UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04014

Meridian Fund, Inc.®

(Exact name of registrant as specified in charter)

60 E. Sir Francis Drake Boulevard

Suite 306

Larkspur, CA 94939

(Address of principal executive offices) (Zip code)

Gregg B. Keeling

60 E. Sir Francis Drake Boulevard

Suite 306

Larkspur, CA 94939

(Name and address of agent for service)

registrant’s telephone number, including area code: 415-461-8770

Date of fiscal year end: June 30

Date of reporting period: June 30, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

MERIDIAN FUND, INC.

July 5, 2012

To Our Shareholders:

Stocks declined in the quarter ended June 30, 2012 as worries about European economies intensified, domestic economic indicators weakened and emerging markets such as China, India and Brazil showed slowing growth. The S&P 500 declined 3.3%, the NASDAQ lost 5.1% and the Russell 2000, which includes smaller companies, fell 3.8%. The quarter’s best performing sectors included utilities, consumer staples and health care stocks. Energy, industrials and financials were among the worst performing groups. The yield on the ten-year Treasury bond fell from 2.22% to 1.66% during the quarter, reflecting concerns regarding slowing domestic economic growth.

GDP grew at 1.9% during the first quarter of 2012, a meaningful decline from 3% in the fourth quarter. It is widely speculated that unusually favorable winter weather across much of the country pulled some economic activity into the fourth quarter from the first. The increase in GDP came from personal consumption expenditures, exports and residential fixed investment, offset by declining federal, state and local government spending. We continue to believe that the economy will expand modestly in 2012. It is difficult to foresee greater upside given that ongoing concerns regarding deficits, government spending, health care and taxes will likely be a drag on domestic growth. Euro zone economic problems are likely to persist and there is risk that growth in emerging market economies could slow further. Historically high corporate profit margins may be difficult to sustain and act as a headwind to earnings growth. Recent sharp increases in crop prices could raise the unwelcome specter of food inflation. On the positive side, interest rates remain low and recent declines in energy related commodities, if they persist, may provide some relief.

Long-term investment results, history clearly shows, are improved by buying good companies or mutual funds consistently over an extended period of time.

We welcome those new shareholders who joined the Meridian Funds during the quarter and we appreciate the continued confidence of our existing shareholders.

Jamie England

William Tao

Larry Cordisco

Jim O’Connor

Meridian Equity Income Fund® (MEIFX)

The Meridian Equity Income Fund’s net asset value per share at June 30, 2012 was $10.71. This represents an increase of 4.8% calendar year-to-date. The Fund’s total return and average annual compound rate of return since inception January 31, 2005 were 39.2% and 4.6%, respectively. At the close of the quarter, total net assets were $30,743,736 and were invested 4.3% in cash and other assets net of liabilities and 95.7% in stocks. At the close of the quarter there were 474 shareholders in the Equity Income Fund.

The Fund continues to seek to invest in companies that have the potential for capital appreciation and that have, in our opinion, the ability to grow dividends. The Fund is diversified with 59 holdings representing 57 different industry groups. At the end of the June 2012 quarter, the portfolio’s average holding had a five-year average return on equity of 19.4% and an average dividend yield of 3.8%, both measures substantially higher than the average S&P 500 stock, with an average market capitalization of $42.9 billion and an average debt to capital ratio of 40.2%.

During the quarter we purchased shares of Digital Realty Trust. We sold our shares in American Eagle Outfitters, Kimco Realty, Mattel, PPL Corporation, R.R. Donnelley & Sons, Verizon Communications and Willis Group Holdings.

Abbott Laboratories, one of the Fund’s largest holdings, is a leading manufacturer and marketer of healthcare products. Areas of focus include pharmaceuticals, diagnostic products, nutritional products and vascular devices. We believe Abbott’s diversification and business mix position it well for steady growth amid the dynamic changes occurring in the healthcare industry. In particular, diagnostics, nutritional products and expansion into emerging markets stand out as growth drivers. Abbott’s over 3% dividend yield is well supported by earnings, cash flow and low financial leverage. Moreover, Abbott has a forty year track record of increasing dividends. At less than 13x this year’s earnings, we believe Abbott represents an attractive investment.

Meridian Growth Fund® (MERDX)

The Meridian Growth Fund’s net asset value per share at June 30, 2012 was $45.06. This represents an increase of 8.2% calendar year-to-date. The Fund’s total return and average annual compound rate of return since inception August 1, 1984 were 2,597.6% and 12.5%, respectively. At the close of the quarter, total net assets were $2,484,083,833 and were invested 5.4% in cash, cash equivalents and other assets net of liabilities and 94.6% in stocks. At the close of the quarter there were 95,703 shareholders in the Growth Fund.

Despite macroeconomic worries, there are reasons for some optimism. Corporate balance sheets are relatively strong and employment levels continue to gradually increase. Many small and mid-sized growth stocks sell at what we believe are reasonable valuations. We continue to follow the investment strategy that has served the Fund well for the past 28 years. Our portfolio remains diversified. We invest in growth companies which we identify as being, for

2

the most part, market leaders, having strong returns on capital, solid growth prospects and selling at reasonable valuations. The Fund is invested in 54 positions along with Treasury Bills. Our heaviest areas of concentration remain the technology and consumer sectors.

During the quarter we purchased shares of LKQ Corporation, Tumi Holdings and World Fuel Services. We sold our positions in Cooper Industries, T. Rowe Price Group and Willis Group Holdings.

East West Bancorp, one of the Fund’s largest holdings, is the largest Chinese American bank with most of its retail branches located in California. As a group, Chinese Americans have a very favorable economic profile relative to the rest of the population in terms of median household income, business formation rate and unemployment rate, etc. We believe that the bank should continue to benefit from the immigration of Chinese Americans and the increase in trade between US and China, as it is one of the few foreign banks with a full service banking license in China. East West is, in our opinion, well capitalized, with superior credit quality relative to its regional peers, and is well positioned to make more acquisitions to further strengthen its competitive position in the California market. The company has an experienced management team with a strong track record. We believe East West is positioned to grow faster than the industry over the next few years.

Meridian Value Fund® (MVALX)

The Meridian Value Fund’s net asset value per share at June 30, 2012 was $30.60. This represents an increase of 9.0% calendar year-to-date. The Fund’s total return and average annual compound rate of return since June 30, 1995 were 762.1% and 13.5%, respectively. The comparable period returns for the S&P 500 with dividends were 239.9% and 7.5%, respectively. At the close of the quarter, total net assets were $688,647,460 and were invested 8.0% in cash, cash equivalents and other assets net of liabilities and 92.0% in stocks. At the close of the quarter there were 33,743 shareholders in the Value Fund.

Our investment strategy remains unchanged. We continue to seek out-of-favor companies typically having experienced an extended period of declining earnings. In recent years most earnings problems have been related to poor economic conditions. With some stability in the economy, albeit tenuous, we now see more companies that meet our strategy for company-specific reasons. These investments are the traditional strength and point of differentiation of the Meridian Value Fund. The Fund is invested in 52 positions, representing 34 industry groups along with Treasury Bills. We continue to invest in companies of all market capitalizations and our largest areas of concentration are technology, retail and transportation.

During the quarter we purchased shares of Brocade Communications, Haemonetics Corp, Lancaster Colony Corp. and Maidenform Brands.

3

Equifax, one of the Fund’s largest holdings, is a leading provider of information solutions that help financial institutions and other entities make decisions about extending credit. It holds the number one market share position in the majority of its geographic regions, generates strong margins and cash flow and maintains conservative financial leverage. The recession caused both borrowers and lenders to retrench, bringing down the earnings of Equifax as well. Consumer borrowing is improving in areas such as credit cards, auto loans and home mortgages. We believe that Equifax is particularly well positioned for this improvement beyond its core consumer credit database. It is up-selling exclusive data such as wealth and income data to help customers make more informed credit decisions. Additional growth opportunities are international expansion, commercial credit decision making and personal credit score monitoring. We believe the company is a compelling value at twelve times our four dollar per share estimate of earnings power.

Miscellaneous

You can sign up for E-mail Alerts on our website at www.meridianfund.com. When you sign up for E-mail Alerts you will receive notification of news items, shareholder reports, SEC filings and other information regarding the Meridian Funds.

The Meridian Funds are no-load and there are no transaction fees or commissions charged when you purchase shares directly through our transfer agent, BNY Mellon Investment Servicing (U.S.), Inc. This is a very cost-effective way to purchase shares of the Meridian Funds if you do not need the services of a broker-dealer or if you make multiple purchases.

The information provided in this report should not be considered investment advice or a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in a particular Fund’s portfolio at the time you receive this report or that securities sold have not been repurchased. Securities discussed are presented as illustrations of companies that fit a particular Fund’s investment strategy and do not represent a Fund’s entire portfolio and in the aggregate may represent only a small percentage of a Fund’s portfolio holdings. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that investment decisions Fund management makes in the future will be profitable or will equal the investment performance of the securities discussed herein. Management’s views presented herein and any discussion of a particular Fund’s portfolio holdings or performance are as of June 30, 2012 and are subject to change without notice. Past performance is not predictive of future results.

4

Meridian Equity Income Fund

Summary of Portfolio Holdings

June 30, 2012

| Portfolio Holdings by Category (% of total net assets) |

||||||||

| Software & Services |

3.5 | % | $ | 1,062,727 | ||||

| Media |

3.3 | 1,011,712 | ||||||

| Health Care Products |

2.0 | 606,018 | ||||||

| Chemicals-Specialty |

1.9 | 598,400 | ||||||

| Asset Management & Custody Banks |

1.9 | 596,505 | ||||||

| Consumer Products-Household |

1.9 | 590,579 | ||||||

| Soft Drinks |

1.9 | 589,553 | ||||||

| Home Improvement Retail |

1.9 | 577,591 | ||||||

| Industrial Conglomerates |

1.9 | 577,268 | ||||||

| Insurance-Multi-Line |

1.9 | 571,967 | ||||||

| Multi-Utilities |

1.8 | 559,601 | ||||||

| Telecommunication Services-Integrated |

1.8 | 559,149 | ||||||

| Leisure & Amusement |

1.8 | 558,601 | ||||||

| Hypermarkets & Super Centers |

1.8 | 551,834 | ||||||

| Tobacco |

1.8 | 545,171 | ||||||

| Media-Broadcasting & Cable TV |

1.8 | 541,860 | ||||||

| Air Freight & Logistics |

1.7 | 536,749 | ||||||

| Pharmaceuticals |

1.7 | 532,711 | ||||||

| Banking-Regional Banks |

1.7 | 517,410 | ||||||

| Data Processing & Outsourced Services |

1.7 | 515,124 | ||||||

| Food Distributors |

1.7 | 512,732 | ||||||

| REITs-Diversified |

1.7 | 510,476 | ||||||

| Banking-Commercial |

1.7 | 510,045 | ||||||

| Food & Meats-Packaged |

1.6 | 505,922 | ||||||

| Aerospace & Defense |

1.6 | 505,064 | ||||||

| Electrical Components & Equipment |

1.6 | 498,406 | ||||||

| Energy |

1.6 | 495,850 | ||||||

| Brewers |

1.6 | 495,159 | ||||||

| Chemicals-Diversified |

1.6 | 494,575 | ||||||

| Semiconductor Equipment Manufacturing |

1.6 | 492,992 | ||||||

| Railroads |

1.6 | 488,036 | ||||||

| Computer Hardware |

1.6 | 487,212 | ||||||

5

Meridian Equity Income Fund

Summary of Portfolio Holdings (continued)

June 30, 2012

| Health Care Technology |

1.6 | % | $ | 484,125 | ||||

| Construction & Engineering |

1.6 | 482,880 | ||||||

| Household-Home Furnishings |

1.6 | 482,292 | ||||||

| Diversified Capital Markets |

1.6 | 480,392 | ||||||

| Environmental Facilities & Services |

1.6 | 477,286 | ||||||

| Oil & Gas-Storage & Transportation |

1.5 | 476,584 | ||||||

| Insurance-Property & Casualty |

1.5 | 472,746 | ||||||

| Retail |

1.5 | 470,793 | ||||||

| Distribution & Wholesale |

1.5 | 469,046 | ||||||

| Consulting Services |

1.5 | 468,214 | ||||||

| Electronic Equipment Manufacturing |

1.5 | 466,830 | ||||||

| Independent Power Producers & Energy |

1.5 | 458,324 | ||||||

| Retail-Drug Store |

1.5 | 455,532 | ||||||

| Restaurants |

1.5 | 448,404 | ||||||

| Semiconductors |

1.5 | 446,580 | ||||||

| Diversified Financial Services |

1.4 | 442,416 | ||||||

| Paper & Packaging |

1.4 | 437,175 | ||||||

| Office Supplies |

1.4 | 434,565 | ||||||

| Steel |

1.4 | 432,439 | ||||||

| Industrial Machinery |

1.4 | 425,626 | ||||||

| Paper & Forest Products |

1.3 | 413,413 | ||||||

| Metal & Glass Containers |

1.3 | 405,900 | ||||||

| Food Retail |

1.3 | 404,745 | ||||||

| Office Services & Supplies |

1.3 | 390,717 | ||||||

| Health Care Equipment & Supplies |

1.3 | 389,656 | ||||||

| Cash & Other Assets, Less Liabilities |

4.3 | 1,330,057 | ||||||

|

|

|

|

|

|||||

| 100.0 | % | $ | 30,743,736 | |||||

|

|

|

|

|

|||||

6

Meridian Growth Fund

Summary of Portfolio Holdings

June 30, 2012

| Portfolio Holdings by Category (% of total net assets) |

||||||||

| Retail |

14.9 | % | $ | 370,585,322 | ||||

| Tech-Software |

11.6 | 287,115,216 | ||||||

| Technology |

6.7 | 165,848,794 | ||||||

| Banking-Commercial |

5.5 | 136,397,866 | ||||||

| Energy |

4.9 | 122,721,657 | ||||||

| Health Care Products |

4.5 | 110,701,266 | ||||||

| Brokerage & Money Management |

4.1 | 102,163,114 | ||||||

| Leisure & Amusement |

3.1 | 77,845,729 | ||||||

| Building Products |

3.0 | 74,104,332 | ||||||

| Restaurants |

2.9 | 72,227,319 | ||||||

| Cellular Communications |

2.9 | 72,084,101 | ||||||

| Industrial Services |

2.8 | 70,223,468 | ||||||

| Insurance Brokers |

2.8 | 68,429,020 | ||||||

| Flooring & Carpets |

2.6 | 65,374,148 | ||||||

| U.S. Government Obligations |

2.6 | 64,995,229 | ||||||

| Electronic Equipment Manufacturing |

2.4 | 60,112,353 | ||||||

| Distribution & Wholesale |

2.2 | 55,172,699 | ||||||

| Health Care Technology |

2.1 | 53,430,977 | ||||||

| Trucking |

2.1 | 51,022,666 | ||||||

| Real Estate Management & Services |

2.0 | 48,751,984 | ||||||

| Industrial Conglomerates |

1.8 | 45,043,406 | ||||||

| Consumer Services |

1.8 | 44,136,569 | ||||||

| Health Care Information Services |

1.7 | 42,113,617 | ||||||

| Furniture & Fixtures |

1.5 | 38,331,307 | ||||||

| Air Freight & Logistics |

1.5 | 36,915,575 | ||||||

| Chemicals-Specialty |

1.2 | 29,580,000 | ||||||

| Business Services |

1.1 | 26,362,307 | ||||||

| Automotive Wholesale Services |

0.9 | 22,802,180 | ||||||

| Cash & Other Assets, Less Liabilities |

2.8 | 69,491,612 | ||||||

|

|

|

|

|

|||||

| 100.0 | % | $ | 2,484,083,833 | |||||

|

|

|

|

|

|||||

7

Meridian Value Fund

Summary of Portfolio Holdings

June 30, 2012

| Portfolio Holdings by Category (% of total net assets) |

||||||||

| Diversified Financial Services |

8.6 | % | $ | 59,329,272 | ||||

| Leisure & Amusement |

7.8 | 53,797,729 | ||||||

| Technology |

6.5 | 45,018,907 | ||||||

| Industrial |

5.1 | 34,920,211 | ||||||

| Railroads |

4.9 | 33,725,233 | ||||||

| Energy |

4.5 | 31,286,709 | ||||||

| Retail |

3.8 | 26,144,092 | ||||||

| Transportation |

3.6 | 24,542,925 | ||||||

| Industrial Services |

3.4 | 23,170,283 | ||||||

| Utilities |

3.1 | 21,603,187 | ||||||

| Brokerage & Money Management |

2.8 | 19,531,000 | ||||||

| Automotive Wholesale Services |

2.7 | 18,553,700 | ||||||

| Office Services & Supplies |

2.7 | 18,257,757 | ||||||

| Business Services |

2.5 | 17,247,087 | ||||||

| Industrial Products |

2.2 | 15,304,179 | ||||||

| Agriculture |

2.2 | 15,281,188 | ||||||

| Home Improvement Retail |

2.2 | 14,915,845 | ||||||

| Health Care Services |

2.1 | 14,468,766 | ||||||

| Consulting Services |

2.1 | 14,233,005 | ||||||

| Household Appliances |

2.0 | 13,862,500 | ||||||

| Pharmaceuticals |

1.9 | 13,330,544 | ||||||

| Metals |

1.9 | 12,748,428 | ||||||

| Banking-Commercial |

1.7 | 11,961,909 | ||||||

| Semiconductors |

1.7 | 11,630,140 | ||||||

| Tech-Software |

1.7 | 11,579,523 | ||||||

| Health Care Products |

1.6 | 10,783,005 | ||||||

| Storage |

1.3 | 8,576,568 | ||||||

| Banking |

1.0 | 6,922,080 | ||||||

| Restaurants |

1.0 | 6,698,184 | ||||||

| REITs-Diversified |

0.9 | 6,469,526 | ||||||

| Aerospace & Defense |

0.9 | 6,161,548 | ||||||

| Food |

0.8 | 5,739,526 | ||||||

| U.S. Government Obligations |

0.7 | 4,999,220 | ||||||

| Air Freight & Logistics |

0.6 | 4,330,404 | ||||||

| Apparel |

0.2 | 1,561,728 | ||||||

| Cash & Other Assets, Less Liabilities |

7.3 | 49,961,552 | ||||||

|

|

|

|

|

|||||

| 100.0 | % | $ | 688,647,460 | |||||

|

|

|

|

|

|||||

8

Meridian Fund, Inc.

Disclosure of Fund Expenses (Unaudited)

For the Six Month Period January 1, 2012 to June 30, 2012

We believe it is important for you to understand the impact of fees and expenses on your investment. All mutual funds have operating expenses. As a shareholder of the Fund, you incur ongoing costs, which generally include costs for portfolio management and administrative services, and other Fund expenses. Operating expenses, which are deducted from a Fund’s gross income, directly reduce the investment return of the portfolio. A Fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period and assume reinvestment of all dividends and distributions.

| Beginning Account Value 1/1/12 |

Ending Account Value 6/30/12 |

Expense Ratio(1) |

Expenses Paid During Period(2) |

|||||||||||||

| Actual Fund Return |

||||||||||||||||

| ( See explanation below) |

||||||||||||||||

| Meridian Equity Income Fund |

$ | 1,000.00 | $ | 1,047.90 | 1.25 | %(3) | $ | 6.40 | ||||||||

| Meridian Growth Fund |

$ | 1,000.00 | $ | 1,082.40 | 0.86 | % | $ | 4.48 | ||||||||

| Meridian Value Fund |

$ | 1,000.00 | $ | 1,089.80 | 1.14 | % | $ | 5.96 | ||||||||

| Hypothetical 5% Return(4) |

||||||||||||||||

| ( See explanation below) |

||||||||||||||||

| Meridian Equity Income Fund |

$ | 1,000.00 | $ | 1,018.75 | 1.25 | %(3) | $ | 6.31 | ||||||||

| Meridian Growth Fund |

$ | 1,000.00 | $ | 1,020.70 | 0.86 | % | $ | 4.34 | ||||||||

| Meridian Value Fund |

$ | 1,000.00 | $ | 1,019.30 | 1.14 | % | $ | 5.76 | ||||||||

| (1) | Annualized, based on the Fund’s most recent fiscal half-year expenses. |

| (2) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 183, the number of days in the most recent fiscal half-year, then divided by 366. |

| (3) | See note 2 to Financial Statements. |

| (4) | Before expenses. |

9

Meridian Fund, Inc.

Disclosure of Fund Expenses (Unaudited) (continued)

For the Six Month Period January 1, 2012 to June 30, 2012

The table above illustrates your Fund’s costs in two ways:

Actual Fund Return: This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, the third column shows the period’s annualized expense ratio, and the last column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund at the beginning of the period. You may use the information here, together with your account value, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period.”

Hypothetical 5% Return: This section is intended to help you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had a return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. You can assess your Fund’s costs by comparing this 5% Return hypothetical example with the 5% Return hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as short-term redemption and exchange fees or sales and service charges you may pay third party broker/dealers. Had these transactional costs been included, your costs would have been higher. Therefore, the hypothetical section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

10

Management’s Discussion of Meridian Equity Income Fund® Performance

During the fiscal year ended June 30, 2012, the Meridian Equity Income Fund gained 3.09% compared to a gain of 5.38% for the S&P 500 with reinvested dividends.

The Equity Income Fund is highly diversified. During the period the Fund was invested in companies individually comprising 67 sectors. During the period each sector holding was typically weighted between 1.50% and 1.75% of net assets. As a result of this strategy one sector cannot move the performance dramatically in any direction.

The Fund’s strongest performance was from companies in the apparel, home improvement, insurance, hypermarkets & super centers and household consumer products sectors. The Fund’s weakest performance was from companies in the commercial printing, packaging, office services & supplies, diversified capital markets and retail drug stores sectors.

The Fund strategy emphasizes investments in companies that typically pay dividends or interest, have the potential for capital appreciation and which the Investment Adviser believes may have the capacity to raise dividends in the future.

Value of $10,000 invested in the Meridian Equity Income Fund and the S&P 500 Index

Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares and do not reflect the imposition of a 2% redemption fee on shares held 60 days or less to deter market timers. If reflected, the taxes and fees would reduce the performance quoted. Net asset value, investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost.

| * | Inception date. |

11

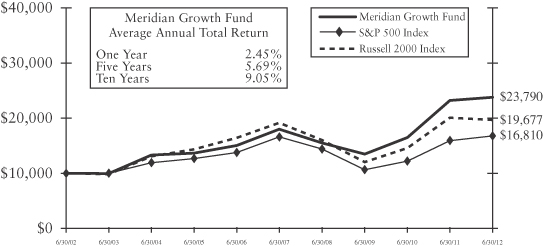

Management’s Discussion of Meridian Growth Fund®

Performance

During the fiscal year ended June 30, 2012, the Meridian Growth Fund gained 2.45% compared to a gain of 5.38% for the S&P 500 with reinvested dividends, a loss of 2.08% for the Russell 2000.

The Growth Fund’s performance reflected the strength of our holdings in the retail, commercial banking, brokerage & money management, healthcare products and industrial conglomerates sectors (representing approximately fourteen, five, five, four and four percent of total portfolio holdings, respectively), as well as the performance of individual stocks that may be the only issue we own in a particular sector. This was offset primarily by relative weakness in the technology, energy, insurance brokers and distribution & wholesale sectors (representing approximately nineteen, five, five, and three percent of total portfolio holdings, respectively), as well as the performance of individual stocks that may be the only issue we own in a particular sector.

Value of $10,000 invested in the Meridian Growth Fund, the Russell 2000 Index and the S&P 500 Index

Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares and do not reflect the imposition of a 2% redemption fee on shares held 60 days or less to deter market timers. If reflected, the taxes and fees would reduce the performance quoted. Net asset value, investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost.

12

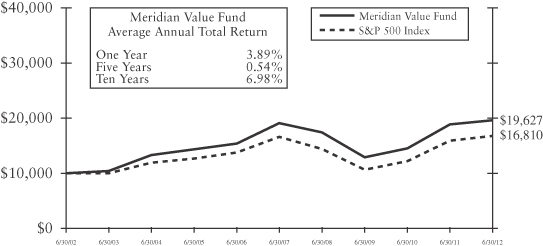

Management’s Discussion of Meridian Value Fund®

Performance

During the fiscal year ended June 30, 2012, the Meridian Value Fund gained 3.89% compared to a gain of 5.38% for the S&P 500 with reinvested dividends.

The Value Fund’s performance reflected the strength of our holdings in the diversified financial services, leisure & amusement, retail, railroad and industrial sectors (together representing approximately twenty-nine percent of total portfolio holdings), as well as the performance of individual stocks that may comprise the only holding in a particular sector. This was offset primarily by relative weakness in the energy, industrial products, technology and brokerage and money management sector holdings, along with weakness in individual stocks in sectors including real estate and storage that represent the only issue we may own in a particular sector.

The Meridian Value Fund’s strategy is to invest in stocks, across a range of market capitalizations, which the Investment Adviser believes are undervalued in relation to the issuer’s long-term earnings power, asset value and/or the stock market in general. Based on this strategy, the Fund’s average compounded annual return for the ten-year period from June 30, 2002 to June 30, 2012 was a 6.98% gain compared to 5.30% gain for the S&P 500, with reinvested dividends. The Meridian Value Fund’s average compounded annual return from inception to June 30, 2012 was a gain of 12.59%, compared to a gain of 8.36% for the S&P 500, with reinvested dividends. (Inception date: February 10, 1994. Prior to June 30, 1995 the Value Fund’s cash position was approximately 50%, as the Fund was in the start-up process of becoming fully invested).

Value of $10,000 invested in the Meridian Value Fund and the S&P 500 Index

Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares and do not reflect the imposition of a 2% redemption fee on shares held 60 days or less to deter market timers. If reflected, the taxes and fees would reduce the performance quoted. Net asset value, investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost.

13

Meridian Equity Income Fund

Schedule of Investments

June 30, 2012

The accompanying notes are an integral part of the financial statements.

14

Meridian Equity Income Fund

Schedule of Investments (continued)

June 30, 2012

The accompanying notes are an integral part of the financial statements.

15

Meridian Equity Income Fund

Schedule of Investments (continued)

June 30, 2012

The accompanying notes are an integral part of the financial statements.

16

Meridian Growth Fund

Schedule of Investments

June 30, 2012

The accompanying notes are an integral part of the financial statements.

17

Meridian Growth Fund

Schedule of Investments (continued)

June 30, 2012

The accompanying notes are an integral part of the financial statements.

18

Meridian Value Fund

Schedule of Investments

June 30, 2012

The accompanying notes are an integral part of the financial statements.

19

Meridian Value Fund

Schedule of Investments (continued)

June 30, 2012

The accompanying notes are an integral part of the financial statements.

20

Meridian Value Fund

Schedule of Investments (continued)

June 30, 2012

| Value | ||||||

| U.S. GOVERNMENT OBLIGATIONS - 0.7% |

| |||||

| U.S. Treasury Bill @ .076%** |

$ | 4,999,220 | ||||

| TOTAL U.S. GOVERNMENT OBLIGATIONS |

4,999,220 | |||||

|

|

|

|||||

| TOTAL INVESTMENTS - 92.7% |

638,685,908 | |||||

| CASH AND OTHER ASSETS, LESS LIABILITIES - 7.3% |

49,961,552 | |||||

|

|

|

|||||

| NET ASSETS - 100.0% |

$ | 688,647,460 | ||||

|

|

|

|||||

ADR - American Depositary Receipt

REIT - Real Estate Investment Trust

| * | Non-income producing securities |

| ** | Annualized yield at date of purchase |

The accompanying notes are an integral part of the financial statements.

21

Meridian Fund, Inc.

Statements of Assets and Liabilities

June 30, 2012

| Equity Income Fund |

Growth Fund | Value Fund | ||||||||||

| ASSETS |

||||||||||||

| Investments (Cost $26,660,171, $1,922,790,327 and $511,657,081 respectively) |

$ | 29,413,679 | $ | 2,414,592,221 | $ | 638,685,908 | ||||||

| Cash |

1,299,624 | 64,499,948 | 49,390,904 | |||||||||

| Receivable for: |

||||||||||||

| Capital shares purchased |

— | 748,718 | 16,134 | |||||||||

| Securities sold |

— | 16,019,993 | 2,307,925 | |||||||||

| Dividends |

67,936 | 1,115,419 | 757,277 | |||||||||

| Interest |

5 | 188 | 124 | |||||||||

| Prepaid expenses |

28,177 | 28,247 | 8,152 | |||||||||

|

|

|

|

|

|

|

|||||||

| TOTAL ASSETS |

30,809,421 | 2,497,004,734 | 691,166,424 | |||||||||

|

|

|

|

|

|

|

|||||||

| LIABILITIES |

||||||||||||

| Payable for: |

||||||||||||

| Capital shares sold |

1,300 | 1,524,457 | 450,825 | |||||||||

| Securities purchased |

— | 9,413,623 | 1,259,771 | |||||||||

| Accrued expenses: |

||||||||||||

| Investment advisory fees |

17,703 | 1,507,200 | 549,107 | |||||||||

| Pricing fees |

4,313 | 42,505 | 14,112 | |||||||||

| Professional fees |

37,735 | 135,685 | 103,952 | |||||||||

| Other payables and accrued expenses |

4,634 | 297,431 | 141,197 | |||||||||

|

|

|

|

|

|

|

|||||||

| TOTAL LIABILITIES |

65,685 | 12,920,901 | 2,518,964 | |||||||||

|

|

|

|

|

|

|

|||||||

| NET ASSETS |

$ | 30,743,736 | $ | 2,484,083,833 | $ | 688,647,460 | ||||||

|

|

|

|

|

|

|

|||||||

| Capital shares issued and outstanding, par value $0.01 (500,000,000, 500,000,000 and 500,000,000 shares authorized, respectively) |

2,871,195 | 55,127,855 | 22,506,868 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net asset value per share (offering and redemption price) |

$ | 10.71 | $ | 45.06 | $ | 30.60 | ||||||

|

|

|

|

|

|

|

|||||||

| Net Assets consist of: |

||||||||||||

| Paid in capital |

$ | 31,852,749 | $ | 1,838,533,579 | $ | 719,409,059 | ||||||

| Accumulated net realized gain(loss) |

(4,380,537 | ) | 151,583,139 | (160,072,920 | ) | |||||||

| Net unrealized appreciation on investments |

2,753,508 | 491,801,894 | 127,028,827 | |||||||||

| Undistributed net investment income |

518,016 | 2,165,221 | 2,282,494 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 30,743,736 | $ | 2,484,083,833 | $ | 688,647,460 | |||||||

|

|

|

|

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

22

Meridian Fund, Inc.

