Table of Contents

Exhibit 1

ANNUAL INFORMATION FORM

March 28, 2016

Table of Contents

Annual Information Form

| Section

|

Page

|

|||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 9 | ||||

| 11 | ||||

| 14 | ||||

| 17 | ||||

| 17 | ||||

| 25 | ||||

| 28 | ||||

| 29 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 36 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 49 | ||||

| 50 | ||||

| 52 | ||||

| 53 | ||||

| 56 | ||||

| 56 | ||||

| 10. Interests of Management & Others in Material Transactions |

57 | |||

| 58 | ||||

| 58 | ||||

| 58 | ||||

| 58 | ||||

In this Annual Information Form, we use the terms “you” and “your” to refer to the shareholder, while “we”, “us”, “our”, “Company” and “Magna” refer to Magna International Inc. and, where applicable, its subsidiaries. We also use the term “Executive Management” to refer, collectively, to our Chief Executive Officer; Chief Financial Officer; Chief Legal Officer; Chief Marketing Officer; Chief Operating Officer - Exteriors, Seating, Mirrors, Closures and Cosma; Chief Human Resources Officer; Chief Technology Officer; and EVP, Corporate Projects and Strategy Development. All amounts referred to in this Annual Information Form are presented in U.S. dollars unless we have stated otherwise. In this Annual Information Form, a reference to “fiscal year” is a reference to the fiscal or financial year from January 1 to December 31 of the year stated. Sales figures disclosed in this Annual Information Form have been prepared in accordance with United States Generally Accepted Accounting Principles (U.S. GAAP). Where we have referred to specific customers, the reference includes the customers’ operating divisions and subsidiaries, unless we have stated otherwise. Information (including 2014 comparative information) in this Annual Information Form does not include our former interiors operations, which we sold during 2015, and does not include our acquisition of the Getrag Group of Companies which was completed in January 2016, unless otherwise stated. Effective March 25, 2015, Magna’s Common Shares were split on a two-for-one basis. All references in this Circular to a number of shares or dividend amounts, reflect the post-stock split number or amount, unless otherwise stated. References to our “Circular” refer to our Management Information Circular/Proxy Statement dated March 28, 2016 for our 2016 Annual and Special Meeting of Shareholders to be held on May 5, 2016 (the “Meeting”). The information in this Annual Information Form is current as of March 24, 2016, unless otherwise stated.

| 1 |

|

Table of Contents

This Annual Information Form contains statements that constitute “forward-looking information” or “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of applicable securities legislation, including but not limited to statements relating to: implementation of our business and capital strategy; future returns of capital to our shareholders through dividends and share repurchases; growth prospects of our business, including through organic growth, acquisitions, joint ventures or as a result of supplier consolidation; and estimates of future environmental clean-up and remediation costs. The forward-looking statements in this Annual Information Form are presented for the purpose of providing information about management’s current expectations and plans and such information may not be appropriate for other purposes. Forward-looking statements may include financial and other projections, as well as statements regarding our future plans, objectives or economic performance, or the assumptions underlying any of the foregoing, and other statements that are not recitations of historical fact. We use words such as “may”, “would”, “could”, “should”, “will”, “likely”, “expect”, “anticipate”, “believe”, “intend”, “plan”, “forecast”, “outlook”, “project”, “estimate” and similar expressions suggesting future outcomes or events to identify forward-looking statements. Any such forward-looking statements are based on information currently available to us and assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. However, whether actual results and developments will conform to our expectations and predictions is subject to a number of risks, assumptions and uncertainties, many of which are beyond our control, and the effects of which can be difficult to predict, including, without limitation:

In evaluating any forward-looking statements in this Annual Information Form, we caution readers not to place undue reliance on any particular statement. Readers should specifically consider the various factors, including those contained under “Section 3. Description of the Business – Risk Factors”, which could cause actual events or results to differ materially from those indicated by our forward-looking statements. Unless otherwise required by applicable securities laws, we do not intend, nor do we undertake any obligation, to update or revise any forward-looking statements contained in this Annual Information Form to reflect subsequent information, events, results or circumstances or otherwise.

|

2 |

Table of Contents

Issuer

Magna was originally incorporated under the laws of the Province of Ontario, Canada on November 16, 1961. Our charter documents currently consist of articles of amalgamation dated December 31, 2010, which were issued pursuant to the Business Corporations Act (Ontario). Our registered and head office is located at 337 Magna Drive, Aurora, Ontario, Canada L4G 7K1.

Subsidiaries

A list of our principal subsidiaries and each of their jurisdictions of incorporation as of December 31, 2015 is set out below. Our legal structure (including that of our subsidiaries) is not necessarily indicative of our operational structure.

| Subsidiary(1)(2) | Voting Securities | Jurisdiction of

| ||

| 175 Holdings ULC

|

100% | Alberta | ||

| Magna US Holding, Inc.

|

100% | Delaware | ||

| Cosma International of America, Inc.

|

100% | Michigan | ||

| 1305290 Ontario Inc.

|

100% | Ontario | ||

| Magna International Investments S.A.

|

100% | Luxembourg | ||

| Magna International Automotive Holding GmbH

|

100% | Austria | ||

| Magna Automotive Europe GmbH

|

100% | Austria | ||

| Magna Automotive Holding AG

|

100% | Austria | ||

| Magna Metalforming AG

|

100% | Austria | ||

| Magna Steyr AG & Co. KG

|

100% | Austria | ||

| Magna Steyr Fahrzeugtechnik AG & Co. KG

|

100% | Austria | ||

| New Magna Investments N.V.

|

100% | Belgium | ||

| Magna Automotive Holding (Germany) GmbH

|

100% | Germany | ||

| Cosma Tooling Ireland(3)

|

100% | Ireland | ||

| Autolaunch Limited

|

100% | Ireland | ||

| Magna Exteriors and Interiors Corp.

|

100% | Ontario | ||

| Magna International (Hong Kong) Limited

|

100% | Hong Kong | ||

| Magna Powertrain Inc.

|

100% | Ontario | ||

| Magna Seating Inc.

|

100% | Ontario | ||

| Magna Structural Systems Inc.

|

100% | Ontario | ||

Notes:

| (1) | The table shows the percentages of the votes attached to all voting securities, and of each class of non-voting securities, owned by us or over which control or direction is exercised by us. Parent/subsidiary relationships are identified by indentations. Percentages represent the total equity interest in a subsidiary, which is not necessarily indicative of percentage voting control. |

| (2) | Subsidiaries not shown each represent less than 10% of our total consolidated revenues and total consolidated assets (although not all subsidiaries shown necessarily each represent more than 10% of our total consolidated assets and total consolidated sales) and, if considered in aggregate as a single subsidiary, represent less than 20% of our total consolidated revenues and total consolidated assets. |

| (3) | As of December 31, 2015, Cosma Tooling Ireland was wholly-owned by two of our holding company subsidiaries. Those subsidiaries were dissolved effective March 3, 2016 and, accordingly, are not included in the table above. |

| 3 |

|

Table of Contents

2. General Development of the Business

We are a leading global automotive supplier with 292 manufacturing operations and 83 product development, engineering and sales centres in 29 countries, as at December 31, 2015. Our approximately 129,000 employees are focused on delivering superior value to our customers through innovative products and processes, and World Class Manufacturing. Our product and service capabilities include:

| • Seating Systems |

• Vision Systems |

• Roof Systems | ||

| • Closure Systems |

• Exterior Systems |

• Electronic Systems | ||

| • Body and Chassis Systems |

• Powertrain Systems |

• Vehicle Engineering & Contract Assembly | ||

Our Corporate Culture

The foundation of our operating structure is a decentralized, entrepreneurial corporate culture, the key elements of which are as follows:

Decentralization

We follow a corporate policy of functional and operational decentralization, which we believe increases flexibility, customer responsiveness and productivity. Our manufacturing and assembly operations are conducted through Divisions, each of which is an autonomous business unit operating within pre-determined guidelines. Each Division is a separate profit center under the authority of a general manager who has the discretion to determine rates of pay, hours of work and sources of supply, within the framework of our Employee’s Charter, our Operational Principles and our corporate policies. Our Executive Management team allocates capital, coordinates our mergers and acquisitions and strategic alliances strategy, ensures customer and employee satisfaction and manages succession planning. Executive Management also interfaces with the investment community and is responsible for our long-term strategic planning and future growth, as well as monitoring the performance of the management of our product areas.

