UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04033

Sit Mutual Funds II, Inc.

(Exact name of registrant as specified in charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP Treasurer

Sit Mutual Funds, Inc.

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Copy to:

Mike Radmer, Esq.

Dorsey & Whitney

Suite 1500

50 South Sixth Street

Minneapolis, MN 55402-1498

Registrant’s telephone number, including area code: (612) 332-3223

Date of fiscal year end: March 31, 2020

Date of reporting period: March 31, 2020

| Item 1: | Reports to Stockholders |

|

|

Annual Report March 31, 2020 |

| ||

| U.S. Government Securities Fund |

||||

| Quality Income Fund | ||||

| Tax-Free Income Fund | ||||

| Minnesota Tax-Free Income Fund | ||||

| Important Information on Paperless Delivery | ||||

| Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from Sit Mutual Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will remain available on the Funds’ website (sitfunds.com) and you will be notified by mail each time a report is posted and provided with a website link to access the report. |

||||

| If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports electronically from the Fund by calling 1-800-332-5580 or by enrolling online at sitfunds.com, or, if you are invested through your financial intermediary, you may contact them directly. |

||||

| You may elect to receive all future reports in paper free of charge. You can inform the Funds by calling 1-800-332-5580, or, if you are invested through your financial intermediary, you may contact them directly. Your election to receive reports in paper will apply to all funds held with Sit Mutual Funds or through your financial intermediary, as applicable.

|

||||

|

|

||||

|

BOND FUNDS ANNUAL REPORT TABLE OF CONTENTS |

| Page | ||||

| 2 | ||||

| Fund Reviews and Schedules of Investments |

||||

| 4 | ||||

| 12 | ||||

| 20 | ||||

| 38 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 56 | ||||

| 62 | ||||

| 69 | ||||

| 70 | ||||

| 71 | ||||

| 72 | ||||

| 74 | ||||

This document must be preceded or accompanied by a Prospectus.

|

|

May 5, 2020

Dear fellow shareholders:

|

2 |

|

SIT MUTUAL FUNDS ANNUAL REPORT |

|

|

|

|

MARCH 31, 2020 |

3 |

|

|

| Sit U.S. Government Securities Fund - Class S and Class Y

|

| OBJECTIVE & STRATEGY |

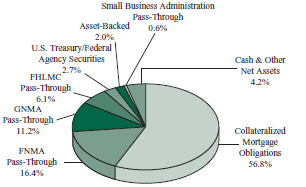

The objective of the U.S. Government Securities Fund is to provide high current income and safety of principal, which it seeks to attain by investing solely in debt obligations issued, guaranteed or insured by the U.S. government or its agencies or its instrumentalities.

Agency mortgage securities and U.S. Treasury securities are the principal holdings in the Fund. The mortgage securities that the Fund purchases consist of pass-through securities including those issued by Government National Mortgage Association (GNMA), Federal National Mortgage Association (FNMA), and Federal Home Loan Mortgage Corporation (FHLMC).

Information on this page is unaudited.

|

4 |

|

SIT MUTUAL FUNDS ANNUAL REPORT |

|

|

|

|

|

Information on this page is unaudited.

|

MARCH 31, 2020 |

5 |

|

|

SCHEDULE OF INVESTMENTS

March 31, 2020

Sit U.S. Government Securities Fund

| See accompanying notes to financial statements. |

||||

|

6 |

|

SIT MUTUAL FUNDS ANNUAL REPORT |

|

| See accompanying notes to financial statements. |

||||

|

MARCH 31, 2020 |

|

7 |

|

|

|

SCHEDULE OF INVESTMENTS

March 31, 2020

Sit U.S. Government Securities Fund (Continued)

| See accompanying notes to financial statements. |

||||

|

8 |

|

SIT MUTUAL FUNDS ANNUAL REPORT |

|

| See accompanying notes to financial statements. |

||||

|

MARCH 31, 2020 |

|

9 |

|

|

|

SCHEDULE OF INVESTMENTS

March 31, 2020

Sit U.S. Government Securities Fund (Continued)

| See accompanying notes to financial statements. |

||||

|

10 |

|

SIT MUTUAL FUNDS ANNUAL REPORT |

|

(19) Options outstanding as of March 31, 2020 were as follows:

| Description | Contracts | Exercise Price ($) |

Expiration Date |

Counterparty | Notional Amount ($) |

Cost/ Premiums ($) |

Value ($) | |||||||||||||||||

|

|

||||||||||||||||||||||||

| Put Options Purchased - U.S. Treasury Futures: |

||||||||||||||||||||||||

| 5-Year |

525 | 121.25 | May 2020 | Societe Generale | 63,656,250 | 243,616 | 49,219 | |||||||||||||||||

A summary of the levels for the Fund’s investments as of March 31, 2020 is as follows (see Note 2-significant accounting policies in the notes to financial statements):

| Investment in Securities | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | ||||||||||||||

| Quoted | Other significant | Significant | ||||||||||||||

| Price ($) | observable inputs ($) | unobservable inputs ($) | Total ($) | |||||||||||||

| Assets |

||||||||||||||||

| Mortgage Pass-Through Securities |

— | 143,355,702 | — | 143,355,702 | ||||||||||||

| U.S. Treasury / Federal Agency Securities |

— | 11,318,941 | — | 11,318,941 | ||||||||||||

| Collateralized Mortgage Obligations |

— | 237,674,716 | — | 237,674,716 | ||||||||||||

| Asset-Backed Securities |

— | 8,192,297 | — | 8,192,297 | ||||||||||||

| Put Options Purchased |

49,219 | — | — | 49,219 | ||||||||||||

| Short-Term Securities |

10,104,845 | — | — | 10,104,845 | ||||||||||||

| 10,154,064 | 400,541,656 | — | 410,695,720 | |||||||||||||

There were no transfers into or out of level 3 during the reporting period.

| See accompanying notes to financial statements. | ||

|

MARCH 31, 2020 |

11 | |

|

|

|

|

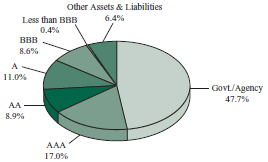

OBJECTIVE & STRATEGY

The objective of the Quality Income Fund is to provide high current income and safety of principal, which it seeks to attain by investing at least 80% of its assets in debt securities issued by the U.S. government and its agencies, debt securities issued by corporations, and mortgage and other asset-backed securities. The Fund invests at least 50% of its assets in U.S. government debt securities, which are securities issued, guaranteed or insured by the U.S. government, its agencies or instrumentalities.

| Information on this page is unaudited. | ||

| 12 |

SIT MUTUAL FUNDS ANNUAL REPORT | |

|

|

|

|

| Information on this page is unaudited. |

||||

|

MARCH 31, 2020 |

|

13 |

|

|

|

SCHEDULE OF INVESTMENTS

March 31, 2020

Sit Quality Income Fund

| Name of Issuer | Principal Amount ($) |

Coupon Rate (%) |

Maturity Date |

Fair Value ($) |

||||||||||||

| Asset-Backed Securities - 10.4% |

||||||||||||||||

| Agency - 1.4% |

||||||||||||||||

| FNMA Grantor Trust, Series 2004-T5, Class A11 1 |

623,229 | 2.21 | 5/28/35 | 586,026 | ||||||||||||

| FNMA REMICS, Series 2001-W2, Class AS5 14 |

2,443 | 6.47 | 10/25/31 | 2,504 | ||||||||||||

| Small Business Administration, Series 2000-20D, Class 1 |

12,406 | 7.47 | 4/1/20 | 12,406 | ||||||||||||

| Small Business Administration, Series 2006-20D, Class 1 |

206,195 | 5.64 | 4/1/26 | 219,435 | ||||||||||||

| Small Business Administration, Series 2007-20B, Class 1 |

155,686 | 5.49 | 2/1/27 | 167,431 | ||||||||||||

| Small Business Administration, Series 2007-20J, Class 1 |

266,635 | 5.57 | 10/1/27 | 283,441 | ||||||||||||

|

|

|

|||||||||||||||

| 1,271,243 | ||||||||||||||||

|

|

|

|||||||||||||||

| Non-Agency - 9.0% |

||||||||||||||||

| ACE Securities Corp. Manufactured Housing Trust, Series 2003-MH1, Class M2 1, 4 |

499,642 | 6.50 | 8/15/30 | 505,899 | ||||||||||||

| Aegis Asset Backed Securities Corp., Series 2003-2, Class M1, 1 Mo. Libor + 1.13% 1 |

747,206 | 2.07 | 11/25/33 | 606,212 | ||||||||||||

| Bayview Opportunity Master Fund, Series 2017-SPL5, Class A 1, 4 |

335,221 | 3.50 | 6/28/57 | 327,779 | ||||||||||||

| Centex Home Equity Loan Trust, Series 2004-A, Class AF4 14 |

102,684 | 5.01 | 8/25/32 | 99,108 | ||||||||||||

| Centex Home Equity Loan Trust, Series 2004-A, Class AF5 14 |

310,000 | 5.43 | 1/25/34 | 282,567 | ||||||||||||

| Centex Home Equity Loan Trust, Series 2004-D, Class AF6 14 |

1,727 | 5.17 | 9/25/34 | 1,719 | ||||||||||||

| CIT Home Equity Loan Trust, Series 2003-1, Class A6 14 |

423 | 4.56 | 10/20/32 | 420 | ||||||||||||

| Countrywide Asset-Backed Certificates, Series 2004-S1, Class A3 14 |

85,672 | 5.12 | 2/25/35 | 85,388 | ||||||||||||

| Credit Acceptance Auto Loan Trust, Series 2018-2A, Class B 4 |

500,000 | 3.94 | 7/15/27 | 491,111 | ||||||||||||

| GSAMP Trust, Series 2004-FM1, Class M1, 1 Mo. Libor + 0.98% 1 |

174,105 | 1.92 | 11/25/33 | 159,888 | ||||||||||||

| Home Equity Mortgage Loan Asset-Backed Trust, Series 2003-A, Class AV2, 1 Mo. Libor + 0.86% 1 |

323,222 | 1.81 | 10/25/33 | 303,874 | ||||||||||||

| Mill City Mortgage Loan Trust, Series 2017-3, Class A1 1, 4 |

276,816 | 2.75 | 1/25/61 | 276,401 | ||||||||||||

| New Century Home Equity Loan Trust, Series 2003-5, Class AI7 1 |

2,937 | 5.05 | 11/25/33 | 2,905 | ||||||||||||

| NovaStar Mortgage Funding Trust, Series 2004-2, Class M2, 1 Mo. Libor + 1.02% 1 |