Statements of Operations

For the Year Ended June 30, 2012

| Equity Income Fund |

Growth Fund | Value Fund | ||||||||||

| INVESTMENT INCOME |

||||||||||||

| Dividends |

$ | 1,127,713 | $ | 26,545,336 | $ | 10,714,452 | ||||||

| Foreign tax withholding |

— | (113,907 | ) | (49,495 | ) | |||||||

| Interest |

842 | 61,934 | 17,697 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total investment income |

1,128,555 | 26,493,363 | 10,682,654 | |||||||||

|

|

|

|

|

|

|

|||||||

| EXPENSES |

||||||||||||

| Investment advisory fees |

303,946 | 18,808,464 | 7,352,597 | |||||||||

| Custodian fees |

10,946 | 258,974 | 69,619 | |||||||||

| Directors’ fees and expenses |

887 | 198,162 | 55,263 | |||||||||

| Pricing fees |

29,929 | 253,006 | 91,396 | |||||||||

| Professional fees |

67,700 | 343,552 | 149,694 | |||||||||

| Registration and filing fees |

35,868 | 57,403 | 31,499 | |||||||||

| Reports to shareholders |

607 | 518,661 | 239,536 | |||||||||

| Transfer agent fees |

14,056 | 594,212 | 398,520 | |||||||||

| Miscellaneous expenses |

514 | 35,230 | 11,927 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total expenses |

464,453 | 21,067,664 | 8,400,051 | |||||||||

| Fees waived by Adviser (Note 2) |

(52,027 | ) | — | — | ||||||||

|

|

|

|

|

|

|

|||||||

| Net expenses |

412,426 | 21,067,664 | 8,400,051 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net investment income |

716,129 | 5,425,699 | 2,282,603 | |||||||||

|

|

|

|

|

|

|

|||||||

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS |

||||||||||||

| Net realized gain on investments |

1,247,536 | 182,254,242 | 67,572,308 | |||||||||

| Net change in unrealized appreciation/depreciation on investments |

(1,059,666 | ) | (132,481,769 | ) | (51,595,129 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net realized and unrealized gain on investments |

187,870 | 49,772,473 | 15,977,179 | |||||||||

|

|

|

|

|

|

|

|||||||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 903,999 | $ | 55,198,172 | $ | 18,259,782 | ||||||

|

|

|

|

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

23

Meridian Fund, Inc.

Statements of Changes in Net Assets

| Equity Income Fund | Growth Fund | |||||||||||||||

| Year Ended June 30, 2012 |

Year Ended June 30, 2011 |

Year Ended June 30, 2012 |

Year Ended June 30, 2011 |

|||||||||||||

| OPERATIONS |

||||||||||||||||

| Net investment income |

$ | 716,129 | $ | 623,868 | $ | 5,425,699 | $ | 3,697,464 | ||||||||

| Net realized gain on investments |

1,247,536 | 1,390,957 | 182,254,242 | 183,214,046 | ||||||||||||

| Net change in unrealized appreciation/depreciation on investments |

(1,059,666 | ) | 4,992,670 | (132,481,769 | ) | 431,052,677 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase in net assets from operations |

903,999 | 7,007,495 | 55,198,172 | 617,964,187 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| DISTRIBUTIONS TO SHAREHOLDERS |

|

|||||||||||||||

| Distributions from ordinary income |

(666,723 | ) | (617,600 | ) | (3,952,996 | ) | (3,004,679 | ) | ||||||||

| Distributions from net realized capital gains |

— | — | (179,546,182 | ) | (345,185 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net distributions |

(666,723 | ) | (617,600 | ) | (183,499,178 | ) | (3,349,864 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| CAPITAL SHARE TRANSACTIONS |

||||||||||||||||

| Proceeds from sales of shares |

1,755,274 | 4,344,602 | 606,354,021 | 944,903,617 | ||||||||||||

| Reinvestment of distributions |

661,090 | 611,890 | 177,474,961 | 3,175,566 | ||||||||||||

| Redemption fees |

3,282 | 218 | 172,598 | 237,068 | ||||||||||||

| Less: redemptions of shares |

(7,556,784 | ) | (639,833 | ) | (786,698,568 | ) | (386,114,353 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Increase (decrease) resulting from capital share transactions |

(5,137,138 | ) | 4,316,877 | (2,696,988 | ) | 562,201,898 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total increase (decrease) in net assets |

(4,899,862 | ) | 10,706,772 | (130,997,994 | ) | 1,176,816,221 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET ASSETS |

||||||||||||||||

| Beginning of year |

35,643,598 | 24,936,826 | 2,615,081,827 | 1,438,265,606 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| End of year |

$ | 30,743,736 | $ | 35,643,598 | $ | 2,484,083,833 | $ | 2,615,081,827 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Undistributed net investment income at end of year |

$ | 518,016 | $ | 468,610 | $ | 2,165,221 | $ | 692,785 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of the financial statements.

24

Meridian Fund, Inc.

Statements of Changes in Net Assets

| Value Fund | ||||||||

| Year Ended June 30, 2012 |

Year Ended June 30, 2011 |

|||||||

| OPERATIONS |

||||||||

| Net investment income |

$ | 2,282,603 | $ | 3,256,620 | ||||

| Net realized gain on investments |

67,572,308 | 115,450,037 | ||||||

| Net change in unrealized appreciation/depreciation on investments |

(51,595,129 | ) | 110,782,863 | |||||

|

|

|

|

|

|||||

| Net increase in net assets from operations |

18,259,782 | 229,489,520 | ||||||

|

|

|

|

|

|||||

| DISTRIBUTIONS TO SHAREHOLDERS |

||||||||

| Distributions from ordinary income |

(3,256,492 | ) | (2,508,893 | ) | ||||

|

|

|

|

|

|||||

| Net distributions |

(3,256,492 | ) | (2,508,893 | ) | ||||

|

|

|

|

|

|||||

| CAPITAL SHARE TRANSACTIONS |

||||||||

| Proceeds from sales of shares |

17,262,910 | 41,931,473 | ||||||

| Reinvestment of distributions |

3,188,208 | 2,443,388 | ||||||

| Redemption fees |

8,236 | 6,091 | ||||||

| Less: redemptions of shares |

(216,127,160 | ) | (204,985,104 | ) | ||||

|

|

|

|

|

|||||

| Decrease resulting from capital share transactions |

(195,667,806 | ) | (160,604,152 | ) | ||||

|

|

|

|

|

|||||

| Total increase (decrease) in net assets |

(180,664,516 | ) | 66,376,475 | |||||

|

|

|

|

|

|||||

| NET ASSETS |

||||||||

| Beginning of year |

869,311,976 | 802,935,501 | ||||||

|

|

|

|

|

|||||

| End of year |

$ | 688,647,460 | $ | 869,311,976 | ||||

|

|

|

|

|

|||||

| Undistributed net investment income at end of year |

$ | 2,282,494 | $ | 3,256,383 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of the financial statements.

25

Meridian Equity Income Fund

Financial Highlights

Selected data for each share of capital stock outstanding throughout each period

| For the Fiscal Year Ended June 30, | For the

fiscal period from January 31, 2005 through June 30, 2005+ |

|||||||||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||||||||||||

| Net Asset Value - Beginning of Period |

$ | 10.61 | $ | 8.51 | $ | 6.88 | $ | 10.37 | $ | 13.14 | $ | 11.05 | $ | 10.10 | $ | 10.00 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Income (Loss) from Investment Operations |

||||||||||||||||||||||||||||||||

| Net Investment Income |

0.22 | 1 | 0.20 | 1 | 0.19 | 1 | 0.22 | 1 | 0.24 | 1 | 0.18 | 0.15 | 0.06 | |||||||||||||||||||

| Net Gains (Losses) on Investments (both realized and unrealized) |

0.09 | 2.11 | 1.63 | (2.96 | ) | (2.25 | ) | 2.19 | 0.93 | 0.04 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total From Investment Operations |

0.31 | 2.31 | 1.82 | (2.74 | ) | (2.01 | ) | 2.37 | 1.08 | 0.10 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Less Distributions |

||||||||||||||||||||||||||||||||

| Distributions from Net Investment Income |

(0.21 | ) | (0.21 | ) | (0.19 | ) | (0.22 | ) | (0.22 | ) | (0.17 | ) | (0.12 | ) | 0.00 | |||||||||||||||||

| Distributions from Net Realized Capital Gains |

0.00 | 0.00 | 0.00 | (0.53 | ) | (0.54 | ) | (0.11 | ) | (0.01 | ) | 0.00 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total Distributions |

(0.21 | ) | (0.21 | ) | (0.19 | ) | (0.75 | ) | (0.76 | ) | (0.28 | ) | (0.13 | ) | 0.00 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net Asset Value - End of Period |

$ | 10.71 | $ | 10.61 | $ | 8.51 | $ | 6.88 | $ | 10.37 | $ | 13.14 | $ | 11.05 | $ | 10.10 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total Return |

3.09% | 27.30% | 26.44% | (26.75% | ) | (15.84% | ) | 21.61% | 10.75% | 1.00% | 2 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||||||||||

| Net Assets, End of Period (000’s) |

$ | 30,744 | $ | 35,644 | $ | 24,937 | $ | 20,719 | $ | 33,519 | $ | 43,188 | $ | 25,451 | $ | 8,412 | ||||||||||||||||

| Ratio of Expenses to Average Net Assets |

|

|||||||||||||||||||||||||||||||

| Before fees waived |

1.41% | 1.25% | 1.30% | 1.43% | 1.25% | 4 | 1.29% | 1.67% | 3.96% | 5 | ||||||||||||||||||||||

| After fees waived6 |

1.25% | 1.25% | 3 | 1.25% | 1.25% | 1.25% | 1.25% | 1.25% | 1.25% | 5 | ||||||||||||||||||||||

| Ratio of Net Investment Income to Average Net Assets |

|

|||||||||||||||||||||||||||||||

| After fees waived |

2.17% | 2.04% | 2.27% | 2.73% | 2.02% | 1.64% | 1.80% | 2.11% | 5 | |||||||||||||||||||||||

| Portfolio Turnover Rate |

31% | 29% | 63% | 49% | 62% | 37% | 60% | 25% | ||||||||||||||||||||||||

| + | The Fund commenced investment operations on January 31, 2005. |

| 1 | Per share net investment income has been calculated using the average daily shares method. |

| 2 | Not Annualized. |

| 3 | Includes fees waived, which were less than 0.01%. |

| 4 | The Advisor recouped $4,849 during the fiscal year ended June 30, 2008, representing previously reimbursed expenses. Had such payment not been made, the expense ratio would have been 1.24%. |

| 5 | Annualized. |

| 6 | See note 2 to Financial Statements. |

The accompanying notes are an integral part of the financial statements.

26

Meridian Growth Fund

Financial Highlights

Selected data for each share of capital stock outstanding throughout each period

| For the Fiscal Year Ended June 30, | ||||||||||||||||||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||||||||||||||||||||

| Net Asset Value - Beginning of Year |

$ | 47.61 | $ | 33.94 | $ | 27.89 | $ | 33.60 | $ | 42.74 | $ | 38.54 | $ | 35.77 | $ | 35.38 | $ | 27.24 | $ | 28.10 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Income (Loss) from Investment Operations |

|

|||||||||||||||||||||||||||||||||||||||

| Net Investment Income (Loss) |

0.10 | 1 | 0.08 | 1 | 0.08 | 1 | 0.15 | 1 | 0.05 | 1 | 0.04 | (0.01 | ) | (0.07 | ) | (0.04 | ) | (0.08 | ) | |||||||||||||||||||||

| Net Gains (Losses) on Investments (both realized and unrealized) |

0.69 | 13.67 | 6.11 | (4.68 | ) | (5.56 | ) | 7.29 | 3.58 | 1.02 | 9.10 | (0.11 | ) | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total From Investment Operations |

0.79 | 13.75 | 6.19 | (4.53 | ) | (5.51 | ) | 7.33 | 3.57 | 0.95 | 9.06 | (0.19 | ) | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Less Distributions |

||||||||||||||||||||||||||||||||||||||||

| Distributions from Net Investment Income |

(0.07 | ) | (0.07 | ) | (0.12 | ) | (0.09 | ) | (0.05 | ) | (0.01 | ) | 0.00 | 0.00 | 0.00 | (0.06 | ) | |||||||||||||||||||||||

| Distributions from Net Realized Capital Gains |

(3.27 | ) | (0.01 | ) | 0.00 | (1.09 | ) | (3.58 | ) | (3.12 | ) | (0.80 | ) | (0.56 | ) | (0.92 | ) | (0.61 | ) | |||||||||||||||||||||

| Distributions from Paid in Capital Distribution |

0.00 | 0.00 | (0.02 | ) | (0.00 | )2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Distributions |

(3.34 | ) | (0.08 | ) | (0.14 | ) | (1.18 | ) | (3.63 | ) | (3.13 | ) | (0.80 | ) | (0.56 | ) | (0.92 | ) | (0.67 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Net Asset Value - End of Year |

$ | 45.06 | $ | 47.61 | $ | 33.94 | $ | 27.89 | $ | 33.60 | $ | 42.74 | $ | 38.54 | $ | 35.77 | $ | 35.38 | $ | 27.24 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Return |

2.45% | 40.51% | 22.18% | (13.01% | ) | (13.80% | ) | 19.69% | 10.08% | 2.65% | 33.65% | (0.20% | ) | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Ratios/Supplemental Data |

|

|||||||||||||||||||||||||||||||||||||||

| Net Assets, End of Year (000’s) |

$ | 2,484,084 | $ | 2,615,082 | $ | 1,438,266 | $ | 1,197,656 | $ | 1,516,015 | $ | 2,066,750 | $ | 1,689,374 | $ | 1,693,564 | $ | 1,273,302 | $ | 448,393 | ||||||||||||||||||||

| Ratio of Expenses to Average Net |

0.85% | 0.81% | 0.84% | 0.86% | 0.84% | 0.84% | 0.85% | 0.86% | 0.88% | 0.95% | ||||||||||||||||||||||||||||||

| Ratio of Net Investment Income (Loss) to Average Net Assets |

0.22% | 0.18% | 0.24% | 0.52% | 0.13% | 0.11% | (0.03% | ) | (0.21% | ) | (0.21% | ) | (0.47% | ) | ||||||||||||||||||||||||||

| Portfolio Turnover Rate |

25% | 26% | 37% | 35% | 39% | 40% | 29% | 32% | 19% | 27% | ||||||||||||||||||||||||||||||

| 1 | Per share net investment income (loss) has been calculated using the average daily shares method. |

| 2 | Distribution includes a return of capital that rounds to less than $.01 per share. |

The accompanying notes are an integral part of the financial statements.

27

Meridian Value Fund

Financial Highlights

Selected data for each share of capital stock outstanding throughout each period

| For the Fiscal Year Ended June 30, | ||||||||||||||||||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||||||||||||||||||||

| Net Asset Value - Beginning of Year |

$ | 29.59 | $ | 22.80 | $ | 20.53 | $ | 29.43 | $ | 38.79 | $ | 36.14 | $ | 38.11 | $ | 40.35 | $ | 31.65 | $ | 30.34 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Income (Loss) from Investment Operations |

||||||||||||||||||||||||||||||||||||||||

| Net Investment Income (Loss) |

0.09 | 1 | 0.10 | 1 | 0.07 | 1 | 0.22 | 1 | 0.15 | 1 | 0.41 | 0.18 | 0.19 | 0.00 | (0.03 | ) | ||||||||||||||||||||||||

| Net Gains (Losses) on Investments (both realized and unrealized) |

1.05 | 2 | 6.77 | 2.45 | (7.80 | ) | (3.12 | ) | 7.74 | 2.45 | 2.96 | 8.70 | 1.34 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total From Investment Operations |

1.14 | 6.87 | 2.52 | (7.58 | ) | (2.97 | ) | 8.15 | 2.63 | 3.15 | 8.70 | 1.31 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Less Distributions |

||||||||||||||||||||||||||||||||||||||||

| Distributions from Net Investment Income |

(0.13 | ) | (0.08 | ) | (0.25 | ) | 0.00 | (0.35 | ) | (0.41 | ) | (0.32 | ) | (0.28 | ) | 0.00 | 0.00 | |||||||||||||||||||||||

| Distributions from Net Realized Capital Gains |

0.00 | 0.00 | 0.00 | (1.32 | ) | (6.04 | ) | (5.09 | ) | (4.28 | ) | (5.11 | ) | 0.00 | 0.00 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Distributions |

(0.13 | ) | (0.08 | ) | (0.25 | ) | (1.32 | ) | (6.39 | ) | (5.50 | ) | (4.60 | ) | (5.39 | ) | 0.00 | 0.00 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Net Asset Value - End of Year |

$ | 30.60 | $ | 29.59 | $ | 22.80 | $ | 20.53 | $ | 29.43 | $ | 38.79 | $ | 36.14 | $ | 38.11 | $ | 40.35 | $ | 31.65 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Return |

3.89% | 2 | 30.13% | 12.20% | (25.72% | ) | (8.82% | ) | 23.90% | 7.35% | 8.00% | 27.49% | 4.32% | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||||||||||||||||||

| Net Assets, End of Year (000’s) |

$ | 688,647 | $ | 869,312 | $ | 802,936 | $ | 831,572 | $ | 1,319,186 | $ | 1,819,440 | $ | 1,686,874 | $ | 2,271,478 | $ | 2,226,590 | $ | 1,456,552 | ||||||||||||||||||||

| Ratio of Expenses to Average Net Assets |

1.14% | 1.09% | 1.09% | 1.12% | 1.09% | 1.08% | 1.09% | 1.08% | 1.09% | 1.11% | ||||||||||||||||||||||||||||||

| Ratio of Net Investment Income (Loss) to Average Net Assets |

0.31% | 0.37% | 0.27% | 0.97% | 0.44% | 0.59% | 0.49% | 0.48% | 0.01% | (0.12% | ) | |||||||||||||||||||||||||||||

| Portfolio Turnover Rate |

20% | 38% | 45% | 87% | 61% | 75% | 58% | 59% | 81% | 60% | ||||||||||||||||||||||||||||||

| 1 | Per share net investment income (loss) has been calculated using the average daily shares method. |

| 2 | Includes a gain resulting from litigation payments on securities owned in a prior year. Without these gains, the net realized gains on investments per share would have been $0.99, and the return would have been 3.69%. |

The accompanying notes are an integral part of the financial statements.

28

Meridian Fund, Inc.

Notes to Financial Statements

For the Year Ended June 30, 2012

| 1. | Organization and Significant Accounting Policies: Meridian Fund, Inc. (the “Meridian Funds”) is comprised of the Meridian Equity Income Fund (the “Equity Income Fund”), the Meridian Growth Fund (the “Growth Fund”) and the Meridian Value Fund (the “Value Fund”). The Equity Income Fund, the Growth Fund and the Value Fund (each a “Fund” and collectively, the “Funds”) are registered under the Investment Company Act of 1940, as no-load, diversified, open-end management investment companies. The Equity Income Fund began operations and was registered on January 31, 2005. The Growth Fund began operations and was registered on August 1, 1984. The Value Fund began operations on February 10, 1994 and was registered on February 7, 1994. |

The primary investment objective of the Equity Income Fund is to seek long-term growth of capital along with income as a component of total return.

The primary investment objective of the Growth Fund is to seek long-term growth of capital.

The primary investment objective of the Value Fund is to seek long-term growth of capital.

The following is a summary of significant accounting policies for all of the Funds:

| a. | Investment Valuations: Marketable securities are valued at the closing price or last sales price on the principal exchange or market on which they are traded; or, if there were no sales that day, at the last reported bid price. Securities and other assets for which reliable market quotations are not readily available or for which a significant event has occurred since the time of the most recent market quotation, will be valued at their fair value as determined by Aster Investment Management Company, Inc. (the “Adviser”) under the guidelines established by, and under the general supervision and responsibility of, the Funds’ Board of Directors (the “Board”). Short-term debt securities with original or remaining maturities in excess of 60 days are valued at the mean of their quoted bid and asked prices. Short-term debt securities with 60 days or less to maturity are valued at amortized cost which approximates fair market value. |

| b. | Federal Income Taxes: It is the Funds’ policy to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and to distribute all of their taxable income to their shareholders; therefore, no federal income tax provision is required. |

| c. | Security Transactions: Security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses on security transactions are determined on the basis of specific identification for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date. Interest income is accrued daily. |

| d. | Cash and Cash Equivalents: All highly liquid investments with an original maturity of three months or less are considered to be cash equivalents. Available funds are automatically swept into a Cash Reserve account, which preserves capital with a consistently competitive rate of return. Interest accrues daily and is credited by the third business day of the following month. |

29

Meridian Fund, Inc.

Notes to Financial Statements (continued)

For the Year Ended June 30, 2012

| e. | Expenses: Expenses arising in connection with a Fund are charged directly to that Fund. Expenses common to the Funds are generally allocated to each Fund in proportion to their relative net assets. |

| f. | Use of Estimates: The preparation of financial statements in accordance with accounting principals generally accepted in the U.S. (“GAAP”) requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and revenue and expenses at the date of the financial statements. Actual amounts could differ from those estimates. |

| g. | Distributions to Shareholders: The Funds record distributions to shareholders on the ex-dividend date. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations which may differ from GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences do not require reclassification. |

Distributions which exceed net investment income and net realized capital gains are reported as distributions in excess of net investment income or distributions in excess of net realized capital gains for financial reporting purposes but not for tax purposes. To the extent they exceed net investment income and net realized capital gains for tax purposes, they are reported as distributions of paid-in-capital.

| h. | Guarantees and Indemnification: Under the Funds’ organizational documents, its Officers and Directors are indemnified against certain liability arising out of the performance of their duties to the Funds. Additionally, in the normal course of business, the Funds enter into contracts with service providers that contain general indemnification clauses. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote. |

| i. | Foreign Currency Translation: Securities denominated in foreign currencies are converted into U.S. dollars using the spot market rate of exchange at the time of valuation. Purchases and sales of such securities and related dividend and interest income are converted into U.S. dollars using the spot market rate of exchange prevailing on the respective dates of such translations. Foreign securities and currency transactions may involve risks not associated with U.S. securities and currency. The Funds do not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments as reported in the Statement of Operations. |

| j. | Fair Value Measurements: As described in Note 1.a. above, the Funds utilize various methods to determine and measure the fair value of investment securities on a recurring basis. The |

30

Meridian Fund, Inc.

Notes to Financial Statements (continued)

For the Year Ended June 30, 2012

| objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below: |

Level 1 - quoted prices in active markets for identical securities;

Level 2 - other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.); and

Level 3 - significant unobservable inputs (including the Fund’s determinations as to the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The summary of inputs used to value the Funds’ securities as of June 30, 2012 is as follows:

| Valuation Inputs |

Equity Income Fund |

Growth Fund | Value Fund | |||||||||

| Level 1 - Quoted Prices* |

$ | 29,413,679 | $ | 2,349,596,992 | $ | 633,686,688 | ||||||

| Level 2 - Other Significant Observable Inputs** |

— | 64,995,229 | 4,999,220 | |||||||||

| Level 3 - Significant Unobservable Inputs |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Market Value of Investments |

$ | 29,413,679 | $ | 2,414,592,221 | $ | 638,685,908 | ||||||

|

|

|

|

|

|

|

|||||||

| * | Level 1 investments are comprised of common stock with industry classifications as defined on the Schedule of Investments. |

| ** | Level 2 investments are limited to U.S. Treasury Securities. |

During the fiscal year ended June 30, 2012 there were no reportable transfers between levels.

| 2. | Related Parties: Effective July 13, 2012, the Meridian Funds, on behalf of each Fund, entered into a new Investment Management Agreement and Service Agreement with the Adviser (the “Management Agreement”). The Funds’ Board, and each Fund’s shareholders, approved, among other matters, the Management Agreement with the Adviser. Please see the Board Consideration of Proposed Management Agreement (unaudited) and Shareholder Meeting Results (unaudited) sections for additional information. |

Prior to his death on February 16, 2012, Richard F. Aster, Jr. owned approximately 96% of the Adviser. In connection with his death, Mr. Aster’s ownership interest in the Adviser, among other

31

Meridian Fund, Inc.

