Jason Duffy Vice President |

Insurance & Risk Management FMR LLC 88 Black Falcon, First Floor, East Side, STE 167, V7E, Boston, MA, 02210 Phone: 617-563-9480 jason.duffy@fmr.com |

May 03, 2023

U.S. Securities and Exchange Commission

Judiciary Plaza

450 Fifth Street, NW

Washington, DC 20543

RE: |

Fidelity Investments Mutual Funds (FMR LLC) Rule 17g Compliance Filing Fidelity Bond Coverage Period: July 1, 2022 – July 1, 2023 |

To Whom It May Concern:

We submit the following excess bond policies on behalf of Fidelity Investments Mutual Funds for $50,000,000 excess of $100,000,000 in coverage:

Everest Reinsurance Company

Policy No: FL5FD00012-211 (Equity and High Income Funds) Policy No: FL5FD00135-211 (Fixed Income & Asset Allocation Funds) Participation: $7M part of $50M x $100M

XL Specialty Insurance Company

Policy No: ELU183617-22 (Equity and High Income Funds)

Policy No: ELU1-183647-22 (Fixed Income & Asset Allocation Funds) Participation: $5M part of $50M x $100M

Ironshore Insurance Services

Policy No: FI4NAB095D003 (Equity and High Income Funds) Policy No: FI4NAB095H003 (Fixed Income & Asset Allocation Funds) Participation: $5M part of $50M x $100M

Freedom Specialty Insurance Company

Policy No: XJO2208785 (Equity and High Income Funds)

Policy No: XJO2208786 (Fixed Income & Asset Allocation Funds)

Participation: $10M part of $50M x $100M

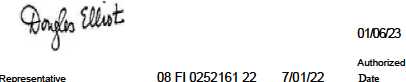

Twin City Fire Insurance Co. (The Hartford)

Policy No: 08 FI 0252161-22 (Equity and High Income Funds) Policy No: 08 FI 0252157-22 (Fixed Income & Asset Allocation Funds) Participation: $10M part of $50M x $100M

Houston Casualty Company

Policy No: 24-MGU-22-A54574 (Equity and High Income Funds) Policy No: 24-MGU-22-A54576 (Fixed Income & Asset Allocation Funds) Participation: $8M part of $50M x $100M

London: Mosaic Syndicate 1609

Policy No: B080113016P22 (Equity and High Income Funds) Policy No: B080113012P22 (Fixed Income & Asset Allocation Funds) Participation: $5M part of $50M x $100M

The lead bond insurance policy, statement confirming payment of premiums, resolution of a majority of independent trustees approving coverage, joint insured bond statement and the Fidelity Bond Insurance Recovery Agreement have been submitted. The accession number is 0000880195-22-000023.

Sincerely,

Jason R. Duffy

Enc.

IRONSHORE INDEMNITY INC.

(A Stock Company)

175 Berkeley Street

Boston, MA 02116

Toll Free: (877) IRON411

This Policy is issued by the stock insurance company listed above (herein "Insurer").

EXCESS LIABILITY INSURANCE POLICY DECLARATIONS

UNLESS OTHERWISE PROVIDED IN THE FOLLOWED POLICY, THIS POLICY IS A CLAIMS MADE POLICY WHICH COVERS ONLY

CLAIMS FIRST MADE AGAINST THE INSUREDS DURING THE POLICY PERIOD. PLEASE READ THIS POLICY CAREFULLY.

Policy No. FI4NAB095D003

ITEM 1. INSURED COMPANY PRINCIPAL ADDRESS:

| Fidelity Equity & High Income Funds | |||

| c/o FMR LLC 88 Black Falcon First Floor, | |||

| East Side, Suite 167 | |||

| ITEM 2. | COVERAGE PROVIDED: | Excess Fidelity Insurance Binder | |

| ITEM 3. | FOLLOWED POLICY: | FMR Funds Concentric Custom Bond | |

| INSURER: | Berkshire Hathaway Specialty Insurance Company | ||

| POLICY NUMBER: | 47-EPF-315882-02 | ||

| ITEM 4. | POLICY PERIOD: | ||

| From July 01, 2022 12:01 A.M. To July 01, 2023 12:01 A.M. | |||

| (Local time at the address shown in ITEM 1.) | |||

| ITEM 5. | |||

| Premium: | Plus all applicable Taxes, Fees and Surcharges. | ||

| Premium: | $ | 13,503.00 | |

| ---------------------- | - | ---------------- | |

| Total Amount Due: | $ | 13,503.00 | |

| See Invoice for the date Premium is due and payable. Failure to pay the | |||

| premium in full may result in voidance of coverage. | |||

| ITEM 6. | LIMIT OF LIABILITY/AGGREGATE LIMIT: $5,000,000 for all Loss under all Coverages combined. | ||

Form: EXC.003; Edited (03.14.08)

Page 1 of 3

ITEM 7. UNDERLYING POLICY LIMITS/ATTACHMENT POINT: $100,000,000

ITEM 8. PENDING & PRIOR LITIGATION DATE: N/A

ITEM 9. NOTICE TO INSURER:

| A. | Notice of Claim, Wrongful Act or Loss: |

| Send to Company Indicated Above c/o Ironshore Insurance Services, LLC 28 Liberty Street 5th Floor New York, NY 10005 | |

| B. | All other notices: |

| Send to Company Indicated Above c/o Ironshore Insurance Services, LLC 28 Liberty Street 5th Floor New York, NY 10005 |

ITEM 10. BROKER:

Mary Coughlin

WILLIS TOWERS WATSON NORTHEAST INC

Three Copley Place 100 Huntington Avenue

800 Boylston Street SUITE NO 300

Boston, MA 02116

LICENSE #: N/A

ITEM 11. FORMS AND ENDORSEMENTS:

1. ADM-OFAC-0419 - Sanction Limitation and Exclusion Clause 2. IRON.END.ALL.016 (0419) Insurer Address Change 3. EDO.008 (708) Quota Share Amendment of Declarations (Excess) 4. EXC.END.049 (0913) Tie-In Limits

THESE DECLARATIONS, TOGETHER WITH THE COMPLETED AND SIGNED APPLICATION, FOR THIS POLICY AND THE FOLLOWED POLICY, INCLUDING INFORMATION FURNISHED IN CONNECTION THEREWITH WHETHER DIRECTLY OR THROUGH PUBLIC FILING, AND THE POLICY FORM ATTACHED HERETO, CONSTITUTE THE INSURANCE POLICY.

Form: EXC.003; Edited (03.14.08)

Page 2 of 3

Ironshore Indemnity Inc. by:

Form: EXC.003; Edited (03.14.08)

Page 3 of 3

IRONSHORE INDEMNITY INC.

(A Stock Company)

175 Berkeley Street

Boston, MA 02116

Toll Free: (877) IRON411

Policy Number: FI4NAB095D003

EXCESS LIABILITY INSURANCE POLICY

| I. | INSURING AGREEMENT | |

| In | consideration of the payment of the premium and in reliance upon all statements made in the application for this | |

| Policy | and the Followed Policy, including the information furnished in connection therewith, whether directly or through | |

| public | filing, and subject to all terms, definitions, conditions, exclusions and limitations of this policy, the Insurer agrees | |

| to | provide insurance coverage to the Insureds in accordance with the terms, definitions, conditions, exclusions and | |

| limitations | of the Followed Policy, except as may be otherwise provided in this Policy. | |

| II. | LOSS PAYABLE PROVISION | |

| It | is agreed the Insurer shall pay the Insured as defined in the Followed Policy for Loss by reason of exhaustion by | |

| payments | of all Underlying Policy Limits of all underlying policies by the underlying insurers issuing such underlying | |

| policies | and/or the Insureds, subject to i) the terms and conditions of the Followed Policy as that form is submitted to | |

| the | Insurer; ii) the Limit of Liability as stated in Item 6 of the Declarations; and iii) the terms and conditions of, and the | |

| endorsements | attached to, this Policy. In no event shall this policy grant broader coverage than would be provided by | |

| the | Followed Policy. | |

| III. | DEFINITIONS | |

| A. | The Terms “Insurer” and “Followed Policy” shall have the meanings attributed to them in the Declarations. | |

| B. | The term "Insureds” means those individuals and entities insured by the Followed Policy. | |

| C. | The term "Policy Period" means the period set forth in Item 4 of the Declarations. | |

| D. | The term "Underlying Policy Limits/Attachment Point" means an amount equal to the aggregate of all limits of liability as set forth in Item 7 of the Declarations for all Underlying Policies, plus the uninsured retention, if any, applicable to the Underlying Policies. | |

| IV. | POLICY TERMS | |

| A. | This policy is subject to the same representations contained in the Application for the Followed Policy and has the same terms, definitions, conditions, exclusions and limitations (except as regards the premium, the limits of liability, the policy period and as may be otherwise in this Policy) as are contained in the Followed Policy. | |

| B. | If during the Policy Period or any Discovery Period the terms, conditions, exclusions or limitations of the Followed Policy are changed in any manner, the Insureds shall as a condition precedent to their rights to coverage under this policy give to the Insurer written notice of the full particulars thereof and secure the Insurers affirmative consent to such modification before coverage will be effective. | |

