UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to § 240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Expeditors® 2019 Notice of Annual Meeting & Proxy Statement EXPEDITORS INTERNATIONAL OF WASHINGTON, INC. CORPORATE HEADQUARTERS SEATTLE, WA

EXPEDITORS NOTICE OF ANNUAL MEETING & PROXY STATEMENT 2023 Strength through Adversity Unity Discipline Mission Relationships Integrity Commitment Diversity

Resolve Our People Expeditors International of Washington Inc. Corporate Headquarters Seattle, WA

March 21, 2023

To Our Stakeholders

A few words could describe how capably our company rose to meet the challenges that confronted us in 2022: “exceptional,” “outstanding,” and “magnificent” easily come to mind. In February 2022 we were tested by the sudden and profound disruption of a major cyber-attack, requiring us to shut down all of our critical systems until we could adequately assess the degree and extent of the attack. For the roughly three weeks of the shutdown, our freight booking and handling staff around the world worked tirelessly to expedite shipments by old-school methods – over the phones and with paper and pencil, at times even arranging shipments with competitors – in an all-out effort to support our customers and keep their freight moving.

Post-attack, Expeditors still managed to generate three of the most profitable consecutive quarters in our 41-years. Throughout most of 2022, we continued to face ongoing impacts of the severe, pandemic-induced global supply chain disruptions that led to crippling shortages of available capacity, soaring rates, and labor and equipment shortages around the globe. In typical fashion, Expeditors’ highly talented and motivated workforce turned each adverse event into another success for the Company.

Conditions rapidly began to reverse course in the fourth quarter, and in these early days of 2023 we look to be in a very different operating environment. Leading global economic indicators are flashing warning signals, and a great many of the supply chain disruptions that defined the pandemic era have dissipated. Industry volumes are declining, and plummeting rates are considerably below their COVID-era peaks. But rapidly changing operating conditions are nothing new to our highly professional organization, and we are shifting the mindset throughout our global network to adapt yet again. We added headcount to address the surging volumes and complexities encountered during the pandemic. Now that we are in much different operating environment, we are laser focused on controlling expenses and seeking revenue growth opportunities. Our experience and past success teach us we also need to prepare for the next cycle of global growth and increased activity. We will continue to invest in critical technology and new initiatives that will lead to profitable growth.

We cannot adequately express our gratitude to each and every dedicated Expeditors employee for their superhuman efforts following the cyber-attack; nor to the customers who stayed with us throughout the worst days of our systems shutdown; our highly valued carrier partners, who understood what we were enduring and knew that we would get past it; and the government authorities, who helped us find innovative workarounds and trusted us to do the right thing. To all of you, we simply say thank you.

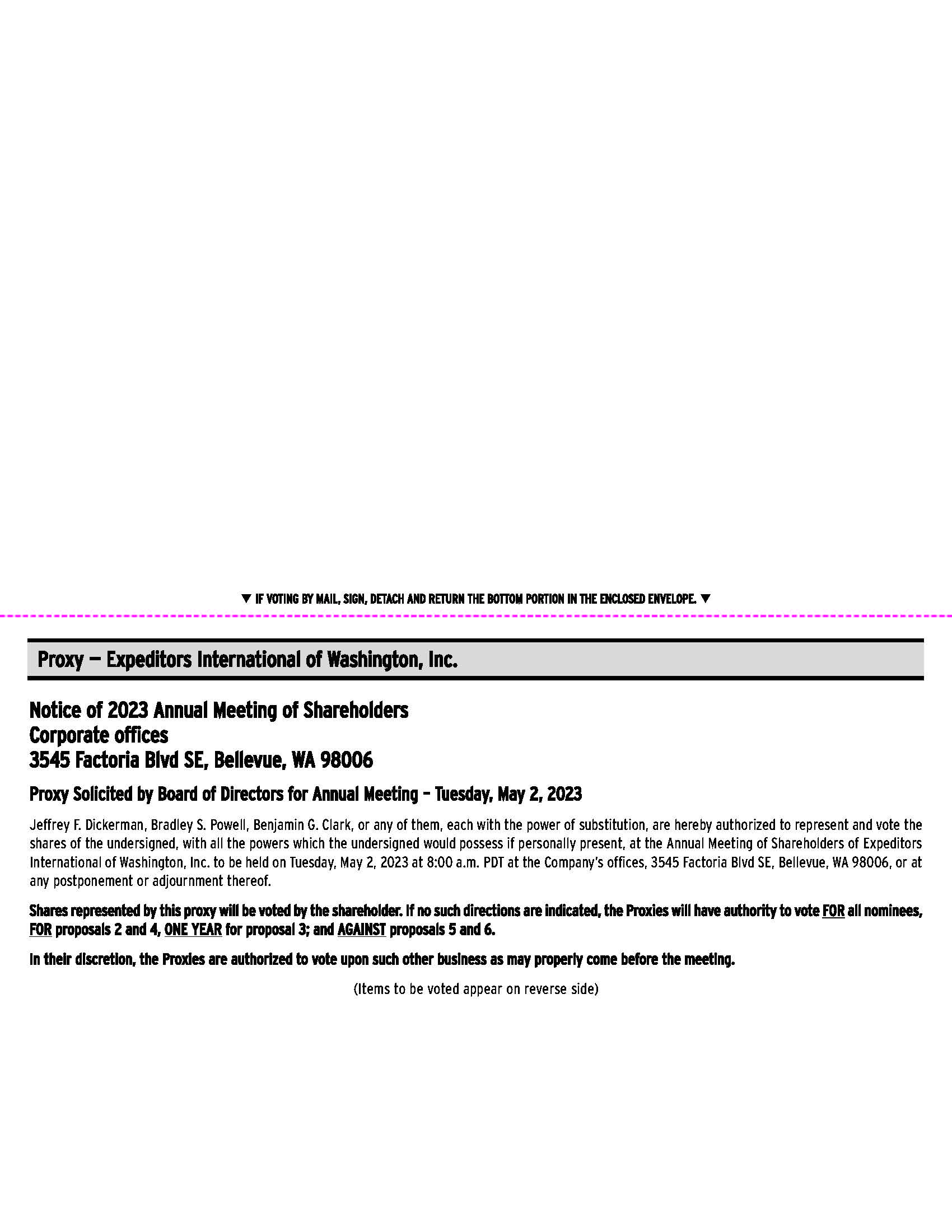

We ask for your vote:

We ask you to vote FOR the Board’s nine recommended director nominees and three proposals put forth by the Board of Directors.

We also ask you to carefully evaluate and to vote AGAINST two shareholder proposals that we believe are unnecessary and costly for shareholders.

One shareholder proposal is substantively moot, since our policy on severance and termination payments is more restrictive than what the proposal recommends.

The other proposal asks we provide “DEI reports” on our hiring, retention, and promotion of employees. Equal opportunity to be hired and to succeed without regard to gender, race, ethnicity or sexual orientation is a fundamental principle at Expeditors. Our employee-first approach focuses on the substance of achieving a breadth of perspectives at all levels. We support initiatives that expand opportunities for underrepresented groups. We make all employees feel welcome and provide equal access to career development opportunities. We are grateful and proud that an overwhelming majority of our employees believe in our culture and share in our drive to succeed. They are the reason we do succeed.

We thank you for investing with us and remain dedicated to sustaining your trust.

On behalf of the entire Board of Directors, we thank our employees, customers, service providers, communities and you, our shareholders, for your continued support and your investment in our business.

Sincerely,

/s/ Robert P. Carlile

Chairman of the Board

TABLE OF CONTENTS

Tuesday |

• Election of Directors |

May 2, 2023 |

• Approve (advisory) Named Executive Officer Compensation |

8:00 A.M. Pacific Time |

• Approve (advisory) the Frequency of Advisory Votes on Executive Officer Compensation |

|

• Ratification of Independent Registered Public Accounting Firm |

|

• Vote on two shareholder proposals, if presented at Meeting |

Expeditors International |

|

3545 Factoria Blvd SE |

|

Bellevue, WA 98006 |

Record Date: Close of business on March 7, 2023 |

Attending the Annual Meeting

Attendance at the Meeting is limited to shareholders able to present evidence of ownership as of the Record Date. All shareholders must be prepared to present valid photo identification to be admitted to the Meeting. Cameras (including cellular phones), recording devices and other electronic devices, and the use of cellular phones, will not be permitted at the Meeting. Representatives will be at the entrance to the Meeting, and these representatives will have the authority, on the Company’s behalf, to determine whether the admission policy and procedures have been followed and whether you will be granted admission to the Meeting.

Availability of Proxy Materials

This Notice of Annual Meeting of Shareholders and related proxy materials are being distributed or made available to shareholders beginning on or about March 21, 2023. This includes instructions on how to access these materials (including our Proxy Statement and 2022 Annual Report to shareholders) online.

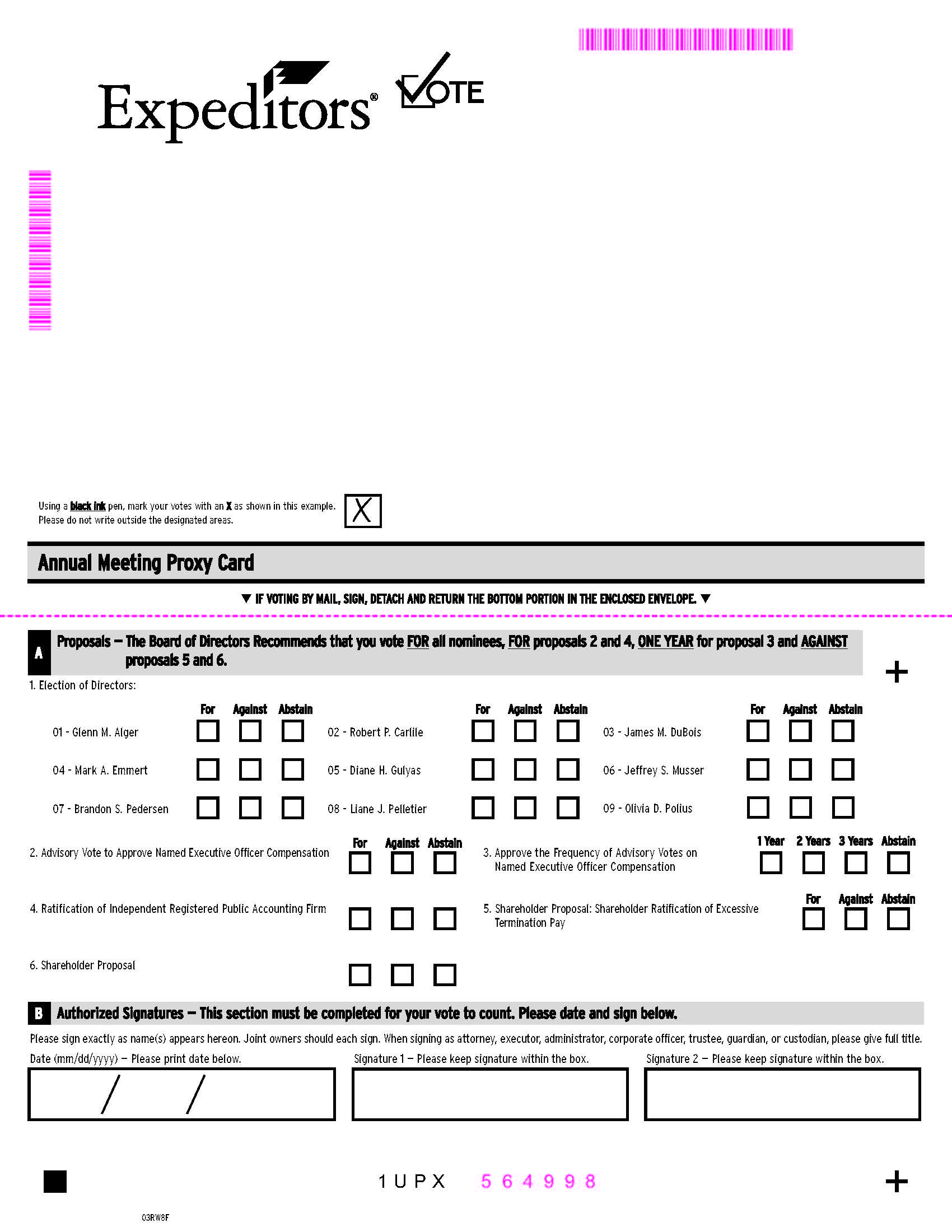

Please vote your shares

We encourage shareholders to vote promptly, as this will save the expense of additional proxy solicitation.

