Table of Contents

The Northwestern Mutual Life Insurance Company

VariableLife

June 30, 2007

Semi-Annual Reports

Northwestern Mutual Series Fund, Inc. Fidelity® VIP Mid Cap Portfolio Russell Investment Funds

Northwestern Mutual Variable Life Account

Northwestern Mutual Variable Life Account II

Northwestern Mutual®

90-1899 (0786) (REV 0707)

Table of Contents

How To Get More Information

Northwestern Mutual Express:

1-800-519-4665

Get up-to-date information about your Variable CompLife policy at your convenience with your policy number and your Personal Identification Number (PIN). Call toll-free to review policy values, fund performance information, and request a change to the allocations of your existing assets or future premiums/dividends.

Information on the Internet:

Northwestern Mutual Financial Network WWW.NMFN.COM

To obtain current performance information and information about Northwestern Mutual, visit us on our website. You can also visit us at our customer service section from our Web site for information on Policy values and current fund performance. This site also allows you to view past confirmation and policy statements, as well as transfer funds online.

To sign up for this service please call 1-866-424-2609 between 7 a.m. - 6 p.m. Central Time Monday – Friday. As always, your Investment Services representative of the Northwestern Mutual Financial Network is available to answer any questions you have about your variable life insurance policy or any of our products.

For inforce policy service on Variable CompLife, Custom Variable Universal Life, and Variable Whole Life, please call 1-866-424-2609, between 7 a.m. - 6 p.m. Central Time Monday – Friday.

For inforce policy service on Variable Executive Life, Variable Joint Life, Executive Variable Universal Life, and Survivorship Variable Universal Life, please call 1-866-464-3800, between 7:30 a.m. and 5:00 p.m. Central Time Monday - Friday.

Table of Contents

Contents

| Northwestern Mutual Series Fund, Inc. - Semi-Annual Report |

||

| Fidelity® VIP Mid Cap Portfolio - Semi-Annual Report (This report follows the end of the Northwestern Mutual Series Fund, Inc.) |

||

| Russell Investment Funds - Semi-Annual Report (This report follows the end of the Fidelity® VIP Mid Cap Portfolio.) |

||

| Prospectus Supplements |

||

The performance data quoted represents past performance. Past performance is historical and does not guarantee future performance. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Current performances may be lower or higher than the performance data quoted. For the most recent month-end performance information visit www.nmfn.com.

Table of Contents

Semi-Annual Report June 30, 2007

Northwestern Mutual Series Fund, Inc.

A Series Fund Offering Eighteen Portfolios

| · | Growth Stock Portfolio |

| · | Janus Capital Appreciation Portfolio |

| · | Large Cap Core Stock Portfolio |

| · | Index 500 Stock Portfolio |

| · | Capital Guardian Domestic Equity Portfolio |

| · | T. Rowe Price Equity Income Portfolio |

| · | Mid Cap Growth Stock Portfolio |

| · | Index 400 Stock Portfolio |

| · | AllianceBernstein Mid Cap Value Portfolio |

| · | Small Cap Growth Stock Portfolio |

| · | T. Rowe Price Small Cap Value Portfolio |

| · | International Growth Portfolio |

| · | Franklin Templeton International Equity Portfolio |

| · | Money Market Portfolio |

| · | Select Bond Portfolio |

| · | High Yield Bond Portfolio |

| · | Balanced Portfolio |

| · | Asset Allocation Portfolio |

Table of Contents

Letter to Policy Owners

June 30, 2007

Stocks managed solid returns during the six months ended June 30, 2007, despite a bumpy ride, while bonds produced modest but positive results. Once again, the riskiest, lowest-rated securities outperformed across virtually all markets. This ready acceptance of risk in pursuit of higher returns appears to us to be at odds with some important investment developments. Volatility is rising — reflecting the high degree of leverage in the system and fluidity of global capital flows — at a time when asset prices stand at lofty levels and the U.S. economy faces the challenge of a swooning housing market.

One way to see these trends at work is to look at the U.S. economy, where the effect of leverage is evident in housing. Home sales, housing starts, and price appreciation all hit records in 2005, and leverage worked to drive up asset prices as long as buyers had ready access to cheap financing. But with rates rising and lenders pulling back hard on credit, capital is no longer as cheap or easy to come by, with a predictable effect — prices of existing homes fell 2%

year-over-year through May, 2007. And with estimates of $500 billion or more in adjustable-rate sub-prime loans to reset next year, we think we have yet to see the full effect of higher rates on home prices and the economy.

