UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

OR |

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 000-13611

SPARTAN MOTORS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Michigan |

|

38-2078923 |

|

|

|

|

|

1541 Reynolds Road |

|

|

Registrant’s Telephone Number, Including Area Code: (517) 543-6400

Securities registered pursuant to Section 12(b) of the Securities Exchange Act

|

Title of Class |

|

Name of Exchange on which Registered |

|

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: None | ||

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes |

No |

X |

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

Yes |

No |

X |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes |

X |

No |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes |

X |

No |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. X

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

|

Large accelerated filer |

Accelerated filer |

X |

Non-accelerated filer |

Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2).

|

Yes |

No |

X |

The aggregate market value of the registrant’s voting stock held by non-affiliates of the registrant, based on the last sales price of such stock on NASDAQ Global Select Market on June 30, 2013, the last business day of the registrant’s most recently completed second fiscal quarter: $200,165,585.

The number of shares outstanding of the registrant’s Common Stock, $.01 par value, as of February 28, 2013: 34,206,668 shares

Documents Incorporated by Reference

Portions of the definitive proxy statement for the registrant’s May 21, 2014 annual meeting of shareholders, to be filed with the Securities and Exchange Commission no later than 120 days after December 31, 2013, are incorporated by reference in Part III.

FORWARD-LOOKING STATEMENTS

This Form 10-K contains some statements that are not historical facts. These statements are called “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements involve important known and unknown risks, uncertainties and other factors and can be identified by phrases using “estimate,” “anticipate,” “believe,” “project,” “expect,” “intend,” “predict,” “potential,” “future,” “may,” “will,” “should” and similar expressions or words. Our future results, performance or achievements may differ materially from the results, performance or achievements discussed in the forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions (“Risk Factors”) that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what may be expressed or forecasted in such forward-looking statements.

Risk Factors include the risk factors listed and more fully described in Item 1A below, “Risk Factors”, as well as risk factors that we have discussed in previous public reports and other documents filed with the Securities and Exchange Commission. The list in Item 1A below includes all known risks our management believes could materially affect the results described by forward-looking statements contained in this Form 10-K. However, these risks may not be the only risks we face. Our business, operations, and financial performance could also be affected by additional factors that are not presently known to us or that we currently consider to be immaterial to our operations. In addition, new Risk Factors may emerge from time to time that may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, although we believe that the forward-looking statements contained in this Form 10-K are reasonable, we cannot provide you with any guarantee that the anticipated results will be achieved. All forward-looking statements in this Form 10-K are expressly qualified in their entirety by the cautionary statements contained in this section and investors should not place undue reliance on forward-looking statements as a prediction of actual results. The Company undertakes no obligation to update or revise any forward-looking statements to reflect developments or information obtained after the date this Form 10-K is filed with the Securities and Exchange Commission.

PART I

Item 1. Business.

When used in this Form 10-K, “Company”, “we”, “us” or “our” refers to Spartan Motors, Inc. and, depending on the context, could also be used to refer generally to the Company and its subsidiaries, which are described below.

General

Spartan Motors, Inc. was organized as a Michigan corporation on September 18, 1975, and is headquartered in Charlotte, Michigan. Spartan Motors began development of its first product that same year and shipped its first fire truck chassis in October 1975.

We are known as a leading, niche market engineer and manufacturer in the heavy-duty, custom vehicles marketplace. We have five wholly owned operating subsidiaries: Spartan Motors Chassis, Inc., located at the corporate headquarters in Charlotte, Michigan (“Spartan Chassis”); Crimson Fire, Inc. located in Brandon, South Dakota (“Crimson”); Crimson Fire Aerials, Inc., located in Ephrata, Pennsylvania (“Crimson Aerials”); Utilimaster Corporation, located in Wakarusa and Bristol, Indiana (“Utilimaster”); and Classic Fire, LLC (“Classic Fire”), located in Ocala, Florida. We are also a participant in a joint venture, Spartan-Gimaex Innovations, LLC (“Spartan-Gimaex”), with Gimaex Holding, Inc. Spartan Chassis is a leading designer, engineer and manufacturer of custom heavy-duty chassis. The chassis consist of a frame assembly, engine, transmission, electrical system, running gear (wheels, tires, axles, suspension and brakes) and, for fire trucks and some specialty chassis applications, a cab. Spartan Chassis customers are original equipment manufacturers (“OEMs”) who complete their heavy-duty vehicle product by mounting the body or apparatus on our chassis. Crimson engineers and manufactures fire trucks built on chassis platforms purchased from either Spartan Chassis or outside sources. Crimson Aerials engineers and manufactures aerial ladder components for fire trucks. Classic Fire engineers and manufactures fire trucks that are built on commercial chassis and offered at a lower price point for use as brush trucks, urban interface, tankers and smaller rescues. Spartan-Gimaex is a 50/50 joint venture that was formed to leverage the complementary footprints, capabilities, brands, technologies and product portfolios of both companies to enable technology sharing, joint product development, commercial agreements and additional purchasing leverage, with the goal of enabling both companies to amass a true global presence in the emergency response vehicle market. Utilimaster is a leading manufacturer of specialty vehicles made to customer specifications in the delivery and service market, including walk-in vans and hi-cube vans, as well as truck bodies.

Our business strategy is to further diversify product lines and develop innovative design, engineering and manufacturing expertise in order to be the best value producer of custom vehicle products. Our diversification across several sectors provides numerous opportunities while minimizing overall risk. Additionally, our business model provides the agility to quickly respond to market needs, take advantage of strategic opportunities when they arise and correctly size operations to ensure stability and growth.

We have an innovative team focused on building lasting relationships with our customers. This is accomplished by striving to deliver premium custom vehicles, vehicle components, and services. We believe we can best carry out our long-term business plan and obtain optimal financial flexibility by using a combination of borrowings under our credit facilities, as well as internally or externally generated equity capital, as sources of expansion capital.

Our Segments

We identify our reportable segments based on our management structure and the financial data utilized by our chief operating decision maker to assess segment performance and allocate resources among our operating units. We have three reportable segments: Emergency Response Vehicles, Delivery and Service Vehicles, and Specialty Chassis and Vehicles. For certain financial information related to each segment, see Note 15, Business Segments, of the Notes to Consolidated Financial Statements appearing in Item 8 of this Form 10-K.

Emergency Response Vehicles

Our Emergency Response Vehicles segment consists of the operations of our Crimson, Crimson Aerials, Classic Fire and Spartan-Gimaex subsidiaries (together “Spartan ERV”) and the emergency response chassis operations of our Spartan Chassis subsidiary. This segment engineers and manufactures emergency response chassis, emergency response bodies and aerial equipment. Spartan ERV specializes in the manufacture of aerial ladders and emergency response vehicle bodies which are mounted on custom chassis from Spartan Chassis, commercial chassis or other custom chassis. The emergency response chassis operations of Spartan Chassis designs and manufactures custom chassis for emergency response vehicles. Sales from the Emergency Response Vehicles segment represented 35.2%, 34.5% and 36.3% of our consolidated sales for the years ended December 31, 2013, 2012 and 2011, respectively.

The Emergency Response Vehicles segment has extensive engineering experience in creating custom vehicles that perform specialized tasks, and generally manufactures vehicles only upon receipt of confirmed purchase orders; thus, it does not have significant amounts of completed product inventory. As an emergency response vehicle producer, Spartan Motors believes it holds a unique position for continued growth due to its engineering reaction time, manufacturing expertise and flexibility. Spartan Motors markets its emergency response vehicles throughout the U.S. and Canada, as well as in select markets in South America and Asia. The Emergency Response Vehicles segment employed approximately 700 associates in Charlotte, Michigan; Brandon, South Dakota; Ephrata, Pennsylvania; and Ocala, Florida as of January 31, 2014, approximately 175 of which were contracted employees.

