Corporate Presentation

Welcome to Orbotech’s

Investor and Analyst Day

June 8

th

, 2010

Exhibit 99.1 |

Corporate Presentation

2

Agenda

Company Overview

9:00 –

12:30

Market Analysis

12:30 –

1:10

DisplaySearch

Prismark

Lunch

1:10 –

2:00

Product Demonstrations

2:00 –

3:45

Conclusion

3:45 |

Corporate Presentation

Orbotech Company Overview |

Corporate Presentation

4

Disclaimer

Except

for

historical

information,

the

matters

discussed

in

this

presentation

are

forward-looking

statements

that

are

subject

to

certain

risks

and

uncertainties

which

could

cause

the

actual

results

to

differ

materially

from

those

projected,

including

industry

trends,

the

timing

and

strength

of

Orbotech’s

or

competitors’

new

product

and

service

offerings,

the

mix

of

product

and

service

revenues,

changes

in

Orbotech’s

or

competitors’

business

or

pricing

strategies,

changes

in

the

prevailing

political

and

regulatory

framework

in

which

Orbotech

(the

“Company”)

operates

or

in

economic

or

technological

trends

or

conditions,

including

currency

fluctuations,

inflation

and

consumer

confidence,

on

a

global,

regional

or

national

basis

and

other

risks

detailed

from

time

to

time

in

the

Company’s

reports

filed

with

the

SEC.

The

Company

assumes

no

obligation

to

update

the

information

herein

contained,

except

as

required

by

law.

Private Securities Litigation Reform Act of 1995

Safe Harbor |

Corporate Presentation

Assets and Strategy

Rani

Cohen

President and CEO |

Virtually Every Electronic Device in the World

Is Produced Using Orbotech Systems |

Corporate Presentation

7

Over 25 Years of Leadership

A world leader in

yield-enhancing

and production solutions for

the electronics industry:

