ogng_10q.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

|

x

|

Quarterly Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| |

|

| |

For the quarterly period ended June 30, 2013

|

| |

|

|

o

|

Transition Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| |

|

| |

For the transition period from__________to__________

|

Commission File Number: 0-13597

Bravo Enterprises Ltd.

(formerly Organa Gardens International Inc.)

(Exact name of small business issuer as specified in it’s charter)

Nevada

(State or other jurisdiction of incorporation or organization)

88-0195105

(I.R.S. Employer Identification No.)

35 South Ocean Avenue,

Patchogue, New York, 11772

(Address of principal executive offices)

888-488-6882

(Issuer’s telephone number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). o Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o |

Accelerated filer

|

o |

|

Non-accelerated filer

|

o |

Smaller reporting company

|

x |

| (Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

APPLICABLE ONLY TO CORPORATE ISSUERS

On August 15, 2013, there were 152,271,030 shares outstanding of the issuer’s common stock.

| INDEX |

|

PAGE

|

|

| |

|

|

|

| Part I. FINANCIAL INFORMATION |

|

|

|

| |

|

|

|

|

| Item 1. |

Financial Statements

|

|

|

F-1 |

|

| |

|

|

|

|

|

| |

Balance Sheet as of June 30, 2013 (Unaudited) and December 31, 2012

|

|

|

F-1 |

|

| |

|

|

|

|

|

| |

Statements of Operations (Unaudited) For the Three and Six Month Periods Ended June 30, 2013 and 2012, and the Period from January 1, 1996 through June 30, 2013

|

|

|

F-2 |

|

| |

|

|

|

|

|

| |

Statements of Cash Flows (Unaudited) For the Six Months Ended June 30, 2013 and 2012, and the Period from January 1, 1996 through June 30, 2013

|

|

|

F-3 |

|

| |

|

|

|

|

|

| |

Statements of Other Comprehensive Loss (Unaudited) For the Three and Six Month Periods Ended June 30, 2013 and 2012 and the Period from January 1, 1996 through June 30, 2013

|

|

|

F-4 |

|

| |

|

|

|

|

|

| |

Notes To Financial Statements (Unaudited)

|

|

|

F-5 |

|

| |

|

|

|

|

|

| Item 2. |

Management's Discussion and Analysis or Plan of Operation

|

|

|

4-6 |

|

| |

|

|

|

|

|

| Item 3. |

Quantitative and Qualitative Disclosures About Market Risk

|

|

|

6 |

|

| |

|

|

|

|

|

| Item 4T. |

Controls and Procedures

|

|

|

6 |

|

| |

|

|

|

|

|

| Part II. OTHER INFORMATION |

|

|

|

|

| |

|

|

|

|

|

| Item 1. |

Legal Proceedings

|

|

|

7 |

|

| |

|

|

|

|

|

| Item 1A. |

Risk Factors |

|

|

7 |

|

| |

|

|

|

|

|

| Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds

|

|

|

7 |

|

| |

|

|

|

|

|

| Item 3. |

Defaults Upon Senior Securities

|

|

|

9 |

|

| |

|

|

|

|

|

| Item 4. |

Mine Safety Disclosures

|

|

|

9 |

|

| |

|

|

|

|

|

| Item 5. |

Other Information

|

|

|

9 |

|

| |

|

|

|

|

|

| Item 6. |

Exhibits

|

|

|

10 |

|

| |

|

|

|

|

|

| SIGNATURES |

|

|

11 |

|

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

BRAVO ENTERPRISES LTD.

(formerly Organa Gardens International Inc.)

(A Development Stage Company)

CONDENSED BALANCE SHEETS

| |

|

June 30,

2013

(Unaudited)

|

|

|

December 31,

2012

|

|

| |

|

|

|

|

|

|

|

ASSETS

|

|

| |

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

Cash

|

|

$ |

457 |

|

|

$ |

86,781 |

|

|

Taxes recoverable

|

|

|

1,081 |

|

|

|

1,233 |

|

|

Accounts receivable – related party

|

|

|

1,456 |

|

|

|

2,683 |

|

|

Accounts receivable

|

|

|

4,597 |

|

|

|

671 |

|

|

Prepaid expenses

|

|

|

38,400 |

|

|

|

- |

|

|

TOTAL CURRENT ASSETS

|

|

|

45,991 |

|

|

|

171,368 |

|

| |

|

|

|

|

|

|

|

|

|

AVAILABLE FOR SALE SECURITIES – related parties

|

|

|

22,275 |

|

|

|

3,030 |

|

|

INTANGIBLE ASSETS – net of amortization of $ 41,465 (2012 - $Nil)

|

|

|

1,451,278 |

|

|

|

1,492,743 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$ |

1,519,544 |

|

|

$ |

1,587,141 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

| |

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$ |

489,567 |

|

|

$ |

494,057 |

|

|

Due to related parties

|

|

|

219 |

|

|

|

2,142 |

|

|

TOTAL CURRENT LIABILITIES

|

|

|

489,786 |

|

|

|

496,199 |

|

| |

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

| Convertible preferred stock: |

|

|

|

|

|

|

|

|

|

- Class A voting stock, $0.001 par value, 5,000,000 shares authorized

|

|

|

- |

|

|

|

- |

|

|

- Class B voting stock, $0.001 par value, 5,000,000 shares authorized

|

|

|

- |

|

|

|

- |

|

|

Common stock, $.001 par value, 500,000,000 shares authorized

|

|

|

|

|

|

|

|

|

|

152,271,030 (December 31, 2012 – 147,178,530) shares issued and outstanding

|

|

|

152,271 |

|

|

|

147,178 |

|

|

Additional paid-in capital

|

|

|

26,369,621 |

|

|

|

26,214,714 |

|

|

Shares to be issued

|

|

|

- |

|

|

|

93,000 |

|

|

Subscriptions receivable

|

|

|

- |

|

|

|

(80,000 |

) |

|

Deferred compensation

|

|

|

(51,796 |

) |

|

|

(84,160 |

) |

|

Deficit accumulated during the development stage

|

|

|

(21,000,850 |

) |

|

|

(20,741,057 |

) |

|

Deficit accumulated prior to the development stage

|

|

|

(4,460,633 |

) |

|

|

(4,460,633 |

) |

|

Accumulated other comprehensive income

|

|

|

21,145 |

|

|

|

1,900 |

|

|

TOTAL STOCKHOLDERS’ EQUITY

|

|

|

1,029,758 |

|

|

|

1,090,942 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

$ |

1,519,544 |

|

|

$ |

1,587,141 |

|

The accompanying notes are an integral part of these financial statements

BRAVO ENTERPRISES LTD.

