Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: June 30, 2012

Table of Contents

Item 1: Report to Shareholders

Table of Contents

PARNASSUS FUNDS®

SEMIANNUAL REPORT ¡ JUNE 30, 2012

PARNASSUS FUNDS

| Parnassus FundSM | PARNX | |

| Parnassus Equity Income FundSM – Investor Shares | PRBLX | |

| Parnassus Equity Income Fund – Institutional Shares | PRILX | |

| Parnassus Mid-Cap FundSM | PARMX | |

| Parnassus Small-Cap FundSM | PARSX | |

| Parnassus Workplace Fund® | PARWX | |

| Parnassus Fixed-Income FundSM | PRFIX | |

Table of Contents

| Letter from Parnassus Investments | 4 | |||

| Fund Performance and Commentary | ||||

| Parnassus Fund | 6 | |||

| Parnassus Equity Income Fund | 10 | |||

| Parnassus Mid-Cap Fund | 14 | |||

| Parnassus Small-Cap Fund | 17 | |||

| Parnassus Workplace Fund | 19 | |||

| Parnassus Fixed-Income Fund | 21 | |||

| Responsible Investing Notes | 23 | |||

| Fund Expenses | 24 | |||

| Portfolios of Investments | ||||

| Parnassus Fund | 25 | |||

| Parnassus Equity Income Fund | 27 | |||

| Parnassus Mid-Cap Fund | 29 | |||

| Parnassus Small-Cap Fund | 31 | |||

| Parnassus Workplace Fund | 33 | |||

| Parnassus Fixed-Income Fund | 34 | |||

| Financial Statements | 36 | |||

| Notes to Financial Statements | 43 | |||

| Financial Highlights | 51 | |||

| Additional Information | 58 | |||

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

August 3, 2012

Enclosed are the semiannual reports for the Parnassus Funds. It has been a difficult quarter, but I think you’ll find the reports make for interesting reading. Our reports will let you know about the companies we invest in and how we are structuring our portfolios. Below is a photograph of a recent reunion of our interns.

Seated (from left to right): Robby Klaber, Sherry Chen, Andrea Reichert, Jerome Dodson, Jeanine Cotter, Lori Keith and Ryan Wilsey. Standing (from left to right): Brian French, Billy Hwan, Matthew Gershuny, Ben Allen, Todd Ahlsten, David Pogran, Ian Sexsmith, Minh Bui, Romahlo Wilson and Nick Gallus.

Interns

We have several top-notch interns helping our team this summer. Nick Gallus is an MBA candidate at the Haas School of Business at the University of California, Berkeley. His previous work experience includes five years at Piper Jaffray in Minneapolis, where he was most recently an analyst covering Internet stocks. Nick received an undergraduate business degree from the University of Minnesota, while volunteering as a mentor at the Carlson School of Management. He is an avid outdoor enthusiast, who enjoys hiking, mountain biking and skiing.

4

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

Sherry Chen is also an MBA candidate at the Haas School of Business at the University of California, Berkeley. In her spare time, she works for the Berkeley Student Food Collective, which sells locally-sourced food on campus. Sherry graduated cum laude from Harvard College with a degree in economics. Her experience includes work as a private equity associate at Clarity Partners in Los Angeles, an investment banking analyst at Citigroup in New York and a writer for the Let’s Go travel guide for China.

For the first time, we also have an Environmental, Social and Governance intern working with us this summer. Grace Chang is working towards an MBA and an MA in Conflict Resolution at the University of Oregon. She graduated from Swarthmore College with a BA degree in political science. Her background includes public policy research analysis, and she is a disability rights advocate, bicycling enthusiast and yoga practitioner.

Finally, I would like to thank all of you for investing in the Parnassus Funds.

Yours truly,

Jerome L. Dodson

President

5

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

Ticker: PARNX

As of June 30, 2012, the net asset value per share (“NAV”) of the Parnassus Fund was $39.38, so the total return for the quarter was a loss of 4.90%. This compares to a loss of 2.75% for the S&P 500 Index (“S&P 500”) and a loss of 4.71% for the Lipper Multi-Cap Core Average, which represents the average multi-cap core fund followed by Lipper (“Lipper average”). For the quarter, we were more than two percentage points behind the S&P 500, but very close to the Lipper average.

For the year-to-date, we are still ahead of both the S&P 500 and the Lipper average, as we have gained 11.78%, compared to 9.49% for the S&P 500 and 7.11% for the Lipper average. Below is a table comparing the Parnassus Fund with the S&P 500 and the Lipper average over the past one-, three-, five- and ten-year periods. We’re ahead of both benchmarks for the one- and five-year periods, and we’re ahead of the Lipper average for the three-year period, but we’re slightly behind the S&P 500 for the three-year period. We’re also slightly behind both benchmarks for the ten-year period.

Company Analysis

Four companies hurt the Fund the most, each cutting 30¢ or more from the NAV. Three are involved in telecommunications and one is an oil-and-gas producer.

6

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

these near-term concerns, Cisco remains the market leader in networking and data-center equipment and is poised to benefit as Internet traffic grows. High costs for a customer to switch to a competitor, massive scale and a large global sales force create a strong competitive advantage for Cisco. At nine times this year’s earnings estimates, the stock is trading near the bottom of its five-year valuation range; we believe there is significant upside in the stock.

Qualcomm provides software and designs semiconductors for manufacturers of cellular telephones. Its stock sank 18.1% from $68.02 to $55.68, while slicing 30¢ off the value of each Parnassus share. The weak economy caused Qualcomm’s customers to sell fewer handsets, which hurt Qualcomm’s license revenue. Its semiconductor business also struggled because it couldn’t fill all of its orders, due to a shortage of its new 28-nanometer semiconductors. The silver-lining here is that demand is very strong. Customers like the new higher-speed chip that uses less power. Since its manufacturing partners are

urgently increasing capacity to meet demand, we should see significantly higher profits this year.

Despite the difficult quarter, our three homebuilding stocks moved much higher, each contributing 32¢ or more to the NAV. PulteGroup added 35¢, as its stock climbed 20.9% from $8.85 to $10.70, while Toll Brothers contributed 34¢, with its stock rising 23.9% from $23.99 to $29.73. DR Horton moved each fund share higher by 32¢, since its stock rose 21.2% from $15.17 to $18.38.

The homebuilding stocks moved up at the beginning of the quarter on hopes for a housing recovery, then pulled back after the economy created fewer jobs than expected. In June, though, the stocks moved higher again, as new housing starts reached a two-year high, and pending home sales also climbed to their highest level in the last two years. The influential Case-Shiller index showed that home prices increased for the first time in eight months. Low home prices, rising rents and low mortgage rates are creating powerful inducements for potential buyers.

Outlook and Strategy

Note: This section represents the thoughts of Jerome L. Dodson and applies to the three funds that he manages: the Parnassus Fund, the Parnassus Small-Cap Fund and the Parnassus Workplace Fund. The other portfolio managers discuss their thoughts in their respective reports.

Housing has a special role in the American economy. It leads us in and out of recessions, creates booms and busts and also is a tool of monetary policy wielded by the Federal Reserve System (“the Fed”).

As we have seen, housing created the boom that ended in late 2007. Housing prices skyrocketed during that period, and bankers would lend to almost anyone who was breathing. Some people bought homes as an investment, and others bought homes to shelter their families. Far too many, though, bought houses as a speculation. The difference between an investor and a speculator is that an investor buys a house with a longer-term perspective, so he or she can receive the rental income it provides and make loan payments out of the rental income. A speculator buys a house without worrying about collecting rent to cover mortgage payments and other expenses, but buys that house only in the hope that it will soon appreciate in value, and he will be able to sell it to the next speculator at a higher price. (This is sometimes known as the greater fool theory, since one fool overpays for a house in the hopes of selling it to a greater fool in the near future.) This orgy of speculation ended badly in 2008, as people could no longer make payments on

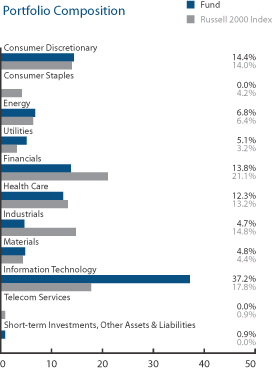

| Parnassus Fund Sector Weightings as of June 30, 2012 (percentage of net assets) | ||

Top 10 Holdings

(percentage of net assets)

| Finisar Corp. | 5.4% | |||

| Ciena Corp. | 5.3% | |||

| PulteGroup Inc. | 5.2% | |||

| DR Horton Inc. | 4.3% | |||

| Applied Materials Inc. | 4.2% | |||

| Toll Brothers Inc. | 4.1% | |||

| Wells Fargo & Co. | 4.1% | |||

| Gilead Sciences Inc. | 4.0% | |||

| Walgreen Co. | 4.0% | |||

| Riverbed Technology Inc. | 3.7% | |||

Portfolio characteristics and holdings are subject to change periodically.

