Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: June 30, 2013

Table of Contents

Item 1: Report to Shareholders

Table of Contents

PARNASSUS FUNDS®

SEMIANNUAL REPORT ¡ JUNE 30, 2013

PARNASSUS FUNDS

| Parnassus FundSM | PARNX | |

| Parnassus Equity Income FundSM – Investor Shares | PRBLX | |

| Parnassus Equity Income Fund – Institutional Shares | PRILX | |

| Parnassus Mid-Cap FundSM | PARMX | |

| Parnassus Small-Cap FundSM | PARSX | |

| Parnassus Workplace Fund® | PARWX | |

| Parnassus Asia FundSM | PAFSX | |

| Parnassus Fixed-Income FundSM | PRFIX | |

Table of Contents

| Letter from Parnassus Investments | 4 | |||

| Fund Performance and Commentary | ||||

| Parnassus Fund | 7 | |||

| Parnassus Equity Income Fund | 10 | |||

| Parnassus Mid-Cap Fund | 13 | |||

| Parnassus Small-Cap Fund | 17 | |||

| Parnassus Workplace Fund | 20 | |||

| Parnassus Asia Fund | 22 | |||

| Parnassus Fixed-Income Fund | 24 | |||

| Responsible Investing Notes | 26 | |||

| Fund Expenses | 28 | |||

| Portfolios of Investments | ||||

| Parnassus Fund | 30 | |||

| Parnassus Equity Income Fund | 32 | |||

| Parnassus Mid-Cap Fund | 35 | |||

| Parnassus Small-Cap Fund | 37 | |||

| Parnassus Workplace Fund | 39 | |||

| Parnassus Asia Fund | 41 | |||

| Parnassus Fixed-Income Fund | 42 | |||

| Financial Statements | 46 | |||

| Notes to Financial Statements | 53 | |||

| Financial Highlights | 64 | |||

| Additional Information | 67 | |||

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

August 2, 2013

Enclosed are the semiannual reports for all the Parnassus Funds. I think that you’ll find that they make for interesting reading, as they describe our investment strategy and the results for the quarter. They will also give you insights into the companies we invest in. Below is a photograph of a recent reunion of our interns.

Front Row (from left to right): Chi Tran-Brandli, Rachel Tan, Cina Loarie, Jerome Dodson, Thao Dodson, Rachel Chang, Madeline Lissner and Annie Lee. Middle Row: Lori Lai, Andrea Reichert, Hallie Marshall, Ben Allen, Katherine Loarie, Bryan Wong, Ian Sexsmith, Minh Bui, Matthew Gershuny, Robert Klaber, Fred Jones and Marie Lee. Back Row: Russ Caprio, Dan Beck, Josh Harrington, Iyassu Essayas, Ryan Wilsey, Peter Tsai, Gee Leung, Ben Hamlin, Billy Hwan and John Haskell.

Interns

We have eight terrific interns on our research team this summer. Ben Hamlin is an MBA candidate at the Haas School of Business at the University of California, Berkeley. Prior to business school, he spent four years in the equity capital markets division of Bank of America Merrill Lynch. He graduated with honors from Claremont McKenna College, with a degree in economics. Ben enjoys cooking, tennis, travelling, and serves on the board of a non-profit that assists microfinance recipients.

John Haskell earned an MBA from the Harvard Business School this past May. His experience includes stints at Boston Consulting Group, Eagle Capital Management and the Capital Group. John studied comparative literature and society at Columbia University, where he earned a bachelor’s degree with honors. He also studied in China on a Fulbright Grant and in Syria on a scholarship from the U.S. National Security Education Program. John’s favorite leisure activities are reading fiction and playing with his dachshund.

4

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

Annie Lee is an MBA candidate at the Wharton School at the University of Pennsylvania. She holds a bachelor’s degree in business administration and a master’s degree in accounting from the University of Texas at Austin. She worked in Visa’s corporate finance group and the investment banking division of RBC Capital Markets. Annie is a founding board member of Nonprofit Investor, an organization that evaluates non-profits, and a board member of Leap, an arts education non-profit in San Francisco. In her free time, Annie enjoys traveling, playing piano and attending concerts.

Madeline Lissner is also an MBA candidate at the Wharton School. Previously, she was an investment banker in the New York offices of Centerview Partners and Citigroup. Madeline graduated magna cum laude from Harvard College, where she studied economics and served as Secretary of her class. At Wharton, Madeline has led character-development backpacking treks in locations such as Antarctica and Patagonia.

Bryan Wong is pursuing his MBA at the Haas School of Business at the University of California, Berkeley. Prior to business school, he was a senior associate at the David & Lucile Packard Foundation and an analyst at two hedge funds, Wohl Capital and Khan Capital Management. Bryan earned a bachelor’s degree from Yale University with distinction in political science and international studies. He is an avid San Francisco Giants fan and is looking forward to getting married in August.

The following three interns are helping our environmental, social and governance (ESG) research team this summer. Rachel Chang is a senior at the University of California, Berkeley, where she is pursuing a bachelor’s degree in business with a minor in energy and resources. She previously interned with a social impact consulting firm in Singapore and the Lawrence Berkeley National Laboratory’s Department of Energy Efficiency.

Emily Dwyer graduated from Smith College in May, where she double-majored in economics and environmental science and policy. While at Smith, Emily served as the Student Liaison and Intern for the Environmental Science & Policy department. During her junior year, she studied at the Graduate Institute of International and Developmental Studies in Geneva, Switzerland, and interned for the United Nations Environment Programme Finance Initiative (UNEP FI).

Cina Loarie earned a bachelor’s degree in biology from Duke University and a master’s degree in conservation from Scripps Institution of Oceanography at the University of California, San Diego. She worked as an analyst at the China Greentech Initiative in Beijing and as a project manager at the California Ocean Protection Council in Oakland. Cina holds a 100-ton captain’s license from the U.S. Coast Guard, making her the first certified skipper to intern at Parnassus Investments. Cina plans to pursue her master’s degree in sustainable business administration from the Presidio Graduate School in San Francisco this coming fall.

In other personnel news, Amy Phan has accepted an offer to join Parnassus Investments as a full-time Marketing Associate in August, upon completion of her current internship with the firm. Amy graduated in May from the University of California, Berkeley as a quadruple major, with bachelor’s degrees in environmental economics and policy, media studies, political economy and sociology. She was on the leadership team of MarketingCamp San Francisco 2013 and is a strong advocate for the LGBTQIA community.

Andrew Saeta is currently interning on our sales and marketing team. He graduated from Stanford University in May with a bachelor’s degree in science, technology and society. As a member of the varsity swim team, Andrew earned four NCAA All-American honors, three PAC-12 First Team Academic All-American honors and competed in the 2008 and 2012 U.S. Olympic Trials. Andrew’s interests outside of the pool include designing and distributing custom t-shirts and playing guitar.

Flora Dai is a software engineer intern, working on improving the user experience on our website. She is working towards a bachelor’s degree in electrical engineering and computer science at the University of California, Berkeley. She is a music enthusiast and during her spare time, enjoys playing the piano.

Greg Owyang is an information technology intern, working to support our technology infrastructure. He is working towards a bachelor’s degree in mechanical engineering at the California State Polytechnic University, Pomona. He enjoys snowboarding and playing video games in his spare time.

5

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

Downey Blount is a Compliance Project Manager, who will be handling special projects over the next three months. Downey brings a wealth of experience, as her prior positions include Mutual Fund Administration Manager at Montgomery Asset Management and Chief Compliance Officer at Matthews International Capital Management. She has a bachelor’s degree from the University of California, Santa Barbara, and attended law school at the University of San Francisco. Downey is fluent in Spanish and spent a year living in Spain.

Yours truly,

Jerome L. Dodson

President

6

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

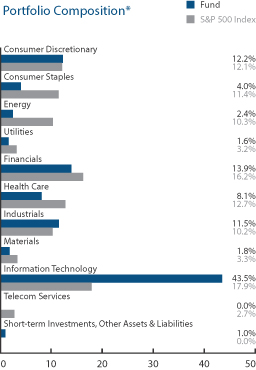

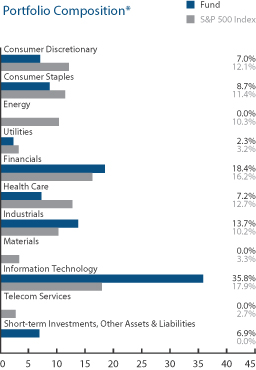

Ticker: PARNX

As of June 30, 2013, the net asset value per share (“NAV”) of the Parnassus Fund was $45.81, so the total return for the quarter was 6.61%. This compares favorably to 2.91% for the S&P 500 Index (“S&P 500”) and 2.57% for the Lipper Multi-Cap Core Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”). For the quarter, we beat the S&P 500 by 3.7 percentage points and the Lipper average by 4.04 percentage points. Although we lagged our benchmarks by quite a bit at the end of the first quarter, we bounced back nicely in the second quarter, so that now we’re only a little over a percentage point behind the S&P 500 for the year-to-date: 12.78% vs. 13.82%; and only about half a percentage point behind the Lipper average: 12.78% vs. 13.34%. As you’ll see in the Company Analysis section, technology and telecommunications stocks helped us the most in this comeback quarter, but we also had help from financial stocks and a consumer-products company.

