UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-04010

OCM Mutual Fund

(Exact name of registrant as specified in charter)

2600 Kitty Hawk Road, Suite 119

Livermore, California 94551

(Address of principal executive offices) (Zip code)

Gregory M. Orrell

Orrell Capital Management, Inc

2600 Kitty Hawk Road, Suite 119

Livermore, California 94551

(Name and address of agent for service)

Registrant's telephone number, including area code: (925) 455-0802

Date of fiscal year end: November 30

Date of reporting period: May 31, 2021

Item 1. Report to Stockholders.

Semi-Annual Report

May 31, 2021

(Unaudited)

OCM GOLD FUND

Shareholder Letter – May 31, 2021 |

Dear Fellow Shareholders:

For the six-month fiscal period ending May 31, 2021, the OCM Gold Fund Advisor Class gained 19.03% while the Investor Class gained 18.68% (13.36% after maximum sales load) compared to a 22.64% gain in the Philadelphia Gold and Silver Index (“XAU”)1 and a 16.95% gain for the S&P 500 Index2. Although the U.S. economy showed signs of finding its post Covid footing over the period, policy makers in the U.S. maintained aggressive fiscal and monetary policies that helped fuel financial asset and commodities prices higher along with inflation during the first half of the year. The London PM Fix3 gold price closed the six- month fiscal period at $1,899.95 per ounce, up 7.8% for the six-month fiscal period ending May 31, 2021. Your Fund’s broader exposure to the precious metals mining industry through the ownership of junior gold producers and exploration and development companies led to an underperformance versus the major producers weighted XAU Index over the period. Over longer time periods as indicated in the performance chart below, your Fund’s investment strategy and active management style have proven to outperform the XAU Index.

Market Commentary

Inflation over the 12-month period ending May 31, 2021 was 4.99% as measured by the Consumer Price Index, an index that has proven too narrow, in our opinion, to accurately measure the true cost of living. As certain inflation measures heat up, debate rages whether Federal Reserve4 (the “Fed”) Chairman Jerome Powell is correct when he refers to inflation as being “transitory” or is he just telling the markets what it wants to hear. We are firmly of the opinion that the Fed has been sowing the seeds of inflation through its zero-interest rate policy, massive monetization of debt and balance sheet expansion since the Asian Financial crisis in 1997 and the failure of Long-Term Capital Management in 1998 sent the Fed down a path of not allowing market forces to correct excesses naturally. At this point, the Fed may have boxed itself into a corner. In our view, it must continue its aggressive monetary measures or risk financial markets unraveling and the untenable economic consequences. We believe the market will ultimately hold the Fed accountable by testing its theoretical economic models that defy historical laws of economics.

In our opinion, the Fed risks losing institutional credibility should it be unable to control inflation with its rhetoric and limited ability tighten monetary policy if it remains steadfast in preserving the wealth effect from higher equity markets. A possible catalyst to undermining Fed’s credibility would be if it continues down the path of monetizing ever increasing government deficits through its balance sheet to maintain interest rates at below market levels in a rising inflationary environment.

U.S. Treasury yields are presently trading at negative real yields (yield – inflation) across all maturities. One of the characteristics of the gold bull market in the 1970’s was the loss of purchasing power of the U.S. dollar punctuated by negative real rates. While the Fed remains confident the U.S. dollar will maintain its world reserve currency

– 1 –

OCM GOLD FUND

Shareholder Letter – May 31, 2021 (Continued) |

status, over the first half of 2021 we have seen minor central banks in Brazil, Thailand, Serbia and Hungary exhibit less confidence in the dollar by adding gold to their holdings. The central bank of Hungary’s gold purchases in March 2021 tripled its gold holdings.

Former Prime Minister of Great Britain, Benjamin Disraeli, once described confidence in money as suspicion asleep. In an era of irredeemable fiat currencies, which has existed since Nixon closed the “Gold Window” in 1971, confidence is at the forefront of maintaining the current monetary system based on paper currencies. Accelerating dollar debasement risks repudiation of the dollar as a store of value, in our opinion, which threatens to undermine confidence in the global monetary system and may set the stage for a new monetary system not anchored by the U.S. dollar.

It is our opinion cryptocurrencies, such as Bitcoin, are based on the market and a new generation sensing that something is wrong with the current monetary system. The premise for the cryptocurrency market therefore is correct, in our opinion, that undisciplined monetary policies threaten the future purchasing power of the U.S. dollar. However, we believe what the cryptocurrency crowd fails to recognize is the lack of intrinsic value to cryptocurrencies along with the ability to create an endless number of “limited supply” cryptocurrencies. Consequently, we believe cryptocurrencies are nothing more than a speculative bet on price movement that will end poorly for those hoping cryptocurrencies are the disruptor for the current monetary system. Disillusioned Dogecoin founder, Jackson Palmer, alleges “the cryptocurrency industry leverages a network of shady business connections, bought influencers and pay for play media outlets to perpetuate a cult-like “get rich quick” funnel designed to extract new money from the financially desperate and naïve”. It is our belief that every generation must re-learn an appreciation for gold’s monetary characteristics that have withstood the test of 5,000 years of attempts to replace it as the best form of money.

Despite higher inflation and negative real yields, investor sentiment toward gold remained tepid during the first half of the Fund’s fiscal year. Continued strength in the broad equity market continued to attract investor capital flows as investors remained optimistic on the reopening of the economy and the Fed maintaining its accommodating monetary policy. By almost any measure, the equity market is at unprecedented valuations. Comparing the peak of the dot com bubble to the current market should give investors reason to pause when they look at a Total Market Capitalization (Wilshire 5000 Index) to Gross Domestic Product (“GDP”) chart (Fig. 1). We continue to believe gold assets represent the reciprocal of financial assets and therefore large capital flows into gold assets have historically come when bond and equity markets are out of favor.

– 2 –

OCM GOLD FUND

Shareholder Letter – May 31, 2021 (Continued) |

Fig 1

Source: Data Longermtrends.net

Gold Mining Industry/Investment Strategy Review

In our opinion, the impact of higher gold and silver prices on the precious metals mining industry has yet to be appreciated by generalist investors. While the market remains focused on big technology and disruptors, shares of gold mining companies in the XAU on average delivered a 50% greater return on capital than the S&P 500 over the past year. A long running criticism of the industry in the past was that management/boards were poor stewards of capital. The industry now boasts balance sheets and cash flow statements that compare favorably to the average S&P 500 company. We believe the stage is set for a significant re-rating of precious metals equities when investor sentiment shifts toward the group.

We continue to position your Fund’s portfolio through our long-held investment strategy of owning allocations across major, intermediate/mid-tier and junior gold producers along with exploration and development companies. The Fund’s performance has historically benefitted from identifying special situations that we believe are undervalued.