You may vote in the following ways:

By Order of the Board of Directors,

Expeditors International of Washington, Inc.

/s/ Jeffrey F. Dickerman

Jeffrey F. Dickerman

Corporate Secretary

Bellevue, Washington

March 21, 2023

Notice of Annual Meeting & Proxy Statement | 1

PROXY SUMMARY

This Proxy Statement and the accompanying form of proxy are furnished in connection with the solicitation of proxies by the Board of Directors of Expeditors International of Washington, Inc. (the Company, Expeditors, we, us, our) for use at the Annual Meeting of Shareholders (the Annual Meeting). This proxy summary is intended to provide a broad overview of the items that you will find elsewhere in this Proxy Statement. As this is only a summary, we encourage you to read the entire Proxy Statement for more information about these topics prior to voting.

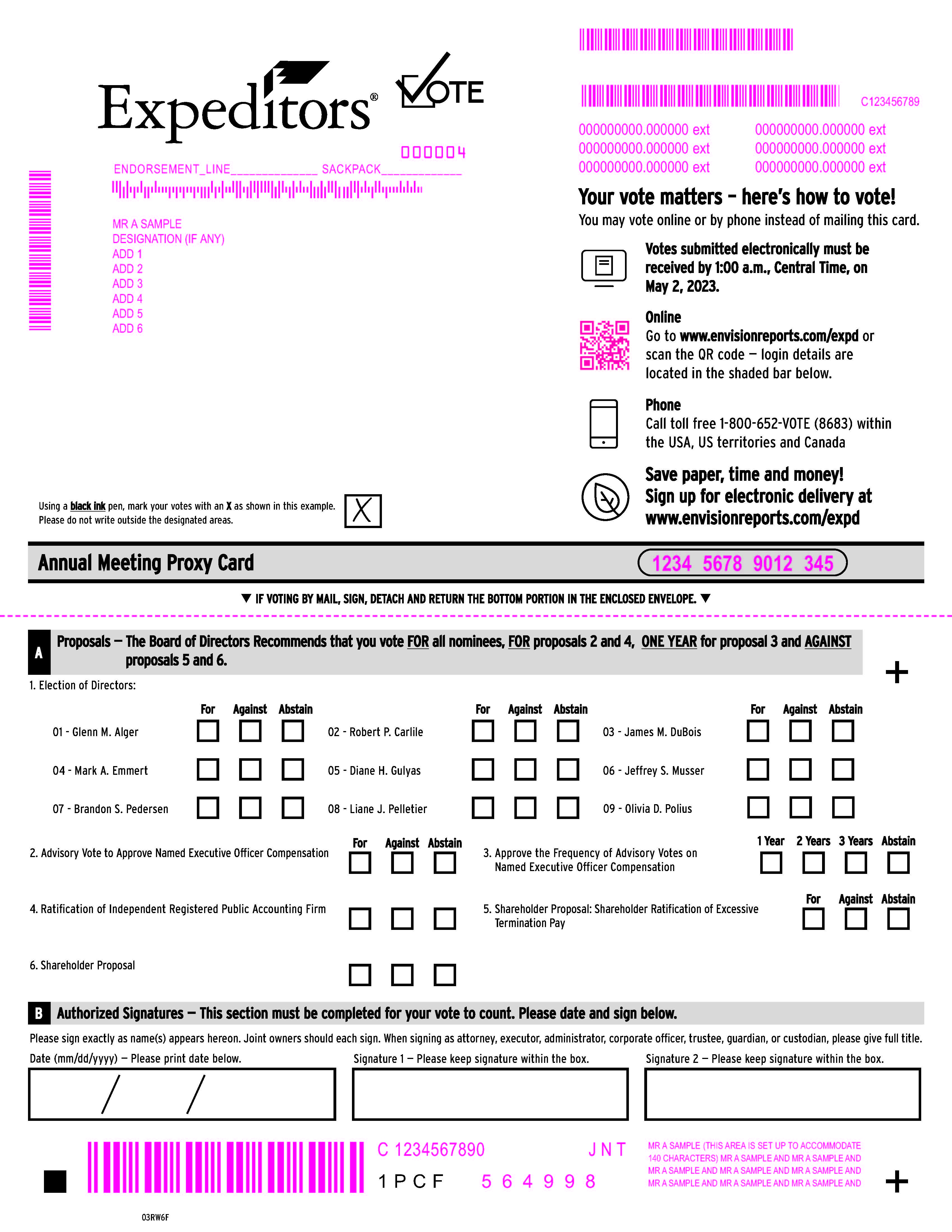

Meeting Agenda & Voting Recommendations |

|

|

Proposal |

Board's Voting Recommendation |

Page |

|

No. 1: Election of Directors |

ü |

FOR (each nominee) |

6 |

|

|

|

|

No. 2: Advisory Vote to Approve Named Executive Officer Compensation |

ü |

FOR |

21 |

|

|

|

|

No. 3: Advisory Vote to Approve Frequency of Advisory Votes on Executive Officer Compensation |

ü |

1 YEAR |

35 |

|

|

|

|

No. 4: Ratification of Independent Registered Public Accounting Firm |

ü |

FOR |

36 |

|

|

|

|

No. 5: Shareholder Proposal: Shareholder Ratification of Excessive Termination Pay |