7

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

their loans and banks started to foreclose. At first, it was just the speculators who got wiped out, then the investors who could no longer rent their houses for enough to cover their costs. Next to go were the people who bought a house to live in, but paid more than they could afford. Finally, foreclosures hit people who bought a house they could afford, but they lost their jobs or suffered other financial calamities.

The crash of ‘08 was different than most other housing recessions, because of its severity and because it was not caused by the Fed. What usually happens is that the Fed sees speculation creeping into the system, so it decides to raise interest rates. Because housing is so sensitive to interest rates, it’s the first sector to go. As soon as interest rates rise, housing starts decline. This causes the economy to slow down and, sometimes, go into a recession. This happens because housing is so central to our economy.

When construction drops, virtually every other sector of the economy is affected. Bricklayers, carpenters, plumbers and electricians have less work. Fewer people buy furniture, home appliances, pots and pans, dishes, drapes and rugs, and so on throughout the economy.

Once the Fed senses that the economy has slowed down enough or is even close to a recession, it takes its foot off the brakes and steps on the gas pedal by reducing interest rates. Most of the time, this means more houses get built and people start buying all that stuff that goes with buying a new house. The economy comes back to life.

This time, though, it’s not working. The Fed didn’t raise interest rates to cool off the economy. Fed Chairman Alan Greenspan, who was widely admired at the time for our apparent prosperity, didn’t raise rates. He let the speculation continue, and the irrational exuberance was finally curtailed, not by higher interest rates, but by a mountain of bad loans crashing down on the banking system and paralyzing the economy.

Had Greenspan raised interest rates before the speculation got out of control, it would have been much easier to revive the economy. Interest rates are now very low, but not enough people are buying homes. Bankers have a lot of money to lend, but they’re not lending with wild abandon like they did in the 2004-2007 period. It’s not just that they’re more careful than they were during the boom, they’re over-cautious and, sometimes, won’t even lend to good credit risks.

Homebuilders are also having trouble. Too many homes were built during the boom, so we have excess capacity. They built houses for speculators—not just homeowners. Since not many new homes are being sold, people aren’t buying all that other stuff that drives the economy.

As I indicated in my last quarterly report, we need some of John Maynard Keynes’ “animal spirits” to get the economy moving again. This is not easy at the present time. Bankers are reluctant to lend and businesses are reluctant to invest, even though earnings are good and corporations have a lot of cash on their balance sheets. It’s as if everyone had been chastened by the last orgy of speculation, and no one wants to take any chances.

Casting a pall over the economy is the situation in Europe. Each day, we hear more bad news about Greece, Spain, Italy, Ireland and all the others. Sometimes there’s good news, that there’s going to be a new development, then there’s bad news that nothing can be done.

In addition to the sick men of Europe, we have bad news at home. We aren’t creating enough new jobs, and in June, it looked like U.S. manufacturing had contracted after two years of expansion.

Despite all the economic bad news, I’m more optimistic now than I’ve been in the last two years. Our portfolio is positioned for a strong economic recovery that will start this year. Here is what I see happening.

Housing will pull the economy out of its slump, just as it always has—but it’s taking much longer than usual. I live in San Francisco and home prices are moving sharply higher, especially in areas favored by employees of technology firms like Google, Facebook and Apple. Prices in Silicon Valley are also moving upward. Higher home prices are not just a West Coast phenomenon fueled by technology firms. Higher home prices are spreading to other areas of the country from New York to Miami. Right now, this is just happening to the more desirable areas of the country, but it will spread to other areas as well.

8

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

Right now, demand is picking up for housing. Interest rates are low, and homes are more affordable now than they have been in years. Rents have moved much higher in many parts of the country, and in some places, it will be cheaper to own than to rent. This demand is having a big impact on supply. For years now, less than 600,000 homes per year have been under construction. We need about 1.5 million a year, just to accommodate our population growth. In my view, the excess capacity created during the boom is about to disappear. While it’s true that in some parts of the country, there are many foreclosed homes for sale, in other parts of the country, there are very few homes on the market. Supply and demand are uneven across the nation, but taken as a whole, I think there will soon be more demand than supply.

If I’m right, there will be a surge in home construction. Housing will take off and jump-start the economy. It will take some animal spirits, but I think we’ll start feeling them in the very near future.

Our portfolio is positioned for this upturn, as we have major investments in homebuilders, information technology, telecommunications and financial services. All these stocks should do well when the economy recovers.

Yours truly,

Jerome L. Dodson

Portfolio Manager

9

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

As of June 30, 2012, the NAV of the Parnassus Equity Income Fund-Investor Shares was $27.91. After taking dividends into account, the total return for the second quarter was a loss of 0.96%. This compares to a decline of 2.75% for the S&P 500 Index (“S&P 500”) and a drop of 2.18% for the Lipper Equity Income Fund Average, which represents the average equity income fund followed by Lipper (“Lipper average”). We’re pleased that the Fund provided good downside protection during the volatile second quarter. For the first half of 2012, the Fund rose 6.59% versus a gain of 9.49% for the S&P 500 and 6.34% for the Lipper average.

10

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

Company Analysis

There were two stocks that reduced the NAV by at least 11¢ during the quarter. Qualcomm, a company that provides semiconductors and software for mobile devices, reduced the Fund’s NAV by 11¢ as the stock fell 18.1% to $55.68 from $68.02 per share. After a great start to 2012, smartphone sales growth slowed during the second quarter as the global economy weakened and consumers waited for new models. Since Qualcomm earns a royalty on sales of mobile devices, the company’s growth expectations declined, pushing the stock lower.

Qualcomm’s semiconductor division faced a separate challenge. The company’s foundry partners failed to build enough chipsets to fulfill Qualcomm’s customers’ orders. These chipsets are selling rapidly, because they help mobile devices power

multimedia and wireless connectivity, and extend battery life. We anticipate that smartphone sales will increase during the second half of 2012, as new models are introduced, and that the foundries will add enough capacity to fulfill Qualcomm’s orders. For these reasons, we like Qualcomm’s prospects for the rest of the year.

Surprisingly, the Fund’s second largest loser was Procter & Gamble (“P&G”). This company typically outperforms during stock market declines because of its predictable global brands such as Crest, Gillette, Tide and Pampers. P&G’s stock fell 8.9% for the quarter from $67.21 to $61.25 per share and trimmed the Fund’s NAV by 11¢. The company has faced several headwinds recently, including a weakening global economy and market share losses in several categories, such as laundry, men’s shaving and skin care.

Given P&G’s subpar performance, we had tough questions for management during a May meeting at our office in San Francisco. P&G has fantastic brands, but its prices in some cases are too high versus competing products. Currently, about 80% of P&G’s products in the U.S. are priced at a premium to branded competitors’ products, leading some customers to buy lower priced alternatives. In our meeting, P&G’s management discussed a host of actions, including targeted price cuts, innovation, promotion and cost cutting programs, that should help stem share losses and increase earnings.

While it may take a few quarters to see tangible results, P&G owns fantastic global brands and the company’s actions should halt the market share loss. Considering that P&G has increased dividends every year since 1957 and has a legacy of innovation, investors seem overly pessimistic regarding the company’s prospects. We think P&G is a bargain, trading at a price-to-earnings (PE) ratio of 15x estimated fiscal 2012 earnings and providing a 3.8% dividend yield, so we bought more of the stock during the quarter.

The Fund had five winners that added at least 8¢ to the NAV during the quarter. Gen-Probe, a maker of equipment to diagnose human diseases, soared 19.5% from $66.41 to $79.37 per share and boosted the Fund’s NAV by 11¢. The company accepted a buyout offer from Hologic in April, so we sold our shares. Gen-Probe was a fantastic investment for the Fund, as we began buying shares in August of 2009 for around $38 per share. Matt Gershuny, Portfolio Manager of the Parnassus Mid-Cap Fund and a Senior Research Analyst, did an outstanding job helping us manage this investment.

McCormick, the spice and seasoning company, had a strong quarter, rising 11.4% to $60.65 from $54.43 and boosting the NAV by 9¢.