Below is a table comparing the Parnassus Fund with the S&P 500 and the Lipper average over the past one-, three-, five- and ten-year periods ended June 30, 2013. We’re ahead of both benchmarks for all periods except for the ten-year period, where we’re slightly behind both the S&P 500 and the Lipper average.

7

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

8

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

Outlook and Strategy

Note: This section represents my thoughts and applies to two of the funds that I manage: the Parnassus Fund and the Parnassus Workplace Fund, which are managed as a pair. The outlook and strategy for the Parnassus Small-Cap Fund appears in that Fund’s section and was written by myself and Portfolio Manager, Ryan Wilsey. There is no outlook and strategy section for the new Parnassus Asia Fund, since that section already contains general thoughts about the ideas behind the Asia Fund.

The economy continues to grow at a slow pace with modest increases in job creation. Normally after a recession, the economy starts to grow at a rapid clip, with new job creation sometimes exceeding 300,000 or 400,000 per month. Since 2009, the economy has expanded slowly with job creation hovering in the range of 100,000 to, at most, 200,000. Looked at in one way, this slow growth is frustrating, because the unemployment rate remains high, and there are concerns that the economy may fall into a recession again.

Looked at another way, the slow growth phenomenon may not be all bad. The measured pace of growth may prevent the economy from overheating. The stock market seems to like the slow and steady rate of growth, as it has moved sharply higher this year with a gain of 13.82% for the S&P 500 for the first six months of the year.

Many economists and top government officials, including Federal Reserve Chairman Ben Bernanke, are concerned that the rate of growth is so slow, that the economy could fall back into a recession. In fact, Chairman Bernanke has had the Fed purchase $85 billion of securities per month, mostly in mortgage securities, to stimulate the economy.

Although I agree with the Bernanke policy, I think it’s highly unlikely that the economy will fall back into a recession, even if the Fed tapers off its purchase of securities and reduces the economic stimulus. The reason for my optimism is the state of the housing market. As many of you know, I’m convinced that almost without exception, the housing market is what drives the economy into a recession and pulls the economy out of a recession. It was clearly speculation in the housing market and abuse of subprime mortgages that drove us into the great recession of 2008. The crash of the housing market is what drove us to the brink of financial meltdown in 2008 and has kept the economy on its knees for so long.

Housing is now driving the economy forward. Existing home sales grew 12.9% in May, and home prices in the twenty largest American cities jumped 12.1% in April; the largest increase since 2006. At first glance, these numbers might cause concern that the housing market may be overheating again, but remember that these increases are from low bases. Lenders are more disciplined than they were in the 2006-2007 period, so it’s unlikely that things will get out of hand in the housing market – at least not right away. Also, for most of the country, housing prices are still far below their peaks of 2007-2008.

As home prices recover and construction picks up, bricklayers, carpenters, plumbers and electricians have more work. People will buy more furniture, home appliances, pots and pans, dishes, drapes and rugs, and so on throughout the economy. This is a force that is not easy to stop, so the economy should keep growing. Interest rates will rise slowly, but this should not choke off the expansion, since they remain low compared to historic levels.

Our portfolio is positioned to take advantage of this growth in the economy, as evidenced by our continuing position in homebuilders and our holdings in telecommunications and technology stocks. Even with the big move up in the stock market this year, stocks don’t appear to be overvalued. Volatility will continue, and may have big moves down when there are concerns that interest rates are moving higher. For us, though, this will be a good time to buy.

Yours truly,

Jerome L. Dodson

Portfolio Manager

9

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

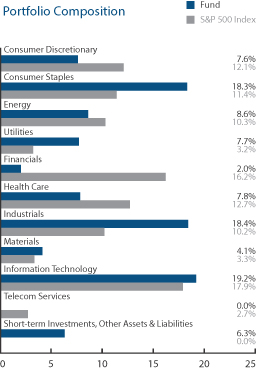

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

As of June 30, 2013, the NAV of the Parnassus Equity Income Fund-Investor Shares was $33.17. After taking dividends into account, the total return for the second quarter was 1.40%. This compares to increases of 2.91% for the S&P 500 Index (“S&P 500”) and 2.17% for the Lipper Equity Income Fund Average, which represents the average return of the equity income funds followed by Lipper (“Lipper average”). For the first half of 2013, the Fund posted a return of 14.28%, which compares favorably to gains of 13.82% for the S&P 500 and 13.01% for the Lipper average.

10

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

it dropped 26.7% from $36.31 to $26.61, slicing 25¢ off the Fund’s NAV. In June, Iron Mountain’s management announced that the IRS had put on hold the company’s application to become a real estate investment trust (REIT), and that the agency was “tentatively adverse” to the application before doing so. One silver lining is that the halt was not specific to Iron Mountain, but rather, applied to a large number of other applicants as well. Since a REIT structure would drastically reduce Iron Mountain’s tax bill and increase its dividend, the stock fell sharply on the news.

11

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

Schwab’s earnings would be almost triple their current 15¢ quarterly rate. We trimmed our Schwab position in response to the big move up, but still held some stock at quarter-end.

Applied Materials, the manufacturer of semiconductor capital equipment, climbed 10.6% to $14.91 from $13.48 and increased the NAV by 14¢. The company’s customers are steadily increasing their capacity to build chips for computing devices, such as smartphones and tablets. Importantly for an equipment maker like Applied Materials, as the technical specifications for these chips evolve, they become more difficult and expensive to manufacture. This trend should continue for many years, and the company is well-positioned to profit from it. Another positive is that Applied Materials’ management team has significantly improved over the past 18 months, with the promotion of Gary Dickerson to President and the addition of Bob Halliday as Chief Financial Officer. These executives have already reshaped the company’s culture, with a focus on innovation, cost control and anticipating customer needs.

Google climbed 10.9% to $880.37 from $794.03 and added 13¢ to the NAV. The company reported excellent first quarter results in April, with revenues 31% higher than last year. Google’s mobile advertising sales are surging, and the company has done an excellent job at monetizing its non-search services, such as YouTube. We trimmed our Google position at an average price of $908 during the quarter, because we expect more modest investment returns given the current valuation.

Outlook and Strategy

Our overall strategy is basically unchanged from last quarter. We still think there are pockets of fragility in the global economy, but are encouraged by the fact that the housing market in the United States has roared back to life. According to the latest Case-Shiller report, national home prices rose at an average annual rate of 12.1% in April and were up a record 2.5% as compared to the previous month. This real estate recovery has increased the wealth of millions of American homeowners and encouraged new home construction. Since a homebuilding recovery usually precedes a broader economic expansion, it’s a great sign that builders sought permits in May at the highest rate since the spring of 2008.

Federal Reserve Chairman Ben Bernanke has taken note of the strength in the real estate market and the overall economy. On June 19, he announced that if the economy keeps improving as he expects, the central bank would soon reduce the size of its quantitative easing (QE) program, which is designed to boost asset prices and keep interest rates low. Bernanke specified that by year-end the Fed would ratchet down its monthly bond purchases from the current pace of $85 billion and likely end the program in 2014. Since the Fed has played a major role in propping up debt markets, we expect bonds to display increased volatility as QE tapers off and eventually expires. We wouldn’t be surprised to see turbulence in the stock market as well, since changes in the value of credit securities normally impact equity prices.

We’re still paying close attention to events overseas that could potentially impair the value of our portfolio companies. Europe’s persistent economic contraction and fragile credit system top our list of global concerns. Amazingly, the 17 nations that comprise the Eurozone are, in aggregate, enduring their sixth consecutive quarter of recession. This is the longest recession for the region since records began in 1995. We think that Europe’s banking system is still vulnerable to a credit shock, so the Fund didn’t own any financial firms with significant exposure to Europe as of quarter-end.

The market surge that culminated in the S&P 500’s record high in May lifted many of our stocks close to their intrinsic values. Two stocks, Nike and Valeant Pharmaceuticals, actually exceeded our fair value assessment, so we no longer own them as of quarter-end. In addition to these outright sales, we trimmed a handful of other positions in the Fund. We reinvested the sales proceeds into existing portfolio companies, as well as three new holdings: Apple, Thomson Reuters and National Oilwell Varco. These are terrific businesses with stocks that we think offer asymmetric payoffs, with far more potentially to gain than to lose. We hope to write about these stocks in detail as Fund winners in future reports.

