Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04014

Meridian Fund, Inc.®

(Exact name of registrant as specified in charter)

100 Fillmore Street, Suite 325

Denver, CO 80206

(Address of principal executive offices) (Zip code)

David J. Corkins

100 Fillmore Street, Suite 325

Denver, CO 80206

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-398-2929

Date of fiscal year end: June 30

Date of reporting period: June 30, 2015

Table of Contents

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

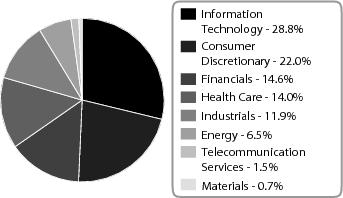

Portfolio Performance and Composition (Unaudited)

| • | Cimpress provides marketing products and services through the Internet to small and micro businesses. The company returned 108% over the one-year period due to organic revenue growth, which has accelerated for each of the last

four quarters, and to the expansion of net margins. These factors, in addition to attractive acquisitions, have resulted in adjusted earnings-per-share doubling over the past two years even in the face of headwinds from currency exposures. We

reduced our position during the period as the risk-reward profile for the company has become less favorable. |

| • | Carter’s is a leading manufacturer and retailer of infant and toddler apparel. The company continues to benefit from stable demand and solid execution, which has led to double-digit earnings growth. Key drivers of performance for Carter’s include continued store growth, e-commerce initiatives, improved OshKosh fundamentals and international expansion. We reduced the position as the company returned 56% over the period. |

| • | SS&C Technologies is a technology provider to the financial services industry. The company returned 42% over the one-year period. SS&C has continued to create shareholder value through its acquisition strategy – with two acquisitions being announced in the last 12 months. The most recent acquisition, Advent Software, is the largest in the company’s history. We continue to like the stability of the company’s revenues, especially now that approximately 92% of total revenues are recurring in nature. We reduced the position size, as the earnings-per-share multiple has expanded and the share price has approached our estimate of fair value. |

| • | Stratasys is a 3-D printing company that specializes in rapid prototyping and additive manufacturing solutions. The company continues to invest in channel development, which has put near-term pressure on margins and |

| Meridian Funds | 4 | www.meridianfund.com |

Table of Contents

Portfolio Performance and Composition (Unaudited) (continued)

| earnings. Given the nascent industry, we believe these investments will generate attractive long-term returns. Our investment thesis is supported by continued market share gains, a solid balance sheet and robust consumable revenue growth. We added to the position during the period. | |

| • | CHC Group is a helicopter service company that specializes in transportation to offshore oil and gas platforms. The company underperformed over the past year due to continued low oil prices and declining activity in the offshore

segment of the market. We believe the company is still well-positioned for the long term, but its exposure to large exploration and production companies will likely continue to be a drag on performance in the short term. We maintained our

position. |

| • | RigNet provides communication- and network-based services to the oil and gas industry, specifically offshore drilling rigs. The market’s concern with the decline in offshore drilling activity negatively impacted share price performance. The outlook this year for the oil and gas industry remains difficult to predict; however, we have conviction that RigNet can still grow at a positive rate based on the recurring revenue from service contracts. We added to the position during the period. |

| Meridian Funds | 5 | www.meridianfund.com |

Table of Contents

Portfolio Performance and Composition (Unaudited) (continued)

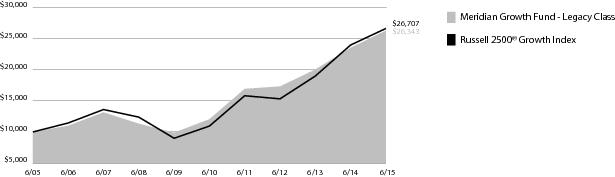

| Share Class | Inception | 1 Year | 5 Year | 10 Year | Since Inception |

| Legacy Class (MERDX) | 8/1/84 | 11.85% | 16.89% | 10.17% | 12.76% |

| Investor Class (MRIGX) | 11/15/13 | 11.56% | — | — | 10.84% |

| Advisor Class (MRAGX) | 11/15/13 | 11.08% | — | — | 10.44% |

| Institutional Class (MRRGX) | 12/24/14 | — | — | — | 3.70% |

| Russell 2500® Growth Index | 8/1/84 | 11.30% | 19.55% | 10.32% | N/A |

| Meridian Funds | 6 | www.meridianfund.com |

Table of Contents

Portfolio Performance and Composition (Unaudited) (continued)

| Meridian Funds | 7 | www.meridianfund.com |

Table of Contents

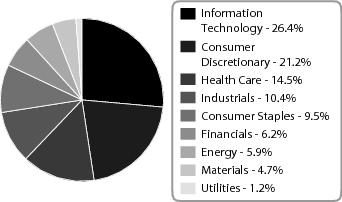

Portfolio Performance and Composition (Unaudited)

| • | Neurocrine Biosciences is a pharmaceutical company with two development-stage programs focused on neurological and endocrine-based health problems. The company came to our attention after poor clinical trial results for one of its programs

resulted in a 40% reduction in the share price. We invested because the issues with the trial were related to trial design, not drug efficacy. Management presented a credible plan for addressing the design issues, and the company’s valuation

was capturing only a fraction of the potential cash flows that could be generated by both drug programs. Over the past year, both of Neurocrine’s drug programs have delivered strong clinical trial results and are on track for

commercialization, which may drive significant earnings and cash flow growth. We have reduced our position somewhat over the past year due to the strong appreciation in share price but continue to hold shares in Neurocrine Biosciences. |

| • | ServiceMaster Global Holdings is a leading provider of termite and pest control services, home warranties and other residential services. The company had problems with marketing and service missteps at its lawn care division, which is no longer part of the company. We invested in ServiceMaster because of its dominant positions in fragmented markets, including 40% market share in home warranties, and consistent sales growth, driven by 80% customer retention and share gains from smaller competitors. The stock outperformed over the past year, as earnings results showed continued revenue growth and much better than expected profit margins driven by cost- |

| Meridian Funds | 8 | www.meridianfund.com |

Table of Contents

Portfolio Performance and Composition (Unaudited) (continued)

| saving initiatives, lower fuel costs and product mix. We remain ServiceMaster shareholders as its business continues to improve and the sectors in which it operates remain attractive. We maintain a significant position in ServiceMaster though we have reduced our position, as the valuation multiple has increased significantly since our initial investment. | |

| • | Denny’s is an iconic casual dining chain with approximately 1,500 franchises and 160 company-owned restaurants. The company came across our contrarian screens repeatedly during years of decline under a series of previous management teams. We invested in 2011 when strong new management took over with a coherent turnaround plan. Denny’s made solid progress, stabilizing the business with menu and marketing improvements and using solid free-cash flow to pay down debt, repurchase shares and fund a successful restaurant remodel program, though sales growth remained subdued. An inflection point came in 2014 as sales improved significantly, aided by lower gas prices that alleviated pressure on Denny’s core customer. This is a trend that accelerated through the remainder of the year and has held up in 2015. We remain shareholders though we reduced our position significantly due to the rise in the stock. |

| Meridian Funds | 9 | www.meridianfund.com |

Table of Contents

Portfolio Performance and Composition (Unaudited) (continued)

| Share Class | Inception | 1 Year | 5 Year | 10 Year | Since Inception |

| Legacy Class (MVALX) | 2/10/94 | 6.84% | 16.79% | 8.19% | 13.22% |

| Investor Class (MFCIX) | 11/15/13 | 6.67% | — | — | 8.54% |

| Advisor Class (MFCAX) | 11/15/13 | 6.38% | — | — | 8.26% |

| Russell 2500® Index | 2/10/94 | 5.92% | 17.85% | 9.09% | 10.46% |

| S&P 500® Index * | 2/10/94 | 7.41% | 17.33% | 7.89% | 9.12% |

| Meridian Funds | 10 | www.meridianfund.com |

Table of Contents

Portfolio Composition (Unaudited)

| Meridian Funds | 11 | www.meridianfund.com |

Table of Contents

Portfolio Performance and Composition (Unaudited)

| Meridian Funds | 12 | www.meridianfund.com |

Table of Contents

Portfolio Performance and Composition (Unaudited) (continued)