44,812 | 1.97 | 9/25/34 | 36,012 | ||||||||||||

| OSCAR US Funding Trust IX, LLC, Series 2018-2A, Class A4 4 |

500,000 | 3.63 | 9/10/25 | 523,409 | ||||||||||||

| OSCAR US Funding Trust VI, LLC, Series 2017-1A, Class A3 4 |

60,530 | 2.82 | 6/10/21 | 60,608 | ||||||||||||

| OSCAR US Funding Trust VI, LLC, Series 2017-1A, Class A4 4 |

940,000 | 3.30 | 5/10/24 | 951,835 | ||||||||||||

| Towd Point Mortgage Trust, Series 2019-MH1, Class A1A 1, 4 |

985,267 | 2.18 | 2/25/60 | 964,946 | ||||||||||||

| Towd Point Mortgage Trust, Series 2019-MH1, Class A2 1, 4 |

800,000 | 3.00 | 11/25/58 | 756,607 | ||||||||||||

| Towd Point Mortgage Trust, Series 2019-SJ1, Class A1 1, 4 |

1,015,989 | 3.75 | 11/25/58 | 993,875 | ||||||||||||

| Towd Point Mortgage Trust, Series 2019-SJ3, Class A1 1, 4 |

662,845 | 3.00 | 11/25/59 | 657,509 | ||||||||||||

|

|

|

|||||||||||||||

| 8,088,072 | ||||||||||||||||

|

|

|

|||||||||||||||

| Total Asset-Backed Securities |

9,359,315 | |||||||||||||||

|

|

|

|||||||||||||||

| Collateralized Mortgage Obligations - 18.7% |

||||||||||||||||

| Agency - 10.1% |

||||||||||||||||

| FHLMC REMICS, Series 2528, Class KM |

24,223 | 5.50 | 11/15/22 | 25,176 | ||||||||||||

| FHLMC REMICS, Series 3104, Class BY |

102,396 | 5.50 | 1/15/26 | 111,052 | ||||||||||||

| FHLMC REMICS, Series 3806, Class JA |

244,010 | 3.50 | 2/15/26 | 253,736 | ||||||||||||

| FHLMC REMICS, Series 4759, Class NA |

787,878 | 3.00 | 8/15/44 | 823,569 | ||||||||||||

| FHLMC REMICS, Series 4776, Class QG |

823,929 | 3.00 | 9/15/42 | 841,120 | ||||||||||||

| FHLMC Structured Pass-Through Certificates, Series T-60, Class 1A2 |

784,129 | 7.00 | 3/25/44 | 925,742 | ||||||||||||

| FNMA Grantor Trust, Series 2004-T1, Class 2A 1 |

441,669 | 3.74 | 8/25/43 | 472,058 | ||||||||||||

| FNMA REMICS, Series 2003-52, Class NA |

28,707 | 4.00 | 6/25/23 | 29,306 | ||||||||||||

| FNMA REMICS, Series 2005-19, Class PA |

4,211 | 5.50 | 7/25/34 | 4,217 | ||||||||||||

| FNMA REMICS, Series 2005-68, Class PC |

2,557 | 5.50 | 7/25/35 | 2,578 | ||||||||||||

| FNMA REMICS, Series 2008-65, Class CD |

204 | 4.50 | 8/25/23 | 205 | ||||||||||||

| FNMA REMICS, Series 2009-13, Class NX |

1,519 | 4.50 | 3/25/24 | 1,548 | ||||||||||||

| FNMA REMICS, Series 2009-71, Class MB |

29,957 | 4.50 | 9/25/24 | 31,330 | ||||||||||||

| FNMA REMICS, Series 2009-88, Class DA |

258 | 4.50 | 10/25/20 | 259 | ||||||||||||

| FNMA REMICS, Series 2012-19, Class GH |

25,236 | 3.00 | 11/25/30 | 26,009 | ||||||||||||

| See accompanying notes to financial statements. |

||||

|

14 |

|

SIT MUTUAL FUNDS ANNUAL REPORT |

|

| Name of Issuer | Principal Amount ($) |

Coupon Rate (%) |

Maturity Date |

Fair Value ($) |

||||||||||||

| FNMA REMICS, Series 2013-74, Class AD |

103,951 | 2.00 | 7/25/23 | 105,122 | ||||||||||||

| FNMA REMICS, Series 2017-97, Class DP |

843,543 | 3.50 | 10/25/46 | 877,697 | ||||||||||||

| FNMA REMICS, Series 2018-1, Class TE |

496,131 | 3.50 | 3/25/44 | 517,640 | ||||||||||||

| FNMA REMICS, Series 2018-25, Class AG |

607,933 | 3.50 | 4/25/47 | 647,667 | ||||||||||||

| FRESB Mortgage Trust, Series 2018-SB45, Class A5H 1 |

780,880 | 2.96 | 11/25/37 | 817,363 | ||||||||||||

| FRESB Mortgage Trust, Series 2018-SB46, Class A5H 1 |

833,243 | 2.89 | 12/25/37 | 871,975 | ||||||||||||

| NCUA Guaranteed Notes Trust, Series 2010-R1, Class 1A, 1 Mo. Libor + 0.45% 1 |

205,473 | 1.47 | 10/7/20 | 205,344 | ||||||||||||

| NCUA Guaranteed Notes Trust, Series 2010-R3, Class 2A, 1 Mo. Libor + 0.56% 1 |

924,454 | 1.58 | 12/8/20 | 924,451 | ||||||||||||

| Seasoned Credit Risk Transfer Trust, Series 2019-4, Class M55D |

476,487 | 4.00 | 2/25/59 | 515,467 | ||||||||||||

| Vendee Mortgage Trust, Series 1993-1, Class ZB |

47,234 | 7.25 | 2/15/23 | 50,525 | ||||||||||||

|

|

|

|||||||||||||||

| 9,081,156 | ||||||||||||||||

|

|

|

|||||||||||||||

| Non-Agency - 8.6% |

||||||||||||||||

| Bear Stearns ALT-A Trust, Series 2004-12, Class 1A1, 1 Mo. Libor + 0.70% 1 |

794,811 | 1.65 | 1/25/35 | 770,926 | ||||||||||||

| COLT Mortgage Loan Trust, Series 2019-1, Class A1 1, 4 |

257,766 | 3.71 | 3/25/49 | 255,502 | ||||||||||||

| GSR Mortgage Loan Trust, Series 2005-5F, Class 8A1, 1 Mo. Libor + 0.50% 1 |

32,531 | 1.45 | 6/25/35 | 29,157 | ||||||||||||

| JP Morgan Mortgage Trust, Series 2019-1, Class A6 1, 4 |

107,152 | 4.00 | 5/25/49 | 106,282 | ||||||||||||

| JP Morgan Mortgage Trust, Series 2020-2, Class A4 1, 4 |

990,739 | 3.50 | 7/25/50 | 989,957 | ||||||||||||

| MASTR Adjustable Rate Mortgages Trust, Series 2004-13, Class 3A1 1 |

153,193 | 4.68 | 11/21/34 | 144,724 | ||||||||||||

| MASTR Alternative Loan Trust, Series 2003-4, Class 2A1 |

67,411 | 6.25 | 6/25/33 | 69,977 | ||||||||||||

| MASTR Alternative Loan Trust, Series 2003-5, Class 4A1 |

85,906 | 5.50 | 7/25/33 | 87,740 | ||||||||||||

| MASTR Alternative Loan Trust, Series 2003-8, Class 3A1 |

61,686 | 5.50 | 12/25/33 | 61,651 | ||||||||||||

| MASTR Asset Securitization Trust, Series 2005-2, Class 1A3 |

34,000 | 5.35 | 11/25/35 | 34,078 | ||||||||||||

| New Residential Mortgage Loan Trust, Series 2017-2A, Class A4 1, 4 |

508,203 | 4.00 | 3/25/57 | 523,811 | ||||||||||||

| New Residential Mortgage Loan Trust, Series 2017-3A, Class A1 1, 4 |

536,073 | 4.00 | 4/25/57 | 555,205 | ||||||||||||

| New Residential Mortgage Loan Trust, Series 2017-5A, Class A1, 1 Mo. Libor + 1.50% 1, 4 |

225,427 | 2.45 | 6/25/57 | 213,609 | ||||||||||||

| New Residential Mortgage Loan Trust, Series 2018-1A, Class A1A 1, 4 |

365,201 | 4.00 | 12/25/57 | 377,588 | ||||||||||||

| New Residential Mortgage Loan Trust, Series 2018-4A, Class A1S, 1 Mo. Libor + 0.75% 1, 4 |

593,196 | 1.70 | 1/25/48 | 551,050 | ||||||||||||

| Oaks Mortgage Trust, Series 2015-1, Class A9 1, 4 |

735,652 | 3.00 | 4/25/46 | 729,652 | ||||||||||||

| Prime Mortgage Trust, Series 2004-CL1, Class 1A1 |

62,501 | 6.00 | 2/25/34 | 63,522 | ||||||||||||

| RAAC Trust, Series 2004-SP3, Class AI5 1 |

211 | 4.89 | 12/25/32 | 210 | ||||||||||||

| Sequoia Mortgage Trust, Series 2012-2, Class B1 1 |

556,381 | 4.20 | 4/25/42 | 543,453 | ||||||||||||

| Sequoia Mortgage Trust, Series 2017-4, Class A4 1, 4 |

250,283 | 3.50 | 7/25/47 | 247,948 | ||||||||||||

| Sequoia Mortgage Trust, Series 2018-3, Class A4 1, 4 |

462,730 | 3.50 | 3/25/48 | 460,655 | ||||||||||||

| Sequoia Mortgage Trust, Series 2020-2, Class A4 1, 4 |

843,254 | 3.50 | 3/25/50 | 846,818 | ||||||||||||

| Structured Asset Securities, Corp. Mtg Pass-Through Certificates, Series 2003-22A, Class 3A 1 |

53,311 | 4.21 | 6/25/33 | 50,479 | ||||||||||||

| WaMu Mortgage Pass Through Certificates, Series 2002-AR2 Class A, US FED + 1.25% 1 |

82,471 | 2.23 | 2/27/34 | 73,344 | ||||||||||||

|

|

|

|||||||||||||||

| 7,787,338 | ||||||||||||||||

|

|

|

|||||||||||||||

| Total Collateralized Mortgage Obligations |

16,868,494 | |||||||||||||||

|

|

|

|||||||||||||||

| Corporate Bonds - 17.0% |

||||||||||||||||

| Ameriprise Financial, Inc. |

600,000 | 3.00 | 4/2/25 | 597,462 | ||||||||||||

| Biogen, Inc. |

900,000 | 4.05 | 9/15/25 | 951,569 | ||||||||||||

| Citizens Financial Group, Inc. (Subordinated) |

464,000 | 3.75 | 7/1/24 | 462,227 | ||||||||||||

| Credit Suisse Group Funding Guernsey, Ltd. 4 |

450,000 | 3.75 | 3/26/25 | 444,235 | ||||||||||||

| Delta Air Lines 2015-1 Class A Pass Through Trust |

603,658 | 3.88 | 7/30/27 | 544,898 | ||||||||||||

| Doric Nimrod Air Finance Alpha 2012-1 Trust 4 |

380,158 | 5.13 | 11/30/22 | 385,708 | ||||||||||||

| Duke Energy Florida Project Finance, LLC |

891,480 | 1.73 | 9/1/22 | 902,020 | ||||||||||||

| Georgia-Pacific, LLC |

645,000 | 7.38 | 12/1/25 | 815,485 | ||||||||||||

| Glencore Finance Canada, Ltd. 4 |

1,000,000 | 4.95 | 11/15/21 | 990,350 | ||||||||||||

| John Hancock Life Insurance Co. (Subordinated) 4 |

900,000 | 7.38 | 2/15/24 | 1,050,590 | ||||||||||||

| JPMorgan Chase & Co., 3 Mo. Libor + 0.80% 1 |

900,000 | 2.53 | 5/10/23 | 902,855 | ||||||||||||

| See accompanying notes to financial statements. |

||||

|

MARCH 31, 2020 |

|

15 |

|

SCHEDULE OF INVESTMENTS

March 31, 2020

Sit Quality Income Fund (Continued)