Bare PCB Production

Flat Panel Displays

Other Markets

Nuclear Medical Imaging –

A leading

provider of specialized application products

Check Processing & Business Process Outsourcing –

A leading provider of recognition software and services

A leading provider of machine vision, electro-optics,

artificial intelligence and imaging technologies |

Corporate Presentation

8

World Wide Installed Base

Medical Imaging

2,000

Recognition

1,000

Bare PCB Production

9,000

FPD Manufacturing

1,400

Installations |

Global

Infrastructure •

Over 1600 employees worldwide

in

more than 30 locations close to customers

Israel

610 Employees

Headquarters

Main R&D Center

& Production Center

Israel

610 Employees

Headquarters

Main R&D Center

& Production Center

Europe

150 Employees

6 Offices

3 CS Centers

3 R&D Centers

3 Production Centers

Europe

150 Employees

6 Offices

3 CS Centers

3 R&D Centers

3 Production Centers

N. America

220 Employees

2 Offices

4 CS Centers

1 R&D Center

1 Production Center

N. America

220 Employees

2 Offices

4 CS Centers

1 R&D Center

1 Production Center

Japan

100 Employees

1 Office

1 CS Center

1 R&D Center

Japan

100 Employees

1 Office

1 CS Center

1 R&D Center

Pacific

550 Employees

18 Offices

20 CS Centers

1 R&D Center

2 Production Centers

Pacific

550 Employees

18 Offices

20 CS Centers

1 R&D Center

2 Production Centers |

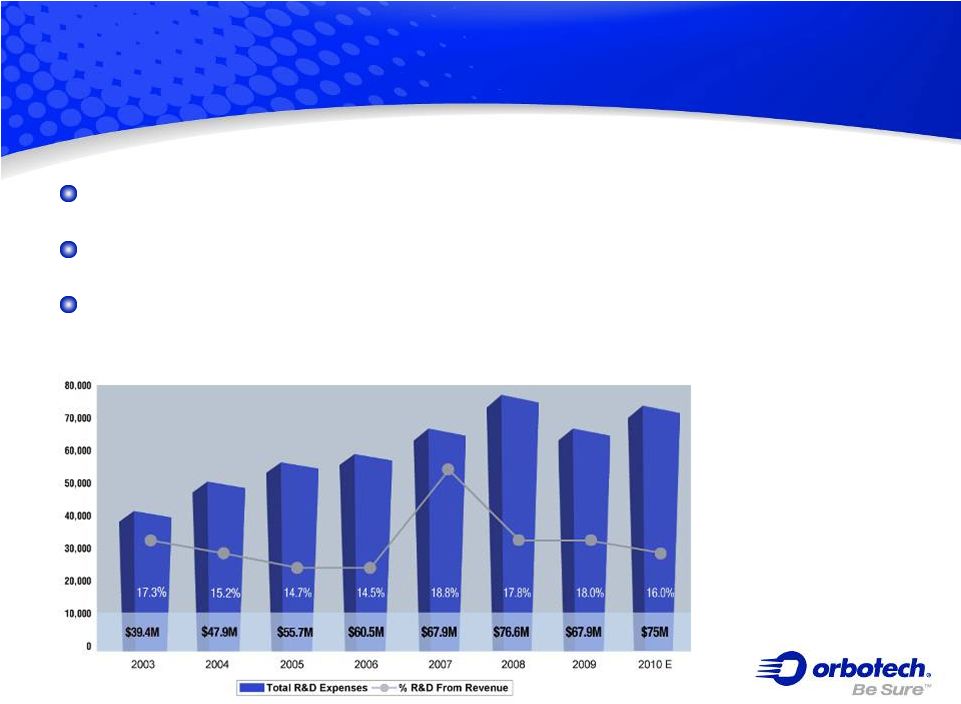

Continuous R&D Investment

Significant product sales are from products introduced recently

400 Scientists and Engineers

Commitment to continued investment despite economic downturns

|

11

Growth Through Diversification

New Markets for Core

Technologies |

Corporate Presentation

12

Key Success Factors |

Corporate Presentation

13

Main Contributors

Technological innovation

Operational excellence

Professional customer support

Niche markets –

gain leadership

position

Prudent financial management |

Corporate Presentation

14

Critical Factors

Ability to identify, change and adjust

Outsourcing

Shift to China

Products

Solutions

Local

Global

Product Life Cycle

People |

Corporate Presentation

15

Looking Ahead |

Corporate Presentation

16

The Environment

External

Global economic situation

Cyclicality, market shifts

Competitive landscape

Internal

National, cultural diversity

Truly global –

operations, R&D, distribution

Two big, different divisions together with “start-ups”

|

Corporate Presentation

17

Our Strategy

Technological leadership and

innovation

Customer focus

Operational excellence

To be the leader in every industry we serve

Diversification

within

our

markets

New markets |

Corporate Presentation

18

Well Positioned for Market Growth

Source: Management estimates

Orbotech’s Business is Leveraged

to

Electronics Markets that are Expecting Growth… |

Corporate Presentation

19

Well Positioned for Continued Success

Leadership in all current industries

Significant on-going R&D investment

Proven ability to leverage:

Core technology competencies

Extensive global infrastructure

Operational performance and execution

Financial strength |

Corporate Presentation

20

Thank You |

Corporate Presentation

Printed Circuit Boards

Richard Klapholz

Corporate VP and President

PCB Division |

Corporate Presentation

22

Orbotech Presence in PCB

Presence in all leading PCB shops worldwide

Proven solutions for multiple applications and production levels

Recognized supplier of “must-have”

enabling technologies for

advanced production |

Corporate Presentation

23

PCB Market Overview

Pacific -

Fast recovery driven by stronger

demand + growing attractiveness

Utilization 85% + for computing, communication

and consumer products

Smartphone growth pushing expansion and

advancement in HDI and FC-CSP

Intel CULV technology increases HDI penetration to PC

Japan –

Slowly recovering

Capacity utilization has recovered to 80%

Capacity

expansions

continue

–

overseas

West -

Strongly hit by the financial crisis

Recession terminated any volume production

Industry maintained by low-volume niche markets

Source: Management estimates |

PCB

Market Drivers Equipment Demand Capacity & Capability

Mobile phones

High continued unit growth expected

PCs

Mini-note PC’s (“NetBooks”)

as a significant new category

Consumer electronic “hits”

Flat screen TVs

e-Books

Sources: Industry sources and management estimates

(M Units) |

Corporate Presentation

25

PCB Market Growth

Demand Driven by Growth in Consumer Electronics

New PCB plants are built

LDI

CAM & Engineering

LP

AOI

Verification

AOR

Inkjet |

PCB

Market Trends Technology

Smart phones drive advanced HDI

Fine

pitch

packages

Finer

lines

and

spaces

Smaller vias

Increase in HDI usage in PCs

6/6 L/S in Intel’s roadmap for 2014

Prismark view: L/S won’t go below 10/10µm

Strong growth in FC-CSP segment

Sources: Industry sources and management estimates

26

400µm |

Corporate Presentation

27

PCB Market Trends

Technology Example: iPhone

3G

One Main HDI PCB, Several Flex, Many IC Substrates

Source: Prismark (04/’

