Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2013

Table of Contents

Item 1: Report to Shareholders

Table of Contents

PARNASSUS FUNDS®

ANNUAL REPORT ¡ DECEMBER 31, 2013

PARNASSUS FUNDS

| Parnassus FundSM | PARNX | |

| Parnassus Equity Income FundSM – Investor Shares | PRBLX | |

| Parnassus Equity Income Fund – Institutional Shares | PRILX | |

| Parnassus Mid-Cap FundSM | PARMX | |

| Parnassus Small-Cap FundSM | PARSX | |

| Parnassus Workplace Fund® | PARWX | |

| Parnassus Asia FundSM | PAFSX | |

| Parnassus Fixed-Income FundSM | PRFIX | |

Table of Contents

| Letter from Parnassus Investments | 4 | |||

| Fund Performance and Commentary | ||||

| Parnassus Fund | 6 | |||

| Parnassus Equity Income Fund | 10 | |||

| Parnassus Mid-Cap Fund | 14 | |||

| Parnassus Small-Cap Fund | 18 | |||

| Parnassus Workplace Fund | 21 | |||

| Parnassus Asia Fund | 24 | |||

| Parnassus Fixed-Income Fund | 28 | |||

| Responsible Investing Notes | 31 | |||

| Fund Expenses | 32 | |||

| Report of Independent Registered Public Accounting Firm | 33 | |||

| Portfolios of Investments | ||||

| Parnassus Fund | 34 | |||

| Parnassus Equity Income Fund | 36 | |||

| Parnassus Mid-Cap Fund | 39 | |||

| Parnassus Small-Cap Fund | 41 | |||

| Parnassus Workplace Fund | 43 | |||

| Parnassus Asia Fund | 45 | |||

| Parnassus Fixed-Income Fund | 47 | |||

| Financial Statements | 50 | |||

| Notes to Financial Statements | 57 | |||

| Financial Highlights | 68 | |||

| Additional Information | 71 | |||

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

February 3, 2014

It was a great year for the stock market and for the Parnassus Funds! Three of our funds had returns in excess of 30% – the Parnassus Fund, the Parnassus Equity Income Fund and the Parnassus Workplace Fund. The other two domestic equity funds, the Parnassus Small-Cap and the Parnassus Mid-Cap, each gained over 28% in 2013. Although they did not beat their benchmarks, they had excellent absolute returns. Enclosed you will find the reports on all the funds, which I think you will enjoy reading.

One fund I want to highlight is the Parnassus Equity Income Fund. It had a total return of 34.01% (investor shares) compared to 32.38% for the S&P 500 Index and 27.92% for the Lipper Equity Income Fund Average, which represents the average return of the equity income funds followed by Lipper. I have joked in the past that the Equity Income Fund was for widows and orphans because of its relative conservative stance. Normally, it doesn’t keep up with the market in really good years like 2013, but it doesn’t go down as much as the market in really bad years like 2008. However, after its performance in 2013, I can no longer refer to the Equity Income Fund as being for widows and orphans only. After its gain of 34% in 2013, it should now be identified as an “all-weather” fund. In other words, it can still beat the market in bad years, but it can also keep up with the market in good years. While the Equity Income Fund’s performance has been impressive, I should remind investors that past performance is no guarantee of future results. This “all-weather” designation is a real tribute to lead manager, Todd Ahlsten, and his co-manager, Ben Allen. They are a tremendous team and they have done a wonderful job.

New Staff Members

Downey Blount recently joined us as a Senior Compliance Officer of Parnassus Investments, and Deputy Chief Compliance Officer of Parnassus Funds Distributor. Downey has been with us on a temporary basis since June, and has done an excellent job with several compliance projects during that time. Downey brings a wealth of experience, which includes work as Chief Compliance Officer at Matthews International Capital Management and Mutual Fund Administration Manager at Montgomery Asset Management. She has a BA degree from University of California, Santa Barbara, and attended law school at the University of San Francisco. Downey is fluent in Spanish, and spent a year living in Spain.

Natasha L. Watts is an Institutional Sales & Marketing Associate. Prior to joining Parnassus Investments in 2013, Natasha was an analyst at Rockwood Real Estate Advisors. Previously, she was an analyst intern at Eastdil Secured, a real estate investment bank. Natasha graduated as a double major with bachelor’s degrees in economics and French and received a minor in biological sciences from the University of Southern California. She enjoys traveling around the world and learning new languages. She also speaks Farsi and French.

Changes in Board of Trustees

Herb Houston, who has served over 20 years as a Trustee of the Parnassus Funds, has retired as of the end of 2013. He has been the Rock of Gibraltar for the Parnassus Funds, serving over 20 years, the most in our firm’s history. His steadfast leadership has guided the Funds through good times and bad – mostly good. He has seen the Funds grow from less than $100 million to more than $10 billion in assets. Herb also served as the lead Trustee. I would like to thank him for his years of service.

The Trustees have elected Alecia DeCoudreaux, President of Mills College, as a new Trustee. She was selected from a list of many qualified candidates, and we’re delighted to welcome her to the board. She’s a woman of many talents, including a background in law, business and education. Her list of accomplishments includes executive leadership positions at Eli Lilly & Company, most recently as Vice President and Deputy General Counsel, as well as service as a Trustee of Wellesley College and work with many community organizations. I’m delighted that someone of her caliber has joined our board.

30-Year Anniversary Celebration

The Parnassus Funds were established 30 years ago in 1984 with initial assets of $330,000. We’ve grown a lot since then, with total assets now over $10 billion. We’d like you to help us celebrate that milestone. The celebration will be on Wednesday, March 26, 2014, at the Palace Hotel in San Francisco (corner of Market and New Montgomery). The reception will begin

4

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

at 6:00 pm and the program will last from 6:30 pm until 8:30 pm. You will have an opportunity to meet the Parnassus Trustees and the Parnassus staff. There will also be presentations by the portfolio managers and an opportunity for questions and discussions. If you would like to come, please RSVP to rsvp@parnassus.com or by calling 415-778-2607 by Wednesday, March 19.

Finally, I would like to thank all of you for the confidence you’ve displayed in us by investing in the Parnassus Funds.

Yours truly,

Jerome L. Dodson

President

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Please see the following pages for more detailed information regarding each Fund’s performance, including information regarding the Funds’ Lipper rankings, and the risks associated with investing in the Funds.

5

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

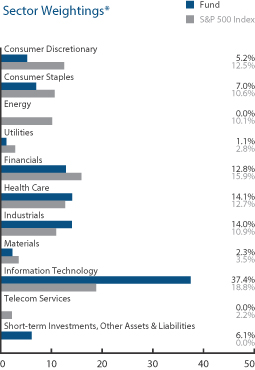

Ticker: PARNX

As of December 31, 2013, the net asset value per share (“NAV”) of the Parnassus Fund was $45.86, so after taking dividends into account, the total return for the year was 34.22%. This compares to 32.38% for the S&P 500 Index (“S&P 500”) and 32.46% for the Lipper Multi-Cap Core Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”). It was a great year for the stock market and especially for the Parnassus Fund; since we beat our benchmarks by almost two percentage points. If you held your shares at the beginning of the year, the value of those holdings has increased by more than a third.

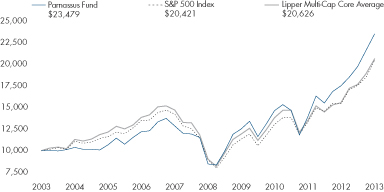

Below is a table comparing the Parnassus Fund with the S&P 500 and the Lipper average over the past one-, three-, five- and ten-year periods. As you can see, we are well ahead of both benchmarks for all periods. Most striking is the five-year number, where we have gained an average of 22.64% per year since the end of 2008. This is almost five percentage points per year ahead of the benchmarks.

On page 8, you will also see a graph that shows the growth of a hypothetical $10,000 investment in the Fund over the past ten years. The graph shows that the Fund has grown more than the same amount invested in either of the benchmarks.

6

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

would have to purchase more equipment, because all the telecom traffic was straining their networks. Somehow, the carriers were able to postpone major purchases until this year when the dam finally broke. Ciena’s order backlog hit record levels and the company gained market share.

