Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04058

The Korea Fund, Inc.

(Exact name of registrant as specified in charter)

| 1633 Broadway, New York, NY | 10019 | |

| (Address of principal executive offices) | (Zip code) |

Lawrence G. Altadonna

1633 Broadway,

New York, New York 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-739-3371

Date of fiscal year end: June 30, 2016

Date of reporting period: June 30, 2016

Table of Contents

Item 1. Report to Shareholders

Annual Report

June 30, 2016

Table of Contents

The Korea Fund, Inc. Portfolio Manager’s Report

June 30, 2016 (unaudited)

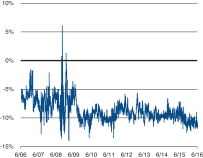

During the fiscal year from July 1, 2015 to June 30, 2016, the MSCI Korea (Total Return) Index fell by 0.33% in Korean Won terms and 3.48% in US Dollar terms. The KOSPI Index, with higher exposure to small and mid-cap stocks, fell by 5.01% and 8.01% in Korean Won and US Dollar terms, respectively. The market’s decline was driven by a number of external factors. Firstly, expectations of rising US interest rates led to a strong US Dollar against many emerging market currencies, thus prompting outflows from emerging equity markets to which Korea was not immune. Secondly, the Renminbi started to depreciate following a few years of steady appreciation. The pace of depreciation accelerated in the summer of 2015 and early 2016, causing fears that China might pursue competitive devaluation. Given China is Korea’s largest trading partner, a weaker Renminbi would have negative implications for the Korean economy. Thirdly, China’s economic slowdown, together with Saudi Arabia’s changes in crude production strategy, led to price weakness across a broad range of commodities including crude oil. As a result, economies highly dependent on China or commodities faced a significant slowdown in growth. As a result of weak external demand and lower commodity prices, Korea’s exports registered a decline of 10.8% in the second half of 2015, and 10.0% in the first half of 2016.

Given weak global demand, oversupply was seen in a number of sectors including semiconductor, auto, display panels and shipping. In particular, there was significant financial distress in the shipping and shipbuilding industries, and in some cases debt restructuring was required or considered. So far, state-owned banks have borne the brunt of the credit costs, and the hit to private sector banks have not been as serious. However, if the economic deterioration continues, there will be a higher risk that levels of non-performing loans will rise at private sector banks as well.

The summer of 2015 marked a reversal of the housing market in Korea. During the first half of 2015, housing transaction volumes rose significantly while prices also saw modest gains, supported by rising rents and record low interest rates. However, the stronger housing market was accompanied by faster growth in mortgage loans, and the government became concerned about the household debt increase. In July 2015, the Korean government introduced a set of new policies aimed at tightening housing loans. This dealt a blow to market sentiment and housing transactions declined in the subsequent months, although prices remained largely stable. During the first five months of 2016, nationwide housing transactions fell by 18.8% compared to the same period last year.

Fund’s Performance

From July 1, 2015 to June 30, 2016, the total return of The Korea Fund, Inc.’s (the “Fund”) Net Asset Value (NAV) was -8.35% (net of fees) in USD terms, underperforming the Fund’s benchmark MSCI Korea (Total Return) Index, which returned -3.48%.

| 06.30.16 | The Korea Fund, Inc. Annual Report | 1 |

Table of Contents

The Korea Fund, Inc. Portfolio Manager’s Report

June 30, 2016 (unaudited) (continued)

Over the reporting period, stock selection in the technology and consumer discretionary sectors contributed to the Fund’s underperformance. The slowdown in personal computer and mobile phone shipments were worse than we expected, which led to weak memory chip prices and drove down the share price of SK Hynix, one of the world’s largest memory chipmakers. In the consumer sector, the Fund was hurt by holdings in Hotel Shilla, a duty free store and hotel operator. In late 2015 the government surprisingly granted duty free licenses to new operators, increasing the number of duty free stores in downtown Seoul. The concerns over intensified competition led to a sharp decline in Hotel Shilla’s share price. In the industrial sector, Hyundai Development, a local residential housing developer, also detracted from performance as sentiment in the housing market soured on tighter government regulation and increasing supply.

Positive contributors over the period include LG Household & Healthcare, whose cosmetics products continued to enjoy solid demand from Chinese consumers. The company’s household goods and beverage division also benefited from improving profit margins. Investment in BGF Retail, a convenience store operator, added to performance as the company expanded its store network and grew same store sales amid increasing single person household customers.

Outlook

We continue to hold a cautious view on Korea’s export outlook, as global demand is unlikely to recover in the near term. In our view, there are pockets of strength in the technology industry where new products such as OLED display panels and 3D NAND memory chips drive strong demand. Petroleum products are also seeing healthy demand as the low crude oil prices stimulated more consumption. But for many traditional export sectors such as auto, ships and steel, we believe the demand outlook remains problematic.

On the domestic front, we believe the medium term outlook of the housing market is still positive. The Bank of Korea cut the interest rate by 25bps to 1.25% in June 2016, and may cut further in the second half of 2016. The record low interest rates, combined with rising rents, should provide support to housing demand, in our view. Moreover, housing prices are still reasonable relative to household income and mortgage payment burden. Given the weak economy and the upcoming Presidential election in 2017, we believe the government is unlikely to over-regulate the housing market, which has a meaningful impact on domestic demand.

In view of the highly uncertain macro outlook, the Fund expects to maintain a relatively defensive stance in the near term. We continue to look for companies with earnings improvement and reasonable valuation. We also favor those companies with dominant positions in their industries and relatively stable cash flows.

| 2 | The Korea Fund, Inc. Annual Report | 06.30.16 |

Table of Contents

The Korea Fund, Inc. Portfolio Manager’s Report

June 30, 2016 (unaudited) (continued)

The information contained herein has been obtained from sources believed to be reliable but the investment manager and its affiliates do not warrant the information to be accurate, complete or reliable. The opinions expressed herein are solely those of the Fund’s Portfolio Manager and are subject to change at any time and without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Investors should consider the investment objectives, risks, charges and expenses of any mutual fund carefully before investing. This and other information is contained in the Fund’s annual and semiannual reports, proxy statement and other Fund information, which may be obtained by contacting your financial advisor or visiting the Fund’s website at www.thekoreafund.com.

This information is unaudited and is intended for informational purposes only. It is presented only to provide information on investment strategies and opportunities. The Fund seeks long-term capital appreciation through investment in securities, primarily equity securities, of Korean companies. Investing in non-U.S. securities entails additional risks, including political and economic risk and the risk of currency fluctuations, as well as lower liquidity. These risks, which can result in greater price volatility, will generally be enhanced in less diversified funds that concentrate investments in a particular geographic region. The Fund is a closed-end exchange traded management investment company. This material is presented only to provide information and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. After the initial public offering, shares are sold on the open market through a stock exchange, where shares may trade at a premium or a discount. Holdings are subject to change daily.

| 06.30.16 | The Korea Fund, Inc. Annual Report | 3 |

Table of Contents

The Korea Fund, Inc. Performance & Statistics

June 30, 2016 (unaudited)

| Total Return(1) | 1 Year | 5 Year | 10 Year | |||||||||

| Market Price |

-8.75 | % | -3.09 | % | 1.95 | % | ||||||

| Net Asset Value (“NAV”) |

-8.35 | % | -2.99 | % | 1.53 | %(2) | ||||||

| MSCI Korea (Total Return)(3) |

-3.48 | % | -2.48 | % | 3.05 | % | ||||||

| MSCI Korea (Price Return)(3) |

-4.88 | % | -3.50 | % | 1.90 | % | ||||||

|

KOSPI(4) |

-8.01 | % | -2.76 | % | 2.28 | % | ||||||

| 4 | The Korea Fund, Inc. Annual Report | 06.30.16 |

Table of Contents

The Korea Fund, Inc. Performance & Statistics

June 30, 2016 (unaudited) (continued)