| Name of Issuer | Principal Amount ($) |

Coupon Rate (%) |

Maturity Date |

Fair Value ($) |

||||||||||||

| Liberty Mutual Insurance Co. (Subordinated) 4 |

700,000 | 8.50 | 5/15/25 | 837,054 | ||||||||||||

| Merck & Co., Inc. |

375,000 | 3.88 | 1/15/21 | 379,413 | ||||||||||||

| Nationwide Mutual Insurance Co. (Subordinated), 3 Mo. Libor + 2.29% 1, 4 |

725,000 | 3.03 | 12/15/24 | 724,031 | ||||||||||||

| Pfizer, Inc. |

350,000 | 2.20 | 12/15/21 | 351,035 | ||||||||||||

| Procter & Gamble Co. |

325,000 | 2.30 | 2/6/22 | 332,431 | ||||||||||||

| Prudential Insurance Co. of America (Subordinated) 4 |

700,000 | 8.30 | 7/1/25 | 846,296 | ||||||||||||

| RenaissanceRe Finance, Inc. |

500,000 | 3.70 | 4/1/25 | 536,544 | ||||||||||||

| SBA Tower Trust, Series 2014-2A, Class C 4 |

750,000 | 3.87 | 10/8/24 | 759,028 | ||||||||||||

| State Street Corp. |

400,000 | 1.95 | 5/19/21 | 398,243 | ||||||||||||

| Tyson Foods, Inc. |

200,000 | 2.25 | 8/23/21 | 199,082 | ||||||||||||

| United Airlines 2014-2 Class B Pass Through Trust |

580,877 | 4.63 | 9/3/22 | 543,475 | ||||||||||||

| US Airways 2013-1 Class A Pass Through Trust |

652,360 | 3.95 | 11/15/25 | 651,971 | ||||||||||||

| Walmart, Inc. |

500,000 | 3.13 | 6/23/21 | 510,888 | ||||||||||||

| Wisconsin Public Service Corp. |

200,000 | 3.35 | 11/21/21 | 201,028 | ||||||||||||

|

|

|

|||||||||||||||

| Total Corporate Bonds |

15,317,918 | |||||||||||||||

|

|

|

|||||||||||||||

| Mortgage Pass-Through Securities - 11.1% |

||||||||||||||||

| Federal Home Loan Mortgage Corporation - 0.6% |

||||||||||||||||

| Freddie Mac |

121,151 | 3.00 | 9/1/27 | 127,121 | ||||||||||||

| Freddie Mac |

25,296 | 3.50 | 7/1/26 | 26,627 | ||||||||||||

| Freddie Mac |

161,287 | 4.00 | 7/1/26 | 170,167 | ||||||||||||

| Freddie Mac |

172,423 | 4.00 | 1/1/27 | 181,930 | ||||||||||||

| Freddie Mac |

1,764 | 4.50 | 12/1/21 | 1,839 | ||||||||||||

| Freddie Mac |

7,473 | 4.50 | 7/1/26 | 7,817 | ||||||||||||

| Freddie Mac |

11,325 | 5.00 | 10/1/25 | 12,200 | ||||||||||||

| Freddie Mac |

119 | 5.50 | 5/1/20 | 119 | ||||||||||||

| Freddie Mac |

31 | 5.50 | 7/1/20 | 31 | ||||||||||||

| Freddie Mac |

23 | 5.50 | 12/1/20 | 23 | ||||||||||||

| Freddie Mac |

4,647 | 5.50 | 3/1/21 | 4,703 | ||||||||||||

| Freddie Mac |

3,222 | 5.50 | 3/1/21 | 3,238 | ||||||||||||

|

|

|

|||||||||||||||

| 535,815 | ||||||||||||||||

|

|

|

|||||||||||||||

| Federal National Mortgage Association - 7.7% |

||||||||||||||||

| Fannie Mae |

937,854 | 2.29 | 11/1/22 | 966,290 | ||||||||||||

| Fannie Mae |

1,281,340 | 2.35 | 5/1/23 | 1,331,268 | ||||||||||||

| Fannie Mae |

261,477 | 2.50 | 6/1/23 | 271,134 | ||||||||||||

| Fannie Mae |

202,480 | 3.00 | 8/1/28 | 212,004 | ||||||||||||

| Fannie Mae |

1,312,100 | 3.23 | 11/1/20 | 1,312,121 | ||||||||||||

| Fannie Mae |

462,882 | 3.50 | 1/1/26 | 487,273 | ||||||||||||

| Fannie Mae |

13,471 | 4.00 | 9/1/24 | 14,161 | ||||||||||||

| Fannie Mae |

99,138 | 4.00 | 6/1/25 | 104,292 | ||||||||||||

| Fannie Mae |

18,411 | 4.00 | 10/1/31 | 20,077 | ||||||||||||

| Fannie Mae |

82,930 | 4.50 | 4/1/25 | 87,451 | ||||||||||||

| Fannie Mae |

7,835 | 5.00 | 9/1/20 | 8,222 | ||||||||||||

| Fannie Mae |

327 | 5.50 | 1/1/21 | 328 | ||||||||||||

| Fannie Mae |

451 | 5.50 | 10/1/21 | 454 | ||||||||||||

| Fannie Mae |

792,777 | 5.50 | 8/1/40 | 914,903 | ||||||||||||

| Fannie Mae |

1,074,068 | 5.50 | 2/1/42 | 1,215,949 | ||||||||||||

|

|

|

|||||||||||||||

|

|

6,945,927 | |||||||||||||||

|

|

|

|||||||||||||||

| See accompanying notes to financial statements. |

||||

|

16 |

|

SIT MUTUAL FUNDS ANNUAL REPORT |

|

| Name of Issuer | Principal Amount ($) |

Coupon Rate (%) |

Maturity Date |

Fair Value ($) |

||||||||||||

| Government National Mortgage Association - 0.1% |

||||||||||||||||

| Ginnie Mae, US Treasury + 1.50% 1 |

34,526 | 3.88 | 4/20/33 | 35,704 | ||||||||||||

| Ginnie Mae, US Treasury + 1.50% 1 |

8,422 | 3.88 | 4/20/42 | 8,608 | ||||||||||||

| Ginnie Mae |

14,801 | 5.00 | 12/20/23 | 15,472 | ||||||||||||

| Ginnie Mae |

9,430 | 5.00 | 9/15/24 | 9,836 | ||||||||||||

| Ginnie Mae |

35,179 | 5.00 | 6/20/26 | 37,764 | ||||||||||||

|

|

|

|||||||||||||||

| 107,384 | ||||||||||||||||

|

|

|

|||||||||||||||

| Other Federal Agency Securities - 2.7% |

||||||||||||||||

| Small Business Administration Pools, PRIME - 2.50% 1 |

582,094 | 2.25 | 5/25/43 | 582,256 | ||||||||||||

| Small Business Administration Pools, PRIME + 0.77% 1 |

450,801 | 5.52 | 3/25/30 | 486,014 | ||||||||||||

| Small Business Administration Pools, PRIME + 0.80% 1 |

1,271,181 | 5.55 | 2/25/28 | 1,363,779 | ||||||||||||

|

|

|

|||||||||||||||

| 2,432,049 | ||||||||||||||||

|

|

|

|||||||||||||||

| Total Mortgage Pass-Through Securities |

10,021,175 | |||||||||||||||

|

|

|

|||||||||||||||

| Taxable Municipal Bonds - 13.0% |

||||||||||||||||

| Atlanta Downtown Development Authority 17 |

225,000 | 6.88 | 2/1/21 | 235,690 | ||||||||||||

| Berks County Industrial Development Authority |

270,000 | 3.20 | 5/15/21 | 270,521 | ||||||||||||

| City of Oklahoma City OK |

1,000,000 | 2.75 | 3/1/26 | 1,055,380 | ||||||||||||

| City of San Antonio TX |

1,000,000 | 6.04 | 8/1/33 | 1,012,930 | ||||||||||||

| City of Westminster Co. Water & Wastewater Utility Revenue |

1,000,000 | 5.82 | 12/1/30 | 1,020,940 | ||||||||||||

| City of Wilkes-Barre PA 17 |

1,000,000 | 3.24 | 11/15/21 | 1,035,310 | ||||||||||||

| City of Worcester MA 17 |

250,000 | 6.75 | 11/1/34 | 258,500 | ||||||||||||

| Colorado Housing & Finance Authority |

5,000 | 4.00 | 11/1/31 | 5,216 | ||||||||||||

| Financial Consulting Services Group, LLC 4 |

1,000,000 | 5.50 | 2/1/21 | 1,000,000 | ||||||||||||

| Kentucky Higher Education Student Loan Corp. |

605,000 | 3.92 | 6/1/32 | 653,394 | ||||||||||||

| Massachusetts Educational Financing Authority |

430,000 | 4.00 | 1/1/32 | 445,987 | ||||||||||||

| Massachusetts Educational Financing Authority |

750,000 | 4.41 | 7/1/34 | 847,995 | ||||||||||||

| New Hampshire Housing Finance Authority |

350,000 | 4.00 | 7/1/35 | 361,396 | ||||||||||||

| New Hampshire Housing Finance Authority |

5,000 | 4.00 | 1/1/37 | 5,270 | ||||||||||||

| New Jersey Economic Development Authority |

365,000 | 4.43 | 12/1/21 | 376,220 | ||||||||||||

| New Jersey Economic Development Authority |

500,000 | 2.88 | 6/15/24 | 481,700 | ||||||||||||

| New York City Transitional Finance Authority Future Tax Secured Revenue |

750,000 | 6.27 | 8/1/39 | 750,060 | ||||||||||||

| Patoka Lake Regional Water & Sewer District |

705,000 | 2.33 | 1/1/25 | 721,194 | ||||||||||||

| Tennessee Housing Development Agency |

80,000 | 3.50 | 7/1/31 | 82,271 | ||||||||||||

| Wisconsin Housing & Economic Development Authority 8 |

750,000 | 3.50 | 3/1/46 | 778,620 | ||||||||||||

| Wisconsin Public Finance Authority (Statler Hilton) 6 |

500,000 | 3.50 | 12/15/27 | 381,385 | ||||||||||||

|

|

|

|||||||||||||||

| Total Taxable Municipal Bonds |

11,779,979 | |||||||||||||||

|

|

|

|||||||||||||||

| U.S. Treasury / Federal Agency Securities - 23.4% |

||||||||||||||||

| Federal Agency Issues - 1.4% |

||||||||||||||||

| Federal Agricultural Mortgage Corp., 3 Mo. Libor + 0.37% 1 |

250,000 | 1.37 | 3/9/23 | 251,933 | ||||||||||||

| Pershing Road Development Co., LLC, 3 Mo. Libor + 0.40% 1, 4 |

250,000 | 1.98 | 9/15/21 | 246,250 | ||||||||||||

| U.S. Department of Housing and Urban Development |

800,000 | 4.28 | 8/1/27 | 809,369 | ||||||||||||

|

|

|

|||||||||||||||

| 1,307,552 | ||||||||||||||||

|

|

|

|||||||||||||||

| U.S. Treasury - 22.0% |

||||||||||||||||

| U.S. Treasury Bill 6 |

4,500,000 | 0.02 | 6/11/20 | 4,499,188 | ||||||||||||

| U.S. Treasury Bill 6 |

4,500,000 | 0.04 | 5/26/20 | 4,499,708 | ||||||||||||

| U.S. Treasury Bill 6 |

4,500,000 | 0.13 | 10/1/20 | 4,497,242 | ||||||||||||

| See accompanying notes to financial statements. |

||||

|

MARCH 31, 2020 |

|

17 |

|

SCHEDULE OF INVESTMENTS

March 31, 2020

Sit Quality Income Fund (Continued)

| Name of Issuer | Principal Amount ($) |

Coupon Rate (%) |

Maturity Date |

Fair Value ($) |

||||||||||||

| U.S. Treasury Floating Rate Note, 3 Mo. Libor + 0.05% 1 |

2,250,000 | 0.13 | 10/31/20 | 2,249,667 | ||||||||||||

| U.S. Treasury Note |

4,000,000 | 2.00 | 2/28/21 | 4,070,312 | ||||||||||||

|

|

|

|||||||||||||||

| 19,816,117 | ||||||||||||||||

|

|

|

|||||||||||||||

| Total U.S. Treasury / Federal Agency Securities |

21,123,669 | |||||||||||||||

|

|

|

|||||||||||||||

| Short-Term Securities - 27.9% |

||||||||||||||||

| Fidelity Inst. Money Mkt. Gvt. Fund, 0.30% |

25,199,363 | 25,199,363 | ||||||||||||||

|

|

|

|||||||||||||||

| (cost: $25,199,363) |

||||||||||||||||

| Total Investments in Securities - 121.5% |

109,669,913 | |||||||||||||||

|

|

|

|||||||||||||||

| Other Assets and Liabilities, net - (21.5%) |

(19,396,883 | ) | ||||||||||||||

|

|

|

|||||||||||||||

| Total Net Assets - 100.0% |

$ | 90,273,030 | ||||||||||||||

|

|

|

|||||||||||||||

| 1 | Variable rate security. Rate disclosed is as of March 31, 2020. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions, or, for mortgage-backed securities, are impacted by the individual mortgages which are paying off over time. These securities do not indicate a reference rate and spread in their descriptions. |