(formerly Organa Gardens International Inc.)

CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

| |

|

Three Months ended

June 30,

|

|

|

Six Months ended

June 30,

|

|

|

For the period from January 1,

1996 to

June 30,

|

|

| |

|

2013

|

|

|

2012

|

|

|

2013

|

|

|

2012

|

|

|

2013

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES - Water Unit Sales – related party

|

|

$ |

1,300 |

|

|

|

- |

|

|

$ |

1,300 |

|

|

$ |

- |

|

|

$ |

3,696 |

|

| - Water Unit Sales - other |

|

|

|

|

|

|

- |

|

|

|

4,104 |

|

|

|

|

|

|

|

4,703 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL REVENUES

|

|

|

1,300 |

|

|

|

- |

|

|

|

5,404 |

|

|

|

- |

|

|

|

8,399 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

COST OF GOODS SOLD

|

|

|

600 |

|

|

|

- |

|

|

|

2,965 |

|

|

|

|

|

|

|

4,465 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

GROSS PROFIT

|

|

|

700 |

|

|

|

- |

|

|

|

2,439 |

|

|

|

- |

|

|

|

3,934 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GENERAL & ADMINISTRATIVE EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Litigation settlement

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,291,070 |

|

|

Management and consulting fees

|

|

|

27,655 |

|

|

|

15,766 |

|

|

|

144,373 |

|

|

|

31,840 |

|

|

|

5,159,041 |

|

|

Consulting fees – stock based compensation

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,989,869 |

|

|

Exploration costs

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

113,678 |

|

|

Loss on settlement of debt

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

718,784 |

|

|

General and administrative

|

|

|

25,382 |

|

|

|

19,095 |

|

|

|

57,812 |

|

|

|

37,442 |

|

|

|

2,986,173 |

|

|

Professional fees

|

|

|

8,196 |

|

|

|

3,697 |

|

|

|

18,582 |

|

|

|

10,570 |

|

|

|

1,236,563 |

|

|

Amortization

|

|

|

20,732 |

|

|

|

- |

|

|

|

41,465 |

|

|

|

- |

|

|

|

41,465 |

|

|

Interest expense

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

98,282 |

|

|

Research and development costs

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

285,231 |

|

|

Software development costs

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

737,300 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL GENERAL & ADMIN. EXPENSES

|

|

|

81,965 |

|

|

|

38,558 |

|

|

|

262,232 |

|

|

|

79,852 |

|

|

|

15,657,456 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER (INCOME ) EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest, Royalty and Other Income

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(82,138 |

) |

|

(Gain)/loss on sale of securities – related parties

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(21,541 |

) |

|

Property option income

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(130,000 |

) |

|

Write-down of securities – Legacy Platinum Group

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

258,580 |

|

|

Write-down of securities – Golden Star Enterprises

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

15,768 |

|

|

Write-down of interest in ACGT Corporation

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,406,000 |

|

|

Write-down of interest in oil and gas properties

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3,815,659 |

|

|

Loss on Iceberg Drive Inn Investment

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

85,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL OTHER (INCOME ) EXPENSES

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,347,328 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before Income Taxes

|

|

|

(81,265 |

) |

|

|

(38,558 |

) |

|

|

(259,793 |

) |

|

|

(79,852 |

) |

|

|

(21,000,850 |

) |

|

Income Tax Provision

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS FOR THE PERIOD

|

|

$ |

(81,265 |

) |

|

|

(38,558 |

) |

|

$ |

(259,793 |

) |

|

$ |

(79,852 |

) |

|

$ |

(21,000,850 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BASIC NET LOSS PER SHARE |

|

$ |

(.00 |

) |

|

|

(.02 |

) |

|

$ |

(.01 |

) |

|

$ |

(.03 |

) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE COMMON |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SHARES OUTSTANDING |

|

|

149,112,239 |

|

|

|

3,053,524 |

|

|

|

148,228,834 |

|

|

|

3,053,524 |

|

|

|

|

|

The accompanying notes are an integral part of these financial statements

BRAVO ENTERPRISES LTD.

(formerly Organa Gardens International Inc.)

(A development stage company)

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

| |

|

Six months ended

June 30,

|

|

|

For the period from

January 1, 1996

to June 30,

|

|

| |

|

2013

|

|

|

2012

|

|

|

2013

|

|

| |

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

Net loss for the period

|

|

$ |

(259,793 |

) |

|

$ |

(79,852 |

) |

|

$ |

(21,000,850 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- amortization of license

|

|

|

41,465 |

|

|

|

- |

|

|

|

41,465 |

|

|

- fees and services paid for with common shares

|

|

|

32,364 |

|

|

|

39,340 |

|

|

|

3,609,882 |

|

|

- non cash research and development

|

|

|

- |

|

|

|

- |

|

|

|

105,000 |

|

|

- other stock-based compensation

|

|

|

- |

|

|

|

- |

|

|

|

1,989,468 |

|

|

- interest paid for with common shares

|

|

|

- |

|

|

|

- |

|

|

|

80,872 |

|

|

- loss on settlement of debt

|

|

|

- |

|

|

|

- |

|

|

|

718,784 |

|

|

- software development costs paid for with common shares

|

|

|

- |

|

|

|

- |

|

|

|

600,000 |

|

|

- non cash exploration costs

|

|

|

- |

|

|

|

- |

|

|

|

110,000 |

|

|

- write-down of interest in oil and gas properties

|

|

|

- |

|

|

|

- |

|

|

|

2,970,722 |

|

|

- write-down of equities in Legacy Platinum Group Inc.

|

|

|

- |

|

|

|

- |

|

|

|

258,580 |

|

|

- write-down of equities in Golden Star Enterprises ltd.