Right up there with Ciena was Applied Materials, maker of equipment used in semiconductor-manufacturing, which added $1.10 to the NAV, as its stock rocketed up 54.6% from $11.44 to $17.69.

7

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

conditions for manufacturing and construction. The stock did move higher later in the year, as conditions improved and investors became more bullish. The company then announced plans to shift to a more predictable subscription-based pricing model. Autodesk is poised to benefit from its leading design and engineering software, as the recovery continues in construction and manufacturing.

Shares of San Francisco-based Wells Fargo rose 32.8% from $34.18 to $45.40 for a gain of 39¢ for each fund share. Unlike other large banks, Wells Fargo did not make many bad loans, so it came out of the financial crisis with a strong balance sheet. This has enabled the bank to become the biggest real estate lender in the country, and one of the largest lenders to business and consumers. Wells Fargo has been increasing its market share, and with the housing market recovering and the economy improving, the bank has now reported ten consecutive quarters of record earnings, with each quarter higher than the one before it.

Outlook and Strategy

Note: This section represents the thoughts of Jerome L. Dodson and applies to the Parnassus Fund and the Parnassus Workplace Fund.

In general, I’m an optimist, but I wasn’t optimistic enough about last year’s returns. It’s an understatement to say that I was amazed that the stock market was up 30% last year. The market is a leading indicator, so that means that the economy should be very strong in 2014. I think that’s correct. The housing market is strong, and that always drives the economy higher. Janet Yellen has been confirmed as head of the Federal Reserve, so she will provide plenty of fuel to keep the economy growing. Also, unemployment is now down to 7%, and more jobs means more spending which is good for the economy. I wish it was down to 4%, but at least it’s headed in the right direction. Democrats and Republicans in Congress have stopped feuding – at least over the budget – and that’s definitely a plus for the economy.

Does all this good economic news mean the stock market will move much higher in 2014? In the long-run, the stock market moves along with the economy, but in the short-run, valuations have a big impact on what the market does. Right now, the market looks fully-valued. While I expect the market to move higher in 2014, I don’t think the gains will be that big – maybe something in the 5-10% range. Of course, I don’t think it’s possible for anyone, including me, to make accurate predictions on the market, so this is just my personal opinion.

Usually, the market cools off after a year of 30% gains, but sometimes it can keep on going much higher. For example, the Parnassus Fund was up 26% in 2012, so I expected modest gains in 2013. Instead, the Fund was up 34% last year. Because the market is so unpredictable, it’s better not to make investment decisions based on market forecasts.

8

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

My expertise is in identifying good companies, putting a value on them, then investing in the ones that are undervalued. Those are the ones in our portfolios right now. Although I believe our stocks are undervalued, they aren’t as undervalued as they were at the beginning of 2013. I anticipate modest gains in 2014.

Yours truly,

Jerome L. Dodson

Portfolio Manager

9

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

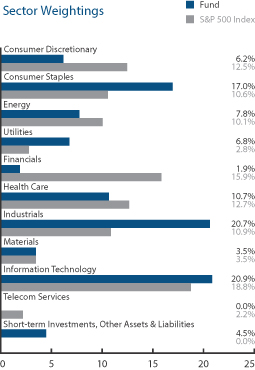

Ticker: Investors Shares - PRBLX

Ticker: Institutional Shares - PRILX

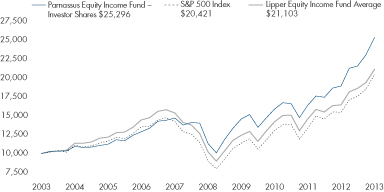

As of December 31, 2013, the NAV of the Parnassus Equity Income Fund-Investor Shares was $36.68. After taking dividends into account, the total return for the year was 34.01%. This compares to increases of 32.38% for the S&P 500 Index (“S&P 500”) and 27.92% for the Lipper Equity Income Fund Average, which represents the average return of the equity income funds followed by Lipper (“Lipper average”).

Below is a table that summarizes the performances of the Fund, the S&P 500 and the Lipper average. The returns are for the one-, three-, five- and ten-year periods. On page 12 is a graph showing the growth of a hypothetical $10,000 investment in the Fund over the last ten years.

10

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

points to our gain versus the index. For the year, five stocks boosted the NAV by at least 50¢. Just as important, the Fund had only one loser, and it had a very modest impact on the NAV.

Company Analysis

C.H. Robinson, a Minnesota-based logistics company, fell 7.7% from $63.22 to $58.34, trimming the NAV by 1¢. C.H. Robinson underperformed the market significantly this year, because its truck brokerage margin fell below expectations. This dynamic, which has been an issue for the company since 2010, intensified in 2013. This was due to a combination of tepid

economic growth, which limited demand for high-margin rush shipments, increased trucking prices caused by new regulations and certain competitors’ decisions to accept lower prices in order to gain market share.

We don’t know precisely when Robinson’s truck brokerage margin will stabilize, but we’re confident that it eventually will. If trucking capacity remains constrained, then shipping demand will eventually outstrip carrier supply. In this scenario, smaller brokers won’t be able to find trucks, and shippers will have to pay up for access to Robinson’s massive carrier network. While we wait for the pricing environment to improve, Robinson’s large technology investments and headcount growth are strengthening the company’s already dominant position in its industry. As for valuation, the stock is down almost 30% from its 2010 high of $81 per share, so we think that Robinson’s current challenges are already priced into the stock.

For the second year in a row, the Fund’s biggest winner was Bay Area biotech company Gilead Sciences, whose stock soared 104.6% to $75.15 from $36.73 and added 61¢ to the NAV. Our average cost for Gilead is about $20 per share, so it’s now among the biggest winners in the Fund’s history.

We initially bought Gilead in 2010 because of its valuable HIV/AIDS therapeutic franchise. However, the stock’s amazing run over the past two years has been fueled by the company’s progress in developing a cure for hepatitis C. In December, Gilead’s drug Sovaldi was approved by the FDA to treat hepatitis genotype 1-4 patients. Given Sovaldi’s high cure rates, excellent safety profile and the unfortunate fact that about 150 million people have hepatitis C worldwide (including over 4 million Americans), it could be among the world’s biggest-selling drugs within a few years.

We think the drug offers a huge social benefit, even considering its high price tag of $1,000 per day. The drug’s short duration, typically 12-24 weeks, offers a cure with much better outcomes and lower overall costs than existing therapies. The company also has a generous program to help low-income patients obtain treatment. We sold a portion of our Gilead stock during its spectacular run, but the Fund still owns some shares, as we expect 2014 to be another good year for the company.

Semiconductor-equipment-maker Applied Materials rose 54.6% to $17.69 from $11.44 and boosted the NAV by 61¢. Applied Materials’ Taiwanese foundry and flash memory customers placed large tool orders in 2013, due to strong end-market demand for smartphone-related chips. Building on this momentum, Applied Materials announced in September a merger with rival Tokyo Electron for $9 billion. This historic deal, which we expect to close in the second half of

| Parnassus Equity Income Fund as of December 31, 2013 (percentage of net assets) |

Top 10 Holdings

(percentage of net assets)

| Apple Inc. | 4.3% | |||

| Motorola Solutions Inc. | 4.0% | |||

| Applied Materials Inc. | 3.9% | |||

| C.H. Robinson Inc. | 3.9% | |||

| Mondelez International Inc. | 3.6% | |||

| Procter & Gamble Co. | 3.4% | |||

| Xylem Inc. | 3.2% | |||

| Allergan Inc. | 3.2% | |||

| Pentair Ltd. | 3.1% | |||

| MasterCard Inc. | 2.8% | |||

Portfolio characteristics and holdings are subject to change periodically.

11

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

As we mentioned last quarter, market leaders in the consumer electronics industry can shift quickly, so we’re keeping a close eye on Apple’s competitors, especially Samsung. For now, we think that Apple’s “competitive moat,” which is a competitive advantage that is difficult to emulate, is still widening, and we’re still comfortable with the stock’s valuation, so we didn’t sell any of our Apple shares as of year-end.