Form: EXC.004; Edited (07.12.07)

Page 1 of 2

| C. | As a condition precedent to their rights under this policy, the Insureds shall give to the Insurer as soon as practicable written notice in accordance with the terms, conditions, definitions, exclusions and limitations of the Followed Policy. |

| D. | Notwithstanding any of the terms of this policy which might be construed otherwise, this policy shall drop down only in the event of reduction or exhaustion of the Underlying Limit and shall not drop down for any other reason including, but not limited to, uncollectibility (in whole or in part) of any Underlying Limits. The risk of uncollectibility of such Underlying Limits (in whole or in part) whether because of financial impairment or insolvency of an underlying insurer or for any other reason, is expressly retained by the Insureds and is not in any way or under any circumstances insured or assumed by the carrier. |

Ironshore Indemnity Inc. by:

Form: EXC.004; Edited (07.12.07)

Page 2 of 2

IRONSHORE INDEMNITY INC.

(A Stock Company)

175 Berkeley Street

Boston, MA 02116

Toll Free: (877) IRON411

| Endorsement # 1 | |

| Policy Number: FI4NAB095D003 | Effective Date of Endorsement: July 01, 2022 |

| Insured Name: Fidelity Equity & High Income Funds | |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

SANCTION LIMITATION AND EXCLUSION CLAUSE

No Insurer shall be deemed to provide cover and no Insurer shall be liable to pay any claim or provide any benefit hereunder to the extent that the provision of such cover, payment of such claim or provision of such benefit would expose that Insurer to any sanction, prohibition or restriction under United Nations resolutions or the trade or economic sanctions, laws or regulations of the European Union, United Kingdom or United States of America.

ALL OTHER TERMS, CONDITIONS AND EXCLUSIONS OF THIS POLICY REMAIN UNCHANGED.

ADM-OFAC-0419

Page 1 of 1

IRONSHORE INDEMNITY INC.

(A Stock Company)

175 Berkeley Street

Boston, MA 02116

Toll Free: (877) IRON411

| Endorsement # 2 | |

| Policy Number: FI4NAB095D003 | Effective Date of Endorsement: July 01, 2022 |

| Insured Name: Fidelity Equity & High Income Funds | |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

INSURER ADDRESS CHANGE

It is hereby understood and agreed that the street address of the Insurer’s main administrative office and mailing address is changed to:

175 Berkeley Street

Boston, MA 02116

The street address for the Representative of the Insurer and Notice of Claim reporting is changed to: c/o Ironshore Insurance Services LLC.

28 Liberty Street, 5th Floor

New York, NY 10005

The street address for the Service of Process/Suit provision in this policy is changed to: 175 Berkeley Street Boston, MA 02116

For the purposes of this endorsement:

| 1. | “Insurer” means the “Insurer”, “Underwriter” or “Company” or other name specifically ascribed in this policy as the insurance company or underwriter for this policy. |

| 2. | “Notice of Claim reporting” means any “notice of claim/circumstance”, “notice of loss”, “notice of wrongful act”, or other such reference in the policy designated for the reporting of claims, loss, acts, occurrences or situations that may give rise or result in loss under this policy. |

| 3. | “Policy” means the policy, bond or other insurance product to which this endorsement is added. |

ALL OTHER TERMS, CONDITIONS AND EXCLUSIONS OF THIS POLICY REMAIN UNCHANGED.

IRON.END.ALL.016 (0419)

Page 1 of 1

IRONSHORE INDEMNITY INC.

(A Stock Company)

175 Berkeley Street

Boston, MA 02116

Toll Free: (877) IRON411

| Endorsement # 3 | |

| Policy Number: FI4NAB095D003 | Effective Date of Endorsement: July 01, 2022 |

| Insured Name: Fidelity Equity & High Income Funds | |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

QUOTA SHARE AMENDMENT OF DECLARATIONS (EXCESS)

In consideration of the premium charged, it is hereby understood and agreed that:

| 1. | Item 6. of the Declarations is deleted and replaced by the following: |

Item 6. Aggregate Quota Share Layer Limit of Liability: $50,000,000

Maximum aggregate Limit of Liability for all Claims made during the Policy Period.

Subject to all of its terms and conditions, this Policy shall provide coverage for Claims in excess of the Underlying Insurance, up to the Insurer’s quota share participation of the aggregate maximum limit stated above. Any Loss within the Aggregate Quota Share Layer Limit of Liability stated above shall be paid pro rata by each of the insurers subscribing to this Aggregate Quota Share Layer Limit of Liability in accordance with the proportion set forth in the Participation Agreement entered into by each such insurer. The participation of such insurers is set forth below in Item 7. of the Declarations. The obligations of such insurers who subscribe to the quota share arrangement are several and not joint, and are limited to the extent of their individual subscriptions. No subscribing insurers is responsible for the obligation of any co-subscribing insurer.

The Insurer's participation is set forth at Item 12. of the Declarations. The Insurer has full claims and underwriting control of its portion of the quota share arrangement and no action or omission by any of the co-subscribing insurers shall bind the Insurer or be deemed a waiver of any coverage defense the Insurer has under this Policy or available at law. The Insurer shall act on its own behalf with respect to all other matters concerning this Policy, and no other insurer subscribing to the Policy may act on behalf of or bind the Insurer with respect to the Policy terms or any matter concerning the Policy. All notices by an Insured to the Insurer under this Policy shall be provided to the Insurer at the address specified in the Declarations.

2. The Declarations are amended by the addition of the following:

Item 12.

Insurer's Quota-Share Participation: 10%

EDO.008 (7/08)

Page 1 of 2

Insurer's Limit of Liability:

$5,000,000

The Insurer agrees to pay on behalf of the Insured under the Policy that proportion of covered Loss set forth above in the manner provided under Item 3. of the Declarations and in full conformance with all the terms and conditions of the Policy.

| 3. Ite | m 7. of the Declarations is amended by adding the following: | |||

| Quota Share Layer Attachment Point: | $ | 100,000,000 | ||

| Quota Share Participant | Policy Number | Limit of Liability | ||

| National Casualty Company | XJO2208785 | $10,000,000 part of $50,000,000 | ||

| Twin City Fire Insurance Company | 08 FI 0252161 -22 | $10,000,000 part of $50,000,000 | ||

| Tokio Marine HCC | 24-MGU-22-A54576 | $8,000,000 part of $50,000,000 | ||

| Everest Reinsurance Company | FL5FD00012-221 | $7,000,000 part of $50,000,000 | ||

| Lloyd’s America, Inc. | 13016 | P22 | $5,000,000 part of $50,000,000 | |

| XL Specialty Insurance Company | ELU183647-22 | $5,000,000 part of $50,000,000 | ||

| Ironshore Indemnity Inc. | FI4NAB095D003 | $5,000,000 part of $50,000,000 | ||

| 4. | Item 5. of the Declarations is deleted and replaced by the following: |

| Item 5. | Total Quota Share Layer Premium: | $ | 156,528 |

| Insurer's Quota-Share Participation Premium: | $ | 13,503 |

The Total Quota Share Layer Premium is payable pro rata to each of the insurers subscribing to this Quota Share Layer in accordance with the proportion set forth in its Participation Agreement.