Thank you for your trust and investment with us,

|

|

|||

| Todd C. Ahlsten | Benjamin E. Allen | |||

| Lead Portfolio Manager | Portfolio Manager | |||

12

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

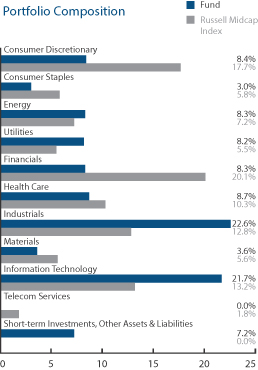

Ticker: PARMX

As of June 30, 2013, the NAV of the Parnassus Mid-Cap Fund was $22.50, so the total return for the quarter was 1.08%. This compares to 2.21% for the Russell Midcap Index (“Russell”) and 2.57% for the Lipper Multi-Cap Core Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”).

For the year-to-date, we are behind both the Russell and the Lipper average, as we have gained 11.00%, compared to 15.45% for the Russell and 13.34% for the Lipper average. Normally, we’d be thrilled with an 11% return for six-months, but it’s hard to celebrate when we’re trailing our benchmarks by such a large margin.

Our strategy of owning high-quality businesses at good prices should continue to generate shareholder wealth over the long-term. Since we began managing the Fund on September 30, 2008, the Fund’s annualized return is 12.03%, ahead of the Russell’s 11.94% and the Lipper average’s 8.77%. We’re also proud of our five-year return, which is well ahead of both the Russell and Lipper averages. Our three-year return is slightly behind the Russell but well ahead of the Lipper average, which we consider to be adequate considering the Fund’s relatively low risk profile.

Below is a table comparing the Parnassus Mid-Cap Fund with the Russell and the Lipper average for the one-, three- and five-year periods ended June 30, 2013, and for the period since inception on April 29, 2005.

13

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

Company Analysis

Three stocks reduced the Fund’s NAV by 5¢ or more in the quarter, while three stocks added at least 7¢. The stock that hurt us the most was Iron Mountain, the nation’s largest document management company. The stock sank 26.7% to $36.31 from $26.61, slicing 17¢ from the NAV. In June, Iron Mountain’s management announced that the IRS had put on hold the company’s application to become a real estate investment trust (REIT), and that the agency was “tentatively adverse” to the application before doing so. One silver lining is that the halt was not specific to Iron Mountain, but applied to a large number of other applicants as well. Since a REIT structure would drastically reduce Iron Mountain’s tax bill and increase its dividend, the stock fell sharply on the news.

14

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

Spectra Energy, a leading natural gas pipeline and storage company, added 7¢ to each Fund share, as its stock jumped 12.1% from $30.75 to $34.46. Strong distribution segment results, which saw higher customer usage due to colder weather, drove better than expected earnings results. Investor sentiment moved higher after the company announced plans to move its U.S. transmission and storage assets into a tax-advantaged master-limited partnership subsidiary.

Outlook and Strategy

Years of government stimulus, including near-zero inter-bank borrowing rates and over a trillion dollars of bond-buying, have driven mid-cap stocks up almost 200% from their March of 2009 lows. Investors now see easy Fed policy as a sign to buy stocks. So when the Fed recently signaled that it will probably wind down its $85 billion a month bond buying program next year, the markets sold off.

The stimulus of the past few years has helped get the country back on track. GDP has grown for the past fifteen quarters, consumer confidence hit a high in June, and the housing market is thriving, with home prices in multiple U.S. cities reaching record highs. The unemployment rate is also down to 7.6%, well below the 10% rate at recession peak.

We don’t think investors should fear the end of stimulus. We expect the Fed to proceed slowly, in a way that encourages continued economic growth. The economy will eventually become self-sustaining, and this should drive further stock market gains. In the meantime, we are using the market turbulence to buy the best businesses we can.

Our process of finding undervalued companies is always on a stock-by-stock basis. We currently own more technology and industrial companies than our benchmarks, because we’re finding especially good bargains in these sectors. Most of our holdings in these areas also have secular growth drivers, robust free cash flow and significant cash balances, which help mitigate downside risk.

During the quarter, we initiated a few sizeable positions. Autodesk is the market leader in 3D design and engineering software, which is used to design everything from Nike sneakers to San Francisco’s new Bay Bridge. Designers, architects and manufacturers are trained to use the company’s quality software early in their careers, so it’s difficult for them to switch to competing products. This in turn allows Autodesk to consistently raise prices with little resistance from clients.

Autodesk’s sluggish European growth recently disappointed investors, but the company has opportunities to expand its business in North America, Latin America and Asia. The recovery in the manufacturing and construction sectors, particularly in the U.S., should boost demand for Autodesk’s engineering design software. Since we believe Autodesk is a great business, we bought the stock when the price dropped and the valuation became attractive.

Another new position is Intuit. You probably know Intuit for its user-friendly TurboTax software. What is less appreciated by investors is its small business software segment, which offers products that simplify small businesses’ day-to-day tasks. The company has over five million users of its QuickBooks accounting software. Like Autodesk, Intuit’s widespread adoption creates high switching costs. The company’s competitive advantage is reflected in its impressive returns on capital, averaging 23.5% over the past ten years. We think management is top notch, and so is the company’s workplace, which Fortune magazine recognized in 2012 in its Top 100 Best Places to Work survey.

We also bought Cardinal Health, a leading pharmaceutical distributor in the United States. Cardinal is poised to benefit from greater health care spending on prescription drugs, driven by an aging population and expansion of health care insurance. Similar to Patterson Companies, another leading medical distributor, which we own in the Fund, we believe Cardinal is a wide-moat franchise with good growth prospects, solid free cash flow generation and a reasonable valuation.

15

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

We remain committed to generating market-beating returns over the long-run, by focusing on our process of investing in attractively-valued, well-managed companies with strong growth prospects and competitive advantages.

Thank you for your investment in the Parnassus Mid-Cap Fund.

|

|

|||

| Matthew D. Gershuny | Lori A. Keith | |||

| Lead Portfolio Manager | Portfolio Manager |

16

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

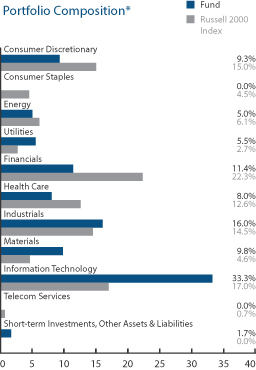

Ticker: PARSX

As of June 30, 2013, the NAV of the Parnassus Small-Cap Fund was $25.63, so the total return for the second quarter was a gain of 2.81%. By comparison, the Russell 2000 Index of smaller companies (“Russell 2000”) had a gain of 3.08%, and the Lipper Small-Cap Core Average, which represents the average return of the small-cap core funds followed by Lipper (“Lipper average”), had a gain of 2.44%. For the quarter, we underperformed the Russell 2000, but were slightly ahead of the Lipper average.

Year-to-date, the Fund is trailing both indices, up 7.83%, compared to 15.86% for the Russell 2000 and 14.78% for the Lipper average. Below is a table comparing the Parnassus Small-Cap Fund with the Russell 2000 and the Lipper average over the past one-, three- and five-year periods ended June 30, 2013 and the period since inception. Although our one- and three-year performance has been subpar, our longer-term five-year and since inception performance exceeded both benchmarks. Since our investment process (identifying high-quality businesses that are temporarily out-of-favor) remains the same, we expect to return to outperformance in the future.

17

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

manufacturing process. Additionally, most of Blount’s sales are replacement chains sold to end customers, where its Oregon brand has excellent name recognition.

18

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

Interest rates have begun to rise, with the 10-year Treasury jumping from 1.6% at the beginning of May to 2.5% at the end of June, and we have positioned our portfolio to benefit. Our bank investments in First Horizon National, Pinnacle Financial Partners and TCF Financial benefit from increasing rates because they earn a higher return on their loans. Additionally, Insperity benefits because the company collects payroll cash from employers in advance of paying employees and can invest this cash in short-term investments. Recently, short-term investments have yielded very little, but as rates increase, this cash will generate meaningful earnings for Insperity.

Consumers and businesses continue to demand ever-faster Internet speeds. As carriers deploy faster networks, consumers have quickly found new ways to consume data, such as streaming their favorite television shows and sporting events. Finisar and Ciena make high-speed optical networking-equipment that moves enormous amounts of data very quickly. As carriers compete to attract and retain customers, we expect significant reinvestment in their networks, which will benefit both Finisar and Ciena.

Thanks to faster Internet speeds, business software is transitioning to a Software-as-a-Service (SaaS) model, where the software is hosted at a central data center and employees access it via high-speed Internet service. Our Riverbed Technology investment benefits from this transition, because it offers technology that accelerates data-transfer across the Internet. Using Riverbed, employees can access SaaS without any annoying delays.

We also own a collection of businesses that benefit from company-specific trends. For example, thanks to its superior technology, Gentex supplies nine out of ten auto-dimming rearview car mirrors around the world. Gentex will benefit for many years as this safety feature trickles down from luxury cars to mid- and lower-priced cars. Another example is our most recent investment, MRC Global, the largest distributor of pipes and valves to the energy sector. The company benefits from the rapid expansion of shale drilling in the U.S., which requires significant amounts of pipes and valves.