Notes to Financial Statements (continued)

For the Year Ended June 30, 2012

assets, was transferred (the “Transfer”) to a trust (the “Trust”). First Republic Trust Company (“First Republic”), as a co-trustee of the Trust, has sole authority to act under the Trust agreement with respect to the Trust’s ownership interest in the Adviser. In this regard, First Republic has the authority, on behalf of the Trust, without limitation, to make all decisions regarding the Trust’s ownership interest in the Adviser, as well as the administration, management and operations of the Adviser. First Republic has advised that it is considering its options with respect to its holdings of shares of the Adviser, and First Republic has indicated that it has hired an independent financial adviser to assist it in identifying and evaluating potential options. A transfer by the Trust of some or all of its shares in the Adviser may result in a change of control of the Adviser, thereby requiring shareholder approval of a new management agreement.

The Funds were previously managed by the Adviser under an Investment Management Agreement, Power of Attorney and Service Agreement, dated November 1, 2000 (for the Growth Fund and the Value Fund), and an Investment Management Agreement, dated January 31, 2005 (for the Equity Income Fund) (together, the “Previous Management Agreements”). The Management Agreement has the same fee rates as, and is otherwise substantially similar to, the Previous Management Agreements for each Fund. None of the differences between the Management Agreement and the Previous Management Agreements are considered to be material in nature.

The Adviser receives from the Equity Income Fund, as compensation for its services, an annual fee of 1% of the first $10,000,000 of the Equity Income Fund’s net assets, 0.90% of the next $20,000,000 of the Equity Income Fund’s net assets, 0.80% of the next $20,000,000 of the Equity Income Fund’s net assets and 0.70% of the Equity Income Fund’s net assets in excess of $50,000,000. The fee is paid monthly in arrears and calculated based on that month’s daily average net assets.

The Adviser receives from the Growth Fund, as compensation for its services, an annual fee of 1% of the first $50,000,000 of the Growth Fund’s net assets and 0.75% of the Growth Fund’s net assets in excess of $50,000,000. The fee is paid monthly in arrears and calculated based on that month’s daily average net assets.

The Adviser receives from the Value Fund, as compensation for its services, an annual fee of 1% of the Value Fund’s net assets. The fee is paid monthly in arrears and calculated based on that month’s daily average net assets.

The Adviser voluntarily agreed to waive its fee and reimburse expenses, to the extent that total annual operating expenses for the Equity Income Fund exceeds 1.25%. The Investment Adviser has voluntarily agreed to limit the operating expenses of the Growth and Value Funds to 2.50%. With respect to these limits, the Adviser waived fees in the amount of $52,027 for the Equity Income Fund but did not waive fees for the Growth and Value Funds, during the fiscal year ended June 30, 2012.

For a period not to exceed three years from the date on which a waiver or reimbursement of expenses in excess of the expense limitation is made by the Adviser, the Equity Income Fund will

32

Meridian Fund, Inc.

Notes to Financial Statements (continued)

For the Year Ended June 30, 2012

carry forward, and may repay the Adviser such amounts; provided the Fund is able to effect such reimbursement and maintain the expense limitation.

At June 30, 2012, the balance of carried forward recoupable expenses along with the year of expiration for the Equity Income Fund was:

| Amount |

Expiration | |||

| $12,855 |

2013 | |||

| 1,193 |

2014 | |||

| 52,027 |

2015 | |||

Subject to the approval of the Board, the Fund will repay the Adviser the amount of its reimbursement for the Equity Income Fund for up to three years following the reimbursement to the extent the Equity Income Fund’s expenses drop below 1.25%, after giving effect to repayment by the Fund. Either the Fund or the Adviser can modify or terminate this arrangement at any time.

The Richard F. Aster, Jr. Trust owns the majority of the shares of the Adviser. Beneficial ownership in the Funds by the Richard F. Aster, Jr. Trust as of June 30, 2012 were as follows:

| Equity Income Fund* |

72.92 | % | ||

| Growth Fund |

0.88 | % | ||

| Value Fund |

2.99 | % |

| * | The Richard F. Aster, Jr. Trust redeemed 427,658 shares of the Equity Income Fund in August 2012. As of the date that these financial statements were issued, the Richard F. Aster, Jr. Trust was the benefical owner of 68.41% of the outstanding shares of the Equity Income Fund. |

| 3. | Capital Shares Transactions: Transactions in capital shares for the fiscal year ended June 30, 2012 and the fiscal year ended June 30, 2011 were as follows: |

| Equity Income Fund | ||||||||

| June 30, 2012 |

June 30, 2011 |

|||||||

| Increase in Fund shares: |

||||||||

| Shares sold |

168,446 | 430,560 | ||||||

| Shares issued from reinvestment of distributions |

66,844 | 62,694 | ||||||

|

|

|

|

|

|||||

| 235,290 | 493,254 | |||||||

| Shares redeemed |

(722,117 | ) | (64,601 | ) | ||||

|

|

|

|

|

|||||

| Net increase (decrease) |

(486,827 | ) | 428,653 | |||||

|

|

|

|

|

|||||

33

Meridian Fund, Inc.

Notes to Financial Statements (continued)

For the Year Ended June 30, 2012

| Growth Fund | ||||||||

| June 30, 2012 |

June 30, 2011 |

|||||||

| Increase in Fund shares: |

||||||||

| Shares sold |

13,733,443 | 21,278,458 | ||||||

| Shares issued from reinvestment of distributions |

4,381,018 | 72,106 | ||||||

|

|

|

|

|

|||||

| 18,114,461 | 21,350,564 | |||||||

| Shares redeemed |

(17,918,599 | ) | (8,799,381 | ) | ||||

|

|

|

|

|

|||||

| Net increase |

195,862 | 12,551,183 | ||||||

|

|

|

|

|

|||||

| Value Fund | ||||||||

| June 30, 2012 |

June 30, 2011 |

|||||||

| Increase in Fund shares: |

||||||||

| Shares sold |

601,947 | 1,509,297 | ||||||

| Shares issued from reinvestment of distributions |

117,473 | 86,096 | ||||||

|

|

|

|

|

|||||

| 719,420 | 1,595,393 | |||||||

| Shares redeemed |

(7,589,319 | ) | (7,430,764 | ) | ||||

|

|

|

|

|

|||||

| Net decrease |

(6,869,899 | ) | (5,835,371 | ) | ||||

|

|

|

|

|

|||||

| 4. | Directors and Officers: Certain Directors and/or Officers of the Funds are also Directors and/or Officers of the Adviser. The sole Director and acting Chief Executive Officer of the Adviser is a Director of the Funds and is a minority shareholder of the Adviser. Directors and Officers of the Funds who are Directors and/or Officers of the Adviser receive no compensation from the Funds. Prior to January 1, 2012, the Directors of the Funds who are considered not interested persons, as defined in the Investment Company Act of 1940 (the “Non-Interested Directors”), received compensation in the amount of a minimum of $13,000 per year, and that, upon the election of each Non-Interested Director, a portion of such compensation could be invested in any of the Funds, at each Non-Interested Director’s discretion. |

Effective January 1, 2012, each Non-Interested Director will be paid an annual fee set at $40,000. An additional $5,000 will be paid to each Non-Interested Director for attendance at each in-person meeting of the Board and an additional $1,000 will be paid to each Non-Interested Director for participating in a telephonic meeting of the Board. An additional $3,000 will be paid to each member of the Audit or Governance Committee of the Board for attendance at an in-person Audit or Governance Committee meeting and an additional $1,000 will be paid to each member of the Audit or Governance Committee of the Board for participating in a telephonic Audit or Governance Committee meeting.

34

Meridian Fund, Inc.

Notes to Financial Statements (continued)

For the Year Ended June 30, 2012

An additional $10,000 will be paid to the Chairman of the Board and the Chairman of a Committee of the Board. The Chairman of the Board will also receive an additional $2,500 for attending each in-person meeting of the Board. The Chairman of a Committee will receive an additional $2,000 for attending each in person Committee meeting.

| 5. | Investment Transactions: The cost of investments purchased and the proceeds from sales of investments, excluding short-term securities and U.S. government obligations, for the fiscal year ended June 30, 2012, were as follows: |

| Purchases | Proceeds from Sales | |||||||

| Equity Income Fund |

$ | 9,784,584 | $ | 14,304,185 | ||||

| Growth Fund |

600,511,437 | 785,848,759 | ||||||