Notes to Performance & Statistics:

| (1) | Past performance is no guarantee of future results. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares. Total return for a period of more than one year represents the average annual total return. |

| Performance at market price will differ from results at NAV. Although market price returns typically reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in the Fund’s dividends. |

| An investment in the Fund involves risk, including the loss of principal. Total return, market price and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one-time public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets less total liabilities divided by the number of shares outstanding. Holdings are subject to change daily. |

| (2) | See Note 8 in the Notes to Financial Statements. |

| (3) | Morgan Stanley Capital International (“MSCI”) Korea Index is a market capitalization-weighted index of equity securities of companies domiciled in Korea. The index is designed to represent the performance of the Korean stock market and excludes certain market segments unavailable to U.S. based investors. The MSCI Korea (Total Return) returns assume reinvestment of dividends (net of foreign withholding taxes) while the MSCI Korea (Price Return) returns do not and, unlike Fund returns, do not reflect any fees or expenses. Total return for a period of more than one year represents the average annual return. |

| (4) | The Korea Composite Stock Price Index (“KOSPI”) is an unmanaged capitalization-weighted index of all common shares on the Stock Market Division of the Korea Exchange (formerly the “Korea Stock Exchange”). The KOSPI returns, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly in an index. Total return for a period of more than one year represents the average annual return. |

| (5) | The NAV disclosed in the Fund’s financial statements may differ due to accounting principles generally accepted in the United States of America. |

| 06.30.16 | The Korea Fund, Inc. Annual Report | 5 |

Table of Contents

The Korea Fund, Inc. Schedule of Investments

June 30, 2016

| Shares | Value | |||||||

|

|

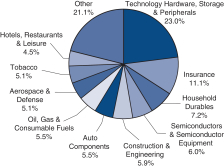

COMMON STOCK–96.5% |

|||||||

| Aerospace & Defense–5.1% | ||||||||

| 36,420 | Hanwha Techwin Co., Ltd. |

$ 1,548,652 | ||||||

| 135,743 | Korea Aerospace Industries Ltd. |

8,702,812 | ||||||

| 34,353 | LIG Nex1 Co., Ltd. (c) |

2,919,216 | ||||||

|

|

|

|||||||

| 13,170,680 | ||||||||

|

|

|

|||||||

| Auto Components–5.5% | ||||||||

| 228,903 | Hankook Tire Co., Ltd. |

10,183,978 | ||||||

| 419,170 | Hanon Systems |

3,836,216 | ||||||

|

|

|

|||||||

| 14,020,194 | ||||||||

|

|

|

|||||||

| Banks–3.0% | ||||||||

| 23,000 | KB Financial Group, Inc. |

654,026 | ||||||

| 212,952 | Shinhan Financial Group Co., Ltd. |

6,999,520 | ||||||

|

|

|

|||||||

| 7,653,546 | ||||||||

|

|

|

|||||||

| Commercial Services & Supplies–1.2% | ||||||||

| 55,800 | KEPCO Plant Service & Engineering Co., Ltd. |

3,154,776 | ||||||

|

|

|

|||||||

| Construction & Engineering–5.9% | ||||||||

| 433,450 | Hyundai Development Co. |

15,037,513 | ||||||

|

|

|

|||||||

| Electronic Equipment, Instruments & Components–1.5% | ||||||||

| 167,600 | LG Display Co., Ltd. |

3,880,531 | ||||||

|

|

|

|||||||

| Food & Staples Retailing–2.0% | ||||||||

| 27,200 | BGF retail Co., Ltd. (c) |

5,064,493 | ||||||

|

|

|

|||||||

| Hotels, Restaurants & Leisure–4.5% | ||||||||

| 320,457 | Kangwon Land, Inc. |

11,627,791 | ||||||

|

|

|

|||||||

| Household Durables–7.2% | ||||||||

| 190,431 | Coway Co., Ltd. |

17,339,234 | ||||||

| 8,590 | Hanssem Co., Ltd. |

1,196,377 | ||||||

|

|

|

|||||||

| 18,535,611 | ||||||||

|

|

|

|||||||

| Industrial Conglomerates–1.1% | ||||||||

| 38,700 | LG Corp. |

2,152,177 | ||||||

| 4,134 | SK Holdings Co., Ltd. |

730,680 | ||||||

|

|

|

|||||||

| 2,882,857 | ||||||||

|

|

|

|||||||

| Insurance–11.1% | ||||||||

| 225,900 | Dongbu Insurance Co., Ltd. |

13,597,033 | ||||||

| 104,300 | Hyundai Marine & Fire Insurance Co., Ltd. |

2,659,600 | ||||||

| 104,550 | Korean Reinsurance Co. |

1,112,285 | ||||||

| 48,485 | Samsung Fire & Marine Insurance Co., Ltd. |

11,136,023 | ||||||

|

|

|

|||||||

| 28,504,941 | ||||||||

|

|

|

|||||||

| Machinery–1.6% | ||||||||

| 76,200 | Hyundai Elevator Co., Ltd. (c)(d) |

4,129,245 | ||||||

|

|

|

|||||||

| Metals & Mining–0.3% | ||||||||

| 1,940 | Korea Zinc Co., Ltd. |

860,291 | ||||||

|

|

|

|||||||

| Oil, Gas & Consumable Fuels–5.5% | ||||||||

| 125,800 | S-Oil Corp. |

8,336,656 | ||||||

| 45,700 | SK Innovation Co., Ltd. |

5,630,888 | ||||||

|

|

|

|||||||

| 13,967,544 | ||||||||

|

|

|

|||||||

| 6 | The Korea Fund, Inc. Annual Report | 06.30.16 |

Table of Contents

The Korea Fund, Inc. Schedule of Investments

June 30, 2016 (continued)

| Shares | Value | |||||||

| Personal Products–2.2% | ||||||||

| 5,818 | LG Household & Health Care Ltd. |

$ 5,681,596 | ||||||

|

|

|

|||||||

| Semiconductors & Semiconductor Equipment–6.0% | ||||||||

| 542,391 | SK Hynix, Inc. |

15,434,810 | ||||||

|

|

|

|||||||

| Specialty Retail–0.9% | ||||||||

| 37,475 | Hotel Shilla Co., Ltd. (c) |

2,223,433 | ||||||

|

|

|

|||||||

| Technology Hardware, Storage & Peripherals–23.0% | ||||||||

| 47,263 | Samsung Electronics Co., Ltd. |

58,859,032 | ||||||

|

|

|

|||||||

| Tobacco–5.1% | ||||||||

| 110,100 | KT&G Corp. |

13,039,691 | ||||||

|

|

|

|||||||

| Wireless Telecommunication Services–3.8% | ||||||||

| 51,460 | SK Telecom Co., Ltd. |

9,667,623 | ||||||

|

|

|

|||||||

| Total Common Stock (cost–$168,633,093) |

247,396,198 | |||||||

|

|

|

|||||||

|

|

SHORT-TERM INVESTMENTS–3.9% |

|||||||

| Collateral Invested for Securities on Loan (b)–3.9% | ||||||||

| 9,822,428 | BlackRock T-Fund, Institutional Class (cost–$9,822,428) |

9,822,428 | ||||||

|

|

|

|||||||

| Total Investments (cost–$178,455,521) (a)–100.4% | 257,218,626 | |||||||

| Liabilities in excess of other assets–(0.4)% |

(929,434 | ) | ||||||

|

|

|

|||||||

| Net Assets–100.0% | $256,289,192 | |||||||

|

|

|

|||||||

Notes to Schedule of Investments:

| (a) | Securities with an aggregate value of $247,396,198, representing 96.5% of net assets, were valued utilizing modeling tools provided by a third-party vendor. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (b) | Purchased with cash collateral received from securities on loan. |

| (c) | A portion of securities on loan with an aggregate value of $9,384,046; cash collateral of $9,822,428 was received with which the Fund invested in the BlackRock T-Fund Institutional Class. |

| (d) | Non-income producing. |

| (e) | Fair Value Measurements – See Note 1(b) in the Notes to Financial Statements. |

| Level 1 – Quoted Prices |

Level 2 – Other Significant Observable Inputs |

Level 3 – Significant Unobservable Inputs |

Value at 6/30/16 |

|||||||||||||

| Investments in Securities—Assets | ||||||||||||||||

| Common Stock |

$ | — | $ | 247,396,198 | $ | — | $ | 247,396,198 | ||||||||

| Collateral Invested for Securities on Loan |

9,822,428 | — | — | 9,822,428 | ||||||||||||

| Totals |

$ | 9,822,428 | $ | 247,396,198 | $ | — | $ | 257,218,626 | ||||||||

At June 30, 2016, there were no transfers between Levels 1 and 2.

