|

|

|

|

UNITED STATES |

|

|

SECURITIES AND EXCHANGE COMMISSION |

|

|

WASHINGTON, D.C. 20549 |

|

|

FORM 10-K |

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF |

|

|

THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

FOR THE FISCAL YEAR ENDED JANUARY 31, 2011 |

COMMISSION FILE NO. 001-09097 |

|

|

|

REX AMERICAN RESOURCES CORPORATION |

|

(Exact name of registrant as specified in its charter) |

|

|

|

|

|

Delaware |

|

31-1095548 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

2875 Needmore Road, Dayton, Ohio |

|

45414 |

|

(Address of principal executive offices) |

|

(Zip Code) |

|

|

|

|

|

Registrant’s telephone number, including area code (937) 276-3931 |

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

|

|

|

|

|

Title of each class |

|

Name of each exchange |

|

|

|

|

|

Common Stock, $.01 par value |

|

New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one):

|

|

|

|

|

|

Large accelerated filer o |

Accelerated filer þ |

Non-accelerated filer o |

Smaller reporting company o |

|

(Do not check if a smaller reporting company) |

|||

|

|

|

There were 9,600,056 shares of the registrant’s Common Stock outstanding as of April 14, 2011. |

|

Documents Incorporated by Reference |

|

Portions of REX American Resources Corporation’s definitive Proxy Statement for its Annual Meeting of Shareholders on June 7, 2011 are incorporated by reference into Part III of this Form 10-K. |

FORWARD-LOOKING STATEMENTS

This Form 10-K contains or may contain forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Such statements can be identified by use of forward-looking terminology such as “may,” “expect,” “believe,” “estimate,” “anticipate” or “continue” or the negative thereof or other variations thereon or comparable terminology. Readers are cautioned that there are risks and uncertainties that could cause actual events or results to differ materially from those referred to in such forward-looking statements. These risks and uncertainties include the risk factors set forth from time to time in the Company’s filings with the Securities and Exchange Commission and include among other things: the impact of legislative changes, the price volatility and availability of corn, sorghum, distillers grains, ethanol, gasoline and natural gas, ethanol plants operating efficiently and according to forecasts and projections, changes in the national or regional economies, weather, the effects of terrorism or acts of war and changes in real estate market conditions. The Company does not intend to update publicly any forward-looking statements except as required by law. Other factors that could cause actual results to differ materially from those in the forward-looking statements are set forth in Item 1A.

AVAILABLE INFORMATION

REX makes available free of charge on its Internet website its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. REX’s Internet website address is www.rexamerican.com. The contents of the Company’s website are not a part of this report.

PART I

|

|

|

|

Item 1. |

Business |

Overview

REX was incorporated in Delaware in 1984 as a holding company to succeed to the entire ownership of three affiliated corporations, Rex Radio and Television, Inc., Stereo Town, Inc. and Kelly & Cohen Appliances, Inc., which were formed in 1980, 1981 and 1983, respectively. Our principal offices are located at 2875 Needmore Road, Dayton, Ohio 45414. Our telephone number is (937) 276-3931. Historically, we were a specialty retailer in the consumer electronics and appliance industry serving small to medium-sized towns and communities. In addition, we have been an investor in various alternative energy entities beginning with synthetic fuel partnerships in 1998 and later ethanol production facilities beginning in 2006. Recognizing the change in our business, we changed our corporate name from REX Stores Corporation to REX American Resources Corporation in 2010.

In fiscal year 2007, we began to evaluate strategic alternatives for our retail segment with a focus on closing unprofitable or marginally profitable retail stores and monetizing our retail-related real estate assets. We did not believe that we were generating an adequate return from our retail business due to the competitive nature of the consumer electronics and appliance industry and the overall economic conditions in the United States. Reflecting this focus, we sold approximately 60% of our owned retail and vacant stores in fiscal year 2007 and leased back a portion of the stores which had been operating as electronics and appliance retail stores. In fiscal year 2008, we commenced an evaluation of a broad range of alternatives intended to derive value from the remaining retail operations and our remaining real estate portfolio. We engaged an investment banking firm to assist us in analyzing and ultimately marketing our retail operations. As part of those marketing efforts, late in fiscal year 2008, we initially leased 37 owned store locations to an unrelated third party. During fiscal year 2009, the lease agreements were terminated. At January 31, 2011, we had lease agreements for all or parts of eight former retail properties and had 22 vacant former retail properties. We

2

also own one former distribution center, which is partially leased, partially occupied by our corporate office personnel and partially vacant. We are marketing these vacant properties to lease or sell. Should our marketing efforts result in additional tenants to whom we lease property, we would expect to execute leases with terms of five to twenty years.

We completed our exit of the retail business as of July 31, 2009. Going forward, our only retail related activities will consist of the administration of extended service plans we previously sold and the payment of related claims. Net sales and expenses related to extended service plans are classified as discontinued operations.

We are currently invested in five ethanol production entities, one of which we have a majority ownership interest in. We may make additional investments in the alternative energy segment during fiscal year 2011.

Our ethanol operations are highly dependent on commodity prices, especially prices for corn, sorghum, ethanol, distillers grains and natural gas. As a result of price volatility for these commodities, our operating results can fluctuate substantially. The price and availability of corn and sorghum are subject to significant fluctuations depending upon a number of factors that affect commodity prices in general, including crop conditions, weather, federal policy and foreign trade. Because the market price of ethanol is not always directly related to corn and sorghum prices, at times ethanol prices may lag movements in corn prices and, in an environment of higher prices, reduce the overall margin structure at the plants. As a result, at times, we may operate our plants at negative or marginally positive operating margins.

We expect our ethanol plants to produce approximately 2.8 gallons of ethanol for each bushel of grain processed in the production cycle. We refer to the difference between the price per gallon of ethanol and the price per bushel of grain (divided by 2.8) as the “crush spread.” Should the crush spread decline, it is possible that our ethanol plants will generate operating results that do not provide adequate cash flows for sustained periods of time. In such cases, production at the ethanol plants may be reduced or stopped altogether in order to minimize variable costs at individual plants. This was the case for Levelland Hockley County Ethanol, LLC (“Levelland Hockley”) during fiscal year 2010. This plant was unable to source affordable grain supplies, and combined with the lower than normal industry crush spreads that existed in the latter portions of fiscal year 2010, the plant ceased production operations in January 2011. We expect decisions to be made on an individual plant basis, as there are different market conditions at each of our ethanol plants.

We attempt to manage the risk related to the volatility of grain and ethanol prices by utilizing forward grain purchase and forward ethanol and distillers grain sale contracts. We attempt to match quantities of ethanol and distillers grains sale contracts with an appropriate quantity of grain purchase contracts over a given period of time when we can obtain an adequate gross margin resulting from the crush spread inherent in the contracts we have executed. However, the market for future ethanol sales contracts is not a mature market. Consequently, we generally execute contracts for no more than three months into the future at any given time. As a result of the relatively short period of time our contracts cover, we generally cannot predict the future movements in the crush spread for more than three months; thus, we are unable to predict the likelihood or amounts of future income or loss from the operations of our ethanol facilities.

