DEF 14A0000074260falseOLD REPUBLIC INTERNATIONAL CORPORATION00000742602022-01-012022-12-31iso4217:USD000007426022022-01-012022-12-3100000742602021-01-012021-12-31000007426022021-01-012021-12-3100000742602020-01-012020-12-31000007426022020-01-012020-12-31000007426012022-01-012022-12-310000074260ecd:PeoMemberori:ChangeInPensionValueMember2022-01-012022-12-310000074260ecd:NonPeoNeoMemberori:ChangeInPensionValueMember2022-01-012022-12-310000074260ecd:PeoMemberori:ChangeInPensionValueMember2021-01-012021-12-310000074260ecd:NonPeoNeoMemberori:ChangeInPensionValueMember2021-01-012021-12-310000074260ecd:PeoMemberori:ChangeInPensionValueMember2020-01-012020-12-310000074260ecd:NonPeoNeoMemberori:ChangeInPensionValueMember2020-01-012020-12-310000074260ecd:PeoMemberori:StockOptionsAdjustmentsMember2022-01-012022-12-310000074260ecd:NonPeoNeoMemberori:StockOptionsAdjustmentsMember2022-01-012022-12-310000074260ecd:PeoMemberori:StockOptionsAdjustmentsMember2021-01-012021-12-310000074260ecd:NonPeoNeoMemberori:StockOptionsAdjustmentsMember2021-01-012021-12-310000074260ecd:PeoMemberori:StockOptionsAdjustmentsMember2020-01-012020-12-310000074260ecd:NonPeoNeoMemberori:StockOptionsAdjustmentsMember2020-01-012020-12-310000074260ecd:PeoMemberori:StockAwardsAdjustmentsMember2022-01-012022-12-310000074260ori:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000074260ecd:PeoMemberori:StockAwardsAdjustmentsMember2021-01-012021-12-310000074260ori:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000074260ecd:PeoMemberori:StockAwardsAdjustmentsMember2020-01-012020-12-310000074260ori:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000074260ecd:PeoMemberori:StockOptionsGrantedDuringTheYearUnvestedMember2022-01-012022-12-310000074260ecd:NonPeoNeoMemberori:StockOptionsGrantedDuringTheYearUnvestedMember2022-01-012022-12-310000074260ecd:PeoMemberori:StockOptionsGrantedDuringTheYearUnvestedMember2021-01-012021-12-310000074260ecd:NonPeoNeoMemberori:StockOptionsGrantedDuringTheYearUnvestedMember2021-01-012021-12-310000074260ecd:PeoMemberori:StockOptionsGrantedDuringTheYearUnvestedMember2020-01-012020-12-310000074260ecd:NonPeoNeoMemberori:StockOptionsGrantedDuringTheYearUnvestedMember2020-01-012020-12-310000074260ecd:PeoMemberori:StockAwardsGrantedDuringTheYearUnvestedMember2022-01-012022-12-310000074260ecd:NonPeoNeoMemberori:StockAwardsGrantedDuringTheYearUnvestedMember2022-01-012022-12-310000074260ecd:PeoMemberori:StockAwardsGrantedDuringTheYearUnvestedMember2021-01-012021-12-310000074260ecd:NonPeoNeoMemberori:StockAwardsGrantedDuringTheYearUnvestedMember2021-01-012021-12-310000074260ecd:PeoMemberori:StockAwardsGrantedDuringTheYearUnvestedMember2020-01-012020-12-310000074260ecd:NonPeoNeoMemberori:StockAwardsGrantedDuringTheYearUnvestedMember2020-01-012020-12-310000074260ori:StockOptionsGrantedInPriorYearsUnvestedMemberecd:PeoMember2022-01-012022-12-310000074260ori:StockOptionsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000074260ori:StockOptionsGrantedInPriorYearsUnvestedMemberecd:PeoMember2021-01-012021-12-310000074260ori:StockOptionsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000074260ori:StockOptionsGrantedInPriorYearsUnvestedMemberecd:PeoMember2020-01-012020-12-310000074260ori:StockOptionsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000074260ecd:PeoMemberori:StockAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310000074260ecd:NonPeoNeoMemberori:StockAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310000074260ecd:PeoMemberori:StockAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310000074260ecd:NonPeoNeoMemberori:StockAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310000074260ecd:PeoMemberori:StockAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310000074260ecd:NonPeoNeoMemberori:StockAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310000074260ecd:PeoMemberori:StockOptionsGrantedInPriorYearsVestedMember2022-01-012022-12-310000074260ecd:NonPeoNeoMemberori:StockOptionsGrantedInPriorYearsVestedMember2022-01-012022-12-310000074260ecd:PeoMemberori:StockOptionsGrantedInPriorYearsVestedMember2021-01-012021-12-310000074260ecd:NonPeoNeoMemberori:StockOptionsGrantedInPriorYearsVestedMember2021-01-012021-12-310000074260ecd:PeoMemberori:StockOptionsGrantedInPriorYearsVestedMember2020-01-012020-12-310000074260ecd:NonPeoNeoMemberori:StockOptionsGrantedInPriorYearsVestedMember2020-01-012020-12-310000074260ecd:PeoMemberori:StockAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310000074260ecd:NonPeoNeoMemberori:StockAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310000074260ecd:PeoMemberori:StockAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310000074260ecd:NonPeoNeoMemberori:StockAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310000074260ecd:PeoMemberori:StockAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310000074260ecd:NonPeoNeoMemberori:StockAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-31000007426032022-01-012022-12-31000007426052022-01-012022-12-31000007426062022-01-012022-12-31

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Old Republic International Corporation

(Name of Registrant as Specified In Its Charter)

__________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

Securities and Exchange Commission

450 Fifth Street, N.W.

Judiciary Plaza

Washington, D.C. 20549

March 31, 2023

RE: Old Republic International Corporation

Commission File No. 001-10607

Definitive Proxy Material

Dear Staff:

I am filing, pursuant to Rule 14a-6 of Regulation 14A under Sub-section 14 of the Securities Exchange Act of 1934, a definitive copy of the Notice, Proxy Statement and form of Voting Stock Proxy solicitation materials for the Annual Meeting of Shareholders of Old Republic International Corporation (the “Company”) to be held on May 25, 2023. Definitive copies of the proxy materials, together with the Annual Report to Shareholders, will first be available to shareholders of the Company no earlier than March 31, 2022.

Pursuant to sub-part 232.101(b)(1) of Regulation S-T, the Company has elected not to submit its Annual Report to Shareholders in an electronic format. In accordance with Rule 14a-3(c), seven copies will be filed separately with the Commission.

Sincerely yours,

/William J. Dasso/

William J. Dasso

Counsel

| | | | | | | | |

| NOTICE OF ANNUAL MEETING OF THE SHAREHOLDERS |

| | |

| TIME AND DATE | 3:00 P.M. Central Daylight Time, Thursday, May 25, 2023. |

| |

| PLACE | This year's Annual Meeting of the Shareholders will be held virtually. There will be no physical location and Old Republic's representatives will participate via webcast. |

| The virtual meeting can be accessed at the following internet link: |

| www.virtualshareholdermeeting.com/ORI2023 |

| | |

| ITEMS OF BUSINESS | Item 1 | To elect four members of the Class 3 Board of Directors, each for a term of three years. |

| Item 2 | To ratify the selection of KPMG LLP (“KPMG”) as the Company’s independent registered public accounting firm for 2023. |

| Item 3 | To vote in an advisory capacity concerning the Company’s executive compensation. |

| Item 4 | To approve the amendment and restatement of our Certificate of Incorporation to limit the liability of officers of Old Republic as permitted by recent amendments to Delaware law. |

| Item 5 | To recommend, by non-binding vote, the frequency of executive compensation votes. |

| Item 6 | To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

| | |

| RECORD DATE | You can vote if you are a shareholder of record on March 27, 2023. |

| |

| ANNUAL REPORT TO SHAREHOLDERS | Our annual report to shareholders for 2023 is printed together with this proxy statement. The Company’s Forms 10-K, 10-Q and other reports to shareholders may also be accessed through our website at www.oldrepublic.com or by writing to Investor Relations at the Company address. |

| PROXY VOTING | It is important that your shares be represented and voted at the Annual Meeting of the Shareholders. You can vote your shares by completing and returning your proxy card, by voting on the Internet, or by telephone. |