Employee’s Charter & Employee Equity and Profit Participation

We are committed to operating our business in a way that is based on fairness and concern for our employees. Our Employee’s Charter and our Operational Principles set out key principles outlining this commitment. One bedrock principle in our Employee’s Charter is participation by our employees in our financial success, as reflected in our long-standing practice of sharing 10% of our pre-tax profits with eligible employees. See “Section 3. Description of the Business – Human Resources” for a description of our human resource principles (including our Employee’s Charter) and our employee equity and profit sharing program.

Incentive-Based Management Compensation

We maintain an incentive-based compensation system for Management which directly links executive compensation and corporate performance, as measured by profitability. Our approach to executive compensation is described in further detail in the sections of our Circular titled “Compensation and Performance Report” and “Compensation Discussion & Analysis”.

Responsible Corporate Citizenship

We are committed to being a responsible corporate citizen that conducts business in a legal and ethical manner. We have demonstrated this commitment in a number of ways, including our support of social and charitable causes, our actions to reduce the environmental impact of our operations, our activities to promote a safe and healthful work environment for our employees and our comprehensive ethics and legal compliance program. See “Section 3. Description of the Business – Environmental Matters”, “Corporate Social Responsibility” and “Ethics & Legal Compliance”.

|

4 |

Table of Contents

Reporting Segments

Our success is directly dependent upon the levels of North American and European (and currently, to a lesser extent, Asian and Rest of World) car and light truck production by our customers. Given the differences between the regions in which we operate, our operations are segmented on a geographic basis. Our segments consist of North America, Europe, Asia and Rest of World. Consistent with the above, our internal financial reporting separately segments key internal operating performance measures between North America, Europe, Asia and Rest of World for our Chief Executive Officer to assist in the assessment of operating performance, the allocation of resources and our long-term strategic direction and future global growth.

Our external sales by reporting segment for 2015 and 2014 were as follows:

| Reporting Segment | (U.S. dollars, in Millions)

|

|||||||

|

2015

|

2014 | |||||||

| North America

|

$18,908 | $18,643 | ||||||

| Europe

|

10,912 | 13,280 | ||||||

| Asia

|

1,846 | 1,773 | ||||||

| Rest of World

|

461 | 694 | ||||||

| Corporate and Other

|

7 | 13 | ||||||

| TOTAL

|

$32,134 | $34,403 | ||||||

| 5 |

|

Table of Contents

Geographic Markets and Customers

North America

Our North American production sales accounted for approximately 55% and 51% of our consolidated sales in 2015 and 2014, respectively. Our primary customers in North America in 2015 included BMW, Daimler, Fiat Chrysler, Ford, General Motors, Honda, Mazda, PACCAR, Renault-Nissan, Tata Motors, Tesla, Toyota and Volkswagen.

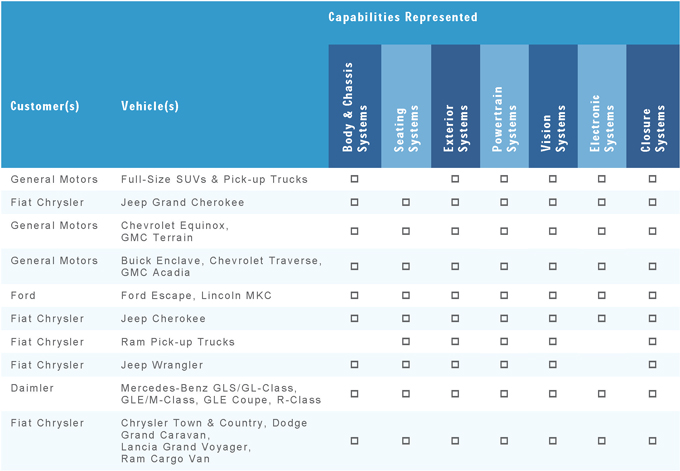

Our top ten North American programs/platforms based on 2015 production sales were:

Note: Capabilities represented may not be on each vehicle or each trim level of each vehicle. Additionally, our capabilities in each product area range from components to full systems, only some of which may be represented on any particular program.

|

6 |

Table of Contents

Europe

Our European production and vehicle assembly sales accounted for approximately 30% and 35% of our consolidated sales in 2015 and 2014, respectively. Our primary customers in Europe in 2015 included BMW, Daimler, Fiat Chrysler, Ford, Geely, General Motors, Hyundai-Kia, MAN, PSA Peugeot Citroën, Renault-Nissan, Tata Motors, Toyota and Volkswagen.

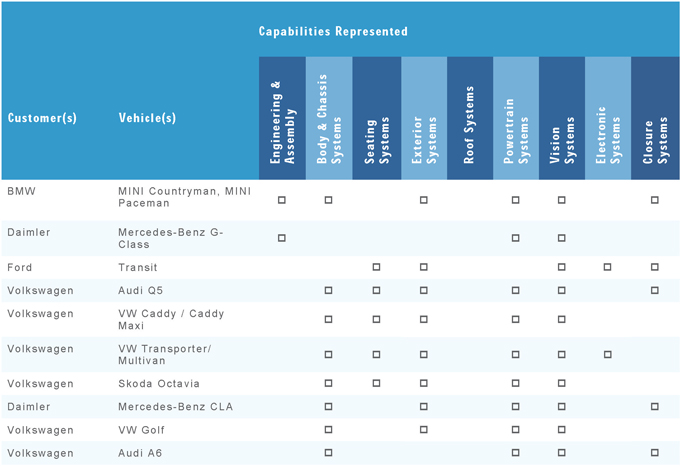

Our top ten European programs/platforms based on 2015 production and vehicle assembly sales were:

Note: Capabilities represented may not be on each vehicle or each trim level of each vehicle. Additionally, our capabilities in each product area range from components to full systems, only some of which may be represented on any particular program.

| 7 |

|

Table of Contents

Asia

Our Asian production sales accounted for approximately 5% of our consolidated sales in each of 2015 and 2014. Our primary customers in Asia in 2015 included BMW, Chang’An Auto, Chery Automobile, Daimler, Fiat Chrysler, First Automobile Works, Ford, Geely, General Motors, Great Wall Automobile, Honda, Hyundai-Kia, Mahindra, PSA Peugeot Citroën, Qoros Auto, Renault-Nissan, SAIC Motor, Toyota and Volkswagen.

Rest of World

Our Rest of World production sales accounted for approximately 1% and 2% of our consolidated sales in 2015 and 2014, respectively. Our primary customers in Rest of World in 2015 included Daimler, Fiat Chrysler, Ford, General Motors, Renault-Nissan and Volkswagen.

Customer Concentration

Worldwide sales to our six largest customers represented the following proportions of our consolidated sales in 2015 and 2014:

| Customer | 2015 | 2014 | ||||||||||

| General Motors

|

20% | 18% | ||||||||||

| Fiat Chrysler

|

16% | 16% | ||||||||||

| Ford

|

15% | 14% | ||||||||||

| Daimler

|

12% | 12% | ||||||||||

| Volkswagen

|

10% | 12% | ||||||||||

| BMW

|

10% | 11% | ||||||||||

| Other

|

17% | 17% | ||||||||||

| TOTAL

|

100% | 100% | ||||||||||

|

8 |

Table of Contents

Recent Trends in the Automotive Industry

A number of general trends have been impacting the automotive industry and our business in recent years, and are expected to continue, including the following:

Prevalence of Vehicles Built From High-Volume Global Vehicle Platforms

Automobile manufacturers continue to increase the range of vehicles built from high-volume global platforms, allowing automobile manufacturers to: realize economies of scale; remain competitive; differentiate their vehicles for different markets; expand the number of market segments in which they compete; respond to lifestyle trends; and meet the tastes of consumers. The prevalence of global vehicle platforms provides Tier 1 automotive suppliers increased opportunities to supply larger volumes of products which may be common across multiple vehicles built from the same platform. However, the consolidation of platforms to fewer global platforms may increase warranty/recall risks and amplify the impact on suppliers of failing to win programs built from global platforms.