The Small-Cap Fund invests in high-quality businesses that are temporarily out-of-favor. We have positioned the Fund to benefit from a sustained housing recovery, higher interest rates, increased demand for faster Internet and competitively advantaged businesses with specific drivers. Our investment process remains the same since inception, so we expect to return to outperformance in the future. We thank you for investing in the Parnassus Small-Cap Fund.

| Yours truly,

Jerome L. Dodson Lead Portfolio Manager |

Ryan Wilsey Portfolio Manager |

19

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

Ticker: PARWX

As of June 30, 2013, the NAV of the Parnassus Workplace Fund was $25.15, so the total return for the quarter was 4.75%. This compares favorably to 2.91% for the S&P 500 Index (“S&P 500”) and 2.65% for the Lipper Large-Cap Core Average, which represents the average return of the large-cap core funds followed by Lipper (“Lipper average”). Although we lagged the S&P 500 by more than two percentage points in the first quarter of the year, we’ve now practically closed the gap. For the year-to-date, we’re up 13.44%, compared to 13.82% for the S&P 500 and 13.19% for the Lipper average.

Below is a table comparing the Parnassus Workplace Fund with the S&P 500 and the Lipper average for the past one-, three- and five-year periods ended June 30, 2013, and for the period since inception. As you can see from the table, we’re ahead of all the benchmarks for all periods.

Company Analysis

Four companies each contributed 12¢ or more to the NAV of the Parnassus Workplace Fund. Only one company knocked 12¢ or more off the price of each fund share, and that was Autodesk, which sliced 15¢ off the NAV, as its stock sank 17.7% from $41.24 to $33.94. The company provides software for architects, engineers and designers, and weak demand in Europe caused the company to miss earnings expectations and lower revenue guidance for the full-year. Despite the weak start to the

20

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

21

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

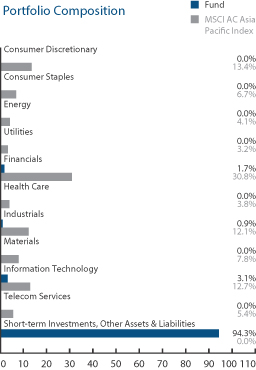

Ticker: PAFSX

As of June 30, 2013, the NAV of the Parnassus Asia Fund was $14.95, so the total return since inception on April 30, 2013 was a loss of 0.33%. This compares favorably to a loss of 7.52% for the MSCI AC Asia Pacific Index (“MSCI Index”) and a loss of 7.95% for the Lipper Pacific Region Average, which represents the average return of the Asia Pacific Region funds followed by Lipper (“Lipper average”). Below you will find a table comparing the Asia Fund with the MSCI Index and the Lipper average for the period since inception.

As you can see, we are well ahead of both of our benchmarks, but I cannot credit my brilliance in stock-picking for these terrific results. As shown in the portfolio report, we have less than 6% of the Fund’s assets in stocks with the rest in cash. The reason we have been able to beat the benchmarks by so much is that we held most of our assets in cash, while the Asian markets had big moves down after the big run-up over the past year. So we were lucky to be in cash instead of Asian stocks over the past two months.

Why did we have so much cash on hand? The Fund invests principally in stocks of Asian companies that we believe are financially sound and have good prospects for the future. The companies in which the Fund invests must, in our opinion, be undervalued, but they must also have good prospects for long-term capital appreciation over the course of the expected holding period. As we invest the initial assets of the Fund, we are being very careful and deliberate in making investment decisions. We will continue to have cash holdings where we believe that such cash holdings, given the risks and characteristics of the available securities in which the Fund may invest, are more beneficial to shareholders than investments in such securities.

22

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

23

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

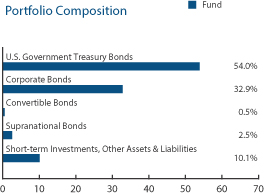

Ticker: PRFIX

As of June 30, 2013, the NAV of the Parnassus Fixed-Income Fund was $17.04, producing a loss for the quarter of 1.65% (including dividends). This compares favorably to a loss of 2.33% for the Barclays U.S. Aggregate Bond Index (“Barclays Aggregate Index”) and a loss of 3.06% for the Lipper A-Rated Bond Fund Average, which represents the average return of all A-rated bond funds followed by Lipper (“Lipper average”). For the first half of 2013, the Fund posted a loss of 2.07%, which compares favorably to losses of 2.44% for the Barclays Aggregate Index and 2.81% for the Lipper average.

Below is a table comparing the performance of the Fund with that of the Barclays Aggregate Index and the Lipper average. Average annual total returns are for the one-, three-, five- and ten-year periods ended June 20, 2013. For June 2013, the 30-day subsidized SEC yield was 0.82%, and the unsubsidized SEC yield was 0.71%.

Before discussing the Fund’s performance this quarter, I would like to briefly introduce myself. I joined Parnassus on May 1st as Portfolio Manager for the Fixed-Income Fund and was most recently with Wells Fargo in their Fixed Income Group. It’s a pleasure to be part of such a dedicated team, and I am honored to have the privilege of working for you, our shareholders.

24

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

reacted by sending yields higher and prices lower, in anticipation of less demand for bonds coming from the Federal Reserve. Subsequently, the yield on the 10-Year Treasury climbed to 2.49% as of the close of the quarter.

Because of the Fund’s shortened duration during the last two months, it outperformed with a loss of 1.65%, as compared to the Barclays Aggregate Index’s negative 2.33% return.

Outlook and Strategy

There are several strategic differences between the allocation of the Fund and the Barclays Aggregate Index. Aside from having a shorter duration, the Fund also owns more corporate bonds than the benchmark. The corporate credits have been carefully selected using the same criteria as the Parnassus equity funds. In fact, many of the companies in which the Fund has invested are also holdings in Parnassus equity funds. Those credits should outperform their peers and the market as a whole due to their strong competitive advantages and improving fundamentals.

25

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

By Milton Moskowitz

Mondelez International, a new company, joined the Parnassus portfolio ranks in 2013, and one of its first initiatives, in June, was to launch a Cocoa Life Sustainability program in the Ivory Coast. Undertaken with the cooperation of the Ivorian government and CARE International, the program will help some 4,000 cocoa farmers in that West African country to boost their productivity and organize community development projects like building new schools. The first of a series of cocoa initiatives planned for the next three years, this is a logical investment for Mondelez since it considers itself the world’s largest chocolate maker, sold under such brand names as Cadbury, Milka, Toblerone and Lacta.

Mondelez was created last year when Kraft Foods decided to split itself in two. One part, still called Kraft Foods, retained the packaged grocery products, such as Kraft Macaroni & Cheese, Philadelphia cream cheese, Velveeta, Oscar Mayer meats and Maxwell House coffee. With revenues of $18.3 billion and 23,000 employees, Kraft ranks 151st on this year’s Fortune 500 list.

The second part holds all the fun snack products, such as Oreo cookies, Trident chewing gum, Nabisco crackers, LU cookies and the extensive chocolate larder of Cadbury, long an icon of social responsibility in the United Kingdom. With revenues of $35 billion and 110,000 employees, Mondelez debuted on the Fortune 500 list this year in the 88th position.

What about that name? Employees were asked to submit their ideas, and from the 1,700 names received the company took two – monde, meaning world, and delez, a made-up word signifying delicious – and cobbled them into Mondelez, pronounced “mohn-dah-Leez.” It flashes over the ticker-tape as MDLZ.

PepsiCo, another giant from the food and beverage world (No. 43 on the Fortune 500 list), is also a recent addition to our portfolio – and it has an interesting problem. The company’s Frito-Lay division blazed its way to the top of the snack market with a line of salty, high calorie treats: Fritos, Doritos, Lay’s potato chips, supplemented with sugary Pepsi-Cola. The people at PepsiCo are well aware of the healthy food movement, and they are incorporating it into their business strategy. PepsiCo has reduced the sodium and calories in its products, and now has in place such rules as these: “We do not offer full-calorie soft drinks for students in K-12 SChools.” “We do not offer energy drinks for students in K-12 schools.” Beyond that, PepsiCo has established a Global Nutrition Group, whose goal is to increase sales of nutritious products from $10 billion in 2010 to $30 billion by 2020. The brands defined as nutritious by PepsiCo include: Quaker Oats, Gatorade and Tropicana.

You will see a manifestation of this good-for-you policy this summer when PepsiCo enters the U.S. yogurt market with a partner, the Theo Muller Group, a 100-year old German dairy company. PepsiCo has also set up partnerships with two other dairy companies: Wimm-Bill-Dan in Russia and Almarie of Saudi Arabia. The new yogurt line will carry the Quaker brand name.

