Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2012 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number 001-31568

New England Realty Associates Limited Partnership

(Exact name of registrant as specified in its charter)

| Massachusetts (State or other jurisdiction of incorporation or organization) |

04-2619298 (I.R.S. employer identification no.) |

|

39 Brighton Avenue, Allston, Massachusetts (Address of principal executive offices) |

02134 (Zip Code) |

|

Registrant's telephone number, including area code: (617) 783-0039 |

||

Securities registered pursuant to Section 12(b) of the Act: |

||

Depositary Receipts (Title of each Class) |

NYSE AMEX (Name of each Exchange on which Registered) |

|

Securities registered pursuant to Section 12(g) of the Act: |

||

Class A Limited Partnership Units (Title of class) |

||

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

At June 30, 2012, the aggregate market value of the registrant's securities held by non-affiliates of the registrant was $57,067,931 based on the closing price of the registrant's traded securities on the NYSE Amex Exchange on such date. For this computation, the Registrant has excluded the market value of all Depositary Receipts reported as beneficially owned by executive officers and directors of the General Partner of the Registrant; such exclusion shall not be deemed to constitute an admission that any such person is an affiliate of the Registrant.

Effective January 3, 2012, the Partnership authorized a 3-for-1 forward split of its Depositary Receipts listed on the NYSE Amex and a concurrent adjustment of the exchange ratio of Depositary Receipts for Class A Units of the Partnership from 10-to-1 to 30-to-1, such that each Depositary Receipt represents one-thirtieth (1/30) of a Class A Unit of the Partnership.

All references to Depositary Receipts in the report are reflective of the 3-for-1 forward split.

As of March 1, 2013, there were 104,039 of the registrant's Class A units (3,121,176 Depositary Receipts) of limited partnership issued and outstanding and 24,709 Class B units issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None.

NEW ENGLAND REALTY ASSOCIATES LIMITED PARTNERSHIP

2

NEW ENGLAND REALTY ASSOCIATES LIMITED PARTNERSHIP

General

New England Realty Associates Limited Partnership ("NERA" or the "Partnership"), a Massachusetts Limited Partnership, was formed on August 12, 1977 as the successor to five real estate limited partnerships (collectively, the "Colonial Partnerships"), which filed for protection under Chapter XII of the Federal Bankruptcy Act in September 1974. The bankruptcy proceedings were terminated in late 1984. In July 2004, the General Partner extended the termination date of the Partnership until 2057, as allowed in the Partnership Agreement.

The authorized capital of the Partnership is represented by three classes of partnership units ("Units"). There are two categories of limited partnership interests ("Class A Units" and "Class B Units") and one category of general partnership interests (the "General Partnership Units"). The Class A Units were initially issued to creditors and limited partners of the Colonial Partnerships and have been registered under Section 12(g) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Each Class A Unit is exchangeable for 30 publicly traded depositary receipts ("Receipts"), which are currently listed on the NYSE Amex Exchange and are registered under Section 12(b) of the Exchange Act. The Class B Units were issued to the original general partners of the Partnership. The General Partnership Units are held by the current general partner of the Partnership, NewReal, Inc. (the "General Partner"). The Class A Units represent an 80% ownership interest, the Class B Units represent a 19% ownership interest, and the General Partnership Units represent a 1% ownership interest.

The Partnership is engaged in the business of acquiring, developing, holding for investment, operating and selling real estate. The Partnership, directly or through 24 subsidiary limited partnerships or limited liability companies, owns and operates various residential apartment buildings, condominium units and commercial properties located in Massachusetts and New Hampshire. As used herein, the Partnership's subsidiary limited partnerships and limited liabilities companies are each referred to as a "Subsidiary Partnership" and are collectively referred to as the "Subsidiary Partnerships."

The Partnership owns between a 99.67% and 100% interest in each of the Subsidiary Partnerships, except in nine limited liability companies (the "Investment Properties" or "Joint Ventures") in which the Partnership has between a 40% and 50% ownership interest. The majority shareholder of the General Partner indirectly owns between 43.2% and 57%, the President of Hamilton owns between 2.5% and 4.5%, and five other management employees of Hamilton own collectively between 0% and 2.3%, respectively. The Partnership's interest in the Investment Properties is accounted for on the equity method in the Consolidated Financial Statements. See Note 1 to the Consolidated Financial Statements—"Principles of Consolidation." See Note 14 to the Consolidated Financial Statements—"Investment in Unconsolidated Joint Ventures" for a description of the properties and their operations. Of those Subsidiary Partnerships not wholly owned by the Partnership, except for the Investment Properties, the remaining ownership interest is held by an unaffiliated third party. In each such case, the third party has entered into an agreement with the Partnership, pursuant to which any benefit derived from its ownership interest in the applicable Subsidiary Partnerships will be returned to the Partnership.

The long-term goals of the Partnership are to manage, rent and improve its properties and to acquire additional properties with income and capital appreciation potential as suitable opportunities arise. When appropriate, the Partnership may sell or refinance selected properties. Proceeds from any such sales or refinancing will be used to reduce debt, reinvested in acquisitions of other properties,

3

distributed to the partners, repurchase equity interests, or used for operating expenses or reserves, as determined by the General Partner.

Operations of the Partnership

The Partnership is managed by the General Partner, NewReal, Inc., a Massachusetts corporation wholly owned by Harold Brown and Ronald Brown. The General Partner has engaged The Hamilton Company, Inc. (the "Hamilton Company" or "Hamilton") to perform general management functions for the Partnership's properties in exchange for management fees. The Hamilton Company is wholly owned by Harold Brown and employs Ronald Brown and Harold Brown. The Partnership, Subsidiary Partnerships, and the Investment Properties currently contract with the management company for 49 individuals at the Properties and 14 individuals at the Joint Ventures who are primarily involved in the supervision and maintenance of specific properties. The General Partner has no employees.

As of February 1, 2013, the Partnership and its Subsidiary Partnerships owned 2,251 residential apartment units in 20 residential and mixed-use complexes (collectively, the "Apartment Complexes"). The Partnership also owns 19 condominium units in a residential condominium complex, all of which are leased to residential tenants (collectively referred to as the "Condominium Units"). The Apartment Complexes, the Condominium Units and the Investment Properties are located primarily in the metropolitan Boston area of Massachusetts.

As of February 1, 2013, the Subsidiary Partnerships also owned a commercial shopping center in Framingham, Massachusetts, one commercial building in Newton and one in Brookline, Massachusetts and commercial space in mixed-use buildings in Boston, Brockton and Newton, Massachusetts. These properties are referred to collectively as the "Commercial Properties." See Note 2 to the Consolidated Financial Statements, included as a part of this Form 10-K.

Additionally, as of February 1, 2013, the Partnership owned a 40-50% interest in nine residential and mixed use complexes, the Investment Properties, with a total of 799 residential units, one commercial unit, and a parking lot. See Note 14 to the Consolidated Financial Statements for additional information on these investments.

The Apartment Complexes, Investment Properties, Condominium Units and Commercial Properties are referred to collectively as the "Properties."

Harold Brown and, in certain cases, Ronald Brown, and officers and employees of the Hamilton Company own or have owned interests in certain of the Properties, Subsidiary Partnerships and Joint Ventures. See "Item 13. Certain Relationships, Related Transactions and Director Independence."

The leasing of real estate in the metropolitan Boston area of Massachusetts is highly competitive. The Apartment Complexes, Condominium Units and the Investment Properties must compete for tenants with other residential apartments and condominium units in the areas in which they are located. The Commercial Properties must compete for commercial tenants with other shopping malls and office buildings in the areas in which they are located. Thus, the level of competition at each Property depends on how many other similarly situated properties are in its vicinity. See "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Factors that May Affect Future Results."