Growth of the Automotive Industry Outside of Our Traditional Markets

The local demand for vehicles in China, India and other markets outside of North America and Western Europe continues to increase. This increasing local demand has helped boost the local automotive industry in these countries and has attracted investments in manufacturing from North American, European and Asian-based automobile manufacturers, through stand-alone investments and/or joint ventures with local partners. More recently, there has been increasing migration of component and vehicle design, development and engineering to certain of these markets. Automotive suppliers have followed and will likely continue to follow the expansion of automobile manufacturers into these regions. While this expansion may provide new opportunities for automotive suppliers, it may also result in exposure to a number of risks of conducting business in such markets.

Growth of B to D Vehicle Segments

The local demand for vehicles in growing markets consists primarily of demand for B segment (sub-compact), C segment (compact) and D segment (mid-size) cars. Automobile manufacturers that have established product offerings in these vehicle segments, and their preferred suppliers, will likely have an advantage in realizing the opportunities available in these higher growth vehicle segments.

Governmental Regulation and Enforcement

The automotive industry is subject to greater governmental regulation seeking to promote higher corporate average fuel economy, reduce carbon dioxide (CO2)/greenhouse gas emissions, improve vehicle safety and increase vehicle recyclability. While increased regulation generally presents new challenges for the automotive industry, it may also provide new revenue opportunities for automotive suppliers that produce and market new products and technologies.

In addition to greater regulation, the automotive industry has in recent years been the subject of increased government enforcement of antitrust and competition laws, particularly by the United States Department of Justice and the European Commission. Currently, we are aware of investigations being conducted in a number of automotive product areas.

Increasing Consumer Demand For, and Industry Focus On, Fuel-Efficient and Environmentally-Friendly Vehicles

Periodically elevated fuel prices, growing consumer awareness of environmental issues and other factors have increased consumer demand for vehicles that are more fuel-efficient and environmentally-friendly. As a result, automobile manufacturers are becoming increasingly focused on the development and manufacture of hybrid, electric and other alternative-energy vehicles. This trend is also manifesting itself in the increased use of materials such as aluminum, plastic, advanced high-strength steels and other materials which are designed to reduce vehicle weight and increase fuel efficiency. Automotive suppliers which emphasize technological innovation and broad product capabilities are expected to benefit from the growing demand for these features.

| 9 |

|

Table of Contents

Growth of Cooperative Arrangements

In order to achieve economies of scale and defray development costs, competing automobile manufacturers continue to enter into cooperative alliances and arrangements relating to: shared purchasing of components; joint engine, powertrain and/or platform development and sharing; and other forms of cooperation. Cooperation among competing automobile manufacturers is expected to continue.

Growth of Electronics in Vehicles

The importance of electronics in the automotive value chain has been increasing in recent years. Automobile manufacturers are increasingly seeking to replace vehicle functions traditionally performed using mechanical hardware with electric and electronically controlled alternatives, as well as seeking to increase on-demand functionality of systems and modules, and develop more efficient vehicle powertrains and thermal management modules through integrated electronics. In addition, automobile manufacturers are incorporating a growing number of electronic hardware and software systems into their vehicles, including those aimed at in-car connectivity and integration of personal electronics; driver assistance systems, such as enhanced navigation or traffic avoidance; and active safety systems. Automotive suppliers that possess sophisticated electronic hardware and software systems integration capabilities are expected to benefit from this accelerating trend. However, the growth of electronic hardware and software systems in vehicles may increase: warranty/recall risks, including if the complexity and/or interconnectedness of such systems makes repair or replacement more costly; risks related to vehicle cyber-attacks; and other risks.

Supplier Consolidation

Consolidation in the automotive supply industry is driven by a number of factors, including: industry/economic cyclicality; manufacturing over-capacity; significant capital investments required in the automotive sector; continued growth in global platforms; sourcing strategies of automobile manufacturers and their efforts to optimize the stability of their supply chains; and the scale advantages of larger suppliers. This trend is expected to continue in the future, and could intensify, particularly during periods of economic deterioration.

Pricing Pressures

Automobile manufacturers continue to seek ways to reduce their costs of producing vehicles as competition for market share intensifies. In addition to seeking cost efficiencies in their own production, marketing and administrative structures, automobile manufacturers have placed significant pressure on automotive suppliers to reduce the price of their components, assemblies, modules and systems. This pricing pressure has historically come in different forms, including:

| • | long-term agreements containing pre-determined price reductions for each year of a vehicle production program; |

| • | retroactive incremental price reductions and annual price reduction demands above and beyond those contained in any long-term agreement; |

| • | pressure to absorb more design and engineering costs previously paid for by the automobile manufacturer and to recover these costs through amortization in the piece price of the particular components designed or engineered by the supplier; |

| • | pressure to assume or offset commodities cost increases, including for steel and resins; |

| • | refusal to increase the price paid for suppliers’ products to fully offset inflationary cost increases in the manufacturing process; and |

| • | pressure to own and/or capitalize tooling and recover these costs through amortization in the piece price of the components produced by this tooling. |

In many cases, automotive suppliers bear the risk of not being able to fully recover the design, engineering and tooling costs in circumstances where vehicle production volumes are lower than anticipated or programs are terminated early. In addition, automobile manufacturers continue to request that their automotive suppliers bear the cost of the repair and replacement of defective products that are either covered under the automobile manufacturers’ warranty and/or are the subject of a recall, including in situations where the automobile manufacturer has directed the purchase of sub-components from their preferred suppliers.

|

10 |

Table of Contents

Some of these trends may present risks to our operations, profitability and/or financial condition. These risks are described in detail under “Section 3. Description of the Business – Risk Factors”, which all readers are strongly encouraged to read and consider carefully.

Our Board of Directors (“Board”) is responsible for overseeing our long-term strategy and allocating capital through a capital expenditures budget which supports the strategic priorities approved by the Board, as well as our product and program commitments to our customers. Through our strategy, we seek to strengthen our position as a leading global automotive supplier and generate sustainable growth in order to create long-term shareholder value. The elements of our strategy include the operational and growth priorities discussed below.

Operational Priorities

Accelerated Focus on Innovation and Technology

We seek to be recognized by our customers as an industry leader in product, process and materials innovation. In order to help achieve this strategic goal, we intend to continue to direct significant resources to commercialize new products and processes which will provide additional value to our customers in such areas as:

| • | weight reduction or “light-weighting”; |

| • | fuel efficiency and reduced emissions; |

| • | active and passive safety; and |

| • | comfort, convenience and vehicle connectivity. |

For a description of our research and development process and recent innovations, see “Section 3. Description of the Business – Research & Development”.

World Class Manufacturing

Our goal is to be recognized as a leader in “World Class Manufacturing”. Our global operating units have embraced this goal and we are committed to achieving “best in class” performance in all areas of manufacturing at each of our operating Divisions globally. In order to drive continuous improvement, we monitor our progress in achieving our goal of World Class Manufacturing using an assessment process similar to that used by our customers in evaluating their suppliers, supplemented with elements we view as critical to achieving world class manufacturing in accordance with our Operational Principles. Best practices, “lessons learned” and key initiatives are shared among our global operating units, including through a regular internal World Class Manufacturing conference that brings together our senior corporate and operating group leadership.

Leadership Development

A key element to the success of our business remains our ability to attract, retain and develop skilled personnel to match the pace of our global growth. We have implemented and continue to enhance our Leadership Development and Succession program to help identify, train and develop future leaders with the skills and expertise needed to manage a complex, global business.