|

|

|

- |

|

|

|

- |

|

|

|

15,768 |

|

|

- write-down of interest in ACGT Corporation

|

|

|

- |

|

|

|

- |

|

|

|

2,250,937 |

|

|

- loss on Iceberg Drive Inn investment

|

|

|

- |

|

|

|

- |

|

|

|

85,000 |

|

|

- (Gain)/loss on sale of securities held for resale – related parties

|

|

|

- |

|

|

|

- |

|

|

|

(21,816 |

) |

|

- non cash option income received in shares

|

|

|

- |

|

|

|

- |

|

|

|

(130,000 |

) |

|

- interest accrued on promissory notes receivable

|

|

|

- |

|

|

|

- |

|

|

|

(63,136 |

) |

|

- other non-cash expenses

|

|

|

- |

|

|

|

- |

|

|

|

2,557,382 |

|

|

- net changes in working capital items

|

|

|

(18,068 |

) |

|

|

(1,782 |

) |

|

|

238,233 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS USED IN OPERATING ACTIVITIES

|

|

|

(204,212 |

) |

|

|

(42,294 |

) |

|

|

(5,583,989 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest received on promissory notes receivable

|

|

|

- |

|

|

|

- |

|

|

|

63,136 |

|

|

Investment in Iceberg Acquisition Corporation

|

|

|

- |

|

|

|

- |

|

|

|

(120,000 |

) |

|

Proceeds from sale of securities – related party

|

|

|

- |

|

|

|

- |

|

|

|

136,790 |

|

|

Interest in oil and gas properties, net of finders fees

|

|

|

- |

|

|

|

- |

|

|

|

(1,522,804 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS USED IN INVESTING ACTIVITIES

|

|

|

- |

|

|

|

- |

|

|

|

(1,442,878 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net proceeds on sale of common stock

|

|

|

147,000 |

|

|

|

- |

|

|

|

5,350,325 |

|

|

Net advances (to) from related parties

|

|

|

(29,112 |

) |

|

|

58,773 |

|

|

|

1,256,999 |

|

|

Advances receivable

|

|

|

- |

|

|

|

- |

|

|

|

420,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS PROVIDED BY FINANCING ACTIVITIES

|

|

|

117,888 |

|

|

|

58,773 |

|

|

|

7,027,324 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH

|

|

|

(86,324 |

) |

|

|

14,920 |

|

|

|

457 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH, BEGINNING OF PERIOD

|

|

|

86,781 |

|

|

|

90 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH, END OF PERIOD

|

|

$ |

457 |

|

|

$ |

15,010 |

|

|

$ |

457 |

|

See Supplemental Cash Flow Information (Note 8).

The accompanying notes are an integral part of these financial statements

BRAVO ENTERPRISES LTD.

(formerly Organa Gardens International Inc.)

(A development stage company)

CONDENSED STATEMENTS OF OTHER COMPREHENSIVE (LOSS)

(Unaudited)

| |

|

Three months ended

June 30,

|

|

|

Six months ended

June 30,

|

|

|

For the period from January 1,

|

|

| |

|

2013

|

|

|

2012

|

|

|

2013

|

|

|

2012

|

|

|

2013

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS

|

|

$ |

(81,265 |

) |

|

$ |

(38,558 |

) |

|

$ |

(259,973 |

) |

|

$ |

(79,582 |

) |

|

$ |

(21,000,850 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gains (losses) on related party securities

|

|

|

(22,058 |

) |

|

|

(4,819 |

) |

|

|

19,245 |

|

|

|

(1,559 |

) |

|

|

21,145 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL OTHER COMPREHENSIVE INCOME (LOSS), net of tax

|

|

|

(22,058 |

) |

|

|

(4,819 |

) |

|

|

19,245 |

|

|

|

(1,559 |

) |

|

|

21,145 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME (LOSS)

|

|

$ |

(103,323 |

) |

|

$ |

(43,377 |

) |

|

$ |

(240,728 |

) |

|

$ |

(81,411 |

) |

|

$ |

(20,979,705 |

) |

The accompanying notes are an integral part of these financial statements

BRAVO ENTERPRISES LTD.

(formerly Organa Gardens International Inc.)

(A development stage company)

NOTES TO CONDENSED FINANCIAL STATEMENTS

NOTE 1 – NATURE OF OPERATIONS

The Company was incorporated as Venture Investments Inc. under the Laws of the State of Nevada on November 29, 1983. The Company underwent a name change to Asdar Group on December 10, 1987, a name change to Precise Life Sciences Ltd. on April 30, 2002, a name change to Iceberg Brands Corporation on February 18, 2003, a name change toAvalon Gold Corporation on August 28, 2003, a name change to Avalon Energy Corporation on March 22, 2005, a name change to Shotgun Energy Corporation on September 25,2007 and a name change to Organa Gardens International Inc. on February 26, 2009 and a name change to Bravo Enterprises Ltd. on June 1, 2012. The Company was dormant from1991 to 1996 and currently has nominal revenue generating operations. The Company was considered a development stage company since January 1, 1996 and as a result of changing its business focus to air to water harvesting units is considered to be a development stage company. Expected operations will consist of manufacturing and distributing air to water harvesting units worldwide.

GOING CONCERN

The financial statements have been prepared on the basis of a going concern which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has not generated any revenues or completed development of any commercially acceptable products or services to date and has incurred losses of $25,461,483 since inception. The Company will depend almost exclusively on outside capital through the issuance of common shares to finance ongoing operating losses and to fund the manufacture and distribution of the air to water harvesting units. The ability of the Company to continue as a going concern is dependent on raising additional capital and ultimately on generating future profitable operations. There can be no assurance that the Company will be able to raise the necessary funds when needed to finance its ongoing costs. These factors raise substantial doubt about the ability of the Company to continue as a going concern. The accompanying financial statements do not include any adjustments relative to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might result from the outcome of this uncertainty.

In April, 2012, a majority of the shareholders entitled to vote on such matters approved a change of name from Organa Gardens International Inc. to “Bravo Enterprises Ltd.” and a one-for-twenty (1:20) stock split of all of this Company’s outstanding common stock, without any change in par value for the shares of common stock of this Company. The stock split did not include a change in the authorized capital of the Company. On April 23, 2012, a Certificate of Amendment to its Articles of Incorporation was filed with the State of Nevada changing the name to Bravo Enterprises Ltd., effective June 1, 2012. As advised on May 9, 2012, the Company’s CUSIP Number changed from 68618Y 10 6 to 10567L 10 7. On June 8, 2012, the Company began to trade as Bravo Enterprises Ltd. under the same trading symbol being “OGNG”. Pre-split the total shares outstanding was 61,796,467 and post-split the total shares outstanding was 3,089,823.