With housing weighing on consumer spending and confidence, U.S. economic growth in the first quarter ran at the slowest pace in four years, though it appears to have bounced back in the second quarter. Call it a “mid-cycle slowdown” as the economy takes a breather from its extended recovery that began in 2002.

But even as U.S. growth slowed, the global economy appeared very healthy, so much so that many foreign central banks raised interest rates to keep their economies from overheating. Rapid growth among emerging market countries in particular helped drive positive performance for companies in Energy, Materials, and Industrials, which were three of the four best-performing sectors in the S&P 500® Index. This U.S. stock benchmark returned 6.29% for the six months and touched a record high.

In addition, equities continued to benefit from a ready supply of investment capital — demand from sources as diverse as foreign central banks, hedge funds and private equity firms, corporate cash, petrodollars, and overseas household savings provided a boost to global asset prices. And while there is no widely available gauge of leverage in the system, our sense is that it is another key factor keeping asset prices across many markets in the neighborhood of all-time highs.

These effects were not limited to U.S. markets — emerging market stocks attracted massive global asset flows, helping them outperform shares in developed economies. For the six months, the MSCI Emerging Market Index returned 16.11%, compared with 10.89% for the MSCI EAFE Index, a measure of performance in developed countries. As a result, many European and emerging market stock indices reached record highs in recent months.

In the U.S. bond market too, volatility and acceptance of risk were dominant themes. In terms of volatility, in May and June alone the yield on the bellwether 10-year Treasury note jumped from around 4.65% to 5.30%, before finishing the period at 5.02%. For the six months, the investment-grade Lehman Aggregate Bond Index returned just 0.98% while a measure of “junk bond” performance returned almost three times that amount, as Lehman’s U.S. Corporate High-Yield Index returned 2.87%.

With prices and leverage in so many markets at lofty levels, it makes sense to be on guard against complacency — in the euphoria of rising markets, it’s easy to forget that asset prices can also go down. This is especially true because with yields rising and bond investors seemingly less receptive to the large debt offerings used to finance headline-grabbing buyouts, the cheap capital that has supported stock performance may be increasingly hard to come by.

But of course, there’s no way to know when, or even if, the effects of global capital flows and leverage will reverse themselves. One famous example worth recalling here is former Fed Chairman Alan Greenspan’s “irrational exuberance” speech — more than three years before the market peaked in 2000. In this environment, it makes sense to take a prudent, measured approach that doesn’t leave you overexposed to any single area or segment of the market. Your financial representative can work with you to regularly review your insurance and investment goals and help evaluate your portfolio’s composition and its suitability for your financial objectives.

Mark G. Doll

Senior Vice President

Investments

The Northwestern Mutual Life Insurance Company

(Northwestern Mutual)

Table of Contents

Northwestern Mutual Series Fund, Inc.

Table of Contents

| Series Fund Overview and Schedules of Investments: |

||

| 1 | ||

| 4 | ||

| 6 | ||

| 9 | ||

| 14 | ||

| 17 | ||

| 20 | ||

| 23 | ||

| 28 | ||

| 31 | ||

| 34 | ||

| 38 | ||

| 41 | ||

| 44 | ||

| 46 | ||

| 55 | ||

| 60 | ||

| 75 | ||

| 92 | ||

| 96 | ||

| 100 | ||

| 106 | ||

| 109 | ||

| 115 | ||

| 116 | ||

| 118 | ||

| Approval and Continuance of Investment Advisory and Sub-Advisory Agreements |

120 | |

Table of Contents

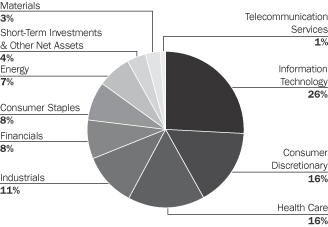

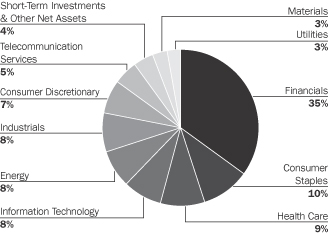

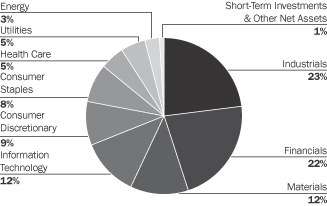

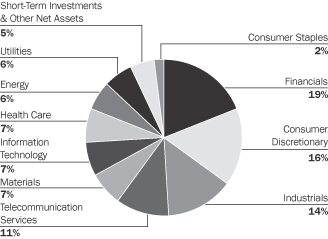

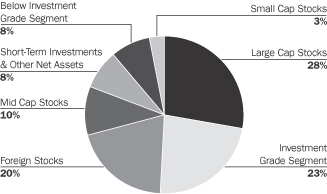

Sector Allocation 6/30/07

Sector Allocation is based on Net Assets.