Charles Schwab, the San Francisco-based bank and brokerage firm, soared 81.1% from $14.36 to $26.00 and added 52¢ to the NAV. While earnings increased only modestly throughout the year, the real driver for the stock was not net income, but rather an expected increase in interest rates. With rates currently at extremely low levels, Schwab earns far less than normal on its banking assets, money market products and margin loans to brokerage clients. When rates eventually return to their pre-crisis levels, the company should more than double its current rate of earnings. We sold a portion of our Schwab position during the year in response to the stock’s big move, but still held some shares as of year-end.

MasterCard jumped 70.1% this year, from $491.28 to $835.46, increasing each Fund share by 50¢. Like Gilead, MasterCard has been one of the best performers in the Fund’s history, as it has quadrupled from our average cost of $206 per share. The company had another fantastic year, and we believe the long-term looks outstanding. In late July, the stock shot up after management raised earnings expectations for 2013, and reaffirmed its three-year outlook for annual revenue and EPS growth of 12.5% and 20%, respectively. The stock jumped again in mid-December, after the company announced positive capital allocation actions, including an 83% increase in the dividend and a $3.5 billion stock buyback plan.

Outlook and Strategy

The most important recent event that informs our outlook for 2014 is the tapering of the Federal Reserve’s Quantitative Easing (QE) program. The potential impact of the taper stems from the truly staggering scope of this program. As a result of QE, the central bank’s balance sheet just surpassed the $4 trillion mark, and currently has a value equal to 24% of the nation’s gross domestic product (GDP). In proportion to the overall economy, our central bank is now four times larger than it was before the 2008 credit crisis. The only other times in the Fed’s 100-year history that its balance sheet has even approached this size, relative to GDP, was during the Great Depression and in the wake of World War II. Suffice it to say, from an economic standpoint, we’re living through very unusual times.

It’s impossible to know how much QE drove stocks in the past few years, as opposed to actual improvements in fundamentals. One thing that appears certain is that the Fed, through its highly accommodative actions, has increased the risk tolerance of many investors. It’s done this since 2008 by repeatedly stepping in to stem even modest stock market declines. As the Fed slowly removes its implicit safety net, we wouldn’t be surprised to see a period of increased volatility or even a temporary market correction.

12

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

We hope that the economy continues to improve, that corporate earnings accelerate in 2014, and that these positives outweigh any negative headwinds represented by the QE taper. While we wait to see the outcome of these competing macro forces, we’re staying true to our process of investing in stocks with attractive, long-term risk-reward payoffs. As a reminder, since we construct the portfolio from the bottom-up, macro factors matter to us only insofar as they inform our view of an individual holding.

The Fund enters 2014 with a diverse set of companies, each with a unique investment thesis. The biggest concentrations in the portfolio are in the technology, industrials and consumer staples sectors. Relative to the index, the portfolio has very few holdings in the financials and consumer discretionary sectors. We expect this collection of stocks to do well under a wide range of economic and market scenarios.

The latest addition to the Fund is Allergan, a pharmaceutical company based in Irvine, California. Half of the company’s sales comes from its eye care division, and the other half comes from cosmetic products. We’re excited about the long-term prospects of this business.

Thank you for your trust and investment with us,

|

|

|

|||

| Todd C. Ahlsten | Ben E. Allen | |||

| Lead Portfolio Manager | Portfolio Manager |

13

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

Ticker: PARMX

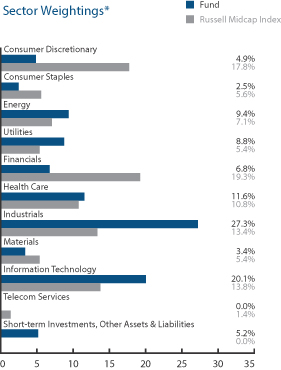

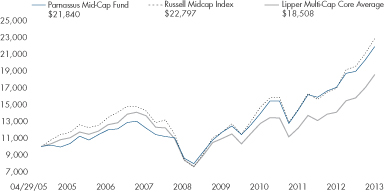

As of December 31, 2013, the NAV of the Parnassus Mid-Cap Fund was $25.10, so after taking dividends into account, the total return for 2013 was 28.27%. This compares to 34.76% for the Russell Midcap Index (“Russell”) and 32.46% for the Lipper Multi-Cap Core Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”).

We are pleased that the Fund had such a strong return in 2013 but are disappointed that we fell behind our benchmarks. The reason we lagged is because of our goal to take on less risk than the index, so it’s hard for us to outperform when the market surges. The Fund’s longer-term track record remains very good. The Fund has outperformed both the Russell and its Lipper peers over the three-year period. For the five-year period and for the period since inception, the Fund is ahead of its Lipper peers but slightly behind the Russell.

Below is a table comparing the Parnassus Mid-Cap Fund with the Russell and the Lipper average for the one-, three- and five-year periods and for the period since inception on April 29, 2005. On page 16 is a graph showing the growth of a hypothetical $10,000 investment in the Fund since inception.

14

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

Company Analysis

The Fund had just three stocks that reduced the NAV this year. While together they took a meager 6¢ from the Fund, they were costly investments, because the Russell went up so much. In fact, these three stocks accounted for almost half of our underperformance relative to the market.

The stock that hurt us the most was Teradata, a hardware and software provider of complex data analytics systems. The stock plunged 26.5% during the year, from $61.89 to $45.49, cutting 4¢ from the NAV. Early in the year, the stock was under pressure after the company missed revenue expectations, because fewer large customers bought its product suite. Deal flow improved by mid-year, but an abrupt slowdown in demand from China pushed the stock lower at year-end. We’re holding onto the stock, because we expect enterprise demand to improve and the shares are trading at a depressed valuation.

15

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

deal to buy Tokyo Electron, a rival Japanese maker of semiconductor production equipment. We believe that CEO Gary Dickerson and his team’s focus on R&D, cost management and market share gains will drive significant earnings growth ahead, so we’re hanging on to the stock.

Outlook and Strategy

The consensus view is that U.S. stocks will go up again in 2014. Strategists are predicting mid-to-high single digit gains for most market segments. We agree that the domestic economic expansion, supported by population gains, low interest rates, continuing employment gains and tepid inflation are positive tailwinds for stocks. However, even as the economy improves, we don’t expect the remarkable returns that we’ve seen over the past few years to persist.

The reason is that there’s little corporate sales growth, and profit margins are at all-time highs. The Russell’s earnings growth is decelerating, from 19% in 2012 and 13% in 2013, to an estimated 10% in 2014, and earnings growth, fueled by cost reductions and share buybacks, is getting harder to come by. The multiple that investors are willing to pay for earnings has crept up, and at 19 times earnings, is 10% above the ten-year average. Finally, the Fed’s December announcement that it will taper its bond buying program will inevitably drive investors to less risky assets. This also opens the door to eventual rate tightening, which will temper market bulls.

Fortunately, we are still finding plenty of good opportunities. We recently added to our health care exposure, because we believe an aging global population, rising incomes in developing markets, greater domestic health care coverage and an improving domestic economy will lead more people to seek medical treatment.

In this sector, we initiated a position in Allergan, a leader in medical devices and specialty pharmaceuticals. We have followed the company for years, appreciating its increasing relevancy due to market leading anti-aging and eye care products. The stock dropped sharply over the summer as investors worried that Restasis, a dry–eye treatment, could face generic competition when it goes off patent in 2014. We felt that investors overreacted, which provided an opportunity to buy this great business at an attractive valuation.

We also added to our position in Dentsply, a leading manufacturer of dental consumables and implants. A slowdown in patient visits has depressed demand for Dentsply’s consumables over the past few years. We see conditions gradually improving, as unemployment declines and patients return for treatments, such as fillings and root canals, which were put off over the past few years. We expect the company’s earnings growth to accelerate over the next five years, aided by improving demand for its leading products and further margin expansion.

In the energy space, we initiated a position in MRC Global, the world’s largest distributor of valves, pipes and fittings to the energy, utility and industrial sectors. We already own several distributors, including dental distributor Patterson Companies and pharmaceutical distributor Cardinal Health. We love this business model, because distributors benefit from buying

16

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

power with suppliers. A pause in customer demand for MRC’s products due to permitting issues gave us an opportunity to buy this difficult-to-replicate business (the company seamlessly supplies over 200,000 SKUs of specialized pipes to customers around the world) at a good price.