NOTE 2 – BASIS OF PRESENTATION

The unaudited interim financial statements have been prepared in accordance with generally accepted accounting principles for interim financial information and with the instructions to Form 10-Q and Regulation S-X Article 8 “Financial Statements of Smaller Reporting Companies” as promulgated by the Securities and Exchange Commission ("SEC"). Accordingly, these financial statements do not include all of the disclosures required by generally accepted accounting principles for complete financial statements. These unaudited interim financial statements should be read in conjunction with the audited financial statements for the period ended December 31, 2012 indexed in Form 10-K. In the opinion of management, the unaudited interim financial statements furnished herein include all adjustments, all of which are of a normal recurring nature, necessary for a fair statement of the results for the interim period presented.

NOTE 2 – BASIS OF PRESENTATION (con’t.)

The preparation of financial statements in accordance with generally accepted accounting principles requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities known to exist as of the date the financial statements are published, and the reported amounts of revenues and expenses during the reporting period. Uncertainties with respect to such estimates and assumptions are inherent in the preparation of the Company's financial statements; accordingly, it is possible that the actual results could differ from these estimates and assumptions that could have a material effect on the reported amounts of the Company's financial position and results of operations. Operating results for the three month period ended March 31, 2013 are not necessarily indicative of the results that may be expected for the year ending December 31, 2013.

Concentration of Credit Risk

Cash in bank accounts is at risk to the extent that it exceeds U.S.Federal Deposit Insurance Corporation and Canadian Deposit Insurance Corporation insured amounts. To minimize risk, the Company places its cash with high credit quality institutions. All cash is deposited in one prominent Canadian financial institution.

Fair Value of Financial Instruments

The Company’s financial instruments include cash, receivables, prepaid expenses, available-for-sale securities and due to related parties. Management believes the fair values of these financial instruments approximate their carrying values due to their short-term nature. The Company adopted ASC Topic 820-10 for all financial assets and liabilities and non-financial assets and liabilities that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually). Topic 820-10 defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements Topic 820-10 defines fair value as the price that would be received upon sale of an asset or paid upon transfer of a liability in an orderly transaction between market participants at the measurement date and in the principal or most advantageous market for that asset or liability. The fair value should be calculated based on assumptions that market participants would use in pricing the asset or liability, not on assumptions specific to the entity. In addition, the fair value of liabilities should include consideration of nonperformance risk including our own credit risk. In addition to defining fair value, Topic 820-10 expands the disclosure requirements around fair value and establishes a fair value hierarchy for valuation inputs. The hierarchy prioritizes the inputs into three levels based on the extent to which inputs used in measuring fair value are observable in the market. Each fair value measurement is reported in one of the three levels which is determined by the lowest level input that is significant to the fair value measurement in its entirety. These levels are:

* Level 1 – inputs are based upon unadjusted quoted prices for identical instruments traded in active markets.

* Level 2 – inputs are based upon quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant assumptions are observable in the market or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

* Level 3 – inputs are generally unobservable and typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability. The fair values are therefore determined using model-based techniques that include option pricing models, discounted cash flow models, and similar techniques.

In general, and where applicable, we use quoted prices in an active market for identical derivative assets and liabilities that are traded on exchanges. These derivative assets and liabilities are included in Level 1.The application of the three levels of the fair value hierarchy under Topic 820-10-35 to our assets and liabilities are described below:

| |

|

Fair Value Measurements

|

|

| |

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total Fair Value

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$ |

457 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

457 |

|

|

Taxes recoverable

|

|

|

1,081 |

|

|

|

|

|

|

|

|

|

|

|

1,081 |

|

|

Accounts Receivable

|

|

|

6,053 |

|

|

|

|

|

|

|

|

|

|

|

6,053 |

|

|

Available securities

|

|

|

22,275 |

|

|

|

- |

|

|

|

- |

|

|

|

22,275 |

|

|

Prepaid Expenses

|

|

|

38,400 |

|

|

|

|

|

|

|

|

|

|

|

38,400 |

|

|

Intangible Assets

|

|

|

- |

|

|

|

- |

|

|

|

1,451,278 |

|

|

|

1,451,278 |

|

|

Total

|

|

$ |

68,266 |

|

|

$ |

- |

|

|

$ |

1,451,278 |

|

|

$ |

1,519,544 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current and related party

|

|

$ |

489,786 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

489,786 |

|

|

Total

|

|

$ |

489,786 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

489,786 |

|

NOTE 2 – BASIS OF PRESENTATION (con’t.)

Foreign Currency Translation

The financial statements are presented in United States dollars. In accordance with ASC Topic 830 “Foreign Currency Matters”, foreign denominated monetary assets and liabilities are translated to their United States dollar equivalents using foreign exchange rates that prevailed at the balance sheet date. Non-monetary assets and liabilities are translated at exchange rates prevailing at the transaction date. Revenue and expenses are translated at average rates of exchange during the year. Related translation adjustments are reported as a separate component of stockholders’ equity, whereas gains or losses resulting from foreign currency transactions are included in results of operations.

Available For Sale Securities – related parties

The Company holds marketable equity securities which are available-for-sale and as such, their carrying value is adjusted to market at the end of each reporting period. As required by ASC Topic 220 (formerly SFAS 130),, unrealized gains and losses on these investments are recorded as a component of accumulated other comprehensive income (loss) and are recorded as a component of net income (loss) when realized. However, if there is a permanent decline in the market value of available-for-sale securities, this permanent market value adjustment is taken into income in the period.

Stock-Based Compensation

On January 1, 2006, the Company adopted the fair value recognition provisions of ASC Topic 718 & 505. Prior to January 1, 2006, the Company accounted for share-based payments under the recognition and measurement provisions of ASC Topic 718. In accordance with ASC Topic 718 no compensation cost was required to be recognized for options granted that had an exercise price equal to the market value of the underlying common stock on the date of grant. . The Company uses the Black-Scholes pricing model to calculate the fair value of options and warrants issued to both employees and non-employees. Stock issued for compensation is valued using the market price of the stock on the date of the related agreement.

In addition, deferred stock compensation related to non-vested options is required to be eliminated against additional paid-in capital. The Company accounts for equity instruments issued in exchange for the receipt of goods or services from other than employees in accordance with ASC Topic 718 & 505. Costs are measured at the estimated fair market value of the consideration received or the estimated fair value of the equity instruments issued, whichever is more reliably measurable.