| |

| March 31, 2023 | By order of the Board of Directors |

| Thomas A. Dare Senior Vice President, General Counsel and Secretary |

| | | | | |

| Table of Contents |

| 1 | GENERAL INFORMATION |

| 2 | Voting Procedures |

| 3 | Householding of Proxies |

| 3 | Other Matters for the Annual Meeting of the Shareholders |

| 3 | Expenses of Solicitation |

| 3 | Principal Holders of Securities |

| 6 | Highlights of Some Recent Developments |

| 7 | ITEM 1: ELECTION OF DIRECTORS |

| 8 | Board of Directors’ Recommendation |

| 11 | CORPORATE GOVERNANCE: BINDING ORGANIZATION, PURPOSE, AND LONG-TERM STRATEGY |

| 14 | Leadership Structure and Risk Management |

| 15 | Board of Directors’ Responsibilities and Independence |

| 17 | Recent Developments in Our Corporate Governance |

| 18 | Board Diversity and Skills |

| 20 | Procedures for the Approval of Related Person Transactions |

| 20 | Delinquent Section 16(a) Reports |

| 20 | The Board and Its Committees |

| 24 | Shareholder Communications with the Board |

| 24 | ITEM 2: RATIFICATION OF THE SELECTION OF AN INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

| 25 | External Audit Services |

| 25 | Board of Directors’ Recommendation |

| 26 | Audit Committee Report for 2022 |

| 26 | COMPENSATION MATTERS |

| 26 | Compensation Committee Report for 2022 |

| 27 | Compensation Committee Interlocks and Insider Participation |

| 27 | Directors’ Compensation |

| 28 | Compensation Discussion and Analysis |

| 30 | Summary Compensation Table |

| 31 | CEO Pay Ratio Disclosure |

| 32 | Pay versus Performance |

| 36 | Annual Salary Compensation Practices |

| 36 | Incentive Awards and Bonuses |

| 37 | Key Employee Performance Recognition Plans (KEPRP) |

| 37 | Deferred Compensation Under the KEPRPs |

| 38 | 2023 Performance Recognition Plan (PRP) |

| 38 | Summary of the 2023 Performance Recognition Plan |

| 41 | Stock Option and Restricted Stock Awards Under Incentive Compensation Plans |

| 42 | Stock Option and Restricted Stock Grants During 2022 |

| 42 | Exercises of Stock Options During 2022 |

| 43 | Equity Compensation Plan Information |

| 43 | Outstanding Equity Awards at Year End 2022 |

| 44 | Performance Grants Under the 2022 Incentive Compensation Plan |

| 45 | Clawback Policy |

| 45 | Hedging Prohibited |

| 45 | Change of Control, Severance or Retirement |

| 45 | Stock Ownership Guidelines |

| 46 | Pension Plan |

| 47 | ORI 401(k) Savings and Profit Sharing Plan |

| 47 | Other Benefits |

| 48 | ITEM 3: VOTE ON EXECUTIVE COMPENSATION |

| 48 | Background |

| 48 | 2022 Executive Compensation Vote |

| 48 | Proposed Resolution |

| 48 | Advisory Vote |

| 49 | ITEM 4: AMENDED AND RESTATED CERTIFICATE OF INCORPORATION |

| 49 | Background |

| 49 | Reasons for the Proposed Amended and Restated Charter |

| | | | | |

| 50 | Text of Proposed Amendment |

| 50 | Timing and Effect of Charter Amendment |

| 50 | Required Vote |

| 50 | Board of Directors' Recommendation |

| 50 | ITEM 5: FREQUENCY OF ADVISORY VOTE ON EXECUTIVE COMPENSATION |

| 50 | Background |

| 51 | Proposed Resolution |

| 51 | Required Vote |

| 51 | Board of Directors' Recommendation |

| 52 | OTHER INFORMATION |

| 52 | Shareholder Proposals or Director Nominations for the 2024 Annual Meeting of the Shareholders |

| |

| A1 | APPENDIX 1: AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF OLD REPUBLIC INTERNATIONAL CORPORATION |

Proxy Statement

OLD REPUBLIC INTERNATIONAL CORPORATION

ANNUAL MEETING OF THE SHAREHOLDERS

May 25, 2023

This proxy statement is being furnished to the shareholders of Old Republic International Corporation, a Delaware insurance holding corporation (together with its subsidiaries, the "Company", "Old Republic" or "ORI"), with its executive office at 307 North Michigan Avenue, Chicago, Illinois 60601. This Statement is furnished in connection with the solicitation of proxies by ORI’s Board of Directors for use at the Annual Meeting of the Shareholders to be held on May 25, 2023 and any adjournments thereof. The approximate date on which this proxy statement and the accompanying proxy are first being sent to the shareholders is March 31, 2023.

Old Republic intends to conduct our 2023 Annual Meeting of Shareholders as a "virtual" meeting. Shareholders of record at the close of business on March 27, 2023, are invited to vote their shares at proxyvote.com. Important information about attending and voting at the virtual meeting will be posted on Old Republic's website (www.oldrepublic.com) under the heading "2023 Annual Meeting Information".

Virtual meeting date: Thursday May 25, 2023

Virtual meeting time: 3 P.M. Central Daylight Time

Virtual meeting link: www.virtualshareholdermeeting.com/ORI2023

Shareholders may vote their shares, submit questions, and review the list of registered shareholders during the virtual meeting using the directions on the meeting website shown above. Such questions must be germane to matters properly before the Annual Meeting and of general Company concern. Additional information regarding the rules and procedures for the meeting will be posted on the meeting website and can be viewed during the meeting. Technical assistance will be available for those attending the meeting. If there are any technical issues in convening or hosting the meeting, additional information will be promptly posted on Old Republic's website (www.oldrepublic.com) under the heading "2023 Annual Meeting Information".

All shareholders will need their sixteen-digit control number in order to be authenticated and to vote during the meeting. Each shareholder's control number can be found on your notice or proxy card. Shareholders without a control number may attend as guests of the meeting, but they will not have the option to vote their shares or review the list of registered shareholders during the virtual meeting.

Your proxy may be revoked at any time before shares are voted by written notification addressed to the persons named therein as proxies, and mailed or delivered to the Company at the above address. All shares represented by effective proxies will be voted at the meeting and at any adjournments thereof.

If the enclosed proxy is properly executed and returned in time for voting, the shares represented thereby will be voted as indicated thereon. If no specification is made, the shares represented thereby will be voted by the Company’s proxy committee (whose members are listed on the proxy card) for: (Item 1) the election of the director nominees named below (or substitutes thereof if any nominees are unable or refuse to serve); (Item 2) the selection of the Company’s independent registered public accounting firm; (Item 3) the advisory vote concerning the Company’s executive compensation as recommended by the Board of Directors; (Item 4) the approval of the Amended and Restated Certificate of Incorporation; (Item 5) to recommend, by non-binding vote, the frequency of executive compensation votes and (Item 6) in the discretion of the proxy committee upon any other matters which may properly come before the meeting.

The Company has one class of voting stock outstanding - Common Stock, $1.00 par value per share ("Common Stock"). On March 1, 2023, there were 296,317,226 shares of Common Stock outstanding and entitled to one vote

each on all matters to be considered at the meeting. Shareholders of record as of the close of business on March 27, 2023 are entitled to notice of and to vote at the meeting. There are no cumulative voting rights with respect to the election of directors.

VOTING PROCEDURES

The Company’s Restated Certificate of Incorporation and Amended and Restated By-laws prescribe voting procedures for certain, but not all, corporate actions. When no procedures are prescribed, the General Corporation Law of the State of Delaware applies. Matters presented at the Company’s Shareholder Meetings are decided as follows: (1) directors are elected by a plurality of the shares present in person or by proxy at the meeting and entitled to vote; (2) amendments to the Company’s Restated Certificate of Incorporation are determined by the affirmative vote of the majority of shares outstanding and entitled to vote, except for: (a) amendments that concern approval thresholds for plans of merger or other business transactions not unanimously approved by the Board of Directors, which require the approval of 80% of the shares entitled to vote, or (b) amendments that concern the number or terms of the Board of Directors, which require the approval of 66-2/3% of the shares entitled to vote; (3) shareholder action to repeal, alter, amend or adopt new by-laws, which require the approval of 66% of the shares entitled to vote; and (4) all other matters are determined by the affirmative vote of the majority of shares present in person or by proxy at the meeting and entitled to vote.

Under Delaware law, the votes at the Company’s Annual Meeting of the Shareholders will be counted by the inspectors of election appointed by the chair at the meeting. The inspectors are charged with ascertaining the number of shares outstanding, the number of shares present, whether in person or by proxy, and the validity of all proxies. The inspectors are entitled to rule on any voting challenges and are responsible for the tabulation of the voting results.