Emergency Response Chassis

We custom manufacture emergency response chassis in response to customer specifications through our Spartan Chassis subsidiary. These specifications vary based on such factors as application, terrain, street configuration and the nature of the community, state or country in which the fire truck will be utilized. Spartan Chassis has four fire truck models within this product line: (1) the “Gladiator” chassis; (2) the “Metro Star” chassis; (3) the “Metro Star X” chassis and (4) the “Metro Star RT” (rescue transport).

Spartan Chassis strives to develop innovative engineering solutions to meet customer requirements, and designs new products anticipating the future needs of the marketplace. New vehicle systems and components are regularly introduced by Spartan Chassis that incrementally improve the level of product performance, reliability, and safety for vehicle occupants. Spartan Chassis monitors the availability of new technology and works closely with its component manufacturers to apply new technology to its products.

Over the past few years, Spartan Chassis has introduced innovations on our emergency response chassis such as: heated roll down side glass; optimized engine tunnel; a new Angle of Approach (AoA) chassis that exceeds all NFPA angle-of-approach and departure standards with its 19-degree approach angle; and the Advanced Protection System (APS), an unequaled occupant restraint system which includes additional airbag positions and intelligent seats providing best-in-class protection against frontal impact, rollover, side impact and occupant ejection.

Emergency Response Bodies

We engineer and manufacture bodies for custom and commercial emergency response vehicles and apparatus through our Crimson, Classic Fire and Spartan-Gimaex subsidiaries. These subsidiaries market products through a network of dealers throughout North America, and in select markets in South America and Asia under the Spartan ERV brand. The Spartan ERV product lines include pumpers and aerial fire apparatus, heavy- and light-duty rescue units, tankers and quick attack units. Spartan ERV is recognized in the industry for its innovative design and engineering, with signature features such as Tubular Stainless Steel body structure (known as the Tri-MaxTM body frame), Vibra-TorqTM mounting system, and Smart Access pump panels that are designed to offer the safety, reliability and durability that firefighters need to get the job done. Spartan ERV’s product lines also include an array of lower price point apparatus built on commercial chassis such as brush trucks, urban interface rescue vehicles and tankers.

Aerial Ladders

We engineer, manufacture and market aerial ladder components for fire trucks under the Spartan ERV brand through our Crimson Aerials subsidiary in Ephrata, Pennsylvania, which began operations in 2003 and has developed a full line of aerial products. Spartan ERV Aerials introduced its first models in 2004 and is poised to produce the next generation of aerial devices in terms of technology, operation and serviceability. Spartan ERV Aerials primarily sells its products to Spartan ERV.

Delivery and Service Vehicles

We manufacture delivery and service vehicles through our Utilimaster subsidiary, which was acquired on November 30, 2009. Utilimaster, which was established in 1973, designs, develops, and manufactures products to customer specifications for use in the package delivery, one-way truck rental, bakery/snack delivery, utility, and linen/uniform rental businesses. Utilimaster serves a diverse customer base and also sells aftermarket parts and assemblies. The majority of its revenues are from walk-in vans sold to customers in the delivery and service market. Its remaining revenues are attributable to commercial truck bodies, along with aftermarket parts and assemblies. Sales from the Delivery and Service Vehicles segment represented 38.2%, 44.2% and 38.9% of our consolidated sales for the years ended December 31, 2013, 2012 and 2011, respectively. Utilimaster employed approximately 760 associates as of January 31, 2014, of which approximately 100 were contracted employees.

Utilimaster’s sales and distribution efforts are designed to sell to national, fleet and commercial dealer accounts within these niches under the Aeromaster®, Trademaster®, Metromaster® and Utilivan® brand names. Utilimaster markets its products throughout the U.S. and Canada.

The principal types of commercial vehicles manufactured by Utilimaster are walk-in vans, cutaway vans and truck bodies. Walk-in vans are assembled on a “stripped” truck chassis supplied with engine and drive train components, but without a cab. Walk-in vans are sold under the Aeromaster® brand, and are typically used in multi-stop applications that include the delivery of packages, the distribution of food products and the delivery of uniforms/linens. Cutaway vans are installed on “cutaway” van chassis, and are sold under the Utilimaster, Utilivan®, Metromaster® and Trademaster® brand names. Cutaway bodies are primarily used for local delivery of parcels, freight and perishable food. Truck bodies are installed on a chassis that is supplied with a finished cap. Utilimaster’s truck bodies are typically fabricated with pre-painted panels, aerodynamic front and side corners, hardwood floors and various door configurations to accommodate end-user loading and unloading requirements. Utilimaster’s truck bodies are sold under the Utilimaster brand name and are used for diversified dry freight transportation. In addition to vehicles, Utilimaster sells aftermarket parts and assemblies for its walk-in vans and truck bodies. In the years ended December 31, 2013, 2012 and 2011, aftermarket parts and assemblies sales represented 12.2%, 27.8% and 28.2% of the Delivery and Service Vehicles segment sales.

Our Delivery and Service Vehicles segment began shipments of the "Reach "TM commercial van in the first quarter of 2012. The Reach TM offers greatly improved fuel economy and reduced CO2 emissions, as well as enhanced aesthetics and functional improvements.

Specialty Chassis and Vehicles

Our Specialty Chassis and Vehicles segment consists of the Spartan Chassis operations that engineer and manufacture motor home chassis, defense vehicles and other specialty chassis and distribute related aftermarket parts and assemblies. Our specialty vehicle products are manufactured to customer specifications upon receipt of confirmed purchase orders. As a specialty chassis and vehicle manufacturer, we believe we hold a unique position for continued growth due to the high quality and performance of our products, our engineering reaction time, manufacturing expertise and flexibility. Our specialty vehicle products are generally sold through original equipment manufacturers in the case of chassis and vehicles and to dealer distributors or directly to consumers for aftermarket parts and assemblies. Sales from our Specialty Chassis and Vehicles segment represented 26.6%, 21.3% and 24.8% of our consolidated sales for the years ended December 31, 2013, 2012 and 2011. The Specialty Chassis and Vehicles segment employed approximately 420 associates in Charlotte, Michigan as of January 31, 2014, of which approximately 100 were contracted employees.

Motor Home Chassis

We custom manufacture chassis to the individual specifications of our motor home OEM customers through our Spartan Chassis subsidiary. These specifications vary based on specific interior and exterior design specifications, power requirements, horsepower and electrical needs of the motor home bodies to be attached to the Spartan chassis. Spartan Chassis’s motor home chassis are separated into three models: (1) the “Mountain Master” series chassis; (2) the “K2” series chassis and (3) the “K3” series chassis.

Versions of these three basic product models are designed and engineered in order to meet customer requirements. This allows the chassis to be adapted to the specific floor plan and manufacturing process used by the OEM. We seek to develop innovative engineering solutions to meet our customer’s requirements and strive to anticipate future market needs by working closely with OEMs and listening to end users. We monitor the availability of new technology and work closely with our component manufacturers to apply new technology to our products. Over the past few years we have introduced new innovations, including: electronic steering control, heavy duty air ride independent front suspension and multiplexed electrical controls. More recent innovations include our certified 2013 EPA compliant clean diesel technology and front engine gas chassis concepts which target the largest growth segment in class A recreational vehicles.