We also believe that increasing global demand for energy will drive significant capital spending over the next three years, pushing revenue and earnings growth for MRC, along with our holdings Spectra Energy and Cameron International. We believe that our energy services and infrastructure stocks will perform well going forward, because each is a leading operator in a growing market.

Overall, we remain committed to our investment process of investing in increasingly relevant, well-managed companies with competitive advantages and attractive valuations.

Thank you for your investment.

Yours truly,

|

|

|

|||

| Matthew D. Gershuny |

Lori A. Keith |

|||

| Lead Portfolio Manager |

Portfolio Manager |

17

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

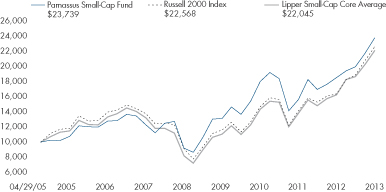

Ticker: PARSX

As of December 31, 2013, the NAV of the Parnassus Small-Cap Fund was $28.72, so after taking dividends into account, the total return for the year was 28.33%. This compares to a return of 38.82% for the Russell 2000 Index (“Russell 2000”) of smaller companies and 36.74% for the Lipper Small-Cap Core Average, which represents the average return of the small-cap core funds followed by Lipper (“Lipper average”).

Usually, we would be thrilled to report a 28.3% gain for the year. However, we trailed the Russell 2000 by over ten percentage points. Although we are never proud to trail our benchmark, it is not surprising to us this year. Our goal is to outperform during down years and attempt to keep up during boom years by buying high-quality, competitively-advantaged businesses. Although this approach of focusing on lower-risk companies contributed to our underperformance this year, it has served our investors well in the past.

Below is a table comparing the performance of the Parnassus Small-Cap Fund with that of the Russell 2000 and the Lipper average over the past one-, three- and five-year periods and the period since inception. Although our short-term performance

18

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

when Cisco clarified that its new semiconductor would not replace that of EZchip. We’ve had a lot of ups and downs with this stock, but we’re hanging on to it, because of its best-in-class technology and its undisputed leadership in network-processors.

Turning to the winners, the biggest contributor was Gentex, a manufacturer of auto-dimming car mirrors. Gentex soared 75.3% during the year, from $18.82 to $32.99, contributing 61¢ to each fund share. Thanks to its superior technology, Gentex supplies 90% of all auto-dimming car mirrors around the world. The company benefited from increasing new car sales, as well as adoption by additional car models. We are holding our shares because we expect this important safety feature to expand downward from luxury cars to mid- and lower-priced cars.

The Fund’s second best performer was Ciena, a manufacturer of optical equipment used in telecommunications networks. The stock climbed 52.4%, from $15.70 to $23.93, for a gain of 53¢ per fund share. During the year, telecommunications carriers increased their purchases from Ciena to accommodate rapidly increasing traffic on their networks, and Ciena’s order backlog hit record levels. The company’s innovative products gained market share, and we expect further share gains in 2014, so the stock should continue to do well.

Finisar also manufactures optical equipment for telecommunications networks and data-centers. Its stock rose 46.8%, from $16.30 to $23.92, adding 49¢ to the NAV. The company’s data-center division, which accounts for 70% of the firm’s revenue, had robust sales because customers upgraded equipment to handle increasing Internet traffic. We see further upside to the stock, as Internet traffic continues to grow, driving strong demand for Finisar’s equipment.

VCA Antech, the largest veterinary laboratory and animal hospital operator in the country, jumped 49.0%, from $21.05 to $31.36, for an increase of 42¢ for each fund share. The company’s laboratory segment operates in a market with only two suppliers, which allowed it to increase prices, while its hospital segment benefited from improving pet-care spending. Additionally, management announced the company’s first share buyback in April.

Shares of InterMune, a biotechnology company focused on respiratory diseases, shot up 52.0%, from $9.69 to $14.73, contributing 32¢ to the NAV. The stock rose as sales of Esbriet, the company’s treatment for idiopathic pulmonary fibrosis, grew more than 160%. During the year, the company won additional approval for Esbriet in the United Kingdom and Italy. Having only recently launched in these two new countries, Esbriet should have significant room to grow.

Outlook & Strategy

The market continued to climb a wall of worry in 2013, with the Russell 2000 reaching a new, all-time high at the end of the year. The strong stock market gains were propelled by an improving economy, as well as very low interest rates, which made equities more attractive to investors than other asset classes. The economy showed clear signs of improvement throughout the year, with unemployment declining from 7.8% to 7.0%, while GDP growth increased to 4.1% – up from no growth at the end of last year. The Federal Reserve maintained ultra-low interest rates in order to stimulate the economy, forcing investors to seek greater returns from higher-risk assets, which led to more than $300 billion of global equity inflows.

| Parnassus Small-Cap Fund as of December 31, 2013 (percentage of net assets) | ||

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Top 10 Holdings

(percentage of net assets)

| Gentex Corp. | 5.0% | |||

| Dominion Diamond Corp. | 4.8% | |||

| Blount International Inc. | 4.8% | |||

| First American Financial Corp. | 4.7% | |||

| Compass Minerals International Inc. | 4.6% | |||

| UTi Worldwide Inc. | 4.6% | |||

| VCA Antech Inc. | 4.4% | |||

| Ciena Corp. | 4.3% | |||

| Riverbed Technology Inc. | 4.3% | |||

| MICROS Systems Inc. | 4.3% | |||

Portfolio characteristics and holdings are subject to change periodically.

19

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

Air Lease, the fastest growing airplane leasing company, is run by what we believe is the best CEO in the industry and benefits from increasing air travel in emerging markets.

Blount International, the largest manufacturer of saw chains, operates in a market with only two suppliers and benefits from increased chainsaw sales in emerging markets.

Dominion Diamond, the lowest-cost North American diamond miner, benefits from increased demand for diamond engagement rings in China and India.

Harman International offers the best car infotainment systems and benefits from increasing adoption of these systems in mid- and lower-priced cars.

Micros Systems, the largest provider of point-of-sale systems for restaurants, hotels and retailers, benefits from increasing adoption of its systems.

MRC Global, the largest distributor of valves to the U.S. energy sector, operates in a market with only two suppliers and benefits from increased domestic oil and gas production.

Orient-Express Hotels has 45 iconic luxury properties and benefits from improving luxury travel trends.

Regal-Beloit, the leader in energy-efficient motors, benefits from increased demand for energy saving products.

Thermon Group, the second largest manufacturer of heat-tracing equipment used to prevent freezing pipes, operates in a market with only two suppliers and benefits from increased oil production in cold-climate regions.

UTi Worldwide, a leading global logistics company, benefits from increasing global trade.

Thank you for investing in the Parnassus Small-Cap Fund.

Yours truly,

|

|

|

|||

| Jerome L. Dodson | Ryan Wilsey | |||

| Lead Portfolio Manager | Portfolio Manager |

20

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

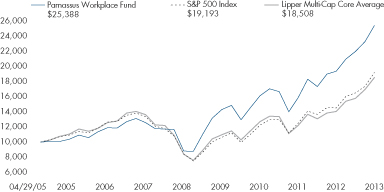

Ticker: PARWX

As of December 31, 2013, the NAV of the Parnassus Workplace Fund was $26.99, so after taking dividends into account, the total return for the year was 31.15%, compared to a gain of 32.38% for the S&P 500 Index (“S&P 500”) and a gain of 32.46% for the Lipper Multi-Cap Core Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”). It was a great year for the stock market, with the S&P 500 returning over 30%. The Workplace Fund also returned over 30%, but it was slightly behind the benchmarks.

Our goal for the Workplace Fund is to position it as a relatively conservative equity fund, so it tends to lag a bit in years when the market moves sharply higher, but it tends to outperform in difficult years. Given the nature of the Fund, I’m delighted that it was able to go up almost as much as the market in an outstanding year. Below is a table that compares the Parnassus Workplace Fund with the S&P 500 and the Lipper average for the one-, three- and five-year periods and the period since inception. You will notice that the Workplace Fund has outperformed both of its benchmarks for all periods with the exception of the one year period. Most striking is the five-year period, where the Workplace Fund beat both of the

21

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

22

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

year, reporting disappointing quarterly earnings related to its acquisition of online bank ING Direct and HSBC’s private label credit-card portfolio, which had customer losses and higher expenses than expected. The stock dropped and we added to our position, because we believed the acquisitions were sound strategic fits and that execution would improve. This is what actually happened late in the year, as earnings moved higher and so did the stock.