The crush spread realized in 2010 was subject to significant volatility. For calendar year 2010, the average Chicago Board of Trade (“CBOT”) near-month corn price was approximately $4.30 per bushel, with highs reaching approximately $6.25 per bushel in December 2010. We believe corn prices were affected late in the year by global weather conditions, export demand, speculation, currency valuation and global economic conditions. Ethanol prices also had significant fluctuations ranging from approximately $1.50 per gallon in June to approximately $2.38 per gallon in December. Ethanol and corn prices have tended to trade in the same direction but with narrowing spreads, particularly late in the year. In 2010, the CBOT crush spread ranged

3

from a low of approximately $0.05 per gallon in December to a high of approximately $0.55 per gallon in February. We believe ethanol demand late in 2010 was also impacted by the uncertainty of the extension of the Volumetric Ethanol Tax Credit Blender Credit. Crush spreads have continued to decline in 2011 and have at times, become negative (absent the consideration of distillers grains). Prices for distillers grains we sell generally trend with grain prices. These prices have partially offset the decline in the crush spread.

We reported segment profit (before income taxes and noncontrolling interests) from our alternative energy segment of approximately $13.4 million in fiscal year 2010 compared to approximately $17.8 million in fiscal year 2009. The decline in profitability primarily resulted from impairment charges and loss on deconsolidation of Levelland Hockley. Levelland Hockley reported a loss from operations during fiscal year 2010, and ceased production in January 2011. These losses were partially offset as One Earth Energy, LLC (“One Earth”) was in production for a full year during fiscal year 2010. We expect that future operating results will be based upon annual production of between 100 and 115 million gallons of ethanol, which assumes that One Earth will operate at or near nameplate capacity. However, due to the inherent volatility of the crush spread, we cannot predict the likelihood of future operating results being similar to the fiscal year 2010 results.

We plan to seek and evaluate various investment opportunities including energy related, agricultural or other ventures we believe fit our investment criteria. We can make no assurances that we will be successful in our efforts to find such opportunities.

Additional information regarding our business segments is presented below and in Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) in this Form 10-K. See Note 18 of the Notes to the Consolidated Financial Statements for information regarding the net sales and revenues and operating results for each of our business segments for the fiscal years ended January 31, 2011, 2010 and 2009.

Fiscal Year

All references in this report to a particular fiscal year are to REX’s fiscal year ended January 31. For example, “fiscal year 2010” means the period February 1, 2010 to January 31, 2011. We refer to our fiscal year by reference to the year immediately preceding the January 31 fiscal year end date.

Alternative Energy Overview

As part of our ongoing efforts to diversify and increase our earnings, we began investing in the ethanol industry during fiscal year 2006. Our business strategy focuses on partnering with farmer groups, local groups, or farmer-controlled cooperatives to develop and operate ethanol production plants. We seek to identify quality ethanol plant opportunities characterized by strong plant construction partners and plant management, located near adequate feedstock supply with good transportation capabilities or other economically beneficial attributes, and that utilize leading ethanol production technology. Our partnership model generally enables farmer groups to retain local management of the project, while we provide capital and additional business administration experience.

We follow a flexible model for our investments in ethanol plants, taking both minority and majority ownership positions. The form and structure of our investments is tailored to the specific needs and goals of each project and the local farmer group or investor with whom we are partnering. We generally participate in the management of our projects through our membership on the board of managers of the limited liability companies that own the plants.

4

Ethanol Investments

We have invested in five entities as of January 31, 2011, utilizing both equity and debt investments. As of January 31, 2011, all of the entities we are invested in are operating except for Levelland Hockley. The following table is a summary of our ethanol investments at January 31, 2011:

|

|

|

|

|

|

|

|

|

|

|

|

|

Entity |

|

Nameplate |

|

Effective |

|

Effective |

|

|||

|

|

|

|

|

|

|

|

|

|||

|

One Earth Energy, LLC |

|

|

100 |

|

|

74 |

% |

|

74.0 |

|

|

NuGen Energy, LLC |

|

|

100 |

|

|

48 |

% |

|

48.0 |

|

|

Patriot Renewable Fuels, LLC |

|

|

100 |

|

|

23 |

% |

|

23.0 |

|

|

Big River Resources, LLC-W Burlington |

|

|

92 |

|

|

10 |

% |

|

9.2 |

|

|

Big River Resources, LLC-Galva |

|

|

100 |

|

|

10 |

% |

|

10.0 |

|

|

Big River United Energy, LLC |

|

|

100 |

|

|

5 |

% |

|

5.0 |

|

|

Levelland Hockley County Ethanol, LLC |

|

|

40 |

|

|

49 |

% |

|

19.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

632 |

|

|

|

|

|

188.8 |

|

One Earth Energy, LLC

On October 30, 2007, we acquired 74% of the outstanding membership units of One Earth Energy, LLC, or One Earth, for $50.8 million. We consolidate One Earth with our financial results and include them in our alternative energy segment. One Earth completed construction in the second quarter of fiscal year 2009 of its ethanol production facility in Gibson City, Illinois. The plant has a nameplate capacity of 100 million gallons of ethanol and 320,000 tons of dried distillers grains (“DDG”) per year.

One Earth commenced production operations late in the second quarter of fiscal year 2009 and began generating revenue in the third quarter of fiscal year 2009.

NuGen Energy, LLC

Effective July 1, 2010, we acquired a 48% equity interest in NuGen Energy, LLC, or NuGen, which operates an ethanol producing facility in Marion, South Dakota with an annual nameplate capacity of 100 million gallons of ethanol and 320,000 tons of DDG. Our investment included $2,410,000 paid at closing to the then sole shareholder of NuGen and $6,805,000 contributed directly to NuGen. An additional $6,451,000 is due based upon cash distributions from NuGen that we are entitled to until such balance is paid (“Contingent Consideration”). We determined that the fair value of the Contingent Consideration, at the acquisition date, was $4,611,000.

We have an option to purchase for $1,138,000, (which is payable in cash, partially based upon cash distributions from NuGen that we are entitled to) additional ownership units from NuGen’s majority shareholder, which, if exercised, would result in us owning 51% of the total outstanding voting and economic interests of NuGen on a fully diluted basis.

Patriot Renewable Fuels, LLC

5

On December 4, 2006, we acquired a 23% ownership interest in Patriot Renewable Fuels, LLC, or Patriot, for $16 million. Patriot commenced production operations in the second quarter of fiscal year 2008. The plant is located in Annawan, Illinois and has a nameplate capacity of 100 million gallons of ethanol and 320,000 tons of DDG per year.

Big River Resources, LLC

We have invested $20 million in Big River Resources, LLC, or Big River, for a 10% ownership interest. Big River is a holding company for several entities including Big River Resources West Burlington, LLC which operates an ethanol plant with a nameplate capacity of 92 million gallons of ethanol and 294,000 tons of DDG per year. This plant is located in West Burlington, Iowa. The facility has been in operation since 2004.

Big River completed construction in the second quarter of fiscal year 2009 of its second plant which has a nameplate capacity of 100 million gallons of ethanol and 320,000 tons of DDG per year. This plant is located in Galva, Illinois.

In August 2009, Big River acquired a 50.5% interest in an ethanol production facility which has a nameplate capacity of 100 million gallons of ethanol and 320,000 tons of DDG per year. The plant is located in Dyersville, Iowa. Reflecting REX’s 10% ownership interest in Big River, REX has an effective 5% ownership interest in this entity.

Big River also operates five agricultural elevators with a storage capacity of 10 million bushels.