ALL OTHER TERMS, CONDITIONS AND EXCLUSIONS REMAIN UNCHANGED.

EDO.008 (7/08)

Page 2 of 2

IRONSHORE INDEMNITY INC. (A Stock Company) 175 Berkeley Street Boston, MA 02116 Toll Free: (877) IRON411 |

|

| Endorsement # 4 | |

| Policy Number: FI4NAB095D003 | Effective Date of Endorsement: July 01, 2022 |

Insured Name: Fidelity Equity & High Income Funds

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

TIE-IN LIMITS

It is hereby understood and agreed as follows:

Any payment of Loss under this Policy shall serve to reduce the Limit of Liability under Policy Number IA7NAB0949003. Any payment of Loss under Policy Number IA7NAB0949003 shall serve to reduce the Limit of Liability of this Policy. It is understood and agreed that only one Limit of Liability shall apply to any Loss that may be insured by this Policy and Policy Number IA7NAB0949003 and in no event will the Limit of Liability of this Policy and the Limit of Liability of Policy Number IA7NAB0949003 apply in the aggregate to any Loss arising from a Wrongful Act or Related Wrongful Acts.

ALL OTHER TERMS, CONDITIONS AND EXCLUSIONS OF THIS POLICY REMAIN UNCHANGED.

EXC.END.049 (0913)

Page 1 of 1

Liberty Mutual Group California Privacy Notice

Commercial Lines (excluding Workers’ Compensation)

(Effective January 1, 2020)

Liberty Mutual Group and its affiliates, subsidiaries, and partners (collectively “Liberty Mutual” or “we”, “us” and “our”) provide insurance to companies and other insurers. This Privacy Notice explains how we gather use, and share your data. This Privacy Notice applies to you if you are a Liberty Mutual commercial line insured or are a commercial line claimant residing in California. It does not apply to covered employees or claimants under Workers’ Compensation policies. If this notice does not apply to you, go to libertymutual.com/privacy to review the applicable Liberty Mutual privacy notice.

What Data Does Liberty Mutual Gather?

We may collect the following categories of data:

- Identifiers, including a real name, alias, postal address, unique personal identifier, online identifier, Internet Protocol address, email address, account name, Social Security Number, driver’s license number, or other similar identifiers;

- Personal information described in California Civil Code § 1798.80(e), such as your name, signature, Social Security Number, physical characteristics or description, address, telephone number, driver’s license or state identification card number, insurance policy number, education, employment, employment history, bank account number, financial information, medical information, or health insurance information;

- Protected classification characteristics, including age, race, color, national origin, citizenship, religion or creed, marital status, medical condition, physical or mental disability, sex (including gender, gender identity, gender expression, pregnancy or childbirth and related medical conditions), sexual orientation, or veteran or military status;

- Commercial information, including records of personal property, products or services purchased, obtained, or considered, or other purchasing or consuming histories and tendencies;

- Internet or other similar network activity, including browsing history, search history, information on a consumer’s interaction with a website, application, or advertisement;

- Professional or employment related information, including current or past job history or performance evaluations;

- Inferences drawn from other personal information, such as a profile reflecting a person’s preferences, characteristics, psychological trends, predispositions, behavior, attitudes, intelligence, abilities, and aptitudes;

- Risk data, including data about your driving and/or accident history; this may include data from consumer reporting agencies, such as your motor vehicle records and loss history information, health data, or criminal convictions; and

- Claims data, including data about your previous and current claims, which may include data regarding your health, criminal convictions, third party reports, or other personal data.

For information about the types of personal data we have collected about California consumers in the past twelve (12) months, please go to libertymutual.com/privacy and click on the link for the California Supplemental Privacy Policy.

How We Get the Personal Data:

We gather your personal data directly from you.

For example, you provide us with data when you:

§ ask about, buy insurance or file a claim

Version 1.0 (last updated October 13, 2019)

We also gather your personal data from other people. For

example:

§ your insurance agent or broker

1

§ pay your policy |

§ your employer, association or business (if you are insured through them) |

§ visit our websites, call us, or visit our office |

§ our affiliates or other insurance companies about your transactions with them § consumer reporting agencies, Motor Vehicle Departments, and inspection services, to gather your credit history, driving record, claims history, or value and condition of your property § other public directories and sources § third parties, including other insurers, brokers and insurance support organizations who you have communicated with about your policy or claim, anti-fraud databases, sanctions lists, court judgments and other databases, government agencies, open electoral register or in the event of a claim, third parties including other parties to the claim witnesses, experts loss adjustors and claim handlers § other third parties who take out a policy with us and are required to provide your data such as when you are named as a beneficiary or where a family member has taken out a policy which requires your personal data |

For information about how we have collected personal data in the past twelve (12) months, please go to libertymutual.com/privacy and click on the link for the California Supplemental Privacy Policy.

How Does Liberty Mutual Use My Data?

Liberty Mutual uses your data to provide you with our products and services, and as otherwise provided in this Privacy Notice. Your data may be used to:

| Business Purpose | Data Categories | ||

| Market, sell and provide insurance. This includes | · | Identifiers | |

| for example: | · | Personal Information | |

| · | calculating your premium; | · | Protected Classification Characteristics |

| · | determining your eligibility for a quote; | · | Commercial Information |

| · | confirming your identity and service your | · | Internet or other similar network activity |

| policy; | · | Professional or employment related information | |

| · | Inferences drawn from other personal information | ||

| · | Risk data | ||

| · | Claims data | ||

| Manage your claim. This includes, for example: | · | Identifiers | |

| · | managing your claim, if any; | · | Personal Information |

| · | conducting claims investigations; | · | Protected Classification Characteristics |

| · | conducting medical examinations; | · | Commercial Information |

| · | conducting inspections, appraisals; | · | Internet or other similar network activity |

| · | providing roadside assistance; | · | Professional or employment related information |

| · | providing rental car replacement, or repairs; | · | Inferences drawn from other personal information |

| · | Risk data | ||

| · | Claims data | ||

2

Version 1.0 (last updated October 13, 2019)

| Day to Day Business and Insurance Operations. | · | Identifiers | |

| This includes, for example: | · | Personal Information | |

| · | creating, maintaining, customizing and securing | · | Protected Classification Characteristics |

| accounts; | · | Commercial Information | |

| · | supporting day-to-day business and insurance | · | Internet or other similar network activity |

| related functions; | · | Professional or employment related information | |

| · | doing internal research for technology | · | Inferences drawn from other personal information |

| development; | · | Risk data | |

| · | marketing and creating products and services; | · | Claims data |

| · | conducting audits related to a current contact | ||

| with a consumer and other transactions; | |||

| · | as described at or before the point of gathering | ||

| personal data or with your authorization; | |||

| Security and Fraud Detection. This includes for | · | Identifiers | |

| example: | · | Personal Information | |

| · | detecting security issues; | · | Protected Classification Characteristics |

| · | protecting against fraud or illegal activity, and | · | Commercial Information |

| to comply with regulatory and law enforcement | · | Internet or other similar network activity | |

| authorities; | · | Professional or employment related information | |

| · | managing risk and securing our systems, assets, | · | Inferences drawn from other personal information |

| infrastructure and premises; roadside | · | Risk data | |

| assistance, rental car replacement, or repairs | · | Claims data | |

| · | help to ensure the safety and security of Liberty | ||

| staff, assets and resources, which may include | |||

| physical and virtual access controls and access | |||

| rights management; | |||

| · | supervisory controls and other monitoring and | ||

| reviews, as permitted by law; and emergency | |||

| and business continuity management; | |||

| Regulatory and Legal Requirements. This includes | · | Identifiers | |

| for example: | · | Personal Information | |

| · | controls and access rights management; | · | Protected Classification Characteristics |

| · | to evaluate or conduct a merger, divestiture, | · | Commercial Information |

| restructuring, reorganization, dissolution, or | · | Internet or other similar network activity | |