The Second Amended and Restated Contract of Limited Partnership of the Partnership (the "Partnership Agreement") authorizes the General Partner to acquire real estate and real estate related investments from or in participation with either or both of Harold Brown and Ronald Brown, or their affiliates, upon the satisfaction of certain terms and conditions, including the approval of the Partnership's Advisory Committee and limitations on the price paid by the Partnership for such investments. The Partnership Agreement also permits the Partnership's limited partners and the General Partner to make loans to the Partnership, subject to certain limitations on the rate of interest

4

that may be charged to the Partnership. Except for the foregoing, the Partnership does not have any policies prohibiting any limited partner, General Partner or any other person from having any direct or indirect pecuniary interest in any investment to be acquired or disposed of by the Partnership or in any transaction to which the Partnership is a party or has an interest in or from engaging, for their own account, in business activities of the types conducted or to be conducted by the Partnership. The General Partner is not limited in the number or amount of mortgages which may be placed on any Property, nor is there a policy limiting the percentage of Partnership assets which may be invested in any specific Property.

Industry Segments

The Partnership operates in only one industry segment—real estate. The Partnership does not have any foreign operations, and its business is not seasonal. See the Consolidated Financial Statements attached hereto and incorporated by reference herein for financial information relating to our industry segment.

Unit Distributions

Effective January 3, 2012, the Partnership authorized a 3-for-1 forward split of its Depositary Receipts listed on the NYSE Amex and a concurrent adjustment of the exchange ratio of Depositary Receipts for Class A Units of the Partnership from 10-to-1 to 30-to-1, such that each Depositary Receipt represents one-thirtieth (1/30) of a Class A Unit of the Partnership. All references to Depositary Receipts in the report are reflective of the 3-for-1 forward split.

In 2012 the Partnership paid four quarterly distributions of an aggregate $30.00 per Unit ($1.00 per Receipt) for a total payment of $3,932,410 in 2012. In 2011, the Partnership paid four quarterly distributions of an aggregate of $28.00 per Unit ($0.93 per Receipt) for a total payment of $3,681,566 in 2011. In February 2013, the Partnership approved a quarterly distribution of $7.50 per Unit ($0.25 per Receipt), payable on March 31, 2013.

On August 20, 2007, NewReal, Inc., the General Partner authorized an equity repurchase program ("Repurchase Program") under which the Partnership was permitted to purchase, over a period of twelve months, up to 300,000 Depositary Receipts (each of which is one-thirtieth of a Class A Unit). On January 15, 2008, the General Partner authorized an increase in the Repurchase Program from 300,000 to 600,000 Depositary Receipts. On January 30, 2008 the General Partner authorized an increase the Repurchase Program from 600,000 to 900,000 Depositary Receipts. On March 6, 2008, the General Partner authorized the increase in the total number of Depositary Receipts that could be repurchased pursuant to the Repurchase Program from 900,000 to 1,500,000. On August 8, 2008, the General Partner re-authorized and renewed the Repurchase Program for an additional 12-month period ended August 19, 2009. On March 22, 2010, the General Partner re-authorized and renewed the Repurchase Program that expired on August 19, 2009. Under the terms of the renewed Repurchase Program, the Partnership may purchase up to 1,500,000 Depositary Receipts from the start of the program in 2007 through March 31, 2015. The Repurchase Program requires the Partnership to repurchase a proportionate number of Class B Units and General Partner Units in connection with any repurchases of any Depositary Receipts by the Partnership based upon the 80%, 19% and 1% fixed distribution percentages of the holders of the Class A, Class B and General Partner Units under the Partnership's Second Amended and Restate Contract of Limited Partnership. Repurchases of Depositary Receipts or Partnership Units pursuant to the Repurchase Program may be made by the Partnership from time to time in its sole discretion in open market transactions or in privately negotiated transactions. From August 20, 2007 through December 31, 2012, the Partnership has repurchased 1,219,927 Depositary Receipts at an average price of $24.62 per receipt (or $738.60 per underlying Class A Unit), 1,921 Class B Units and 101 General Partnership Units, both at an average

5

price of $613.94 per Unit, totaling approximately $31,386,000 including brokerage fees paid by the Partnership.

On September 17, 2008, the Partnership completed the issuance of an aggregate of 6,642 Class A Units held in treasury to current holders of Class B and General Partner Units upon the simultaneous retirement to treasury of 6,309 Class B Units and 333 General Partner Units pursuant to an equity distribution plan authorized by the Board of Directors of the General Partner on August 8, 2008 and as further described under Item 3.02 of the Partnership's Current Report on Form 8-K as filed with the Securities and Exchange Commission on September 18, 2008, which is incorporated herein by reference. Harold Brown, the treasurer of the General Partner, controls 75% of the issued and outstanding Class B Units of the Partnership and 75% of the issued and outstanding equity of the General Partner, Ronald Brown, the brother of Harold Brown and the president of the General Partner, owns 25% of the issued and outstanding Class B Units of the Partnership and 25% of the issued and outstanding equity of the General Partner. The 75% of the issued and outstanding Class B units of the Partnership, controlled by Harold Brown, are owned by HBC Holdings LLC, an entity of which he is the manager.

Property Transactions

On May 18, 2011, the Partnership sold Avon Street Apartments, a 66 unit residential apartment complex located at 130 Avon Street, Malden, Massachusetts. The sales price was $8,750,000, which resulted in a financial statement gain of approximately $7,700,000. The net proceeds of the sale, of approximately $5,444,000 were held by a qualified intermediary in order for the Partnership to structure a tax free exchange in accordance with Section 1031 of the IRS code. This tax free exchange was completed with the purchase of Battle Green Apartments as described below.

On June 1, 2011, the Partnership purchased the Battle Green Apartments, a 48 unit residential apartment complex located at 34-42 Worthen Road, Lexington, Massachusetts. The purchase price was $10,000,000. The Partnership used cash, the proceeds from the sale of Avon Street and borrowed $3,998,573 from Harold Brown, Treasurer of the General Partner to make this purchase. This loan had an interest rate of 6% and was secured by the Partnership's ownership interest in Battle Green Apartments, LLC. The term of the loan is four years with a provision requiring payment in whole or in part upon demand within six months of notice or prepay without penalty. On July 27, 2011, the Partnership financed the Battle Green Apartments with a new $5,000,000 mortgage at 4.95% which matures in August 2026. Principal payments will be made using a 30 year amortization schedule. Deferred financing costs associated with this mortgage totaled approximately $100,000 and accordingly the effective interest rate is 5.07%. After paying off the existing loan of $3,998,573, approximately $1,000,000 was received by the Partnership. The interest paid on this loan to Harold Brown was $38,123 in 2011. The mortgage balance outstanding on December 31, 2012 was $4,893,448.

During 2012, the Partnership and its Subsidiary Partnerships completed improvements to certain of the Properties at a total cost of approximately $2,360,000. These improvements were funded from cash reserves and, to some extent, escrow accounts established in connection with the financing or refinancing of the applicable Properties. These sources have been adequate to fully fund improvements. The most significant improvements were made at Westgate Woburn, Hamilton Oaks, 62 Boylston Street, Olde English, Clovelly, 1144 Commonwealth Ave and 140 North Beacon Street at a cost of approximately $445,000, 280,000, $271,000, $206,000, $185,000, $133,000 and $113,000 respectively. The Partnership plans to invest approximately $2,300,000 in capital improvements in 2013.

Advisory Committee

The Advosry Committee members are Gregory Dube, Robert Nahigian, and Edward Sarkesian. These Advisory Committee members are not affiliated with the General Partner. The Advisory

6

Committee meets with the General Partner to review the progress of the Partnership, assist the General Partner with policy formation, review the appropriateness, timing and amount of proposed distributions, approve or reject proposed acquisitions and investments with affiliates, and advise the General Partner on various other Partnership affairs. Per the Partnership Agreement, the Advisory Committee has no binding power except that it must approve certain investments and acquisitions or sales by the Partnership from or with affiliates of the Partnership.

Available Information

The Partnership's website is www.thehamiltoncompany.com. On its website, the Partnership makes available, free of charge, its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934, as amended. These forms are made available as soon as reasonably practical after the Partnership electronically files or furnishes such materials to the Securities and Exchange Commission. In addition, the Partnership's website includes other items related to corporate governance matters, including, among other things, the Partnership's corporate governance guidelines, charters of various committees of the Board of Directors, and the Partnership's code of business conduct and ethics applicable to all employees, officers and directors. Copies of these documents may be obtained, free of charge, from the website. Any shareholder may obtain copies of these documents, free of charge, by sending a request in writing to: Director of Investor Relations, New England Realty Associates Limited Partnership, 39 Brighton Avenue, Allston, MA 02134.