Shares of Corning rose 41.2% from $12.62 to $17.82, adding 31¢ to the NAV. The company makes most of its profits by selling special glass for high-definition television sets and computer screens. Increased demand for larger, higher definition television sets combined with good cost controls made earnings exceed expectations. In addition, the stock moved higher in October after Corning announced it was acquiring full ownership of its joint-venture with Samsung for $2.2 billion. Corning expects the acquisition to increase its earnings by 20%, as it gains additional scale and manufacturing flexibility in special glass.

Yours truly,

Jerome L. Dodson

Portfolio Manager

23

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

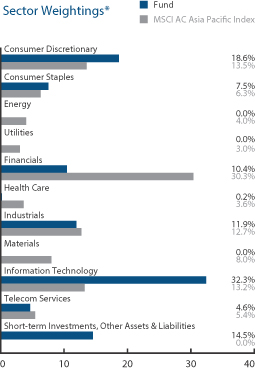

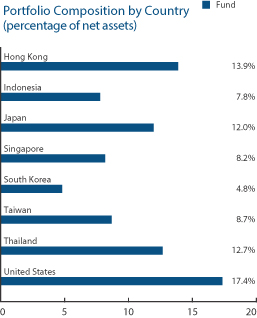

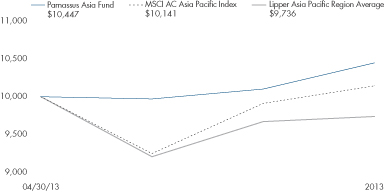

Ticker: PAFSX

As of December 31, 2013, the NAV of the Parnassus Asia Fund was $15.67, so the Fund was up 4.47%. This compares to a gain of 1.48% for the MSCI AC Asia Pacific Index (“MSCI Index”) and a loss of 2.57% for the Lipper Asia Pacific Region Average, which represents the average return of the Asia Pacific Region funds followed by Lipper (“Lipper average”). Below you will find a table comparing the Parnassus Asia Fund with the MSCI Index and the Lipper average for the period since inception on April 30, 2013.

You will notice that we are substantially ahead of both benchmarks — by about three percentage points ahead of the MSCI Index and by almost seven percentage points ahead of the Lipper average.

Even though we were way ahead of the indices, I really can’t brag too much about our performance. Much of the relative performance was due to the high cash position in the portfolio for most of the year. While some of the Asian markets had big moves down this year, we were safely in cash with much of our assets. Since it took us a while to become invested in stocks, we had the good fortune of being in cash during much of the time when many Asian markets moved sharply lower. In other words, I was lucky.

24

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

25

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

Samsung Electronics contributed 12¢ to the value of each fund share, as its stock price rose 15.3% from $1,129.35 to $1,302.62. Worldwide, the South Korean consumer-electronics giant ranks first in sales of mobile phones and second behind Intel in semiconductors. Although Samsung lost a couple of patent battles with Apple, its Galaxy 4 smartphone is outselling the iPhone, and the company continues its strategy of rapid product innovation with different-sized tablets, wearable smartphones and bendable screen displays. With strong distribution in both developed and developing markets, Samsung is poised for higher earnings, when it creates the next “must-have” gadget.

The stock price of Rakuten climbed 20.7% from $12.37 to $14.93, lifting the value of each fund share by 12¢. Based in Japan, Rakuten is an international online shopping mall with tens of thousands of merchants and also a major player in online financial services including securities brokerage and credit-cards. In Japan, e-commerce reaped the benefits of improved customer demand this year, while the effects of the government’s stimulus program (known as Abenomics) gave the company a boost. Operations in Taiwan, Thailand, Malaysia, and especially Indonesia, performed well, strengthening Rakuten’s presence in Southeast Asia’s fast-growing markets.

Lenovo increased the Fund’s NAV by 11¢, as its stock price climbed 25.8% from $0.97 to $1.22. (Because they are more liquid, we own the Hong Kong-listed shares, as opposed to the US-listed ADR’s; one ADR is equal to 20 shares with a value of $24.40 at year-end.) This maker of personal computers (PCs) and other technology products is the number one brand in China, and this year it surpassed Hewlett-Packard as the largest PC manufacturer in the world. Although investors are concerned that the PC market may be contracting, Lenovo was able to gain market share and keep its PC sales growing, while protecting profitability with low-cost manufacturing. The company has also expanded its product line to include smartphones and tablets, and now sells more mobile devices than PCs. Lenovo plans to sell its phones and tablets in more developed markets such as the U.S. in the near future, a strategy that should extend the company’s track record of profitable growth.

Applied Materials, the big maker of equipment used in semiconductor-manufacturing, added 10¢ to each fund share, as its stock gained 12.2% from $15.77 to $17.69. Although based in Silicon Valley, Applied has announced a merger with Tokyo Electron and will have more than half its sales in Asia. The company had a strong start in 2013, as robust demand from chipmakers and manufacturers of flat-panel displays helped earnings and pushed the stock higher. The big event, though, was the announcement that Applied would merge with Tokyo Electron, a rival Japanese maker of semiconductor equipment. The stock moved higher on the news, since the combined company will benefit from a wider customer base, enormous cost savings and much more pricing power.

Outlook and Strategy

Those of you who read the results of the other Parnassus Funds discussed earlier in this report may have noticed that three of the Parnassus Funds each earned more than 30% this year, including the Parnassus Fund, the Parnassus Equity Income Fund and the Parnassus Workplace Fund. Other shareholders may have noticed that the Japanese stock market was up 49% this year, so why wasn’t the Parnassus Asia Fund up more?

26

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

The short answer is that except for Japan and Taiwan, all the Asian countries where we have holdings were down. Also, for an American investor, Japan’s stock market gain is not what it seems. While Japan’s Nikkei Index was up 49%, that is measured in yen terms. Since the yen fell about 19% against the dollar, that meant the gain for Americans in our currency was only about 25% – not bad, but not 49%. (All results in the Parnassus Asia Fund are translated into dollars.) Although we have some Japanese stocks in our portfolio, and these did well for us, only about 12% of our assets were in Japan.

The most important factor, though, is that, on balance, the Asian economies are not doing as well as the American economy and the stock markets reflect that. Although the U.S. economy has been slow to recover, it is recovering and things are improving here more than in Asia. Last year, the Hong Kong stock market dropped 2.8%, Indonesia was down 4.7%, Singapore was down 0.2%, South Korea was down 2.9%, Thailand was down 13.1% and China was down 10.2%. Although Taiwan was up 12.1%, its currency was down 3.4% in relation to the U.S. dollar, so the return expressed in American currency was only 8.3%.

I expect most Asian markets to do much better in 2014 than they did in 2013. The real wild card is Thailand. It has a well-developed economy, and its costs are among the lowest in Asia, so I believe it should thrive in 2014. The difficulty is that there is a lot of political instability in the country, with the opposition party known as “yellow shirts” conducting strong, and sometimes violent, protests against the government party known as “red shirts.” Right now, it looks as if this instability might affect the tourism industry, which accounts for 12% of the economy. If the political situation improves, the economy could be strong and the stock market could soar, since valuations are very low right now.

I think all the other Asian stock markets where we have holdings should do better in 2014 than they did in 2013. (Japan is the exception since it ran up so much in 2013. I expect it to do reasonably well in 2014, but nothing like the 49% it gained in 2013). Asian economies tend to follow the U.S., since the U.S. buys so many products from Asia. Most of the companies in the Fund’s portfolio have strong links to the American economy, so if the United States does well, I believe Asia should do well, too.

Billy Hwan, our senior research analyst, and I visited Asia twice last year, as did Maria Kamin and Rachel Tan from our ESG team. Billy and I visited over 50 companies in Asia, and we also attended two investment conferences in that part of the world. This has given us a much better view of various Asian economies than we had a year ago, and we’ve found some good companies to invest in.

Billy is a graduate of Stanford University and the Haas School of Business at the University of California, Berkeley, and he has also had some terrific Asia experience. He worked at the Government of Singapore Investment Corporation, studied and worked in Japan, as well as studied for a year in Taiwan. He has been invaluable to me in terms of finding good investments for the Fund.