Growth Priorities

Organic Growth and M&A

We expect to grow organically and through acquisitions. We continue to consider acquisition opportunities that allow us to: expand our customer base; strengthen our position in priority product areas or facilitate entry into new product areas; expand in growing geographic markets; or acquire innovative technologies. Additionally, we regularly evaluate our existing product capabilities and, in some cases, we may exit product areas where our competitive position is not sufficiently strong or our level of investment return does not justify continued investment. We may also exit product areas to the extent we believe that our capital resources could be better utilized elsewhere. In this regard, we completed a number of transactions in 2015 and early 2016 designed to

| 11 |

|

Table of Contents

strategically reposition our product portfolio, including our acquisitions of the Getrag Group of Companies (“Getrag”) and Stadco Automotive Ltd. (“Stadco”), the sale of our interiors operations to Grupo Antolin and several other transactions described under “Recent Developments in Our Business – Acquisitions and Divestitures”.

Pursuing Business on Global Vehicle Platforms

The proliferation of global vehicle platforms and increased platform and component sharing among automobile manufacturers requires global suppliers with financial strength and capability to support automobile manufacturers’ regional product development activities and produce common products simultaneously in multiple regions around the world. We believe that our strong financial position, operational scale, technological know-how, focus on innovation, continuing world class manufacturing efforts, and global customer relationships support us in realizing the opportunities presented by the growth in global platforms and component sharing.

Focus on Non-Traditional Markets

In recognition of the fact that much of the future growth potential in the automotive industry lies in growing markets outside of North America and Western Europe, we will continue to focus on markets that have or are expected to become key regions for vehicle production, including China, India, Thailand, Eastern Europe and other non-traditional markets for us. This strategy allows us to support the global needs of our traditional North American and European customers and to make inroads with other customers. In emphasizing growing markets, we seek to win business supplying products that can be manufactured in multiple locations globally, to take advantage of our customers’ continuing trend towards assembling higher volumes of vehicles built on global platforms in multiple locations around the world.

Diversifying our Automotive Sales Base

Although we sell to all of the world’s largest automobile manufacturers and are present in all significant automobile producing regions in the world, a substantial proportion of our business has traditionally been with the Detroit 3 automobile manufacturers in North America (General Motors, Fiat Chrysler and Ford) and the German-based automobile manufacturers in Western Europe (Daimler, Volkswagen and BMW). Although we aim to maintain and grow our business with our traditional customers, we seek to further diversify our sales, as profitable opportunities arise, as follows:

| Region: | by increasing the proportion of our business in non-traditional markets for us, | |

| Customer: | by increasing the proportion of our business with customers outside of our top six, including with Asian-based automobile manufacturers, and | |

| Vehicle Segment: | by increasing the proportion of our business in the B to D (sub-compact to mid-size car) segments. | |

We aim to further diversify our sales base in coming years by: continuing to demonstrate our technical capabilities; pursuing new programs from our customers, with particular emphasis on global platforms; and pursuing takeover business. At the same time, we seek to protect our position in our traditional markets through innovation in technology, processes and products.

Maintaining Target Capital Structure

We previously disclosed our intention to achieve an Adjusted Debt ratio of 1.0 – 1.5 times EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization) by the end of 2015. We returned significant amounts of capital to our shareholders in recent years in the form of dividends and share repurchases, made significant levels of investment in our business, including the acquisition of Getrag, and issued the Senior Notes (discussed below). As a result, we achieved an Adjusted Debt ratio of 1.23 times EBITDA, roughly in the middle of our targeted range. Going forward, we look to maintain the efficiency of our capital structure and continue to create shareholder value by ensuring the amount of cash on our balance sheet remains at a level reasonably required to run our business, including through an industry downturn, while maintaining an investment grade credit rating.

|

12 |

Table of Contents

Creating Long-Term Shareholder Value

We believe that success in executing the elements of our strategy discussed above, together with the following actions will help us continue to create long-term shareholder value:

| • | strengthening our commitment to conducting business in a legal and ethical manner, including through our comprehensive global employee training and education initiatives designed to reinforce the principles embodied in our Employee’s Charter, our Operational Principles and our Code of Conduct and Ethics (the “Code of Conduct”); |

| • | reinforcing our unique, decentralized, entrepreneurial corporate culture; |

| • | maintaining our executive compensation system which directly links executive compensation and corporate performance, as measured by profitability; |

| • | maintaining our employee equity participation and profit sharing plans; |

| • | allocating capital resources strategically; and |

| • | continuing to focus on growing our earnings. |

| 13 |

|

Table of Contents

Recent Developments in Our Business

Acquisitions and Divestitures

We have completed a number of acquisitions, divestitures, financings and securities/corporate transactions in the last three fiscal years, including those listed below. None of these acquisitions constitute “significant acquisitions” within the meaning of such term in National Instrument 51-102 – Continuous Disclosure Obligations of the Canadian Securities Administrators.

2016

In January 2016, we acquired Getrag, one of the world’s largest suppliers of transmissions. Getrag has an 80-year history in transmissions and is a global supplier of automotive transmission systems, including manual, automated-manual, dual clutch hybrid and other advanced systems. The total consideration transferred by us for the acquisition was approximately €1.75 billion, and is subject to working capital and other customary price adjustments.

2015

In December 2015 we entered into a partnership agreement in China with Chongqing Xingqiaorui (“Xingqiaorui”), a Tier 1 supplier of automotive body-in-white components to Changan Ford. Under the terms of the arrangement, Xingqiaorui transferred a 53% controlling interest in its three China manufacturing facilities and cash consideration of $36 million. In exchange, we transferred a 47% non-controlling equity interest in our Chongqing manufacturing facility and cash consideration of $136 million to Xingqiaorui.

In November 2015, we acquired Stadco, a United Kingdom-based supplier of steel and aluminum stampings, as well as vehicle assemblies primarily to Jaguar and Land Rover, for total cash consideration of $115 million.

In August 2015, we:

| • | sold substantially all of our interiors operations (excluding our seating operations) to Grupo Antolin, a leading global supplier of automotive interior systems. As part of the transaction, the sale of two of our joint ventures in China to Grupo Antolin was completed in October 2015 following receipt of required regulatory approvals. The proceeds of the sale, net of transaction costs were $549 million; and |

| • | entered into a joint venture arrangement for the manufacture and sale of roof and other accessories for the Jeep market to automobile manufacturers, as well as aftermarket customers. We contributed our aftermarket Jeep brand roof tops business and received a 49% interest in the newly formed joint venture and cash proceeds of $118 million. |

In May 2015, we sold our battery pack business to Samsung SDI Co., Ltd. for proceeds of approximately $120 million.

In February 2015, we acquired the head-up display and electronic components business units of Philips & Lite-On Digital Solutions (PLDS) in Germany, as well as PLDS’ ultrasonic sensor business in Taiwan.

2014

In October 2014, we acquired the Techform Group of Companies, an automotive supplier of hinges, door locking rods and other closure products, which has operations in Canada, the United States and China, for cash consideration of $23 million.

In August 2014, we completed the sale of five composites manufacturing operations in the U.S. and Mexico to Continental Structural Plastics Inc.

2013

In November 2013, we acquired the remaining 49% interest of Textile Competence Centre Kft, a textile plant in Germany, along with certain fixed assets and licenses employed in the business that were owned by the non-controlling shareholder, for cash consideration of $9 million.

|

14 |

Table of Contents

Financings and Securities/Corporate Transactions

Issuance of Senior Unsecured Notes

On April 9, 2014, we filed a short form base shelf prospectus (“Shelf Prospectus”) with the Ontario Securities Commission (“OSC”) and a corresponding shelf registration statement with the United States Securities and Exchange Commission (“SEC”) on Form F-10 (“Registration Statement”) to provide for the potential offering in Ontario and the United States of up to an aggregate of $2 billion of senior unsecured notes from time to time over a 25 month period.

We issued the following senior unsecured notes pursuant to the Shelf Prospectus and Registration Statement:

| Issuance Date

|

Amount Issued

|

Interest Rate

|

Maturity Date

| |||

| June 16, 2014

|

$750,000,000 | 3.635% | June 15, 2024 | |||

| September 23, 2015

|

$650,000,000 | 4.150% | October 1, 2025 | |||

| November 24, 2015

|

€550,000,000 | 1.900% | November 24, 2023 | |||

We also issued, on December 7, 2015, CAD425,000,000 principal amount of senior unsecured notes (the “Canadian Notes”, and together with the senior unsecured notes in the table above, the “Senior Notes”), by way of private placement to accredited investors in each of the provinces of Canada. The privately placed notes bear interest at an annual rate of 3.10% and will mature on December 15, 2022.