These two corporate behemoths, Mondelez and PepsiCo, share one unusual characteristic: each is headed by a woman. The CEO of Mondelez is Irene Rosenfeld, who has spent her entire working life in the food industry, virtually all of it with Kraft. For two years, 2004 to 2006, she headed up the Frito-Lay division of PepsiCo. The CEO of PepsiCo is India-born Indra Nooyi, who worked at the Boston Consulting Group before joining PepsiCo in 1994. She became the fifth CEO in Pepsi’s history in 2006. Only 21 companies on the Fortune 500 list have a female CEO.

Target, the nation’s fourth largest retailer, has philanthropy in its genes, having been nurtured by the Dayton department store chain based in Minneapolis. Dayton started the 5% Club 67 years ago; it was composed of companies which pledged to allocate 5% of taxable income to charity; Target continues to honor that pledge. This year it formed a partnership with Feed USA, tagging 50 different products whose sales would trigger food giveaways to needy families. The program is expected to generate donations of 10 million meals…“More than 2,000 children die each day due to diarrheal diseases caused by unsafe water,” according to Chelsea Clinton. In 2010, Procter & Gamble made a commitment to the Clinton Global Initiative, promising to deliver two billion liters of clear water to developing countries every year until 2020. In May, it delivered its six billionth liter in Myanmar, claiming to have saved some 32,000 lives…Google has set a high bar with its Global Impact Awards. In April, it announced a $3 million grant to three organizations – Polaris Project, Liberty Asia and La Strada International – that are engaged in identifying and quashing human trafficking (prostitution, slave labor, medical experimentation). Then, in June, Google went to London to announce four awards to non-profit groups working to improve the world. The winners were: Integrity Action, CDI Apps for Food, Solar Air and the Zoological society of London. Each grant was worth $750,000.

26

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

Milton Moskowitz is the co-author of the Fortune magazine survey, “The 100 Best Companies to Work For,” and the co-originator of the annual Working Mother magazine survey, “The 100 Best Companies for Working Mothers.” Mr. Moskowitz serves as a consultant to Parnassus Investments in evaluating workplaces for potential investments by the Parnassus Workplace Fund. Neither Fortune magazine nor Working Mother magazine has any role in the management of the Parnassus Funds, and there is no affiliation between Parnassus Investments and either publication.

27

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

As a shareholder of the Funds, you incur ongoing costs, which include portfolio management fees, administrative fees, shareholder reports, and other fund expenses. The Funds do not charge transaction fees, so you do not incur transaction costs such as sales charges (loads) on purchase payments, reinvested dividends, or other distributions, redemption fees, and exchange fees. The information on this page is intended to help you understand your ongoing costs of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The following example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the period of January 1, 2013 through June 30, 2013.

Actual Expenses

In the example below, the first line for each Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of each Fund provides information about hypothetical account values and hypothetical expenses based on the Fund’s expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. You may compare the ongoing costs of investing in the Fund with other mutual funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

28

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

Please note that the expenses shown in the table are meant to highlight only your ongoing costs in these Funds. Therefore, the second line of each Fund is useful in comparing only ongoing costs and will not help you determine the relative total costs of owning other mutual funds, which may include transactional costs such as loads.

| Beginning January 1, 2013 |

Ending June 30, 2013 |

Expenses Paid

During Period* |

||||||||||

| Parnassus Fund: Actual | $1,000.00 | $1,127.77 | $4.75 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,020.33 | $4.51 | |||||||||

| Parnassus Equity Income Fund – Investor Shares: Actual | $1,000.00 | $1,042.79 | $4.78 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,020.33 | $4.51 | |||||||||

| Parnassus Equity Income Fund – Institutional Shares: Actual | $1,000.00 | $1,143.06 | $3.61 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,021.42 | $3.41 | |||||||||

| Parnassus Mid-Cap Fund: Actual | $1,000.00 | $1,110.01 | $6.28 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,032.83 | $6.05 | |||||||||

| Parnassus Small-Cap Fund: Actual | $1,000.00 | $1,078.25 | $6.18 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,018.84 | $6.01 | |||||||||

| Parnassus Workplace Fund: Actual | $1,000.00 | $1,134.42 | $6.03 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,019.14 | $5.71 | |||||||||

| Parnassus Asia Fund: Actual | $1,000.00 | $996.67 | $2.46 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,006.03 | $2.47 | |||||||||

| Parnassus Fixed-Income Fund: Actual | $1,000.00 | $979.26 | $3.34 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,021.42 | $3.41 | |||||||||

*Expenses are equal to the Fund’s annualized expense ratio of 0.90%, 0.90%, 0.68%, 1.20%, 1.20%, 1.14%, 5.00% and 0.68% for the Parnassus Fund, Parnassus Equity Income Fund – Investor Shares, Parnassus Equity Income Fund – Institutional Shares, Parnassus Mid-Cap Fund, Parnassus Small-Cap Fund, Parnassus Workplace Fund, Parnassus Asia Fund and Parnassus Fixed-Income Fund, respectively, multiplied by the average account value over the period, multiplied by the ratio of days in the period. The ratio of days in the period is 181/365 (to reflect the one-half year period) for the Parnassus Fund, Parnassus Equity Income Fund – Investor Shares, Parnassus Equity Income Fund – Institutional Shares, Parnassus Mid-Cap Fund, Parnassus Small-Cap Fund, Parnassus Workplace Fund and Parnassus Fixed-Income Fund and the ratio is 62/365 for the Parnassus Asia Fund (to reflect the period from inception to June 30, 2013).

29

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

Portfolio of Investments as of June 30, 2013 (unaudited)

The accompanying notes are an integral part of these financial statements.

30

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

PARNASSUS FUND

Portfolio of Investments as of June 30, 2013 (unaudited) (continued)

The accompanying notes are an integral part of these financial statements.

31

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

Portfolio of Investments as of June 30, 2013 (unaudited)

The accompanying notes are an integral part of these financial statements.

32

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

PARNASSUS EQUITY INCOME FUND

Portfolio of Investments as of June 30, 2013 (unaudited) (continued)

The accompanying notes are an integral part of these financial statements.

33

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

PARNASSUS EQUITY INCOME FUND

Portfolio of Investments as of June 30, 2013 (unaudited) (continued)

|

Principal ($) |

Short-Term Securities | Percent of Net Assets |

Market Value ($) |

|||||||||

| Securities Purchased with Cash Collateral from Securities Lending | ||||||||||||

| Registered Investment Companies | ||||||||||||

| 193,711,369 | Invesco Aim Government & Agency Portfolio Short-Term Investments Trust, Institutional Class variable rate, 0.02% |

3.0 | % | 193,711,369 | ||||||||

|

|

|

|||||||||||

| Total short-term securities (cost $649,252,626) | 10.2 | % | 649,252,626 | |||||||||

|

|

|

|||||||||||

| Total securities (cost $5,378,561,630) |

103.9 | % | 6,593,898,117 | |||||||||

|

|

|

|||||||||||

| Payable upon return of securities loaned | (3.0 | %) | (193,711,369 | ) | ||||||||

| Other assets and liabilities - net | (0.9 | %) | (52,589,667 | ) | ||||||||

|

|

|

|||||||||||

| Total net assets | 100.0 | % | 6,347,597,081 | |||||||||

|

|

|

|||||||||||

| W Fund ownership consists of 5% or more of the shares outstanding of the ”affiliated company,” as defined under the Investment Company Act of 1940. |

| |||||||||||

| q This security is non-income producing. |

| |||||||||||

| l This security, or a partial position of this security, was on loan at June 30, 2013. The total value of the securities on loan at June 30, 2013 was $189,097,665. |

| |||||||||||

| a Market value adjustments have been applied to these securities to reflect potential early withdrawal. |

| |||||||||||

The accompanying notes are an integral part of these financial statements.

34

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

Portfolio of Investments as of June 30, 2013 (unaudited)

The accompanying notes are an integral part of these financial statements.

35

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

PARNASSUS MID-CAP FUND

Portfolio of Investments as of June 30, 2013 (unaudited) (continued)

| Principal Amount ($) |

Short-Term Securities | Percent of Net Assets |

Market Value ($) |

|||||||||

| Time Deposits | ||||||||||||

| 15,260,281 | BBH Cash Management Service | |||||||||||

| Citibank, Nassau 0.03%, due 07/01/2013 |

7.8 | % | 15,260,281 | |||||||||

|

|

|

|||||||||||

| Securities Purchased with Cash Collateral from Securities Lending | ||||||||||||

| Registered Investment Companies | ||||||||||||

| 6,267,614 | Invesco Aim Government & Agency Portfolio Short-Term Investments Trust, Institutional Class variable rate, 0.02% |

3.3 | % | 6,267,614 | ||||||||

|

|

|

|||||||||||

| Total short-term securities (cost $21,527,895) |

11.1 | % | 21,527,895 | |||||||||

|

|

|

|||||||||||

| Total securities (cost $179,831,836) |

103.9 | % | 202,263,558 | |||||||||

|

|

|

|||||||||||

| Payable upon return of securities loaned | (3.3 | %) | (6,267,614 | ) | ||||||||

| Other assets and liabilities - net | (0.6 | %) | (1,246,029 | ) | ||||||||

|

|

|

|||||||||||

| Total net assets | 100.0 | % | 194,749,915 | |||||||||

|

|

|

|||||||||||

| q This security is non-income producing. |

| |||||||||||

| l This security, or a partial position of this security, was on loan at June 30, 2013. The total value of the securities on loan at June 30, 2013 was $6,104,384. |

| |||||||||||

The accompanying notes are an integral part of these financial statements.

36

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

Portfolio of Investments as of June 30, 2013 (unaudited)

The accompanying notes are an integral part of these financial statements.

37

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

PARNASSUS SMALL-CAP FUND

Portfolio of Investments as of June 30, 2013 (unaudited) (continued)

|

Principal ($) |

Short-Term Securities | Percent of Net Assets |

Market Value ($) |

|||||||||

| Securities Purchased with Cash Collateral from Securities Lending | ||||||||||||

| Registered Investment Companies | ||||||||||||

| 51,150,228 | Invesco Aim Government & Agency Portfolio Short-Term Investments Trust, Institutional Class variable rate, 0.02% |

7.4 | % | 51,150,228 | ||||||||

|

|

|

|||||||||||

| Total short-term securities (cost $59,714,530) |

8.6 | % | 59,714,530 | |||||||||

|

|

|

|||||||||||

| Total securities (cost $683,525,050) |

106.9 | % | 738,961,327 | |||||||||

|

|

|

|||||||||||

| Payable upon return of securities loaned | (7.4 | %) | (51,150,228 | ) | ||||||||

| Other assets and liabilities - net | 0.5 | % | 3,292,577 | |||||||||

|

|

|

|||||||||||

| Total net assets | 100.0 | % | 691,103,676 | |||||||||

|

|

|

|||||||||||

| q This security is non-income producing. |

| |||||||||||

| l This security, or a partial position of this security, was on loan at June 30, 2013. The total value of the securities on loan at June 30, 2013 was $49,882,595. |

| |||||||||||

| WFund ownership consists of 5% or more of the shares outstanding of the ”affiliated company,” as defined under the Investment Company Act of 1940. |

| |||||||||||

The accompanying notes are an integral part of these financial statements.

38

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

Portfolio of Investments as of June 30, 2013 (unaudited)

The accompanying notes are an integral part of these financial statements.

39

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

PARNASSUS WORKPLACE FUND

Portfolio of Investments as of June 30, 2013 (unaudited) (continued)

|

Principal Amount ($) |

Short-Term Securities | Percent of Net Assets |

Market Value ($) |

|||||||||

| Securities Purchased with Cash Collateral from Securities Lending |

|

|||||||||||

| Registered Investment Companies | ||||||||||||

| 1,628,550 | Invesco Aim Government & Agency Portfolio Short-Term Investments Trust, Institutional Class variable rate, 0.02% |

0.5 | % | 1,628,550 | ||||||||

|

|

|

|||||||||||

| Total short-term securities (cost $26,776,665) |

7.5 | % | 26,776,665 | |||||||||

|

|

|

|||||||||||

| Total securities (cost $314,045,984) |

100.6 | % | 360,816,095 | |||||||||

|

|

|

|||||||||||

| Payable upon return of securities loaned |

(0.5 | %) | (1,628,550 | ) | ||||||||

| Other assets and liabilities - net | (0.1 | %) | (345,883 | ) | ||||||||

|

|

|

|||||||||||

| Total net assets | 100.0 | % | 358,841,662 | |||||||||

|

|

|

|||||||||||

| q This security is non-income producing. |

| |||||||||||

| l This security, or a partial position of this security, was on loan at June 30, 2013. The total value of the securities on loan at June 30, 2013 was $1,585,584. |

| |||||||||||

The accompanying notes are an integral part of these financial statements.

40

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

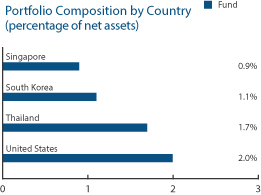

Portfolio of Investments as of June 30, 2013 (unaudited)

| Shares | Equities | Percent of Net Assets |

Market Value ($) |

|||||||||

| Singapore | ||||||||||||

| 2,500 | Keppel Corp., Ltd. | 0.9 | % | 20,447 | ||||||||

|

|

|

|||||||||||

| South Korea | ||||||||||||

| 20 | Samsung Electronics Co., Ltd. | 1.1 | % | 23,386 | ||||||||

|

|

|

|||||||||||

| Thailand | ||||||||||||

| 30,000 | Thanachart Capital PCL | 1.7 | % | 36,885 | ||||||||

|

|

|

|||||||||||

| United States | ||||||||||||

| 3,000 | Applied Materials Inc. | 2.0 | % | 44,730 | ||||||||

|

|

|

|||||||||||

| Total investment in equities (cost $127,808) |

5.7 | % | 125,448 | |||||||||

|

|

|

|||||||||||

|

Principal ($) |

Short-Term Securities | Percent of Net Assets |

Market Value ($) |

|||||||||

| Time Deposits | ||||||||||||

| 2,056,044 | BBH Cash Management Service Citibank, Nassau 0.03%, due 07/01/2013 |

93.9 | % | 2,056,044 | ||||||||

|

|

|

|||||||||||

| Total short-term securities (cost $2,056,044) |

93.9 | % | 2,056,044 | |||||||||

|

|

|

|||||||||||

| Total securities (cost $2,183,852) |

99.6 | % | 2,181,492 | |||||||||

|

|

|

|||||||||||

| Other assets and liabilities - net | 0.4 | % | 7,959 | |||||||||

|

|

|

|||||||||||

| Total net assets | 100.0 | % | 2,189,451 | |||||||||

|

|

|

|||||||||||

The accompanying notes are an integral part of these financial statements.

41

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

Portfolio of Investments as of June 30, 2013 (unaudited)

The accompanying notes are an integral part of these financial statements.

42

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

PARNASSUS FIXED-INCOME FUND

Portfolio of Investments as of June 30, 2013 (unaudited) (continued)

The accompanying notes are an integral part of these financial statements.

43

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

PARNASSUS FIXED-INCOME FUND

Portfolio of Investments as of June 30, 2013 (unaudited) (continued)

| Principal Amount ($) |

Short-Term Securities | Percent of Net Assets |

Market Value ($) |

|||||||||

| Community Development Loans a | ||||||||||||

| 2,500,000 | MicroVest Plus, LP Note 2.50%, matures 10/15/2013 |

1.2 | % | 2,456,438 | ||||||||

| Time Deposits | ||||||||||||

| 16,191,007 | BBH Cash Management Service Citibank, Nassau 0.03%, due 07/01/2013 |

8.2 | % | 16,191,007 | ||||||||

|

|

|

|||||||||||

| Total short-term securities (cost $18,647,445) |

9.4 | % | 18,647,445 | |||||||||

|

|

|

|||||||||||

| Total securities (cost $192,926,442) |

99.3 | % | 196,548,290 | |||||||||

|

|

|

|||||||||||

| Other assets and liabilities - net | 0.7 | % | 1,351,675 | |||||||||

|

|

|

|||||||||||

| Total net assets | 100.0 | % | 197,899,965 | |||||||||

|

|

|

|||||||||||

| a Market value adjustments have been applied to these securities to reflect potential early withdrawal. |

| |||||||||||

The accompanying notes are an integral part of these financial statements.

44

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

THIS PAGE LEFT INTENTIONALLY BLANK

45

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2013 (unaudited)

| Parnassus Fund |

Parnassus Equity Income Fund |

Parnassus Mid-Cap Fund |

||||||||||

| Assets | ||||||||||||

| Investments in stocks and bonds, at market value – Unaffiliated | ||||||||||||

| cost of $411,866,043, $4,433,323,096, $158,303,941, $601,556,958, $287,269,319, $127,808, $174,278,997 |

$ | 475,431,931 | $ | 5,589,876,734 | $ | 180,735,663 | ||||||

| Investments in stocks and bonds, at market value – Affiliated | ||||||||||||

| cost of $ $0, $295,985,908, $0, $22,253,562, $0, $0, $0 |

- | 354,768,757 | - | |||||||||

| Investments in short-term securities | ||||||||||||

| (at cost which approximates market value) |

15,572,078 | 649,252,626 | 21,527,895 | |||||||||

| Cash | 170,008 | 255,381 | - | |||||||||

| Receivables | ||||||||||||

| Investment securities sold | 6,443,136 | 6,317,200 | - | |||||||||

| Dividends and interest |

384,965 | 3,844,196 | 163,253 | |||||||||

| Capital shares sold |

117,129 | 11,679,218 | 373,089 | |||||||||

| Due from Parnassus Investments |

71 | - | - | |||||||||

| Other assets | 51,173 | 209,619 | 18,345 | |||||||||

| Total assets |

$ | 498,170,491 | $ | 6,616,203,731 | $ | 202,818,245 | ||||||

| Liabilities | ||||||||||||

| Payable upon return of loaned securities | 11,783,820 | 193,711,369 | 6,267,614 | |||||||||

| Payable for investment securities purchased | 5,663,988 | 66,480,124 | 1,718,060 | |||||||||

| Capital shares redeemed | 83,217 | 5,811,725 | 44,467 | |||||||||

| Fees payable to Parnassus Investments | - | 669 | 25 | |||||||||

| Distributions payable | - | 2,208,582 | - | |||||||||

| Accounts payable and accrued expenses | 221,551 | 394,181 | 38,164 | |||||||||

| Total liabilities |

$ | 17,752,576 | $ | 268,606,650 | $ | 8,068,330 | ||||||

| Net assets | $ | 480,417,915 | $ | 6,347,597,081 | $ | 194,749,915 | ||||||

| Net assets consist of | ||||||||||||

| Undistributed net investment income (loss) | 1,978,561 | 4,106,824 | 552,624 | |||||||||

| Unrealized appreciation (depreciation) on securities and foreign currency | 63,565,888 | 1,215,336,487 | 22,431,722 | |||||||||

| Accumulated net realized gain (loss) on securities and foreign currency | 52,164,757 | 380,847,380 | 4,523,464 | |||||||||

| Capital paid-in | 362,708,709 | 4,747,306,390 | 167,242,105 | |||||||||

| Total net assets |

$ | 480,417,915 | $ | 6,347,597,081 | $ | 194,749,915 | ||||||

| Net asset value and offering per share | ||||||||||||

| Net assets investor shares | $ | 480,417,915 | $ | 4,984,182,428 | $ | 194,749,915 | ||||||

| Net assets institutional shares | - | $ | 1,363,414,653 | - | ||||||||

| Shares outstanding investor shares | 10,488,307 | 150,280,305 | 8,654,826 | |||||||||

| Shares outstanding institutional shares | - | 41,038,213 | - | |||||||||

| Net asset values and redemption price per share | ||||||||||||

| (Net asset value divided by shares outstanding) |

||||||||||||

| Investor shares |

$ | 45.81 | $ | 33.17 | $ | 22.50 | ||||||

| Institutional shares |

- | $ | 33.22 | - | ||||||||

The accompanying notes are an integral part of these financial statements.

46

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

| Parnassus Small-Cap Fund |

Parnassus Workplace Fund |

Parnassus Asia Fund |

Parnassus Fixed-Income Fund |

|||||||||||

| $ |

671,046,765 |

|

$ | 334,039,430 | $ | 125,448 | $ | 177,900,845 | ||||||

| 8,200,032 | - | - | - | |||||||||||

| 59,714,530 | 26,776,665 | 2,056,044 | 18,647,445 | |||||||||||

| - | - | - | - | |||||||||||

| 13,219,670 | 2,781,610 | - | - | |||||||||||

| 618,349 | 170,812 | 122 | 1,573,851 | |||||||||||

| 439,143 | 526,757 | 10,000 | 96,850 | |||||||||||

| 308 | - | - | 63 | |||||||||||

| 69,899 | 26,345 | 25,430 | 15,416 | |||||||||||

| $ | 753,308,696 | $ | 364,321,619 | $ | 2,217,044 | $ | 198,234,470 | |||||||

| 51,150,228 | 1,628,550 | - | - | |||||||||||

| 5,649,024 | 3,703,265 | - | - | |||||||||||

| 5,249,240 | 91,556 | - | 210,954 | |||||||||||

| - | 35 | 24,241 | - | |||||||||||

| - | - | - | 36,248 | |||||||||||

| 156,528 | 56,551 | 3,352 | 87,303 | |||||||||||

| $ | 62,205,020 | $ | 5,479,957 | $ | 27,593 | $ | 334,505 | |||||||

| $ | 691,103,676 | $ | 358,841,662 | $ | 2,189,451 | $ | 197,899,965 | |||||||

| (712,723 | ) | 1,190,810 | (4,431 | ) | 28,044 | |||||||||

|

|

55,436,277 |

|

46,770,111 | (2,360 | ) | 3,621,848 | ||||||||

|

|

28,557,028 |

|

19,112,262 | (497 | ) | 2,420,515 | ||||||||

| 607,823,094 | 291,768,479 | 2,196,739 | 191,829,558 | |||||||||||

| $ | 691,103,676 | $ | 358,841,662 | $ | 2,189,451 | $ | 197,899,965 | |||||||

| $ | 691,103,676 | $ | 358,841,662 | $ | 2,189,451 | $ | 197,899,965 | |||||||

| - | - | - | - | |||||||||||

| 26,969,244 | 14,268,058 | 146,497 | 11,614,629 | |||||||||||

| - | - | - | - | |||||||||||

| $ | 25.63 | $ | 25.15 | $ | 14.95 | $ | 17.04 | |||||||

| - | - | - | - | |||||||||||

The accompanying notes are an integral part of these financial statements.

47

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

STATEMENT OF OPERATIONS

Six Months Ended June 30, 2013 (unaudited)

| Parnassus Fund |

Parnassus Equity Income Fund |

Parnassus Mid-Cap Fund |

||||||||||

| Investment income | ||||||||||||

| Dividends – Unaffiliated | $ | 3,662,767 | $ | 57,123,820 | $ | 1,411,063 | ||||||

| Dividends – Affiliated | - | 4,871,893 | - | |||||||||

| Interest | 6,149 | 274,894 | 1,957 | |||||||||

| Securities lending | 130,265 | 248,461 | 6,603 | |||||||||

| Foreign withholding tax | (50,047 | ) | (1,143,715 | ) | (17,817 | ) | ||||||

| Total investment income |

$ | 3,749,134 | $ | 61,375,353 | $ | 1,401,806 | ||||||

| Expenses | ||||||||||||

| Investment advisory fees | 1,561,766 | 17,626,508 | 683,746 | |||||||||

| Transfer agent fees | ||||||||||||

| Investor shares |

170,570 | 546,184 | 37,193 | |||||||||

| Institutional shares |

- | 148,553 | - | |||||||||

| Fund administration | 87,565 | 1,042,613 | 29,456 | |||||||||

| Service provider fees | 172,175 | 3,954,893 | 150,546 | |||||||||

| Reports to shareholders | 41,831 | 283,538 | 11,210 | |||||||||

| Registration fees and expenses | 20,344 | 53,140 | 11,926 | |||||||||

| Custody fees | 9,472 | 122,668 | 5,285 | |||||||||

| Overdraft charges | 389 | - | - | |||||||||

| Professional fees | 23,265 | 95,213 | 11,669 | |||||||||

| Trustee fees and expenses | 10,979 | 117,474 | 3,012 | |||||||||

| Proxy voting fees | 2,422 | 2,422 | 2,422 | |||||||||

| Pricing service fees | 1,824 | 3,030 | 1,824 | |||||||||

| Other expenses | 6,055 | 70,242 | 1,294 | |||||||||

| Total expenses |

$ | 2,108,657 | $ | 24,066,478 | $ | 949,583 | ||||||

| Fees waived by Parnassus Investments |

- | - | - | |||||||||

| Net expenses |

$ | 2,108,657 | $ | 24,066,478 | $ | 949,583 | ||||||

| Net investment gain (loss) |

$ | 1,640,477 | $ | 37,308,875 | $ | 452,223 | ||||||

| Realized and unrealized gain (loss) on investments and foreign currency related transactions | ||||||||||||

| Net realized gain from securities transactions | 48,451,534 | 347,409,185 | 4,105,953 | |||||||||

| Net realized loss from foreign currency related transactions | - | - | - | |||||||||

| Net change in unrealized appreciation (depreciation) of securities | 7,493,524 | 349,706,813 | 11,025,496 | |||||||||

| Net change in unrealized depreciation on foreign currency related transactions | - | - | - | |||||||||

| Net realized and unrealized gain (loss) on securities and foreign currency related transactions | $ | 55,945,058 | $ | 697,115,998 | $ | 15,131,449 | ||||||

| Net increase (decrease) in net assets resulting from operations | $ | 57,585,535 | $ | 734,424,873 | $ | 15,583,672 | ||||||

The accompanying notes are an integral part of these financial statements.

48

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

| Parnassus Fund |

Parnassus Fund |

Parnassus Asia Fund |

Parnassus Fund |

|||||||||||

| $ | 3,241,441 | $ | 2,882,814 | $ | 70 | $ | - | |||||||

| - | - | - | - | |||||||||||

| 3,352 | 3,303 | 95 | 2,643,141 | |||||||||||

| 279,110 | 524 | - | 235 | |||||||||||

| (15,957 | ) | (45,515 | ) | - | - | |||||||||

| $ | 3,507,946 | $ | 2,841,126 | $ | 165 | $ | 2,643,376 | |||||||

| 3,033,627 | 1,278,378 | 3,471 | 529,652 | |||||||||||

| 417,300 | 66,560 | 308 | 68,091 | |||||||||||

| - | - | - | - | |||||||||||

| 125,755 | 57,436 | 113 | 37,981 | |||||||||||

| 481,483 | 259,701 | 469 | 121,479 | |||||||||||

| 85,164 | 24,569 | 1,834 | 30,343 | |||||||||||

| 26,131 | 16,038 | 3,479 | 15,870 | |||||||||||

| 16,053 | 6,150 | 586 | 5,856 | |||||||||||

| - | - | - | - | |||||||||||

| 33,369 | 16,263 | 1,818 | 11,258 | |||||||||||

| 15,879 | 6,563 | 16 | 5,271 | |||||||||||

| 2,422 | 2,422 | 142 | - | |||||||||||

| 1,824 | 1,824 | 1,267 | 1,517 | |||||||||||

| 9,555 | 4,002 | 127 | 3,018 | |||||||||||

| $ | 4,248,562 | $ | 1,739,906 | $ | 13,630 | $ | 830,336 | |||||||

| (27,893 | ) | - | (9,034 | ) | (109,532 | ) | ||||||||

| $ | 4,220,669 | $ | 1,739,906 | $ | 4,596 | $ | 720,804 | |||||||

| $ | (712,723 | ) | $ | 1,101,220 | $ | (4,431 | ) | $ | 1,922,572 | |||||

| 31,961,695 | 17,158,350 | - | 1,976,396 | |||||||||||

| - | - | (497 | ) | - | ||||||||||

| 20,845,444 | 21,266,576 | (2,271 | ) | (8,338,202 | ) | |||||||||

|

|

- |

|

- | (89 | ) | - | ||||||||

| $ |

52,807,139 |

|

$ | 38,424,926 | $ | (2,857 | ) | $ | (6,361,806 | ) | ||||

| $ | 52,094,416 | $ | 39,526,146 | $ | (7,288 | ) | $ | (4,439,234 | ) | |||||

The accompanying notes are an integral part of these financial statements.

49

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2013 | |||

STATEMENT OF CHANGES IN NET ASSETS

June 30, 2013 (unaudited)

| Parnassus Fund | Parnassus Equity Income Fund | |||||||||||||||

|

Six Months Ended June 30, 2013 |

Year Ended December 31, 2012 |

Six Months Ended June 30, 2013 |

Year Ended December 31, 2012 |

|||||||||||||

| Investment income (loss) from operations | ||||||||||||||||

| Net investment income (loss) |

$ | 1,640,477 | $ | 2,822,728 | $ | 37,308,875 | $ | 65,061,663 | ||||||||

| Net realized gain from securities transactions |

48,451,534 | 38,628,021 | 347,409,185 | 158,577,885 | ||||||||||||

| Net realized gain (loss) on foreign currency related transactions |

- | - | - | - | ||||||||||||

| Net change in unrealized appreciation of securities |

7,493,524 | 49,389,071 | 349,706,813 | 429,061,129 | ||||||||||||

| Net change in unrealized appreciation (depreciation) on foreign currency related transactions |

- | - | - | - | ||||||||||||

| Increase (decrease) in net assets resulting from operations |

$ | 57,585,535 | $ | 90,839,820 | $ | 734,424,873 | $ | 652,700,677 | ||||||||

| Distributions | ||||||||||||||||

| From net investment income |

||||||||||||||||

| Investor shares |

- | (9,038,094 | ) | (29,025,828 | ) | (99,149,285 | ) | |||||||||

| Institutional shares |

- | - | (8,749,571 | ) | (25,615,604 | ) | ||||||||||

| From realized capital gains |

||||||||||||||||

| Investor shares |

- | (28,877,922 | ) | - | (58,989,019 | ) | ||||||||||

| Institutional shares |

- | - | - | (14,243,218 | ) | |||||||||||

| Distributions to shareholders |

$ | - | $ | (37,916,016 | ) | $ | (37,775,399 | ) | $ | (197,997,126 | ) | |||||

| Capital share transactions | ||||||||||||||||

| Investor shares |

||||||||||||||||

| Proceeds from sale of shares |

71,700,881 | 142,515,430 | 806,626,043 | 919,395,706 | ||||||||||||

| Reinvestment of dividends |

- | 36,803,472 | 27,567,518 | 148,863,674 | ||||||||||||

| Shares repurchased |

(119,004,019 | ) | (116,678,830 | ) | (428,663,245 | ) | (820,365,375 | ) | ||||||||

| Institutional shares |

||||||||||||||||

| Proceeds from sale of shares |

- | - | 359,534,690 | 511,214,786 | ||||||||||||

| Reinvestment of dividends |

- | - | 6,059,355 | 27,478,143 | ||||||||||||

| Shares repurchased |

- | - | (150,465,861 | ) | (239,941,100 | ) | ||||||||||

| Increase (decrease) in net assets from capital share transactions |

(47,303,138 | ) | 62,640,072 | 620,658,500 | 546,645,834 | |||||||||||

| Increase in net assets |

$ | 10,282,397 | $ | 115,563,876 | $ | 1,317,307,974 | $ | 1,001,349,385 | ||||||||

| Net Assets | ||||||||||||||||

| Beginning of year |

470,135,518 | 354,571,642 | 5,030,289,107 | 4,028,939,722 | ||||||||||||

| End of period |

$ | 480,417,915 | $ | 470,135,518 | $ | 6,347,597,081 | $ | 5,030,289,107 | ||||||||

| Undistributed net investment income (loss) |

$ | 1,978,561 | $ | 338,083 | $ | 4,106,824 | $ | 4,573,346 | ||||||||

| Shares issued and redeemed | ||||||||||||||||

| Investor shares |

||||||||||||||||

| Shares sold |

1,668,366 | 3,472,615 | 24,939,096 | 32,388,933 | ||||||||||||

| Shares issued through dividend reinvestment |

- | 955,905 | 835,478 | 5,175,425 | ||||||||||||

| Shares repurchased |

(2,752,936 | ) | (2,921,063 | ) | (13,262,395 | ) | (28,783,567 | ) | ||||||||

| Institutional shares |

||||||||||||||||

| Shares sold |

- | - | 11,121,261 | 17,890,411 | ||||||||||||

| Shares issued through dividend reinvestment |

- | - | 183,319 | 953,852 | ||||||||||||

| Shares repurchased |

- | - | (4,681,652 | ) | (8,287,202 | ) | ||||||||||

| Net increase (decrease) in shares outstanding |

||||||||||||||||

| Investor shares |

(1,084,570 | ) | 1,507,457 | 12,512,179 | 8,780,791 | |||||||||||

| Institutional shares |

- | - | 6,622,928 | 10,557,061 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

50

Table of Contents

| Semiannual Report • 2013 | PARNASSUS FUNDS | |||

| Parnassus Mid-Cap Fund | Parnassus Small-Cap Fund | Parnassus Workplace Fund | ||||||||||||||||||||

|

Six Months Ended June 30, 2013 |

Year Ended December 31, 2012 |

Six Months Ended June 30, 2013 |

Year Ended December 31, 2012 |

Six Months Ended June 30, 2013 |

Year Ended December 31, 2012 |

|||||||||||||||||

| $ | 452,223 | $ | 684,919 | $ | (712,723 | ) | $ | (108,870 | ) | $ | 1,101,220 | $ | 1,341,142 | |||||||||

| 4,105,953 | 3,940,018 | 31,961,695 | 2,546,701 | 17,158,350 | 19,713,405 | |||||||||||||||||

|

|

- |

|

- | - | - | - | - | |||||||||||||||

|

|

11,025,496 |

|

8,652,009 | 20,845,444 | 109,255,075 | 21,266,576 | 26,335,362 | |||||||||||||||

|

|

- |

|

- | - | - | - | - | |||||||||||||||

| $ |

15,583,672 |

|

$ | 13,276,946 | $ | 52,094,416 | $ | 111,692,906 | $ | 39,526,146 | $ | 47,389,909 | ||||||||||

| - | (1,876,476 | ) | - | - | - | (6,214,474 | ) | |||||||||||||||

| - | - | - | - | - | - | |||||||||||||||||

| - | (2,209,948 | ) | - | (125,438 | ) | - | (14,123,379 | ) | ||||||||||||||

| - | - | - | - | - | - | |||||||||||||||||

| $ | - | $ | (4,086,424 | ) | $ | - | $ | (125,438 | ) | $ | - | $ | (20,337,853 | ) | ||||||||

| 69,193,732 | 74,466,129 | 100,182,295 | 219,766,653 | 89,692,829 | 98,053,970 | |||||||||||||||||

| - | 3,930,160 | - | 116,403 | - | 19,493,159 | |||||||||||||||||

| (18,991,383 | ) | (19,922,223 | ) | (141,153,412 | ) | (296,295,200 | ) | (51,406,226 | ) | (79,838,936 | ) | |||||||||||

| - | - | - | - | - | - | |||||||||||||||||