMemberlnw:GamingGroupMember2023-01-012023-03-310000750004lnw:GamingMachineSalesMemberlnw:GamingGroupMember2024-01-012024-03-310000750004lnw:GamingMachineSalesMemberlnw:GamingGroupMember2023-01-012023-03-310000750004lnw:GamingSystemsMemberlnw:GamingGroupMember2024-01-012024-03-310000750004lnw:GamingSystemsMemberlnw:GamingGroupMember2023-01-012023-03-310000750004lnw:TableProductsMemberlnw:GamingGroupMember2024-01-012024-03-310000750004lnw:TableProductsMemberlnw:GamingGroupMember2023-01-012023-03-310000750004lnw:GamingGroupMember2024-01-012024-03-310000750004lnw:GamingGroupMember2023-01-012023-03-310000750004lnw:SciPlayMemberlnw:MobileMember2024-01-012024-03-310000750004lnw:SciPlayMemberlnw:MobileMember2023-01-012023-03-310000750004lnw:SciPlayMemberlnw:WebAndOtherMember2024-01-012024-03-310000750004lnw:SciPlayMemberlnw:WebAndOtherMember2023-01-012023-03-310000750004lnw:SciPlayMember2024-01-012024-03-310000750004lnw:SciPlayMember2023-01-012023-03-310000750004lnw:IGamingGroupMember2024-01-012024-03-310000750004lnw:IGamingGroupMember2023-01-012023-03-310000750004lnw:ProprietaryPlatformRevenueMemberlnw:SciPlayMember2024-01-012024-03-310000750004us-gaap:OperatingSegmentsMemberlnw:GamingGroupMember2024-01-012024-03-310000750004lnw:SciPlayMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000750004lnw:IGamingBusinessSegmentMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000750004lnw:CorporateAndReconcilingItemsMember2024-01-012024-03-310000750004us-gaap:OperatingSegmentsMemberlnw:GamingGroupMember2023-01-012023-03-310000750004lnw:SciPlayMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000750004lnw:IGamingBusinessSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000750004lnw:CorporateAndReconcilingItemsMember2023-01-012023-03-310000750004us-gaap:EmployeeSeveranceMember2024-01-012024-03-310000750004us-gaap:EmployeeSeveranceMember2023-01-012023-03-310000750004lnw:StrategicReviewAndRelatedCostsMember2024-01-012024-03-310000750004lnw:StrategicReviewAndRelatedCostsMember2023-01-012023-03-310000750004lnw:ContingentConsiderationAdjustmentMember2024-01-012024-03-310000750004lnw:ContingentConsiderationAdjustmentMember2023-01-012023-03-310000750004lnw:RestructuringIntegrationAndOtherMember2024-01-012024-03-310000750004lnw:RestructuringIntegrationAndOtherMember2023-01-012023-03-310000750004us-gaap:NotesReceivableMemberlnw:UnitedStatesAndCanadaMember2024-03-310000750004us-gaap:NotesReceivableMemberlnw:UnitedStatesAndCanadaMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-03-310000750004us-gaap:NotesReceivableMemberlnw:UnitedStatesAndCanadaMember2023-12-310000750004us-gaap:NotesReceivableMemberlnw:UnitedStatesAndCanadaMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310000750004us-gaap:NotesReceivableMemberlnw:InternationalMember2024-03-310000750004us-gaap:NotesReceivableMemberlnw:InternationalMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-03-310000750004us-gaap:NotesReceivableMemberlnw:InternationalMember2023-12-310000750004us-gaap:NotesReceivableMemberlnw:InternationalMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310000750004us-gaap:NotesReceivableMember2024-03-310000750004us-gaap:NotesReceivableMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-03-310000750004us-gaap:NotesReceivableMember2023-12-310000750004us-gaap:NotesReceivableMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310000750004lnw:UnitedStatesAndCanadaMember2023-12-310000750004lnw:InternationalMember2023-12-310000750004lnw:UnitedStatesAndCanadaMember2024-01-012024-03-310000750004lnw:InternationalMember2024-01-012024-03-310000750004lnw:UnitedStatesAndCanadaMember2024-03-310000750004lnw:InternationalMember2024-03-310000750004us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-03-310000750004us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310000750004srt:LatinAmericaMember2024-03-310000750004lnw:FinancialAssetCurrentOrNotYetDueMembersrt:LatinAmericaMember2024-03-310000750004srt:LatinAmericaMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-03-310000750004us-gaap:LandMember2024-03-310000750004us-gaap:LandMember2023-12-310000750004us-gaap:BuildingAndBuildingImprovementsMember2024-03-310000750004us-gaap:BuildingAndBuildingImprovementsMember2023-12-310000750004us-gaap:MachineryAndEquipmentMember2024-03-310000750004us-gaap:MachineryAndEquipmentMember2023-12-310000750004us-gaap:FurnitureAndFixturesMember2024-03-310000750004us-gaap:FurnitureAndFixturesMember2023-12-310000750004us-gaap:ConstructionInProgressMember2024-03-310000750004us-gaap:ConstructionInProgressMember2023-12-310000750004us-gaap:PropertyPlantAndEquipmentOtherTypesMember2024-03-310000750004us-gaap:PropertyPlantAndEquipmentOtherTypesMember2023-12-310000750004us-gaap:CustomerRelationshipsMember2024-03-310000750004us-gaap:CustomerRelationshipsMember2023-12-310000750004us-gaap:IntellectualPropertyMember2024-03-310000750004us-gaap:IntellectualPropertyMember2023-12-310000750004us-gaap:LicensingAgreementsMember2024-03-310000750004us-gaap:LicensingAgreementsMember2023-12-310000750004lnw:BrandNameMember2024-03-310000750004lnw:BrandNameMember2023-12-310000750004us-gaap:TradeNamesMember2024-03-310000750004us-gaap:TradeNamesMember2023-12-310000750004us-gaap:PatentsMember2024-03-310000750004us-gaap:PatentsMember2023-12-310000750004lnw:GamingGroupMember2023-12-310000750004lnw:SocialBusinessSegmentMember2023-12-310000750004lnw:IGamingBusinessSegmentMember2023-12-310000750004lnw:SocialBusinessSegmentMember2024-01-012024-03-310000750004lnw:IGamingBusinessSegmentMember2024-01-012024-03-310000750004lnw:GamingGroupMember2024-03-310000750004lnw:SocialBusinessSegmentMember2024-03-310000750004lnw:IGamingBusinessSegmentMember2024-03-310000750004us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMemberlnw:SeniorSecuredRevolverMaturing2027Member2024-03-310000750004us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMemberlnw:SeniorSecuredRevolverMaturing2027Member2023-12-310000750004us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMemberlnw:SeniorSecuredCreditFacilityTermLoanBMaturingIn2029Member2024-03-310000750004us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMemberlnw:SeniorSecuredCreditFacilityTermLoanBMaturingIn2029Member2023-12-310000750004lnw:SeniorUnsecuredNotesMaturing2028Memberus-gaap:SeniorNotesMember2024-03-310000750004lnw:SeniorUnsecuredNotesMaturing2028Memberus-gaap:SeniorNotesMember2023-12-310000750004us-gaap:SeniorNotesMemberlnw:SeniorUnsecuredNotesMaturing2029Member2024-03-310000750004us-gaap:SeniorNotesMemberlnw:SeniorUnsecuredNotesMaturing2029Member2023-12-310000750004lnw:SeniorUnsecuredNotesMaturing2031Memberus-gaap:SeniorNotesMember2024-03-310000750004lnw:SeniorUnsecuredNotesMaturing2031Memberus-gaap:SeniorNotesMember2023-12-310000750004lnw:CapitalLeaseObligationsPayableMonthlyMemberus-gaap:CapitalLeaseObligationsMember2024-03-310000750004lnw:CapitalLeaseObligationsPayableMonthlyMemberus-gaap:CapitalLeaseObligationsMember2023-12-310000750004lnw:TermLoanFacilityMemberlnw:TheCreditAgreementMemberlnw:AdjustedSecuredOvernightFinancingRateMember2024-01-162024-01-160000750004lnw:TermLoanFacilityMemberus-gaap:BaseRateMemberlnw:TheCreditAgreementMember2024-01-162024-01-160000750004us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2022-03-310000750004us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2022-04-300000750004us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2024-03-310000750004us-gaap:InterestRateSwapMember2024-01-012024-03-310000750004us-gaap:InterestRateSwapMember2023-01-012023-03-310000750004us-gaap:InterestRateSwapMemberus-gaap:OtherAssetsMember2024-03-310000750004us-gaap:InterestRateSwapMemberus-gaap:OtherAssetsMember2023-12-310000750004us-gaap:AccruedLiabilitiesMember2023-12-310000750004us-gaap:OtherNoncurrentLiabilitiesMember2023-12-310000750004us-gaap:AccruedLiabilitiesMember2024-03-310000750004us-gaap:OtherNoncurrentLiabilitiesMember2024-03-3100007500042022-01-012022-03-310000750004us-gaap:CommonStockMember2023-12-310000750004us-gaap:AdditionalPaidInCapitalMember2023-12-310000750004us-gaap:RetainedEarningsMember2023-12-310000750004us-gaap:TreasuryStockCommonMember2023-12-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000750004us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000750004us-gaap:TreasuryStockCommonMember2024-01-012024-03-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000750004us-gaap:CommonStockMember2024-03-310000750004us-gaap:AdditionalPaidInCapitalMember2024-03-310000750004us-gaap:RetainedEarningsMember2024-03-310000750004us-gaap:TreasuryStockCommonMember2024-03-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000750004us-gaap:CommonStockMember2022-12-310000750004us-gaap:AdditionalPaidInCapitalMember2022-12-310000750004us-gaap:RetainedEarningsMember2022-12-310000750004us-gaap:TreasuryStockCommonMember2022-12-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000750004us-gaap:NoncontrollingInterestMember2022-12-310000750004us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000750004us-gaap:TreasuryStockCommonMember2023-01-012023-03-310000750004us-gaap:RetainedEarningsMember2023-01-012023-03-310000750004us-gaap:NoncontrollingInterestMember2023-01-012023-03-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000750004us-gaap:CommonStockMember2023-03-310000750004us-gaap:AdditionalPaidInCapitalMember2023-03-310000750004us-gaap:RetainedEarningsMember2023-03-310000750004us-gaap:TreasuryStockCommonMember2023-03-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000750004us-gaap:NoncontrollingInterestMember2023-03-310000750004us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310000750004us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310000750004lnw:SciPlayMemberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310000750004lnw:SciPlayMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310000750004lnw:LiabilityAwardsMember2024-01-012024-03-310000750004lnw:LiabilityAwardsMember2023-01-012023-03-310000750004us-gaap:RestrictedStockUnitsRSUMember2023-12-310000750004us-gaap:RestrictedStockUnitsRSUMember2024-03-310000750004lnw:ShareRepurchaseProgramMarch2022Member2022-02-250000750004lnw:ShareRepurchaseProgramMarch2022Member2024-01-012024-03-310000750004us-gaap:GuaranteeOfBusinessRevenueMember1993-06-300000750004us-gaap:PerformanceGuaranteeMember1993-06-300000750004lnw:EcosaludMember1999-06-011999-06-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-11693