Intangible Assets

Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 350 , “Intangibles-Goodwill and Other” requires that goodwill and intangible assets with indefinite useful lives no longer be amortized, but instead tested for impairment at least annually in accordance with the provisions of ASC 350. This standard also requires that intangible assets with definite useful lives be amortized over their respective estimated useful lives to their estimated residual values, and reviewed for impairment. The Company's intangible assets consist of the acquisition of the license to import and distribute wine & liquor products and various brands and labels. The Company determined that the intangibles have an estimated useful life of 18 years and will be reviewed annually for impairment. Amortization will be recorded over the estimated useful life of the assets using the straight-line method for financial statement purposes. The Company will commence amortization when the economic benefits of the assets begin to be consumed in January, 2013. Other intangibles are carried at acquisition cost less accumulated amortization. Amortization is provided over the estimated useful lives of the assets on straight line basis per annum.

Definite life intangible assets are tested for recoverability whenever events or changes in circumstances indicate that the carrying amounts may not be recoverable. These tests involve the use of estimates and assumptions appropriate in the circumstances. In assessing fair value, valuation models are used that include discounted cash flows. The models use assumptions that include levels of growth in assets under management from net sales and market, pricing and margin changes, synergies achieved on acquisition, discount rates, and observable data for comparable transactions. As of June 30, 2013, the Company believed there was no impairment of its intangible assets and recorded the value of the intangible, net of amortization of $41,465 in the amount of $1,451,278. (2012- $Nil).

NOTE 2 – BASIS OF PRESENTATION (con’t.)

Income Taxes

The Company follows the liability method of accounting for income taxes as set forth in ASC Topic 740-10. Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax balances. Deferred tax assets and liabilities are measured using enacted or substantially enacted tax rates expected to apply to the taxable income in the years in which those differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the date of enactment or substantive enactment. A valuation allowance is provided for deferred tax assets if it is more likely than not that the Company will not realize the future benefit, or if the future deductibility is uncertain. In accordance with ASC 740-10. This interpretation introduces a new approach that changes how enterprises recognize and measure tax benefits associated with tax positions and how enterprises disclose uncertainties related to income tax positions in their financial statements.

Revenue Recognition

Sales are recognized upon purchase by customers at our product facility. All sales at our product facility are final, allowing for no sales returns. As at June 30, 2013, $6,053 (2012 - $Nil) is in accounts receivable from the sale of water units.

Recent Accounting Pronouncements

There have been no recent accounting pronouncements not yet adopted by the Company which would have a material impact on our financial statements at June 30, 2013.

The Company adopted certain amendments to Accounting Standards Codification (“ASC”) 820, “Fair Value Measurements,” effective January 1, 2012. These amendments include a consistent definition of fair value, enhanced disclosure requirements for “Level 3” fair value adjustments and other changes to required disclosures. Their adoption did not have a material impact on the Company’s consolidated financial statements.

The Company adopted the amendments to ASC 220, “Comprehensive Income,” effective January 1, 2012. The amendments pertained to presentation and disclosure only.

The Company adopted the amendments to ASC 350, “Intangibles-Goodwill and Others,” effective January 1, 2012. The amended guidance allows us to do an initial qualitative assessment of relevant events and circumstances to determine if fair value of a reporting unit is more likely than not to be less than its carrying value, prior to performing the two-step quantitative goodwill impairment test. The adoption of these amendments did not have a material impact on the Company’s financial statements.

NOTE 3 – AVAILABLE-FOR-SALE SECURITIES – RELATED PARTIES

Golden Star Enterprises Ltd.

During 2004, the Company received 111,111 restricted Rule 144 shares of Golden Star Enterprises Ltd. (“Golden Star”), a public company with directors and significant shareholders in common. The restricted shares were received as non-refundable consideration pursuant to agreements with Golden Star dated November 10, 2004 and December 10, 2004 to acquire certain mineral property interests from the Company. These agreements were subsequently terminated. Effective December 31, 2004 the Company recorded, as other comprehensive loss for the year, a $10,000 unrealized loss in the carrying value of its shares of Golden Star. During the years ended December 31, 2005 and 2006 the Company recorded additional unrealized losses in the carrying value of its shares of Golden Star totalling $90,000 and $8,889 respectively, which were recorded as other comprehensive loss for those years. During the year ended December 31, 2007, the Company sold 2,500 shares resulting in a realized gain of $165 and recorded an additional unrealized loss of $473 in 2007. During the year ended December 31, 2008, the Company sold 10,000 shares resulting in a realized loss of $800 and recorded an additional unrealized loss of $15,026 to December 31, 2008. As a result, the carrying value of the available for sale shares of Golden Star is $2,712 as at December 31, 2008.

During the year ended December 31, 2009, the Company recorded an unrealized gain of $1,232. As a result, the carrying value of the available for sale shares of Golden Star is $3,945 as at December 31, 2009.

NOTE 3 – AVAILABLE-FOR-SALE SECURITIES – RELATED PARTIES (con’t)

During the year ended December 31, 2010, the Company sold Nil Golden Star shares and recorded an unrealized gain of $11,774. As a result, the carrying value of the available for sale shares of Golden Star is $2,860 as at December 31, 2010. Effective December 31, 2010, the Company recorded a $12,859 write-down of its investment in Golden due to an other-than-temporary decline in the value of the shares.

During the year ended December 31, 2011, the Company sold Nil Golden Star shares and recorded an unrealized loss of $2,623. As a result, the carrying value of the available for sale shares of Golden Star is $237 as at December 31, 2011. Effective December 31, 2011, the Company recorded a $2,909 write-down of its investment in Golden due to an other-than-temporary decline in the value of the shares. During the year ended December 31, 2012, the Company sold Nil Golden Star shares and recorded an unrealized loss of $148. As a result, the carrying value of the available for sale shares of Golden Star is $89 as at December 31, 2012.

During the six month period ended June 30, 2013, the Company sold Nil Golden Star shares and recorded an additional unrealized gain of $128 to June 30, 2013. As a result, the carrying value of the available for sale shares of Golden Star is $217 as at June 30, 2013.

Legacy Platinum Group Inc.

During 2003 the Company settled an outstanding debt receivable of $122,988 from Legacy Platinum Group Inc. (“Legacy”) for the issue of 1,229,880 restricted shares of Legacy representing a then 9.8% interest in Legacy. During 2004, the Company wrote this investment down to $1 because management determined that it was not recoverable within a reasonable period of time. Effective December 31, 2007, the Company recorded, as other comprehensive income for the year, a $604,440 unrealized gain in the carrying value of its shares of Legacy.