Securities Lending Transactions Accounted for as Secured Borrowings:

| Remaining Contractual Maturity of the Agreements As of June 30, 2016 |

||||||||||||||||||||

| Overnight and Continuous |

Up to 30 days | 30 - 90 days | Greater than 90 days |

Total | ||||||||||||||||

| Securities Lending Transactions | ||||||||||||||||||||

| Common Stock |

$ | 9,822,428 | $ | — | $ | — | $ | — | $ | 9,822,428 | ||||||||||

| Gross amount of recognized liabilities for securities lending transactions | $ | 9,822,428 | ||||||||||||||||||

| See accompanying Notes to Financial Statements | 06.30.16 | The Korea Fund, Inc. Annual Report | 7 |

Table of Contents

The Korea Fund, Inc. Statement of Assets and Liabilities

June 30, 2016

| Assets: | ||||||||

| Investments, at value, including securities on loan of $9,384,046 (cost–$178,455,521) |

$257,218,626 | |||||||

| Cash |

918,833 | |||||||

| Foreign currency, at value (cost–$9,570,956) |

9,655,337 | |||||||

| Dividends receivable (net of foreign withholding taxes) |

174,856 | |||||||

| Securities lending income receivable, including income from invested cash collateral (net of rebates) |

27,784 | |||||||

| Prepaid expenses and other assets |

166,681 | |||||||

| Total Assets |

268,162,117 | |||||||

| Liabilities: | ||||||||

| Payable for collateral for securities on loan |

9,822,428 | |||||||

| Payable for investments purchased |

1,527,573 | |||||||

| Investment management fees payable |

154,414 | |||||||

| Accrued expenses and other liabilities |

368,510 | |||||||

| Total Liabilities |

11,872,925 | |||||||

| Net Assets | $256,289,192 | |||||||

| Net Assets: | ||||||||

| Common Stock: |

||||||||

| Par value ($0.01 per share, applicable to 6,987,896 shares issued and outstanding) |

$69,879 | |||||||

| Paid-in-capital in excess of par |

203,065,171 | |||||||

| Dividends in excess of net investment income |

(216,537) | |||||||

| Accumulated net realized loss |

(25,478,037) | |||||||

| Net unrealized appreciation |

78,848,716 | |||||||

| Net Assets | $256,289,192 | |||||||

| Net Asset Value Per Share | $36.68 | |||||||

| 8 | The Korea Fund, Inc. Annual Report | 06.30.16 | See accompanying Notes to Financial Statements |

Table of Contents

The Korea Fund, Inc. Statement of Operations

Year ended June 30, 2016

| Investment Income: | ||||||||

| Dividends (net of foreign withholding taxes of $765,178) |

$3,785,253 | |||||||

| Securities lending income, including income from invested cash collateral (net of rebates) |

251,067 | |||||||

| Interest (net of foreign withholding taxes of $1,355) |

8,950 | |||||||

| Total Investment Income |

4,045,270 | |||||||

| Expenses: | ||||||||

| Investment management |

2,043,259 | |||||||

| Directors |

387,966 | |||||||

| Legal |

299,670 | |||||||

| Insurance |

158,216 | |||||||

| Custodian and accounting agent |

139,285 | |||||||

| Audit and tax services |

109,083 | |||||||

| Stockholder communications |

39,221 | |||||||

| Transfer agent |

25,121 | |||||||

| New York Stock Exchange listing |

23,837 | |||||||

| Miscellaneous |

45,083 | |||||||

| Total Expenses |

3,270,741 | |||||||

| Net Investment Income | 774,529 | |||||||

| Realized and Change in Unrealized Gain (Loss): | ||||||||

| Net realized loss on: |

||||||||

| Investments |

(2,755,565) | |||||||

| Foreign currency transactions |

(35,707) | |||||||

| Payments from Affiliates (See Note 9) |

23,127 | |||||||

| Net change in unrealized appreciation/depreciation of: |

||||||||

| Investments |

(27,590,029) | |||||||

| Foreign currency transactions |

131,047 | |||||||

| Net realized and change in unrealized loss |

(30,227,127) | |||||||

| Net Decrease in Net Assets Resulting from Investment Operations | $(29,452,598) | |||||||

| See accompanying Notes to Financial Statements | 06.30.16 | The Korea Fund, Inc. Annual Report | 9 |

Table of Contents

The Korea Fund, Inc. Statement of Changes in Net Assets

| Year ended June 30, 2016 |

Year ended June 30, 2015 |

|||||||||||||||

| Investment Operations: | ||||||||||||||||

| Net investment income (loss) |

$774,529 | $(175,924) | ||||||||||||||

| Net realized gain (loss) |

(2,768,145) | 18,069,387 | ||||||||||||||

| Net change in unrealized appreciation/depreciation |

(27,458,982) | (40,798,793) | ||||||||||||||

| Net decrease in net assets resulting from investment operations |

(29,452,598) | (22,905,330) | ||||||||||||||

| Distributions to Stockholders from Net Realized Gains | (31,317,886) | — | ||||||||||||||

| Common Stock Transactions: | ||||||||||||||||

| Cost of shares repurchased |

(12,398,811) | (25,782,648) | ||||||||||||||

| Total decrease in net assets |

(73,169,295) | (48,687,978) | ||||||||||||||

| Net Assets: | ||||||||||||||||

| Beginning of year |

329,458,487 | 378,146,465 | ||||||||||||||

| End of year* |

$256,289,192 | $329,458,487 | ||||||||||||||

| *Including dividends in excess of net investment income of: |

$(216,537) | $(955,359) | ||||||||||||||

| Shares Activity: | ||||||||||||||||

| Shares outstanding, beginning of year |

7,353,874 | 7,988,733 | ||||||||||||||

| Shares repurchased |

(365,978) | (634,859) | ||||||||||||||

| Shares outstanding, end of year |

6,987,896 | 7,353,874 | ||||||||||||||

| 10 | The Korea Fund, Inc. Annual Report | 06.30.16 | See accompanying Notes to Financial Statements |

Table of Contents

The Korea Fund, Inc. Notes to Financial Statements

June 30, 2016

1. Organization and Significant Accounting Policies

The Korea Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940 and the rules and regulations thereunder, as amended, as a closed-end, non-diversified management investment company organized as a Maryland corporation, and accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services—Investment Companies. Allianz Global Investors U.S. LLC (“AllianzGI U.S.” or the “Investment Manager”) serves as the Fund’s investment manager. AllianzGI U.S. is an indirect, wholly-owned subsidiary of Allianz Asset Management of America L.P. (“AAM”). AAM is an indirect, wholly-owned subsidiary of Allianz SE, a publicly traded European insurance and financial services company. The Fund has authorized 200 million shares of common stock with $0.01 par value.