LIGHT & WONDER, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Nevada | | 81-0422894 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

6601 Bermuda Road, Las Vegas, Nevada | | 89119 |

| (Address of principal executive offices) | | (Zip Code) |

(702) 897-7150

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $.001 par value | LNW | The Nasdaq Stock Market |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

Common stock outstanding as of May 3, 2024 was 90,137,722.

LIGHT & WONDER, INC. AND SUBSIDIARIES

INDEX TO FINANCIAL AND OTHER INFORMATION

THREE MONTHS ENDED MARCH 31, 2024

| | | | | | | | |

| | Page |

| | |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| | |

| | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| Item 5. | | |

| | |

| Item 6 | | |

Glossary of Terms

The following terms or acronyms used in this Quarterly Report on Form 10-Q are defined below:

| | | | | | | | |

|

|

| Term or Acronym | | Definition |

| 2023 10-K | | 2023 Annual Report on Form 10-K filed with SEC on February 27, 2024 |

| | |

| | |

| | |

| | |

| | |

| 2028 Unsecured Notes | | 7.000% senior unsecured notes due 2028 issued by LNWI |

| 2029 Unsecured Notes | | 7.250% senior unsecured notes due 2029 issued by LNWI |

| 2031 Unsecured Notes | | 7.500% senior unsecured notes due 2031 issued by LNWI |

| AEBITDA | | Adjusted EBITDA, our primary performance measure of profit or loss for our business segments |

| | |

| ASC | | Accounting Standards Codification |

| ASU | | Accounting Standards Update |

| ASX | | Australian Securities Exchange |

| | |

| | |

| CMS | | casino-management system |

| | |

| | |

| | |

| | |

| D&A | | depreciation, amortization and impairments (excluding goodwill) |

| | |

| | |

| | |

| | |

| Exchange Act | | Securities Exchange Act of 1934, as amended |

| FASB | | Financial Accounting Standards Board |

| | |

| | |

| | |

| | |

| KPIs | | Key Performance Indicators |

| L&W | | Light & Wonder, Inc. |

| | |

| LBO | | licensed betting office |

| | |

| LNWI | | Light and Wonder International, Inc., a wholly-owned subsidiary of L&W and successor to Scientific Games International, Inc. |

| LNWI Credit Agreement | | That certain credit agreement, dated as of April 14, 2022, among LNWI, as the borrower, L&W, as a guarantor, the lenders from time to time party thereto, JPMorgan Chase Bank, N.A., as Administrative Agent, Collateral Agent and Swingline Lender, BofA Securities, Inc., BNP Paribas Securities Corp., Deutsche Bank Securities Inc., Fifth Third Bank, National Association, Barclays Bank PLC, Citizens Bank, N.A., Goldman Sachs Bank USA, Morgan Stanley Senior Funding, Inc., Royal Bank of Canada, Truist Securities, Inc., Credit Suisse Loan Funding LLC and Macquarie Capital (USA) Inc. as Lead Arrangers and Joint Bookrunners, as amended, restated, amended and restated, supplemented or otherwise modified from time to time |

| LNWI Revolver | | Revolving credit facility with aggregate commitments of $750 million extended pursuant to the LNWI Credit Agreement |

| LNWI Term Loan B | | Term loan facility, issued pursuant to the LNWI Credit Agreement |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Note | | a note in the Notes to Consolidated Financial Statements in this Quarterly Report on Form 10-Q, unless otherwise indicated |

| | |

| | |

| Participation | | refers to gaming machines provided to customers through service or leasing arrangements in which we earn revenues and are paid based on: (1) a percentage of the amount wagered less payouts; (2) fixed daily-fees; (3) a percentage of the amount wagered; or (4) a combination of (2) and (3) |

| | |

| | |

| | |

| | |

| | |

| R&D | | research and development |

| | |

| | |

| | |

| RSU | | restricted stock unit |

| SciPlay | | Our SciPlay business segment |

| | |

| SEC | | Securities and Exchange Commission |

| | |

| Securities Act | | Securities Act of 1933, as amended |

| Senior Notes or Unsecured Notes | | refers to the 2028 Unsecured Notes, 2029 Unsecured Notes and 2031 Unsecured Notes, collectively |

| SG&A | | selling, general and administrative |

| | |

| | |

| | |

| | |

| Shufflers | | various models of automatic card shufflers, deck checkers and roulette chip sorters |

| SOFR | | Secured Overnight Financing Rate |

| | |

| | |

| U.S. GAAP | | accounting principles generally accepted in the U.S. |

| U.S. jurisdictions | | the 50 states in the U.S. plus the District of Columbia, U.S. Virgin Islands and Puerto Rico |

| | |

| VGT | | video gaming terminal |

| VLT | | video lottery terminal |

| | |

| | |

| | |

Intellectual Property Rights

All ® notices signify marks registered in the United States. © 2024 Light & Wonder, Inc. or one of its Subsidiaries. All Rights Reserved.

The MONOPOLY name and logo, the distinctive design of the game board, the four corner squares, the MR. MONOPOLY name and character, as well as each of the distinctive elements of the board, cards, and the playing pieces are trademarks of Hasbro for its property trading game and game equipment and are used with permission. © 1935, 2024 Hasbro. All Rights Reserved. Licensed by Hasbro.

and James Bond indicia © 1962-2024 Danjaq, LLC and MGM.

and James Bond indicia © 1962-2024 Danjaq, LLC and MGM.  and all other James Bond related trademarks are trademarks of Danjaq, LLC. All Rights Reserved.

and all other James Bond related trademarks are trademarks of Danjaq, LLC. All Rights Reserved.THE FLINTSTONES™ and all related characters and elements © & ™ Hanna-Barbera.

©2024 Playboy Enterprises International, Inc. PLAYBOY, PLAYMATE, PLAYBOY BUNNY, and the Rabbit Head Design are trademarks of Playboy Enterprises International, Inc. and used under license by Light & Wonder, Inc.

FORWARD-LOOKING STATEMENTS

Throughout this Quarterly Report on Form 10-Q, we make “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements describe future expectations, plans, results or strategies and can often be identified by the use of terminology such as “may,” “will,” “estimate,” “intend,” “plan,” “continue,” “believe,” “expect,” “anticipate,” “target,” “should,” “could,” “potential,” “opportunity,” “goal,” or similar terminology. The forward-looking statements contained in this Quarterly Report on Form 10-Q are generally located in the material set forth under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” but may be found in other locations as well. These statements are based upon management’s current expectations, assumptions and estimates and are not guarantees of timing, future results or performance. Therefore, you should not rely on any of these forward-looking statements as predictions of future events. Actual results may differ materially from those contemplated in these statements due to a variety of risks and uncertainties and other factors, including, among other things:

•our inability to successfully execute our strategy;

•slow growth of new gaming jurisdictions, slow addition of casinos in existing jurisdictions and declines in the replacement cycle of gaming machines;

•risks relating to foreign operations, including anti-corruption laws, fluctuations in currency rates, restrictions on the payment of dividends from earnings, restrictions on the import of products and financial instability;

•difficulty predicting what impact, if any, new tariffs imposed by and other trade actions taken by the U.S. and foreign jurisdictions could have on our business;

•U.S. and international economic and industry conditions, including increases in benchmark interest rates and the effects of inflation;

•public perception of our response to environmental, social and governance issues;