The sections entitled “DESCRIPTION OF THE NOTES” in the Prospectus Supplements dated June 11, 2014, September 16, 2015 and November 17, 2015 (each to the Shelf Prospectus) from pages S-22 to S-30, S-22 to S-30 and S-26 to S-40, respectively, are hereby incorporated by reference into this Annual Information Form. The Prospectus Supplements have been filed on SEDAR (www.sedar.com).

Global Credit Facility

We maintain a $2.25 billion syndicated revolving credit facility that expires on June 22, 2020. The facility includes a $200 million Asian tranche, a $50 million Mexican tranche and a tranche for Canada, U.S. and Europe, which is fully transferable between jurisdictions and can be drawn in U.S. dollars, Canadian dollars or euros.

Euro-Commercial Paper Program

On February 3, 2016 we established a euro-commercial paper program (the “ECP Program”) backstopped by our Global Credit Facility. Under the ECP Program, one of our indirect wholly-owned subsidiaries may, from time to time, issue euro-commercial paper notes (the “ECP Notes”), subject to an aggregate maximum of €500 million or its equivalent in alternative currencies. Any ECP Notes issued will be guaranteed by us.

Normal Course Issuer Bid

On November 10, 2015, the Toronto Stock Exchange (“TSX”) accepted our Notice of Intention to Make a Normal Course Issuer Bid relating to the purchase of up to 40,000,000 Magna Common Shares (the “2016 Bid”), representing approximately 9.9% of our “public float” of Common Shares. The primary purposes of the 2016 Bid are purchases for cancellation, as well as purchases to fund our stock-based compensation awards or programs and/or our obligations to our deferred profit sharing plans. The 2016 Bid commenced on November 13, 2015 and will terminate no later than November 12, 2016. Purchases of Common Shares under the 2016 Bid are made on the TSX or the NYSE at the market price at the time of purchase in accordance with the rules and policies of the TSX or in compliance with Rule 10b-18 under the U.S. Securities Exchange Act of 1934, respectively. Purchases may also be made through other published markets, or by such other means permitted by the TSX, including by private agreement pursuant to an issuer bid exemption order issued by a securities regulatory authority. Purchases made by way of such private agreements under an issuer bid exemption order are at a discount to the prevailing market price and are included in computing the number of Common Shares purchased under the 2016 Bid.

| 15 |

|

Table of Contents

We have purchased the following Common Shares pursuant to the 2016 Bid as at March 24, 2016, and under our previous normal course issuer bid which commenced on November 13, 2014 and terminated on November 12, 2015 (“2015 Bid”):

| 2016 Bid

|

2015 Bid

|

|||||||||

| Shares purchased and cancelled

|

8,339,969 | 12,926,514 | ||||||||

| Shares purchased and retained for stock-based compensation awards or programs and/or deferred profit sharing plans

|

124,325 | 38,376 | ||||||||

| TOTAL |

8,464,294(1) | 12,964,890(2) | ||||||||

Notes:

| (1) | 540,000 Common Shares were purchased by way of private agreement with an arm’s length, third-party seller at a discount to prevailing market prices pursuant to an issuer bid exemption order issued to us by the OSC effective November 27, 2015. |

| (2) | 8,980,000 Common Shares were purchased by way of private agreements from five arm’s length, third-party sellers at a discount to prevailing market prices pursuant to issuer bid exemption orders issued to us by the OSC effective November 25, 2014, August 25, 2015 and September 15, 2015. |

Stock Split

On March 25, 2015 we completed a two-for-one stock split (the “Stock Split”), implemented by way of a stock dividend, as a result of which shareholders of record at the close of business on March 11, 2015 received one additional Common Share for each Common Share held. All equity-based compensation plans and arrangements and our normal course issuer bid were adjusted to reflect the issuance of additional Common Shares due to the Stock Split.

|

16 |

Table of Contents

3. Description of the Business

We are a leading global automotive supplier with 292 manufacturing operations and 83 product development, engineering and sales centres in 29 countries, as at December 31, 2015.

Our success is primarily dependent upon the levels of North American and European (and currently, to a lesser extent Asian and Rest of World) car and light truck production by our customers and the relative amount of content we have on various programs. Vehicle production is affected by consumer demand, which in turn is significantly impacted by consumer confidence. A worsening of economic and political conditions, including through rising interest rates or inflation, high unemployment, increasing energy prices, declining real estate values, increased volatility in global capital markets, sovereign debt concerns, an increase in protectionist measures, international conflicts and/or other factors may result in lower consumer confidence. A number of other factors, discussed under “Risk Factors”, also affect our success, including such things as relative currency values, commodities prices, price reduction pressures from our customers, the financial condition of the automotive supply base and competition from manufacturers with operations in low-cost countries.

Despite operating our business on a geographic basis, we possess product and service capabilities which span across such geographic regions. Details regarding our product and service capabilities follow:

Seating Systems

We develop and manufacture complete seating solutions and seat hardware systems for the global automotive industry.

|

Complete Seating Systems

• Reconfigurable Seat Solutions

(Auto, Heavy Truck, Bus)

• In-Vehicle Stowable Seats

• Ingress/Egress Solutions

• Comfort Systems

• Lightweight Seat Solutions

• Thin Seating

• Safety Systems Integration |

Seat Structures & Mechanisms

• Seat Structures (including High Strength Steel, Aluminum and Magnesium)

• Manual and Power Recliners

• Manual and Power Adjusters (Fore/Aft and Lift)

• Seat Attach Latches

• Specialty Mechanisms (Stow-in-Floor, Stand Up, Reversible, Push-Button Entry, Seat Memory) |

Foam & Trim Products

• Conventional Foam

• Recycled Foam

• Renewable Foam Formulations

• Black Foam

• Dual Firmness Foam

• Trim Covers (Cloth & Leather) |

The technologies and processes used in the manufacture of seating and seat hardware systems include: traditional “cut and sew” technology; manual and automated assembly; as well as our patented Multi-Material Mold-In-Place™ technology.

| 17 |

|

Table of Contents

Closure Systems

We engineer and manufacture closure systems and modules for the global automotive industry.

|

Door Modules

• Structural Door Modules

• Sealed Modules

• Hardware Trim Modules

• Integrated Trim Modules

• Integrated Inner Panel Modules

• Liftgate and Tailgate Modules

• Mid-Door Modules

• Complete Doors |

Power Closure Systems

• Power Sliding Doors

• Power Liftgates

• Power Decklids

• Anti-Pinch Strips |

Engineered Glass

• Manual and Power Truck & Van Sliding Windows

• Front and Rear Quarter Windows

• Liftglass Assembly

• Windshields and Backlights

• Fixed Roof Glass Modules

• Bus Windows | |||

| Window Systems

• Dual Rail Cable and Drum Systems

• Single Rail Cable and Drum Systems

• Convertible Quarter Glass

• Arm and Sector Systems |

Latching Systems

• Side Door and Sliding Door Latches

• Hood and Liftgate Latches

• Tailgate and Decklid Latches

• Cargo Door Latches

• Rear Access Door Latches |

Running Boards & Roof Racks

• Automated, Platform and Tube-Style Running Boards

• Functional and Cosmetic Roof Racks | ||||

| Sealing Systems

• Window Surround Modules

• Backlight, Belt, Windshield, Door Surround and Roof Drip Moldings

• Door, Inner and Outer Belt Seals

• Complete Convertible Sealing Systems |

Electronic Features

• Electronic Control Unit Design

• Obstacle Detection and Anti-Pinch

• Non-Contact Sensing |

Handle Assemblies

• Inside and Outside Handles | ||||

| Hinges & Rods

• Decklid, Hood and Convertible Hinges

• Torsion, Wood, Hood Prop and Door Latch Rods |

Composite Components

• Applied Door Headers

• Structural Metals and Plastic Components |

• |

The primary processes involved in the manufacture of closure systems and modules include: light stamping; injection molding; extrusion processes, such as co-extrusion, thermoset and thermoplastic extrusion; as well as manual and automated assembly.