09) |

28

PCB Market Trends

Technology Example: iPad

Main board using 1+8+1 HDI construction

Source: Prismark Discovery: iPad

(04/’10)

|

Corporate Presentation

29

2008-2010 PCB Volume by Region [$M]

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

2008

2009

2010F

PCB Market Trends

Regional Growth -

Mainly in Pacific in 2010

Source: Prismark (05/’

10) NT Information (05/’10)

Growth is primarily in China

China’s Production will Exceed 2008 Peak

PCB Volume Growth by Region

7.7%

5.5%

8.2%

15.2%

8.0%

13.5%

9.5%

-17.5%

-30.1%

-18.4%

-4.7%

-1.6%

-19.9%

-4.4%

Americas

Europe

Japan

China

SE Asia

Taiwan

S.Korea

2009

2010F |

Corporate Presentation

30

Ensure Advanced Product Capabilities

Keep pace with pattern miniaturization

Gain long-lasting investment protection

Minimize Cost of Operations

Guarantee highest production yields

Save on material and time

Maximize Productivity

Assure highest machine uptime

Benefit from digital production versatility

PCB Manufacturers’

Critical Requirements

“Increasing Business Profitability” |

Corporate Presentation

31

Bare PCB Solutions |

Corporate Presentation

33

PerFix™

Automated Optical Repair

Accurately repairs any type of

excess copper (short)

on fine-line PCBs

Overcomes traditional limitations

of manual repair

Opportunity for significant

customer cost-savings

by reducing panel scrap

The Industry’s Only Automated Solution |

Corporate Presentation

34

Enabling technology for complex

and advanced applications

Increased adoption for

high-end

mainstream applications

Used in all segments

including

packaging and solder mask

Paragon™

Laser Direct Imaging (LDI) Systems

LDI Becoming a “Must Have”

Solution |

Corporate Presentation

35

LDI: The New Photolithography Industry Standard

1990

2000

2010

2020

Automatic

Exposure

Effective T/P

Increased need for

patterning digitization

Improved LDI cost of

ownership

Laser Direct Imaging

will increasingly replace Automatic

Exposure at all production stages |

Corporate Presentation

36

Sprint™

Inkjet Legend Printers

Next Generation Solution

High speed, high accuracy direct

legend imaging

Integrated UV ink curing

Prints fine features with tight registration

requirements and high yield

Significantly cuts cycle time –

cost effective

Supports the use of multiple commercial inks |

Corporate Presentation

37

Future Annual Total

Addressable Market (TAM)

Near

Far

Legend

PCB

Soldermask

PCB

Etch Resist

PCB

Active Printed

Electronics

Full PCB

Production

Embedded

Passives PCB

Inkjet for Electronics –

The Vision

Inkjet will become a major patterning

technology in Electronics production |

Corporate Presentation

38

PCB Market Outlook

5-10 Year Horizon

All additional exposure capacity for

advanced PCB’s will be LDI-based

The LDI revolution has just started

All legend printing will digitalized

No more “old”