•the effects of health epidemics, contagious disease outbreaks and public perception thereof;

•changes in, or the elimination of, our share repurchase program;

•resulting pricing variations and other impacts of our common stock being listed to trade on more than one stock exchange;

•level of our indebtedness, higher interest rates, availability or adequacy of cash flows and liquidity to satisfy indebtedness, other obligations or future cash needs;

•inability to further reduce or refinance our indebtedness;

•restrictions and covenants in debt agreements, including those that could result in acceleration of the maturity of our indebtedness;

•competition;

•inability to win, retain or renew, or unfavorable revisions of, existing contracts, and the inability to enter into new contracts;

•risks and uncertainties of potential changes in U.K. gaming legislation, including any new or revised licensing and taxation regimes, responsible gambling requirements and/or sanctions on unlicensed providers;

•inability to adapt to, and offer products that keep pace with, evolving technology, including any failure of our investment of significant resources in our R&D efforts;

•the outcome of any legal proceedings that may be instituted following completion of the SciPlay merger;

•failure to retain key management and employees;

•unpredictability and severity of catastrophic events, including but not limited to acts of terrorism, war, armed conflicts or hostilities, the impact such events may have on our customers, suppliers, employees, consultants, business partners or operations, as well as management’s response to any of the aforementioned factors;

•changes in demand for our products and services;

•dependence on suppliers and manufacturers;

•SciPlay’s dependence on certain key providers;

•ownership changes and consolidation in the gaming industry;

•fluctuations in our results due to seasonality and other factors;

•risks as a result of being publicly traded in the United States and Australia, including price variations and other impacts relating to the secondary listing of the Company’s common stock on the ASX;

•the possibility that we may be unable to achieve expected operational, strategic and financial benefits of the SciPlay merger;

•security and integrity of our products and systems, including the impact of any security breaches or cyber-attacks;

•protection of our intellectual property, inability to license third-party intellectual property and the intellectual property rights of others;

•reliance on or failures in information technology and other systems;

•litigation and other liabilities relating to our business, including litigation and liabilities relating to our contracts and licenses, our products and systems, our employees (including labor disputes), intellectual property, environmental laws and our strategic relationships;

•reliance on technological blocking systems;

•challenges or disruptions relating to the completion of the domestic migration to our enterprise resource planning system;

•laws and government regulations, both foreign and domestic, including those relating to gaming, data privacy and security, including with respect to the collection, storage, use, transmission and protection of personal information and other consumer data, and environmental laws, and those laws and regulations that affect companies conducting business on the internet, including online gambling;

•legislative interpretation and enforcement, regulatory perception and regulatory risks with respect to gaming, especially internet wagering and social gaming;

•changes in tax laws or tax rulings, or the examination of our tax positions;

•opposition to legalized gaming or the expansion thereof and potential restrictions on internet wagering;

•significant opposition in some jurisdictions to interactive social gaming, including social casino gaming and how such opposition could lead these jurisdictions to adopt legislation or impose a regulatory framework to govern interactive social gaming or social casino gaming specifically, and how this could result in a prohibition on interactive social gaming or social casino gaming altogether, restrict our ability to advertise our games, or substantially increase our costs to comply with these regulations;

•expectations of shift to regulated digital gaming;

•inability to develop successful products and services and capitalize on trends and changes in our industries, including the expansion of internet and other forms of digital gaming;

•the continuing evolution of the scope of data privacy and security regulations, and our belief that the adoption of increasingly restrictive regulations in this area is likely within the U.S. and other jurisdictions;

•incurrence of restructuring costs;

•goodwill impairment charges including changes in estimates or judgments related to our impairment analysis of goodwill or other intangible assets;

•stock price volatility;

•failure to maintain adequate internal control over financial reporting;

•dependence on key executives;

•natural events that disrupt our operations, or those of our customers, suppliers or regulators; and

•expectations of growth in total consumer spending on social casino gaming.

Additional information regarding risks and uncertainties and other factors that could cause actual results to differ materially from those contemplated in forward-looking statements is included from time to time in our filings with the SEC, including under “Risk Factors” in Part II, Item 1A of this Quarterly Report on Form 10-Q and Part I, Item 1A in our 2023 10-K. Forward-looking statements speak only as of the date they are made and, except for our ongoing obligations under the U.S. federal securities laws, we undertake no and expressly disclaim any obligation to publicly update any forward-looking statements whether as a result of new information, future events or otherwise.

You should also note that this Quarterly Report on Form 10-Q may contain references to industry market data and certain industry forecasts. Industry market data and industry forecasts are obtained from publicly available information and industry publications. Industry publications generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. Although we believe industry information to be accurate, it is not independently verified by us and we do not make any representation as to the accuracy of that information. In general, we believe there is less publicly available information concerning the international gaming, social and digital gaming industries than the same industries in the U.S.

Due to rounding, certain numbers presented herein may not precisely recalculate.

PART I. FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements (unaudited)

LIGHT & WONDER, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(in millions, except per share amounts)

| | | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2024 | | 2023 | | |

| Revenue: | | | | | |

| Services | $ | 517 | | | $ | 477 | | | |

| Products | 239 | | | 193 | | | |

| | | | | |

| Total revenue | 756 | | | 670 | | | |

| Operating expenses: | | | | | |

Cost of services(1) | 112 | | | 108 | | | |

Cost of products(1) | 107 | | | 94 | | | |

| | | | | |

| Selling, general and administrative | 218 | | | 192 | | | |

| Research and development | 62 | | | 54 | | | |

| Depreciation, amortization and impairments | 86 | | | 101 | | | |

| | | | | |

| Restructuring and other | 6 | | | 19 | | | |

| Operating income | 165 | | | 102 | | | |

| Other (expense) income: | | | | | |

| Interest expense | (75) | | | (75) | | | |

| | | | | |

| | | | | |

| Other income (expense), net | 10 | | | (1) | | | |

| Total other expense, net | (65) | | | (76) | | | |

| Net income before income taxes | 100 | | | 26 | | | |

| Income tax (expense) benefit | (18) | | | 1 | | | |

| | | | | |

| | | | | |

| Net income | 82 | | | 27 | | | |

| Less: Net income attributable to noncontrolling interest | — | | | 5 | | | |

| Net income attributable to L&W | $ | 82 | | | $ | 22 | | | |

| Per Share - Basic: | | | | | |

| Net income attributable to L&W | $ | 0.91 | | | $ | 0.24 | | | |

| | | | | |

| | | | | |

| Per Share - Diluted: | | | | | |

| Net income attributable to L&W | $ | 0.88 | | | $ | 0.23 | | | |

| | | | | |

| | | | | |

| Weighted average number of shares used in per share calculations: | | | | | |

Basic shares | 90 | | | 91 | | | |

Diluted shares | 92 | | | 93 | | | |

| | | | | |

| (1) Excludes D&A. |

See accompanying notes to consolidated financial statements.

LIGHT & WONDER, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in millions)

| | | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 | | |

| Net income | $ | 82 | | | $ | 27 | | | |

| Other comprehensive (loss) income | | | | | |

| Foreign currency translation (loss) gain, net of tax | (29) | | | 13 | | | |

| | | | | |

| Derivative financial instruments unrealized gain (loss), net of tax | 6 | | | (7) | | | |

| Total other comprehensive (loss) income | (23) | | | 6 | | | |

| | | | | |

| Total comprehensive income | 59 | | | 33 | | | |

| Less: comprehensive income attributable to noncontrolling interest | — | | | 5 | | | |

| Comprehensive income attributable to L&W | $ | 59 | | | $ | 28 | | | |

See accompanying notes to consolidated financial statements.

LIGHT & WONDER, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in millions, except par value)

| | | | | | | | | | | |

| | As of |

| March 31, 2024 | | December 31, 2023 |

| ASSETS |

| Current assets: | | | |

| Cash and cash equivalents | $ | 450 | | | $ | 425 | |

| Restricted cash | 97 | | | 90 | |

Receivables, net of allowance for credit losses of $33 and $38, respectively | 504 | | | 506 | |

| Inventories | 175 | | | 177 | |

| Prepaid expenses, deposits and other current assets | 114 | | | 113 | |

| Total current assets | 1,340 | | | 1,311 | |

| Non-current assets: | | | |

| Restricted cash | 6 | | | 6 | |

Receivables, net of allowance for credit losses of $7 and $3, respectively | 57 | | | 37 | |

| Property and equipment, net | 246 | | | 236 | |

| Operating lease right-of-use assets | 48 | | | 52 | |

| Goodwill | 2,925 | | | 2,945 | |

| Intangible assets, net | 568 | | | 605 | |

| Software, net | 160 | | | 158 | |

| Deferred income taxes | 166 | | | 142 | |

| Other assets | 72 | | | 60 | |

| Total assets | $ | 5,588 | | | $ | 5,552 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current liabilities: |

| Current portion of long-term debt | $ | 22 | | | $ | 22 | |

| Accounts payable | 211 | | | 241 | |

| Accrued liabilities | 381 | | | 404 | |

| Income taxes payable | 63 | | | 29 | |

| Total current liabilities | 677 | | | 696 | |

| Deferred income taxes | 20 | | | 20 | |

| Operating lease liabilities | 34 | | | 39 | |

| Other long-term liabilities | 170 | | | 180 | |

| Long-term debt, excluding current portion | 3,852 | | | 3,852 | |

| Total liabilities | 4,753 | | | 4,787 | |

Commitments and contingencies (Note 15) | | | |

| Stockholders’ equity: | | | |

Common stock, par value $0.001 per share, 199 shares authorized; 117 and 116 shares issued, respectively, and 90 shares outstanding | 1 | | | 1 | |

| Additional paid-in capital | 1,154 | | | 1,118 | |

| Retained earnings | 762 | | | 680 | |

Treasury stock, at cost, 27 and 26 shares, respectively | (776) | | | (751) | |

| Accumulated other comprehensive loss | (306) | | | (283) | |

| Total stockholders’ equity | 835 | | | 765 | |

| | | |

| | | |

| Total liabilities and stockholders’ equity | $ | 5,588 | | | $ | 5,552 | |

|

See accompanying notes to consolidated financial statements.