|

18 |

Table of Contents

Body and Chassis Systems

We provide metal body systems, components, assemblies and modules, including complete vehicle frames, chassis systems and body-in-white systems, as well as related engineering services, for the global automotive industry.

|

Body Systems

• Complete Body-In-White

• Floor Pans

• Underbody Assemblies

• Door, Hood and Deck Assemblies

• Roof Panels

• Fender and Quarter Panels

• Tailgate and Liftgate Assemblies

• A, B, C and D Pillars

• Bumper Beams

• Door Intrusion Systems

• Heat Shields |

Chassis Systems

• Crossmember Assemblies

• Radiator Supports

• Shock Towers

• Engine Cradles

• Front and Rear Sub-Frame Assemblies

• Front and Rear Suspension Modules

• Control Arms

• Frame Rails

• Full Frame Assemblies |

Engineering & Tooling

• Program Management

• Program Engineering

• Computer-Aided Engineering (CAE) Design Verification

• Prototype Build

• Testing and Validation

• Tooling and Automated Systems

• Research and Development |

We employ a number of different forming technologies such as: hydroforming; stamping; hot stamping; roll forming; aluminum casting; draw bending; advanced welding technologies; as well as finishing technologies such as: e-coating; heat treating; and high temperature wax coating.

| 19 |

|

Table of Contents

Vision Systems

We design, engineer and manufacture vision systems for the global automotive industry.

|

Interior Mirrors

• Auto-dimming Glass

• Framed and Frameless Glass

• Telematics, Compass and Temperature Displays

• Rear Vision Video

• Garage Door Openers

• Electronic Toll Collection |

Exterior Mirrors

• Auto-dimming Glass

• Framed and Frameless Glass

• Integrated Cameras and Sensors

• Blind Spot Detection

• Power Folding and Power Extending Technologies

• Reverse and Forward Spotlight Lighting

• Ground Illumination & Projection Lighting

|

Actuators

• Mirror Adjustment

• Bend Lighting

• Active Grille Shutter

• Heating, Ventilating and Air Conditioning (HVAC) | |||

| Door Handle Illumination

• Pocket and Ground Illumination

• Projection Logo Lights |

Headlamps & Tail Lamps

• LED Lighting

• Halogen & High Intensity Discharge (HID) Reflectors

• Halogen & HID Projectors and Bi-Function Projectors |

Small Lighting

• Fog Lamps

• Centre High Mount Stop Lamps | ||||

The primary processes involved in the manufacture of our vision products include: electronics integration; injection molding; painting; as well as manual and automated assembly.

|

20 |

Table of Contents

Electronic Systems

We design, engineer and manufacture electronic components and sub-systems for the global automotive industry.

|

Driver Assistance Systems

• Automated Reverse and Parking Assistance (camera-based and ultrasonic)

• Semi-Autonomous Driving

• Automated Emergency Braking

• Surround View |

Secure Connectivity

• Cyber Threat Detection & Prevention

• Over-the-Air Updates

• Emergency Services (e-Call)

|

Electronic Controllers

• Body/Mirror

• Chassis

• Glow Plug

• Lighting

• Motor | |||

|

• Object / Lane Detection (including cross traffic recognition)

|

Head-Up Displays

|

|||||

| • Trailer Angle Detection

• Object and Lane Detection

• Traffic Sign Recognition |

• Combiner Head-Up Displays

• Windshield Head-Up Displays

|

|||||

|

• Lighting Automation |

||||||

The primary processes involved in the manufacture of electronics products include: surface mount placements of electronic components on printed circuit boards; as well as manual and automated assembly of electronic modules.

| 21 |

|

Table of Contents

Exterior Systems

We design, engineer and manufacture various exterior components and systems for the global automotive industry, including commercial truck product markets.

|

Fascia & Trim

• Front and Rear Bumper Fascias

• Energy Management Systems

• Spoilers & Grilles

• Rocker Panels and Claddings

• Decklid and Pillar Appliques

• Wheel Opening Moldings

|

Front End Modules

• Front End Carriers / Grille Opening Reinforcements

• Full or Partial Front End Modular Assemblies (Fascia, Cooling Components, Headlamps, Sensors, Wiring and Latches)

|

Liftgate & Exterior Modules

• Liftgate Modules

• Polycarbonate Roof Modules | |||

| Active Aerodynamics

• Hidden & Class A Active Grille Systems |

Lightweight Composites

• Hoods, Roofs & Decklids

• Fenders

• Structural Beams & Reinforcements

• Underbody Shields |

• | ||||

We utilize a number of different technologies and processes in connection with these products, including: molding technologies, such as injection molding, structural reaction injection, reaction injection, compression and thermoset molding; finishing processes, including painting, hardcoating, chrome plating, vacuum metallization and anodizing; and manual and automated assembly and sequencing.

|

22 |

Table of Contents

Powertrain Systems

We design, engineer and manufacture powertrain systems and components for the global automotive industry.

|

Transmissions

• Manual Transmissions

• Dual-Clutch Automatic Transmissions

• Hybrid Transmissions

• Electric Vehicle Transmissions |

Driveline Systems

• Transfer Cases

• Coupling Systems

• Actuators & System Control

• AWD/4x4 Disconnect Systems

• Rear Drive Modules (RDM)

• Front and Rear Axle Drives

• Power Take-Off Units

• Limited Slip Differentials

• Electric Drive Systems |

Fluid Pressure & Controls

• Engine Oil, Vacuum and Water Pumps

• Tandem Pumps

• Transmission Oil Pumps

• ePumps (Coolant, Oil, Purge & Vacuum)

• Mass Balancer Systems

• Electronic Cooling Fans

• Thermal Management Modules

• High Pressure Hydraulic Pumps

• Electric Cam Phasers

| |||

| Metal Forming Solutions

• Transmission Clutch Modules

• Clutch Hubs & Housings

• Die Casting Products

• Accessory Drives

• Oil Pan Modules

• Flexplates / Driveplates

• Planetary Carriers

• Geared Products

• Dampeners

• Electronic One-Way Clutches |

Engineering Services

• System Engineering and Architecture

• Vehicle, Engine & Drivetrain Engineering

• Electrics / Electronics / Mechatronics

• Simulation & Testing Services

• Technical Application Software & Support

• Prototyping & Low-Volume Production |

We employ a variety of different manufacturing capabilities and processing technologies in our powertrain operations, including: metal die-forming; flow-forming; stamping and spinning; synchronous roll-forming; die-spline rolling; precision-heavy stamping; fineblanking; aluminum die casting and precision machining; magnesium machining; plastic injection molding; welding; soft and hard processing of gears and shafts; rotary swaging; hardening; laser welding; manual and automated assembly; and end-of-line testing. We also possess extensive powertrain integration capabilities.

We conduct some of our powertrain operations through joint ventures, including a non-controlling, 50% voting (76.7% equity) partnership interest in the Litens Automotive Partnership (“Litens”), a partnership with certain members of its senior management. Litens is a leading supplier of highly-engineered drive subsystems and components. Its product offerings include accessory drive systems and products, such as auto tensioners and idlers, overrunning alternator decoupler assemblies, Torqfiltr™ crankshaft vibration control technology, isolating crank pulley assemblies and clutched waterpump pulleys and assemblies; timing drive systems and products, such as belt and chain tensioners and idlers, SmartSprocket™ tuned sprockets and clutched waterpump pulleys and assemblies; and other specialty products for vehicle start / stop subsystems. Litens has manufacturing operations in North America (Canada), Europe (Germany), Asia (China and India) and Rest of World (Brazil).

| 23 |

|

Table of Contents

Roof Systems

We design, engineer and manufacture vehicle roof systems for the global automotive industry.

|

Sliding Folding & Modular Roofs

• Roof Openings with Fixed C pillars

• Various Fabric Solutions

• Flash to the Roof Panels

• Rail-to-Rail Concepts

• Roof Openings Spanning the Entire Vehicle Width

• Roof Openings with Intermediate Positions |

Retractable Hard Tops

• Multi-Piece Modules

• Integration Services

• Design Services |

Soft Tops

• Classic Soft Tops

• Manual and Fully Automatic Soft Tops |

Processes employed in our roof systems operations include: “cut and sew” of complete fabric covers; backlight gluing; as well as manual and automated complete roof assembly.