During the year ended December 31, 2008, the Company sold 150,000 Legacy shares resulting in a realized gain of $26,100 and recorded an additional unrealized gain of $270,562 to December 31, 2008. As a result, the carrying value of the available for sale shares of Legacy was $885,502 as at December 31, 2008.

During the year ended December 31, 2009, the Company sold 30,985 Legacy shares resulting in a realized loss of $2,987 (net of commissions of $595) and recorded an additional unrealized loss of $797,161 to December 31, 2009. As a result, the carrying value of the available for sale shares of Legacy is $ 62,934 as at December 31, 2009.

During the year ended December 31, 2010, the Company the Company received 2,627,440 restricted shares of Legacy valued to $131,372 pursuant to a debt settlement and sold Nil Legacy shares. The Company recorded an unrealized gain in the carrying value of its available-for-sale securities totaling $35,021, which was recorded as other comprehensive income (loss). As a result, the carrying value of the available for sale shares of Legacy is $58,822 as at December 31, 2010. Effective December 31, 2010, the Company recorded a $78,823 write-down of its investment in Legacy due to an other-than-temporary decline in the value of the shares.

During the year ended December 31, 2011, the Company sold Nil Legacy shares and recorded an unrealized loss of $52,939. As a result, the carrying value of the available for sale shares of Legacy is $5,882 as at December 31, 2011. Effective December 31, 2011, the Company recorded a $51,469 write-down of its investment in Legacy due to an other-than-temporary decline in the value of the shares. During the year ended December 31, 2012, the Company sold Nil Legacy shares and recorded an unrealized loss of $2,941. As a result, the carrying value of the available for sale shares of Legacy is $2,941 as at December 31, 2012.

During the six month period ended June 30, 2013, the Company sold Nil Legacy shares and recorded an additional unrealized gain of $19,117 to June 30, 2013. As a result, the carrying value of the available for sale shares of Legacy is $22,058 as at June 30, 2013.

Available for sale securities – related parties include the following:

| |

|

June 30,

|

|

|

December 31,

|

|

| |

|

2013

|

|

|

2012

|

|

| |

|

|

|

|

|

|

|

3,676,335 (2012-3,676,335) shares of Legacy Platinum Group Inc.

|

|

$ |

22,058 |

|

|

$ |

2,941 |

|

|

98,612 (2012- 98,612) shares of Golden Star Enterprises Ltd.

|

|

|

217 |

|

|

|

89 |

|

| |

|

|

|

|

|

|

|

|

| |

|

$ |

22,275 |

|

|

$ |

3,030 |

|

NOTE 4 – INTANGIBLE ASSETS

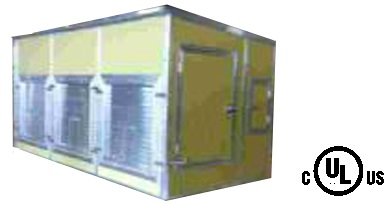

On November 23, 2012, the Company signed an Exclusive Licensing Agreement with Water-For-The-World-Manufacturing Inc. of Wellpinit, Washington with respect to its commercial atmospheric water harvester system.

Water-For-The-World-Manufacturing Inc. is a leader in the design, manufacture and distribution of water from air systems known as Air-to-Water Harvesters that extracts moisture from the air through a dehumidification process then filters and purifies the water for consumption. The company has developed a unique air drive system that will enable the machine not only to be powered through a conventional power source but also in emergency situations the machine can be powered directly from an engine using its patented drive system. The atmospheric water harvester can produce up to 3000 gallons of drinking water under optimum conditions.

Water-For-The-World-Manufacturing Inc. has appointed Bravo Enterprises Ltd. as its exclusive worldwide manufacturing and sales representative for the consideration of 120,000,000 restricted common shares of Bravo Enterprises Ltd. The company has proven concept and developed a production model exclusively for the generation of water for human consumption.

A portion of the 120,000,000 restricted common share consideration is being received by certain shareholders that also owned shares in Bravo Enterprises Ltd. prior to the November 23, 2012 agreement. The value of these shares considered a related party portion is $67,257 and as such, this amount has been eliminated from the transaction.

Intangible assets include the following:

|

Description

|

|

June 30,

|

|

|

December 31,

|

|

| |

|

2013

|

|

|

2012

|

|

|

18 year general license to manufacture and distribute water units

|

|

$ |

1,560,000 |

|

|

$ |

1,560,000 |

|

|

Less: related party portion of consideration for license

|

|

|

(67,257 |

) |

|

|

(67,257 |

) |

|

Less: accumulated amortization

|

|

|

(41,465 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Balance

|

|

$ |

1,451,278 |

|

|

$ |

1,492,743 |

|

NOTE 5 – DEFERRED COMPENSATION

On July 1, 2011, the Company entered into an agreement with Charlton Investments Ltd. (“Charlton”), a private company controlled by a significant shareholder, with a two-year term, whereby Charlton provides investment-banking services to the Company (valued at $30,000) in exchange for 100,000 restricted shares of the Company’s common stock.

On July 1, 2011, the Company entered into agreements with three consultants, for a twelve month term, whereby the consultants provide consulting services to the Company (valued at $45,000) in exchange for 150,000 shares of the Company’s common stock.

On July 16, 2012 the Company entered into an agreement with Palisades Financial Ltd. (“Palisades”), a private company controlled by a significant shareholder, with a two year term, whereby Palisades provides investor relations services to the Company (valued at $27,625) in exchange for 1,250,000 restricted shares of the Company’s common stock.

On July 16, 2012, the Company entered into an agreement with 1063244 Alberta Ltd. (“1063244”), a private company controlled by a significant shareholder, with a two-year term, whereby 1063244 provides investment-banking services to the Company (valued at $33,150) in exchange for 1,500,000 restricted shares of the Company’s common stock.

On July 16, 2012, the Company entered into agreements with two consultants, for a two year term, whereby the consultants provide consulting services to the Company (valued at $38,675) in exchange for 1,750,000 shares of the Company’s common stock.

The Company amortizes the costs of these services over the respective terms of the contracts. During the six months ended June 30, 2013 and 2012, the Company recorded amortization of deferred compensation totaling $32,364 and $39,340 respectively. As of June 30, 2013 the unamortized portion of the deferred compensation totaled $51,796. (December 31, 2012 - $84,160).