| 4 | 144A Restricted Security. The total value of such securities as of March 31, 2020 was $19,651,598 and represented 21.8% of net assets. These securities have been determined to be liquid by the Adviser in accordance with guidelines established by the Board of Directors. |

| 6 | Zero coupon or convertible capital appreciation bond, for which the rate disclosed is either the effective yield on purchase date or the coupon rate to be paid upon conversion to coupon paying. |

| 8 | Securities the income from which is treated as a tax preference that is included in alternative minimum taxable income for purposes of computing federal alternative minimum tax (AMT). At March 31, 2020, 0.9% of net assets in the Fund was invested in such securities. |

| 14 | Step Coupon: A bond that pays a coupon rate that increases on a specified date(s). Rate disclosed is as of March 31, 2020. |

| 17 | Security that is either an absolute and unconditional obligation of the United States Government or is collateralized by securities, loans, or leases guaranteed by the U.S. Government or its agencies or instrumentalities. |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

| See accompanying notes to financial statements. |

||||

|

18 |

|

SIT MUTUAL FUNDS ANNUAL REPORT |

|

A summary of the levels for the Fund’s investments as of March 31, 2020 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| Investment in Securities | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | ||||||||||||||

| Quoted | Other Significant | Other Significant | ||||||||||||||

| Price ($) | Observable Inputs ($) | Observable Inputs ($) | Total ($) | |||||||||||||

| Assets |

||||||||||||||||

| Asset-Backed Securities |

— | 9,359,315 | — | 9,359,315 | ||||||||||||

| Collateralized Mortgage Obligations |

— | 16,868,494 | — | 16,868,494 | ||||||||||||

| Corporate Bonds |

— | 15,317,918 | — | 15,317,918 | ||||||||||||

| Mortgage Pass-Through Securities |

— | 10,021,175 | — | 10,021,175 | ||||||||||||

| Taxable Municipal Bonds |

— | 11,779,979 | — | 11,779,979 | ||||||||||||

| U.S. Treasury / Federal Agency Securities |

— | 21,123,669 | — | 21,123,669 | ||||||||||||

| Short-Term Securities |

25,199,363 | — | — | 25,199,363 | ||||||||||||

| 25,199,363 | 84,470,550 | — | 109,669,913 | |||||||||||||

There were no transfers into or out of level 3 during the reporting period.

| See accompanying notes to financial statements. |

||||

|

MARCH 31, 2020 |

|

19 |

|

|

|

|

|

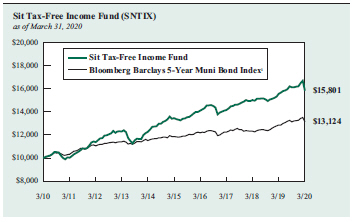

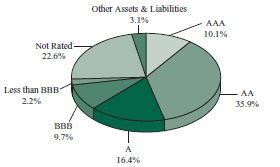

OBJECTIVE & STRATEGY

The objective of the Tax-Free Income Fund is to provide a high level of current income that is exempt from federal income tax, consistent with preservation of capital, by investing primarily in investment-grade municipal securities.

Such municipal securities generate interest income that is exempt from both federal regular income tax and federal alternative minimum tax. During normal market conditions, the Fund invests 100% of its net assets in such tax-exempt municipal securities.

| Information on this page is unaudited. | ||

| 20 |

SIT MUTUAL FUNDS ANNUAL REPORT | |

|

|

|

|

| Information on this page is unaudited. |

||||

|

MARCH 31, 2020 |

|

21 |

|

SCHEDULE OF INVESTMENTS

March 31, 2020

Sit Tax-Free Income Fund

| Name of Issuer | Principal Amount ($) |

Coupon Rate (%) |

Maturity Date |

Fair Value ($) |

||||||||||||

| Municipal Bonds - 92.5% |

||||||||||||||||

| Alabama - 0.4% |

||||||||||||||||

| Clio Water & Sewer Rev. (AGM Insured) |

340,000 | 3.10 | 1/1/33 | 340,449 | ||||||||||||

| Pell City Special Care Facs. Finance Auth. Rev. (Noland Health Services, Inc.) |

500,000 | 5.00 | 12/1/31 | 526,080 | ||||||||||||

| Russell Co. Board of Education Rev. |

345,000 | 3.05 | 12/1/34 | 345,159 | ||||||||||||

|

|

|

|||||||||||||||

| 1,211,688 | ||||||||||||||||

|

|

|

|||||||||||||||

| Alaska - 0.7% |

||||||||||||||||

| AK Hsg. Finance Corp. Mtg. Rev. |

190,000 | 4.13 | 12/1/37 | 193,614 | ||||||||||||

| AK Hsg. Finance Corp. Mtg. Rev. |

800,000 | 3.75 | 12/1/40 | 856,120 | ||||||||||||

| AK Hsg. Finance Corp. Rev. (State Capital Proj.) |

500,000 | 4.00 | 6/1/36 | 545,245 | ||||||||||||

| AK Industrial Dev. & Export Auth. Rev. (Boys & Girls Home) 2, 5, 15 |

250,000 | 5.50 | N/A | 12,500 | ||||||||||||

| AK Industrial Dev. & Export Auth. Rev. (GTR Fairbanks Community Hospital Foundation) |

250,000 | 5.00 | 4/1/33 | 268,793 | ||||||||||||

| AK Industrial Dev. & Export Auth. Rev. (Tanana Chiefs Conference Proj.) |

300,000 | 4.00 | 10/1/49 | 328,725 | ||||||||||||

|

|

|

|||||||||||||||

| 2,204,997 | ||||||||||||||||

|

|

|

|||||||||||||||

| Arizona - 2.3% |

||||||||||||||||

| AZ Health Facs. Auth. Rev. (Scottsdale Lincoln Hospital Proj.) 1 |

250,000 | 4.00 | 12/1/39 | 250,163 | ||||||||||||

| AZ Industrial Dev. Auth. Rev. (Bridgewater Avondale Proj.) |

500,000 | 5.38 | 1/1/38 | 456,430 | ||||||||||||

| AZ Industrial Dev. Auth. Rev. (Pinecrest Academy Horizon) 4 |

500,000 | 5.75 | 7/15/38 | 525,750 | ||||||||||||

| Glendale Industrial Dev. & Auth. Rev. (Beatitudes Campus Proj.) |

300,000 | 5.00 | 11/15/36 | 281,292 | ||||||||||||

| Glendale Industrial Dev. & Auth. Rev. (Glencroft Retirement Community) |

400,000 | 5.00 | 11/15/36 | 387,256 | ||||||||||||

| La Paz Co. Industrial Dev. Auth. (Charter School Solutions Harmony Public Proj.) |

750,000 | 5.00 | 2/15/48 | 805,380 | ||||||||||||

| Maricopa Co. Industrial Dev. Auth. Education Rev. (Horizon Community Learning Center) |

300,000 | 5.00 | 7/1/35 | 286,410 | ||||||||||||

| Maricopa Co. Industrial Dev. Auth. Rev. (Christian Care Surprise Inc.) 4 |

250,000 | 5.75 | 1/1/36 | 246,665 | ||||||||||||

| Maricopa Co. Industrial Dev. Auth. Rev. (Paradise School Proj.) |

1,000,000 | 4.00 | 7/1/54 | 1,082,330 | ||||||||||||

| Peoria Industrial Dev. Auth. Rev. (Sierra Winds Life Care Community) |

400,000 | 5.25 | 11/15/29 | 375,504 | ||||||||||||

| Phoenix City Industrial Dev. Auth. Rev. (Vista College Preparatory Proj.) |

400,000 | 4.13 | 7/1/38 | 441,520 | ||||||||||||

| Pima Co. Industrial Dev. Auth. Education Rev. (American Leadership Academy Proj.) 4 |

1,000,000 | 5.38 | 6/15/35 | 983,100 | ||||||||||||

| Pima Co. Industrial Dev. Auth. Education Rev. (American Leadership Academy Proj.) 4 |

370,000 | 4.75 | 6/15/37 | 330,262 | ||||||||||||

| Quechan Indian Tribe of Fort Yuma Rev. (Tribal Economic Dev.) |

370,000 | 9.75 | 5/1/25 | 391,541 | ||||||||||||

| Tempe Industrial Dev. Auth. Rev. (Mirabella at ASU Proj.) 4 |

500,000 | 4.70 | 10/1/24 | 494,025 | ||||||||||||

|

|

|

|||||||||||||||

| 7,337,628 | ||||||||||||||||

|

|

|

|||||||||||||||

| Arkansas - 0.7% |

||||||||||||||||

| Clarksville School District No. 17 of Johnson Co. G.O. |

500,000 | 2.70 | 12/1/24 | 500,350 | ||||||||||||

| Rogers City Rev. |

1,000,000 | 3.88 | 11/1/39 | 1,080,880 | ||||||||||||

| Springdale City Sales & Use Tax Rev. Ref. (BAM Insured) |

500,000 | 3.60 | 4/1/41 | 518,145 | ||||||||||||

|

|

|

|||||||||||||||

| 2,099,375 | ||||||||||||||||

|

|

|

|||||||||||||||

| California - 4.7% |

||||||||||||||||

| CA School Facs. Finance Auth. Rev. (Azusa Unified School District) (AGM Insured) 6 |

500,000 | 6.00 | 8/1/29 | 630,700 | ||||||||||||

| CA State G.O. |

500,000 | 4.00 | 12/1/40 | 535,830 | ||||||||||||

| Carlsbad Unified School District G.O. Capital Appreciation 6 |

400,000 | 6.00 | 8/1/31 | 514,968 | ||||||||||||

| Colton Joint Unified School District G.O. (AGM Insured) 6 |

1,000,000 | 6.00 | 8/1/35 | 1,163,620 | ||||||||||||

| Encinitas Union School District G.O. Capital Appreciation 6 |

500,000 | 7.00 | 8/1/35 | 666,115 | ||||||||||||

| Hartnell Community College G.O. 6 |

500,000 | 7.00 | 8/1/34 | 593,385 | ||||||||||||

| Healdsburg Unified School District G.O. 6 |

1,250,000 | 5.00 | 8/1/37 | 1,285,162 | ||||||||||||

| Imperial Community College District G.O. Capital Appreciation (AGM Insured) 6 |

250,000 | 6.75 | 8/1/40 | 320,240 | ||||||||||||

| Los Alamitos Unified School District Capital Appreciation C.O.P. 6 |

1,100,000 | 6.00 | 8/1/34 | 1,195,524 | ||||||||||||

| Martinez Unified School District G.O. 6 |

250,000 | 6.13 | 8/1/35 | 302,745 | ||||||||||||

| Placentia-Yorba Linda Unified School District C.O.P. Capital Appreciation (AGM Insured) 6 |