Vehicle Engineering & Contract Assembly

We provide components, systems, vehicle engineering and contract vehicle assembly services for the automotive industry. We are a leading brand-independent assembler of complete vehicles, and an experienced engineering and manufacturing partner.

|

Engineering Services

• Design & Vehicle Concepts

• Complete Vehicle Development & Integration

• Systems & Modules Development

• Safety Engineering

• Prototype and Low-Volume Production

• Test Bed Services

• Hybrid & Electric Vehicles |

Contract Manufacturing

• Vehicle Contract Manufacturing

• Door Modules

• Industrial Services |

Fuel Systems

• Fuel Tanks (Steel, Plastic & Aluminum)

• Tank Filler Pipes (Steel & Plastic)

• Diesel Misfueling Protection

• Fuel, Oil and Cooling Caps

• Selective Catalytic Reduction (SCR) Tank Caps

• Compressed Natural Gas (CNG) and Hydrogen Gas (H2) Fuel Systems |

Processes employed in our vehicle engineering and contract assembly operations include: manual and automated welding; bonding and riveting; manual and automated painting/coating (dipped and sprayed) and sealing; cycler testing; as well as manual and automated assembly.

Tooling / Engineering / Other

We design, engineer and manufacture tooling for our own use, as well as for sale to our customers. Additionally, we provide engineering support services, independent of particular production programs on which we may have production sales.

|

24 |

Table of Contents

We have historically emphasized technology development and product and process innovation as a key element of our business strategy. See “Section 2. Our Business Strategy – Operational Priorities”. We expect that our involvement in the development of innovative product and process technologies in cooperation with automobile manufacturers will increase as automobile manufacturers further involve automotive suppliers in the vehicle development process.

Our research and development activities are conducted through our “innovation development process” or “IDP”. These activities involve close collaboration between our Corporate R&D group, under the global direction of our Executive Vice-President and Chief Technology Officer and each of our operating groups.

The IDP involves a multi-stage process aimed at turning ideas into innovations that can ultimately be commercialized. The initial stage of the process is designed to foster generation of ideas and includes, among other things: identification, understanding and analysis of social, digital, demographic, regulatory, industry and other trends which may create demand for and thus drive development of new automotive technologies; review of academic research; and automotive customer input.

Concepts that progress past this initial stage are further evaluated, including with respect to: fit with our innovation pillars (discussed below); commercialization potential; as well as risks and challenges to further development. Selected innovations then progress through subsequent stages towards product or process realization, validation and, eventually, product launch.

To augment our own innovation efforts and gain access to innovative thinking outside of our company and the automotive industry we are also open to working with potential inventors, entrepreneurs, universities and start-up companies to help bring innovative ideas to market. We currently collaborate with technical institutions, the venture capital community and over 50 universities in Canada, the U.S. and Europe to develop innovative solutions to unmet needs in the automotive industry. In support of these “open innovation” efforts, we have undertaken a number of initiatives and investments in recent years, including the following:

| • | we partnered with Techstars, Ford and Verizon Telematics to support the Techstars Mobility, driven by Detroit program, a mentorship-driven technology accelerator that aims to create a Metro-Detroit hub for bringing new technologies to market that incorporate mobile devices, wireless connectivity and cloud data resources into vehicles. The first 10 startup companies were selected in June 2015 and have received financial assistance, intensive business training and access to corporate experts to act as mentors. |

| • | we partnered with Argus Cyber Security Ltd. to deliver a solution that addresses vehicle security concerns related to cyber-attacks in the growing vehicle connectivity market. Through this partnership, Magna brings a comprehensive range of automotive electronic systems, as well as safety-critical system design expertise while Argus delivers its Intrusion Prevention System (IPS) solution and cloud-based monitoring service that protects a vehicle’s critical on-board systems from being hacked. Unlike typical solutions that simply set up a firewall, the Magna/Argus system actively monitors for suspicious and/or potentially malicious activity for early detection and prevention. The system allows for a complete, integrated package that is ready-to-embed and can be seamlessly integrated into any vehicle product line without changes to existing vehicle architecture; and |

| • | we made a number of venture capital investments in emerging technology companies, including investments related to radar-based driver assistance systems and radar-based collision mitigation and vehicle-to-vehicle communication systems. |

| 25 |

|

Table of Contents

Innovations

Innovation is a foundation of Magna’s past success, an important factor in our competitiveness, a key operational priority and a critical element of our business strategy. Our current strategic focus on innovation is aimed at developing products and processes that fit within one of the four innovation pillars discussed below. Some examples of recent innovations within such pillars follow:

EYERIS™ GENERATION 3.0 VISION SYSTEM The latest generation of our EYERIS™ vision system builds on the innovative technology of previous

EYERIS platforms, incorporating improved field of view as well as enhanced camera resolution. The EYERIS Gen 3.0 will be featured on Fiat Chrysler’s 2016 Jeep Grand Cherokee and the upcoming 2017 Chrysler Pacifica. As part of a fusion system

with radar in the front of the Jeep vehicle, the system provides lane keeping assistance, automatic high beams, automatic emergency braking and adaptive cruise control.

CAMERA-BASED AUTOMATIC EMERGENCY BRAKING (AEB) SYSTEM

We developed the automotive industry’s

first camera-based automatic emergency braking (AEB) system. The system, which will be available on the 2016 Chevrolet Volt features a forward-collision warning and automatic emergency braking feature that alerts the driver to slowing vehicles in

their path and applies the brakes to slow or even stop the vehicle to mitigate or avoid a collision. The AEB system works with or without driver involvement by processing data from a forward-facing camera that is installed behind the vehicle

windscreen. The camera, combined with a data processor, provides a complete, real-time image of the road ahead. The system, which can also be combined with radar and other sensors in certain vehicles, operates when driving forward between 8 km/h (5

mph) and 60 km/h (37 mph) and can detect vehicles up to approximately 60 metres (197 feet) away.

TRAILER TOW BACK-UP ASSIST SYSTEM We continued to build on our leadership in

camera-based driver assistance systems with the rear view camera and image processing technologies featured on the 2016 Ford F-150 Pro Trailer Backup Assist System. The system allows a driver to more conveniently and safely back-up a trailer with an

automated system in which the driver steers the trailer using a control knob, while the truck steers its own wheels. The first-to-market system is enabled by our rear view camera which measures the angle between the truck and trailer, as well as our

image processing algorithm, which calculates trailer angle by detecting target decals on the trailer. The Ford Back-Up Assist System was selected as the top Consumer Electronics Show (CES) 2016 Innovation Award honoree in the Vehicle Intelligence

category.

ACTIVE AERODYNAMIC (ACTERO™) SYSTEMS We are a leader in the development of active aerodynamic systems. Building on the success of our innovative active grille

shutters and a growing demand for improvements in vehicle aerodynamics, we have expanded our product development to include active front deflectors, active liftgate spoilers and active tailgate and underbody panels that, like the active grille

shutter, are designed to improve fuel economy by redirecting air_ow to reduce vehicle drag

GETRAG DUAL-CLUTCH TRANSMISSION Our 7DCT300 is a dual-clutch transmission designed

for front-transverse installation in mid-sized and compact vehicles. It is highly adaptable for a variety of vehicle applications, including sports models and is suitable for vehicles with all-wheel drive and those designed with start/stop and

sailing capabilities. The technology allows for increased comfort and greater fuel efficiency due to its fully demand-controlled actuation and innovative “Smart Actuation” for wet clutches. The 7DCT300 is also up to 10% lighter then

predecessor transmissions while offering up to 20% higher torque capacity.

CARBON FIBER HOOD

We

manufacture the automotive industry’s first volume production of carbon fiber hoods. The hoods, which appear in the 2016 Cadillac ATS-V and CTS-V high performance model vehicles, are 27% lighter than aluminium hoods and 72% lighter than steel

hoods.

ALUMINUM OIL PANS & HIGH-PRESSURE ALUMINUM DIE CAST COMPONENTS

Jointly with General

Motors, we developed transmission oil pans made from aluminum. The oil pans, which are featured on the Cadillac CT6 Sedan, are approximately 2.5 to 3 pounds lighter than traditional steel oil pans, a weight savings of approximately 60%. We worked

closely with GM to refine the design for optimum formability in order to stamp the pans into the required shape within the space allowed.

Using a high-pressure die-casting

process, we also manufacture 13 aluminum die-cast components for the body structure of the Cadillac CT6. One of the 13 components, a front body hinge-pillar, uses a one-piece die-cast construction to replace a 35-part stamped and welded

construction, reducing the number of components in the entire body by 20%. The high-pressure vacuum die-casting process allows for the manufacture of aluminum components with thinner walls (down to 1.8 mm) which increases structural strength,

vehicle performance and reduces weight. The reduction in the number of parts also reduces assembly complexity for our customer.

|

26 |

Table of Contents

In addition to the innovations described above, a number of our innovations have received accolades and awards, including the following:

| • | Our PureView™ Seamless Sliding Window, a first-to-market window design that eliminates the vertical seams that mark the edges of a conventional pick-up truck rear sliding window to create a flush exterior appearance, was selected as the winner of a 2015 Automotive News PACE Award in the product category. |

| • | Our SmartLatch™ electronic side-door latch an industry first innovation that requires no cables, rods or moving handles in the door, has been selected as a finalist in the product category for the 2016 Automotive News Pace Awards. |

| • | The Center of Automotive Management (CAM) and PricewaterhouseCoopers (PwC) awarded us the Automotive INNOVATIONS Award 2015 as the most innovative supplier in the Drivetrain Technology category. The award honoured two of our technologies in particular: |

| o | Our FLEX4™ technology, the first all-wheel drive (AWD) disconnect system that automatically shifts between true two- and four-wheel drive and reduces fuel consumption by up to ten percent compared to other AWD systems; and |

| o | Our MILA Blue concept vehicle, a natural-gas powered A-segment lightweight vehicle that produces less than 49g CO2/km. |

| • | The U.S. Department of Energy (DOE) awarded its Distinguished Achievement Award to Ford and Magna in connection with our collaborative development of the Multi-Material Lightweight Vehicle (MMLV) concept, a redesigned 2013 Ford Fusion which uses advanced material solutions to achieve reductions in weight, energy use and greenhouse gas emissions. |

| 27 |

|

Table of Contents

Facilities

As at December 31, 2015, we had the following manufacturing and product development, engineering and sales facilities:

| Geographic Region | Manufacturing | Product Development, Engineering and Sales

| ||

| North America

|

129

|

23

| ||

| Europe

|

106

|

35

| ||

| Asia

|

44

|

23

| ||

| Rest of World

|

13

|

2

| ||

| TOTAL |

292

|

83

| ||

Our manufacturing facilities occupied approximately 59 million square feet, of which approximately 64% was leased from third parties (including 34% leased from Granite Real Estate Investment Trust (“Granite REIT”), a Canadian-based, publicly-traded real estate investment trust). The remaining 36% of manufacturing facilities were owned by us. Most of our manufacturing facilities maintain an in-house tooling capability with a staff of experienced tool and die makers. We are operating many of our manufacturing facilities on a multi-shift basis.

Our product development and engineering facilities occupied approximately 2.7 million square feet, of which approximately 84% was leased from third parties (including 32% leased from Granite REIT) and the remaining 16% was owned by us.

Leases typically have terms of at least five years with one or more options to renew. Among other terms, our leases typically require us to return the facilities to the condition in which we received them at start of the lease (reasonable wear and tear excepted). From time to time, the cost of doing so may be significant due to such factors as the length of the lease period, the nature of the manufacturing operations, the extent of modifications made to the lease premises over the term of the lease and other factors.

Key Commodities

We purchase the majority of our commodities from regional suppliers where we do business. Factors such as price, quality, transportation costs, warehousing costs, availability of supply and timeliness of delivery have an impact on the decision to source from certain suppliers. We also purchase some key commodities offshore when shortages occur or when we choose to source one supplier for a global program. Prices for certain key commodities used in our parts production, particularly steel and resin, continue to be volatile. Approximately two-thirds of our steel is acquired through resale programs operated by automobile manufacturers and the balance is generally acquired through annual or six month contracts. Under customer steel resale programs we are not exposed to steel price increases, thus helping to manage our production costs. Most of our resin purchases fluctuate directly with market indexes, although we do participate in some customer resale programs and also typically enter into financial hedges on a small portion of our resin purchases. To date, we have not experienced any significant difficulty in obtaining supplies of parts, components or key commodities for our manufacturing operations. Consistent with lean manufacturing principles, we do not carry inventories of key commodities or finished products significantly in excess of those reasonably required to meet production and shipping schedules.

|

28 |

Table of Contents

As at December 31, 2015, we employed approximately 129,000 people as follows:

| Geographic Region

|

Number of Employees

| |

| North America

|

67,275

| |

| Europe

|

43,100

| |

| Asia

|

15,075

| |

| Rest of World

|

3,525

| |

| TOTAL

|

128,975

| |

Human Resource Principles

Employee Equity Participation and Profit Sharing Program

To ensure employees participate in profits and share ownership, a key principle expressed in our Employee’s Charter, we have a long-standing practice of allocating 10% of our annual pre-tax profits before profit sharing to eligible employees under our employee equity and profit participation program.

Management Incentive Compensation

We believe that the managers who run their business units as if they owned them are best able to generate strong operating and financial performance. In order to create such an entrepreneurial culture within the framework of a large, global, public company, we maintain a decentralized operating structure which gives significant operational autonomy to our managers at each of the three primary levels of management – Divisional, Group and Executive. Additionally, we employ the following basic compensation principles for management:

| • | minimal fixed compensation in the form of salaries; |

| • | annual profit-based incentive bonuses, portion of which is deferred for almost three years and delivered in the form of equity; |

| • | long-term incentives in the form of stock options which, in the case of our most senior Executive and Group managers, are performance-vested; and |

| • | the absence of pensions or retirement benefits. |

Our compensation system also incorporates a number of other important elements, including significant equity maintenance requirements for senior management, as well as various compensation risk management tools to promote responsible decision-making. For a detailed discussion of our executive compensation, see “Compensation and Performance Report” and “Compensation Discussion & Analysis” in our Circular.

Employee’s Charter

We are committed to an operating philosophy based on fairness and concern for people. This philosophy is part of our “Fair Enterprise” culture in which employees and management share in the responsibility to help ensure our success. Our Employee’s Charter embodies this philosophy through the following principles:

| • | Job Security – Being competitive by making a better product for a better price is the best way to enhance job security. We are committed to working together with our employees to help protect their job security. To assist in this regard, we provide job counselling, training and employee assistance programs to our employees. |

| 29 |

|

Table of Contents

| • | A Safe and Healthful Workplace – We strive to provide our employees with a working environment which is safe and healthful. |

| • | Fair Treatment – We offer equal opportunities based on an individual’s qualifications and performance, free from discrimination or favouritism. |

| • | Competitive Wages and Benefits – We provide our employees with information which enables them to compare their total compensation, including wages and benefits, with those earned by employees of direct competitors and local companies with which an employee’s Division competes for labour. If total compensation is not competitive, it will be adjusted. |

| • | Employee Equity and Profit Participation – We believe that our employees should share in our financial success. |

| • | Communication and Information – Through regular monthly meetings between management and employees and through publications, we provide our employees with information so that they know what is going on in the company and in the industry. |

| • | Employee Hotline – Should any of our employees have a problem, or feel the foregoing principles are not being met, we encourage them to contact the Hotline to register their complaints. Employees do not have to give their names, but if they do, it is held in strict confidence. Hotline investigators will respond to employees. The Hotline is committed to investigating and resolving all concerns or complaints and must report the outcome to our Global Human Resources Department. |

Human Resource Policies