We cannot predict the future of the stock markets in Asia or chart the direction of the Asian economies next year, but we do have the ability to find good companies and invest in them. We are optimistic about the prospects for that part of the world, and if we’re right, the Fund should do very well in 2014.

Yours truly,

Jerome L. Dodson

Portfolio Manager

27

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

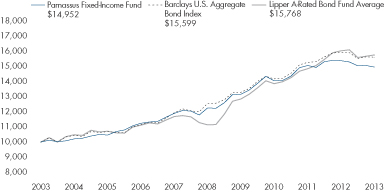

Ticker : PRFIX

As of December 31, 2013, the NAV of the Parnassus Fixed-Income Fund was $16.43, producing a loss for the year of 2.71% (including dividends). This compares to a loss of 2.02% for the Barclays U.S. Aggregate Bond Index (“Barclays Aggregate Index”) and a loss of 1.69% for the Lipper A-Rated Bond Fund Average, which represents the average return of all A-rated bond funds followed by Lipper (“Lipper average”).

Below is a table comparing the performance of the Fund with that of the Barclays Aggregate Index and the Lipper average. Average annual total returns are for the one-, three-, five- and ten-year periods. For December 2013, the 30-day subsidized SEC yield was 1.32%, and the unsubsidized SEC yield was 1.24%.

2013 Review

The past year was a tumultuous period for bond markets, as the Federal Reserve instituted a policy change and dominated headlines. In late 2012, the Federal Reserve removed the deadline from its Quantitative Easing (QE) program. Because of the open-ended nature of the program, it was quickly dubbed “QE-infinity” and the markets rejoiced at the continued flow of cheap money. This led to higher asset prices and lower yields, with the yield on the 10-year Treasury initially dropping to 1.63% by May 2nd from 1.83% on January 1st.

28

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

that would directly benefit from the improving economy and generate a higher return for investors. However, the allocation to Treasury bonds is still above the 36% weighting in the benchmark. The Fund’s heavy weighting in Treasuries meant that its performance very closely reflects this return.

Corporate Credits lost less value during the year than Treasury bonds because credit spreads tightened. Credit spreads represent the premium an investor receives to hold riskier corporate debt instead of Treasury bonds, and is therefore referred to as a “spread over Treasuries”. In times of rising interest rates, or when the base Treasury rate increases, this credit spread can act as a buffer and shrink, protecting some of the value of the bonds. Because corporations continued to perform well and have robust balance sheets, investors accepted a smaller premium over Treasuries during 2013. Within the benchmark, corporate credits lost 1.53% over the year. The Fund benefitted from its relatively high allocation to corporate credits for the year of 37% versus 22% for the index.

The final major component of the Barclays Aggregate Index is asset-backed, or securitized, bonds. Securitized bonds are typically composed of multiple loans that have physical collateral, usually real estate. Most securitized bonds are built from mortgages, so they have different characteristics than corporate credits or Treasury bonds, and are an important component of a diversified portfolio. Securitized debt represents 32% of the benchmark and, due to a prospectus modification made on September 30th, the Fund is now able to invest in this asset class. Because Quantitative Easing (QE) involves purchasing both

| Parnassus Fixed-Income Fund as of December 31, 2013 (percentage of net assets) | ||

Portfolio characteristics and holdings are subject to change periodically.

Treasury bonds and mortgage-backed securities, it’s my belief that the gradual reduction of QE will push prices down since the Federal Reserve, currently the largest buyer, will no longer artificially elevate demand. I believe there will be opportunities throughout 2014 to increase the Fund’s allocation to this asset class from its year-end weight of 10%.

Outlook and Strategy

In the upcoming year, it’s likely that the Federal Reserve will continue to take center stage. Navigating through the end of QE, while keeping the market informed and the economy on track, will be a gargantuan task.

29

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

During most of the past four years, companies were rewarded by their shareholders for holding exceptionally high levels of cash. While this gave investors in both their stocks and bonds increased confidence in corporate credit profiles, cash stockpiling was a major drag on economic growth. This sentiment began to evaporate last year as investors became aggravated by extremely high corporate cash levels, since cash provides a much lower return, especially when compared to the return on producing a new product line or entering a new market. This, to me, signals the beginning of higher growth: as companies are pressured to deploy their cash and reinvest in their businesses, the economy grows.

Because of this outlook, I have positioned the Fund for a growing economy. First, this means that the Fund’s duration is shorter than the Barclays Aggregate Index’s, so it will have comparatively lower interest rate sensitivity. Second, the Fund still has a relatively high allocation to corporate credits. It’s my expectation that increasing consumer demand, and productivity gains due to advances in software, will drive revenues and cash flows higher. This should continue to benefit corporations, particularly those sensitive to capital expenditures, such as high-tech industrial firms.

Next, convertible bonds will likely play a more important role in the upcoming year. The Parnassus Fixed-Income Fund can invest up to 20% of its assets in convertible bonds. This asset class typically does well during periods of growth, since it benefits from equity price appreciation, so it can be a way to supplement fixed-income returns. Finally, mortgage pools will be opportunistically added throughout 2014, so that the Fund reaps the benefits of this asset class as the housing market continues to recover.

Thank you for your investment in the Parnassus Fixed-Income Fund.

Yours truly,

Samantha D. Palm

Portfolio Manager

30

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

By Milton Moskowitz

The outpouring of respect, admiration and love touched off by the death of Nelson Mandela brought 2013 to a close with a crescendo of applause. It was a spontaneous and worldwide celebration of his life. Mandela’s life had special meaning for Parnassus and other members of the social investment community because it legitimized the use of non-financial measures in the appraisal of companies as investments.

Little by little, the anti-apartheid campaign gained strength, coming to a head during the 1980s. General Motors and IBM pulled out of South Africa. Between 1985 and 1988, 114 American companies, including Eastman Kodak, Dow Chemical, Exxon and Ford, withdrew their investments. Parnassus Investments was born in this maelstrom at the end of 1984 and aligned itself with the protestors.

2014 got under way with the elevation of Mary Barra to president and CEO of General Motors. She is the first female to head up a major auto maker. Her appointment came two years after Virginia Rometty was named CEO of IBM, a holding in two Parnassus Funds. Of the Fortune 500 companies, 22 are now led by a female CEO, including two Parnassus Funds holdings, Mondelez International and PepsiCo.

Fast Retailing, one of the first holdings in Parnassus’s newly launched Asia Fund, is the parent of Uniqlo, fastest growing apparel chain in the world. Noted for selling stylish clothes at reasonable prices, Uniqlo has stores in 15 countries and is just beginning its U.S. push with 17 stores, mainly in the New York metropolitan area and the Bay Area. The company is nothing if not ambitious. It has a simple goal of becoming the world’s largest clothing retailer. Uniqlo has 793 stores in its home country, Japan, 99 of them in Tokyo. The company has established a partnership with the Grameen Healthcare Trust to attack poverty, illiteracy and poor sanitation. They are opening stores to sell clothes to the poor, investing the profits in community businesses. Their mission statement is simple: “Changing clothes. Changing conventional wisdom. Changing the world.”

Another Asian holding is Hong Kong-based Lenovo, the company that bought IBM’s personal computer business, retaining the ThinkPad brand name. This business has done so well that Lenovo has jumped into first place in worldwide PC sales – and the company now plans to enter the mobile phone market. Lenovo has a well-developed social responsibility platform. It is one of the constituents of the Hang Seng corporate sustainability index, and it is a signatory and member of the United Nations Global Compact. Piracy has been a problem for many companies entering the Chinese market, and Lenovo has been a leader in fighting for the protection of intellectual property rights. The company has an Employee Code of Conduct that requires employees to report any evidence of fraud or danger to health and safety.