| other sale or transfer of some or all of Liberty’s | · | Professional or employment related information | |

| assets, whether as a going concern or as part of | · | Inferences drawn from other personal information | |

| bankruptcy, liquidation, or similar proceeding, | · | Risk data | |

| in which personal data held by Liberty is | · | Claims data | |

| among the assets transferred; | |||

| · | exercising and defending our legal rights and | ||

| positions; | |||

| · | to meet Liberty contract obligations; | ||

| · | to respond to law enforcement requests and as | ||

| required by applicable law, court order, or | |||

| governmental regulations; | |||

| · | as otherwise permitted by law. | ||

| Improve Your Customer Experience and Our | · | Identifiers | |

| Products. This includes for example: | · | Personal Information | |

| · | Commercial Information | ||

3

Version 1.0 (last updated October 13, 2019)

| · | improve your customer experience, our | · | Internet or other similar network activity |

| products and service; | · | Professional or employment related information | |

| · | to provide, support, personalize and develop | · | Inferences drawn from other personal information |

| our website, products and services; | · | Risk data | |

| · | create and offer new products and services; | · | Claims data |

| Analytics to identify, understand and manage our | · | Identifiers | |

| risks and products. This includes for example: | · | Personal Information | |

| · | conducting analytics to better identify, | · | Protected Classification Characteristics |

| understand and manage risk and our products; | · | Commercial Information | |

| · | Internet or other similar network activity | ||

| · | Professional or employment related information | ||

| · | Inferences drawn from other personal information | ||

| · | Risk data | ||

| · | Claims data | ||

| Customer service and technical support. This | · | Identifiers | |

| includes for example: | · | Personal Information | |

| · | answer questions and provide notifications; | · | Commercial Information |

| · | provide customer and technical support; | · | Internet or other similar network activity |

| · | Professional or employment related information | ||

| · | Inferences drawn from other personal information | ||

| · | Risk data | ||

| · | Claims data | ||

| How Does Liberty Mutual Share My Data? | |||

Liberty Mutual does not sell your personal data as defined by the California Consumer Privacy Act.

Liberty Mutual shares personal data of California consumers with the following categories of third parties:

- Liberty Mutual affiliates;

- Service Providers;

- Public entities and institutions (e.g. regulatory, quasi-regulatory, tax or other authorities, law enforcement agencies, courts, arbitrational bodies, and fraud prevention agencies);

- Professional advisors including law firms, accountants, auditors, and tax advisors;

- Insurers, re-insurers, policy holders, and claimants; and

- As permitted by law.

Liberty Mutual shares the following categories of personal data regarding California consumers to service providers for business purposes:

| Identifiers | Personal Data; | ||||

| Protected Classification Characteristics; | Commercial Information; | ||||

| Internet or other similar network activity; | Claims Data; | ||||

| Inferences drawn from other personal information; | Risk Data; | ||||

| Professional, employment, and education information; | |||||

| For information about how we have shared personal information in the past twelve (12) | months, | please | go | to | |

| libertymutual.com/privacy and click on the link for the California Supplemental Privacy Policy. | |||||

What Privacy Rights Do I Have?

The California Consumer Privacy Act provides California residents with specific rights regarding personal information.

These rights are subject to certain exceptions. Our response may be limited as permitted under law.

4

Version 1.0 (last updated October 13, 2019)

Access or Deletion

You may have the right to request that Liberty Mutual disclose certain information to you about our collection and use of your personal data in the twelve (12) months preceding such request, including a copy of the personal data we have collected. You also may have the right to request that Liberty Mutual delete personal data that Liberty Mutual collected from you, subject to certain exceptions.

Specifically, you have the right to request that we disclose the following to you, in each case for the twelve (12) month period preceding your request:

- the categories of personal data we have collected about you;

- the categories of sources from which the personal data was/is collected;

- our business or commercial purpose for collecting personal data;

- the categories of third parties with whom we share personal data;

- the specific pieces of data we have collected about you;

- the categories of personal data about you, if any, that we have disclosed for monetary or other valuable consideration, including the categories of third parties to which we have disclosed the data, by category or categories of personal data for each third party to which we disclosed the personal data; and

- the categories of personal data about you that we disclosed for a business purpose.

You can make a request by either:

Calling: 800-344-0197

Online: Mail: |

libertymutualgroup.com/privacy-policy/data-request Liberty Mutual Insurance Company 175 Berkeley St., 6th Floor Boston, MA 02116 Attn: Privacy Office |

You may also make a verifiable consumer request on behalf of your minor child.

You or your authorized agent may only make a verifiable consumer request for access or data deletion twice within a twelve (12) month period. The verifiable consumer request must provide sufficient information that allows Liberty Mutual to reasonably verify that you are the person about whom Liberty Mutual collected personal data or an authorized representative of such person; and describe your request with sufficient detail that allows Liberty Mutual to properly understand, evaluate, and respond to it. For more information about how Liberty Mutual will verify your identity and how an authorized agent may make a request on your behalf, go to libertymutual.com/privacy and click on the California Supplemental Privacy Policy.

Response Timing

Liberty Mutual will respond to a verifiable consumer request within forty-five (45) days of its receipt. If more time is needed, Liberty Mutual will inform you of the reason and extension period in writing.

Any disclosures that will be provided will only cover the twelve (12) month period preceding our receipt of the verifiable consumer request. If Liberty Mutual is unable to fulfill your request, you will be provided with the reason that the request cannot be completed. For more information about how we will respond to requests, go to libertymutual.com/privacy and click on the California Supplemental Privacy Policy.

Rights to opt in and out of data selling

California consumers have the right to direct businesses not to sell your personal data (opt-out rights), and personal data of minors under 16 years of age will not be sold, as is their right, without theirs or their parents' opt-in consent. Liberty Mutual does not sell the personal data of consumers. For more information, go to libertymutual.com/privacy and click on the California Supplemental Privacy Policy.

5

Version 1.0 (last updated October 13, 2019)

No account needed

You do not need to create an account with Liberty Mutual to exercise your rights. Liberty Mutual will only use personal data provided in a request to review and comply with the request.

No discrimination

You have the right not to be discriminated against for exercising any of your CCPA rights. Unless permitted by the CCPA, exercising your rights will not cause Liberty Mutual to:

- Deny you goods or services;

- Charge you different prices or rates for goods or services, including through granting discounts or other benefits, or imposing penalties;

- Provide you a different level or quality of goods or services; or

- Suggest that you may receive a different price or rate for goods or services, or a different level or quality of goods or services.

Will Liberty Mutual Update This Privacy Notice?

We reserve the right to makes changes to this notice at any time and for any reason. The updated version of this policy will be effective once it is accessible. You are responsible for reviewing this policy to stay informed of any changes or updates.

Who Do I Contact Regarding Privacy?

If you have any questions or comments about this Notice or the Supplemental CCPA Notice, your rights, or are requesting the Notice in an alternative format, please do not hesitate to contact Liberty Mutual at:

Phone: Email: Postal Address: |

800-344-0197 privacy@libertymutual.com Liberty Mutual Insurance Company 175 Berkeley St., 6th Floor Boston, MA 02116 Attn: Privacy Office |

6

Version 1.0 (last updated October 13, 2019)

AXA XL - Professional Insurance

100 Constitution Plaza, 17th Floor,

Hartford, CT 06103

Phone 860-246-1863, Fax 860-246-1899

August 9, 2022

Mary Coughlin

Willis Towers Watson Northeast Inc

75 Arlington Street

Floor 10

Boston, MA 02116

Re: Fidelity Equity and High Income Funds

Excess Policy

Dear Mary,

Enclosed, please find the policy for Fidelity Equity and High Income Funds. Thank you for choosing AXA XL

Insurance. Please call if you have any questions or concerns.