The Fund’s investment objective is to seek long-term capital appreciation through investment in securities, primarily equity securities, of Korean companies. There can be no assurance that the Fund will meet its stated objective.

The preparation of the Fund’s financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires the Fund’s management to make estimates and assumptions that affect the reported amounts and disclosures in the Fund’s financial statements. Actual results could differ from those estimates.

In the normal course of business, the Fund enters into contracts that contain a variety of representations that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

In June 2014, the FASB issued an Accounting Standards Update (“ASU”) 2014-11 that expands secured borrowing accounting for certain repurchase agreements. ASU 2014-11 also sets forth additional disclosure requirements for certain transactions accounted for as sales, in order to provide financial statement users with information to compare to similar transactions accounted for as secured borrowings. ASU 2014-11 became effective for annual periods beginning after December 15, 2014, and for interim periods beginning after March 15, 2015. The Fund has adopted the ASU. The financial statements have been modified to provide enhanced disclosures surrounding secured borrowing transactions, if any. See the Notes to Schedule of Investments for additional details.

The following is a summary of significant accounting policies consistently followed by the Fund:

(a) Valuation of Investments

Portfolio securities and other financial instruments for which market quotations are readily available are stated at market value. Market value is generally determined on the basis of official closing prices, last reported sales prices, or if no sales or closing prices are reported, on the basis of quotes obtained from a quotation reporting system, established market makers, or independent pricing services. Investments in mutual funds are valued at the net asset value per share (“NAV”) as reported on each business day.

Portfolio securities and other financial instruments for which market quotations are not readily available, or for which a development/event occurs that may significantly impact the value of a security, are fair-valued, in good faith, pursuant to procedures established by the Board of Directors (the “Board”), or persons acting at their discretion pursuant to procedures established by the Board. The Fund’s investments are valued daily and the Fund’s NAV is calculated as of the close of regular trading (normally 4:00 p.m. Eastern Time) on the New York Stock Exchange (“NYSE”) on each day the NYSE is open for business using prices supplied by an independent pricing service or broker/dealer quotations, or by using the last sale or settlement price on the exchange that is the primary market for such securities, or the mean between the last bid and ask quotations. For foreign equity securities (with certain exceptions, if any), the Fund fair values its securities daily using modeling tools provided by a statistical research service. This service utilizes statistics and programs based on historical performance of markets and other economic data (which may include changes in the value of U.S. securities or security indices).

Short-term debt instruments maturing in 60 days or less are valued at amortized cost, if their original term to maturity was 60 days or less, or by amortizing premium or discount based on their value on the 61st day prior to maturity, if the original term to maturity exceeded 60 days.

Investments initially valued in currencies other than the U.S. dollar are converted to the U.S. dollar using exchange rates obtained from pricing services. As a result, the NAV of the Fund’s shares may be affected by changes in the value of currencies in relation to the U.S. dollar. The value of securities traded in markets outside the United States or denominated in currencies other than the U.S. dollar may be affected significantly on a day that the NYSE is closed. The prices used by the Fund to value securities may differ from the value that would be realized if the securities were sold and these differences could be material to the Fund’s financial statements.

| 06.30.16 | The Korea Fund, Inc. Annual Report | 11 |

Table of Contents

The Korea Fund, Inc. Notes to Financial Statements

June 30, 2016 (continued)

1. Organization and Significant Accounting Policies (continued)

(b) Fair Value Measurements

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants. The three levels of the fair value hierarchy are described below:

| • | Level 1—quoted prices in active markets for identical investments that the Fund has the ability to access |

| • | Level 2—valuations based on other significant observable inputs, which may include, but are not limited to, quoted prices for similar assets or liabilities, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates or other market corroborated inputs |

| • | Level 3—valuations based on significant unobservable inputs (including the Investment Manager’s and the Valuation Committee’s own assumptions and securities whose price was determined by using a single broker’s quote) |

The valuation techniques used by the Fund to measure fair value during the year ended June 30, 2016 were intended to maximize the use of observable inputs and to minimize the use of unobservable inputs.

The Fund’s policy is to recognize transfers between levels at the end of the reporting period. An investment asset’s or liability’s level within the fair value hierarchy is based on the lowest level input, individually or in aggregate, that is significant to the fair value measurement. The objective of fair value measurement remains the same even when there is a significant decrease in the volume and level of activity for an asset or liability and regardless of the valuation techniques used. Investments categorized as Level 1 or 2 as of period end may have been transferred between Levels 1 and 2 since the prior period due to changes in the valuation method utilized in valuing the investments.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following are certain inputs and techniques that the Fund generally uses to evaluate how to classify each major category of assets and liabilities within Level 2 and Level 3, in accordance with U.S. GAAP.

Equity Securities (Common Stock)—Equity securities traded in inactive markets and certain foreign equity securities are valued using inputs which include broker-dealer quotes, recently executed transactions adjusted for changes in the benchmark index, or evaluated price quotes received from independent pricing services that take into account the integrity of the market sector and issuer, the individual characteristics of the security, and information received from broker-dealers and other market sources pertaining to the issuer or security. To the extent that these inputs are observable, the values of equity securities are categorized as Level 2. To the extent that these inputs are unobservable, the values are categorized as Level 3.

(c) Investment Transactions and Investment Income

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on an identified cost basis. Interest income on uninvested cash is recorded upon receipt. Dividend income is recorded on the ex-dividend date. Korean-based corporations have generally adopted calendar year-ends, and their interim and final corporate actions are normally approved, finalized and announced by their boards of directors and stockholders in the first and third quarters of each calendar year. Generally, estimates of their dividends are accrued on the ex-dividend date principally in the prior December and/or June period ends. These dividend announcements are recorded by the Fund on such ex-dividend dates. Any subsequent adjustments thereto by Korean corporations are recorded when announced. Presently, dividend income from Korean equity investments is earned primarily in the last calendar quarter of each year, and will be received primarily in the first calendar quarter of the following year. Certain other dividends and related withholding taxes, if applicable, from Korean securities may be recorded subsequent to the ex-dividend date as soon as the Fund is informed of such dividends and taxes. Dividend and interest income on the Statement of Operations are shown net of any foreign taxes withheld on income from foreign securities.

(d) Federal Income Taxes

The Fund intends to distribute all of its taxable income and to comply with the other requirements of Subchapter M of the U.S. Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required. The Fund may be subject to excise tax based on distributions to stockholders.

Accounting for uncertainty in income taxes establishes for all entities, including pass-through entities such as the Fund, a minimum threshold for financial statement recognition of the benefit of positions taken in filing tax returns (including whether an entity is taxable in a particular jurisdiction), and requires certain expanded tax disclosures. In accordance with provisions set forth under U.S. GAAP, the Investment Manager has reviewed the Fund’s tax positions for all open tax years.

| 12 | The Korea Fund, Inc. Annual Report | 06.30.16 |

Table of Contents

The Korea Fund, Inc. Notes to Financial Statements

June 30, 2016 (continued)

1. Organization and Significant Accounting Policies (continued)

As of June 30, 2016, the Fund has recorded no liability for net unrecognized tax benefits relating to uncertain income tax positions they have taken. The Fund’s federal income tax returns for the prior three years, as applicable, remain subject to examination by the Internal Revenue Service.

(e) Foreign Investment and Exchange Controls in Korea

The Foreign Exchange Transaction Act, the Presidential Decree relating to such Act and the regulations of the Minister of Strategy and Finance (formerly known as Minister of Finance and Economy) issued thereunder impose certain limitations and controls which generally affect foreign investors in Korea. Through August 18, 2005, the Fund had a license from the Ministry of Finance and Economy to invest in Korean securities and to repatriate income received from dividends and interest earned on, and net realized capital gains from, its investments in Korean securities or to repatriate from investment principal up to 10% of the NAV (taken at current value) of the Fund (except upon termination of the Fund, or for expenses in excess of Fund income, in which case the foregoing restriction shall not apply). Under the Foreign Exchange Transaction Act, the Minister of Strategy and Finance has the power, with prior (posterior in case of urgency) public notice of scope and duration, to suspend all or a part of foreign exchange transactions when emergency measures are deemed necessary in case of radical change in the international or domestic economic situation. The Fund could be adversely affected by delays in, or the refusal to grant, any required governmental approval for such transactions.