LIGHT & WONDER, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

| | | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2024 | | 2023 | | |

| Cash flows from operating activities: | | | | | |

| Net income | $ | 82 | | | $ | 27 | | | |

| | | | | |

| | | | | |

| Adjustments to reconcile net income to net cash provided by operating activities | 110 | | | 138 | | | |

| Changes in working capital accounts, excluding the effects of acquisition | 6 | | | 32 | | | |

| | | | | |

| | | | | |

| Change in deferred income taxes and other | (27) | | | (12) | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net cash provided by operating activities | 171 | | | 185 | | | |

| | | | | |

| | | | | |

| Cash flows from investing activities: | | | | | |

| Capital expenditures | (66) | | | (53) | | | |

| | | | | |

| | | | | |

Other(1) | (5) | | | (4) | | | |

| | | | | |

| Net cash used in investing activities | (71) | | | (57) | | | |

| | | | | |

| | | | | |

| Cash flows from financing activities: | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Payments on long-term debt | — | | | (6) | | | |

| Payments of debt issuance and deferred financing costs | (2) | | | — | | | |

| Payments on license obligations | (5) | | | (12) | | | |

| | | | | |

| Purchase of L&W common stock | (25) | | | (28) | | | |

| Purchase of SciPlay’s Class A common stock | — | | | (8) | | | |

| Net redemptions of common stock under stock-based compensation plans and other | (33) | | | (11) | | | |

| | | | | |

| | | | | |

| | | | | |

| Net cash used in financing activities | (65) | | | (65) | | | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (3) | | | — | | | |

| Increase in cash, cash equivalents and restricted cash | 32 | | | 63 | | | |

| Cash, cash equivalents and restricted cash, beginning of period | 521 | | | 967 | | | |

| Cash, cash equivalents and restricted cash, end of period | $ | 553 | | | $ | 1,030 | | | |

| | | | | |

| | | | | |

| Supplemental cash flow information: | | | | | |

| Cash paid for interest | $ | 63 | | | $ | 63 | | | |

| Income taxes paid | 8 | | | 9 | | | |

| | | | | |

| | | | | |

| Supplemental non-cash transactions: | | | | | |

| Non-cash interest expense | $ | 2 | | | $ | 3 | | | |

| | | | | |

| | | | | |

(1) The three months ended March 31, 2023 includes $3 million in cash used in discontinued operations. |

See accompanying notes to consolidated financial statements.

LIGHT & WONDER, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(amounts in USD, table amounts in millions, except per share amounts)

(1) Description of the Business and Summary of Significant Accounting Policies

Description of the Business

We are a leading cross-platform global games company with a focus on content and digital markets. Our portfolio of revenue-generating activities primarily includes supplying game content and gaming machines, CMSs and table game products and services to licensed gaming entities; providing social casino and other mobile games, including casual gaming, to retail customers; and providing a comprehensive suite of digital gaming content, distribution platforms and player account management systems, as well as various other iGaming content and services. We report our results of operations in three business segments—Gaming, SciPlay and iGaming—representing our different products and services.

Basis of Presentation and Principles of Consolidation

The accompanying condensed consolidated financial statements have been prepared in accordance with U.S. GAAP and include the accounts of L&W, its wholly owned subsidiaries, and those subsidiaries in which we have a controlling financial interest. All intercompany balances and transactions have been eliminated in consolidation.

In the opinion of L&W and its management, we have made all adjustments necessary to present fairly our consolidated financial position, results of operations, comprehensive income and cash flows for the periods presented. Such adjustments are of a normal, recurring nature. These unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and related notes included in our 2023 10-K. Interim results of operations are not necessarily indicative of results of operations to be expected for a full year.

Significant Accounting Policies

There have been no changes to our significant accounting policies described within the Notes of our 2023 10-K.

Computation of Basic and Diluted Net Income Attributable to L&W Per Share

Basic and diluted net income attributable to L&W per share are based upon net income attributable to L&W divided by the weighted average number of common shares outstanding during the period. Diluted net income attributable to L&W per share reflects the effect of the assumed exercise of stock options and RSUs only in the periods in which such effect would have been dilutive to net income.

For the three months ended March 31, 2024 and 2023, we included 2 million of common stock equivalents in the calculation of diluted net income attributable to L&W per share.

New Accounting Guidance

There have been no recent accounting pronouncements or changes in accounting pronouncements since those described within the Notes of our 2023 10-K that are expected to have a material impact on our consolidated financial statements.

(2) Revenue Recognition

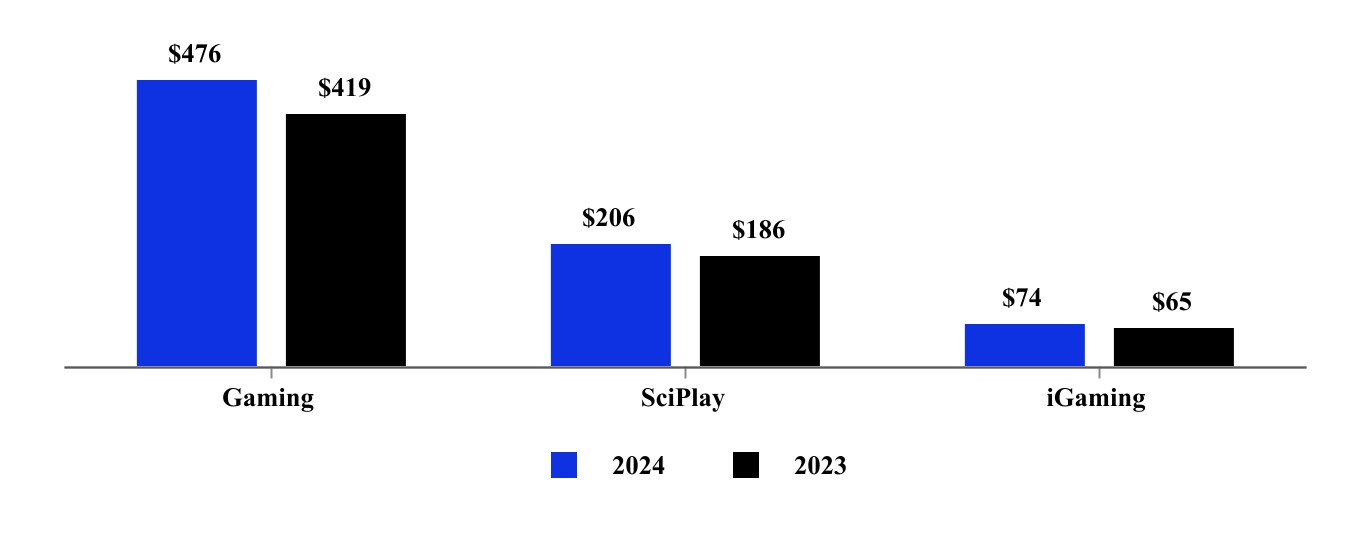

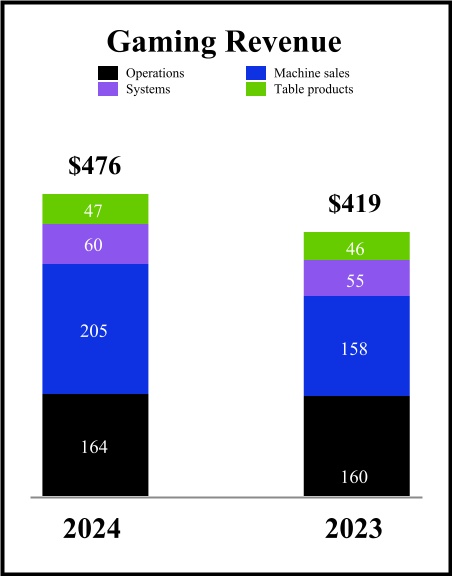

The following table disaggregates our revenues by type within each of our business segments:

| | | | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2024 | | 2023 |

| Gaming | | | | |

| Gaming operations | | $ | 164 | | | $ | 160 | |

| Gaming machine sales | | 205 | | | 158 | |

| Gaming systems | | 60 | | | 55 | |

| Table products | | 47 | | | 46 | |

| Total | | $ | 476 | | | $ | 419 | |

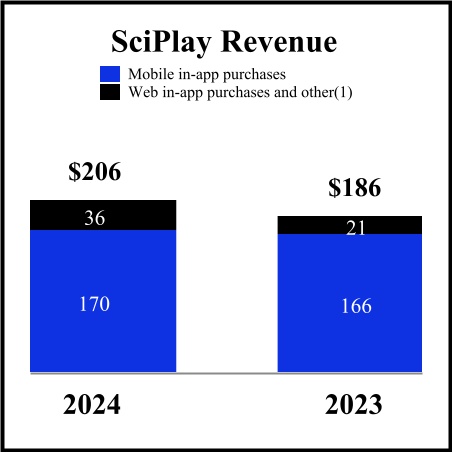

| SciPlay | | | | |

| Mobile in-app purchases | | $ | 170 | | | $ | 166 | |

Web in-app purchases and other(1) | | 36 | | | 21 | |

| Total | | $ | 206 | | | $ | 186 | |

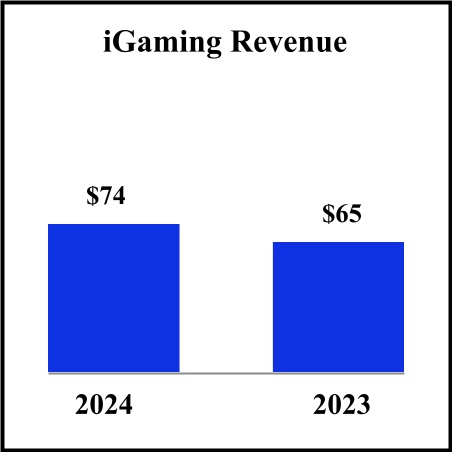

| iGaming | | $ | 74 | | | $ | 65 | |

|

(1) Other represents $12 million in revenue generated via our proprietary platform during the three months ended March 31, 2024, along with advertising and other revenue, which were not material for the periods presented. |

The amount of rental income revenue that is outside the scope of ASC 606 was $127 million and $117 million for the three months ended March 31, 2024 and 2023, respectively.

Contract Liabilities and Other Disclosures

The following table summarizes the activity in our contract liabilities for the reporting period:

| | | | | | | | |

| | Three Months Ended March 31, 2024 |

Contract liability balance, beginning of period(1) | | $ | 27 | |

| Liabilities recognized during the period | | 16 | |

| Amounts recognized in revenue from beginning balance | | (13) | |

Contract liability balance, end of period(1) | | $ | 30 | |

| (1) Contract liabilities are included within Accrued liabilities and Other long-term liabilities in our consolidated balance sheets. |

The timing of revenue recognition, billings and cash collections results in billed receivables, unbilled receivables (contract assets), and customer advances and deposits (contract liabilities) on our consolidated balance sheets. Other than contracts with customers with financing arrangements exceeding 12 months, revenue recognition is generally proximal to conversion to cash. The following table summarizes our balances in these accounts for the periods indicated (other than contract liabilities disclosed above):

| | | | | | | | | | | |

| Receivables | | Contract Assets(1) |

| Beginning of period balance | $ | 543 | | | $ | 24 | |

End of period balance, March 31, 2024 | 561 | | | 24 | |

| | | |

| | | |

(1) Contract assets are included primarily within Prepaid expenses, deposits and other current assets in our consolidated balance sheets. |

As of March 31, 2024, we did not have material unsatisfied performance obligations for contracts expected to be long-term or contracts for which we recognize revenue at an amount other than for which we have the right to invoice for goods or services delivered or performed.

(3) Business Segments

We report our operations in three business segments—Gaming, SciPlay and iGaming—representing our different products and services. A detailed discussion regarding the products and services from which each reportable business segment derives its revenue is included in Notes 3 and 4 in our 2023 10-K.

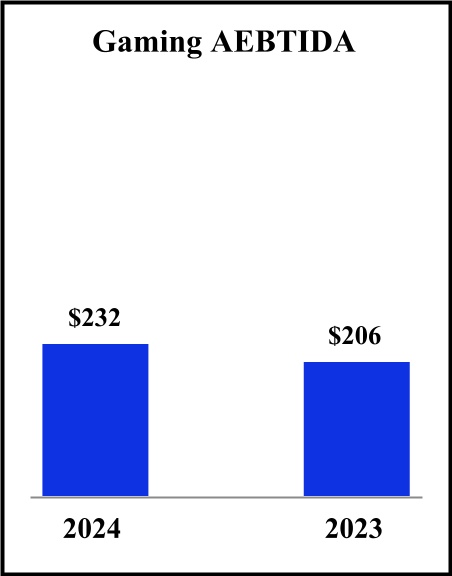

In evaluating financial performance, our Chief Operating Decision Maker (defined as our Chief Executive Officer) focuses on AEBITDA as management’s primary segment measure of profit or loss, which is described in footnote (2) to the

below table. The accounting policies for our business segments are the same as those described within the Notes in our 2023 10-K. The following tables present our segment information:

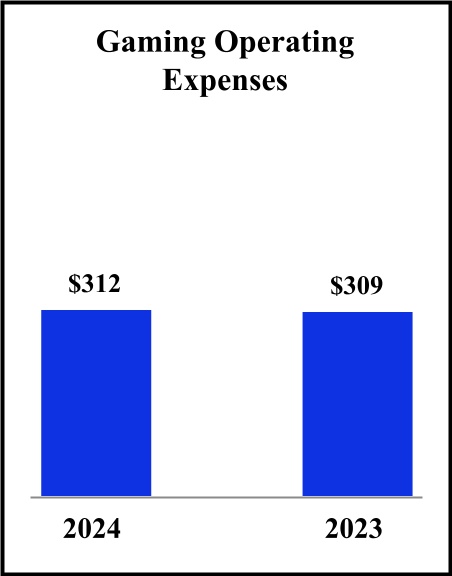

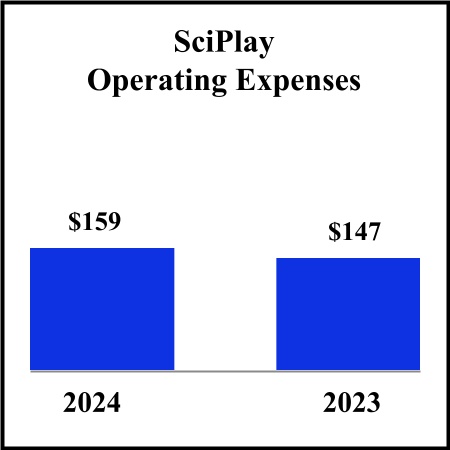

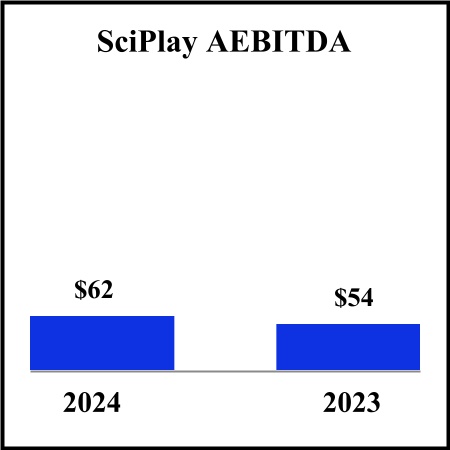

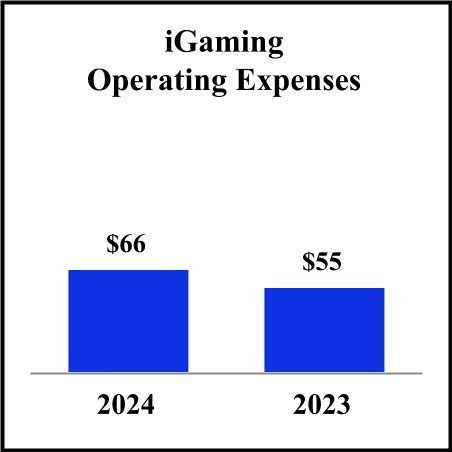

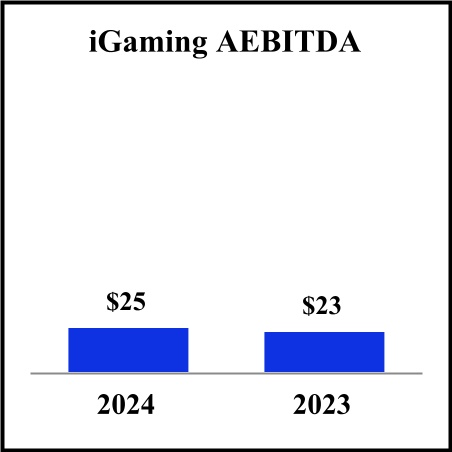

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| Gaming | | SciPlay | | iGaming | | Unallocated and Reconciling Items(1) | | Total |