Riverbed Technology joined Whole Foods Market and TV station KPIX in sponsoring a program to feed hungry families in the San Francisco Bay Area. The drive concentrated on getting people to make food donations to bins located in Whole Foods stores…One of latest benefits at perk-happy Google is a special death benefit. In event of an employee’s death, Google will pay one-half of his/her salary to spouse or domestic partner for the next 10 years. In addition, it will send $1,000 a month for children still in school until they reach age 19…Roche Holdings, Switzerland’s pharmaceutical giant and a recent addition to the Parnassus Funds portfolio, specializes in exemplary workplaces. Roche owns 11 different companies in the United States – and the two largest, Genentech in South San Francisco and Roche Diagnostics in Indianapolis, both make Fortune’s list of the 100 Best Companies to Work For.

Milton Moskowitz is the co-author of the Fortune magazine survey, “The 100 Best Companies to Work For,” and the co-originator of the annual Working Mother magazine survey, “The 100 Best Companies for Working Mothers.” Mr. Moskowitz serves as a consultant to Parnassus Investments in evaluating companies for workplace issues and responsible investing. Neither Fortune magazine nor Working Mother magazine has any role in the management of the Parnassus Funds, and there is no affiliation between Parnassus Investments and either publication.

31

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

As a shareholder of the Funds, you incur ongoing costs, which include portfolio management fees, administrative fees, shareholder reports, and other fund expenses. The Funds do not charge transaction fees, so you do not incur transaction costs such as sales charges (loads) on purchase payments, reinvested dividends, or other distributions, redemption fees, and exchange fees. The information on this page is intended to help you understand your ongoing costs of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The following example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the period of July 1, 2013 through December 31, 2013.

Actual Expenses

In the example below, the first line for each Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of each Fund provides information about hypothetical account values and hypothetical expenses based on the Fund’s expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. You may compare the ongoing costs of investing in the Fund with other mutual funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in the table are meant to highlight only your ongoing costs in these Funds. Therefore, the second line of each Fund is useful in comparing only ongoing costs and will not help you determine the relative total costs of owning other mutual funds, which may include transactional costs such as loads.

| Beginning Account Value July 1, 2013 |

Ending Account Value December 31, 2013 |

Expenses Paid During Period* |

||||||||||

| Parnassus Fund: Actual | $1,000.00 | $1,190.13 | $4.97 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,020.67 | $4.58 | |||||||||

| Parnassus Equity Income Fund – Investor Shares: Actual | $1,000.00 | $1,172.62 | $4.93 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,020.67 | $4.58 | |||||||||

| Parnassus Equity Income Fund – Institutional Shares: Actual | $1,000.00 | $1,173.45 | $3.73 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,021.78 | $3.47 | |||||||||

| Parnassus Mid-Cap Fund: Actual | $1,000.00 | $1,155.55 | $6.52 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,033.37 | $6.15 | |||||||||

| Parnassus Small-Cap Fund: Actual | $1,000.00 | $1,190.19 | $6.62 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,019.16 | $6.11 | |||||||||

| Parnassus Workplace Fund: Actual | $1,000.00 | $1,156.05 | $6.20 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,019.46 | $5.80 | |||||||||

| Parnassus Asia Fund: Actual | $1,000.00 | $1,048.16 | $7.49 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,017.90 | $7.37 | |||||||||

| Parnassus Fixed-Income Fund: Actual | $1,000.00 | $993.48 | $3.42 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,021.78 | $3.47 | |||||||||

* Expenses are equal to the Fund’s annualized expense ratio of 0.90%, 0.90%, 0.68%, 1.20%, 1.20%, 1.14%, 1.45% and 0.68% for the Parnassus Fund, Parnassus Equity Income Fund – Investor Shares, Parnassus Equity Income Fund – Institutional Shares, Parnassus Mid-Cap Fund, Parnassus Small-Cap Fund, Parnassus Workplace Fund, Parnassus Asia Fund and Parnassus Fixed-Income Fund, respectively, multiplied by the average account value over the period, multiplied by the ratio of days in the period. The ratio of days in the period is 184/365 (to reflect the one-half year period).

32

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of the Parnassus Funds and the Parnassus Income Funds

San Francisco, California

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of the Parnassus Funds (comprised of Parnassus Fund, Parnassus Mid-Cap Fund, Parnassus Small-Cap Fund, Parnassus Workplace Fund and Parnassus Asia Fund) and the Parnassus Income Funds (comprised of Parnassus Equity Income Fund and Parnassus Fixed-Income Fund) (collectively, the “Trusts”) as of December 31, 2013, and the related statements of operations for the year then ended for Parnassus Fund, Parnassus Mid-Cap Fund, Parnassus Small-Cap Fund, Parnassus Workplace Fund, Parnassus Equity Income Fund and Parnassus Fixed-Income Fund and for the period April 30, 2013 (inception date) through December 31, 2013 for Parnassus Asia Fund, the statements of changes in net assets for each of the two years in the period then ended for Parnassus Fund, Parnassus Mid-Cap Fund, Parnassus Small-Cap Fund, Parnassus Workplace Fund, Parnassus Equity Income Fund and Parnassus Fixed-Income Fund and for the period April 30, 2013 (inception date) through December 31, 2013 for Parnassus Asia Fund, and the financial highlights for each of the five years in the period then ended for Parnassus Fund, Parnassus Mid-Cap Fund, Parnassus Small-Cap Fund, Parnassus Workplace Fund, Parnassus Equity Income Fund and Parnassus Fixed-Income Fund and for the period April 30, 2013 (inception date) through December 31, 2013 for Parnassus Asia Fund. These financial statements and financial highlights are the responsibility of the Trusts’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Trusts are not required to have, nor were we engaged to perform, an audit of their internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trusts’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2013, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the funds constituting the Parnassus Funds and the Parnassus Income Funds as of December 31, 2013, the results of their operations for the periods then ended, the changes in their net assets for each of the two years in the period then ended for Parnassus Fund, Parnassus Mid-Cap Fund, Parnassus Small-Cap Fund, Parnassus Workplace Fund, Parnassus Equity Income Fund and Parnassus Fixed-Income Fund and for the period April 30, 2013 (inception date) through December 31, 2013 for Parnassus Asia Fund, and the financial highlights for each of the five years in the period then ended for Parnassus Fund, Parnassus Mid-Cap Fund, Parnassus Small-Cap Fund, Parnassus Workplace Fund, Parnassus Equity Income Fund and Parnassus Fixed-Income Fund and for the period April 30, 2013 (inception date) through December 31, 2013 for Parnassus Asia Fund, in conformity with accounting principles generally accepted in the United States of America.

San Francisco, California

February 3, 2014

33

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

Portfolio of Investments as of December 31, 2013

The accompanying notes are an integral part of these financial statements.

34

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

PARNASSUS FUND

Portfolio of Investments as of December 31, 2013 (continued)

The accompanying notes are an integral part of these financial statements.

35

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

Portfolio of Investments as of December 31, 2013

The accompanying notes are an integral part of these financial statements.

36

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

PARNASSUS EQUITY INCOME FUND

Portfolio of Investments as of December 31, 2013 (continued)

The accompanying notes are an integral part of these financial statements.

37

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

PARNASSUS EQUITY INCOME FUND

Portfolio of Investments as of December 31, 2013 (continued)

| W Fund ownership consists of 5% or more of the shares outstanding of the Affiliated Issuer, as defined under the Investment Securities Act of 1940. | ||||||

| q This security is non-income producing. | ||||||

| l This security, or partial position of this security, was on loan at December 31, 2013. | ||||||

| The total value of the securities on loan at December 31, 2013 was $186,102,150. | ||||||

| a Market value adjustments have been applied to these securities to reflect potential early withdrawal. | ||||||

| ADR American Depository Receipt | ||||||

The accompanying notes are an integral part of these financial statements.

38

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

Portfolio of Investments as of December 31, 2013

The accompanying notes are an integral part of these financial statements.

39

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

PARNASSUS MID-CAP FUND

Portfolio of Investments as of December 31, 2013 (continued)

The accompanying notes are an integral part of these financial statements.

40

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

Portfolio of Investments as of December 31, 2013

The accompanying notes are an integral part of these financial statements.

41

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

PARNASSUS SMALL-CAP FUND

Portfolio of Investments as of December 31, 2013 (continued)

| Principal Amount ($) |

Short-Term Securities |

Percent of Net Assets |

Market Value ($) |

|||||||||

| Time Deposits | ||||||||||||

| 7,115,398 | BBH Cash Management Service BTMU, Grand Cayman 0.03%, due 01/02/2014 |

0.9 | % | 7,115,398 | ||||||||

|

|

|

|||||||||||

| Securities Purchased with Cash Collateral from Securities Lending | ||||||||||||

| Registered Investment Companies | ||||||||||||

| 73,019,925 | Invesco Aim Government & Agency Portfolio Short-Term Investments Trust, Institutional Class variable rate, 0.03% |

9.4 | % | 73,019,925 | ||||||||

|

|

|

|||||||||||

| Total short-term securities (cost $80,135,323) |

10.3 | % | 80,135,323 | |||||||||

|

|

|

|||||||||||

| Total securities (cost $684,997,190) |

109.5 | % | 849,448,123 | |||||||||

|

|

|

|||||||||||

| Payable upon return of securities loaned | (9.4 | %) | (73,019,925 | ) | ||||||||

| Other assets and liabilities - net | (0.1 | %) | (772,981 | ) | ||||||||

|

|

|

|||||||||||

| Total net assets | 100.0 | % | 775,655,217 | |||||||||

|

|

|

|||||||||||

| W Fund ownership consists of 5% or more of the shares outstanding of the Affiliated Issuer, as defined under the Investment Securities Act of 1940. |

| |||||||||||

| q This security is non-income producing. |

| |||||||||||

| l This security, or partial position of this security, was on loan at December 31, 2013. |

| |||||||||||

| The total value of the securities on loan at December 31, 2013 was $71,519,454. | ||||||||||||

The accompanying notes are an integral part of these financial statements.

42

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

Portfolio of Investments as of December 31, 2013

The accompanying notes are an integral part of these financial statements.

43

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

PARNASSUS WORKPLACE FUND

Portfolio of Investments as of December 31, 2013 (continued)

The accompanying notes are an integral part of these financial statements.

44

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

Portfolio of Investments as of December 31, 2013

The accompanying notes are an integral part of these financial statements.

45

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

PARNASSUS ASIA FUND

Portfolio of Investments as of December 31, 2013 (continued)

The accompanying notes are an integral part of these financial statements.

46

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

Portfolio of Investments as of December 31, 2013

The accompanying notes are an integral part of these financial statements.

47

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

PARNASSUS FIXED-INCOME FUND

Portfolio of Investments as of December 31, 2013 (continued)

The accompanying notes are an integral part of these financial statements.

48

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

PARNASSUS FIXED-INCOME FUND

Portfolio of Investments as of December 31, 2013 (continued)

The accompanying notes are an integral part of these financial statements.

49

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2013 | |||

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2013

| Parnassus Fund |

Parnassus Equity Income Fund |

Parnassus Mid-Cap Fund |

||||||||||

| Assets | ||||||||||||

| Investments in common stocks and bonds, at market value-Unaffliliated | ||||||||||||

| (cost $450,683,544, $5,169,128,584, $180,170,434, $571,048,518, $353,271,252, $2,749,917, $171,240,784) |

$ | 567,132,950 | $ | 7,318,522,639 | $ | 228,719,891 | ||||||

| Investments in stocks, at market value-Affliliated | ||||||||||||

| (cost of $0, $325,967,151, $0, $33,813,349, $0, $0, $0) |

- | 411,352,250 | - | |||||||||

| Investments in short-term securities | ||||||||||||

| (at cost which approximates market value) |

57,462,026 | 527,254,331 | 19,573,876 | |||||||||

| Cash | 170,535 | 263,083 | 367 | |||||||||

| Receivables | ||||||||||||

| Dividends and interest |

308,644 | 9,084,357 | 288,468 | |||||||||

| Capital shares sold |

352,308 | 23,463,808 | 1,132,194 | |||||||||

| Due from Parnassus Investments |

- | - | - | |||||||||

| Other assets | 53,584 | 255,495 | 34,069 | |||||||||

| Total assets |

$ | 625,480,047 | $ | 8,290,195,963 | $ | 249,748,865 | ||||||

| Liabilities | ||||||||||||

| Payable upon return of loaned securities | 52,349,125 | 190,104,852 | 8,239,278 | |||||||||

| Payable for investment securities purchased | - | - | - | |||||||||

| Capital shares redeemed | 245,785 | 3,833,074 | 128,087 | |||||||||

| Fees payable to Parnassus Investments | 342,531 | 4,351,540 | 175,218 | |||||||||

| Accounts payable and accrued expenses | 241,774 | 617,979 | 43,897 | |||||||||

| Total liabilities |

$ | 53,179,215 | $ | 198,907,445 | $ | 8,586,480 | ||||||

| Net assets | $ | 572,300,832 | $ | 8,091,288,518 | $ | 241,162,385 | ||||||

| Net assets consist of | ||||||||||||

| Undistributed net investment income | 1,049,129 | 120,773 | 7,209 | |||||||||

| Unrealized appreciation on securities and foreign currency | 116,449,406 | 2,234,779,154 | 48,549,457 | |||||||||

| Accumulated net realized gain (loss) on securities and foreign currency | 364,590 | 61,522,946 | 2,253,720 | |||||||||

| Capital paid-in | 454,437,707 | 5,794,865,645 | 190,351,999 | |||||||||

| Total net assets |

$ | 572,300,832 | $ | 8,091,288,518 | $ | 241,162,385 | ||||||

| Net asset value and offering per share | ||||||||||||

| Net assets investor shares | $ | 572,300,832 | $ | 6,282,234,642 | $ | 241,162,385 | ||||||

| Net assets institutional shares | - | $ | 1,809,053,876 | - | ||||||||

| Shares outstanding investor shares | 12,478,753 | 171,289,485 | 9,608,936 | |||||||||

| Shares outstanding institutional shares | - | 49,246,910 | - | |||||||||

| Net asset values and redemption price per share | ||||||||||||

| (Net asset value divided by shares outstanding) |

||||||||||||

| Investor shares |

$ | 45.86 | $ | 36.68 | $ | 25.10 | ||||||

| Institutional shares |

- | $ | 36.73 | - | ||||||||

The accompanying notes are an integral part of these financial statements.

50

Table of Contents

| Annual Report • 2013 | PARNASSUS FUNDS | |||

| Parnassus Fund |

Parnassus Workplace Fund |

Parnassus Asia Fund |

Parnassus Fixed-Income |

|||||||||||

| $ |

732,414,300 |

|

$ | 447,051,220 | $ | 2,887,403 | $ | 171,342,482 | ||||||

| 36,898,500 | - | - | - | |||||||||||

| 80,135,323 | 61,646,690 | 427,317 | 3,544,518 | |||||||||||

| 223 | 808 | 13 | 73 | |||||||||||

| 407,471 | 270,430 | 585 | 1,223,189 | |||||||||||

| 877,367 | 990,887 | 30,710 | 64,082 | |||||||||||

| - | - | 15,756 | - | |||||||||||

| 72,923 | 40,309 | 27,374 | 11,893 | |||||||||||

| $ | 850,806,107 | $ | 510,000,344 | $ | 3,389,158 | $ | 176,186,237 | |||||||

| 73,019,925 | 31,585,950 | - | - | |||||||||||

| 566,883 | - | - | - | |||||||||||

| 786,010 | 2,072,008 | - | 237,195 | |||||||||||

| 644,089 | 334,005 | - | 78,910 | |||||||||||

| 133,983 | 68,494 | 13,278 | 80,370 | |||||||||||

| $ | 75,150,890 | $ | 34,060,457 | $ | 13,278 | $ | 396,475 | |||||||

| $ | 775,655,217 | $ | 475,939,887 | $ | 3,375,880 | $ | 175,789,762 | |||||||

| 32,998 | 14,510 | - | - | |||||||||||

| 164,450,933 | 93,779,968 | 137,486 | 101,698 | |||||||||||

| 2,217,245 | 843,486 | - | (40,310 | ) | ||||||||||

| 608,954,041 | 381,301,923 | 3,238,394 | 175,728,374 | |||||||||||

| $ | 775,655,217 | $ | 475,939,887 | $ | 3,375,880 | $ | 175,789,762 | |||||||

| $ | 775,655,217 | $ | 475,939,887 | $ | 3,375,880 | $ | 175,789,762 | |||||||

| - | - | - | - | |||||||||||