The Fund relinquished its license from the Korean Ministry of Finance and Economy effective August 19, 2005. The Fund had engaged in negotiations with the Korean Ministry of Finance and Economy concerning the feasibility of the Fund’s license being amended to allow the Fund to repatriate more than 10% of Fund capital. However, the Ministry of Finance and Economy advised the Fund that the license cannot be amended as a result of a change in the Korean regulations. As a result of the relinquishment of the license, the Fund is subject to the Korean securities transaction tax equal to 0.3% of the fair market value of any portfolio securities transferred by the Fund on the Korea Exchange and 0.5% of the fair market value of any portfolio securities transferred outside of the Korea Exchange. The relinquishment did not otherwise affect the Fund’s operations. For the year ended June 30, 2016, the Fund incurred $467,276 in transaction taxes in connection with portfolio securities transferred by the Fund on the Korea Exchange.

Certain securities held by the Fund may be subject to aggregate or individual foreign ownership limits. These holdings are in industries that are deemed to be of national importance.

(f) Dividends and Distributions

The Fund declares dividends from net investment income and distributions of net realized capital gains, if any, at least annually. The Fund records dividends and distributions on the ex-dividend date. The amount of dividends from net investment income and distributions from net realized capital gains is determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. These “book-tax” differences are considered either temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal income tax treatment; temporary differences do not require reclassification. To the extent dividends and/or distributions exceed current and accumulated earnings and profits for federal income tax purposes, they are reported as dividends and/or distributions to stockholders from return of capital.

(g) Foreign Currency Translation

The Fund’s accounting records are maintained in U.S. dollars as follows: (1) the foreign currency market values of investments and other assets and liabilities denominated in foreign currencies are translated at the prevailing exchange rate at the end of the period; and (2) purchases and sales, income and expenses are translated at the prevailing exchange rate on the respective dates of such transactions. The resulting net foreign currency gain (loss) is included in the Fund’s Statement of Operations.

The Fund does not generally isolate that portion of the results of operations arising as a result of changes in foreign currency exchange rates from the fluctuations arising from changes in the market prices of securities. Accordingly, such foreign currency gain (loss) is included in net realized and unrealized gain (loss) on investments. However, the Fund does isolate the effect of fluctuations in foreign currency exchange rates when determining the gain (loss) upon the sale or maturity of foreign currency denominated debt obligations pursuant to U.S. federal income tax regulations; such amount is categorized as foreign currency gain (loss) for both financial reporting and income tax reporting purposes.

At June 30, 2016, the Korean WON/U.S. $ exchange rate was WON 1,151.85 to U.S. $1.

(h) Securities Lending

The Fund may engage in securities lending. The loans are secured by collateral at least equal, at all times, to the market value of the loaned securities. During the term of the loan, the Fund will continue to receive any dividends or amounts

| 06.30.16 | The Korea Fund, Inc. Annual Report | 13 |

Table of Contents

The Korea Fund, Inc. Notes to Financial Statements

June 30, 2016 (continued)

1. Organization and Significant Accounting Policies (continued)

equivalent thereto, on the loaned securities while receiving a fee from the borrower and/or earning interest on the investment of the cash collateral. Securities lending income is disclosed as such in the Statement of Operations. Income generated from the investment of cash collateral, less negotiated rebate fees paid to borrowers and transaction costs, is allocated between the Fund and securities lending agent. Cash collateral received for securities on loan is invested in securities identified in the Schedule of Investments and the corresponding liability is recognized as such in the Statement of Assets and Liabilities. Loans are subject to termination at the option of the borrower or the Fund.

Upon termination of the loan, the borrower will return to the lender securities identical to the loaned securities. The Fund may pay reasonable finders’, administration and custodial fees in connection with a loan of its securities and may share the interest earned on the collateral with the borrower. The Fund bears the risk of delay in recovery of, or even loss of rights in, the securities loaned should the borrower of the securities fail financially. The Fund also bears the risk of loss in the event the securities purchased with cash collateral depreciate in value.

(i) Rights

The Fund may receive rights. A right is a privilege granted to existing stockholders of a corporation to subscribe for shares of a new issue of common stock before it is issued. Rights normally have a short life, usually two to four weeks, are freely transferable and entitle the holder to buy the new common stock at a lower price than the public offering price. Rights may entail greater risks than certain other types of investments. Generally, rights do not carry the right to receive dividends or exercise voting rights with respect to the underlying securities, and they do not represent any rights in the assets of the issuer. In addition, their value does not necessarily change with the value of the underlying securities, and they cease to have value if they are not exercised on or before their expiration date. If the market price of the underlying stock does not exceed the exercise price during the life of the right, the right will expire worthless. Rights may increase the potential profit or loss to be realized from the investment as compared with investing the same amount in the underlying securities.

2. Principal Risks

In the normal course of business, the Fund trades financial instruments and enters into financial transactions where risk of potential loss exists due to, among other things, changes in the market (market risk) or failure of the other party to a transaction to perform (counterparty risk). The Fund is also exposed to other risks such as, but not limited to, foreign currency risk.

To the extent the Fund directly invests in foreign currencies or in securities that trade in, and receive revenues in, foreign currencies, or in derivatives that provide exposure to foreign currencies, it will be subject to the risk that those currencies will decline in value relative to the U.S. dollar, or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency being hedged. Currency rates in foreign countries may fluctuate significantly over short periods of time for a number of reasons, including economic growth, inflation, changes in interest rates, intervention (or the failure to intervene) by U.S. or foreign governments, central banks or supranational entities such as the International Monetary Fund, or the imposition of currency controls or other political developments in the United States or abroad. As a result, the Fund’s investments in foreign currency-denominated securities may reduce the returns of the Fund. The local emerging market currencies in which the fund may be invested may experience substantially greater volatility against the U.S. dollar than the major convertible currencies in developed countries.

The Fund is subject to elements of risk not typically associated with investments in the U.S., due to concentrated investments in foreign issuers located in a specific country or region. Such concentrations will subject the Fund to additional risks resulting from future political or economic conditions in such country or region and the possible imposition of adverse governmental laws or currency exchange restrictions affecting such country or region, which could cause the securities and their markets to be less liquid and prices more volatile than those of comparable U.S. companies.

The market values of securities may decline due to general market conditions (market risk) which are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates, adverse changes to credit markets or adverse investor sentiment. They may also decline due to factors that affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry. Equity securities and equity-related investments generally have greater market price volatility than fixed income securities, although under certain market conditions fixed income securities may have comparable or greater price volatility. Credit ratings downgrades may also negatively affect securities held by the Fund. Even when markets perform well, there is no assurance that the investments held by the Fund will increase in value along with the broader market. In addition, market risk includes the risk that geopolitical events will disrupt the economy on a national or global level.

| 14 | The Korea Fund, Inc. Annual Report | 06.30.16 |

Table of Contents

The Korea Fund, Inc. Notes to Financial Statements

June 30, 2016 (continued)

2. Principal Risks (continued)

The Fund is exposed to counterparty risk, or the risk that an institution or other entity with which the Fund has unsettled or open transactions will default. The potential loss to the Fund could exceed the value of the financial assets recorded in the Fund’s financial statements. Financial assets, which potentially expose the Fund to counterparty risk, consist principally of cash due from counterparties and investments. The Investment Manager seeks to minimize the Fund’s counterparty risk by performing reviews of each counterparty and by minimizing concentration of counterparty risk by undertaking transactions with multiple customers and counterparties on recognized and reputable exchanges. Delivery of securities sold is only made once the Fund has received payment. Payment is made on a purchase once the securities have been delivered by the counterparty. The trade will fail if either party fails to meet its obligation.