Sincerely,

Bill Caporale

ko

| Policy Number: | ELU183617-22 | XL Specialty Insurance Company |

| Renewal of Number: | ELU175956-21 | (Hereafter called the Insurer) |

| EXCESS POLICY DECLARATIONS | ||

Executive Offices: 70 Seaview Avenue Stamford, CT 06902-6040 Telephone 877-953-2636 |

Regulatory Office: 505 Eagleview Blvd., Ste. 100 Exton, PA 19341-1120 Telephone: 800-327-1414 |

THIS IS A CLAIMS MADE POLICY. EXCEPT AS OTHERWISE PROVIDED HEREIN, THIS POLICY ONLY APPLIES TO CLAIMS FIRST MADE DURING THE POLICY PERIOD. THE LIMIT OF LIABILITY AVAILABLE TO PAY DAMAGES OR SETTLEMENTS SHALL BE REDUCED AND MAY BE EXHAUSTED BY THE PAYMENT OF DEFENSE EXPENSES. THIS POLICY DOES NOT PROVIDE FOR ANY DUTY BY THE INSURER TO DEFEND ANY INSURED. PLEASE READ AND REVIEW THE POLICY CAREFULLY.

Item 1. Name and Mailing Address of Insured Entity:

Fidelity Equity and High Income Funds

c/o FMR LLC

88 Black Falcon

First Floor, East Side, Suite167

Mailzone V7E

Boston, MA 02210

The Insured Entity will be the sole agent for and will act on behalf of the Insured with respect to all matters under this Policy.

| Item 2. | Policy Period: | From: | July 01, 2022 | To: | July 01, 2023 | ||||

| At 12:01AM Standard Time at your Mailing Address Shown Above | |||||||||

| Item 3. | Limit of Liability: | ||||||||

| $5,000,000 part of $50,000,000 Aggregate each Policy Period (including Defense Expenses) | |||||||||

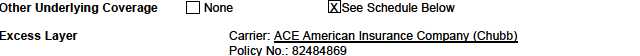

| Item 4. | Schedule of Underlying Insurance: | ||||||||

| Insurer | Policy No | Limit of Liability | |||||||

| Berkshire Hathaway | |||||||||

| (a) | Primary Policy | Specialty Insurance | |||||||

| Company | 47-EPF-315882-02 | $ | 15,000,000 | ||||||

| Federal Insurance | |||||||||

| (b) | Underlying Excess Policy | Company | 82484869 | $ | 10,000,000 | ||||

| National Union Fire | |||||||||

| Insurance Company of | |||||||||

| Pittsburgh PA | 01-317-28-50 | $ | 10,000,000 | ||||||

| ICI Mutual Insurance | |||||||||

| Company | 87153322 | B | $ | 15,000,000 | |||||

| Allied World Assurance | |||||||||

| Company, AG | C014840/012 | $ | 15,000,000 | ||||||

| Travelers Casualty and | |||||||||

| Surety Company of | |||||||||

| America | 106547262 | $ | 10,000,000 | ||||||

| Continental Casualty | |||||||||

| Company | 287042220 | $ | 10,000,000 | ||||||

| AXIS Insurance | |||||||||

| Company | P-001-000158021-03 | $ | 5,000,000 part of $15,000,000 | ||||||

| Starr Indemnity & | |||||||||

| Liability Company | 1000059071221 | $ | 10,000,000 part of $15,000,000 | ||||||

| Lloyd's of London | B080113016 | P22 | $ | 5,000,000 part of $50,000,000 | |||||

| XS 70 01 05 14 | Page 1 of 2 | ||||||||

- 2014 X.L. America, Inc. All Rights Reserved. May not be copied without permission.

| National Casualty | ||||

| Company | XJO2208785 | $10,000,000 part of $50,000,000 | ||

| Twin City Fire | ||||

| Insurance Company | 08 FI 0252161 -22 | $10,000,000 part of $50,000,000 | ||

| US Specialty Insurance | ||||

| Company | 24-MGU-22-A54574 | $8,000,000 part of $50,000,000 | ||

| Everest Reinsurance | ||||

| Company | FL5FD00012-221 | $7,000,000 part of $50,000,000 | ||

| Ironshore Indemnity | ||||

| Inc. | FI4NAB095D003 | $5,000,000 part of $50,000,000 | ||

| Item 5. | Notices required to be given to the Insurer must be addressed to: | |||

| XL Professional Insurance | ||||

| 100 Constitution Plaza, 17th Floor | ||||

| Hartford, CT 06103 | ||||

| by electronic mail (email) to: proclaimnewnotices@axaxl.com. | ||||

| Toll Free Telephone: 877-953-2636 | ||||

| Item 6. | Premium: | |||

| Taxes, Surcharges or Fees: | $ | 0.00 | ||

| Total Policy Premium: | $ | 15,589.00 | ||

| Item 7. | Policy Forms and Endorsements Attached at Issuance: | |||

| XS 71 00 05 14 XS 80 07 12 14 XL 83 23 09 00 | ||||

THESE DECLARATIONS AND THE POLICY, WITH THE ENDORSEMENTS, ATTACHMENTS, AND THE APPLICATION SHALL CONSTITUTE THE

ENTIRE AGREEMENT BETWEEN THE INSURER AND THE INSURED RELATING TO THIS INSURANCE.

XS 70 01 05 14

Page 2 of 2

- 2014 X.L. America, Inc. All Rights Reserved. May not be copied without permission.

IN WITNESS

XL SPECIALTY INSURANCE COMPANY

REGULATORY OFFICE

505 EAGLEVIEW BOULEVARD, SUITE 100

| DEPARTMENT: REGULATORY |

| EXTON, PA 19341-1120 |

| PHONE: 800-688-1840 |

It is hereby agreed and understood that the following In Witness Clause supercedes any and all other In Witness clauses in this policy.

All other provisions remain unchanged.

IN WITNESS WHEREOF, the Insurer has caused this policy to be executed and attested, and, if required by state law, this policy shall not be valid unless countersigned by a duly authorized representative of the Insurer.

Joseph Tocco President |

Toni Ann Perkins Secretary |

LAD 400 0915 XLS

- 2015 X.L. America, Inc. All Rights Reserved. May not be copied without permission.

POLICYHOLDER DISCLOSURE

NOTICE OF TERRORISM

INSURANCE COVERAGE

Coverage for acts of terrorism is included in your policy. You are hereby notified that the Terrorism Risk Insurance

Act, as amended in 2019, defines an act of terrorism in Section 102(1) of the Act: The term “act of terrorism” means any act or acts that are certified by the Secretary of the Treasury - in consultation with the Secretary of Homeland Security, and the Attorney General of the United States —to be an act of terrorism; to be a violent act or an act that is dangerous to human life, property, or infrastructure; to have resulted in damage within the United States, or outside the United States in the case of certain air carriers or vessels or the premises of a United States mission; and to have been committed by an individual or individuals as part of an effort to coerce the civilian population of the United States or to influence the policy or affect the conduct of the United States Government by coercion. Under your coverage, any losses resulting from certified acts of terrorism may be partially reimbursed by the United States Government under a formula established by the Terrorism Risk Insurance Act, as amended. However, your policy may contain other exclusions which might affect your coverage, such as an exclusion for nuclear events. Under the formula, the United States Government generally reimburses 80% beginning on January

1, 2020, of covered terrorism losses exceeding the statutorily established deductible paid by the insurance company providing the coverage. The Terrorism Risk Insurance Act, as amended, contains a $100 billion cap that limits U.S. Government reimbursement as well as insurers’ liability for losses resulting from certified acts of terrorism when the amount of such losses exceeds $100 billion in any one calendar year. If the aggregate insured losses for all insurers exceed $100 billion, your coverage may be reduced.

The portion of your annual premium that is attributable to coverage for acts of terrorism is waived and does not include any charges for the portion of losses covered by the United States government under the Act.

PN161 12 20 T

© 2020 X.L. America, Inc.

Includes copyrighted material of National Association of Insurance Commissioners, with its permission.

NOTICE TO POLICYHOLDERS

U.S. TREASURY DEPARTMENT’S OFFICE OF FOREIGN ASSETS CONTROL

(“OFAC”)

No coverage is provided by this Policyholder Notice nor can it be construed to replace any provisions of your policy. You should read your policy and review your Declarations page for complete information on the coverages you are provided.

This Policyholder Notice provides information concerning possible impact on your insurance coverage due to the impact of U.S. Trade Sanctions1. Please read this Policyholder Notice carefully.

