Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2011

Table of Contents

PARNASSUS FUNDS®

ANNUAL REPORT ¡ DECEMBER 31, 2011

PARNASSUS FUNDS

| Parnassus FundSM | PARNX | |

| Parnassus Equity Income FundSM – Investor Shares | PRBLX | |

| Parnassus Equity Income Fund – Institutional Shares | PRILX | |

| Parnassus Mid-Cap FundSM | PARMX | |

| Parnassus Small-Cap FundSM | PARSX | |

| Parnassus Workplace Fund® | PARWX | |

| Parnassus Fixed-Income FundSM | PRFIX | |

Table of Contents

| Letter from Parnassus Investments | 4 | |||

| Fund Performance and Commentary | ||||

| Parnassus Fund | 6 | |||

| Parnassus Equity Income Fund | 10 | |||

| Parnassus Mid-Cap Fund | 14 | |||

| Parnassus Small-Cap Fund | 18 | |||

| Parnassus Workplace Fund | 20 | |||

| Parnassus Fixed-Income Fund | 22 | |||

| Responsible Investing Notes | 25 | |||

| Fund Expenses | 26 | |||

| Report of Independent Registered Public Accounting Firm |

27 | |||

| Portfolios of Investments | ||||

| Parnassus Fund | 28 | |||

| Parnassus Equity Income Fund | 30 | |||

| Parnassus Mid-Cap Fund | 32 | |||

| Parnassus Small-Cap Fund | 34 | |||

| Parnassus Workplace Fund | 36 | |||

| Parnassus Fixed-Income Fund | 38 | |||

| Financial Statements | 40 | |||

| Notes to Financial Statements | 47 | |||

| Financial Highlights | 55 | |||

| Additional Information | 59 | |||

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

February 10, 2012

Last year was a very difficult year for all investors, including shareholders of the Parnassus Funds. There was extreme volatility in the capital markets as stocks took heart-stopping plunges, only to be followed by remarkable recoveries. Economic problems are plaguing Europe, Asia and the Americas. Despite all this, the U.S. economy is making a slow, but steady recovery.

For 2011, three of our six funds beat their Lipper peers: the Equity Income Fund, the Mid-Cap Fund and the Fixed-Income Fund. Although the other three funds, the Parnassus Fund, the Workplace Fund and the Small-Cap Fund, all underperformed for the year, they are each substantially ahead of their Lipper peers and their market benchmarks for the three- and five-year periods.

I would like to thank all of you for investing with Parnassus. We’ll continue to work hard, investing in responsible companies that are good businesses and that are selling at attractive valuations.

Yours truly,

Jerome L. Dodson

President

4

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

5

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

Ticker: PARNX

As of December 31, 2011, the net asset value per share (“NAV”) of the Parnassus Fund was $35.23, so after taking dividends into account, the total return for the quarter was 17.33%. This compares to 11.80% for the S&P 500 Index (“S&P 500”) and 10.82% for the Lipper Multi-Cap Core Average, which represents the average multi-cap core fund followed by Lipper (“Lipper average”). For the quarter, we beat both our benchmarks by substantial amounts.

If we were to look at just the quarter, I would be delighted with our performance. Unfortunately, we have to look at our quarterly returns in the context of the entire year. For the year, we show a loss of 5.01%, compared to a gain of 2.09% for the S&P 500 and a loss of 2.68% for the Lipper average. As you can see, despite the strong quarter, we are far below our benchmarks for the year. Essentially, we fell into such a deep hole during the year, that the fourth quarter results were only a start to digging ourselves out. I’ll give more details on how we fell into that hole in the first place in the company analysis section.

Below is a table comparing the Parnassus Fund with the S&P 500 and the Lipper average over the past one-, three-, five- and ten-year periods. As you can see from the table, we’re lagging the indices for the one- and ten-year periods, but we’re substantially ahead of the benchmarks for the three- and five-year periods. On page 8 is a graph showing the growth of a hypothetical $10,000 investment in the Fund over the last ten years.

6

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

telecommunications market and an inventory correction brought soaring sales to a screeching halt. “Inventory correction” is a very innocuous-sounding term, but it can mean big swings in quarter-to-quarter earnings. Because the company’s products had been so much in demand, there were long lead times between when a customer ordered and when it could get delivery. During these times of perceived shortages, customers tended to order more products than they needed for their immediate use, so they would have plenty of inventory available. When lead times are reduced, customers feel more comfortable and figure they can get more supply whenever they need it, so they reduce orders or even stop ordering completely—at least for a while. This is what happened to Finisar. The weakness in China, the inventory correction and the less-than-anticipated capital expenditures by the telecommunications service-providers all combined to wreak havoc with the company’s stock.

7

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

who are working are reluctant to buy a new home if their neighbor lost a job or if they’re afraid of losing a job themselves.

This is truly a vicious circle. Weakness in the housing market hurts job creation, and weak job creation hurts the demand for housing. At some point, though, people will start buying homes in greater numbers, construction will pick up, new jobs will be created and this will fuel more demand for housing. This is the way it has always worked, and at some point it will happen again. Unfortunately, it’s impossible to predict exactly when this will happen. If the most recent recession were more typical, the housing market would have picked up at the end of 2009—about a year after the recession ended. By my reckoning, a housing pick-up is two years overdue. In any case, it should happen before too long, and at that point homebuilding stocks should move much higher.

There are already some glimmers of hope on the horizon, as prices seem to be firming and sales are picking up. The three housing stocks in our portfolio reflected these improved statistics. For the fourth quarter of 2011, DR Horton’s stock rose 39.5% from $9.04 to $12.61, Toll Brothers rose 41.5% from $14.43 to $20.42 and PulteGroup rose 59.8% from $3.95 to $6.31. They are still trading at very depressed levels, but they have moved much higher. It’s possible that this may signal the start of a recovery in housing.

The two stocks tied to consumer electronics that hurt the Fund during the year are Corning and MIPS Technologies. Corning makes special glass for computer screens, high-definition television sets, smart phones and other consumer electronic devices. Manufacturers reduced orders for glass, because they expected weaker sales of consumer-electronic items. At the end of November, Corning announced that it was temporarily shutting down 25% of its manufacturing capacity for special glass. The stock fell 32.8% during the year from $19.32 to $12.98, resulting in a loss of 40¢ per fund share.

MIPS Technologies designs the architecture for special semiconductors known as embedded processors and collects royalties for use of its designs in consumer products such as digital televisions, set-top boxes, WiFi access points and routers, as well as communication and entertainment products. The stock sank 41.9% from our average cost of $8.57, where we bought it during the year, to $4.98, where we sold it in the fourth quarter. Weak demand for consumer electronics sent the stock on a downward spiral. We bought the stock in hopes that its design for smart-phone processors would be accepted by a number of manufacturers who would achieve substantial sales with the MIPS design. Unfortunately, we came to the conclusion that MIPS could not break into the smart phone market in a substantial way, so we sold our shares.

The other stock that hurt the Fund during the year was Hewlett-Packard (HP), which sliced 78¢ off the NAV, as its stock dropped 38.8% from $42.10 to $25.76. In the last quarterly report, I wrote how a once-great company like HP had suffered a sharp decline, because of a dysfunctional board and weak management at the top. I indicated that we were still hanging on because the company still had some good products, and there were still some good people working there. Moreover, the stock was trading at very depressed levels. Since then, I have decided to exit the position, because there are a lot of other stocks trading at depressed levels that have better management and more upside potential.

8

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

Despite the difficult year for the Parnassus Fund, there were three stocks that each contributed 40¢ or more to the NAV. Our biggest winner was MasterCard, one of the world’s largest payment processors, whose stock soared 42.0% from $224.11 at the beginning of the year to $318.30, where we sold it late in the year. The stock added 69¢ to each fund share. At the beginning of 2011, the stock was under pressure because the Federal Reserve, acting under the Dodd-Frank Act’s Durbin Amendment, proposed reducing debit card fees from 44¢ to 12¢, a drop of 73%. In June, the Fed softened its original rule, establishing a 24¢ limit, or a 45% reduction. The Durbin Amendment also requires debit-card issuers to offer two unaffiliated networks for processing transactions, and this enables MasterCard to gain market share from Visa, the market-leader. The company reported strong earnings throughout the year.

Valeant Pharmaceuticals, a diversified drug company, added 45¢ to the NAV, as its stock climbed 33.4% from our cost of $36.80 to $49.09, where we sold it early in the year, because this equity met our target price. Earnings surged for the company, both because of strong performance in emerging markets and higher earnings in its U.S. and Canadian dermatology business.