– 3 –

OCM GOLD FUND

Shareholder Letter – May 31, 2021 (Continued) |

Over the six months covered in this report, the Fund’s top performing position was Aya Gold and Silver, Inc., a silver producer in Morocco with growing silver reserves and production. Other strong performers in the portfolio included exploration and development companies Matador Mining Ltd. and Emerald Resources N.L. A large detractor to the Fund’s performance over the six-month fiscal period was Resolute Mining Ltd., which struggled to deliver on production guidance. Over the past year, we have increased the portfolio allocation to exploration and development companies as we believe the industry is starved for new gold reserves which will lead larger producers to acquire reserves in the ground of these smaller companies.

Your Fund’s long-held investment strategy remains a disciplined approach to searching out value and growth opportunities across all segments of the precious metals industry on a global basis. We believe companies that possess strong management, large reserves in the ground in stable jurisdictions, and exhibit capital discipline while holding equity dear will be the companies that outperform over time as they deliver higher levels of free cash flow to maintain a sustainable business model to create shareholder value. We are specifically targeting companies with existing production that possess large reserve expansion potential where shareholder value can be created through the drill bit. Your Fund has the flexibility to maneuver within the precious metals sector to invest in opportunities that larger funds and exchange traded funds cannot; from major gold producers with over one million ounces of annual production to junior producers with less than 100,000 ounces of annual production to small exploration and development companies with micro capitalizations. The Fund’s performance has historically benefitted from identifying special situations that we believe are undervalued.

Conclusion

We believe the investment thesis for owning gold assets remains simple and compelling for investors looking to hedge against monetary debasement and inflated financial asset valuations. Total U.S. federal debt has risen from $10 trillion to $28 trillion since the 2008 Financial Crisis while the Fed’s balance sheet has expanded from $900 billion to $ 8 trillion over the same time. In our opinion, the Fed has embraced the progressive agenda put forward by the Democratic Party and is willing to finance it by expanding its balance sheet and monetizing debt. Once the government’s Covid stimulus wears off, the prospect of economic activity slowing down is real in our view, especially if consumers are squeezed by higher inflation, basically stagflation. In our opinion, it is difficult to conjure up the fiscal and monetary response by policy makers that does not lead to accelerated currency debasement and a favorable environment for gold assets. We believe the slow appreciation of the improved fundamentals of the precious metals mining industry creates an opportunity for investors to position in gold assets at attractive valuations ahead of meaningful capital flows into gold assets looking for protection against monetary debasement.

– 4 –

OCM GOLD FUND

Shareholder Letter – May 31, 2021 (Continued) |

We appreciate your shareholding and confidence in the OCM Gold Fund, and we look forward to meeting the investment objective of preserving your purchasing power. Should you have any questions regarding the Fund or gold, please contact your financial adviser or you may contact us directly at 1-800-779-4681. For questions regarding your account, please contact Shareholder Service at 1-800-628-9403.

Sincerely,

Gregory M. Orrell

Portfolio Manager

July 19, 2021

The Philadelphia Gold and Silver Index (XAU)1 is an unmanaged capitalization-weighted index composed of 16 companies listed on U.S. exchanges involved in the gold and silver mining industry. The index is generally considered as representative of the gold and silver share market. You cannot invest directly in an index.

The S&P 500 Index2, a registered trademark of McGraw-Hill Co., Inc. is a market capitalization-weighted index of 500 widely held common stocks. You cannot invest directly in an index.

London PM Fix3 is a price per ounce for each of the precious metals (gold, silver, platinum and palladium) determined daily at 10:30 and 15:00 GMT by a brief conference call among the five members of the London Gold Pool (Scotia- Mocatta, Barclays Capital, Deutsche Bank, HSBC and Société Générale). The London spot fix price is the price fixed at the moment when the conference call terminates.

Federal Reserve4 is the central bank of the United States and arguably the most powerful financial institution in the world. The Federal Reserve System was founded by the U.S. Congress in 1913 to provide the nation with a safe, flexible, and stable monetary and financial system.

– 5 –

OCM GOLD FUND

Shareholder Letter – May 31, 2021 (Continued) |

Investing in the Fund involves risks including the loss of principal. Many of the companies in which the Fund invests are smaller capitalization companies, which may subject the Fund to greater risk than securities of larger, more-established companies, as smaller companies often have limited product lines, markets or financial resources, and may be subject to more-abrupt market movements. The Fund also invests in securities of gold and precious metals companies which may be subject to greater price fluctuations over short periods of time. The Fund is a non-diversified investment company meaning it will invest in fewer securities than diversified investment companies and its performance may be more volatile. The Fund contains international securities that may provide the opportunity for greater return but also have special risks associated with foreign investing including fluctuations in currency, government regulation, differences in accounting standards and liquidity.

Investor Class Performance as of May 31, 2021

OCMGX |

OCMGX |

Philadelphia |

S&P 5002 |

||

Six Months |

18.68% |

13.36% |

22.64% |

16.95% |

|

One Year |

29.76% |

23.97% |

38.13% |

40.32% |

|

3 Year Annualized |

30.43% |

28.46% |

26.59% |

18.00% |

|

5 Year Annualized |

16.87% |

15.80% |

16.25% |

17.16% |

|

10 Year Annualized |

0.48% |

0.01% |

-1.26% |

14.38% |

Advisor Class Performance as of May 31, 2021

OCMAX |

Philadelphia |

S&P 5002 |

||

Six Months |

19.03% |

22.64% |

16.95% |

|

One Year |

30.79% |

38.13% |

40.32% |

|

3 Year Annualized |

31.54% |

26.59% |

18.00% |

|

5 Year Annualized |

17.85% |

16.25% |

17.16% |

|

10 Year Annualized |

1.21% |

-1.26% |

14.38% |

The performance data quoted above represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s Total Annual Operating Expenses for the Fund’s Investor Class and Advisor

– 6 –

OCM GOLD FUND

Shareholder Letter – May 31, 2021 (Continued) |

Class are 2.29% and 1.79% respectively. Please review the Fund’s prospectus for more information regarding the Fund’s fees and expenses. For performance information current to the most recent month-end, please call toll-free 800-628-9403. The returns shown include the reinvestment of all dividends but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

1 |

The Philadelphia Gold and Silver Index (XAU) is an unmanaged capitalization-weighted index composed of 16 companies listed on U.S. exchanges involved in the gold and silver mining industry. The index is generally considered as representative of the gold and silver share market. You cannot invest directly in an index. |

|

2 |

The S&P 500 Index, a registered trademark of McGraw-Hill Co., Inc. is a market capitalization-weighted index of 500 widely held common stocks. You cannot invest directly in an index. |

