As filed with the Securities and Exchange Commission on September 24, 2010

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

Registration Statement Under The Securities Act of 1933

Great-West Life & Annuity Insurance Company

(Exact Name of Registrant as Specified in its Charter)

|

Colorado |

|

6311 |

|

84-0467907 |

|

(State or other jurisdiction of incorporation or organization) |

|

(Primary Standard Industrial Classification Code) |

|

(I.R.S. Employer Identification Number) |

8515 East Orchard Road, Greenwood Village, Colorado 80111 (800) 537-2033

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

|

Mitchell T.G. Graye |

|

Copy to: |

|

President and Chief Executive Officer |

|

Stephen E. Roth, Esq. |

|

Great-West Life & Annuity Insurance Company |

|

Sutherland Asbill & Brennan LLP |

|

8515 East Orchard Road |

|

1275 Pennsylvania Avenue, N.W. |

|

Greenwood Village, CO 80111 |

|

Washington, DC |

|

(800) 537-2033 |

|

20004-2415 |

|

(Name, Address, Including Zip Code, and

Telephone Number, Including Area Code, |

|

|

Approximate date of commencement of proposed sale to the public: Continuously on and after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

|

Large Accelerated Filer o |

|

Accelerated Filer o |

|

Non-Accelerated Filer x |

|

Smaller Reporting Company o |

|

(Do not check if a smaller reporting company) |

|

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of |

|

Amount to |

|

Proposed |

|

Proposed |

|

Amount of |

|

|||

|

Guaranteed Income Annuity Contracts |

|

N/A* |

|

N/A* |

|

$ |

50,000,000 |

* |

$ |

3,565 |

|

|

|

* |

The proposed maximum aggregate offering price is estimated solely for the purposes of determining the registration fee. The amount to be registered and the proposed maximum offering price per unit are not applicable since these securities are not issued in predetermined amounts or units. |

|||||||||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

SecureFoundationSM

Group Fixed Deferred Annuity Contract

Issued by:

8515 East Orchard Road

Greenwood Village, CO 80111

Tel. (800) 537-2033

[November , 2010]

This prospectus describes the SecureFoundationSM Group Fixed Deferred Annuity Contract (the “Contract”) issued by Great-West Life & Annuity Insurance Company. The Contract will be offered to sponsors (“Plan Sponsor”) of retirement plans established under Section 403(b) of the Internal Revenue Code (“Retirement Plan”). The Contract describes the Guaranteed Lifetime Withdrawal Benefit (“GLWB”). A certificate (“Certificate”) will be issued to participants in each Retirement Plan who purchase shares of one of the Maxim SecureFoundation mutual funds, which currently consist of the Maxim SecureFoundationSM Lifetime 2015 Portfolio, Maxim SecureFoundationSM Lifetime 2025 Portfolio, Maxim SecureFoundationSM Lifetime 2035 Portfolio, Maxim SecureFoundationSM Lifetime 2045 Portfolio, Maxim SecureFoundationSM Lifetime 2055 Portfolio (the “SecureFoundation Lifetime Portfolios”), and the Maxim SecureFoundationSM Balanced Portfolio (each, a “Covered Fund” and together, the “Covered Funds”). A Retirement Plan participant who elects the GLWB is referred to as a “GLWB Participant.” The Contract provides for guaranteed income for the life of a designated person based on the GLWB Participant’s investment in one or more of the Covered Funds, provided all conditions specified in the Contract are met, regardless of how long the designated person lives or the actual performance or value of the Covered Funds. The Contract and the Certificate have no cash value and no surrender value. The interests of the Retirement Plan and the GLWB Participant in the Contract and the Certificate, as applicable, may not be transferred, sold, assigned, pledged, charged, encumbered, or alienated in any way, however, if the Retirement Plan is consolidated or merged with another plan or if the assets and liabilities of the Retirement Plan are transferred to another plan, the Contract may be assigned to the new Plan Sponsor and/or trustee.

Plan Sponsors may apply to purchase a Contract through GWFS Equities, Inc. (“GWFS Equities”), the principal underwriter for the Contract or other broker-dealers that have entered into a selling agreement with GWFS Equities. GWFS Equities will use its best efforts to sell the Contracts, but is not required to sell any specific number or dollar amount of Contracts.

This prospectus provides important information that a prospective purchaser of a Contract or a GLWB Participant should know before investing. Please retain this prospectus for future reference.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus does not constitute an offering in any jurisdiction in which such offering may not be lawfully made.

The Contract nor the Certificate:

· Is NOT a bank deposit

· Is NOT FDIC insured

· Is NOT insured or endorsed by a bank or any government agency

· Is NOT available in every state

The purchase of the Contract is subject to certain risks. See “Risk Factors” on page 4. The Contract is novel and innovative. While we understand that the Internal Revenue Service may be considering tax issues associated with products similar to the Contract, to date the tax consequences of the Contract have not been addressed in published legal authorities. Under the circumstances, the Plan Sponsor and prospective GLWB Participants should therefore consult a tax advisor before purchasing a Contract or a GLWB.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the SEC is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

TABLE OF CONTENTS

|

SUMMARY |

1 |

|

|

|

|

PRELIMINARY NOTE REGARDING TERMS USED IN THIS PROSPECTUS |

1 |

|

WHAT IS THE GLWB? |

1 |

|

HOW MUCH WILL THE GLWB COST? |

2 |

|

CAN THE GLWB PARTICIPANT CANCEL THE GLWB? |

2 |

|

CAN THE CONTRACT OWNER/PLAN SPONSOR CANCEL THE CONTRACT? |

2 |

|

WHAT PROTECTION DOES THE GLWB PROVIDE? |

2 |

|

HOW DOES THE GLWB WORK? |

3 |

|

HOW DOES THE CONTRACT OWNER/PLAN SPONSOR APPLY FOR THE CONTRACT? |

3 |

|

HOW DOES A RETIREMENT PLAN PARTICIPANT ELECT THE GLWB? |

3 |

|

WHAT ARE THE DESIGNATED INVESTMENT OPTIONS? |

4 |

|

IS THE GLWB RIGHT FOR RETIREMENT PLAN PARTICIPANTS? |

4 |

|

|

|

|

RISK FACTORS |

4 |

|

|

|

|

THE CONTRACT |

7 |

|

|

|

|

INVESTMENT OPTIONS — THE COVERED FUNDS |

7 |

|

|

|

|

MAXIM SECUREFOUNDATIONSM BALANCED PORTFOLIO |

7 |

|

|

|

|

INVESTMENT OBJECTIVE |

8 |

|

PRINCIPAL INVESTMENT STRATEGIES |

8 |

|

|

|

|

MAXIM SECUREFOUNDATIONSM LIFETIME PORTFOLIOS |

8 |

|

|

|

|

INVESTMENT OBJECTIVE |

8 |

|

PRINCIPAL INVESTMENT STRATEGIES |

8 |

|

|

|

|

ADDING AND REMOVING COVERED FUNDS |

9 |

|

|

|

|

IRA ROLLOVERS |

9 |

|

|

|

|

THE ACCUMULATION PHASE |

9 |

|

|

|

|

COVERED FUND VALUE |

9 |

|

BENEFIT BASE |

10 |

|

SUBSEQUENT CONTRACT CONTRIBUTIONS TO YOUR ACCOUNT |

10 |

|

RATCHET DATE ADJUSTMENTS TO THE BENEFIT BASE |

10 |

|

EXCESS WITHDRAWALS DURING THE ACCUMULATION PHASE |

11 |

|

TYPES OF EXCESS WITHDRAWALS |

12 |

|

TREATMENT OF A DISTRIBUTION DURING THE ACCUMULATION PHASE |

12 |

|

LOANS |

12 |

|

DEATH DURING THE ACCUMULATION PHASE |

12 |

|

|

|

|

THE GAW PHASE |

13 |

|

|

|

|

INSTALLMENTS |

13 |

|

CALCULATION OF INSTALLMENT AMOUNT |

13 |

|

INSTALLMENT FREQUENCY OPTIONS |

15 |

|

VESTING |

15 |

|

LUMP SUM DISTRIBUTION OPTION |

16 |

|

SUSPENDING AND RE-COMMENCING INSTALLMENTS AFTER A LUMP SUM DISTRIBUTION |

16 |

|

OPTIONAL RESETS OF THE GAW% DURING THE GAW PHASE |

16 |

|

EFFECT OF EXCESS WITHDRAWALS DURING THE GAW PHASE |

17 |

|

DEATH DURING THE GAW PHASE |

18 |

|

If the GLWB Participant Dies After the Initial Installment Date as a Sole Covered Person |