A quorum for the Company’s Annual Meeting of the Shareholders is a majority of the shares outstanding and entitled to vote appearing in person or by proxy at the meeting. Under Delaware law, abstentions are counted in determining the quorum of the meeting and as having voted on any proposal on which an abstention is voted. Therefore, on those proposals that require a plurality vote of the shares entitled to vote in person or by proxy at the meeting, the vote of an abstention has no effect. However, on those proposals that require an affirmative vote of at least a majority of shares present in person or by proxy at the meeting, the vote of an abstention has the effect of a vote against the proposal.

Shares beneficially owned but registered in the name of a broker or bank will be counted for the determination of a quorum for the meeting if there is a discretionary voting item on the meeting agenda within the meaning of section 402.08 of the New York Stock Exchange (“NYSE”) Listed Company Manual. If there is a discretionary item on the agenda and the broker or bank does not vote these shares (a “non-vote”), they will not be counted as having voted on the proposal. Therefore, on those proposals that require a plurality or at least a majority vote of the shares at the meeting that are entitled to vote, a non-vote will have no effect. However, on those proposals that require an affirmative vote of at least a majority of the shares outstanding that are entitled to vote, a non-vote has the effect of a vote against the proposal. If there are no discretionary voting items on the meeting agenda, shares beneficially held in the name of a broker or bank shall not be counted in determining a quorum. This year Item 2 is a discretionary voting item; all other items are non-discretionary.

Shareholders can simplify their voting and save Old Republic expense by voting by telephone or by Internet. If you vote by telephone or Internet, you need not mail back your proxy card. Telephone and Internet voting information is provided on your proxy card. A sixteen-digit control number, located on the proxy card, is designed to verify your identity and allow you to vote your shares and confirm that your voting instructions have been properly recorded. If your shares are held in the name of a bank or broker, follow the voting instructions on the form you receive from that firm. To revoke a proxy given, or change your vote cast, by telephone or Internet, you must do so by following the directions on your proxy card, provided such changes are made by 11:59 PM, Eastern Daylight Time on May 24, 2023.

HOUSEHOLDING OF PROXIES

The Securities and Exchange Commission (“SEC”) has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for annual reports and proxy statements with respect to two or more shareholders sharing the same address by delivering a single annual report and/or proxy statement addressed to those shareholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for shareholders and cost savings for companies. The Company and some brokers who distribute annual reports and proxy materials may deliver a single annual report and/or proxy statement to multiple shareholders sharing an address unless contrary instructions have been received from the affected shareholders.

Once you have received notice from your broker or the Company that your broker or the Company will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. You may request to receive promptly at any time a separate copy of our annual report or proxy statement by sending a written request to the Company at the above address, attention Investor Relations, or by visiting our website, www.oldrepublic.com and downloading this material.

If, at any time, you no longer wish to participate in householding and would prefer to receive a separate annual report and proxy statement in the future, please notify your broker if your shares are held in a brokerage account, or if you hold registered shares, the Company’s transfer agent, EQ Shareowner Services, P.O. Box 64874, St. Paul, MN 55164, phone number 800-401-1957.

OTHER MATTERS FOR THE ANNUAL MEETING OF THE SHAREHOLDERS

The Company knows of no matters, other than those referred to herein that will be presented at the meeting. If, however, any other appropriate business should properly be presented at the meeting, or any adjustment or postponement thereof, the proxies named in the enclosed form of proxy will vote the proxies in accordance with their best judgment.

EXPENSES OF SOLICITATION

All expenses incident to the solicitation of proxies by the Company will be paid by the Company. In addition to solicitation by mail, the Company has retained D. F. King & Company of New York City, to assist in the solicitation of proxies. Fees for this solicitation are expected to be approximately $10,500. In a limited number of instances, regular employees of the Company may solicit proxies in person or by telephone.

PRINCIPAL HOLDERS OF SECURITIES

The following tabulation shows with respect to (i) each person who is known to be the beneficial owner of more than 5% of the Common Stock of the Company; (ii) the Company’s Employees Savings and Stock Ownership Plan (ESSOP); (iii) each director and executive officer of the Company (including nominees); and (iv) all directors and executive officers, as a group: (a) the total number of shares of Common Stock beneficially owned as of March 1, 2023, except as otherwise noted, and (b) the percent of the class of Common Stock so owned:

| | | | | | | | | | | | | | | | | | | | |

| Title of Class | | Name of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | Percent of Class(*) |

| | | | | | |

| Common Stock | | BlackRock, Inc. | | 34,047,196 | (1) | 11.2 |

| Shareholders’ beneficial ownership | | 55 East 52nd Street | | | | |

| of more than 5% of the Common | | New York, New York 10022 | | | | |

| Stock and the ESSOP ownership | | | | | | |

| | The Vanguard Group | | 27,820,739 | (1) | 9.1 |

| | 100 Vanguard Blvd. | | | | |

| | Malvern, Pennsylvania 19355 | | | | |

| | | | | | |

| | State Street Corporation | | 25,905,414 | (1) | 8.5 |

| | State Street Financial Center | | | | |

| | One Lincoln Street | | | | |

| | Boston, Massachusetts 02111 | | | | |

| | | | | | |

| | Old Republic International Corporation | | 19,363,060 | (2) | 6.6 |

| | Employees Savings and Stock Ownership Trust | | | | |

| | 307 N. Michigan Avenue | | | | |

| | Chicago, Illinois 60601 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Name of Beneficial Owner | | Shares Subject to Stock Options(*) | | Shares Held by Employee Plans(*)(2)(3) | | Other Shares Beneficially Owned(*) | | Total | | Percent of Class (*) |

| Directors' and Executive Officers' (including nominees) Beneficial Ownership | | Barbara A. Adachi | | 0 | | 0 | | 2,300 | | 2,300 | | ** |

| Steven J. Bateman | | 0 | | 0 | | 27,559 | | 27,559 | | ** |

| Lisa J. Caldwell | | 0 | | 0 | | 10,786 | | 10,786 | | ** |

| Thomas A. Dare | | 27,125 | | 3,893 | | 26,306 | | 57,324 | | ** |

| Jimmy A. Dew | | 0 | | 132,207 | | 745,657 | | 877,864 | (4) | 0.3 |

| John M. Dixon | | 0 | | 0 | | 21,061 | | 21,061 | | ** |

| W. Todd Gray | | 28,425 | | 3,025 | | 42,155 | | 73,605 | | ** |

| | Michael D. Kennedy | | 0 | | 0 | | 10,272 | | 10,272 | | ** |

| | Charles J. Kovaleski | | 0 | | 0 | | 14,453 | | 14,453 | | ** |

| | Spencer LeRoy III | | 0 | | 0 | | 100,686 | | 100,686 | (5) | ** |

| | Peter B. McNitt | | 0 | | 0 | | 10,280 | | 10,280 | | ** |

| | Stephen J. Oberst | | 158,600 | | 86,832 | | 36,805 | | 282,237 | (6) | 0.1 |

| | Glenn W. Reed | | 0 | | 0 | | 14,415 | | 14,415 | | ** |

| | Craig R. Smiddy | | 287,500 | | 31,851 | | 78,584 | | 397,935 | | 0.1 |

| | J. Eric Smith | | 0 | | 0 | | 0 | | 0 | (7) | ** |

| | Frank J. Sodaro | | 37,000 | | 2,446 | | 26,310 | | 65,756 | | ** |

| | Arnold L. Steiner | | 0 | | 0 | | 638,318 | | 638,318 | (8) | 0.2 |

| | Fredricka Taubitz | | 0 | | 0 | | 21,000 | | 21,000 | | ** |

| | Steven R. Walker | | 0 | | 0 | | 70,000 | | 70,000 | (9) | ** |

| | Rande K. Yeager | | 0 | | 74,993 | | 61,297 | | 136,290 | | ** |

| | Directors and all Executive Officers, as a group (20 individuals) | | 538,650 | | 335,247 | | 1,958,244 | | 2,832,141 | | 1.0% |

* Calculated pursuant to Rule 13d 3(d) of the Securities Exchange Act of 1934. Unless otherwise stated below, each such person has sole voting and investment power with respect to all such shares. Under Rule 13d 3(d), shares not outstanding that are subject to options, warrants, rights or conversion privileges exercisable within 60 days are deemed outstanding for the purpose of calculating the number and percentage owned by such person, but are not deemed outstanding for the purpose of calculating the percentage owned by each other person listed. Further, the amount of shares beneficially owned includes restricted stock awarded to Messrs. Smiddy, Gray, Oberst, Sodaro and Yeager of 70,000, 20,000, 30,000, 20,000 and 16,000 shares, respectively, in 2022. These shares are included in their individual ownership but are subject to a 3 year vesting period. During the restricted period, the shareholder has voting power, but no dispositive power, with respect to such shares. The

“Outstanding Equity Awards Table” shown elsewhere in this Proxy Statement shows the unvested restricted stock for each named executive officer. None of the options shown for executive officers were exercised prior to the Company’s record date and therefore are not eligible to vote at the Annual Meeting of the Shareholders.