– 7 –

OCM GOLD FUND

Schedule of Investments – May 31, 2021 |

| Shares | Value | |||||||

| COMMON STOCKS 96.3% | ||||||||

| Major Gold Producers 23.9% | ||||||||

| 80,000 | Agnico Eagle Mines Ltd. | $ | 5,740,000 | |||||

| 155,000 | AngloGold Ashanti Ltd. ADR | 3,684,350 | ||||||

| 200,000 | Barrick Gold Corp. | 4,816,000 | ||||||

| 75,000 | Kinross Gold Corp. | 607,500 | ||||||

| 35,000 | Kirkland Lake Gold Ltd. | 1,516,550 | ||||||

| 65,000 | Newmont Corp. | 4,776,200 | ||||||

| 21,140,600 | ||||||||

| Intermediate/Mid-Tier Gold Producers 19.7% | ||||||||

| 325,000 | Alamos Gold, Inc. | 2,967,250 | ||||||

| 300,000 | B2Gold Corp. | 1,534,641 | ||||||

| 140,000 | Endeavour Mining Corp. | 3,360,649 | ||||||

| 700,000 | IAMGOLD Corp.* | 2,534,000 | ||||||

| 50,000 | Northern Star Resources Ltd. | 440,950 | ||||||

| 700,000 | OceanaGold Corp.* | 1,483,321 | ||||||

| 25,000 | Pan American Silver Corp. | 841,000 | ||||||

| 500,000 | Resolute Mining Ltd.* | 225,486 | ||||||

| 154,840 | SSR Mining, Inc. | 2,872,282 | ||||||

| 80,000 | Torex Gold Resources, Inc.* | 1,167,453 | ||||||

| 17,427,032 | ||||||||

Junior Gold Producers 25.6% | ||||||||

| 450,000 | Argonaut Gold, Inc.* | 1,128,632 | ||||||

| 200,000 | Calibre Mining Corp.* | 349,309 | ||||||

| 250,000 | Dundee Precious Metals, Inc. | 1,823,111 | ||||||

| 150,000 | Fortuna Silver Mines, Inc.* | 1,041,718 | ||||||

| 250,000 | Galiano Gold, Inc.* | 332,500 | ||||||

| 1,399,950 | Jaguar Mining, Inc. | 7,485,868 | ||||||

| 175,000 | K92 Mining, Inc.* | 1,247,206 | ||||||

| 1,000,000 | Perseus Mining Ltd.* | 1,079,248 | ||||||

| 550,000 | Roxgold, Inc.* | 1,060,756 | ||||||

| 3,750,000 | Superior Gold, Inc.* | 2,452,198 | ||||||

| 500,000 | Wesdome Gold Mines Ltd.* | 4,610,545 | ||||||

| 22,611,091 | ||||||||

| Exploration and Development Companies 12.0% | ||||||||

| 255,128 | Adriatic Metals PLC* | $ | 503,490 | |||||

| 298,300 | Adventus Mining Corp.* | 281,485 | ||||||

| 500,000 | Ascot Resources Ltd.* | 546,312 | ||||||

| 75,000 | Augusta Gold Corp.* | 129,750 | ||||||

| 1,375,000 | Emerald Resources N.L.* | 1,044,076 | ||||||

| 1,282,000 | Euro Sun Mining, Inc.* | 435,080 | ||||||

| 200,000 | Galway Metals, Inc.* | 162,238 | ||||||

| 1,000,000 | GR Silver Mining Ltd.* | 587,700 | ||||||

| 123,880 | Integra Resources Corp.* | 395,809 | ||||||

| 775,000 | Liberty Gold Corp.* | 1,116,216 | ||||||

| 1,000,000 | Maritime Resources Corp.* | 169,688 | ||||||

| 1,000,000 | Matador Mining Ltd.* | 370,028 | ||||||

| 616,500 | Montage Gold Corp.* | 489,893 | ||||||

| 400,000 | Orca Gold, Inc.* | 208,592 | ||||||

| 500,000 | Orezone Gold Corp.* | 504,925 | ||||||

| 400,000 | Paramount Gold Nevada Corp.* | 428,000 | ||||||

| 100,000 | Prosper Gold Corp.* | 144,856 | ||||||

| 3,000,000 | Royal Road Minerals Ltd.* | 943,630 | ||||||

| 4,578,755 | RTG Mining, Inc.* | 600,053 | ||||||

| 200,000 | Sun Peak Metals Corp.* | 67,875 | ||||||

| 2,512,040 | Sutter Gold Mining, Inc.*,# | — | ||||||

| 1,210,500 | Tajiri Resources Corp.* | 95,189 | ||||||

| 1,595,000 | Thor Explorations Ltd.* | 541,304 | ||||||

| 530,000 | West Vault Mining, Inc.* | 592,252 | ||||||

| 450,000 | Westhaven Gold Corp.* | 260,740 | ||||||

| 10,619,181 | ||||||||

Royalty/Streaming Companies 8.5% | ||||||||

| 70,000 | Maverix Metals, Inc. | 402,500 | ||||||

| 300,000 | Nomad Royalty Co., Ltd. | 268,190 | ||||||

| 100,000 | Osisko Gold Royalties Ltd. | 1,430,000 | ||||||

| 75,000 | Sandstorm Gold Ltd.* | 653,250 | ||||||

| 100,000 | Wheaton Precious Metals Corp. | 4,796,788 | ||||||

| 7,550,728 | ||||||||

See notes to financial statements.

– 8 –

OCM GOLD FUND

Schedule of Investments – May 31, 2021 (Continued) |

| Shares | Value | ||||||

| Primary Silver Producers 6.6% | |||||||

| 797,000 | Aya Gold & Silver, Inc.* | $ | 4,895,075 | ||||

| 100,000 | Hecla Mining Co. | 900,000 | |||||

| 5,795,075 | |||||||

| Total Common Stocks | |||||||

| (Cost $36,864,754) | 85,143,707 | ||||||

| WARRANTS 1.4% | |||||||

| Exploration and Development Companies 0.0% | |||||||

| 641,000 | Euro Sun Mining, Inc. Exercise Price 0.55 CAD, Exp. 6/5/2023* | — | |||||

| 225,000 | Westhaven Gold Corp. Exercise Price 1.00 CAD, Exp. 3/3/2023* | 41,439 | |||||

| 41,439 | |||||||

| Primary Silver Producers 1.4% | |||||||

| 350,000 | Aya Gold & Silver, Inc. Exercise Price 3.30 CAD, Exp. 9/3/2023* | 1,193,610 | |||||

| 1,193,610 | |||||||

| Total Warrants | |||||||

| (Cost $0) | 1,235,049 | ||||||

| SHORT-TERM INVESTMENT 2.8% | |||||||

| 2,455,409 | UMB Money Market Fiduciary, 0.01% | $ | 2,455,409 | ||||

| Total Short-Term Investment | |||||||

| (Cost $2,455,409) | 2,455,409 | ||||||

| Total Investments | |||||||

| (Cost $39,320,163) | 100.5 | % | 88,834,165 | ||||

| Liabilities less Other Assets | (0.5) | % | (428,700) | ||||

| TOTAL NET ASSETS | 100.0 | % | 88,405,465 | ||||

ADR – American Depository Receipt

PLC – Public Limited Company

CAD – Canadian Dollars

|

* |

Non-income producing security. |

|

# |

Level 3 security fair valued under procedures established by the Board of Trustees, represents 0.00% of Net Assets. The total value of this security is $0. |

See notes to financial statements.