18 |

|

If the GLWB Participant Dies After the Initial Installment Date while Joint Covered Person is Living |

18 |

|

|

|

|

THE SETTLEMENT PHASE |

18 |

|

|

|

|

EXAMPLES OF HOW THE GLWB WORKS |

18 |

|

|

|

|

GUARANTEE BENEFIT FEE |

21 |

|

|

|

|

WILL A GLWB PARTICIPANT PAY THE SAME AMOUNT (IN DOLLARS) FOR THE WITHDRAWAL GUARANTEE EVERY MONTH? |

22 |

|

|

|

|

DIVORCE PROVISIONS UNDER THE CONTRACT |

23 |

|

DURING THE ACCUMULATION PHASE |

23 |

|

DURING THE GAW PHASE |

23 |

|

If there is a Sole Covered Person |

24 |

|

If there are two Covered Persons |

24 |

|

DURING THE SETTLEMENT PHASE |

24 |

|

|

|

|

EFFECT OF ANNUITIZATION |

24 |

|

|

|

|

ELECTION OF ANNUITY OPTIONS |

24 |

|

|

|

|

TERMINATION OF THE CONTRACT |

25 |

|

|

|

|

IF THE PLAN SPONSOR TERMINATES THE CONTRACT |

25 |

|

IF GREAT-WEST TERMINATES THE CONTRACT |

25 |

|

OTHER TERMINATION |

25 |

|

|

|

|

MISCELLANEOUS PROVISIONS |

25 |

|

|

|

|

PERIODIC COMMUNICATIONS TO GLWB PARTICIPANTS |

25 |

|

AMENDMENTS TO THE CONTRACT |

26 |

|

ASSIGNMENT |

26 |

|

CANCELLATION |

26 |

|

MISSTATEMENTS |

26 |

|

|

|

|

FINANCIAL CONDITION OF THE COMPANY |

26 |

|

|

|

|

TAXATION OF THE CONTRACT AND GLWB |

27 |

|

|

|

|

IN GENERAL |

27 |

|

SECTION 403(B) CONTRACTS |

27 |

|

|

|

|

ABOUT US |

28 |

|

|

|

|

SALES OF THE CONTRACTS |

29 |

|

|

|

|

ADDITIONAL INFORMATION |

29 |

|

|

|

|

OWNER QUESTIONS |

29 |

|

RETURN PRIVILEGE |

29 |

|

STATE REGULATION |

30 |

|

EVIDENCE OF DEATH, AGE, GENDER, OR SURVIVAL |

30 |

|

|

|

|

LEGAL MATTERS |

30 |

|

|

|

|

EXPERTS |

30 |

|

|

|

|

WHERE YOU CAN FIND MORE INFORMATION |

30 |

|

|

|

|

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE |

30 |

|

|

|

|

DEFINITIONS |

32 |

SecureFoundationSM

Group Fixed Deferred Annuity Contract

Issued by:

8515 East Orchard Road

Greenwood Village, CO 80111

Tel. (800) 537-2033

SUMMARY

Preliminary Note Regarding Terms Used in This Prospectus.

Certain terms used in this prospectus have specific and important meanings. Some important terms are explained below, and in most cases the meaning of other important terms is explained the first time they are used in the prospectus. You will also find in the back of this prospectus a listing of all of the terms, with the meaning of each term explained.

· The “Contract” is the SecureFoundation Group Fixed Deferred Contract issued by Great-West Life & Annuity Insurance Company.

· “We,” “us,” “our,” “Great-West,” or the “Company” means Great-West Life & Annuity Insurance Company.

· “Covered Person” or “Covered Persons” means the person or persons, respectively, named in the Contract whose age is used for certain important purposes under the Contract, including determining the amount of the guaranteed income that may be provided by the Contract. The GLWB Participant must be a Covered Person.

· “Covered Fund” or “Covered Funds” refer to the Maxim SecureFoundationSM Lifetime 2015 Portfolio, Maxim SecureFoundationSM Lifetime 2025 Portfolio, Maxim SecureFoundationSM Lifetime 2035 Portfolio, Maxim SecureFoundationSM Lifetime 2045 Portfolio, Maxim SecureFoundationSM Lifetime 2055 Portfolio, and the Maxim SecureFoundationSM Balanced Portfolio.

We believe that in most cases the GLWB Participant will be the only Covered Person. Therefore, for ease of reference, most of the discussion in this prospectus assumes that the GLWB Participant is the only Covered Person. In some places in the prospectus, however, we explain how certain features of the GLWB differ if there are joint Covered Persons.

The following is a summary of the GLWB. You should read the entire prospectus in addition to this summary.

What is the GLWB?

The GLWB is the payment of guaranteed minimum lifetime income that the GLWB Participant will receive, regardless of how long the Covered Person lives or how the Covered Fund performs. The GLWB does not have a cash value. Provided all conditions of the Contract are met, if the value of the shares in the GLWB Participant’s Covered Fund (“Covered Fund Value”) equals zero as a result of Covered Fund performance, the Guarantee Benefit Fee, certain other fees that are not directly associated with the Contract (e.g., custodian fees or advisory fees), and/or Guaranteed Annual Withdrawal(s) (“GAW”), we will make annual payments to the GLWB Participant for the rest of his life.

The amount of the GAW that you may take may increase from time to time based on the Covered Fund Value. It may also decrease if the GLWB Participant takes Excess Withdrawals (discussed below).

The guaranteed income that may be provided by the GLWB is based on the age and life of the Covered Person (or if there are joint Covered Persons, on the age of the younger joint Covered Person and the lives of both Covered Persons) as of the date we calculate the first Installment. A joint Covered Person must be the spouse of the GLWB Participant and the spouse must be the GLWB Participant’s sole beneficiary under the Retirement Plan.

How much will the GLWB cost?

While the Contract is in force, a Guarantee Benefit Fee will be calculated and deducted from the Covered Fund Value on a monthly basis. It will be paid by redeeming the number of fund shares of the Covered Fund equal to the Guarantee Benefit Fee. The Guarantee Benefit Fee is calculated as a specified percentage of the Covered Fund Value at the time the Guarantee Benefit Fee is calculated. If we do not receive the Guarantee Benefit Fee (except during the Settlement Phase), including as a result of the failure of the Retirement Plan’s custodian to submit it to us, the GLWB will terminate as of the date that the fee is due. We will not provide notice prior to termination of the Contract or GLWB and we will not refund the Guarantee Benefit Fee paid upon termination of the Contract or GLWB.

The Guarantee Benefit Fee pays for the insurance protections provided by the Contract.

The guaranteed maximum or minimum Guarantee Benefit Fee we can ever charge is shown below. The amount we currently charge is also shown below.

· The maximum Guarantee Benefit Fee, as a percentage of a GLWB Participant’s Covered Fund Value, on an annual basis, is 1.5%.

· The minimum Guarantee Benefit Fee, as a percentage of a GLWB Participant’s Covered Fund Value, on an annual basis, is 0.70%.

· The current Guarantee Benefit Fee, as a percentage of a GLWB Participant’s Covered Fund Value, on an annual basis, is 0.90%.

We may change the current Guarantee Benefit Fee at any time within the minimum and maximum range described above upon thirty (30) days prior written notice to the GLWB Participant and the Plan Sponsor. We determine the Guarantee Benefit Fee based on observations of a number of experience factors, including, but not limited to, interest rates, volatility, investment returns, expenses, mortality, and lapse rates. We reserve the right to change the Guarantee Benefit Fee at our discretion and for any reason, whether or not these experience factors change (although we will never increase the fee above the maximum or decrease the fee below the minimum). We do not need the happening of any event before we may change the Guarantee Benefit Fee.

The Guarantee Benefit Fee is in addition to any charges that are imposed in connection with advisory, custodial and other services, and charges imposed by the Covered Funds.

Premium taxes may be applicable in certain states. Premium tax applicability and rates vary by state and may change. We reserve the right to deduct any such tax from premium when received.

Can the GLWB Participant cancel the GLWB?

The GLWB Participant may cancel the GLWB by causing the Covered Fund Value or the Benefit Base of each Covered Fund to be reduced to zero prior to the Settlement Phase due to one or more Excess Withdrawals or by failing to pay the Guarantee Benefit Fee. If the GLWB Participant cancels the GLWB, then the GLWB Participant will be prohibited from making any Transfer into the same Covered Fund for at least ninety (90) calendar days.