** Less than one-tenth of one percent.

(1) Reflects the number of shares as of December 31, 2022 shown in the most recent Schedule 13G filings with the SEC. BlackRock, Inc. has reported sole and shared voting power for 33,331,220 and 0 shares, respectively, and sole and shared dispositive power for 34,047,196 and 0 shares, respectively. The Vanguard Group has reported that it has sole and shared voting power for 0 and 123,017 shares, respectively, and sole and shared dispositive power for 27,417,179 shares and 403,560 shares, respectively. State Street Corporation has reported that it has no sole and shared voting power for 25,338,784 shares and sole and shared dispositive power for 0 and 25,905,414 shares, respectively.

(2) Reflects the number of shares held as of December 31, 2022 as follows:

(a)Under the terms of the ORI 401(k) Savings and Profit Sharing Plan (“401(k) Plan”), a participant is entitled to vote the Company Common Stock held by the 401(k) Plan, the shares of which have been allocated to the participant’s account. The Executive Committee of the Company is authorized and has delegated the Employee Benefit Management Advisory Group the authority to vote the Company’s Common Stock held by the 401(k) Plan until such time as the shares of such stock have been allocated to a participant’s account or where a participant fails to exercise his or her voting rights. In these regards, the Executive Committee or its delegee may be deemed to have sole investment power with respect to unallocated stock and shared power for allocated stock held by the 401(k) Plan.

(b)In addition to the 401(k) Plan, the Old Republic International Employees Retirement Plan holds an aggregate of 2,829,509 shares of the Company’s Common Stock not included in this table. The voting of these shares is controlled, directly or indirectly in a fiduciary capacity, by the Executive Committee or its delegee.

(c)American Business & Mercantile Insurance Mutual Inc. (“ABM”) and its subsidiary own 1,286,700 shares of the Company’s Common Stock. ABM is a mutual insurer controlled by its policyholders and indirectly by the Company through management agreements, the ownership of its surplus notes, and by directors and officers who are employees of the Company. These shares are not included in this table.

(3) Includes only the shares that have been allocated to the employer matching, employee savings and/or non-elective contribution accounts, of the director or executive officer as a participant in the 401(k). Excludes those shares for which the director or executive officer may be deemed to have investment and voting power as a result of being a member of the Executive Committee.

(4) Mr. Dew left the Company’s Board on May 26, 2022 and his ownership is shown as of that date.

(5) Includes 40,587 shares held in IRA or Roth IRA trusts for Mr. LeRoy’s benefit.

(6) Includes 34 shares held by Mr. Oberst's son.

(7) Mr. Smith was elected a Director effective March 17, 2023.

(8) Includes 107,771 shares owned by Mr. Steiner directly, 95,596 shares held in a trust for which Mr. Steiner is the trustee, 343,750 shares held in trust for Mr. Steiner’s children, for which he is a co-trustee, and 91,201 shares held by the Steiner Foundation for which Mr. Steiner disclaims beneficial ownership.

(9) Includes 30,000 shares held in IRA and SEP-IRA trusts for Mr. Walker’s benefit, and 26,500 shares held by his wife.

HIGHLIGHTS OF SOME RECENT DEVELOPMENTS

Set forth below is a summary of recent developments, some of which are discussed in greater detail in the relevant section of this proxy statement:

| | |

| ITEM 1 |

| ELECTION OF DIRECTORS |

The following table lists the nominees and continuing directors of the Company. Four Class 3 directors are to be elected at the Annual Meeting of the Shareholders for a term of three years and until their successors are elected and qualified. The nominees are current directors standing for re-election. It is intended that, in the absence of contrary specifications, votes will be cast pursuant to the enclosed proxies for the election of such nominees. Should any of the nominees become unable or unwilling to accept nomination or election, it is intended that, in the absence of contrary specifications, the proxies will be voted for the balance of those named and for a substitute nominee or nominees. However, the Company does not expect such an occurrence. All of the nominees have consented to be slated and to serve as directors if elected.

Arnold L. Steiner is not slated for reelection at the end of his three-year term expiring at the upcoming Annual Meeting of Shareholders. At that time, the size of the board will be reduced from fourteen to thirteen members.

J. Eric Smith was elected a Class 1 director, effective March 17, 2023. He is considered independent and was also named a member of the Compensation and Governance and Nominating Committees. The Governance and Nominating Committee approved his nomination and he was unanimously elected by the Board of Directors. No third party was involved in his recruitment or selection as a director and no fee was paid to any individual or entity in connection with his selection.

Given the reasons and background information cited next to each nominee’s name below, the Board of Directors believes that each of the nominees and the other continuing directors are highly qualified to serve Old Republic’s shareholders and other stakeholders.

| | | | | | | | | | | | | | |

| Name | | Age | | Positions with Company, Business Experience and Qualifications |

Nominees For Election: CLASS 3 (Term to expire in 2026) |

| | | | |

| Barbara A. Adachi | | 72 | | Director since 2021. Retired from Deloitte in 2013, she was formerly the chief executive and National Managing Partner for Deloitte Consulting’s Human Capital Consulting Practice. For over 20 years, she focused on human capital strategy, organization transformation, executive compensation and diversity, equity, and inclusion. Prior to Deloitte, she spent 18 years in the insurance industry specializing in employee benefits and workers’ compensation. Her extensive business experience in insurance, consulting and human capital matters harmonizes well with the Company’s business needs. She became NACD Directorship Certified ® in 2022. |

| Charles J. Kovaleski | | 74 | | Director since 2018. Retired as an attorney, he was formerly with Attorneys’ Title Insurance Fund, Orlando, Florida as well as an officer with one of the Company’s Title subsidiaries for many years. His extensive general business experience, particularly in real estate and title insurance, harmonizes well with the Company’s business needs. |

| Craig R. Smiddy | | 58 | | Director since 2019. President and Chief Executive Officer as of the same date and Chair of the Executive Committee since December 2021. Prior to that, President and Chief Operating Officer of the Company since June 2018. From 2013 to 2018, he was Chief Operating Officer and then later appointed President of Old Republic General Insurance Group, Inc. Before joining the Company, he was President of the Specialty Markets Division of Munich Reinsurance America, Inc. His significant experience in, and knowledge of, the business and the risk factors associated with the insurance industry and especially the insurance specialty markets harmonize well with the Company’s business needs. |

| Fredricka Taubitz | | 79 | | Director since 2003. Chair of the Audit Committee. A CPA by training, she was until 2000 Executive Vice President and Chief Financial Officer of Zenith National Insurance Corp. Until 1985, she was a partner with the accounting firm of Coopers & Lybrand (now PricewaterhouseCoopers LLP). Her long professional career, significant experience in, and knowledge of, the business and the risk factors associated with the insurance industry harmonize well with the Company’s business needs. |

BOARD OF DIRECTORS’ RECOMMENDATION

The Board of Directors recommends a vote FOR the Class 3 directors listed above. Proxies solicited by the Board of Directors will be voted in favor of the election of these nominees unless shareholders specify to the contrary. The results of this vote shall be disclosed in a filing made with the SEC shortly after the Annual Meeting of the Shareholders and will be available for review on the Company’s website, www.oldrepublic.com.

| | | | | | | | | | | | | | |

Continuing Directors: CLASS 2 (Term expires in 2025) |

| | | | |

Steven J. Bateman | | 64 | | Director since 2017. An audit partner with the accounting firm of PricewaterhouseCoopers LLP until his retirement, he had a 37 year career as an auditor and business advisor for a large number of organizations engaged in all major insurance fields. During that period of time, he gained a wealth of knowledge and experience in the business and the risk factors associated with the insurance industry. His background and experience harmonize well with the Company’s business and the Board’s governance objectives. |

| Lisa J. Caldwell | | 62 | | Director since 2021. Ms. Caldwell is the Chief Executive Officer of Caldwell Collection, LLC, a fashion retail organization, and previously served as the Executive Vice President and Chief Human Resources Officer of Reynolds American, R. J. Reynolds Tobacco Company, and RAI Services until her retirement in 2018. She is a member of the founding board of directors of Triad Business Bank and she has served in leadership roles at many charitable and educational organizations. Ms. Caldwell brings to the Board her general business and entrepreneurial expertise. Her experience as an executive officer of a large corporation and her extensive knowledge of human resource matters harmonize well with the Company’s business and the Board’s governance objectives. |

| John M. Dixon | | 83 | | Director since 2003. Chair of the Compensation Committee. Formerly Chief Executive Partner with the law firm of Chapman and Cutler, Chicago, Illinois until his retirement in 2002. His qualifications include his extensive background as an attorney and his knowledge of corporate law and the legal and other risks associated with corporations similar to the Company. Mr. Dixon’s skills and experience harmonize well with the Company’s business and the Board’s governance objectives. |

| Glenn W. Reed | | 70 | | Director since 2017. Mr. Reed served as a Managing Director of The Vanguard Group, Inc., one of the world’s largest asset-management firms, until his retirement from the firm in 2017. While at Vanguard, Mr. Reed had overall responsibility for Vanguard’s corporate finance and mutual fund finance functions, most recently heading up the firm’s Strategy division. Prior to joining Vanguard in 2007, he served as general counsel for a multi-line health and life insurance company following a 21-year career as a partner of the Chicago-based law firm of Gardner, Carton & Douglas (now Faegre Drinker Biddle & Reath). This long experience and deep knowledge in these fields harmonize well with the Company’s business needs and the Board’s governance objectives. |

| | | | | | | | | | | | | | |

Continuing Directors: CLASS 1 (Term expires in 2024) |

| | | | |

| Michael D. Kennedy | | 66 | | Director since 2020. Mr. Kennedy is a senior client partner with Korn Ferry, the global organizational consulting firm, where he is a member of that firm's global financial services market and a leader with Korn Ferry's Diversity Center of Expertise. Prior to joining Korn Ferry, he served in senior positions at several financial services firms, including GE Capital, Wachovia and J.P. Morgan & Co. He was appointed by President Obama to serve as the chair of the Federal Retirement Thrift Investment Board, the largest pension fund in the U.S., where he served until his term ended in 2020. He brings to the board his expertise and long experience in the financial services industry, which harmonize well with the Company’s business and the Board’s governance objectives. |

| Spencer LeRoy III | | 76 | | Director since 2015. Chairman of the Board since October 27, 2021. Until his retirement in 2014, he was Senior Vice President, Secretary and General Counsel of the Company since 1992. Prior to that, he was a partner with the law firm of Lord, Bissell and Brook, (now Locke Lord LLP). His legal career involved all aspects of insurance, corporate governance and financial-related matters. He has a long and significant legal experience and extensive knowledge of the Company and its risk factors, which harmonize well with the Company’s business and the Board’s governance objectives. |

| Peter B. McNitt | | 68 | | Director since 2019. He is the retired Vice Chair of BMO Harris Bank; a position he held since 2006. Prior to that, he led BMO Harris’ U.S. Corporate Banking as Executive Vice President and U.S. Investment Banking as Executive Managing Director. He also serves as a director of Hub Group, Inc. (NASDAQ: HUB), a provider of intermodal highway and logistics services. He has long-term experience and deep knowledge gained during his more than 40 year-long career. His wide range of responsibilities focused on the delivery of the full breadth of wealth, and commercial and investment banking services to customers. His extensive experience harmonizes well with the Company’s business needs and governance objectives. |

| J. Eric Smith | | 65 | | Director since 2023. He was the President and Chief Executive of Swiss Re Americas from 2011 to 2020. Mr. Smith also held a number of executive roles in his career, including President of USAA Life Insurance Company and President of Allstate Financial Services. He also held various positons in property and casualty insurance with Country Financial over a 20 year period. His significant experience in, and knowledge of, the business and the risk factors associated with the insurance industry and especially the insurance specialty markets harmonize well with the Company’s business needs. |

| Steven R. Walker | | 77 | | Director since 2006. Lead Independent Director since July 1, 2021 and Chair of the Governance and Nominating Committee. Formerly Senior Counsel and Partner with Leland, Parachini, Steinberg, Matzger & Melnick, LLP, attorneys, San Francisco, California. He has significant experience as both an attorney and a business manager during a long career largely focused on the title insurance industry. His extensive experience harmonizes well with the Company’s business needs and governance objectives. |

| | |

| CORPORATE GOVERNANCE: |

| BINDING ORGANIZATION, PURPOSE, AND LONG-TERM STRATEGY |

Old Republic is a for-profit Organization that is a shareholder-owned insurance holding company chartered under the General Corporation Law of the State of Delaware. As a holding company, it has no operations of its own; rather its primary assets are the stock and debt instruments issued by its over 100 subsidiaries. Many of these subsidiaries produce revenue and provide risk management, claims management and other services for the Company’s insurance underwriting subsidiaries and outside parties.

Shareholders are not the direct owners of the Company’s assets or properties. Their rights are limited by Delaware law, which provides that shareholders delegate to the board of directors the responsibility for controlling, directing, and using those assets and properties based on the directors’ business judgment. Old Republic’s shareholders can be confident that the Board of Directors’ successful, long-standing governance practices are guided by its experienced business judgment and by the Company’s charter and by-law provisions.

Our insurance subsidiaries are vested with a public trust. Accepting premium and insurance-related fees from policyholders and other buyers of related services forms the basis of this trust. This makes policyholders important stakeholders. They depend on these subsidiaries’ ability to meet their obligations of financial indemnity over long periods of time. State insurance laws impose requirements on insurance companies to protect the legitimate interests of policyholders, as well as the community at large. Old Republic is by necessity governed for the long run envisaged by the long-term promises of financial indemnity and the public trust imbued in its insurance subsidiaries. Together with the principles and practices contained in the charter and by-laws, our governance is intended to ensure the following:

•Operation of the business within the law, with integrity, and in a socially responsible manner,

•Maintenance of the business’s competitive position to enable the continued growth of economic value in the interests of all stakeholders.

Old Republic’s Purpose, included in our Mission statement, is to provide quality insurance security and related services to businesses, individuals, and public institutions, and to be a dependable long-term steward of the trust that policyholders, shareholders, and other important stakeholders place in us.

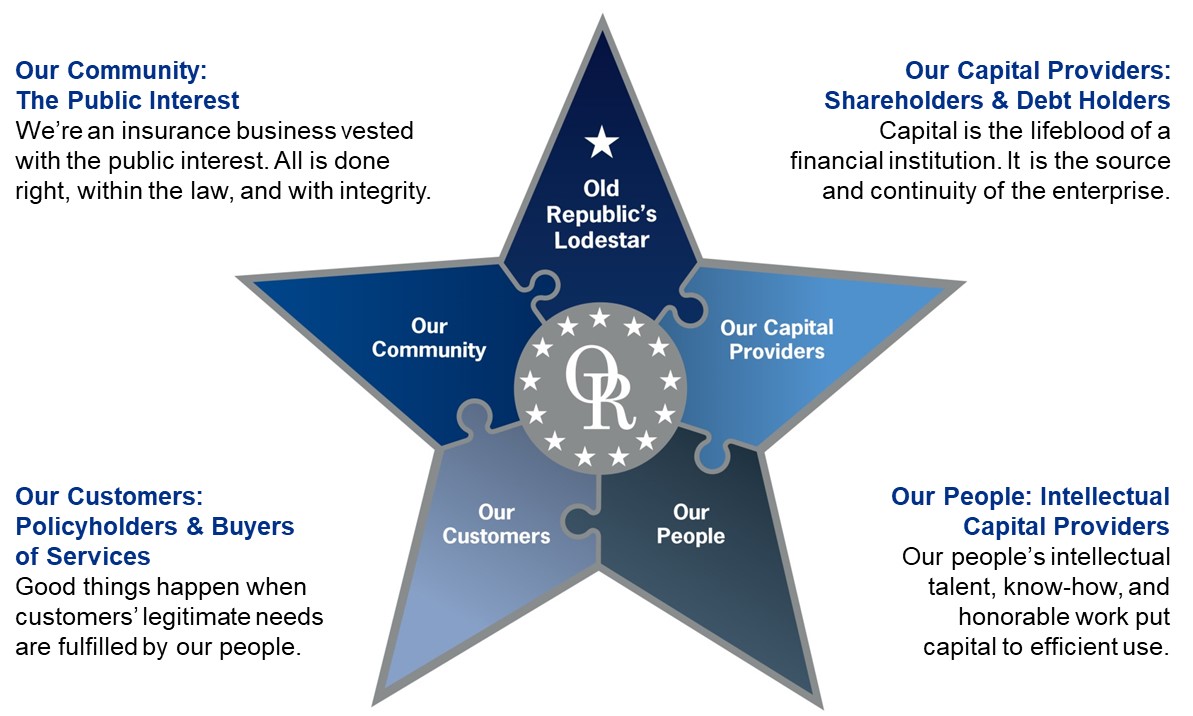

Our Lodestar embodies the Company’s Mission by binding organization, purpose, and long-term strategy into a coordinated whole.

