Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K |

| | | |

| | (Mark one) | |

X | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended January 28, 2017 |

| | or |

| | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from ________ to ________ |

Commission file number 0-14678

Ross Stores, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 94-1390387 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

5130 Hacienda Drive, Dublin, California | | 94568-7579 |

(Address of principal executive offices) | | (Zip Code) |

|

Registrant's telephone number, including area code | | (925) 965-4400 |

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common stock, par value $.01 | | Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

Title of each class

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes X No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes X No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Large accelerated filer X Accelerated filer Non-accelerated filer Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No X

The aggregate market value of the voting common stock held by non-affiliates of the Registrant as of July 30, 2016 was $24,019,302,284, based on the closing price on that date as reported by the NASDAQ Global Select Market®. Shares of voting stock held by each director and executive officer have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of Common Stock, with $.01 par value, outstanding on March 6, 2017 was 391,895,145.

Documents incorporated by reference:

Portions of the Proxy Statement for the Registrant's 2017 Annual Meeting of Stockholders, which will be filed on or before May 29, 2017, are incorporated herein by reference into Part III.

PART I

ITEM 1. BUSINESS

Ross Stores, Inc. and its subsidiaries (“we” or the “Company”) operate two brands of off-price retail apparel and home fashion stores—Ross Dress for Less® (“Ross”) and dd’s DISCOUNTS®.

Ross is the largest off-price apparel and home fashion chain in the United States, with 1,340 locations in 36 states, the District of Columbia and Guam, as of January 28, 2017. Ross offers first-quality, in-season, name brand and designer apparel, accessories, footwear, and home fashions for the entire family at savings of 20% to 60% off department and specialty store regular prices every day. Ross' target customers are primarily from middle income households.

We also operate 193 dd’s DISCOUNTS stores in 15 states as of January 28, 2017. dd's DISCOUNTS features more moderately-priced first-quality, in-season, name brand apparel, accessories, footwear, and home fashions for the entire family at savings of 20% to 70% off moderate department and discount store regular prices every day. The typical dd’s DISCOUNTS store is located in an established shopping center in a densely populated urban or suburban neighborhood and its target customers typically come from households with more moderate incomes than Ross customers.

The merchant, store field, and distribution organizations for Ross and dd’s DISCOUNTS are separate and distinct. The two chains share certain other corporate and support services.

Both our Ross and dd's DISCOUNTS brands target value-conscious women and men between the ages of 18 and 54. The decisions we make, from merchandising, purchasing, and pricing, to the locations of our stores, are based on these customer profiles. We believe that both brands derive a competitive advantage by offering a wide assortment of product within each of our merchandise categories in organized and easy-to-shop store environments.

Our mission is to offer competitive values to our target customers by focusing on the following key strategic objectives:

• Maintain an appropriate level of recognizable brands, labels, and fashions at strong discounts throughout the store.

• Meet customer needs on a local basis.

• Deliver an in-store shopping experience that reflects the expectations of the off-price customer.

• Manage real estate growth to compete effectively across all our markets.

We refer to our fiscal years ended January 28, 2017, January 30, 2016, and January 31, 2015 as fiscal 2016, fiscal 2015, and fiscal 2014, respectively, all of which were 52-week years.

Merchandising, Purchasing, and Pricing

We seek to provide our customers with a wide assortment of first-quality, in-season, brand name and designer apparel, accessories, footwear, and home merchandise for the entire family at savings of 20% to 60% below department and specialty store regular prices every day at Ross, and 20% to 70% below moderate department and discount store regular prices at dd’s DISCOUNTS. We sell recognizable brand name merchandise that is current and fashionable in each category. New merchandise typically is received from three to six times per week at both Ross and dd’s DISCOUNTS stores. Our buyers review their merchandise assortments on a weekly basis, enabling them to respond to selling trends and purchasing opportunities in the market. Our merchandising strategy is reflected in our advertising, which emphasizes a strong value message. Our stores offer a treasure-hunt shopping experience where customers can find great savings every day on a broad assortment of brand name bargains for the family and the home.

Merchandising. Our merchandising strategy incorporates a combination of off-price buying techniques to purchase advance-of-season, in-season, and past-season merchandise for both Ross and dd’s DISCOUNTS. We believe nationally recognized name brands sold at compelling discounts will continue to be an important determinant of our success. We generally leave the brand name label on the merchandise we sell.

We have established merchandise assortments that we believe are attractive to our target customers. Although we offer fewer classifications of merchandise than most department stores, we generally offer a large selection within each classification with a wide assortment of vendors, labels, prices, colors, styles, and fabrics within each size or item. Our merchandise offerings include, but are not limited to, apparel (including footwear and accessories), small furniture, home accents, bed and bath, toys, luggage, gourmet food, cookware, watches, and sporting goods.

Purchasing. We have a combined network of more than 8,000 merchandise vendors and manufacturers for both Ross and dd’s DISCOUNTS and believe we have adequate sources of first-quality merchandise to meet our requirements. We purchase the vast majority of our merchandise directly from manufacturers, and we have not experienced any difficulty in obtaining sufficient merchandise inventory.

We believe our ability to effectively execute certain off-price buying strategies is a key factor in our success. Our buyers use a number of methods that enable us to offer our customers brand name and designer merchandise at strong discounts every day relative to department and specialty stores for Ross and moderate department and discount stores for dd’s DISCOUNTS. By purchasing later in the merchandise buying cycle than department, specialty, and discount stores, we are able to take advantage of imbalances between retailers’ demand for products and manufacturers’ supply of those products.

Unlike most department and specialty stores, we typically do not require that manufacturers provide promotional allowances, co-op advertising allowances, return privileges, split shipments, drop shipments to stores, or delayed deliveries of merchandise. For most orders, only one delivery is made to one of our six distribution centers. These flexible requirements further enable our buyers to obtain significant discounts on purchases.

The majority of the apparel and apparel-related merchandise that we offer in all of our stores is acquired through opportunistic purchases created by manufacturer overruns and canceled orders both during and at the end of a season. These buys are referred to as "close-out" purchases. Close-outs can be shipped to stores in-season, allowing us to get in-season goods into our stores at great values or can be stored as packaway merchandise.

Packaway merchandise is purchased with the intent that it will be stored in our warehouses until a later date, which may even be the beginning of the same selling season in the following year. Packaway purchases are an effective method of increasing the percentage of prestige and national brands at competitive savings within our merchandise assortments. Packaway merchandise is mainly fashion basics and, therefore, not usually affected by shifts in fashion trends.

In fiscal 2016, we continued our emphasis on this important sourcing strategy in response to compelling opportunities available in the marketplace. Packaway accounted for approximately 49% and 47% of total inventories as of January 28, 2017 and January 30, 2016, respectively. We believe the strong discounts we offer on packaway merchandise are one of the key drivers of our business results.

Our primary buying offices are located in New York City and Los Angeles, the nation's two largest apparel markets. These strategic locations allow our buyers to be in the market on a daily basis, sourcing opportunities and negotiating purchases with vendors and manufacturers. These locations also enable our buyers to strengthen vendor relationships—a key element to the success of our off-price buying strategies.

At the end of fiscal 2016, we had approximately 760 merchants for Ross and dd’s DISCOUNTS combined. The Ross and dd’s DISCOUNTS buying organizations are separate and distinct, and each includes merchandise management, buyers, and assistant buyers. Ross and dd’s DISCOUNTS buyers have on average eight years of experience, including merchandising positions with other retailers such as Bloomingdale's, Burlington Stores, Foot Locker, Kohl’s, Lord & Taylor, Macy's, Nordstrom, Saks, and TJX. We expect to continue to make additional targeted investments in our merchant organization to further develop our relationships with an expanding number of manufacturers and vendors. Our ongoing objective is to strengthen our ability to procure the most desirable brands and fashions at competitive discounts.

The off-price buying strategies utilized by our experienced team of merchants enable us to purchase Ross merchandise at net prices that are lower than prices paid by department and specialty stores, and to purchase dd’s DISCOUNTS merchandise at net prices that are lower than prices paid by moderate department and discount stores.

Pricing. Our policy is to sell brand name merchandise at Ross that is priced 20% to 60% below most department and specialty store regular prices. At dd’s DISCOUNTS, we sell more moderate brand name product and fashions that are priced 20% to 70% below most moderate department and discount store regular prices. Our pricing policy is reflected on the price tag displaying our selling price as well as the comparable value for that item in department and specialty stores for Ross merchandise, or in more moderate department and discount stores for dd’s DISCOUNTS merchandise.

Our pricing strategy at Ross differs from that of a department or specialty store. We purchase our merchandise at lower prices and mark it up less than a department or specialty store. This strategy enables us to offer customers

consistently low prices and compelling value. On a weekly basis our buyers review specified departments in our stores for possible markdowns based on the rate of sale as well as at the end of fashion seasons to promote faster turnover of merchandise inventory and to accelerate the flow of fresh product. A similar pricing strategy is in place at dd’s DISCOUNTS where prices are compared to those in moderate department and discount stores.

Stores

As of January 28, 2017, we operated a total of 1,533 stores comprised of 1,340 Ross stores and 193 dd’s DISCOUNTS stores. Our stores are located predominantly in community and neighborhood shopping centers in heavily populated urban and suburban areas. Where the size of the market and real estate opportunities permit, we cluster Ross stores to benefit from economies of scale in advertising, distribution, and field management. We do the same for dd’s DISCOUNTS stores.

We believe a key element of our success at both Ross and dd’s DISCOUNTS is our organized, attractive, easy-to-shop, in-store environments which allow customers to shop at their own pace. While our stores promote a self-service, treasure hunt shopping experience, the layouts are designed to enhance customer convenience in their merchandise presentation, dressing rooms, checkout, and merchandise return areas. Our store's sales area is based on a prototype single floor design with a racetrack aisle layout. A customer can locate desired departments by signs displayed just below the ceiling of each department. We enable our customers to select among sizes and prices through prominent category and sizing markers. At most stores, shopping carts and/or baskets are available at the entrance for customer convenience. Cash registers are primarily located at store exits for customer ease and efficient staffing.

We accept a variety of payment methods. We provide refunds on all merchandise (not used, worn, or altered) returned with a receipt within 30 days. Merchandise returns having a receipt older than 30 days are exchanged or refunded with store credit.

Operating Costs

Consistent with the other aspects of our business strategy, we strive to keep operating costs as low as possible. Among the factors which have enabled us to do this are: labor costs that are generally lower than full-price department and specialty stores due to a store design that creates a self-service retail format and due to the utilization of labor saving technologies; economies of scale with respect to general and administrative costs resulting from centralized merchandising, marketing, and purchasing decisions; and flexible store layout criteria which facilitate conversion of existing buildings to our formats.

Information Systems

We continue to invest in new information systems and technology to provide a platform for growth over the next several years. Recent initiatives include enhancements to our information and data security, merchandising, distribution, transportation, and store systems. These initiatives support future growth, the execution and achievement of our plans, as well as ongoing stability and compliance.

Distribution

We own and operate six distribution processing facilities—three in California, one in Pennsylvania, and two in South Carolina. We ship all of our merchandise to our stores through these distribution centers, which are large, highly automated, and built to suit our specific off-price business model.

Currently we own four and lease three other warehouse facilities for packaway storage. We also use other third-party facilities, including two warehouses for storage of packaway inventory.

We utilize third-party cross dock facilities to distribute merchandise to stores on a regional basis. Shipments are made by contract carriers to the stores three to six times per week depending on location.

We believe that our distribution centers with their current expansion capabilities will provide adequate processing capacity to support our current store growth. Information on the size and locations of our distribution centers and warehouse facilities is found under “Properties” in Item 2.

Advertising

Advertising for Ross Dress for Less relies primarily on television to communicate the Ross value proposition—savings off the same brands carried at leading department or specialty stores every day. This strategy reflects our belief that television is the most efficient and cost effective medium for communicating our brand position. While television is our primary advertising medium, we continue to utilize additional channels, including social media, to communicate our brand position. Advertising for dd’s DISCOUNTS is primarily focused on new store grand openings and local media initiatives.

Trademarks

The trademarks for ROSS®, Ross Dress For Less®, and dd’s DISCOUNTS® have been registered with the United States Patent and Trademark Office.

Employees

As of January 28, 2017, we had approximately 78,600 total employees, which includes both full and part-time employees. Additionally, we hire temporary employees especially during the peak seasons. Our employees are non-union. Management considers the relationship between the Company and our employees to be good.

Competition

We believe the principal competitive factors in the off-price retail apparel and home fashion industry are offering significant discounts on brand name merchandise, offering a well-balanced assortment that appeals to our target customers, and consistently providing store environments that are convenient and easy to shop. To execute this concept, we continue to make strategic investments in our merchandising organization. We also continue to make improvements to our core merchandising system to strengthen our ability to plan, buy, and allocate product based on more local versus regional trends. We believe that we are well-positioned to compete based on each of these factors.

Nevertheless, the retail apparel market is highly fragmented and competitive. We face a challenging macro-economic and retail environment that creates intense competition for business from department stores, specialty stores, discount stores, warehouse stores, other off-price retailers, and manufacturer-owned outlet stores, many of which are units of large national or regional chains that have substantially greater resources. We also compete with online retailers that sell apparel and home fashions. The retail apparel and home-related businesses may become even more competitive in the future.

Available Information

The internet address for our corporate website is www.rossstores.com. Our Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Proxy Statements, and any amendments to those reports are made available free of charge on or through the Investors section of our corporate website promptly after being electronically filed with the Securities and Exchange Commission. The information found on our corporate website is not part of this, or any other report or regulatory filing we file with or furnish to the Securities and Exchange Commission.

ITEM 1A. RISK FACTORS

Our Annual Report on Form 10-K for fiscal 2016, and information we provide in our Annual Report to Stockholders, press releases, and other investor communications, including those on our corporate website, may contain forward-looking statements with respect to anticipated future events and our projected growth, financial performance, operations, and competitive position that are subject to risks and uncertainties that could cause our actual results to differ materially from those forward-looking statements and our prior expectations and projections. Refer to Management’s Discussion and Analysis for a more complete identification and discussion of “Forward-Looking Statements.”

Our financial condition, results of operations, cash flows, and the performance of our common stock may be adversely affected by a number of risk factors. Risks and uncertainties that apply to both Ross and dd's DISCOUNTS include, without limitation, the following:

Competitive pressures in the apparel and home-related merchandise retailing industry are high.

The retail industry is highly competitive and the marketplace is highly fragmented, as many different retailers compete for market share by utilizing a variety of store and online formats and merchandising strategies. We expect competition to increase in the future. There are no significant economic barriers for others to enter our retail sector. We compete with many other local, regional, and national retailers, traditional department stores, upscale mass merchandisers, other off-price retailers, specialty stores, internet and catalog businesses, and other forms of retail commerce, for customers, associates, store locations, and merchandise. Our retail competitors constantly adjust their pricing, business strategies and promotional activity (particularly during holiday periods) in response to changing market conditions or their own financial condition. The substantial sales growth in the e-commerce industry within the last decade has also encouraged the entry of many new competitors, new business models, and an increase in competition from established companies looking for ways to create successful online off-price shopping alternatives. Intense pressures from our competitors, our inability to adapt effectively and quickly to a changing competitive landscape, or a failure to effectively execute our off-price model, could reduce demand for our merchandise, decrease our inventory turnover, cause greater markdowns, and negatively affect our sales and margins.

Unexpected changes in the level of consumer spending on or preferences for apparel and home-related merchandise could adversely affect us.

Our success depends on our ability to effectively buy and resell merchandise that meets customer demand. We work on an ongoing basis to identify customer trends and preferences, and to obtain merchandise inventory to meet anticipated customer needs. It is very challenging to successfully do this well and consistently across our diverse merchandise categories and in the multiple markets in which we operate throughout the United States. Although our off-price business model provides us certain advantages and could allow us greater flexibility than traditional retailers in adjusting our merchandise mix to ever-changing consumer tastes, our merchandising decisions may still fail to correctly anticipate and match consumer trends and preferences, particularly in our newer geographic markets. Failure to correctly anticipate and match the trends, preferences, and demands of our customers could adversely affect our business, financial condition, and operating results.

Unseasonable weather may affect shopping patterns and consumer demand for seasonal apparel and other merchandise.

Unseasonable weather and prolonged, extreme temperatures, and events such as storms, affect consumers’ buying patterns and willingness to shop, and could adversely affect the demand for merchandise in our stores, particularly in apparel and seasonal merchandise. Among other things, weather conditions may also affect our ability to deliver our products to our stores or require us to close certain stores temporarily, thereby reducing store traffic. Even if stores are not closed, many customers may be unable to go, or may decide to avoid going to stores in bad weather. As a result, unseasonable weather in any of our markets could lead to disappointing sales and increase our markdowns, which may negatively affect our sales and margins.

We are subject to impacts from the macro-economic environment, financial and credit markets, and geopolitical conditions that affect consumer confidence and consumer disposable income.

Consumer spending habits for the merchandise we sell are affected by many factors, including prevailing economic conditions, recession and fears of recession, levels of unemployment, salaries and wage rates, housing costs, energy and fuel costs, income tax rates and the timing of tax refunds, inflation, consumer confidence in future economic conditions, consumer perceptions of personal well-being and security, availability of consumer credit, consumer debt levels, and consumers’ disposable income. Adverse developments in any of these areas could reduce demand for our merchandise, decrease our inventory turnover, cause greater markdowns, and negatively affect our sales and margins. All of our stores are located in the United States and its territories, so we are especially susceptible to changes in the U.S. economy.

In order to achieve our planned gross margins, we must effectively manage our inventories, markdowns, and inventory shortage.

We purchase the majority of our inventory based on our sales plans. If our sales plans significantly differ from actual demand, we may experience higher inventory levels and need to take markdowns on excess or slow-moving inventory, resulting in decreased profit margins. We also may have insufficient inventory to meet customer demand, leading to lost sales opportunities. As a regular part of our business, we purchase “packaway” inventory with the intent that it will be stored in our warehouses until a later date. The timing of the release of packaway inventory to our stores varies by merchandise category and by season, but it typically remains in storage less than six months. Packaway inventory is frequently a significant portion of our overall inventory. If we make packaway purchases that do not meet consumer preferences at the later time of release to our stores, we could have significant inventory markdowns. Changes in packaway inventory levels could impact our operating cash flow. Although we have various systems to help protect against loss or theft of our inventory, both when in storage and once distributed to our stores, we may have damaged, lost, or stolen inventory (called “shortage”) in higher amounts than we forecast, which would result in write-offs, lost sales, and reduced margins.

We depend on the market availability, quantity, and quality of attractive brand name merchandise at desirable discounts, and on the ability of our buyers to purchase merchandise to enable us to offer customers a wide assortment of merchandise at competitive prices.

Opportunistic buying, lean inventory levels, and frequent inventory turns are critical elements of our off-price business strategy. And maintaining an overall pricing differential to department and specialty stores is key to our ability to attract customers and sustain our sales and gross margins. Our opportunistic buying places considerable discretion on our merchants, who are in the marketplace continually and who are generally purchasing merchandise for the current or upcoming season. Our ability to meet or exceed our operating performance targets depends upon the continuous, sufficient availability of high quality merchandise that we can acquire at prices sufficiently below those paid by conventional retailers and that represent a value to our customers. To the extent that certain of our vendors are better able to manage their inventory levels and reduce the amount of their excess inventory, the amount of high quality merchandise available to us could be materially reduced. To the extent that certain of our vendors decide not to sell to us or go out of business, the amount of high quality merchandise available to us could also be materially reduced. Because a significant portion of the apparel and other goods we sell is originally manufactured in other countries, changes in U.S. tariffs, trade relationships, or tax policies that reduce the supply or increase the relative cost of imported goods, could also result in disruptions to our existing supply relationships. Shortages or disruptions in the availability to us of high quality merchandise would likely have a material adverse effect on our sales and margins.

Information or data security breaches, including cyber-attacks on our transaction processing and computer information systems, could result in theft or unauthorized disclosure of customer, credit card, employee, or other private and valuable information that we handle in the ordinary course of our business.

Like other large retailers, we rely on commercially available computer and telecommunications systems to process, transmit, and store payment card and other personal and confidential information, and to provide information or data security for those transactions. Some of the key information systems and processes we use to handle payment card transactions and check approvals, and the levels of security technology utilized in payment cards, are controlled by the banking and payment card industry, not by us. Cyber criminals may attempt to penetrate our information systems to misappropriate customer or business information, including but not limited to credit/debit card, personnel, or trade information. Despite security measures we have in place, our facilities and systems (or those of third-party service providers we utilize or connect to) may be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming and/or human errors, phishing and similar fraudulent attacks, or other similar events. It is also possible that an associate within our Company or a third party we do business with may purposefully or inadvertently cause a security breach involving such information. The increasing sophistication of cyber criminals

and advances in computer capabilities and remote access increases these risks. A breach of our information or data security, or our failure or delay in detecting and mitigating a loss of personal or business information, could result in damage to our reputation, loss of customer confidence, violation (or alleged violation) of applicable laws, and expose us to civil claims, litigation, and regulatory action and to unanticipated costs and disruption of our operations.

Disruptions in our supply chain or in our information systems could impact our ability to process sales and to deliver product to our stores in a timely and cost-effective manner.

Various information systems are critical to our ability to operate and to manage key aspects of our business. We depend on the integrity and consistent operations of these systems to process transactions in our stores, track inventory flow, manage merchandise allocation and distribution logistics, generate performance and financial reports, and support merchandising decisions.

We are currently making, and will continue to make, significant technology investments to improve or replace information processes and systems that are key to managing our business. We must monitor and choose the right investments and implement them at the right pace. The risk of system disruption is increased whenever significant system changes are undertaken. Excessive technological change could impact the effectiveness of adoption, and could make it more difficult for us to realize benefits from new technology. Targeting the wrong opportunities, failing to make the best investments, or making an investment commitment significantly above or below our needs could damage our competitive position and adversely impact our business and results of operations. Additionally, the potential problems and interruptions associated with implementing technology system changes could disrupt or reduce the efficiency of our operations in the short term. These initiatives might not provide the anticipated benefits or may provide them on a delayed schedule or at a higher cost.

Our information systems, including our back-up systems, are subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, internal or external security breaches, catastrophic events such as severe storms, fires, earthquakes, floods, acts of terrorism, and design or usage errors by our employees or by third parties. If our information systems or our back-up systems are damaged or cease to function properly, we may have to make significant investments to fix or replace them, and we may suffer interruptions in our operations in the interim. Any material interruption in our computer systems could have a material adverse effect on our business and results of operations.

A disruption within our logistics or supply chain network could adversely affect our ability to timely and efficiently transport merchandise to our stores or our distribution centers, which could impair our ability to meet customer demand for products and result in lost sales or increased supply chain costs. Such disruptions may result from: damage or destruction to our distribution centers; weather-related events; natural disasters; trade restrictions; tariffs; third-party strikes, work stoppages or slowdowns; shipping capacity constraints; supply or shipping interruptions or costs; or other factors beyond our control. Any such disruptions could negatively impact our financial performance or financial condition.

We need to obtain acceptable new store sites with favorable consumer demographics to achieve our planned growth.

Successful growth requires us to find appropriate real estate sites in our targeted market areas. We compete with other retailers and businesses for acceptable store locations. For the purpose of identifying locations we rely, in part, on consumer demographics. While we believe consumer demographics are helpful indicators of acceptable store locations, we recognize that this information cannot predict future consumer preferences and buying trends with complete accuracy. Time frames for negotiations and store development vary from location to location and can be subject to unforeseen delays or unexpected cancellations. We may not be able to open new stores or, if opened, operate those stores profitably. Construction and other delays in store openings could have a negative impact on our business and operating results. Additionally, we may not be able to renegotiate our current lease terms which could negatively impact our operating results. New stores may not achieve the same sales or profit levels as our existing stores, and adding stores to existing markets may adversely affect the sales and profitability of other existing stores. If we cannot acquire sites on attractive terms, it could limit our ability to grow or adversely affect the economics of our new stores in various markets.

To achieve growth, we need to expand in existing markets and enter new geographic markets.

Our growth strategy is based on successfully expanding our off-price model in current markets and in new geographic regions. There are significant risks associated with our ability to continue to expand our current business and to enter new markets. Stores we open in new markets may take longer to reach expected sales and profit levels on a consistent basis and may have higher construction, occupancy, advertising, or operating costs than stores we open in existing markets, thereby affecting our overall profitability. New markets may have competitive conditions, consumer tastes

and discretionary spending patterns that are more difficult to predict or satisfy than our existing markets. Our limited operating experience and limited brand recognition in new markets may require us to build brand awareness in that market through greater investments in advertising and promotional activity than we originally planned. We may find it more difficult in new markets to hire, motivate, and retain qualified associates.

Consumer problems or legal issues involving the quality, safety, or authenticity of products we sell could harm our reputation, result in lost sales, and/or increase our costs.

Various governmental authorities regulate the quality and safety of merchandise we sell. These laws and regulations frequently change, and the ultimate cost of compliance cannot be precisely estimated. Because of our opportunistic buying strategy, we sometimes obtain merchandise in new categories or from new vendors that we have not dealt with before. Although our vendor arrangements typically place contractual responsibility on the vendor for resulting liability and we generally rely on our vendors to provide authentic merchandise that matches the stated quality attributes and complies with applicable product safety and other laws, vendor non-compliance with consumer product safety laws may subject us to product recalls, make certain products unsalable, or require us to incur significant compliance costs.

Regardless of fault, any real or perceived issues with the quality and safety of merchandise, particularly products such as food and children’s items, issues with the authenticity of merchandise, or our inability, or that of our vendors, to comply on a timely basis with such laws and regulatory requirements, could adversely affect our reputation, result in lost sales, inventory write-offs, uninsured product liability or other legal claims, penalties or losses, merchandise recalls, and increased costs.

An adverse outcome in various legal, regulatory, or tax matters could increase our costs.

As an ordinary part of our business, we are involved in various legal proceedings, regulatory reviews, tax audits, or other legal matters. These may include lawsuits, inquiries, demands, or other claims or proceedings by governmental entities and private plaintiffs, including those relating to employment and employee benefits (including classification, employment rights, discrimination, wage and hour, and retaliation), securities, real estate, tort, commercial, consumer protection, privacy, product compliance and safety, advertising, comparative pricing, intellectual property, tax, escheat, and whistle-blower claims. We continue to be involved in a number of employment-related lawsuits, including class actions which are primarily in California.

We are subject to federal, state, and local rules and regulations in the United States, and to various international laws, which change from time to time. These legal requirements collectively affect multiple aspects of our business, including the cost of health care, workforce management and employee benefits, minimum wages, advertising, comparative pricing, import/export, sourcing and manufacturing, data protection, intellectual property, and others. If we fail to comply (or are alleged not to comply) with any of these requirements, we may be subject to fines, settlements, penalties, or other costs. We are also subject to the continuous examination of our tax returns and reports by federal, state, and local tax authorities, and these examining authorities may challenge positions we take.

Significant judgment is required in evaluating and estimating our provision and accruals for both legal claims and for taxes. Actual results may differ and our costs may exceed the reserves we establish in estimating the probable outcomes. In addition, applicable accounting principles and interpretations may change from time to time, and those changes could have material effects on our reported operating results and financial condition.

Damage to our corporate reputation or brands could adversely affect our sales and operating results.

Our reputation is partially based on perceptions of various subjective qualities and overall integrity. Any incident that erodes the trust or confidence of our customers or the general public could adversely affect our reputation and business, particularly if the incident results in significant adverse publicity or governmental inquiry. Such an incident could also include alleged acts or omissions by or situations involving our suppliers (or their contractors or subcontractors). The use of social media platforms, including blogs, social media websites, and other forms of internet-based communications which allow individuals access to a broad audience of consumers and other interested persons, continues to increase. The availability of information (whether correct or erroneous) on social media platforms is virtually immediate, as is its impact. Many social media platforms immediately publish the content their subscribers and participants post, often without filters or checks on accuracy of the content posted. The opportunity for dissemination of information, including inaccurate information, is seemingly limitless and readily available. Information concerning our Company may be posted on such platforms at any time. Information posted may be adverse to our interests or may be inaccurate, each of which could negatively impact sales, diminish customer trust, reduce employee morale and productivity, and lead to difficulties in recruiting and retaining qualified associates. The harm may be immediate, without affording us an opportunity for redress or correction.

We must continually attract, train, and retain associates with the retail talent necessary to execute our off-price retail strategies.

Like other retailers, we face challenges in recruiting and retaining sufficient talent in our buying organization, management, and other key areas. Many of our retail store associates are in entry level or part-time positions with historically high rates of turnover. Our ability to control labor costs is subject to numerous external factors, including prevailing wage rates and health and other insurance costs, as well as the impact of legislation or regulations governing minimum wage or healthcare benefits.

Any increase in labor costs may adversely impact our profitability or, if we fail to pay such higher wages, may result in increased turnover. Excessive turnover may result in higher costs associated with finding, hiring, and training new associates. If we cannot hire enough qualified associates, or if there is a disruption in the supply of personnel we hire from third-party providers, especially during our peak season, our operations could be negatively impacted.

Because of the distinctive nature of our off-price model, we must also attract, train, and retain our key associates across the Company, including within our buying organization. The loss of one or more of our key personnel or the inability to effectively identify a suitable successor for a key role could have a material adverse effect on our business. There is no assurance that we will be able to attract or retain highly qualified associates in the future, and any failure to do so could have a material adverse effect on our growth, operations, or financial position.

We must effectively advertise and market our business.

Customer traffic and demand for our merchandise is influenced by our advertising and marketing activities, the name recognition and reputation of our brands, and the location of our stores. Although we use marketing and advertising programs to attract customers to our stores, particularly through television, our competitors may spend more or use different approaches, which could provide them with a competitive advantage. Our advertising and other promotional programs may not be effective or may be perceived negatively, or could require increased expenditures, which could adversely affect sales or increase costs.

We are subject to risks associated with selling and importing merchandise produced in other countries.

A predominant portion of the apparel and other goods we sell (even when purchased domestically, often as excess inventory sold to us by a domestic vendor) is originally manufactured in other countries. In addition, we directly source a portion of the products sold in our stores from foreign vendors predominantly in Asia (including China). We also buy product from foreign sources indirectly through domestic vendors and manufacturers' representatives. Although our foreign purchases of merchandise are negotiated and paid for in U.S. dollars, decreases in the value of the U.S. dollar relative to foreign currencies could increase the cost of products we purchase from overseas vendors.

To the extent that our vendors are located overseas or rely on overseas sources for a large portion of their products, any event causing a disruption of imports, including the imposition of import restrictions, war, and acts of terrorism could adversely affect our business. The flow of merchandise from our vendors could also be adversely affected by financial or political instability in any of the countries in which the goods we purchase are manufactured, if the instability affects the production or export of merchandise from those countries. Trade restrictions in the form of tariffs or quotas, or both, applicable to the products we sell could also affect the importation of those products and could increase the cost and reduce the supply of products available to us.

When we are the importer of record, we may be subject to regulatory or other requirements similar to those applicable to a manufacturer. These risks and uncertainties include import duties and quotas, compliance with anti-dumping regulations, work stoppages, economic uncertainties and adverse economic conditions (including inflation and recession), foreign government regulations, employment and labor matters, concerns relating to human rights, working conditions, and other issues in factories or countries where merchandise is produced, transparency of sourcing and supply chains, exposure on product warranty and intellectual property issues, consumer perceptions of the safety of imported merchandise, wars and fears of war, political unrest, natural disasters, regulations to address climate change, and trade restrictions. We cannot predict whether any of the countries from which our products are sourced, or in which our products are currently manufactured or may be manufactured in the future, will be subject to trade restrictions imposed by the U.S. or foreign governments or the likelihood, type or effect of any such restrictions.

We require our vendors (for both import and domestic purchasing) to adhere to various conduct, compliance, and other requirements including those relating to environmental, employment and labor (including wages and working conditions), health, safety, and anti-bribery standards. From time to time, our vendors, their contractors, or their subcontractors may be alleged to not be in compliance with these standards or applicable local laws. Although we have implemented policies and procedures to facilitate our compliance with laws and regulations relating to doing

business in foreign markets and importing merchandise, there can be no assurance that suppliers and other third parties with whom we do business will not violate such laws and regulations or our policies. Significant or continuing noncompliance with such standards and laws by one or more vendors could have a negative impact on our reputation, could subject us to claims and liability, and could have an adverse effect on our results of operations.

Changes in U.S. tax or tariff policy regarding apparel and home-related merchandise produced in other countries could adversely affect our business.

The U.S. government has indicated an intention to review and potentially to significantly change U.S. tax and trade policies. Potential changes may include disallowance of the tax deductions for imported merchandise or the imposition of significant tariffs on products imported into the U.S. This exposes us to risks of disruption and cost increases in our established patterns for sourcing our merchandise, and creates increased uncertainties in planning our sourcing strategies and forecasting our margins.

A predominant portion of the apparel and other goods we sell is originally manufactured in other countries. Changes in U.S. tariffs, quotas, trade relationships, or tax provisions that reduce the supply or increase the relative cost of goods produced in other countries are likely to increase our cost of goods and/or increase our effective tax rate. Although such changes would have implications across the entire industry, we may fail to effectively adapt and to manage the adjustments in strategy that would be necessary in response to those changes. In addition to the general uncertainty and overall risk from those potential changes in U.S. laws and policies, as we make business decisions in the face of the uncertainty of those potential changes, we may incorrectly anticipate the outcomes, miss out on business opportunities, or fail to effectively adapt our business strategies and manage the adjustments that are necessary in response to those changes. These risks could adversely affect our revenues, increase our effective tax rates, and reduce our profitability.

We may experience volatility in revenues and earnings.

Our business has slower and busier periods based on holiday and back-to-school seasons, weather, and other factors. Although our off-price business is historically subject to less seasonality than traditional retailers, we may still experience unexpected decreases in sales from time to time, which could result in increased markdowns and reduced margins. Significant operating expenses, such as rent expense and associate salaries, do not adjust proportionately with our sales. If sales in a certain period are lower than our plans, we are generally not able to adjust these operating expenses concurrently, which may impact our operating results.

A natural or man-made disaster in California or in another region where we have a concentration of stores, offices, or a distribution center could harm our business.

Our corporate headquarters, Los Angeles buying office, three operating distribution centers, two warehouses, and approximately 24% of our stores are located in California. Natural or other disasters, such as earthquakes and hurricanes, tornadoes, floods, or other extreme weather and climate conditions, or fires, explosions, and acts of war or terrorism, or public health issues (such as epidemics), in any of our markets could disrupt our operations or our supply chain, or could shut down, damage, or destroy our stores or distribution facilities.

To support our continuing operations, our new store and distribution center growth plans, and our stock repurchase program and quarterly dividends, we must maintain sufficient liquidity.

We depend upon our operations to generate strong cash flows to support our general operating activities, and to supply capital to finance our operations, make capital expenditures and acquisitions, manage our debt levels, and return value to our stockholders through dividends and stock repurchases. If we are unable to generate sufficient cash flows from operations to support these activities, our growth plans and our financial performance would be adversely affected. If necessary to support our operations, we could be forced to suspend our stock repurchase program and/or discontinue payment of our quarterly cash dividends. Any failure to pay dividends or repurchase stock, after we have announced our intention to do so, may negatively impact our reputation and investor confidence in us, and may negatively impact our stock price.

We have borrowed on occasion to finance some of our activities. If our access to capital is restricted or our borrowing costs increase, our operations and financial condition could be adversely impacted. In addition, if we do not properly allocate our capital to maximize returns, our operations, cash flows, and returns to stockholders could be adversely affected.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

At January 28, 2017, we operated a total of 1,533 stores, of which 1,340 were Ross stores in 36 states, the District of Columbia and Guam, and 193 were dd’s DISCOUNTS stores in 15 states. All stores are leased, with the exception of three locations which we own.

During fiscal 2016, we opened 71 new Ross stores and closed five existing stores. The average approximate Ross store size is 28,400 square feet.

During fiscal 2016, we opened 22 new dd’s DISCOUNTS stores and closed one existing store. The average approximate dd’s DISCOUNTS store size is 23,200 square feet.

During fiscal 2016, no one store accounted for more than 1% of our sales.

We carry earthquake insurance to help mitigate the risk of financial loss due to an earthquake.

Our real estate strategy in 2017 is to primarily open stores in states where we currently operate, to increase our market penetration and reduce overhead and advertising expenses as a percentage of sales in each market. We also expect to continue our store expansion in newer markets in 2017. Important considerations in evaluating a new store location in both newer and more established markets are the availability and quality of potential sites, demographic characteristics, competition, and population density of the local trade area. In addition, we continue to consider opportunistic real estate acquisitions.

The following table summarizes the locations of our stores by state/territory as of January 28, 2017 and January 30, 2016.

|

| | | | |

State/Territory | | January 28, 2017 | | January 30, 2016 |

Alabama | | 23 | | 19 |

Arizona | | 74 | | 71 |

Arkansas | | 8 | | 6 |

California | | 364 | | 347 |

Colorado | | 33 | | 31 |

Delaware | | 2 | | 1 |

District of Columbia | | 1 | | 1 |

Florida | | 185 | | 179 |

Georgia | | 56 | | 55 |

Guam | | 1 | | 1 |

Hawaii | | 17 | | 17 |

Idaho | | 11 | | 11 |

Illinois | | 62 | | 55 |

Indiana | | 9 | | 8 |

Kansas | | 10 | | 7 |

Kentucky | | 9 | | 9 |

Louisiana | | 18 | | 17 |

Maryland | | 24 | | 23 |

Mississippi | | 8 | | 8 |

Missouri | | 21 | | 17 |

Montana | | 6 | | 6 |

Nevada | | 33 | | 32 |

New Jersey | | 13 | | 13 |

New Mexico | | 12 | | 11 |

North Carolina | | 45 | | 42 |

North Dakota | | 1 | | 0 |

Oklahoma | | 23 | | 22 |

Oregon | | 30 | | 31 |

Pennsylvania | | 44 | | 43 |

South Carolina | | 23 | | 22 |

South Dakota | | 1 | | 0 |

Tennessee | | 31 | | 30 |

Texas | | 222 | | 211 |

Utah | | 17 | | 17 |

Virginia | | 38 | | 36 |

Washington | | 42 | | 41 |

Wisconsin | | 13 | | 3 |

Wyoming | | 3 | | 3 |

Total | | 1,533 | | 1,446 |

Where possible, we obtain sites in buildings requiring minimal alterations, allowing us to establish stores in new locations in a relatively short period of time at reasonable costs in a given market. At January 28, 2017, the majority of our stores had unexpired original lease terms ranging from three to ten years with three to four renewal options of five years each. The average unexpired original lease term of our leased stores is five years or 21 years if renewal options are included. See Note E of Notes to Consolidated Financial Statements.

See additional discussion under “Stores” in Item 1.

The following table summarizes the location and approximate sizes of our distribution centers, warehouses, and office locations as of January 28, 2017. Square footage information for the distribution centers and warehouses represents total ground floor area of the facility. Square footage information for office space represents total space owned and leased. See additional discussion in Management’s Discussion and Analysis.

|

| | | | | |

Location | | Approximate Square Footage |

| | Own / Lease |

Distribution centers | | | | |

Carlisle, Pennsylvania | | 465,000 |

| | Own |

Fort Mill, South Carolina | | 1,200,000 |

| | Own |

Moreno Valley, California | | 1,300,000 |

| | Own |

Perris, California | | 1,300,000 |

| | Own |

Rock Hill, South Carolina | | 1,200,000 |

| | Own |

Shafter, California | | 1,700,000 |

| | Own |

| | | | |

Warehouses | | | | |

Carlisle, Pennsylvania | | 239,000 |

| | Lease |

Carlisle, Pennsylvania | | 246,000 |

| | Lease |

Fort Mill, South Carolina | | 251,000 |

| | Lease |

Fort Mill, South Carolina | | 423,000 |

| | Own |

Fort Mill, South Carolina | | 428,000 |

| | Own |

Perris, California | | 699,000 |

| | Own |

Riverside, California | | 449,000 |

| | Own |

| | | | |

Office space | | | | |

Dublin, California | | 414,000 |

| | Own |

Los Angeles, California | | 87,000 |

| | Lease |

New York City, New York | | 572,000 |

| | Own |

See additional discussion under “Distribution” in Item 1.

ITEM 3. LEGAL PROCEEDINGS

Like many retailers, we have been named in class action lawsuits, primarily in California, alleging violation of wage and hour laws and consumer protection laws. Class action litigation remains pending as of January 28, 2017.

We are also party to various other legal and regulatory proceedings arising in the normal course of business. Actions filed against us may include commercial, product and product safety, consumer, intellectual property, and labor and employment-related claims, including lawsuits in which private plaintiffs or governmental agencies allege that we violated federal, state, and/or local laws. Actions against us are in various procedural stages. Many of these proceedings raise factual and legal issues and are subject to uncertainties.

We believe that the resolution of our pending class action litigation and other currently pending legal and regulatory proceedings will not have a material adverse effect on our financial condition, results of operations, or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

Executive Officers of the Registrant

The following sets forth the names and ages of our executive officers, indicating each person's principal occupation or employment during at least the past five years. The term of office is at the discretion of our Board of Directors.

|

| | | | | |

Name | | Age |

| | Position |

Michael Balmuth | | 66 |

| | Executive Chairman of the Board |

Barbara Rentler | | 59 |

| | Chief Executive Officer |

Bernie Brautigan | | 52 |

| | President, Merchandising, Ross Dress for Less |

James S. Fassio | | 62 |

| | President and Chief Development Officer |

Brian Morrow | | 57 |

| | President and Chief Merchandising Officer, dd's DISCOUNTS |

Michael O’Sullivan | | 53 |

| | President and Chief Operating Officer |

Lisa Panattoni | | 54 |

| | President, Merchandising, Ross Dress for Less |

John G. Call | | 58 |

| | Executive Vice President, Finance and Legal, and Corporate Secretary |

Michael J. Hartshorn | | 49 |

| | Group Senior Vice President, Chief Financial Officer and Principal Accounting Officer |

Mr. Balmuth has served as Executive Chairman of the Board of Directors since 2014. From 1996 to 2014, he was Vice Chairman of the Board of Directors and Chief Executive Officer. He also served as President from 2005 to 2009. Previously, Mr. Balmuth was Executive Vice President, Merchandising from 1993 to 1996 and Senior Vice President and General Merchandise Manager from 1989 to 1993. Before joining Ross, he was Senior Vice President and General Merchandising Manager at Bon Marché in Seattle from 1988 to 1989 and Executive Vice President and General Merchandising Manager for Karen Austin Petites from 1986 to 1988.

Ms. Rentler has served as Chief Executive Officer and a member of the Board of Directors since 2014. From 2009 to 2014, she was President and Chief Merchandising Officer, Ross Dress for Less and Executive Vice President, Merchandising, from 2006 to 2009. She also served at dd’s DISCOUNTS as Executive Vice President and Chief Merchandising Officer from 2005 to 2006 and Senior Vice President and Chief Merchandising Officer from 2004 to 2005. Prior to that, she held various merchandising positions since joining the Company in 1986.

Mr. Brautigan has served as President, Merchandising, Ross Dress for Less since March 2016 with responsibility for the Ladies and Children’s apparel businesses, Shoes, and Accessories. Previously he was Group Executive Vice President, Merchandising, Ross Dress for Less from 2014 to 2016. He was also Executive Vice President of Merchandising at Ross from 2009 to 2014, Senior Vice President and General Merchandise Manager, from 2006 to 2009, and Group Vice President of Shoes from 2003 to 2006. Prior to Ross, he spent 20 years in various merchandising positions at Macy’s East.

Mr. Fassio has served as President and Chief Development Officer since 2009. Prior to that, he was Executive Vice President, Property Development, Construction and Store Design from 2005 to 2009 and Senior Vice President, Property Development, Construction and Store Design from 1991 to 2005. He joined the Company in 1988 as Vice President of Real Estate. Prior to joining Ross, Mr. Fassio held various retail and real estate positions with Safeway Stores, Inc.

Mr. Morrow has served as President and Chief Merchandising Officer, dd’s DISCOUNTS since December 2015. Prior to joining Ross, Mr. Morrow served as President, Chief Merchandising Officer of Stein Mart from 2014 to 2015 and Executive Vice President and Chief Merchandising Officer from 2010 to 2014. From 2008 to 2009, he served as Executive Vice President, General Merchandise Manager at Macy’s West. He also held roles as Senior Vice President, General Merchandise Manager at Mervyn’s in 2008 and Macy’s North/Marshall Field’s from 2006 to 2008. For approximately 20 years prior to this, Mr. Morrow held various merchandising roles at The May Department Stores Company.

Mr. O’Sullivan has served as President and Chief Operating Officer since 2009 and a member of the Board of Directors since 2014. From 2005 to 2009, he was Executive Vice President and Chief Administrative Officer and Senior Vice President, Strategic Planning and Marketing from 2003 to 2005. Before joining Ross, Mr. O’Sullivan was a partner with Bain & Company, providing consulting advice to retail, consumer goods, financial services and private equity clients since 1991.

Ms. Panattoni has served as President, Merchandising, Ross Dress for Less since 2014 with responsibility for all of the Home businesses, Men’s, Lingerie, and Cosmetics. Previously, she was Group Executive Vice President, Merchandising at Ross from 2009 to 2014. She joined the Company in 2005 as Senior Vice President and General Merchandise Manager of Home and was promoted to Executive Vice President later that same year. Prior to joining Ross, Ms. Panattoni was with The TJX Companies, where she served as Senior Vice President of Merchandising and Marketing for HomeGoods from 1998 to 2004 and as Divisional Merchandise Manager of the Marmaxx Home Store from 1994 to 1998.

Mr. Call has served as Executive Vice President, Finance and Legal, and Corporate Secretary since 2014. From 2012 to 2014, Mr. Call was Group Senior Vice President and Chief Financial Officer, with additional oversight for Legal and the Corporate Secretary function. From 1997 to 2012, he was Senior Vice President and Chief Financial Officer and also served as Corporate Secretary from 1997 to 2009. Mr. Call was Senior Vice President, Chief Financial Officer, Secretary and Treasurer of Friedman’s from 1993 until 1997. For ten years prior to joining Friedman’s, Mr. Call held various positions with Ernst & Young LLP.

Mr. Hartshorn has served as Group Senior Vice President, Chief Financial Officer since March 2015. Previously, he was Senior Vice President and Chief Financial Officer from 2014 to March 2015, Senior Vice President and Deputy Chief Financial Officer from 2012 to 2014, Group Vice President, Finance and Treasurer from 2011 to 2012, and Vice President, Finance and Treasurer from 2006 to 2011. From 2002 to 2006, he held a number of management roles in the Ross IT and supply chain organizations. He initially joined the Company in 2000 as Director and Assistant Controller. For seven years prior to joining Ross, Mr. Hartshorn held various financial roles at The May Department Stores Company.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

General information. See the information set forth under the caption "Quarterly Financial Data (Unaudited)" under Note K of Notes to Consolidated Financial Statements in Item 8 of this Annual Report, which is incorporated herein by reference. Our stock is traded on The NASDAQ Global Select Market® under the symbol ROST. There were 847 stockholders of record as of March 6, 2017 and the closing stock price on that date was $67.40 per share.

Cash dividends. On February 28, 2017, our Board of Directors declared a quarterly cash dividend of $0.1600 per common share, payable on March 31, 2017. Our Board of Directors declared cash dividends of $0.1350 per common share in March, May, August, and November 2016, cash dividends of $0.1175 per common share in February, May, August, and November 2015, and cash dividends of $0.1000 per common share in February, May, August, and November 2014.

Issuer purchases of equity securities. Information regarding shares of common stock we repurchased during the fourth quarter of fiscal 2016 is as follows:

|

| | | | | | | | | | |

Period | | Total number of shares (or units) purchased¹ |

| | Average price paid per share (or unit) | | Total number of shares (or units) purchased as part of publicly announced plans or programs |

| | Maximum number (or approximate dollar value) of shares (or units) that may yet be purchased under the plans or programs ($000) |

November | | | | | | | | |

(10/30/2016 - 11/26/2016) | | 662,860 |

| | $64.23 | | 660,463 |

| | $127,300 |

December | | | | | | | | |

(11/27/2016 - 12/31/2016) | | 1,074,861 |

| | $67.66 | | 1,074,861 |

| | $54,500 |

January | | | | | | | | |

(01/01/2017 - 01/28/2017) | | 829,184 |

| | $66.15 | | 824,491 |

| | $0 |

Total | | 2,566,905 |

| | $66.29 | | 2,559,815 |

| | $0 |

|

|

¹ We acquired 7,090 shares of treasury stock during the quarter ended January 28, 2017. Treasury stock includes shares acquired from employees for tax withholding purposes related to vesting of restricted stock grants. All remaining shares were repurchased under our publicly announced stock repurchase program. |

In February 2017, our Board of Directors approved a new, two-year $1.75 billion stock repurchase program through fiscal 2018.

See Note H of Notes to Consolidated Financial Statements for equity compensation plan information. The information under Item 12 of this Annual Report on Form 10-K under the caption “Equity compensation plan information” is incorporated herein by reference.

Stockholder Return Performance Graph

The following information in this Item 5 shall not be deemed filed for purposes of Section 18 of the Securities Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933.

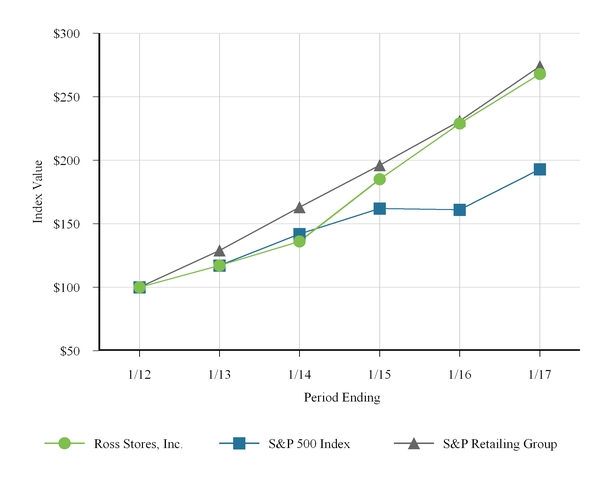

The graph below compares total stockholder returns over the last five years for our common stock with the Standard & Poor’s (“S&P”) 500 Index and the S&P Retailing Group. The cumulative total return listed below assumed an initial investment of $100 and reinvestment of dividends at each fiscal year end, and measures the performance of this investment as of the last trading day in the month of January for each of the following five years. These measurement dates are based on the historical month-end data available and may vary slightly from our actual fiscal year-end date for each period. Data with respect to returns for the S&P indexes is not readily available for periods shorter than one month. The graph is a historical representation of past performance only and is not necessarily indicative of future performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Among Ross Stores, Inc., the S&P 500 Index, and S&P Retailing Group

|

| | | | | | | | | | | | | | | | | | |

| | | | Indexed Returns for Years Ended |

| | Base Period |

| | | | | | | | | | |

Company / Index | | 2012 |

| | 2013 |

| | 2014 |

| | 2015 |

| | 2016 |

| | 2017 |

|

Ross Stores, Inc. | | 100 |

| | 117 |

| | 136 |

| | 185 |

| | 229 |

| | 268 |

|

S&P 500 Index | | 100 |

| | 117 |

| | 142 |

| | 162 |

| | 161 |

| | 193 |

|

S&P Retailing Group | | 100 |

| | 129 |

| | 163 |

| | 196 |

| | 231 |

| | 274 |

|

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data is derived from our consolidated financial statements. The data set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” the section “Forward-Looking Statements” in this Annual Report on Form 10-K and our consolidated financial statements and notes thereto.

|

| | | | | | | | | | | | | | | | | | | | |

($000, except per share data) | 2016 |

| | 2015 |

| | 2014 |

| | 2013 |

|

| 2012 |

| ¹ |

| | | | | | | | | | |

Operations | | | | | | | | | | |

Sales | $ | 12,866,757 |

| | $ | 11,939,999 |

| | $ | 11,041,677 |

| | $ | 10,230,353 |

| | $ | 9,721,065 |

| |

Cost of goods sold | 9,173,705 |

| | 8,576,873 |

| | 7,937,956 |

| | 7,360,924 |

| | 7,011,428 |

| |

Percent of sales | 71.3 | % | | 71.8 | % | | 71.9 | % | | 72.0 | % | | 72.1 | % | |