Specialty Vehicle Chassis

Through our Spartan Chassis subsidiary, we develop specialized chassis to unique customer requirements and actively seek additional applications of our existing products and technology in the specialty vehicle market. Over the past few years we have expanded into highly customized niche markets for specialty vehicle chassis, including high power/high capability drill rigs and specialty bus applications and assembly of the Isuzu N-Series Gasoline Cab-Forward Trucks, a direct result of our alliance with Isuzu Commercial Truck of America.

Aftermarket Parts and Assemblies

The aftermarket parts and assemblies operation of Spartan Chassis supplies aftermarket repair parts and sub-assemblies along with limited servicing and refurbishment for our products in the defense, motor home and emergency response markets.

Marketing

We market our specialty vehicles, including custom emergency response chassis, emergency response bodies and other specialty vehicles, throughout the U.S. and Canada, as well as select markets in South America and Asia, primarily through the direct contact of our sales department with OEMs, dealers and end users. We utilize dealer organizations that establish close working relationships through their sales departments with end users. These personal contacts focus on the quality of the group’s specialty products and allow us to keep customers updated on new and improved product lines and end users’ needs.

Through our Utilimaster subsidiary, we sell delivery and service vehicles to commercial vehicle dealers, leasing companies and directly to end-users, and the Reach TM commercial van through the Isuzu dealer network. Utilimaster also markets its products directly to several national and fleet accounts (national accounts typically have 1,000+ vehicle fleets and fleet accounts typically have 100+ vehicle fleets), and through a network of independent truck dealers in the U.S. and, to a lesser extent, in Canada. Utilimaster has organized its sales force and product engineering staff into market teams. Utilimaster also provides aftermarket support, including parts sales and field service, to all of its customers through its Customer Service Department located in Bristol, Indiana, as well as maintaining the only online parts resource among the major delivery and service vehicle manufacturers. Utilimaster does not provide financing to dealers, fleet or national accounts. Utilimaster also maintains multi-year supply agreements with certain key fleet customers in the parcel and linen/uniform rental industries.

In 2013 and consistent with prior years, our representatives attended trade shows, rallies and expositions throughout North America as well as Europe and Asia to promote our products. Trade shows provide the opportunity to display products and to meet directly with OEMs who purchase chassis, dealers who sell finished vehicles and consumers who buy the finished products. Participation in these events also allows us to better identify what customers and end users are looking for in the future. We use these events to create a competitive advantage by relaying this information back to our advanced product development team for future projects.

Our sales and marketing team is responsible for promoting and selling our manufactured goods and producing product literature. The sales group consists of approximately 40 salespeople based in Company locations in Charlotte, Michigan; Brandon, South Dakota; Ephrata, Pennsylvania; Ocala, Florida; and Bristol, Indiana; with 14 additional salespeople located throughout North America and one in South America.

Competition

The principal methods of building competitive advantages we utilize include short engineering reaction time, custom design capability, high product quality, superior customer service and quick delivery. We compete with companies that manufacture for similar markets, including some divisions of large diversified organizations that have total sales and financial resources exceeding ours. Certain competitors are vertically integrated and manufacture their own chassis and/or apparatuses, although they generally do not sell their chassis to outside customers (other OEMs). Our direct competitors in the emergency vehicle apparatus market are principally smaller manufacturers. Our competition in the delivery and service vehicle market, primarily walk-in vans, comes from a small number of manufacturers.

Because of the lack of reliable published statistics, we are unable to state with certainty our position in most of our markets compared to our competitors. The emergency vehicle market and, to a lesser degree, the custom chassis market are fragmented. We believe that no one company has a dominant position in either of those markets. We are the leading manufacturer of walk-in vans in the United States, and believe we have a market share of approximately 50% in this market. The cutaway and truck body markets are highly fragmented, making the determination of our market share difficult. However, we believe we are one of the top five manufacturers of these products in the United States.

Manufacturing

We manufacture our products in six locations in Charlotte, Michigan, Bristol and Wakarusa, Indiana, Brandon, South Dakota, Ephrata, Pennsylvania and Ocala, Florida.

Spartan Chassis currently has six principal assembly facilities in Charlotte, Michigan for its custom chassis products. Most of these facilities have been updated over the past few years in order to increase efficiencies and to improve the quality of our manufacturing process. Due to the custom nature of our business, our chassis are built to customer specifications on non-automated assembly lines. Generally, Spartan Chassis designs, engineers and assembles its specialized heavy-duty truck chassis using primarily commercially available components purchased from outside suppliers. This approach facilitates prompt serviceability of finished products, reduces production costs, expedites the development of new products and reduces the potential of costly down time for the end user.

Crimson’s products are manufactured and assembled at its manufacturing facility located in Brandon, South Dakota. The chassis for its products are purchased from Spartan Chassis and from outside commercial chassis manufacturers. Crimson’s facilities do not use automated assembly lines since each vehicle is manufactured to meet specifications of an end user customized order. The chassis is rolled down the production line as other components are added and connected. The body is manufactured at the facility with components such as pumps, tanks, and electrical control units purchased from outside suppliers.

Crimson Aerials’ products are manufactured and assembled at its manufacturing facility located in Ephrata, Pennsylvania, utilizing a chassis produced by Spartan Chassis. Crimson Aerials also refurbishes aerial ladders and other fire truck components manufactured by it and other manufacturers.

Classic Fire’s products are manufactured and assembled at its plant in Ocala, Florida, utilizing mainly commercial chassis to build specialty emergency response vehicles. They also design, engineer and produce pump modules along with Compressed Air Foam Systems (CAFS) to be used in the truck’s multiplex system.

Through 2012, Utilimaster’s manufacturing operations were located in Wakarusa, Indiana. During the first quarter of 2013, we completed the move of Utilimaster’s walk-in van production to a new, single building facility in Bristol, Indiana. The move has enabled all walk-in van production to take place in one building, thereby eliminating non value added product movement and increasing manufacturing efficiency. Utilimaster’s truck body production remains in leased facilities in Wakarusa, Indiana. Utilimaster builds commercial vehicles and installs other related equipment on truck chassis. These commercial vehicles are built on an assembly line from engineered structural components, such as floors, roofs, and wall panels. After assembly, Utilimaster installs optional equipment and finishes based on customer specifications. At each step of the manufacturing, installation and finish process, Utilimaster conducts quality control procedures to ensure product and specification integrity.

Suppliers

We are dedicated to establishing long-term and mutually beneficial relationships with our suppliers. Through these relationships, we benefit from new innovations, higher quality, reduced lead times, smoother/faster manufacturing ramp-up of new vehicle introductions and lower total costs of doing business. The combined buying power of our subsidiaries and a corporate supply chain management initiative allow us to benefit from economies of scale and to focus on a common vision.

The single largest commodity directly utilized in production is aluminum, which we purchase under purchase agreements based on forecasted production requirements. To a lesser extent we are dependent upon suppliers of lumber, fiberglass and steel for our manufacturing. We have no significant long-term material supply contracts. There are several readily available sources for the majority of these raw materials. However, we are heavily dependent on specific component part products from a few single source vendors. We maintain a qualification, on-site inspection, assistance, and performance measurement system to control risks associated with reliance on suppliers. We normally do not carry inventories of such raw materials or components in excess of those reasonably required to meet production and shipping schedules. Material and component cost increases are passed on to our customers whenever possible. However, there can be no assurance that there will not be any supply issues over the long-term.