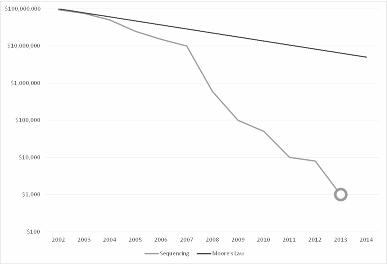

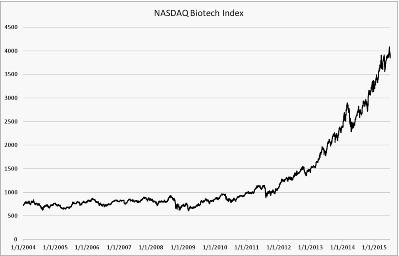

| • | Health and Wellness |

| • | Defense / Homeland Security / Cyberwarfare |

| Meridian Funds | 13 | www.meridianfund.com |

Table of Contents

Portfolio Performance and Composition (Unaudited) (continued)

| Meridian Funds | 14 | www.meridianfund.com |

Table of Contents

Portfolio Performance and Composition (Unaudited) (continued)

| Meridian Funds | 15 | www.meridianfund.com |

Table of Contents

Portfolio Performance and Composition (Unaudited) (continued)

| Share Class | Inception | 1 Year | 5 Year | 10 Year | Since Inception |

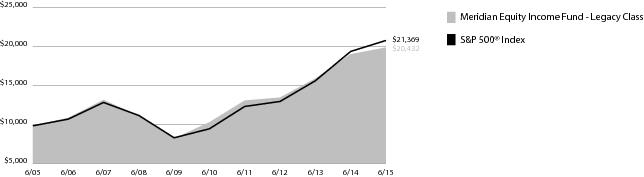

| Legacy Class (MEIFX) | 1/31/05 | 4.46% | 14.24% | 7.41% | 7.21% |

| Investor Class (MRIEX) | 11/15/13 | 4.44% | — | — | 7.01% |

| Advisor Class (MRAEX) | 11/15/13 | 4.24% | — | — | 6.77% |

| S&P 500® Index | 1/31/05 | 7.41% | 17.33% | 7.89% | 7.73% |

| Meridian Funds | 16 | www.meridianfund.com |

Table of Contents

Portfolio Performance and Composition (Unaudited) (continued)

| Meridian Funds | 17 | www.meridianfund.com |

Table of Contents

Portfolio Composition (Unaudited)

| Meridian Funds | 18 | www.meridianfund.com |

Table of Contents

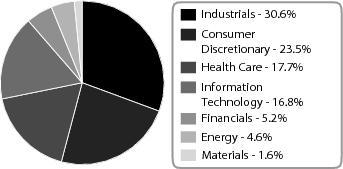

Portfolio Performance and Composition (Unaudited)

| • | Cimpress provides marketing products and services through the Internet to small and micro businesses. The company returned 108% over the one-year period due to organic revenue growth, which has accelerated for each of the last

four quarters, and to the expansion of net margins. These factors, in addition to attractive acquisitions, have resulted in adjusted earnings-per-share doubling over the past two years even in the face of headwinds from currency exposures. We

reduced our position over the period as the risk-reward profile for the company has become less favorable. |

| • | 2U Inc. is a leading technology company that helps enable top colleges and universities to develop and deliver online degree programs. 2U’s business development, growth and profit targets continue to track at or ahead of

plan and should continue to scale higher as the company delivers on its expansion strategy. We increased our position during the year given the company’s large addressable market, limited competition and solid execution. |

| • | ServiceMaster provides essential residential and commercial services primarily through its Terminix (termite and pest control) and American Home Shield (home warranty) brands. We like the stability and pricing power in both of these businesses which provide essential services for homeowners. In its first year as a public company, ServiceMaster executed well, with revenue up 7% and EBITDA up 16% in the most recently reported quarter. We increased our position over the past 12 months and the company returned 98% over the period. |

| • | RigNet provides communication- and network-based services to the oil and gas industry, specifically offshore drilling rigs. The market’s concern with the decline in offshore drilling activity negatively impacted share

price performance. The outlook this year for the oil and gas industry remains difficult to predict; however, we have conviction that RigNet can still grow at a positive rate based on the recurring revenue from service contracts. We added to the

position during the period. |

| • | Stratasys is a 3-D printing company that specializes in rapid prototyping and additive manufacturing solutions. The company continues to invest in channel development, which has put near-term pressure on margins and |

| Meridian Funds | 19 | www.meridianfund.com |

Table of Contents

Portfolio Performance and Composition (Unaudited) (continued)

| earnings. Given the nascent industry, we believe these investments will generate attractive long-term returns. Our investment thesis is supported by continued market share gains, a solid balance sheet and robust consumable revenue growth. We added to the position during the period. | |

| • | Evolution Petroleum is a small oil exploration and production company that uses technology to increase production rates for established oil and natural gas wells. The company declined 37% over the 12-month period, primarily due to the impact of the rapid decline in oil prices in late 2014. Despite the decline, we continue to like the company’s strong balance sheet, which has no debt. Unlike most exploration and production companies, Evolution Petroleum has positive free-cash flow even at these depressed commodity prices. We added to the position during the year. |

| Meridian Funds | 20 | www.meridianfund.com |

Table of Contents

Portfolio Performance and Composition (Unaudited) (continued)

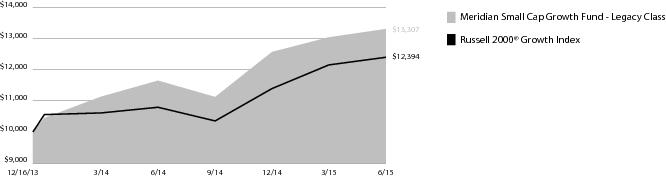

| Share Class | Inception | 1 Year | Since Inception |

| Legacy Class (MSGGX) | 12/16/13 | 14.23% | 20.43% |

| Investor Class (MISGX) | 12/16/13 | 14.14% | 20.37% |

| Advisor Class (MSGAX) | 12/16/13 | 13.82% | 20.01% |

| Institutional Class (MSGRX) | 12/24/14 | — | 6.13% |

| Russell 2000® Growth Index | 12/16/13 | 12.34% | 12.45% |

| Meridian Funds | 21 | www.meridianfund.com |

Table of Contents

Portfolio Composition (Unaudited)

| Meridian Funds | 22 | www.meridianfund.com |

Table of Contents

Table of Contents

| Actual | Annualized

Expense Ratio |

Beginning

Account Value January 1, 2015 |

Ending

Account Value June 30, 2015 |

Expenses

Paid During the Period 1 |

| Legacy Class (MERDX) | 0.84% | $1,000.00 | $1,039.30 | $4.25 |

| Investor Class (MRIGX) | 1.18% | $1,000.00 | $1,037.80 | $5.96 |

| Advisor Class (MRAGX) | 1.55% | $1,000.00 | $1,035.80 | $7.82 |

| Institutional Class (MRRGX) | 0.90% | $1,000.00 | $1,038.80 | $4.55 |

| Hypothetical 2 | Annualized

Expense Ratio |

Beginning

Account Value January 1, 2015 |

Ending

Account Value June 30, 2015 |

Expenses

Paid During the Period 1 |

| Legacy Class (MERDX) | 0.84% | $1,000.00 | $1,020.63 | $4.21 |

| Investor Class (MRIGX) | 1.18% | $1,000.00 | $1,018.94 | $5.91 |

| Advisor Class (MRAGX) | 1.55% | $1,000.00 | $1,017.11 | $7.75 |

| Institutional Class (MRRGX) | 0.90% | $1,000.00 | $1,020.33 | $4.51 |

| 1 | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181 days, the number of days in the most recent fiscal half-year, then divided by 365. |

| 2 | Hypothetical 5% return before expenses. |

| Actual | Annualized

Expense Ratio |

Beginning

Account Value January 1, 2015 |

Ending

Account Value June 30, 2015 |

Expenses

Paid During the Period 1 |

| Legacy Class (MVALX) | 1.10% | $1,000.00 | $1,042.50 | $5.57 |

| Investor Class (MFCIX) | 1.35% | $1,000.00 | $1,041.20 | $6.83 |

| Advisor Class (MFCAX) | 1.60% | $1,000.00 | $1,039.80 | $8.09 |

| Meridian Funds | 23 | www.meridianfund.com |

Table of Contents

| Hypothetical 2 | Annualized

Expense Ratio |

Beginning

Account Value January 1, 2015 |

Ending

Account Value June 30, 2015 |

Expenses

Paid During the Period 1 |

| Legacy Class (MVALX) | 1.10% | $1,000.00 | $1,019.34 | $5.51 |

| Investor Class (MFCIX) | 1.35% | $1,000.00 | $1,018.10 | $6.76 |

| Advisor Class (MFCAX) | 1.60% | $1,000.00 | $1,016.86 | $8.00 |

| 1 | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181 days, the number of days in the most recent fiscal half-year, then divided by 365. |

| 2 | Hypothetical 5% return before expenses. |

| Actual | Annualized

Expense Ratio |

Beginning

Account Value January 1, 2015 |

Ending

Account Value June 30, 2015 |

Expenses

Paid During the Period 1 |

| Legacy Class (MEIFX) | 1.25% | $1,000.00 | $1,038.20 | $6.32 |

| Investor Class (MRIEX) | 1.35% | $1,000.00 | $1,038.10 | $6.82 |

| Advisor Class (MRAEX) | 1.60% | $1,000.00 | $1,037.40 | $8.08 |

| Hypothetical 2 | Annualized

Expense Ratio |

Beginning

Account Value January 1, 2015 |

Ending

Account Value June 30, 2015 |

Expenses

Paid During the Period 1 |

| Legacy Class (MEIFX) | 1.25% | $1,000.00 | $1,018.60 | $6.26 |

| Investor Class (MRIEX) | 1.35% | $1,000.00 | $1,018.10 | $6.76 |

| Advisor Class (MRAEX) | 1.60% | $1,000.00 | $1,016.86 | $8.00 |

| 1 | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181 days, the number of days in the most recent fiscal half-year, then divided by 365. |