Selling, general and administrative | 1,890,408 |

| | 1,738,755 |

| | 1,615,371 |

| | 1,526,366 |

| | 1,437,886 |

| |

Percent of sales | 14.7 | % | | 14.6 | % | | 14.6 | % | | 14.9 | % | | 14.8 | % | |

Interest expense (income), net | 16,488 |

| | 12,612 |

| | 2,984 |

| | (247 | ) | | 6,907 |

| |

Earnings before taxes | 1,786,156 |

| | 1,611,759 |

| | 1,485,366 |

| | 1,343,310 |

| | 1,264,844 |

| |

Percent of sales | 13.9 | % | | 13.5 | % | | 13.5 | % | | 13.1 | % | | 13.0 | % | |

Provision for taxes on earnings | 668,502 |

| | 591,098 |

| | 560,642 |

| | 506,006 |

| | 478,081 |

| |

Net earnings | $ | 1,117,654 |

| | $ | 1,020,661 |

| | $ | 924,724 |

| | $ | 837,304 |

| | $ | 786,763 |

| |

Percent of sales | 8.7 | % | | 8.5 | % | | 8.4 | % | | 8.2 | % | | 8.1 | % | |

Basic earnings per share² | $ | 2.85 |

| | $ | 2.53 |

| | $ | 2.24 |

| | $ | 1.97 |

| | $ | 1.80 |

| |

Diluted earnings per share² | $ | 2.83 |

| | $ | 2.51 |

| | $ | 2.21 |

| | $ | 1.94 |

| | $ | 1.77 |

| |

| | | | | | | | | | |

Cash dividends declared | | | | | | | | | | |

per common share² | $ | 0.540 |

| | $ | 0.470 |

| | $ | 0.400 |

| | $ | 0.255 |

| ³

| $ | 0.295 |

| |

| | | | | | | | | | |

¹ Fiscal 2012 was a 53-week year; all other fiscal years presented were 52 weeks. | |

² All per share amounts have been adjusted for the two-for-one stock split effective June 11, 2015. | |

³ Dividend declaration of $0.10 per share for the fourth quarter which historically had been declared in January was declared in February 2014. | |

Selected Financial Data

|

| | | | | | | | | | | | | | | | | | | | | |

($000, except per share data) | | 2016 |

| | 2015 |

| | 2014 |

| | 2013 |

|

| 2012 |

| 1 |

| | | | | | | | | | | |

Financial Position | | | | | | | | | | | |

Cash and cash equivalents | | $ | 1,111,599 |

| | $ | 761,602 |

| | $ | 696,608 |

| | $ | 423,168 |

| | $ | 646,761 |

| |

Merchandise inventory | | 1,512,886 |

| | 1,419,104 |

| | 1,372,675 |

| | 1,257,155 |

| | 1,209,237 |

| |

Property and equipment, net | | 2,328,048 |

| | 2,342,906 |

| | 2,273,752 |

| | 1,875,299 |

| | 1,493,284 |

| |

Total assets | | 5,309,351 |

| | 4,869,119 |

|

| 4,687,370 |

|

| 3,886,251 |

|

| 3,649,782 |

|

|

Return on average assets | | 22 | % | | 21 | % | | 22 | % | | 22 | % | | 23 | % | |

Working capital | | 1,060,543 |

| | 769,348 |

| | 590,471 |

| | 463,875 |

| | 588,438 |

| |

Current ratio | | 1.6:1 |

| | 1.5:1 | | 1.4:1 | | 1.3:1 | | 1.4:1 | |

Long-term debt | | 396,493 |

| | 396,025 |

|

| 395,562 |

|

| 149,681 |

|

| 149,628 |

|

|

Long-term debt as a percent | |

|

| | | | | | | | | |

of total capitalization | | 13 | % | | 14 | % | | 15 | % | | 7 | % | | 8 | % | |

Stockholders' equity | | 2,748,017 |

| | 2,471,991 |

| | 2,279,210 |

| | 2,007,302 | | 1,766,863 |

| |

Return on average | |

|

| | | | | | | | | |

stockholders' equity | | 43 | % | | 43 | % | | 43 | % | | 44 | % | | 48 | % | |

Book value per common share | |

|

| | | | | | | | | |

outstanding at year-end2 | | $ | 7.01 |

| | $ | 6.14 |

| | $ | 5.49 |

| | $ | 4.70 |

| | $ | 4.00 |

| |

| |

|

| | | | | | | | | |

Operating Statistics | |

|

| | | | | | | | | |

Number of stores opened | | 93 |

| | 90 |

| | 95 |

| | 88 |

| | 82 |

| |

Number of stores closed | | 6 |

| | 6 |

| | 9 |

| | 11 |

| | 8 |

| |

Number of stores at year-end | | 1,533 |

| | 1,446 |

| | 1,362 |

| | 1,276 |

| | 1,199 |

| |

Comparable store sales increase3 | | | | | | | | | | | |

(52-week basis) | | 4 | % | | 4 | % | | 3 | % | | 3 | % | | 6 | % | |

Sales per average square foot of | |

|

| | | | | | | | | |

selling space (52-week basis) | | $ | 395 |

| | $ | 383 |

| | $ | 372 |

| | $ | 362 |

| | $ | 355 |

| |

Square feet of selling space | |

|

| | | | | | | | | |

at year-end (000) | | 33,300 |

| | 31,900 |

| | 30,400 |

| | 28,900 |

| | 27,800 |

| |

Number of employees at year-end | | 78,600 |

| | 77,800 |

| | 71,400 |

| | 66,300 |

| | 57,500 |

| |

Number of common stockholders | |

|

| | | | | | | | | |

of record at year-end | | 848 |

| | 842 |

| | 817 |

| | 823 |

| | 831 |

| |

| | | | | | | | | | | |

¹ Fiscal 2012 was a 53-week year; all other fiscal years presented were 52 weeks. | | |

2 All per share amounts have been adjusted for the two-for-one stock split effective June 11, 2015. | |

3 Comparable stores are stores open for more than 14 complete months. |

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

Ross Stores, Inc. operates two brands of off-price retail apparel and home fashion stores—Ross Dress for Less® (“Ross”) and dd’s DISCOUNTS®. Ross is the largest off-price apparel and home fashion chain in the United States with 1,340 locations in 36 states, the District of Columbia and Guam as of January 28, 2017. Ross offers first-quality, in-season, name brand and designer apparel, accessories, footwear, and home fashions for the entire family at savings of 20% to 60% off department and specialty store regular prices every day. We also operate 193 dd’s DISCOUNTS stores in 15 states as of January 28, 2017 that feature a more moderately-priced assortment of first-quality, in-season, name brand apparel, accessories, footwear, and home fashions for the entire family at savings of 20% to 70% off moderate department and discount store regular prices every day.

Our primary objective is to pursue and refine our existing off-price strategies to maintain and improve both profitability and financial returns over the long term. In establishing appropriate growth targets for our business, we closely monitor market share trends for the off-price industry and believe our share gains over the past few years were driven mainly by continued focus on value by consumers. Our sales and earnings gains in 2016 continued to benefit from efficient execution of our off-price model throughout all areas of our business. Our merchandise and operational strategies are designed to take advantage of the expanding market share of the off-price industry as well as the ongoing customer demand for name brand fashions for the family and home at compelling discounts every day.

We refer to our fiscal years ended January 28, 2017, January 30, 2016, and January 31, 2015 as fiscal 2016, fiscal 2015, and fiscal 2014, respectively.

All share and per share amounts have been adjusted for the two-for-one stock split effective June 11, 2015.

Results of Operations