We are subject to certain risks and uncertainties as described below. These risks and uncertainties may not be the only ones we face; there may be additional risks that we do not presently know of or that we currently consider immaterial. All of these risks could adversely affect our business, financial condition, results of operations and cash flows. Our ability to pay distributions on, and the market price of, our equity securities may be adversely affected if any of such risks are realized. All investors should consider the following risk factors before deciding to purchase or sell securities of the Partnership.

We are subject to risks inherent in the ownership of real estate. We own and manage multifamily apartment complexes and commercial properties that are subject to varying degrees of risk generally incident to the ownership of real estate. Our financial condition, the value of our properties and our ability to make distributions to our shareholders will be dependent upon our ability to operate our properties in a manner sufficient to generate income in excess of operating expenses and debt service charges, which may be affected by the following risks, some of which are discussed in more detail below:

- •

- changes in the economic climate in the markets in which we own and manage properties, including interest rates, the

overall level of economic activity, the availability of consumer credit and mortgage financing, unemployment rates and other factors;

- •

- a lessening of demand for the multifamily and commercial units that we own;

- •

- competition from other available multifamily residential and commercial units and changes in market rental rates;

- •

- increases in property and liability insurance costs;

- •

- changes in real estate taxes and other operating expenses (e.g., cleaning, utilities, repair and maintenance costs, insurance and administrative costs, security, landscaping, pest control, staffing and other general costs);

7

- •

- changes in laws and regulations affecting properties (including tax, environmental, zoning and building codes, and housing

laws and regulations);

- •

- weather and other conditions that might adversely affect operating expenses;

- •

- expenditures that cannot be anticipated, such as utility rate and usage increases, unanticipated repairs and real estate

tax valuation reassessments or mileage rate increases;

- •

- our inability to control operating expenses or achieve increases in revenues;

- •

- the results of litigation filed or to be filed against us;

- •

- risks related to our joint ventures;

- •

- risks of personal injury claims and property damage related to mold claims because of diminished insurance coverage;

- •

- catastrophic property damage losses that are not covered by our insurance;

- •

- risks associated with property acquisitions such as environmental liabilities, among others;

- •

- changes in market conditions that may limit or prevent us from acquiring or selling properties;

- •

- the perception of tenants and prospective tenants as to the attractiveness, convenience and safety of our properties or

the neighborhoods in which they are located; and

- •

- the Partnership does not carry directors and officers insurance.

We are dependent on rental income from our multifamily apartment complexes and commercial properties. If we are unable to attract and retain tenants or if our tenants are unable to pay their rental obligations, our financial condition and funds available for distribution to our shareholders will be adversely affected.

Our multifamily apartment complexes and commercial properties are subject to competition. Our properties and joint venture investments are located in developed areas that include other properties. The properties also compete with other rental alternatives, such as condominiums, single and multifamily rental homes, owner occupied single and multifamily homes, and commercial properties in attracting tenants. This competition may affect our ability to attract and retain residents and to increase or maintain rental rates.

The properties we own are concentrated in Eastern Massachusetts and Southern New Hampshire. Our performance, therefore, is linked to economic conditions and the market for available rental housing and commercial space in these states. A decline in the market for apartment housing and/or commercial properties may adversely affect our financial condition, results of operations and ability to make distributions to our shareholders.

Our insurance may not be adequate to cover certain risks. There are certain types of risks, generally of a catastrophic nature, such as earthquakes, floods, windstorms, act of war and terrorist attacks that may be uninsurable, or are not economically insurable, or are not fully covered by insurance. Moreover, certain risks, such as mold and environmental exposures, generally are not covered by our insurance. Should an uninsured loss or a loss in excess of insured limits occur, we could lose our equity in the affected property as well as the anticipated future cash flow from that property. Any such loss could have a material adverse effect on our business, financial condition and results of operations.

Debt financing could adversely affect our performance. The vast majority of our assets are encumbered by project specific, non-recourse, non-cross-collateralized mortgage debt. There is a risk that these properties will not have sufficient cash flow from operations for payments of required principal and interest. We may not be able to refinance these loans at an amount equal to the loan

8

balance and the terms of any refinancing may not be as favorable as the terms of existing indebtedness. If we are unable to make required payments on indebtedness that is secured by a mortgage, the Partnership will either invest additional money in the property or the property securing the mortgage may be foreclosed with a consequent loss of income and value to us.

Real estate investments are generally illiquid, and we may not be able to sell our properties when it is economically or strategically advantageous to do so. Real estate investments generally cannot be sold quickly, and our ability to sell properties may be affected by market conditions. We may not be able to diversify or vary our portfolio promptly in accordance with our strategies or in response to economic or other conditions.

Our access to public debt markets is limited. Substantially all of our debt financings are secured by mortgages on our properties because of our limited access to public debt markets.

Litigation may result in unfavorable outcomes. Like many real estate operators, we may be involved in lawsuits involving premises liability claims, housing discrimination claims and alleged violations of landlord-tenant laws, which may give rise to class action litigation or governmental investigations. Any material litigation not covered by insurance, such as a class action, could result in substantial costs being incurred. The Partnership does not carry directors and officers liability insurance.

Our financial results may be adversely impacted if we are unable to sell properties and employ the proceeds in accordance with our strategic plan. Our ability to pay down debt, reduce our interest costs, repurchase Depositary Receipts and acquire properties is dependent upon our ability to sell the properties we have selected for disposition at the prices and within the deadlines we have established for each respective property.

The costs of complying with laws and regulations could adversely affect our cash flow and ability to make distributions to our shareholders. Our properties must comply with Title III of the Americans with Disabilities Act (the "ADA") to the extent that they are "public accommodations" or "commercial facilities" as defined in the ADA. The ADA does not consider apartment complexes to be public accommodations or commercial facilities, except for portions of such properties that are open to the public. In addition, the Fair Housing Amendments Act of 1988 (the "FHAA") requires apartment complexes first occupied after March 13, 1990, to be accessible to the handicapped. Other laws also require apartment communities to be handicap accessible. Noncompliance with these laws could result in the imposition of fines or an award of damages to private litigants. We may be subject to lawsuits alleging violations of handicap design laws in connection with certain of our developments. If compliance with these laws involves substantial expenditures or must be made on an accelerated basis, our ability to make distributions to our shareholders could be adversely affected.

Under various federal, state and local laws, an owner or operator of real estate may be liable for the costs of removal or remediation of certain hazardous or toxic substances on, under or in the property. This liability may be imposed without regard to whether the owner or operator knew of, or was responsible for, the presence of the substances. Other law imposes on owners and operators certain requirements regarding conditions and activities that may affect human health or the environment. Failure to comply with applicable requirements could complicate our ability to lease or sell an affected property and could subject us to monetary penalties, costs required to achieve compliance and potential liability to third parties. We are not aware of any material noncompliance, liability or claim relating to hazardous or toxic substances or other environmental matters in connection with any of our properties. Nonetheless, it is possible that material environmental contamination or conditions exist, or could arise in the future, in the apartment communities or on the land upon which they are located.

We are subject to the risks associated with investments through joint ventures. Nine of our properties are owned by joint ventures in which we do not have a controlling interest. We may enter into joint

9

ventures, including joint ventures that we do not control, in the future. Any joint venture investment involves risks such as the possibility that the co-venturer may seek relief under federal or state insolvency laws, or have economic or business interests or goals that are inconsistent with our business interests or goals. While the bankruptcy or insolvency of our co-venturer generally should not disrupt the operations of the joint venture, we could be forced to purchase the co-venturer's interest in the joint venture or the interest could be sold to a third party. We also may guarantee the indebtedness of our joint ventures. If we do not have control over a joint venture, the value of our investment may be affected adversely by a third party that may have different goals and capabilities than ours.