In accordance with the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) regulations, or any other U.S. Trade Sanctions applied by any regulatory body, if it is determined that you or any other insured, or any person or entity claiming the benefits of this insurance has violated

U.S. sanctions law, is a Specially Designated National and Blocked Person (“SDN”), or is owned or controlled by an SDN, this insurance will be considered a blocked or frozen contract. When an insurance policy is considered to be such a blocked or frozen contract, neither payments nor premium refunds may be made without authorization from OFAC. Other limitations on the premiums and payments also apply.

1 “U.S Trade Sanctions” may be promulgated by Executive Order, act of Congress, regulations from the

U.S. Departments of State, Treasury, or Commerce, regulations from the State Insurance Departments, etc.

PN CW 05 0519

©2019 X.L. America, Inc. All rights reserved. May not be copied without permission.

Includes copyrighted material of Insurance Services Office, Inc., with its permission.

NOTICE TO POLICYHOLDERS

PRIVACY POLICY

The AXA XL insurance group (the “Companies”), believes personal information that we collect about our customers, potential customers, and proposed insureds (referred to collectively in this Privacy Policy as “customers”) must be treated with the highest degree of confidentiality. For this reason and in compliance with the Title V of the Gramm-Leach-Bliley Act (“GLBA”), we have developed a Privacy Policy that applies to all of our companies. For purposes of our Privacy Policy, the term “personal information” includes all information we obtain about a customer and maintain in a personally identifiable way. In order to assure the confidentiality of the personal information we collect and in order to comply with applicable laws, all individuals with access to personal information about our customers are required to follow this policy.

Our Privacy Promise

Your privacy and the confidentiality of your business records are important to us. Information and the analysis of information is essential to the business of insurance and critical to our ability to provide to you excellent, cost-effective service and products. We understand that gaining and keeping your trust depends upon the security and integrity of our records concerning you. Accordingly, we promise that:

| 1. | We will follow strict standards of security and confidentiality to protect any information you share with us or information that we receive about you; |

| 2. | We will verify and exchange information regarding your credit and financial status only for the purposes of underwriting, policy administration, or risk management and only with reputable references and clearinghouse services; |

| 3. | We will not collect and use information about you and your business other than the minimum amount of information necessary to advise you about and deliver to you excellent service and products and to administer our business; |

| 4. | We will train our employees to handle information about you or your business in a secure and confidential manner and only permit employees authorized to use such information to have access to such information; |

| 5. | We will not disclose information about you or your business to any organization outside the XL Catlin insurance group of Companies or to third party service providers unless we disclose to you our intent to do so or we are required to do so by law; |

| 6. | We will not disclose medical information about you, your employees, or any claimants under any policy of insurance, unless you provide us with written authorization to do so, or unless the disclosure is for any specific business exception provided in the law; |

| 7. | We will attempt, with your help, to keep our records regarding you and your business complete and accurate, and will advise you how and where to access your account information (unless prohibited by law), and will advise you how to correct errors or make changes to that information; and |

| 8. | We will audit and assess our operations, personnel and third party service providers to assure that your privacy is respected. |

Collection and Sources of Information

We collect from a customer or potential customer only the personal information that is necessary for (a) determining eligibility for the product or service sought by the customer, (b) administering the product or service obtained, and (c) advising the customer about our products and services. The information we collect generally comes from the following sources:

- Submission – During the submission process, you provide us with information about you and your business, such as your name, address, phone number, e-mail address, and other types of personal identification information;

- Quotes – We collect information to enable us to determine your eligibility for the particular insurance product and to determine the cost of such insurance to you. The information we collect will vary with the type of insurance you seek;

PN CW 02 0119

Page 1 of 3

© 2019 X.L. America, Inc. All Rights Reserved.

May not be copied without permission.

NOTICE TO POLICYHOLDERS

- Transactions – We will maintain records of all transactions with us, our affiliates, and our third party service providers, including your insurance coverage selections, premiums, billing and payment information, claims history, and other information related to your account;

- Claims – If you obtain insurance from us, we will maintain records related to any claims that may be made under your policies. The investigation of a claim necessarily involves collection of a broad range of information about many issues, some of which does not directly involve you. We will share with you any facts that we collect about your claim unless we are prohibited by law from doing so. The process of claim investigation, evaluation, and settlement also involves, however, the collection of advice, opinions, and comments from many people, including attorneys and experts, to aid the claim specialist in determining how best to handle your claim. In order to protect the legal and transactional confidentiality and privileges associated with such opinions, comments and advice, we will not disclose this information to you; and

- Credit and Financial Reports – We may receive information about you and your business regarding your credit. We use this information to verify information you provide during the submission and quote processes and to help underwrite and provide to you the most accurate and cost-effective insurance quote we can provide.

Retention and Correction of Personal Information

We retain personal information only as long as required by our business practices and applicable law. If we become aware that an item of personal information may be materially inaccurate, we will make reasonable effort to re-verify its accuracy and correct any error as appropriate.

Storage of Personal Information

We have in place safeguards to protect data and paper files containing personal information.

Sharing/Disclosing of Personal Information

We maintain procedures to assure that we do not share personal information with an unaffiliated third party for marketing purposes unless such sharing is permitted by law. Personal information may be disclosed to an unaffiliated third party for necessary servicing of the product or service or for other normal business transactions as permitted by law.

We do not disclose personal information to an unaffiliated third party for servicing purposes or joint marketing purposes unless a contract containing a confidentiality/non-disclosure provision has been signed by us and the third party. Unless a consumer consents, we do not disclose “consumer credit report” type information obtained from an application or a credit report regarding a customer who applies for a financial product to any unaffiliated third party for the purpose of serving as a factor in establishing a consumer’s eligibility for credit, insurance or employment. “Consumer credit report type information” means such things as net worth, credit worthiness, lifestyle information (piloting, skydiving, etc.) solvency, etc. We also do not disclose to any unaffiliated third party a policy or account number for use in marketing. We may share with our affiliated companies information that relates to our experience and transactions with the customer.

Policy for Personal Information Relating to Nonpublic Personal Health Information

We do not disclose nonpublic personal health information about a customer unless an authorization is obtained from the customer whose nonpublic personal information is sought to be disclosed. However, an authorization shall not be prohibited, restricted or required for the disclosure of certain insurance functions, including, but not limited to, claims administration, claims adjustment and management, detection, investigation or reporting of actual or potential fraud, misrepresentation or criminal activity, underwriting, policy placement or issuance, loss control and/or auditing.

PN CW 02 0119

Page 2 of 3

© 2019 X.L. America, Inc. All Rights Reserved.

May not be copied without permission.

NOTICE TO POLICYHOLDERS

Access to Your Information

Our employees, employees of our affiliated companies, and third party service providers will have access to information we collect about you and your business as is necessary to effect transactions with you. We may also disclose information about you to the following categories of person or entities:

- Your independent insurance agent or broker;

- An independent claim adjuster or investigator, or an attorney or expert involved in the claim;

- Persons or organizations that conduct scientific studies, including actuaries and accountants;

- An insurance support organization;

- Another insurer if to prevent fraud or to properly underwrite a risk;

- A state insurance department or other governmental agency, if required by federal, state or local laws; or

- Any persons entitled to receive information as ordered by a summons, court order, search warrant, or subpoena.

Violation of the Privacy Policy

Any person violating the Privacy Policy will be subject to discipline, up to and including termination.

For more information or to address questions regarding this privacy statement, please contact your broker.

PN CW 02 0119

Page 3 of 3

© 2019 X.L. America, Inc. All Rights Reserved.

May not be copied without permission.