Total revenue | $ | 476 | | | $ | 206 | | | $ | 74 | | | $ | — | | | $ | 756 | |

AEBITDA(2) | 232 | | | 62 | | | 25 | | | (38) | | | $ | 281 | |

Reconciling items to net income before income taxes: |

D&A | (61) | | | (6) | | | (13) | | | (6) | | | (86) | |

| | | | | | | | | |

Restructuring and other | — | | | — | | | (3) | | | (3) | | | (6) | |

| | | | | | | | | |

Interest expense | | | | | | | (75) | | | (75) | |

| | | | | | | | | |

| | | | | | | | | |

Other income, net | | | | | | | 8 | | | 8 | |

Stock-based compensation | | | | | | | (22) | | | (22) | |

Net income before income taxes | | | | | | | | | $ | 100 | |

| | | | | | | | | |

| | | | | | | | | |

| (1) Includes amounts not allocated to the business segments (including corporate costs) and items to reconcile the total business segments AEBITDA to our consolidated net income before income taxes. |

| (2) AEBITDA is reconciled to net income before income taxes with the following adjustments, as applicable: (1) depreciation and amortization expense and impairment charges (including goodwill impairments); (2) restructuring and other, which includes charges or expenses attributable to: (i) employee severance; (ii) management restructuring and related costs; (iii) restructuring and integration; (iv) cost savings initiatives; (v) major litigation; and (vi) acquisition- and disposition-related costs and other unusual items; (3) interest expense; (4) gain (loss) on debt refinancing transactions; (5) change in fair value of investments and remeasurement of debt and other; (6) other income (expense), net, including foreign currency gains or losses and earnings from equity investments; and (7) stock-based compensation. AEBITDA is presented as our primary segment measure of profit or loss. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2023 |

| Gaming | | SciPlay | | iGaming | | Unallocated and Reconciling Items(1) | | Total |

Total revenue | $ | 419 | | | $ | 186 | | | $ | 65 | | | $ | — | | | $ | 670 | |

AEBITDA(2) | 206 | | | 54 | | | 23 | | | (34) | | | $ | 249 | |

Reconciling items to net income before income taxes: |

D&A | (79) | | | (6) | | | (11) | | | (5) | | | (101) | |

| Restructuring and other | (7) | | | (1) | | | (1) | | | (10) | | | (19) | |

| Interest expense | | | | | | | (75) | | | (75) | |

| | | | | | | | | |

| | | | | | | | | |

| Other expense, net | | | | | | | (2) | | | (2) | |

| Stock-based compensation | | | | | | | (26) | | | (26) | |

Net income before income taxes | | | | | | | | | $ | 26 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

(1) Includes amounts not allocated to the business segments (including corporate costs) and reconciling items to reconcile the total business segments AEBITDA to our consolidated net income before income taxes. |

(2) AEBITDA is described in footnote (2) to the first table in this Note 3. |

(4) Restructuring and Other

Restructuring and other includes charges or expenses attributable to: (i) employee severance; (ii) management restructuring and related costs; (iii) restructuring and integration; (iv) cost savings initiatives; (v) major litigation; and (vi)

acquisition- and disposition-related costs and other unusual items. The following table summarizes pre-tax restructuring and other costs for the periods presented:

| | | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 | | |

| Employee severance and related | $ | 1 | | | $ | 9 | | | |

Strategic review and related(1) | 1 | | | 4 | | | |

Contingent acquisition consideration(2) | 1 | | | — | | | |

| | | | | |

| Restructuring, integration and other | 3 | | | 6 | | | |

| Total | $ | 6 | | | $ | 19 | | | |

| (1) Includes costs associated with the SciPlay merger, ASX listing, sale of discontinued operations (including ongoing separation activities), rebranding and related activities. Refer to the Notes in our 2023 10-K for more information regarding these activities. |

| (2) Represents contingent consideration fair value adjustment (see Note 11). |

(5) Receivables, Allowance for Credit Losses and Credit Quality of Receivables

Receivables

The following table summarizes the components of current and long-term receivables, net: | | | | | | | | | | | |

| As of |

| March 31, 2024 | | December 31, 2023 |

| Current: | | | |

| Receivables | $ | 537 | | | $ | 544 | |

| Allowance for credit losses | (33) | | | (38) | |

| Current receivables, net | 504 | | | 506 | |

| Long-term: | | | |

| Receivables | 64 | | | 40 | |

| Allowance for credit losses | (7) | | | (3) | |

| Long-term receivables, net | 57 | | | 37 | |

| Total receivables, net | $ | 561 | | | $ | 543 | |

Allowance for Credit Losses

We manage our receivable portfolios using both geography and delinquency as key credit quality indicators. The following table summarizes geographical delinquencies of total receivables, net:

| | | | | | | | | | | | | | | | | | | | | | | |

| As of |

| March 31, 2024 | | Balances over 90 days past due | | December 31, 2023 | | Balances over 90 days past due |

| Receivables: | | | | | | | |

| U.S. and Canada | $ | 316 | | | $ | 4 | | | $ | 344 | | | $ | 13 | |

| International | 285 | | | 41 | | | 240 | | | 50 | |

| Total receivables | 601 | | | 45 | | | 584 | | | 63 | |

| Receivables allowance: | | | | | | | |

| U.S. and Canada | (16) | | | (3) | | | (17) | | | (3) | |

| International | (24) | | | (11) | | | (24) | | | (12) | |

| Total receivables allowance | (40) | | | (14) | | | (41) | | | (15) | |

| Receivables, net | $ | 561 | | | $ | 31 | | | $ | 543 | | | $ | 48 | |

| | | | | | | |

| | | | | | | |

Account balances are charged against the allowances after all internal and external collection efforts have been exhausted and the potential for recovery is considered remote.

The activity in our allowance for receivable credit losses for each of the three months ended March 31, 2024 and 2023 is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| 2024 | | 2023 |

| Total | | U.S. and Canada | | International | | Total |

| Beginning allowance for credit losses | $ | (41) | | | $ | (17) | | | $ | (24) | | | $ | (40) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Provision | (1) | | | — | | | (1) | | | (1) | |

| Charge-offs and recoveries | 2 | | | 1 | | | 1 | | | 1 | |

| Allowance for credit losses as of March 31 | $ | (40) | | | $ | (16) | | | $ | (24) | | | $ | (40) | |

|

As of March 31, 2024, 6% of our total receivables, net, were past due by over 90 days, compared to 9% as of December 31, 2023.

Credit Quality of Receivables

We have certain concentrations of outstanding receivables in international locations that impact our assessment of the credit quality of our receivables. We monitor the macroeconomic and political environment in each of these locations in our assessment of the credit quality of our receivables. The international customers with significant concentrations (generally deemed to be exceeding 10%) of our receivables with terms longer than one year are in the Latin America region (“LATAM”) and are primarily comprised of Mexico, Peru and Argentina. The following table summarizes our LATAM receivables:

| | | | | | | | | | | | | | | | | |

| As of March 31, 2024 |

| Total | | Current | | Balances over 90 days past due |

| Receivables | $ | 61 | | | $ | 47 | | | $ | 14 | |

| Allowance for credit losses | (18) | | | (11) | | | (7) | |

| Receivables, net | $ | 43 | | | $ | 36 | | | $ | 7 | |

We continuously review receivables and, as information concerning credit quality and/or overall economic environment arises, reassess our expectations of future losses and record an incremental reserve if warranted at that time. Our current allowance for credit losses represents our current expectation of credit losses; however, future expectations could change as international unrest or other macro-economic factors impact the financial stability of our customers.

The fair value of receivables is estimated by discounting expected future cash flows using current interest rates at which similar loans would be made to borrowers with similar credit ratings and remaining maturities. As of March 31, 2024 and December 31, 2023, the fair value of receivables, net, approximated the carrying value due to contractual terms of receivables generally being less than 24 months.

(6) Inventories

Inventories consisted of the following:

| | | | | | | | | | | | | | |

| | | As of |

| | | March 31, 2024 | | December 31, 2023 |

| Parts and work-in-process | | $ | 126 | | | $ | 113 | |

| Finished goods | | 49 | | | 64 | |

| Total inventories | | $ | 175 | | | $ | 177 | |

Parts and work-in-process include parts for gaming machines and our finished goods inventory primarily consist of gaming machines for sale.

(7) Property and Equipment, net

Property and equipment, net consisted of the following:

| | | | | | | | | | | | | | |

| | As of |

| | March 31, 2024 | | December 31, 2023 |

| Land | | $ | 6 | | | $ | 6 | |

| Buildings and leasehold improvements | | 59 | | | 59 | |

| Gaming machinery and equipment | | 738 | | | 718 | |

| Furniture and fixtures | | 27 | | | 26 | |

| Construction in progress | | 10 | | | 7 | |

| Other property and equipment | | 96 | | | 94 | |

| Less: accumulated depreciation | | (690) | | | (674) | |

| Total property and equipment, net | | $ | 246 | | | $ | 236 | |

Depreciation expense is excluded from Cost of services, Cost of products and Other operating expenses and is separately presented within D&A.

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Depreciation expense | $ | 31 | | | $ | 28 | |

|

(8) Intangible Assets, net and Goodwill

Intangible Assets, net

The following tables present certain information regarding our intangible assets as of March 31, 2024 and December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of | |

| March 31, 2024 | | December 31, 2023 | |

| Gross Carrying

Value | | Accumulated

Amortization | | | Net Balance | | Gross Carrying

Value | | Accumulated

Amortization | | Net Balance | |

| Amortizable intangible assets: | | | | | | | | | | | | | |

| Customer relationships | $ | 901 | | | $ | (581) | | | | $ | 320 | | | $ | 904 | | | $ | (567) | | | $ | 337 | | |

Intellectual property | 942 | | | (779) | | | | 163 | | | 947 | | | (771) | | | 176 | | |

| Licenses | 292 | | | (224) | | | | 68 | | | 290 | | | (217) | | | 73 | | |

| Brand names | 129 | | | (121) | | | | 8 | | | 129 | | | (120) | | | 9 | | |

| Trade names | 163 | | | (158) | | | | 5 | | | 163 | | | (157) | | | 6 | | |

| Patents and other | 11 | | | (7) | | | | 4 | | | 11 | | | (7) | | | 4 | | |

| Total intangible assets | $ | 2,438 | | | $ | (1,870) | | | | $ | 568 | | | $ | 2,444 | | | $ | (1,839) | | | $ | 605 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

|

The following reflects intangible amortization expense included within D&A:

| | | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 | | |

| Amortization expense | $ | 37 | | | $ | 58 | | | |

|

Goodwill

The table below reconciles the change in the carrying value of goodwill, by business segment, for the period from December 31, 2023 to March 31, 2024.

| | | | | | | | | | | | | | | | | | | | | | | |

| Gaming(1) | | SciPlay | | iGaming | | Totals |

Balance as of December 31, 2023 | $ | 2,388 | | | $ | 210 | | | $ | 347 | | | $ | 2,945 | |

| | | | | | | |

| | | | | | | |

| Foreign currency adjustments | (8) | | | — | | | (12) | | | (20) | |

Balance as of March 31, 2024 | $ | 2,380 | | | $ | 210 | | | $ | 335 | | | $ | 2,925 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(1) Accumulated goodwill impairment charges for the Gaming segment as of March 31, 2024 were $989 million. |

(9) Software, net

Software, net consisted of the following:

| | | | | | | | | | | | | | |

| | | As of |

| | | March 31, 2024 | | December 31, 2023 |

| Software | | $ | 1,101 | | | $ | 1,083 | |

| Accumulated amortization | | (941) | | | (925) | |

| Software, net | | $ | 160 | | | $ | 158 | |

The following reflects amortization of software included within D&A:

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Amortization expense | $ | 18 | | | $ | 15 | |

(10) Long-Term Debt

The following table reflects our outstanding debt (in order of priority and maturity):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of |

| March 31, 2024 | | December 31, 2023 |

| | Final Maturity | | Rate(s) | | Face Value | | Unamortized debt discount/premium and deferred financing costs, net | | Book Value | | Book Value |

| Senior Secured Credit Facilities: | | | | | | | | | | | |

| LNWI Revolver | 2027 | | variable | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| LNWI Term Loan B | 2029 | | variable | | 2,167 | | | (26) | | | 2,141 | | | 2,141 | |

| LNWI Senior Notes: | | | | | | | | | | | |

| 2028 Unsecured Notes | 2028 | | 7.000% | | 700 | | | (6) | | | 694 | | | 694 | |

| 2029 Unsecured Notes | 2029 | | 7.250% | | 500 | | | (5) | | | 495 | | | 495 | |

| 2031 Unsecured Notes | 2031 | | 7.500% | | 550 | | | (7) | | | 543 | | | 543 | |

| Other | — | | — | | 1 | | | — | | | 1 | | | 1 | |

| Total long-term debt outstanding | | | | | $ | 3,918 | | | $ | (44) | | | $ | 3,874 | | | $ | 3,874 | |

| Less: current portion of long-term debt | | | | | | | | | (22) | | | (22) | |

| Long-term debt, excluding current portion | | | | | | | | | $ | 3,852 | | | $ | 3,852 | |

Fair value of debt(1) | | | | | $ | 3,963 | | | | | | | |

| | | | | | | | | | | |

|

|

|

|

| (1) Fair value of our fixed rate and variable interest rate debt is classified within Level 2 in the fair value hierarchy and has been calculated based on the quoted market prices of our securities. |

LNWI Term Loan B Repricing

On January 16, 2024, we amended the LNWI Credit Agreement and reduced the applicable margin on the LNWI Term Loan B. Following the amendment, the interest rate for the Term Loan B is either (i) the Adjusted Term SOFR Rate (as defined in the LNWI Credit Agreement) plus 2.75% per annum or (ii) a base rate plus 1.75% per annum.

We were in compliance with the financial covenants under all debt agreements as of March 31, 2024 (for information regarding our financial covenants of all debt agreements, see Note 15 in our 2023 10-K).

For additional information regarding the terms of our credit facilities and Senior Notes, see Note 15 in our 2023 10-K.

(11) Fair Value Measurements

The fair value of our financial assets and liabilities is determined by reference to market data and other valuation techniques as appropriate. We believe the fair value of our financial instruments, which are principally cash and cash equivalents, restricted cash, receivables, other current assets, accounts payable and accrued liabilities, approximates their recorded values. Our assets and liabilities measured at fair value on a recurring basis are described below.

Derivative Financial Instruments

As of March 31, 2024, we held the following derivative instruments that were accounted for pursuant to ASC 815:

Interest Rate Swap Contracts

We use interest rate swap contracts as described below to manage exposure to interest rate fluctuations by reducing the uncertainty of future cash flows on a portion of our variable rate debt.

In April 2022, we entered into interest rate swap contracts to hedge a portion of our interest expense associated with our variable rate debt to effectively fix the interest rate that we pay. These interest rate swap contracts were designated as cash flow hedges under ASC 815. We pay interest at a weighted-average fixed rate of 2.8320% and receive interest at a variable rate equal to one-month Chicago Mercantile Exchange Term SOFR. The total notional amount of these interest rate swaps was $700 million as of March 31, 2024. These hedges mature in April 2027.

All gains and losses from these hedges are recorded in other comprehensive income (loss) until the future underlying payment transactions occur. Any realized gains or losses resulting from the hedges are recognized (together with the hedged transaction) as interest expense. We estimate the fair value of our interest rate swap contracts by discounting the future cash flows of both the fixed rate and variable rate interest payments based on market yield curves. The inputs used to measure the fair value of our interest rate swap contracts are categorized as Level 2 in the fair value hierarchy as established by ASC 820.

The following table shows the gain and interest income on our interest rate swap contracts:

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Gain (loss) recorded in accumulated other comprehensive loss, net of tax | $ | 6 | | | $ | (7) | |

| Interest income recorded related to interest rate swap contracts | 4 | | | 3 | |

We do not expect to reclassify material amounts from accumulated other comprehensive loss to interest expense in the next twelve months.

The following table shows the effect of interest rate swap contracts designated as cash flow hedges on interest expense in the consolidated statements of income:

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Total interest expense which reflects the effects of cash flow hedges | $ | (75) | | | $ | (75) | |

| Hedged item | (5) | | | (5) | |

| Derivative designated as hedging instrument | 9 | | | 8 | |

The following table shows the fair value of our hedges:

| | | | | | | | | | | | | | | | | |

| | | As of |

| Balance Sheet Line Item | | March 31, 2024 | | December 31, 2023 |

| | | | | |

| Interest rate swaps | Other assets | | $ | 28 | | | $ | 20 | |

| | | | | |

|

|

|

|

|

Contingent Acquisition Consideration Liabilities

In connection with our acquisitions, we have recorded certain contingent consideration liabilities (including redeemable non-controlling interest), of which the values are primarily based on reaching certain earnings-based metrics. The related liabilities were recorded at fair value on their respective acquisition dates as a part of the consideration transferred and are remeasured each reporting period (other than for redeemable non-controlling interest, which is measured based on its redemption value). The inputs used to measure the fair value of our liabilities are categorized as Level 3 in the fair value hierarchy.

The table below reconciles the change in the contingent acquisition consideration liabilities (including deferred purchase price) for the period from December 31, 2023 to March 31, 2024.

| | | | | | | | | | | | | | | | | |

| Total | | Included in Accrued Liabilities | | Included in Other Long-Term Liabilities |

Balance as of December 31, 2023 | $ | 59 | | | $ | 39 | | | $ | 20 | |

| | | | | |

| Payments | (1) | | | | | |

Fair value adjustments(1) | 1 | | | | | |

Other adjustments(2) | (5) | | | | | |

Balance as of March 31, 2024 | $ | 54 | | | $ | 41 | | | $ | 13 | |

| (1) Amount included in Restructuring and other (see Note 4). |

(2) Represents extinguishment of $5 million in redeemable non-controlling interest liability associated with SciPlay’s acquisition of Alictus Yazilim Anonim Şirketi in 2022, as specified financial targets for the second year were not met. The gain was recorded in other income (expense), net in our consolidated statements of income. |

(12) Stockholders’ Equity

Changes in Stockholders’ Equity

The following tables present certain information regarding our stockholders’ equity as of March 31, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| Common Stock | | Additional Paid in Capital | | Retained Earnings | | Treasury Stock | | Accumulated Other Comprehensive Loss | | | | Total |

| January 1, 2024 | $ | 1 | | | $ | 1,118 | | | $ | 680 | | | $ | (751) | | | $ | (283) | | | | | $ | 765 | |

| Settlement of liability awards | — | | | 65 | | | — | | | — | | | — | | | | | 65 | |

| Vesting of RSUs, net of tax withholdings and other | — | | | (43) | | | — | | | — | | | — | | | | | (43) | |

| Purchase of treasury stock | — | | | — | | | — | | | (25) | | | — | | | | | (25) | |

| | | | | | | | | | | | | |

| Stock-based compensation | — | | | 14 | | | — | | | — | | | — | | | | | 14 | |

| Net income | — | | | — | | | 82 | | | — | | | — | | | | | 82 | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | (23) | | | | | (23) | |

| March 31, 2024 | $ | 1 | | | $ | 1,154 | | | $ | 762 | | | $ | (776) | | | $ | (306) | | | | | $ | 835 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2023 |

| | Common Stock | | Additional Paid in Capital | | Accumulated Loss | | Treasury Stock | | Accumulated Other Comprehensive Loss | | Noncontrolling Interest | | Total |

| January 1, 2023 | $ | 1 | | | $ | 1,370 | | | $ | 517 | | | $ | (580) | | | $ | (318) | | | $ | 171 | | | $ | 1,161 | |

| Settlement of liability awards | — | | | 25 | | | — | | | — | | | — | | | — | | | 25 | |

| Vesting of RSUs, net of tax withholdings and other | — | | | (14) | | | — | | | — | | | — | | | — | | | (14) | |

| Purchase of treasury stock | — | | | — | | | — | | | (28) | | | — | | | — | | | (28) | |

| Purchase of SciPlay’s Class A common stock | — | | | (8) | | | — | | | — | | | — | | | — | | | (8) | |

| Stock-based compensation | — | | | 15 | | | — | | | — | | | — | | | — | | | 15 | |

| Net income | — | | | — | | | 22 | | | — | | | — | | | 5 | | | 27 | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 6 | | | — | | | 6 | |

| | | | | | | | | | | | | |

| March 31, 2023 | $ | 1 | | | $ | 1,388 | | | $ | 539 | | | $ | (608) | | | $ | (312) | | | $ | 176 | | | $ | 1,184 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Stock-based Compensation

The following reflects total stock-based compensation expense recognized under all programs:

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2024 | | 2023 | | |

| | | | | | | | | |

| Related to L&W RSUs | | | | | $ | 22 | | | $ | 19 | | | |

| Related to SciPlay RSUs | | | | | — | | | 7 | | | |

Total(1) | | | | | $ | 22 | | | $ | 26 | | | |

| | | | | | | | | |

|

(1) Includes $8 million and $11 million of stock-based compensation classified as liability awards as of March 31, 2024 and 2023, respectively. |

Restricted Stock Units

A summary of the changes in RSUs outstanding under our equity-based compensation plans during the three months ended March 31, 2024 is presented below:

| | | | | | | | | | | |

| Number of Restricted Stock Units | | Weighted Average Grant Date Fair Value |

Unvested RSUs as of December 31, 2023 | 2.3 | | | $ | 55.53 | |

| Granted | 1.3 | | | $ | 99.65 | |

| Vested | (1.2) | | | $ | 73.52 | |

| Cancelled | — | | | $ | 49.73 | |

Unvested RSUs as of March 31, 2024 | 2.4 | | | $ | 71.10 | |

|

| | | |

|

The weighted-average grant date fair value of RSUs granted during the three months ended March 31, 2024 and 2023 was $99.65 and $56.93, respectively. The fair value of each RSU grant is based on the market value of our common stock at the time of grant. As of March 31, 2024, we had $144 million of unrecognized stock-based compensation expense relating to unvested RSUs amortized over a weighted-average period of approximately 1.5 years. The fair value at vesting date of RSUs vested during the three months ended March 31, 2024 and 2023 was $124 million and $44 million, respectively.

Share Repurchase Program

On March 1, 2022, our Board of Directors approved a share repurchase program under which the Company is authorized to repurchase, from time to time through February 25, 2025, up to an aggregate amount of $750 million of shares of our outstanding common stock. During the three months ended March 31, 2024, we repurchased approximately 0.2 million shares of common stock under the program at an aggregate cost of $25 million (including excise tax).

(13) Income Taxes

We consider new evidence (both positive and negative) at each reporting date that could affect our view of the future realization of deferred tax assets. We evaluate information such as historical financial results, historical taxable income, projected future taxable income, expected timing of the reversals of existing temporary differences and available prudent and feasible tax planning strategies in our analysis. Based on the available evidence, valuation allowances in certain U.S. and non-U.S. jurisdictions remain consistent as of March 31, 2024.

Our income tax (including discrete items) was an expense of $18 million and a benefit of $1 million for the three months ended March 31, 2024 and 2023, respectively. For the three months ended March 31, 2024, our effective tax rate differs from the U.S. statutory rate of 21% primarily as a result of tax benefits related to equity compensation. In all periods, we recorded tax expense relative to pre-tax earnings in jurisdictions without valuation allowances.

(14) Leases

Our total operating lease expense was $7 million and $6 million for the three months ended March 31, 2024, and 2023, respectively. The total amount of variable and short-term lease payments was immaterial for all periods presented.

Supplemental balance sheet and cash flow information related to operating leases is as follows:

| | | | | | | | | | | |

| As of |

| March 31, 2024 | | December 31, 2023 |

| Operating lease right-of-use assets | $ | 48 | | | $ | 52 | |

| Accrued liabilities | 19 | | | 19 | |

| Operating lease liabilities | 34 | | | 39 | |

| Total operating lease liabilities | $ | 53 | | | $ | 58 | |

| | | |

| | | |

| Weighted average remaining lease term, years | 3 | | 4 |

| Weighted average discount rate | 6 | % | | 6 | % |

| | | |

| | | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 | | |

| Cash paid for amounts included in the measurement of lease liabilities: | | | | | |

| Operating cash flows for operating leases | $ | 6 | | | $ | 5 | | | |

| Right-of-use assets obtained in exchange for new lease liabilities: | | | | | |

| Operating leases | $ | 1 | | | $ | — | | | |

Lease liability maturities:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Remainder of 2024 | | 2025 | | 2026 | | 2027 | | 2028 | | Thereafter | | Less Imputed Interest | | Total |

| Operating leases | $ | 15 | | | $ | 18 | | | $ | 13 | | | $ | 7 | | | $ | 4 | | | $ | 1 | | | $ | (5) | | | $ | 53 | |

| | | | | | | | | | | | | | | |

As of March 31, 2024, we did not have material additional operating leases that have not yet commenced.

(15) Litigation

We are involved in various legal proceedings, including those discussed below. We record an accrual for legal contingencies when it is both probable that a liability has been incurred and the amount or range of the loss can be reasonably estimated (although, as discussed below, there may be an exposure to loss in excess of the accrued liability). We evaluate our accruals for legal contingencies at least quarterly and, as appropriate, establish new accruals or adjust existing accruals to reflect (1) the facts and circumstances known to us at the time, including information regarding negotiations, settlements, rulings and other relevant events and developments, (2) the advice and analyses of counsel and (3) the assumptions and judgment of management. Legal costs associated with our legal proceedings are expensed as incurred. We had accrued liabilities of $11 million and $12 million for all of our legal matters that were contingencies as of March 31, 2024 and December 31, 2023, respectively.

Substantially all of our legal contingencies are subject to significant uncertainties and, therefore, determining the likelihood of a loss and/or the measurement of any loss involves a series of complex judgments about future events. Consequently, the ultimate outcomes of our legal contingencies could result in losses in excess of amounts we have accrued.

We may be unable to estimate a range of possible losses for some matters pending against us or our subsidiaries, even when the amount of damages claimed against us or our subsidiaries is stated because, among other things: (1) the claimed amount may be exaggerated or unsupported; (2) the claim may be based on a novel legal theory or involve a large number of parties; (3) there may be uncertainty as to the likelihood of a class being certified or the ultimate size of the class; (4) there may be uncertainty as to the outcome of pending appeals or motions; (5) the matter may not have progressed sufficiently through discovery or there may be significant factual or legal issues to be resolved or developed; and/or (6) there may be uncertainty as to the enforceability of legal judgments and outcomes in certain jurisdictions. Other matters have progressed sufficiently that we are able to estimate a range of possible loss. For those legal contingencies disclosed below, and those related to the previously disclosed settlement agreement entered into in February 2015 with SNAI S.p.a. (“SNAI”), as to which a loss is reasonably possible, whether in excess of a related accrued liability or where there is no accrued liability, and for which we are able to estimate a range of possible loss, the current estimated range is up to approximately $13 million in excess of the accrued liabilities (if any) related to those legal contingencies. This aggregate range represents management’s estimate of additional possible loss in excess of the accrued liabilities (if any) with respect to these matters based on currently available information, including any damages claimed by the plaintiffs, and is subject to significant judgment and a variety of assumptions and inherent uncertainties. For example, at the time of making an estimate, management may have only preliminary, incomplete, or inaccurate information about the facts underlying a claim; its assumptions about the future rulings of the court or other tribunal on significant issues, or the behavior and incentives of adverse parties, regulators, indemnitors or co‑defendants, may prove to be wrong; and the outcomes it is attempting to predict are often not amenable to the use of statistical or other quantitative analytical tools. In addition, from time to time an outcome may occur that management had not accounted for in its estimate because it had considered that outcome to be remote. Furthermore, as noted above, the aggregate range does not include any matters for which we are not able to estimate a range of possible loss. Accordingly, the estimated aggregate range of possible loss does not represent our maximum loss exposure. Any such losses could have a material adverse impact on our results of operations, cash flows or financial condition. The legal proceedings underlying the estimated range will change from time to time, and actual results may vary significantly from the current estimate.

Colombia Litigation