We are subject to risks associated with development, acquisition and expansion of multifamily apartment complexes and commercial properties. Development projects and acquisitions and expansions of apartment complexes are subject to a number of risks, including:

- •

- availability of acceptable financing;

- •

- competition with other entities for investment opportunities;

- •

- failure by our properties to achieve anticipated operating results;

- •

- construction costs of a property exceeding original estimates;

- •

- delays in construction; and

- •

- expenditure of funds on, and the devotion of management time to, transactions that may not come to fruition.

We are subject to control by our directors and officers. The directors and executive officers of the General Partner and members of their families and related entities owned approximately 33.84% of our depositary receipts as of December 31, 2012. Additionally, management decisions rest with our General Partner without limited partner approval.

Competition for skilled personnel could increase our labor costs. We and our management company compete with various other companies in attracting and retaining qualified and skilled personnel who are responsible for the day-to-day operations of our properties. Competitive pressures may require that we enhance our pay and benefits package to compete effectively for such personnel. We may not be able to offset such added costs by increasing the rates we charge our tenants. If there is an increase in these costs or if we fail to attract and retain qualified and skilled personnel, our business and operating results could be harmed.

We depend on our key personnel. Our success depends to a significant degree upon the continued contribution of key members of the management company, who may be difficult to replace. The loss of services of these executives could have a material adverse effect on us. There can be no assurance that the services of such personnel will continue to be available to us. We do not hold key-man life insurance on any of our key personnel.

Changes in market conditions could adversely affect the market price of our Depositary Receipts. As with other publicly traded equity securities, the value of our depositary receipts depends on various market conditions, which may change from time to time. Among the market conditions that may affect the value of our depositary receipts are the following:

- •

- the extent of investor interest in us;

- •

- the general reputation of real estate companies and the attractiveness of our equity securities in comparison to other

equity securities, including securities issued by other real estate companies;

- •

- our financial performance; and

- •

- general stock and bond market conditions.

10

The market value of our depositary is based primarily upon the market's perception of our growth potential and our current and potential future earnings and cash distributions. Consequently, our depositary receipts may trade at prices that are higher or lower than our net asset value per depositary receipt.

We face possible risks associated with the physical effects of climate change. We cannot predict with the certainty whether climate change is occurring and, if so at what rate. However, the physical effects of climate change could have a material effect on our properties, operations, and business. To the extent climate change causes changes in weather patterns, our markets could experience increases in storm intensity and rising sea levels. Over time, these conditions could result in declining demand for our buildings or the inability of us to operate the buildings at all. Climate change may also have indirect effects on our business by increasing the cost of (or making unavailable) property insurance on terms we find acceptable, increasing the cost of energy and increasing the cost of snow removal at our properties. Proposed federal legislation to address climate change could increase utility and other costs of operating our properties which, if not offset by rising rental income, would reduce our net income. There can be no assurance that climate change will not have a material adverse effect on our properties, operations or business.

Security breaches and other disruptions could compromise our information and expose us to liability, which would cause our business and reputation to suffer. In the ordinary course of our business, we collect and store sensitive data, including intellectual property, our proprietary business information and that of our tenants and business partners, including personally identifiable information of our tenants and employees, in our data centers and on our networks. Despite our security measures, our information technology and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance or other disruptions. Any such breach could compromise our networks and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings, liability under laws that protect the privacy of personal information, disrupt our operations, and damage our reputation, which could adversely affect our business.

Risk of changes in the tax law applicable to real estate partnerships. Since the Internal Revenue Service, the United States Treasury Department and Congress frequently review federal income legislation, we cannot predict whether, when or to what extent new federal tax laws, regulations, interpretations or rulings will be adopted. Any such legislative action may prospectively or retroactively modify our tax treatment and therefore, may adversely affect taxation to us, and/or our partners.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

The Partnership and its Subsidiary Partnerships own the Apartment Complexes, the Condominium Units, the Commercial Properties and a 40-50% interest in nine Investment Properties.

See also "Item 13. Certain Relationships and Related Transactions and Director Independence" for information concerning affiliated transactions.

Apartment Complexes

The table below lists the location of the 2,251 Apartment Units, the number and type of units in each complex, the range of rents and vacancies as of February 1, 2013, the principal amount

11

outstanding under any mortgages as of December 31, 2012, the fixed interest rates applicable to such mortgages, and the maturity dates of such mortgages.

Apartment Complex

|

Number and Type of Units |

Rent Range | Vacancies | Mortgage Balance and Interest Rate As of December 31, 2012 |

Maturity Date of Mortgage |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Battle Green LLC |

48 units | 0 | $ | 4,893,448 | 2026 | ||||||||

34–42 Worthen Road |

0 three-bedroom | N/A | 4.95 | % | |||||||||

Lexington, MA |

24 two-bedroom | $1,860–2,150 | |||||||||||

|

24 one-bedroom | $1,490–1,710 | |||||||||||

|

0 studios | N/A | |||||||||||

Boylston Downtown L.P. |

269 units |

0 |

$ |

19,500,000 |

2013 |

||||||||

62 Boylston Street |

0 three-bedroom | N/A | 4.84 | % | |||||||||

Boston, MA |

0 two-bedroom | N/A | |||||||||||

|

53 one-bedroom | $1,650–2,500 | |||||||||||

|

216 studios | $1,190–1,850 | |||||||||||

Brookside Associates, LLC |

44 units |

2 |

$ |

2,723,830 |

2020 |

||||||||

5-7–10-12 Totman Road |

0 three-bedroom | N/A | 5.81 | % | |||||||||

Woburn, MA |

34 two-bedroom | $1,175–1,340 | |||||||||||

|

10 one-bedroom | $1,100–1,160 | |||||||||||

|

0 studios | N/A | |||||||||||

Clovelly Apartments L.P. |

103 units |

2 |

$ |

4,160,000 |

2023 |

||||||||

160–170 Concord Street |

0 three-bedroom | N/A | 5.62 | % | |||||||||

Nashua, NH |

53 two-bedroom | $865–1,260 | |||||||||||

|

50 one-bedroom | $800–935 | |||||||||||

|

0 studios | N/A | |||||||||||

Commonwealth 1137 L.P. |

35 units |

0 |

$ |

3,750,000 |

2023 |

||||||||

1131–1137 Commonwealth Ave. |

29 three-bedroom | $1,800–2,550 | 5.65 | % | |||||||||

Allston, MA |

4 two-bedroom | $1,625–1,800 | |||||||||||

|

1 one-bedroom | $775 | |||||||||||

|

1 studio | $950 | |||||||||||

Commonwealth 1144 L.P. |

261 units |

0 |

$ |

14,780,000 |

2023 |

||||||||

1144–1160 Commonwealth Ave. |

0 three-bedroom | N/A | 5.61 | % | |||||||||

Allston, MA |

11 two bedroom | $1,050–1,450 | |||||||||||

|

109 one-bedroom | $875–1,425 | |||||||||||

|

141 studios | $750–1,150 | |||||||||||

Courtyard at Westgate, LLC |

20 units |

0 |

$ |

2,000,000 |

2015 |

||||||||

105–107 Westgate Drive |

0 three-bedroom | N/A | 5.25 | % | |||||||||

Burlington, MA |

12 two bedroom | $1,500–1,925 | |||||||||||

|

8 one-bedroom | $1,235–1,360 | |||||||||||

|

0 studios | N/A | |||||||||||

Dean Street Associates, LLC |

69 units |

0 |

$ |

5,213,958 |

2014 |

||||||||

38–48 Dean Street |

0 three-bedroom | N/A | 5.13 | % | |||||||||

Norwood, MA |

66 two-bedroom | $1,150–1,325 | |||||||||||

|

3 one-bedroom | $1,125 | |||||||||||

|

0 studios | N/A | |||||||||||

Executive Apartments L.P |

72 units |

3 |

$ |

2,415,000 |

2023 |

||||||||

545–561 Worcester Road |

1 three-bedroom | $1,350 | 5.59 | % | |||||||||

Framingham, MA |

47 two-bedroom | $1,000–1,200 | |||||||||||

|

24 one-bedroom | $760–1,100 | |||||||||||

|

0 studios | N/A | |||||||||||

12

Apartment Complex

|

Number and Type of Units |

Rent Range | Vacancies | Mortgage Balance and Interest Rate As of December 31, 2012 |