| 2 | Hypothetical 5% return before expenses. |

| Meridian Funds | 24 | www.meridianfund.com |

Table of Contents

| Actual | Annualized

Expense Ratio |

Beginning

Account Value January 1, 2015 |

Ending

Account Value June 30, 2015 |

Expenses

Paid During the Period 1 |

| Legacy Class (MSGGX) | 1.20% | $1,000.00 | $1,058.70 | $6.13 |

| Investor Class (MISGX) | 1.33% | $1,000.00 | $1,057.90 | $6.79 |

| Advisor Class (MSGAX) | 1.60% | $1,000.00 | $1,056.50 | $8.16 |

| Institutional Class (MSGRX) | 1.10% | $1,000.00 | $1,058.70 | $5.61 |

| Hypothetical 2 | Annualized

Expense Ratio |

Beginning

Account Value January 1, 2015 |

Ending

Account Value June 30, 2015 |

Expenses

Paid During the Period 1 |

| Legacy Class (MSGGX) | 1.20% | $1,000.00 | $1,018.84 | $6.01 |

| Investor Class (MISGX) | 1.33% | $1,000.00 | $1,018.20 | $6.66 |

| Advisor Class (MSGAX) | 1.60% | $1,000.00 | $1,016.86 | $8.00 |

| Institutional Class (MSGRX) | 1.10% | $1,000.00 | $1,019.34 | $5.51 |

| 1 | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181 days, the number of days in the most recent fiscal half-year, then divided by 365. |

| 2 | Hypothetical 5% return before expenses. |

| Meridian Funds | 25 | www.meridianfund.com |

Table of Contents

Performance and Expense Disclosures

| Meridian Funds | 26 | www.meridianfund.com |

Table of Contents

Schedule of Investments

| Meridian Funds | 27 | www.meridianfund.com |

Table of Contents

Schedule of Investments (continued)

| N.V.—Naamloze Vennootschap is the Dutch term for limited liability company |

| Plc—Public Limited Company |

| * | Non-income producing securities |

| Meridian Funds | 28 | www.meridianfund.com |

Table of Contents

Schedule of Investments

| Meridian Funds | 29 | www.meridianfund.com |

Table of Contents

Schedule of Investments (continued)

| N.V.—Naamloze Vennootschap is the Dutch term for limited liability company |

| Plc—Public Limited Company |

| * | Non-income producing securities |

| Meridian Funds | 30 | www.meridianfund.com |

Table of Contents

Schedule of Investments

| Meridian Funds | 31 | www.meridianfund.com |

Table of Contents

Schedule of Investments (continued)

| ADR—American Depositary Receipt. |

| Plc—Public Limited Company |

| ^ | Securities, or a portion thereof, were pledged as collateral for call options written by the Fund. |

| * | Non-income producing securities |

| Meridian Funds | 32 | www.meridianfund.com |

Table of Contents

Schedule of Investments

| Meridian Funds | 33 | www.meridianfund.com |

Table of Contents

Schedule of Investments (continued)

| Meridian Funds | 34 | www.meridianfund.com |

Table of Contents

Schedule of Investments (continued)

| Shares | Value | |

| Materials - 1.5% | ||

| Chemicals - 1.5% | ||

| Balchem Corp. | 65,264 | $ 3,636,510 |

| Total Materials | 3,636,510 | |

| Total

Investments - 90.0% (Cost $208,164,264) |

224,066,114 | |

| Cash and Other Assets, Less Liabilities - 10.0% | 24,824,505 | |

| Net Assets - 100.0% | $248,890,619 | |

| ADR—American Depositary Receipt. |

| N.V.—Naamloze Vennootschap is the Dutch term for limited liability company |

| Plc—Public Limited Company |

| * | Non-income producing securities |

| Meridian Funds | 35 | www.meridianfund.com |

Table of Contents

Statements of Assets and Liabilities

| June 30, 2015 | Meridian

Growth Fund |

Meridian

Contrarian Fund |

Meridian

Equity Income Fund |

Meridian

Small Cap Growth Fund |

| Assets | ||||

|

Investments, at

value1 |

$1,819,512,500 | $620,831,849 | $42,099,048 | $224,066,114 |

|

Cash and cash

equivalents |

193,145,586 | 51,920,165 | 11,871,945 | 27,068,566 |

| Receivables and other assets: | ||||

|

Fund shares

purchased |

438,450 | 9,156 | 14,250 | 2,030,816 |

|

Investments

sold |

— | 10,348,317 | — | — |

|

Dividends and

Interest |

241,281 | 291,110 | 61,602 | 88,419 |

|

Prepaid

expenses |

74,616 | 52,018 | 53,876 | 44,135 |

|

Total

Assets |

2,013,412,433 | 683,452,615 | 54,100,721 | 253,298,050 |

| Liabilities | ||||

| Payables and other accrued expenses: | ||||

|

Call options

written2 |

— | — | 18,390 | — |

|

Fund shares

sold |

708,371 | 261,230 | 48,500 | 124,948 |

|

Investments

purchased |

3,302,568 | 3,719,797 | — | 4,011,940 |

|

Investment advisory

fees |

1,257,740 | 570,339 | 38,955 | 188,356 |

|

Distribution

fees |

331 | — | 216 | 31 |

|

Service plan

fees |

12,945 | 298 | 406 | 16,507 |

|

Professional

fees |

140,153 | 49,289 | 17,066 | 18,924 |

|

Directors'

fees |

1,322 | 491 | 22 | 10 |

|

Transfer agent

fees |

48,926 | 28,756 | 1,109 | 21,686 |

|

Other |

144,774 | 54,514 | 14,712 | 25,029 |

|

Total

liabilities |

5,617,130 | 4,684,714 | 139,376 | 4,407,431 |

|

Net

Assets |

$2,007,795,303 | $678,767,901 | $53,961,345 | $248,890,619 |

| Net Assets Consist of | ||||

|

Paid in

capital |

$1,622,969,651 | $496,796,884 | $50,155,426 | $229,061,124 |

|

Accumulated net realized gain on investments, written options, and foreign currency

transactions |

176,354,229 | 78,329,598 | 1,906,298 | 3,927,645 |

|

Net unrealized appreciation on investments and foreign currency

translations |

208,471,423 | 104,418,723 | 1,862,180 | 15,901,850 |

|

Net unrealized appreciation on written

options |

— | — | 37,441 | — |

|

Undistributed (distributions in excess of) net investment

income |

— | (777,304) | — | — |

|

Net

Assets |

$2,007,795,303 | $678,767,901 | $53,961,345 | $248,890,619 |

|

1 Investments at

cost |

1,611,041,077 | 516,413,126 | 40,236,868 | 208,164,264 |

| 2 | Written options, premium received of $—, $—, $55,831, and $—, respectively. |

| Meridian Funds | 36 | www.meridianfund.com |

Table of Contents

Statements of Assets and Liabilities (continued)