– 9 –

OCM GOLD FUND

Schedule of Investments – May 31, 2021 (Continued) |

SUMMARY OF INVESTMENTS BY COUNTRY

Country |

Value |

Percent of |

||||||

Australia |

$ | 3,159,786 | 3.5% | |||||

Canada |

67,892,847 | 76.4 | ||||||

Cayman Islands |

3,360,649 | 3.8 | ||||||

Jersey |

943,631 | 1.1 | ||||||

South Africa |

3,684,350 | 4.1 | ||||||

United Kingdom |

503,490 | 0.6 | ||||||

United States1 |

8,689,359 | 9.8 | ||||||

Virgin Islands (British) |

600,053 | 0.7 | ||||||

Total |

$ | 88,834,165 | 100.0% | |||||

|

1 |

Includes short-term investments. |

See notes to financial statements.

– 10 –

OCM GOLD FUND

Statement of Assets and Liabilities – May 31, 2021 |

Assets: |

||||

Investments in unaffiliated issuers, at value (cost $39,320,163) |

$ | 88,834,165 | ||

Interest and dividends receivable |

163,868 | |||

Receivable for fund shares sold |

54,513 | |||

Prepaid expenses and other assets |

45,838 | |||

Total assets |

89,098,384 | |||

Liabilities: |

||||

Payable for fund shares redeemed |

69,342 | |||

Accrued distribution fees |

38,601 | |||

Investment securities purchased |

450,194 | |||

Investment adviser fees |

68,743 | |||

Accrued transfer agent fees and expenses |

17,429 | |||

Accrued fund administration and accounting fees |

12,378 | |||

Accrued Trustees’ fees |

3,509 | |||

Accrued audit fees |

23,228 | |||

Accrued report to shareholders |

9,495 | |||

Total liabilities |

692,919 | |||

Net Assets |

$ | 88,405,465 | ||

Net Assets Consist of: |

||||

Shares of beneficial interest, no par value: unlimited shares authorized |

$ | 40,823,339 | ||

Total distributable earnings |

47,582,126 | |||

Net Assets |

$ | 88,405,465 | ||

Calculation of Maximum Offering Price: |

||||

Investor Class: |

||||

Net asset value and redemption price per share |

$ | 14.03 | ||

Maximum sales charge (4.50% of offering price) |

0.66 | |||

Offering price to public |

$ | 14.69 | ||

Shares outstanding |

1,491,749 | |||

Advisor Class: |

||||

Net asset value and redemption price per share |

$ | 15.79 | ||

Shares outstanding |

4,273,850 | |||

Total Shares Outstanding |

5,765,599 |

See notes to financial statements.

– 11 –

OCM GOLD FUND

Statement of Operations – Six Months Ended May 31, 2021 |

Investment Income |

||||

Interest |

$ | 125 | ||

Dividend (net of foreign withholding taxes of $76,161) |

543,754 | |||

Total investment income |

543,879 | |||

Expenses |

||||

Investment advisory fees |

374,691 | |||

Fund administration and accounting fees |

69,020 | |||

Transfer agent fees and expenses |

66,142 | |||

Distribution fees - Investor Class |

61,278 | |||

Distribution fees - Advisor Class |

45,021 | |||

Federal and state registration fees |

23,265 | |||

Custody fees |

15,334 | |||

Legal fees |

14,724 | |||

Chief Compliance Officer fees |

12,561 | |||

Reports to shareholders |

8,235 | |||

Audit fees |

7,729 | |||

Trustees’ fees |

5,109 | |||

Other expenses |

7,215 | |||

Total expenses |

710,324 | |||

Net investment loss |

(166,445 | ) | ||

Realized and Unrealized Gain on Investments: |

||||

Net realized gain on investments and foreign currency transactions |

975,071 | |||

Net change in unrealized appreciation/depreciation on investments and foreign currency translations |

12,947,145 | |||

Net gain on investments |

13,922,216 | |||

Net increase in net assets from operations |

$ | 13,755,771 |

See notes to financial statements.

– 12 –

OCM GOLD FUND

Statements of Changes in Net Assets |

Six Months Ended |

Year Ended |

|||||||

Operations: |

||||||||

Net investment loss |

$ | (166,445 | ) | $ | (703,102 | ) | ||

Net realized gain on investments and foreign currency transactions |

975,071 | 317,376 | ||||||

Net change in unrealized appreciation/depreciation on investments and foreign currency transactions |

12,947,145 | 17,186,699 | ||||||

Net increase from payment by affiliates (Note 3) |

— | 4,158 | ||||||

Net increase in net assets from operations |

13,755,771 | 16,805,131 | ||||||

Distributions Paid to Shareholders |

||||||||

Distributions: |

||||||||

Investor Class |

(192,546 | ) | (1,489,153 | ) | ||||

Advisor Class |

(884,171 | ) | (792,591 | ) | ||||

Total |

(1,076,717 | ) | (2,281,744 | ) | ||||

Fund Share Transactions |

||||||||

Investor Class: |

||||||||

Net proceeds from shares sold |

655,008 | 1,346,996 | ||||||

Distributions reinvested |

171,134 | 1,410,502 | ||||||

Payment of shares redeemed1 |

(1,382,446 | ) | (13,385,671 | ) | ||||

Net decrease in net assets from Investor Class share transactions |

(556,304 | ) | (10,628,173 | ) | ||||

Advisor Class: |

||||||||

Net proceeds from shares sold |

13,986,217 | 56,148,361 | ||||||

Distributions reinvested |

839,586 | 748,817 | ||||||

Payment of shares redeemed2 |

(12,488,746 | ) | (21,820,965 | ) | ||||

Net increase in net assets from Advisor Class share transactions |

2,337,057 | 35,076,213 | ||||||

Net increase in net assets from Fund share transactions |

1,780,753 | 24,448,040 | ||||||

Total increase in net assets |

14,459,807 | 38,971,427 | ||||||

Net Assets, Beginning of Period |

73,945,658 | 34,974,231 | ||||||

Net Assets, End of Period |

$ | 88,405,465 | $ | 73,945,658 | ||||

See notes to financial statements.