500,000 | 6.25 | 10/1/28 | 534,295 | ||||||||||||

| Redondo Beach School District G.O. 6 |

600,000 | 6.38 | 8/1/34 | 764,214 | ||||||||||||

| Reef-Sunset Unified School District (BAM Insured) 6 |

750,000 | 5.00 | 8/1/38 | 803,235 | ||||||||||||

| See accompanying notes to financial statements. |

||||

|

22 |

|

SIT MUTUAL FUNDS ANNUAL REPORT |

|

| Name of Issuer | Principal Amount ($) |

Coupon Rate (%) |

Maturity Date |

Fair Value ($) |

||||||||||||

| Ripon Unified School District G.O. (BAM Insured) 6 |

270,000 | 4.50 | 8/1/30 | 297,418 | ||||||||||||

| Ripon Unified School District G.O. (BAM Insured) 6 |

80,000 | 4.50 | 8/1/30 | 87,418 | ||||||||||||

| Sacramento Co. Water Financing Auth. Rev. (NATL-RE FGIC Insured) 1 |

500,000 | 1.63 | 6/1/39 | 461,830 | ||||||||||||

| San Jose Financing Auth. Rev. (Civic Center Garage Proj.) 9 |

400,000 | 5.00 | 6/1/39 | 441,224 | ||||||||||||

| South Tahoe Joint Powers Financing Auth. Tax Allocation Ref. (South Tahoe Redev. Proj.) (AGM Insured) |

500,000 | 5.00 | 10/1/30 | 567,950 | ||||||||||||

| Sulphur Springs Union School District C.O.P. (AGM Insured) 6 |

450,000 | 6.50 | 12/1/37 | 558,387 | ||||||||||||

| Tracy Joint Unified School District G.O. Capital Appreciation 6 |

600,000 | 7.00 | 8/1/41 | 615,318 | ||||||||||||

| Tustin Unified School District G.O. Capital Appreciation 6 |

500,000 | 6.00 | 8/1/28 | 531,985 | ||||||||||||

| Upland Unified School District G.O. Capital Appreciation 6 |

1,000,000 | 7.00 | 8/1/41 | 1,242,520 | ||||||||||||

| Val Verde Unified School District G.O. Capital Appreciation (AGM Insured) 6 |

500,000 | 6.00 | 8/1/34 | 630,475 | ||||||||||||

|

|

|

|||||||||||||||

| 14,744,558 | ||||||||||||||||

|

|

|

|||||||||||||||

| Colorado - 4.7% |

||||||||||||||||

| Aerotropolis Regional Transportation Auth. Rev. |

400,000 | 5.00 | 12/1/51 | 365,672 | ||||||||||||

| Broadway Station Metropolitan District No. 2 G.O. |

750,000 | 5.13 | 12/1/48 | 722,160 | ||||||||||||

| Broadway Station Metropolitan District No. 3 G.O. |

500,000 | 5.00 | 12/1/49 | 456,130 | ||||||||||||

| Buffalo Highlands Metropolitan District G.O. |

350,000 | 5.25 | 12/1/38 | 325,633 | ||||||||||||

| CO Educational & Cultural Facs. Auth. Rev. (CO Springs Charter Academy Proj.) |

250,000 | 5.60 | 7/1/34 | 251,500 | ||||||||||||

| CO Educational & Cultural Facs. Auth. Rev. Ref. (Windsor Charter Academy) 4 |

800,000 | 5.00 | 9/1/36 | 767,936 | ||||||||||||

| CO Health Facs. Auth. Rev. (Covenant Retirement Community) |

650,000 | 5.00 | 12/1/48 | 682,305 | ||||||||||||

| CO Science and Technology Park Metropolitan District No.1 Rev. |

500,000 | 5.00 | 12/1/33 | 487,780 | ||||||||||||

| Copper Ridge Metropolitan District Rev. |

350,000 | 5.00 | 12/1/43 | 317,516 | ||||||||||||

| Copperleaf Metro District No. 2 G.O. |

500,000 | 5.75 | 12/1/45 | 502,575 | ||||||||||||

| Copperleaf Metro District No. 4 G.O. |

750,000 | 5.00 | 12/1/49 | 667,402 | ||||||||||||

| Creekwalk Marketplace Business Improvement District Rev. 4 |

500,000 | 5.50 | 12/1/39 | 437,370 | ||||||||||||

| Crystal Crossing Metro District G.O. |

500,000 | 5.25 | 12/1/40 | 472,305 | ||||||||||||

| Denver 9th Avenue Metropolitan District No. 2 G.O |

500,000 | 5.00 | 12/1/48 | 474,735 | ||||||||||||

| Denver Urban Renewal Auth. Tax Allocation 4 |

500,000 | 5.25 | 12/1/39 | 469,620 | ||||||||||||

| DIATC Metropolitan District G.O. 4 |

500,000 | 5.00 | 12/1/49 | 465,670 | ||||||||||||

| Haskins Station Metropolitan District G.O. |

500,000 | 5.00 | 12/1/49 | 421,965 | ||||||||||||

| Hunters Overlook Metropolitan District No. 5 G.O. |

500,000 | 5.00 | 12/1/49 | 462,910 | ||||||||||||

| Iron Mountain Metropolitan District No. 2 G.O. |

635,000 | 5.00 | 12/1/39 | 568,281 | ||||||||||||

| Lambertson Farms Metro District No. 1 G.O. |

500,000 | 5.00 | 12/15/25 | 452,055 | ||||||||||||

| Leyden Rock Metropolitan District No. 10 G.O. |

250,000 | 5.00 | 12/1/45 | 239,910 | ||||||||||||

| Mirabelle Metropolitan Dist. No. 2 G.O. |

500,000 | 5.00 | 12/1/49 | 437,910 | ||||||||||||

| Painted Prairie Public Improvement Auth. Rev. |

500,000 | 5.00 | 12/1/39 | 459,445 | ||||||||||||

| Palisade Metropolitan District No. 2 G.O. |

500,000 | 5.00 | 12/1/46 | 458,850 | ||||||||||||

| St. Vrain Lakes Metropolitan District No. 2 G.O. |

500,000 | 5.00 | 12/1/37 | 475,735 | ||||||||||||

| STC Metropolitan District No. 2 G.O. |

500,000 | 5.00 | 12/1/49 | 450,580 | ||||||||||||

| Tallman Gulch Metropolitan District G.O. |

500,000 | 5.25 | 12/1/47 | 444,720 | ||||||||||||

| Thompson Crossing Metropolitan District No. 4 G.O. |

500,000 | 5.00 | 12/1/49 | 469,150 | ||||||||||||

| Vauxmont Metropolitan District G.O. (AGM Insured) |

500,000 | 3.25 | 12/15/50 | 519,230 | ||||||||||||

| Velocity Metropolitan District No. 3 G.O. |

500,000 | 5.38 | 12/1/39 | 480,320 | ||||||||||||

| Wild Plum Metropolitan District G.O. |

595,000 | 5.00 | 12/1/49 | 617,729 | ||||||||||||

|

|

|

|||||||||||||||

| 14,825,099 | ||||||||||||||||

|

|

|

|||||||||||||||

| Connecticut - 0.9% |

||||||||||||||||

| CT Hsg. Finance Auth. Rev. |

550,000 | 3.88 | 11/15/35 | 592,185 | ||||||||||||

| CT Hsg. Finance Auth. Rev. 9 |

505,000 | 4.25 | 6/15/43 | 561,020 | ||||||||||||

| CT Hsg. Finance Auth. Rev. |

1,000,000 | 3.85 | 5/15/45 | 1,043,000 | ||||||||||||

| CT Hsg. Finance Auth. Rev. 9 |

455,000 | 4.30 | 6/15/48 | 503,066 | ||||||||||||

|

|

|

|||||||||||||||

| 2,699,271 | ||||||||||||||||

|

|

|

|||||||||||||||

| See accompanying notes to financial statements. |

||||

|

MARCH 31, 2020 |

|

23 |

|

SCHEDULE OF INVESTMENTS

March 31, 2020

Sit Tax-Free Income Fund (Continued)

| Name of Issuer | Principal Amount ($) |

Coupon Rate (%) |

Maturity Date |

Fair Value ($) |

||||||||||||

| District of Columbia - 0.4% |

||||||||||||||||

| District of Columbia Hsg. Finance Agency Rev. (Multi-Family Dev. Program) |

600,000 | 4.05 | 9/1/43 | 653,196 | ||||||||||||

| District of Columbia Rev. (Ingleside Rock Creek Proj.) |

500,000 | 5.00 | 7/1/37 | 477,695 | ||||||||||||

|

|

|

|||||||||||||||

| 1,130,891 | ||||||||||||||||

|

|

|

|||||||||||||||

| Florida - 9.2% |

||||||||||||||||

| Alachua Co. Health Facs. Auth. Rev. (Oak Hammock University) |

385,000 | 8.00 | 10/1/32 | 422,041 | ||||||||||||

| Alta Lakes Community Dev. District Special Assessment |

500,000 | 4.40 | 5/1/39 | 464,530 | ||||||||||||

| Ave Maria Stewardship Community District Special Assessment. (AGM Insured) |

295,000 | 3.00 | 5/1/38 | 310,198 | ||||||||||||

| Bay Co. Educational Facs. Rev. (Bay Haven Charter) |

430,000 | 5.25 | 9/1/30 | 434,893 | ||||||||||||

| Blackburn Creek Community Dev. District Special Assessment (Grand Palm Proj.) |

200,000 | 6.25 | 5/1/35 | 208,212 | ||||||||||||

| Capital Trust Agency Rev. (Elim Senior Housing, Inc.) 4 |

250,000 | 5.00 | 8/1/27 | 225,138 | ||||||||||||

| Capital Trust Agency Rev. (Elim Senior Housing, Inc.) 4 |

250,000 | 5.38 | 8/1/32 | 215,855 | ||||||||||||

| Capital Trust Agency Rev. (River City Educational Services, Inc. Proj.) |

500,000 | 5.38 | 2/1/35 | 470,480 | ||||||||||||

| Capital Trust Agency Rev. (Tallahassee Tapestry) 2, 4, 5 |

550,000 | 6.75 | 12/1/35 | 352,105 | ||||||||||||

| Capital Trust Agency Rev. (Tapestry Walden Senior Hsg. Proj.) 2, 4, 5 |

250,000 | 6.75 | 7/1/37 | 159,278 | ||||||||||||

| Capital Trust Agency Rev. (Tuscan Gardens Senior Living Center) |

250,000 | 7.00 | 4/1/35 | 212,000 | ||||||||||||

| Capital Trust Agency Rev. (University Bridge LLC Student Housing Proj.) 4 |

500,000 | 5.25 | 12/1/43 | 482,245 | ||||||||||||

| Celebration Pointe Community Dev. District Special Assessment Rev. 4 |

250,000 | 5.00 | 5/1/32 | 254,095 | ||||||||||||

| Collier Co. Industrial Dev. Auth. Rev. (Arlington of Naples Proj.) 4, 5 |

250,000 | 7.25 | 5/15/26 | 217,812 | ||||||||||||

| Collier Co. Industrial Dev. Auth. Rev. (Arlington of Naples Proj.) 4, 5 |

750,000 | 8.13 | 5/15/44 | 653,438 | ||||||||||||

| Collier Co. Industrial Dev. Auth. Rev. (NCH Healthcare System Proj.) |

415,000 | 6.25 | 10/1/39 | 433,248 | ||||||||||||

| Dowden West Community Dev. District Special Assessment 4 |

360,000 | 5.40 | 5/1/39 | 375,239 | ||||||||||||

| Durbin Crossing Community Dev. District Special Assessment (AGM Insured) |

520,000 | 5.00 | 5/1/32 | 634,135 | ||||||||||||

| Escambia Co. Housing Finance Auth. Rev. (Multi-County Program) |

990,000 | 3.75 | 10/1/49 | 1,051,251 | ||||||||||||

| FL Hsg. Finance Corp. (GNMA/FNMA Collateralized) |

75,000 | 5.00 | 7/1/26 | 75,620 | ||||||||||||

| FL Hsg. Finance Corp. (GNMA/FNMA/FHLMC Collateralized) |

990,000 | 4.20 | 1/1/45 | 1,094,752 | ||||||||||||

| FL Hsg. Finance Corp. (GNMA/FNMA/FHLMC Collateralized) |

500,000 | 3.30 | 7/1/49 | 513,910 | ||||||||||||

| FL State Department of Education |

1,000,000 | 4.38 | 7/1/30 | 1,018,830 | ||||||||||||

| FRERC Community Dev. District Special Assessment |

1,000,000 | 5.38 | 11/1/40 | 933,340 | ||||||||||||

| Gramercy Farms Community Dev. District Special Assessment 6 |

420,000 | 3.24 | 5/1/39 | 201,600 | ||||||||||||

| Harbor Bay Community Dev. District Special Assessment |

350,000 | 4.10 | 5/1/48 | 307,520 | ||||||||||||

| Heritage Harbour North Community Dev. District Special Assessment |

200,000 | 5.00 | 5/1/34 | 208,022 | ||||||||||||

| Lake Co. Educational Project. Rev. (Imagine South Lake Charter School Proj.) 4 |