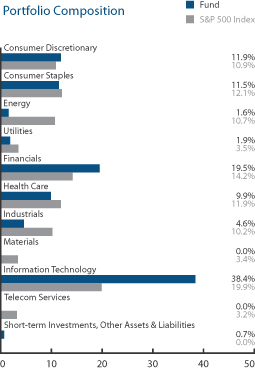

| Parnassus Equity Income Fund Sector Weightings as of June 30, 2012 (percentage of net assets) |

Top 10 Holdings

(percentage of net assets)

| Gilead Sciences Inc. | 4.7% | |||

| PepsiCo Inc. | 4.7% | |||

| Procter & Gamble Co. | 4.5% | |||

| Waste Management Inc. | 4.3% | |||

| Teleflex Inc. | 3.8% | |||

| Applied Materials Inc. | 3.5% | |||

| Questar Corp. | 3.3% | |||

| CVS Caremark Corp. | 3.3% | |||

| Google Inc. | 3.2% | |||

| Sysco Corp. | 3.1% | |||

Portfolio characteristics and holdings are subject to change periodically.

11

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

McCormick’s brand strength remains solid. Their customers are buying more of the company’s products, despite the fact that management has increased prices to offset higher costs.

Records and document management company Iron Mountain had an outstanding quarter as its stock rose 14.4% to $32.96 from $28.80, while increasing the NAV by 9¢. The stock moved higher in early June when management announced a plan to convert the company into a real estate investment trust. The conversion, if approved by the U.S. government, would occur at the earliest on January 1, 2014, and would enable Iron Mountain to significantly lower its tax rate and increase its dividend.

VeriSign, the Internet company that operates registry services for domain names, contributed 8¢ to the NAV, as the stock rose 13.6% for the quarter from $38.34 to $43.57 per share. During the quarter, VeriSign’s regulator, ICANN, approved the renewal of the company’s .com contract for another six years. This secures a large, predictable earnings stream for VeriSign.

Salt Lake City-based Questar, a natural gas company, rose 8.3% during the quarter from $19.26 to $20.86, increasing the NAV by 8¢. Questar’s Wexpro division, which drills natural gas wells at a regulated 20% pre-tax return on equity, continues to grow earnings. Meanwhile, the company’s utility and natural gas pipeline businesses provide a stable stream of earnings to support Questar’s 3.1% dividend.

Outlook and Strategy

Our investment philosophy is to make as much money as possible for our shareholders, while shielding the Fund as best we can from large potential losses. Regarding the latter, we think the most significant investment risks are related to consumer spending in the United States, the debt crisis in Europe and a potential sharp deceleration in China’s growth. Our strategy is to avoid companies that would be most impacted by these macro themes, while remaining fully invested in businesses with attractive long-term prospects.

The consumer spending issue is actually related to a major strength in the economy: record high corporate profitability. Amazingly, annual corporate profits in our country now exceed $1.6 trillion. At 11% of GDP, companies in aggregate are almost twice as profitable now as they were in the 1990s, a decade known for large productivity gains and growth. As managers of an equity portfolio, we’re delighted that businesses, including those in the Fund, are making a lot of money. However, we’re concerned that high profits have been enabled in large part by low compensation.

Economic data confirms this relationship between profits and wages. While aggregate profits are at an all-time high, total wages as a percentage of GDP are at an all-time low of 44%. The best remedy for this problem is for companies to start hiring aggressively. While we hope this happens soon, the recent data doesn’t look good. In May and June, the country added just 69,000 and 80,000 jobs, respectively, well below the 200,000 required to drive down the unemployment rate. For now, massive government deficit spending is offsetting low compensation, and helping corporate earnings stay high, but clearly such an economic model isn’t sustainable.

Without an improvement in the job market, it’s unlikely that consumers as a whole will meaningfully increase spending from current levels. We’re especially concerned about how this might impact companies that sell discretionary products. For this reason, our consumer-related investments are heavily skewed toward companies that sell staples, like PepsiCo and Proctor & Gamble, and we’re significantly underexposed to consumer discretionary stocks, relative to the index.

While European leaders promised in late June, during their 19th summit on the topic, to more forcefully address their continent’s debt crisis, we still think they’re a long way from a lasting solution. In our view, the U.S. companies most at risk from a worsening of the Euro-zone crisis are banks that have significant European exposure, both to sovereign and corporate borrowers. This is one of the key reasons why the Fund doesn’t currently own any large multinational banks. Our financial exposure at quarter-end was limited to just two companies, Charles Schwab and SEI Investments, both of which should hold up relatively well even if the European crisis gets worse.

The final key risk area is China, whose economy is supported by enormous exports to the developed world, especially the U.S. and Europe. Clearly, if our concerns about the U.S. consumer and European debt markets prove true, China will experience a setback, because their exports would shrink. A sign that this slowdown may already be starting is the central bank of China’s recent surprise interest rate cut, the second in just one month.

12

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

Since growth in China, along with other emerging market economies, has been offsetting sluggishness in the developed world, a slowdown there could have serious repercussions to the global economy and financial markets. This would be especially true for energy companies, which have benefitted from China’s seemingly insatiable demand for commodities. In light of this risk, the Fund is significantly underweighted the energy sector, relative to the index.

Our time-tested process and long-tenured team have produced a portfolio of 40 companies across a wide range of industries. We think these businesses have terrific potential for long-term growth, defensible competitive positions and top-notch management teams. So even if the bearish scenarios detailed above play out, we’re confident in the long-term business prospects of our Fund holdings.

We thank you for your investment in the Fund,

|

|

|||

| Todd C. Ahlsten | Benjamin E. Allen | |||

| Portfolio Manager | Portfolio Manager |

13

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

Ticker: PARMX

As of June 30, 2012, the NAV of the Parnassus Mid-Cap Fund was $19.53, so the total return for the quarter was a loss of 1.76%. This compares to a loss of 4.40% for the Russell Midcap Index (“Russell”) and a loss of 4.71% for the Lipper Multi-Cap Core Average, which represents the average multi-cap core fund followed by Lipper (“Lipper average”). We’re pleased that the Fund outperformed its benchmarks by such a wide margin this quarter.

For the year-to-date, the Fund is well ahead of its benchmarks, rising 10.40% compared to 7.97% for the Russell and 7.11% for the Lipper average. The Fund’s longer-term performance also remains excellent. The Fund has handily outperformed the Lipper average in the one-, three- and five-year periods and for the period since inception, and the Russell in the one- and five-year periods and for the period since inception. In the three-year period, the Fund’s annual return is only slightly behind the Russell.

Below is a table comparing the Parnassus Mid-Cap Fund with the Russell and the Lipper average for the one-, three- and five-year periods and for the period since inception on April 29, 2005.

Second Quarter Review

Domestic equity markets declined in the second quarter. Investors focused on disappointing U.S. economic news, including weak manufacturing data and anemic jobs creation. They were also worried about a potential “fiscal cliff” in early 2013, which refers to

policy changes that will raise taxes and lower spending. These actions could reduce gross domestic product (GDP) by as much as four percentage points next year, sending the country back into recession.

Mid-cap stocks had a relatively weak quarter, as the Russell fell 4.40%. The Russell was also volatile, falling 10.34% through June 4th, before jumping 6.65% at quarter-end. The market rallied at quarter-end because of record corporate profits here in the United States and indications that European leaders were working to solve their fiscal problems.

The Fund outperformed the Russell by 264 basis points (one basis point equals 0.01%) and the Lipper average by 295 basis points. Risky assets fell a lot during the quarter, so the Fund benefited from our strategy of owning less risky companies with larger market values and higher returns on capital. As usual, stock selection had a greater influence on the Fund’s return than sector allocation. Our holdings in the industrials, information technology and materials sectors helped us the most this quarter, increasing our return relative to the Russell by 225 basis points. Strong stock picking in the consumer discretionary and materials sectors also boosted performance, contributing 71 and 58 basis points, respectively.