W&T Offshore, an oil- and gas-producer, contributed 42¢ to the value of each fund share, as its stock climbed 18.7% from $17.87 to $21.21. Profits increased for W&T in 2011, as oil prices climbed from $91.38 to $99.65 a barrel, because of supply disruptions in Libya. The company also announced significant acquisitions of onshore oil assets in the West Texas Permian Basin, which diversified the company’s assets and provided significant growth opportunities.

Outlook and Strategy

This section represents my thoughts and applies to the three funds that I manage: the Parnassus Fund, the Parnassus Small-Cap Fund and the Parnassus Workplace Fund. The other portfolio managers will discuss their thoughts in their respective reports.

All three of my funds underperformed this year and all three lost money. This is the first time that has happened since the Small-Cap Fund and the Workplace Fund were established in 2005. Although the quotations for the funds and the stocks in them are down, I don’t think this means a permanent loss of capital for the Fund, or for our shareholders who maintain a long-term approach to investing. I can’t control what the market will pay for a given security at a given point in time, but I can make sure that we buy good businesses at prices that are below our estimates of intrinsic value. The market value of our stocks moved higher early in the year, then dropped as the economic outlook turned bleak and the stock market became very volatile. Investors sold off our stocks at prices that I consider far below fair value. Right now, my view is that stocks in the portfolios are undervalued.

It already looks as if our stocks are making a comeback in the fourth quarter. All three funds had substantial gains in the last three months of the year, with the Parnassus Fund up 17.33%, the Small-Cap Fund up 10.53% and the Workplace Fund up 13.48%. I expect this trend to continue into 2012. Economic indicators are looking better, including more jobs and an increase in manufacturing.

Given this outlook, I don’t plan to make major changes in the portfolios. When the recovery strengthens, our portfolios should do very well.

For December, there was a net increase of 200,000 jobs added to the American economy—up from a gain of 100,000 in the previous month. If this trend continues, the housing market will improve and our homebuilders should make some strong gains. As I indicated in the company analysis section, housing and jobs are closely related. More jobs will mean more housing construction, and the vicious circle I described earlier will become a virtuous circle with new construction creating more jobs and more jobs creating demand for more housing.

The telecommunications stocks we own should also do well with an economic recovery. As the economy picks up, people will buy more electronic devices that send and receive data across the internet, and service providers will have to invest more to expand their networks. This will give a big boost to our telecommunications stocks.

Nothing is guaranteed, of course, but I feel much more positive about the economy and our investments than I did about three months ago.

Yours truly,

Jerome L. Dodson

Portfolio Manager

9

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

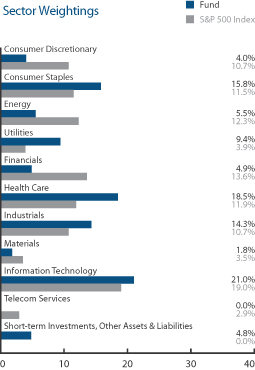

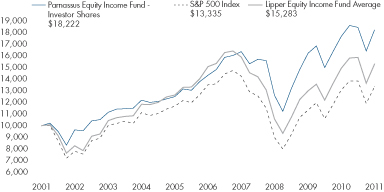

As of December 31, 2011, the NAV of the Parnassus Equity Income Fund-Investor Shares was $26.35. After taking dividends into account, the total return for the quarter was 11.01%. This compares to an increase of 11.80% for the S&P 500 Index (“S&P 500”) and an increase of 11.82% for the Lipper Equity Income Fund Average, which represents the average equity income fund followed by Lipper (“Lipper average”). For the year, the Fund rose 3.13% versus 2.09% for the S&P 500 and 3.11% for the Lipper average.

10

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

Our second biggest contributor to outperformance in 2011 was the materials sector, which added 54 basis points of outperformance. Our investments in this sector actually rose 13.3% during 2011, while the average materials stock in the S&P 500 fell 9.3%.

The Fund generated slight outperformance from the industrial, energy-utility and healthcare sectors, and was held back by the financials and telecommunications sectors. The only sector that had a significantly negative impact on the Fund was consumer staples, which trimmed our lead by 51 basis points versus the S&P 500. While we owned good companies, such as CVS Caremark, Procter & Gamble and foodservice company Sysco, our investments rose only 7.2%, much less than the

13.9% return for the S&P 500’s consumer staples category.

11

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

The Fund had six stocks that each increased the NAV by at least 15¢. MasterCard, the payment processing company, rose an amazing 66.4% during 2011 from $224.11 per share to $372.82 adding 46¢ to the Fund’s NAV. The company began 2011 with a murky regulatory outlook, as the Federal Reserve had not yet released its final debit fee rules. At the time, investors worried that the Federal Reserve would cut MasterCard’s debit-card “swipe-fees” to around 12¢ per transaction from 44¢ before the rule change. We bought a significant position in MasterCard after Parnassus senior analyst Matt Gershuny convinced me that investors were anticipating a near worst-case scenario for Senator Durbin’s legislation.

MasterCard’s stock soared in June when the Federal Reserve announced its final rules, which set the swipe fee at a higher-than-expected 24¢ per transaction. The stock continued to move up in the second half of 2011 after the company reported strong earnings growth that exceeded 35% for both the May and October quarters.

Valeant Pharmaceuticals had a fantastic year, and its stock boosted the Fund’s NAV by 27¢. The stock began the year at $28.29 per share and soared 74.9% by the time we sold it in May for an average price of $49.48. The big catalysts for the stock were Valeant’s successful integration of acquisitions, superb international growth, new dermatology products and a plan to acquire drug maker Cephalon.

We repurchased Valeant shares in September for an average cost of $37.85, and the stock subsequently rose 23.4% to its year-end price of $46.69. We bought the stock after it had dropped when pharmaceuticals giant Teva outbid Valeant to win control of Cephalon. Valeant’s stock bounced back by year-end after the company reported strong third quarter results and announced another attractive acquisition.

Google, the world’s leading internet search business, rose 8.7% from $593.97 to $645.90 and added 20¢ to the NAV. The company continued to strengthen its search, mobile and display advertising businesses in 2011.

Teleflex, a maker of single-use medical devices such as catheters, added 16¢ to the Fund’s NAV as its stock rose 13.9% for the year from $53.81 to $61.29. After several years of divesting a non-core division serving the automotive, aerospace and marine industries, Teleflex finally became a pure-play healthcare company in 2011. The stock rose, as investors now see a clear path to higher margins and consistent organic growth.

Gen-Probe, a company that sells molecular diagnostic equipment to screen blood and diagnose diseases, boosted the NAV by 15¢, even though its stock price increased just 1.3% in 2011 from $58.35 to $59.12. On April 28th, a rumor surfaced that Gen-Probe might be acquired. In response, the stock jumped 13% that day and soon reached a high of $87. Given the abrupt move in the stock, we trimmed our Gen-Probe position from 3% of Fund’s assets to 1% during the second quarter, realizing an average selling price of $82.30 per share.

12

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

Questar, a Utah-based natural gas utility, pipeline operator and energy production company, also boosted the NAV by 15¢, as the stock rose 14.1% from $17.41 per share to $19.86. The company is a unique, high-return, high-growth utility that was spun off from QEP Resources in 2010. I think this utility is a great long-term investment that can generate growth and dividends for many years to come.

Outlook and Strategy

The range of possible outcomes for the economy and financial markets for 2012 is unusually wide. In the bullish scenario, the world’s central bankers will likely play an important role. Since 2009, these bankers have been able to pull various levers to help the global economy avoid a disastrous downturn. If the economy finally breaks out of its doldrums in 2012, they should get credit for keeping business moving long enough for the animal spirits in the private market to come alive again. If a robust recovery comes this year, I’d expect earnings to grow, unemployment to abate and stock markets to rise meaningfully.

If this scenario plays out, our strategy is to gain as much as possible, within the limits imposed by our risk management discipline. Going back to 2007, there have been four calendar years in which the stock market has registered a positive return. In three of those four, the Fund beat the index, including in 2009, when the stock market rallied an amazing 26.5%. I certainly hope that the stock market is up this year, and if it is, that we once again outperform a rising index.

Unfortunately, I think the more likely scenario is that business activity will remain subdued. It’s even possible that there will be a worsening of the European debt crisis, a significant slowdown in China and a stalled, zero-growth economy in North America. These factors, and many others that we can’t possibly anticipate, would impact our portfolio companies and their stocks in various negative ways. Since U.S. corporate profit margins are unusually high at the moment, if Europe enters recession and the North American economy weakens, net incomes could drop for many companies, including those in the portfolio. Because most analysts expect record margins to continue, earnings would miss expectations in this scenario, leading to a stock market correction.

If this happens, my strategy would be to limit losses as much as possible. The reason I care so much about downside protection is simple: it’s far easier to recoup small losses than large ones. In fact, a significant contributor to our outperformance for the last five years is that the Fund suffered a much smaller loss in the 2008-2009 bear market than the index, and therefore recovered from that loss much faster in the subsequent bull market.

The Fund’s three biggest underweighted sectors versus the index are financials, energy and consumer discretionary. Our major overweighted sectors are healthcare, utilities and consumer staples. This positioning is defensive, consistent with my view that there’s meaningful downside risk for stocks in 2012. Notwithstanding my views about the potential risks to the economy, I’m confident in the long-term business prospects of the 39 companies owned by the Fund. No matter what happens in 2012, my team and our process should continue to deliver attractive risk-adjusted returns over the long-term.

Thank you for your trust and investment in the Parnassus Equity Income Fund.

Highest regards,

Todd C. Ahlsten

Portfolio Manager

13

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

Ticker: PARMX

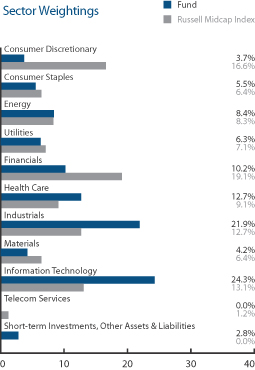

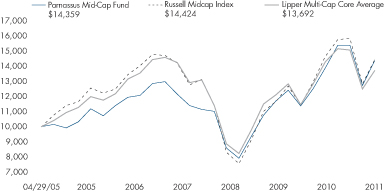

As of December 31, 2011, the NAV of the Parnassus Mid-Cap Fund was $17.69, so after taking dividends into account, the total return for the quarter was a gain of 12.78%. This compares to a gain of 12.31% for the Russell Midcap Index (the “Russell”) and a gain of 10.82% for the average multi-cap core fund followed by Lipper (the “Lipper average”). For the year, the Fund was up 3.33%, ahead of both the Russell’s loss of 1.55% and the Lipper average’s 2.68% loss. We are pleased that the Fund had a positive return in this volatile year and beat its money-losing benchmarks by such a wide margin.

Our strategy of investing in attractively valued businesses with secular growth opportunities, durable competitive advantages and quality management teams has enabled the Fund to beat its Lipper peers over the three-year and five-year periods and the period since inception. While we’ve outperformed the Russell over five years, we lag that index in the three-year and since inception periods.

Below is a table comparing the Parnassus Mid-Cap Fund with the Russell and the Lipper average for the one-, three- and five-year periods and for the period since inception on April 29, 2005. On page 16 is a graph showing the growth of a hypothetical $10,000 investment in the Fund since inception.

14

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

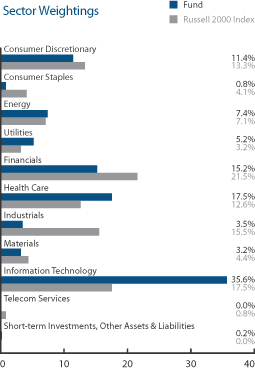

perform well over the long-term and regardless of the economic environment. Good stock picking in the healthcare, industrial and information technology sectors helped us the most this year, while poor stock selection in the financial and consumer staples sectors hurt the Fund.

On a sector basis, the Fund’s underweighted positions in financial and telecom services issues and overweighted position in the healthcare sector, all relative to the index, were the most positive allocation decisions for the year. We lost ground in the year due to the Fund being overweighted relative to the index in the technology sector and underweighted relative to the index in the consumer discretionary sector.

15

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

integrating and extracting value from the companies he purchases.

Verisk, a risk management and data-analytics company serving the insurance, mortgage and healthcare industries, added 14¢ to each fund share, as its stock price rose 18.6% from our average cost of $33.83 to $40.13. Despite good operating results throughout the year, the company’s stock was flat through October. Then the stock surged after management reported better-than-expected third quarter results and a positive outlook. This outlook is the result of a dominant competitive position, a high percentage of recurring revenue, sustainably strong margins and an aggressive acquisition and stock buyback plan.

Business analytics software company Teradata added 13¢ to each fund share this year, as its stock went up 17.9% from $41.16 to $48.51. Strong enterprise demand for its analytics solutions drove better-than-expected earnings throughout 2011, but the high point came in the second quarter, when management raised revenue guidance materially. This optimism was short-lived, though: as investors drove the stock down toward year-end, due to soft demand in Europe and delays in large enterprise deals. We added to our positions on this weakness, believing that Teradata’s business fundamentals are in good shape, and will drive better-than-expected earnings growth over the next few years.

Outlook and Strategy

The market has been volatile for some time now. The Russell was down 2% in 2011, up 25% in 2010, up 40% in 2009 and down 41% in 2008. These extreme swings have been driven by economic and political uncertainty, and not enough has changed to believe 2012 will bring anything different.

The uncertainty is currently driven by concern about the rates of growth for the U.S. and Chinese economies and the direction of the European financial crisis. We can see a positive scenario where the U.S. economy grows slowly, China has a soft landing and European leaders band together to solve their countries’ debt issues. It’s also possible that the U.S. and Chinese economies slow drastically and the euro zone dissolves. There is no consensus on the issues at hand, and the range of possible outcomes is wide.

Our overall bias is cautious, and our best guess is that the U.S. economy and markets will remain subdued. We continue to build the portfolio from the bottom-up, positioning it to perform well throughout the economic cycle. Our process has currently yielded a portfolio with above average returns on capital, a testament to our emphasis on companies with excellent competitive positions. While many of these stocks performed well in 2011, we think there’s more room to go, because they are still attractively valued.

16

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

Throughout the year, we increased our information technology exposure, taking advantage of volatility to buy high-quality businesses at good prices. We sold off some of our healthcare stocks because of valuation concerns and a belief that the government may cut spending in this area. We are most overweighted in the industrial and information technology sectors, owning businesses that are well-positioned to capture an increasing share in attractively growing end-markets. We remain underweighted in the consumer discretionary sector, where very few companies meet our competitive moat criterion.

Even in these volatile times, our overall strategy has resulted in excellent long-term results for investors. Since we began managing the Fund in October of 2008, its annualized total return is 8.48%, ahead of the Russell’s 7.42% and the Lipper’s 4.33%. While there will be up-years and down-years going forward, we’re confident that our strategy will yield attractive risk-adjusted returns in the long-run.

Thank you for your investment.

Yours truly,

|

|

| ||

| Matthew D. Gershuny | Benjamin E. Allen | Lori A. Keith | ||

| Portfolio Manager | Portfolio Manager | Portfolio Manager |

17

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

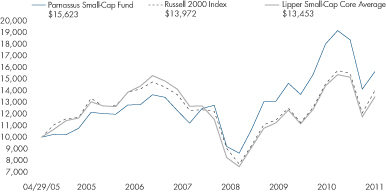

Ticker: PARSX

As of December 31, 2011, the NAV of the Parnassus Small-Cap Fund was $20.08, so after taking dividends into account, the total return for the quarter was 10.53%. This compares to a return of 15.47% for the Russell 2000 Index (“Russell 2000”) of smaller companies and 15.15% for the Lipper Small-Cap Core Average, which represents the average small-cap core fund followed by Lipper (“Lipper average”), so we underperformed both indices.

For the year, the Fund was down 13.29%, compared to a loss of 4.18% for the Russell 2000 and a loss of 3.41% for the Lipper average. I’ll talk about the reasons for the Fund’s poor performance in the company analysis section.

Below is a table comparing the performance of the Parnassus Small-Cap Fund with that of the Russell 2000 and the Lipper average over the past one-, three- and five-year periods and the period since inception. While our one-year number is very disappointing, we’re substantially ahead of both benchmarks for the three- and five-year periods and for the period since inception. On the following page is a graph showing the growth of a hypothetical $10,000 investment in the Fund since inception.

18

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

19

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

Ticker: PARWX

As of December 31, 2011, the NAV of the Parnassus Workplace Fund was $19.64, so after taking dividends into account, the total return for the quarter was 13.48%. This compares to a return of 11.80% for the Standard & Poor’s 500 Index (“S&P 500”) and 11.04% for the Lipper Large-Cap Core Average, which represents the average large-cap core fund followed by Lipper (“Lipper average”). We beat both indices by substantial amounts for the quarter, but unfortunately, it was not enough for the Fund to beat the benchmarks for the year.

For the year, the Fund was down 1.62%, compared to a gain of 2.09% for the S&P 500 and a loss of 0.66% for the Lipper average. I’ll talk about what caused our underperformance in the company analysis section of the report.

Below is a table comparing the Parnassus Workplace Fund with the S&P 500 and the Lipper average for the one-, three- and five-year periods and the period since inception. While we’re lagging our benchmarks for the one-year period, the Fund is way ahead of the indices for the three- and five-year periods and for the period since inception. On the following page is a graph showing the growth of a hypothetical $10,000 investment in the Fund since inception.

20

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

21

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

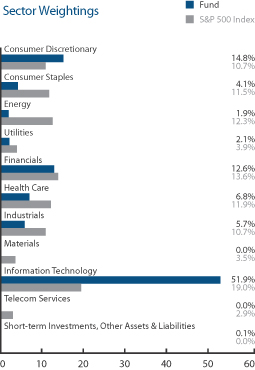

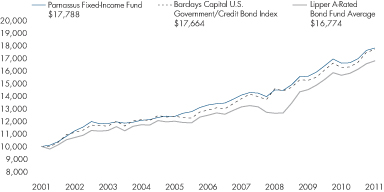

Ticker: PRFIX

As of December 31, 2011, the NAV of the Parnassus Fixed-Income Fund was $17.53, producing a total return for the quarter of 0.98% (including dividends). This compares to a gain of 1.18% for the Barclays Capital U.S. Government/Credit Bond Index (“Barclays Capital Index”) and a gain of 1.31% for the Lipper A-Rated Bond Fund Average, which represents the average return of all A-rated bond funds followed by Lipper (“Lipper average”). For the year, the Fund was up 7.24% compared to a gain of 8.74% for the Barclays Capital Index and a gain of 6.80% for the Lipper average.

Below is a table comparing the performance of the Fund with that of the Barclays Capital Index and the Lipper average. Average annual total returns are for the one-, three-, five- and ten-year periods. The 30-day SEC yield for the Fund for December 2011 was 0.95%. On the following page is a graph showing the growth of a hypothetical $10,000 investment in the Fund over the last 10 years.

22

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

the portfolio contributed positively to the NAV.

Our investments in U.S. Treasuries were the biggest winners, adding 89¢ to the NAV. Corporate bonds increased the NAV by 43¢ and our convertible bonds added 3¢.

For the year, the Fund lagged the Barclays Capital Index by 150 basis points, due to our lower exposure to U.S. government bonds and corporate bonds. On the other hand, the Fund outpaced the Lipper average by 44 basis points, as we benefited from our greater exposure to the strong U.S. Treasury bond market.

Outlook and Strategy

The consensus view that the U.S. will muddle through another year of slow growth and that Europe will find an orderly solution for its debt crisis is certainly possible. However, I’m still concerned about downside rather than upside risks to those scenarios. In my opinion, many of the problems that have undermined global economic growth are

| Parnassus Fixed-Income Fund as of December 31, 2011 (percentage of net assets) | ||

Sector Weightings

| U.S. Government Treasury Bonds | 58.1% | |||

| Corporate Bonds | 29.9% | |||

| Convertible Bonds | 1.4% | |||

| Short-term Investments, Other Assets & Liabilities | 10.6% | |||

|

|

|

|||

| 100.0% | ||||

Portfolio characteristics and holdings are subject to change periodically.

unresolved, with both public and private sector debt levels still too high. While some investors think that these issues will be solved quickly, deleveraging is a long-term process that hampers economic growth for many years.

I think that the situation in Europe remains a major risk factor. There are significant amounts of European government and bank debt that come due in 2012, at a time when the funding costs of Europe’s peripheral countries remain at near record highs. According to research by Goldman Sachs, there is a total of about €1 trillion of European government debt due to be refinanced or repaid in 2012, with more than €360 billion just in the first quarter.

Furthermore, the combination of slowing economic growth and global fiscal austerity measures has the potential to create an environment prone to political turmoil. At the same time, several countries, including the U.S., France, Russia and China, will appoint new political leaders or reappoint existing ones in 2012. It is unclear how these political transitions will impact economic growth, but they will surely increase uncertainty and volatility in financial markets.

While U.S. equity markets managed to decouple from the rest of the world in 2011, I think that it is precarious to assume that the U.S. economy can do the same. In my view, the global economy is now much more fragile and vulnerable to external shocks than it was a year ago. As such, I prefer to maintain a defensive investment strategy given the potential for downside risk.

23

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

As of the end of 2011, the Fund is positioned for slow economic growth and continued low interest rates. U.S. Treasuries should perform well in a slowing economy and provide downside protection to external economic shocks. These securities continue to be our largest holding, representing 58.1% of the Fund’s total net assets. The rest of the portfolio consists of corporate bonds (29.9%), cash and short-term securities (10.6%), and convertible bonds (1.4%).

As always, I remain vigilant to changes in the economic and financial outlook and will position the portfolio accordingly.

Thank you for your trust and investments in the Parnassus Fixed-Income Fund.

Yours truly,

Minh T. Bui

Portfolio Manager

24

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

By Milton Moskowitz

Reading the Financial Times on the last day of 2011, I came across a letter to the editor from Mr. Leonard S. Hyman of Sleepy Hollow, New York. He said:

So far this year we have seen the Arab spring, the Russian awakening and the Occupy movement. How about a “Stockholder spring” next, to wrest control of corporations from self-perpetuating boards of directors who overpay their chief executive pals to produce random results and overpay them even more when they screw up and have to be removed from office?

That rallying cry followed three mind-blowing blunders by corporations heretofore regarded as upstanding citizens with regard for their customers, employees and communities where they operate:

| • | First, the wildly successful movie rental company Netflix arbitrarily changed its pricing plan, touching off a stampede of exiting customers. More than 800,000 members fled. Netflix stock once sold for $304 a share; it ended 2011 at $69.29. |

| • | Then Bank of America, which became the largest bank in America via a string of acquisitions, announced that it would charge debit cardholders a monthly fee of $5. Customer outrage forced the bank to abandon this plan. |

| • | Verizon Wireless, the nation’s largest cellphone provider, decided to slap a $2 charge on customers who pay their bills online or over the phone. Negative reaction was immediate, with more than 100,000 customers signing an online petition for Verizon to drop the fee, which they did one day after announcing it. |

In some 50 years of business reporting I can’t remember a comparable consumer revolt, one that shamed companies into reversing a course of action so quickly. On the other hand, I could hardly believe that companies, in this day and age, would move ahead with new fees without doing some serious research on how their customers would react.

“The primary reason we get up in the morning to go to work is not to make money. The primary reason is to serve customers; the result is you make money.” This declaration comes from John Stumpf, CEO of Wells Fargo, in an interview appearing in the fall issue of DiversityInc, a magazine devoted to exploring diversity issues in business. Wells Fargo is the nation’s fourth largest bank and a major holding of the Parnassus Fund and the Parnassus Workplace Fund. In this candid interview, Stumpf laid out the position Wells holds: “We are the largest home lender to persons of color. We do more than anyone else with low- and moderate-income customers. Our portfolio, after all of this difficult time, has performed better than any of the large underwriters. In fact, it might come as a surprise to you that 93 percent of our borrowers are current on their mortgages, 5 percent are past due and about 2 percent are in some area of foreclosure. These numbers are better than the industry’s by 50 percent and better than some of our large bank competitors by maybe 100 percent.”

Good news also came at the end of the year from IBM, another holding of the Workplace Fund, when the information technology leader announced the selection of Virginia Rometty as CEO, succeeding Sam Palmisano, who said: “Ginni got it because she deserved it. It’s got zero to do with progressive social policies.” Rometty has been with IBM since 1981. Women account for 30% of the workforce at IBM and hold 29% of manager and executive positions. Only 11 other Fortune 500 companies have female CEOs. They are: Wellpoint, Xerox, Sunoco, Avon (Andrea Jung will soon be replaced), DuPont, TJX, KeyCorp, PepsiCo, Kraft, BJ’s Wholesale Club and Archer Daniels Midland.

In November, Cisco Systems, provider of switches and routers connecting computers to the internet, completed a challenging public-private partnership project in the state of Karnataka in southwest India. Karnataka is India’s 9th largest state, with a population of 61 million. The rural Raichur district in the state was ravaged by floods in 2009 — and Cisco contributed $10 million to relief efforts. The company then marshaled resources to construct houses in five villages and build a primary healthcare center. Using Cisco technology, the local government was able to bring healthcare services to an area that previously had none. Cisco also set up computer labs in 11 schools, donated 110 computers and used solar power to keep them running. D.V. Sadananda Gowda, chief minister of Karnataka, acknowledged what he called a “remarkable achievement,” praising Cisco for its commitment.

Milton Moskowitz is the co-author of the Fortune magazine survey, “The 100 Best Companies to Work For,” and the co-originator of the annual Working Mother magazine survey, “The 100 Best Companies for Working Mothers.” Mr. Moskowitz serves as a consultant to Parnassus Investments in evaluating workplaces for potential investments by the Parnassus Workplace Fund. Neither Fortune magazine nor Working Mother magazine has any role in the management of the Funds, and there is no affiliation between Parnassus and either publication.

25

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

As a shareholder of the Funds, you incur ongoing costs, which include portfolio management fees, administrative fees, shareholder reports, and other fund expenses. The Funds do not charge transaction fees, so you do not incur transaction costs such as sales charges (loads) on purchase payments, reinvested dividends, or other distributions, redemption fees, and exchange fees. The information on this page is intended to help you understand your ongoing costs of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The following example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the period of July 1, 2011 through December 31, 2011.

Actual Expenses

In the example below, the first line for each Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of each Fund provides information about hypothetical account values and hypothetical expenses based on the Fund’s expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. You may compare the ongoing costs of investing in the Fund with other mutual funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in the table are meant to highlight only your ongoing costs in these Funds. Therefore, the second line of each Fund is useful in comparing only ongoing costs and will not help you determine the relative total costs of owning other mutual funds, which may include transactional costs such as loads.

| Beginning July 1, 2011 |

Ending Account Value |

Expenses Paid

During Period* |

||||||||||

| Parnassus Fund: Actual | $1,000.00 | $945.92 | $4.86 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,020.21 | $5.04 | |||||||||

| Parnassus Equity Income Fund – Investor Shares: Actual | $1,000.00 | $987.26 | $4.96 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,020.21 | $5.04 | |||||||||

| Parnassus Equity Income Fund – Institutional Shares: Actual | $1,000.00 | $988.54 | $3.91 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,021.27 | $3.97 | |||||||||

| Parnassus Mid-Cap Fund: Actual | $1,000.00 | $932.61 | $5.85 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,019.16 | $6.11 | |||||||||

| Parnassus Small-Cap Fund: Actual | $1,000.00 | $849.77 | $5.59 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,019.16 | $6.11 | |||||||||

| Parnassus Workplace Fund: Actual | $1,000.00 | $952.20 | $5.90 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,019.16 | $6.11 | |||||||||

| Parnassus Fixed-Income Fund: Actual | $1,000.00 | $1,048.54 | $3.87 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,021.42 | $3.82 | |||||||||

* Expenses are equal to the Fund’s annualized expense ratio of 0.97%, 0.99%, 0.75%, 1.20%, 1.20%, 1.20% and 0.75% for the Parnassus Fund, Parnassus Equity Income Fund – Investor Shares, Parnassus Equity Income Fund – Institutional Shares, Parnassus Mid-Cap Fund, Parnassus Small-Cap Fund, Parnassus Workplace Fund and Parnassus Fixed-Income Fund, respectively, multiplied by the average account value over the period, multiplied by the ratio of days in the period. The ratio of days in the period is 184/365 (to reflect the one-half year period).

26

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of the Parnassus Funds and the Parnassus Income Funds

San Francisco, California

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of the Parnassus Funds (comprised of Parnassus Fund, Parnassus Mid-Cap Fund, Parnassus Small-Cap Fund and Parnassus Workplace Fund) and the Parnassus Income Funds (comprised of Parnassus Equity Income Fund and Parnassus Fixed-Income Fund) (collectively, the “Trusts”) as of December 31, 2011, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Trusts’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Trusts are not required to have, nor were we engaged to perform, an audit of their internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trusts’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2011, by correspondence with the custodian, where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the funds constituting the Parnassus Funds and the Parnassus Income Funds as of December 31, 2011, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

San Francisco, California

February 3, 2012

27

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

Portfolio of Investments as of December 31, 2011

The accompanying notes are an integral part of these financial statements.

28

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

PARNASSUS FUND

Portfolio of Investments as of December 31, 2011 (continued)

| Principal Amount ($) |

Short-Term Securities | Percent of Net Assets |

Market Value ($) |

|||||||||

| Community Development Loans a | ||||||||||||

| 200,000 | Boston Community Loan Fund 1.00%, matures 06/30/2012 |

194,032 | ||||||||||

| 200,000 | Root Capital Loan Fund 1.50%, matures 03/15/2012 |

197,568 | ||||||||||

| 100,000 | Vermont Community Loan Fund 1.00%, matures 10/15/2012 |

94,334 | ||||||||||

|

|

|

|||||||||||

| 0.1 | % | 485,934 | ||||||||||

|

|

|

|||||||||||

| Time Deposits | ||||||||||||

| 7,084,670 | BBH Cash Management Service | |||||||||||

| Bank of America, London, 0.03%, due 01/03/2012 |

2.0 | % | 7,084,670 | |||||||||

|

|

|

|||||||||||

| Securities Purchased with Cash Collateral from Securities Lending | ||||||||||||

| Registered Investment Companies | ||||||||||||

| 13,277,738 | Invesco Aim Government & Agency Portfolio Short-Term Investments Trust, Institutional Class variable rate, 0.02% |

3.7 | % | 13,277,738 | ||||||||

|

|

|

|||||||||||

| Total short-term securities (cost $21,741,233) |

6.1 | % | 21,741,233 | |||||||||

|

|

|

|||||||||||

| Total securities (cost $361,368,991) |

103.8 | % | 368,052,283 | |||||||||

|

|

|

|||||||||||

| Payable upon return of securities loaned | -3.7 | % | (13,277,738 | ) | ||||||||

| Other assets and liabilities - net | -0.1 | % | (202,903 | ) | ||||||||

|

|

|

|||||||||||

| Total net assets | 100.0 | % | 354,571,642 | |||||||||

|

|

|

|||||||||||

| q This security is non-income producing. |

| |||||||||||

| l This security, or partial position of this security, was on loan at December 31, 2011. The total value of the securities on loan at December 31, 2011 was $12,944,481. |

| |||||||||||

| a Market value adjustments have been applied to these securities to reflect early withdrawal. |

| |||||||||||

The accompanying notes are an integral part of these financial statements.

29

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

Portfolio of Investments as of December 31, 2011

The accompanying notes are an integral part of these financial statements.

30

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

PARNASSUS EQUITY INCOME FUND

Portfolio of Investments as of December 31, 2011 (continued)

The accompanying notes are an integral part of these financial statements.

31

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

Portfolio of Investments as of December 31, 2011

The accompanying notes are an integral part of these financial statements.

32

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

PARNASSUS MID-CAP FUND

Portfolio of Investments as of December 31, 2011 (continued)

| Principal Amount ($) |

Short-Term Securities | Percent of Net Assets |

Market Value ($) |

|||||||||

| Time Deposits | ||||||||||||

| 1,655,296 | BBH Cash Management Service | |||||||||||

| HSBC Bank USA, Grand Cayman, 0.03%, due 01/03/2012 |

2.7 | % | 1,655,296 | |||||||||

|

|

|

|||||||||||

| Total short-term securities (cost $1,655,296) |

2.7 | % | 1,655,296 | |||||||||

|

|

|

|||||||||||

| Total securities (cost $58,474,210) |

99.9 | % | 61,228,426 | |||||||||

|

|

|

|||||||||||

| Other assets and liabilities - net | 0.1 | % | 70,880 | |||||||||

|

|

|

|||||||||||

| Total net assets | 100.0 | % | 61,299,306 | |||||||||

|

|

|

|||||||||||

| q This security is non-income producing. |

| |||||||||||

The accompanying notes are an integral part of these financial statements.

33

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

Portfolio of Investments as of December 31, 2011

The accompanying notes are an integral part of these financial statements.

34

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

PARNASSUS SMALL-CAP FUND

Portfolio of Investments as of December 31, 2011 (continued)

| Principal Amount ($) |

Short-Term Securities | Percent of Net Assets |

Market Value ($) |

|||||||||

| Time Deposits | ||||||||||||

| 3,717,167 | BBH Cash Management Service | |||||||||||

| Bank of America, London, 0.03%, due 01/03/2012 |

0.6 | % | 3,717,167 | |||||||||

|

|

|

|||||||||||

| Securities Purchased with Cash Collateral from Securities Lending |

|

|||||||||||

| Registered Investment Companies | ||||||||||||

| 53,983,935 | Invesco Aim Government & Agency Portfolio Short-Term Investments Trust, Institutional Class variable rate, 0.02% | 8.4 | % | 53,983,935 | ||||||||

|

|

|

|||||||||||

| Total short-term securities (cost $57,701,102) |

9.0 | % | 57,701,102 | |||||||||

|

|

|

|||||||||||

| Total securities (cost $776,180,795) |

108.8 | % | 701,516,552 | |||||||||

|

|

|

|||||||||||

| Payable upon return of securities loaned | -8.4 | % | (53,983,935 | ) | ||||||||

| Other assets and liabilities - net | -0.4 | % | (2,707,564 | ) | ||||||||

|

|

|

|||||||||||

| Total net assets | 100.0 | % | 644,825,053 | |||||||||

|

|

|

|||||||||||

| q This security is non-income producing. |

| |||||||||||

| l This security, or partial position of this security, was on loan at December 31, 2011. The total value of the securities on loan at December 31, 2011 was $52,600,545. |

| |||||||||||

The accompanying notes are an integral part of these financial statements.

35

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

Portfolio of Investments as of December 31, 2011

The accompanying notes are an integral part of these financial statements.

36

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

PARNASSUS WORKPLACE FUND

Portfolio of Investments as of December 31, 2011 (continued)

| Principal Amount ($) |

Short-Term Securities | Percent of Net Assets |

Market Value ($) |

|||||||||

| Time Deposits | ||||||||||||

| 286,583 | BBH Cash Management Service | |||||||||||

| Bank of America, London, 0.03%, due 01/03/2012 |

0.1 | % | 286,583 | |||||||||

|

|

|

|||||||||||

| Total short-term securities (cost $286,583) |

0.1 | % | 286,583 | |||||||||

|

|

|

|||||||||||

| Total securities (cost $217,101,945) |

100.0 | % | 216,270,118 | |||||||||

|

|

|

|||||||||||

| Other assets and liabilities - net | -0.0 | % | (1,454 | ) | ||||||||

|

|

|

|||||||||||

| Total net assets | 100.0 | % | 216,268,664 | |||||||||

|

|

|

|||||||||||

| q This security is non-income producing. |

| |||||||||||

The accompanying notes are an integral part of these financial statements.

37

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

Portfolio of Investments as of December 31, 2011

The accompanying notes are an integral part of these financial statements.

38

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

PARNASSUS FIXED-INCOME FUND

Portfolio of Investments as of December 31, 2011 (continued)

The accompanying notes are an integral part of these financial statements.

39

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2011

| Parnassus Fund |

Parnassus Equity Income Fund |

Parnassus Mid-Cap Fund |

||||||||||

| Assets | ||||||||||||

| Investments in common stocks and bonds, at market value | ||||||||||||

| (cost $339,627,758, $3,398,167,276, $56,818,914) |

$ | 346,311,050 | $ | 3,834,735,822 | $ | 59,573,130 | ||||||

| Investments in short-term securities | ||||||||||||

| (at cost which approximates market value) |

21,741,233 | 187,869,739 | 1,655,296 | |||||||||

| Cash | 168,869 | 253,367 | - | |||||||||

| Receivables | ||||||||||||

| Dividends and interest |

183,342 | 4,139,845 | 66,188 | |||||||||

| Capital shares sold |

222,811 | 10,145,507 | 144,685 | |||||||||

| Other assets | 37,977 | 128,981 | 19,449 | |||||||||

| Total assets |

$ | 368,665,282 | $ | 4,037,273,261 | $ | 61,458,748 | ||||||

| Liabilities | ||||||||||||

| Payable upon return of loaned securities | 13,277,738 | - | - | |||||||||

| Capital shares redeemed | 330,651 | 5,397,951 | 80,098 | |||||||||

| Fees payable to Parnassus Investments | 240,899 | 2,261,165 | 52,246 | |||||||||

| Accounts payable and accrued expenses | 244,352 | 674,423 | 27,098 | |||||||||

| Total liabilities |

$ | 14,093,640 | $ | 8,333,539 | $ | 159,442 | ||||||

| Net assets | $ | 354,571,642 | $ | 4,028,939,722 | $ | 61,299,306 | ||||||

| Net assets consist of | ||||||||||||

| Undistributed net investment income | 315,617 | 29,524 | 18,934 | |||||||||

| Unrealized appreciation on securities | 6,683,292 | 436,568,546 | 2,754,216 | |||||||||

| Accumulated net realized gain (loss) | 200,956 | 12,339,595 | (39,538 | ) | ||||||||

| Capital paid-in | 347,371,777 | 3,580,002,057 | 58,565,694 | |||||||||

| Total net assets |

$ | 354,571,642 | $ | 4,028,939,722 | $ | 61,299,306 | ||||||

| Net asset value and offering per share | ||||||||||||

| Net assets investor shares | $ | 354,571,642 | $ | 3,398,904,454 | $ | 61,299,306 | ||||||

| Net assets institutional shares | - | $ | 630,035,268 | - | ||||||||

| Shares outstanding investor shares | 10,065,420 | 128,987,335 | 3,464,792 | |||||||||

| Shares outstanding institutional shares | - | 23,858,224 | - | |||||||||

| Net asset values and redemption price per share | ||||||||||||

| (Net asset value divided by shares outstanding) |

||||||||||||

| Investor shares |

$ | 35.23 | $ | 26.35 | $ | 17.69 | ||||||

| Institutional shares |

- | $ | 26.41 | - | ||||||||

The accompanying notes are an integral part of these financial statements.

40

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2011

| Parnassus Small-Cap Fund |

Parnassus Workplace Fund |

Parnassus Fixed-Income Fund |

||||||||||

| Assets | ||||||||||||

| Investments in common stocks and bonds, at market value | ||||||||||||

| (cost $718,479,693, $216,815,362, $177,405,424) |

$ | 643,815,450 | $ | 215,983,535 | $ | 189,265,624 | ||||||

| Investments in short-term securities | ||||||||||||

| (at cost which approximates market value) |

57,701,102 | 286,583 | 20,599,127 | |||||||||

| Cash | - | - | - | |||||||||

| Receivables | ||||||||||||

| Dividends and interest |

272,754 | 266,671 | 1,598,305 | |||||||||

| Capital shares sold |

528,765 | 164,266 | 451,281 | |||||||||

| Other assets | 64,497 | 27,402 | 14,241 | |||||||||

| Total assets |

$ | 702,382,568 | $ | 216,728,457 | $ | 211,928,578 | ||||||

| Liabilities | ||||||||||||

| Payable upon return of loaned securities | 53,983,935 | - | - | |||||||||

| Capital shares redeemed | 2,920,243 | 238,588 | 55,461 | |||||||||

| Fees payable to Parnassus Investments | 539,565 | 171,228 | 95,088 | |||||||||

| Accounts payable and accrued expenses | 113,772 | 49,977 | 55,526 | |||||||||

| Total liabilities |

$ | 57,557,515 | $ | 459,793 | $ | 206,075 | ||||||

| Net assets | $ | 644,825,053 | $ | 216,268,664 | $ | 211,722,503 | ||||||

| Net assets consist of | ||||||||||||

| Undistributed net investment income | - | 31,803 | 220,893 | |||||||||

| Unrealized appreciation (depreciation) on securities | (74,664,243 | ) | (831,827 | ) | 11,860,200 | |||||||

| Accumulated net realized gain (loss) | (5,825,929 | ) | 1,295,004 | 59,367 | ||||||||

| Capital paid-in | 725,315,225 | 215,773,684 | 199,582,043 | |||||||||

| Total net assets |

$ | 644,825,053 | $ | 216,268,664 | $ | 211,722,503 | ||||||

| Net asset value and offering per share | ||||||||||||

| Net assets investor shares | $ | 644,825,053 | $ | 216,268,664 | $ | 211,722,503 | ||||||

| Net assets institutional shares | - | - | - | |||||||||

| Shares outstanding investor shares | 32,116,572 | 11,010,870 | 12,074,611 | |||||||||

| Shares outstanding institutional shares | - | - | - | |||||||||

| Net asset values and redemption price per share | ||||||||||||

| (Net asset value divided by shares outstanding) |

||||||||||||

| Investor shares |

$ | 20.08 | $ | 19.64 | $ | 17.53 | ||||||

| Institutional shares |

- | - | - | |||||||||

The accompanying notes are an integral part of these financial statements.

41

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

STATEMENT OF OPERATIONS

Year ended December 31, 2011

| Parnassus Fund |

Parnassus Equity Income Fund |

Parnassus Mid-Cap Fund |

||||||||||

| Investment income | ||||||||||||

| Dividends | ||||||||||||

| (net of foreign tax witholding of $0, $340,981, $0) |

$ | 5,789,331 | $ | 81,121,434 | $ | 810,043 | ||||||

| Interest | 17,804 | 50,727 | 510 | |||||||||

| Securities lending | 20,276 | 291,594 | 694 | |||||||||

| Other income | - | 17,220 | - | |||||||||

| Total investment income |

$ | 5,827,411 | $ | 81,480,975 | $ | 811,247 | ||||||

| Expenses | ||||||||||||

| Investment advisory fees | 2,954,041 | 23,769,903 | 445,027 | |||||||||

| Transfer agent fees | ||||||||||||

| Investor shares |

392,080 | 1,052,888 | 47,478 | |||||||||

| Institutional shares |

- | 12,656 | - | |||||||||

| Fund administration | 204,490 | 1,667,199 | 22,447 | |||||||||

| Service provider fees | 463,186 | 6,879,893 | 77,796 | |||||||||

| Reports to shareholders | 90,902 | 597,448 | 16,044 | |||||||||

| Registration fees and expenses | 25,506 | 85,479 | 11,603 | |||||||||

| Custody fees | 32,546 | 160,259 | 5,013 | |||||||||

| Overdraft charges | 30,852 | - | 178 | |||||||||

| Professional fees | 73,054 | 230,732 | 14,276 | |||||||||

| Trustee fees and expenses | 17,486 | 139,808 | 1,446 | |||||||||

| Proxy voting fees | 4,884 | 4,884 | 4,884 | |||||||||

| Pricing service fees | 3,183 | 6,136 | 3,523 | |||||||||

| Other expenses | 15,554 | 97,399 | 1,880 | |||||||||

| Total expenses |

$ | 4,307,764 | $ | 34,704,684 | $ | 651,595 | ||||||

| Fees waived by Parnassus Investments |

- | - | (21,706 | ) | ||||||||

| Net expenses |

$ | 4,307,764 | $ | 34,704,684 | $ | 629,889 | ||||||

| Net investment income |

$ | 1,519,647 | $ | 46,776,291 | $ | 181,358 | ||||||

| Realized and unrealized gain (loss) on investments | ||||||||||||

| Net realized gain from securities transactions | 21,660,697 | 133,047,005 | 2,458,404 | |||||||||

| Net change in unrealized depreciation of securities | (62,273,359 | ) | (68,072,705 | ) | (2,410,283 | ) | ||||||

| Net realized and unrealized gain (loss) on securities | $ | (40,612,662 | ) | $ | 64,974,300 | $ | 48,121 | |||||

| Net increase (decrease) in net assets resulting from operations | $ | (39,093,015 | ) | $ | 111,750,591 | $ | 229,479 | |||||

The accompanying notes are an integral part of these financial statements.

42

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

STATEMENT OF OPERATIONS

Year ended December 31, 2011

| Parnassus Small-Cap Fund |

Parnassus Workplace Fund |

Parnassus Fixed-Income Fund |

||||||||||

| Investment income | ||||||||||||

| Dividends | ||||||||||||

| (net of foreign tax witholding of $64,800, $0, $0) |

$ | 7,590,575 | $ | 3,007,600 | $ | - | ||||||

| Interest | 8,517 | 2,232 | 5,097,282 | |||||||||

| Securities lending | 89,987 | 146 | 66 | |||||||||

| Other income | - | - | - | |||||||||

| Total investment income |

$ | 7,689,079 | $ | 3,009,978 | $ | 5,097,348 | ||||||

| Expenses | ||||||||||||

| Investment advisory fees | 6,448,535 | 1,778,215 | 951,964 | |||||||||

| Transfer agent fees | ||||||||||||

| Investor shares |

705,100 | 141,695 | 134,325 | |||||||||

| Institutional shares |

- | - | - | |||||||||

| Fund administration | 325,162 | 93,843 | 82,520 | |||||||||

| Service provider fees | 1,327,037 | 377,649 | 243,326 | |||||||||

| Reports to shareholders | 129,491 | 41,733 | 43,281 | |||||||||

| Registration fees and expenses | 20,823 | 20,776 | 36,781 | |||||||||

| Custody fees | 42,050 | 13,155 | 10,614 | |||||||||

| Overdraft charges |

34,883 | 1,805 | - | |||||||||

| Professional fees | 82,765 | 40,717 | 31,065 | |||||||||

| Trustee fees and expenses | 17,360 | 5,640 | 6,662 | |||||||||

| Proxy voting fees | 4,884 | 4,884 | - | |||||||||

| Pricing service fees | 3,493 | 3,518 | 3,034 | |||||||||

| Other expenses | 12,842 | 5,525 | 6,242 | |||||||||

| Total expenses |

$ | 9,154,425 | $ | 2,529,155 | $ | 1,549,814 | ||||||

| Fees waived by Parnassus Investments |

(128,241 | ) | - | (116,324 | ) | |||||||

| Net expenses |

$ | 9,026,184 | $ | 2,529,155 | $ | 1,433,490 | ||||||

| Net investment income (loss) |

$ | (1,337,105 | ) | $ | 480,823 | $ | 3,663,858 | |||||

| Realized and unrealized gain (loss) on investments | ||||||||||||

| Net realized gain from securities transactions | 16,134,996 | 8,947,643 | 2,474,277 | |||||||||

| Net change in unrealized appreciation (depreciation) of securities | (153,041,335 | ) | (21,143,733 | ) | 7,242,197 | |||||||

| Net realized and unrealized gain (loss) on securities | $ | (136,906,339 | ) | $ | (12,196,090 | ) | $ | 9,716,474 | ||||

| Net increase (decrease) in net assets resulting from operations | $ | (138,243,444 | ) | $ | (11,715,267 | ) | $ | 13,380,332 | ||||

The accompanying notes are an integral part of these financial statements.

43

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

STATEMENT OF CHANGES IN NET ASSETS

December 31, 2011

| Parnassus Fund | Parnassus Equity Income Fund | |||||||||||||||

| Year Ended December 31, 2011 |

Year Ended December 31, 2010 |

Year Ended December 31, 2011 |

Year Ended December 31, 2010 |

|||||||||||||

| Investment income (loss) from operations | ||||||||||||||||

| Net investment income | $ | 1,519,647 | $ | 1,647,357 | $ | 46,776,291 | $ | 37,746,247 | ||||||||

| Net realized gain from securities transactions | 21,660,697 | 19,219,271 | 133,047,005 | 91,923,881 | ||||||||||||

| Net change in unrealized appreciation (depreciation) | (62,273,359 | ) | 39,426,194 | (68,072,705 | ) | 150,761,420 | ||||||||||

| Increase (decrease) in net assets resulting from operations | $ | (39,093,015 | ) | $ | 60,292,822 | $ | 111,750,591 | $ | 280,431,548 | |||||||

| Distributions | ||||||||||||||||

| From net investment income | ||||||||||||||||

| Investor shares |

(1,230,208 | ) | (1,621,180 | ) | (39,456,429 | ) | (33,871,684 | ) | ||||||||

| Institutional shares |

- | - | (7,634,701 | ) | (3,890,635 | ) | ||||||||||

| From realized capital gains | ||||||||||||||||

| Investor shares |

(29,088,025 | ) | - | (55,849,963 | ) | - | ||||||||||

| Institutional shares |

- | - | (9,990,416 | ) | - | |||||||||||

| Distributions to shareholders | $ | (30,318,233 | ) | $ | (1,621,180 | ) | $ | (112,931,509 | ) | $ | (37,762,319 | ) | ||||

| Capital share transactions | ||||||||||||||||

| Investor shares | ||||||||||||||||

| Proceeds from sale of shares |

179,826,213 | 108,558,919 | 967,612,081 | 1,219,844,958 | ||||||||||||

| Reinvestment of dividends |

28,801,379 | 1,548,830 | 92,158,741 | 33,139,497 | ||||||||||||

| Shares repurchased |

(229,101,779 | ) | (75,498,210 | ) | (810,600,550 | ) | (685,833,625 | ) | ||||||||

| Institutional shares | ||||||||||||||||

| Proceeds from sale of shares |

- | - | 321,381,379 | 281,722,238 | ||||||||||||

| Reinvestment of dividends |

- | - | 15,273,239 | 3,235,103 | ||||||||||||

| Shares repurchased |

- | - | (113,534,763 | ) | (94,625,834 | ) | ||||||||||

| Increase (decrease) in net assets from capital share transactions |

(20,474,187 | ) | 34,609,539 | 472,290,127 | 757,482,337 | |||||||||||

| Increase (decrease) in net assets | $ | (89,885,435 | ) | $ | 93,281,181 | $ | 471,109,209 | $ | 1,000,151,566 | |||||||

| Net Assets | ||||||||||||||||

| Beginning of year | 444,457,077 | 351,175,896 | 3,557,830,513 | 2,557,678,947 | ||||||||||||

| End of year | $ | 354,571,642 | $ | 444,457,077 | $ | 4,028,939,722 | $ | 3,557,830,513 | ||||||||

| Undistributed net investment income | $ | 315,617 | $ | 26,176 | $ | 29,524 | $ | 344,364 | ||||||||

| Shares issued and redeemed | ||||||||||||||||

| Investor shares | ||||||||||||||||

| Shares sold |

4,311,928 | 2,955,182 | 36,235,212 | 49,635,760 | ||||||||||||

| Shares issued through dividend reinvestment |

837,999 | 38,167 | 3,565,198 | 1,340,670 | ||||||||||||

| Shares repurchased |

(6,062,637 | ) | (2,099,485 | ) | (30,557,725 | ) | (27,929,800 | ) | ||||||||

| Institutional shares | ||||||||||||||||

| Shares sold |

- | - | 12,036,031 | 11,329,212 | ||||||||||||

| Shares issued through dividend reinvestment |

- | - | 589,968 | 128,733 | ||||||||||||

| Shares repurchased |

- | - | (4,221,855 | ) | (3,878,344 | ) | ||||||||||

| Net increase (decrease) in shares outstanding | ||||||||||||||||

| Investor shares |

(912,710 | ) | 893,864 | 9,242,685 | 23,046,630 | |||||||||||

| Institutional shares |

- | - | 8,404,144 | 7,579,601 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

44

Table of Contents

| Annual Report • 2011 | PARNASSUS FUNDS | |||

STATEMENT OF CHANGES IN NET ASSETS

December 31, 2011

| Parnassus Mid-Cap Fund | Parnassus Small-Cap Fund | |||||||||||||||

| Year Ended December 31, 2011 |

Year Ended December 31, 2010 |

Year Ended December 31, 2011 |

Year Ended December 31, 2010 |

|||||||||||||

| Investment income (loss) from operations | ||||||||||||||||

| Net investment income (loss) | $ | 181,358 | $ | 490,576 | $ | (1,337,105 | ) | $ | 1,715,829 | |||||||

| Net realized gain from securities transactions | 2,458,404 | 3,122,398 | 16,134,996 | 9,954,404 | ||||||||||||

| Net change in unrealized appreciation (depreciation) | (2,410,283 | ) | 1,604,084 | (153,041,335 | ) | 69,299,921 | ||||||||||

| Increase (decrease) in net assets resulting from operations | $ | 229,479 | $ | 5,217,058 | $ | (138,243,444 | ) | $ | 80,970,154 | |||||||

| Distributions | ||||||||||||||||

| From net investment income | ||||||||||||||||

| Investor shares |

(450,005 | ) | (480,784 | ) | (35,590 | ) | (8,409,293 | ) | ||||||||

| Institutional shares |

- | - | - | - | ||||||||||||

| From realized capital gains | ||||||||||||||||

| Investor shares |

(3,039,992 | ) | (1,426,771 | ) | (21,757,794 | ) | (2,740,344 | ) | ||||||||

| Institutional shares |

- | - | - | - | ||||||||||||

| Distributions to shareholders | $ | (3,489,997 | ) | $ | (1,907,555 | ) | $ | (21,793,384 | ) | $ | (11,149,637 | ) | ||||

| Capital share transactions | ||||||||||||||||

| Investor shares | ||||||||||||||||

| Proceeds from sale of shares |

38,918,732 | 13,716,267 | 825,392,677 | 317,694,405 | ||||||||||||

| Reinvestment of dividends |

3,319,828 | 1,831,250 | 20,071,960 | 10,453,640 | ||||||||||||

| Shares repurchased |

(14,489,838 | ) | (4,850,207 | ) | (485,945,780 | ) | (67,793,100 | ) | ||||||||

| Institutional shares | ||||||||||||||||

| Proceeds from sale of shares |

- | - | - | - | ||||||||||||

| Reinvestment of dividends |

- | - | - | - | ||||||||||||

| Shares repurchased |

- | - | - | - | ||||||||||||

| Increase in net assets from capital share transactions |

27,748,722 | 10,697,310 | 359,518,857 | 260,354,945 | ||||||||||||

| Increase in net assets | $ | 24,488,204 | $ | 14,006,813 | $ | 199,482,029 | $ | 330,175,462 | ||||||||

| Net Assets | ||||||||||||||||

| Beginning of year | 36,811,102 | 22,804,289 | 445,343,024 | 115,167,562 | ||||||||||||

| End of year | $ | 61,299,306 | $ | 36,811,102 | $ | 644,825,053 | $ | 445,343,024 | ||||||||

| Undistributed net investment income | $ | 18,934 | $ | 15,964 | $ | - | $ | 35,186 | ||||||||

| Shares issued and redeemed | ||||||||||||||||

| Investor shares | ||||||||||||||||

| Shares sold |

2,033,779 | 801,243 | 34,269,675 | 15,126,404 | ||||||||||||

| Shares issued through dividend reinvestment |

192,228 | 103,987 | 1,005,620 | 445,118 | ||||||||||||

| Shares repurchased |

(778,154 | ) | (289,219 | ) | (21,751,350 | ) | (3,406,806 | ) | ||||||||

| Institutional shares | ||||||||||||||||

| Shares sold |

- | - | - | - | ||||||||||||

| Shares issued through dividend reinvestment |

- | - | - | - | ||||||||||||

| Shares repurchased |

- | - | - | - | ||||||||||||

| Net increase in shares outstanding | ||||||||||||||||

| Investor shares |

1,447,853 | 616,011 | 13,523,945 | 12,164,716 | ||||||||||||

| Institutional shares |

- | - | - | - | ||||||||||||

The accompanying notes are an integral part of these financial statements.

45

Table of Contents

| PARNASSUS FUNDS | Annual Report • 2011 | |||

STATEMENT OF CHANGES IN NET ASSETS

December 31, 2011

| Parnassus Workplace Fund | Parnassus Fixed-Income Fund | |||||||||||||||

| Year Ended December 31, 2011 |

Year Ended December 31, 2010 |

Year Ended December 31, 2011 |

Year Ended December 31, 2010 |

|||||||||||||

| Investment income (loss) from operations | ||||||||||||||||

| Net investment income | $ | 480,823 | $ | 111,346 | $ | 3,663,858 | $ | 4,278,348 | ||||||||

| Net realized gain from securities transactions | 8,947,643 | 8,131,360 | 2,474,277 | 5,172,860 | ||||||||||||

| Net change in unrealized appreciation (depreciation) | (21,143,733 | ) | 6,213,040 | 7,242,197 | 325,195 | |||||||||||

| Increase (decrease) in net assets resulting from operations | $ | (11,715,267 | ) | $ | 14,455,746 | $ | 13,380,332 | $ | 9,776,403 | |||||||

| Distributions | ||||||||||||||||

| From net investment income | ||||||||||||||||

| Investor shares |

(591,417 | ) | (3,409,715 | ) | (3,789,113 | ) | (5,798,487 | ) | ||||||||

| Institutional shares |

- | - | - | - | ||||||||||||

| From realized capital gains | ||||||||||||||||

| Investor shares |

(8,160,168 | ) | (4,022,229 | ) | (2,720,539 | ) | (3,634,397 | ) | ||||||||

| Institutional shares |

- | - | - | - | ||||||||||||

| Distributions to shareholders | $ | (8,751,585 | ) | $ | (7,431,944 | ) | $ | (6,509,652 | ) | $ | (9,432,884 | ) | ||||

| Capital share transactions | ||||||||||||||||

| Investor shares | ||||||||||||||||

| Proceeds from sale of shares |

199,444,524 | 100,942,506 | 69,977,815 | 70,767,524 | ||||||||||||

| Reinvestment of dividends |

8,211,012 | 7,163,399 | 5,930,625 | 8,686,082 | ||||||||||||

| Shares repurchased |

(114,410,804 | ) | (66,938,672 | ) | (51,243,059 | ) | (37,534,327 | ) | ||||||||

| Institutional shares | ||||||||||||||||

| Proceeds from sale of shares |

- | - | - | - | ||||||||||||

| Reinvestment of dividends |

- | - | - | - | ||||||||||||

| Shares repurchased |

- | - | - | - | ||||||||||||

| Increase in net assets from capital share transactions |

93,244,732 | 41,167,233 | 24,665,381 | 41,919,279 | ||||||||||||

| Increase in net assets | $ | 72,777,880 | $ | 48,191,035 | $ | 31,536,061 | $ | 42,262,798 | ||||||||

| Net Assets | ||||||||||||||||

| Beginning of year | 143,490,784 | 95,299,749 | 180,186,442 | 137,923,644 | ||||||||||||

| End of year | $ | 216,268,664 | $ | 143,490,784 | $ | 211,722,503 | $ | 180,186,442 | ||||||||