silk screen printing

Inkjet as a major imaging technology

in PCB manufacture

All PCB makers will have moved

(at least partially) to digital repair

technologies

Sources: Management estimates |

PCB

Market Outlook The Digital Path

AOI

CAM

LDI

Used by over 70% out of top 25

makers; more than 200 customers

Automated Optical Repair

Pre Engineering

Orbotech has the vision, capabilities and endurance to

commercialize innovative production technologies

Digital Production will play a larger

role in the future PCB production

Used by virtually all PCB makers

Used by dozens of PCB makers

Used by virtually all PCB makers

Used by virtually all PCB makers

Best selling Inkjet solution

The

only

automated

repair

solution

in

the market

New Manufacturing Solutions

Inkjet

Laser Plotter |

Corporate Presentation

40

Thank You |

Corporate Presentation

Flat Panel Displays

Jay Cho

VP/GM Tester & Repair Business Group

FPD Division |

Corporate Presentation

42

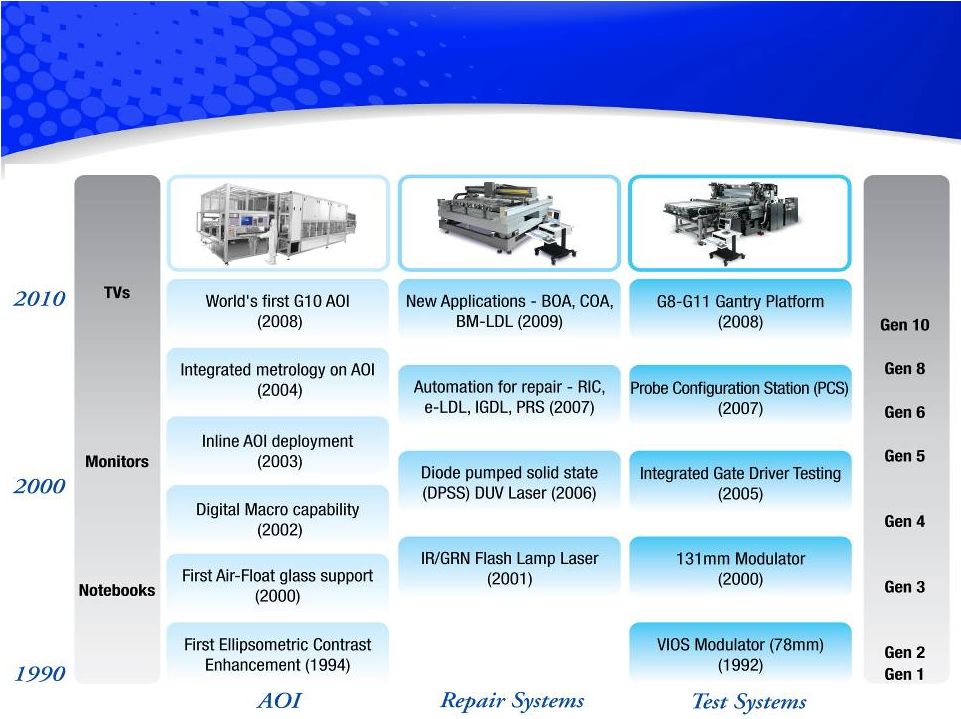

Orbotech is a world leader in yield management

Automated Optical Inspection (AOI)

Test

Repair

Flat Panel Displays |

Corporate Presentation

43

Orbotech Presence in FPD

Presence in all LCD fabs

Proven solutions for all generations

All platforms extendable to any & all glass sizes, support niche

applications as well as mainstream LCD |

Corporate Presentation

44

FPD Market Overview

LCD

CAPEX

driven

sales

–

in

turn

driven

by Large Area (esp. TV)

Supply Chain drives cyclicality

LCD Equipment TAM:

~$10Bn avg

tool spending

~$1Bn of which is inspection, test,

measurement and repair

Main trends: Consumer demand growth,

cost & pricing pressures, product innovation

$6Bn~$12Bn/year

total LCD spending

Sources: Industry sources and management estimates

TFT Array Manufacturing

~50%

Color Filter

Manufacturing

~22%

Cell

Manufacturing

~22%

Module

Module

~6%

~6% |

Corporate Presentation

45

FPD Market Outlook

Source: DisplaySearch

May 2010

Strong recovery 2010+2011

2010 CAPEX: over $13Bn

Expected similar

investment level in 2011

Based largely on China

Investment plans

Our own TAM –

out of above total spending:

~$350m/year out of ~$1Bn total TFT Test, Inspection and

Repair |

Corporate Presentation

46

FPD Market Outlook

Regional Growth

Source: DisplaySearch

April 2010

Source: DisplaySearch

April 2010

Significant increase

in Chinese

investments |

Corporate Presentation

47

Xining

Ürümqi

Lhasa

Kunming

Chengdu

Chongqing

Nanning

Guangzhou

Hong Kong

Fuzhou

Changsha

Xi‘an

Lanzhou

Yinchuan

Taiyuan

Tianjin

Hailar

Qingdao

Nanchang

Haikou

Shiquanhe

Kashi

Guiyang

Taipei

CATIC (SVA-NEC)