– 13 –

OCM GOLD FUND

Statements of Changes in Net Assets (Continued) |

Six Months Ended |

Year Ended |

|||||||

Transactions in shares |

|

|

||||||

Investor Class: |

|

|

||||||

Shares sold |

52,513 | 113,065 | ||||||

Shares issued on reinvestment of distributions |

13,454 | 171,177 | ||||||

Shares redeemed |

(110,429 | ) | (1,353,678 | ) | ||||

Net decrease in Investor Class shares outstanding |

(44,462 | ) | (1,069,436 | ) | ||||

Advisor Class: |

||||||||

Shares sold |

989,840 | 4,511,934 | ||||||

Shares issued on reinvestment of distributions |

58,836 | 81,305 | ||||||

Shares redeemed |

(906,640 | ) | (1,768,380 | ) | ||||

Net increase in Advisor Class shares outstanding |

142,036 | 2,824,859 | ||||||

Net Increase in Fund Shares Outstanding |

97,574 | 1,755,423 | ||||||

|

1 |

Net of redemption fees of $1,553 for the six months ended May 31, 2021 and $3,343 for the year ended November 30, 2020, respectively. |

|

2 |

Net of redemption fees of $24,903 for the six months ended May 31, 2021 and $146,148 for the year ended November 30, 2020, respectively. |

See notes to financial statements.

– 14 –

OCM GOLD FUND

Notes to Financial Statements – May 31, 2021 |

Note 1. Organization

OCM Mutual Fund (the “Trust”) is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Trust was organized as a Massachusetts business trust on January 6, 1984 and consists of the OCM Gold Fund (the “Fund”). The Fund is a non-diversified fund. The investment objective for the Fund is long-term growth of capital through investing primarily in equity securities of domestic and foreign companies engaged in activities related to gold and precious metals.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services—Investment Companies.”

Note 2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security Valuation – Portfolio securities that are listed on national securities exchanges, other than the NASDAQ Stock Market LLC, are valued at the last sale price as of the close of business of such securities exchanges, or, in the absence of recorded sales, at the average of readily available closing bid and ask prices on such exchanges. NASDAQ Global Select Market, Global Market and Capital Market securities are valued at the NASDAQ Official Closing Price (“NOCP”). If a NOCP is not issued for a given day, these securities are valued at the average of readily available closing bid and ask prices. Unlisted securities are valued at the average of the quoted bid and ask prices in the over-the-counter market. Short-term investments which mature in less than 60 days are valued at amortized cost (unless the Trust’s Board of Trustees determines that this method does not represent fair value). Short-term investments which mature after 60 days are valued at market. Securities and other assets for which market quotations are not readily available are valued at fair value as determined in good faith by the investment adviser under procedures established by and under the general supervision and responsibility of the Trust’s Board of Trustees. For each investment that is fair valued, the investment adviser considers, to the extent applicable, various factors including, but not limited to, the type of security, the financial condition of the company, comparable companies in the public market, the nature and duration of the cause for a quotation not being readily available and other relevant factors.

Fair Value Measurements and Disclosures defines fair value, establishes a framework for measuring fair value in accordance with GAAP, and expands disclosure about fair value measurements. It also provides guidance on determining when there has been a significant decrease in the volume and level of activity for an asset or a liability, when a transaction is not orderly, and how that information must be incorporated into a fair value measurement.

– 15 –

OCM GOLD FUND

Notes to Financial Statements – May 31, 2021 (Continued) |

Under Fair Value Measurements and Disclosures, various inputs are used in determining the value of the Fund’s investments. These inputs are summarized into three broad levels as described below:

|

● |

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access. |

|

● |

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

|

● |

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs to measure fair value may fall into different Levels of the fair value hierarchy. In such cases, for disclosure purposes, the Level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest Level input that is significant to the fair value measurement in its entirety.

– 16 –

OCM GOLD FUND

Notes to Financial Statements – May 31, 2021 (Continued) |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used, as of May 31, 2021, in valuing the Fund’s assets carried at fair value:

Sector |

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||

Common Stocks |

||||||||||||||||

Major Gold Producers |

$ | 21,140,600 | $ | — | $ | — | $ | 21,140,600 | ||||||||

Intermediate/Mid-Tier Gold Producers |

17,427,032 | — | — | 17,427,032 | ||||||||||||

Junior Gold Producers |

22,611,091 | — | — | 26,611,091 | ||||||||||||

Exploration and Development Companies |

10,619,181 | — | — | 10,619,181 | ||||||||||||

Royalty/Streaming Companies |

7,550,728 | — | — | 7,550,728 | ||||||||||||

Primary Silver Producers |

5,795,075 | — | — | 5,795,075 | ||||||||||||

Warrants |

— | 1,235,049 | — | 1,235,049 | ||||||||||||

Short-Term Investment |

2,455,409 | — | — | 2,455,409 | ||||||||||||

Total |

$ | 87,599,116 | $ | 1,235,049 | $ | — | $ | 88,834,165 | ||||||||

The Fund held three Level 2 securities at May 31, 2021. Euro Sun Mining, Inc., Westhaven Gold Corp. and Aya Gold & Silver, Inc., all Warrants, are being valued at intrinsic value, in accordance with procedures established by and under the general supervision of the Trust’s Board of Trustees. The Fund held one Level 3 security at May 31, 2021. Sutter Gold Mining, Inc. (“SGM CN”) has ceased operations and a receiver for the company’s assets has been appointed. The common shares of SGM CN will be valued at zero, in accordance with procedures established by and under the general supervision of the Trust’s Board of Trustees, until such time as the receiver has finalized the sale of the company’s assets.

There was no Level 3 activity during the six months ended May 30, 2021 and did not warrant a Level 3 rollforward disclosure.

The Level 3 investments for the Fund represented 0.00% of net assets and did not warrant a disclosure of significant unobservable valuation inputs.

– 17 –

OCM GOLD FUND

Notes to Financial Statements – May 31, 2021 (Continued) |

Foreign Currency – Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations for the six months ended May 31, 2021 are included within the realized and unrealized gain/loss on investments section of the Statement of Operations.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair value of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates. Such fluctuations for the six months ended May 31, 2021 are included within the realized and unrealized gain/loss on investments section of the Statement of Operations.