NOTE 6- STOCKHOLDERS’ EQUITY

In April, 2012, a majority of the shareholders entitled to vote on such matters approved a change of name from Organa Gardens International Inc. to “Bravo Enterprises Ltd.” and a one-for-twenty (1:20) stock split of all of this Company’s outstanding common stock, without any change in par value for the shares of common stock of this Company. The stock split did not include a change in the authorized capital of the Company. On April 23, 2012, a Certificate of Amendment to its Articles of Incorporation was filed with the State of Nevada changing the name to Bravo Enterprises Ltd., effective June 1, 2012. As advised on May 9, 2012, the Company’s CUSIP Number changed from 68618Y 10 6 to 10567L 10 7. On June 8, 2012, the Company began to trade as Bravo Enterprises Ltd. under the same trading symbol being “OGNG”. Pre-split the total shares outstanding was 61,796,467 and post-split the total shares outstanding was 3,089,823.

(1) 2013 Stock Transactions- During the six months ended June 30, 2013:

(a) The Company issued 80,000 restricted common shares valued at $8,000 to a consultant for her services earned in 2012.

(b) The Company issued 800,000 restricted common shares for cash in the amount of $80,000 pursuant to private placement subscription agreements.

(c) The Company issued 62,500 restricted common shares for cash received in 2012 in the amount of $5,000 pursuant to a private placement subscription agreement.

(d) The Company issued 150,000 restricted common shares for cash in the amount of $15,000 pursuant to a private placement subscription agreement.

(e) The Company issued 4,000,000 common shares for cash in the amount of $52,000 pursuant to the exercise of incentive stock options in accordance with the 2012 Stock Option Plan.

(2) 2012 Stock Transactions - None.

(3) 2013 Stock Options

The Company’s stock option activity is as follows:

| |

|

Number of options

|

|

|

Weighted Average Exercise Price

|

|

|

Weighted Average Remaining Contractual Life

(in years)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2011

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Granted during 2012

|

|

|

26,000,000 |

|

|

|

0.013 |

|

|

|

5.00 |

|

|

Exercised during 2012

|

|

|

(19,000,000 |

) |

|

|

0.013 |

|

|

|

|

|

|

Balance, December 31, 2012

|

|

|

7,000,000 |

|

|

|

0.013 |

|

|

|

5.00 |

|

|

Granted during the period

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Exercised during the period

|

|

|

(4,000,000 |

) |

|

|

- |

|

|

|

- |

|

|

Balance June 30, 2013

|

|

|

3,000,000 |

|

|

|

0.013 |

|

|

|

5.00 |

|

On December 7, 2012 the Company filed Registration Statements on Form S-8 to register 26,000,000 to be issue pursuant to the Company’s 2012 Stock. Incentive and Option Plan. All 26,000,000 shares have been granted and 23,000,000 have been exercised under the December 2012 Stock Option Plan. In 2012, the Company recognized stock-based compensation of $70,000 in accordance with SFAS 123R which represented the fair value of stock options granted to consultants in exchange for services rendered to the Company.

(4) 2012 Stock Options

The Company’s stock option activity is as follows:

| |

|

Number of options

|

|

|

Weighted Average Exercise Price

|

|

|

Weighted Average Remaining Contractual Life

(in years)

|

|

|

Balance, December 31, 2011

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Granted during the period

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercised during the period

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance June 30, 2012

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

NOTE 7 – RELATED PARTY TRANSACTIONS

During the six months ended June 30, 2013, the Company incurred $8,000 (2012 -$2,000) in fees to directors.

During the six months ended June 30, 2013, the Company incurred $109,850 (2012 -$Nil) in consulting and management fees to shareholders or companies controlled by shareholders.

During the six months ended June 30, 2013, the Company incurred $17,254 (2012 - $16,879) in rent and office expenses to a private company controlled by a shareholder.

During the six months ended June 30, 2013, two companies controlled by significant shareholders earned $15,192 (2012 - $15,942) pursuant to the expired portion of deferred compensation agreements (see Note 5).

The following amounts are due to related parties at:

| |

|

June 30,

2013

|

|

|

December 31,

2012

|

|

| |

|

|

|

|

|

|

|

Significant shareholders

|

|

$ |

219 |

|

|

$ |

2,142 |

|

NOTE 8 – SUPPLEMENTAL CASH FLOW INFORMATION

| |

|

Six months

ended June 30,

|

|

| |

|

2013

|

|

|

2012

|

|

|

Cash paid during the period for:

|

|

|

|

|

|

|

|

Interest

|

|

$ |

- |

|

|

$ |

- |

|

|

Income taxes

|

|

$ |

- |

|

|

$ |

- |

|

During the six months ended June 30, 2013 the Company issued:

(a) 80,000 restricted common shares valued at $8,000 to a consultant for her services earned in 2012.

(b) 800,000 restricted common shares for cash in the amount of $80,000 pursuant to private placement subscription agreements.

(c) 62,500 restricted common shares for cash received in 2012 in the amount of $5,000 pursuant to a private placement subscription agreement.

(d) 150,000 restricted common shares for cash in the amount of $15,000 pursuant to a private placement subscription agreement.

(e) 4,000,000 common shares for cash in the amount of $52,000 pursuant to the exercise of incentive stock options pursuant to the 2012 Stock Option Plan.

During the six months ended June 30, 2012 the Company issued no shares.

As of June 30, 2013, the Company had net operating loss carryforwards of approximately $25,400,000 that may be available to reduce future years' taxable income and will expire between the years 2013 - 2033. Availability of tax losses is subject to change of ownership limitations under Internal Revenue Code 382. Future tax benefits which may arise as a result of these losses have not been recognized in these financial statements, as their realization is determined not likely to occur and accordingly, the Company has recorded a valuation allowance for the deferred tax asset relating to these tax loss carryforwards.