| June 30, 2015 | Meridian

Growth Fund |

Meridian

Contrarian Fund |

Meridian

Equity Income Fund |

Meridian

Small Cap Growth Fund |

| Net Asset Value | ||||

| Legacy Class | ||||

|

Net

Assets |

$1,937,346,211 | $677,138,489 | $53,125,370 | $ 59,459,125 |

|

Shares

outstanding3 |

51,250,824 | 16,744,278 | 4,245,176 | 4,581,136 |

|

Net Asset value per share (offering and redemption

price) |

$ 37.80 | $ 40.44 | $ 12.51 | $ 12.98 |

| Investor Class | ||||

|

Net

Assets |

$ 42,061,714 | $ 1,007,592 | $ 335,310 | $131,210,528 |

|

Shares

outstanding3 |

1,118,405 | 24,943 | 26,762 | 10,113,611 |

|

Net Asset value per share (offering and redemption

price) |

$ 37.61 | $ 40.40 | $ 12.53 | $ 12.97 |

| Advisor Class | ||||

|

Net

Assets |

$ 8,812,689 | $ 621,820 | $ 500,665 | $ 45,185,955 |

|

Shares

outstanding3 |

235,817 | 15,459 | 40,059 | 3,500,581 |

|

Net Asset value per share (offering and redemption

price) |

$ 37.37 | $ 40.22 | $ 12.50 | $ 12.91 |

| Institutional Class | ||||

|

Net

Assets |

$ 19,574,689 | $ — | $ — | $ 13,035,011 |

|

Shares

outstanding3 |

517,924 | — | — | 1,003,966 |

|

Net Asset value per share (offering and redemption

price) |

$ 37.79 | $ — | $ — | $ 12.98 |

| 3 | 500,000,000 shares authorized, $0.01 par value. |

| Meridian Funds | 37 | www.meridianfund.com |

Table of Contents

Statements of Operations

| For the Year Ended June 30, 2015 | Meridian

Growth Fund |

Meridian

Contrarian Fund |

Meridian

Equity Income Fund |

Meridian

Small Cap Growth Fund |

| Investment Income | ||||

|

Dividends |

$ 8,986,325 | $ 7,930,418 | $ 442,208 | $ 642,401 |

|

Foreign taxes

withheld |

(100,496) | (81,522) | (2,011) | (7,279) |

|

Interest

Income |

— | — | 52,300 | — |

|

Total investment

income |

8,885,829 | 7,848,896 | 492,497 | 635,122 |

| Expenses | ||||

|

Investment advisory

fees |

15,283,202 | 7,097,226 | 215,449 | 1,242,499 |

|

Custodian

fees |

185,800 | 72,219 | 11,741 | 30,784 |

| Distribution and service plan fees: | ||||

|

Investor

Class |

74,240 | 550 | 212 | 30,745 |

|

Advisor

Class |

30,518 | 2,014 | 1,185 | 77,401 |

|

Directors' fees

|

258,608 | 91,646 | 2,776 | 15,321 |

|

Pricing

fees |

195,531 | 82,758 | 22,598 | 31,350 |

|

Audit and tax

fees |

133,248 | 38,295 | 3,080 | 6,884 |

|

Legal

fees |

91,484 | 32,128 | 1,218 | 3,925 |

|

Registration and filing

fees |

99,881 | 70,425 | 55,645 | 100,039 |

|

Shareholder

communications |

200,508 | 62,766 | 1,967 | 20,182 |

|

Transfer agent

fees |

516,358 | 312,641 | 11,736 | 143,872 |

|

Recoupment of investment advisory fees previously

waived |

— | — | — | 11,972 |

|

Miscellaneous

expenses |

162,094 | 53,286 | 7,602 | 9,822 |

|

Total

expenses |

17,231,472 | 7,915,954 | 335,209 | 1,724,796 |

|

Less waivers and/or reimbursements (Note

5) |

(18,313) | (23,426) | (44,499) | (51,290) |

|

Net

expenses |

17,213,159 | 7,892,528 | 290,710 | 1,673,506 |

|

Net investment income

(loss) |

(8,327,330) | (43,632) | 201,787 | (1,038,384) |

| Realized and Unrealized Gain (Loss) | ||||

|

Net realized gain on investments and foreign currency

transactions |

256,624,172 | 98,718,841 | 7,924,649 | 6,225,848 |

|

Net realized loss on written

options |

— | — | (12,559) | — |

|

Net change in unrealized appreciation(depreciation) on investments and foreign currency

translations |

(15,775,934) | (53,402,467) | (6,192,919) | 15,017,109 |

|

Net change in unrealized appreciation on written

options |

— | — | 37,441 | — |

|

Total realized and unrealized

gain |

240,848,238 | 45,316,374 | 1,756,612 | 21,242,957 |

|

Net Increase in net assets resulting from

operations |

$232,520,908 | $ 45,272,742 | $ 1,958,399 | $20,204,573 |

| Meridian Funds | 38 | www.meridianfund.com |

Table of Contents

Statements of Changes in Net Assets

| Meridian Growth Fund | Meridian Contrarian Fund | ||||

| Changes in Net Assets From: | Year

Ended June 30, 2015 |

Year

Ended June 30, 2014 |

Year

Ended June 30, 2015 |

Year

Ended June 30, 2014 | |

| Operations | |||||

|

Net investment

income/(loss) |

$ (8,327,330) | $ (5,858,482) | $ (43,632) | $ 109,511 | |

|

Net realized gain on investments, written options, and foreign currency

transactions |

256,624,172 | 556,304,765 | 98,718,841 | 157,634,506 | |

|

Net change in unrealized appreciation (depreciation) on investments, written options, and foreign currency

translations |

(15,775,934) | (212,344,132) | (53,402,467) | (1,572,341) | |

|

Net increase in net assets resulting from operations and foreign currency

translations |

232,520,908 | 338,102,151 | 45,272,742 | 156,171,676 | |

| Distributions to Shareholders From: | |||||

| Net Investment income: | |||||

|

Legacy

Class |

— | (1,246) | (1,287,678) | (3,275,946) | |

|

Investor

Class |

— | — | — | (41) | |

|

Advisor

Class |

— | — | — | (51) | |

|

Institutional

Class |

— | — | — | — | |

| Net Realized Gains: | |||||

|

Legacy

Class |

(219,516,396) | (598,507,009) | (115,863,711) | (2,568,833) | |

|

Investor

Class |

(3,083,406) | — | (174,302) | — | |

|

Advisor

Class |

(595,614) | — | (155,510) | — | |

|

Institutional

Class |

— | — | — | — | |

|

Decrease in net assets from

distributions |

(223,195,416) | (598,508,255) | (117,481,201) | (5,844,871) | |

| Fund Share Transactions | |||||

|

Net increase (decrease) in net assets resulting from fund share transactions (Note

2) |

(46,379,756) | 192,310,546 | (15,931,502) | (87,941,564) | |

|

Total increase (decrease) in net

assets |

(37,054,264) | (68,095,558) | (88,139,961) | 62,385,241 | |

| Net Assets | |||||

|

Beginning of

Year |

2,044,849,567 | 2,112,945,125 | 766,907,862 | 704,522,621 | |

|

End of

Year* |

$2,007,795,303 | $2,044,849,567 | $ 678,767,901 | $766,907,862 | |

|

*Includes accumulated undistributed (distributions in excess of) net investment

income |

$ — | $ — | $ (777,304) | $ 150,000 | |

| Meridian Funds | 39 | www.meridianfund.com |

Table of Contents

Statements of Changes in Net Assets (continued)

| Meridian Equity Income Fund | Meridian Small Cap Growth Fund | ||||

| Changes in Net Assets From: | Year

Ended June 30, 2015 |

Year

Ended June 30, 2014 |

Year

Ended June 30, 2015 |

For

the Period December 16, 2013 to June 30, 2014 | |

| Operations | |||||

|

Net investment

income/(loss) |

$ 201,787 | $ 553,968 | $ (1,038,384) | $ (49,643) | |

|

Net realized gain on investments, written options, and foreign currency

transactions |

7,912,090 | 2,242,362 | 6,225,848 | 1,120,438 | |

|

Net change in unrealized appreciation (depreciation) on investments, written options, and foreign currency

translations |

(6,155,478) | 2,899,378 | 15,017,109 | 884,741 | |

|

Net increase in net assets resulting from operations and foreign currency

translations |

1,958,399 | 5,695,708 | 20,204,573 | 1,955,536 | |

| Distributions to Shareholders From: | |||||

| Net Investment income: | |||||

|

Legacy

Class |

(664,498) | (500,908) | — | — | |

|

Investor

Class |

(876) | (148) | — | — | |

|

Advisor

Class |

(2,071) | (145) | — | — | |

|

Institutional Class

|

— | — | — | — | |

| Net Realized Gains: | |||||

|

Legacy

Class |

(5,535,693) | — | (836,030) | — | |

|

Investor

Class |

(7,536) | — | (939,505) | — | |

|

Advisor

Class |

(19,039) | — | (556,328) | — | |

|

Institutional Class

|

— | — | — | — | |

|

Decrease in net assets from

distributions |

(6,229,713) | (501,201) | (2,331,863) | — | |

| Fund Share Transactions | |||||

|

Net increase (decrease) in net assets resulting from fund share transactions (Note

2) |

24,525,359 | (184,365) | 212,520,461 | 16,541,912 | |

|

Total increase in net

assets |

20,254,045 | 5,010,142 | 230,393,171 | 18,497,448 | |

| Net Assets | |||||

|

Beginning of

Year |

33,707,300 | 28,697,158 | 18,497,448 | — | |

|

End of

Year* |

$53,961,345 | $33,707,300 | $248,890,619 | $18,497,448 | |

|

*Includes accumulated undistributed net investment

income |

$ — | $ 481,813 | $ — | $ — | |

| Meridian Funds | 40 | www.meridianfund.com |

Table of Contents

Financial Highlights

| For the Fiscal Year Ended June 30, | |||||

| Legacy Class | 2015 | 2014 | 2013 | 2012 | 2011 |

| Per Share Operating Performance | |||||

|

Net asset value, beginning of

period |

$ 37.86 | $ 44.31 | $ 45.06 | $ 47.61 | $ 33.94 |

| Income from investment operations | |||||

|

Net investment income

(loss)1 |

(0.15) | (0.11) | 0.05 | 0.10 | 0.08 |

|

Net realized and unrealized

gain |

4.37 | 6.89 | 6.23 | 0.69 | 13.67 |

|

Net increase from investment

operations |

4.22 | 6.78 | 6.28 | 0.79 | 13.75 |

| Less distributions to shareholders: | |||||

|

Distributions from net investment

income |

0.00 | (0.00) 2 | (0.15) | (0.07) | (0.07) |

|

Distributions from net realized capital

gains |

(4.28) | (13.23) | (6.88) | (3.27) | (0.01) |

|

Total distributions to

shareholders |

(4.28) | (13.23) | (7.03) | (3.34) | (0.08) |

|

Redemption

fees |

0.00 2 | 0.00 | 0.00 | 0.00 | 0.00 |

|

Net asset value, end of

period |

$ 37.80 | $ 37.86 | $ 44.31 | $ 45.06 | $ 47.61 |

|

Total

return |

11.85% | 17.31% | 15.54% | 2.45% | 40.51% |

| Ratios to Average Net Assets | |||||

|

Ratio of net investment income (loss) to average net

assets |

(0.41)% | (0.27)% | 0.11% | 0.22% | 0.18% |

|

Ratio of expenses to average net

assets: |

0.84% | 0.86% | 0.87% | 0.85% | 0.81% |

| Supplemental Data | |||||

|

Net Assets, End of Period

(000's) |

$1,937,346 | $2,021,197 | $2,112,945 | $2,484,084 | $2,615,082 |

|

Portfolio Turnover

Rate |

46% | 96% | 37% | 25% | 26% |

| 1 | Per share net investment income has been calculated using the average daily shares method. |