X |

AGAINST |

38 |

|

|

|

|

No. 6: Shareholder Proposal |

X |

AGAINST |

40 |

|

|

|

|

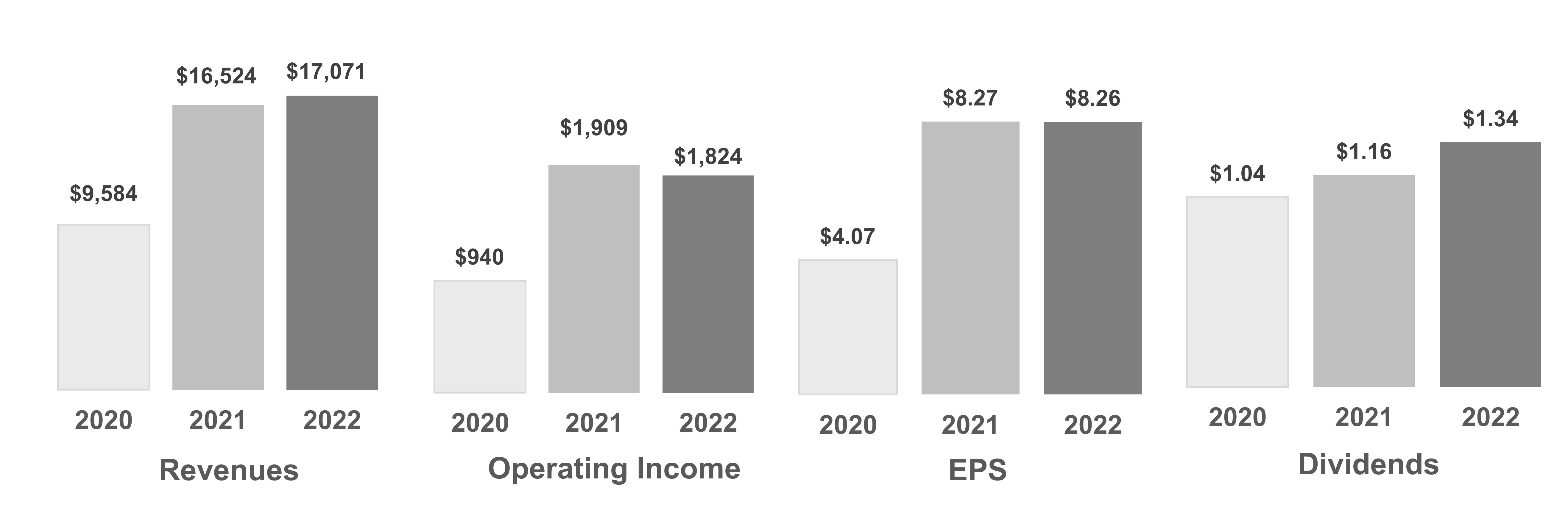

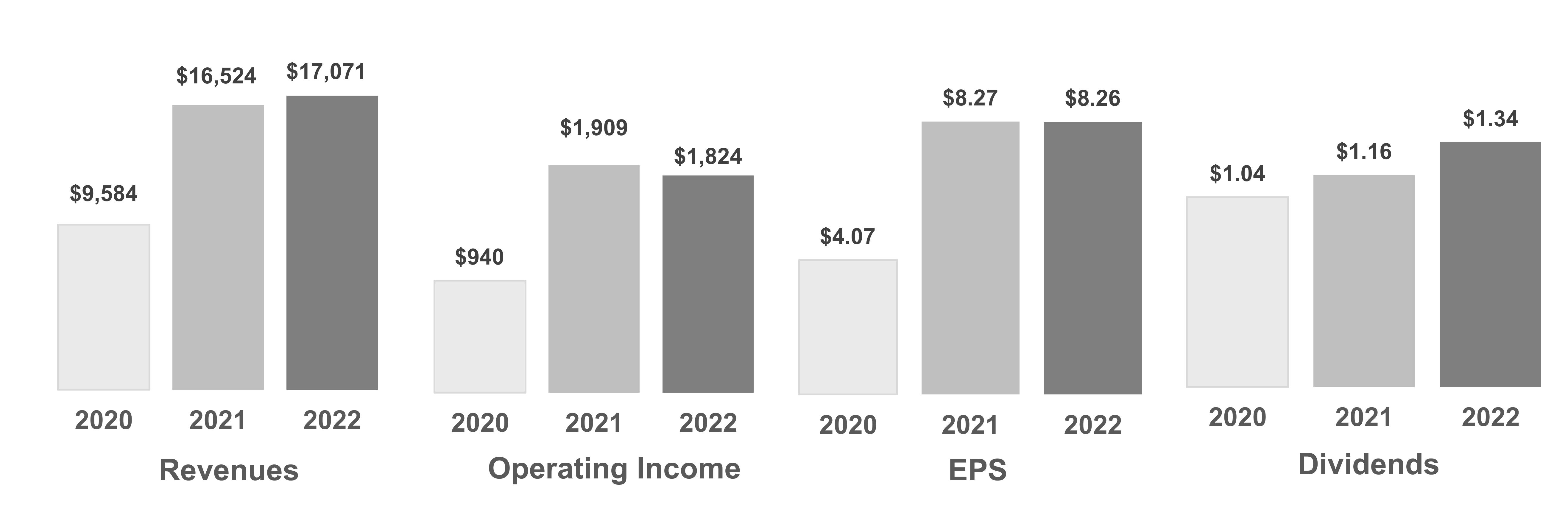

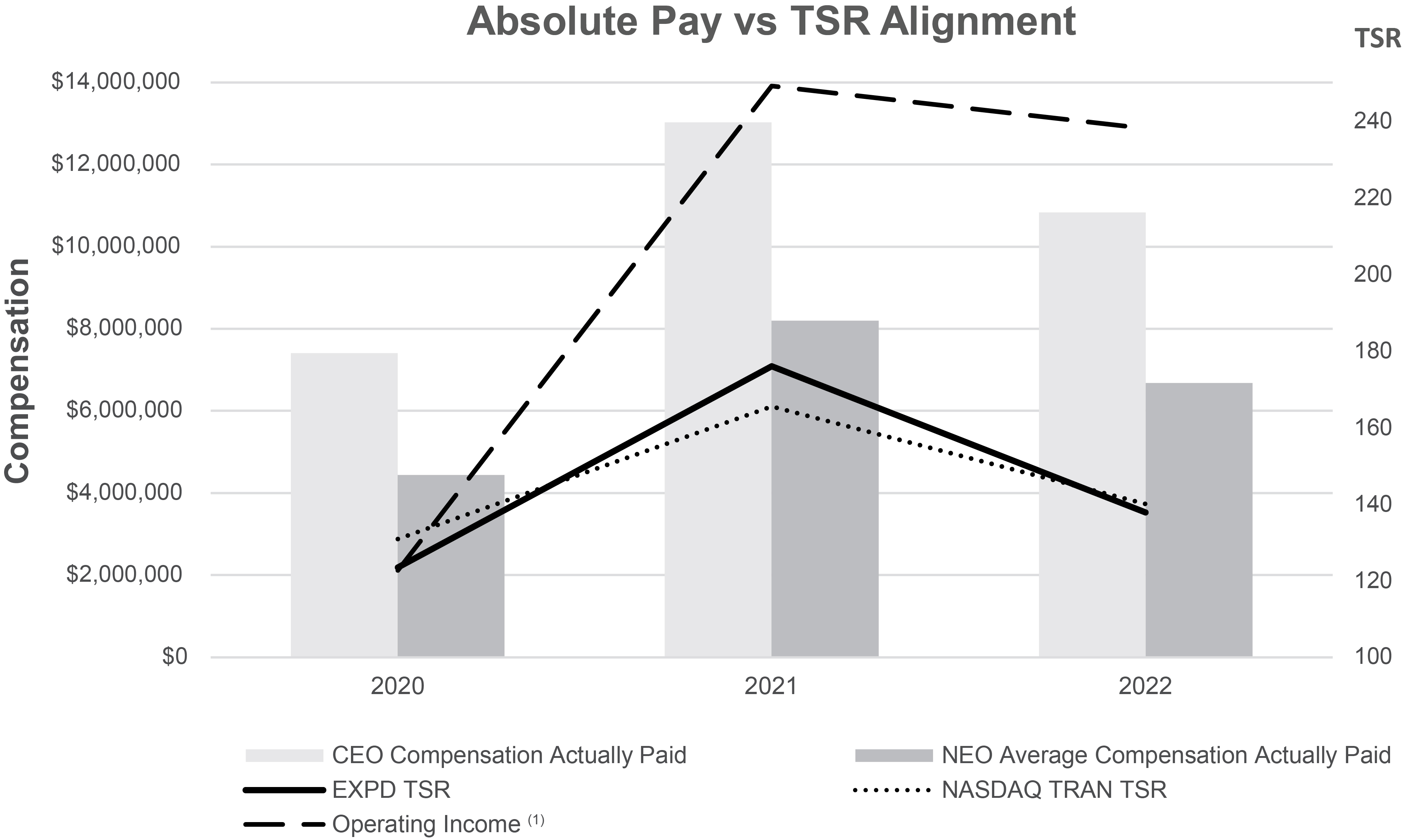

2020-2022 Financial Performance

(Data in millions except dividends and earnings per share (EPS))

Despite ongoing global supply chain disruptions, scarce capacity, historically high and volatile buy and sell rates, and shortages of labor and equipment – not to mention a cyber-attack that prompted us to proactively shut down all of our critical systems for approximately three weeks – we grew revenues by 3%, generated more than $2 billion in operating cash flow, and returned $1.8 billion to shareholders via stock repurchases and dividends as 2022 was one of the most profitable years in our Company’s history. Last year also marked the beginning of the end of many of the disruptions that so severely impacted the worldwide transportation industry throughout the COVID-19 pandemic. As we start 2023, Expeditors is adjusting to a very different operating environment that has been altered in so many ways, from how people shop and to where they work, and, with not less but more uncertainty than prior to COVID-19. Even as conditions change, Expeditors’ mission remains the same: to provide solutions and the highest level of service to our customers around the world.

2022 Highlights

Notice of Annual Meeting & Proxy Statement | 2

Vote NO on Shareholder Proposals 5 and 6

ENHANCING OUR COMMITMENT TO SUSTAINABILITY

Expeditors has always been committed to the fundamental values of good environmental, social and governance (ESG) corporate citizenship since our Company’s inception. Indeed, this commitment is part of our business model and is reflected in the various long-standing mechanisms that we have put in place to promote the best interests of all Expeditors’ stakeholders – including our shareholders, employees, service providers, customers, and communities. Our commitments and their results have not gone unnoticed: In 2022, we obtained a “low risk” ESG rating from Sustainalytics/Morningstar, ranking in the top 7% of firms in our industry group.

Because we believe that ESG is intrinsically linked to our strategy, we conducted a third-party Materiality Assessment in 2022. In addition, we also appointed our first Director of Environmental Sustainability and set our own Scope 1 & 2 CO2 emissions reduction targets. As we gain momentum with these steps forward, we will continue to focus on making a difference not only by managing our own emissions, but also by collaborating with our customers and service providers – something we are well-positioned to do because we operate as an intermediary at the supply chain orchestration level (i.e., we are non-asset based, meaning that we do not own or operate any airplanes, ships or trucks).

Additional information about our programs to sustain a healthy environment and reduce greenhouse gas emissions, as well as our approach to social responsibility and sound governance is set forth on pages 19-20 of this proxy statement, and can also be found in our latest ESG report, which is updated annually: www.expeditors.com/sustainability.

Our Compensation Program in Brief

The 2008 Executive Incentive Compensation Plan (“Incentive Compensation Plan”) is a primary component of our compensation program. This shareholder-approved plan has been in place since 1985 and is designed to drive superior financial results and is effective because of its simplicity, transparency, and focus on a key operating metric: U.S. GAAP operating income. The unique design of The Plan incentivizes our management team to continually increase our GAAP operating income, which in turn drives long-term shareholder value.

GAAP operating income is comprehensive, simple, objective, and easily understood. It drives both short- and long-term growth, efficiency, creates a prudent and entrepreneurial environment, and rewards management for delivering profitable results.

We use GAAP operating income because we believe that management must be held accountable for our results, regardless of external market forces that may adversely affect the level of bonus payouts. It creates a culture of

Notice of Annual Meeting & Proxy Statement | 3

shared economic interests among our top managers and ensures a universal and daily focus on the achievement of superior financial results. Equally important, our focus on continual improvement in operating income drives long-term shareholder value creation.

Company performance funds an Incentive Pool with up to 10% of our U.S. GAAP operating income before bonus. The Incentive Pool is paid out at a fixed percentage of operating income, with fluctuations in the amounts paid directly linked to actual changes in operating income, aligning both the short- and long-term interests of employees and shareholders. Furthermore, no incentive payments will be made for a quarter in which we have no or negative operating income, and any cumulative operating losses, should they occur, must be made up by future operating income before we would start to fund the Incentive Pool for incentive payments.

We believe this policy protects shareholder interests while strongly incentivizing our management team to maintain and increase positive operating income every fiscal quarter. We encourage you to read further details of The Plan in our Compensation Discussion & Analysis.

Over the years we have increasingly shifted the balance of our compensation towards equity-based incentives via Restricted Stock Unit and Performance Stock Unit programs for all executives, as we remain fully committed to a strong pay-for-performance compensation philosophy that is unique to our culture and that is right for our shareholders, our customers and our employees.

Compensation Highlights

We value our shareholders’ views on Named Executive Officer (NEO) compensation and our incentive compensation programs. We continue to extend outreach and regularly engage with those representing half of the outstanding shares to understand their perspectives on our Company performance, including our compensation programs. Shareholders supported our annual advisory vote on NEO compensation by an average of 92% over the past three years by voting FOR our proposals.

Total compensation to our CEO and to our other NEO decreased 17% and 19%, respectively, from 2021 primarily due to participation in our Incentive Compensation Plan. While our shareholder-approved Incentive Compensation Plan performed as designed in 2022, delivering performance-based compensation tied directly to operating income, the Compensation Committee of the Board of Directors took the following actions to reduce the growth of NEO compensation:

Highlights of our compensation program include:

― |

A minimum 5% growth in quarterly operating income is required for senior managers to earn an unreduced payout from the Incentive Compensation Plan |

― |

Pay for performance (over 85% of NEO pay is 'at risk' and directly linked to performance) |

― |

No guaranteed bonuses |

― |

No retirement bonuses |

― |

No perquisites |

― |

NEO allocation of the Executive Incentive Compensation Pool is reduced over time |

― |

NEO allocation of the Executive Incentive Compensation Pool is limited to preset allocation percentages |

― |

NEO Executive Incentive Compensation is strictly tied to U.S. GAAP operating income |

― |

Incentive compensation is subject to clawback policy |

― |

Double trigger vesting of unvested equity upon a change in control |

Notice of Annual Meeting & Proxy Statement | 4

DIRECTOR IDENTIFICATION & NOMINATION PROCESS

The Policy on Director Nominations, which can be found on the Company’s website at https://investor.expeditors.com, describes the process by which Director nominees are selected by the Nominating and Corporate Governance Committee, and includes the criteria the Committee will consider in determining the qualifications of any candidate for Director. In reviewing candidates for the Board, the Committee considers the entirety of each candidate’s credentials in the context of these standards. With respect to the nomination of continuing Directors for re-election, the individual’s contributions to the Board are also considered.