NOTE 10 – COMMITMENTS AND CONTINGENCIES

On February 21, 2002, the Company issued 350,000 shares valued at $119,000 to Empire Sterling Corporation for services to be rendered with respect to the acquisition of ACGT Corporation (“ACGT”). The shares were to be held in trust and not sold until all necessary financing was in place to complete the ACGT acquisition. Empire Sterling Corporation breached the trust agreement and the Company placed a stop transfer on these shares and requested they be returned to the Company. Empire Sterling Corporation failed to return the share certificate and as such, the Company commenced court proceedings against the principals of Empire Sterling Corporation. The Company argued for an interim injunction against all parties and was successful. On May 9, 2002, the Court ordered Empire Sterling Corporation to deposit the shares with the Court pending judicial disposition. The Company continued to file legal process claiming ownership of the shares and breach of trust inter alia. The Company was successful and has now applied to have the share certificates released and subsequently cancelled. As of June 30, 2013, the Company is still in the process of having the certificates released.

In February, 2008, the Company received a demand notice from CGG Veritas for failure to pay an outstanding balance of $317,380 pursuant to a Master Agreement and Job Supplement for the Shotgun Draw 2D Seismic Program in Utah. In accordance with Section 15.3 of the Master Agreement and Job Supplement dated March 21, 2007, CGG has demanded payment by April 25, 2008. If CGG Veritas is forced to proceed with litigation of this matter, it will seek reimbursement of its attorneys’ fees and expenses related to the litigation. The Company is currently examining various alternatives to resolve this matter. CGG Veritas has not proceeded with litigation as of June 30, 2013.

As of August 1, 2012, the Company has leased 1250 sq. ft of office space from Holm Investments Ltd. at $2,500 per month for a period of 3 years.

|

Payments

|

|

2013

|

|

|

2014

|

|

|

2015

|

|

|

TOTAL

|

|

|

Office Rent

|

|

$ |

30,000 |

|

|

$ |

30,000 |

|

|

$ |

30,000 |

|

|

$ |

90,000 |

|

NOTE 11 – SUBSEQUENT EVENTS

In August, 2013, the Company issued 75,000 restricted common shares for cash received in the amount of $20,500 pursuant to two private placement subscription agreements.

In August, 2013, the Company signed a marketing and sales agreement with Splash Water Solutions Canada Ltd., a privately owned Company based in British Columbia, Canada. The agreement calls for Splash Canada to set up at least one showroom store to market Bravo’s Atmospheric Water Harvesting Machines, the AIRMAX 3000 and the AIRWELL 3000. Under the terms of the agreement, Splash Canada must meet minimum purchase order requirements from Bravo of the AIRMAX 3000 and AIRWELL 3000 and branded accessories in order to maintain its exclusive marketing rights for Canada annually and non-exclusive rights for the rest of the world.

Item 2. Management’s Discussion and Analysis or Plan of Operation.

The following should be read in conjunction with our financial statements and the related notes that appear elsewhere in this quarterly report. The discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements.

Our Company, Bravo Enterprises Ltd., was formed under the laws of the State of Nevada on November 29, 1983 under the name Venture Group, Inc. On February 11, 1986, an amendment to the Articles of Incorporation was filed changing the corporate name to Asdar Corporation. On December 10, 1987, another amendment to the Articles of Incorporation was filed changing the corporate name to Asdar Group. On February 18, 2001, Asdar Group filed a Certificate of Reinstatement with the Secretary of State of Nevada. On April 30, 2002, another amendment to the Articles of Incorporation was filed changing the corporate name to Precise Life Sciences Ltd. Additional amendments to the Articles of Incorporation were filed changing the corporate name as follows:

| February 18, 2003 |

- Iceberg Brands Corporation |

| August 28, 2003 |

- Avalon Gold Corporation |

| March 22, 2005 |

- Avalon Energy Corporation |

| September 25, 2007 |

- Shotgun Energy Corporation |

| April 7, 2009 |

- Organa Gardens International Inc. |

| June 8, 2012 |

- Bravo Enterprises Ltd. |

Air to Water Harvesting Units Project.

On November 23, 2012, the Company signed an exclusive licensing agreement with Water-For-The-World-Manufacturing Inc, a Company incorporated in Washington State with respect to its commercial atmospheric water harvester system.

Water-For-The-World-Manufacturing Inc is the legal and beneficial owner of all right, title, intellectual property and patent interest in with respect to certain Water Harvesting Equipment.

Water-For-The-World-Manufacturing Inc is the legal and beneficial owner of Water Harvesting Equipment and has developed packaging, accessories and promotional materials for the purposes of its sale. The Product is described as Air-to-Water Harvesters.

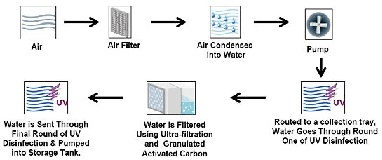

The harvesters feature innovative technology that operates by:

* Pulling air through a filter and coil.

* This cools the incoming air, thus producing condensation.

* It then captures the water.

* The water is pumped through a series of filtration systems and germicidal ultraviolet reactors for purification.

Water-For-The-World-Manufacturing Inc. is a leader in the design, manufacture and distribution of water from air systems known as Air-to-Water Harvesters that extracts moisture from the air through a dehumidification process then filters and purifies the water for consumption. The company has developed a unique air drive system that will enable the machine not only to be powered through a conventional power source but also in emergency situations the machine can be powered directly from an engine using its patented drive system. The atmospheric water harvester can produce up to 3000 gallons of drinking water under optimum conditions.

Bravo Enterprises Ltd. (“Bravo”) requested and Water For The World Manufacturing Inc. has agreed to grant Bravo, the exclusive manufacturing, distribution and marketing rights for the Water Harvesting Equipment. The term of this agreement is for a period of nine (9) years and is renewable for an additional nine (9) years.

Water For The World Manufacturing Inc. appointed Bravo its exclusive world wide manufacturing and sales representative (the "Territory") for consideration of 120,000,000 restricted common shares of Bravo to be issued to Water For The World Manufacturing Inc. and/or its nominees Bravo will use its best efforts to advertise and promote the sale of the Product and to make regular and sufficient contact with the present and prospective customers of the Company in the Territory.

A portion of the 120,000,000 restricted common share consideration is being received by certain shareholders that also owned shares in Bravo Enterprises Ltd. prior to the November 23, 2012 agreement. The value of these shares considered a related party portion is $67,257 and as such, this amount has been eliminated from the transaction.

Intangible assets include the following:

|

Description

|

|

June 30,

|

|

|

December 31,

|

|

| |

|

2013

|

|

|

2012

|

|

|

18 year general license to manufacture and distribute water units

|

|

$ |

1,560,000 |

|

|

$ |

1,560,000 |

|

|