In the assembly of delivery and service vehicles, we use chassis supplied by third parties, and generally do not purchase these chassis for inventory. For this market, we typically accept shipment of truck chassis owned by dealers or end users, for the purpose of installing and/or manufacturing our specialized commercial vehicles on such chassis. In the event of a labor disruption or other uncontrollable event adversely affecting the limited number of companies which manufacture and/or deliver such commercial truck chassis, Utilimaster’s level of manufacturing could be substantially reduced.

Research and Development

Our success depends on our ability to respond quickly to changing market demands and new regulatory requirements. Thus, we emphasize research and development and commit significant resources to develop and adapt new products and production techniques. We dedicate a portion of our facilities to research and development projects and focus on implementing the latest technology from component manufacturers into existing products and manufacturing prototypes of new product lines. We spent $10.9 million, $12.9 million and $13.9 million on research and development in 2013, 2012 and 2011, respectively.

Product Warranties

Our subsidiaries all provide limited warranties against assembly and construction defects. These warranties generally provide for the replacement or repair of defective parts or workmanship for a specified period following the date of sale. The end users also may receive limited warranties from suppliers of components that are incorporated into our chassis and vehicles. For more information concerning our product warranties, see Note 12, Commitments and Contingent Liabilities, of the Notes to Consolidated Financial Statements appearing in this Form 10-K.

Patents, Trademarks and Licenses

We have 16 United States patents (provisional and regular), which include rights to the design and structure of chassis and certain peripheral equipment, and have 16 pending patent applications in the United States. The existing patents will expire on various dates from 2016 through 2025 and all are subject to payment of required maintenance fees. We also own 30 United States trademark and service mark registrations. The trademark and service mark registrations are generally renewable under applicable laws, subject to payment of required fees and the filing of affidavits of use. In addition, we have various international trademark applications pending.

We believe our products are identified by our trademarks and that our trademarks are valuable assets to all of our business segments. We are not aware of any infringing uses or any prior claims of ownership of our trademarks that could materially affect our business. It is our policy to pursue registration of our primary marks whenever possible and to vigorously defend our patents, trademarks and other proprietary marks against infringement or other threats to the greatest extent practicable under applicable laws.

Environmental Matters

Compliance with federal, state and local environmental laws and regulations has not had, nor is it expected to have, a material effect on our capital expenditures, earnings or competitive position.

Associates

We employed 1,900 associates as of January 31, 2014, substantially all of which are full-time, including 375 contracted associates. Management presently considers its relations with associates to be positive.

Customer Base

In 2013, our customer base included one major customer as defined by sales of more than 10% of total net sales. Sales to Jayco, Inc. in 2013, which is a customer of our Specialty Chassis and Vehicles segment, were $65.1 million.

In 2012, our customer base included one major customer as defined by sales of more than 10% of total net sales. Sales to United Parcel Service in 2012, which is a customer of our Delivery and Service Vehicles segment, were $59.1 million.

In 2011, our customer base included one major customer as defined by sales of more than 10% of total net sales. Sales to United Parcel Service in 2011, which is a customer of our Delivery and Service Vehicles segment, were $73.5 million.

Sales to customers classified as major amounted to 13.9%, 12.6% and 17.3% of total revenues in 2013, 2012 and 2011, respectively. We do have other significant customers which, if the relationship changes significantly, could have a material adverse impact on our financial position and results of operations. We believe that we have developed strong relationships with our customers and continually work to develop new customers and markets. See related risk factors in Item 1A of this Form 10-K.

Sales to customers outside the United States were $33.1 million, $44.2 million and $22.7 million for the years ended December 31, 2013, 2012 and 2011, respectively, or 7.1%, 9.1% and 5.3%, respectively, of sales for those years. All of our long-lived assets are located in the United States.

Backlog Orders

Our backlog orders, by reportable segment are summarized in the following table (in thousands).

|

December 31, 2013 |

December 31, 2012 |

|||||||

|

Emergency Response Vehicles |

$ | 156,489 | $ | 95,769 | ||||

|

Delivery and Service Vehicles |

73,148 | 39,656 | ||||||

|

Specialty Chassis and Vehicles |

13,024 | 26,600 | ||||||

|

Total consolidated |

$ | 242,661 | $ | 162,025 | ||||

The increase in our Emergency Response Vehicles backlog is the result of strong order intake for fire truck bodies due to market share gains domestically along with increased international orders, including a $20 million, 70 unit order from Peru. The increase in Delivery and Service Vehicles backlog is due to an increase in major fleet orders, mainly for our Reach TM commercial van, from the December 31, 2012 level. Of the decrease in Specialty Chassis and Vehicles backlog, approximately $7.5 million is due to a decrease in outstanding aftermarket parts and assemblies orders, $4.0 million is due to the absence of orders for defense related vehicles at December 31, 2013, and the remainder is due to decreased order intake for motor home chassis in the fourth quarter of 2013. We expect to fill all of the backlog orders at December 31, 2013 during 2014.

Although the backlog of unfilled orders is one of many indicators of market demand, several factors, such as changes in production rates, available capacity, new product introductions and competitive pricing actions, may affect actual sales. Accordingly, a comparison of backlog from period to period is not necessarily indicative of eventual actual shipments.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other reports (and amendments thereto) filed or furnished pursuant to Section 13(a) of the Securities Exchange Act are available, free of charge, on our internet website (www.SpartanMotors.com) as soon as reasonably practicable after we electronically file or furnish such materials with the Securities and Exchange Commission.

The public may read and copy materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NW, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Item 1A. Risk Factors.

The Company’s financial condition, results of operations and cash flows are subject to various risks, many of which are not exclusively within the Company’s control that may cause actual performance to differ materially from historical or projected future performance. The risks described below are the risks known to us that we believe could materially affect our business, financial condition, results of operations, or cash flows. However, these risks may not be the only risks we face. Our business could also be affected by additional factors that are not presently known to us, factors we currently consider to be immaterial to our operations, or factors that emerge as new risks in the future.

We depend on local and municipal governments for a substantial portion of our business.

Local and municipal governments are the end customer for a substantial proportion of our products, including custom fire truck chassis, fire truck bodies, aerial ladders and other fire truck related apparatus. These markets are cyclical later in an economic downturn and are heavily impacted by municipal capital spending budgets, which have been negatively impacted by weakened municipal tax revenues. These budgetary constraints may have a significant adverse effect on the overall fire and emergency vehicle market and/or cause a shift in the fire and emergency vehicle market away from highly customized products toward commercially produced vehicles. These changes could result in weakened demand for our products, which may have an adverse impact on our net sales, financial condition, profitability and/or cash flows.

The integration of businesses or assets we have acquired or may acquire in the future involves challenges that could disrupt our business and harm our financial condition.

As part of our growth strategy, we have pursued and expect we will continue to selectively pursue, acquisitions of businesses or assets in order to diversify, expand our capabilities, enter new markets, or increase our market share. Integrating any newly acquired business or assets can be expensive and can require a great deal of management time and other resources. If we are unable to successfully integrate the newly acquired businesses with our existing business, we may not realize the synergies we expect from the acquisition, and our business and results of operations would suffer from our current expectations.

Re-configuration or relocation of our production operations could negatively impact our earnings.

We may, from time to time, re-configure our production lines or relocate production of products between buildings or locations or to new locations in order to maximize the efficient utilization of our existing production capacity or take advantage of opportunities to increase manufacturing efficiencies, including, but not limited to, the move of our Utilimaster operations. Costs incurred to effect these re-configurations or re-locations may exceed our estimate, and efficiencies gained may be less than anticipated, each of which may have a negative impact on our results of operations and financial position.

Disruptions within our dealer network could adversely affect our business.