550,000 | 5.00 | 1/15/39 | 537,510 | ||||||||||||

| Lakewood Ranch Stewardship District Cap. Improvement Special Assesment Rev. (Azario Proj.) |

580,000 | 4.00 | 5/1/40 | 522,690 | ||||||||||||

| Lakewood Ranch Stewardship District Cap. Improvement Special Assesment Rev. (NE Sector Proj.) |

435,000 | 3.85 | 5/1/39 | 393,327 | ||||||||||||

| Lakewood Ranch Stewardship District Cap. Improvement Special Assessment Rev. |

250,000 | 4.25 | 5/1/25 | 251,640 | ||||||||||||

| Lakewood Ranch Stewardship District Cap. Improvement Special Assessment Rev. (Country Club East Proj.) |

150,000 | 6.70 | 5/1/33 | 158,196 | ||||||||||||

| Lakewood Ranch Stewardship District Cap. Improvement Special Assessment Rev. (Lakewood Center) |

200,000 | 7.40 | 5/1/30 | 208,954 | ||||||||||||

| Lakewood Ranch Stewardship District Cap. Improvement Special Assessment Rev. (Lakewood National) |

300,000 | 5.25 | 5/1/37 | 311,658 | ||||||||||||

| Lakewood Ranch Stewardship District Cap. Improvement Special Assessment Rev. (Lakewood Ranch) |

400,000 | 5.00 | 5/1/36 | 411,096 | ||||||||||||

| Lakewood Ranch Stewardship District Cap. Improvement Special Assessment Rev. (NE Sector Proj.) |

300,000 | 5.00 | 5/1/38 | 300,564 | ||||||||||||

| Lakewood Ranch Stewardship District Cap. Improvement Special Assessment Rev. (NE Sector Proj.) |

550,000 | 5.30 | 5/1/39 | 563,112 | ||||||||||||

| Lakewood Ranch Stewardship District Cap. Improvement Special Assessment Rev. (Webb Proj.) 4 |

320,000 | 5.00 | 5/1/37 | 325,712 | ||||||||||||

| Lakewood Ranch Stewardship District Special Assessment (Lake Club Phase 4 Proj.) |

500,000 | 4.50 | 5/1/49 | 481,680 | ||||||||||||

| Lexington Oaks Community Dev. District Special Assessment Rev. |

235,000 | 5.65 | 5/1/33 | 242,722 | ||||||||||||

| Live Oak No. 2 Community Dev. District Special Assessment |

400,000 | 4.00 | 5/1/35 | 420,484 | ||||||||||||

| Long Lake Ranch Community Dev. District Special Assessment |

110,000 | 5.63 | 5/1/24 | 111,338 | ||||||||||||

| LT Ranch Community Dev. District Special Assessment |

500,000 | 4.00 | 5/1/40 | 455,420 | ||||||||||||

| Magnolia Creek Community Dev. District Rev. 2, 5, 15 |

250,000 | 5.60 | N/A | 45,000 | ||||||||||||

| Marshall Creek Community Dev. District Cap. Improvement Special Assessment Rev. |

250,000 | 5.00 | 5/1/32 | 247,978 | ||||||||||||

| Miami-Dade Co. Transit Sales Tax Rev. |

500,000 | 5.00 | 7/1/34 | 579,260 | ||||||||||||

| New River Community Dev. District Cap. Improvement Special Assessment Rev. 2, 5, 15 |

230,000 | 5.00 | N/A | 2 | ||||||||||||

| See accompanying notes to financial statements. |

||||

|

24 |

|

SIT MUTUAL FUNDS ANNUAL REPORT |

|

| Name of Issuer | Principal Amount ($) |

Coupon Rate (%) |

Maturity Date |

Fair Value ($) |

||||||||||||

| Northern Palm Beach Co. Improvement District Special Assessment |

500,000 | 5.00 | 8/1/29 | 519,730 | ||||||||||||

| Northern Palm Beach Co. Improvement District Special Assessment |

250,000 | 5.00 | 8/1/37 | 256,942 | ||||||||||||

| Orange Co. Health Facs. Auth. Rev. (Presbyterian Retirement Community Proj.) |

550,000 | 5.00 | 8/1/34 | 600,336 | ||||||||||||

| Orange Co. Health Facs. Auth. Rev. (Presbyterian Retirement Community Proj.) |

500,000 | 5.00 | 8/1/35 | 552,490 | ||||||||||||

| Orange Co. Health Facs. Auth. Rev. (Presbyterian Retirement Community Proj.) |

250,000 | 5.00 | 8/1/41 | 272,962 | ||||||||||||

| Orange Co. Hsg. Finance Auth. Rev. (GNMA/FNMA/FHLMC Collateralized) |

415,000 | 3.95 | 3/1/40 | 435,621 | ||||||||||||

| Orange Co. Hsg. Finance Auth. Rev. (GNMA/FNMA/FHLMC Collateralized) |

375,000 | 4.00 | 9/1/48 | 402,446 | ||||||||||||

| Orlando Tourist Dev. Rev. (Senior Lien Tourist Dev.) (AGM Insured) |

250,000 | 5.00 | 11/1/38 | 299,158 | ||||||||||||

| Palm Beach Co. Health Facs. Auth. Rev. (ACTS Retirement-Life Community, Inc.) |

500,000 | 5.00 | 11/15/32 | 513,860 | ||||||||||||

| Palm Beach Co. Health Facs. Auth. Rev. (Lifespace Communities, Inc.) |

500,000 | 4.00 | 5/15/53 | 440,735 | ||||||||||||

| Palm Beach Co. Health Facs. Auth. Rev. (Sinai Residences Boca Raton Proj.) |

600,000 | 7.25 | 6/1/34 | 630,750 | ||||||||||||

| Palm Beach Co. Health Facs. Auth. Rev. (Sinai Residences Boca Raton Proj.) |

690,000 | 7.50 | 6/1/49 | 723,631 | ||||||||||||

| Parker Road Community Dev. Dist. Special Assessment |

500,000 | 4.10 | 5/1/50 | 414,810 | ||||||||||||

| Pinellas Co. Industrial Dev. Auth. Rev. |

500,000 | 5.00 | 7/1/39 | 499,960 | ||||||||||||

| Seven Oaks Community Dev. District Special Assessment Rev |

250,000 | 5.50 | 5/1/33 | 259,582 | ||||||||||||

| Southern Groves Community Dev. District No. 5 Special Assessment |

500,000 | 4.00 | 5/1/43 | 450,350 | ||||||||||||

| Tolomato Community Dev. District Special Assessment |

500,000 | 4.25 | 5/1/37 | 471,070 | ||||||||||||

| Tolomato Community Dev. District Special Assessment 2, 5 |

120,000 | 6.61 | 5/1/40 | 1 | ||||||||||||

| Tolomato Community Dev. District Special Assessment 6 |

185,000 | 7.00 | 5/1/40 | 160,116 | ||||||||||||

| Tolomato Community Dev. District Special Assessment 6 |

110,000 | 7.00 | 5/1/40 | 74,466 | ||||||||||||

| Tolomato Community Dev. District Special Assessment 6 |

45,000 | 7.00 | 5/1/40 | 35,202 | ||||||||||||

| Tolomato Community Dev. District Special Assessment (AGM Insured) |

500,000 | 3.75 | 5/1/40 | 549,695 | ||||||||||||

| Trout Creek Community Dev. District Special Assessment |

300,000 | 5.38 | 5/1/38 | 310,767 | ||||||||||||

| University Park Recreation District Special Assessment (BAM Insured) |

750,000 | 3.50 | 5/1/50 | 808,492 | ||||||||||||

| Waters Edge Community Dev. District Cap. Improvement Rev. |

9,000 | 5.35 | 5/1/39 | 8,682 | ||||||||||||

| Waters Edge Community Dev. District Cap. Improvement Rev. 6 |

165,000 | 6.60 | 5/1/39 | 144,669 | ||||||||||||

| Wiregrass Community Dev. District Special Assessment |

245,000 | 5.38 | 5/1/35 | 252,847 | ||||||||||||

| Zephyr Ridge Community Dev. District Special Assessment 2, 5, 15 |

450,000 | 5.25 | N/A | 198,000 | ||||||||||||

|

|

|

|||||||||||||||

| 28,785,500 | ||||||||||||||||

|

|

|

|||||||||||||||

| Georgia - 3.4% |

||||||||||||||||

| Clarke Co. Hospital Auth. Rev. (Piedmont Healthcare) |

350,000 | 5.00 | 7/1/46 | 395,524 | ||||||||||||

| Cobb Co. Dev. Auth. Rev. (Presbyterian Village Proj.) 4 |

650,000 | 5.00 | 12/1/39 | 572,760 | ||||||||||||

| Fulton Co. Dev. Auth. Rev. (Woodruff Arts Center) |

500,000 | 5.00 | 3/15/44 | 584,070 | ||||||||||||

| GA Housing & Finance Authority Rev. |

1,280,000 | 3.80 | 12/1/37 | 1,318,080 | ||||||||||||

| GA Housing & Finance Authority Rev. |

1,000,000 | 4.00 | 12/1/37 | 1,022,050 | ||||||||||||

| GA Housing & Finance Authority Rev. |

465,000 | 3.85 | 12/1/38 | 500,386 | ||||||||||||

| GA Housing & Finance Authority Rev. |

270,000 | 4.00 | 12/1/39 | 281,132 | ||||||||||||

| GA Housing & Finance Authority Rev. |

650,000 | 3.80 | 12/1/40 | 683,670 | ||||||||||||

| GA Housing & Finance Authority Rev. |

605,000 | 3.85 | 12/1/41 | 622,019 | ||||||||||||

| GA Housing & Finance Authority Rev. |

990,000 | 3.50 | 12/1/46 | 1,022,036 | ||||||||||||

| GA Housing & Finance Authority Rev. |

600,000 | 4.00 | 12/1/48 | 640,164 | ||||||||||||

| GA Housing & Finance Authority Rev. |

600,000 | 4.20 | 12/1/48 | 652,986 | ||||||||||||

| GA Housing & Finance Authority Rev. |

1,000,000 | 3.25 | 12/1/49 | 1,024,640 | ||||||||||||

| GA Tax Allocation (Beltline Proj.) |

500,000 | 5.00 | 1/1/30 | 501,440 | ||||||||||||

| Gainesville Hospital Auth. Rev. (Northeast Georgia Health System, Inc. Proj.) |

500,000 | 5.00 | 2/15/37 | 599,910 | ||||||||||||

| Glynn-Brunswick Memorial Hospital Auth. Rev. (Southeast Georgia Health System Proj.) |