Can the Contract Owner/Plan Sponsor cancel the Contract?

As Contract Owner, the Plan Sponsor has the right to cancel the Contract upon 75 days written notice to us without additional charges. If the Plan Sponsor cancels the Contract, then the GLWB Participants in the Retirement Plan will lose their GLWB and all associated benefits. We will not return any portion of the Guarantee Benefit Fee that has been collected. However, for GLWB Participants that have reached the Settlement Phase on or before the date that the Plan Sponsor cancels the Contract, Installments will continue for as long as the GLWB Participant shall live.

What protection does the GLWB provide?

The GLWB provides two basic protections to GLWB Participants who purchase the GLWB as a source or potential source of lifetime retirement income or other long-term purposes. Provided that certain conditions are met, the GLWB protects the GLWB Participant from:

· longevity risk, which is the risk that a GLWB Participant will outlive the assets invested in the Covered Fund; and

· income volatility risk, which is the risk of downward fluctuations in a GLWB Participant’s retirement income due to changes in market performance.

Both of these risks increase as a result of poor market performance early in retirement. Point-in-time risk (which is the risk of retiring on the eve of a down market) significantly contributes to both longevity and income volatility risk.

The GLWB does not provide a guarantee that the Covered Fund or the GLWB Participant’s Account will retain a certain value or that the value of the Covered Fund or the GLWB Participant’s Account will remain steady or grow over time. Instead, it provides for a guarantee, under certain specified conditions, that regardless of the performance of the Covered Funds in the Account and regardless of how long the GLWB Participant lives, the GLWB Participant will be able to receive a guaranteed level of annual income for life. Therefore, it is important to understand that while the preservation of capital may be one of the GLWB Participant’s goals, the achievement of that goal is not guaranteed by the GLWB.

How does the GLWB work?

The GLWB has three phases: an “Accumulation Phase,” a “GAW Phase,” and a “Settlement Phase.”

|

· |

The Accumulation Phase: During the Accumulation Phase, the GLWB Participant may make additional Contract Contributions to the Covered Fund, which establishes the Benefit Base (this is the sum of all Contract Contributions minus any withdrawals and any adjustments made on the “Ratchet Date” as described later in this prospectus), and take Distributions from the Account just as the GLWB Participant otherwise would be permitted to (although Excess Withdrawals will reduce the amount of the Benefit Base under the Contract). The GLWB Participant is responsible for managing withdrawals during the Accumulation Phase. |

|

|

|

|

· |

The GAW Phase: After the GLWB Participant (or if there are joint Covered Persons, the younger joint Covered Person) has turned age 55, then the GLWB Participant can enter the GAW Phase and begin to take GAWs (which are annual withdrawals that do not exceed a specified amount) without reducing the Benefit Base. GAWs before age 59 ½ may result in certain tax penalties, and may not be permissible in certain circumstances. |

|

|

|

|

· |

Settlement Phase: If the Covered Fund Value falls to zero as a result of Covered Fund performance, the Guarantee Benefit Fee, certain other fees that are not directly associated with the GLWB or Contract (e.g., custodian fees or advisory fees), and/or GAWs, the Settlement Phase will begin. During the Settlement Phase, we make Installments to the GLWB Participant for life. However, the Settlement Phase may never occur, depending on how long the GLWB Participant lives and how well the Covered Fund performs. |

The Installments that a GLWB Participant may receive when in the GAW Phase or Settlement Phase are determined by multiplying the vested Benefit Base by the GAW Percentage (GAW%), which is determined by the age of the Covered Person(s) as of the date we calculate the first Installment. As described in more detail below, the amount of the Installments may increase on an annual basis during the GAW Phase due to positive Covered Fund performance, and will decrease as a result of any Excess Withdrawals.

If the GLWB Participant withdraws any of his Covered Fund Value during the Accumulation Phase to satisfy any contribution limitation imposed under federal law, we will consider that to be an Excess Withdrawal. Any withdrawals to satisfy a GLWB Participant’s required distribution obligations under the Code will be considered an Excess Withdrawal if taken during the Accumulation Phase. Each GLWB Participant should consult a qualified tax advisor regarding contribution limits and other tax implications. We will deem withdrawals taken during the GAW Phase to meet required minimum distribution requirements, in the proportion of the GLWB Participant’s Covered Fund Value to his overall Account balance (and not taking into account any other retirement balances of the GLWB Participant), to be within the contract limits for the Contract and will not treat such withdrawals as Excess Withdrawals.

How does the Contract Owner/Plan Sponsor apply for the Contract?

The Contract Owner/Plan Sponsor may apply for the Contract by completing an application or other form authorized by us and executing the Contract. The Contract Owner/Plan Sponsor is also required to add one or more Covered Funds to the eligible investment options for the Retirement Plan. If the application or form is accepted by us at our Administrative Office, we will issue a Contract to the Contract Owner/Plan Sponsor describing the rights and obligations under the Contract.

How does a Retirement Plan participant elect the GLWB?

A Retirement Plan participant must elect the GLWB in connection with his purchase of shares of a Covered Fund in his Account under the Retirement Plan. However, the actual date of election of the GLWB will depend on which Covered Fund shares are purchased. For the SecureFoundation Lifetime Portfolios, a GLWB Participant will not be deemed to have actually elected the GLWB until the first business day of the year that is ten years prior to the date in the name of the fund. There is no minimum initial investment. Subject to federal tax law and Retirement Plan limitations on Section 403(b) contributions, a GLWB Participant may invest any amount in any Covered Fund. However, the Benefit Base is limited to $5,000,000. Any amount over $5,000,000 will not increase the GLWB Participant’s Benefit Base.

The GLWB may only be elected by participants in Retirement Plans that offer the Covered Funds.

What are the Designated Investment Options?

The following is a list of the currently available Covered Funds

|

Maxim SecureFoundationSM Lifetime 2015 Portfolio |

|

Maxim SecureFoundationSM Lifetime 2025 Portfolio |

|

Maxim SecureFoundationSM Lifetime 2035 Portfolio |

|

Maxim SecureFoundationSM Lifetime 2045 Portfolio |

|

Maxim SecureFoundationSM Lifetime 2055 Portfolio |

|

Maxim SecureFoundationSM Balanced Portfolio |

In general, if the GLWB Participant purchases shares of one of the Covered Funds, the GLWB Participant is required to purchase the GLWB. However, the actual date of purchase will depend on which Covered Fund shares are purchased. For the SecureFoundation Lifetime Portfolios, the GLWB Participant will not be deemed to have purchased the GLWB until the first business day of the year that is ten years prior to the date in the name of the fund. Thus, it is possible to redeem the shares of a Maxim SecureFoundationSM Lifetime Portfolio prior to the date in which the GLWB Participant would have been deemed to have purchased the GLWB. For example, if a GLWB Participant purchases shares of the Maxim SecureFoundationSM Lifetime 2055 Portfolio today, he will not purchase the GLWB until January 3, 2045, will not have any rights or benefits under the GLWB until January 3, 2045, and will not be charged the Guarantee Benefit Fee until the end of January 2045 and, if the GLWB Participant chooses to redeem all of his shares prior to January 3, 2045, the GLWB Participant will not be charged the Guarantee Benefit Fee.

A GLWB Participant may also later decide not to maintain the GLWB. If so, the GLWB Participant will need to redeem all shares in the Covered Fund in order to cancel the GLWB. A GLWB Participant cannot remain invested in a Covered Fund without owning the GLWB.

Is the GLWB right for Retirement Plan participants?

The GLWB may be right for a Retirement Plan participant if he believes that he may outlive his retirement investments or is concerned about market risk. If a Retirement Plan participant believes that his retirement investments will be sufficient to provide for retirement expenses regardless of market performance or lifespan, then the GLWB may not be right for the Retirement Plan participant.

The GLWB does not protect the actual value of a Retirement Plan participant’s investments in the Account or guarantee the Covered Fund Value. For example, if a Retirement Plan participant invests $500,000 in a Covered Fund, and the Covered Fund Value has dropped to $400,000 on the Initial Installment Date, we are not required to add $100,000 to the Covered Fund Value. Instead, the GLWB guarantees that when a GLWB Participant reaches the Initial Installment Date, he may begin GAWs based upon a Benefit Base of $500,000, rather than $400,000 (so long as specified conditions are met).

