Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Dec. 31, 2023 |

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

| Pay vs Performance Disclosure |

|

|

|

|

| Pay vs Performance Disclosure, Table |

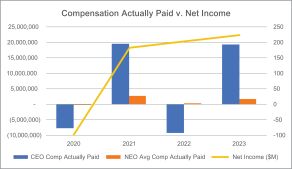

The following table shows the total compensation for our CEO for the past three fiscal years as set forth in the Summary Compensation Table, the “compensation actually paid” to our CEO and, on an average basis our other NEOs (in each case, as determined under SEC rules), our TSR, the TSR of our peer group over the same period, our net income (loss), and the financial performance measure that we have selected for compensatory purposes, adjusted EBITDA. See “Compensation Discussion and Analysis” for information regarding the Company’s philosophy and how the Company aligns executive compensation with the Company’s performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Value of $100

Investment

Based on |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year |

|

Summary

Compensation

Table Total for

CEO (1) |

|

|

Compensation

Actually Paid

CEO (2) |

|

|

Average

Summary

Compensation

Table Total for

other NEOs (3) |

|

|

Average

Compensation

Actually Paid

for NEOs (4) |

|

|

TSR (5) |

|

|

Peer

Group

TSR(6) |

|

|

Net Income

(loss) $ in

millions (7) |

|

|

Company

Selected

Measure:

Adjusted

EBITDA $ in

millions (8) |

|

|

|

|

|

|

|

|

|

|

| 2023 |

|

|

13,541,716 |

|

|

|

19,471,327 |

|

|

|

1,445,754 |

|

|

|

1,829,459 |

|

|

|

109.42 |

|

|

|

164.00 |

|

|

|

223.8 |

|

|

|

430 |

|

| 2022 |

|

|

6,274,658 |

|

|

|

(9,191,709 |

) |

|

|

1,519,954 |

|

|

|

342,164 |

|

|

|

75.18 |

|

|

|

114.00 |

|

|

|

202.9 |

|

|

|

385 |

|

|

|

|

|

|

|

|

|

|

| 2021 |

|

|

6,830,772 |

|

|

|

19,752,199 |

|

|

|

1,497,830 |

|

|

|

2,878,943 |

|

|

|

126.07 |

|

|

|

169.00 |

|

|

|

183.2 |

|

|

|

372 |

|

| 2020 |

|

|

5,073,042 |

|

|

|

(7,730,792 |

) |

|

|

1,207,543 |

|

|

|

(387,858 |

) |

|

|

80.05 |

|

|

|

122.00 |

|

|

|

(99.1 |

) |

|

|

330 |

|

| (1) |

Mr. Grizzle was the CEO for each of 2020, 2021, 2022 and 2023. |

| (2) |

SEC rules require certain adjustments be made to the Summary Compensation Table totals to determine “compensation actually paid” as reported in the Pay versus Performance Table. “Compensation actually paid” does not necessarily represent cash and/or equity value transferred to our CEO without restriction, but rather is a value calculated under applicable SEC rules. In general, “compensation actually paid” is calculated as Summary Compensation Table total compensation adjusted to include the fair market value of equity awards as of December 31 of the applicable year or, if earlier, the vesting date (rather than the grant date) and certain adjustments in the values of pensions. Compensation actually paid generally fluctuates due to stock price achievement and varying levels of projected and actual achievement of performance goals (as reflected in the significant decrease to 2020 and 2022 compensation actually paid). For information regarding the decisions made by our MDCC in regard to the CEOs compensation for each fiscal year, please see the “Compensation Discussion and Analysis” sections in this proxy statement and in the proxy statement for our annual meeting of shareholders for 2020, 2021 and 2022. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year |

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SCT Total Compensation |

|

|

13,541,716 |

|

|

|

6,274,658 |

|

|

|

6,830,772 |

|

|

|

5,073,042 |

|

| Less: Stock Award Values Reported in SCT for the Covered Year ($) |

|

|

(11,019,636 |

) |

|

|

(4,433,797 |

) |

|

|

(4,442,344 |

) |

|

|

(3,539,454 |

) |

| Plus: Fair Value at Year-End for Stock Awards Granted in the Covered Year that Remain Outstanding ($) |

|

|

15,171,133 |

|

|

|

1,376,041 |

|

|

|

7,261,925 |

|

|

|

1,030,646 |

|

| Change in Fair Value during the Year of Outstanding Unvested Stock Awards Granted in Prior Years ($) |

|

|

1,778,114 |

|

|

|

(8,646,831 |

) |

|

|

6,754,468 |

|

|

|

(8,114,358 |

) |

| Change in Fair Value of Stock Awards Granted in Prior Years that Vested in the Covered Years ($) |

|

|

— |

|

|

|

(3,761,780 |

) |

|

|

3,347,378 |

|

|

|

(2,180,668 |

) |

| Less: Fair Value of Stock Awards Forfeited during the Covered Year ($) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Compensation Actually Paid ($) |

|

|

19,471,327 |

|

|

|

(9,191,709 |

) |

|

|

19,752,199 |

|

|

|

(7,730,792 |

) |

| (3) |

The following non-CEO named executive officers are included in the average figures shown |

| |

a. |

2023: Christopher Calzaretta, Mark Hershey, Austin So and Monica Maheshwari |

| |

b. |

2022: Christopher Calzaretta, Mark Hershey, Austin So and Ellen Romano |

| |

c. |

2021: Brian MacNeal, Charles Chiappone, Mark Hershey, and Ellen Romano |

| |

d. |

2020: Brian MacNeal, Charles Chiappone, Mark Hershey, and Ellen Romano |

| (4) |

Average “compensation actually paid” for our non-CEO NEOs in each of 2023, 2022, 2021 and 2020 reflects the adjustments to the Summary Compensation Table totals required by the SEC rules. For information regarding the decisions made by our MDCC in regard to the non-CEO NEOs compensation for each fiscal year, please see the “Compensation Discussion and Analysis” in this proxy statement and in the proxy statement for our annual meeting of shareholders for 2021, 2022 and 2023. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year |

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SCT Total Compensation |

|

|

1,445,754 |

|

|

|

1,519,954 |

|

|

|

1,497,830 |

|

|

|

1,207,543 |

|

| Less: Stock Award Values Reported in SCT for the Covered Year ($) |

|

|

(638,773 |

) |

|

|

(884,408 |

) |

|

|

(631,405 |

) |

|

|

(489,702 |

) |

| Plus: Fair Value at Year-End for Stock Awards Granted in the Covered Year that Remain Outstanding ($) |

|

|

847,663 |

|

|

|

396,089 |

|

|

|

966,107 |

|

|

|

142,599 |

|

| Change in Fair Value during the Year of Outstanding Unvested Stock Awards Granted in Prior Years ($) |

|

|

170,743 |

|

|

|

(601,087 |

) |

|

|

706,872 |

|

|

|

(807,863 |

) |

| Change in Fair Value of Stock Awards Granted in Prior Years that Vested in the Covered Years ($) |

|

|

4,072 |

|

|

|

(88,384 |

) |

|

|

339,539 |

|

|

|

(312,079 |

) |

| Less: Fair Value of Stock Awards Forfeited during the Covered Year ($) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Less: Aggregate Change in Actuarial Present Value of Accumulated Benefit Under Pension Plans ($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(128,357 |

) |

| Plus: Aggregate Service Cost and Prior Service Cost for Pension Plans ($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Compensation Actually Paid ($) |

|

|

1,829,459 |

|

|

|

342,164 |

|

|

|

2,878,943 |

|

|

|

(387,858 |

) |

| (5) |

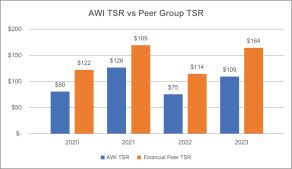

For the relevant fiscal year, represents the cumulative total shareholder return (TSR) of Armstrong World Industries for the measurement periods ending on December 31 of each of 2023, 2022, 2021 and 2020, respectively, assuming $100 invested in our shares of Common Stock on December 31, 2019, and reinvestment of all dividends. |

| (6) |

For the relevant fiscal year, represents the cumulative TSR of our financial peer group (“Peer Group TSR”) for the measurement periods ending on December 31 of each of 2023, 2022, 2021 and 2020, respectively, assuming $100 invested in shares of common stock of our Peer Group on December 31, 2019, and reinvestment of all dividends. The financial peer group is composed of the following companies: Allegion PLC, A.O. Smith Corporation, Apogee Enterprises, Inc., Acuity Brands, Inc., Masonite International Corp., Fortune Brands Home & Security, Inc., James Hardie Industries, Lennox International Inc., Masco Corporation, Mohawk Industries, Inc., Owens Corning, Sherwin-Williams Company, Simpson Manufacturing Co., Inc. and Interface, Inc. |

| (7) |

Reflects “Net Income (Loss)” as reported in the Company’s Consolidated Income Statements included in the Company’s Annual Reports on Form 10-K for each of the years ended December 31, 2023, 2022, 2021 and 2020. |

| (8) |

Company-selected Measure is adjusted EBITDA, which is operating income plus depreciation, amortization plus/minus non-cash pension impact and plus/minus earnout/deferred purchase price accruals and certain acquisition-related charges, subject to certain exceptions and described more fully in “Compensation Discussion and Analysis” in this proxy statement. |

|

|

|

|

| Company Selected Measure Name |

EBITDA

|

|

|

|

| Named Executive Officers, Footnote |

| (3) |

The following non-CEO named executive officers are included in the average figures shown |

| |

a. |

2023: Christopher Calzaretta, Mark Hershey, Austin So and Monica Maheshwari |

| |

b. |

2022: Christopher Calzaretta, Mark Hershey, Austin So and Ellen Romano |

| |

c. |

2021: Brian MacNeal, Charles Chiappone, Mark Hershey, and Ellen Romano |

| |

d. |

2020: Brian MacNeal, Charles Chiappone, Mark Hershey, and Ellen Romano |

|

|

|

|

| Peer Group Issuers, Footnote |

For the relevant fiscal year, represents the cumulative TSR of our financial peer group (“Peer Group TSR”) for the measurement periods ending on December 31 of each of 2023, 2022, 2021 and 2020, respectively, assuming $100 invested in shares of common stock of our Peer Group on December 31, 2019, and reinvestment of all dividends. The financial peer group is composed of the following companies: Allegion PLC, A.O. Smith Corporation, Apogee Enterprises, Inc., Acuity Brands, Inc., Masonite International Corp., Fortune Brands Home & Security, Inc., James Hardie Industries, Lennox International Inc., Masco Corporation, Mohawk Industries, Inc., Owens Corning, Sherwin-Williams Company, Simpson Manufacturing Co., Inc. and Interface, Inc.

|

|

|

|

| PEO Total Compensation Amount |

$ 13,541,716

|

$ 6,274,658

|

$ 6,830,772

|

$ 5,073,042

|

| PEO Actually Paid Compensation Amount |

$ 19,471,327

|

(9,191,709)

|

19,752,199

|

(7,730,792)

|

| Adjustment To PEO Compensation, Footnote |

| (2) |

SEC rules require certain adjustments be made to the Summary Compensation Table totals to determine “compensation actually paid” as reported in the Pay versus Performance Table. “Compensation actually paid” does not necessarily represent cash and/or equity value transferred to our CEO without restriction, but rather is a value calculated under applicable SEC rules. In general, “compensation actually paid” is calculated as Summary Compensation Table total compensation adjusted to include the fair market value of equity awards as of December 31 of the applicable year or, if earlier, the vesting date (rather than the grant date) and certain adjustments in the values of pensions. Compensation actually paid generally fluctuates due to stock price achievement and varying levels of projected and actual achievement of performance goals (as reflected in the significant decrease to 2020 and 2022 compensation actually paid). For information regarding the decisions made by our MDCC in regard to the CEOs compensation for each fiscal year, please see the “Compensation Discussion and Analysis” sections in this proxy statement and in the proxy statement for our annual meeting of shareholders for 2020, 2021 and 2022. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year |

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SCT Total Compensation |

|

|

13,541,716 |

|

|

|

6,274,658 |

|

|

|

6,830,772 |

|

|

|

5,073,042 |

|

| Less: Stock Award Values Reported in SCT for the Covered Year ($) |

|

|

(11,019,636 |

) |

|

|

(4,433,797 |

) |

|

|

(4,442,344 |

) |

|

|

(3,539,454 |

) |

| Plus: Fair Value at Year-End for Stock Awards Granted in the Covered Year that Remain Outstanding ($) |

|

|

15,171,133 |

|

|

|

1,376,041 |

|

|

|

7,261,925 |

|

|

|

1,030,646 |

|

| Change in Fair Value during the Year of Outstanding Unvested Stock Awards Granted in Prior Years ($) |

|

|

1,778,114 |

|

|

|

(8,646,831 |

) |

|

|

6,754,468 |

|

|

|

(8,114,358 |

) |

| Change in Fair Value of Stock Awards Granted in Prior Years that Vested in the Covered Years ($) |

|

|

— |

|

|

|

(3,761,780 |

) |

|

|

3,347,378 |

|

|

|

(2,180,668 |

) |

| Less: Fair Value of Stock Awards Forfeited during the Covered Year ($) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Compensation Actually Paid ($) |

|

|

19,471,327 |

|

|

|

(9,191,709 |

) |

|

|

19,752,199 |

|

|

|

(7,730,792 |

) |

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 1,445,754

|

1,519,954

|

1,497,830

|

1,207,543

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 1,829,459

|

342,164

|

2,878,943

|

(387,858)

|

| Adjustment to Non-PEO NEO Compensation Footnote |

| (4) |

Average “compensation actually paid” for our non-CEO NEOs in each of 2023, 2022, 2021 and 2020 reflects the adjustments to the Summary Compensation Table totals required by the SEC rules. For information regarding the decisions made by our MDCC in regard to the non-CEO NEOs compensation for each fiscal year, please see the “Compensation Discussion and Analysis” in this proxy statement and in the proxy statement for our annual meeting of shareholders for 2021, 2022 and 2023. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year |

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SCT Total Compensation |

|

|

1,445,754 |

|

|

|

1,519,954 |

|

|

|

1,497,830 |

|

|

|

1,207,543 |

|

| Less: Stock Award Values Reported in SCT for the Covered Year ($) |

|

|

(638,773 |

) |

|

|

(884,408 |

) |

|

|

(631,405 |

) |

|

|

(489,702 |

) |

| Plus: Fair Value at Year-End for Stock Awards Granted in the Covered Year that Remain Outstanding ($) |

|

|

847,663 |

|

|

|

396,089 |

|

|

|

966,107 |

|

|

|

142,599 |

|

| Change in Fair Value during the Year of Outstanding Unvested Stock Awards Granted in Prior Years ($) |

|

|

170,743 |

|

|

|

(601,087 |

) |

|

|

706,872 |

|

|

|

(807,863 |

) |

| Change in Fair Value of Stock Awards Granted in Prior Years that Vested in the Covered Years ($) |

|

|

4,072 |

|

|

|

(88,384 |

) |

|

|

339,539 |

|

|

|

(312,079 |

) |

| Less: Fair Value of Stock Awards Forfeited during the Covered Year ($) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Less: Aggregate Change in Actuarial Present Value of Accumulated Benefit Under Pension Plans ($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(128,357 |

) |

| Plus: Aggregate Service Cost and Prior Service Cost for Pension Plans ($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Compensation Actually Paid ($) |

|

|

1,829,459 |

|

|

|

342,164 |

|

|

|

2,878,943 |

|

|

|

(387,858 |

) |

|

|

|

|

| Compensation Actually Paid vs. Total Shareholder Return |

|

|

|

|

| Compensation Actually Paid vs. Net Income |

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

|

|

|

|

| Total Shareholder Return Vs Peer Group |

|

|

|

|

| Tabular List, Table |

Most Important Financial Performance Measures . Listed below are the financial performance measures which in our assessment represent the most important financial performance measures we used to link compensation actually paid to our named executive officers, for 2023, to company performance.

| |

b. |

Absolute Total Shareholder Return |

| |

c. |

Adjusted Free Cash Flow |

| |

e. |

Mineral Fiber Adjusted EBITDA |

|

|

|

|

| Total Shareholder Return Amount |

$ 109.42

|

75.18

|

126.07

|

80.05

|

| Peer Group Total Shareholder Return Amount |

164

|

114

|

169

|

122

|

| Net Income (Loss) |

$ 223,800,000

|

$ 202,900,000

|

$ 183,200,000

|

$ (99,100,000)

|

| Company Selected Measure Amount |

430,000,000

|

385,000,000

|

372,000,000

|

330,000,000

|

| PEO Name |

Mr. Grizzle

|

|

|

|

| Measure:: 1 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Adjusted EBITDA

|

|

|

|

| Non-GAAP Measure Description |

Company-selected Measure is adjusted EBITDA, which is operating income plus depreciation, amortization plus/minus non-cash pension impact and plus/minus earnout/deferred purchase price accruals and certain acquisition-related charges, subject to certain exceptions and described more fully in “Compensation Discussion and Analysis” in this proxy statement.

|

|

|

|

| Measure:: 2 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Absolute Total Shareholder Return

|

|

|

|

| Measure:: 3 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Adjusted Free Cash Flow

|

|

|

|

| Measure:: 4 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Revenue

|

|

|

|

| Measure:: 5 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Mineral Fiber Adjusted EBITDA

|

|

|

|

| PEO | Stock Award Values Reported in STC for the Covered Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

$ (11,019,636)

|

$ (4,433,797)

|

$ (4,442,344)

|

$ (3,539,454)

|

| PEO | Fair Value at YearEnd For Stock Awards Granted in the Covered Year that Remain Outstanding [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

15,171,133

|

1,376,041

|

7,261,925

|

1,030,646

|

| PEO | Change in Fair Value During the Year of Outstanding Unvested Stock Awards Granted in Prior Years [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

1,778,114

|

(8,646,831)

|

6,754,468

|

(8,114,358)

|

| PEO | Change in Fair Value of Stock Awards Granted in Prior Years that Vested in the Covered Years [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

(3,761,780)

|

3,347,378

|

(2,180,668)

|

| PEO | Fair Value of Stock Awards Forfeited During the Covered Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

| Non-PEO NEO | Stock Award Values Reported in STC for the Covered Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(638,773)

|

(884,408)

|

(631,405)

|

(489,702)

|

| Non-PEO NEO | Fair Value at YearEnd For Stock Awards Granted in the Covered Year that Remain Outstanding [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

847,663

|

396,089

|

966,107

|

142,599

|

| Non-PEO NEO | Change in Fair Value During the Year of Outstanding Unvested Stock Awards Granted in Prior Years [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

170,743

|

(601,087)

|

706,872

|

(807,863)

|

| Non-PEO NEO | Change in Fair Value of Stock Awards Granted in Prior Years that Vested in the Covered Years [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

4,072

|

(88,384)

|

339,539

|

(312,079)

|

| Non-PEO NEO | Fair Value of Stock Awards Forfeited During the Covered Year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

$ 0

|

$ 0

|

$ 0

|

0

|

| Non-PEO NEO | Aggregate Change in Actuarial Present Value of Accumulated Benefit Under Pension Plans [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

$ (128,357)

|