Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04058

The Korea Fund, Inc.

(Exact name of registrant as specified in charter)

1633 Broadway, New York, NY 10019

(Address of principal executive offices) (Zip code)

Orhan Dzemaili

1633 Broadway,

New York, New York 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-739-3357

Date of fiscal year end: June 30

Date of reporting period: June 30, 2019

Table of Contents

Item 1. Report to Shareholders

Annual Report

June 30, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (www.thekoreafund.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling the Fund’s stockholder servicing agent at (800) 254-5197.

If you prefer to receive paper copies of your shareholder reports after January 1, 2021, direct investors may inform the Fund at any time by calling the Fund’s stockholder servicing agent at (800) 254-5197. If you invest through a financial intermediary, you should contact your financial intermediary directly. Paper copies are provided free of charge and your election to receive reports in paper will apply to all funds held with the fund complex if you invest directly with the Fund or all funds held in your account if you invest through your financial intermediary.

Table of Contents

Annual Report

June 30, 2019

Table of Contents

The Korea Fund, Inc. Portfolio Manager’s Report

June 30, 2019 (unaudited)

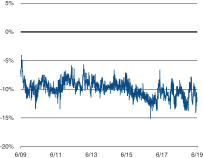

During the fiscal year from July 1, 2018 to June 30, 2019, The Korea Fund, Inc.’s (the “Fund”) benchmark, the MSCI Korea 25/50 Index (Total Return) fell by -6.82% in Korean Won terms and -10.06% in U.S. Dollar (“USD”) terms. The Korean equity market fell during the second half of 2018, as the U.S. started to impose tariffs on Chinese imports and China retaliated with similar measures. This raised concerns that if the trade war became protracted, global economic growth could be effected negatively. Meanwhile, the U.S. Federal Reserve continued to raise interest rates and reduce the size of its balance sheet, putting pressure on global equity markets. The Korean market recovered in the early part of 2019, as the U.S. and China entered negotiations in an effort to resolve the trade tensions. The U.S. Federal Reserve also turned more dovish, signaling that its balance sheet reduction program would end soon and interest rate hikes would pause. In early May, when it appeared a trade agreement was close to being reached between the U.S. and China, the negotiations collapsed. At the same time, the U.S. put Huawei Technologies Co. Ltd, a Chinese multinational technology company, on the Commerce Department’s Entity List, restricting exports of a range of U.S. products and services to the company. There were media reports that a number of other Chinese technology companies might face similar treatment. The Korean equity market again corrected sharply as a result of these trade tensions between the U.S. and China, as well as trade tensions within the technology space.

The technology sector, which accounts for a major portion of Korea’s exports, saw demand deteriorate throughout the financial year under review. A number of factors contributed to this. Following a strong up cycle, the semiconductor industry had a supply surplus, which resulted in the price of memory chips falling significantly. The replacement cycle for smartphones lengthened as product innovation slowed, while price points continued to rise. Partly due to trade conflicts, corporate and consumer demand for technology products had also weakened.

On the Korean domestic front, President Moon’s income-led economic growth policy manifested through unprecedented large increases in the minimum wage, which seemingly resulted in unintended negative consequences. The unemployment rate rose, along with a significant decline in new job creation, while the income gap widened. The cost pressure from more frequent minimum wage hikes led to price increases for a wide range of goods and services, thus creating additional headwind for consumption. Although the administration took steps to replace certain senior officials including the Minister of Finance and President’s Chief of Staff, the government’s policy direction remained largely unchanged. Meanwhile, the export picture continued to deteriorate and declined in the first half of 2019 compared to a year ago. In addition to the weak technology sector, slower growth in China also contributed to Korea’s weak export performance.

| 06.30.19 | The Korea Fund, Inc. Annual Report | 1 |

Table of Contents

The Korea Fund, Inc. Portfolio Manager’s Report

June 30, 2019 (unaudited) (continued)

Fund’s Performance

From July 1, 2018 to June 30, 2019, the total return of the Fund’s Net Asset Value (“NAV”) was -9.92% (net of fees) in USD terms, marginally outperforming the Fund’s benchmark, the MSCI Korea 25/50 Index (Total Return), by 0.14%.

Over the reporting period, stock selection in the consumer discretionary and communication services sectors contributed to the Fund’s outperformance. In the consumer discretionary sector, the Fund’s performance was helped by its holdings in Fila Korea, a global sportswear company. Fila Korea’s share price appreciated as the company’s successful brand renewal led to a turnaround of its loss making domestic business, while its joint venture with Anta Sports in China also delivered strong growth, as well as profitability. In the communication services sector the Fund was helped by holdings in AfreecaTV, an internet platform specializing in the live broadcasting of e-sports. The stock outperformed relative to the Korean equity market on the back of resilient revenue growth fueled by the rise in the number of users and an increase in their spending, as well as accelerating contribution from advertising.

On the other hand, the Fund’s performance was hurt by its overweight position in the insurance sector. The share price of non-life insurance stocks declined on earnings deterioration in auto insurance, as the pace of auto premium hikes were slower than expectations, hence delaying earnings turnaround. In addition the Fund’s overweight position in Samsung Electro-Mechanics detracted from the Fund’s performance. Concerns for slowing demand amidst global macro uncertainties and spillover from correction of regional multi-layer ceramic capacitor (“MLCC”) stocks led to a sharp correction in the company’s share price.

Outlook

With the exception of the U.S., the global economy has seen weaker growth in recent quarters. Fearing the possible spillover effect to the U.S. economy, the U.S. Federal Reserve has turned more dovish and signaled an interest rate cut may be imminent. On the trade front, following a meeting at the G20 summit, the U.S. and China have agreed to a truce in their trade war, with negotiations to resume in the future. However, we are not confident that this truce can be sustained for an extended period, as the positions of the two countries seem far apart and difficult to reconcile.

The negative impact from President Moon’s economic policies continues, but it is our opinion that the likelihood of further negative policy surprises seem to be diminishing. In particular, we believe the government is likely to focus on attempting to revive the economy in the short term to gain public favor ahead of the national assembly election in April 2020. The government has recently set the minimum wage hike for 2020 at 2.9%, which is at the low end of investor

| 2 | The Korea Fund, Inc. Annual Report | 06.30.19 |

Table of Contents

The Korea Fund, Inc. Portfolio Manager’s Report

June 30, 2019 (unaudited) (continued)

expectations. We feel that this indicates that the government is now more willing to compromise on its policy agenda in order to support the economy. That said, we do not expect a major turnaround in domestic economic conditions in the near term given the government’s policy direction and its economic team remains largely unchanged, and previous policies such as higher corporate taxes and draconian property measures remain in place. Still, the Bank of Korea appears to be prepared to cut interest rates, which, in our view, should provide some support to the economy.

As U.S.-China conflicts in trade and technology may become protracted, we remain cautious on Korea’s export outlook. In the near term, smartphone demand appears to remains weak while there is delay in technology related capital expenditure. The recent political dispute between Korea and Japan adds another layer of uncertainty, as a prolonged delay or curb in technology material exports to Korea could cause disruptions to industrial production. Over the medium term, we believe the semiconductor cycle will recover, as supply and demand return to balance, which could help Korean exports return to healthier growth.

The information contained herein has been obtained from sources believed to be reliable but the investment manager and its affiliates do not warrant the information to be accurate, complete or reliable. The opinions expressed herein are solely those of the Fund’s Portfolio Manager and are subject to change at any time and without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Investors should consider the investment objectives, risks, charges and expenses of any mutual fund carefully before investing. This and other information is contained in the Fund’s annual and semiannual reports, proxy statement and other Fund information, which may be obtained by contacting your financial advisor or visiting the Fund’s website at www.thekoreafund.com.

This information is unaudited and is intended for informational purposes only. It is presented only to provide information on investment strategies and opportunities. The Fund seeks long-term capital appreciation through investment in securities, primarily equity securities, of Korean companies. Investing in non-U.S. securities entails additional risks, including political and economic risk and the risk of currency fluctuations, as well as lower liquidity. These risks, which can result in greater price volatility, will generally be enhanced in less diversified funds that concentrate investments in a particular geographic region. The Fund is a closed-end exchange traded management investment company. This material is presented only to provide information and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. After the initial public offering, shares are sold on the open market through a stock exchange, where shares may trade at a premium or a discount. Holdings are subject to change daily.

| 06.30.19 | The Korea Fund, Inc. Annual Report | 3 |

Table of Contents

The Korea Fund, Inc. Performance & Statistics

June 30, 2019 (unaudited)

| Total Return(1) | 1 Year | 5 Year | 10 Year | |||||||||

| Market Price |

-10.97 | % | 0.15 | % | 6.04 | % | ||||||

| Net Asset Value (“NAV”) |

-9.92 | % | -0.15 | % | 6.26 | % | ||||||

| MSCI Korea Index 25/50 (Total Return)(2) |

-10.06 | % | 0.48 | % | 7.47 | % | ||||||

| MSCI Korea Index (Total Return)(2) |

-9.12 | % | 0.96 | % | 7.75 | % | ||||||

| MSCI Korea Index (Price Return)(2) |

-10.90 | % | -0.60 | % | 6.42 | % | ||||||

|

KOSPI(3) |

-11.59 | % | -1.39 | % | 5.39 | % | ||||||

| 4 | The Korea Fund, Inc. Annual Report | 06.30.19 |

Table of Contents

The Korea Fund, Inc. Performance & Statistics

June 30, 2019 (unaudited) (continued)

Notes to Performance & Statistics:

| (1) | Past performance is no guarantee of future results. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares. Total return for a period of more than one year represents the average annual total return. |

| Performance at market price will differ from results at NAV. Although market price returns typically reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in the Fund’s dividends. |

| An investment in the Fund involves risk, including the loss of principal. Total return, market price and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one-time public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets less total liabilities divided by the number of shares outstanding. Holdings are subject to change daily. |

| (2) | Morgan Stanley Capital International (“MSCI”) Korea Index is a market capitalization-weighted index of equity securities of companies domiciled in Korea. The index is designed to represent the performance of the Korean stock market and excludes certain market segments unavailable to U.S. based investors. The MSCI Korea Index (Total Return) returns assume reinvestment of dividends (net of foreign withholding taxes) while the MSCI Korea Index (Price Return) returns do not and, unlike Fund returns, do not reflect any fees or expenses. Effective July 1, 2017, the Board approved The MSCI Korea Index 25/50 as the primary benchmark for the Fund. The MSCI Korea Index 25/50 is designed to measure the performance of the large and mid cap segments of the Korean market. It applies certain investment limits that are imposed on regulated investment companies, or RICs, under the current US Internal Revenue Code. One requirement of a RIC is that at the end of each quarter of its tax year no more than 25% of the value of the RIC’s assets may be invested in a single issuer and the sum of the weights of all issuers representing more than 5% of the fund should not exceed 50% of the fund’s total assets. The index covers approximately 85% of the free float-adjusted market capitalization in Korea. The returns assume reinvestment of dividends (net of foreign withholding taxes) but do not reflect any fees or expenses. It is not possible to invest directly in an index. Total Return for a period of more than one year represents the average annual return. |

| (3) | The Korea Composite Stock Price Index (“KOSPI”) is an unmanaged capitalization-weighted index of all common shares on the Stock Market Division of the Korea Exchange (formerly the “Korea Stock Exchange”). The KOSPI returns, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly in an index. Total return for a period of more than one year represents the average annual return. |

| (4) | The NAV disclosed in the Fund’s financial statements may differ from this NAV due to accounting principles generally accepted in the United States of America. |

| 06.30.19 | The Korea Fund, Inc. Annual Report | 5 |

Table of Contents

The Korea Fund, Inc. Schedule of Investments

June 30, 2019

| Shares | Value | |||||||

| COMMON STOCK–98.2% |

||||||||

| Aerospace & Defense–1.9% | ||||||||

| 112,019 | Hanwha Aerospace Co., Ltd. (d) |

$ 3,228,922 | ||||||

|

|

|

|||||||

| Airlines–1.9% | ||||||||

| 86,888 | Jeju Air Co., Ltd. |

2,495,904 | ||||||

| 41,472 | Jin Air Co., Ltd. |

758,356 | ||||||

|

|

|

|||||||

| 3,254,260 | ||||||||

|

|

|

|||||||

| Auto Components–2.7% | ||||||||

| 22,544 | Hyundai Mobis Co., Ltd. |

4,599,503 | ||||||

|

|

|

|||||||

| Automobiles–3.2% | ||||||||

| 44,474 | Hyundai Motor Co. |

5,397,593 | ||||||

|

|

|

|||||||

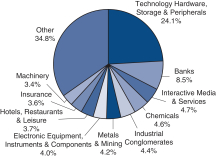

| Banks–8.5% | ||||||||

| 95,667 | Hana Financial Group, Inc. |

3,100,788 | ||||||

| 142,535 | KB Financial Group, Inc. |

5,649,973 | ||||||

| 142,115 | Shinhan Financial Group Co., Ltd. |

5,527,429 | ||||||

|

|

|

|||||||

| 14,278,190 | ||||||||

|

|

|

|||||||

| Biotechnology–1.1% | ||||||||

| 10,382 | Celltrion, Inc. (d) |

1,850,389 | ||||||

|

|

|

|||||||

| Chemicals–4.6% | ||||||||

| 22,566 | LG Chem Ltd. |

6,935,309 | ||||||

| 3,714 | Lotte Chemical Corp. |

813,516 | ||||||

|

|

|

|||||||

| 7,748,825 | ||||||||

|

|

|

|||||||

| Construction & Engineering–0.7% | ||||||||

| 23,506 | Hyundai Engineering & Construction Co., Ltd. |

1,092,953 | ||||||

|

|

|

|||||||

| Electric Utilities–2.8% | ||||||||

| 211,518 | Korea Electric Power Corp. (d) |

4,682,241 | ||||||

|

|

|

|||||||

| Electronic Equipment, Instruments & Components–4.0% | ||||||||

| 63,115 | Samsung Electro-Mechanics Co., Ltd. (c) |

5,370,152 | ||||||

| 6,610 | Samsung SDI Co., Ltd. |

1,356,135 | ||||||

|

|

|

|||||||

| 6,726,287 | ||||||||

|

|

|

|||||||

| Entertainment–0.8% | ||||||||

| 3,271 | NCSoft Corp. |

1,353,139 | ||||||

|

|

|

|||||||

| Food & Staples Retailing–1.9% | ||||||||

| 5,870 | BGF retail Co., Ltd. |

1,072,680 | ||||||

| 60,132 | GS Retail Co., Ltd. |

2,048,970 | ||||||

|

|

|

|||||||

| 3,121,650 | ||||||||

|

|

|

|||||||

| Hotels, Restaurants & Leisure–3.7% | ||||||||

| 207,145 | Kangwon Land, Inc. |

5,426,740 | ||||||

| 59,990 | Paradise Co., Ltd. |

848,985 | ||||||

|

|

|

|||||||

| 6,275,725 | ||||||||

|

|

|

|||||||

| Household Durables–1.2% | ||||||||

| 29,174 | LG Electronics, Inc. |

2,007,351 | ||||||

|

|

|

|||||||

| Industrial Conglomerates–4.4% | ||||||||

| 63,169 | LG Corp. |

4,205,423 | ||||||

| 10,456 | Samsung C&T Corp. |

867,454 | ||||||

| 11,244 | SK Holdings Co., Ltd. |

2,262,606 | ||||||

|

|

|

|||||||

| 7,335,483 | ||||||||

|

|

|

|||||||

| 6 | The Korea Fund, Inc. Annual Report | 06.30.19 |

Table of Contents

The Korea Fund, Inc. Schedule of Investments

June 30, 2019 (continued)

| Shares | Value | |||||||

| Insurance–3.6% | ||||||||

| 67,718 | DB Insurance Co., Ltd. |

$ 3,477,831 | ||||||

| 105,863 | Hyundai Marine & Fire Insurance Co., Ltd. |

2,609,283 | ||||||

|

|

|

|||||||

| 6,087,114 | ||||||||

|

|

|

|||||||

| Interactive Media & Services–4.7% | ||||||||

| 82,950 | AfreecaTV Co., Ltd. |

4,429,083 | ||||||

| 35,834 | NAVER Corp. |

3,541,504 | ||||||

|

|

|

|||||||

| 7,970,587 | ||||||||

|

|

|

|||||||

| IT Services–0.5% | ||||||||

| 4,627 | Samsung SDS Co., Ltd. |

862,518 | ||||||

|

|

|

|||||||

| Machinery–3.4% | ||||||||

| 47,089 | Daewoo Shipbuilding & Marine Engineering Co., Ltd. (d) |

1,335,055 | ||||||

| 36,295 | Hyundai Heavy Industries Co., Ltd. |

3,728,585 | ||||||

| 2,129 | Hyundai Heavy Industries Holdings Co., Ltd. |

598,169 | ||||||

|

|

|

|||||||

| 5,661,809 | ||||||||

|

|

|

|||||||

| Marine–1.8% | ||||||||

| 730,797 | Pan Ocean Co., Ltd. (d) |

2,941,643 | ||||||

|

|

|

|||||||

| Metals & Mining–4.2% | ||||||||

| 6,906 | Korea Zinc Co., Ltd. |

2,848,378 | ||||||

| 20,144 | POSCO |

4,276,266 | ||||||

|

|

|

|||||||

| 7,124,644 | ||||||||

|

|

|

|||||||

| Oil, Gas & Consumable Fuels–1.8% | ||||||||

| 11,669 | S-Oil Corp. |

847,528 | ||||||

| 16,296 | SK Innovation Co., Ltd. |

2,246,236 | ||||||

|

|

|

|||||||

| 3,093,764 | ||||||||

|

|

|

|||||||

| Personal Products–2.0% | ||||||||

| 2,937 | LG Household & Health Care Ltd. |

3,345,140 | ||||||

|

|

|

|||||||

| Pharmaceuticals–1.0% | ||||||||

| 2,918 | Hanmi Pharm Co., Ltd. |

1,022,306 | ||||||

| 3,369 | Yuhan Corp. |

713,734 | ||||||

|

|

|

|||||||

| 1,736,040 | ||||||||

|

|

|

|||||||

| Road & Rail–1.6% | ||||||||

| 22,573 | CJ Logistics Corp. (d) |

2,633,122 | ||||||

|

|

|

|||||||

| Semiconductors & Semiconductor Equipment–2.8% | ||||||||

| 78,561 | SK Hynix, Inc. |

4,725,396 | ||||||

|

|

|

|||||||

| Specialty Retail–0.5% | ||||||||

| 8,959 | Hotel Shilla Co., Ltd. |

754,018 | ||||||

|

|

|

|||||||

| Technology Hardware, Storage & Peripherals–24.1% | ||||||||

| 996,216 | Samsung Electronics Co., Ltd. |

40,566,236 | ||||||

|

|

|

|||||||

| Textiles, Apparel & Luxury Goods–2.8% | ||||||||

| 70,170 | Fila Korea Ltd. |

4,660,128 | ||||||

|

|

|

|||||||

| Total Common Stock (cost–$124,037,810) |

165,114,670 | |||||||

|

|

|

|||||||

| 06.30.19 | The Korea Fund, Inc. Annual Report | 7 |

Table of Contents

The Korea Fund, Inc. Schedule of Investments

June 30, 2019 (continued)

| Shares | Value | |||||||

| SHORT-TERM INVESTMENTS–2.5% |

||||||||

| Collateral Invested for Securities on Loan (b)–2.5% | ||||||||

| 4,195,510 | BlackRock T-Fund, Institutional Class (cost–$4,195,510) |

$ 4,195,510 | ||||||

|

|

|

|||||||

| Total Investments (cost–$128,233,320) (a)–100.7% |

169,310,180 | |||||||

| Liabilities in excess of other assets–(0.7)% |

(1,217,677 | ) | ||||||

|

|

|

|||||||

| Net Assets–100.0% | $168,092,503 | |||||||

|

|

|

|||||||

Notes to Schedule of Investments:

| (a) | Securities with an aggregate value of $160,564,159, representing 95.5% of net assets, were valued utilizing modeling tools provided by a third-party vendor. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (b) | Purchased with cash collateral received from securities on loan. |

| (c) | A portion of security on loan with a value of $3,994,077; cash collateral (included in liabilities) of $4,195,510 was received with which the Fund invested in the BlackRock T-Fund Institutional Class. |

| (d) | Non-income producing. |

| (e) | Fair Value Measurements – See Note 1(b) in the Notes to Financial Statements. |

| Level 1 – Quoted Prices |

Level 2 – Other Significant Observable Inputs |

Level 3 – Significant Unobservable Inputs |

Value at 6/30/19 |

|||||||||||||

| Investments in Securities—Assets |

| |||||||||||||||

| Common Stock: |

||||||||||||||||

| Food & Staples Retailing |

$ | 1,072,680 | $ | 2,048,970 | — | $ | 3,121,650 | |||||||||

| Insurance |

3,477,831 | 2,609,283 | — | 6,087,114 | ||||||||||||

| All Other |

— | 155,905,906 | — | 155,905,906 | ||||||||||||

| Collateral Invested for Securities on Loan |

4,195,510 | — | — | 4,195,510 | ||||||||||||

| Totals |

$ | 8,746,021 | $ | 160,564,159 | — | $ | 169,310,180 | |||||||||

Securities Lending Transactions Accounted for as Secured Borrowings:

| Remaining Contractual Maturity of the Agreements As of June 30, 2019 |

||||||||||||||||||||

| Overnight and Continuous |

Up to 30 days | 30 - 90 days | Greater than 90 days |

Total | ||||||||||||||||

| Securities Lending Transactions |

| |||||||||||||||||||

| Common Stock |

$ | 4,195,510 | $ | — | $ | — | $ | — | $ | 4,195,510 | ||||||||||

| Gross amount of recognized liabilities for securities lending transactions |

|

$ | 4,195,510 | |||||||||||||||||

| 8 | The Korea Fund, Inc. Annual Report | 06.30.19 | See accompanying Notes to Financial Statements |

Table of Contents

The Korea Fund, Inc. Statement of Assets and Liabilities

June 30, 2019

| Assets: | ||||||||

| Investments, at value, including securities on loan of $3,994,077 (cost–$128,233,320) |

$169,310,180 | |||||||

| Cash |

694,145 | |||||||

| Foreign currency, at value (cost–$2,146,947) |

2,206,189 | |||||||

| Dividends receivable (net of foreign withholding taxes) |

408,166 | |||||||

| Securities lending income receivable, including income from invested cash collateral (net of rebates) |

12,776 | |||||||

| Prepaid expenses and other assets |

106,171 | |||||||

| Total Assets |

172,737,627 | |||||||

| Liabilities: | ||||||||

| Payable for collateral for securities on loan |

4,195,510 | |||||||

| Investment management fees payable |

100,513 | |||||||

| Payable for shares repurchased |

26,706 | |||||||

| Accrued expenses and other liabilities |

322,395 | |||||||

| Total Liabilities |

4,645,124 | |||||||

| Net Assets | $168,092,503 | |||||||

| Net Assets: | ||||||||

| Common Stock: |

||||||||

| Par value ($0.01 per share, applicable to 5,128,007 shares issued and outstanding) |

$51,280 | |||||||

| Paid-in-capital in excess of par |

130,348,745 | |||||||

| Total distributable earnings |

37,692,478 | |||||||

| Net Assets | $168,092,503 | |||||||

| Net Asset Value Per Share | $32.78 | |||||||

| See accompanying Notes to Financial Statements | 06.30.19 | The Korea Fund, Inc. Annual Report | 9 |

Table of Contents

The Korea Fund, Inc. Statement of Operations

Year ended June 30, 2019

| Investment Income: | ||||||||

| Dividends (net of foreign withholding taxes of $660,675) |

$3,318,783 | |||||||

| Securities lending income, including income from invested cash collateral (net of rebates) |

243,857 | |||||||

| Interest (net of foreign withholding taxes of $587) |

3,905 | |||||||

| Total Investment Income |

3,566,545 | |||||||

| Expenses: | ||||||||

| Investment management |

1,429,875 | |||||||

| Directors |

331,746 | |||||||

| Legal |

133,453 | |||||||

| Insurance |

130,842 | |||||||

| Custodian and accounting agent |

113,821 | |||||||

| Audit and tax services |

98,566 | |||||||

| Stockholder communications |

36,127 | |||||||

| Transfer agent |

25,692 | |||||||

| New York Stock Exchange listing |

12,287 | |||||||

| Miscellaneous |

78,549 | |||||||

| Total Expenses |

2,390,958 | |||||||

| Net Investment Income | 1,175,587 | |||||||

| Realized and Change in Unrealized Gain (Loss): | ||||||||

| Net realized loss on: |

||||||||

| Investments |

(1,825,238) | |||||||

| Foreign currency transactions |

(326,511) | |||||||

| Net change in unrealized appreciation/depreciation of: |

||||||||

| Investments |

(23,631,012) | |||||||

| Foreign currency transactions |

245,211 | |||||||

| Net realized and change in unrealized loss |

(25,537,550) | |||||||

| Net Decrease in Net Assets Resulting from Investment Operations | $(24,361,963) | |||||||

| 10 | The Korea Fund, Inc. Annual Report | 06.30.19 | See accompanying Notes to Financial Statements |

Table of Contents

The Korea Fund, Inc. Statement of Changes in Net Assets

| Year ended June 30, 2019 |

Year ended June 30, 2018 |

|||||||||||||||

| Investment Operations: | ||||||||||||||||

| Net investment income |

$1,175,587 | $1,122,093 | ||||||||||||||

| Net realized gain (loss) |

(2,151,749) | 36,682,480 | ||||||||||||||

| Net change in unrealized appreciation/depreciation |

(23,385,801) | (28,811,483) | ||||||||||||||

| Net increase (decrease) in net assets resulting from investment operations |

(24,361,963) | 8,993,090 | ||||||||||||||

| Dividends and Distributions to Stockholders from: | ||||||||||||||||

| Net investment income |

— | (1,268,827) | ||||||||||||||

| Net realized gains |

— | (21,348,039) | ||||||||||||||

| Total distributions paid* |

(27,459,569) | — | ||||||||||||||

| Total dividends and distributions to stockholders |

(27,459,569) | (22,616,866) | ||||||||||||||

| Common Stock Transactions: | ||||||||||||||||

| Cost of shares repurchased |

(7,403,889) | (19,034,667) | ||||||||||||||

| Total decrease in net assets |

(59,225,421) | (32,658,443) | ||||||||||||||

| Net Assets: | ||||||||||||||||

| Beginning of year |

227,317,924 | 259,976,367 | ||||||||||||||

| End of year** |

$168,092,503 | $227,317,924 | ||||||||||||||

| Shares Activity: | ||||||||||||||||

| Shares outstanding, beginning of year |

5,363,003 | 5,822,293 | ||||||||||||||

| Shares repurchased |

(234,996) | (459,290) | ||||||||||||||

| Shares outstanding, end of year |

5,128,007 | 5,363,003 | ||||||||||||||

| * | Distributions from net investment income and net realized capital gains are combined for the year ended June 30, 2019. See Note 1 in the Notes to Financial Statements for more information regarding new accounting pronouncements. The dividends and distributions to stockholders for the year ended June 30, 2018 have not been reclassified to conform to the current year presentation. |

| ** | Net Assets – End of year includes undistributed net investment income of $1,727,277 as of June 30, 2018. |

| See accompanying Notes to Financial Statements | 06.30.19 | The Korea Fund, Inc. Annual Report | 11 |

Table of Contents

The Korea Fund, Inc. Financial Highlights

For a share of stock outstanding throughout each period:^

| Year ended June 30, | ||||||||||||||||||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||||||||||||||||||

| Net asset value, beginning of year |

$42.39 | $44.65 | $36.68 | $44.80 | $47.33 | |||||||||||||||||||||||||||||||

| Investment Operations: |

||||||||||||||||||||||||||||||||||||

| Net investment income (loss) (1) |

0.22 | 0.20 | 0.16 | 0.11 | (0.02 | ) | ||||||||||||||||||||||||||||||

| Net realized and change in unrealized gain (loss) |

(4.76 | ) | 1.13 | 7.75 | (4.11 | ) | (2.84 | ) | ||||||||||||||||||||||||||||

| Total from investment operations |

(4.54 | ) | 1.33 | 7.91 | (4.00 | ) | (2.86 | ) | ||||||||||||||||||||||||||||

| Dividends and Distributions to Stockholders from: |

||||||||||||||||||||||||||||||||||||

| Net investment income |

(0.61 | ) | (0.23 | ) | (0.28 | ) | — | — | ||||||||||||||||||||||||||||

| Net realized gains |

(4.62 | ) | (3.80 | ) | (0.05 | ) | (4.35 | ) | — | |||||||||||||||||||||||||||

| Total dividends and distributions to stockholders |

(5.23 | ) | (4.03 | ) | (0.33 | ) | (4.35 | ) | — | |||||||||||||||||||||||||||

| Common Stock Transactions: |

||||||||||||||||||||||||||||||||||||

| Accretion to net asset value resulting from share repurchases and tender offer |

0.16 | 0.44 | 0.39 | 0.23 | 0.33 | |||||||||||||||||||||||||||||||

| Net asset value, end of year |

$32.78 | $42.39 | $44.65 | $36.68 | (3) | $44.80 | ||||||||||||||||||||||||||||||

| Market price, end of year |

$28.84 | $38.26 | $40.04 | $32.33 | $40.57 | |||||||||||||||||||||||||||||||

| Total Return: (2) |

||||||||||||||||||||||||||||||||||||

| Net asset value |

(9.92 | )% | 3.39 | % | 22.83 | % | (8.35 | )%(3) | (5.35 | )% | ||||||||||||||||||||||||||

| Market price |

(10.97 | )% | 4.41 | % | 25.09 | % | (8.75 | )% | (5.03 | )% | ||||||||||||||||||||||||||

| RATIOS/SUPPLEMENTAL DATA: |

|

|||||||||||||||||||||||||||||||||||

| Net assets, end of year (000s) |

$168,093 | $227,318 | $259,976 | $256,289 | $329,458 | |||||||||||||||||||||||||||||||

| Ratio of expenses to average net assets |

1.25 | % | 1.13 | % | 1.18 | %(4) | 1.20 | % | 1.13 | % | ||||||||||||||||||||||||||

| Ratio of net investment income (loss) to average net assets |

0.62 | % | 0.43 | % | 0.40 | %(4) | 0.28 | % | (0.05 | )% | ||||||||||||||||||||||||||

| Portfolio turnover rate |

27 | % | 69 | % | 67 | % | 44 | % | 51 | % | ||||||||||||||||||||||||||

| ^ | A “—” may reflect actual amounts rounding to less than $0.01 or 0.01%. |

| (1) | Calculated on average common shares outstanding during the year. |

| (2) | Total return is calculated by subtracting the value of an investment in the Fund at the beginning of the specified year from the value at the end of the year and dividing the remainder by the value of the investment at the beginning of the year and expressing the result as a percentage. The calculation assumes that all dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares. Total return on net asset value may reflect adjustments to conform to U.S. GAAP. |

| (3) | Payments from Affiliates increased the end of year net asset value and total return by less than $0.01 and 0.01%, respectively. |

| (4) | Inclusive of tender offer expenses of 0.05%. |

| 12 | The Korea Fund, Inc. Annual Report | 06.30.19 | See accompanying Notes to Financial Statements |

Table of Contents

The Korea Fund, Inc. Notes to Financial Statements

June 30, 2019

1. Organization and Significant Accounting Policies

The Korea Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940 and the rules and regulations thereunder, as amended, as a closed-end, non-diversified management investment company organized as a Maryland corporation, and accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services—Investment Companies. Allianz Global Investors U.S. LLC (“AllianzGI U.S.” or the “Investment Manager”) serves as the Fund’s investment manager. AllianzGI U.S. is an indirect, wholly-owned subsidiary of Allianz Asset Management of America L.P. (“AAM”). AAM is an indirect, wholly-owned subsidiary of Allianz SE, a publicly traded European insurance and financial services company. The Fund has authorized 200 million shares of common stock with $0.01 par value.

The Fund’s investment objective is to seek long-term capital appreciation through investment in securities, primarily equity securities, of Korean companies. There can be no assurance that the Fund will meet its stated objective.

The preparation of the Fund’s financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires the Fund’s management to make estimates and assumptions that affect the reported amounts and disclosures in the Fund’s financial statements. Actual results could differ from those estimates.

Like many other companies, the Fund’s organizational documents provide that its officers (“Officers”) and the Board of Directors of the Fund (the “Board” or the “Directors”) are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, both in some of its principal service contracts and in the normal course of its business, the Fund enters into contracts that provide indemnifications to other parties for certain types of losses or liabilities. The Directors’ maximum exposure under these arrangements is unknown as this could involve future claims against the Fund.

The following is a summary of significant accounting policies consistently followed by the Fund:

(a) Valuation of Investments

Portfolio securities and other financial instruments for which market quotations are readily available are stated at market value. Market value is for various types of securities and other instruments are determined on the basis of closing prices or last sales prices on an exchange or other market, or based on quotes or other market information obtained from quotation reporting systems, established market makers or independent pricing services. Investments in mutual funds are valued at the net asset value per share (“NAV”) as reported on each business day.

Portfolio securities and other financial instruments for which market quotations are not readily available (including in cases where available market quotations are deemed to be unreliable), are fair-valued, in good faith, pursuant to procedures established by the Board of Directors (the “Board”) of the Fund, or persons acting at their discretion pursuant to procedures established by the Board. The Fund’s investments are valued daily and the Fund’s NAV is calculated as of the close of regular trading (normally 4:00 p.m. Eastern Time) on the New York Stock Exchange (“NYSE”) on each day the NYSE is open for business using prices supplied by an independent pricing service or broker/dealer quotations, or by using the last sale or settlement price on the exchange that is the primary market for such securities, or the mean between the last bid and ask quotations. In unusual circumstances, the Board may determine the NAV as of 4:00 p.m., Eastern Time, notwithstanding an earlier, unscheduled close or halt of trading on the NYSE. For foreign equity securities (with certain exceptions, if any), the Fund fair values its securities daily using modeling tools provided by a statistical research service. This service utilizes statistics and programs based on historical performance of markets and other economic data (which may include changes in the value of U.S. securities or security indices).

Short-term investments having a remaining maturity of 60 days or less shall be valued at amortized cost unless the Board of Directors or its Valuation Committee determines that particular circumstances dictate otherwise.

Investments initially valued in currencies other than the U.S. dollar are converted to the U.S. dollar using exchange rates obtained from pricing services. As a result, the NAV of the Fund’s shares may be affected by changes in the value of currencies in relation to the U.S. dollar. The value of securities traded in markets outside the United States or denominated in currencies other than the U.S. dollar may be affected significantly on a day that the NYSE is closed. The prices used by the Fund to value securities may differ from the value that would be realized if the securities were sold and these differences could be material to the Fund’s financial statements.

(b) Fair Value Measurements

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants. The three levels of the fair value hierarchy are described below:

| • | Level 1—quoted prices in active markets for identical investments that the Fund has the ability to access |

| 06.30.19 | The Korea Fund, Inc. Annual Report | 13 |

Table of Contents

The Korea Fund, Inc. Notes to Financial Statements

June 30, 2019 (continued)

1. Organization and Significant Accounting Policies (continued)

| • | Level 2—valuations based on other significant observable inputs, which may include, but are not limited to, quoted prices for similar assets or liabilities, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates or other market corroborated inputs |

| • | Level 3—valuations based on significant unobservable inputs (including the Investment Manager’s or Valuation Committee’s own assumptions and securities whose price was determined by using a single broker’s quote) |

The valuation techniques used by the Fund to measure fair value during the year ended June 30, 2019 were intended to maximize the use of observable inputs and to minimize the use of unobservable inputs.

An investment asset’s or liability’s level within the fair value hierarchy is based on the lowest level input, individually or in aggregate, that is significant to the fair value measurement. The objective of fair value measurement remains the same even when there is a significant decrease in the volume and level of activity for an asset or liability and regardless of the valuation techniques used.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following are certain inputs and techniques that the Fund generally uses to evaluate how to classify each major category of assets and liabilities within Level 2 and Level 3, in accordance with U.S. GAAP.

Equity Securities (Common Stock)—Equity securities traded in inactive markets and certain foreign equity securities are valued using inputs which include broker-dealer quotes, recently executed transactions adjusted for changes in the benchmark index, or evaluated price quotes received from independent pricing services that take into account the integrity of the market sector and issuer, the individual characteristics of the security, and information received from broker-dealers and other market sources pertaining to the issuer or security. To the extent that these inputs are observable, the values of equity securities are categorized as Level 2. To the extent that these inputs are unobservable, the values are categorized as Level 3.

(c) Investment Transactions and Investment Income

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on an identified cost basis. Interest income on uninvested cash is recorded upon receipt. Dividend income is recorded on the ex-dividend date. Korean-based corporations have generally adopted calendar year-ends, and their interim and final corporate actions are normally approved, finalized and announced by their boards of directors and stockholders in the first and third quarters of each calendar year. Generally, estimates of their dividends are accrued on the ex-dividend date principally in the prior December and/or June period ends. These dividend announcements are recorded by the Fund on such ex-dividend dates. Any subsequent adjustments thereto by Korean corporations are recorded when announced. Presently, dividend income from Korean equity investments is earned primarily in the last calendar quarter of each year, and will be received primarily in the first calendar quarter of the following year. Certain other dividends and related withholding taxes, if applicable, from Korean securities may be recorded subsequent to the ex-dividend date as soon as the Fund is informed of such dividends and taxes. Dividend and interest income on the Statement of Operations are shown net of any foreign taxes withheld on income from foreign securities.

(d) Federal Income Taxes

The Fund intends to distribute all of its taxable income and to comply with the other requirements of Subchapter M of the U.S. Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required. The Fund may be subject to excise tax based on distributions to stockholders.

Accounting for uncertainty in income taxes establishes for all entities, including pass-through entities such as the Fund, a minimum threshold for financial statement recognition of the benefit of positions taken in filing tax returns (including whether an entity is taxable in a particular jurisdiction), and requires certain expanded tax disclosures. In accordance with provisions set forth under U.S. GAAP, the Investment Manager has reviewed the Fund’s tax positions for all open tax years.

As of June 30, 2019, the Fund has recorded no liability for net unrecognized tax benefits relating to uncertain income tax positions they have taken. The Fund’s federal income tax returns for the prior three years, as applicable, remain subject to examination by the Internal Revenue Service.

(e) Foreign Investment and Exchange Controls in Korea

The Foreign Exchange Transaction Act, the Presidential Decree relating to such Act and the regulations of the Minister of Strategy and Finance (formerly known as Minister of Finance and Economy) issued thereunder impose certain limitations and controls which generally affect foreign investors in Korea. Through August 18, 2005, the Fund had a license from the Ministry of Finance and Economy to invest in Korean securities and to repatriate income received from

| 14 | The Korea Fund, Inc. Annual Report | 06.30.19 |

Table of Contents

The Korea Fund, Inc. Notes to Financial Statements

June 30, 2019 (continued)

1. Organization and Significant Accounting Policies (continued)

dividends and interest earned on, and net realized capital gains from, its investments in Korean securities or to repatriate from investment principal up to 10% of the NAV (taken at current value) of the Fund (except upon termination of the Fund, or for expenses in excess of Fund income, in which case the foregoing restriction shall not apply). Under the Foreign Exchange Transaction Act, the Minister of Strategy and Finance has the power, with prior (posterior in case of urgency) public notice of scope and duration, to suspend all or a part of foreign exchange transactions when emergency measures are deemed necessary in case of radical change in the international or domestic economic situation. The Fund could be adversely affected by delays in, or the refusal to grant, any required governmental approval for such transactions.

The Fund relinquished its license from the Korean Ministry of Finance and Economy effective August 19, 2005. The Fund had engaged in negotiations with the Korean Ministry of Finance and Economy concerning the feasibility of the Fund’s license being amended to allow the Fund to repatriate more than 10% of Fund capital. However, the Ministry of Finance and Economy advised the Fund that the license cannot be amended as a result of a change in the Korean regulations. As a result of the relinquishment of the license, the Fund is subject to the Korean securities transaction tax equal to 0.3% of the fair market value of any portfolio securities transferred by the Fund on the Korea Exchange and 0.5% of the fair market value of any portfolio securities transferred outside of the Korea Exchange. The relinquishment did not otherwise affect the Fund’s operations. For the year ended June 30, 2019, the Fund incurred $244,573 in transaction taxes in connection with portfolio securities transferred by the Fund on the Korea Exchange. Net realized gain on investments on the Statement of Operations is shown net of the transaction taxes incurred by the Fund. Effective June 3, 2019, the transaction tax was reduced to 0.25% for securities transferred on the Korea Exchange and 0.45% for securities transferred outside of the Korea Exchange.

Certain securities held by the Fund may be subject to aggregate or individual foreign ownership limits. These holdings are in industries that are deemed to be of national importance.

(f) Dividends and Distributions

The Fund declares dividends from net investment income and distributions of net realized capital gains, if any, at least annually. The Fund records dividends and distributions on the ex-dividend date. The amount of dividends from net investment income and distributions from net realized capital gains is determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. These “book-tax” differences are considered either temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal income tax treatment; temporary differences do not require reclassification. To the extent dividends and/or distributions exceed current and accumulated earnings and profits for federal income tax purposes, they are reported as dividends and/or distributions to stockholders from return of capital.

(g) Foreign Currency Translation

The Fund’s accounting records are maintained in U.S. dollars as follows: (1) the foreign currency market values of investments and other assets and liabilities denominated in foreign currencies are translated at the prevailing exchange rate at the end of the period; and (2) purchases and sales, income and expenses are translated at the prevailing exchange rate on the respective dates of such transactions. The resulting net foreign currency gain (loss) is included in the Fund’s Statement of Operations.

The Fund does not generally isolate that portion of the results of operations arising as a result of changes in foreign currency exchange rates from the fluctuations arising from changes in the market prices of securities. Accordingly, such foreign currency gain (loss) is included in net realized and unrealized gain (loss) on investments. However, the Fund does isolate the effect of fluctuations in foreign currency exchange rates when determining the gain (loss) upon the sale or maturity of foreign currency denominated debt obligations pursuant to U.S. federal income tax regulations; such amount is categorized as foreign currency gain (loss) for both financial reporting and income tax reporting purposes.

At June 28, 2019, the Korean WON (“(Won)”)/U.S. dollar (“$”) exchange rate was (Won)1,154.65 to U.S. $1.

(h) Securities Lending

The Fund may engage in securities lending. The loans are secured by collateral at least equal, at all times, to the market value of the loaned securities. During the term of the loan, the Fund will continue to receive any dividends or amounts equivalent thereto, on the loaned securities while receiving a fee from the borrower and/or earning interest on the investment of the cash collateral. Securities lending income is disclosed as such in the Statement of Operations. Income generated from the investment of cash collateral, less negotiated rebate fees paid to borrowers and transaction costs, is allocated between the Fund and securities lending agent. Cash collateral received for securities on loan is invested in securities identified in the Schedule of Investments and the corresponding liability is recognized as such in the Statement of Assets and Liabilities. Loans are subject to termination at the option of the borrower or the Fund.

Upon termination of the loan, the borrower will return to the lender securities identical to the loaned securities. The Fund may pay reasonable finders’, administration and custodial fees in connection with a loan of its securities and may

| 06.30.19 | The Korea Fund, Inc. Annual Report | 15 |

Table of Contents

The Korea Fund, Inc. Notes to Financial Statements

June 30, 2019 (continued)

1. Organization and Significant Accounting Policies (continued)

share the interest earned on the collateral with the borrower. The Fund bears the risk of delay in recovery of, or even loss of rights in, the securities loaned should the borrower of the securities fail financially. The Fund also bears the risk of loss in the event the securities purchased with cash collateral depreciate in value.

(i) New Accounting Pronouncements

In August 2018, the FASB issued Accounting Standard Update (“ASU”) 2018-13, “Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the disclosure requirements for fair value measurement”. ASU 2018-13 removes the disclosure requirements for the amounts of and reasons for transfers between Level 1 and Level 2 of the fair value hierarchy, the policy for timing of transfers between levels and the valuation processes for Level 3 fair value measurements. The ASU is effective for annual periods beginning after December 15, 2019, and interim periods within those annual periods. Management has reviewed ASU 2018-13 and resolved to adopt immediately certain aspects of the ASU related to the removal of certain fair measurement disclosures.

On October 17, 2018, the Securities and Exchange Commission (“SEC”) adopted changes to Regulation S-X to simplify the reporting of information by registered investment companies in financial statements. The amendments require presentation of the total, rather than the components, of distributable earnings on the Statement of Assets and Liabilities and also require presentation of the total, rather than the components, of distributions to stockholders, except for tax return of capital distributions, if any, on the Statement of Changes in Net Assets. The amendments also removed the requirement for parenthetical disclosure of undistributed net investment income on the Statement of Changes in Net Assets. These Regulation S-X amendments are reflected in the Fund’s financial statements for the year ended June 30, 2019. The distributions to stockholders in the June 30, 2018, Statements of Changes in Net Assets presented herein have not been reclassified to conform to the current year presentation.

2. Principal Risks

In the normal course of business, the Fund trades financial instruments and enters into financial transactions where risk of potential loss exists due to, among other things, changes in the market (market risk) or failure of the other party to a transaction to perform (counterparty risk). The Fund is also exposed to other risks such as, but not limited to, foreign currency risk.

To the extent the Fund directly invests in foreign currencies or in securities that trade in, and receive revenues in, foreign currencies, or in derivatives that provide exposure to foreign currencies, it will be subject to the risk that those currencies will decline in value relative to the U.S. dollar, or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency being hedged. Currency rates in foreign countries may fluctuate significantly over short periods of time for a number of reasons, including economic growth, inflation, changes in interest rates, intervention (or the failure to intervene) by U.S. or foreign governments, central banks or supranational entities such as the International Monetary Fund, or the imposition of currency controls or other political developments in the United States or abroad. As a result, the Fund’s investments in foreign currency-denominated securities may reduce the returns of the Fund. The local emerging market currencies in which the Fund may be invested may experience substantially greater volatility against the U.S. dollar than the major convertible currencies in developed countries.

The Fund is subject to elements of risk not typically associated with investments in the U.S., due to concentrated investments in foreign issuers located in a specific country or region. Such concentrations will subject the Fund to additional risks resulting from future political or economic conditions in such country or region and the possible imposition of adverse governmental laws or currency exchange restrictions affecting such country or region, which could cause the securities and their markets to be less liquid and prices more volatile than those of comparable U.S. companies.

The market values of securities may decline due to general market conditions (market risk) which are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates, adverse changes to credit markets or adverse investor sentiment. They may also decline due to factors that affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry. Equity securities and equity-related investments generally have greater market price volatility than fixed income securities, although under certain market conditions fixed income securities may have comparable or greater price volatility. Credit ratings downgrades may also negatively affect securities held by the Fund. Even when markets perform well, there is no assurance that the investments held by the Fund will increase in value along with the broader market. In addition, market risk includes the risk that geopolitical events will disrupt the economy on a national or global level.

The Fund is exposed to counterparty risk, or the risk that an institution or other entity with which the Fund has unsettled or open transactions will default. The potential loss to the Fund could exceed the value of the financial assets recorded in the Fund’s financial statements. Financial assets, which potentially expose the Fund to counterparty risk, consist

| 16 | The Korea Fund, Inc. Annual Report | 06.30.19 |

Table of Contents

The Korea Fund, Inc. Notes to Financial Statements

June 30, 2019 (continued)

2. Principal Risks (continued)

principally of cash due from counterparties and investments. The Investment Manager seeks to minimize the Fund’s counterparty risk by performing reviews of each counterparty and by minimizing concentration of counterparty risk by undertaking transactions with multiple customers and counterparties on recognized and reputable exchanges. Delivery of securities sold is only made once the Fund has received payment. Payment is made on a purchase once the securities have been delivered by the counterparty. The trade will fail if either party fails to meet its obligation.

3. Investment Manager

The Fund has an Investment Management Agreement (the “Management Agreement”) with the Investment Manager. Subject to the supervision of the Fund’s Board, the Investment Manager is responsible for managing, either directly or through others selected by it, the Fund’s investment activities, business affairs, and other administrative matters. Pursuant to the Management Agreement, the Investment Manager receives an annual fee, payable monthly, at the annual rate of 0.75% of the value of the Fund’s average daily net assets up to $250 million; 0.725% of the next $250 million of average daily net assets; 0.70% of the next $250 million of average daily net assets; 0.675% of the next $250 million of average daily net assets and 0.65% of average daily net assets in excess of $1 billion. For the year ended June 30, 2019, the Fund paid investment management fees at an effective rate of 0.750% of the Fund’s average daily net assets.

4. Investments in Securities

For the year ended June 30, 2019, purchases and sales of investments, other than short-term securities were $51,346,959 and $84,397,207, respectively.

5. Income Tax Information

For the year ended June 30, 2019, the tax character of the dividends and distributions paid was $3,194,672 from ordinary income and $24,264,897 from long-term capital gains. For the year ended June 30, 2018, the tax character of dividends and distributions paid was $1,268,827 from ordinary income and $21,348,039 from long-term capital gains.

At June 30, 2019, the Fund had no distributable earnings.

In accordance with U.S. Treasury regulations, the Fund elected to defer to the following taxable year Post-October short-term capital losses of $2,538,906 and Post-October long-term capital losses of $232,602 arising after October 31, 2018.

In accordance with U.S. Treasury regulations, the Fund elected to defer to the following taxable year late-year ordinary losses of $311,316 arising after December 31, 2018.

In accordance with U.S. Treasury regulations, the Fund elected to defer to the following taxable year late-year “specified” ordinary losses of $83,926 arising after October 31, 2018.

At June 30, 2019, permanent “book-tax” differences were primarily attributable to the differing treatment of foreign currency transactions, taxable overdistributions and reclassification of distributions. These adjustments were to decrease undistributed net investment income $202,296, increase accumulated net realized gain by $327,389 and decrease paid-in-capital by $125,093. Net investment income, net realized gains or losses and net assets were not affected by these adjustments.

At June 30, 2019, the cost basis of portfolio securities for federal income tax purposes was $128,511,448. Gross unrealized appreciation was $54,395,048; gross unrealized depreciation was $13,596,316; and net unrealized appreciation was $40,798,732. The difference between book and tax cost basis was attributable to wash sale loss deferrals and PFIC mark-to-market adjustments.

6. Discount Management Program

The Fund has a share repurchase program under which the Fund will repurchase in each twelve month period ended June 30, up to 10% of its common stock outstanding as of the close of business on June 30 the prior year, but will permit shares to be repurchased at differing discount trigger levels that will not be announced. The Fund will repurchase shares at a discount, in accordance with procedures approved by the Board. Subject to these procedures, the timing and amount of any shares repurchased will be determined by the Board and/or its Discount Management Committee in consultation with the Investment Manager.

For the year ended June 30, 2019, the Fund repurchased 234,996 shares of its common stock on the open market, which represented approximately 4% of the shares outstanding at June 30, 2018 at a total cost, inclusive of commissions ($0.015 per share), of $7,403,889 at a per-share weighted average discount NAV of 11.37%. For the year ended June 30, 2018, the Fund repurchased 459,290 shares of its common stock on the open market, which represented approximately 8% of the shares outstanding at June 30, 2017 at a total cost, inclusive of commissions (weighted average of $0.023 per share; $0.015 per share at June 30, 2018), of $19,034,667 at a per-share weighted average discount to NAV of 11.12%.

| 06.30.19 | The Korea Fund, Inc. Annual Report | 17 |

Table of Contents

The Korea Fund, Inc. Notes to Financial Statements

June 30, 2019 (continued)

7. Fund Ownership

At June 30, 2019, the City of London Investment Group PLC, Lazard Asset Management LLC, 1607 Capital Partners and Gates William Henry held approximately 37%, 14%, 9% and 6%, respectively, of the Fund’s outstanding shares. Investment activities of these stockholders could have a material impact to the Fund.

8. Subsequent Events

In preparing these financial statements, the Fund’s management has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued.

There were no subsequent events identified that require recognition or disclosure.

| 18 | The Korea Fund, Inc. Annual Report | 06.30.19 |

Table of Contents

The Korea Fund, Inc. Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of The Korea Fund, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of The Korea Fund, Inc. (the “Fund”) as of June 30, 2019, the related statement of operations for the year ended June 30, 2019, the statement of changes in net assets for each of the two years in the period ended June 30, 2019, including the related notes, and the financial highlights for each of the five years in the period ended June 30, 2019 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of June 30, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended June 30, 2019 and the financial highlights for each of the five years in the period ended June 30, 2019 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of June 30, 2019 by correspondence with the custodian, transfer agent and brokers. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, New York

August 23, 2019

We have served as the auditor of the Fund since 1984.

| 06.30.19 | The Korea Fund, Inc. Annual Report | 19 |

Table of Contents

The Korea Fund, Inc. Tax Information/Stockholder Meeting Results/

Changes to the Fund Officers/ Proxy Voting Policies & Procedures (unaudited)

Tax Information:

As required by the Internal Revenue Code, stockholders must be notified regarding certain tax attributes of distributions made by the Fund.

During the year ended June 30, 2019, the Fund distributed of $24,264,897 long-term capital gains (or the maximum amount allowable):

Under the Jobs and Growth Tax Relief Reconciliation Act of 2003, the following percentages of ordinary dividends paid during the fiscal year ended June 30, 2018, are designated as “qualified dividend income”: 100%

Corporate stockholders are generally entitled to take the dividend received deduction on the portion of a Fund’s dividend distribution that qualifies under tax law. The percentage of the following Fund’s ordinary income dividends paid during the fiscal year ended June 30, 2019, that qualify for the corporate dividend received deduction is 0%.

Foreign Tax Credit: The Fund has elected to pass-through the credit for taxes paid to foreign countries. The gross foreign dividends and foreign tax per share paid during the fiscal year ended June 30, 2019 is $0.757257 and $0.125721, respectively.

Since the Fund’s tax year is not the calendar year, another notification will be sent with respect to calendar year 2019.

In January 2020, stockholders will be advised on IRS Form 1099-DIV as to the federal tax status of the dividends and distributions received during calendar year 2019. The amount that will be reported will be the amount to use on the stockholder’s 2019 federal income tax return and may differ from the amount which must be reported in connection with the Fund’s tax year ended June 30, 2019. Stockholders are advised to consult their tax advisers as to the federal, state and local tax status of the dividend income received from the Fund.

Stockholder Meeting Results:

The Fund held a meeting of stockholders on October 26, 2018. Stockholders voted as indicated below:

| Affirmative | Against | Abstain | ||||||||

| Election of Richard A. Silver — Class III to serve until 2021 |

4,485,010 | 311,022 | 53,520 | |||||||

Messrs. Joseph T. Grause, Jr. and Julian Reid, who serve as Class I Directors, and Mr. Christopher B. Brader, who serves as Class II Director, continue to serve as Directors of the Fund.

Changes to the Fund Officers:

Effective May 8, 2019, Joseph Quirk resigned as President and Chief Executive Officer of the Fund and Thomas J. Fuccillo was appointed President and Chief Executive Officer of the Fund.

Effective May 8, 2019, Angela Borreggine was appointed Secretary and Chief Legal Officer of the Fund.

Proxy Voting Policies & Procedures:

A description of the policies and procedures that the Fund has adopted to determine how to vote proxies relating to portfolio securities and information about how the Fund voted proxies relating to portfolio securities held during the most recent twelve month period ended June 30 is available (i) without charge, upon request, by calling the Fund’s stockholder servicing agent at (800) 254-5197; (ii) on the Fund’s website at www.thekoreafund.com; and (iii) on the Securities and Exchange Commission website at www.sec.gov.

| 20 | The Korea Fund, Inc. Annual Report | 06.30.19 |

Table of Contents

The Korea Fund, Inc. Privacy Policy (unaudited)

Please read this Policy carefully. It gives you important information about how Allianz Global Investors U.S. and its U.S. affiliates (“AllianzGI US,” “we” or “us”) handle non-public personal information (“Personal Information”) that we may receive about you. It applies to all of the past, present and future clients and stockholders of AllianzGI US and the funds and accounts it manages, advises, administers or distributes, and will continue to apply when you are no longer a client or shareholder. As used throughout this Policy, “AllianzGI US” means Allianz Global Investors U.S. LLC, Allianz Global Investors Distributors LLC and the family of registered and unregistered funds managed by one or more of these firms. AllianzGI US is part of a global investment management group, and the privacy policies of other Allianz Global Investors entities outside of the United States may have provisions in their policies that differ from this Privacy Policy. Please refer to the website of the specific non-US Allianz Global Investors entity for its policy on privacy.

We Care about Your Privacy

We consider your privacy to be a fundamental aspect of our relationship with you, and we strive to maintain the confidentiality, integrity and security of your Personal Information. To ensure your privacy, we have developed policies that are designed to protect your Personal Information while allowing your needs to be served.

Information We May Collect

In the course of providing you with products and services, we may obtain Personal Information about you, which may come from sources such as account application and other forms, from other written, electronic, or verbal communications, from account transactions, from a brokerage or financial advisory firm, financial advisor or consultant, and/or from information you provide on our website.

You are not required to supply any of the Personal Information that we may request. However, failure to do so may result in us being unable to open and maintain your account, or to provide services to you.

How Your Information Is Shared

We do not disclose your Personal Information to anyone for marketing purposes. We disclose your Personal Information only to those service providers, affiliated and non-affiliated, who need the information for everyday business purposes, such as to respond to your inquiries, to perform services, and/or to service and maintain your account. This applies to all of the categories of Personal Information we collect about you. The affiliated and non-affiliated service providers who receive your Personal Information also may use it to process your transactions, provide you with materials (including preparing and mailing prospectuses and shareholder reports and gathering shareholder proxies), and provide you with account statements and other materials relating to your account. These service providers provide services at our direction, and under their agreements with us, are required to keep your Personal Information confidential and to use it only for providing the contractually required services. Our service providers may not use your Personal Information to market products and services to you except in conformance with applicable laws and regulations. We also may provide your Personal Information to your respective brokerage or financial advisory firm, custodian, and/or to your financial advisor or consultant.

In addition, we reserve the right to disclose or report Personal Information to non-affiliated third parties, in limited circumstances, where we believe in good faith that disclosure is required under law, to cooperate with regulators or law enforcement authorities or pursuant to other legal process, or to protect our rights or property, including to enforce our Privacy Policy or other agreements with you. Personal Information collected by us may also be transferred as part of a corporate sale, restructuring, bankruptcy, or other transfer of assets.

Security of Your Information

We maintain your Personal Information for as long as necessary for legitimate business purposes or otherwise as required by law. In maintaining this information, we have implemented appropriate procedures that are designed to restrict access to your Personal Information only to those who need to know that information in order to provide products and/or services to you. In addition, we have implemented physical, electronic and procedural safeguards to help protect your Personal Information.

Privacy and the Internet

The Personal Information that you provide through our website, as applicable, is handled in the same way as the Personal Information that you provide by any other means, as described above. This section of the Policy gives you additional information about the way in which Personal Information that is obtained online is handled.

Online Enrollment, Account Access and Transactions

When you visit our website, you can visit pages that are open to the general public, or, where available, log into protected pages to enroll online, access information about your account, or conduct certain transactions. Access to these secure pages is permitted only after you have created a User ID and Password. The User ID and Password must be supplied each time you want to access your account information online. This information serves to verify your identity. When you enter Personal Information to enroll or access your account online, you will log into secure pages. By using our website, you consent to this Privacy Policy and to the use of your Personal Information in accordance with the

| 06.30.19 | The Korea Fund, Inc. Annual Report | 21 |

Table of Contents

The Korea Fund, Inc. Privacy Policy (unaudited) (continued)

practices described in this Policy. If you provide Personal Information to effect transactions, a record of the transactions you have performed while on the site is retained by us. For additional terms and conditions governing your use of our website, please refer to the Investor Mutual Fund Access—Disclaimer which is incorporated herein by reference and is available on our website.

Cookies and Similar Technologies