3. Investment Manager/Sub-Administrator

The Fund has an Investment Management Agreement (the “Management Agreement”) with the Investment Manager. Subject to the supervision of the Fund’s Board, the Investment Manager is responsible for managing, either directly or through others selected by it, the Fund’s investment activities, business affairs, and other administrative matters. Pursuant to the Management Agreement, the Investment Manager receives an annual fee, payable monthly, at the annual rate of 0.75% of the value of the Fund’s average daily net assets up to $250 million; 0.725% of the next $250 million of average daily net assets; 0.70% of the next $250 million of average daily net assets; 0.675% of the next $250 million of average daily net assets and 0.65% of average daily net assets in excess of $1 billion. For the year ended June 30, 2016, the Fund paid investment management fees at an effective rate of 0.75% of the Fund’s average daily net assets.

The Investment Manager has retained its affiliate, Allianz Global Investors Fund Management LLC (the “Sub-Administrator” or “AGIFM”) to provide administrative services to the Fund. The Investment Manager, and not the Fund, pays a portion of the fee it receives as Investment Manager to the Sub-Administrator in return for its services. The Sub-Administrator is an indirect, wholly-owned subsidiary of AAM.

4. Investments in Securities

For the year ended June 30, 2016, purchases and sales of investments, other than short-term securities were $114,945,966 and $155,161,089, respectively.

5. Income Tax Information

For the year ended June 30, 2016, the tax character of distributions paid of $31,317,886 was comprised entirely of long-term capital gains. No dividends or distributions were paid in the year ended June 30, 2015.

At June 30, 2016, the Fund had distributable earnings of $332,778 and $346,996 from ordinary income and long-term capital gains, respectively.

In accordance with U.S. Treasury regulations, the Fund elected to defer to the following taxable year realized Post-October short-term capital losses of $13,690,103 and long-term capital losses of $11,966,309 arising after October 31, 2015 and late year ordinary losses of $549,316 related to certain ordinary losses realized after December 31, 2015.

At June 30, 2016, permanent “book-tax” differences were primarily attributable to the differing treatment of foreign currency transactions. These adjustments were to increase dividends in excess of net investment income and decrease accumulated net realized loss by $35,707. Net investment income, net realized gains or losses and net assets were not affected by these adjustments.

At June 30, 2016, the cost basis of portfolio securities for federal income tax purposes was $178,624,144. Gross unrealized appreciation was $83,879,789; gross unrealized depreciation was $5,285,307; and net unrealized appreciation was $78,594,482. The difference between book and tax cost basis was attributable to wash sale loss deferrals.

6. Discount Management Program

On November 2, 2015, the Fund announced an adjustment to its share repurchase program under which the Fund will continue to repurchase, in each twelve month period ended June 30, up to 10% of its common shares outstanding as of the close of business on June 30 of the prior year, but will permit shares to be repurchased at differing discount trigger levels that will not be announced. The Fund will repurchase shares at a discount, in accordance with procedures approved by the Board. Subject to these procedures, the timing and amount of any shares repurchased will be determined by the Board and/or its Discount Management Committee in consultation with the Investment Manager.

For the year ended June 30, 2016, the Fund repurchased 365,978 shares of its common stock on the open market, which represented approximately 5% of the shares outstanding at June 30, 2015 at a total cost, inclusive of commissions

| 06.30.16 | The Korea Fund, Inc. Annual Report | 15 |

Table of Contents

The Korea Fund, Inc. Notes to Financial Statements

June 30, 2016 (continued)

6. Discount Management Program (continued)

($0.03 per share), of $12,398,811 at a per-share weighted average discount NAV of 10.09%. For the year ended June 30, 2015, the Fund repurchased 634,859 shares of its common stock on the open market, which represented approximately 8% of the shares outstanding at June 30, 2014 at a total cost, inclusive of commissions ($0.03 per share), of $25,782,648 at a per-share weighted average discount to NAV of 9.25%.

7. Fund Ownership

At June 30, 2016, the City of London Investment Group PLC, Lazard Asset Management LLC, Aberdeen Asset Management and 1607 Capital Partners held approximately 34%, 14%, 8% and 7%, respectively, of the Fund’s outstanding shares.

8. Fund Shares Issued

On December 22, 2008, the Fund declared a capital gain distribution of $90.30 per share. The distribution was made in newly issued Fund shares, based on the Fund’s market price per share on January 26, 2009 (“Pricing Date”), unless a cash election was made. The total cash distribution was limited to 20% of the aggregate dollar amount of the total distribution (excluding any cash paid in lieu of fractional shares). On January 29, 2009 (the payable date) the Fund issued 8,007,555 shares based on the market price of $21.99 per share on the Pricing Date. NAV total return for periods that include December 2008 and January 2009 had been calculated assuming that this capital gain distribution was paid entirely in newly issued Fund shares priced at the Fund’s NAV at the close of business on the Pricing Date. In addition, the Fund adjusted its NAV on December 31, 2008 for purposes of calculating performance by using the actual number of shares outstanding on such date (excluding any estimate of shares to be issued upon reinvestment).

9. Payments from Affiliates

During the year ended June 30, 2016, the Investment Manager reimbursed the Fund $23,127 for realized losses resulting from trading errors. There were no payments from affiliates for the year ended June 30, 2015.

10. Subsequent Events

In preparing these financial statements, the Fund’s management has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued.

There were no subsequent events identified that require recognition or disclosure.

| 16 | The Korea Fund, Inc. Annual Report | 06.30.16 |

Table of Contents

The Korea Fund, Inc. Financial Highlights

For a share of stock outstanding throughout each year:

| Year ended June 30, | ||||||||||||||||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||||||||||||||

| Net asset value, beginning of year |

$44.80 | $47.33 | $38.53 | $40.51 | $54.59 | |||||||||||||||||||||||||||||||

| Investment Operations: |

||||||||||||||||||||||||||||||||||||

| Net investment income (loss) |

0.11 | (1) | (0.02 | )(1) | (0.14 | )(1) | (0.13 | )(1) | (0.14 | ) | ||||||||||||||||||||||||||

| Net realized and change in unrealized gain (loss) |

(4.11 | ) | (2.84 | ) | 8.56 | (2.26 | ) | (8.72 | ) | |||||||||||||||||||||||||||

| Total from investment operations |

(4.00 | ) | (2.86 | ) | 8.42 | (2.39 | ) | (8.86 | ) | |||||||||||||||||||||||||||

| Distributions to Stockholders from |

||||||||||||||||||||||||||||||||||||

| Net Realized Gains |

(4.35 | ) | — | — | — | (5.45 | ) | |||||||||||||||||||||||||||||

| Common Stock Transactions: |

||||||||||||||||||||||||||||||||||||

| Accretion to net asset value resulting from share repurchases |

0.23 | 0.33 | 0.38 | 0.41 | 0.23 | |||||||||||||||||||||||||||||||

| Net asset value, end of year |

$36.68 | (3) | $44.80 | $47.33 | $38.53 | $40.51 | ||||||||||||||||||||||||||||||

| Market price, end of year |

$32.33 | $40.57 | $42.72 | $34.47 | $36.56 | |||||||||||||||||||||||||||||||

| Total Return: (2) |

||||||||||||||||||||||||||||||||||||

| Net asset value |

(8.35 | )%(3) | (5.35 | )% | 22.84 | % | (4.89 | )% | (15.25 | )% | ||||||||||||||||||||||||||