We pursue our Mission and Purpose using the long-standing principles and practices of: 1) our governance, 2) our service culture, 3) our value system, 4) the institutional memory that connects successive generations of managers, and 5) appreciation of our people and the intellectual capital they bring to managing our wide-ranging business. We are focused on achieving two interrelated outcomes:

A. Create long-term value for all stakeholders, including shareholders, policyholders, our people, and the North American community at large. We believe that this desired outcome is best achieved by:

•Enhancing the Company’s competitive position, which increases its economic value to all stakeholders in a socially responsible manner.

•Steadily building the Company’s business competitiveness and earnings prospects. This adds to our financial and intellectual capital and provides a financial cushion to support insurance obligations in case they prove greater than anticipated.

B. Create long-term value for long-term shareholders, whose interests are aligned with our Mission as they provide and support the capital base of the business. We measure this value over consecutive 10-year annual periods by assessing:

•Total returns of Old Republic’s common stock in the market place. This is calculated as the sum of the annual change in market value per share, assuming cash dividends are reinvested on a pre-tax basis in shares when paid.

•Total returns of Old Republic’s common stock book value. This is calculated as the sum of the annual change in book value per share, plus cash dividends.

•Total operating return on shareholders’ equity. This is calculated by dividing net operating income (excluding both realized and unrealized investment gains or losses) by shareholders’ equity.

In assessing the above, we seek to achieve consecutive 10-year annual compound total returns per share that exceed comparable returns of the Standard & Poor’s (S&P) 500 Index and the S&P P&C Insurance Index.

Our Long-Term Strategy is aligned with our Mission and governing principles. The linchpin of this strategy is the conservative, long-term management of Old Republic’s balance sheet. The maintenance of a strong financial position supports the insurance subsidiaries’ risk-taking and obligations to policyholders, and underlies our stewardship for all stakeholders. We accomplish this through enterprise risk management and with insurance underwriting discipline. This discipline rests on key operating tenets of our business:

•Employing disciplined risk selection, evaluation, and pricing practices to reduce the possibility of adverse risk selection and to mitigate the uncertainty of insurance underwriting outcomes;

•Focusing on diversification and spreading of insured risks by geography, distribution, types of insurance coverage, among industries, with competency and proficiency;

•Reducing and mitigating insured exposures through underwriting risk-sharing arrangements with policyholders and additionally through reinsurance to manage risk and bring greater efficiencies to capital management.

Achieving positive underwriting results is complemented by investment income, which we derive from investments of underwriting cash flows, shareholders’ capital, and funds provided by debt holders. Through the years, the combination of underwriting and investment income has led to: 1) increased earnings over cycles, 2) balance sheet strength, and 3) increasing cash dividends to shareholders. This strategy is evaluated each year by the Board of Directors when it reviews and approves management’s annual operating and capital allocation budgets. The evaluation includes, among other things, these major considerations:

•The business’s performance over multi-year insurance cycles. Reviews of 10-year trends are favored, as these likely include one or two economic and/or insurance underwriting cycles. This provides enough time for these cycles to run their course, for premium rate changes and subsequent underwriting results to appear in financial statements, and for reserved loss costs to be quantified with greater accuracy;

•The allocation of capital to Old Republic’s key insurance underwriting subsidiaries, based on their risk-taking appetites and abilities, and their reserves to pay claims.

Old Republic’s capital management strategy is underpinned by:

•Retaining favorable independent financial ratings for the Company’s insurance underwriting subsidiaries;

•Returning excess capital to shareholders, including through increasing cash dividend payments over time based on the Company’s earnings power and trends.

Old Republic’s consistent cash dividend policy has produced these results:

•Dividend payments have been made without interruption since 1942 (in 82 of the Company’s 99 years);

•The annual cash dividend rate has been raised in each of the past 42 years.

The following table shows the total return to shareholders, assuming reinvested cash dividends on a pre-tax basis, of Old Republic’s common stock in comparison with the selected benchmark and a peer group of companies.

The Peer Group has been approved by the Compensation Committee of Old Republic’s Board of Directors. The Peer Group consists of American Financial Group, Inc.; American International Group, Inc.; W.R. Berkley Corporation; Chubb Limited; Cincinnati Financial Corporation; CNA Financial Corporation; Fidelity National Financial, Inc.; First American Financial Corporation; The Hartford Financial Services Group, Inc.; Stewart Information Services Corporation; and The Travelers Companies, Inc.

The binding of Organization, Purpose, and Long-Term Strategy is buttressed by Old Republic’s by-laws and charter provisions from which its long-established policies of corporate governance emanate. The structure and policies of this governance have emphasized the stability, continuity, and sustainability of the enterprise for achieving long-term value for all stakeholders and are discussed in the following two sections.

LEADERSHIP STRUCTURE AND RISK MANAGEMENT

The Company’s leadership structure and its risk management processes are overseen and monitored by the Board of Directors. Old Republic’s Board holds management accountable for protecting and enhancing the value of the Company and its businesses and holds its CEO responsible for setting the proper tone in shaping and nurturing the Company’s culture and values for the benefit of shareholders and all other stakeholders. These other stakeholders include: the policyholders to whom long-term promises of financial indemnity and stability are made by the Company’s insurance subsidiaries, the employees who provide the intellectual capital and business relationships necessary for the conduct and success of the Company, the debt holders who extend a portion of the capital at risk, and the regulators who protect the public interest vested in the Company’s insurance businesses. To meet these responsibilities and objectives, the Board expects the CEO to be a knowledgeable and well-rounded leader who, as chief enterprise risk manager, is dedicated to Old Republic’s overall Mission and is best qualified to address and balance the interests of all stakeholders.

A Lead Independent Director is nominated by the Governance and Nominating Committee and is elected annually by the Independent Directors, who meet as a group four times each year. The Lead Independent Director chairs the

meetings of the Independent Directors and serves as that group’s liaison to the Chairman and CEO. In this capacity, the Lead Independent Director may preside at Board meetings in the Chairman’s absence, provide input to meeting agendas of the: 1) full Board, 2) Independent Directors, and 3) Board committees, and act as liaison among various committee chairs in the resolution of inter-committee governance issues that may arise on occasion.

Old Republic’s business is managed through a relatively flat, non-bureaucratic organizational structure. The CEO is primarily responsible for managing enterprise-wide risks. The CEO and the Company use long-established control processes and a variety of long-established methods to coordinate system-wide risk taking and risk management. These processes and methods are based on the following major functions: lines of business responsibility, enterprise functions, and internal audit and peer reviews.

The managers of the lines of business operations are responsible for identifying, monitoring, quantifying, and mitigating insurance underwriting risks falling within their areas of responsibility. These managers use reports covering annual, quarterly or monthly time frames to identify the status and content of risk, including pricing or underwriting changes. These management reports ensure the continuity and timeliness of appropriate risk management monitoring and enterprise-wide oversight of existing or emerging issues.

The enterprise functions incorporate system-wide risk management, including asset/liability matching that aligns underwriting exposure, regulatory and public interest compliance, finance, actuarial, and legal functions. These functions are independent of lines of business operations and are coordinated on an enterprise-wide basis by the CEO and other executive officers.

The internal audit processes provide independent assessments of management’s performance and internal control systems. Internal audit activities are intended to give reasonable assurance that resources are adequately protected and that significant financial, managerial and operating information is materially complete, accurate and reliable. This process is also intended to ensure that employees’ actions are in compliance with corporate policies, standards, procedures, internal control guidelines, and applicable laws and regulations.

The corporate culture, the actions of our employees, and continuity of employment are critical to the Company’s risk management processes. Old Republic’s Code of Business Conduct and Ethics provides a framework for all employees to conduct themselves with integrity in the delivery of the Company’s services to its customers and in connection with all Company relationships and activities.