Federal Income Taxes – The Fund intends to comply with the requirements of the Internal Revenue Code necessary to qualify as a regulated investment company and to make the requisite distributions of income to its shareholders to relieve it from all or substantially all federal income taxes. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding on the applicable county’s tax rules and rate.

Accounting for Uncertainty in Income Taxes (“Income Tax Statement”) requires an evaluation of tax positions taken (or expected to be taken) in the course of preparing the Fund’s tax returns to determine whether these positions meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on the Statement of Operations. As of May 31, 2021, the Fund did not have any interest or penalties associated with the underpayment of any income taxes.

The Income Tax Statement requires management of the Fund to analyze all open tax years, fiscal years 2018-2021 as defined by the Internal Revenue Service statute of limitations for all major jurisdictions, including federal tax authorities and certain state tax authorities. As of and during the six months ended May 31, 2021, the Fund did not have a liability for any unrecognized tax benefits. The Fund has no examinations in progress and is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

– 18 –

OCM GOLD FUND

Notes to Financial Statements – May 31, 2021 (Continued) |

Share Classes – The Fund offers two classes of shares, Investor Class and Advisor Class. The outstanding shares of the Fund on April 1, 2010 were renamed “Investor Class shares.” The Advisor Class shares commenced operations on April 1, 2010. The two classes represent interests in the same portfolio of investments and have the same rights. Income, expenses (other than expenses attributable to a specific class) and realized and unrealized gains and losses on investments are allocated to each class of shares in proportion to their relative net assets.

Securities Transactions and Investment Income – Securities transactions are accounted for on a trade date basis. Realized gains and losses on sales of securities are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Distributions to Shareholders – The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense or gain items for financial statement and tax purposes. To the extent that these differences are attributable to permanent book and tax accounting differences, the components of net assets have been adjusted.

Redemption Fee – A 1.50% redemption fee is retained by the Fund to offset transaction costs and other expenses associated with short-term investing. The fee is imposed on redemptions or exchanges of shares held less than three months from their purchase date. The Fund records the fee as a reduction of shares redeemed and as a credit to shares of beneficial interest. For the six months ended May 31, 2021, the Investor Class and the Advisor Class received $1,553 and $24,903 in redemption fees, respectively.

Guarantees and Indemnifications – In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. Also, under the Fund’s organizational documents, its officers and Trustees are indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. The Fund notes that insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to trustees and officers, the Fund has been advised that in the opinion of the Securities and Exchange Commission (the “SEC”) such indemnification is against public policy as expressed in that Act and is, therefore, unenforceable. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund expects the risk of loss to be remote.

– 19 –

OCM GOLD FUND

Notes to Financial Statements – May 31, 2021 (Continued) |

Use of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Derivative Instruments – Equity securities in the gold mining industry, particularly the smaller companies, may occasionally issue warrants as part of their capital structure. A warrant gives the holder the right to purchase the underlying equity at the exercise price until the expiration date of the warrant. The Fund may hold such warrants for exposure to smaller companies in the portfolio or other reasons associated with the Fund’s overall objective of long-term growth, though warrants will typically not be a significant part of the Fund’s portfolio. The Fund’s maximum risk in holding warrants is the loss of the entire amount paid for the warrants. At May 31, 2021, the Fund held warrants as listed on the Schedule of Investments.

Note 3. Investment Advisory Agreement and Affiliated Parties

The Fund has an investment advisory agreement with Orrell Capital Management, Inc. (“OCM” or the “Adviser”). Under the agreement, the Fund pays OCM a fee computed daily and payable monthly, at the following annual rates based upon average daily net assets:

Assets |

Fee Rate |

$0 to $250 million |

0.950% |

$250 million to $500 million |

0.800% |

$500 million to $1 billion |

0.700% |

Over $1 billion |

0.600% |

Under the investment advisory agreement, the Adviser is responsible for reimbursing the Fund to maintain a voluntary ratio of expenses to average daily net assets for the Investor Class shares and Advisor Class shares at 2.99% and 2.49%, respectively.

The Fund does not compensate Trustees and Officers affiliated with OCM. For the six months ended May 31, 2021, the expenses accrued for Trustees who are not affiliated with OCM are reported on the Statement of Operations. The Fund pays fees and related expenses for the services of the Fund’s Chief Compliance Officer. The expenses incurred for the Chief Compliance Officer are reported on the Statement of Operations.

– 20 –

OCM GOLD FUND

Notes to Financial Statements – May 31, 2021 (Continued) |

Affiliates reimbursed the Fund $4,158 for losses on a trading error by the Adviser during the year ended November 30, 2020. This amount is reported on the Fund’s Statement of Changes in Net Assets. This reimbursement had no impact to the Fund’s net asset value per share or total return.

Note 4. Distribution Agreement and Plan

The Trust has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended. The Plan authorizes the Fund to reimburse the distributor for marketing expenses incurred in distributing shares of the Fund, including the cost of printing sales material and making payments to dealers of the Fund’s Investor Class and Advisor Class, in any fiscal year, subject to limits of 0.99% and 0.25%, respectively, of the average daily net assets of each respective class. For the six months ended May 31, 2021, the Investor Class and the Advisor Class incurred $61,278 and $45,021, respectively, in expenses under the Plan.

Note 5. Purchases and Sales of Securities

Purchases and sales of investment securities (excluding short-term securities and U.S. government obligations) for the six months ended May 31, 2021 were $4,788,714 and $2,898,665, respectively. There were no purchases or sales of U.S. government obligations.

Note 6. Federal Income Tax Information

At May 31, 2021, gross unrealized appreciation and depreciation of investments owned by the Fund, based on cost for federal income tax purposes were as follows:

Cost of investments |

$ | 42,140,357 | ||

Unrealized appreciation on investments |

$ | 48,300,864 | ||

Unrealized depreciation on investments |

(1,607,056 | ) | ||

Net unrealized appreciation on investments |

$ | 46,693,808 |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to investments in passive foreign investment companies (“PFICs”).