Sector Allocation is subject to change.

Expense Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Portfolio expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2007 to June 30, 2007).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs or separate account charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs or separate account charges were included, your costs would have been higher.

| Beginning Account Value January 1, 2007 |

Ending Account Value June 30, 2007 |

Expenses 2007* | |||||||

| Actual |

$ | 1,000.00 | $ | 1,067.90 | $ | 2.15 | |||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.71 | $ | 2.11 | |||

| * | Expenses are equal to the Portfolio’s annualized expense ratio of 0.42%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

Growth Stock Portfolio

1

Table of Contents

Growth Stock Portfolio

Northwestern Mutual Series Fund, Inc.

Schedule of Investments

June 30, 2007 (unaudited)

| Common Stocks (96.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Consumer Discretionary (15.6%) | ||||

| Abercrombie & Fitch Co. |

80,500 | 5,875 | ||

| *Comcast Corp. — Class A |

278,550 | 7,833 | ||

| Fortune Brands, Inc. |

69,200 | 5,700 | ||

| Hilton Hotels Corp. |

299,800 | 10,034 | ||

| International Game Technology |

162,200 | 6,439 | ||

| J.C. Penney Co., Inc. |

86,000 | 6,225 | ||

| Johnson Controls, Inc. |

99,900 | 11,566 | ||

| *Kohl’s Corp. |

91,800 | 6,521 | ||

| The McGraw-Hill Companies, Inc. |

129,200 | 8,796 | ||

| News Corp. — Class A |

353,600 | 7,500 | ||

| NIKE, Inc. — Class B |

116,000 | 6,762 | ||

| Omnicom Group, Inc. |

88,000 | 4,657 | ||

| Staples, Inc. |

296,850 | 7,044 | ||

| *Starbucks Corp. |

157,900 | 4,143 | ||

| Starwood Hotels & Resorts Worldwide, Inc. |

57,900 | 3,883 | ||

| Target Corp. |

126,800 | 8,064 | ||

| Time Warner, Inc. |

329,200 | 6,926 | ||

| Total |

117,968 | |||

| Consumer Staples (7.8%) |

||||

| Altria Group, Inc. |

77,900 | 5,464 | ||

| Avon Products, Inc. |

236,000 | 8,673 | ||

| CVS/Caremark Corp. |

309,129 | 11,268 | ||

| PepsiCo, Inc. |

193,400 | 12,542 | ||

| The Procter & Gamble Co. |

162,400 | 9,937 | ||

| Walgreen Co. |

127,100 | 5,534 | ||

| Wal-Mart Stores, Inc. |

118,300 | 5,691 | ||

| Total |

59,109 | |||

| Energy (7.5%) |

||||

| Baker Hughes, Inc. |

102,300 | 8,606 | ||

| ConocoPhillips |

50,316 | 3,950 | ||

| Diamond Offshore Drilling, Inc. |

51,900 | 5,271 | ||

| EOG Resources, Inc. |

92,000 | 6,722 | ||

| Exxon Mobil Corp. |

124,034 | 10,404 | ||

| Schlumberger, Ltd. |

106,500 | 9,046 | ||

| Valero Energy Corp. |

97,900 | 7,231 | ||

| XTO Energy, Inc. |

91,400 | 5,493 | ||

| Total |

56,723 | |||

| Financials (8.3%) |

||||

| American Express Co. |

146,400 | 8,957 | ||

| American International Group, Inc. |

81,900 | 5,735 | ||

| *The Blackstone Group LP |

25,800 | 755 | ||

| Chicago Mercantile Exchange Holdings, Inc. |

6,900 | 3,687 | ||

| Genworth Financial, Inc. |

70,400 | 2,422 | ||

| The Goldman Sachs Group, Inc. |

43,100 | 9,342 | ||

| Legg Mason, Inc. |

68,000 | 6,690 | ||

| Common Stocks (96.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Financials continued |