BOARD OF DIRECTORS’ RESPONSIBILITIES AND INDEPENDENCE

Old Republic believes that good corporate governance begins with a Board of Directors that appreciates the Company’s special place as a holding company for state-regulated insurance underwriting companies that are vested with a public trust. In line with the governance features set forth in the Company’s Corporate Governance Guidelines (see Governance section at www.oldrepublic.com), Old Republic seeks to attract and has retained for many years Board members who possess certain critical personal characteristics, most importantly: (i) intelligence, honesty, good judgment, high ethics, and standards of integrity, fairness and responsibility, (ii) respect within the social, business and professional community for their principles and insights; (iii) demonstrated analytic ability; and (iv) ability and initiative to frame insightful questions, to challenge questionable assumptions collegially, and to disagree in a constructive fashion in such circumstances as may arise in the course of the Company’s activities.

The Board of Directors’ main responsibility is to oversee the Company’s operations, directly and through several committees operating in a coordinated and collegial manner. In exercising this responsibility, each director is expected to utilize his or her business judgment in the best interests of the Company, its shareholders and all other stakeholders. The Board’s oversight duties include:

•Ascertain that strategies and policies are in place to encourage the growth of consolidated earnings and shareholders’ equity over the long term;

•Ascertain that the Company’s business is managed in a sound and conservative manner that takes into account the public interest vested in its insurance subsidiaries;

•Provide advice and counsel to management on business opportunities and strategies;

•Review and approve major corporate transactions;

•Monitor the adequacy of the Company’s internal control and financial reporting systems and practices to safeguard assets and to comply with applicable laws and regulations;

•Ascertain that appropriate policies and practices are in place for managing the risks faced by the enterprise;

•Evaluate periodically the performance of the CEO in the context of the Company’s Mission and performance;

•Review and approve senior management’s base and incentive compensation taking into account the business’s performance gauged by its intermediate and long-term returns on equity, growth of operating earnings, and financial soundness;

•Periodically review senior management development and succession plans at corporate and operating subsidiary levels;

•Select and recommend for shareholder election candidates deemed qualified for Board service;

•Select and retain an independent registered public accounting firm for the purpose of expressing its opinion on the annual financial statements and internal controls over financial reporting of the Company and its subsidiaries;

•Act as the Board of Directors of the Company’s significant regulated insurance company subsidiaries; and

•Monitor, review and approve the operations and major policy decisions of the Company’s insurance subsidiaries.

In considering the qualifications and independence of Board members and candidates, the Governance and Nominating Committee and full Board seek to identify individuals who, at a minimum:

•Satisfy the requirements for director independence, as set out in the Company’s Corporate Governance Guidelines, in the Listed Company Standards of the NYSE, and in the regulations of the SEC;

•Are, or have been, senior executives of businesses or professional organizations; and

•Have significant business, financial, accounting and/or legal backgrounds that lend themselves to the unique nature of the Company’s insurance underwriting operations so as to address market, customer, and societal needs.

In attracting and retaining members of the Board of Directors, the Company adheres faithfully to a non-discrimination policy. While the Company does not have a formal policy governing diversity among directors or candidates, the Board believes that diverse backgrounds are valuable attributes to service on our Board. In addition to the professional and personal qualifications already noted, consideration is given to matters of inclusion in the nomination process.

Old Republic places great value on members’ long-term, successful experience in businesses and professions that can add to its Mission and long-term strategy. Long board tenure is favored, as it enables a knowledge-based, long-term perspective on the Company’s business and provides greater assurance of stability, continuity, and sustainability of the enterprise and its Mission. Old Republic’s and its significant regulated insurance company subsidiaries’ Boards of Directors have been classified into three classes for many decades. This staggered board organization recognizes policyholders’ dependence on stability and reliability to meet obligations of financial indemnity over long periods of time.

The long-term orientation to board service notwithstanding, an individual will not be slated for election to the Board following his or her 75th birthday, unless such individual is subject to a review by the Governance and Nominating Committee. This review will consider an individual's willingness to serve and his or her ability to make an ongoing contribution to the Company's governance and operations. Pursuant to this policy, the Board, at its meeting to slate directors for 2023, evaluated the qualifications and long-term and continuing contributions of Ms. Taubitz as a director. The Board, with Ms. Taubitz abstaining, unanimously recommended waiving the policy’s application and she was slated as an incumbent director for re-election.

As part of its governance duties, the Board reviews the Annual Meeting of the Shareholders vote concerning directors and considers votes withheld from the election of a director as the equivalent to a vote against the director. In the event that any director receives fewer votes for than against his or her election or re-election, the Governance and Nominating Committee is committed to investigating the reason or reasons for such a withhold vote. Following its investigation, the Governance and Nominating Committee will make such recommendations to the full Board as it deems appropriate in light of the circumstances. Such actions may include a recommendation by the Governance and Nominating Committee that the director resign, and the Board will act on the Governance and Nominating Committee’s recommendation, and the Board’s resignation policy is for a director to resign if the Board requests such resignation.

Following the Shareholder meeting, twelve of the Company’s directors will have been affirmatively determined to qualify as “independent” directors in accordance with Section 303A.02 of the Listed Company Standards of the NYSE, Rule 10C-1 and item 407 (a) of Regulation S-K of the SEC. Neither they nor any members of their immediate families have had any of the types of disqualifying relationships with the Company or any of its subsidiaries in the last three years, as set forth in subsection (b) of Section 303A.02 of the NYSE’s Listed Company Standards. The entire Board and each of its standing Committees conduct an annual self-evaluation that includes a determination of each member’s independence. To facilitate this annual self-evaluation process, each director completes an anonymous questionnaire on the Board’s performance, and the responses are then aggregated and provided to the Chair of the Governance and Nominating Committee, who in turn reviews the responses with the full Board of Directors at the next scheduled Board meeting. Similarly, as part of this annual self-evaluation process, each director serving on either the Audit Committee, Compensation Committee or the Governance and Nominating Committee completes an anonymous questionnaire on their respective committee’s performance, and the responses are then aggregated and provided to the Chair of the Governance and Nominating Committee, who in turn reviews the responses with respective committee members at their next scheduled meeting. During 2022, the independent directors held a meeting in executive session without management directors in accordance with NYSE Listed Company Standards. Mr. Walker was the Lead Independent Director in 2022.

Directors receive a broad array of public and internal proprietary information upon becoming members of the Board. This enables them to become familiar with the Company’s business, strategic plans, significant financial, accounting and management matters, compliance programs, conflict of interest policies, Code of Business Conduct and Ethics (see Code of Business Conduct and Ethics in the Governance section at www.oldrepublic.com), Corporate Governance Guidelines (see Governance section at www.oldrepublic.com), principal officers, and the independent registered public accounting firm. Further, the Company supports directors taking advantage of, and attending, director education programs whenever convenient and appropriate. Even with such assistance and in part as the result of the specialized nature of the Company’s businesses and the regulatory framework in which it operates, it is the Company’s view that some time is typically required for a new director to develop knowledge of the Company’s business. Reflecting this necessary personal development, each director is expected to serve two or more three-year terms on the Company’s classified Board, on several of its significant regulated insurance company subsidiaries’ boards, and on one or more Board Committees. Owing to the risk-taking nature of much of the Company’s business, a demonstrated long-term orientation in a Board member’s business dealings and thought processes is considered very important.

RECENT DEVELOPMENTS IN OUR CORPORATE GOVERNANCE

The Board is committed to corporate governance principles and practices with a long-term orientation. Further, the Board periodically reviews these principles and practices to ensure they are properly aligned with the interests of all stakeholders. Included in these principles and practices is a consideration of environmental, social, and governance (“ESG”) matters. The Board is committed to creating and maintaining board oversight, with input from committee members, on matters related to sustainability, human capital, ethics, information security and other ESG topics.

Executive Management has engaged with the Company’s shareholders and has solicited feedback on a diverse set of ESG areas, reaching out to the Company’s largest shareholders, representing over 50% of institutional shares outstanding, and speaking with all shareholders that responded. The Company’s Chief Executive Officer and Chair of the Executive Committee, Craig R. Smiddy, leads all such meetings and provides a summary of the discussions to the Board of Directors.