Maturity Date of Mortgage |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Hamilton Oaks Associates, LLC |

268 units |

10 |

$ | 11,925,000 | 2023 | ||||||||

30–50 Oak Street Extension |

0 three-bedroom | N/A | 5.59 | % | |||||||||

40–60 Reservoir Street |

96 two-bedroom | $1,200–1,325 | |||||||||||

Brockton, MA |

159 one-bedroom | $840–1,050 | |||||||||||

|

13 studios | $770–850 | |||||||||||

Highland Street Apartments L.P. |

36 units |

2 |

$ |

1,050,000 |

2023 |

||||||||

38–40 Highland Street |

0 three-bedroom | N/A | 5.59 | % | |||||||||

Lowell, MA |

24 two-bedroom | $900–1,000 | |||||||||||

|

10 one-bedroom | $775–885 | |||||||||||

|

2 studios | $800 | |||||||||||

Linhart L.P |

9 units |

0 |

$ |

1,964,119 |

2014 |

||||||||

4–34 Lincoln Street |

0 three-bedroom | N/A | 4.25 | % | |||||||||

Newton, MA |

0 two-bedroom | N/A | |||||||||||

|

5 one-bedroom | $1,050–1,250 | |||||||||||

|

4 studios | $950–1,000 | |||||||||||

Nashoba Apartments L.P. |

32 units |

1 |

$ |

2,000,000 |

2013 |

||||||||

284 Great Road |

0 three-bedroom | N/A | 5.30 | % | |||||||||

Acton, MA |

32 two-bedroom | $1,165–1,500 | |||||||||||

|

0 one-bedroom | N/A | |||||||||||

|

0 studios | N/A | |||||||||||

North Beacon 140 L.P. |

65 units |

0 |

$ |

6,937,000 |

2023 |

||||||||

140–154 North Beacon Street |

10 three-bedroom | $2,100–2,350 | 5.59 | % | |||||||||

Brighton, MA |

54 two-bedroom | $1,550–1,870 | |||||||||||

|

1 one-bedroom | $800 | |||||||||||

|

0 studios | N/A | |||||||||||

Olde English Apartments L.P. |

84 units |

1 |

$ |

3,080,000 |

2023 |

||||||||

703–718 Chelmsford Street |

0 three-bedroom | N/A | 5.63 | % | |||||||||

Lowell, MA |

47 two-bedroom | $990–1,215 | |||||||||||

|

30 one-bedroom | $900–1,125 | |||||||||||

|

7 studios | $825–900 | |||||||||||

Redwood Hills L.P. |

180 units |

6 |

$ |

6,743,000 |

2023 |

||||||||

376–384 Sunderland Road |

0 three-bedroom | N/A | 5.59 | % | |||||||||

Worcester, MA |

89 two-bedroom | $995–1,225 | |||||||||||

|

91 one-bedroom | $825–975 | |||||||||||

|

0 studios | N/A | |||||||||||

River Drive L.P. |

72 units |

1 |

$ |

3,465,000 |

2023 |

||||||||

3–17 River Drive |

0 three-bedroom | N/A | 5.62 | % | |||||||||

Danvers, MA |

60 two-bedroom | $1,025–1,225 | |||||||||||

|

5 one-bedroom | $950–990 | |||||||||||

|

7 studios | $825–890 | |||||||||||

School Street 9, LLC |

184 units |

7 |

$ |

15,308,474 |

2013 |

||||||||

9 School Street |

0 three-bedroom | N/A | 5.47 | % | |||||||||

Framingham, MA |

96 two-bedroom | $1,145–1,350 | |||||||||||

|

88 one-bedroom | $900–1,150 | |||||||||||

|

0 studios | N/A | |||||||||||

WCB Associates, LLC |

180 units |

3 |

$ |

7,000,000 |

2023 |

||||||||

10–70 Westland Street |

1 three-bedroom | $1,200 | 5.66 | % | |||||||||

985–997 Pleasant Street |

94 two-bedroom | $1,010–1,150 | |||||||||||

Brockton, MA |

85 one-bedroom | $825–950 | |||||||||||

|

0 studios | N/A | |||||||||||

13

Apartment Complex

|

Number and Type of Units |

Rent Range | Vacancies | Mortgage Balance and Interest Rate As of December 31, 2012 |

Maturity Date of Mortgage |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Westgate Apartments, LLC |

220 units |

1 |

$ | 7,931,885 | 2014 | ||||||||

2–20 Westgate Drive |

0 three-bedroom | N/A | 7.07 | % | |||||||||

Woburn, MA |

110 two-bedroom | $1,190–1,500 | |||||||||||

|

110 one-bedroom | $880–1,310 | |||||||||||

|

0 studios | N/A | |||||||||||

Current free rent concessions would result in an average reduction in unit rents of less than $1.77 per month per unit. Free rent expense amortized in 2012 was approximately $48,000 compared to approximately $231,000 in 2011.

On June 1, 2011, the Partnership purchased the Battle Green Apartments, a 48 unit residential apartment complex located at 34-42 Worthen Road, Lexington, Massachusetts. The purchase price was $10,000,000. The purchase price equates to a capitalization rate of 5.0% on the trailing 12 months actual operating income provided by the seller. Operating income is equal to earnings before interest, depreciation and income taxes. Based on the Partnerships operating expectation, the capitalization rate for this investment is 6.2%. The Partnership used cash reserves, the proceeds from the sale of Avon Street and borrowed $3,998,573 from Harold Brown, Treasurer of the General Partner to make this purchase. This loan had an interest rate of 6% and was secured by the Partnership's ownership interest in Battle Green Apartments, LLC. On July 27, 2011, the Partnership financed the Battle Green Apartments with a new $5,000,000 mortgage at 4.95% which matures in August 2026. Proceeds for the financing were used to pay off the loan from Harold Brown and the balance was deposited in the Partnerships operating account. Principal payments will be made using a 30 year amortization schedule. See Note 2 to the Consolidated Financial statements for additional information.

See Note 5 to the Consolidated Financial Statements, included as part of this Form 10-K, for information relating to the mortgages payable of the Partnership and its Subsidiary Partnerships.

Condominium Units

The Partnership owns and leases to residential tenants 19 Condominium Units in the metropolitan Boston area of Massachusetts.

The table below lists the location of the 19 Condominium Units, the type of units, the range of rents received by the Partnership for such units, and the number of vacancies as of February 1, 2013.

Condominiums

|

Number and Type of Units Owned by Partnership |

Rent Range | Vacancies | Mortgage Balance and Interest Rate As of December 31, 2012 |

Maturity Date of Mortgage |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Riverside Apartments |

19 units | 0 | — | — | ||||||||||

8–20 Riverside Street |

0 three-bedroom | N/A | ||||||||||||

Watertown, MA |

12 two-bedroom | $1,275–1,500 | ||||||||||||

|

5 one-bedroom | $1,250–1,350 | ||||||||||||

|

2 studios | $1,075 | ||||||||||||

Commercial Properties

BOYLSTON DOWNTOWN LP. In 1995, this Subsidiary Partnership acquired the Boylston Downtown property in Boston, Massachusetts ("Boylston"). This mixed-use property includes 17,218 square feet of rentable commercial space. As of February 1, 2013, the commercial space had a 0% vacancy rate, and the average rent per square foot was $24.74. For mortgage balance, interest rate and maturity date information see "Apartment Complexes," above.

14

HAMILTON OAKS ASSOCIATES, LLC. The Hamilton Oaks Apartment complex, acquired by the Partnership in December 1999 through Hamilton Oaks Associates, LLC, includes 6,075 square feet of rentable commercial space, occupied by a daycare center. As of February 1, 2013, the commercial space was fully occupied, and the average rent per square foot was $12.50. The Partnership also rents roof space for a cellular phone antenna at an average rent of approximately $36,794 per year through November 2015. For mortgage balance, interest rate and maturity date information see "Apartment Complexes," above.

LINHART LP. In 1995, the Partnership acquired the Linhart property in Newton, Massachusetts ("Linhart"). This mixed-use property includes 21,555 square feet of rentable commercial space. As of February 1, 2013, the commercial space was fully occupied, and the average rent per square foot was $24.34. For mortgage balance, interest rate and maturity date information see "Apartment Complexes," above.

NORTH BEACON 140 LP. In 1995, this Subsidiary Partnership acquired the North Beacon property in Boston, Massachusetts ("North Beacon"). This mixed-use property includes 1,050 square feet of rentable commercial space. The property was fully rented as of February 1, 2013, and the average rent per square foot as of that date was $32.50. For mortgage balance, interest rate and maturity date information see "Apartment Complexes," above.

STAPLES PLAZA. In 1999, the Partnership acquired the Staples Plaza shopping center in Framingham, Massachusetts ("Staples Plaza"). The shopping center consists of 39,600 square feet of rentable commercial space. As of December 31, 2012, the mortgage had an outstanding balance $6,000,000 with interest rate of 5.97%, matures in 2018. As of February 1, 2013, Staples Plaza was fully occupied, and the average net rent per square foot was $22.26.

HAMILTON LINEWT ASSOCIATES, LLC. In 2007, the Partnership acquired a retail block in Newton, Massachusetts. The property consists of approximately 6,000 square feet of rentable commercial space. The property was fully rented at an average rent of $35.63 per square foot. The Partnership obtained a mortgage in January 2008 of $1,700,000 on this property. The mortgage balance at December 31, 2012 is $1,528,429 the interest rate is 5.75% and matures in January 2018.

HAMILTON CYPRESS LLC. In 2008, the Partnership acquired a medical office building in Brookline, Massachusetts. The property consists of approximately 20,000 square feet of rentable commercial space at December 31, 2012. The property was 71% occupied at an average rent of $35.21per square foot. One lease covering 7,037 square feet is expiring on March 31, 2013 which will increase the vacancy rate to 64%. The new rents are expected to average $34.00 per square foot. The Partnership assumed a mortgage of approximately $4,011,000. The mortgage balance at December 31, 2012 is $3,686,380, the interest rate is 5.92% and matures in May 2013. This mortgage was paid off on February 25, 2013.

15

The following information is provided for commercial leases:

Thru December 31,

|

Annual base rent for expiring leases |

Total square feet for expiring leases |

Total number of leases expiring |

Percentage of Annual base rent for expiring leases |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2013 |

$ | 470,463 | 23,773 | 11 | 17 | % | |||||||

2014 |

588,422 | 29,523 | 10 | 22 | % | ||||||||

2015 |

266,098 | 8,471 | 8 | 10 | % | ||||||||

2016 |

593,346 | 27,073 | 3 | 22 | % | ||||||||

2017 |

448,101 | 11,997 | 6 | 16 | % | ||||||||

2018 |

58,050 | 1,262 | 1 | 2 | % | ||||||||

2019 |

200,375 | 5,800 | 2 | 7 | % | ||||||||

2020 |

64,657 | 1,106 | 1 | 2 | % | ||||||||

2021 |

64,800 | 1,800 | 1 | 2 | % | ||||||||

2022 |

0 | — | — | 0 | % | ||||||||

Totals |

$ | 2,754,312 | 110,805 | 43 | 100 | % | |||||||

Commercial rental income is accounted for using the straight line method. Forty percent of our commercial leases contain rent escalations which range from $0.50 – $2.00 per square foot per year.

Investment Properties

See Note 14 to the Financial Statements and Exhibit 99.1 for additional information regarding the Investment Properties.

The Partnership has a 50% ownership interest in the properties summarized below:

Investment Properties

|

Number and Type of Units |

Range | Vacancies | Mortgage Balance and Interest Rate As of December 31, 2012 |

Maturity Date of Mortgage |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

345 Franklin, LLC |

40 Units | 0 | $ | 6,850,179 | 2014 | |||||||||

345 Franklin Street |

0 three-bedroom | N/A | 6.90 | % | ||||||||||

Cambridge, MA |

39 two-bedroom | $2,200–2,750 | ||||||||||||

|

1 one-bedroom | $1,900 | ||||||||||||

|

0 studios | N/A | ||||||||||||

Hamilton on Main Apartments, LLC |

148 Units |

2 |

$ |

15,611,045 |

2015 |

|||||||||

223 Main Street |

0 three-bedroom | N/A | 5.18 | % | ||||||||||

Watertown, MA |

93 two-bedroom | $1,350–1,750 | ||||||||||||

|

31 one-bedroom | $1,200–1,650 | ||||||||||||

|

24 studios | $1,050–1,225 | ||||||||||||

Hamilton Minuteman, LLC |

42 Units |

0 |

$ |

5,433,472 |

2017 |

|||||||||

1 April Lane |

0 three-bedroom | N/A | 5.67 | % | ||||||||||

Lexington, MA |

40 two-bedroom | $1,485–1,850 | ||||||||||||

|

2 one-bedroom | $1,475–1,500 | ||||||||||||

|

0 studios | N/A | ||||||||||||

Hamilton Essex 81 LLC |

49 Units |

0 |

$ |

8,352,317 |

2016 |

|||||||||

Residential |

0 three-bedroom | N/A | 5.79 | % | ||||||||||

81–83 Essex Street |

11 two-bedroom | $1,390–2,225 | ||||||||||||

Boston, Massachusetts |

38 one-bedroom | $1,315–1,575 | ||||||||||||

|

0 studios | N/A | ||||||||||||

Hamilton Essex Development LLC |

Parking Lot |

$ |

2,093,184 |

2013 |

||||||||||

Commercial |

2.8 | % | ||||||||||||

81–83 Essex Street |

||||||||||||||

Boston, Massachusetts |

||||||||||||||

16

Investment Properties

|

Number and Type of Units |

Range | Vacancies | Mortgage Balance and Interest Rate As of December 31, 2012 |

Maturity Date of Mortgage |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Hamilton 1025, LLC |

48 Units |

1 | $ | 4,934,741 | 2016 | |||||||||

Units to be retained |

0 three-bedroom | N/A | 5.67 | % | ||||||||||

1025 Hancock Street |

32 two-bedroom | $1,450–1,600 | ||||||||||||

Quincy, Massachusetts |

16 one-bedroom | $1,300–1,350 | ||||||||||||

|

0 studios | N/A | ||||||||||||

Hamilton Bay, LLC(A) |

15 Units |

2 |

$ |

1,668,000 |

2013 |

|||||||||

Units held for sale |

0 three-bedroom | N/A | 5.75 | % | ||||||||||

165–185 Quincy Shore Drive |

0 two-bedroom | N/A | ||||||||||||

Quincy, Massachusetts |

15 one-bedroom | $1,294–1,450 | ||||||||||||

|

0 studios | N/A | ||||||||||||

Hamilton Bay Apartments, LLC |

48 Units |

1 |

$ |

4,702,087 |

2017 |

|||||||||

165–185 Quincy Shore Drive |

0 three-bedroom | N/A | 5.57 | % | ||||||||||

Quincy, Massachusetts |

24 two-bedroom | $1,350–1,800 | ||||||||||||

|

24 one-bedroom | $1,350–1,750 | ||||||||||||

The Partnership has a 40% ownership interest in the property summarized below: |

||||||||||||||

Hamilton Park Towers, LLC |

409 Units |

0 |

$ |

88,611,686 |

2019 |

|||||||||

175–185 Freeman Street, |

71 three-bedroom | $2,075–4,020 | 5.57 | % | ||||||||||

Brookline, |

227 two-bedroom | $2,025–3,325 | ||||||||||||

Massachusetts |

111 one-bedroom | $1,600–2,450 | ||||||||||||

|

0 studios | |||||||||||||

Current free rent concessions would result in an average reduction in unit rents of less than $1.00 per month per unit. |

||||||||||||||

- (A)

- Represents unsold units at February 1, 2013.

345 FRANKLIN, LLC. In November 2001, the Partnership invested approximately $1,533,000 for a 50% ownership interest in a 40-unit apartment building in Cambridge, Massachusetts. This property has a 12-year mortgage, with a remaining balance at December 31, 2012 of approximately $6,850,000 at 6.9% which is amortized on a 30-year schedule, with a final payment of approximately $6,685,000 in 2014. This investment is referred to as 345 Franklin, LLC.

HAMILTON ON MAIN, LLC. In August 2004, the Partnership invested $8,000,000 for a 50% ownership interest in a 280-unit apartment complex located in Watertown, Massachusetts. The total purchase price was $56,000,000. As of May 2008, the Partnership sold 137 units as condominiums. Gains from these sales were taxed as ordinary income (approximately $50,000 per unit). The majority of the sales proceeds were applied to reduce the mortgage with the final payment made during the second quarter of 2007. With the sale of the units and the payments of the liabilities, the assets were combined with Hamilton on Main Apartments, LLC. An entity partially owned by the majority shareholder of the General Partner and the President of the management company, 31% and 5%, respectively, was the sales agent and received a variable commission on each sale of 3% to 5%. Hamilton on Main, LLC is known as Hamilton Place.

17

In 2005, Hamilton on Main Apartments, LLC obtained a ten year mortgage on the three buildings to be retained. The mortgage is $16,825,000, with interest only of 5.18% for three years and amortizing on a 30 year schedule for the remaining seven years when the balance is due. The net proceeds after funding escrow accounts and closing costs on the mortgage were approximately $16,700,000, which were used to reduce the existing mortgage. Hamilton on Main LLC paid a fee of approximately $400,000 in connection with this early extinguishment of debt. At December 31, 2012, the remaining balance on the mortgage is approximately $15,611,000.

HAMILTON MINUTEMAN, LLC. In September 2004, the Partnership invested approximately $5,075,000 for a 50% ownership interest in a 42-unit apartment complex located in Lexington, Massachusetts. The purchase price was $10,100,000. In October 2004, the Partnership obtained a mortgage on the property in the amount of $8,025,000 and returned $3,775,000 to the Partnership. The Partnership obtained a new 10-year mortgage in the amount of $5,500,000 in January 2007. The interest on the new loan is 5.67% fixed for the ten year term with interest only payments for five years and amortized over a 30 year period for the balance of the loan. This loan required a cash contribution by the Partnership of $1,250,000 in December 2006. At December 31, 2012 the remaining balance on this mortgage is approximately $5,433,000. This investment is referred to as Hamilton Minuteman, LLC.

HAMILTON ESSEX 81, LLC. On March 7, 2005, the Partnership invested $2,000,000 for a 50% ownership interest in a building comprising 49 apartments, one commercial space and a 50-car surface parking lot located in Boston, Massachusetts. The purchase price was $14,300,000, with a $10,750,000 mortgage. The Partnership plans to operate the building and initiate development of the parking lot. In June 2007, the Partnership separated the parcels, formed an additional limited liability company for the residential apartments and obtained a mortgage on the property. The new limited liability company formed for the residential apartments and commercial space is referred to as Hamilton Essex 81, LLC. In August 2008, the Partnership restructured the mortgages on both parcels at Essex 81 and transferred the residential apartments to Hamilton Essex 81, LLC. The mortgage on Hamilton Essex 81, LLC is $8,600,000 at 5.79% amortized over 30 years, due in August 2016. The mortgage on Essex Development, LLC, or the parking lot is $2,144,796 with a variable interest rate of 2.25% over the daily Libor rate (0.21% at December 31, 2012) and was originally due in August 2011. This loan was extended to August 2013 with the same conditions except for the addition of fixed principal payments in the amount of $4,301 per month. The cost associated with the extension was approximately $6,000. Harold Brown has issued a personal guaranty up to $1,000,000 of this mortgage. In the event that he is obligated to make payments to the lender as a result of this guaranty, the Partnership and other investors have, in turn, agreed to indemnify him for their proportionate share of any such payments. At December 31, 2012 the remaining balance on the mortgage at Essex 81 LLC is approximately $8,352,000 and the remaining balance on the mortgage at Essex Development is approximately $2,093,000. The investment in the parking lot is referred to as Hamilton Essex Development, LLC; the investment in the apartments is referred to as Hamilton Essex 81, LLC.

HAMILTON 1025, LLC. On March 2, 2005, the Partnership invested $2,352,000 for a 50% ownership interest in a 176-unit apartment complex with an additional small commercial building located in Quincy, Massachusetts. The purchase price was $23,750,000. The Partnership sold 127 of the units as condominiums and retained 49 units for long-term investment. The Partnership obtained a new 10-year mortgage in the amount of $5,000,000 on the units to be retained by the Partnership. The interest on the new loan is 5.67% fixed for the 10 year term with interest only payments for five years and amortized over a 30 year period for the balance of the loan term. At December 31, 2012, the mortgage balance is approximately $4,935,000. This investment is referred to as Hamilton 1025, LLC.

HAMILTON BAY, LLC. On October 3, 2005, the Partnership invested $2,500,000 for a 50% ownership interest in a 168-unit apartment complex in Quincy, Massachusetts. The purchase price was $30,875,000. The Partnership plans to sell the majority of units as condominium and retain 48 units for long-term investment. Gains from the sales of units will be taxed at ordinary income rates

18

(approximately $47,000 per unit). In February 2007, the Partnership refinanced the 48 units which will be retained with a new mortgage in the amount of $4,750,000 with an interest rate of 5.57%, interest only for five years. The loan will be amortized over 30 years thereafter and matures in March 2017. The balance on the mortgage is approximately $4,700,000 at December 31, 2012. This investment is referred to as Hamilton Bay Apartments, LLC. In April 2008, the Partnership refinanced an additional 20 units and obtained a new mortgage in the amount of $2,368,000 with interest at 5.75%, interest only, which matures in 2013. At December 31, 2012, 15 of the 20 units are still owned by the Partnership. No unit was sold during the year ended December 31, 2012. As of February 1, 2013, the Partnership sold 105 units, the proceeds of which went to pay down the mortgage on the property. The balance on the new mortgage is approximately $1,668,000 at December 31, 2012. This investment is referred to as Hamilton Bay, LLC.

HAMILTON PARK TOWERS, LLC On October 28, 2009 the Partnership invested approximately $15,925,000 in a joint venture to acquire a 40% interest in a residential property located in Brookline, Massachusetts. The property, referred to as Dexter Park, is a 409 unit residential complex. The purchase price was $129,500,000. The total mortgage is $89,914,000 with an interest rate of 5.57% and it matures in 2019. The mortgage calls for interest only payments for the first two years of the loan and amortized over 30 years thereafter. The balance of this mortgage is approximately $88,612,000 at December 31, 2012. In order to fund this investment, the Partnership used approximately $8,757,000 of its cash reserves and borrowed approximately $7,168,000 with an interest rate of 6% from HBC Holdings, LLC, an entity owned by Harold Brown and his affiliates ("HBC"). The term of the loan is four years with a provision requiring payment in whole or in part upon demand by HBC with six months notice. On August 17, 2010, HBC gave six months written notice to the Partnership requesting a principal pay down of $2,500,000. During the fourth quarter of 2010, the Partnership paid HBC $2,500,000 as requested. During 2011, the Partnership elected to make principal payments of $1,000,000 on August 1, 2011, $1,000,000 on October 3, 2011, and an additional $1,000,000 on December 15, 2011 reducing the loan balance to $1,668,600. This loan will remain subject to the original terms of the Note, including HBC's right to demand payment of the balance of the loan in whole or in part upon six months notice. The interest paid during the year ended December 31, 2012 and 2011 was $18,960 and $238,673, respectively. This loan is collateralized by the Partnership's 99% ownership interest in 62 Boylston Street. A majority of the apartments were leased at the time of the acquisition. As a result, the Partnership amortized the intangible assets associated with the "in place" leases over a 12 month period which began in November 2009. . The intangible asset was fully amortized effective November 2010. This investment, Hamilton Park Towers, LLC is referred to as Dexter Park.

The Partnership, the Subsidiary Partnerships, and the Investment Properties and their properties are not presently subject to any material litigation, and, to management's knowledge, there is not any material litigation presently threatened against them. The properties are occasionally subject to ordinary routine legal and administrative proceedings incident to the ownership of residential and commercial real estate. Some of the legal and other expenses related to these proceedings are covered by insurance and none of these costs and expenses are expected to have a material adverse effect on the Consolidated Financial Statements of the Partnership.

ITEM 4. MINE SAFETY DISCLOSURE

Not applicable.

19

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Each Class A Unit is exchangeable, through Computershare Trust Company ("Computershare") (formerly Equiserve LP), the Partnership's Depositary Agent, for 30 Depositary Receipts ("Receipts"). The Receipts are listed and publicly traded on the NYSE Amex Exchange under the symbol "NEN." There has never been an established trading market for the Class B Units or General Partnership Units.

In 2012, the high and low bid quotations for the Receipts were $30.84 and $23.02 respectively. The table below sets forth the high and low bids for each quarter of 2012 and 2011 and the distributions paid on the Partnership's Depositary Receipts:

Effective January 3, 2012, the Partnership authorized a 3-for-1 forward split of its Depositary Receipts listed on the NYSE Amex and a concurrent adjustment of the exchange ratio of Depositary Receipts for Class A Units of the Partnership from 10-to-1 to 30-to-1, such that each Depositary Receipt represents one-thirtieth (1/30) of a Class A Unit of the Partnership.

All references to Depositary Receipts in the report are reflective of the 3-for-1 forward split.

| |

2012 | 2011 | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Low Bid | High Bid | Close | Distributions | Low Bid | High Bid | Close | Distributions | |||||||||||||||||

First Quarter |

$ | 23.02 | $ | 28.96 | $ | 27.50 | $ | 0.25 | $ | 21.35 | $ | 22.58 | $ | 22.27 | $ | 0.233 | |||||||||

Second Quarter |

$ | 25.00 | $ | 28.48 | $ | 27.25 | $ | 0.25 | $ | 21.75 | $ | 23.85 | $ | 22.90 | $ | 0.233 | |||||||||

Third Quarter |

$ | 25.98 | $ | 29.98 | $ | 28.97 | $ | 0.25 | $ | 20.53 | $ | 24.00 | $ | 22.98 | $ | 0.233 | |||||||||

Fourth Quarter |

$ | 28.06 | $ | 30.84 | $ | 29.70 | $ | 0.25 | $ | 20.45 | $ | 24.84 | $ | 23.75 | $ | 0.233 | |||||||||

Distribution to Limited & General Partners were:

| |

2012 | 2011 | |||||

|---|---|---|---|---|---|---|---|

Class A—Limited Partners (80%) |

$ | 3,145,928 | $ | 2,945,253 | |||

Class B—Limited Partners (19%) |

747,158 | 699,497 | |||||

Class C—General Partner (1%) |

39,324 | 36,816 | |||||

Total |

$ | 3,932,410 | $ | 3,681,566 | |||

On March 15, 2013, the closing price on the NYSE Amex Exchange for a Depositary Receipt was $35.50. There were 2,990,182 Depositary Receipts outstanding and 4,359 Units (representing 130,770 receipts) held by 1,063 record holders.

Any portion of the Partnership's cash, which the General Partner deems not necessary for cash reserves, is distributed to the Partners, and distributions are made on a quarterly basis. The Partnership has made annual distributions to its Partners since 1978. In 2012, the Partnership made distributions of $30.00 per Unit ($1.00 per Receipt) and in 2011, the Partnership made distributions of $28.00 per Unit, ($0.93 per Receipt). The total value of the distribution in 2012 was $3,932,410 and $3,681,566 in 2011. In February 2013, the Partnership declared a quarterly distribution of $7.50 per Unit ($0.25 per Receipt) payable on March 31, 2013.

See "Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters" for certain information relating to the number of holders of each class of Units.

20

On August 20, 2007, NewReal, Inc., the General Partner authorized an equity repurchase program ("Repurchase Program") under which the Partnership was permitted to purchase, over a period of twelve months, up to 300,000 Depositary Receipts (each of which is one-tenth of a Class A Unit). On January 15, 2008, the General Partner authorized an increase in the Repurchase Program from 300,000 to 600,000 Depositary Receipts. On January 30, 2008 the General Partner authorized an increase the Repurchase Program from 600,000 to 900,000 Depositary Receipts. On March 6, 2008, the General Partner authorized the increase in the total number of Depositary Receipts that could be repurchased pursuant to the Repurchase Program from 900,000 to1, 500,000. On August 8, 2008, the General Partner re-authorized and renewed the Repurchase Program for an additional 12-month period ended August 19, 2009. On March 22, 2010, the General Partner re-authorized and renewed the Repurchase Program that expired on August 19, 2009. Under the terms of the renewed Repurchase Program, the Partnership may purchase up to 1,500,000 Depositary Receipts from the start of the program in 2007 through March 31, 2015. The Repurchase Program requires the Partnership to repurchase a proportionate number of Class B Units and General Partner Units in connection with any repurchases of any Depositary Receipts by the Partnership based upon the 80%, 19% and 1% fixed distribution percentages of the holders of the Class A, Class B and General Partner Units under the Partnership's Second Amended and Restate Contract of Limited Partnership. Repurchases of Depositary Receipts or Partnership Units pursuant to the Repurchase Program may be made by the Partnership from time to time in its sole discretion in open market transactions or in privately negotiated transactions. From August 20, 2007 through December 31, 2012, the Partnership has repurchased 1,219,927 Depositary Receipts at an average price of $24.62 per receipt (or $738.60 per underlying Class A Unit), 1,921 Class B Units and 101 General Partnership Units, both at an average price of $613.94 per Unit, totaling approximately $31,386,000 including brokerage fees paid by the Partnership.

On September 17, 2008, the Partnership completed the issuance of an aggregate of 6,642 Class A Units held in treasury to current holders of Class B and General Partner Units upon the simultaneous retirement to treasury of 6,309 Class B Units and 333 General Partner Units pursuant to an equity distribution plan authorized by the Board of Directors of the General Partner on August 8, 2008 and as further described under Item 3.02 of the Partnership's Current Report on Form 8-K as filed with the Securities and Exchange Commission on September 18, 2008, which is incorporated herein by reference. Harold Brown, the treasurer of the General Partner, owns 75% of the issued and outstanding Class B Units of the Partnership and 75% of the issued and outstanding equity of the General Partner, Ronald Brown, the brother of Harold Brown and the president of the General Partner, owns 25% of the issued and outstanding Class B Units of the Partnership and 25% of the issued and outstanding equity of the General Partner.

21

See Note 8 to the Consolidated Financial Statements for information concerning this repurchase program.

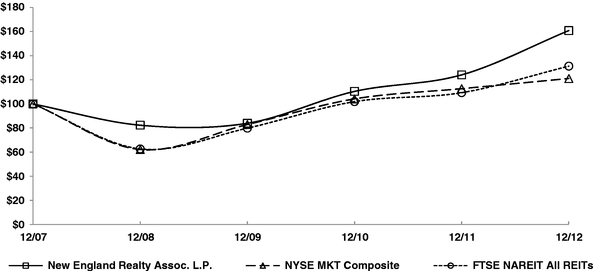

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among New England Realty Assoc. L.P., the NYSE MKT Composite Index,

and the FTSE NAREIT All REITs Index

*$100 invested on 12/31/07 in stock or index, including reinvestment of dividends.

Fiscal year ending December 31.

The Partnership does not have any securities authorized for issuance under any equity compensation plans that are subject to disclosure under Item 201(d) of Regulation S-K.

ITEM 6. SELECTED FINANCIAL DATA

The information required by this Item is included on page 49 of this Form 10-K.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward Looking Statements