Levelland Hockley County Ethanol, LLC

On September 30, 2006, we acquired 47% of the outstanding membership units of Levelland Hockley for $11.5 million. On December 29, 2006, we purchased a $5.0 million convertible secured promissory note from Levelland Hockley. On July 1, 2007, we converted the note into equity and increased our ownership percentage to approximately 56%. On February 20, 2008, we purchased an additional $5.0 million convertible secured promissory note from Levelland Hockley. The balance of this note at January 31, 2011 was $5.2 million, including accrued interest. On January 29, 2009, we agreed to fund up to $2.0 million in the form of a subordinated revolving line of credit with Levelland Hockley and to issue a $1.0 million letter of credit for the benefit of Levelland Hockley. On September 1, 2010, we agreed to increase our line of credit to $4.0 million, inclusive of the $1.0 million letter of credit. We were issued warrants in the amount of 1,298,700 at $3.08 per share in conjunction with the issuance of the line of credit. At January 31, 2011, there was $3.8 million outstanding under the subordinated revolving line of credit.

Levelland Hockley, which is located in Levelland, Texas, commenced production operations in the first quarter of fiscal year 2008. The plant has a nameplate capacity of 40 million gallons of ethanol and 135,000 tons of dried distillers grains (“DDG”) per year.

The plant was shut down in early January 2011 as a result of industry wide low crush margins and the plant’s inability to source grain at affordable prices. On January 31, 2011 we sold 814,000 of our membership units to Levelland Hockley for $1, reducing our ownership interest in Levelland Hockley to 49%. As a result, we no longer have a controlling financial interest in Levelland Hockley, and, therefore, effective January 31, 2011, we deconsolidated Levelland Hockley and began using the equity method of accounting to account for the results of Levelland Hockley. In connection with the deconsolidation, we recorded our remaining non controlling equity interest and our debt investments at fair value. Our estimate of fair value for all of our investments in Levelland Hockley was $0 at January 31, 2011. We recorded a pretax charge of

6

approximately $18.4 million as a result of deconsolidating Levelland Hockley and writing our remaining investments in Levelland Hockley to $0 at January 31, 2011.

Ethanol Industry

Ethanol is a renewable fuel source produced by processing corn and other biomass through a fermentation process that creates combustible alcohol that can be used as an additive or replacement to fossil fuel based gasoline. The majority of ethanol produced in the United States is made from corn because of its wide availability and ease of convertibility from large amounts of carbohydrates into glucose, the key ingredient in producing alcohol that is used in the fermentation process. Ethanol production can also use feedstocks such as grain sorghum, switchgrass, wheat, barley, potatoes and sugarcane as carbohydrate sources. Most ethanol plants have been located near large corn production areas, such as Illinois, Indiana, Iowa, Minnesota, Nebraska, Ohio and South Dakota. Railway access and interstate access are vital for ethanol facilities due to the large amount of demand in the east- and west-coast markets, primarily as a result of the stricter air quality requirements in large parts of those markets, and the limited ethanol production facilities.

According to the Renewable Fuels Association, or RFA, the United States fuel ethanol industry experienced record production of an estimated 13 billion gallons in 2010. As of January 2011, the number of operating ethanol plants increased to 204, up from 54 in 2000 and are located in 29 states with a total capacity of 13.5 billion gallons annually.

On December 19, 2007, the Energy Independence and Security Act of 2007 (the “Energy Act of 2007”) was enacted. The Energy Act of 2007 established new levels of renewable fuel mandates, including two different categories of renewable fuels: conventional biofuels and advanced biofuels. Corn-based ethanol is considered conventional biofuels which was subject to a renewable fuel standard (“RFS”) of at least 12.0 billion gallons per year in 2010, with an expected increase to at least 15.0 billion gallons per year by 2015. Advanced biofuels include ethanol derived from cellulose, hemicellulose or other non-corn starch sources; biodiesel; and other fuels derived from non-corn starch sources. Advanced biofuels RFS levels are set to reach at least 21.0 billion gallons per year, resulting in a total RFS from conventional and advanced biofuels of at least 36.0 billion gallons per year by 2022.

Ethanol Production

The plants we have invested in are designed to use the dry milling method of producing ethanol. In the dry milling process, the entire corn kernel is first ground into flour, which is referred to as “meal,” and processed without separating out the various component parts of the grain. The meal is processed with enzymes, ammonia and water, and then placed in a high-temperature cooker. It is then transferred to fermenters where yeast is added and the conversion of sugar to ethanol begins. After fermentation, the resulting liquid is transferred to distillation columns where the ethanol is separated from the remaining “stillage” for fuel uses. The anhydrous ethanol is then blended with denaturant, such as natural gasoline, to render it undrinkable and thus not subject to beverage alcohol tax. With the starch elements of the corn consumed in the above described process, the principal co-product produced by the dry milling process is dry distillers grains with solubles, or DDGS. DDGS is sold as a protein used in animal feed and recovers a significant portion of the total corn cost.

The Primary Uses of Ethanol

Blend component. Today, much of the ethanol blending in the U.S. is done for the purpose of extending the volume of fuel sold at the gas pump. Blending ethanol allows refiners to produce more fuel from a given

7

barrel of oil. Currently, ethanol is blended into approximately 90% of the gasoline sold in the United States, the majority as E10 (a blend of 10% ethanol and 90% gasoline), according to the RFA. Going forward, the industry is attempting to expand the E-85 market, as well as to raise the federal cap on ethanol blend above the current 10% for most vehicles in use. The U.S. Environmental Protection Agency approved the use of 15% ethanol in gasoline for cars and light duty trucks made in 2007 and later. In January 2011, the EPA expanded this to include cars, pickups and SUV’s made in model years 2001 through 2006. This covers approximately 62% of light duty vehicles on the road. Despite this, it will take time for this measure to be implemented and currently several lawsuits have been filed to stop the expanded measure from moving forward.

Clean air additive. Ethanol is employed by the refining industry as a fuel oxygenate, which when blended with gasoline, allows engines to combust fuel more completely and reduce emissions from motor vehicles. Ethanol contains 35% oxygen, approximately twice that of Methyl Tertiary Butyl Ether, or MTBE, an alternative oxygenate to ethanol, the use of which is being phased out because of environmental and health concerns. The additional oxygen in ethanol results in more complete combustion of the fuel in the engine cylinder. Ethanol is non-toxic, water soluble and quickly biodegradable.

Octane enhancer. Ethanol increases the octane rating of gasoline with which it is blended. As such, ethanol is used by gasoline suppliers as an octane enhancer both for producing regular grade gasoline from lower octane blending stocks and for upgrading regular gasoline to premium grades.

Legislation

The United States ethanol industry is highly dependent upon federal and state legislation. See Item 1A. Risk Factors for a discussion of legislation affecting the U.S. ethanol industry.

Synthetic Fuel Partnerships

We had invested in three limited partnerships which owned facilities producing synthetic fuel. The partnerships earned federal income tax credits under Section 29/45K of the Internal Revenue Code based upon the tonnage and content of solid synthetic fuel produced and sold to unrelated parties. The Section 29/45K tax credit program expired on December 31, 2007. As such, we do not expect to receive additional income from these investments except for the possibility of an additional payment on a facility formerly located in Gillette, Wyoming. Based upon the modified terms of a sales agreement we are currently not able to predict the likelihood and timing of payments for production from September 30, 2006 to December 31, 2007 for this facility. We expect the payments, if any, to be made within the next year. We have not recognized this income and will recognize income, if any, upon receipt of payment or upon our ability to reasonably assure ourselves of the timing and collectability of payment.

See Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations and Notes 4 and 17 of the Notes to the Consolidated Financial Statements for further discussions.

Real Estate Operations

At January 31, 2011, we had lease agreements, as landlord, for all or parts of eight owned former retail stores (88,000 square feet leased and 10,000 square feet vacant). We have 22 owned former retail stores (281,000 square feet), that are vacant at January 31, 2011. We are marketing these vacant properties to lease or sell. In addition, one former distribution center is partially leased (266,000 square feet), partially occupied by our corporate office personnel (10,000 square feet) and partially vacant (190,000 square feet).

8

A typical lease agreement has an initial term of five to twenty years with renewal options. Most of our lessees are responsible for a portion of maintenance, taxes and other executory costs. We require our lessees to maintain adequate levels of insurance. We recognized lease revenue of approximately $1,285,000 and $913,000 during fiscal years 2010 and 2009, respectively.

Retail

When we operated retail stores, we offered extended service contracts to our customers which typically provided, inclusive of manufacturers’ warranties, one to five years of warranty coverage. We plan to manage and administer these contracts and to recognize the associated income and expenses, including the cost to repair or replace covered products, over the remaining life of the contracts. We have classified as discontinued operations all retail related activities, including those activities associated with extended service plans, in the Consolidated Statements of Operations for all periods presented.

Facilities

At January 31, 2011, we owned eight former retail store properties that were leased to outside, unrelated parties. Of the eight leased properties, one of the properties is only partially leased. There were also 22 vacant former retail store properties that we were attempting to either lease or sell. In addition, we have one former distribution center that is partially leased, partially occupied by our corporate office and partially vacant.

Employees

At January 31, 2011, we had eight employees supporting our corporate functions. None of our employees are represented by a labor union. We expect this employment to remain relatively stable at its current level as we have completed our exit from the retail business.

At January 31, 2011, One Earth had 50 employees.

We consider our relationship with our employees to be good.

Service Marks

We have registered our service mark “REX”, and we own an application to register the mark “Farmers Energy”, with the United States Patent and Trademark Office. We are not aware of any adverse claims concerning our service marks.

|

|

|

|

Item 1A. |

Risk Factors |

We encourage you to carefully consider the risks described below and other information contained in this report when considering an investment decision in REX common stock. Any of the events discussed in the risk factors below may occur. If one or more of these events do occur, our results of operations, financial condition or cash flows could be materially adversely affected. In this instance, the trading price of REX stock could decline, and investors might lose all or part of their investment.

We have concentrations of cash deposits at financial institutions that exceed federal insurance limits.

We generally have cash deposits that exceed federal insurance limits. Should the financial institutions we deposit our cash at experience insolvency or other financial difficulty, our access to cash deposits could be limited. In extreme cases, we could lose our cash deposits entirely. This would negatively impact our liquidity and results of operations.

9

The current interest rate environment has resulted in lower yields on our excess cash.

We have experienced lower yields on our excess cash compared to historical yields. Should the present economic conditions result in a sustained period of historically low interest rates, our interest income would be negatively impacted.

Risks Related to our Synthetic Fuel Investments and Income Tax Benefits

We face synthetic fuel risks as future IRS audits may result in the disallowance of previously recognized tax credits.

We have recognized investment income of approximately $53.9 million from the sales of our partnership interests from years that the partnerships have not been audited by the Internal Revenue Service (IRS). Should the tax credits be denied on any future audit and we fail to prevail through the IRS or the legal process, there could be significant refunds of previously recognized income with a significant adverse impact on earnings and cash flows.

The production and sale of synthetic fuel qualified for Section 29/45K tax credits if certain requirements were satisfied, including a requirement that the synthetic fuel differs significantly in chemical composition from the coal used to produce the synthetic fuel and that the fuel was produced from a facility placed in service before July 1, 1998.

We may not be able to generate sufficient taxable income to realize our deferred tax assets.

We have approximately $11.0 million of net deferred tax assets recorded on our consolidated financial statements. Should future results of operations or other factors cause us to determine that it is unlikely that we will generate sufficient taxable income to fully utilize our deferred tax assets; we would then be required to establish a valuation allowance against such deferred tax assets. We would increase our income tax expense by the amount of the tax benefit we do not expect to realize. This would reduce our net income and could have a material adverse effect on our results of operations and our financial position.

Risks Related to our Alternative Energy Business

Certain of our ethanol investments are subject to the risks of a development stage business which could adversely affect returns on our ethanol investment and our results of operations.

We do not have long term experience investing in the ethanol industry. We entered into our first agreement to invest in an ethanol plant in November 2005. At January 31, 2011, we were invested in five entities that own and operate seven ethanol production facilities. One facility has been in production since 2004, but the remaining facilities all became operational or were acquired in fiscal year 2008 or later. Our ethanol investments have been managed by our Chief Executive Officer, our Chief Operating Officer and our Chief Financial Officer. We do not otherwise have a dedicated ethanol development or management staff. As a consequence, our ethanol investments are subject to many of the risks associated with a development stage company, including an unproven business model, a lack of operating history and an undeveloped operating structure. These development stage risks could result in our making investments in ethanol plants that perform substantially below our expectations, which would adversely affect our results of operations and financial condition.

10

If cash flow from operations of our ethanol plants is not sufficient to service debt, the plants could fail and we could lose our entire investment.

Our ethanol plants financed approximately 60% of plant construction cost with debt. The debt typically has a balloon payment due after five years. The ability of each company owning the plant to repay borrowings incurred will depend upon the plant’s financial and operating performance. The cash flows and capital resources of an ethanol plant may be insufficient to repay its debt obligations. If a plant cannot service its debt, it may be forced to reduce or delay capital expenditures, sell assets, restructure its indebtedness or seek additional capital. If unable to do so, the value of our investment could decline significantly.

The institutional senior lenders to the companies which own and operate our ethanol plants hold liens on the plant’s assets. If a company fails to make its debt service payments, the senior lender will have the right to repossess the plant’s assets in addition to other remedies, which are superior to our rights as an equity investor or subordinated lender. Such action could have a material adverse impact on our investment in the ethanol plant.

We operate in a capital intensive industry. Limitations to external financing could adversely affect our financial performance.

In general, continued volatility in the capital markets has resulted in reduced availability of capital for the ethanol industry. We may need to incur additional financing to fund growth of our business or in times of increasing liquidity requirements (such as increases in raw material costs). Any delays to obtain additional financing, or our inability to do so, could have a material adverse impact on our financial results.

The financial returns on our ethanol investments are highly dependent on commodity prices, which are subject to significant volatility and uncertainty, and the availability of supplies, so our results could fluctuate substantially.

The financial returns on our ethanol investments are substantially dependent on commodity prices, especially prices for corn or other feedstock, natural gas, ethanol and unleaded gasoline. As a result of the volatility of the prices for these items, the returns may fluctuate substantially and our investments could experience periods of declining prices for their products and increasing costs for their raw materials, which could result in operating losses at our ethanol plants.

Our returns on ethanol investments are highly sensitive to grain prices. Corn or sorghum are the principal raw materials our ethanol plants use to produce ethanol and co-products. As a result, changes in the price of corn or sorghum can significantly affect their businesses. Rising corn or sorghum prices result in higher costs of ethanol and co-products. Because ethanol competes with non-corn-based fuels, our ethanol plants generally will be unable to pass along increased grain costs to their customers. At certain levels, grain prices may make ethanol uneconomical to produce.

The price of corn and sorghum is influenced by weather conditions and other factors affecting crop yields, transportation costs, farmer planting decisions, exports, the value of the U.S. dollar and general economic, market and regulatory factors. These factors include government policies and subsidies with respect to agriculture and international trade, and global and local demand and supply. The significance and relative effect of these factors on the price of corn and sorghum is difficult to predict. Any event that tends to negatively affect the supply of corn or sorghum, such as adverse weather or crop disease, could increase corn and sorghum prices and potentially harm the business of our ethanol plants. Increasing domestic ethanol capacity could boost the demand for corn and sorghum and result in increased corn or sorghum prices. Our ethanol plants may also have difficulty, from time to time, in physically sourcing corn or sorghum on

11

economical terms due to supply shortages. Such a shortage could require our ethanol plants to suspend operations which would have a material adverse effect on the financial returns on our ethanol investments.

The spread between ethanol and corn and sorghum prices can vary significantly. The gross margin at our ethanol plants depends principally on the spread between ethanol and corn or sorghum prices. Fluctuations in the spread are likely to continue to occur. A sustained narrow spread or any further reduction in the spread between ethanol and corn prices, whether as a result of sustained high or increased corn prices or sustained low or decreased ethanol prices, would adversely affect the results of operations at our ethanol plants.

The market for natural gas is subject to market conditions that create uncertainty in the price and availability of the natural gas that our ethanol plants use in their manufacturing process. Our ethanol plants rely upon third parties for their supply of natural gas, which is consumed as fuel in the manufacture of ethanol. The prices for and availability of natural gas are subject to volatile market conditions. These market conditions often are affected by factors beyond the ethanol plants’ control, such as weather conditions, overall economic conditions and foreign and domestic governmental regulation and relations. Significant disruptions in the supply of natural gas could impair the ethanol plants’ ability to economically manufacture ethanol for their customers. Furthermore, increases in natural gas prices or changes in our natural gas costs relative to natural gas costs paid by competitors may adversely affect results of operations and financial position at our ethanol plants.

Fluctuations in the selling price and production costs of gasoline may reduce profit margins at our ethanol plants. Ethanol is marketed as a fuel additive to reduce vehicle emissions from gasoline, as an octane enhancer to improve the octane rating of gasoline with which it is blended and, to a lesser extent, as a gasoline substitute. As a result, ethanol prices are influenced by the supply and demand for gasoline and our ethanol plants’ results of operations and financial position may be materially adversely affected if gasoline demand or price decreases.

New plants under construction or decreases in demand for ethanol may result in excess production capacity in the ethanol industry, which may cause the price of ethanol and/or distillers grains to decrease.

According to the Renewable Fuels Association, or RFA, domestic ethanol production nameplate capacity has increased to approximately 14.1 billion gallons per year at January 2011. The RFA estimates that, as of January 2011, approximately 560 million gallons per year of additional production capacity is under construction. Excess capacity in the ethanol industry would have an adverse effect on the results of our ethanol investments. In a manufacturing industry with excess capacity, producers have an incentive to manufacture additional products for so long as the price exceeds the marginal cost of production (i.e., the cost of producing only the next unit, without regard for interest, overhead or fixed costs). This incentive could result in the reduction of the market price of ethanol to a level that is inadequate to generate sufficient cash flow to cover costs.

Excess capacity may also result from decreases in the demand for ethanol, which could result from a number of factors, including, but not limited to, regulatory developments and reduced U.S. gasoline consumption. Reduced gasoline consumption could occur as a result of increased prices for gasoline or crude oil, which could cause businesses and consumers to reduce driving or acquire vehicles with more favorable gasoline mileage or acquire hybrid vehicles.

In addition, because ethanol production produces distillers grains as a co-product, increased ethanol production will also lead to increased supplies of distillers grains. An increase in the supply of distillers

12

grains, without corresponding increases in demand, could lead to lower prices or an inability to sell our ethanol plants’ distillers grains production. A decline in the price of distillers grains or the distillers grains market generally could have a material adverse effect on the results of our ethanol investments.

We depend on our partners to operate our ethanol investments.

Our investments currently represent both majority and minority equity positions, and day-to-day operating control of each plant generally remains with the local farmers’ cooperative or investor group that has promoted the plant. We may not have the ability to directly modify the operations of the plants in response to changes in the business environment or in response to any deficiencies in local operations of the plants. In addition, local plant operators, who also represent the primary suppliers of corn and other crops to the plants, may have interests, such as the price and sourcing of corn and other crops, that may differ from our interest, which is based solely on the operating profit of the plant. The limitations on our ability to control day-to-day plant operations could adversely affect plant results of operations.

We may not successfully acquire or develop additional ethanol investments.

The growth of our ethanol business depends on our ability to identify and develop new ethanol investments. Our ethanol development strategy depends on referrals, and introductions, to new investment opportunities from industry participants, such as ethanol plant builders, financial institutions, marketing agents and others. We must continue to maintain favorable relationships with these industry participants, and a material disruption in these sources of referrals would adversely affect our ability to expand our ethanol investments.

Any expansion strategy will depend on prevailing market conditions for the price of ethanol and the costs of corn and natural gas and the expectations of future market conditions. There is increasing competition for suitable sites for ethanol plants. Even if suitable sites or opportunities are identified, we may not be able to secure the services and products from contractors, engineering firms, construction firms and equipment suppliers necessary to build or expand ethanol plants on a timely basis or on acceptable economic terms. Construction costs associated with expansion may increase to levels that would make a new plant too expensive to complete or unprofitable to operate. Additional financing may also be necessary to implement any expansion strategy, which may not be accessible or available on acceptable terms.

Our ethanol plants may be adversely affected by technological advances and efforts to anticipate and employ such technological advances may prove unsuccessful.

The development and implementation of new technologies may result in a significant reduction in the costs of ethanol production. For instance, any technological advances in the efficiency or cost to produce ethanol from inexpensive, cellulosic sources such as wheat, oat or barley straw could have an adverse effect on our ethanol plants, because those facilities are designed to produce ethanol from corn, which is, by comparison, a raw material with other high value uses. We cannot predict when new technologies may become available, the rate of acceptance of new technologies by competitors or the costs associated with new technologies. In addition, advances in the development of alternatives to ethanol could significantly reduce demand for or eliminate the need for ethanol.

Any advances in technology which require significant unanticipated capital expenditures to remain competitive or which reduce demand or prices for ethanol would have a material adverse effect on the results of our ethanol investments.

In addition, alternative fuels, additives and oxygenates are continually under development. Alternative fuel additives that can replace ethanol may be developed, which may decrease the demand for ethanol. It is also

13

possible that technological advances in engine and exhaust system design and performance could reduce the use of oxygenates, which would lower the demand for ethanol, and the results of our ethanol investments may be materially adversely affected.

The U.S. ethanol industry is highly dependent upon a myriad of federal and state legislation and regulation and any changes in legislation or regulation could materially and adversely affect our results of operations and financial position.

The elimination or significant reduction of the blender’s credit could have a material adverse effect on the results of our ethanol investments. The cost of production of ethanol is made significantly more competitive with regular gasoline by federal tax incentives. The American Jobs Creation Act of 2004 created the Volumetric Ethanol Tax Credit, referred to as the “blender’s credit.” This credit currently allows gasoline distributors who blend ethanol with gasoline to receive a federal excise tax credit of $0.45 per gallon of pure ethanol, or $0.045 per gallon if blended with 10% ethanol (E10), and $0.3825 per gallon if blended with 85% ethanol (E85). The $0.45 per gallon incentive for ethanol was scheduled to expire on December 31, 2010 but was extended to December 31, 2011. The blender’s credit could be eliminated or reduced at any time through an act of Congress and may not be renewed in 2011 or may be renewed on different terms. In addition, the blender’s credit, as well as other federal and state programs benefiting ethanol (such as tariffs), generally are subject to U.S. government obligations under international trade agreements, including those under the World Trade Organization Agreement on Subsidies and Countervailing Measures, and might be the subject of challenges thereunder, in whole or in part.