350,000 | 5.00 | 8/1/47 | 407,645 | ||||||||||||

|

|

|

|||||||||||||||

| 10,828,512 | ||||||||||||||||

|

|

|

|||||||||||||||

| Idaho - 0.5% |

||||||||||||||||

| ID Health Facs. Authority Rev. (Terraces Boise Proj.) |

380,000 | 7.00 | 10/1/24 | 390,404 | ||||||||||||

| ID Health Facs. Authority Rev. (Terraces Boise Proj.) |

250,000 | 7.38 | 10/1/29 | 257,330 | ||||||||||||

| See accompanying notes to financial statements. |

||||

|

MARCH 31, 2020 |

|

25 |

|

SCHEDULE OF INVESTMENTS

March 31, 2020

Sit Tax-Free Income Fund (Continued)

| Name of Issuer | Principal Amount ($) |

Coupon Rate (%) |

Maturity Date |

Fair Value ($) |

||||||||||||

| ID Health Facs. Authority Rev. (Terraces Boise Proj.) |

500,000 | 8.00 | 10/1/44 | 515,265 | ||||||||||||

| ID Hsg. & Fin. Assoc. Nonprofit Facs. Rev. (Idaho Arts Charter School Proj.) |

380,000 | 5.75 | 12/1/32 | 400,896 | ||||||||||||

|

|

|

|||||||||||||||

| 1,563,895 | ||||||||||||||||

|

|

|

|||||||||||||||

| Illinois - 6.6% |

||||||||||||||||

| Bellwood G.O. |

500,000 | 5.88 | 12/1/27 | 556,385 | ||||||||||||

| Bolingbrook Special Tax (AGM Insured) |

998,000 | 4.00 | 3/1/30 | 1,129,147 | ||||||||||||

| Burbank Educational Facs. Rev. (Intercultural Montessori Language School) 4 |

500,000 | 6.00 | 9/1/35 | 519,355 | ||||||||||||

| Bureau Co. Township High School Dist. No. 502 G.O. (BAM Insured) |

500,000 | 6.25 | 12/1/33 | 590,035 | ||||||||||||

| Chicago Heights G.O. (NATL-RE Insured) |

500,000 | 4.50 | 12/1/29 | 545,355 | ||||||||||||

| Chicago Midway Airport Rev. (Second Lien) |

500,000 | 5.25 | 1/1/35 | 545,165 | ||||||||||||

| Chicago Park Dist. G.O (Limited Tax) |

1,000,000 | 5.00 | 1/1/28 | 1,077,080 | ||||||||||||

| Chicago Transit Auth. Sales Tax Rev. |

250,000 | 5.25 | 12/1/30 | 264,195 | ||||||||||||

| IL Educational Facs. Auth. Rev. |

250,000 | 4.50 | 11/1/36 | 272,932 | ||||||||||||

| IL Educational Facs. Auth. Rev. (Field Museum of Natural History) |

500,000 | 3.90 | 11/1/36 | 555,820 | ||||||||||||

| IL Fin. Auth. Rev. (Admiral Lake Proj.) |

670,000 | 5.13 | 5/15/38 | 601,626 | ||||||||||||

| IL Fin. Auth. Rev. (Christian Homes, Inc.) |

500,000 | 5.00 | 5/15/36 | 479,140 | ||||||||||||

| IL Fin. Auth. Rev. (Edward Elmhurst Healthcare) |

1,000,000 | 5.00 | 1/1/44 | 1,147,690 | ||||||||||||

| IL Fin. Auth. Rev. (Institute of Technology) |

500,000 | 4.00 | 9/1/41 | 477,155 | ||||||||||||

| IL Fin. Auth. Rev. (Lifespace Communities) |

500,000 | 5.00 | 5/15/35 | 516,600 | ||||||||||||

| IL Fin. Auth. Rev. (Lifespace Communities) |

500,000 | 5.00 | 5/15/45 | 508,550 | ||||||||||||

| IL Fin. Auth. Rev. (Rogers Park Montessori School Proj.) |

100,000 | 5.00 | 2/1/24 | 101,864 | ||||||||||||

| IL Fin. Auth. Rev. (Westminster Village) |

500,000 | 5.25 | 5/1/38 | 477,505 | ||||||||||||

| IL Fin. Auth. Sports Facs. Rev. (North Shore Ice Arena Proj.) |

1,000,000 | 6.25 | 12/1/38 | 630,630 | ||||||||||||

| IL G.O. |

250,000 | 5.50 | 7/1/33 | 256,800 | ||||||||||||

| IL G.O. (AGM Insured) |

500,000 | 4.00 | 2/1/30 | 495,365 | ||||||||||||

| IL Housing Dev. Auth. Rev. (FHA Insured) |

1,000,000 | 3.15 | 7/1/44 | 1,041,510 | ||||||||||||

| IL Housing Dev. Auth. Rev. (GNMA/FNMA/FHLMC Collateralized) |

440,000 | 3.88 | 4/1/41 | 474,879 | ||||||||||||

| IL Housing Dev. Auth. Rev. (GNMA/FNMA/FHLMC Collateralized) |

340,000 | 4.00 | 10/1/48 | 363,470 | ||||||||||||

| IL Rev. |

500,000 | 5.00 | 6/15/33 | 506,995 | ||||||||||||

| IL Sports Facilities Auth. Rev. (State Tax Supported) (AGM Insured) |

1,000,000 | 5.25 | 6/15/31 | 1,139,430 | ||||||||||||

| La Salle & Bureau Counties Township High School Dist. No. 120 LaSalle-Peru G.O. (BAM Insured) |

250,000 | 5.00 | 12/1/31 | 299,878 | ||||||||||||

| Macon & Moultrie Counties Community Unit School District No. 3 Mt Zion G.O. |

335,000 | 5.50 | 12/1/41 | 369,391 | ||||||||||||

| Macon Co. School District No. 61 Decatur G.O. (AGM Insured) |

250,000 | 5.25 | 1/1/37 | 256,895 | ||||||||||||

| Macoupin Sangamon & Montgomery Counties Community Unit School District G.O. (AGM Insured) |

990,000 | 4.25 | 12/1/35 | 1,066,200 | ||||||||||||

| Madison Counties Community College District No. 536 G.O. (Lewis & Clark Cmnty. College) |

345,000 | 5.00 | 5/1/29 | 346,083 | ||||||||||||

| Malta Tax Allocation Rev. 2, 5 |

1,921,000 | 5.75 | 12/30/25 | 614,720 | ||||||||||||

| Metropolitan Pier & Exposition Auth. Rev. (McCormick Place Expansion Proj.) |

250,000 | 5.00 | 6/15/57 | 243,395 | ||||||||||||

| Richton Park Public Library District G.O. |

250,000 | 4.50 | 12/15/32 | 264,010 | ||||||||||||

| Southwestern IL Dev. Auth. Tax Allocation Ref. (Local Govt. Program) 2 |

385,000 | 7.00 | 10/1/22 | 223,300 | ||||||||||||

| University of Illinois (AGM Insured) |

1,000,000 | 4.13 | 4/1/48 | 1,106,270 | ||||||||||||

| Upper Illinois River Valley Dev. Auth. Rev. (Cambridge Lakes Learning Center) 4 |

145,000 | 4.00 | 12/1/22 | 142,478 | ||||||||||||

| Upper Illinois River Valley Dev. Auth. Rev. (Cambridge Lakes Learning Center) 4 |

250,000 | 5.25 | 12/1/37 | 242,975 | ||||||||||||

| Upper Illinois River Valley Dev. Auth. Rev. (Prairie Crossing Charter) 4 |

250,000 | 5.00 | 1/1/45 | 236,090 | ||||||||||||

|

|

|

|||||||||||||||

| 20,686,363 | ||||||||||||||||

|

|

|

|||||||||||||||

| Indiana - 1.1% |

||||||||||||||||

| Carmel Multifamily Hsg. Rev. (Barrington Carmel Proj.) 2, 5 |

164,203 | 6.00 | 11/15/22 | 1,642 | ||||||||||||

| Evansville Hsg. Rev. (Silver Birch Evansville Proj.) |

250,000 | 5.45 | 1/1/38 | 225,732 | ||||||||||||

| IN Finance Auth. Rev. (BHI Senior Living) |

775,000 | 5.88 | 11/15/41 | 822,942 | ||||||||||||

| IN Finance Auth. Rev. (BHI Senior Living) |

425,000 | 6.00 | 11/15/41 | 453,798 | ||||||||||||

| IN Finance Auth. Rev. (BHI Senior Living) |

170,000 | 5.25 | 11/15/46 | 175,843 | ||||||||||||

| See accompanying notes to financial statements. |

||||

|

26 |

|

SIT MUTUAL FUNDS ANNUAL REPORT |

|

| Name of Issuer | Principal Amount ($) |

Coupon Rate (%) |

Maturity Date |

Fair Value ($) |

||||||||||||

| IN Finance Auth. Rev. (Greencroft Obligated Group) |

350,000 | 6.50 | 11/15/33 | 372,278 | ||||||||||||

| IN Housing & Community Dev. Auth. Rev. (Hammond Assisted Living Proj.) |

500,000 | 5.75 | 1/1/36 | 441,740 | ||||||||||||

| Merrillville Industry Economic Dev. Rev. (Belvedere Housing Proj.) |

300,000 | 5.75 | 4/1/36 | 256,782 | ||||||||||||

| Mishawaka Multifamily Hsg. Rev. (Silver Birch Mishawaka Proj.) 4 |

500,000 | 5.38 | 1/1/38 | 438,350 | ||||||||||||

| Richmond Hospital Auth. Rev. (Reid Hospital & Health Care) |

350,000 | 5.00 | 1/1/35 | 391,860 | ||||||||||||

|

|

|

|||||||||||||||

| 3,580,967 | ||||||||||||||||

|

|

|

|||||||||||||||

| Iowa - 0.9% |

||||||||||||||||

| IA Fin. Auth. Rev. (Lifespace Communities, Inc.) |

650,000 | 5.00 | 5/15/36 | 673,517 | ||||||||||||

| IA Fin. Auth. Rev. (Lifespace Communities, Inc.) |

550,000 | 5.00 | 5/15/47 | 560,120 | ||||||||||||

| IA Fin. Auth. Rev. (Lifespace Communities, Inc.) |

530,000 | 4.00 | 5/15/55 | 464,020 | ||||||||||||

| North Polk Community School District G.O. (AGM Insured) |

1,000,000 | 4.00 | 6/1/31 | 1,004,770 | ||||||||||||

|

|

|

|||||||||||||||

| 2,702,427 | ||||||||||||||||

|

|

|

|||||||||||||||

| Kansas - 0.1% |

||||||||||||||||

| Wichita Health Care Facs. Rev. (Kansas Masonic Home) |

300,000 | 5.25 | 12/1/36 | 289,641 | ||||||||||||

|

|

|

|||||||||||||||

| Kentucky - 0.1% |

||||||||||||||||

| Pikeville Hospital Rev. Ref. (Pikeville Medical Center) |

425,000 | 6.50 | 3/1/41 | 439,726 | ||||||||||||

|

|

|

|||||||||||||||

| Louisiana - 1.5% |

||||||||||||||||

| Denham Springs/Livingston Hsg. & Mtg. Finance Auth. Rev. (GNMA/FHLMC Collateralized) |

15,279 | 5.00 | 11/1/40 | 15,374 | ||||||||||||

| LA Hsg. Fin. Agy. Single Family Mtg. Rev. (Mtg. Backed Sec. Prog.) (GNMA/FHLMC Collateralized) |

75,000 | 4.60 | 6/1/29 | 76,872 | ||||||||||||

| LA Local Government Environmental Facilities & Community Development Auth. |

500,000 | 5.25 | 11/15/25 | 506,705 | ||||||||||||

| LA Local Government Environmental Facilities & Community Development Auth. |

500,000 | 6.00 | 11/15/30 | 520,475 | ||||||||||||

| LA Local Government Environmental Facilities & Community Development Auth. Rev. 4 |

300,000 | 5.65 | 11/1/37 | 299,322 | ||||||||||||

| LA Local Government Environmental Facilities & Community Development Auth. Rev. 4 |

500,000 | 5.00 | 7/1/39 | 492,670 | ||||||||||||

| LA Local Government Environmental Facilities & Community Development Auth. Rev. 4 |

300,000 | 5.50 | 11/1/39 | 286,662 | ||||||||||||

| LA Local Government Environmental Facilities & Community Development Auth. Rev. 4 |