| Market price |

(8.75 | )% | (5.03 | )% | 23.93 | % | (5.72 | )% | (15.59 | )% | ||||||||||||||||||||||||||

| RATIOS/SUPPLEMENTAL DATA: |

||||||||||||||||||||||||||||||||||||

| Net assets, end of year (000s) |

$256,289 | $329,458 | $378,146 | $334,829 | $387,629 | |||||||||||||||||||||||||||||||

| Ratio of expenses to average net assets |

1.20 | % | 1.13 | % | 1.13 | % | 1.14 | % | 1.12 | % | ||||||||||||||||||||||||||

| Ratio of net investment income (loss) to average net assets |

0.28 | % | (0.05 | )% | (0.33 | )% | (0.31 | )% | (0.29 | )% | ||||||||||||||||||||||||||

| Portfolio turnover rate |

44 | % | 51 | % | 60 | % | 35 | % | 43 | % | ||||||||||||||||||||||||||

| (1) | Calculated on average shares outstanding. |

| (2) | Total return is calculated by subtracting the value of an investment in the Fund at the beginning of the specified year from the value at the end of the year and dividing the remainder by the value of the investment at the beginning of the year and expressing the result as a percentage. The calculation assumes that all dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares. Total return on net asset value may reflect adjustments to conform to U.S. GAAP. |

| (3) | Payments from Affiliates increased the net asset value and total return by less than $0.01 and 0.01%, respectively. |

| See accompanying Notes to Financial Statements | 06.30.16 | The Korea Fund, Inc. Annual Report | 17 |

Table of Contents

The Korea Fund, Inc. Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of The Korea Fund, Inc.:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of The Korea Fund, Inc. (the “Fund”) at June 30, 2016, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at June 30, 2016 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, New York

August 24, 2016

| 18 | The Korea Fund, Inc. Annual Report | 06.30.16 |

Table of Contents

The Korea Fund, Inc. Tax Information/Stockholder Meeting Results/Proxy Voting

Policies & Procedures (unaudited)

Tax Information:

As required by the Internal Revenue Code, stockholders must be notified regarding certain tax attributes of distributions made by the Fund.

During the year end June 30, 2016, the Fund distributed $31,317,886 of long-term (15%) capital gains (or the maximum amount allowable).

Foreign Tax Credit. The Fund has elected to pass-through the credit for taxes paid to foreign countries. The gross foreign dividends and foreign tax per share paid during the fiscal year ended June 30, 2016 is $0.635790 and $0.106911, respectively.

Since the Fund’s tax year is not the calendar year, another notification will be sent with respect to calendar year 2016. In January 2017, stockholders will be advised on IRS Form 1099-DIV as to the federal tax status of the dividends and distributions received during calendar year 2016. The amount that will be reported will be the amount to use on the stockholder’s 2016 federal income tax return and may differ from the amount which must be reported in connection with the Fund’s tax year ended June 30, 2016. Stockholders are advised to consult their tax advisers as to the federal, state and local tax status of the dividend income received from the Fund.

Stockholder Meeting Results:

The Fund held its annual meeting of stockholders on October 29, 2015. Stockholders voted as indicated below:

| Affirmative | Against | Abstain | ||||||||

| Re-election of Marran H. Ogilvie — Class III to serve until 2018 |

4,050,315 | 86,227 | 11,937 | |||||||

| Re-election of Richard A. Silver — Class III to serve until 2018 |

4,068,005 | 68,401 | 12,074 | |||||||

Messrs. Christopher B. Brader, Joseph T. Grause, Jr. and Julian Reid continue to serve as Directors of the Fund.

Proxy Voting Policies & Procedures:

A description of the policies and procedures that the Fund has adopted to determine how to vote proxies relating to portfolio securities and information about how the Fund voted proxies relating to portfolio securities held during the most recent twelve month period ended June 30 is available (i) without charge, upon request, by calling the Fund’s stockholder servicing agent at (800) 254-5197; (ii) on the Fund’s website at www.thekoreafund.com; and (iii) on the Securities and Exchange Commission website at www.sec.gov.

| 06.30.16 | The Korea Fund, Inc. Annual Report | 19 |

Table of Contents

The Korea Fund, Inc. Privacy Policy (unaudited)

Please read this Policy carefully. It gives you important information about how Allianz Global Investors U.S. and its U.S. affiliates (“AllianzGI US,” “we” or “us”) handle non-public personal information (“Personal Information”) that we may receive about you. It applies to all of our past, present and future clients and stockholders of AllianzGI US and the funds and accounts it manages, advises, sub-advises, administers or distributes, and will continue to apply when you are no longer a client or stockholder. As used throughout this Policy, “AllianzGI US” means Allianz Global Investors U.S. LLC, Allianz Global Investors Fund Management LLC, Allianz Global Investors Distributors LLC, NFJ Investment Group LLC and the family of registered and unregistered funds managed by one or more of these firms. AllianzGI US is part of a global investment management group, and the privacy policies of other Allianz Global Investors entities outside of the United States may have provisions in their policies that differ from this Privacy Policy. Please refer to the website of the specific non-US Allianz Global Investors entity for its policy on privacy.

We Care about Your Privacy

We consider your privacy to be a fundamental aspect of our relationship with you, and we strive to maintain the confidentiality, integrity and security of your Personal Information. To ensure your privacy, we have developed policies that are designed to protect your Personal Information while allowing your needs to be served.

Information We May Collect

In the course of providing you with products and services, we may obtain Personal Information about you, which may come from sources such as account application and other forms, from other written, electronic, or verbal communications, from account transactions, from a brokerage or financial advisory firm, financial advisor or consultant, and/or from information you provide on our website.

You are not required to supply any of the Personal Information that we may request. However, failure to do so may result in us being unable to open and maintain your account, or to provide services to you.

How Your Information Is Shared

We do not disclose your Personal Information to anyone for marketing purposes. We disclose your Personal Information only to those service providers, affiliated and non-affiliated, who need the information for everyday business purposes, such as to respond to your inquiries, to perform services, and/or to service and maintain your account. This applies to all of the categories of Personal Information we collect about you. The affiliated and non-affiliated service providers who receive your Personal Information also may use it to process your transactions, provide you with materials (including preparing and mailing prospectuses and stockholder reports and gathering stockholder proxies), and provide you with account statements and other materials relating to your account. These service providers provide services at our direction, and under their agreements with us, are required to keep your Personal Information confidential and to use it only for providing the contractually required services. Our service providers may not use your Personal Information to market products and services to you except in conformance with applicable laws and regulations. We also may provide your Personal Information to your respective brokerage or financial advisory firm, custodian, and/or to your financial advisor or consultant.

In addition, we reserve the right to disclose or report Personal Information to non-affiliated third parties, in limited circumstances, where we believe in good faith that disclosure is required under law, to cooperate with regulators or law enforcement authorities or pursuant to other legal process, or to protect our rights or property, including to enforce our Privacy Policy or other agreements with you. Personal Information collected by us may also be transferred as part of a corporate sale, restructuring, bankruptcy, or other transfer of assets.

Security of Your Information

We maintain your Personal Information for as long as necessary for legitimate business purposes or otherwise as required by law. In maintaining this information, we have implemented appropriate procedures that are designed to restrict access to your Personal Information only to those who need to know that information in order to provide products and/or services to you. In addition, we have implemented physical, electronic and procedural safeguards to help protect your Personal Information.