| 2 | Less than $0.005 per share. |

| Meridian Funds | 41 | www.meridianfund.com |

Table of Contents

Financial Highlights

| For

the Fiscal Year Ended June 30,2015 |

For

the Period Ended June 30,2014 |

For

the Fiscal Year Ended June 30,2015 |

For

the Period Ended June 30,2014 | ||||

| Investor

Class |

Investor

Class1 |

Advisor

Class |

Advisor

Class1 | ||||

| Per Share Operating Performance | |||||||

|

Net asset value, beginning of

period |

$ 37.78 | $ 35.67 | $ 37.72 | $ 35.67 | |||

| Income from investment operations | |||||||

|

Net investment

loss2 |

(0.27) | (0.16) | (0.41) | (0.21) | |||

|

Net realized and unrealized

gain |

4.37 | 2.27 | 4.33 | 2.26 | |||

|

Net increase from investment

operations |

4.10 | 2.11 | 3.92 | 2.05 | |||

| Less distributions to shareholders: | |||||||

|

Distributions from net realized capital

gains |

(4.28) | (0.00) 3 | (4.28) | (0.00) 3 | |||

|

Total distributions to

shareholders |

(4.28) | (0.00) 3 | (4.28) | (0.00) 3 | |||

|

Redemption

fees |

0.01 | 0.00 | 0.01 | 0.00 | |||

|

Net asset value, end of

period |

$ 37.61 | $ 37.78 | $ 37.37 | $ 37.72 | |||

|

Total

return |

11.56% | 5.92% 4 | 11.08% | 5.75% 4 | |||

| Ratios to Average Net Assets | |||||||

|

Ratio of net investment loss to average net

assets |

(0.73)% | (0.70)% 5 | (1.11)% | (0.93)% 5 | |||

|

Ratio of expenses to average net

assets: |

|||||||

|

Before fees

waived |

1.16% | 1.30% 5 | 1.69% | 2.00% 5 | |||

|

After fees

waived6 |

1.16% | 1.30% 5 | 1.55% | 1.55% 5 | |||

| Supplemental Data | |||||||

|

Net Assets, End of Period

(000's) |

$ 42,062 | $ 18,749 | $ 8,812 | $ 4,904 | |||

|

Portfolio Turnover

Rate |

46% | 96% 4 | 46% | 96% 4 | |||

| 1 | Commenced operations on November 15, 2013. |

| 2 | Per share net investment income has been calculated using the average daily shares method. |

| 3 | Less than $0.005 per share. |

| 4 | Not Annualized. |

| 5 | Annualized. |

| 6 | See Note 5 to Financial Statements. |

| Meridian Funds | 42 | www.meridianfund.com |

Table of Contents

Financial Highlights

| Institutional Class | For

the Period Ended June 30, 20151 |

| Per Share Operating Performance | |

|

Net asset value, beginning of

period |

$ 36.44 |

| Income from investment operations | |

|

Net investment

loss2 |

(0.04) |

|

Net realized and unrealized

gain |

1.39 |

|

Net increase from investment

operations |

1.35 |

| Less distributions to shareholders: | |

|

Distributions from net investment

income |

0.00 |

|

Distributions from net realized capital

gains |

0.00 |

|

Total distributions to

shareholders |

0.00 |

|

Net asset value, end of

period |

$ 37.79 |

|

Total

return |

3.70% 3 |

| Ratios to Average Net Assets | |

|

Ratio of net investment loss to average net

assets |

(0.21)% 4 |

|

Ratio of expenses to average net

assets: |

|

|

Before fees

waived |

1.15% 4 |

|

After fees

waived5 |

0.90% 4 |

| Supplemental Data | |

|

Net Assets, End of Period

(000's) |

$ 19,575 |

|

Portfolio Turnover

Rate |

46% 3 |

| 1 | Commenced operations on December 24, 2014. |

| 2 | Per share net investment income has been calculated using the average daily shares method. |

| 3 | Not Annualized. |

| 4 | Annualized. |

| 5 | See Note 5 to Financial Statements. |

| Meridian Funds | 43 | www.meridianfund.com |

Table of Contents

Financial Highlights

| For the Fiscal Year Ended June 30, | |||||

| Legacy Class | 2015 | 2014 | 2013 | 2012 | 2011 |

| Per Share Operating Performance | |||||

|

Net asset value, beginning of

period |

$ 45.52 | $ 37.20 | $ 30.60 | $ 29.59 | $ 22.80 |

| Income from investment operations | |||||

|

Net investment income

(loss)1 |

(0.00) 2 | 0.01 | 0.14 | 0.09 | 0.10 |

|

Net realized and unrealized

gain |

2.66 | 8.63 | 6.57 | 1.05 3 | 6.77 |

|

Net increase from investment

operations |

2.66 | 8.64 | 6.71 | 1.14 | 6.87 |

| Less distributions to shareholders: | |||||

|

Distributions from net investment

income |

(0.09) | (0.18) | (0.11) | (0.13) | (0.08) |

|

Distributions from net realized capital

gains |

(7.65) | (0.14) | 0.00 | 0.00 | 0.00 |

|

Total distributions to

shareholders |

(7.74) | (0.32) | (0.11) | (0.13) | (0.08) |

|

Redemption

fees |

0.00 2 | 0.00 | 0.00 | 0.00 | 0.00 |

|

Net asset value, end of

period |

$ 40.44 | $ 45.52 | $ 37.20 | $ 30.60 | $ 29.59 |

|

Total

return |

6.84% | 23.31% | 21.98% | 3.89% 3 | 30.13% |

| Ratios to Average Net Assets | |||||

|

Ratio of net investment income (loss) to average net

assets |

(0.01)% | 0.01% | 0.41% | 0.31% | 0.37% |

|

Ratio of expenses to average net

assets: |

1.11% | 1.13% | 1.16% | 1.14% | 1.09% |

| Supplemental Data | |||||

|

Net Assets, End of Period

(000's) |

$677,138 | $764,882 | $704,523 | $688,467 | $869,312 |

|

Portfolio Turnover

Rate |

76% | 67% | 55% | 20% | 38% |

| 1 | Per share net investment income has been calculated using the average daily shares method. |

| 2 | Less than $0.005 per share. |

| 3 | Includes a gain resulting from litigation payments on securities owned in a prior year. Without these gains, the net realized gains on investments per share would have been $0.99, and the total return would have been 3.69%. |

| Meridian Funds | 44 | www.meridianfund.com |

Table of Contents

Financial Highlights

| For

the Fiscal Year Ended June 30,2015 |

For

the Period Ended June 30,2014 |

For

the Fiscal Year Ended June 30,2015 |

For

the Period Ended June 30,2014 | ||||

| Investor

Class |

Investor

Class1 |

Advisor

Class |

Advisor

Class1 | ||||

| Per Share Operating Performance | |||||||

|

Net asset value, beginning of

period |

$ 45.47 | $ 42.64 | $ 45.41 | $ 42.64 | |||

| Income from investment operations | |||||||

|

Net investment

loss2 |

(0.09) | (0.02) | (0.22) | (0.08) | |||

|

Net realized and unrealized

gain |

2.66 | 3.03 | 2.68 | 3.02 | |||

|

Net increase from investment

operations |

2.57 | 3.01 | 2.46 | 2.94 | |||

| Less distributions to shareholders: | |||||||

|

Distributions from net investment

income |

0.00 | (0.18) | 0.00 | (0.17) | |||

|

Distributions from net realized capital

gains |

(7.65) | (0.00) | (7.65) | (0.00) | |||

|

Total distributions to

shareholders |

(7.65) | (0.18) | (7.65) | (0.17) | |||

|

Redemption

fees |

0.01 | 0.00 | 0.00 | 0.00 | |||

|

Net asset value, end of

period |

$ 40.40 | $ 45.47 | $ 40.22 | $ 45.41 | |||

|

Total

return |

6.67% | 7.08% 3 | 6.38% | 6.91% 3 | |||

| Ratios to Average Net Assets | |||||||

|

Ratio of net investment loss to average net

assets |

(0.21)% | (0.09)% 4 | (0.52)% | (0.30)% 4 | |||

|

Ratio of expenses to average net

assets: |

|||||||

|

Before fees

waived |

2.34% | 3.51% 4 | 3.46% | 7.46% 4 | |||

|

After fees

waived5 |

1.35% | 1.35% 4 | 1.60% | 1.60% 4 | |||

| Supplemental Data | |||||||

|

Net Assets, End of Period

(000's) |

$ 1,008 | $ 1,564 | $ 622 | $ 462 | |||

|

Portfolio Turnover

Rate |

76% | 67% 3 | 76% | 67% 3 | |||

| 1 | Commenced operations on November 15, 2013. |

| 2 | Per share net investment income has been calculated using the average daily shares method. |

| 3 | Not Annualized. |

| 4 | Annualized. |

| 5 | See Note 5 to Financial Statements. |

| Meridian Funds | 45 | www.meridianfund.com |

Table of Contents

Financial Highlights

| For the Fiscal Year Ended June 30, | |||||

| Legacy Class | 2015 | 2014 | 2013 | 2012 | 2011 |

| Per Share Operating Performance | |||||

|

Net asset value, beginning of

period |

$ 14.59 | $ 12.35 | $ 10.71 | $ 10.61 | $ 8.51 |

| Income from investment operations | |||||

|

Net investment income

(loss)1 |

0.12 | 0.24 | 0.24 | 0.22 | 0.20 |

|

Net realized and unrealized

gain |

0.47 | 2.22 | 1.68 | 0.09 | 2.11 |

|

Net increase from investment

operations |

0.59 | 2.46 | 1.92 | 0.31 | 2.31 |

| Less distributions to shareholders: | |||||

|

Distributions from net investment

income |

(0.25) | (0.22) | (0.28) | (0.21) | (0.21) |

|

Distributions from net realized capital

gains |

(2.42) | 0.00 | 0.00 | 0.00 | 0.00 |

|

Total distributions to

shareholders |

(2.67) | (0.22) | (0.28) | (0.21) | (0.21) |

|

Redemption

fees |

0.00 2 | 0.00 2 | 0.00 | 0.00 | 0.00 |

|

Net asset value, end of

period |

$ 12.51 | $ 14.59 | $ 12.35 | $ 10.71 | $ 10.61 |

|

Total

return |

4.46% | 20.04% | 18.28% | 3.09% | 27.30% |

| Ratios to Average Net Assets | |||||

|

Ratio of net investment income to average net

assets |

0.88% | 1.75% | 2.08% | 2.17% | 2.04% |

|

Ratio of expenses to average net

assets: |

|||||

|

Before fees

waived |

1.33% | 1.37% | 1.53% | 1.41% | 1.25% |

|

After fees

waived3 |

1.25% | 1.25% | 1.25% | 1.25% | 1.25% 4 |

| Supplemental Data | |||||

|

Net Assets, End of Period

(000's) |

$53,125 | $ 33,649 | $ 28,697 | $30,744 | $ 35,644 |

|

Portfolio Turnover

Rate |

266% | 35% | 44% | 31% | 29% |

| 1 | Per share net investment income has been calculated using the average daily shares method. |

| 2 | Less than $0.005 per share. |

| 3 | See Note 5 to Financial Statements. |

| 4 | Includes fees waived, which were less than 0.01%. |

| Meridian Funds | 46 | www.meridianfund.com |

Table of Contents

Financial Highlights

| For

the Fiscal Year Ended June 30,2015 |

For

the Period Ended June 30,2014 |

For

the Fiscal Year Ended June 30,2015 |

For

the Period Ended June 30,2014 | ||||

| Investor

Class |

Investor

Class1 |

Advisor

Class |

Advisor

Class1 | ||||

| Per Share Operating Performance | |||||||

|

Net asset value, beginning of

period |

$ 14.60 | $ 13.87 | $ 14.58 | $ 13.87 | |||

| Income from investment operations | |||||||

|

Net investment income

(loss)2 |

(0.02) | 0.15 | (0.02) | 0.13 | |||

|

Net realized and unrealized

gain |

0.61 | 0.79 | 0.58 | 0.78 | |||

|

Net increase from investment

operations |

0.59 | 0.94 | 0.56 | 0.91 | |||

| Less distributions to shareholders: | |||||||

|

Distributions from net investment

income |

(0.24) | (0.21) | (0.22) | (0.20) | |||

|

Distributions from net realized capital

gains |

(2.42) | (0.00) | (2.42) | (0.00) | |||

|

Total distributions to

shareholders |

(2.66) | (0.21) | (2.64) | (0.20) | |||

|

Net asset value, end of

period |

$ 12.53 | $ 14.60 | $ 12.50 | $ 14.58 | |||

|

Total

return |

4.44% | 6.87% 3 | 4.24% | 6.69% 3 | |||

| Ratios to Average Net Assets | |||||||

|

Ratio of net investment income (loss) to average net

assets |

(0.13)% | 1.72% 4 | (0.11)% | 1.55% 4 | |||

|

Ratio of expenses to average net

assets: |

|||||||

|

Before fees

waived |

16.83% | 39.23% 4 | 7.46% | 132.38% 4 | |||

|

After fees

waived5 |

1.35% | 1.35% 4 | 1.60% | 1.60% 4 | |||

| Supplemental Data | |||||||

|

Net Assets, End of Period

(000's) |

$ 335 | $ 45 | $ 501 | $ 13 | |||

|

Portfolio Turnover

Rate |

266% | 35% 3 | 266% | 35% 3 | |||

| 1 | Commenced operations on November 15, 2013. |

| 2 | Per share net investment income has been calculated using the average daily shares method. |

| 3 | Not Annualized. |

| 4 | Annualized. |

| 5 | See Note 5 to Financial Statements. |

| Meridian Funds | 47 | www.meridianfund.com |

Table of Contents

Financial Highlights

| For

the Fiscal Year Ended June 30,2015 |

For

the Period Ended June 30,2014 |

For

the Fiscal Year Ended June 30,2015 |

For

the Period Ended June 30,2014 | ||||

| Legacy

Class |

Legacy

Class1 |

Investor

Class |

Investor

Class1 | ||||

| Per Share Operating Performance | |||||||

|

Net asset value, beginning of

period |

$ 11.65 | $ 10.00 | $ 11.65 | $ 10.00 | |||

| Income from investment operations | |||||||

|

Net investment

loss2 |

(0.09) | (0.04) | (0.10) | (0.04) | |||

|

Net realized and unrealized

gain |

1.72 | 1.69 | 1.73 | 1.69 | |||

|

Net increase from investment

operations |

1.63 | 1.65 | 1.63 | 1.65 | |||

| Less distributions to shareholders: | |||||||

|

Distributions from net investment

income |

0.00 | 0.00 | (0.01) | 0.00 | |||

|

Distributions from net realized capital

gains |

(0.30) | 0.00 | (0.30) | 0.00 | |||

|

Total distributions to

shareholders |

(0.30) | 0.00 | (0.31) | 0.00 | |||

|

Redemption

fees |

0.00 3 | 0.00 | 0.00 | 0.00 | |||

|

Net asset value, end of

period |

$ 12.98 | $ 11.65 | $ 12.97 | $ 11.65 | |||

|

Total

return |

14.23% | 16.50% 4 | 14.14% | 16.50% 4 | |||

| Ratios to Average Net Assets | |||||||

|

Ratio of net investment loss to average net

assets |

(0.69)% | (0.61)% 5 | (0.83)% | (0.70)% 5 | |||

|

Ratio of expenses to average net

assets: |

|||||||

|

Before fees

waived |

1.24% | 2.35% 5 | 1.33% | 3.63% 5 | |||

|

After fees

waived6 |

1.20% | 1.20% 5 | 1.33% | 1.35% 5 | |||

| Supplemental Data | |||||||

|

Net Assets, End of Period

(000's) |

$ 59,459 | $ 9,839 | $131,211 | $ 2,135 | |||

|

Portfolio Turnover

Rate |

45% | 78% 4 | 44% | 78% 4 | |||

| 1 | Commenced operations on December 16, 2013. |

| 2 | Per share net investment income has been calculated using the average daily shares method. |

| 3 | Less than $0.005 per share. |

| 4 | Not Annualized. |

| 5 | Annualized. |

| 6 | See Note 5 to Financial Statements. |

| Meridian Funds | 48 | www.meridianfund.com |

Table of Contents

Financial Highlights

| For

The Fiscal Year Ended June 30,2015 |

For

The Period Ended June 30,2014 |

For

The Period Ended June 30,2015 | |||

| Advisor

Class |

Advisor

Class1 |

Institutional

Class2 | |||

| Per Share Operating Performance | |||||

|

Net asset value, beginning of

period |

$ 11.63 | $ 10.00 | $ 12.23 | ||

| Income from investment operations | |||||

|

Net investment income

(loss)3 |

(0.13) | (0.06) | (0.02) | ||

|

Net realized and unrealized

gain |

1.71 | 1.69 | 0.77 | ||

|

Net increase from investment

operations |

1.58 | 1.63 | 0.75 | ||

| Less distributions to shareholders: | |||||

|

Distributions from net realized capital

gains |

(0.30) | 0.00 | 0.00 | ||

|

Total distributions to

shareholders |

(0.30) | 0.00 | 0.00 | ||

|

Redemption

fees |

0.00 4 | 0.00 | 0.00 | ||

|

Net asset value, end of

period |

$ 12.91 | $ 11.63 | $ 12.98 | ||

|

Total

return |

13.82% | 16.30% 5 | 6.13% 5 | ||

| Ratios to Average Net Assets | |||||

|

Ratio of net investment loss to average net

assets |

(1.09)% | (1.01)% 6 | (0.29)% 6 | ||

|

Ratio of expenses to average net

assets: |

|||||

|

Before fees

waived |

1.69% | 2.99% 6 | 2.03% 6 | ||

|

After fees

waived7 |

1.60% | 1.60% 6 | 1.10% 6 | ||

| Supplemental Data | |||||

|

Net Assets, End of Period

(000's) |

$ 45,186 | $ 6,524 | $ 13,035 | ||

|

Portfolio Turnover

Rate |

44% | 78% 5 | 44% 5 | ||

| 1 | Commenced operations on December 16, 2013. |

| 2 | Commenced operations on December 24, 2014. |

| 3 | Per share net investment income has been calculated using the average daily shares method. |