Ethanol can be imported into the U.S. duty-free from some countries, which may undermine the ethanol industry in the U.S. Imported ethanol is generally subject to a $0.54 per gallon tariff that was designed to offset the $0.45 per gallon ethanol incentive that is available under the federal excise tax incentive program for refineries that blend ethanol in their fuel. A special exemption from the tariff, known as the Caribbean Basin Initiative, exists for ethanol imported from 24 countries in Central America and the Caribbean Islands, which is limited to a total of 7% of U.S. production per year. Imports from the exempted countries may increase as a result of new plants under development. Since production costs for ethanol in these countries are estimated to be significantly less than what they are in the U.S., the duty-free import of ethanol through the countries exempted from the tariff may negatively affect the demand for domestic ethanol and the price at which our ethanol plants sell ethanol. Any changes in the tariff or exemption from the tariff could have a material adverse effect on the results of our ethanol investments. In addition, the North America Free Trade Agreement, or NAFTA, allows Canada and Mexico to export ethanol to the United States duty-free.

The effect of the renewable fuel standard (“RFS”) program in the Energy Independence and Security Act of 2007 (the “2007 Act”) is uncertain. The mandated minimum level of use of renewable fuels in the RFS under the 2007 Act will increase from 12.95 billion gallons per year in 2010 to 36 billion gallons per year in 2022. The RFS mandate level for conventional biofuels, which includes corn-based ethanol, for 2011 is 12.6 billion gallons. This requirement progressively increases to 15 billion gallons by 2015 and remains at that level through 2022. The 2007 Act also requires the increased use of “advanced” biofuels, which are alternative biofuels produced without using corn starch such as cellulosic ethanol and biomass-based diesel, with 21 billion gallons of the mandated 36 billion gallons of renewable fuel required to come from advanced biofuels by 2022. Required RFS volumes for both general and advanced renewable fuels in years to follow 2022 will be determined by a governmental administrator, in coordination with the U.S. Department of Energy and U.S. Department of Agriculture. Increased competition from other types of biofuels could have a material adverse effect on the results of our ethanol investments.

The RFS program and the 2007 Act also include provisions allowing “credits” to be granted to fuel producers who blend in their fuel more than the required percentage of renewable fuels in a given year.

14

These credits may be used in subsequent years to satisfy RFS production percentage and volume standards and may be traded to other parties. The accumulation of excess credits could further reduce the impact of the RFS mandate schedule and result in a lower ethanol price or could result in greater fluctuations in demand for ethanol from year to year, both of which could have a material adverse effect on the results of our ethanol investments.

Waivers of the RFS minimum levels of renewable fuels included in gasoline could have a material adverse effect on the results of our ethanol investments. Under the RFS as passed as part of the Energy Policy Act of 2005, the U.S. Environmental Protection Agency, in consultation with the Secretary of Agriculture and the Secretary of Energy, may waive the renewable fuels mandate with respect to one or more states if the Administrator of the U.S. Environmental Protection Agency, or EPA, determines upon the petition of one or more states that implementing the requirements would severely harm the economy or the environment of a state, a region or the U.S., or that there is inadequate supply to meet the requirement. In addition, the 2007 Act allows any other person subject to the requirements of the RFS or the EPA Administrator to file a petition for such a waiver. Any waiver of the RFS with respect to one or more states could adversely offset demand for ethanol and could have a material adverse effect on the results of our ethanol investments.

Changes in corporate average fuel economy standards could adversely impact ethanol prices. Flexible fuel vehicles receive preferential treatment in meeting federally mandated corporate average fuel economy (“CAFE”) standards for automobiles manufactured by car makers. High blend ethanol fuels such as E85 result in lower fuel efficiencies. Absent the CAFE preferences, car makers would not likely build flexible-fuel vehicles. Any change in CAFE preferences could reduce the growth of E85 markets and result in lower ethanol prices.

Various studies have criticized the efficiency of ethanol, in general, and corn-based ethanol in particular, which could lead to the reduction or repeal of incentives and tariffs that promote the use and domestic production of ethanol or otherwise negatively impact public perception and acceptance of ethanol as an alternative fuel.

Although many trade groups, academics and governmental agencies have supported ethanol as a fuel additive that promotes a cleaner environment, others have criticized ethanol production as consuming considerably more energy and emitting more greenhouse gases than other biofuels and as potentially depleting water resources. Other studies have suggested that corn-based ethanol is less efficient than ethanol produced from switchgrass or wheat grain and that it negatively impacts consumers by causing prices for dairy, meat and other foodstuffs from livestock that consume corn to increase. If these views gain acceptance, support for existing measures promoting use and domestic production of corn-based ethanol could decline, leading to reduction or repeal of these measures. These views could also negatively impact public perception of the ethanol industry and acceptance of ethanol as an alternative fuel.

Federal support of cellulosic ethanol may result in reduced incentives to corn-derived ethanol producers.

The American Recovery and Reinvestment Act of 2009 and the Energy Independence and Security Act of 2007 provide funding opportunities in support of cellulosic ethanol obtained from biomass sources such as switchgrass and poplar trees. The amended RFS mandates an increasing level of production of non-corn derived biofuels. These federal policies may suggest a long-term political preference for cellulosic processes using alternative feedstocks such as switchgrass, silage or wood chips. Cellulosic ethanol has a smaller carbon footprint and is unlikely to divert foodstuff from the market. Several cellulosic ethanol plants are under development and there is a risk that cellulosic ethanol could displace corn ethanol. Our plants are

15

designed as single-feedstock facilities, located in corn production areas with limited alternative feedstock nearby, and would require significant additional investment to convert to the production of cellulosic ethanol. The adoption of cellulosic ethanol as the preferred form of ethanol could have a significant adverse effect on our ethanol business.

Our ethanol business is affected by environmental and other regulations which could impede or prohibit our ability to successfully operate our plants.

Our ethanol production facilities are subject to extensive air, water and other environmental regulations. We have had to obtain numerous permits to construct and operate our plants. Regulatory agencies could impose conditions or other restrictions in the permits that are detrimental or which increase our costs. More stringent federal or state environmental regulations could be adopted which could significantly increase our operating costs or require us to expend considerable resources.

Our ethanol plants emit various airborne pollutants as by-products of the ethanol production process, including carbon dioxide. In 2007, the U.S. Supreme Court classified carbon dioxide as an air pollutant under the Clean Air Act in a case seeking to require the EPA to regulate carbon dioxide in vehicle emissions. In February 2010, the EPA released its final regulations on the Renewable Fuel Standard program (RFS2). We believe our plants are grandfathered at their current operating capacity, but plant expansion will need to meet a 20% threshold reduction in greenhouse gas (GHG) emissions from a 2005 baseline measurement to produce ethanol eligible for the RFS2 mandate. Additionally, legislation is pending in Congress on a comprehensive carbon dioxide regulatory scheme, such as a carbon tax or cap-and-trade system. To expand our plant capacity, we may be required to obtain additional permits, install advanced technology such as corn oil extraction, or reduce drying of certain amounts of distillers grains.

The California Air Resources Board has adopted a Low Carbon Fuel Standard requiring a 10% reduction in GHG emissions from transportation fuels by 2020. An Indirect Land Use Charge is included in this lifecycle GHG emission calculation. While this standard is being challenged by lawsuits, implementation of such a standard could have an adverse impact on our market for corn-based ethanol if determined that in California corn-based ethanol fails to achieve lifecycle GHG emission reductions.

Our revenue from the sale of distillers grains depends upon its continued market acceptance as an animal feed.

Distillers grains is a co-product from the fermentation of corn to produce ethanol. Antibiotics may be used during the fermentation process to control bacterial contamination; therefore antibiotics may be present in small quantities in distillers grains marketed as animal feed. The U. S. Food and Drug Administration’s, or FDA’s, Center for Veterinary Medicine has expressed concern about potential animal and human health hazards from the use of distillers grains as an animal feed due to the possibility of antibiotic residues. If the public became concerned about the impact of distillers grains in the food supply or as an acceptable animal feed, the market for distillers grains could be negatively impacted, which would have a negative impact on our results of operations.

The price of distillers grains may decline as a result of China’s antidumping investigation of distillers grains originating in the United Sates.

Estimates indicate that as much as 10 to 15 percent of the distiller grains produced in the United States will be exported to China in the coming year. However, this export market may be jeopardized if the Chinese government imposes trade barriers in response to the outcome of an antidumping investigation currently being conducted by the Chinese Ministry of Commerce. If producers and exporters of distiller grains are

16

subjected to trade barriers when selling distiller grains to Chinese customers, there may be a reduction in the price of distillers grains in the United States. Declines in the price we receive for our distillers grains could lead to decreased revenues and may result in our inability to operate the ethanol plant profitably.

We face significant competition in the ethanol industry.

We face significant competition for new ethanol investment opportunities. There are varied enterprises seeking to participate in the ethanol industry. Some enterprises provide financial and management support similar to our business model. Other enterprises seek to acquire or develop plants which they will directly own and operate. Many of our competitors are larger and have greater financial resources and name recognition than we do. We must compete for investment opportunities based on our strategy of supporting and enhancing local development of ethanol plant opportunities. We may not be successful in competing for investment opportunities based on our strategy.

The ethanol industry is primarily comprised of smaller entities that engage exclusively in ethanol production and large integrated grain companies that produce ethanol along with their base grain business. Recently, several large oil companies have entered the ethanol production market. If these companies increase their ethanol plant ownership or other oil companies seek to engage in direct ethanol production, there would be less of a need to purchase ethanol from independent producers like our ethanol plants.

There is a consolidation trend in the ethanol industry, partly a result of companies recently seeking protection under the United States Bankruptcy Code. As a result, firms are growing in size and scope. Larger firms offer efficiencies and economies of scale, resulting in lower costs of production. In addition, plants currently being or recently sold as part of a bankruptcy proceeding may have significantly lower costs than our ethanol plants. Absent significant growth and diversification, our ethanol plants may not be able to operate profitably in a more competitive environment. No assurance can be given that our ethanol plants will be able to compete successfully or that competition from larger companies with greater financial resources will not have a materially adverse affect on the results of our ethanol investments.

We are exposed to credit risk from our sales of ethanol and distillers grains to customers.

The inability of a customer to make payments to us for our accounts receivable may cause us to experience losses and may adversely impact our liquidity and our ability to make our payments when due.

We may not be able to hire and retain qualified personnel to operate our ethanol plants.

Our ability to attract and retain competent personnel has a significant impact on operating efficiencies and plant profitability. Competition for key plant employees in the ethanol industry can be intense, and we may not be able to attract and retain qualified employees. Failure to do so could have a negative impact on our financial results at individual plants.

Our plants depend on an uninterrupted supply of energy and water to operate. Unforeseen plant shutdowns could harm our business.

Our plants require a significant and uninterrupted supply of natural gas, electricity and water to operate. We generally rely on third parties to provide these resources. If there is an interruption in the supply of energy or water for any reason, such as supply, delivery or mechanical problems and we are unable to secure an adequate alternative supply to sustain plant operations, we may be required to stop production. A production halt for an extended period of time could result in material losses.

17

Potential business disruption from factors outside our control, including natural disasters, severe weather conditions, accidents, strikes, unexpected equipment failures and unforeseen plant shutdowns, could adversely affect our cash flow and operating results.

The debt agreements for the ethanol plants contain restrictive financial and performance covenants.

Our subsidiaries that operate ethanol plants (“Ethanol subsidiaries”) have debt agreements that contain covenants with several financial and performance restrictions. A breach of any of these covenants could result in a default under the applicable agreement. If a default were to occur, the Ethanol subsidiary would likely seek a waiver of that default, attempt to reset the covenant, or refinance the instrument and accompanying obligations. If the Ethanol subsidiary was unable to obtain this relief, the default could result in the acceleration of the total due related to that debt obligation. If a default were to occur, the Ethanol subsidiary may not be able to pay its debts or borrow sufficient funds to refinance them. In addition, certain lease agreements could also be in default if a default of the debt agreement occurs. Any of these events, if they occur, could materially adversely affect our results of operations, financial condition, and cash flows.

The debt agreements for the ethanol plants limit, or otherwise restrict the amount of dividends and other payments the ethanol operating subsidiaries can transfer to their members.

We are dependent on dividends from our ethanol subsidiaries to generate cash flow. Presently, all of our ethanol subsidiaries have debt agreements that limit payments to members. Therefore, these companies cannot distribute all of the cash they generate to their members. Furthermore, we may not be able to use the excess cash flow from one subsidiary to fund corporate needs or needs of another operating ethanol subsidiary.

Changes in interest rates could have a material adverse effect on the results of our ethanol investments.

One Earth and Patriot have interest rate swaps at January 31, 2011 that, in essence, fix the interest rate on a portion of their variable rate debt. During fiscal years 2010, 2009 and 2008, we recognized losses on these swaps. Further reductions in interest rates could increase the liability position of the interest rate swaps, requiring us to record additional expense which could be material. The liability for these interest rate swaps could also result in a default of the term loan agreements’ restrictive financial covenants.

In addition, increases in interest rates could have a negative impact on results of operations as all of the debt our ethanol plants have is variable rate debt. Furthermore, the interest rate swaps do not fix the interest rate on the entire portion of the related debt.

Risks Related to the Wind Down and Exit of our Retail business and Risks Related to our Real Estate Segment.

Our future costs associated with administering extended product service contracts may result in higher than expected costs.

We will continue to administer extended product service contracts that have contractual maturities over the next three years. To the extent we do not have products or an adequate repair service network to satisfy warranty claims, we may incur material costs as we would be required to refund cash to customers for warranted products.

We have a significant amount of vacant warehouse and retail space after the completion of the wind down of our retail business.

18

At January 31, 2011, we own one distribution facility and 23 former retail store properties comprising approximately 492,000 square feet that are completely or partially vacant. We are currently marketing these facilities for lease or sale. We may not be able to successfully lease or sell these properties which could result in lost opportunities for revenue or future impairment charges related to the carrying value of the associated assets. We also have costs related to the vacant properties such as property taxes and utilities that we would have to bear without any revenue from such properties.

|

|

|

|

Item 1B. |

Unresolved Staff Comments |

None.

|

|

|

|

Item 2. |

Properties |

The information required by this Item 2 is set forth in Item 1 of this report under “Ethanol Investments”, “Real Estate Operations” and “Facilities” and is incorporated herein by reference.

|

|

|

|

Item 3. |

Legal Proceedings |

We are involved in various legal proceedings incidental to the conduct of our business. We believe that these proceedings will not have a material adverse effect on our financial condition or results of operations.

Executive Officers of the Company

Set forth below is certain information about each of our executive officers.

|

|

|

|

|

|

|

Name |

|

Age |

|

Position |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stuart Rose |

|

56 |

|

Chairman of the Board and Chief Executive Officer* |

|

Douglas Bruggeman |

|

50 |

|

Vice President-Finance, Chief Financial Officer and Treasurer |

|

Edward Kress |

|

61 |

|

Secretary* |

|

Zafar Rizvi |

|

61 |

|

President and Chief Operating Officer |

*Also serves as a director.