Privacy and the Internet

The Personal Information that you provide through our website, as applicable, is handled in the same way as the Personal Information that you provide by any other means, as described above. This section of the Policy gives you additional information about the way in which Personal Information that is obtained online is handled.

| • | Online Enrollment, Account Access and Transactions: When you visit our website, you can visit pages that are open to the general public, or, where available, log into protected pages to enroll online, access information about your account, or conduct certain transactions. Access to the secure pages of our website is permitted only after you have created a User ID and Password. The User ID and Password must be supplied each time you want to access your account information online. This information serves to verify your identity. When you enter Personal Information into our website (including your Social Security Number or Taxpayer Identification Number and your password) to enroll or access your account online, you will log |

| 20 | The Korea Fund, Inc. Annual Report | 06.30.16 |

Table of Contents

The Korea Fund, Inc. Privacy Policy (unaudited) (continued)

| into secure pages. By using our website, you consent to this Privacy Policy and to the use of your Personal Information in accordance with the practices described in this Policy. If you provide Personal Information to effect transactions on our website, a record of the transactions you have performed while on the site is retained by us. For additional terms and conditions governing your use of our website, please refer to the Investor Mutual Fund Access–Disclaimer which is incorporated herein by reference and is available on our website. |

| • | Cookies and Similar Technologies: Cookies are small text files stored in your computer’s hard drive when you visit certain web pages. Cookies and similar technologies help us to provide customized services and information. We use these technologies on our website to improve our website and services, including to evaluate the effectiveness of our site, and to enhance the site user experience. Because an industry-standard Do-Not-Track protocol is not yet established, our website will continue to operate as described in this Privacy Policy and will not be affected by any Do-Not-Track signals from any browser. |

Changes to Our Privacy Policy

We may modify this Privacy Policy from time-to-time to reflect changes in related practices and procedures, or applicable laws and regulations. If we make changes, we will notify you on our website and the revised Policy will become effective immediately upon posting to our website. We also will provide account owners with a copy of our Privacy Policy annually. We encourage you to visit our website periodically to remain up to date on our Privacy Policy. You acknowledge that by using our website after we have posted changes to this Privacy Policy, you are agreeing to the terms of the Privacy Policy as modified.

Obtaining Additional Information

If you have any questions about this Privacy Policy or our privacy related practices in the United States, you may contact us via our dedicated email at PrivacyUS@allianzgi.com.

| 06.30.16 | The Korea Fund, Inc. Annual Report | 21 |

Table of Contents

The Korea Fund, Inc. Dividend Reinvestment and Cash Purchase Plan (unaudited)

The Fund has adopted a Dividend Reinvestment Plan (the “Plan”) which allows common stockholders to reinvest Fund distributions in additional common shares of the Fund. American Stock Transfer & Trust Company, LLC (the “Plan Agent”) serves as agent for common stockholders in administering the Plan. Participants in the Plan have the option of making additional cash payments to the Plan Agent, semi-annually, in any amount from $100 to $3,000, for investment in the Fund’s shares. The Plan Agent will use all such cash payments received from participants to purchase Fund shares on the open market on or shortly after the 15th of February and August of each year, and in no event more than 45 days after such dates except where temporary curtailment or suspension of purchases is necessary to comply with applicable provisions of federal securities law. Any voluntary cash payments received more than 30 days prior to the 15th of February or August will be returned by the Plan Agent. Participants may withdraw their entire voluntary cash payment by written notice received by the Plan Agent not less than 48 hours before such payment is to be invested. It is important to note that participation in the Plan and automatic reinvestment of Fund distributions does not ensure a profit, nor does it protect against losses in a declining market.

Automatic enrollment/voluntary participation. Under the Plan, common stockholders whose shares are registered with the Plan Agent (“registered stockholders”) are automatically enrolled as participants in the Plan and will have all Fund distributions of income, capital gains and returns of capital (together, “distributions”) reinvested by the Plan Agent in additional common shares of the Fund, unless the stockholder elects to receive cash. Registered stockholders who elect not to participate in the Plan will receive all distributions in cash paid by check and mailed directly to the stockholder of record (or if the shares are held in street or other nominee name, to the nominee) by the Plan Agent. Participation in the Plan is voluntary. Participants may terminate or resume their enrollment in the Plan at any time without penalty by notifying the Plan Agent online at www.amstock.com, by calling (800) 254-5197, by writing to the Plan Agent, American Stock Transfer & Trust Company, LLC, at P.O. Box 922, Wall Street Station, New York, NY 10269-0560, or, as applicable, by completing and returning the transaction form attached to the Plan statement. A proper notification will be effective immediately and apply to the Fund’s next distribution if received by the Plan Agent at least three (3) days prior to the record date for the distribution; otherwise, a notification will be effective shortly following the Fund’s next distribution and will apply to the Fund’s next succeeding distribution thereafter. If you withdraw from the Plan and so request, the Plan Agent will arrange for the sale of your shares and send you the proceeds, minus a transaction fee and brokerage commissions.

How shares are purchased under the Plan. For each Fund distribution, the Plan Agent will acquire common shares for participants either (i) through receipt of newly issued common shares from the Fund (“newly issued shares”) or (ii) by purchasing common shares of the Fund on the open market (“open market purchases”). If, on a distribution payment date, the net asset value per common share of the Fund (“NAV”) is equal to or less than the market price per common share plus estimated brokerage commissions (often referred to as a “market premium”), the Plan Agent will invest the distribution amount on behalf of participants in newly issued shares at a price equal to the greater of (i) NAV or (ii) 95% of the market price per common share on the payment date. If the NAV is greater than the market price per common share plus estimated brokerage commissions (often referred to as a “market discount”) on a distribution payment date, the Plan Agent will instead attempt to invest the distribution amount through open market purchases. If the Plan Agent is unable to invest the full distribution amount in open market purchases, or if the market discount shifts to a market premium during the purchase period, the Plan Agent will invest any un-invested portion of the distribution in newly issued shares at a price equal to the greater of (i) NAV or (ii) 95% of the market price per share as of the last business day immediately prior to the purchase date (which, in either case, may be a price greater or lesser than the NAV per common shares on the distribution payment date). No interest will be paid on distributions awaiting reinvestment. Under the Plan, the market price of common shares on a particular date is the last sales price on the exchange where the shares are listed on that date or, if there is no sale on the exchange on that date, the mean between the closing bid and asked quotations for the shares on the exchange on that date. The NAV per common share on a particular date is the amount calculated on that date (normally at the close of regular trading on the New York Stock Exchange) in accordance with the Fund’s then current policies.

Fees and expenses. No brokerage charges are imposed on reinvestments in newly issued shares under the Plan. However, all participants will pay a pro rata share of brokerage commissions incurred by the Plan Agent when it makes open market purchases. There are currently no direct service charges imposed on participants in the Plan, although the Fund reserves the right to amend the Plan to include such charges. The Plan Agent imposes a transaction fee (in addition to brokerage commissions that are incurred) if it arranges for the sale of your common shares held under the Plan.

Shares held through nominees. In the case of a registered stockholder such as a broker, bank or other nominee (together, a “nominee”) that holds common shares for others who are the beneficial owners, the Plan Agent will administer the Plan on the basis of the number of common shares certified by the nominee/record stockholder as representing the total amount registered in such stockholder’s name and held for the account of beneficial owners who are to participate in the Plan. If your common shares are held through a nominee and are not registered with the Plan Agent, neither you nor the nominee will be participants in or have distributions reinvested under the Plan. If you are a beneficial owner of common shares and wish to participate in the Plan, and your nominee is unable or unwilling to become a registered stockholder and a Plan participant on your behalf, you may request that your nominee arrange to

| 22 | The Korea Fund, Inc. Annual Report | 06.30.16 |

Table of Contents

The Korea Fund, Inc. Dividend Reinvestment and Cash Purchase Plan (unaudited) (continued)

have all or a portion of your shares re-registered with the Plan Agent in your name so that you may be enrolled as a participant in the Plan. Please contact your nominee for details or for other possible alternatives. Participants whose shares are registered with the Plan Agent in the name of one nominee firm may not be able to transfer the shares to another firm and continue to participate in the Plan.