| 4 | Less than $0.005 per share. |

| 5 | Not Annualized. |

| 6 | Annualized. |

| 7 | See Note 5 to Financial Statements. |

| Meridian Funds | 49 | www.meridianfund.com |

Table of Contents

Notes to Financial Statements

| 1. | Organization and Significant Accounting Policies: Meridian Fund, Inc. (the “Meridian Funds” or the “Company”) comprises the following separate series: the Meridian Growth Fund (the “Growth Fund”), the Meridian Contrarian Fund (the “Contrarian Fund”), the Meridian Equity Income Fund (the “Equity Income Fund”), and the Meridian Small Cap Growth Fund (the “Small Cap Growth Fund”) (each a “Fund” and collectively, the “Funds”). The Company is registered as an open-end investment company under the Investment Company Act of 1940 and is organized as a Maryland Corporation. |

| The Meridian Funds offer four share classes: Legacy Class Shares, Investor Class Shares, Advisor Class Shares and Institutional Class Shares. As of June 30, 2015, Institutional Class Shares of the Meridian Equity Income Fund and Meridian Contrarian Fund are not currently being offered for sale. Legacy Class Shares are available to investors who have continuously held an investment in any Meridian Fund prior to November 15, 2013. Institutional Class Shares are available to certain eligible investors including endowments, foundations and qualified retirement plans. Advisor Class and Investor Class Shares are available for purchase through financial intermediary platforms. All Classes are sold without a sales charge and have identical rights and privileges with respect to the Fund in general, and exclusive voting rights with respect to Class specific matters. Net Asset Value per share may differ by class due to each class having its own expenses directly attributable to that class. Investor Class and Advisor Class Shares are subject to shareholder servicing and sub-transfer agent fees. Advisor Class Shares are also subject to certain expenses related to the distribution of these shares. See Note 11 for further information on additional share classes and changes to shareholder servicing and distribution plans. | |

| The primary investment objectives of the Growth Fund and Contrarian Fund are to seek long-term growth of capital. | |

| The primary investment objective of the Equity Income Fund is to seek long-term growth of capital along with income as a component of total return. | |

| The primary investment objective of the Small Cap Growth Fund is to seek long-term growth of capital by investing primarily in equity securities of small capitalization companies. | |

| The Funds’ Board of Directors (the “Board”), and the Board and shareholders of Jordan Opportunity Fund (the “Target Fund”), approved the reorganization of the Target Fund into the Equity Income Fund pursuant to which the Equity Income Fund acquired substantially all of the assets and assumed substantially all of the liabilities of the Target Fund in exchange for an equal aggregate value of newly-issued Legacy Class shares of the Equity Income Fund. | |

| Each shareholder of the Target Fund received Legacy Class shares of the Equity Income Fund in an amount equal to the aggregate net asset value of such shareholder’s Target Fund shares, as determined at the close of business on June 12, 2015, less the costs of the Target Fund’s reorganization. | |

| The reorganization was accomplished by a tax-free exchange of shares of the Equity Income Fund in the following amounts and at the following conversion ratios: |

| Target Fund | Shares

Prior To Reorganization |

Conversion

Ratio |

Shares

of Equity Income Fund | ||

| Jordan Opportunity Fund | 2,510,536 | 1.327805 | 3,333,502 |

| Target Fund | Paid-In

Capital |

Distributions

in Excess of Net Investment Income |

Realized

Gain/Loss |

Net

Unrealized Appreciation/ Depreciation |

Net Assets | ||||

| Jordan Opportunity Fund | $40,461,298 | $(312,518) | $324,647 | $1,636,531 | $42,109,958 |

| Meridian Funds | 50 | www.meridianfund.com |

Table of Contents

Notes to Financial Statements (continued)

| Target Fund | Fair Value of Investments | Cost of Investments | |

| Jordan Opportunity Fund | $42,122,077 | $40,485,547 |

| • | Net investment loss: $(149,432) |

| • | Net realized and change in unrealized gain/loss on investments: $4,396,282 |

| • | Net increase in net assets resulting from operations: $4,246,850 |

| a. | Share Valuation: The NAV of each Fund is calculated by dividing the sum of the value of the securities held by each Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses), by the total number of shares outstanding of each Fund. The result is rounded to the nearest cent. Each Funds’ shares will not be priced on the days in which the New York Stock Exchange (NYSE) is closed for trading. |

| b. | Investment Valuations: Equity securities are valued at the closing price or last sales price on the principal exchange or market on which they are traded; or, if there were no sales that day, at the last reported bid price. |

| Fixed income (debt) securities with original or remaining maturities in excess of 60 days are valued at the mean of their quoted bid and asked prices. Short-term debt securities with 60 days or less to maturity are valued at amortized cost which approximates fair market value. | |

| Exchange-traded options are valued at the mean between the last bid and ask prices at the close of the options market in which the options trade. An exchange-traded option for which there is no mean price is valued at the last bid (long positions) or ask (short positions) price. If no bid or ask price is available, the prior day’s price will be used, unless it is determined that the prior day’s price no longer reflects the fair value of the option. | |

| Securities and other assets for which reliable market quotations are not readily available or for which a significant event has occurred since the time of the most recent market quotation, will be valued based upon other available factors deemed relevant by the Adviser under the guidelines established by, and under the general supervision and responsibility of, the Board. These factors include but are not limited to (i) attributes specific to the investment; (ii) the principal market for the investment; (iii) the customary participants in the principal market for the investment; (iv) data assumptions by market participants for the investment, if reasonably available; (v) quoted prices for similar investments in active markets; and (vi) other factors, such as future cash flows, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and/or default rates. Valuations based on such factors are reported to the Board on a quarterly basis. | |

| c. | Fair Value Measurements: As described in Note 1.b. above, the Funds utilize various methods to determine and |

| Meridian Funds | 51 | www.meridianfund.com |

Table of Contents

Notes to Financial Statements (continued)

| measure the fair value of investment securities on a recurring basis. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3) that are significant to the fair value instrument. The three levels of the fair value hierarchy are described below: | |

| Level 1 - quoted prices in active markets for identical securities; | |

| Level 2 - other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.); and | |

| Level 3 - significant unobservable inputs (including the Fund’s determinations as to the fair value of investments). | |

| The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The summary of inputs used to value the Funds’ securities as of June 30, 2015 is as follows: |

| Valuation Inputs | Growth

Fund |

Contrarian

Fund |

Equity

Income Fund |

Small

Cap Growth Fund | ||||

|

Level 1 - Quoted

Prices* |

$1,819,512,500 | $620,831,849 | $41,594,673 | $224,066,114 | ||||

|

Level 2 - Other Significant Observable

Inputs |

— | — | 504,375 | — | ||||

|

Level 3 - Significant Unobservable

Inputs |

— | — | — | — | ||||

|

Total Market Value of

Investments |

$1,819,512,500 | $620,831,849 | $42,099,048 | $224,066,114 | ||||

|

Call Options Written (Level

1) |

$ — | $ — | $ (18,390) | $ — |

| * | Level 1 investments are comprised of common stock with industry classifications as defined on the Schedule of Investments. |

| d. | Investment Transactions and Investment Income: Security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses on security transactions are determined on the basis of specific identification for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date. Interest income is accrued daily. |

| e. | Option writing: When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and subsequently adjusted to the current fair value of the option written. Premiums received from writing options that expire unexercised are treated by the Fund on the expiration date as realized gains from investments. The difference between the premium and amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain or, if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security or currency in determining whether the Fund has realized a gain or loss. If a put option is exercised, the premium reduces the cost basis of the securities purchased by the Fund. The Fund as writer of an option bears the market risk of an unfavorable change in the price of the security underlying the written option. |

| Meridian Funds | 52 | www.meridianfund.com |

Table of Contents

Notes to Financial Statements (continued)

| f. | Allocation of Income, Expenses, Gains and Losses: Income, gains and losses are allocated on a daily basis to each share class based on the relative proportion of the net assets of the class to each Fund’s total net assets. Expenses are allocated on the basis of relative net assets of the class to the Fund, or if an expense is specific to a share class, to that specific share class. |

| g. | Use of Estimates: The preparation of financial statements in accordance with accounting principals generally accepted in the U.S. (“GAAP”) requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and revenue and expenses at the date of the financial statements. Actual amounts could differ from those estimates, and such differences could be significant. |

| h. | Foreign Currency Translation: Securities denominated in foreign currencies are converted into U.S. dollars using the spot market rate of exchange at the time of valuation. Purchases and sales of such securities and related dividend and interest income are converted into U.S. dollars using the spot market rate of exchange prevailing on the respective dates of such translations. The Funds do not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments as reported in the Statement of Operations. |

| i. | Federal Income Taxes: It is the Funds’ policy to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and to distribute all of their taxable income to their shareholders; therefore, no federal income tax provision is required. |

| j. | Distributions to Shareholders: The Funds record distributions to shareholders on the ex-dividend date. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations which may differ from GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences do not require reclassification. |

| Distributions which exceed net investment income and net realized capital gains are reported as distributions in excess of net investment income or distributions in excess of net realized capital gains for financial reporting purposes but not for tax purposes. To the extent they exceed net investment income and net realized capital gains for tax purposes, they are reported as distributions of paid-in-capital. | |

| k. | Guarantees and Indemnification: Under the Funds’ organizational documents, its Officers and Directors are indemnified against certain liability arising out of the performance of their duties to the Funds. Additionally, in the normal course of business, the Funds enter into contracts with service providers that contain general indemnification clauses. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote. |