NOTICE TO POLICYHOLDERS FRAUD NOTICE |

|

Alabama |

Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject to restitution fines or confinement in prison, or any combination thereof. |

Arkansas |

Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison. |

California |

General: All applications for commercial insurance, other than liability insurance: Any person who knowingly and willfully presents false information in an application for insurance may be guilty of insurance fraud and subject to fines and confinement in prison. All applications for liability insurance and all claim forms: For your protection California law requires the following to appear on this form: Any person who knowingly presents false or fraudulent information to obtain or amend insurance coverage or to make a claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison. |

Colorado |

It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance, and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies. |

District of Columbia |

WARNING: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false information materially related to a claim was provided by the applicant. |

Florida |

Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree. |

Kansas |

A "fraudulent insurance act" means an act committed by any person who, knowingly and with intent to defraud, presents, causes to be presented or prepares with knowledge or belief that it will be presented to or by an insurer, purported insurer, broker or any agent thereof, any written, electronic, electronic impulse, facsimile, magnetic, oral, or telephonic communication or statement as part of, or in support of, an application for the issuance of, or the rating of an insurance policy for personal or commercial insurance, or a claim for payment or other benefit pursuant to an insurance policy for commercial or personal insurance that such person knows to contain materially false information concerning any fact material thereto; or conceals, for the purpose of misleading, information concerning any fact material thereto. |

Kentucky |

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime. |

Louisiana |

Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison. |

Maine |

It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include |

PN CW 01 0122 |

Page 1 of 3 © 2022 X.L. America, Inc. All Rights Reserved. May not be copied without permission. |

NOTICE TO POLICYHOLDERS imprisonment, fines, or denial of insurance benefits. |

|

Maryland |

Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison. |

New Jersey |

Any person who includes any false or misleading information on an application for an insurance policy is subject to criminal and civil penalties. |

New Mexico |

ANY PERSON WHO KNOWINGLY PRESENTS A FALSE OR FRAUDULENT CLAIM FOR PAYMENT OF A LOSS OR BENEFIT OR KNOWINGLY PRESENTS FALSE INFORMATION IN AN APPLICATION FOR INSURANCE IS GUILTY OF A CRIME AND MAY BE SUBJECT TO CIVIL FINES AND CRIMINAL PENALTIES. |

New York |

General: All applications for commercial insurance, other than automobile insurance: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation. All applications for automobile insurance and all claim forms: Any person who knowingly makes or knowingly assists, abets, solicits or conspires with another to make a false report of the theft, destruction, damage or conversion of any motor vehicle to a law enforcement agency, the department of motor vehicles or an insurance company, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand dollars and the value of the subject motor vehicle or stated claim for each violation. Fire: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime. The proposed insured affirms that the foregoing information is true and agrees that these applications shall constitute a part of any policy issued whether attached or not and that any willful concealment or misrepresentation of a material fact or circumstances shall be grounds to rescind the insurance policy. |

Ohio |

Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement is guilty of insurance fraud. |

Oklahoma |

WARNING: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony. |

WARNING: All Workers Compensation Insurance:

Any person or entity who makes any material false statement or representation, who willfully and knowingly omits or conceals any material information, or who employs any device, scheme, or artifice, or who aids and abets any person for the purpose of:

| 1. | obtaining any benefit or payment, |

| 2. | increasing any claim for benefit or payment, or |

| 3. | obtaining workers' compensation coverage under the Administrative Workers' Compensation Act, shall be guilty of a felony punishable pursuant to Section 1663 of Title 21 of the Oklahoma Statutes. |

PN CW 01 0122

Page 2 of 3

© 2022 X.L. America, Inc. All Rights Reserved.

May not be copied without permission.

NOTICE TO POLICYHOLDERS |

|

Pennsylvania |

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties. Automobile Insurance: Any person who knowingly and with intent to injure or defraud any insurer files an application or claim containing any false, incomplete or misleading information shall, upon conviction, be subject to imprisonment for up to seven years and the payment of a fine of up to $15,000. |

Puerto Rico |

Any person who knowingly and with the intention of defrauding presents false information in an insurance application, or presents, helps, or causes the presentation of a fraudulent claim for the payment of a loss or any other benefit, or presents more than one claim for the same damage or loss, shall incur a felony and, upon conviction, shall be sanctioned for each violation by a fine of not less than five thousand dollars ($5,000) and not more than ten thousand dollars ($10,000), or a fixed term of imprisonment for three (3) years, or both penalties. Should aggravating circumstances [be] present, the penalty thus established may be increased to a maximum of five (5) years, if extenuating circumstances are present, it may be reduced to a minimum of two (2) years. |

Rhode Island |

Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison. |

Tennessee |

It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits. Workers’ Compensation: It is a crime to knowingly provide false, incomplete or misleading information to any party to a workers’ compensation transaction for the purpose of committing fraud. Penalties include imprisonment, fines and denial of insurance benefits. |

Utah |

Workers’ Compensation: Any person who knowingly presents false or fraudulent underwriting information, files or causes to be filed a false or fraudulent claim for disability compensation or medical benefits, or submits a false or fraudulent report or billing for health care fees or other professional services is guilty of a crime and may be subject to fines and confinement in state prison. |

Virginia |

It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits. |

Washington |

It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits. |

West Virginia |

Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison. |

All Other States |

Any person who knowingly and willfully presents false information in an application for insurance may be guilty of insurance fraud and subject to fines and confinement in prison. (In Oregon, the aforementioned actions may constitute a fraudulent insurance act which may be a crime and may subject the person to penalties). |

PN CW 01 0122

Page 3 of 3

© 2022 X.L. America, Inc. All Rights Reserved.

May not be copied without permission.

XS 80 07 12 14 |

|

Endorsement No.: 1 Named Insured: Fidelity Equity and High Income Funds Policy No.: ELU183617-22 |

Effective: July 01, 2022 12:01 A.M. Standard Time Insurer: XL Specialty Insurance Company |

EXCESS ENDORSEMENT

In consideration of the premium charged:

| (1) | It is understood and agreed that the Limit of Liability for this Policy as set forth in Item 3 of the Declarations is the maximum amount payable, including Defense Expenses, by the Insurer under this Policy. Any provision of the Underlying Insurance indicating any ability or right to any reinstatement of such policy's limit of liability shall be inapplicable to this Policy, including any provision indicating a reinstatement of such policy's limit of liability during any extended discovery or reporting period. The Insurer shall not be liable to the Insureds or any other person or entity claiming through or in the name or right of the Insureds for any loss or other liability based upon, arising out of, directly or indirectly resulting from, in consequence of, or in any way involving the application or enforcement of any such provision of the Underlying Insurance. |

| (2) | It is understood and agreed that the Insurer is under no obligation to renew this Policy upon its expiration. Any provision of the Underlying Insurance indicating any automatic renewal of this Policy shall be inapplicable to this Policy. The Insurer shall not be liable to the Insureds or any other person or entity claiming through or in the name or right of the Insureds for any loss or other liability based upon, arising out of, directly or indirectly resulting from, in consequence of, or in any way involving the application or enforcement of any such provision of the Underlying Insurance. |

All other terms, conditions and limitations of this Policy shall remain unchanged.

XS 80 07 12 14

Page 1 of 1

- 2015 X.L. America, Inc. All Rights Reserved. May not be copied without permission.

XL 80 23 07 02 |

|

Endorsement No.: 2 Named Insured: Fidelity Equity and High Income Funds Policy No.: ELU175956-21 |

Effective: July 01, 2021 12:01 A.M. Standard Time Insurer: XL Specialty Insurance Company |

TIE IN LIMITS ENDORSEMENT

In consideration of the premium charged, in addition to this Policy, the Insurer or an affiliated company of the Insurer (any such affiliated company being included within the term "Insurer" for the purposes of this endorsement) has also agreed to issue to the person or entity named in Item 1 of the Declarations the following policy(ies) (such policy(ies), the “Other Policy(ies)”):

Other Policy(ies)

Excess Liability Policy (Mutual Funds, $5,000,000 part of $50,000,000 x $100,000,000), Policy No.