Stuart Rose has been our Chairman of the Board and Chief Executive Officer since our incorporation in 1984 as a holding company to succeed to the ownership of Rex Radio and Television, Inc., Kelly & Cohen Appliances, Inc. and Stereo Town, Inc. Prior to 1984, Mr. Rose was Chairman of the Board and Chief Executive Officer of Rex Radio and Television, Inc., which he founded in 1980 to acquire the stock of a corporation which operated four retail stores.

Douglas Bruggeman has been our Vice President–Finance and Treasurer since 1989 and was elected Chief Financial Officer in 2003. From 1987 to 1989, Mr. Bruggeman was our Manager of Corporate Accounting. Mr. Bruggeman was employed with the accounting firm of Ernst & Young prior to joining us in 1986.

Edward Kress has been our Secretary since 1984 and a director since 1985. Mr. Kress has been a partner of the law firm of Dinsmore & Shohl LLP (formerly Chernesky, Heyman & Kress P.L.L.), our legal counsel, since 1988. Mr. Kress has practiced law in Dayton, Ohio since 1974.

Zafar Rizvi was elected President and Chief Operating Officer in 2010. Previously, he had been our Vice President, and has been President of Farmers Energy Incorporated, our alternative energy investment

19

subsidiary, since 2006. From 1991 to 2006, Mr. Rizvi was our Vice President – Loss Prevention. From 1986 to 1991, Mr. Rizvi was employed in the video retailing industry in a variety of management positions.

|

|

|

|

Item 4. |

Removed and Reserved |

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

SHAREHOLDER INFORMATION

Common Share Information and Quarterly Share Prices

Our common stock is traded on the New York Stock Exchange under the symbol REX.

|

|

|

|

|

|

|

|

|

|

Fiscal Quarter ended |

|

High |

|

Low |

|

||

|

|

|

|

|

|

|

||

|

April 30, 2009 |

|

$ |

13.50 |

|

$ |

5.52 |

|

|

July 31, 2009 |

|

|

12.99 |

|

|

9.36 |

|

|

October 31, 2009 |

|

|

13.02 |

|

|

9.75 |

|

|

January 31, 2010 |

|

|

15.41 |

|

|

11.89 |

|

|

|

|

|

|

|

|

|

|

|

April 30, 2010 |

|

$ |

18.40 |

|

$ |

14.87 |

|

|

July 31, 2010 |

|

|

19.30 |

|

|

15.19 |

|

|

October 31, 2010 |

|

|

16.83 |

|

|

12.96 |

|

|

January 31, 2011 |

|

|

17.23 |

|

|

14.84 |

|

As of April 14, 2011, there were 119 holders of record of our common stock, including shares held in nominee or street name by brokers.

Dividend Policy

We did not pay dividends in the current or prior years. We currently have no restrictions on the payment of dividends. Our ethanol subsidiaries have certain restrictions on their ability to pay us dividends.

Issuer Purchases of Equity Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

Period |

|

Total Number |

|

Average Price |

|

Total Number of |

|

Maximum Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

November 1-30, 2010 |

|

— |

|

$ |

— |

|

— |

|

568,044 |

|

|

December 1-31, 2010 |

|

100,000 |

|

$ |

15.63 |

|

100,000 |

|

468,044 |

|

|

January 1-31, 2011 |

|

— |

|

$ |

— |

|

— |

|

468,044 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

100,000 |

|

$ |

15.63 |

|

100,000 |

|

468,044 |

|

|

|

|

|

|

|

|

|

|

|

|

|

20

|

|

|

|

|

|

(1) |

On October 7, 2010, our Board of Directors increased our share repurchase authorization by an additional 500,000 shares. At January 31, 2011, a total of 468,044 shares remained available to purchase under this authorization. |

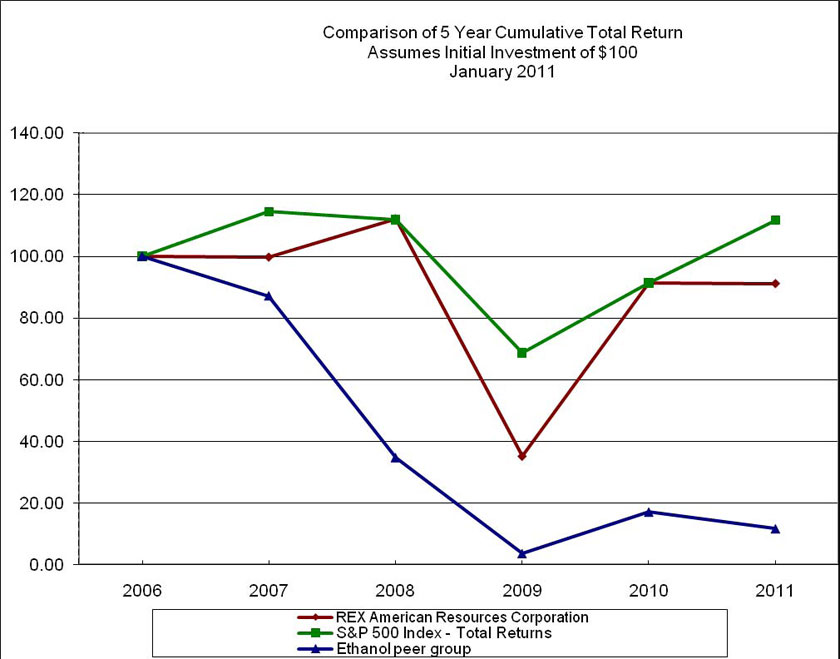

Performance Graph

The following graph compares the yearly percentage change in the cumulative total shareholder return on our Common Stock against the cumulative total return of the S&P 500 Stock Index and a peer group comprised of selected publicly traded consumer ethanol producers (*) for the period commencing January 31, 2006 and ended January 31, 2011. The graph assumes an investment of $100 in our Common Stock and each index on January 31, 2006 and reinvestment of all dividends.

* The peer group (and the month the companies went public) is comprised of Pacific Ethanol, Inc. (March 2005), BioFuel Energy Corp. (June 2007) and Green Plains Renewable Energy, Inc. (March 2006). Returns for the peer group are included upon a full year’s return being available as of January 31.

|

|

|

|

Item 6. |

Selected Financial Data |

The following statements of operations and balance sheet data have been derived from our consolidated financial statements and should be read in conjunction with Management’s Discussion and Analysis of

21

Financial Condition and Results of Operations and the Consolidated Financial Statements and related Notes. Prior period amounts applicable to the statement of operations have been adjusted to recognize the reclassification of the results of our former retail segment and certain real estate assets to discontinued operations as a result of our exit of the retail business and real estate sales. See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for a discussion of income from ethanol investments, derivative financial instruments, gain on sale of real estate, loss and impairment charges related to deconsolidation and long-term debt. These items have fluctuated significantly in recent years and may affect comparability of years.

Five Year Financial Summary

(In Thousands, Except Per Share Amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years Ended January 31, |

|

2011 |

|

2010 |

|

2009 |

|

2008 |

|

2007 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Net sales and revenue |

|

$ |

301,674 |

|

$ |

170,088 |

|

$ |

68,587 |

|

$ |

322 |

|

$ |

257 |

|

|

Net (income) loss attributable to noncontrolling interests |

|

$ |

(3,673 |

) |

$ |

(3,900 |

) |

$ |

3,156 |

|

$ |

841 |

|

$ |

— |

|