We rely, for certain of our products, on a network of independent dealers to market, deliver, provide training for, and service our products to and for customers. Our business is influenced by our ability to initiate and manage new and existing relationships with dealers.

From time to time, an individual dealer or the Company may choose to terminate the relationship, or the dealership could face financial difficulty leading to failure or difficulty in transitioning to new ownership. In addition, our competitors could engage in a strategy to attempt to acquire or convert a number of our dealers to carry their products. We do not believe our business is dependent on any single dealer, the loss of which would have a sustained material adverse effect upon our business.

However, temporary disruption of dealer coverage within a specific local market could temporarily have an adverse impact on our business within the affected market. The loss or termination of a significant number of dealers could cause difficulties in marketing and distributing our products and have an adverse effect on our business, operating results or financial condition. In the event that a dealer in a strategic market experiences financial difficulty, we may choose to provide financial support, such as extending credit, to a dealership, reducing the risk of disruption, but increasing our financial exposure.

We may not be able to successfully implement and manage our growth strategy.

Our growth strategy includes expanding existing market share through product innovation, continued expansion into industrial and global markets, and merger or acquisition related activities.

We believe our future success depends in part on our research and development and engineering efforts, our ability to manufacture or source the products and customer acceptance of our products. As it relates to new markets, our success also depends on our ability to create and implement local supply chain, sales and distribution strategies to reach these markets.

The potential inability to successfully implement and manage our growth strategy could adversely affect our business and our results of operations. The successful implementation of our growth strategy will depend, in part, on our ability to integrate operations with acquired companies.

Our efforts to grow our business in emerging markets are subject to all of these risks plus additional, unique risks. In certain markets, the legal and political environment can be unstable and uncertain which could make it difficult for us to compete successfully and could expose us to liabilities.

We also make investments in new business development initiatives which, like many startups, could have a relatively high failure rate. We limit our investments in these initiatives and establish governance procedures to contain the associated risks, but losses could result and may be material. Our growth strategy also may involve acquisitions, joint venture alliances and additional arrangements of distribution. We may not be able to enter into acquisitions or joint venture arrangements on acceptable terms, and we may not successfully integrate these activities into our operations. We also may not be successful in implementing new distribution channels, and changes could create discord in our existing channels of distribution.

When we introduce new products, we may incur expenses that we did not anticipate, such as recall expenses, resulting in reduced earnings.

The introduction of new products is critical to our future success. We have additional costs when we introduce new products, such as initial labor or purchasing inefficiencies, but we may also incur unexpected expenses. For example, we may experience unexpected engineering or design issues that will force a recall of a new product or increase production costs of the product above levels needed to ensure profitability. In addition, we may make business decisions that include offering incentives to stimulate the sales of products not adequately accepted by the market, or to stimulate sales of older or less marketable products. The costs resulting from these types of problems could be substantial and have a significant adverse effect on our earnings.

Any negative change in our relationship with our major customers could have significant adverse effects on revenues and profits.

Our financial success is directly related to the willingness of our customers to continue to purchase our products. Failure to fill customers’ orders in a timely manner or on the terms and conditions they may impose could harm our relationships with our customers. The importance of maintaining excellent relationships with our major customers may also give these customers leverage in our negotiations with them, including pricing and other supply terms, as well as post-sale disputes. This leverage may lead to increased costs to us or decreased margins. Furthermore, if any of our major customers experience a significant downturn in their business, or fail to remain committed to our products or brands, then these customers may reduce or discontinue purchases from us, which could have an adverse effect on our business, results of operations and financial condition. We had three customers that together accounted for approximately 24% of our total sales in 2013 - any negative change in our relationship with any one of them, or the orders placed by any one of them, could significantly affect our revenues and profits.

We depend on a small group of suppliers for some of our components, and the loss of any of these suppliers could affect our ability to obtain components at competitive prices, which would decrease our sales or earnings.

Most chassis, emergency response vehicle, aerial ladder and specialty vehicle commodity components are readily available from a variety of sources. However, a few proprietary or specialty components are produced by a small group of suppliers.

In addition, Utilimaster generally does not purchase vehicle chassis for its inventory. Utilimaster accepts shipments of vehicle chassis owned by dealers or end-users for the purpose of installing and/or manufacturing its specialized truck bodies on such chassis. There are four primary sources for commercial chassis and Utilimaster has established relationships with all major chassis manufacturers.

Changes in our relationships with these suppliers, shortages, production delays or work stoppages by the employees of such suppliers could have a material adverse effect on our ability to timely manufacture our products and secure sales. If we cannot obtain an adequate supply of components or commercial chassis, this could result in a decrease in our sales and earnings.

Disruption of our supply base could affect our ability to obtain component parts.

We increasingly rely on component parts from global sources in order to manufacture our products. Disruption of this supply base due to international political events or natural disasters could affect our ability to obtain component parts at acceptable prices, or at all, and have a negative impact on our sales, results of operations and financial position.

Changes to laws and regulations governing our business could have a material impact on our operations.

Our manufactured products and the industries in which we operate are subject to extensive federal and state regulations. Changes to any of these regulations or the implementation of new regulations could significantly increase the costs of manufacturing, purchasing, operating or selling our products and could have a material adverse effect on our results of operations. Our failure to comply with present or future regulations could result in fines, potential civil and criminal liability, suspension of sales or production, or cessation of operations.

Certain U.S. tax laws currently afford favorable tax treatment for the purchase and sale of recreational vehicles that are used as the equivalent of second homes. These laws and regulations have historically been amended frequently, and it is likely that further amendments and additional regulations will be applicable to us and our products in the future. Amendments to these laws and regulations and the implementation of new regulations could have a material adverse effect on our results of operations.

Our operations are subject to a variety of federal and state environmental regulations relating to noise pollution and the use, generation, storage, treatment, emission and disposal of hazardous materials and wastes. Although we believe that we are currently in material compliance with applicable environmental regulations, our failure to comply with present or future regulations could result in fines, potential civil and criminal liability, suspension of production or operations, alterations to the manufacturing process, costly cleanup or capital expenditures.

Our businesses are cyclical and this can lead to fluctuations in our operating results.

The industries in which we operate are highly cyclical and there can be substantial fluctuations in our manufacturing shipments and operating results, and the results for any prior period may not be indicative of results for any future period. Companies within these industries are subject to volatility in operating results due to external factors such as economic, demographic and political changes. Factors affecting the manufacture of chassis, emergency response vehicles, aerial ladders, specialty vehicles, delivery and service vehicles and other of our products include but are not limited to:

|

● |

Interest rates and the availability of financing; | |

|

● |

Commodity prices; | |

|

● |

Unemployment trends; | |

|

● |

International tensions and hostilities; | |

|

● |

General economic conditions; | |

|

● |

Various tax incentives; | |

|

● |

Federal, state and municipal budgets; | |

|

● |

Strength of the U.S. dollar compared to foreign currencies; | |

|

● |

Overall consumer confidence and the level of discretionary consumer spending; | |

|

● |

Dealers’ and manufacturers’ inventory levels; and | |

|

● |

Fuel availability and prices. |

Economic, legal and other factors could impact our customers’ ability to pay accounts receivable balances due from them.

In the ordinary course of business, customers are granted terms related to the sale of goods and services delivered to them. These terms typically include a period of time between when the goods and services are tendered for delivery to the customer and when the customer needs to pay for these goods and services. The amounts due under these payment terms are listed as accounts receivable on our balance sheet. Prior to collection of these accounts receivable, our customers could encounter drops in sales, unexpected increases in expenses, or other factors which could impact their ability to continue as a going concern and which could affect the collectability of these amounts. Writing off uncollectible accounts receivable could have a material adverse effect on our earnings and cash flow as the Company has major customers with material accounts receivable balances at any given time.