– 21 –

OCM GOLD FUND

Notes to Financial Statements – May 31, 2021 (Continued) |

The tax character of distributions paid during the fiscal years ended November 30, 2020 and 2019 was as follows:

2020 |

2019 |

|||||||

Ordinary income |

$ | — | $ | — | ||||

Net long-term capital gains |

2,281,744 | 5,446,488 | ||||||

Total distributions |

$ | 2,281,744 | $ | 5,446,488 | ||||

As of November 30, 2020 the components of accumulated earnings on a tax basis were as follows:

Undistributed ordinary income |

$ | 186,726 | ||

Undistributed long-term gains |

102,676 | |||

Tax accumulated earnings |

289,402 | |||

Accumulated capital and other losses |

— | |||

Unrealized appreciation on investments |

34,612,768 | |||

Unrealized appreciation on foreign currency |

902 | |||

Total accumulated earnings |

$ | 34,903,072 |

Note 7. Concentration of Risk

Investing in foreign securities involves certain risks not necessarily found in U.S. markets. These include risks associated with adverse changes in economic, political, regulatory and other conditions, changes in currency exchange rates, exchange control regulations, expropriation of assets or nationalization, imposition of withholding taxes on dividend or interest payments or capital gains, and possible difficulty in obtaining and enforcing judgments against foreign entities. Further, issuers of foreign securities are subject to different, and often less comprehensive, accounting, reporting, and disclosure requirements than domestic issuers.

As the Fund concentrates its investments in the gold mining industry, a development adversely affecting the industry (for example, changes in the mining laws which increases production costs or a significant decrease in the market price of gold) would have a greater adverse effect on the Fund than it would if the Fund invested in a number of different industries.

– 22 –

OCM GOLD FUND

Notes to Financial Statements – May 31, 2021 (Continued) |

Note 8. Illiquid Securities

Pursuant to Rule 22e-4 under the 1940 Act, the Fund has adopted a Liquidity Risk Management Program (“LRMP”) that requires, among other things, that the Fund limits its illiquid investments that are assets to no more than 15% of net assets. An illiquid investment is any security which may not reasonably be expected to be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. If the Advisor, at any time, determines that the value of illiquid securities held by the Fund exceeds 15% of its net asset value, the Advisor will take such steps as it considers appropriate to reduce them as soon as reasonably practicable in accordance with the Fund’s written LRMP.

Note 9. COVID-19 Pandemic

In early 2020, an outbreak of a novel strain of coronavirus (COVID-19) emerged globally. This coronavirus has resulted in closing international borders, enhanced health screenings, healthcare service preparation and delivery, quarantines, cancellations, disruptions to supply chains and customer activity, as well as general public concern and uncertainty. The impact of this outbreak has negatively affected the worldwide economy, as well as the economies of individual countries, the financial health of individual companies and the market in general in significant and unforeseen ways. The future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to the Fund, including political, social and economic risks. Any such impact could adversely affect the Fund’s performance, the performance of the securities in which the Fund invests and may lead to losses on your investment in the Fund. The ultimate impact of COVID-19 on the financial performance of the Fund’s investments is not reasonably estimable at this time.

Note 10. Subsequent Events

Management has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. Management has determined there are no material events that would require disclosure in the Fund’s financial statements through this date.

– 23 –

OCM GOLD FUND

Financial Highlights Investor Class |

Six Months |

Year |

Year |

Year |

Year |

Year |

|||||||||||||||||||

Per Share Operating Performance |

||||||||||||||||||||||||

(For a share outstanding throughout each period) |

||||||||||||||||||||||||

Net asset value, beginning of period |

$ | 11.94 | $ | 8.62 | $ | 7.05 | $ | 9.26 | $ | 11.12 | $ | 7.19 | ||||||||||||

Income from Investment Operations: |

||||||||||||||||||||||||

Net investment loss1 |

(0.05 | ) | (0.16 | ) | (0.14 | ) | (0.19 | ) | (0.21 | ) | (0.24 | ) | ||||||||||||

Net realized and unrealized gain (loss) on investments and foreign currency transactions |

2.27 | 4.05 | 3.37 | (1.36 | ) | 0.10 | 4.17 | |||||||||||||||||

Net increase from payments by affiliates (Note 3) |

— | — | 2 | — | — | — | — | |||||||||||||||||

Total from investment operations |

2.22 | 3.89 | 3.23 | (1.55 | ) | (0.11 | ) | 3.93 | ||||||||||||||||

Less Distributions: |

||||||||||||||||||||||||

Dividends from net investment income |

(0.08 | ) | — | — | — | — | — | |||||||||||||||||

Distribution from net realized gains |

(0.05 | ) | (0.57 | ) | (1.66 | ) | (0.66 | ) | (1.75 | ) | — | 2 | ||||||||||||

Total distributions |

(0.13 | ) | (0.57 | ) | (1.66 | ) | (0.66 | ) | (1.75 | ) | — | 2 | ||||||||||||

Redemption fee proceeds |

— | 2 | — | 2 | — | 2 | — | 2 | — | 2 | — | 2 | ||||||||||||

Net asset value, end of period |

$ | 14.03 | $ | 11.94 | $ | 8.62 | $ | 7.05 | $ | 9.26 | $ | 11.12 | ||||||||||||

Total return |

18.68 | %3 | 48.15 | % | 56.65 | % | (18.24 | )% | 0.94 | % | 54.74 | % | ||||||||||||

Ratios/Supplemental Data: |

||||||||||||||||||||||||

Net assets, end of year (in 000’s) |

$ | 20,936 | $ | 18,343 | $ | 22,467 | $ | 17,146 | $ | 30,492 | $ | 33,841 | ||||||||||||

Ratio of expenses to average net assets |

2.18 | %4 | 2.29 | % | 2.91 | % | 2.93 | % | 2.78 | % | 2.66 | % | ||||||||||||

Ratio of net investment loss to average net assets |

(0.80 | )%4 | (1.53 | )% | (1.89 | )% | (2.27 | )% | (2.17 | )% | (2.07 | )% | ||||||||||||

Portfolio turnover rate |

4 | %3 | 1 | % | 18 | % | 6 | % | 10 | % | 11 | % | ||||||||||||

| 1

|

Based on average shares method. |

|

2 |

Amount represents less than $0.01 per share. |

|

3 |

Not annualized. |

|

4 |

Annualized. |

See notes to financial statements.