ELU183610-22, Issued by: XL Specialty Insurance Company

It is expressly acknowledged by the person or entity named in Item 1 of the Declarations that the premium for these policies has been negotiated with the understanding that all policies would have shared limits of liability. Therefore, in consideration of the premium charged:

| (1) | Any payment of loss or damages, including costs and expenses of defense, under this Policy will reduce the limit of liability available under the Other Policy(ies) for the defense and settlement of, or the payment of any liabilities in connection with, any claim or claims made under the Other Policy(ies). |

| (2) | Any payment of loss or damages, including costs and expenses of defense, under the Other Policy(ies) will reduce the Limit of Liability available under this Policy for the defense and settlement of, or the payment of any liabilities in connection with, any claim or claims made under this Policy during the Policy Period. |

| (3) | If the Insurer shall have paid loss or damages, including costs and expenses of defense, under this Policy and loss or damages, including costs and expenses of defense, under the Other Policy(ies) in an aggregate amount equaling $5,000,000 any and all obligations of the Insurer under this Policy will be completely fulfilled and extinguished, and the Insurer will have no further obligations of any kind or nature whatsoever under this Policy. |

All other terms, conditions and limitations of this Policy shall remain unchanged.

XL 80 23 07 02

Page 1 of 1

EXCESS POLICY COVERAGE FORM

THIS IS A CLAIMS MADE POLICY. EXCEPT AS OTHERWISE PROVIDED HEREIN, THIS POLICY ONLY APPLIES TO CLAIMS FIRST MADE DURING THE POLICY PERIOD. THE LIMIT OF LIABILITY AVAILABLE TO PAY DAMAGES OR SETTLEMENTS SHALL BE REDUCED AND MAY BE EXHAUSTED BY THE PAYMENT OF DEFENSE EXPENSES. THIS POLICY DOES NOT PROVIDE FOR ANY DUTY BY THE INSURER TO DEFEND ANY INSURED. PLEASE READ AND REVIEW THE POLICY CAREFULLY.

In consideration of the payment of the premium and in reliance on all statements made and information furnished to the Insurer identified in the Declarations (the Insurer) and to the issuer(s) of the Underlying Insurance, the Insurer and the insureds agree as follows:

I. INSURING AGREEMENT

The Insurer will provide coverage excess of the Underlying Insurance stated in ITEM 4 of the Declarations. Coverage hereunder will apply in conformance with the terms, conditions, endorsements and warranties of both the Primary Policy stated in ITEM 4 (A) of the Declarations and of any other Underlying Excess Policy stated in ITEM 4 (B) of the Declarations. The coverage hereunder will attach only after all of the Underlying Insurance has been exhausted by the actual payment of covered amounts under the Underlying Insurance by the applicable insurers thereunder or by any other source. To the extent that any terms, conditions, and endorsements of the Policy may be inconsistent with any terms, conditions, and endorsements of the Underlying Insurance, the terms, conditions, and endorsements of this Policy shall govern.

II. DEPLETION OF UNDERLYING LIMITS OF LIABILITY

The coverage hereunder shall attach only after the limits of all Underlying Insurance have been exhausted by payment of covered amounts. Subject to the terms, conditions, and endorsements of this Policy and the Underlying Insurance, this Policy will continue to apply to covered amounts as primary insurance in the event of the exhaustion of all of the limits of liability of such Underlying Insurance as the result of the actual payment of covered amounts by the applicable insurer thereunder or by any other source. Any risk of uncollectibility with respect to the Underlying Insurance will be expressly retained by the insureds and will not be assumed by the Insurer.

III. RIGHTS AND CLAIM PARTICIPATION

The Insurer shall have the same rights, privileges and protections afforded to the insurer(s) of the Underlying Insurance and may, at its sole discretion, elect to participate in the investigation, settlement and/or defense of any claim against the insureds even if the Underlying Insurance has not been exhausted. The insureds will provide such information and cooperation as is reasonably requested. The insureds shall not do anything that prejudices the Insurer’s position or potential rights of recovery, including, but not limited to, terminating any Underlying Insurance.

IV. LIMIT OF LIABILITY

The amount stated in ITEM 3 of the Declarations is the limit of liability of the Insurer and shall be the maximum amount payable, including defense expenses, by the Insurer under this Policy. Defense expenses are part of and not in addition to the limit of liability and the payment of such will reduce the limit of liability.

| V. | NOTICE, ALTERATION, AND TERMINATION |

| (A) | Where the Underlying Insurance permits or requires notice to the Insurer, the insureds shall have the same obligations and rights to notify the Insurer under this Policy. All notices required under the Underlying Insurance policies and this Policy shall be sent to the address set forth in ITEM (5) of the Declarations: Attention Claim Department or by electronic mail to: proclaimnewnotices@xlgroup.com. Notice given to any underlying insurer will not be deemed notice to the Insurer. |

| (B) | No change in or modification of this Policy shall be effective unless made by endorsement. In the event of a change of any kind to any Underlying Insurance that broadens or expands coverage, this Policy will become subject to such change only if and to the extent that the Insurer consents to such change in writing and the insured pays any additional premium that may be required by the Insurer. |

| (C) | This Policy will terminate immediately upon the termination of any of the Underlying Insurance, whether cancelled by the insured or the applicable insurer. Notice of cancellation or non-renewal of any such policies duly given by any of the applicable insurers shall serve as notice of the cancellation or non-renewal of this Policy by the Insurer. |

XS 71 00 05 14

Page 1 of 1

IRONSHORE INDEMNITY INC.

(A Stock Company)

175 Berkeley Street

Boston, MA 02116

Toll Free: (877) IRON411

This Policy is issued by the stock insurance company listed above (herein "Insurer").

EXCESS LIABILITY INSURANCE POLICY DECLARATIONS

UNLESS OTHERWISE PROVIDED IN THE FOLLOWED POLICY, THIS POLICY IS A CLAIMS MADE POLICY WHICH COVERS ONLY

CLAIMS FIRST MADE AGAINST THE INSUREDS DURING THE POLICY PERIOD. PLEASE READ THIS POLICY CAREFULLY.

Policy No. FI4NAB095H003

Expiring No. FI4NAB095H002

| ITEM 1. | INSURED COMPANY PRINCIPAL ADDRESS: | |

| Fidelity Fixed Income and Asset Allocation Funds | ||

| c/o FMR LLC | ||

| 88 Black Falcon Ave | ||

| First Floor, East Side, Suite 167, | ||

| Mailzone V7E | ||

| Boston, MA 02210 | ||

| ITEM 2. | COVERAGE PROVIDED: | Excess Fidelity Insurance |

| ITEM 3. | FOLLOWED POLICY: | FMR FUNDS CONCENTRIC CUSTOM BOND |

| INSURER: | Berkshire Hathaway Specialty Insurance Company | |

| POLICY NUMBER: | 47-EPF-315882-02 | |

| ITEM 4. | POLICY PERIOD: | |

| From: July 01, 2022 12:01 A.M. To: July 01, 2023 12:01 A.M. | ||

| (Local time at the address shown in ITEM 1.) | ||

Form: EXC.003; Edited (03.14.08)

Page 1 of 3

| ITEM 5. | |||

| Premium: | Plus all applicable Taxes, Fees and Surcharges. | ||

| Premium: | $ | 13,503.00 | |

| ---------------------- | - | ---------------- | |

| Total Amount Due: | $ | 13,503.00 | |

| See Invoice for the date Premium is due and payable. Failure to pay the | |||

| premium in full may result in voidance of coverage. | |||

| ITEM 6. | LIMIT OF LIABILITY/AGGREGATE LIMIT: $5,000,000 for all Loss under all Coverages combined. | ||

| ITEM 7. | UNDERLYING POLICY LIMITS/ATTACHMENT POINT: $100,000,000 | ||

| ITEM 8. | PENDING & PRIOR LITIGATION DATE: August 01, 2008 | ||

| ITEM 9. | NOTICE TO INSURER: | ||

| A. | Notice of Claim, Wrongful Act or Loss: |

| Send to Company Indicated Above c/o Ironshore Insurance Services, LLC 28 Liberty Street 5th Floor New York, NY 10005 | |

| B. | All other notices: |

| Send to Company Indicated Above c/o Ironshore Insurance Services, LLC 28 Liberty Street 5th Floor New York, NY 10005 |

ITEM 10. BROKER:

Mary Coughlin

WILLIS TOWERS WATSON NORTHEAST INC

Three Copley Place 100 Huntington Avenue

800 Boylston Street SUITE NO 300

Boston, MA 02116

LICENSE #: N/A

ITEM 11. FORMS AND ENDORSEMENTS: