sgms-20200930000075000412/312020Q3FALSEExclusive of D&A00007500042020-01-012020-09-30xbrli:shares00007500042020-10-29iso4217:USD0000750004us-gaap:ServiceMember2020-07-012020-09-300000750004us-gaap:ServiceMember2019-07-012019-09-300000750004us-gaap:ServiceMember2020-01-012020-09-300000750004us-gaap:ServiceMember2019-01-012019-09-300000750004us-gaap:ProductMember2020-07-012020-09-300000750004us-gaap:ProductMember2019-07-012019-09-300000750004us-gaap:ProductMember2020-01-012020-09-300000750004us-gaap:ProductMember2019-01-012019-09-300000750004sgms:InstantProductsMember2020-07-012020-09-300000750004sgms:InstantProductsMember2019-07-012019-09-300000750004sgms:InstantProductsMember2020-01-012020-09-300000750004sgms:InstantProductsMember2019-01-012019-09-3000007500042020-07-012020-09-3000007500042019-07-012019-09-3000007500042019-01-012019-09-30iso4217:USDxbrli:shares0000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-07-012020-09-3000007500042020-09-3000007500042019-12-3100007500042018-12-3100007500042019-09-30sgms:Segment00007500042020-04-092020-04-090000750004us-gaap:SeniorNotesMembersgms:SeniorUnsecuredNotesMaturing2025Member2020-07-01xbrli:pure0000750004sgms:SeniorSubordinatedNotesMaturing2021Memberus-gaap:SeniorSubordinatedNotesMember2020-07-170000750004us-gaap:DebtInstrumentRedemptionPeriodOneMember2020-01-012020-09-300000750004us-gaap:DebtInstrumentRedemptionPeriodTwoMember2020-01-012020-09-300000750004us-gaap:DebtInstrumentRedemptionPeriodThreeMember2020-01-012020-09-3000007500042020-05-082020-05-080000750004sgms:CertainCovenantInstancesMember2020-05-082020-05-080000750004us-gaap:LondonInterbankOfferedRateLIBORMember2020-05-082020-05-080000750004us-gaap:DebtInstrumentRedemptionPeriodFourMember2020-01-012020-09-300000750004us-gaap:DebtInstrumentRedemptionPeriodFiveMember2020-01-012020-09-300000750004us-gaap:EmployeeStockOptionMember2020-07-012020-09-300000750004us-gaap:EmployeeStockOptionMember2020-01-012020-09-300000750004us-gaap:EmployeeStockOptionMember2019-01-012019-09-300000750004us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-09-300000750004us-gaap:AccountingStandardsUpdate201613Member2020-01-010000750004sgms:GamingGroupMembersgms:GamingOperationsMember2020-07-012020-09-300000750004sgms:GamingGroupMembersgms:GamingOperationsMember2019-07-012019-09-300000750004sgms:GamingGroupMembersgms:GamingOperationsMember2020-01-012020-09-300000750004sgms:GamingGroupMembersgms:GamingOperationsMember2019-01-012019-09-300000750004sgms:GamingMachineSalesMembersgms:GamingGroupMember2020-07-012020-09-300000750004sgms:GamingMachineSalesMembersgms:GamingGroupMember2019-07-012019-09-300000750004sgms:GamingMachineSalesMembersgms:GamingGroupMember2020-01-012020-09-300000750004sgms:GamingMachineSalesMembersgms:GamingGroupMember2019-01-012019-09-300000750004sgms:GamingGroupMembersgms:GamingSystemsMember2020-07-012020-09-300000750004sgms:GamingGroupMembersgms:GamingSystemsMember2019-07-012019-09-300000750004sgms:GamingGroupMembersgms:GamingSystemsMember2020-01-012020-09-300000750004sgms:GamingGroupMembersgms:GamingSystemsMember2019-01-012019-09-300000750004sgms:TableProductsMembersgms:GamingGroupMember2020-07-012020-09-300000750004sgms:TableProductsMembersgms:GamingGroupMember2019-07-012019-09-300000750004sgms:TableProductsMembersgms:GamingGroupMember2020-01-012020-09-300000750004sgms:TableProductsMembersgms:GamingGroupMember2019-01-012019-09-300000750004sgms:GamingGroupMember2020-07-012020-09-300000750004sgms:GamingGroupMember2019-07-012019-09-300000750004us-gaap:OperatingSegmentsMembersgms:GamingGroupMember2020-01-012020-09-300000750004sgms:GamingGroupMember2019-01-012019-09-300000750004sgms:LotterySystemsGroupMembersgms:InstantProductsMember2020-07-012020-09-300000750004sgms:LotterySystemsGroupMembersgms:InstantProductsMember2019-07-012019-09-300000750004sgms:LotterySystemsGroupMembersgms:InstantProductsMember2020-01-012020-09-300000750004sgms:LotterySystemsGroupMembersgms:InstantProductsMember2019-01-012019-09-300000750004sgms:LotterySystemsMembersgms:LotterySystemsGroupMember2020-07-012020-09-300000750004sgms:LotterySystemsMembersgms:LotterySystemsGroupMember2019-07-012019-09-300000750004sgms:LotterySystemsMembersgms:LotterySystemsGroupMember2020-01-012020-09-300000750004sgms:LotterySystemsMembersgms:LotterySystemsGroupMember2019-01-012019-09-300000750004sgms:LotterySystemsGroupMember2020-07-012020-09-300000750004sgms:LotterySystemsGroupMember2019-07-012019-09-300000750004sgms:LotterySystemsGroupMemberus-gaap:OperatingSegmentsMember2020-01-012020-09-300000750004sgms:LotterySystemsGroupMember2019-01-012019-09-300000750004sgms:MobileMembersgms:SciPlayMember2020-07-012020-09-300000750004sgms:MobileMembersgms:SciPlayMember2019-07-012019-09-300000750004sgms:MobileMembersgms:SciPlayMember2020-01-012020-09-300000750004sgms:MobileMembersgms:SciPlayMember2019-01-012019-09-300000750004sgms:WebAndOtherMembersgms:SciPlayMember2020-07-012020-09-300000750004sgms:WebAndOtherMembersgms:SciPlayMember2019-07-012019-09-300000750004sgms:WebAndOtherMembersgms:SciPlayMember2020-01-012020-09-300000750004sgms:WebAndOtherMembersgms:SciPlayMember2019-01-012019-09-300000750004sgms:SciPlayMember2020-07-012020-09-300000750004sgms:SciPlayMember2019-07-012019-09-300000750004sgms:SciPlayMember2020-01-012020-09-300000750004sgms:SciPlayMember2019-01-012019-09-300000750004sgms:SportsAndPlatformMembersgms:DigitalBusinessSegmentMember2020-07-012020-09-300000750004sgms:SportsAndPlatformMembersgms:DigitalBusinessSegmentMember2019-07-012019-09-300000750004sgms:SportsAndPlatformMembersgms:DigitalBusinessSegmentMember2020-01-012020-09-300000750004sgms:SportsAndPlatformMembersgms:DigitalBusinessSegmentMember2019-01-012019-09-300000750004sgms:GamingAndOtherMembersgms:DigitalBusinessSegmentMember2020-07-012020-09-300000750004sgms:GamingAndOtherMembersgms:DigitalBusinessSegmentMember2019-07-012019-09-300000750004sgms:GamingAndOtherMembersgms:DigitalBusinessSegmentMember2020-01-012020-09-300000750004sgms:GamingAndOtherMembersgms:DigitalBusinessSegmentMember2019-01-012019-09-300000750004sgms:DigitalBusinessSegmentMember2020-07-012020-09-300000750004sgms:DigitalBusinessSegmentMember2019-07-012019-09-300000750004us-gaap:OperatingSegmentsMembersgms:DigitalBusinessSegmentMember2020-01-012020-09-300000750004sgms:DigitalBusinessSegmentMember2019-01-012019-09-300000750004sgms:LotterySystemsGroupMemberus-gaap:AccountingStandardsUpdate201409Membersgms:InstantProductsMember2020-07-012020-09-300000750004sgms:LotterySystemsGroupMemberus-gaap:AccountingStandardsUpdate201409Membersgms:InstantProductsMember2020-01-012020-09-300000750004sgms:LotterySystemsGroupMemberus-gaap:AccountingStandardsUpdate201409Membersgms:InstantProductsMember2019-07-012019-09-300000750004sgms:LotterySystemsGroupMemberus-gaap:AccountingStandardsUpdate201409Membersgms:InstantProductsMember2019-01-012019-09-300000750004us-gaap:OperatingSegmentsMembersgms:GamingGroupMember2020-07-012020-09-300000750004sgms:LotterySystemsGroupMemberus-gaap:OperatingSegmentsMember2020-07-012020-09-300000750004us-gaap:OperatingSegmentsMembersgms:SciPlayMember2020-07-012020-09-300000750004us-gaap:OperatingSegmentsMembersgms:DigitalBusinessSegmentMember2020-07-012020-09-300000750004sgms:CorporateAndReconcilingItemsMember2020-07-012020-09-300000750004sgms:GamingBusinessSegmentMemberus-gaap:OperatingSegmentsMember2020-07-012020-09-300000750004us-gaap:OperatingSegmentsMembersgms:LotteryBusinessSegmentMember2020-07-012020-09-300000750004us-gaap:OperatingSegmentsMembersgms:SciPlayBusinessSegmentMember2020-07-012020-09-300000750004us-gaap:OperatingSegmentsMembersgms:GamingGroupMember2019-07-012019-09-300000750004sgms:LotterySystemsGroupMemberus-gaap:OperatingSegmentsMember2019-07-012019-09-300000750004us-gaap:OperatingSegmentsMembersgms:SciPlayMember2019-07-012019-09-300000750004us-gaap:OperatingSegmentsMembersgms:DigitalBusinessSegmentMember2019-07-012019-09-300000750004sgms:CorporateAndReconcilingItemsMember2019-07-012019-09-300000750004sgms:GamingBusinessSegmentMemberus-gaap:OperatingSegmentsMember2019-07-012019-09-300000750004us-gaap:OperatingSegmentsMembersgms:LotteryBusinessSegmentMember2019-07-012019-09-300000750004us-gaap:OperatingSegmentsMembersgms:SciPlayBusinessSegmentMember2019-07-012019-09-300000750004us-gaap:OperatingSegmentsMembersgms:SciPlayMember2020-01-012020-09-300000750004sgms:CorporateAndReconcilingItemsMember2020-01-012020-09-300000750004sgms:GamingBusinessSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-09-300000750004us-gaap:OperatingSegmentsMembersgms:LotteryBusinessSegmentMember2020-01-012020-09-300000750004us-gaap:OperatingSegmentsMembersgms:SciPlayBusinessSegmentMember2020-01-012020-09-300000750004us-gaap:OperatingSegmentsMembersgms:GamingGroupMember2019-01-012019-09-300000750004sgms:LotterySystemsGroupMemberus-gaap:OperatingSegmentsMember2019-01-012019-09-300000750004us-gaap:OperatingSegmentsMembersgms:SciPlayMember2019-01-012019-09-300000750004us-gaap:OperatingSegmentsMembersgms:DigitalBusinessSegmentMember2019-01-012019-09-300000750004sgms:CorporateAndReconcilingItemsMember2019-01-012019-09-300000750004sgms:GamingBusinessSegmentMemberus-gaap:OperatingSegmentsMember2019-01-012019-09-300000750004us-gaap:OperatingSegmentsMembersgms:LotteryBusinessSegmentMember2019-01-012019-09-300000750004us-gaap:OperatingSegmentsMembersgms:SciPlayBusinessSegmentMember2019-01-012019-09-300000750004us-gaap:EmployeeSeveranceMember2020-07-012020-09-300000750004us-gaap:EmployeeSeveranceMember2019-07-012019-09-300000750004us-gaap:EmployeeSeveranceMember2020-01-012020-09-300000750004us-gaap:EmployeeSeveranceMember2019-01-012019-09-300000750004sgms:ContingentConsiderationAdjustmentMember2020-07-012020-09-300000750004sgms:ContingentConsiderationAdjustmentMember2019-07-012019-09-300000750004sgms:ContingentConsiderationAdjustmentMember2020-01-012020-09-300000750004sgms:ContingentConsiderationAdjustmentMember2019-01-012019-09-300000750004sgms:RestructuringIntegrationAndOtherMember2020-07-012020-09-300000750004sgms:RestructuringIntegrationAndOtherMember2019-07-012019-09-300000750004sgms:RestructuringIntegrationAndOtherMember2020-01-012020-09-300000750004sgms:RestructuringIntegrationAndOtherMember2019-01-012019-09-300000750004sgms:ContingenciesRelatedToCOVID19Memberus-gaap:EmployeeSeveranceMember2020-07-012020-09-300000750004sgms:ContingenciesRelatedToCOVID19Memberus-gaap:EmployeeSeveranceMember2020-01-012020-09-300000750004us-gaap:ExtendedMaturityMember2020-09-300000750004us-gaap:NotesReceivableMembercountry:US2020-09-300000750004us-gaap:NotesReceivableMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMembercountry:US2020-09-300000750004us-gaap:NotesReceivableMembercountry:US2019-12-310000750004us-gaap:NotesReceivableMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMembercountry:US2019-12-310000750004us-gaap:NotesReceivableMembersgms:InternationalMember2020-09-300000750004us-gaap:NotesReceivableMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMembersgms:InternationalMember2020-09-300000750004us-gaap:NotesReceivableMembersgms:InternationalMember2019-12-310000750004us-gaap:NotesReceivableMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMembersgms:InternationalMember2019-12-310000750004us-gaap:NotesReceivableMember2020-09-300000750004us-gaap:NotesReceivableMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2020-09-300000750004us-gaap:NotesReceivableMember2019-12-310000750004us-gaap:NotesReceivableMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2019-12-310000750004country:US2019-12-310000750004sgms:InternationalMember2019-12-3100007500042020-01-012020-03-310000750004country:US2020-01-012020-03-310000750004sgms:InternationalMember2020-01-012020-03-3100007500042019-01-012019-03-3100007500042020-03-310000750004country:US2020-03-310000750004sgms:InternationalMember2020-03-3100007500042019-03-3100007500042020-01-012020-06-300000750004country:US2020-01-012020-06-300000750004sgms:InternationalMember2020-01-012020-06-3000007500042019-01-012019-06-3000007500042020-06-300000750004country:US2020-06-300000750004sgms:InternationalMember2020-06-3000007500042019-06-300000750004country:US2020-01-012020-09-300000750004sgms:InternationalMember2020-01-012020-09-300000750004country:US2020-09-300000750004sgms:InternationalMember2020-09-300000750004us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2020-09-300000750004us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2019-12-310000750004srt:LatinAmericaMember2020-09-300000750004srt:LatinAmericaMembersgms:FinancialAssetCurrentOrNotYetDueMember2020-09-300000750004srt:LatinAmericaMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2020-09-300000750004us-gaap:LandMember2020-09-300000750004us-gaap:LandMember2019-12-310000750004sgms:BuildingsandLeaseholdImprovementsMember2020-09-300000750004sgms:BuildingsandLeaseholdImprovementsMember2019-12-310000750004us-gaap:MachineryAndEquipmentMember2020-09-300000750004us-gaap:MachineryAndEquipmentMember2019-12-310000750004us-gaap:FurnitureAndFixturesMember2020-09-300000750004us-gaap:FurnitureAndFixturesMember2019-12-310000750004us-gaap:ConstructionInProgressMember2020-09-300000750004us-gaap:ConstructionInProgressMember2019-12-310000750004us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2020-09-300000750004us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2019-12-310000750004us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2020-01-012020-09-300000750004us-gaap:CustomerRelationshipsMember2020-09-300000750004us-gaap:CustomerRelationshipsMember2019-12-310000750004us-gaap:IntellectualPropertyMember2020-09-300000750004us-gaap:IntellectualPropertyMember2019-12-310000750004us-gaap:LicensingAgreementsMember2020-09-300000750004us-gaap:LicensingAgreementsMember2019-12-310000750004sgms:BrandNameMember2020-09-300000750004sgms:BrandNameMember2019-12-310000750004us-gaap:TradeNamesMember2020-09-300000750004us-gaap:TradeNamesMember2019-12-310000750004us-gaap:PatentsMember2020-09-300000750004us-gaap:PatentsMember2019-12-310000750004us-gaap:TradeNamesMember2020-09-300000750004us-gaap:TradeNamesMember2019-12-310000750004sgms:UKGamingMember2020-01-012020-03-310000750004sgms:UKGamingMember2020-07-012020-09-300000750004sgms:RevenueGrowthEstimateFY2021Membersrt:MinimumMember2020-01-012020-03-310000750004sgms:RevenueGrowthEstimateFY2021Membersrt:MaximumMember2020-01-012020-03-310000750004sgms:RevenueGrowthEstimateFY2022ToFY2027Membersrt:MinimumMember2020-01-012020-03-310000750004sgms:RevenueGrowthEstimateFY2022ToFY2027Membersrt:MaximumMember2020-01-012020-03-310000750004sgms:RevenueEstimatedTerminalGrowthRateMember2020-01-012020-03-310000750004srt:MinimumMember2020-01-012020-03-310000750004srt:MaximumMember2020-01-012020-03-310000750004us-gaap:MeasurementInputRevenueMultipleMembersrt:MinimumMember2020-01-012020-03-310000750004srt:MaximumMemberus-gaap:MeasurementInputRevenueMultipleMember2020-01-012020-03-310000750004srt:MinimumMemberus-gaap:MeasurementInputEbitdaMultipleMember2020-01-012020-03-310000750004srt:MaximumMemberus-gaap:MeasurementInputEbitdaMultipleMember2020-01-012020-03-310000750004sgms:GamingGroupMember2019-12-310000750004sgms:LotterySystemsGroupMember2019-12-310000750004sgms:SocialBusinessSegmentMember2019-12-310000750004sgms:DigitalBusinessSegmentMember2019-12-310000750004sgms:GamingBusinessSegmentMember2020-01-012020-09-300000750004sgms:LotterySystemsMember2020-01-012020-09-300000750004sgms:SciPlayBusinessSegmentMember2020-01-012020-09-300000750004sgms:DigitalBusinessSegmentMember2020-01-012020-09-300000750004sgms:GamingGroupMember2020-01-012020-09-300000750004sgms:LotterySystemsGroupMember2020-01-012020-09-300000750004sgms:SocialBusinessSegmentMember2020-01-012020-09-300000750004sgms:GamingGroupMember2020-09-300000750004sgms:LotterySystemsGroupMember2020-09-300000750004sgms:SocialBusinessSegmentMember2020-09-300000750004sgms:DigitalBusinessSegmentMember2020-09-300000750004sgms:SeniorSecuredRevolverMaturing2024Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMember2020-09-300000750004sgms:SeniorSecuredRevolverMaturing2024Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMember2019-12-310000750004us-gaap:RevolvingCreditFacilityMembersgms:SeniorSecuredCreditFacilityTermLoanB5Maturing2024Memberus-gaap:SecuredDebtMember2020-09-300000750004us-gaap:RevolvingCreditFacilityMembersgms:SeniorSecuredCreditFacilityTermLoanB5Maturing2024Memberus-gaap:SecuredDebtMember2019-12-310000750004sgms:SciPlayRevolverMaturing2024Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMember2020-09-300000750004sgms:SciPlayRevolverMaturing2024Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMember2019-12-310000750004us-gaap:SeniorNotesMembersgms:SeniorSecuredNotesMaturing2025Member2020-09-300000750004us-gaap:SeniorNotesMembersgms:SeniorSecuredNotesMaturing2025Member2019-12-310000750004us-gaap:SeniorNotesMembersgms:SeniorSecuredEuroNotesMaturing2026Member2020-09-300000750004us-gaap:SeniorNotesMembersgms:SeniorSecuredEuroNotesMaturing2026Member2019-12-310000750004us-gaap:SeniorNotesMembersgms:SeniorUnsecuredNotesMaturing2025Member2020-09-300000750004us-gaap:SeniorNotesMembersgms:SeniorUnsecuredNotesMaturing2025Member2019-12-310000750004us-gaap:SeniorNotesMembersgms:SeniorUnsecuredEuroNotesMaturing2026Member2020-09-300000750004us-gaap:SeniorNotesMembersgms:SeniorUnsecuredEuroNotesMaturing2026Member2019-12-310000750004us-gaap:SeniorNotesMembersgms:SeniorUnsecuredNotesMaturing2026Member2020-09-300000750004us-gaap:SeniorNotesMembersgms:SeniorUnsecuredNotesMaturing2026Member2019-12-310000750004us-gaap:SeniorNotesMembersgms:SeniorUnsecuredNotesMaturing2028Member2020-09-300000750004us-gaap:SeniorNotesMembersgms:SeniorUnsecuredNotesMaturing2028Member2019-12-310000750004us-gaap:SeniorNotesMembersgms:SeniorUnsecuredNotesMaturing2029Member2020-09-300000750004us-gaap:SeniorNotesMembersgms:SeniorUnsecuredNotesMaturing2029Member2019-12-310000750004sgms:SeniorSubordinatedNotesMaturing2021Memberus-gaap:SeniorSubordinatedNotesMember2020-09-300000750004sgms:SeniorSubordinatedNotesMaturing2021Memberus-gaap:SeniorSubordinatedNotesMember2019-12-310000750004us-gaap:CapitalLeaseObligationsMembersgms:CapitalLeaseObligationsPayableMonthlyMember2020-09-300000750004us-gaap:CapitalLeaseObligationsMembersgms:CapitalLeaseObligationsPayableMonthlyMember2019-12-310000750004us-gaap:SeniorNotesMembersgms:SeniorSecuredNotesMaturing2025Member2018-02-280000750004sgms:SeniorSecuredEuroNotesMaturing2026Member2020-01-012020-09-300000750004sgms:SeniorSecuredEuroNotesMaturing2026Member2020-07-012020-09-300000750004us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2020-09-300000750004us-gaap:InterestRateSwapMember2020-07-012020-09-300000750004us-gaap:InterestRateSwapMember2019-07-012019-09-300000750004us-gaap:InterestRateSwapMember2020-01-012020-09-300000750004us-gaap:InterestRateSwapMember2019-01-012019-09-300000750004us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:SeniorNotesMembersgms:SeniorSecuredNotesMaturing2025Member2018-02-280000750004sgms:SeniorSecuredNotesMaturing2025Member2018-02-280000750004us-gaap:OtherLiabilitiesMemberus-gaap:InterestRateSwapMember2020-09-300000750004us-gaap:OtherLiabilitiesMemberus-gaap:InterestRateSwapMember2019-12-310000750004us-gaap:OtherAssetsMemberus-gaap:InterestRateSwapMember2020-09-300000750004us-gaap:OtherAssetsMemberus-gaap:InterestRateSwapMember2019-12-310000750004us-gaap:OtherLiabilitiesMemberus-gaap:InterestRateSwapMember2020-07-012020-09-300000750004us-gaap:OtherLiabilitiesMemberus-gaap:InterestRateSwapMember2020-01-012020-09-300000750004us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:OtherAssetsMember2020-07-012020-09-300000750004us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:OtherAssetsMember2020-01-012020-09-300000750004us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMembersgms:SeniorSecuredEuroNotesMaturing2026Member2020-07-012020-09-300000750004us-gaap:AccruedLiabilitiesMember2020-09-300000750004us-gaap:AccruedLiabilitiesMember2019-12-310000750004us-gaap:CommonStockMember2019-12-310000750004us-gaap:AdditionalPaidInCapitalMember2019-12-310000750004us-gaap:RetainedEarningsMember2019-12-310000750004us-gaap:TreasuryStockMember2019-12-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000750004us-gaap:NoncontrollingInterestMember2019-12-310000750004us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310000750004us-gaap:RetainedEarningsMember2020-01-012020-03-310000750004us-gaap:NoncontrollingInterestMember2020-01-012020-03-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310000750004us-gaap:RetainedEarningsMember2020-01-0100007500042020-01-010000750004us-gaap:CommonStockMember2020-03-310000750004us-gaap:AdditionalPaidInCapitalMember2020-03-310000750004us-gaap:RetainedEarningsMember2020-03-310000750004us-gaap:TreasuryStockMember2020-03-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310000750004us-gaap:NoncontrollingInterestMember2020-03-310000750004us-gaap:AdditionalPaidInCapitalMember2020-04-012020-06-3000007500042020-04-012020-06-300000750004us-gaap:NoncontrollingInterestMember2020-04-012020-06-300000750004us-gaap:RetainedEarningsMember2020-04-012020-06-300000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-012020-06-300000750004us-gaap:CommonStockMember2020-06-300000750004us-gaap:AdditionalPaidInCapitalMember2020-06-300000750004us-gaap:RetainedEarningsMember2020-06-300000750004us-gaap:TreasuryStockMember2020-06-300000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-300000750004us-gaap:NoncontrollingInterestMember2020-06-300000750004us-gaap:AdditionalPaidInCapitalMember2020-07-012020-09-300000750004us-gaap:NoncontrollingInterestMember2020-07-012020-09-300000750004us-gaap:RetainedEarningsMember2020-07-012020-09-300000750004us-gaap:CommonStockMember2018-12-310000750004us-gaap:AdditionalPaidInCapitalMember2018-12-310000750004us-gaap:RetainedEarningsMember2018-12-310000750004us-gaap:TreasuryStockMember2018-12-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310000750004us-gaap:NoncontrollingInterestMember2018-12-310000750004us-gaap:AdditionalPaidInCapitalMember2019-01-012019-03-310000750004us-gaap:RetainedEarningsMember2019-01-012019-03-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-03-310000750004us-gaap:AdditionalPaidInCapitalMember2019-04-012019-06-3000007500042019-04-012019-06-300000750004us-gaap:IPOMemberus-gaap:AdditionalPaidInCapitalMember2019-04-012019-06-300000750004us-gaap:IPOMemberus-gaap:NoncontrollingInterestMember2019-04-012019-06-300000750004us-gaap:NoncontrollingInterestMember2019-04-012019-06-300000750004us-gaap:RetainedEarningsMember2019-04-012019-06-300000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-04-012019-06-300000750004us-gaap:CommonStockMember2019-06-300000750004us-gaap:AdditionalPaidInCapitalMember2019-06-300000750004us-gaap:RetainedEarningsMember2019-06-300000750004us-gaap:TreasuryStockMember2019-06-300000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-06-300000750004us-gaap:NoncontrollingInterestMember2019-06-300000750004us-gaap:AdditionalPaidInCapitalMember2019-07-012019-09-300000750004us-gaap:RetainedEarningsMember2019-07-012019-09-300000750004us-gaap:NoncontrollingInterestMember2019-07-012019-09-300000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-07-012019-09-300000750004us-gaap:CommonStockMember2019-09-300000750004us-gaap:AdditionalPaidInCapitalMember2019-09-300000750004us-gaap:RetainedEarningsMember2019-09-300000750004us-gaap:TreasuryStockMember2019-09-300000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-09-300000750004us-gaap:NoncontrollingInterestMember2019-09-300000750004us-gaap:EmployeeStockOptionMember2020-07-012020-09-300000750004us-gaap:EmployeeStockOptionMember2019-07-012019-09-300000750004us-gaap:EmployeeStockOptionMember2020-01-012020-09-300000750004us-gaap:EmployeeStockOptionMember2019-01-012019-09-300000750004us-gaap:RestrictedStockUnitsRSUMember2020-07-012020-09-300000750004us-gaap:RestrictedStockUnitsRSUMember2019-07-012019-09-300000750004us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-09-300000750004us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-09-300000750004us-gaap:RestrictedStockUnitsRSUMembersgms:SciPlayMember2020-07-012020-09-300000750004us-gaap:RestrictedStockUnitsRSUMembersgms:SciPlayMember2019-07-012019-09-300000750004us-gaap:RestrictedStockUnitsRSUMembersgms:SciPlayMember2020-01-012020-09-300000750004us-gaap:RestrictedStockUnitsRSUMembersgms:SciPlayMember2019-01-012019-09-30sgms:classes_of_persons00007500042018-05-040000750004sgms:SciPlayIPOMatterMember2019-10-142019-10-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2020

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-11693

SCIENTIFIC GAMES CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Nevada | | 81-0422894 |

(State or other jurisdiction of | | (I.R.S. Employer Identification No.) |

incorporation or organization) | | |

6601 Bermuda Road, Las Vegas, Nevada 89119

(Address of principal executive offices)

(Zip Code)

(702) 897-7150

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $.001 par value | SGMS | The NASDAQ Stock Market |

| Preferred Stock Purchase Rights | | The NASDAQ Stock Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| | | |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | |

Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

The registrant has the following number of shares outstanding of each of the registrant’s classes of common stock as of October 29, 2020:

Common Stock: 95,169,777

SCIENTIFIC GAMES CORPORATION AND SUBSIDIARIES

INDEX TO FINANCIAL INFORMATION

AND OTHER INFORMATION

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2020

| | | | | | | | |

| | Page |

| | |

| | |

Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| | |

| | |

| | |

Item 1. | | |

| | |

Item 1A. | | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| | |

Item 5. | | |

| | |

Item 6. | | |

| | | | | | | | |

| Glossary of Terms | | |

| The following terms or acronyms used in this Quarterly Report on Form 10-Q are defined below: |

| Term or Acronym | | Definition |

| 2019 10-K | | 2019 Annual Report on Form 10-K filed with the SEC on February 18, 2020 |

| 2021 Notes | | 6.625% senior subordinated notes due 2021 issued by SGI and redeemed in July 2020 |

| 2025 Secured Notes | | 5.000% senior secured notes due 2025 issued by SGI |

| 2026 Secured Euro Notes | | 3.375% senior secured notes due 2026 issued by SGI |

| 2026 Unsecured Euro Notes | | 5.500% senior unsecured notes due 2026 issued by SGI |

| 2022 Unsecured Notes | | 10.000% senior unsecured notes due 2022 issued by SGI |

2025 Unsecured Notes | | 8.625% senior unsecured notes due 2025 issued by SGI |

| 2026 Unsecured Notes | | 8.250% senior unsecured notes due 2026 issued by SGI |

| 2028 Unsecured Notes | | 7.000% senior unsecured notes due 2028 issued by SGI |

| 2029 Unsecured Notes | | 7.250% senior unsecured notes due 2029 issued by SGI |

| AEBITDA | | Adjusted EBITDA, our performance measure of profit or loss for our business segments |

| ASC | | Accounting Standards Codification |

| ASU | | Accounting Standards Update |

| COVID-19 | | Coronavirus disease first identified in 2019 (declared a pandemic by the World Health Organization on March 11, 2020) |

| D&A | | depreciation, amortization and impairments |

| Exchange Act | | Securities Exchange Act of 1934, as amended |

| FASB | | Financial Accounting Standards Board |

| KPIs | | Key Performance Indicators |

| LBO | | licensed betting office |

| LIBOR | | London Interbank Offered Rate |

| LNS | | Lotterie Nazionali S.r.l. |

| Note | | a note in the Notes to Condensed Consolidated Financial Statements in this Quarterly Report on Form 10-Q, unless otherwise indicated |

| Participation | | with respect to our Gaming business, refers to gaming machines provided to customers through service or leasing arrangements in which we earn revenues and are paid based on: (1) a percentage of the amount wagered less payouts; (2) fixed daily-fees; (3) a percentage of the amount wagered; or (4) a combination of (2) and (3), and with respect to our Lottery business, refers to a contract or arrangement in which we earn revenues and are paid based on a percentage of retail sales |

| R&D | | research and development |

| RMG | | real-money gaming |

| RSU | | restricted stock unit |

| SEC | | Securities and Exchange Commission |

| Secured Notes | | refers to the 2025 Secured Notes and 2026 Secured Euro Notes, collectively |

| Securities Act | | Securities Act of 1933, as amended |

| Senior Notes | | the Secured Notes and the Unsecured Notes |

| SciPlay Revolver | | $150 million revolving credit facility agreement entered into by SciPlay Holding Company, LLC, a subsidiary of SciPlay Corporation, that matures in May 2024 |

| SG&A | | selling, general and administrative |

| SGC | | Scientific Games Corporation |

| SGI | | Scientific Games International, Inc., a wholly-owned subsidiary of SGC |

| Shufflers | | various models of automatic card shufflers, deck checkers and roulette chip sorters |

| Unsecured Notes | | refers to the 2026 Unsecured Euro Notes, 2026 Unsecured Notes, 2028 Unsecured Notes and 2029 Unsecured Notes, collectively |

| U.S. GAAP | | accounting principles generally accepted in the U.S. |

| | |

| VGT | | video gaming terminal |

| VLT | | video lottery terminal |

| | |

Intellectual Property Rights

All ® notices signify marks registered in the United States. © 2020 Scientific Games Corporation. All Rights Reserved.

FORWARD-LOOKING STATEMENTS

Throughout this Quarterly Report on Form 10-Q, we make “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements describe future expectations, plans, results or strategies and can often be identified by the use of terminology such as “may,” “will,” “estimate,” “intend,” “plan,” “continue,” “believe,” “expect,” “anticipate,” “target,” “should,” “could,” “potential,” “opportunity,” “goal,” or similar terminology. The forward-looking statements contained in this Quarterly Report on Form 10-Q are generally located in the material set forth under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” but may be found in other locations as well. These statements are based upon management’s current expectations, assumptions and estimates and are not guarantees of timing, future results or performance. Therefore, you should not rely on any of these forward-looking statements as predictions of future events. Actual results may differ materially from those contemplated in these statements due to a variety of risks and uncertainties and other factors, including, among other things:

•the impact of the COVID-19 pandemic and any resulting unfavorable social, political, economic and financial conditions, including the temporary and potentially recurring closure of casinos and lottery operations on a jurisdiction-by-jurisdiction basis;

•natural events and health crises that disrupt our operations or those of our customers, suppliers or regulators;

•incurrence of restructuring costs;

•changes in demand for our products and services;

•dependence on suppliers and manufacturers;

•dependence on key employees;

•goodwill impairment charges including changes in estimates or judgments related to our impairment analysis of goodwill or other intangible assets;

•level of our indebtedness, higher interest rates, availability or adequacy of cash flows and liquidity to satisfy indebtedness, other obligations or future cash needs;

•inability to reduce or refinance our indebtedness;

•restrictions and covenants in debt agreements, including those that could result in acceleration of the maturity of our indebtedness;

•stock price volatility;

•competition;

•U.S. and international economic and industry conditions;

•slow growth of new gaming jurisdictions, slow addition of casinos in existing jurisdictions and declines in the replacement cycle of gaming machines;

•ownership changes and consolidation in the gaming industry;

•opposition to legalized gaming or the expansion thereof and potential restrictions on internet wagering;

•inability to adapt to, and offer products that keep pace with, evolving technology, including any failure of our investment of significant resources in our R&D efforts;

•inability to develop successful products and services and capitalize on trends and changes in our industries, including the expansion of internet and other forms of interactive gaming;

•laws and government regulations, both foreign and domestic, including those relating to gaming, data privacy and security, including with respect to the collection, storage, use, transmission and protection of personal information and other consumer data, and environmental laws, and those laws and regulations that affect companies conducting business on the internet, including online gambling;

•the continuing evolution of the scope of data privacy and security regulations, and our belief that the adoption of increasingly restrictive regulations in this area is likely within the U.S. and other jurisdictions;

•significant opposition in some jurisdictions to interactive social gaming, including social casino gaming and how such opposition could lead these jurisdictions to adopt legislation or impose a regulatory framework to govern interactive social gaming or social casino gaming specifically, and how this could result in a prohibition on interactive social gaming or social casino gaming altogether, restrict our ability to advertise our games, or substantially increase our costs to comply with these regulations;

•legislative interpretation and enforcement, regulatory perception and regulatory risks with respect to gaming, especially internet wagering, social gaming and sports wagering;

•reliance on technological blocking systems;

•expectations of shift to regulated online gaming or sports wagering;

•expectations of growth in total consumer spending on social casino gaming;

•SciPlay’s dependence on certain key providers;

•inability to win, retain or renew, or unfavorable revisions of, existing contracts, and the inability to enter into new contracts;

•protection of our intellectual property, inability to license third-party intellectual property and the intellectual property rights of others;

•security and integrity of our products and systems, including the impact of any security breaches or cyber-attacks;

•reliance on or failures in information technology and other systems;

•challenges or disruptions relating to the implementation of a new global enterprise resource planning system;

•failure to maintain adequate internal control over financial reporting;

•inability to benefit from, and risks associated with, strategic equity investments and relationships;

•inability to achieve some or all of the anticipated benefits of SciPlay being a standalone public company;

•implementation of complex new accounting standards;

•fluctuations in our results due to seasonality and other factors;

•risks relating to foreign operations, including anti-corruption laws, fluctuations in currency rates, restrictions on the payment of dividends from earnings, restrictions on the import of products and financial instability, including the potential impact to our business resulting from the continuing uncertainty around the U.K.’s withdrawal from the European Union;

•possibility that the 2018 renewal of the LNS concession to operate the Italian instant games lottery is not final (pending appeal against existing court rulings relating to third-party protest against the renewal of the concession);

•the impact of U.K. legislation approving the reduction of fixed-odds betting terminals maximum stakes limit on LBO operators, including the related closure of certain LBO shops;

•changes in tax laws or tax rulings, or the examination of our tax positions;

•difficulty predicting what impact, if any, new tariffs imposed by and other trade actions taken by the U.S. and foreign jurisdictions could have on our business;

•the discontinuation or replacement of LIBOR, which may adversely affect interest rates; and

•litigation and other liabilities relating to our business, including litigation and liabilities relating to our contracts and licenses, our products and systems, our employees (including labor disputes), intellectual property, environmental laws and our strategic relationships.

Additional information regarding risks and uncertainties and other factors that could cause actual results to differ materially from those contemplated in forward-looking statements is included from time to time in our filings with the SEC, including under “Risk Factors” in Part II, Item 1A of this Quarterly Report on Form 10-Q and Part I, Item 1A in our 2019 10-K. Forward-looking statements speak only as of the date they are made and, except for our ongoing obligations under the U.S. federal securities laws, we undertake no and expressly disclaim any obligation to publicly update any forward-looking statements whether as a result of new information, future events or otherwise.

You should also note that this Quarterly Report on Form 10-Q may contain references to industry market data and certain industry forecasts. Industry market data and industry forecasts are obtained from publicly available information and industry publications. Industry publications generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. Although we believe industry information to be accurate, it is not independently verified by us and we do not make any representation as to the accuracy of that information. In general, we believe there is less publicly available information concerning the international gaming, lottery, social and digital gaming industries than the same industries in the U.S.

Due to rounding, certain numbers presented herein may not precisely agree or add up on a cumulative basis to the totals previously reported.

PART I. FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

SCIENTIFIC GAMES CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2020 | | 2019 | | 2020 | | 2019 |

| Revenue: | | | | | | | |

| Services | $ | 417 | | | $ | 452 | | | $ | 1,161 | | | $ | 1,368 | |

| Product sales | 124 | | | 255 | | | 376 | | | 731 | |

| Instant products | 157 | | | 148 | | | 425 | | | 438 | |

| Total revenue | 698 | | | 855 | | | 1,962 | | | 2,537 | |

| Operating expenses: | | | | | | | |

Cost of services(1) | 132 | | | 133 | | | 388 | | | 401 | |

Cost of product sales(1) | 87 | | | 115 | | | 247 | | | 333 | |

Cost of instant products(1) | 70 | | | 69 | | | 205 | | | 211 | |

| Selling, general and administrative | 164 | | | 175 | | | 513 | | | 535 | |

| Research and development | 41 | | | 47 | | | 123 | | | 142 | |

| Depreciation, amortization and impairments | 136 | | | 162 | | | 414 | | | 497 | |

| Goodwill impairment | — | | | — | | | 54 | | | — | |

| Restructuring and other | 20 | | | 11 | | | 58 | | | 24 | |

| Operating income (loss) | 48 | | | 143 | | | (40) | | | 394 | |

| Other (expense) income: | | | | | | | |

| Interest expense | (131) | | | (146) | | | (379) | | | (447) | |

| Earnings (loss) from equity investments | 2 | | | 4 | | | (3) | | | 17 | |

| Loss on debt financing transactions | (1) | | | — | | | (1) | | | (60) | |

| (Loss) gain on remeasurement of debt | (24) | | | 19 | | | (26) | | | 21 | |

| Other (expense) income, net | — | | | (5) | | | (4) | | | 2 | |

| Total other expense, net | (154) | | | (128) | | | (413) | | | (467) | |

Net (loss) income before income taxes | (106) | | | 15 | | | (453) | | | (73) | |

| Income tax (expense) benefit | (5) | | | 3 | | | (11) | | | (8) | |

Net (loss) income | (111) | | | 18 | | | (464) | | | (81) | |

| Less: Net income attributable to noncontrolling interest | 6 | | | 4 | | | 15 | | | 6 | |

| Net (loss) income attributable to SGC | $ | (117) | | | $ | 14 | | | $ | (479) | | | $ | (87) | |

| Basic and diluted net (loss) income attributable to SGC per share: | | | | | | | |

| Basic | $ | (1.23) | | | $ | 0.15 | | | $ | (5.09) | | | $ | (0.94) | |

| Diluted | $ | (1.23) | | | $ | 0.15 | | | $ | (5.09) | | | $ | (0.94) | |

| | | | | | | |

| Weighted average number of shares used in per share calculations: | | | | | | | |

| Basic shares | 95 | | | 93 | | | 94 | | | 93 | |

| Diluted shares | 95 | | | 94 | | | 94 | | | 93 | |

| (1) Excludes D&A. |

See accompanying notes to condensed consolidated financial statements. |

SCIENTIFIC GAMES CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2020 | | 2019 | | 2020 | | 2019 |

| Net (loss) income | $ | (111) | | | $ | 18 | | | $ | (464) | | | $ | (81) | |

| Other comprehensive loss: | | | | | | | |

| Foreign currency translation gain (loss), net of tax | 28 | | | (38) | | | 6 | | | (22) | |

| Pension and post-retirement gain, net of tax | — | | | — | | | 1 | | | — | |

| Derivative financial instruments unrealized gain (loss), net of tax | 4 | | | 3 | | | (10) | | | (13) | |

| Total other comprehensive gain (loss) | 32 | | | (35) | | | (3) | | | (35) | |

| Total comprehensive loss | (79) | | | (17) | | | (467) | | | (116) | |

| Less: comprehensive income attributable to noncontrolling interest | 6 | | | 4 | | | 15 | | | 6 | |

| Comprehensive loss attributable to SGC | $ | (85) | | | $ | (21) | | | $ | (482) | | | $ | (122) | |

| | | | | | | |

| See accompanying notes to condensed consolidated financial statements. |

SCIENTIFIC GAMES CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited, in millions, except par value)

| | | | | | | | | | | |

| As of |

| September 30, 2020 | | December 31, 2019 |

ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,045 | | | $ | 313 | |

| Restricted cash | 85 | | | 51 | |

Receivables, net of allowance for credit losses $67 and $36, respectively | 662 | | | 755 | |

| Inventories | 223 | | | 244 | |

| Prepaid expenses, deposits and other current assets | 256 | | | 252 | |

| Total current assets | 2,271 | | | 1,615 | |

| Non-current assets: | | | |

| Restricted cash | 11 | | | 11 | |

Receivables, net of allowance for credit losses $6 and $—, respectively | 24 | | | 53 | |

| Property and equipment, net | 434 | | | 500 | |

| Operating lease right-of-use assets | 96 | | | 105 | |

| Goodwill | 3,234 | | | 3,280 | |

| Intangible assets, net | 1,342 | | | 1,516 | |

| Software, net | 234 | | | 258 | |

| Equity investments | 260 | | | 273 | |

| Other assets | 196 | | | 198 | |

| Total assets | $ | 8,102 | | | $ | 7,809 | |

| | | |

LIABILITIES AND STOCKHOLDERS’ DEFICIT | | | |

Current liabilities: | | | |

Current portion of long-term debt | $ | 44 | | | $ | 45 | |

Accounts payable | 230 | | | 226 | |

Accrued liabilities | 573 | | | 495 | |

Total current liabilities | 847 | | | 766 | |

Deferred income taxes | 93 | | | 91 | |

Operating lease liabilities | 79 | | | 88 | |

Other long-term liabilities | 290 | | | 292 | |

Long-term debt, excluding current portion | 9,334 | | | 8,680 | |

Total liabilities | 10,643 | | | 9,917 | |

Commitments and contingencies (Note 16) |

| |

|

Stockholders’ deficit: | | | |

Common stock, par value $0.001 per share: 199 shares authorized; 112 and 111 shares issued and 95 and 94 shares outstanding, respectively | 1 | | | 1 | |

Additional paid-in capital | 1,246 | | | 1,208 | |

Accumulated loss | (3,439) | | | (2,954) | |

Treasury stock, at cost, 17 shares | (175) | | | (175) | |

Accumulated other comprehensive loss | (295) | | | (292) | |

Total SGC stockholders’ deficit | (2,662) | | | (2,212) | |

Noncontrolling interest | 121 | | | 104 | |

Total stockholders’ deficit | (2,541) | | | (2,108) | |

Total liabilities and stockholders’ deficit | $ | 8,102 | | | $ | 7,809 | |

|

| See accompanying notes to condensed consolidated financial statements. |

SCIENTIFIC GAMES CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in millions)

| | | | | | | | | | | |

| Nine Months Ended |

| September 30, |

| 2020 | | 2019 |

Cash flows from operating activities: | | | |

Net loss | $ | (464) | | | $ | (81) | |

Adjustments to reconcile net loss to cash provided by operating activities | 665 | | | 597 | |

Changes in working capital accounts, net of effects of acquisitions | 101 | | | (120) | |

Changes in deferred income taxes and other | 10 | | | 7 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Net cash provided by operating activities | 312 | | | 403 | |

| | | |

Cash flows from investing activities: | | | |

Capital expenditures | (142) | | | (207) | |

| Acquisition of business, net of cash acquired | (13) | | | — | |

Distributions of capital from equity investments, net | (1) | | | 17 | |

| | | |

Proceeds from sale of asset and other | 22 | | | — | |

Net cash used in investing activities | (134) | | | (190) | |

| | | |

Cash flows from financing activities: | | | |

Borrowings under SGI revolving credit facility | 530 | | | 40 | |

Repayments under SGI revolving credit facility | (90) | | | (365) | |

Proceeds from issuance of senior notes and term loans | 550 | |

| 1,100 | |

| Repayment of notes and term loans (including redemption premium) | (341) | | | (1,050) | |

| Payments on long-term debt | (31) | | | (33) | |

Payments of debt issuance and deferred financing costs | (9) | | | (15) | |

Payments on license obligations | (21) | | | (26) | |

| Sale of future revenue | — | | | 11 | |

| Net proceeds from the sale of SciPlay common stock | — | | | 342 | |

| Payments of deferred SciPlay common stock offering costs | — | | | (9) | |

| Net redemptions of common stock under stock-based compensation plans and other | (1) | | | (6) | |

Net cash provided by (used in) financing activities | 587 | | | (11) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 1 | | | (1) | |

Increase in cash, cash equivalents and restricted cash | 766 | | | 201 | |

| Cash, cash equivalents and restricted cash, beginning of period | 375 | | | 220 | |

Cash, cash equivalents and restricted cash, end of period | $ | 1,141 | | | $ | 421 | |

| | | |

| | | |

Supplemental cash flow information: | | | |

| Cash paid for interest | $ | 335 | | | $ | 391 | |

Income taxes paid | 18 | | | 28 | |

| Distributed earnings from equity investments | 22 | | | 24 | |

| Cash paid for contingent consideration included in operating activities | — | | | 23 | |

Supplemental non-cash transactions: | | | |

| | | |

| | | |

| | | |

Non-cash interest expense | $ | 16 | | | $ | 19 | |

| | | |

| See accompanying notes to condensed consolidated financial statements. |

SCIENTIFIC GAMES CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, amounts in USD, table amounts in millions, except per share amounts)

(1) Description of the Business and Summary of Significant Accounting Policies

Description of the Business

We are a leading developer of technology-based products and services and associated content for the worldwide gaming, lottery, social and digital gaming industries. Our portfolio of revenue-generating activities primarily includes supplying gaming machines and game content, casino-management systems and table game products and services to licensed gaming entities; providing instant and draw-based lottery products, lottery systems and lottery content and services to lottery operators; providing social casino gaming solutions to retail consumers; and providing a comprehensive suite of digital RMG and sports wagering solutions, distribution platforms, content, products and services. We report our operations in four business segments—Gaming, Lottery, SciPlay and Digital.

Basis of Presentation and Principles of Consolidation

The accompanying condensed consolidated financial statements have been prepared in accordance with U.S. GAAP. The accompanying condensed consolidated financial statements include the accounts of SGC, its wholly owned subsidiaries, and those subsidiaries in which we have a controlling financial interest. Investments in other entities in which we do not have a controlling financial interest but we exert significant influence are accounted for in our consolidated financial statements using the equity method of accounting. All intercompany balances and transactions have been eliminated in consolidation.

In the opinion of SGC and its management, we have made all adjustments necessary to present fairly our consolidated financial position, results of operations, comprehensive loss and cash flows for the periods presented. Such adjustments are of a normal, recurring nature. These unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and related notes included in our 2019 10-K. Interim results of operations are not necessarily indicative of results of operations to be expected for a full year.

Impact of COVID-19

In March 2020, the World Health Organization declared the rapidly spreading COVID-19 outbreak a pandemic. In response to the COVID-19 pandemic, governments across the world implemented a number of measures to prevent its spread, including but not limited to, the temporary closure of a substantial number of gaming operations establishments and disruptions to lottery operations, travel restrictions, and cancellation of sporting events, which are affecting our business segments in a number of ways. During the latter part of the second quarter and throughout the third quarter of 2020, lifting of restrictions began, including the reopening of the majority of gaming establishments globally. As gaming operations have yet to return to pre-COVID levels, limited international travel, social distancing measures, decreased operating capacities, high unemployment rates and potential changes in consumer behaviors continue to negatively impact our results of operations, cash flows and financial condition through the third quarter of 2020. Additionally, some casinos have yet to reopen and for those that have opened, it is unknown when mitigation measures (such as capacity limitations) will be lifted, all contributing to continued uncertainty through the remainder of the year and potentially into 2021.

Based on our current estimates regarding the magnitude and length of the disruptions to our business, we do not anticipate these disruptions will impact our ability to meet our obligations when due or our ability to maintain compliance with our debt covenants for at least the next 12 months. However, the ultimate magnitude and length of time that the disruptions from COVID-19 will continue remains uncertain. This uncertainty will require us to continually assess the situation, including the impact of changes to government imposed restrictions, changes in customer behaviors, social distancing measures and decreased gaming establishments operating capacity jurisdiction by jurisdiction. Accordingly, our estimates regarding the magnitude and length of time that these disruptions will continue to impact our results of operations, cash flows and financial condition may change in the future and such changes could be material.

On April 9, 2020, we borrowed $480 million under SGI’s revolving credit facility, which was substantially all of our remaining availability thereunder and on July 1, 2020, SGI issued $550 million in aggregate principal amount of 8.625% senior unsecured notes due 2025 in a private offering and subsequently redeemed all $341 million of our outstanding 2021 Notes and paid accrued and unpaid interest thereon plus related premiums, fees and costs on July 17, 2020. As of September 30, 2020, our total available liquidity (excluding our SciPlay business segment) was $838 million, which included $3 million of undrawn availability under SGI’s revolving credit facility. We have implemented a number of measures to reduce operating costs, conserve liquidity and navigate through this unprecedented situation including permanent reductions in workforce and temporary measures such as: reductions in salaries and workforce (salary reduction measures ceased as of July 31, 2020), unpaid employee furloughs, reductions in hours, temporary elimination of 401(k) matching among other compensation and

benefits reductions, and deferral of certain operating and capital expenditures. We continue to actively manage our daily cash flows and continue to evaluate additional measures that will reduce operating costs and conserve cash. Refer to Note 11 for description of issuance of the 2025 Unsecured Notes on July 1, 2020 and the redemption of the 2021 Notes on July 17, 2020.

Our only financial maintenance covenant (excluding SciPlay’s Revolver) is contained in SGI’s credit agreement. Prior to the Credit Agreement Amendment (as defined below) dated May 8, 2020, this covenant was tested at the end of each fiscal quarter and required us to not exceed a maximum consolidated net first lien leverage ratio of 5.00x Consolidated EBITDA (as defined in the credit agreement). Prior to the Credit Agreement Amendment, this ratio stepped down to 4.75x beginning with the fiscal quarter ending December 31, 2020 and to 4.50x beginning with the fiscal quarter ending December 31, 2021. Additionally, the SciPlay Revolver requires that SciPlay maintain a maximum total net leverage ratio not to exceed 2.50x and maintain a minimum fixed charge coverage ratio of no less than 4.00x. We had no amounts drawn on our SciPlay Revolver as of September 30, 2020.

On May 8, 2020, the requisite lenders under SGI’s revolving credit facility agreed to amend the consolidated net first lien leverage ratio covenant in the credit agreement (the “Credit Agreement Amendment”) to (a) implement a financial covenant relief period through the end of the first quarter ending March 31, 2021 (the “Covenant Relief Period”), as a result of which SGI is not required to maintain compliance with the consolidated net first lien leverage ratio covenant during the Covenant Relief Period, (b) reset the consolidated net first lien leverage ratio covenant following the Covenant Relief Period, (c) impose a minimum liquidity requirement (excluding SciPlay) of at least $275 million during the Covenant Relief Period, (d) further restrict our ability to incur indebtedness and liens, make restricted payments and investments and prepay junior indebtedness during the Covenant Relief Period, subject to certain exceptions and further subject, in some instances, to maintaining minimum liquidity (excluding SciPlay) of at least $400 million and (e) establish a LIBOR floor of 0.500% on borrowings under the revolving credit facility during the Covenant Relief Period. The revised consolidated net first lien leverage ratio will be 6.00x Consolidated EBITDA beginning with the fiscal quarter ending June 30, 2021, stepping down as follows: (1) 5.75x beginning with the fourth quarter of 2021, (2) 5.25x beginning with the second quarter of 2022, (3) 4.75x beginning with the fourth quarter of 2022 and (4) 4.50x beginning with the second quarter of 2023 and thereafter. The revised consolidated net first lien leverage ratio is based on Consolidated EBITDA (as defined in the Credit Agreement Amendment) as follows: (1) for the testing period ending June 30, 2021, Consolidated EBITDA for the fiscal quarter ending June 30, 2021 multiplied by 4, (2) for the testing period ending September 30, 2021, Consolidated EBITDA for the fiscal quarters ending June 30, 2021 and September 30, 2021 multiplied by 2, (3) for the testing period ending December 31, 2021, Consolidated EBITDA for the fiscal quarters ending June 30, 2021, September 30, 2021 and December 31, 2021 multiplied by 4/3 and (4) for all subsequent testing periods, Consolidated EBITDA for the previous twelve months including the quarter for the which the test is performed.

On October 8, 2020, the requisite lenders under SGI’s revolving credit facility agreed to further amend the consolidated net first lien leverage ratio covenant in the credit agreement (the “Credit Agreement Extension Amendment”) to extend the Covenant Relief Period for an additional three quarters. The revised consolidated net first lien leverage ratio will be 6.00x Consolidated EBITDA beginning with the fiscal quarter ending March 31, 2022, stepping down as follows: (1) 5.75x beginning with the third quarter of 2022, (2) 5.25x beginning with the first quarter of 2023, (3) 4.75x beginning with the third quarter of 2023 and (4) 4.50x beginning with the first quarter of 2024 and thereafter. The revised consolidated net first lien leverage ratio is based on Consolidated EBITDA (as defined in the Credit Agreement Extension Amendment) as follows: (1) for the testing period ending March 31, 2022, Consolidated EBITDA for the fiscal quarter ending March 31, 2022 multiplied by 4, (2) for the testing period ending June 30, 2022, Consolidated EBITDA for the fiscal quarters ending March 31, 2022 and June 30, 2022 multiplied by 2, (3) for the testing period ending September 30, 2022, Consolidated EBITDA for the fiscal quarters ending March 31, 2022, June 30, 2022 and September 30, 2022 multiplied by 4/3 and (4) for all subsequent testing periods, Consolidated EBITDA for the previous twelve months including the quarter for the which the test is performed.

Additionally, changes to estimates related to the COVID-19 disruptions could result in other impacts, including but not limited to, additional goodwill impairments (see Note 8), indefinite-lived intangibles, long-lived asset and equity method investments impairment charges, inventory write downs and receivables credit allowance charges (see Notes 5 and 6).

Significant Accounting Policies

There have been no changes to our significant accounting policies described within the Notes of our 2019 10-K other than adoption of ASC 326 as described in Note 5.

Computation of Basic and Diluted Net (Loss) Income Per Share

Basic and diluted net (loss) income attributable to SGC per share were the same for the three months ended September 30, 2020 and for the nine months ended September 30, 2020 and 2019, respectively, as all common stock equivalents during those periods would be anti-dilutive. We excluded 1 million and 2 million of stock options from the diluted

weighted-average common shares outstanding for the three and nine months ended September 30, 2020, respectively, and 2 million of stock options from the diluted weighted-average common shares outstanding for the nine months ended September 30, 2019. We excluded 3 million of RSUs from the calculation of diluted weighted-average common shares outstanding for the three and nine months ended September 30, 2020 and 2019.

Basic and diluted net income per share for the three months ended September 30, 2019 were computed by dividing net income attributable to SGC by the weighted average number of shares outstanding, and the weighted average number of shares outstanding were adjusted to give effect to all potentially dilutive securities using the treasury stock method, respectively.

Acquisitions

On June 22, 2020, SciPlay completed the acquisition of all of the issued and outstanding capital stock of privately held mobile and social game company Come2Play, Ltd. (“Come2Play”), which expanded and diversified SciPlay’s existing portfolio of social games. Come2Play offers Backgammon and Solitaire social games targeted towards casual game players on the same platforms in which we currently offer our existing games. The total purchase consideration was $18 million, which includes our estimate of contingent acquisition consideration. Our preliminary allocation of the purchase price resulted in $13 million intangible assets primarily allocated to customer relationship and acquired technology and $6 million in excess purchase price allocated to goodwill.

New Accounting Guidance - Recently Adopted

The FASB issued ASU No. 2016-13, Financial Instruments - Credit Losses (Topic 326) in 2016. The new guidance replaces the incurred loss impairment methodology in legacy U.S. GAAP with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. For trade and other receivables, loans and other financial instruments, we are required to use a forward-looking expected loss model rather than the incurred loss model for recognizing credit losses, which reflects losses that are probable. We adopted ASC 326 as of January 1, 2020 using the modified retrospective method for all financial assets measured at amortized cost, which resulted in a $6 million cumulative-effect adjustment increase to accumulated loss. See Note 5 for our credit losses policy and the adoption impact of ASC 326 on our consolidated financial statements.

The FASB issued ASU No. 2018-13, Fair Value Measurement, and several subsequent amendments (collectively, Topic 820) in 2018. The standard amends the required quantitative and qualitative disclosure requirements for recurring and nonrecurring fair value measurements. We adopted this standard effective January 1, 2020. The adoption of this standard did not have a material impact on our financial statement disclosures.

In December 2019, the FASB issued ASU No. 2019-12, Income Taxes, to simplify the accounting for income taxes. The guidance eliminates certain exceptions related to the approach for intraperiod tax allocation, the methodology for calculating income taxes in an interim period, and the recognition of deferred tax liabilities for outside basis differences related to changes in ownership of equity method investments and foreign subsidiaries. The guidance also simplifies aspects of accounting for franchise taxes, enacted changes in tax laws or rates and clarifies the accounting for transactions that result in a step-up in the tax basis of goodwill. The standard is effective for fiscal years beginning after December 15, 2020 and interim periods within those fiscal years with early adoption permitted. We adopted this standard effective January 1, 2020. The adoption of this guidance did not have a material effect on our consolidated financial statements.

New Accounting Guidance - Not Yet Adopted

The FASB issued ASU No. 2020-04, Reference Rate Reform (Topic 848) in March 2020. The new guidance provides optional expedients and exceptions for applying U.S. GAAP to contract modifications and hedging relationships, subject to meeting certain criteria, that reference LIBOR or another reference rate expected to be discontinued. This ASU may be applied prospectively through December 31, 2022. We are currently assessing the impact of this standard on our consolidated financial statements.

We do not expect that any additional recently issued accounting guidance will have a significant effect on our consolidated financial statements.

(2) Revenue Recognition

The following table disaggregates revenues by type within each of our business segments:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2020 | | 2019 | | 2020 | | 2019 |

| Gaming | | | | | | | |

| Gaming operations | $ | 92 | | | $ | 149 | | | $ | 227 | | | $ | 451 | |

| Gaming machine sales | 71 | | | 168 | | | 216 | | | 452 | |

| Gaming systems | 43 | | | 77 | | | 115 | | | 218 | |

| Table products | 25 | | | 60 | | | 82 | | | 182 | |

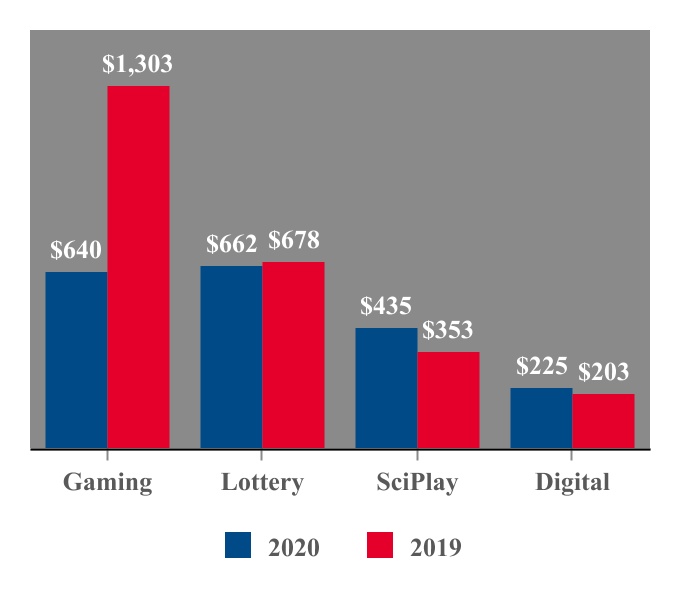

| Total | $ | 231 | | | $ | 454 | | | $ | 640 | | | $ | 1,303 | |

| | | | | | | |

| Lottery | | | | | | | |

| Instant products | $ | 157 | | | $ | 150 | | | $ | 426 | | | $ | 440 | |

| Lottery systems | 84 | | | 70 | | | 236 | | | 238 | |

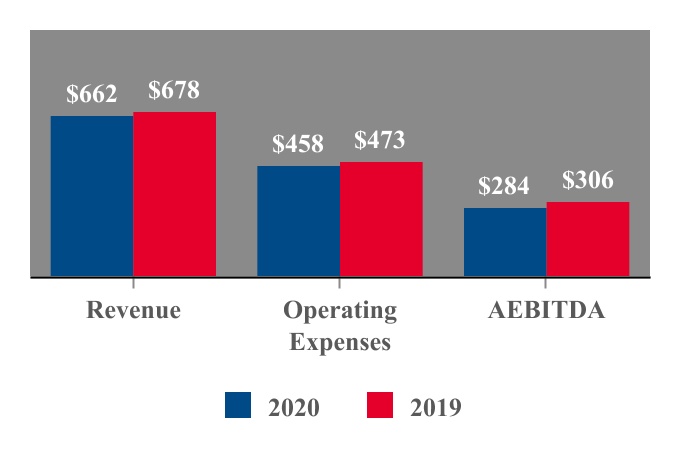

| Total | $ | 241 | | | $ | 220 | | | $ | 662 | | | $ | 678 | |

| | | | | | | |

| SciPlay | | | | | | | |

| Mobile | $ | 132 | | | $ | 97 | | | $ | 377 | | | $ | 293 | |

| Web and other | 19 | | | 19 | | | 58 | | | 60 | |

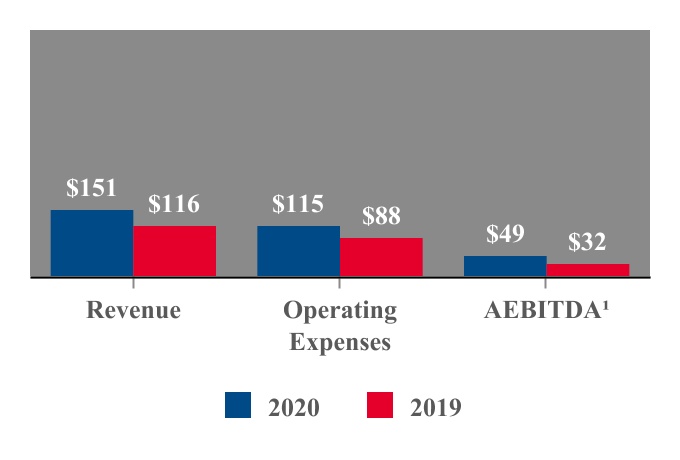

| Total | $ | 151 | | | $ | 116 | | | $ | 435 | | | $ | 353 | |

| | | | | | | |

| Digital | | | | | | | |

| Sports and platform | $ | 31 | | | $ | 29 | | | $ | 95 | | | $ | 85 | |

| Gaming and other | 44 | | | 36 | | | 130 | | | 118 | |

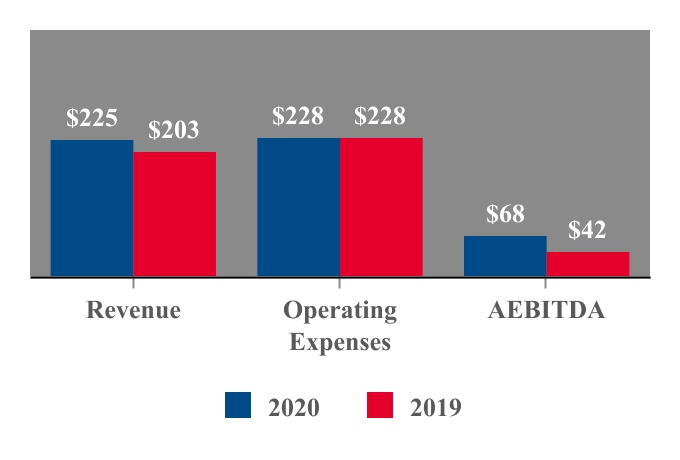

| Total | $ | 75 | | | $ | 65 | | | $ | 225 | | | $ | 203 | |

The amount of rental income revenue that is outside the scope of ASC 606 was $62 million and $148 million for the three and nine months ended September 30, 2020, respectively, and $91 million and $282 million for the three and nine months ended September 30, 2019, respectively.

Contract Liabilities and Other Disclosures

The following table summarizes the activity in our contract liabilities for the reporting period:

| | | | | |

| Nine Months Ended September 30, |

| 2020 |

Contract liability balance, beginning of period(1) | $ | 109 | |

| Liabilities recognized during the period | 52 | |

| Amounts recognized in revenue from beginning balance | (61) | |

Contract liability balance, end of period(1) | $ | 100 | |

| (1) Contract liabilities are included within Accrued liabilities and Other long-term liabilities in our consolidated balance sheets. |

The timing of revenue recognition, billings and cash collections results in billed receivables, unbilled receivables (contract assets), and customer advances and deposits (contract liabilities) on our consolidated balance sheets. Other than contracts with customers with financing arrangements exceeding 12 months, revenue recognition is generally proximal to conversion to cash, except for Lottery instant products sold under percentage of retail sales contracts. Revenue is recognized for such contracts upon delivery to our customers, while conversion to cash is based on the retail sale of the underlying ticket to end consumers. As a result, revenue recognition under ASC 606 does not approximate conversion to cash for such contracts in any periods post-adoption. Total revenue recognized under such contracts for the three and nine months ended September 30, 2020 was $26 million and $66 million, respectively, and $20 million and $69 million for the three and nine months ended September 30, 2019, respectively. The following table summarizes our balances in these accounts for the periods indicated (other than contract liabilities disclosed above):

| | | | | | | | | | | |

| Receivables | | Contract Assets(1) |

Beginning of period balance(2) | $ | 808 | | | $ | 121 | |

End of period balance, September 30, 2020 | 686 | | | 128 | |

| | | |

| | | |

(1) Contract assets are included primarily within Prepaid expenses, deposits and other current assets in our consolidated balance sheets. |

| (2) The beginning of period balance excludes the impact of adoption of ASC 326. |

As of September 30, 2020, we did not have material unsatisfied performance obligations for contracts expected to be long-term or contracts for which we recognize revenue at an amount other than for which we have the right to invoice for goods or services delivered or performed.

(3) Business Segments

We report our operations in four business segments—Gaming, Lottery, SciPlay and Digital—representing our different products and services. A detailed discussion regarding the products and services from which each reportable business segment derives its revenue is included in Notes 2 and 3 in our 2019 10-K.

In evaluating financial performance, our Chief Operating Decision Maker focuses on AEBITDA as management’s segment measure of profit or loss, which is described in Note 2 in our 2019 10-K. The accounting policies of our business segments are the same as those described within the Notes in our 2019 10-K. The following tables present our segment information:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2020 |

| Gaming | | Lottery | | SciPlay | | Digital | | Unallocated and Reconciling Items(1) | | Total |

Total revenue | $ | 231 | | | $ | 241 | | | $ | 151 | | | $ | 75 | | | $ | — | | | $ | 698 | |

AEBITDA | 77 | | | 109 | | | 49 | | | 25 | | | (25) | | | $ | 235 | |

Reconciling items to consolidated net loss before income taxes: |

D&A | (85) | | | (15) | | | (3) | | | (23) | | | (10) | | | (136) | |

| | | | | | | | | | | |

Restructuring and other | (10) | | | (3) | | | — | | | (1) | | | (6) | | | (20) | |

EBITDA from equity investments | | | | | | | | | (11) | | | (11) | |

Earnings from equity investments | | | | | | | | | 2 | | | 2 | |

Interest expense | | | | | | | | | (131) | | | (131) | |

| Loss on debt refinancing transactions | | | | | | | | | (1) | | | (1) | |

| Loss on remeasurement of debt | | | | | | | | | (24) | | | (24) | |

Other expense, net | | | | | | | | | (3) | | | (3) | |

Stock-based compensation | | | | | | | | | (17) | | | (17) | |

Net loss before income taxes | | | | | | | | | | | $ | (106) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1) Includes amounts not allocated to the business segments (including corporate costs) and items to reconcile the total business segments AEBITDA to our consolidated net loss before income taxes. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2019 |

| Gaming | | Lottery | | SciPlay | | Digital | | Unallocated and Reconciling Items(1) | | Total |

Total revenue | $ | 454 | | | $ | 220 | | | $ | 116 | | | $ | 65 | | | $ | — | | | $ | 855 | |

AEBITDA | 226 | | | 99 | | | 32 | | | 17 | | | (30) | | | $ | 344 | |

Reconciling items to consolidated net income before income taxes: |

D&A | (110) | | | (14) | | | (1) | | | (18) | | | (19) | | | (162) | |

Restructuring and other | (5) | | | — | | | — | | | (5) | | | (1) | | | (11) | |

EBITDA from equity investments | | | | | | | | | (15) | | | (15) | |

Earnings from equity investments | | | | | | | | | 4 | | | 4 | |

Interest expense | | | | | | | | | (146) | | | (146) | |

| | | | | | | | | | | |

| Gain on remeasurement of debt | | | | | | | | | 19 | | | 19 | |

Other expense, net | | | | | | | | | (9) | | | (9) | |

| Stock-based compensation | | | | | | | | | (9) | | | (9) | |

Net income before income taxes | | | | | | | | | | | $ | 15 | |

| | | | | | | | | | | |

(1) Includes amounts not allocated to the business segments (including corporate costs) and items to reconcile the total business segments AEBITDA to our consolidated net income before income taxes. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2020 |

| Gaming | | Lottery | | SciPlay | | Digital | | Unallocated and Reconciling Items(1) | | Total |

Total revenue | $ | 640 | | | $ | 662 | | | $ | 435 | | | $ | 225 | | | $ | — | | | $ | 1,962 | |

AEBITDA | 142 | | | 284 | | | 144 | | | 68 | | | (82) | | | $ | 556 | |

Reconciling items to consolidated net loss before income taxes: |

D&A | (260) | | | (47) | | | (7) | | | (67) | | | (33) | | | (414) | |

Goodwill impairment | (54) | | | — | | | — | | | — | | | — | | | (54) | |

| Restructuring and other | (29) | | | (11) | | | (2) | | | (3) | | | (13) | | | (58) | |

EBITDA from equity investments | | | | | | | | | (25) | | | (25) | |

Loss from equity investments | | | | | | | | | (3) | | | (3) | |

Interest expense | | | | | | | | | (379) | | | (379) | |

| Loss on debt refinancing transactions | | | | | | | | | (1) | | | (1) | |

| Loss on remeasurement of debt | | | | | | | | | (26) | | | (26) | |

Other expense, net | | | | | | | | | (8) | | | (8) | |

Stock-based compensation | | | | | | | | | (41) | | | (41) | |

Net loss before income taxes | | | | | | | | | | | $ | (453) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1) Includes amounts not allocated to the business segments (including corporate costs) and items to reconcile the total business segments AEBITDA to our consolidated net loss before income taxes. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2019 |

| Gaming | | Lottery | | SciPlay | | Digital | | Unallocated and Reconciling Items(1) | | Total |

Total revenue | $ | 1,303 | | | $ | 678 | | | $ | 353 | | | $ | 203 | | | $ | — | | | $ | 2,537 | |

AEBITDA | 656 | | | 306 | | | 90 | | | 42 | | | (87) | | | $ | 1,007 | |

Reconciling items to consolidated net loss before income taxes: |

D&A | (336) | | | (53) | | | (5) | | | (56) | | | (47) | | | (497) | |

Restructuring and other | (9) | | | (1) | | | (2) | | | (9) | | | (3) | | | (24) | |

EBITDA from equity investments | | | | | | | | | (50) | | | (50) | |

Earnings from equity investments | | | | | | | | | 17 | | | 17 | |

Interest expense | | | | | | | | | (447) | | | (447) | |

Loss on debt financing transactions | | | | | | | | | (60) | | | (60) | |

| Gain on remeasurement of debt | | | | | | | | | 21 | | | 21 | |

Other expense, net | | | | | | | | | (7) | | | (7) | |

| Stock-based compensation | | | | | | | | | (33) | | | (33) | |

Net loss before income taxes | | | | | | | | | | | $ | (73) | |

| | | | | | | | | | | |

(1) Includes amounts not allocated to the business segments (including corporate costs) and items to reconcile the total business segments AEBITDA to our consolidated net loss before income taxes. |

(4) Restructuring and other

Restructuring and other includes charges or expenses attributable to: (i) employee severance; (ii) management restructuring and related costs; (iii) restructuring and integration; (iv) cost savings initiatives; (v) major litigation; and (vi) acquisition costs and other unusual items. The following table summarizes pre-tax restructuring and other costs for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2020 | | 2019 | | 2020 | | 2019 |

Employee severance and related(1) | | $ | 9 | | | $ | 3 | | | $ | 39 | | | $ | 8 | |

| Contingent consideration adjustment | | — | | | — | | | — | | | 2 | |

| Restructuring, integration and other | | 11 | | | 8 | | | 19 | | | 14 | |

| Total | | $ | 20 | | | $ | 11 | | | $ | 58 | | | $ | 24 | |

|