The Committee annually reviews its nomination procedures to assess the effectiveness of the Policy on Director Nominations. The Committee considers candidates for Director who are recommended by its members, by management, and by search firms retained by the Committee. Per the Policy on Director Nominations, the Committee will also consider any candidate proposed by a shareholder satisfying certain notice provisions and will take into account the size and duration of the recommending shareholder's ownership. In addition, the Committee ensures that, with respect to any new candidates recruited from outside the Company, the initial list of new candidates includes qualified female and racially/ethnically diverse individuals. Furthermore, the Committee will instruct any retained search firms to include the same on their initial lists of potential candidates submitted to the Committee.

All candidates for Director who, after evaluation, are then recommended by the Committee and approved by the Board of Directors will be included in the Company’s recommended slate of Director nominees in its Proxy Statement.

In addition, any shareholder or group of up to 20 shareholders that has continuously beneficially owned at least 3% of the Company’s Common Stock for at least three years, and who satisfies certain notice, information and consent provisions, may nominate up to 20% of the Directors standing for election and include such nominees on the Company's proxy statement pursuant to the Company's proxy access rights. Lastly, a shareholder may nominate a Director candidate for election outside of the Company's proxy statement if the shareholder complies with the notice, information and consent provisions of Article II of the Company’s Bylaws, which can be found on our website at https://investor.expeditors.com.

Our Bylaws and our Policy on Director Nominations require any notice for Director nominees for shareholder consideration or recommendation of candidates to the Committee be submitted by certain deadlines, which are explained in detail under the heading “Deadlines for Shareholder Proposals for the 2024 Annual Meeting of Shareholders.”

Notice of Annual Meeting & Proxy Statement | 5

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

The Company’s Bylaws require a Board of Directors composed of not less than six nor more than 11 members. The Board is currently comprised of nine members. Expeditors’ Directors are elected at each Annual Meeting to hold office until the next Annual Meeting or until the election or qualification of his or her successor. Any vacancy resulting from the non-election of a Director may be filled by the Board of Directors. The nine nominees are named below. Proxies cannot be voted for a greater number of persons than the number of nominees named in this proposal.

Nominees for Election

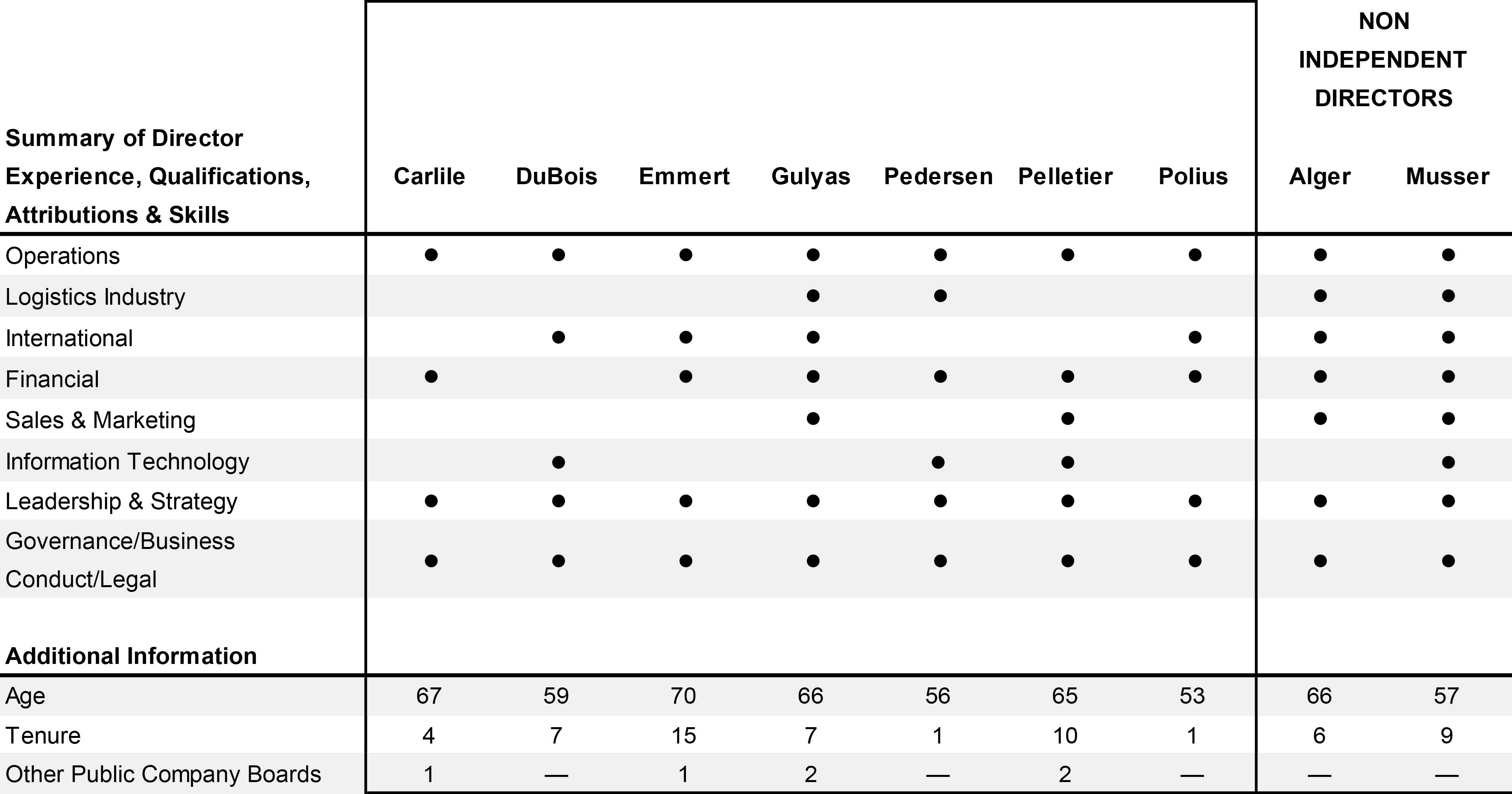

This year’s nominees consist of seven independent Directors and two non-independent Directors. Unless otherwise instructed, it is the intention of the persons named in the accompanying form of proxy to vote shares represented by properly executed proxies for the nine nominees of the Board of Directors named below. Although the Board anticipates that all of the nominees will be available to serve as Directors of the Company, should any one or more of them be unwilling or unable to serve, it is intended that the proxies will be voted for the election of a substitute nominee or nominees designated by the Board of Directors or the seat will remain open until the Board of Directors identifies a nominee.

The following persons are nominated to serve as Directors until the Company’s 2024 Annual Meeting of Shareholders:

ROBERT P. CARLILE

Robert P. Carlile became a director in May 2019 and was appointed as Chairman of the Board in May of 2022. Mr. Carlile was a Partner at KPMG LLP from 2002 to 2016, and a Partner at Arthur Andersen LLP from 1987 to 2002. During his 39-year career in public accounting, Mr. Carlile served as the lead audit partner on numerous public company engagements operating across different industries including technology, retail, transportation, bioscience, and manufacturing. In addition to his experience as a lead audit partner, Mr. Carlile held a variety of operating leadership positions at KPMG and Arthur Andersen in the Pacific Northwest. Since 2017, Mr. Carlile has served on the Board of Directors of publicly traded MicroVision Inc, where he is the Chairman of the Board. Mr. Carlile also serves on the Board of Directors of Virginia Mason Franciscan Health and is a past Chairman of the Northwest Chapter Board of the National Association of Corporate Directors (NACD).

Specific Qualifications, Attributes, Skills & Experience

GLENN M. ALGER

Glenn M. Alger became a Director in May 2017. He is one of the founders of Expeditors and served in various management and senior executive positions over a 25-year period, culminating as President and Chief Operating Officer from September 1999 to May 2007. Prior roles included leading business and operational development in the Americas region and management and evolution of the Company's global products and services. Since his retirement from the Company in 2007, Mr. Alger has been principally engaged as an active investor and manager of his family trust and charitable activities. As a founder, former senior executive of the Company and a long-term shareholder, Mr. Alger brings a deep understanding of both Company operations specifically and the global logistics industry generally.

Specific Qualifications, Attributes, Skills & Experience

Notice of Annual Meeting & Proxy Statement | 6

JAMES M. DuBOIS

James “Jim” DuBois became a Director in May 2016. He was Corporate Vice President and Chief Information Officer (CIO) at Microsoft Corporation from 2014 to 2017. As CIO, he was responsible for the company’s global security, infrastructure, collaboration systems, and business applications. Mr. DuBois was appointed CIO in January 2014 after serving as interim CIO since May 2013. Mr. DuBois served in various other roles at Microsoft, mostly in IT, after joining the company in 1993. These roles include leading IT and product teams for application development, infrastructure and service management. He also served as Microsoft’s Chief Information Security Officer and spent several years working from Asia and then Europe, learning the Microsoft field business while running the respective regional IT teams. He has degrees in computer science and business (accounting). Since leaving Microsoft in September 2017, Mr. DuBois has authored a book on modern IT and currently speaks on this topic and also serves on the boards or technical advisory boards of several startups, private companies, and venture capital partnerships.

Specific Qualifications, Attributes, Skills & Experience

MARK A. EMMERT

Mark A. Emmert became a Director in May 2008. Since 2010, he has been President of the National Collegiate Athletic Association. From 2004 to 2010, Dr. Emmert served as the President of the University of Washington (UW), a $5 billion per year organization with more than 30,000 employees, and is now President Emeritus. Prior to the UW, he was chancellor of Louisiana State University. He also served as the chancellor of the University of Connecticut and held administrative and academic positions at the University of Colorado and Montana State University. Dr. Emmert is a Life Member of the Council on Foreign Relations, a Fellow of the National Academy for Public Administration, and a former Fulbright Fellow. Dr. Emmert is currently on the Board of Directors of the Weyerhaeuser Company.

Specific Qualifications, Attributes, Skills & Experience

DIANE H. GULYAS

Diane H. Gulyas became a Director in November 2015. Ms. Gulyas worked for DuPont from 1978 until her retirement as President of their $4 billion global Performance Polymers business in September of 2014. During her 36-year career at DuPont, Ms. Gulyas served also as Chief Marketing and Sales Officer, President of Electronic and Communication Technologies Platform, and President of the Advanced Fibers divisions. Ms. Gulyas’ qualifications to serve on the Company’s Board of Directors include over 35 years of senior leadership and global business expertise. Since 2006, Ms. Gulyas has served as a public company director and is currently on the Board of Directors of Ingevity Corporation. She also served on the Board of Directors of W.R. Grace & Company, until it was acquired by Standard Industries Holdings in September 2021.

Specific Qualifications, Attributes, Skills & Experience

Notice of Annual Meeting & Proxy Statement | 7

JEFFREY S. MUSSER

Jeffrey S. Musser became a Director in March 2014. He joined the Company in February 1983 and was promoted to District Manager in October 1989. Mr. Musser became Regional Vice President in September 1999, Senior Vice President-Chief Information Officer in January 2005 and Executive Vice President and Chief Information Officer in May 2009. Mr. Musser was appointed President and Chief Executive Officer in March 2014.

Specific Qualifications, Attributes, Skills & Experience

BRANDON S. PEDERSEN

Brandon S. Pedersen became a Director in February 2022. Mr. Pedersen served as Executive Vice President and Chief Financial Officer of Alaska Air Group, the parent company of Alaska Airlines and Horizon Air, from 2010 to 2020. Prior to that, he served as Vice President of Finance and Controller, having joined the company in 2003 from KPMG LLP, where he was an audit partner. During his 15 years in public accounting, he served a diverse range of clients in the retail, transportation and distribution industries. Mr. Pedersen is a member of the Audit Advisory Committee of the University of Washington (an advisory committee to the UW Board of Regents that serves as the University’s audit committee), where he co-facilitates a class on leadership and corporate governance in the Executive MBA program at the UW Foster School of Business. Mr. Pedersen is a Certified Public Accountant.

Specific Qualifications, Attributes, Skills & Experience

LIANE J. PELLETIER

Liane J. Pelletier became a Director of the Company in May 2013. Ms. Pelletier is the former Chairperson, Chief Executive Officer and President of Alaska Communications Systems, a telecommunication and information technology services provider, leading the firm from October 2003 to April 2011. From November 1986 to October 2003, Ms. Pelletier held a number of executive positions at Sprint Corporation, a telecommunications company. Ms. Pelletier is a member of the Compensation and Nominating and Corporate Governance Committees on the Board of Directors of ATN International, and serves on the board of Frontdoor as member of the Audit and Compensation Committees.

Specific Qualifications, Attributes, Skills & Experience

Notice of Annual Meeting & Proxy Statement | 8

OLIVIA D. POLIUS

Olivia D. Polius became a Director of the Company in November 2021. Since 2020, Ms. Polius has served as the divisional Chief Financial Officer for two program strategy divisions at the Bill & Melinda Gates Foundation: Global Policy & Advocacy and U.S. Programs. Ms. Polius also previously served as the divisional Chief Financial Officer for the Gender Equality Division during its start-up phase. Previously Ms. Polius was Head of Finance for Bezos Academy in its inception and startup phase. Bezos Academy is a nonprofit created to develop a network of tuition-free preschools in underserved communities across the United States. From 2013 to 2019, Ms. Polius served as the Chief Financial Officer and Vice President of Finance, Technology and Infrastructure for PATH, a global organization that develops and scales innovative solutions to some of the world’s most pressing health challenges. After starting her career with Arthur Andersen, Ms. Polius spent 11 years in various finance leadership roles in the software industry, including nine years at Attachmate (formerly WRQ, and acquired by Micro Focus) in various roles ranging from Corporate Controller to VP of Finance.

Specific Qualifications, Attributes, Skills & Experience

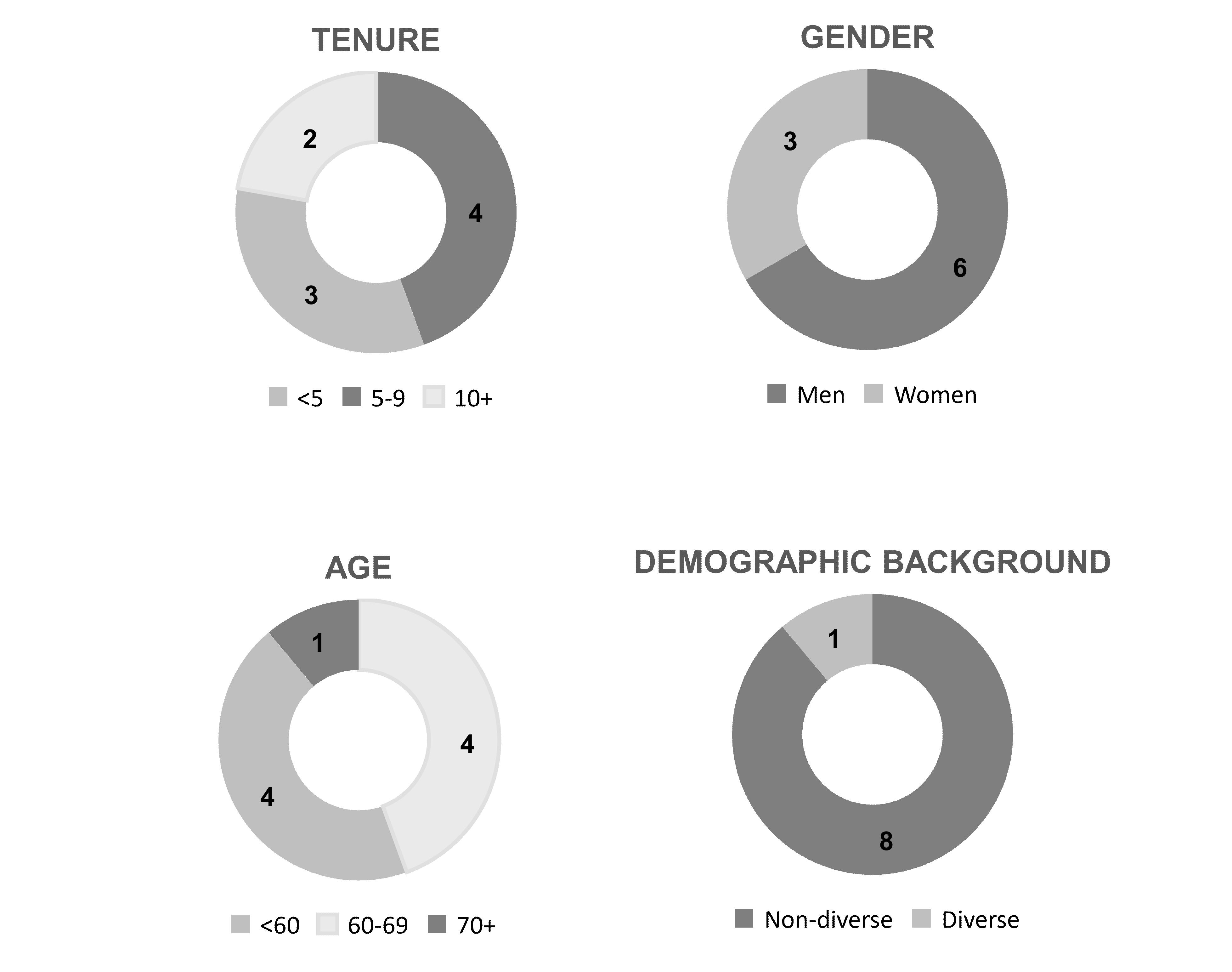

Board Refreshment and Diversity

On our own and in consultation with third parties, our Board has a schedule for evaluating our performance against certain goals, as well as its composition, intending to strike a balance between longer-term service and the fresher perspective that can come from adding new members. We also value industry experience and relevant skills, as our business continues to evolve and our global industry grows more complex.

Because diversity is part of our global culture, we believe that a board should be comprised of directors with diverse backgrounds (including gender, race, and ethnicity), experiences, and perspectives that will improve board decision-making and effectiveness. The Board assesses the effectiveness of our approach to diversity as part of our overall board and committee evaluation process.

Notice of Annual Meeting & Proxy Statement | 9

Summary of Director Nominee Experience, Qualifications, Attributes & Skills

Notice of Annual Meeting & Proxy Statement | 10

Experience and Skills Relevant to the Successful Oversight of our Strategy

|

|

|

Operations Experience and insights into business operations is critical in assessing management’s ability to drive growth and nurture a strong corporate culture. |

|

|

|

Logistics Industry Experience in the global logistics industry, which is highly complex and dependent upon people, processes, and technology. |

|

|

|

International An understanding of diverse business environments, economic conditions, cultures, regulatory frameworks, and a broad perspective on global market opportunities. |

|

|

|

Financial Senior-level experience in the finance function of an enterprise, with proficiency in complex financial management, capital allocation, and financial reporting and internal control processes. |

|

|

|

Sales & Marketing Experience developing strategies to grow sales and market share, build brand awareness and equity, and enhance enterprise reputation. |

|

|

|

Information Technology A significant background working in technology, resulting in knowledge of how to anticipate technological trends, generate disruptive innovation, and extend or create new business models. Experience in the cybersecurity frameworks and processes that protect data and information. |

|

|

|

Leadership & Strategy A practical understanding of organizations, processes, strategic planning, and risk management. Demonstrated strengths in developing talent, planning succession, and driving change and long-term growth. |

|

|

|

Governance/Business A solid foundation in good governance practices and oversight, which are critical to all business operations and as a publicly traded company. |

|

|

|

Conduct/Legal An understanding of international laws and adherence to good conduct is critical for a large company that moves goods across borders around the globe. |

The Board of Directors unanimously recommends a vote FOR the election of each of the Director Nominees

ü |

|

The Board of Directors recommends a vote FOR the election of each of the Director Nominees. |

Notice of Annual Meeting & Proxy Statement | 11

CORPORATE GOVERNANCE

Board Operations

The Board of Directors has policies and procedures to ensure effective operations and governance. Our corporate governance materials, including our Corporate Governance Principles, the Charters of each of the Board’s Committees and our Code of Business Conduct, can be found on our website at https://investor.expeditors.com/corporate-governance/governance-documents. Currently the Board is composed of seven independent Directors and two non-independent Directors. The primary functions of Expeditors’ Board of Directors include:

The Board of Directors has determined that all current Directors except Messrs. Musser and Alger are independent under the applicable independence standards set forth in the rules promulgated under the Securities Exchange Act of 1934, as amended (Exchange Act) and the rules of the NASDAQ Stock Market. The Board has designated that only independent Directors can serve as Committee members.

The Board currently has the following Committees: Nominating and Corporate Governance, Compensation, and Audit. Each Committee operates under a written charter, all of which are available on our website https://investor.expeditors.com/corporate-governance/governance-documents.

Board Practices & Procedures

Notice of Annual Meeting & Proxy Statement | 12

Board Attendance

The Board met ten times in 2022 and each Director attended at least 75% of the total number of Board of Directors meetings and Committee meetings on which they served. While the Company has no established policy requiring Directors to attend the Annual Meeting, all members attended the 2022 Annual Meeting.

Director Retirement Policy

The Board established a guideline, whereby an individual Director will not be nominated to stand for election to the Board of Directors at the next Annual Meeting if the Director has reached an age of 72 years, absent a waiver of such guideline by the Board.

Board’s Role in Risk Oversight

Senior executive management is responsible for the assessment and day-to-day management of risk and brings to the attention of the Board the material risks to the Company. The Board provides oversight and guidance to management regarding material enterprise risks. Oversight responsibilities for certain areas of risk are assigned to the Board's three standing Committees and others are assigned to the full Board. The Board and its Committees regularly discuss with management the Company’s strategies, operations, compliance, policies, cybersecurity and inherent associated risks in order to assess appropriate levels of risk taking and steps taken to monitor, mitigate and control such exposures.

The Board believes the Company’s risk management processes are appropriate and that the active oversight role played by the Board and its Committees provides the right level of oversight for the Company.

SEC Filings & Reports

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports, are available free of charge on our website at https://investor.expeditors.com under the heading “Investor Relations” (see SEC Filings) immediately after they are filed with or furnished to the SEC.

Director Compensation Program

The Board uses a combination of cash and stock-based compensation to attract and retain qualified non-employee candidates to serve on the Board. In setting Director compensation, the Compensation Committee considers the amount of time that Directors expend in fulfilling their duties, as well as the skill level required as members of the Board and its Committees.

Board of Directors' Annual Compensation & Stock Ownership Requirements

Board Retainer |

$125,000 in cash and $200,000 worth of Company restricted stock. |

Chair Retainers |

An additional $175,000 retainer for the Chair of the Board. An additional $30,000 retainer for the Chair of the Audit Committee. An additional $25,000 retainer for the Chair of each of the Compensation Committee and the Nominating and Corporate Governance Committee. |

Stock Ownership Policy |

Each Director is required to retain a minimum of 5x the cash Board retainer in Expeditors’ Common Stock, which is to be accumulated within the first 5 years of a Director joining the Board. |

Notice of Annual Meeting & Proxy Statement | 13

Director Compensation Table

The table below summarizes the compensation paid by the Company to non-employee Directors for the fiscal year ended December 31, 2022:

Name |

Fees Earned |

Stock |

Option |

Non-Equity |

All Other |

Total |

Robert P. Carlile |

$300,000 |

199,962 |

— |

— |

— |

$499,962 |

Glenn M. Alger |

$125,000 |

199,962 |

— |

— |

— |

$324,962 |

James M. DuBois |

$125,000 |

199,962 |

— |

— |

— |

$324,962 |

Mark A. Emmert |

$150,000 |

199,962 |

— |

— |

— |

$349,962 |

Diane H. Gulyas |

$125,000 |

199,962 |

— |

— |

— |

$324,962 |

Brandon S. Pedersen(2) |

$177,500 |

199,962 |

— |

— |

— |

$377,462 |

Liane J. Pelletier |

$150,000 |

199,962 |

— |

— |

— |

$349,962 |

Olivia D. Polius(2) |

$147,500 |

199,962 |

— |

— |

— |

$347,462 |

Shareholder Engagement

We seek our shareholders’ views on environmental, social, and governance (ESG) and compensation matters throughout the year. Management provides regular updates concerning shareholder feedback to the Board, which considers shareholder perspectives along with the interests of all stakeholders when overseeing company strategy, formulating ESG practices, and designing compensation programs.

In 2022, we engaged with shareholders representing more than half of our shares outstanding to discuss matters related to our strategies, compensation programs, ESG and/or operations.

Management welcomes the opportunity to engage with our investors who express a desire to visit our corporate offices during the period after quarterly earnings releases when we are not in a quiet period.

Shareholder Feedback: Enhanced ESG Disclosure

We have always taken sustainability seriously and published our first public sustainability report in 2017, highlighting our commitments and progress across the ESG spectrum. We continue to enhance our disclosures of ESG matters while monitoring developments in ESG reporting. In response to shareholder feedback, in 2021 we first mapped and linked our many disclosures on a range of ESG topics to metrics outlined by the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD) voluntary disclosure frameworks. Further details are included in the Nominating and Corporate Governance Committee Report in this proxy filing and in our latest Sustainability report at www.expeditors.com/sustainability.

Communicating with the Board of Directors

Shareholders may communicate with the Board of Directors and the procedures for doing so are located on the Company’s website at https://investor.expeditors.com. Any matter intended for the Board of Directors, or for one or more individual members, should be directed to the Corporate Secretary of the Company at 1015 Third Avenue, Seattle, Washington 98104, with a request to forward the same to the intended recipient(s). All shareholder communications delivered to the Corporate Secretary of the Company for forwarding to the Board of Directors or specified members will be forwarded in accordance with the instructions received.

Information regarding the submission of comments or complaints relating to the Company’s accounting, internal accounting controls or auditing matters can be found in the Company’s Code of Business Conduct on the Company’s website at https://investor.expeditors.com.

Notice of Annual Meeting & Proxy Statement | 14

Information Requests

We ask that all requests for corporate information concerning Expeditors’ operations be submitted in writing. This policy applies equally to securities analysts and current and potential shareholders. Requests can be made to Expeditors International of Washington, Inc., 1015 Third Avenue, Seattle, Washington 98104, Attention: Chief Financial Officer, or by email to investor@expeditors.com.

Written responses to selected inquiries will be released to the public by a posting on our website at https://investor.expeditors.com and by simultaneous filing with the Securities and Exchange Commission (SEC) under Item 7.01 on Form 8-K.

Fair Disclosure

Any analyst or investor contact, whether by telephone or in person, will be conducted with the understanding that questions directed at ongoing operations will not be discussed. Management will limit responses to discussions of previously disclosed information, including informational discussions directed to the history and operating philosophy of the Company and an understanding of the global logistics industry and its competitive environment. Expeditors will, of course, make public disclosures at other times as required by law, regulation or commercial necessity.

Five Percent Owners of Company Stock

The following table sets forth information, as of December 31, 2022, with respect to all shareholders known by the Company to be beneficial owners of more than 5% of its outstanding Common Stock. Except as noted below, each entity has sole voting and dispositive powers with respect to the shares shown.

Name & Complete Mailing Address |

Number of Shares |

|

Percent of Common Stock Outstanding |

BlackRock, Inc. |

20,658,607 |

(1) |

13.00% |

The Vanguard Group |

19,052,121 |

(2) |

11.97% |

State Street Corporation |

9,110,000 |

(3) |

5.72% |

Notice of Annual Meeting & Proxy Statement | 15

Security Ownership of Directors & Executive Officers

The following table lists the names and the amount and nature of the beneficial ownership of Common Stock of each Director and nominee, of each of the NEO described in the Summary Compensation Table, and all Directors and Executive Officers as a group at March 7, 2023. Except as noted below, each person has sole voting and dispositive powers with respect to the shares shown.

DIRECTORS |

Amount & Nature of |

Percent of Class |

Robert P. Carlile |

9,156 |

* |

Glenn M. Alger (1) |

361,543 |

* |

James M. Dubois |

19,846 |

* |

Mark A. Emmert |

19,095 |

* |

Diane H. Gulyas (2) |

17,846 |

* |

Jeffrey S. Musser (3) |

274,617 |

* |

Brandon S. Pedersen |

1,948 |

* |

Liane J. Pelletier |

33,587 |

* |

Olivia D. Polius |

1,948 |

* |

|

|

|

ADDITIONAL NAMED EXECUTIVE OFFICERS |

|

|

Eugene K. Alger (4) |

37,829 |

* |

Daniel R. Wall (5) |

60,203 |

* |

Richard H. Rostan (6) |

91,815 |

* |

Bradley S. Powell (7) |

14,351 |

* |

|

|

|

All Directors & Executive Officers as a Group (17 persons) (8) |

1,068,250 |

* |

* Less than 1%

Notice of Annual Meeting & Proxy Statement | 16

NOMINATING & CORPORATE GOVERNANCE COMMITTEE REPORT

The Nominating and Corporate Governance Committee is committed to assuring that the Company’s Board and Committees are fit for purpose, contribute to the Company’s strategy and sustainability and continues to learn and improve how it governs.

Nominating & Corporate Governance Committee

The committee charter is available at https://investor.expeditors.com.

All members are independent under Exchange Act and NASDAQ rules.

Key Responsibilities:

2022 Committee Highlights

The Nominating and Corporate Governance Committee met four times in 2022.

Notice of Annual Meeting & Proxy Statement | 17

Corporate Governance Principles

The Committee operates according to the Board’s Governance Principles, available on our website at https://investor.expeditors.com, which includes:

Considerations for Director Nominations

The Committee follows the board’s policy on director nominations, available on our website https://investor.expeditors.com, which features a number of criteria for nominations such as:

Notice of Annual Meeting & Proxy Statement | 18

OUR COMMITMENT TO ESG

The Board of Expeditors believes our responsibility toward ESG starts with “G.” It works to assure that good governance is well established and followed for anything that fundamentally affects the long-term sustainability of the Company.

This is the third year that the Committee dedicates part of its shareholder proxy statement to the matters of ESG. In this year’s report, we highlight new matters or metrics, and invite readers to learn about prior developments in past proxy statements. Further, every reader can learn about the full story of our commitment to ESG in this year’s Sustainability report at https://www.expeditors.com/about-us/sustainability. This online report includes a refresh of 2022 metrics in both the SASB and TCFD reporting frameworks that we have used for several years.

In 2022, the Company conducted a Materiality Assessment with the help of an expert third party firm. Conducting a Materiality Assessment assures that the Company will not get lost in a field of hundreds of ESG topics, but rather will focus most on those factors that are connected deeply to our business and are influential to our long-term value creation.

Since the study was completed, management has ensured that the material matters are incorporated into Company strategy, and the Board is positioned to receive regular reports on them during strategy sessions that occur at every Board meeting.

The most material factors applicable to our global service organization include:

“G” – business continuity, business ethics, cybersecurity and data privacy

“E” – GHG emissions (two dimensions, see more below)

“S” – talent management, diversity and inclusion

Below we share some 2022 highlights on these material factors.

G: The Company Has a Mature Framework

The Chief Ethics and Compliance Officer enhanced the Company’s Code of Business Conduct training and trade compliance programs to keep up with a very dynamic set of sanctions and embargoes. A team of more than 140 subject matter experts assisted staff across the globe, and every employee took over 15 hours of compliance training.

The Company’s General Counsel and Global Data Protection Officer helped navigate the complex and evolving regulatory landscape around privacy and data protection, managed the Global Privacy Policy and kept the board informed on key challenges.

The Company underscored its long-lasting policy against both direct and indirect political contributions embedded in the Company’s Code of Business Conduct by crafting a stand-alone policy prohibiting political contributions. In 2022, the Company made zero political contributions.

Our strategy, investments and focus on cybersecurity were tested by a February 2022 targeted attack. Our recovery and business continuity were enabled by our security framework; incident response plan and teams; strategic partners; and our network support. In terms of Governance, the Board’s experiences coupled with our Company’s team of experts and strategic partners, form the backbone of our Board’s oversight on cyber and technology-risk, information security, and policy development.

E: The Company Has a Dual Focus

The Company has named a credentialed global leader of Environmental Sustainability, who helped the Company set GHG Scope 1 and Scope 2 emissions reduction targets for the Company. In setting these targets, the Company focused first on fairly short-term goals so that current management teams will be held accountable for delivery and so that the Company can monitor advancing technologies that will likely underpin a future round of emissions reduction targets. Please look to this year’s Sustainability report for the Scope 1 and Scope 2 targets.

As a second areas of focus, the Company also dedicated additional product development resources to build more solutions for customers wanting information on the GHG emissions associated with their chosen trade lanes and modes, so that they may consider alternative "green" lanes or mode switches for their transportation needs. Given Expeditors’ deep history with transportation providers, it aggregates information and suggests alternatives to clients. As a reminder to readers, Expeditors arranges for logistics and transportation services that inherently align with lower GHG emissions through cargo consolidation – which optimizes each container by volume and weight – but it operates no transportation assets such as airplanes, ocean vessels, trucks, or trains.

Notice of Annual Meeting & Proxy Statement | 19

S: The Company Has a 40-Year Track Record

The Company legacy stands true today. Set at its founding, its purpose is: “To create unlimited opportunities for our people through sustainable growth and strategic focus, inspiring our premier customer-focused logistics organization.” Every savvy service organization knows that Talent Management is the path to sustainable and profitable business. Like other service organizations, Expeditors focuses intensely on hiring, training, developing, compensating and retaining its employees, all while measuring engagement along the way. In fact, Expeditors considers its approach to its #1 asset to be competitively differentiated and a strategic advantage.

In 2022, memorializing what is fundamental to how the Company operates, we reaffirmed our commitment to the principles established in the International Labor Organization’s Declaration on Fundamental Principles and Rights at Work, the International Labor Organization’s Core Conventions on Labour Standards, the Universal Declaration of Human Rights, and the Organization for Economic Co-operation and Development’s Guidelines for Multinational Enterprise. In making the pledge, we affirmed our commitment to the human rights and labor rights of our employees in the areas of minimum wage, hours and benefits; reasonable working hours; the right to freely choose one’s employment; prohibiting child labor; the health and safety of our employees; the humane treatment of our employees; non- discrimination; and freedom of association and engagement with management.

Finally, in reporting 2022 highlights, the Company submitted its U.S. workforce statistics as 44% women and 42% racially/ethnically diverse. Since only a fraction of the Expeditors work force is in the U.S., more material to our culture is that our managers in over 60 countries hire locally, leveraging regional and local expertise and bringing both a global mindset and cultural vibrancy to the entire Company.

Nominating & Corporate Governance Committee:

Liane Pelletier, Chair

Mark Emmert

Diane Gulyas

Notice of Annual Meeting & Proxy Statement | 20

PROPOSAL NO. 2:

ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATON

We are asking for your non-binding advisory vote on the following resolution, known as “Say-on-Pay,” as required pursuant to section 14A of the Exchange Act:

Resolved: That shareholders approve the compensation of the NEO, as disclosed in the Compensation Discussion & Analysis, the compensation tables, and the related narrative executive compensation disclosures contained in this proxy statement.

We encourage you to read the Compensation Committee Report, including Compensation Discussion and Analysis, as well as the Summary Compensation Table and other related compensation tables and narrative to learn about our executive compensation programs and policies.

2022 was an extraordinary year for the Company in which we achieved a near-record operating results despite being hit by a targeted cyber-attack in February 2022. The Company again achieved record revenues while operating income declined 4% and EPS was flat compared to 2021. Cash flow from operations grew by 145% in 2022 over 2021 largely due to the Company’s performance in 2022 and 2021 and we returned a record $1.8 billion to shareholders via share repurchases and dividends.

Total compensation to our CEO and to our other NEO decreased 17% and 19%, respectively, from 2021 primarily due to participation in our 2008 Executive Incentive Compensation Plan. While our shareholder-approved 2008 Executive Incentive Compensation Plan performed as designed in 2022, delivering performance-based compensation tied directly to operating income, the Compensation Committee of the Board of Directors took the following actions to reduce the growth of NEO compensation:

Our Compensation Structure is a Unique Competitive Advantage

We strongly believe that our core compensation structure, which has been in place since the Company became publicly traded, is responsible for differentiating the Company’s performance from that of many of our competitors. Changes to our compensation programs demonstrate that we remain fully committed to a strong pay-for-performance compensation philosophy that is a unique and foundational characteristic of our Company’s culture. Expeditors' compensation structure has been and will continue to be driven by Company performance and doing what is right for our shareholders, our customers and our employees.

2020-2022 Financial Performance

(Data in millions except dividends and earnings per share)

Notice of Annual Meeting & Proxy Statement | 21

While preserving the core of our compensation structure, we have made substantive adjustments to our programs, including:

Compensation: What We Do and Don't Do

What We Do |

What We Don't Do |

Pay decisions are made by independent Directors; the Committees and the full Board meet regularly in executive session without management present |

No guaranteed bonuses |

Pay for performance (over 85% of CEO pay is 'at risk' and directly linked to performance) |

No pay disconnected from performance (excluding modest base salaries) |

Focus on multiple performance metrics |

No perquisites |

Increase the NEO allocation of the Executive Incentive Compensation pool at time of promotion |

No arbitrary increases to the NEO allocation of the Executive Incentive Compensation pool |

Reduce the NEO allocation of the Executive Incentive Compensation Pool over time |

No supplemental pension benefits |

Limit the NEO allocation of the Executive Incentive Compensation Pool to preset allocation percentages |

No repricing of underwater options |

Strictly tie NEO Executive Incentive Compensation to U.S. GAAP operating income |

No hedging or pledging of Company shares allowed by employees or the Board of Directors |

Double trigger vesting of unvested equity upon a change in control |

No tax gross-ups paid on severance benefits |

Work with an independent compensation consultant |

No retirement bonuses |

Align with shareholders through PSU and RSU |

|

Maintain executive and outside Director share ownership guidelines |

|

Incentive compensation is subject to clawback policy |

|

Engage shareholders on compensation matters |

|

The Board of Directors has elected to submit a non-binding vote on compensation, a so-called "Say-on-Pay" vote, to shareholders on an annual basis. Shareholders supported our advisory vote on NEO compensation by an average of 92% over the past three years by voting FOR our proposals.

Effect of Proposal

The Say-on-Pay proposal is non-binding on the Board of Directors. The approval or disapproval of this proposal by shareholders will not require the Board of Directors or the Compensation Committee to take any action regarding NEO compensation. The final decision on NEO compensation remains with the Board of Directors and/or its Compensation Committee. Although non-binding, the Board of Directors and the Compensation Committee will review and consider the voting results when making future decisions regarding NEO compensation.

ü |

|

The Board of Directors recommends a vote FOR this proposal. |

Notice of Annual Meeting & Proxy Statement | 22

COMPENSATION DISCUSSION & ANALYSIS

This Compensation Discussion and Analysis (CD&A) describes the Company’s executive compensation program in 2022. In particular, this CD&A explains how the Compensation Committee (the Committee) of the Board of Directors made its compensation decisions for the Company’s executives, including the following NEO:

Our Compensation Philosophy

Our Company is committed to a strong pay for performance compensation philosophy that is a foundational characteristic of our Company’s culture. Expeditors has been and will continue to be driven by Company performance and doing what is right for our shareholders, our customers and our employees. While we have implemented changes to our CEO and other NEO compensation over the years, the core compensation structure, which has been in place since the Company became publicly traded, is responsible for differentiating the Company’s performance from that of many of our competitors.

The objective of our core compensation program is to enhance shareholder value over the long term by:

Our core compensation programs directly serve the interests of our Company and its stakeholders through:

Base Salaries

Throughout our history, we have followed a policy of offering our management employees a compensation package that is heavily weighted toward incentive-based compensation. To emphasize at-risk variable pay, we have customarily set annual base salaries of our NEO and other top managers well below competitive market levels. Our NEO base salaries are set at $100,000 and are well below median NEO base salaries in our peer group.

Notice of Annual Meeting & Proxy Statement | 23

2008 Executive Incentive Compensation Plan

The 2008 Executive Incentive Compensation Plan is a primary component of our compensation program. The Plan has been in place since 1985 and its unique design incentivizes our management team to continually increase our operating income, which in turn drives long-term shareholder value. The 2008 Executive Incentive Compensation Plan is designed to drive superior financial results and is effective because of its simplicity, transparency, and focus on a key operating metric.

Operating income captures many elements of managing a healthy business, including:

To be successful, management must optimize the multiple elements of a full income statement, culminating with operating income. This metric is comprehensive, simple, objective and easily understood. It drives both short- and long-term growth, efficiency, and creates a prudent and entrepreneurial environment. We remain committed to our focus on operating income and our view that this broad-based metric is a key driver of shareholder value over the long-term.

Our use of U.S. GAAP operating income rewards management for delivering profitable results. We use U.S. GAAP operating income because we believe that management must be held accountable for our results regardless of external market forces that may adversely affect the level of bonus payouts. Our 2008 Executive Incentive Compensation Plan creates a culture of shared economic interests among our top managers and ensures a universal and daily focus on the achievement of superior financial results. Equally important, our focus on continual improvement in operating income drives long-term shareholder value creation.

Key Terms of the Plan:

The Incentive Pool

In addition to our below-market base salaries, the total incentive cash compensation available to all senior executive management participating in the Incentive Pool, including all NEO, is limited to 10% of pre-bonus operating income. Individual amounts earned under this plan are determined by participation percentages set by the Compensation Committee at the time of promotion. As a result, incentive compensation to the CEO and to each NEO rises and falls in conjunction with our level of operating income. Executive incentive compensation is directly and inextricably tied to performance.

Eligibility for the Incentive Pool

The Compensation Committee determines which executive officers and other key managers are eligible to participate in the 2008 Executive Incentive Compensation Plan. For each quarter, the Committee determined that each NEO and every member of senior executive management would participate in the 2008 Executive Incentive Compensation Plan.

Funding the Incentive Pool

Company performance funds an Incentive Pool with up to 10% of our U.S. GAAP operating income before bonus. The Compensation Committee believes that setting the Incentive Pool at a fixed percentage of operating income with fluctuations in the amounts paid directly linked to actual changes in operating income, aligns both the short- and long-term interests of employees and shareholders.

Notice of Annual Meeting & Proxy Statement | 24

The Company has never incurred an annual or quarterly operating loss since going public in September 1984. Nonetheless, we maintain the following stringent policies in the event that we should incur no or negative operating income for a quarter:

We believe this policy protects shareholder interests while strongly incentivizing our management team to maintain and increase positive operating income every fiscal quarter.

Allocation of the Incentive Pool

The Compensation Committee determined each NEO's allocable portion of the Incentive Pool. This determination is set at the time of promotion to the position and performance is reviewed quarterly. The Compensation Committee considers various factors when establishing each participant's allocable share of the Incentive Pool, including:

For our most senior executive managers, their allocable percentage of the Incentive Pool is likely to decline over time to accommodate additional investments in new areas of growth and personnel.

Determining Payouts Under the Incentive Pool

Payouts under the Plan were determined by multiplying the Incentive Pool by each participant’s allocable portion of the Incentive Pool. For each quarter of fiscal years 2020-2022, we had positive operating income, which resulted in the funding of the Incentive Pool. At the conclusion of each quarter, the Compensation Committee reviewed and approved each NEO incentive payment under the 2008 Executive Incentive Compensation Plan based on the executive officer’s allocable share of the Incentive Pool for that quarter. In 2022, to reduce the growth of compensation to NEO and certain senior executives, the Compensation Committee reduced payouts by 15% for the second quarter and 20% for each of the third and fourth quarters or a combined total of $12.2 million.

Notice of Annual Meeting & Proxy Statement | 25

5% Growth Performance Requirement

In 2017, a minimum 5% growth requirement was added for the CEO to earn an unreduced payout, and in 2020, the requirement was expanded to include all senior executive management. Operating income did grow by more than 5% in 2020, as compared to the same period in 2019, except in the first quarter, and the amount paid to our NEO and senior executives in that quarter was reduced by 5% or a combined total of $487,533. In 2021, operating income did grow by more than 5% in each quarter, as compared to the same period in 2020. In 2022, operating income did grow by more than 5% in each quarter, except in the fourth quarter, and the amount paid to our NEO and senior executives in that quarter was reduced by 5% or a combined total of $814,324.

Determination of NEO RSU Grants

The Compensation Committee considered various factors in determining the size of each RSU grant to NEO for 2022, including:

PSU Grants to CEO and Senior Executive Management

To further align CEO long-term incentive compensation with shareholders’ interests and focus on long-term performance, the Compensation Committee, starting in 2017, shifted a portion of Mr. Musser’s annual pay to longer-term by adopting performance metrics in the form of performance share units (PSU) subject to vesting only if 3-year performance goals were achieved for Net Revenues and EPS. The PSU are awarded in May each year under the Amended and Restated 2017 Omnibus Incentive Plan (the Amended 2017 Plan) that was approved by shareholders. PSU incentive goals are established with the intent that performance in-line with our operating plans should result in a payout that is approximately at target. In order to achieve the maximum goals, our performance would have to exceed our operating plans to a significant degree. Threshold performance goals were set at a level that was meant to be attainable and below which the Company could not justify a payout. In evaluating the difficulty of our target performance goals, the Compensation Committee, comprised entirely of independent Directors, believes these goals are challenging. Beginning in 2019, the Compensation Committee expanded the use of PSU awards to senior executive management, including all other NEO. PSU continue to measure 3-year performance and use Net Revenues and EPS, weighted 25% and 75% respectively.

2020 PSU Performance Criteria & Discussion

The performance period of 2020 PSU awards to Mr. Musser and to senior executive management, including all NEO, was January 1, 2022 to December 31, 2022. The final number of shares earned was based on the Company’s 3-year EPS and Net Revenue growth. In setting targets for the 2020 PSU in May 2020, the Compensation Committee considered a number of factors, including the Company’s past performance, estimated impact of Covid-19 on the global economy, including customers, service providers and employees, current strategies and initiatives, estimated share repurchases, expected macro-economic forces, and global trade expectations. Following the end of the performance period, the Compensation Committee considers the Company’s actual performance compared to targets, including the effect of any significant items during the performance period in making its final determination.

Net revenues are a non-GAAP measure calculated as revenues less directly related operations expenses attributable to the Company’s principal services. The Board believes that net revenues are a better measure than total revenues when evaluating the Company’s operating performance since total revenues earned as a freight consolidator include the carriers’ charges for carrying the shipment, whereas revenues earned in other capacities include primarily the commissions and fees earned by the Company. Net revenue is one of the Company’s primary operational and financial measures and demonstrates management’s ability to concentrate and leverage purchasing power through effective consolidation of shipments from customers utilizing a variety of transportation carriers and optimal routings.

Notice of Annual Meeting & Proxy Statement | 26

For PSU granted in May 2020, the Compensation Committee established 2022 performance criteria for Mr. Musser and senior executive management, including all NEO, based on the following criteria and weightings. The table below also includes the actual achieved performance for the year ended December 31, 2022 used in the final measurement for shares granted to NEO:

PSU Performance Criteria |

|

Weighting |

|

Threshold |

|

Target |

|

Maximum |

|

Actual |

Percent of PSU Earned: |

|

|

|

50% |

|

100% |

|

200% |

|

200% |

Cumulative EPS Growth: |

|

75% |

|

$2.62 |

|

$3.28 |

|

$3.94 |

|

$8.26 |

Net Revenues Growth (in millions): |

|

25% |

|

$2,120 |

|

$2,650 |

|

$3,180 |

|

$4,494 |

PSU Awarded:(1) |

|

|

|

21,207 |

|

42,414 |

|

84,828 |

|

87,815 |

RSU & PSU Vesting and Retirement Eligibility

The RSU and PSU Awards under the Amended 2017 Plan include a dividend equivalent that vests commensurately with the underlying award. In addition, senior executive management who have either (i) attained the age of 55 and completed at least 10 years of continuous service, or (ii) completed at least 30 years of continuous service are deemed "retirement eligible." All NEO are retirement-eligible. RSU vest 1/3 on each successive one-year anniversary of the grant date. PSU vest only if performance goals are achieved for net revenue and earnings per share growth in the second fiscal year after grant. Upon the retirement, death or disability of a retirement-eligible senior executive manager, RSU vest immediately and PSU will fully vest at the end of the applicable performance period. See “Potential Payments upon Termination & Change in Control” for a description of the treatment of RSU and PSU upon an involuntary termination with cause and without cause and a voluntary termination for good reason.

Perquisites & Other Personal Benefits

The Company provides no perquisites or personal benefits to our NEO that are not available to all employees. The Company provides standard benefits packages to all employees that vary by country, based on individual country regulations. Further, the Company does not provide tax “gross-ups” on change in control severance benefits or any other type of benefit.

Risk & Compensation Clawback Recovery

Because the 2008 Executive Incentive Compensation Plan is based on cumulative operating income, any operating losses that are incurred must be recovered from future operating income before any amounts would be due to participants. Since a significant portion of executive compensation comes from the 2008 Executive Incentive Compensation Plan, the Company believes that this cumulative feature is a disincentive to excessive risk taking by its senior managers. No one individual has the authority to commit the Company to excessive risk taking. Due to the nature of the Company’s services, the business has a short operating cycle. The outcome of any higher risk transactions, such as overriding established credit limits, would be known in a relatively short time frame. Management believes that when the potential impact on the bonus is considered in light of this short operating cycle, the potential for gains that could be generated by higher risk business practices is sufficiently mitigated. Management believes that both the stability and the long-term growth in operating income and net earnings are a result of the incentives and recovery mechanism inherent in the Company’s compensation programs. Awards under the 2017 Plan (including any shares subject to an Award) are subject to any Company policy providing for recovery, recoupment, clawback and/or other forfeiture. In addition, the Company's "clawback policy" related to financial restatements includes not just the CEO and Chief Financial Officer (CFO), but all members of senior executive management.

Role of the Compensation Committee, Management & Consultants

Compensation decisions, other than compensation and equity grant determinations for the CEO, are made in consultation with the CEO. Compensation decisions for the CEO are made by our Compensation Committee and approved by our full Board. With respect to the 2008 Executive Incentive Compensation Plan, the CEO recommends allocation percentages for all participating executive officers, which must be reviewed and approved by the Compensation Committee.

The Board believes in overall total compensation targets that are consistent with the underlying compensation philosophy of the Company. The Company recognizes that because it operates in the highly competitive global logistics services industry, the quality of its service depends upon the quality of the executives and other employees it is able to attract and retain. In order to succeed, the Company believes that it must be able to attract and retain qualified executives and employees. The Compensation Committee considers the competitiveness of the entire

Notice of Annual Meeting & Proxy Statement | 27

compensation package of an executive officer relative to that paid by similar companies when evaluating the adequacy of base salaries, the percentage allocations of the 2008 Executive Incentive Compensation Plan and equity grants. The Company’s objective is to offer a total compensation package, which gives the executive officer the opportunity to be rewarded at a level believed to be superior to that offered by the Company’s competitors in the global logistics services industry. The Company believes that the opportunity for achieving superior levels of compensation is predicated on achieving sustained, long-term profitable results that are superior to those of its competitors.

The Compensation Committee used benchmark data on a limited basis to review base salaries and other compensation information and practices disclosed by certain U.S. publicly traded companies in the logistics and transportation industry. The benchmark data has confirmed that the Company’s compensation packages offered to executives are competitive and give executives appropriate incentives to retain and gain profitable customers and grow the Company’s services. Benchmark data was derived from proxy statements filed by Alaska Air Group, Inc., CH Robinson Worldwide, Inc., CSX Corp., JB Hunt Transport Services, Inc., JetBlue Airways Corp., Knight-Swift Transportation Holdings, Inc., Landstar System, Inc., Norfolk Southern Corp., Old Dominion Freight Line, Inc., Ryder System, Inc., Schneider National, Inc., Southwest Airlines Co., Union Pacific Corp., and XPO Logistics. While these companies vary in size in terms of revenue, the Compensation Committee believes the benchmark data derived from this group of companies is useful for the limited comparisons described above.

Since 2016, the Compensation Committee has engaged Meridian Compensation Partners, LLC (Meridian) to provide advice on executive and Director compensation matters. The Compensation Committee has assessed the independence of Meridian pursuant to SEC and NASDAQ rules and determined that no conflict of interest exists that would prevent Meridian from providing independent and objective advice to the Compensation Committee. Meridian has provided consulting services only as directed by the Compensation Committee. Meridian reports directly to the Compensation Committee and does not provide any other services to the Company.

Employment Agreements

The Company has entered into employment agreements with each NEO. Each employment agreement is automatically renewable upon expiration for additional one-year periods unless either party elects otherwise.

Executive Stock Ownership Policy

The Company maintains executive stock ownership guidelines and is governed by the Compensation Committee. These stock ownership guidelines are applicable to our NEO and certain other senior management holding a title of Senior Vice President or above. These guidelines are designed to increase executives’ equity stakes in the Company and to further align executives’ interests with those of shareholders. The guidelines require covered executives to own shares of the Company’s Common Stock sufficient to satisfy the amount specified below as a multiple of the executive’s annual base salary:

|

Guidelines |

|

Chief Executive Officer |

60 x Base Salary |

$6,000,000 |

President, Executive Vice President, or Chief Financial Officer |

20 x Base Salary |

$2,000,000 |

Senior Vice President |

10 x Base Salary |

$1,000,000 |

Executives in the positions above need to achieve the corresponding ownership target within five years of the earlier of promotion to the position or the policy adoption or revision date. This policy excludes stock option grants in the ownership calculation and includes RSU and target PSU grants. As of December 31, 2022, all of our NEO are in compliance with their respective ownership guidelines. When NEO exercise stock options, they must continue to comply with the ownership requirements above.

All executives must hold 75% of the net after-tax shares received upon vesting of any PSU and RSU until their respective stock ownership guidelines are achieved.

Insider Trading Policy Prohibits Hedging or Pledging

The Company’s Insider Trading Policy prohibits its Board of Directors and employees from hedging or pledging their ownership of Company stock, including trading in publicly-traded options, puts, calls or other derivative instruments related to Company stock.

Notice of Annual Meeting & Proxy Statement | 28

Other Retirement or Disability Payments