Shanghai G5

BOE OT

Beijing G5

IVO

Kunshan

G5

Wintek

Suzhou G3

Century Display

Shenzhen G5

Truly

Shanwei

G2.5

Tianma

Shanghai G4.5

BOE

Chengdu G4.5

Tianma

Chengdu G4.5

BOE B3 -

Hefei

Hefei

Zhengzhou

FPD Customer Base in China |

48

FPD Market Outlook

2010-2011 Highlights

Xining

Ürümqi

Lhasa

Kunming

Chengdu

Chongqing

Nanning

Guangzhou

Hong Kong

Fuzhou

Changsha

Xi‘an

Lanzhou

Taiyuan

Tianjin

Hailar

Qingdao

Zhengzhou

Hefei

Nanchang

Haikou

Shiquanhe

Kashi

Wuhan

Guiyang

Taipei

BOE B4 –

Beijing

Largest Opportunity

LG P8E and P7 -

Korea

SEC T8-1 and T8-2 -

Korea

Chinastar

(CSOT) -

Shenzen

AUO 7K G7.5 -

Kunshan

Corporate Presentation

48 |

FPD

Market Drivers Demand Growth Fuels Investments |

Corporate Presentation

50

FPD Market Trends

Technology I: Increase Consumer’s Value

TV

LED Backlight -

improved

contrast & power consumption

3D TV –

based on 240Hz

sequential R/L + active eyeglasses

IT Segment

Touch for mobile IT -

proliferation of lower cost ,

higher performance

Touch technologies

Small Displays

AMOLED: eg

in Google Nexus One |

Corporate Presentation

51

FPD Market Trends

Technology II: Decrease Costs & Price

Across the board

Multiple design & manufacturing cost reduction strategies

Significant cost-downs expected for larger size screens

TV-specific

4-primary Color –

improved brightness, power,

and Backlight cost (most expensive component)

IT Segment

Gate Driver Integration on Glass

Migration to G7 and larger (prev. for TV’s) |

Corporate Presentation

52

FPD Solutions |

Corporate Presentation

53

FPD Automated Optical Inspection (AOI)

In-line and off-line configurations

Models for all generations

Unmatched defect detection with

extremely accurate classification

at the highest throughput rates

Unique image acquisition and

image processing technologies

Industry’s Best Selling AOI Solutions |

Corporate Presentation

54

FPD Testers

Industry-Leading Solution

Functional equivalence of semi-

finished panel to check electrical

functionality

Unique photo-voltaic

system,

IP protected

Quality assurance for 100% panels

Crucial QA step for yield/quality |

Corporate Presentation

55

FPD Repair Systems

Production-proven Technology Leader

Laser cutting of electrical shorts

Multiple laser wavelengths

applied via imaging system

Enhanced with automated defect

classification and repair strategy

Directly increases product yield |

FPD

Roadmap In Sync with Market |

Corporate Presentation

57

FPD Market Outlook

The Yield Enhancement Path

Leadership Through Product Innovation and Customer Focus

Corporate Presentation

57 |

Corporate Presentation

58

Thank You |

Corporate Presentation

Break |

Corporate Presentation

Recognition Software

Barry Cohen

Co-General Manager

Orbograph |

Corporate Presentation

61

Recognition Solutions

A leading provider of recognition-centric

software and services for the check

processing and forms processing markets

Converting handwritten information into

intelligent electronic data

Processing billions of checks and forms

annually

Orbograph Ltd. |

Corporate Presentation

62

Orbograph

Presence

More

than

1000

financial

institutions

use

Orbograph

software

Used in 20 out of 30 of the top U.S. banks that have check

processing operations

Recognized as best-in-class industry leader and innovator

|

Corporate Presentation

63

Secure Internet Connection

Orbograph

Key-Pay Hub

Orbograph

Key-Pay®

Workflow

Images captured (Distributed

& Central)

Back-office recognition

Snippets of image

routed to Key-Pay Hub

Image Capture

Application

Orbograph

Did the engine

read the item?

Result enhancement

Data verification

Average processing

time: 90 seconds

YES

NO

Enhancement Logic

NO

YES

Clip: |

Corporate Presentation

64

Check Processing Automation

Designed to reduce costs from check

processing workflows by as much as

40% |

Images captured

(Distributed & Central)

Automation Services

(recognition)

Data verification

Est. processing window:

1-10 minutes

Field snippets

routed to Key-Pay Hub

Enhancement Logic

Back

Counter/

Branch

Teller Capture

Centralized

Capture

Key Pay Hub

Enhancement

Logic

Data

Verification

Successfully Processed:

High Confidence Items

Low Confidence

Items in Process

A

B

B

Orbograph

Key-Pay Technology |

Corporate Presentation

66

Recognition-based solution designed to

protect against fraudulent check transactions

Fraud Prevention |

Corporate Presentation

67

Data Mining for Marketing

Utilize check image data to generate

focused customer lists for direct marketing

campaigns |

Forms

Processing Automation Automating the labor-intensive manual

processing of hand-written forms

Maximize efficiencies for organizations

overwhelmed with data entry and data

correction requirements

Growth area for Orbograph

Corporate Presentation

68 |

Corporate Presentation

69

Orbograph

Business Model

Sold primarily through industry resellers as

part

of

larger

integrated

solution

-

some

direct sales

Recent shift from selling licenses to

software as a service (SaaS) model

Addresses market need for increased

efficiency, lower labor costs and reduced

software capital investment

Provides recurring revenue stream

Combining Creative Technological

Deployment

with Innovative Business Models |

Corporate Presentation

70

Thank You |

Corporate Presentation

Solar Power

Wendell Blonigan

CEO

Orbotech LT Solar |

Corporate Presentation

72

Solar Power

Orbotech LT Solar, LLC

Recent joint venture with LT Solar

Based in San Jose, CA

Involved in Crystalline Silicon Photovoltaic

(c-Si PV) manufacturing process

Employs some of the most talented

professionals in this field and experienced

management team |

Q3/10

Q4/10

Q1/10

2005

2006

2007

2008

2009

2010

2011

Core I/P & Technology

Development

System & Process

Development

Product

Development

Product

Launch

LT Solar Formed

Core IP Developed

PHTN / LT Solar JDP

PHTN / LT Solar JDP Complete

PHTN Lab Facility Complete

ORBK Acquires PHTN

Orbotech LT Solar, LLC Formed

OLTS Evolution

Product and Company Timeline

ORBK has majority stock

holding in OLTS

OLTS 100% funded by

ORBK and fully

consolidated in results

Corporate Presentation

73 |

PV

Industry

-

Supply

Chain

Wafer Based PV Modules

Raw material:

Silicon

Silicon purified,

conditioning in ingots

& then blocks

Sawing of

blocks to

obtain wafers

Solar cell

Obtained from

Wafer processing

Assembling of

cells in a module

Integration of

the module in

a system |

Corporate Presentation

75

The PhotoVoltaic

Market

Solar Electric Energy

installations have consistently

grown by 20-25% annually,

forecasted to accelerate to 40%

Photovoltaic equipment forecast

to generate revenues of

$2.5 billion in 2010

In 2008, our targeted equipment

segment was $400M

We are researching additional

areas to apply our technology

and expertise

Sources: Management estimates and Solarbuzz, Yole

Development, EPIA, Navigant Consulting

40%

CAGR |

Corporate Presentation

76

Crystalline Silicon PV Manufacturing

Capacity

Sources: Management estimates and Solarbuzz, Yole

Development, EPIA, Navigant Consulting

Crystalline Silicon continues

to be the dominant technology

in PV

New capacity investments

forecasted between 3 to 5 GW

annually, with an installed

capacity CAGR of >30%

In our target equipment segment,

each GW of capacity generates

$100M

Strong opportunity to reduce

the overall CoO in our targeted

segment |

Corporate Presentation

77

Product Development: Aurora PECVD

Thin Film Deposition System

For the deposition on SiNx Anti-Reflective

Coating (ARC)

Coating is used to match refractive indexes,

and improve the efficiency of the solar cell

Applying thin film technology & large-area

industrial processing and equipment

expertise

Combining the high efficiency performance

of direct PECVD and the productivity of high

throughput operation |

Corporate Presentation

78

Thank You |

Corporate Presentation

China Market

Martin Yang

Senior VP PCB Business

Orbotech Pacific |

Corporate Presentation

80

PCB Manufacturing Industry Migration

China’s global share has grown from 8.2% in 2000

to more than 31% in 2008 with a forecast of 37% by 2013

2000

2008

2000

2008

2000

2008

2000

2008

27%

9.3%

16%

6.7%

28%

21.1%

30%

62.9%

Source: Prismark

50%

28% |

Corporate Presentation

81

2001-2010 Orbotech China Sales % of Pacific

China sales percentage in Orbotech’s

Pacific sales increasing in the last decade:

From >30% in 2001 to 60% in 2009

Expect to increase in 2010 |

Corporate Presentation

82

China PCB Market will Keep Growing >10%

Source: Prismark (11/2009) NT Information (01/2010) |

|

Corporate Presentation

84

PCB Manufacturing in China

1,000 PCB Shops

Investment from Taiwan / HK / US / Europe / Japan / Korea

Local Chinese PCB Manufacturer

What did we experience in the past few years ?

Growth in both capacities and technology requirements

(HDI, Packaging)

Geographical spread (due to government promotion policy)

High rise in local PCB shops

Tough competition

price erosion in PCBs |

Technology/Application Trends

Smartphones (0.4mm)

Meiko

Multek

Compeq

CCTC

Low cost phones (India, China)

Foxconn

Founder

Redboard

Meadville

E&E

More 3G infrastructure

Notebooks, Netbooks

Gold Circuit

Hannstar

Xing Ying

IC Substrates, Packaging

Kinsus

Nanya

UTC, Access, SCC, …

Corporate Presentation

85 |

Corporate Presentation

86

Traditional PCB MFG area

New PCB MFG area

FPD MFG area

China PCB Manufacturing Locations |

Corporate Presentation

87

The Rise of Local Chinese Makers

There are already 4 Chinese makers with >$100M in revenues:

Founder, CCTC, Shennan, Fast Print

Heavy investment to become global players by expanding capacity

and improving technology

Founder: from DS/SS and simple MLB to advanced HDI and IC

substrates

CCTC: an HDI PCB supplier to Nokia and others, checking entry to

IC

substrates

Fast Print: from QTA to mass production

Shennan: increase in layer count capability, HDI technology, entry to IC

substrate production

Many smaller makers are expected to reach this size in the short-

medium term |

88

Founder PCB Industrial Park:

March 2008

1 campus: 3 factories (HDI, IC substrates, QTA/Sample)

6 plants in total, more are planned

Goal: #1 in China in 5 years

Founder PCB

Industrial Park |

Corporate Presentation

89

SCC Industrial

Park |

Corporate Presentation

90

FastPrint: The Biggest QTA PCB Shop on Earth |

Corporate Presentation

91

China -

Customers

HannStar

Tripod

AT&S

Gultech |

Corporate Presentation

92

Semco-KS

Dynamic

Foxconn

WUS

China -

Customers |

Corporate Presentation

93

Orbotech in China |

Corporate Presentation

94

Sustained Success for 15 Years

First office

established

-

mid

1990’s

The widest product portfolio supplier with

facilities in China

Established Chinese

PCB manufacturers client base

China represents a large

percentage of Orbotech’s business

OPERATING

IN

GUANGZHOU

SINCE

MID

1990’s |

Corporate Presentation

95

Orbotech China -

Market Status

Customers base

~400 potential customers

~250 active accounts

Very large installed base of Orbotech equipment

1200 Discovery AOI

65 Paragon LDI

Significant potential for further growth |

Corporate Presentation

96

Employees

PCS ~160, 6 remote offices

PCN ~110. 4 remote offices

Two training centers

Pacific Response Center

Pacific R&D center, repair lab and

purchasing

Orbotech

China –

Organization |

PCS

PCN

99% of PCS Customers:

-

ShenZhen

-

GuangZhou

-

ShaJing

-

HuiZhou

-

DongGuan

-

ZhuHai

-

Hong Kong

Orbotech China

Follow the Customers –

Couple of Years Ago

99% of PCN

Customers:

-

Shanghai

-

KunShan

-

SuZhou

-

WuXi

-

ChangShu

-

JianYin

-

NanJing

Corporate Presentation

97 |

Corporate Presentation

98

PCS

PCN

PCB Square, HaiKou

Most PCS Customers

RedBoard, JiangXi

Dynamic, FuJian

Meiko, WuHan

Most PCN

Customers

Foxconn, HuaiAn

Foxconn, YanTai

Foxconn,

YinKou

and

Foxconn, QingHuangDao

Ibiden, BeiJing

TPC, TianJin

Orbotech China

Follow the Customers –

Today

Founder PCB |

Corporate Presentation

99

Orbotech China

Strong Local R&D

and CS Presence

R&D and Engineering Support

R&D engineers are being trained

and deployed locally

Building local customer support

R&D centers in China are due to

open in 2010

More than 165 Customer Support

Engineers |

Corporate Presentation

100

Orbotech China

China Oriented Product Portfolio |

Corporate Presentation

101

Orbotech China

Summary

PCB market worldwide and manufacturing capabilities in China

continue to grow

Orbotech continues its partnership with overseas customers who

move to China

Build close relationship with local Chinese manufacturers

Well established organization and infrastructure in China –

Management, Customer Support, Sales, Operations, Engineering,

R&D

Product portfolio adjustments to match Chinese production needs

Orbotech is well positioned to serve the growing market and

increased demand in China |

Corporate Presentation

102

Thank You |

Corporate Presentation

Customer Support

Mike Butler

VP Customer Support

FPD Division |

Corporate Presentation

104

Orbotech Customer Support Focus

World class professional organization

Provide profitable customer satisfaction

Achieve sure quality and delivery

Meet the company's business targets |

Corporate Presentation

105

Customer Support Value to the Company

Strategically important for

customer relationships

Differentiating factor vs.