Implementing a new enterprise resource planning system could interfere with our business or operations.

We are in the process of implementing a new enterprise resource planning (ERP) system. Phase 1 of this implementation is expected to be completed in 2014, with the second and third phases expected to be completed in 2015 and 2016. This project requires significant investment of capital and human resources, the re-engineering of many processes of our business, and the attention of many associates and managers who would otherwise be focused on other aspects of our business. Should the system not be implemented successfully, or if the system does not perform in a satisfactory manner once implementation is complete, our business and operations could be disrupted and our results of operations negatively affected, including our ability to report accurate and timely financial results.

Global political conditions could have a negative effect on our business.

Concerns regarding acts of terrorism, armed conflicts, natural disasters and budget shortfalls have created significant global economic and political uncertainties that may have material and adverse effects on consumer demand (particularly the specialty and motor home markets), shipping and transportation, the availability of manufacturing components, commodity prices and our ability to engage in overseas markets.

Risks associated with international sales and contracts could have a negative effect on our business.

In 2013 and 2012 we derived approximately 7.1% and 9.1% of our revenue from sales to, or related to, end customers outside the United States. We expect that international sales will continue to account for an increasing amount of our total revenue, especially in our emergency response chassis and emergency response vehicles businesses. Accordingly we face numerous risks associated with conducting international operations, any of which could negatively affect our financial performance, including, but not limited to, changes in foreign country regulatory requirements, the strength of the U.S. dollar compared to foreign currencies, import/export restrictions, the imposition of foreign tariffs and other trade barriers and disruptions in the shipping of exported products.

Additionally, as a U.S. corporation, we are subject to the Foreign Corrupt Practices Act, which may place us at a competitive disadvantage to foreign companies that are not subject to similar regulations.

Fuel shortages, or higher prices for fuel, could have a negative effect on sales.

Gasoline or diesel fuel is required for the operation of motor homes, emergency response vehicles, delivery and service vehicles and the specialty vehicles we manufacture. Particularly in view of increased international tensions and increased global demand for oil, there can be no assurance that the supply of these petroleum products will continue uninterrupted, that rationing will not be imposed or that the price of or tax on these petroleum products will not significantly increase in the future. Increases in gasoline and diesel prices and speculation about potential fuel shortages have had an unfavorable effect on consumer demand for motor homes from time to time in the past and may continue to do so in the future. This, in turn, has a material adverse effect on our sales volume. Increases in the price of oil also can result in significant increases in the price of many of the components in our products, which may have an adverse impact on margins or sales volumes.

Our operating results may fluctuate significantly on a quarter-to-quarter basis.

Our quarterly operating results depend on a variety of factors including, but not limited to, the timing and volume of orders, the completion of product inspections and acceptance by our customers, and various restructuring initiatives that may be undertaken from time to time. In addition, our Utilimaster subsidiary experiences seasonality whereby product shipments in the first and fourth quarters are generally lower than other quarters as a result of the busy holiday delivery operations experienced by some of Utilimaster’s largest customers. Accordingly, our financial results may be subject to significant and/or unanticipated quarter-to-quarter fluctuations.

We could incur asset impairment charges for goodwill, intangible assets or other long-lived assets.

We have a significant amount of goodwill, intangible assets and other long-lived assets. At least annually, we review goodwill and non-amortizing intangible assets for impairment. Identifiable intangible assets, goodwill and other long-lived assets are also reviewed for impairment whenever events or changes in circumstances indicate the carrying amount of an asset may not be recoverable from future cash flows. In 2013, our Emergency Response Vehicles reporting unit recorded a goodwill impairment charge of $4.9 million as a result of that reporting unit’s failure to meet its forecasted results and an expected decline in its future cash flows from levels previously expected. If the operating performance at one or more of our reporting units fails to meet future forecasts, or if future cash flow estimates decline, we could be required, under current U.S. accounting rules, to record additional impairment charges for our goodwill, intangible assets or other long-lived assets. Any write-off of a material portion of such assets could negatively affect our results of operations or financial position.

Our stock price has been and may continue to be volatile, which may result in losses to our shareholders.

The market price of the Company’s common stock has been and may continue to be subject to wide fluctuations in response to, among other things, quarterly fluctuations in operating results, a failure to meet published estimates of or changes in earnings estimates by securities analysts, sales of common stock by existing holders, loss of key personnel, market conditions in our industries, shortages of key product inventory components and general economic conditions.

Credit market developments may reduce availability under our credit agreement.

Due to the current volatile state of the credit markets, there is risk that lenders, even those with strong balance sheets and sound lending practices, could fail or refuse to honor their legal commitments and obligations under existing credit commitments. If our lenders fail to honor their legal commitments under our credit facilities, it could be difficult in the current environment to replace our credit facilities on similar terms. Although we believe that our operating cash flow, access to capital markets and existing credit facilities will give us the ability to satisfy our liquidity needs for at least the next 12 months, the failure of any of the lenders under our credit facilities may impact our ability to finance our operating or investing activities.

If there is a rise in the frequency and size of product liability, warranty and other claims against us, including wrongful death claims, our business, results of operations and financial condition may be harmed.

We are frequently subject, in the ordinary course of business, to litigation involving product liability and other claims, including wrongful death claims, related to personal injury and warranties. We partially self-insure our product liability claims and purchase excess product liability insurance in the commercial insurance market. We cannot be certain that our insurance coverage will be sufficient to cover all future claims against us. Any increase in the frequency and size of these claims, as compared to our experience in prior years, may cause the premiums that we are required to pay for such insurance to rise significantly. It may also increase the amounts we pay in punitive damages, which may not be covered by our insurance. In addition, a major product recall or increased levels of warranty claims could have a material adverse effect on our results of operations.

Increased costs, including costs of raw materials, component parts and labor costs, potentially impacted by changes in labor rates and practices, could reduce our operating income.

Our results of operations may be significantly affected by the availability and pricing of manufacturing components and labor, as well as changes in labor rates and practices. Increases in raw materials used in our products could affect the cost of our supply materials and components, as the rising steel and aluminum prices have impacted the cost of certain of the Company’s manufacturing components. Although we attempt to mitigate the effect of any escalation in components and labor costs by negotiating with current or new suppliers and by increasing productivity or, where necessary, by increasing the sales prices of our products, we cannot be certain that we will be able to do so without it having an adverse impact on the competitiveness of our products and, therefore, our sales volume. If we cannot successfully offset increases in our manufacturing costs, this could have a material adverse impact on our margins, operating income and cash flows. Our profit margins may decrease if prices of purchased component parts or labor rates increase and we are unable to pass on those increases to our customers. Even if we were able to offset higher manufacturing costs by increasing the sales prices of our products, the realization of any such increases often lags behind the rise in manufacturing costs, especially in our operations, due in part to our commitment to give our customers and dealers price protection with respect to previously placed customer orders.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

The following table sets forth information concerning the properties we own or lease. We consider that our properties are generally in good condition, are well maintained, and are generally suitable and adequate to meet our business requirements for the foreseeable future. In 2013, our manufacturing plants, taken as a whole, operated moderately below capacity.