| 2. | Capital Shares Transactions: Transactions in capital shares were as follows: |

| Meridian Funds | 53 | www.meridianfund.com |

Table of Contents

Notes to Financial Statements (continued)

| Year

Ended June 30, 20151 |

Year

Ended June 30, 20142 | |||||

| Shares | Amount | Shares | Amount | |||

| Growth Fund: | ||||||

| Legacy Class | ||||||

|

Shares

sold |

6,497,797 | $ 240,532,008 | 10,014,988 | $ 393,045,340 | ||

|

Shares issued from reinvestment of

distributions |

6,062,601 | 215,889,243 | 16,379,845 | 581,156,891 | ||

|

Redemption

fees |

— | 20,823 | — | 57,692 | ||

|

Shares

redeemed |

(14,697,527) | (549,202,740) | (20,688,964) | (804,765,033) | ||

|

Net

increase/(decrease) |

(2,137,129) | $ (92,760,666) | 5,705,869 | $ 169,494,890 | ||

| Investor Class | ||||||

|

Shares

sold |

920,727 | $ 34,143,889 | 544,259 | $ 20,321,746 | ||

|

Shares issued from reinvestment of

distributions |

83,780 | 2,973,367 | — | — | ||

|

Redemption

fees |

— | 9,917 | — | 3,821 | ||

|

Shares

redeemed |

(382,401) | (14,102,596) | (47,960) | (2,225,053) | ||

|

Net

increase |

622,106 | $ 23,024,577 | 496,299 | $ 18,100,514 | ||

| Advisor Class | ||||||

|

Shares

sold |

176,885 | $ 6,547,088 | 146,597 | $ 5,320,397 | ||

|

Shares issued from reinvestment of

distributions |

15,188 | 536,592 | — | — | ||

|

Redemption

fees |

— | 1,509 | — | 1,301 | ||

|

Shares

redeemed |

(86,276) | (3,194,129) | (16,577) | (606,556) | ||

|

Net

increase |

105,797 | $ 3,891,060 | 130,020 | $ 4,715,142 | ||

| Institutional Class | ||||||

|

Shares

sold |

521,290 | $ 19,592,273 | — | $ — | ||

|

Shares issued from reinvestment of

distributions |

— | — | — | — | ||

|

Shares

redeemed |

(3,366) | (127,000) | — | — | ||

|

Net

increase |

517,924 | $ 19,465,273 | — | $ — | ||

| Meridian Funds | 54 | www.meridianfund.com |

Table of Contents

Notes to Financial Statements (continued)

| Year

Ended June 30, 20151 |

Year

Ended June 30, 20142 | |||||

| Shares | Amount | Shares | Amount | |||

| Contrarian Fund: | ||||||

| Legacy Class | ||||||

|

Shares

sold |

126,877 | $ 5,277,730 | 241,010 | $ 10,132,026 | ||

|

Shares issued from reinvestment of

distributions |

2,985,897 | 113,941,819 | 134,284 | 5,700,050 | ||

|

Redemption

fees |

— | 8,643 | — | 10,129 | ||

|

Shares

redeemed |

(3,171,397) | (134,972,919) | (2,512,845) | (105,721,357) | ||

|

Net

decrease |

(58,623) | $ (15,744,727) | (2,137,551) | $ (89,879,152) | ||

| Investor Class | ||||||

|

Shares

sold |

3,360 | $ 141,443 | 34,399 | $ 1,500,479 | ||

|

Shares issued from reinvestment of

distributions |

3,732 | 142,308 | 1 | 54 | ||

|

Redemption

fees |

— | 139 | — | — | ||

|

Shares

redeemed |

(16,549) | (727,305) | — | — | ||

|

Net

increase/(decrease) |

(9,457) | $ (443,415) | 34,400 | $ 1,500,533 | ||

| Advisor Class | ||||||

|

Shares

sold |

13,232 | $ 582,725 | 10,182 | $ 438,766 | ||

|

Shares issued from reinvestment of

distributions |

2,821 | 107,325 | 1 | 39 | ||

|

Shares

redeemed |

(10,759) | (433,410) | (18) | (1,750) | ||

|

Net

increase |

5,294 | $ 256,640 | 10,165 | $ 437,055 | ||

| Equity Income Fund: | ||||||

| Legacy Class | ||||||

|

Shares

sold |

3,698,867 3 | $45,005,167 3 | 53,466 | $ 735,117 | ||

|

Shares issued from reinvestment of

distributions |

490,554 | 6,112,916 | 36,708 | 494,457 | ||

|

Redemption

fees |

— | 198 | — | 542 | ||

|

Shares

redeemed |

(2,249,917) | (27,399,494) | (107,442) | (1,469,985) | ||

|

Net

increase/(decrease) |

1,939,504 | $ 23,718,787 | (17,268) | $ (239,869) | ||

| Investor Class | ||||||

|

Shares

sold |

22,979 | $ 291,957 | 3,098 | $ 43,105 | ||

|

Shares issued from reinvestment of

distributions |

674 | 8,412 | 11 | 148 | ||

|

Shares

redeemed |

— | — | — | — | ||

|

Net

increase |

23,653 | $ 300,369 | 3,109 | $ 43,253 | ||

| Advisor Class | ||||||

|

Shares

sold |

48,390 | $ 634,811 | 885 | $ 12,285 | ||

|

Shares issued from reinvestment of

distributions |

1,696 | 21,110 | 11 | 145 | ||

|

Redemption

fees |

— | — | — | 2 | ||

|

Shares

redeemed |

(10,910) | (149,718) | (13) | (181) | ||

|

Net

increase |

39,176 | $ 506,203 | 883 | $ 12,251 | ||

| Meridian Funds | 55 | www.meridianfund.com |

Table of Contents

Notes to Financial Statements (continued)

| Year

Ended June 30, 20151 |

Year

Ended June 30, 20142 | |||||

| Shares | Amount | Shares | Amount | |||

| Small Cap Growth Fund: | ||||||

| Legacy Class | ||||||

|

Shares

sold |

3,852,242 | $ 46,370,426 | 844,877 | $8,575,976 | ||

|

Shares issued from reinvestment of

distributions |

70,018 | 835,314 | — | — | ||

|

Redemption

fees |

— | 1,241 | — | — | ||

|

Shares

redeemed |

(185,662) | (2,261,922) | (339) | (3,739) | ||

|

Net

increase |

3,736,598 | $ 44,945,059 | 844,538 | $8,572,237 | ||

| Investor Class | ||||||

|

Shares

sold |

11,475,007 | $138,940,112 | 183,546 | $1,977,647 | ||

|

Shares issued from reinvestment of

distributions |

65,822 | 784,601 | — | — | ||

|

Redemption

fees |

— | 58,412 | — | — | ||

|

Shares

redeemed |

(1,610,523) | (20,312,792) | (241) | (2,514) | ||

|

Net

increase |

9,930,306 | $119,470,333 | 183,305 | $1,975,133 | ||

| Advisor Class | ||||||

|

Shares

sold |

3,469,892 | $ 41,768,471 | 606,032 | $6,471,230 | ||

|

Shares issued from reinvestment of

distributions |

45,993 | 546,859 | — | — | ||

|

Redemption

fees |

— | 4,039 | — | 588 | ||

|

Shares

redeemed |

(576,238) | (7,063,995) | (45,099) | (477,276) | ||

|

Net

increase |

2,939,647 | $ 35,255,374 | 560,933 | $5,994,542 | ||

| Institutional Class | ||||||

|

Shares

sold |

1,008,763 | $ 12,908,934 | — | $ — | ||

|

Shares issued from reinvestment of

distributions |

— | — | — | — | ||

|

Shares

redeemed |

(4,797) | (59,239) | — | — | ||

|

Net

increase |

1,003,966 | $ 12,849,695 | — | $ — | ||

| 1 | For the twelve months ending June 30, 2015 for Legacy, Investor, and Advisor Class Shares of all Funds. For the period from December 24, 2014 for the Institutional Class Shares for the Growth and Small Cap Growth Funds. |

| 2 | For the twelve month period ending June 30, 2014 for Legacy Class Shares of the Growth, Contrarian, and Equity Income Funds. For the period from November 15, 2013 for Institutional and Advisor Class Shares for the Growth, Contrarian, and Equity Income Funds. For the period from December 16, 2013 for all Classes of Small Cap Growth Fund. |

| 3 | Includes shares and dollars issued in connection with reorganization of the Target Fund in the amount of 3,333,502 shares and $42,122,077, respectively. |

| 3. | Investment Transactions: The cost of investments purchased and the proceeds from sales of investments, excluding short-term securities and U.S. government obligations, for the year ended June 30, 2015, were as follows: |

| Purchases | Proceeds from Sales | ||

|

Growth

Fund |

$843,925,650 | $1,154,056,746 | |

|

Contrarian

Fund |

$499,900,865 | $ 630,708,056 | |

|

Equity Income

Fund |

$ 63,350,817 | $ 60,041,566 | |

|

Small Cap Growth

Fund |

$233,786,260 | $ 47,536,966 |

| Meridian Funds | 56 | www.meridianfund.com |

Table of Contents

Notes to Financial Statements (continued)