our competition

Source of recurring revenue

with high profitability |

Corporate Presentation

106

Customer Support Infrastructure

Over 500 employees in 30 countries

Supporting over 8000 AOI systems, 600 Test & Repair systems,

400 LDI, 650 Plotters and 4000 CAM stations

5 response centers, 5 customer training centers

State-of-the-art support tools and programs

Highly Professional Worldwide Organization |

107

Customer Support Services |

Corporate Presentation

108

Customer Support Value Proposition

Examples:

Remote Support Access

Response centers

Translates to:

Faster closed calls

Better Responsiveness

Improved operational efficiencies

Staff Expertise

Increasing Customer Satisfaction & Profitability |

Corporate Presentation

109

Thank You |

Corporate Presentation

Financials

Erez

Simha

Corporate VP & CFO |

Corporate Presentation

111

333.3

83.2

266.5

94.2

323.0

106.5

268.0

109.6

348.0

117.0

0.0

100.0

200.0

300.0

400.0

2006

2007

2008*

2009

2010 (E)

Sales

Service

Annual Revenues ($M)

416.5M

377.6M

429.5M

360.7M

465M |

Corporate Presentation

112

Quarterly Revenues ($M)

66.4

25.5

66.7

27.3

64.4

27.9

70.6

28.8

76.2

26.9

0.0

25.0

50.0

75.0

100.0

Q12009

Q22009

Q32009

Q42009

Q1 2010

Sales

Service

91.9M

99.4M

92.3M

94.0M

103.1M

Combined guidance for Q2-Q3/2010 -

$260-$270m |

Corporate Presentation

113

Sales Distribution Q1/10

By Product Lines

FPD

45%

PCB

50%

Medical

Imaging

3%

Recognition

2% |

Corporate Presentation

114

Sales Distribution Q1/10

By Region

Japan

5%

China

26%

Korea

17%

Europe

7%

North America

8%

Other

3%

Taiwan

34% |

Corporate Presentation

115

Gross Margin Trend

100.5

105.1

94.7

129.2

91.9

94.0

92.3

99.4

103.1

40.7%

41.2%

38.1%

37.0%

39.1%

36.2%

38.1%

40.6%

35.1%

Q1/08

Q2/08

Q3/08

Q4/08

Q1/09

Q2/09

Q3/09

Q4/09

Q1/10

Rev ($M)

G.M (%) |

Corporate Presentation

116

Margin Analysis (Percent)

7.9%

7.0%

12.5%

0%

5%

10%

15%

2008

2009

Q1/10

EBITDA

Non GAAP

Operating Income

4.9%

3.7%

9.3%

0%

5%

10%

15%

2008

2009

Q1/10

For a discussion of the EBITDA and Non-Gaap measures, their limitations and

reconciliation to the comparable GAAP

measures

-

see

our

annual

form

20-f

filings

and

6-k

filings

with

the

SEC.

For a

reconciliation of EBITDA to Net Income see last slide of the financial

presentation. 34.2M

26.5M

12.9M

20.9M

14.4M

9.6M |

Corporate Presentation

117

Operating Model

2009

2010 (E)

Long

Term

Revenues ($M)

$378M

$460M-$470M

100%

100%

Gross Margin

37.6%

42%-43%

43%-45%

Net R&D as % of Revenues

18.0%

16.0%

14%-15%

SG&A % of Revenues

17.3%

14.5%

12%-13%

Non GAAP Operating Margin

3.7%

11.5%-12.5%

15%

GAAP Net Margin

(5.3%)

5%

10%

100% |

Corporate Presentation

118

Financials Summary

Proven record of managing

the business throughout the

cycles

Significant operating leverage

Larger business opportunities

in 2010 |

119

EBITDA Reconciliation –

Q1 2010

2010

Q1

Reported Net Income

1.6

Adjustments of Impairment

0.6

Stock Based compensation

1.4

Taxes

0.8

Financial Expenses

2.2

Depreciation

2.7

Amortization

3.6

EBITDA

12.9

% of Revenues

12.5%

($ Millions) |

Corporate Presentation

120

Thank You |

Corporate Presentation

Summary

Adrian Auman

Corporate VP IR |

Corporate Presentation

122

Summary

Multiple growth drivers in PCB and FPD

Undisputed technology and proven market leadership

Diversified product portfolio

Strong operating and financial leverage

Highly experienced management team |

Corporate Presentation

Break |

Corporate Presentation

Q&A |

Corporate Presentation

Thank You! |