||||

| Lehman Brothers Holdings, Inc. |

95,100 | 7,087 | ||

| NYSE Euronext |

49,900 | 3,674 | ||

| Prudential Financial, Inc. |

77,100 | 7,496 | ||

| UBS AG |

113,000 | 6,781 | ||

| Total |

62,626 | |||

| Health Care (16.1%) |

||||

| Abbott Laboratories |

135,500 | 7,256 | ||

| *Amgen, Inc. |

66,600 | 3,682 | ||

| Baxter International, Inc. |

113,800 | 6,411 | ||

| *Celgene Corp. |

85,500 | 4,902 | ||

| *Genentech, Inc. |

129,400 | 9,790 | ||

| *Genzyme Corp. |

81,600 | 5,255 | ||

| *Gilead Sciences, Inc. |

264,800 | 10,267 | ||

| Johnson & Johnson |

132,200 | 8,146 | ||

| Medtronic, Inc. |

188,400 | 9,770 | ||

| Merck & Co., Inc. |

204,800 | 10,200 | ||

| Novartis AG, ADR |

147,600 | 8,276 | ||

| *St. Jude Medical, Inc. |

135,000 | 5,601 | ||

| *Thermo Fisher Scientific, Inc. |

189,600 | 9,806 | ||

| UnitedHealth Group, Inc. |

111,000 | 5,677 | ||

| Wyeth |

134,100 | 7,689 | ||

| *Zimmer Holdings, Inc. |

102,600 | 8,710 | ||

| Total |

121,438 | |||

| Industrials (11.3%) |

||||

| The Boeing Co. |

95,300 | 9,164 | ||

| Danaher Corp. |

129,600 | 9,785 | ||

| FedEx Corp. |

76,000 | 8,434 | ||

| General Electric Co. |

331,300 | 12,682 | ||

| Honeywell International, Inc. |

173,300 | 9,753 | ||

| Roper Industries, Inc. |

140,200 | 8,005 | ||

| *Spirit AeroSystems Holdings, Inc. |

225,700 | 8,136 | ||

| Textron, Inc. |

69,000 | 7,598 | ||

| United Technologies Corp. |

167,500 | 11,881 | ||

| Total |

85,438 | |||

| Information Technology (25.6%) |

||||

| Accenture, Ltd. — Class A |

219,911 | 9,432 | ||

| *Adobe Systems, Inc. |

44,900 | 1,803 | ||

| *Amdocs, Ltd. |

228,600 | 9,103 | ||

| *Apple, Inc. |

65,100 | 7,945 | ||

| *Autodesk, Inc. |

99,000 | 4,661 | ||

| *BEA Systems, Inc. |

421,100 | 5,765 | ||

| *Broadcom Corp. — Class A |

241,250 | 7,057 | ||

| *Cisco Systems, Inc. |

495,500 | 13,799 | ||

| *Corning, Inc. |

282,100 | 7,208 | ||

| *eBay, Inc. |

248,200 | 7,987 | ||

| *Electronic Arts, Inc. |

130,300 | 6,166 | ||

| *Google, Inc. — Class A |

37,842 | 19,805 | ||

| Hewlett-Packard Co. |

260,500 | 11,624 | ||

| Intel Corp. |

161,000 | 3,825 | ||

| Common Stocks (96.3%) | Shares/ $ Par |

Value $ (000’s) |

|||

| Information Technology continued |

|||||

| International Business Machines Corp. |

69,800 | 7,346 | |||

| KLA-Tencor Corp. |

139,600 | 7,671 | |||

| Maxim Integrated Products, Inc. |

211,300 | 7,060 | |||

| Microsoft Corp. |

378,200 | 11,146 | |||

| *Oracle Corp. |

397,300 | 7,831 | |||

| QUALCOMM, Inc. |

270,700 | 11,745 | |||

| Telefonaktiebolaget LM Ericsson, ADR |

198,700 | 7,926 | |||

| Texas Instruments, Inc. |

232,600 | 8,753 | |||

| *Yahoo!, Inc. |

241,810 | 6,560 | |||

| Total |

192,218 | ||||

| Materials (2.6%) |

|||||

| Monsanto Co. |

164,100 | 11,083 | |||

| Praxair, Inc. |

113,600 | 8,178 | |||

| Total |

19,261 | ||||

| Telecommunication Services (1.5%) |

|||||

| *NII Holdings, Inc. |

141,400 | 11,417 | |||

| Total |

11,417 | ||||

| Total Common Stocks |

726,198 | ||||

| Money Market Investments (3.8%) | |||||

| Federal Government & Agencies (0.2%) |

| ||||

| Fannie Mae, |

1,700,000 | 1,681 | |||

| Total |

1,681 | ||||

| Finance Lessors (2.0%) |

|||||

| (b)Thunder Bay Funding, Inc., 5.31%, 7/16/07 |

15,000,000 | 14,965 | |||

| Total |

14,965 | ||||

| National Commercial Banks (1.6%) |

|||||