– 24 –

OCM GOLD FUND

Financial Highlights Advisor Class |

Six Months |

Year |

Year |

Year |

Year |

Year |

|||||||||||||||||||

Per Share Operating Performance |

||||||||||||||||||||||||

(For a share outstanding throughout each period) |

||||||||||||||||||||||||

Net asset value, beginning of period |

$ | 13.46 | $ | 9.57 | $ | 7.58 | $ | 9.86 | $ | 11.63 | $ | 7.46 | ||||||||||||

Income from Investment Operations: |

||||||||||||||||||||||||

Net investment loss1 |

(0.02 | ) | (0.13 | ) | (0.11 | ) | (0.15 | ) | (0.15 | ) | (0.18 | ) | ||||||||||||

Net realized and unrealized gain (loss) on investments and foreign currency transactions |

2.55 | 4.54 | 3.71 | (1.47 | ) | 0.12 | 4.31 | |||||||||||||||||

Net increase from payments by affiliates (Note 3) |

— | — | 2 | — | — | — | — | |||||||||||||||||

Total from investment operations |

2.53 | 4.41 | 3.60 | (1.62 | ) | (0.03 | ) | 4.13 | ||||||||||||||||

Less Distributions: |

||||||||||||||||||||||||

Dividends from net investment income |

(0.16 | ) | — | — | — | — | — | |||||||||||||||||

Distribution from net realized gains |

(0.05 | ) | (0.57 | ) | (1.66 | ) | (0.66 | ) | (1.75 | ) | — | 2 | ||||||||||||

Total distributions |

(0.21 | ) | (0.57 | ) | (1.66 | ) | (0.66 | ) | (1.75 | ) | — | 2 | ||||||||||||

Redemption fee proceeds |

0.01 | 0.05 | 0.05 | — | 2 | 0.01 | 0.04 | |||||||||||||||||

Net asset value, end of period |

$ | 15.79 | $ | 13.46 | $ | 9.57 | $ | 7.58 | $ | 9.86 | $ | 11.63 | ||||||||||||

Total return |

19.03 | %3 | 49.40 | % | 58.54 | %4 | (17.81 | )%4 | 1.81 | % | 55.98 | % | ||||||||||||

Ratios/Supplemental Data: |

||||||||||||||||||||||||

Net assets, end of year (in 000’s) |

$ | 67,470 | $ | 55,603 | $ | 12,507 | $ | 6,624 | $ | 7,106 | $ | 9,467 | ||||||||||||

Ratio of expenses to average net assets |

1.68 | %5 | 1.79 | % | 2.38 | % | 2.31 | % | 2.05 | % | 2.03 | % | ||||||||||||

Ratio of net investment loss to average net assets |

(0.30 | )%5 | (1.03 | )% | (1.36 | )% | (1.65 | )% | (1.44 | )% | (1.44 | )% | ||||||||||||

Portfolio turnover rate |

4 | %3 | 1 | % | 18 | % | 6 | % | 10 | % | 11 | % | ||||||||||||

|

1 |

Based on average shares method. |

|

2 |

Amount represents less than $0.01 per share. |

|

3 |

Not annualized. |

|

4 |

Total returns would have been higher/lower had expenses not been waived/recovered by the Adviser. |

|

5 |

Annualized. |

See notes to financial statements.

– 25 –

OCM GOLD FUND

Expense Example – For the Period Ended May 31, 2021 |

As a shareholder of the OCM Gold Fund (the “Fund”), you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees on certain redemptions; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from December 1, 2020 to May 31, 2021 (the “period”).

Actual Expenses

The row titled “Actual” in the table below provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 equals 8.6), then multiply the result by the number in the appropriate line for your share class under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the periods.

Hypothetical Example for Comparison Purposes

The row titled “Hypothetical” in the table below provides information about hypothetical account values and hypothetical expenses based on each class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the classes of the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the hypothetical lines of the table are useful in comparing the ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

– 26 –

OCM GOLD FUND

Expense Example – For the Period Ended May 31, 2021 (Continued) |

Expenses Paid During the Period

Beginning |

Ending |

Expenses Paid |

|

Investor Class |

|||

Actual |

$ 1,000.00 |

$ 1,186.80 |

$ 11.89 |

Hypothetical (5% return before expenses) |

1,000.00 |

1,014.06 |

10.95 |

Advisor Class |

|||

Actual |

1,000.00 |

1,190.30 |

9.18 |

Hypothetical (5% return before expenses) |

1,000.00 |

1,016.55 |

8.45 |

|

* |

Expenses are equal to the Investor Class’ and Advisor Class’ annualized expense ratios of 2.18% and 1.68%, respectively, for the period, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

– 27 –

OCM GOLD FUND

Other Information |

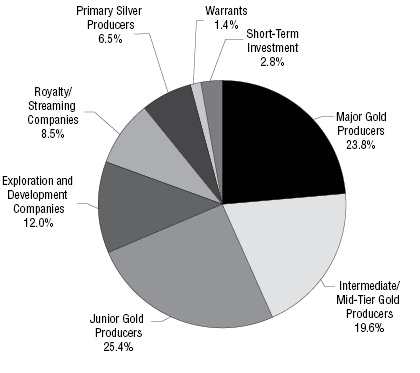

Investments by Sector – As of May 31, 2021

As a Percentage of Total Investments

The Fund files a complete schedule of their portfolio holdings with the U.S. Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-PORT within 60 days of the end of such fiscal quarter. Shareholders may obtain the Fund’s Form N-PORT on the SEC’s website at www.sec.gov.

A description of the Fund’s proxy voting policies and procedures and a record of the Fund’s proxy votes for the year ended June 30, 2020 are available without charge, upon request by calling toll free 1-800-779-4681 and on the SEC’s website at http://www.sec.gov. The Fund’s proxy voting policies and procedures are also available on the Fund’s website at http://www.ocmgoldfund.com.

– 28 –

THIS PAGE INTENTIONALLY LEFT BLANK

OCM Gold Fund

Distributed by:

Northern Lights Distributors, LLC

17605 Wright Street

Omaha, NE 68130

6425-NLD-07/26/2021

Item 2. Code of Ethics.

Not applicable to semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable to semi-annual reports.

Item 4. Principal Accountant Fees and Services

Not applicable to semi-annual reports.

Item 5. Audit Committee of Listed Registrants

| (a) | Not applicable to semi-annual reports. |

| (b) | Not applicable. |

Item 6. Schedule of Investments

| (a) | The schedules of investments in securities in unaffiliated issuers are included as part of the reports to shareholders filed under Item 1. |

| (b) | Not applicable. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 10. Submissions of Matters to a Vote of Security Holders

As of the end of the period covered by this report, the registrant had not adopted any procedures by which shareholders may recommend nominees to the registrant’s Board of Directors.

Item 11. Controls and Procedures.

| (a) | The registrant's certifying officer has concluded that the registrant's disclosure controls and procedures (as defined in Rule 30a-2 under the Investment Company Act of 1940 (the "Act")) are effective in design and operation and are sufficient to form the basis of the certifications required by Rule 30a-2 under the Act, based on their evaluation of these disclosure controls and procedures within 90 days of the filing date of this report on Form N-CSR. |

(b) Not applicable.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 13. Exhibits.

(a)(1) Code of Ethics – Not applicable.

(a)(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(a)(4) Change in the registrant’s independent public accountant – Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

OCM Mutual Fund

| By: | /s/ Gregory M. Orrell | |

| Gregory M. Orrell | ||

| President |

Date: July 30, 2021

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Gregory M. Orrell | |

| Gregory M. Orrell | ||

| President and Treasurer |

Date: July 30, 2021