The GAWs are made from the GLWB Participant’s own investment. We start using our money to make Installments to a GLWB Participant only if the Covered Fund Value is reduced to zero due to Covered Fund performance, the Guarantee Benefit Fee, certain other fees that are not directly associated with the GLWB (e.g., custodian fees or advisory fees), and/or GAWs. We limit our risk under the GLWB in this regard by limiting the amount a GLWB Participant may withdraw each year to GAWs. If a GLWB Participant needs to take Excess Withdrawals, the GLWB Participant may not receive the full benefit of the GLWB. For further information, see “The Accumulation Phase — Excess Withdrawal During the Accumulation Phase” and “The GAW Phase — Excess Withdrawals During the Accumulation Phase.”

If the return on the Covered Fund Value over time is sufficient to generate gains that can sustain constant GAWs, then the GLWB would not have provided any financial gain. Conversely, if the return on the Covered Fund Value over time is not sufficient to generate gains that can sustain constant GAWs, then the GLWB would be beneficial.

Each Retirement Plan participant should discuss his investment strategy and risk tolerance with his financial advisor before electing to invest in Covered Funds and the GLWB.

RISK FACTORS

There are a number of risks associated with the Contract and GLWB as described below.

The guarantee that may be provided is contingent on several conditions being met. In certain circumstances a GLWB Participant may not realize a benefit from the GLWB.

· If the Plan Sponsor selects a new record keeper, the GLWB Participant may lose the entire benefit. Currently, the Contracts are only offered to Plan Sponsors of Retirement Plans that select Great-West as their record keeper. If the Plan Sponsor elects a new record keeper, it is likely that this will result in the termination of the Contract and the GLWB Participant will lose the entire benefit unless the GLWB Participant has already reached Settlement Phase. The Guarantee Benefit Fee will not be refunded.

· The Plan Sponsor may cancel the Contract or remove the Covered Funds. The GLWB is an investment option offered by the Retirement Plan and is contingent on the Retirement Plan offering one or more of the Covered Funds. The Plan Sponsor may elect to cancel the Contract at any time or remove the Covered Funds from the Retirement Plan’s investment options. If the Plan Sponsor takes either of these actions, the GLWB Participant will lose the entire benefit unless the GLWB Participant has already reached Settlement Phase. The Guarantee Benefit Fee will not be refunded.

· The GLWB Participant may die before receiving payments from us or may not live long enough to receive enough income to exceed the amount of the Guarantee Benefit Fees paid. If the GLWB Participant (assuming he is the sole Covered Person) dies before the Covered Fund Value is reduced to zero, the GLWB Participant will never receive any payments under the Contract. Neither the Contract nor the GLWB has any cash value or provides a death benefit. Furthermore, even if the GLWB Participant begins to receive Installments in the Settlement Phase, the GLWB Participant may die before receiving an amount equal to or greater than the amount paid in Guarantee Benefit Fees.

· The Covered Funds may perform well enough so that the GLWB Participant may not need the guarantee that may otherwise be provided by the Contract. The Covered Funds are managed by a registered investment adviser, GW Capital Management, LLC, doing business as Maxim Capital Management, LLC (“MCM”), a wholly owned subsidiary of Great-West. MCM manages the SecureFoundation Lifetime Portfolios to become more conservative as time goes on, which may minimize the likelihood that the GLWB Participant will experience a significant loss of capital at an advanced age. MCM also has the flexibility to manage the SecureFoundationSM Balanced Portfolio conservatively. Therefore, there is a good chance that the Covered Funds will perform well enough that GAWs will not reduce Covered Fund Value to zero. As a result, the likelihood that we will make payments to the GLWB Participant is minimal. In this case, the GLWB Participant will have paid us the Guarantee Benefit Fee for the life of the GLWB and received no payments in the Settlement Phase in return.

· The GLWB Participant may need to make Excess Withdrawals, which have the potential to substantially reduce or even terminate the benefits available under the Contract. Because personal financial needs can arise unpredictably (e.g., unexpected medical bills), the GLWB Participant may need to make a withdrawal from a Covered Fund before the start of the GAW Phase or following the start of the GAW Phase in an amount larger than the GAW. These types of withdrawals are Excess Withdrawals that will reduce or eliminate the guarantee that may otherwise be provided by the Contract. There is no provision under the Contract to cure any decrease in the benefits due to Excess Withdrawals. To avoid making Excess Withdrawals, the GLWB Participant will need to carefully manage any withdrawals. The Contract does not require us to warn the GLWB Participant of Excess Withdrawals or other actions with adverse consequences.

· The GLWB Participant may choose to cancel the GLWB prior to a severe market downturn. The GLWB is designed to protect the GLWB Participant from outliving the assets in the Covered Fund. If the GLWB Participant terminates the GLWB before reaching the GAW Phase or Settlement Phase, we will not make payments to the GLWB Participant, even if subsequent Covered Fund performance reduces the Covered Fund Value to zero.

· The GLWB Participant might not begin making GAWs at the most financially beneficial time. Because of decreasing life expectancy as one ages, in certain circumstances, the longer the GLWB Participant waits to start taking GAWs, the less likely it is that the GLWB Participant will benefit from the GLWB. On the other hand, the earlier the GLWB Participant begins taking GAWs, the lower the GAW Percentage the GLWB Participant will receive and therefore the lower the GAWs (if any) will be. Because of the uncertainty of how long the GLWB Participant will live and how the GLWB Participant’s investments will perform over time, it will be difficult to determine the most financially beneficial time to begin making GAWs.

· If the GLWB Participant moves his assets out of the Retirement Plan, the GLWB Participant may never receive a benefit from the GLWB. The GLWB is currently available to participants in certain Section 403(b) Plans. The Contract is entered into by the Plan Sponsor. If the GLWB Participant moves his assets out of the Retirement Plan, such as by a full distribution of all of the assets in the Plan, or moves to an IRA provider that does not offer the GLWB, the GLWB Participant will cause the GLWB to terminate. In that case, the GLWB Participant may never receive a benefit from the GLWB, and the Guarantee Benefit Fee will not be refunded. See “IRA Rollovers” for further information on how to maintain the Benefit Base after an IRA rollover.

· We reserve the right to increase the Guarantee Benefit Fee at any time. If we increase the Guarantee Benefit Fee, then depending upon how long the GLWB Participant lives, the GLWB Participant may not receive enough income to exceed the amount of total fees paid.

· The deduction of the Guarantee Benefit Fee each month will negatively affect the growth of the Covered Fund Value. The growth of the Plan account value is likely important to the GLWB Participant because the GLWB Participant may never receive Installments during Settlement Phase. Therefore, depending on how long the GLWB Participant lives and how other investment options available to the GLWB Participant under the Retirement Plan perform, the GLWB Participant may be financially better off without electing the Covered Funds and GLWB.

· The Contract limits the GLWB Participant’s investment choices. Only certain funds are available under the Contract. These Covered Funds may be managed in a more conservative fashion than other mutual funds available to the GLWB Participant. If the GLWB Participant does not elect the GLWB, it is possible that the GLWB Participant may invest under the Retirement Plan in other mutual funds (or other types of investments) that experience higher growth or lower losses, depending on the market, than the Covered Funds experience. It is impossible to know how various investments will fare on a comparative basis.

· Covered Funds may become ineligible. If the Covered Fund that the GLWB Participant invests in becomes ineligible for the Contract, the GLWB Participant will be forced to Transfer the Covered Fund Value to another Covered Fund. We reserve the right to designate Covered Funds that were previously eligible for use with the Contract as ineligible for use with the Contract, for any reason including due to changes to their investment objectives. In the event that all Covered Funds become ineligible or are liquidated, we will designate a new fund as a Covered Fund. The new Covered Fund may have higher fees and charges and different investment objectives/strategies than the ineligible Covered Fund. In addition, designating a new fund as a Covered Fund may result in an increase in the current Guarantee Benefit Fee, which will not exceed the maximum Guarantee Benefit Fee of 1.5%. The Guarantee Benefit Fee will not be refunded if the Covered Funds become ineligible or are liquidated.

· We may terminate the Contract upon 75 days written notice to the Contract Owner. If we terminate the Contract, such termination will not adversely affect the GLWB Participant’s rights under the Contract, except that we will not permit additional Contributions to the Covered Fund. However, we will accept reinvested dividends and capital gains. The GLWB Participant will still be obligated to pay the Guarantee Benefit Fee.

· The Contract will terminate if the Guaranteed Benefit Fee is not paid. If we do not receive the Guarantee Benefit Fee (except during the Settlement Phase), including as a result of the failure of the Retirement Plan custodian to submit it to us, the Contract will terminate as of the date that the fee is due.

The GLWB Participant’s receipt of payments from us is subject to our claims paying ability.

· Any payments we are required to make to the GLWB Participant under the Contract will depend on our long-term ability to make such payments. We will make all payments under the Contract in the Settlement Phase from our general account, which is not insulated from the claims of our third party creditors. Therefore, the GLWB Participant’s receipt of payments from us is subject to our claims paying ability.

Currently, our financial strength is rated by three nationally recognized statistical rating organizations (“NRSRO”), ranging from superior to excellent to very strong. Our ratings reflect the NRSROs’ opinions that we have a superior, excellent, or a very strong ability to meet our ongoing obligations. An excellent and very strong rating means that we may have somewhat larger long-term risks than higher rated companies that may impair our ability to pay benefits payable on outstanding insurance policies on time. The financial strength ratings are the NRSROs’ current opinions of our financial strength with respect to our ability to pay under our outstanding insurance policies according to their terms and the timeliness of payments. The NRSRO ratings are not specific to the Contract or Certificate.

Information on our financial condition is available by reviewing our Form 10-K and Form 10-Qs, which are the periodic reports that we file with the Securities and Exchange Commission pursuant to Sections 13 and 15(d) of the Securities Exchange Act of 1934. For further information, see “Financial Condition of the Company” later in this prospectus.

There may be tax consequences associated with the Contract.

· The Contract is novel and innovative and, to date, the tax consequences of the GLWB have not been addressed in published legal authorities. A prospective GLWB Participant should consult a tax advisor before electing the Covered Funds and GLWB. See “Taxation of the Contract and GLWB” later in this prospectus for further discussion of tax issues relating to the GLWB.

Other Information

· You should be aware of various regulatory protections that do and do not apply to the Contract. The Contract is registered in accordance with the Securities Act of 1933. The issuance and sale of the Contract must be conducted in accordance with the requirements of the Securities Act of 1933. We are also subject to applicable periodic reporting requirements and other requirements imposed by the Securities Exchange Act of 1934.

· We are neither an investment company nor an investment adviser and do not provide investment advice in connection with the Contract. Therefore, we are not governed by the Investment Advisers Act of 1940 (the “Advisers Act”) or the Investment Company Act of 1940 (the “1940 Act”). Accordingly, the protections provided by the Advisers Act and the 1940 Act are not applicable with respect to our sale of the Contract.

THE CONTRACT

The Contract is a group fixed deferred annuity contract. The GLWB is offered only to Retirement Plan participants whose assets are invested in one or more Covered Funds. The Contract is designed for Retirement Plan participants who intend to use the investments in the Covered Fund in their Account as the basis for periodic withdrawals (such as systematic withdrawal programs involving regular annual withdrawals of a certain percentage of the Covered Fund Value) to provide income payments for retirement or for other purposes. For more information about the Covered Funds, each Retirement Plan participant should talk to his advisor and review the accompanying prospectuses for the Covered Funds.

Provided that specified conditions are met, the Contract provides for a guaranteed income over the remaining life of the GLWB Participant (or, if these are joint Covered Persons, the remaining lives of both joint Covered Persons), should the Covered Fund Value equal zero as a result of GAWs, the Guarantee Benefit Fee, certain other fees that are not directly associated with the Certificate or Contract (e.g., custodian fees or advisory fees), and/or Covered Fund performance.

INVESTMENT OPTIONS — THE COVERED FUNDS

The Contract provides protection relating to Covered Funds by ensuring that, regardless of how the Covered Fund(s) actually performs or the actual Covered Fund Value when the GLWB Participant begins GAWs for retirement or other purposes, the GLWB Participant will receive predictable income payments for as long as the GLWB Participant lives so long as specified conditions are met.

In general, if the GLWB Participant purchases shares of one of the Covered Funds in his Account, the GLWB Participant is required to purchase the GLWB. The actual date of purchase of the GLWB will depend on which Covered Fund shares are purchased. For the SecureFoundation Lifetime Portfolios, the GLWB is not actually purchased until the first Business Day of the year that is ten years prior to the date in the name of the fund, which is known as the “Guarantee Trigger Date.” (The Guarantee Trigger Date is also your Election Date.) Thus, it is possible to redeem the shares of a SecureFoundation Lifetime Portfolio prior to the Guarantee Trigger Date. For example, if the GLWB Participant purchases shares of the Maxim SecureFoundationSM Lifetime 2055 Portfolio, the GLWB will not be purchased until January 3, 2045, the GLWB Participant will not have any rights or benefits under the GLWB until January 3, 2045, and the GLWB Participant will not be charged the Guarantee Benefit Fee until the end of January 2045, and if the GLWB Participant chooses to redeem all of the shares prior to January 3, 2045, he will not be charged the Guarantee Benefit Fee.

If the GLWB Participant later decides that he does not want to maintain the GLWB, he will need to redeem all of his shares in the Covered Fund in order to cancel the GLWB. The GLWB Participant cannot remain invested in a Covered Fund without owning the GLWB.

The Covered Funds will be held in an Account maintained pursuant to the Retirement Plan. The Company issues the Contracts, but the Company is not the GLWB Participant’s investment adviser and does not provide investment advice to the GLWB Participant in connection with the GLWB.

As described in more detail in the Covered Fund prospectuses, in addition to the Guarantee Benefit Fee, there are certain fees and charges associated with the Covered Funds, which may reduce the Covered Fund Value. These fees may include management fees, distribution fees, acquired fund fees and expenses, redemption fees, exchange fees, advisory fees, and/or administrative fees.

The following information about the Covered Funds is only a summary of important information that the GLWB Participant should know. More detailed information about the Covered Funds’ investment strategies and risks are included in each Covered Fund’s prospectus. Please read that separate prospectus carefully before investing in a Covered Fund.

MAXIM SECUREFOUNDATIONSM BALANCED PORTFOLIO

The portfolio is designed for investors seeking a professionally designed asset allocation program to simplify the accumulation of assets prior to retirement together with the potential benefit of the guarantee that may be provided by the Contract. The portfolio strives to provide shareholders with a high level of diversification primarily through both a professionally designed asset allocation model and professionally selected investments in underlying portfolios (the “Underlying Portfolios”). The intended benefit of asset allocation is diversification, which is expected to reduce volatility over the long-term.

The portfolio is a “fund of funds” that pursues its investment objective by investing in other mutual funds, including Underlying Portfolios that may or may not be affiliated with the Maxim SecureFoundationSM Balanced Portfolio, cash and cash equivalents.

The portfolio has two classes of shares, Class G shares and Class G1 shares. Each class is identical except that Class G1 shares have a distribution or “Rule 12b-1” plan. The distribution plan provides for a distribution fee. Because the distribution fee is paid out of Class G1’s assets on an ongoing basis, over time these fees will increase the cost of the investment and may cost more than paying other types of sales charges.

Investment Objective.

The portfolio seeks long-term capital appreciation and income.

Principal Investment Strategies.

Under normal conditions, the portfolio will invest 50-70% of its net assets (plus the amount of any borrowings for investment purposes) in Underlying Portfolios that invest primarily in equity securities and 30-50% of its net assets (plus the amount of any borrowings for investment purposes) in Underlying Portfolios that invest primarily in fixed income securities.

MAXIM SECUREFOUNDATIONSM LIFETIME PORTFOLIOS

There are five separate SecureFoundation Lifetime Portfolios. These are the:

Maxim SecureFoundationSM Lifetime 2015 Portfolio

Maxim SecureFoundationSM Lifetime 2025 Portfolio

Maxim SecureFoundationSM Lifetime 2035 Portfolio

Maxim SecureFoundationSM Lifetime 2045 Portfolio

Maxim SecureFoundationSM Lifetime 2055 Portfolio

Each SecureFoundation Lifetime Portfolio provides an asset allocation strategy and is designed to meet certain investment goals based on an investor’s investment horizon (such as projected retirement date) and personal objectives.

Each SecureFoundation Lifetime Portfolio is a “fund of funds” that pursues its investment objective by investing in other mutual funds, including mutual funds that may or may not be affiliated with the SecureFoundation Lifetime Portfolios (collectively, “Underlying Portfolios”), cash and cash equivalents. The SecureFoundation Lifetime Portfolios use asset allocation strategies to allocate assets among the Underlying Portfolios.

The SecureFoundation Lifetime Portfolios have two classes of shares, Class G shares and Class G1 shares. Each class is identical except that Class G1 shares have a distribution or “Rule 12b-1” plan. The distribution plan provides for a distribution fee. Because the distribution fee is paid out of Class G1’s assets on an ongoing basis, over time these fees will increase the cost of the investment and may cost more than paying other types of sales charges.

Investment Objective.

Each SecureFoundation Lifetime Portfolio seeks long-term capital appreciation and income consistent with its current asset allocation.

Principal Investment Strategies.

Each SecureFoundation Lifetime Portfolio seeks to achieve its objective by investing in a professionally selected mix of Underlying Portfolios that is tailored for investors planning to retire in, or close to, the year designated in the name of the SecureFoundation Lifetime Portfolio. Depending on its proximity to the year designated in the name of the SecureFoundation Lifetime Portfolio, each SecureFoundation Lifetime Portfolio employs a different combination of investments among different Underlying Portfolios in order to emphasize, as appropriate, growth, income, and/or preservation of capital. Over time until the Guarantee Trigger Date, each SecureFoundation Lifetime Portfolio’s asset allocation strategy will generally become more conservative, with greater emphasis on investments that provide for income and preservation of capital, and less on those offering the potential for growth. Once a SecureFoundation Lifetime Portfolio reaches its Guarantee Trigger Date, the asset allocation between equity and fixed-income investments is anticipated to become relatively static, subject to any revisions to the asset classes, asset allocations, and Underlying Portfolios made by Maxim Capital Management, LLC. After its Guarantee Trigger Date, it is anticipated that each SecureFoundation Lifetime Portfolio will invest 50-70% of its net assets in Underlying Portfolios that invest primarily in equity securities and 30-50% of its net assets in Underlying Portfolios that invest primarily in fixed income securities.

ADDING AND REMOVING COVERED FUNDS

We may, without the consent of the GLWB Participant or the Contract Owner, offer new Covered Fund(s) or cease offering Covered Fund(s). We will notify the Contract Owner whenever the Covered Fund(s) are changed. If we cease offering a Covered Fund in which the GLWB Participant is invested, then the GLWB Participant will be forced to Transfer the Covered Fund Value to another Covered Fund. In the event that we cease offering all of the Covered Funds, we will designate a new fund as a Covered Fund. The new Covered Fund may have higher fees and charges and different investment objectives/strategies than the ineligible Covered Fund. In addition, designating a new fund as a Covered Fund, may result in an increase in the current Guarantee Benefit Fee, which will not exceed the maximum Guarantee Benefit Fee of 1.5%. If the Plan Sponsor removes a Covered Fund, we are not obligated to designate a new Covered Fund.

IRA ROLLOVERS

If the SecureFoundationSM Group Fixed Deferred Annuity Certificate (or individual contract in certain states) that we issue in connection with IRAs (the “IRA Certificate”) has been approved in the GLWB Participant’s state of residence and he or she is eligible and permitted by the terms of his or her Retirement Plan documents, the GLWB Participant may rollover the proceeds of his or her tax deferred Retirement Plan, including the GLWB, to his or her IRA. To preserve the GLWB in the rollover, the IRA provider must offer one or more of the Covered Funds and the IRA Certificate. If the rollover is from a tax-deferred Retirement Plan and the GLWB Participant has previously elected the GLWB as part of his or her investments in the tax-deferred Retirement Plan, the new Benefit Base may be equal to the Benefit Base as it existed under the GLWB Participant’s prior tax-deferred Retirement Plan immediately prior to the rollover. The new benefit base after the IRA rollover will only equal the Benefit Base the GLWB Participant had under the tax-deferred Retirement Plan if the GLWB Participant: (a) invests the rollover or transfer proceeds covered by the Contract immediately prior to distribution from the tax-deferred Retirement Plan in the Covered Fund(s); (b) invest in the same Covered Fund, except if the GLWB Participant is in the Settlement Phase; and (c) the GLWB Participant Requests the restoration of the Benefit Base as it existed under the Retirement Plan. To maintain the same Benefit Base, the GLWB Participant must be in the same Phase that the GLWB Participant was in at the time of the rollover or transfer after the rollover or transfer is complete. If the GLWB Participant does not meet these requirements, a new benefit base will be established that is equal to the Covered Fund Value as of the date of the rollover and the Guarantee Benefit Fee will be calculated as a percentage of the Covered Fund Value.

The GLWB Participant’s new Covered Fund Value after the IRA rollover will initially equal the Covered Fund Value as of the date of the rollover. We will calculate the GLWB Participant’s Guarantee Benefit Fee as a specified percentage of the Covered Fund Value.

THE ACCUMULATION PHASE

As stated previously in this prospectus, the Contract has three phases: an “Accumulation Phase,” “GAW Phase,” and “Settlement Phase.” The Accumulation Phase is described in the following section of this prospectus.

The Accumulation Phase is the period of time between the Election Date, which is the date the GLWB Participant purchases the GLWB, and the first day of the GAW Phase. During this Phase, the GLWB Participant will establish the GLWB Participant’s Benefit Base which will be used later to determine the amount of GAWs.

Covered Fund Value.

The GLWB Participant’s Covered Fund Value is the aggregate value of the shares in each Covered Fund held in the GLWB Participant’s Account. If the GLWB Participant’s Covered Fund Value is reduced to zero as a result of Covered Fund performance, the Guarantee Benefit Fee, certain other fees that are not directly associated with the Contract ( e.g., custodian fees or advisory fees), and/or GAWs, we will make annual payments to the GLWB Participant for the rest of his life. See The Settlement Phase below. The GLWB Participant’s Covered Fund Value also determines the amount of the Guarantee Benefit Fee we deduct. See Guarantee Benefit Fee below.

The GLWB Participant’s Covered Fund Value is an actual cash value separate from the Benefit Base (which is only used to calculate Installment Payments during the GAW Phase and the Settlement Phase). The GLWB Participant’s Covered Fund Value and Benefit Base may not be equal to one another.

We do not increase or decrease the GLWB Participant’s Covered Fund Value. Rather, the GLWB Participant’s Covered Fund Value is increased or decreased in the same manner that all mutual fund values increase or decrease. For example, reinvested dividends, settlements, and positive Covered Fund performance (including capital gains)) will increase the GLWB Participant’s Covered Fund Value, and fees and expenses associated with the Covered Funds and negative Covered Fund performance (including capital losses) will decrease the GLWB Participant’s Covered Fund Value.

The GLWB Participant’s Covered Fund Value will also increase each time the GLWB Participant purchases additional fund shares, such as by making a Contract Contribution, and will decrease each time the GLWB Participant redeems shares, such as through payment of the Guarantee Benefit Fee or as a result of Distributions, Excess Withdrawals, Installments, and Transfers from a Covered Fund to another investment option offered under the Retirement Plan (other than another Covered Fund).

The GLWB Participant’s Covered Fund Value is not affected by any Ratchet or Reset of the Benefit Base (described below).

Benefit Base.

The GLWB Participant’s Benefit Base is separate from the Covered Fund Value. It is not a cash value. Rather, the GLWB Participant’s Benefit Base is used to calculate Installment Payments during the GAW Phase and the Settlement Phase. The GLWB Participant’s Benefit Base and Covered Fund Value may not be equal to one another.

On the GLWB Participant’s Election Date, the initial Benefit Base is equal to the GLWB Participant’s Covered Fund Value on that date. Each Covered Fund will have its own Benefit Base. A Covered Fund Benefit Base cannot be transferred to another Covered Fund unless we require a Transfer as a result of the Covered Fund being eliminated or liquidated.

· We increase the GLWB Participant’s Benefit Base on a dollar-for-dollar basis each time the GLWB Participant makes a Contribution.

· We decrease the GLWB Participant’s Benefit Base on a proportionate basis each time the GLWB Participant makes an Excess Withdrawal.

· On each Ratchet Date (described below), we will increase the GLWB Participant’s Benefit Base to equal the GLWB Participant’s current Covered Fund Value if the GLWB Participant ‘s Covered Fund Value is greater than the GLWB Participant’s Benefit Base. (If so, the GLWB Participant’s Benefit Base will then reflect positive Covered Fund performance.)

A few things to keep in mind regarding the Benefit Base:

· The Benefit Base is used only for purposes of calculating the GLWB Participant’s Installment Payments during the GAW Phase and the Settlement Phase. It has no other purpose. The Benefit Base does not provide and is not available as a cash value or settlement value.

· It is important that the GLWB Participant does not confuse the Benefit Base with the Covered Fund Value.

· During the Accumulation Phase and the GAW Phase, the Benefit Base will be re-calculated each time the GLWB Participant makes a Contract Contribution or Excess Withdrawal, as well as on an annual basis as described below, which is known as the Ratchet Date.

· The maximum Benefit Base is $5,000,000.

Subsequent Contract Contributions to Your Account.

During the Accumulation Phase, the GLWB Participant may make additional Contract Contributions to the Covered Funds in addition to the initial Contract Contribution. Subject to the requirements of federal tax law and the terms of the Retirement Plan, subsequent Contract Contributions can be made by cash deposit, Transfers, or rollovers from certain other retirement accounts. Additional Contract Contributions may not be made after the Accumulation Phase ends.

All additional Contract Contributions made after the Election Date will increase the Benefit Base dollar-for-dollar on the date the Contract Contribution is made. We will not consider the additional purchase of shares of a Covered Fund through reinvested dividends, capital gains, and/or settlements to be a Contract Contribution. However, they will increase the Covered Fund Value.

Great-West reserves the right to refuse additional Contract Contributions at any time and for any reason. If Great-West refuses additional Contract Contributions, the GLWB Participant will retain all other rights under the GLWB.

Ratchet Date Adjustments to the Benefit Base.

During the Accumulation Phase, the Benefit Base will be evaluated and, if necessary, adjusted on an annual basis. This is known as the Ratchet Date and it occurs on the anniversary of the Election Date. It is important to be aware that even though the GLWB Participant’s Covered Fund Value may increase throughout the year due to dividends, capital gains, or settlements from the underlying Covered Fund, the Benefit Base will not similarly increase until the next Ratchet Date. Unlike Covered Fund Value, the GLWB Participant’s Benefit Base will never decrease solely due to negative Covered Fund performance.

On each Ratchet Date during the Accumulation Phase, the Benefit Base is automatically adjusted (“ratcheted”) to the greater of:

(a) the current Benefit Base; or

(b) the current Covered Fund Value.

|

Example of Ratchet Date Adjustments during the Accumulation Period |

|

|

|

Assume the following: |

|

|

|

Benefit Base on Election Date (of January 2, 2009) = $100,000 |

|

|

|

Covered Fund Value on Election Date = $100,000 |

|

|

|

Increase in Covered Fund Value due to Dividends and Capital Gains paid June 30, 2009 = $5,000 |

|

|

|

Covered Fund Value on June 30, 2009 = $105, 000 |

|

|

|

Benefit Base on June 30, 2009 = $100,000 |

|

|

|

No other Contract Contributions, Dividends, or Capital Gains are paid for the rest of the year. |

|

|

|

Covered Fund Value on January 2, 2010 = $105,000 |

|

|

|

So, because the Covered Fund Value is greater than the Benefit Base on the Ratchet Date (January 2, 2010), the Benefit Base is adjusted to $105,000 effective January 2, 2010. |

|

|

Excess Withdrawals During the Accumulation Phase.

Because the GLWB is held in the Account, the GLWB Participant may make withdrawals or change the GLWB Participant’s Account investments at any time and in any amount that the GLWB Participant wishes, subject to any federal tax limitations or Retirement Plan limitations. During the Accumulation Phase, however, any withdrawals or Transfers from the GLWB Participant’s Covered Fund Value will be categorized as Excess Withdrawals. Any withdrawals to satisfy the GLWB Participant’s required distribution obligations under the Code will be considered an Excess Withdrawal if taken during the Accumulation Phase.

The GLWB Participant should carefully consider the effect of an Excess Withdrawal on both the Benefit Base and the Covered Fund Value during the Accumulation Phase, as this may affect the GLWB Participant’s future benefits under the Contract. In the event the GLWB Participant decides to take an Excess Withdrawal, as discussed below, the GLWB Participant’s Covered Fund Value will be reduced dollar-for-dollar in the amount of the Excess Withdrawal. The Benefit Base will be reduced at the time the Excess Withdrawal is made by the ratio of the Covered Fund Value after the Excess Withdrawal reduction is applied. Accordingly, the GLWB Participant’s Benefit Base could be reduced by more than the amount of the withdrawal.

|

Example of Effects of an Excess Withdrawal taken during the Accumulation Period |

|

|

|

Assume the following: |

|

|

|

Covered Fund Value before the Excess Withdrawal adjustment = $50,000 |

|

|

|

Benefit Base = $100,000 |

|

|

|

Excess Withdrawal amount: $10,000 |

|

|

|

So, |

|

|

|

Covered Fund Value after adjustment= $50,000 - $10,000 = $40,000 |

|

|

|

Covered Fund Value adjustment = $40,000/$50,000 = 0.80 |

|

|

|

Adjusted Benefit Base = $100,000 x 0.80 = $80,000 |

Types of Excess Withdrawals.

A Distribution or Transfer during the Accumulation Phase is considered an Excess Withdrawal. An Excess Withdrawal will reduce the GLWB Participant’s Benefit Base and Covered Fund Value. A Distribution occurs when money is paid to the GLWB Participant from the Covered Fund Value. A Transfer occurs when the GLWB Participant transfers money from a Covered Fund to another investment. A Transfer will occur even if you transfer money from one Covered Fund to a different Covered Fund in the Retirement Plan. If the GLWB Participant Transfers any amount out of out of the Maxim SecureFoundationSM Balanced Portfolio or the SecureFoundation Lifetime Portfolios after the Guarantee Trigger Date, then the GLWB Participant will be prohibited from making any Transfers into the same Covered Fund for at least ninety (90) calendar days.

Note: The Contract does not require us to warn the GLWB Participant or provide the GLWB Participant with notice regarding potentially adverse consequences that may be associated with any withdrawals or other types of transactions involving the GLWB Participant’s Covered Fund. The GLWB Participant should carefully monitor his Covered Fund, any withdrawals from his Covered Fund, and any changes to the GLWB Participant’s Benefit Base. The GLWB Participant may contact us at 1-866-317-6586 for information about the GLWB Participant’s Benefit Base.

Treatment of a Distribution During the Accumulation Phase.

At the time of any partial or periodic Distribution, if the Covered Person is 55 years of age or older, the GLWB Participant may elect to begin the GAW Phase (as described below) and begin receiving GAWs at that time. If the GLWB Participant chooses not to begin the GAW Phase, the Distribution will be treated as an Excess Withdrawal and will reduce the GLWB Participant’s Covered Fund Value and your Benefit Base (as described above).

If the Covered Person is not yet 55 years old, then any partial or periodic Distribution will be treated as an Excess Withdrawal as described above.

Any Distribution made during the Accumulation Phase to satisfy any contribution limitation imposed under federal law will be considered an Excess Withdrawal at all times. The GLWB Participant should consult a qualified tax advisor regarding contribution limits and other tax implications.

Loans.

During the Accumulation Phase, the GLWB Participant may take a loan on his or her Account, if allowed by the Retirement Plan and the Code.

Any amount withdrawn from the Covered Fund Value to fund the loan will be treated as an Excess Withdrawal. Loan repayments to the Covered Fund will increase the Benefit Base dollar-for-dollar and are invested in the Covered Fund dollar-for-dollar. If the loan reduces the Covered Fund Value to zero, Transfer(s) will not be permitted into the same Covered Fund for at least ninety (90) calendar days after the loan, but the GLWB Participant may continue to direct other Contract Contributions into the Covered Fund and establish a new Election Date.

If a Retirement Plan loan is outstanding that affects the Covered Fund Value, the GLWB Participant must repay the Plan loan before the GAW Phase can begin and Installments are paid. Retirement Plan loans cannot be made from Covered Fund Value during GAW Phase or Settlement Phase.

Death During the Accumulation Phase.

If a GLWB Participant dies during the Accumulation Phase, then the GLWB will terminate and the Covered Fund Value will be paid to the Beneficiary in accordance with the terms of the Retirement Plan and the Code (unless an election is permitted and made by a Beneficiary that is the spouse of the GLWB Participant). A Beneficiary that is the spouse of the GLWB Participant may choose either to:

· become a new GLWB Participant and maintain the deceased GLWB Participant’s current Benefit Base (or proportionate share if multiple Beneficiaries) as of the date of death; or

· establish a new Account with a new Benefit Base based on the current Covered Fund Value on the date of the deceased GLWB Participant’s death.

In either situation, the spouse Beneficiary shall become a GLWB Participant and the Ratchet Date will be the date when his or her Account is established.

If permitted by the Retirement Plan and the Code, a Beneficiary who is not the spouse of the GLWB Participant cannot elect to maintain the current Benefit Base, but may elect to establish a new GLWB. The Benefit Base and Election Date will be based on the current Covered Fund Value on the date his or her Account is established.

To the extent to that the Beneficiary becomes a GLWB Participant, he or she will be subject to all terms and conditions of the Contract, the Retirement Plan, and the Code. Any election made by Beneficiary pursuant to this section is irrevocable.

THE GAW PHASE

The GAW Phase begins when the GLWB Participant elects to receive GAWs under the Contract. The GAW Phase continues until the Covered Fund Value reaches zero and the Settlement Phase begins.

The GAW Phase cannot begin until all Covered Persons attain age 55 and are eligible to begin distributions under the Retirement Plan and the Code. If the GLWB Participant is still in the employment of the Plan Sponsor, the Code generally does not permit distributions to commence prior to age 59-1/2. The Retirement Plan and the Code may impose other limitations on distributions. Distributions prior to age 59-1/2 may be subject to a penalty tax. Installments will not begin until Great-West receives appropriate and satisfactory information about the age of the Covered Person(s) in good order and in manner reasonably satisfactory to Great-West.

In order to initiate the GAW Phase, the GLWB Participant must submit a written Request to Great-West. At that time, the GLWB Participant must provide sufficient documentation for Great-West to determine the age of each Covered Person.

Because the GAW Phase cannot begin until all Covered Persons under the GLWB attain age 55, any Distributions taken before then will be considered Excess Withdrawals and will be deducted from the Covered Fund Value and Benefit Base. See Accumulation Phase for more information. No Contract Contributions may be made to the Covered Fund(s) on and after the Initial Installment Date, which is the date that GAWs begin.

Because of decreasing life expectancy as the GLWB Participant ages, in certain circumstances, the longer the GLWB Participant waits to start taking GAWs, the less likely it is that the GLWB Participant will benefit from the GLWB. On the other hand, the earlier the GLWB Participant begins taking GAWs, the lower the GAW Percentage the GLWB Participant will receive and therefore the lower the GLWB Participant’s GAWs (if any) will be. The GLWB Participant should talk to his advisor before initiating the GAW Phase to determine the most financially beneficial time for the GLWB Participant to begin taking GAWs.

Installments.

It is important that you understand how the GAW is calculated because it will affect the benefits the GLWB Participant receives under the Contract. Once the GAW Phase has been initiated and the age of the Covered Person(s) is verified, we will determine the amount of the GAW.

To determine the amount of the GAW, we will compare the vested portion of the current Benefit Base to the current Covered Fund Value on the Initial Installment Date. To determine the vested portion of (“Vested %”) of the Benefit Base, the vested portion of each Covered Fund is divided by the total Covered Fund Value. If the GLWB Participant is less than fully vested, the GAW will be based upon the Vested % of the Covered Fund Value and Benefit Base. If the vested Covered Fund Value is greater than the Vested % of the Benefit Base, we will increase the Benefit Base to equal the vested Covered Fund Value, and the GAW will be based on the increased Benefit Base amount. See “The GAW Phase — Vesting” below.

During the GAW Phase, the GLWB Participant’s Benefit Base will receive an annual adjustment or “ratchet” just as it did during the Accumulation Phase. The GLWB Participant’s Ratchet Date will become the anniversary of Initial Installment Date and will no longer be the anniversary of the Election Date.

Just like the Accumulation Phase, the Benefit Base will be automatically adjusted on an annual basis, on the Ratchet Date, to the greater of:

(a) the current Benefit Base; or

(b) the current Covered Fund Value.

The GLWB Participant’s Benefit Base is used to calculate the GAW he receives. However, even though the Benefit Base is adjusted annually, the GAW% will not change unless the GLWB Participant requests a Reset of the GAW%. See “The GAW Phase—Optional Resets of the GAW% During the GAW Phase” below.

It is important to note that Installments during the GAW Phase will reduce the GLWB Participant’s Covered Fund Value on a dollar-for-dollar basis, but they will not reduce the GLWB Participant’s Benefit Base.

Calculation of Installment Amount.

The GAW% is based on the age of the Covered Person(s) as of the date we calculate the first Installment. If there are two Covered Persons the percentage is based on the age of the younger Covered Person.

The GAW is based on a percentage of the Benefit Base pursuant to the following schedule:

|

Sole Covered Person |

|

Joint Covered Person |

|

4.0% for life at ages 55-64 |

|

3.5% for youngest joint life at ages 55-64 |

|

5.0% for life at ages 65-69 |

|

4.5% for youngest joint life at ages 65-69 |

|

6.0% for life at ages 70-79 |

|

5.5% for youngest joint life at ages 70-79 |

|

7.0% for life at ages 80+ |

|

6.5% for youngest joint life at ages 80+ |

The GAW will then be calculated by multiplying the Benefit Base by the GAW%. The amount of the Installment equals the GAW divided by the number of payments per year under the elected Installment Frequency Option, as described below.

|

Numerical Example of GAW Calculation |

|

|

|

Assume the following: |

|

|

|

Sole Covered Person - 100% Vested |

|

Age of Covered Person at Initial Installment Date: 60 |

|

Covered Fund Value = $120,000 |

|

Current Benefit Base = $115,000 |

|

Adjusted Benefit Base at Initial Installment Date = $120,000* |

|

GAW% based on Age = 4.0% |

|

|

|

GAW% x Vested % x = 4.0% x $120,000 = $4,800 |

|

Installment Frequency = Monthly (12 payments per year) |

|

|

|

So GAW/Installment Frequency = $4,800/12 = $400 |

|

The monthly Installment will be $400 |

|

|

|

Numerical Example of GAW Calculation, Joint Covered Persons |

|

|

|

Assume the following: |

|

|

|

Joint Covered Persons - 100% Vested |

|

Age of primary Covered Person at Initial Installment Date: 65 |

|

Age of joint Covered Person at Initial Installment Date: 58 |

|

Youngest Age for Determination of GAW: 58 |

|

Covered Fund Value = $120,000 |

|

Current Benefit Base = $115,000 |

|

Adjusted Benefit Base at Initial Installment Date = $120,000* |

|

GAW% based on Age = 3.5% |

|

|

|

GAW% x Vested % x (Adjusted Benefit Base) = 3.5% x $120,000 = $4,200 |

|

Installment Frequency = Monthly (12 payments per year) |

|

|

|

So GAW/Installment Frequency = $4,200/12 = $350 |

|

The monthly Installment will be $350 |

|

|

* On the Initial Installment Date, we compare the current Benefit Base to the current Covered Fund Value. If the Covered Fund Value is greater than the Benefit Base, we will increase the Benefit Base to equal the Covered Fund Value, and the GAW will be based on the increased Benefit Base amount. See “Installments” above.

Any election which affects the calculation of the GAW is irrevocable. Please consider all relevant factors when making an election to begin the GAW Phase. For example, an election to begin receiving Installments based on a sole Covered Person cannot subsequently be changed to joint Covered Persons once the GAW Phase has begun. Similarly, an election to receive Installments based on joint Covered Persons cannot subsequently be changed to a sole Covered Person.

Installment Frequency Options.

The GLWB Participant’s Installment Frequency Options are as follows:

(a) Annual — the GAW will be paid on the Initial Installment Date and each anniversary annually, or next business day, thereafter.

(b) Semi-Annual — half of the GAW will be paid on the Initial Installment Date and in Installments every 6 month anniversary, or next business day, thereafter.

(c) Quarterly — one quarter of the GAW will be paid on the Initial Installment Date and in Installments every 3 month anniversary, or next business day, thereafter.

(d) Monthly — one-twelfth of the GAW will be paid on the Initial Installment Date and in Installments every monthly anniversary, or next business day, thereafter.

The GLWB Participant may Request to change the Installment Frequency Option starting on each Ratchet Date during the GAW Phase.

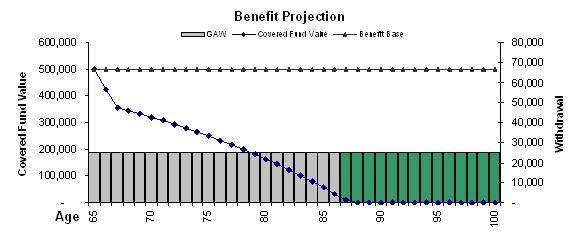

Vesting.