One area of weakness for the Fund this quarter was the financial sector, which cost us 103 basis points. We underweighted the sector, but unfortunately, the sector outperformed the overall index. Making matters worse, the financial stocks we did own underperformed their sector peers.

| Parnassus Mid-Cap Fund | ||||||||||||||||||||||||

| Average

Annual Total Returns (%) |

One Year |

Three Years |

Five Years |

Since Inception on 4/29/05 |

Gross Expense Ratio |

Net Expense Ratio |

||||||||||||||||||

| for periods ended June 30, 2012 |

||||||||||||||||||||||||

| Parnassus Mid-Cap Fund | 2.96 | 19.18 | 4.29 | 6.64 | 1.24 | 1.20 | ||||||||||||||||||

| Russell Midcap Index | -1.65 | 19.44 | 1.06 | 6.37 | NA | NA | ||||||||||||||||||

| Lipper Multi-Cap Core Average | -1.69 | 14.19 | -0.99 | 4.05 | NA | NA | ||||||||||||||||||

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Mid-cap companies can be more sensitive to changing economic conditions and have fewer financial resources than large-cap companies. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contains this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website, or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2012, Parnassus Investments has contractually agreed to limit the total operating expenses to 1.20% of net assets, exclusive of acquired fund fees, until May 1, 2013. This limitation may be continued indefinitely by the Adviser on a year-to-year basis.

14

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

Company Analysis

Three stocks reduced the Fund’s NAV by 10¢ or more in the quarter, while three stocks added at least 8¢ to the NAV. The stock that hurt us the most was Check Point Software Technologies, a leading provider of enterprise network security products. The stock plunged 22.3% from $63.84 to $49.59, taking 12¢ from each fund share. Check Point reported weaker than expected product license growth, as customers delayed orders ahead of the company’s release of its new security operating system. The company’s shift to a subscription model also hurt revenue growth during the quarter, since only a portion of the revenue from subscription product sales is recognized upfront. Despite these short-term issues, we’re hanging

onto the stock, because the fundamental demand for Check Point’s products remains excellent, and its competitive advantage is intact.

First Horizon, a Tennessee-based bank, fell 16.7% from $10.38 to $8.65, cutting 11¢ from the NAV. Its shares fell because of continuing concern about the bank’s exposure to mortgages and home-equity loans in the national market. On June 25th, the bank addressed the concern, announcing that it would take a $250 million charge to build a reserve against future losses. Investors were relieved that the amount was manageable, and the stock jumped 9.4% from $7.91 on June 25th to $8.65 at quarter-end. We believe that the stock will continue to rise, as investors focus on the bank’s core Tennessee operation, which is well-managed and profitable.

Valeant Pharmaceuticals, a specialty drug company, dropped 16.6% from $53.69 to $44.79, reducing each fund share by 10¢. Management issued weaker than expected revenue guidance during the quarter, souring investor sentiment. The issues included price declines in several of Valeant’s overseas generics markets, and patent expirations for a few of its products. We remain bullish on this well-managed business because the company is diversifying its product offering and entering into new markets.

Our biggest winner this quarter was Gen-Probe, a San Diego-based medical technology company that sells molecular diagnostic products for blood screening and disease detection. This investment increased the Fund’s NAV by 9¢, as its stock surged 21.4% from $66.41 to our average selling price of $80.60. The stock went up, when management accepted a buyout offer from medical device maker Hologic in April. We sold our position on this news, believing the shares were fairly valued.

Records and document management company Iron Mountain also contributed 9¢ to the NAV, as its stock jumped 14.4% to $32.96 from $28.80. The shares rose in early June when management announced a plan to convert the company into a REIT (real estate investment trust). We expect the conversion to be approved by the U.S. government sometime in 2013, and for the conversions to occur in early 2014. We are holding onto the stock because the conversion will allow the company to generate substantial tax savings and increase its dividend payments.

Our third largest winner was Scripps Networks, best known for its Food Network, Home and Garden Television (HGTV) and Travel channels. The stock rose 16.8% during the quarter, from $48.69 to $56.86, contributing 8¢ to the NAV. Scripps’ channels have experienced strong ratings and subscriber growth, allowing the company to negotiate higher affiliate fees and command more advertising revenue. Management’s large share repurchase during the quarter was also viewed favorably by investors.

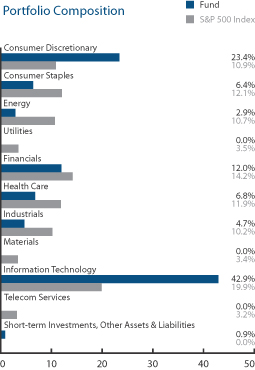

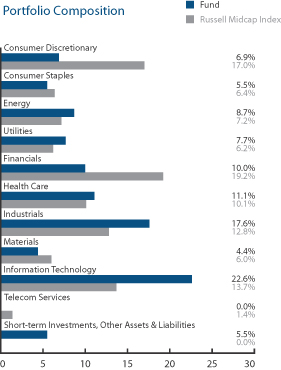

| Parnassus Mid-Cap Fund Sector Weightings as of June 30, 2012 (percentage of net assets) | ||

Top 10 Holdings

(percentage of net assets)

| Teleflex Inc. | 4.1% | |||

| Waste Management Inc. | 4.1% | |||

| Questar Corp. | 3.7% | |||

| Iron Mountain Inc. | 3.4% | |||

| Sysco Corp. | 3.3% | |||

| Insperity Inc. | 3.2% | |||

| Valeant Pharmaceuticals International Inc. | 3.2% | |||

| First Horizon National Corp. | 3.2% | |||

| SEI Investments Co. | 3.1% | |||

| Applied Materials Inc. | 3.0% | |||

Portfolio characteristics and holdings are subject to change periodically.

15

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

Outlook and Strategy

Mid-cap stocks are cheaper after the second quarter’s correction, but we remain cautious on the market. Here in the United States, we are most concerned about weak job creation. From April to June, the United States produced an average of just 75,000 jobs per month, well below the average 226,000 jobs created per month from January to March. As a result, the unemployment rate remains at 8.2%, an unusually high level considering that the economy hasn’t been in recession for two years. Without jobs creation, economic growth will be muted, because people can’t afford to buy or build homes and spend money on discretionary goods and services.

The fiscal cliff in early 2013 is also worrisome. While the most likely outcome is a stop-gap measure that postpones permanent policy changes until later in 2013, the odds of a congressional stalemate are higher than normal this time around, because the issue will likely become politicized given the upcoming election. If Congress doesn’t approve a stop-gap measure, the economy could slow drastically.

Uncertainty in Europe and China are further dampening our market outlook. European leaders have been dragging their feet on addressing their continent’s debt crisis, and it appears that they are still far from a resolution. China’s export-driven economy is vulnerable because of softening consumer spending in the United States and Europe, and the country’s real estate bubble could soon burst. While the Fund’s holdings intentionally have little direct exposure to China and Europe, the overall stock market will move lower if these issues worsen.

Our portfolio is built from the bottom-up, by selecting securities that we believe will perform well regardless of the economic environment. We remain overweight, relative to the Russell, in industrial and information technology stocks, owning businesses in these sectors that are well-positioned to capture increasing share in growing end-markets. For the second consecutive quarter, we have increased our energy exposure. Despite economic uncertainty, we appreciate the long-term value of these companies’ assets, especially natural gas holdings, which have been under pressure lately due to over-supply in the market. We remain underweight in the financial and consumer discretionary sectors, where few companies meet our investment criteria, and where earnings could go down sharply if the economy deteriorates.

We spend much of our time identifying well-managed businesses with good growth prospects and competitive advantages. Our strategy is to initiate positions in these stocks when they trade at attractive valuations, add to these positions when the stocks go down, and sell off the positions when the stocks become too expensive. We are confident that this process will continue to provide investors with long-term outperformance, by providing downside protection in falling markets and upside participation in rising markets.

Thank you for your investment in the Parnassus Mid-Cap Fund,

|

|

|||

| Matthew D. Gershuny | Lori A. Keith | |||

| Portfolio Manager | Portfolio Manager |

16

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

Ticker: PARSX

As of June 30, 2012, the NAV of the Parnassus Small-Cap Fund was $21.81, so the total return for the second quarter was a loss of 7.15%. By comparison, the Russell 2000 Index of smaller companies (“Russell 2000”) had a loss of 3.47% and the Lipper Small-Cap Core Average, which represents the average small-cap core fund followed by Lipper (“Lipper average”) had a loss of 5.08%. For the quarter, we were substantially behind both benchmarks.

Despite our poor showing in the second quarter, we are still ahead of both indices for the year-to-date. The Small-Cap Fund is up 8.62% compared to 8.53% for the Russell 2000 and 6.29% for the Lipper average. Below is a table comparing the Parnassus Small-Cap Fund with the Russell 2000 and the Lipper average over the past one-, three- and five-year periods and the period since inception. As you can see from the table, we are substantially behind the benchmarks for the one-year period. For the three-year period, we are about a percentage point behind the Russell 2000, but we are in-line with the Lipper average. We are well ahead of both benchmarks for the five-year period and for the period since inception.

Company Analysis

Five stocks hurt the Small-Cap Fund the most during the quarter, with each of them cutting 20¢ or more off the NAV. No company made a substantial contribution to the Fund by contributing 20¢ or more.

17

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

cable-networks and telecommunications-providers, whose customers want special features such as video-on-demand and Internet-streaming video. Harmonic provides equipment for these features, so revenue should start growing again as the economy picks up.

First Horizon, a Tennessee-based bank, subtracted 21¢ from the NAV, as its shares fell 16.7% from $10.38 to $8.65. During the previous real-estate boom, the company expanded far beyond its local roots and began originating mortgages on a national basis with disastrous consequences during the housing bust. First Horizon closed down its national operations a couple of years ago, but it’s still suffering losses from those former operations. The company recently took a charge of $250

18

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

Ticker: PARWX

As of June 30, 2012, the NAV of the Parnassus Workplace Fund was $21.46, so the total return for the second quarter was a loss of 5.21%. This compares to a loss of 2.75% for the S&P 500 Index (“S&P 500”) and a loss of 3.95% for the Lipper Large-Cap Core Average, which represents the average large-cap core fund followed by Lipper (“Lipper average”). So for the quarter, we lagged both benchmarks by a substantial margin.

For the year-to-date, the Workplace Fund is slightly behind the S&P 500, but well ahead of the Lipper average. Since the first of the year, the Fund is up 9.27%, while the S&P 500 is up 9.49% and the Lipper average is up 7.95%. Below is a table comparing the Workplace Fund with the S&P 500 and the Lipper average for the past one-, three- and five-year periods, as well as for the period since inception. The Fund is behind the S&P 500 for the one- and three-year periods, but substantially ahead of the S&P 500 for the five-year period and the period since inception. The Workplace Fund is ahead of the Lipper average for all time periods.

Company Analysis

Four companies had the biggest negative impact on the Fund, with each of them taking 13¢ or more off the NAV. The most significant loss came from Qualcomm. Qualcomm provides software and designs semiconductors for manufacturers of cellular telephones. Its stock sank 18.1% from $68.02 to $55.68, while slicing 16¢ off the value of each Parnassus Workplace Fund share. The weak economy caused Qualcomm’s customers to sell fewer handsets, which hurt Qualcomm’s license

19

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

during the housing bust. First Horizon closed down its national operations a couple of years ago, but it’s still suffering losses from those former operations. The company recently took a charge of $250 million, indicating that would cover the losses from its former national division, and the stock jumped 9.3% from $7.91 to $8.65. First Horizon has strong earnings power in its home market where it is the market leader, and we think this potential should move the stock higher.

Walgreen, the largest U.S. drugstore chain, fell 11.7% from $33.49 to $29.58, taking 13¢ away from the Fund’s NAV. Early in the quarter, the stock fell as Walgreen continued its long-running dispute with Express Scripts, a pharmacy-benefit manager,

20

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

Ticker: PRFIX

As of June 30, 2012, the NAV of the Parnassus Fixed-Income Fund was $17.66. After taking dividends into account, the total return for the quarter was a gain of 2.67%. This compares to a gain of 2.56% for the Barclays Capital U.S. Government/Credit Bond Index (“Barclays Capital Index”) and a gain of 2.26% for the Lipper A-Rated Bond Fund Average, which represents the average return of all A-rated bond funds followed by Lipper (“Lipper average”). Since the beginning of the year, the total return for the Fund was 1.78% compared to a gain of 2.65% for the Barclays Capital Index and a gain of 3.62% for the Lipper average.

Below is a table comparing the performance of the Fund with that of the Barclays Capital Index and the Lipper average. Average annual total returns are for the one-, three-, five- and ten-year periods. For June 2012, the 30-day subsidized SEC yield was 0.43% and the unsubsidized SEC yield was 0.32%.

Second Quarter Review

As with the past two years, the positive momentum of the first quarter didn’t last into the second quarter. Weaker global economic data and renewed financial concerns in the euro zone curtailed investors’ optimism. In the U.S., the Federal Open Market Committee (FOMC) adopted a more tepid economic outlook. At its June meeting, the FOMC cut its 2012 GDP growth forecast to a range of 1.9%-2.4% from its April projection of 2.4%-2.9%. In addition, the FOMC expects a slower improvement in the labor market for 2012. It now projects the unemployment rate to improve slightly from the current 8.2% to a range of 8.0%-8.2%, compared to its previous range of 7.8%-8.0%.

21

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

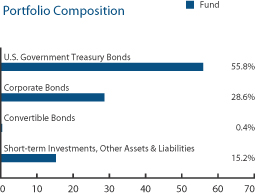

The outperformance relative to the Lipper average came primarily from our higher weighting in the U.S. Treasury market. As of the end of the second quarter, U.S. Treasury bonds represented 56% of the Fund, while most of our peers had a greater exposure to corporate bonds and securitized assets, such as CMBS and MBS.

Outlook and Strategy

In my opinion, the risks to the U.S. economy and global economic growth continue to be weighted to the downside. I am worried that we are facing a dangerous combination of weakening global economic growth on top of a fragile financial system.

Most European economies are contracting and the economic momentum is deteriorating in both the U.S. and in the emerging markets.

The European sovereign and banking crisis has now spread from the peripheral countries to larger economies like Spain. I think that liquidity injections are not a panacea for the current crisis. Instead, increased fiscal and banking integration in the euro zone is likely to be a more sustainable solution. However, this would require major political actions, including treaty changes. Unfortunately, I think that this crisis will have to reach a more severe stage to convince European leaders to stop dithering.

In the meantime, economic uncertainties and further downside risks will likely remain elevated. Capital flight away from the euro zone and into other safe havens will also likely persist. Combined with an economic slowdown in the U.S. and in many other large economies, I think that this is an investment environment that should benefit safe assets such as U.S. government bonds.

Given my outlook for continued economic weaknesses, the Fund’s composition remains similar compared to the end of the first quarter.

U.S. Treasuries continue to be our largest holding, representing 56% of the Fund’s total net assets. The rest of the portfolio includes corporate bonds (29%), and cash and short-term securities (15%).

The Fund has currently no exposure to the U.S. mortgage bond market. While mortgage-backed securities (MBS) offer higher yields than U.S. Treasuries, I think that the prospect of further gains is limited for now. Refinancing activity has been slower than expected, pushing prices of MBS well above the prices at which they were originally sold.

The main risk of owning MBS at this point is that more homeowners take advantage of the historical low interest rates to refinance their loans. If refinancing activity picks up, holders of MBS will suffer losses, as the mortgages will be retired at the prices at which they were originally sold. I think that the risk of increased refinancing largely outweighs the potential of further capital gains. As a result, I prefer to wait for better investment opportunities to invest in that market.

As always, I remain vigilant to changes in the economic and financial outlook and will position the portfolio accordingly.

Thank you for your trust and investments in the Parnassus Fixed-Income Fund.

Yours truly,

Minh T. Bui

Portfolio Manager

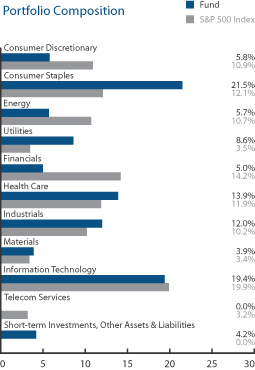

| Parnassus Fixed-Income Fund Sector Weightings as of June 30, 2012 (percentage of net assets) | ||

Portfolio characteristics and holdings are subject to change periodically.

22

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

By Milton Moskowitz

The stock market is like baseball: it’s all about the numbers. Investors who keep their eyes on the stock markets in Hong Kong and Shanghai should be especially wary of the numbers because the Chinese put a great deal of store in numerology. Lucky numbers are important. The Hong Kong government holds an auction of lucky vanity license plates every month. The plate with just an 8 on it went for more than $1 million. A house that has an 8 in its address will command a premium price. The 2008 Olympic Games opened in Beijing at 8:08 p.m. on August 8, 2008.

On June 4 of this year, the Shanghai stock market triggered a socially responsible reaction. The market closed down 64.89 points on that day, which some observers immediately connected to the government crackdown on students in Tiananmen Square on June 4, 1989. Not only that: sharp-eyed numerologists noted that the Shanghai Stock Exchange Composite Index opened that morning at 2346.98, which could be interpreted as the date of the crackdown written backwards, followed by the 23rd anniversary.

Bizarre as it sounds, there were those who put stock in the symbolism of the numbers. New York Times correspondent Keith Bradsher reported that one blogger sent this message: “I want to thank all the stock traders.” And another said: “Maybe God does exist.” The Chinese government took it seriously. It began blocking computer searches for such words as “stock market,” “Shanghai stock,” “index” and “silent tribute.”

It’s the first time I know of that a stock market index was linked to a human rights issue.

One thing I do keep an eye on are opinion pieces in The Economist, the British weekly that has seen its circulation go up, while competitors have declined or gone out of business. This magazine has usually been cool to corporate social responsibility (“CSR”). But in their May 19 issue, they conceded that CSR “is evolving and becoming less flaky.” Citing programs fielded by Nestle, Unilever and Procter & Gamble, the writer of the Schumpeter column concluded that CSR has come a long way from the time it “was just about public relations…today it is encouraging businesses to become more frugal in their use of resources and more imaginative in the way they think about competitive advantage.” High praise from an unlikely quarter.

Another sign of the times: Hitachi, the giant Japanese electronics company, has decided to re-organize its board of directors so that outsiders outnumber insiders for the first time in its 102 year history. About one-half of all Japanese publicly traded companies do not have a single outside director.

Walgreen, the nation’s largest drugstore chain (with 7,700 stores) is rolling out a renovation that will bring pharmacists out from behind the counter and onto the sales floor, where they will be able to counsel customers on use of their medications rather than hanging on the phone answering questions about insurance coverage…Walt Disney Company is introducing a new set of nutritional guidelines for advertising on its child-focused television channels, including all ABC television and radio stations, which it owns. Foods high in sugar, sodium and fat will no longer be permitted to advertise. The rules would bar products like Capri Sun drinks and Kraft Lunchables, both current advertisers on Disney stations. In addition, Disney said it would cut sodium by 25% in the children’s meals served at its amusement parks. Disney’s action drew high praise from the White House, where Michele Obama said: “Disney is doing what no major media company has ever done before in the U.S. – and what I hope every company will do going forward.”

Gilead Sciences, a leading biotech company, maintains a “global access program” that delivers HIV medications to people who need them worldwide, regardless of income or location. Since 2003 it has made these drugs available at substantially lower prices to patients in 130 countries. The company estimates that some 2.4 million people in developing countries are now receiving these medications to treat HIV…Procter & Gamble, the consumer goods behemoth (Gillette, Tide, Pampers et al.), reports that it has saved nearly $1 billion in operating costs from implementation of its environmental sustainability scorecard that measures such metrics as energy and water use, waste disposal and greenhouse gas emissions. P&G has pushed its suppliers to use the scorecard and now it is making it available to any company that asks for it…Another company engaged in measuring its environmental impact is Nike, king of the sportswear market. The Beaverton, Oregon-based company released a Sustainable Business Performance Summary, detailing progress that has been made and setting new goals. Nike has developed a new Manufacturing Index that elevates labor and environmental performance alongside traditional supply chain measurements. The company reported that over the past five years only 5% of factory audits turned up “serious, repeated violations.”

Milton Moskowitz is the co-author of the Fortune magazine survey, “The 100 Best Companies to Work For,” and the co-originator of the annual Working Mother magazine survey, “The 100 Best Companies for Working Mothers.” Mr. Moskowitz serves as a consultant to Parnassus Investments in evaluating workplaces for potential investments by the Parnassus Workplace Fund. Neither Fortune magazine nor Working Mother magazine has any role in the management of the Funds, and there is no affiliation between Parnassus and either publication.

23

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

As a shareholder of the Funds, you incur ongoing costs, which include portfolio management fees, administrative fees, shareholder reports, and other fund expenses. The Funds do not charge transaction fees, so you do not incur transaction costs such as sales charges (loads) on purchase payments, reinvested dividends, or other distributions, redemption fees, and exchange fees. The information on this page is intended to help you understand your ongoing costs of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The following example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the period of January 1, 2012 through June 30, 2012.

Actual Expenses

In the example below, the first line for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of each fund provides information about hypothetical account values and hypothetical expenses based on the fund’s expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. You may compare the ongoing costs of investing in the fund with other mutual funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in the table are meant to highlight only your ongoing costs in these Funds. Therefore, the second line of each fund is useful in comparing only ongoing costs and will not help you determine the relative total costs of owning other mutual funds, which may include transactional costs such as loads.

| Beginning

Account Value January 1, 2012 |

Ending Account Value June 30, 2012 |

Expenses Paid

During Period* |

||||||||||

| Parnassus Fund: Actual | $1,000.00 | $1,117.80 | $4.95 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,020.19 | $4.72 | |||||||||

| Parnassus Equity Income Fund – Investor Shares: Actual | $1,000.00 | $1,065.90 | $4.83 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,020.19 | $4.72 | |||||||||

| Parnassus Equity Income Fund – Institutional Shares: Actual | $1,000.00 | $1,066.90 | $3.60 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,021.38 | $3.52 | |||||||||

| Parnassus Mid-Cap Fund: Actual | $1,000.00 | $1,104.00 | $6.28 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,018.90 | $6.02 | |||||||||

| Parnassus Small-Cap Fund: Actual | $1,000.00 | $1,086.20 | $6.22 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,018.90 | $6.02 | |||||||||

| Parnassus Workplace Fund: Actual | $1,000.00 | $1,092.70 | $6.04 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,019.10 | $5.82 | |||||||||

| Parnassus Fixed-Income Fund: Actual | $1,000.00 | $1,017.80 | $3.76 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,021.13 | $3.77 | |||||||||

* Expenses are equal to the fund’s annualized expense ratio of 0.94%, 0.94%, 0.70%, 1.20%, 1.20%, 1.16% and 0.75% for the Parnassus Fund, Parnassus Equity Income Fund – Investor Shares, Parnassus Equity Income Fund – Institutional Shares, Parnassus Mid-Cap Fund, Parnassus Small-Cap Fund, Parnassus Workplace Fund and Parnassus Fixed-Income Fund, respectively, multiplied by the average account value over the period, multiplied by the ratio of days in the period. The ratio of days in the period is 182/366 (to reflect the one-half year period).

24

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

Portfolio of Investments as of June 30, 2012 (unaudited)

The accompanying notes are an integral part of these financial statements.

25

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

PARNASSUS FUND

Portfolio of Investments as of June 30, 2012 (unaudited) (continued)

The accompanying notes are an integral part of these financial statements.

26

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

Portfolio of Investments as of June 30, 2012 (unaudited)

The accompanying notes are an integral part of these financial statements.

27

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

PARNASSUS EQUITY INCOME FUND

Portfolio of Investments as of June 30, 2012 (unaudited) (continued)

The accompanying notes are an integral part of these financial statements.

28

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

Portfolio of Investments as of June 30, 2012 (unaudited)

The accompanying notes are an integral part of these financial statements.

29

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

PARNASSUS MID-CAP FUND

Portfolio of Investments as of June 30, 2012 (unaudited) (continued)

The accompanying notes are an integral part of these financial statements.

30

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

Portfolio of Investments as of June 30, 2012 (unaudited)

The accompanying notes are an integral part of these financial statements.

31

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

PARNASSUS SMALL-CAP FUND

Portfolio of Investments as of June 30, 2012 (unaudited) (continued)

The accompanying notes are an integral part of these financial statements.

32

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

Portfolio of Investments as of June 30, 2012 (unaudited)

The accompanying notes are an integral part of these financial statements.

33

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

Portfolio of Investments as of June 30, 2012 (unaudited)

The accompanying notes are an integral part of these financial statements.

34

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

PARNASSUS FIXED-INCOME FUND

Portfolio of Investments as of June 30, 2012 (unaudited) (continued)

The accompanying notes are an integral part of these financial statements.

35

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2012 (unaudited)

| Parnassus Fund |

Parnassus Equity Income Fund |

Parnassus Mid-Cap Fund |

||||||||||

| Assets | ||||||||||||

| Investments in common stocks and bonds, at market value | ||||||||||||

| (cost $333,598,207, $3,747,009,447, $67,181,143) |

$ | 366,433,692 | $ | 4,336,712,864 | $ | 73,264,506 | ||||||

| Investments in short-term securities | ||||||||||||

| (at cost which approximates market value) |

18,487,584 | 243,451,983 | 7,959,035 | |||||||||

| Cash | 169,312 | 259,828 | 101 | |||||||||

| Receivables | ||||||||||||

| Investment securities sold |

2,034,464 | - | - | |||||||||

| Dividends and interest |

6,591 | 2,401,066 | 50,303 | |||||||||

| Capital shares sold |

31,390 | 4,055,998 | 570,746 | |||||||||

| Other assets | 55,626 | 163,080 | 23,805 | |||||||||

| Total assets |

$ | 387,218,659 | $ | 4,587,044,819 | $ | 81,868,496 | ||||||

| Liabilities | ||||||||||||

| Payable upon return of loaned securities | 16,907,195 | 33,716,619 | 4,151,673 | |||||||||

| Payable for investment securities purchased | - | 14,506,602 | 152,890 | |||||||||

| Capital shares redeemed | 300,594 | 9,709,544 | 53,028 | |||||||||

| Fees payable to Parnassus Investments | 1,266 | 4,873 | 222 | |||||||||

| Distributions payable | - | 1,764,630 | - | |||||||||

| Accounts payable and accrued expenses | 270,375 | 441,769 | 15,120 | |||||||||

| Total liabilities |

$ | 17,479,430 | $ | 60,144,037 | $ | 4,372,933 | ||||||

| Net assets | $ | 369,739,229 | $ | 4,526,900,782 | $ | 77,495,563 | ||||||

| Net assets consist of | ||||||||||||

| Undistributed net investment income (loss) | 855,632 | (321,165 | ) | 155,278 | ||||||||

| Unrealized appreciation on securities | 32,835,485 | 589,703,417 | 6,083,363 | |||||||||

| Accumulated net realized gain | 14,992,832 | 101,243,080 | 2,745,454 | |||||||||

| Capital paid-in | 321,055,280 | 3,836,275,450 | 68,511,468 | |||||||||

| Total net assets |

$ | 369,739,229 | $ | 4,526,900,782 | $ | 77,495,563 | ||||||

| Net asset value and offering per share | ||||||||||||

| Net assets investor shares | $ | 369,739,229 | $ | 3,683,164,997 | $ | 77,495,563 | ||||||

| Net assets institutional shares | - | $ | 843,735,785 | - | ||||||||

| Shares outstanding investor shares | 9,389,741 | 131,962,938 | 3,967,948 | |||||||||

| Shares outstanding institutional shares | - | 30,170,428 | - | |||||||||

| Net asset values and redemption price per share | ||||||||||||

| (Net asset value divided by shares outstanding) |

||||||||||||

| Investor shares |

$ | 39.38 | $ | 27.91 | $ | 19.53 | ||||||

| Institutional shares |

- | $ | 27.97 | - | ||||||||

The accompanying notes are an integral part of these financial statements.

36

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2012 (unaudited) (continued)

| Parnassus Small-Cap Fund |

Parnassus Workplace Fund |

Parnassus Fixed-Income Fund |

||||||||||

| Assets | ||||||||||||

| Investments in common stocks and bonds, at market value | ||||||||||||

| (cost $620,953,300, $221,411,020, $175,096,801) |

$ | 623,768,450 | $ | 232,271,463 | $ | 188,803,603 | ||||||

| Investments in short-term securities | ||||||||||||

| (at cost which approximates market value) |

38,912,228 | 429,414 | 32,380,134 | |||||||||

| Cash | 131 | 67 | 709 | |||||||||

| Receivables | ||||||||||||

| Investment securities sold |

3,259,540 | 991,278 | - | |||||||||

| Dividends and interest |

241,319 | 45,175 | 1,593,281 | |||||||||

| Capital shares sold |

441,074 | 259,072 | 151,584 | |||||||||

| Other assets | 88,176 | 36,461 | 16,477 | |||||||||

| Total assets |

$ | 666,710,918 | $ | 234,032,930 | $ | 222,945,788 | ||||||

| Liabilities | ||||||||||||

| Payable upon return of loaned securities | 34,728,855 | - | - | |||||||||

| Payable for investment securities purchased | 1,037,800 | - | - | |||||||||

| Capital shares redeemed | 1,226,098 | 163,372 | 436,676 | |||||||||

| Fees payable to Parnassus Investments | 2,695 | 551 | 408 | |||||||||

| Distributions payable | - | - | - | |||||||||

| Accounts payable and accrued expenses | 145,841 | 38,892 | 57,442 | |||||||||

| Total liabilities |

$ | 37,141,289 | $ | 202,815 | $ | 494,526 | ||||||

| Net assets | $ | 629,569,629 | $ | 233,830,115 | $ | 222,451,262 | ||||||

| Net assets consist of | ||||||||||||

| Undistributed net investment income (loss) | (1,529,143 | ) | 383,239 | (8,110 | ) | |||||||

| Unrealized appreciation on securities | 2,815,150 | 10,860,443 | 13,706,802 | |||||||||

| Accumulated net realized gain (loss) | (25,548,242 | ) | 8,771,867 | 59,128 | ||||||||

| Capital paid-in | 653,831,864 | 213,814,566 | 208,693,442 | |||||||||

| Total net assets |

$ | 629,569,629 | $ | 233,830,115 | $ | 222,451,262 | ||||||

| Net asset value and offering per share | ||||||||||||

| Net assets investor shares | $ | 629,569,629 | $ | 233,830,115 | $ | 222,451,262 | ||||||

| Net assets institutional shares | - | - | - | |||||||||

| Shares outstanding investor shares | 28,864,439 | 10,895,187 | 12,592,794 | |||||||||

| Shares outstanding institutional shares | - | - | - | |||||||||

| Net asset values and redemption price per share | ||||||||||||

| (Net asset value divided by shares outstanding) |

||||||||||||

| Investor shares |

$ | 21.81 | $ | 21.46 | $ | 17.66 | ||||||

| Institutional shares |

- | - | - | |||||||||

The accompanying notes are an integral part of these financial statements.

37

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

STATEMENT OF OPERATIONS

Six Months Ended June 30, 2012 (unaudited)

| Parnassus Fund |

Parnassus Equity Income Fund |

Parnassus Fund |

||||||||||

| Investment income | ||||||||||||

| Dividends | ||||||||||||

| (net of foreign tax witholding of $0, $631,865, $3,057) |

$ | 2,312,333 | $ | 47,006,189 | $ | 546,682 | ||||||

| Interest | 6,491 | 258,471 | 597 | |||||||||

| Securities lending | 2,141 | 21,130 | 818 | |||||||||

| Total investment income |

$ | 2,320,965 | $ | 47,285,790 | $ | 548,097 | ||||||

| Expenses | ||||||||||||

| Investment advisory fees | 1,241,141 | 13,078,857 | 291,254 | |||||||||

| Transfer agent fees |

||||||||||||

| Investor shares |

184,604 | 667,538 | 30,072 | |||||||||

| Institutional shares |

- | 17,985 | - | |||||||||

| Fund administration | 71,860 | 811,403 | 12,883 | |||||||||

| Service provider fees | 155,201 | 3,412,760 | 49,131 | |||||||||

| Reports to shareholders | 38,453 | 289,014 | 8,548 | |||||||||

| Registration fees and expenses | 10,580 | 64,275 | 13,928 | |||||||||

| Custody fees | 20,977 | 78,497 | 2,913 | |||||||||

| Professional fees | 38,828 | 87,369 | 12,105 | |||||||||

| Trustee fees and expenses | 7,262 | 82,522 | 1,256 | |||||||||

| Proxy voting fees | 2,430 | 2,430 | 2,430 | |||||||||

| Pricing service fees | 2,007 | 3,589 | 2,007 | |||||||||

| Other expenses | 7,607 | 57,879 | 1,072 | |||||||||

| Total expenses |

$ | 1,780,950 | $ | 18,654,118 | $ | 427,599 | ||||||

| Fees waived by Parnassus Investments |

- | - | (15,844 | ) | ||||||||

| Net expenses |

$ | 1,780,950 | $ | 18,654,118 | $ | 411,755 | ||||||

| Net investment gain |

$ | 540,015 | $ | 28,631,672 | $ | 136,342 | ||||||

| Realized and unrealized gain on investments | ||||||||||||

| Net realized gain from securities transactions | 14,791,876 | 88,903,485 | 2,784,990 | |||||||||

| Net change in unrealized appreciation of securities | 26,152,192 | 153,134,871 | 3,329,147 | |||||||||

| Net realized and unrealized gain on securities | $ | 40,944,068 | $ | 242,038,356 | $ | 6,114,137 | ||||||

| Net increase in net assets resulting from operations | $ | 41,484,083 | $ | 270,670,028 | $ | 6,250,479 | ||||||

The accompanying notes are an integral part of these financial statements.

38

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

STATEMENT OF OPERATIONS

Six months ended June 30, 2012 (unaudited) (continued)

| Parnassus Fund |

Parnassus Workplace |

Parnassus Fund |

||||||||||

| Investment income | ||||||||||||

| Dividends | ||||||||||||

| (net of foreign tax witholding of $53,121, $0, $0) |

$ | 2,461,013 | $ | 1,698,099 | - | |||||||

| Interest | 3,267 | 1,551 | $ | 2,805,141 | ||||||||

| Securities lending | 36,598 | - | 202 | |||||||||

| Total investment income |

$ | 2,500,878 | $ | 1,699,650 | $ | 2,805,343 | ||||||

| Expenses | ||||||||||||

| Investment advisory fees | 2,910,422 | 952,561 | 536,769 | |||||||||

| Transfer agent fees |

||||||||||||

| Investor shares |

397,403 | 75,868 | 80,856 | |||||||||

| Institutional shares |

- | - | - | |||||||||

| Fund administration | 126,276 | 44,017 | 40,373 | |||||||||

| Service provider fees | 547,821 | 192,469 | 124,739 | |||||||||

| Reports to shareholders | 104,929 | 30,732 | 16,871 | |||||||||

| Registration fees and expenses | 22,251 | 17,543 | 17,461 | |||||||||

| Custody fees | 16,017 | 6,684 | 4,693 | |||||||||

| Professional fees | 32,317 | 16,114 | 26,299 | |||||||||

| Trustee fees and expenses | 13,207 | 4,430 | 4,336 | |||||||||

| Proxy voting fees | 2,430 | 2,430 | - | |||||||||

| Pricing service fees | 2,007 | 2,007 | 1,818 | |||||||||

| Other expenses | 11,246 | 3,359 | 3,161 | |||||||||

| Total expenses |

$ | 4,186,326 | $ | 1,348,214 | $ | 857,376 | ||||||

| Fees waived by Parnassus Investments |

(156,305 | ) | - | (46,670 | ) | |||||||

| Net expenses |

$ | 4,030,021 | $ | 1,348,214 | $ | 810,706 | ||||||

| Net investment gain (loss) |

$ | (1,529,143 | ) | $ | 351,436 | $ | 1,994,637 | |||||

| Realized and unrealized gain (loss) on investments | ||||||||||||

| Net realized gain (loss) from securities transactions | (19,722,313 | ) | 7,476,863 | (239 | ) | |||||||

| Net change in unrealized appreciation of securities | 77,479,393 | 11,692,271 | 1,846,602 | |||||||||

| Net realized and unrealized gain on securities | $ | 57,757,080 | $ | 19,169,134 | $ | 1,846,363 | ||||||

| Net increase in net assets resulting from operations | $ | 56,227,937 | $ | 19,520,570 | $ | 3,841,000 | ||||||

The accompanying notes are an integral part of these financial statements.

39

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2012 | |||

STATEMENT OF CHANGES IN NET ASSETS

| Parnassus Fund | Parnassus Equity Income Fund | |||||||||||||||

| Six Months Ended June 30, 2012 (unaudited) |

Year Ended December 31, 2011 |

Six Months Ended June 30, 2012 (unaudited) |

Year Ended December 31, 2011 |

|||||||||||||

| Investment income (loss) from operations | ||||||||||||||||

| Net investment income | $ | 540,015 | $ | 1,519,647 | $ | 28,631,672 | $ | 46,776,291 | ||||||||

| Net realized gain from securities transactions | 14,791,876 | 21,660,697 | 88,903,485 | 133,047,005 | ||||||||||||

| Net change in unrealized appreciation (depreciation) | 26,152,192 | (62,273,359 | ) | 153,134,871 | (68,072,705 | ) | ||||||||||

| Increase (decrease) in net assets resulting from operations | $ | 41,484,083 | $ | (39,093,015 | ) | $ | 270,670,028 | $ | 111,750,591 | |||||||

| Distributions | ||||||||||||||||

| From net investment income | ||||||||||||||||

| Investor shares |

- | (1,230,208 | ) | (23,080,915 | ) | (39,456,429 | ) | |||||||||

| Institutional shares |

- | - | (5,901,446 | ) | (7,634,701 | ) | ||||||||||

| From realized capital gains | ||||||||||||||||

| Investor shares |

- | (29,088,025 | ) | - | (55,849,963 | ) | ||||||||||

| Institutional shares |

- | - | - | (9,990,416 | ) | |||||||||||

| Distributions to shareholders | $ | - | $ | (30,318,233 | ) | $ | (28,982,361 | ) | $ | (112,931,509 | ) | |||||

| Capital share transactions | ||||||||||||||||

| Investor shares | ||||||||||||||||

| Proceeds from sale of shares |

44,058,566 | 179,826,213 | 444,522,572 | 967,612,081 | ||||||||||||

| Reinvestment of dividends |

- | 28,801,379 | 21,575,929 | 92,158,741 | ||||||||||||

| Shares repurchased |

(70,375,062 | ) | (229,101,779 | ) | (384,184,465 | ) | (810,600,550 | ) | ||||||||

| Institutional shares | ||||||||||||||||

| Proceeds from sale of shares |

- | - | 228,179,967 | 321,381,379 | ||||||||||||

| Reinvestment of dividends |

- | - | 4,513,337 | 15,273,239 | ||||||||||||

| Shares repurchased |

- | - | (58,333,947 | ) | (113,534,763 | ) | ||||||||||

| Increase (decrease) in net assets from capital share transactions |

(26,316,496 | ) | (20,474,187 | ) | 256,273,393 | 472,290,127 | ||||||||||

| Increase (decrease) in net assets | $ | 15,167,587 | $ | (89,885,435 | ) | $ | 497,961,060 | $ | 471,109,209 | |||||||

| Net Assets | ||||||||||||||||

| Beginning of year | 354,571,642 | 444,457,077 | 4,028,939,722 | 3,557,830,513 | ||||||||||||

| End of period | $ | 369,739,229 | $ | 354,571,642 | $ | 4,526,900,782 | $ | 4,028,939,722 | ||||||||

| Undistributed net investment income (loss) | $ | 855,632 | $ | 315,617 | $ | (321,165 | ) | $ | 29,524 | |||||||

| Shares issued and redeemed | ||||||||||||||||

| Investor shares | ||||||||||||||||

| Shares sold |

1,119,938 | 4,311,928 | 16,102,480 | 36,235,212 | ||||||||||||

| Shares issued through dividend reinvestment |

- | 837,999 | 768,586 | 3,565,198 | ||||||||||||

| Shares repurchased |

(1,795,616 | ) | (6,062,637 | ) | (13,895,464 | ) | (30,557,725 | ) | ||||||||

| Institutional shares | ||||||||||||||||

| Shares sold |

- | - | 8,258,768 | 12,036,031 | ||||||||||||

| Shares issued through dividend reinvestment |

- | - | 160,433 | 589,968 | ||||||||||||

| Shares repurchased |

- | - | (2,106,997 | ) | (4,221,855 | ) | ||||||||||

| Net increase (decrease) in shares outstanding | ||||||||||||||||

| Investor shares |

(675,678 | ) | (912,710 | ) | 2,975,602 | 9,242,685 | ||||||||||

| Institutional shares |

- | - | 6,312,204 | 8,404,144 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

40

Table of Contents

| Semiannual Report • 2012 | PARNASSUS FUNDS | |||

STATEMENT OF CHANGES IN NET ASSETS (continued)

| Parnassus Mid-Cap Fund | Parnassus Small-Cap Fund | |||||||||||||||

| Six Months Ended June 30, 2012 (unaudited) |

Year Ended December 31, 2011 |

Six Months Ended June 30, 2012 (unaudited) |

Year Ended December 31, 2011 |

|||||||||||||

| Investment income (loss) from operations | ||||||||||||||||

| Net investment income (loss) | $ | 136,342 | $ | 181,358 | $ | (1,529,143 | ) | $ | (1,337,105 | ) | ||||||

| Net realized gain (loss) from securities transactions | 2,784,990 | 2,458,404 | (19,722,313 | ) | 16,134,996 | |||||||||||

| Net change in unrealized appreciation (depreciation) | 3,329,147 | (2,410,283 | ) | 77,479,393 | (153,041,335 | ) | ||||||||||

| Increase (decrease) in net assets resulting from operations | $ | 6,250,479 | $ | 229,479 | $ | 56,227,937 | $ | (138,243,444 | ) | |||||||

| Distributions | ||||||||||||||||