In 2020, the Board amended the Company's by-laws to adopt a proxy access provision. The decision to adopt proxy access reflects the Board's continual assessment of the governance attributes that best serve the long-term interests of all the Company's stakeholders. In 2020 the Company also began issuing an annual Sustainability Report, which can be accessed on the Old Republic website at www.oldrepublic.com. The Company believes this report provides information that is of interest to investors and other stakeholders.

In 2022, after discussion with several shareholders, the Board accelerated the expiration of its Rights Plan to August 18, 2022 and terminated the Plan as of that date. The decision to accelerate the expiration of its Rights Plan reflects the Board's continual assessment of the governance attributes that best serve the long-term interest of all the Company's stakeholders. Old Republic’s governance principles and practices continue to emphasize stability, continuity, and sustainability of the enterprise as primary objectives for achieving the greatest long-term value for all stakeholders. Accordingly, the Company reserves the right to adopt a Rights Plan in the future to deter a possible opportunistic hostile tender offer or other abusive takeover transaction that may favor one group of shareholders over another or that, in the good faith business judgment of the Board, is inadequate and not in the best long-term interests of Old Republic and all of its shareholders and other stakeholders.

Over the last five years, our Board refreshment process has resulted in the following:

•Seven new directors and 6 departures;

•Average tenure reduction from 18 years to 8 years;

•Median director age reduction from 77 years to 70 years;

•23% women directors and 23% minority directors

BOARD DIVERSITY AND SKILLS

The following chart and table details the Board’s diversity and skills.

Data privacy and information security are considered material topics to our Company. In the succession plan and initiatives for Board refreshment, the Governance and Nominating Committee is focused on identifying and attracting directors with relevant experience on cybersecurity and the protection of users’ data.

PROCEDURES FOR THE APPROVAL OF RELATED PERSON TRANSACTIONS

In addition to a Code of Business Conduct and Ethics and a Code of Ethics for the Principal Executive Officer (CEO) and Senior Financial Officer (CFO), Old Republic also has a Conflict of Interest Policy, which is circulated annually and acknowledged by all directors, officers and key employees of the Company and its subsidiaries. This policy states that no director, officer, or employee of the Company or its subsidiaries may acquire or retain any interest that conflicts with the interest of the Company. This includes direct or indirect interests in entities or individuals doing business with the Company or its subsidiaries. If such a conflict occurs, employees are required to give a prior written disclosure of the conflict to the Company for evaluation. Such transactions or relationships shall be reviewed by a subcommittee of the Executive Committee composed of independent members: one from the Executive Committee, who serves as the Chair, and the chairs of the Audit, Compensation, and Governance and Nominating Committees. The current members of this subcommittee are Mr. LeRoy III (Chair), Mr. McNitt, Ms. Taubitz, and Mr. Walker.

Directors, officers, and affected employees are required to provide reasonable prior notice to the Company of any related party transaction, as defined by the Listed Company Standards of the NYSE and SEC rules. Under the procedures established by the subcommittee, a reasonable prior review of such related party transaction must be conducted to determine the appropriate action, if any, to take. If, based upon such prior reviews, the subcommittee concludes that such related party transaction is inconsistent with the interests of the Company and its shareholders, it shall prohibit it. Any director who is the subject of an existing or potential related party transaction will not participate in the decision-making process relating to such transaction. During 2022, there were no proposed related party transactions.

DELINQUENT SECTION 16(a) REPORTS

The Company believes that all reports required by Section 16(a) were properly filed during the year ended December 31, 2022, except that a late Form 4 filing was made by Mr. Kennedy on January 24, 2023 to report ten monthly purchases of 295 shares from April 2022 through January 2023 made pursuant to a 10b5-1 plan, and a late Form 4 filing was made by Mr. Sodaro on January 24, 2023 to report the surrender of 441 shares in connection with the vesting of restricted stock that occurred on May 31, 2022.

THE BOARD AND ITS COMMITTEES

The Board of Directors met four times, once each quarter (February and May virtually and August and December in person). Each incumbent director attended at least 75% of the aggregate of the meetings of the Board and committees on which each served. The Company does not require its Board of Directors to attend the Annual Meeting of the Shareholders, as such meeting is conducted by the Chairman and the CEO, who are designated to represent the entire Board of Directors for the meeting.

Membership on the Company's Audit, Compensation, and Governance and Nominating Committees consists exclusively of independent directors. The members, chairs and vice-chairs of these Committees are recommended each year to the Board by the Governance and Nominating Committee in consultation with the Executive Committee. Each of these Committees has the authority and funding to retain independent advisors or counsel as necessary and appropriate in the fulfillment of its duties. Each chair sets the agenda of their respective Committee's meetings, consulting as necessary and appropriate with the Chairman of the Board. All directors have full and free access to the Company's senior management during scheduled meetings of the Board and its Committees.

The following table shows the membership of the Board of Directors and its Committees as of the date of this proxy statement. The total number of meetings include both virtual and telephonic meetings.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BOARD AND COMMITTEE MEMBERSHIP |

| | | | | | | | Committees | | |

| Director | Independent Directors(a) | Other Directors(b) | Audit | Compensation | Executive | Governance and Nominating |

| Barbara A. Adachi | | l | | | | l | | | | | | l | |

| Steven J. Bateman | | l | | | | l(c)(e) | | l | | | | |

| Lisa J. Caldwell | | l | | | | | | | | l | | | l | |

| John M. Dixon | | l | | | | | | l(g) | l | l | |

| Michael D. Kennedy | | l | | | | l | | | | | | l | |

| Charles J. Kovaleski | | l | | | | l | | | | | | l | |

| Spencer LeRoy III | | l | | | | | | | | l | | |

| Peter B. McNitt | | l | | | | l(c) | | l(d)(g) | l(g) | | |

| Glenn W. Reed | | l | | | | l(c) | | l | | | | |

| Craig R. Smiddy | | | | l | | | | | | l(d) | | |

| J. Eric Smith (h) | | l | | | | | | | | l | | | l | |

| Arnold L. Steiner (i) | | l | | | | | | l | l | l | |

| Fredricka Taubitz | | l | | | | l(c)(d) | | l | l | | |

| Steven R. Walker | | l(d)(f) | | | | l | | | | l | l(d) | |

| Number of meetings | | 4 | | | | 7 | | 5 | | 4 | | 4 | |

(a)Independent Director as that term is defined in SEC regulation and the Listed Company Standards of the NYSE.

(b)The Other Director classification includes all directors who are members of management, or do not currently meet the standard indicated in (a) above.

(c)Financial Experts as that term is defined by SEC regulation.

(d)Chair

(e)Vice Chair

(f)Lead Independent Director

(g)Effective March 1, 2023, Mr. McNitt became Compensation Committee Chair and a member of the Executive Committee; Mr. Dixon was the previous Compensation Committee Chair.

(h)Effective March 17, 2023, Mr. Smith was elected a Director and a member of the Compensation Committee and Governance and Nominating Committee.

(i)Until Mr. Steiner’s term as a Director expires on May 25, 2023

| | | | | | | | |

| Audit Committee |

| Members: | Barbara A. Adachi | Peter B. McNitt |

| Steven J. Bateman, Vice Chair | Glenn W. Reed |

| Michael D. Kennedy | Fredricka Taubitz, Chair |

| Charles J. Kovaleski | Steven R. Walker |

The Audit Committee operates pursuant to a written charter approved by the Board of Directors, performs an annual self-evaluation, and like all Board committees reports through its chair in making recommendations to the full Board. While information appearing on the Company’s website is not incorporated by reference in this proxy statement, the Committee’s charter may be viewed at www.oldrepublic.com. Printed copies are available to shareholders upon request.

The Audit Committee is organized to assist the Board in monitoring: (1) the integrity of the Company’s financial statements and the effectiveness of the Company’s internal controls over financial reporting, (2) the Company’s compliance with legal and regulatory requirements, (3) the qualifications, performance, and independence of the registered public accounting firm, (4) the qualifications and performance of the Company’s internal audit function, and (5) the Company’s data protection and cybersecurity risk exposure and the steps management has taken to assess the overall threat landscape and respond appropriately, including the strategy management implemented to mitigate the Company’s risk exposure. Further, it is charged with preparing the annual report required by SEC rules to be included in the Company’s proxy statement (which is printed below), and serving as the audit committee of each of

the Company’s regulated insurance subsidiaries to the extent required by the National Association of Insurance Commissioners’ Model Audit Rule.

The Audit Committee held seven meetings during 2022 with the Company’s independent registered public accounting firm and management, four of which were held prior to the Company’s filing of quarterly reports on SEC Form 10-Q and its annual report on SEC Form 10-K.