|

Square Footage |

Owned/Leased |

Operating Segment | |||||

|

Manufacturing/Assembly |

|||||||

|

Charlotte, Michigan |

295,000 | Owned | Emergency Response/Specialty Chassis and Vehicles | ||||

|

Charlotte, Michigan |

82,000 |

Owned |

Delivery and Service Vehicles | ||||

|

Brandon, South Dakota |

24,000 | Owned | Emergency Response Vehicles | ||||

|

Brandon, South Dakota |

21,000 | Leased |

Emergency Response Vehicles | ||||

|

Ephrata, Pennsylvania |

45,000 |

Leased |

Emergency Response Vehicles | ||||

|

Ocala, Florida |

50,000 |

Leased |

Emergency Response Vehicles | ||||

|

Bristol, Indiana |

417,000 |

Leased |

Delivery and Service Vehicles | ||||

|

Wakarusa, Indiana |

149,000 |

Leased |

Delivery and Service Vehicles | ||||

| 1,083,000 | |||||||

|

Warehousing |

|||||||

|

Charlotte, Michigan |

130,000 |

Owned |

Emergency Response/Specialty Chassis and Vehicles | ||||

|

Brandon, South Dakota |

1,000 | Owned |

Emergency Response Vehicles | ||||

|

Brandon, South Dakota |

3,000 | Leased |

Emergency Response Vehicles | ||||

|

Ephrata, Pennsylvania |

4,500 |

Leased |

Emergency Response Vehicles | ||||

|

Ocala, Florida |

10,000 | Leased | Emergency Response Vehicles | ||||

|

Wakarusa, Indiana |

20,000 |

Leased |

Delivery and Service Vehicles | ||||

| Bristol, Indiana | 35,000 | Leased | Delivery and Service Vehicles | ||||

| 203,500 | |||||||

|

Research and Development |

|||||||

|

Charlotte, Michigan |

12,000 |

Owned |

Emergency Response/Specialty Chassis and Vehicles | ||||

|

Bristol, Indiana |

3,000 |

Leased |

Delivery and Service Vehicles | ||||

| 15,000 | |||||||

|

Service Area/Inspection |

|||||||

|

Charlotte, Michigan |

58,000 | Owned |

Emergency Response/Specialty Chassis and Vehicles | ||||

|

Brandon, South Dakota |

7,000 |

Leased |

Emergency Response Vehicles | ||||

| 65,000 | |||||||

|

Offices |

|||||||

|

Corporate Offices – Charlotte, MI |

9,000 |

Owned |

Not Applicable | ||||

|

Charlotte, Michigan |

122,000 |

Owned |

Emergency Response/Specialty Chassis and Vehicles | ||||

|

Brandon, South Dakota |

7,000 |

Owned |

Emergency Response Vehicles | ||||

|

Brandon, South Dakota |

3,000 | Leased |

Emergency Response Vehicles | ||||

|

Ephrata, Pennsylvania |

12,500 | Leased |

Emergency Response Vehicles | ||||

|

Ocala, Florida |

3,000 | Owned |

Emergency Response Vehicles | ||||

|

Bristol, Indiana |

36,000 |

Leased |

Delivery and Service Vehicles | ||||

|

Wakarusa, Indiana |

5,000 |

Leased |

Delivery and Service Vehicles | ||||

| 197,500 | |||||||

|

Unutilized |

|||||||

|

Charlotte, Michigan |

113,000 |

Owned |

Not Applicable | ||||

|

Wakarusa, Indiana (1) |

40,000 |

Owned |

Not Applicable | ||||

| 153,000 | |||||||

|

Total square footage |

1,717,000 | ||||||

(1) As of December 31, 2012, the owned office facility in Wakarusa, Indiana has been vacated and is recorded as held-for-sale.

Item 3. Legal Proceedings.

At December 31, 2013, we were parties, both as plaintiff or defendant, to a number of lawsuits and claims arising out of the normal conduct of our businesses. Our management does not currently expect our financial position, future operating results or cash flows to be materially affected by the final outcome of these legal proceedings.

Item 4. Mine Safety Disclosures.

Not applicable

PART II

Item 5. Market For Registrant’s Common Equity, Related Shareholder Matters, and Issuer Purchases of Equity Securities.

Our common stock is traded on the NASDAQ Global Select Market under the symbol “SPAR.”

The following table sets forth the high and low sale prices for our common stock for the periods indicated, all as reported by the NASDAQ Global Select Market:

|

High |

Low |

|||||||

|

Year Ended December 31, 2013: |

||||||||

|

Fourth Quarter |

$ | 7.07 | $ | 5.94 | ||||

|

Third Quarter |

6.27 | 5.47 | ||||||

|

Second Quarter |

6.18 | 4.97 | ||||||

|

First Quarter |

5.80 | 5.04 | ||||||

|

Year Ended December 31, 2012: |

||||||||

|

Fourth Quarter |

$ | 5.33 | $ | 4.48 | ||||

|

Third Quarter |

5.44 | 4.67 | ||||||

|

Second Quarter |

5.24 | 4.08 | ||||||

|

First Quarter |

6.46 | 4.82 | ||||||

On October 24, 2013 our Board of Directors declared a cash dividend of $0.05 per share of common stock, payable on December 19, 2013 to shareholders of record on November 14, 2013.

On May 8, 2013 our Board of Directors declared a cash dividend of $0.05 per share of common stock, which was paid on June 27, 2013 to shareholders of record at the close of business on May 23, 2013.

On October 26, 2012, our Board of Directors declared a cash dividend of $0.05 per outstanding share payable on December 13, 2012 to shareholders of record on November 8, 2012.

On April 26, 2012 our Board of Directors declared a cash dividend of $0.05 per outstanding share payable on June 14, 2012 to shareholders of record on May 10, 2012.

No assurance, however, can be given that any future distributions will be made or, if made, as to the amounts or timing of any future distributions as such distributions are subject to earnings, financial condition, liquidity, capital requirements, and such other factors as our Board of Directors deems relevant. The number of shareholders of record (excluding participants in security position listings) of our common stock on February 28, 2014 was 351. See Item 12 below for information concerning our equity compensation plans.

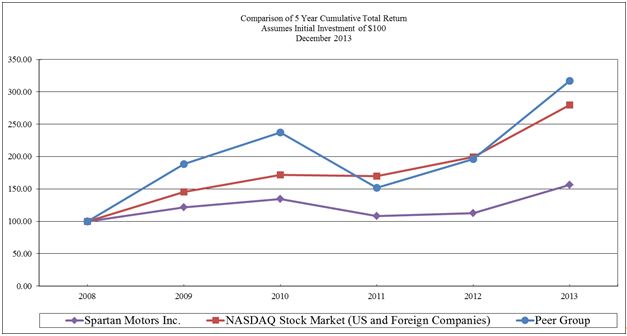

The following graph compares the cumulative total stockholder return on our common stock with the cumulative total return on the Nasdaq Composite Index, the CRSP Trucking and Transportation Index and a company-selected peer group for the period beginning on December 31, 2008 and ending on the last day of 2013. The graph assumes an investment of $100 in our stock, the two indices and the company-selected peer group on December 31, 2008, and further assumes the reinvestment of all dividends. Stock price performance, presented for the period from December 31, 2008 to December 31, 2013, is not necessarily indicative of future results.

The company-selected peer group was determined based on a custom peer group of companies in the specialty manufacturing and automotive industries, against whom we compete for sales or management talent, that were identified for the purpose of benchmarking officer salaries. The company-selected peer group includes: Terex Corporation; Oshkosh Corporation; Federal Signal Corporation; Supreme Industries, Inc.; Miller Industries, Inc.; Navistar International Corporation; Alamo Group, Inc.; Thor Industries, Inc.; Drew Industries, Inc.; Winnebago Industries, Inc.; and Rosenbaur International.

|

12/31/2008 |

12/31/2009 |

12/31/2010 |

12/31/2011 |

12/31/2012 |

12/31/2013 |

|||||||||||||||||||

|

Spartan Motors, Inc. |

$ | 100.00 | $ | 121.83 | $ | 134.22 | $ | 107.95 | $ | 112.72 | $ | 156.07 | ||||||||||||

|

NASDAQ Stock Market |

$ | 100.00 | $ | 145.32 | $ | 171.51 | $ | 170.05 | $ | 199.67 | $ | 279.75 | ||||||||||||

|

Peer Group |

$ | 100.00 | $ | 188.16 | $ | 237.03 | $ | 152.03 | $ | 195.84 | $ | 316.86 | ||||||||||||

The stock price performance graph and related information shall not be deemed “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference by any general statement incorporating by reference this annual report on Form 10-K into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate this information by reference.

Issuer Purchases of Equity Securities

A summary of our purchases of our common stock during the fourth quarter of fiscal year 2013 is as follows:

|

|

|

|

Total Number of |

|

||||||||||||

|

Oct. 1, 2013 to Oct. 31, 2013 |

161 | (2) | 6.55 | -- | 1,000,000 | |||||||||||

|

Nov. 1, 2013 to Nov. 30, 2013 |

-- | -- | -- | 1,000,000 | ||||||||||||

|

Dec. 1, 2013 to Dec. 31, 2013 |

-- | -- | -- | 1,000,000 | ||||||||||||

|

Total |

-- | -- | -- | 1,000,000 | ||||||||||||

|

(1) |

On October 19, 2011, the Board of Directors authorized management to repurchase up to a total of 1.0 million shares of its common stock in open market transactions, contingent upon market conditions. Repurchase of common stock is based on management’s assessment of market conditions. If the Company was to repurchase the full 1.0 million shares of stock under the repurchase program, it would cost the Company approximately $5.7 million based on the closing price of the Company’s stock on February 28, 2014. The Company believes that it has sufficient resources to fund any potential stock buyback in which it may engage. |

|

(2) |

During the quarter ended December 31, 2013 there were 161 shares delivered by associates in satisfaction of tax withholding obligations that occurred upon the vesting of restricted shares. These shares are not repurchased pursuant to the Board of Directors authorization disclosed above. |

Item 6. Selected Financial Data.

The selected financial data shown below for each of the five years in the period ended December 31, 2013 has been derived from our Consolidated Financial Statements. The following data should be read in conjunction with the Consolidated Financial Statements and related Notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this Form 10-K.

Five-Year Operating and Financial Summary

(In Thousands, Except Per Share Data)

|

2013 |

2012 |

2011 |

2010 |

2009 |

||||||||||||||||

| (1) | (2) | |||||||||||||||||||

|

Sales |

$ | 469,538 | $ | 470,577 | $ | 426,010 | $ | 480,736 | $ | 409,538 | ||||||||||

|

Cost of products sold |

416,475 | 405,455 | 363,662 | 407,201 | 328,305 | |||||||||||||||

|

Restructuring charge |

- | 6,514 | 1,731 | 990 | 264 | |||||||||||||||

|

Gross profit |

53,063 | 58,608 | 60,617 | 72,545 | 80,969 | |||||||||||||||

|

Operating expenses: |

||||||||||||||||||||

|

Research and development |

10,911 | 12,873 | 13,931 | 16,912 | 16,962 | |||||||||||||||

|

Selling, general and administrative |

45,495 | 45,707 | 44,305 | 43,869 | 42,448 | |||||||||||||||

|

Goodwill impairment |

4,855 | - | - | - | - | |||||||||||||||

|

Restructuring charge |

- | 2,619 | 1,050 | 1,006 | 576 | |||||||||||||||

|

Operating income (loss) |

(8,198 | ) | (2,591 | ) | 1,331 | 10,758 | 20,983 | |||||||||||||

|

Other income (expense), net |

348 | 234 | (48 | ) | (506 | ) | (805 | ) | ||||||||||||

|

Income (loss) from continuing operations before taxes |

(7,850 | ) | - | 1,283 | 10,252 | 20,178 | ||||||||||||||

|

Income tax expense (benefit) from continuing operations |

(1,881 | ) | 100 | 510 | 3,017 | 7,023 | ||||||||||||||

|

Net earnings (loss) from continuing operations |

(5,969 | ) | (2,457 | ) | 773 | 7,235 | 13,155 | |||||||||||||

|

Loss from discontinued operations, net of tax |

- | - | - | (3,094 | ) | (1,383 | ) | |||||||||||||

|

Less: Net income attributable to non-controlling interest |

2 | - | - | - | - | |||||||||||||||

|

Net earnings (loss) attributable to Spartan Motors, Inc. |

$ | (5,971 | ) | $ | (2,457 | ) | $ | 773 | $ | 4,141 | $ | 11,772 | ||||||||

|

Basic earnings (loss) per share from continuing operations |

$ | (0.18 | ) | $ | (0.07 | ) | $ | 0.02 | $ | 0.22 | $ | 0.40 | ||||||||

|

Basic loss per share from discontinued operations |

- | - | (0.09 | ) | (0.04 | ) | ||||||||||||||

|

Basic earnings (loss) per share |

$ | (0.18 | ) | $ | (0.07 | ) | $ | 0.02 | $ | 0.13 | $ | 0.36 | ||||||||

|

Diluted earnings (loss) per share from continuing operations |

$ | (0.18 | ) | $ | ( 0.07 | ) | $ | 0.02 | $ | 0.22 | $ | 1.40 | ||||||||

|

Diluted loss per share from discontinued operations |

- | - | - | (0.09 | ) | (0.04 | ) | |||||||||||||

|

Diluted earnings (loss) per share |

$ | (0.18 | ) | $ | ( 0.07 | ) | $ | 0.02 | $ | 0.13 | $ | 0.36 | ||||||||

|

Cash dividends per common share |

$ | 0.10 | $ | 0.10 | $ | 0.10 | $ | 0.10 | $ | 0.13 | ||||||||||

|

Basic weighted average common shares outstanding |

33,550 | 33,165 | 33,438 | 33,021 | 32,729 | |||||||||||||||

|

Diluted weighted average common shares outstanding |

33,550 | 33,165 | 33,488 | 33,101 | 32,916 | |||||||||||||||

|

Balance Sheet Data: |

||||||||||||||||||||

|

Net working capital |

$ | 100,575 | $ | 98,833 | $ | 98,673 | $ | 98,230 | $ | 119,737 | ||||||||||

|

Total assets |

253,282 | 245,151 | 248,609 | 241,749 | 293,277 | |||||||||||||||

|

Long-term debt, including current portion |

5,340 | 5,289 | 5,139 | 5,224 | 46,350 | |||||||||||||||

|

Shareholders’ equity |

171,551 | 178,729 | 182,838 | 182,979 | 180,520 | |||||||||||||||

|

(1)

|

On September 20, 2010 we completed the sale of substantially all of the assets of our Road Rescue, Inc. subsidiary. Accordingly, the results of operations for Road Rescue were reclassified into discontinued operations for 2010 and prior years. | ||

|

(2) |

Effective November 30, 2009, we acquired Utilimaster Corporation. The information shown for 2009 includes the results of operations for Utilimaster Corporation for the month of December 2009, and the balance sheet data reflects such acquisition and changes to our debt facilities made in connection with this acquisition. | ||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

General

Spartan Motors, Inc. was organized as a Michigan corporation on September 18, 1975, and is headquartered in Charlotte, Michigan. Spartan Motors began development of its first product that same year and shipped its first fire truck chassis in October 1975.