500,000 | 4.00 | 11/1/44 | 397,835 | ||||||||||||

| LA Local Government Environmental Facilities & Community Development Auth. Rev. 4 |

495,000 | 4.40 | 11/1/44 | 419,418 | ||||||||||||

| LA Public Facs. Auth. Rev. (Belle-Chase Educational Foundation Proj.) (NATL-RE Insured) |

510,000 | 6.50 | 5/1/31 | 538,188 | ||||||||||||

| LA Public Facs. Auth. Rev. (Franciscan Missionaries Health System Proj.) |

300,000 | 5.00 | 7/1/35 | 346,263 | ||||||||||||

| LA Public Facs. Auth. Rev. (Tulane Univ. Proj.) (NATL-RE Insured) 1 |

570,000 | 1.83 | 2/15/36 | 551,925 | ||||||||||||

| St. Tammany Parish Fin. Auth. Rev. (Christwood Proj.) |

300,000 | 5.25 | 11/15/37 | 304,152 | ||||||||||||

|

|

|

|||||||||||||||

| 4,755,861 | ||||||||||||||||

|

|

|

|||||||||||||||

| Maine - 1.0% |

||||||||||||||||

| ME Hsg. Auth. Rev. |

600,000 | 4.00 | 11/15/35 | 637,794 | ||||||||||||

| ME Hsg. Auth. Rev. |

500,000 | 4.00 | 11/15/37 | 538,385 | ||||||||||||

| ME Hsg. Auth. Rev. |

105,000 | 4.50 | 11/15/37 | 109,928 | ||||||||||||

| ME Hsg. Auth. Rev. |

615,000 | 4.13 | 11/15/38 | 678,320 | ||||||||||||

| ME Hsg. Auth. Rev. |

500,000 | 3.85 | 11/15/40 | 526,915 | ||||||||||||

| ME Hsg. Auth. Rev. |

500,000 | 3.10 | 11/15/44 | 509,905 | ||||||||||||

|

|

|

|||||||||||||||

| 3,001,247 | ||||||||||||||||

|

|

|

|||||||||||||||

| Maryland - 0.4% |

||||||||||||||||

| MD Community Dev. Administration Rev. |

350,000 | 4.10 | 9/1/38 | 383,530 | ||||||||||||

| MD Community Dev. Administration Rev. |

350,000 | 4.20 | 7/1/46 | 376,414 | ||||||||||||

| Montgomery Co. Housing Opportunities Commission Rev. |

405,000 | 4.00 | 7/1/38 | 409,986 | ||||||||||||

|

|

|

|||||||||||||||

| 1,169,930 | ||||||||||||||||

|

|

|

|||||||||||||||

| Massachusetts - 2.9% |

||||||||||||||||

| Dedham Municipal Purpose Loan. G.O. (NATL Insured) |

480,000 | 4.00 | 10/15/24 | 481,123 | ||||||||||||

| Ipswich Muncipal Purpose Loan G.O. (AGM Insured) |

500,000 | 4.00 | 6/1/25 | 501,135 | ||||||||||||

| MA Dev. Finance Agy. Rev. |

890,000 | 5.00 | 7/1/44 | 999,381 | ||||||||||||

| See accompanying notes to financial statements. |

||||

|

MARCH 31, 2020 |

|

27 |

|

SCHEDULE OF INVESTMENTS

March 31, 2020

Sit Tax-Free Income Fund (Continued)

| Name of Issuer | Principal Amount ($) |

Coupon Rate (%) |

Maturity Date |

Fair Value ($) |

||||||||||||

| MA Dev. Finance Agy. Rev. (Atrius Health Issue) |

1,375,000 | 4.00 | 6/1/49 | 1,419,082 | ||||||||||||

| MA Dev. Finance Agy. Rev. (Newbridge on the Charles, Inc.) 4 |

300,000 | 5.00 | 10/1/47 | 294,720 | ||||||||||||

| MA Dev. Finance Agy. Rev. (Orchard Cove, Inc.) |

400,000 | 5.00 | 10/1/49 | 416,288 | ||||||||||||

| MA Education Finance Auth. Education Rev. |

50,000 | 5.15 | 1/1/26 | 50,048 | ||||||||||||

| MA Housing Finance Agy. Rev. |

250,000 | 4.75 | 6/1/35 | 257,970 | ||||||||||||

| MA Housing Finance Agy. Rev. |

500,000 | 4.00 | 12/1/38 | 546,335 | ||||||||||||

| MA Housing Finance Agy. Rev. |

500,000 | 3.75 | 12/1/40 | 524,705 | ||||||||||||

| MA Housing Finance Agy. Rev. |

900,000 | 3.85 | 12/1/47 | 959,103 | ||||||||||||

| MA Housing Finance Agy. Rev. |

825,000 | 3.60 | 12/1/59 | 861,671 | ||||||||||||

| MA Housing Finance Agy. Rev. (FHA Insured) |

500,000 | 5.30 | 12/1/38 | 503,205 | ||||||||||||

| MA Housing Finance Agy. Rev. (GNMA/FNMA/FHLMC Collateralized) |

270,000 | 3.90 | 12/1/38 | 275,824 | ||||||||||||

| Northbridge Muncipal Purpose Loan G.O (AGM Insured) |

500,000 | 4.00 | 6/15/25 | 501,040 | ||||||||||||

| Rowley Land Acquisition Loan G.O (AGM Insured) |

360,000 | 4.00 | 5/1/27 | 360,760 | ||||||||||||

|

|

|

|||||||||||||||

| 8,952,390 | ||||||||||||||||

|

|

|

|||||||||||||||

| Michigan - 3.3% |

||||||||||||||||

| Chandler Park Academy Rev. |

130,000 | 5.00 | 11/1/22 | 130,162 | ||||||||||||

| City of Allen Park G.O. (BAM Insured) |

300,000 | 3.25 | 5/1/34 | 312,513 | ||||||||||||

| MI Finance Auth. Rev. (Presbyterian Village) |

250,000 | 5.25 | 11/15/35 | 257,080 | ||||||||||||

| MI Hsg. Dev. Auth. (G.O. of Authority Insured) |

250,000 | 4.63 | 10/1/41 | 259,338 | ||||||||||||

| MI Hsg. Dev. Auth. Rev. |

500,000 | 4.10 | 10/1/35 | 534,055 | ||||||||||||

| MI Hsg. Dev. Auth. Rev. |

500,000 | 3.70 | 12/1/36 | 530,480 | ||||||||||||

| MI Hsg. Dev. Auth. Rev. |

1,500,000 | 4.13 | 12/1/38 | 1,655,220 | ||||||||||||

| MI Hsg. Dev. Auth. Rev. |

300,000 | 3.75 | 10/1/42 | 318,387 | ||||||||||||

| MI Hsg. Dev. Auth. Rev. |

750,000 | 4.00 | 10/1/43 | 813,578 | ||||||||||||

| MI Hsg. Dev. Auth. Rev. |

1,000,000 | 4.00 | 6/1/49 | 1,073,710 | ||||||||||||

| MI Hsg. Dev. Auth. Rev. |

2,000,000 | 3.15 | 6/1/50 | 2,025,160 | ||||||||||||

| MI Hsg. Dev. Auth. Rev. |

1,000,000 | 3.50 | 10/1/54 | 1,039,000 | ||||||||||||

| MI Public Educational Facs. Auth. Rev. (Chandler Park Academy) |

280,000 | 6.35 | 11/1/28 | 280,476 | ||||||||||||

| MI Strategic Fund. Rev. (United Methodist Retirement Facs.) |

415,000 | 5.00 | 11/15/49 | 425,495 | ||||||||||||

| Muskegon Heights Water Supply Rev. (NATL Insured) |

165,000 | 4.15 | 11/1/23 | 167,508 | ||||||||||||

| Muskegon Heights Water Supply Rev. (NATL Insured) |

135,000 | 4.20 | 11/1/24 | 137,114 | ||||||||||||

| Taylor Brownfield Redevelopment Authority (NATL Insured) |

250,000 | 5.00 | 5/1/32 | 281,150 | ||||||||||||

| Universal Academy Michigan Public School Rev. |

135,000 | 6.50 | 12/1/23 | 137,140 | ||||||||||||

|

|

|

|||||||||||||||

| 10,377,566 | ||||||||||||||||

|

|

|

|||||||||||||||

| Minnesota - 0.3% |

||||||||||||||||

| Apple Valley Rev. (Senior Living, LLC Proj.) |

500,000 | 5.00 | 1/1/47 | 323,720 | ||||||||||||

| MN Hsg. Fin. Agy. Mtg. Rev. (Mtg. Backed Securities Program) (GNMA/FNMA Collateralized) |

95,000 | 4.40 | 7/1/32 | 97,575 | ||||||||||||

| Rochester City Rev. (Math & Science Academy Proj.) |

500,000 | 5.13 | 9/1/38 | 455,500 | ||||||||||||

|

|

|

|||||||||||||||

| 876,795 | ||||||||||||||||

|

|

|

|||||||||||||||

| Mississippi - 0.6% |

||||||||||||||||

| MS Development Bank Rev. (Green Bond-Hancock County) 4 |

1,000,000 | 4.55 | 11/1/39 | 864,270 | ||||||||||||

| MS Gaming Tax Rev. |

740,000 | 4.00 | 10/15/38 | 791,267 | ||||||||||||

| MS Home Corp. Single Family Mtg. Rev. (GNMA/FNMA/FHLMC Collateralized) |

365,000 | 4.00 | 12/1/43 | 385,374 | ||||||||||||

|

|

|

|||||||||||||||

| 2,040,911 | ||||||||||||||||

|

|

|

|||||||||||||||

| Missouri - 1.4% |

||||||||||||||||

| Kansas City Industrial Dev. Auth. Rev. (Kansas City Pkg. LLC) |

200,000 | 5.45 | 9/1/23 | 200,272 | ||||||||||||

| Kansas City Industrial Dev. Auth. Rev. (United Methodist Retirement Home, Inc.) 2, 4, 5 |

500,000 | 5.75 | 11/15/36 | 348,205 | ||||||||||||

| Lees Summit Industrial Dev. Auth. Rev. (John Knox Village Proj.) |

370,000 | 5.00 | 8/15/32 | 366,614 | ||||||||||||

| MO Health & Education Facs. Auth. Rev. (Lutheran Senior Services) |

250,000 | 4.00 | 2/1/42 | 231,085 | ||||||||||||

| MO Health & Education Facs. Auth. Rev. (Lutheran Senior Services) |

1,000,000 | 4.00 | 2/1/48 | 897,620 | ||||||||||||

| See accompanying notes to financial statements. |

||||

|

28 |

|

SIT MUTUAL FUNDS ANNUAL REPORT |

|

| Name of Issuer | Principal Amount ($) |

Coupon Rate (%) |

Maturity Date |

Fair Value ($) |

||||||||||||

| MO Hsg. Dev. Commission Rev. (GNMA/FNMA/FHLMC Collateralized) |

690,000 | 3.80 | 11/1/48 | 731,780 | ||||||||||||

| MO Hsg. Dev. Commission Rev. (GNMA/FNMA/FHLMC Collateralized) |

500,000 | 3.05 | 11/1/49 | 504,980 | ||||||||||||

| MO Hsg. Dev. Commission Rev. (GNMA/FNMA/FHLMC Collateralized) |

500,000 | 3.35 | 11/1/49 | 516,050 | ||||||||||||

| MO Hsg. Dev. Commission Rev. (GNMA/FNMA/FHLMC Collateralized) |

750,000 | 2.85 | 5/1/50 | 737,610 | ||||||||||||

|

|

|

|||||||||||||||

| 4,534,216 | ||||||||||||||||

|

|

|

|||||||||||||||

| Montana - 0.4% |

||||||||||||||||

| MT Board of Housing Single Family Rev. |

195,000 | 4.00 | 12/1/38 | 207,377 | ||||||||||||