| (b)UBS Finance LLC, 5.35%, 7/2/07 |

12,200,000 | 12,196 | |||

| Total |

12,196 | ||||

| Total Money Market Investments (Cost: $28,841) |

28,842 | ||||

| Total Investments (100.1%) (Cost $601,549)(a) |

755,040 | ||||

| Other Assets, Less Liabilities (-0.1%) |

(915 | ) | |||

| Net Assets (100.0%) |

754,125 | ||||

| * | Non-Income Producing |

ADR after the name of a security represents — American Depositary Receipt.

The Accompanying Notes are an Integral Part of the Financial Statements.

2

Growth Stock Portfolio

Table of Contents

Growth Stock Portfolio

| (a) | At June 30, 2007 the aggregate cost of securities for federal tax purposes (in thousands) was $601,549 and the net unrealized appreciation of investments based on that cost was $153,491 which is comprised of $162,455 aggregate gross unrealized appreciation and $8,964 aggregate gross unrealized depreciation. |

| (b) | All or a portion of the securities have been committed as collateral for open futures positions or when-issued securities. Information regarding open futures contracts as of period end is summarized below. |

| Issuer (000’s) | Number of Contracts |

Expiration Date |

Unrealized Appreciation/ (Depreciation) (000’s) |

|||||

| S&P 500 Index |

46 | 9/07 | $ | (111 | ) | |||

| (Total Notional Value at |

||||||||

The Accompanying Notes are an Integral Part of the Financial Statements.

Growth Stock Portfolio

3

Table of Contents

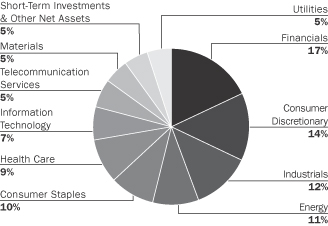

Janus Capital Appreciation Portfolio

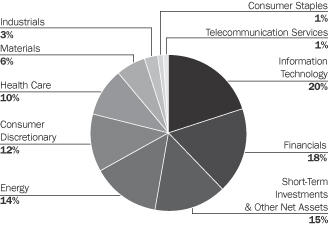

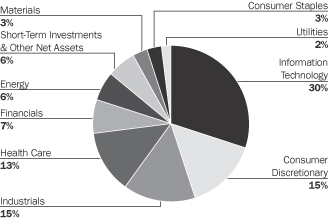

Sector Allocation 6/30/07

Sector Allocation is based on Net Assets.

Sector Allocation is subject to change.

Expense Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Portfolio expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2007 to June 30, 2007).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs or separate account charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs or separate account charges were included, your costs would have been higher.

| Beginning Account Value January 1, 2007 |

Ending Account Value June 30, 2007 |

Expenses June 30, 2007* | |||||||

| Actual |

$ | 1,000.00 | $ | 1,097.70 | $ | 4.16 | |||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.83 | $ | 4.01 | |||

| * | Expenses are equal to the Portfolio’s annualized expense ratio of 0.80%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

4

Janus Capital Appreciation Portfolio

Table of Contents

Janus Capital Appreciation Portfolio

Northwestern Mutual Series Fund, Inc.

Schedule of Investments

June 30, 2007 (unaudited)

| Common Stocks (85.0%) | Shares/ $ Par |

Value $ (000’s) | ||

| Consumer Discretionary (12.0%) |

||||

| Abercrombie & Fitch Co. — Class A |

56,920 | 4,154 | ||

| Boyd Gaming Corp. |

61,050 | 3,003 | ||

| Harrah’s Entertainment, Inc. |

42,820 | 3,651 | ||

| J.C. Penney Co., Inc. |

74,525 | 5,393 | ||

| *Lamar Advertising Co. — Class A |

46,535 | 2,921 | ||

| *Melco PBL Entertainment, ADR |

64,645 | 812 | ||

| Sony Corp., ADR |

14,520 | 746 | ||

| Total |

20,680 | |||

| Consumer Staples (1.3%) |

||||

| Bunge, Ltd. |

27,580 | 2,331 | ||

| Total |

2,331 | |||

| Energy (14.0%) |

||||

| Apache Corp. |

21,895 | 1,786 | ||

| ConocoPhillips |

67,485 | 5,298 | ||

| *Continental Resources, Inc. |

206,100 | 3,298 | ||

| EOG Resources, Inc. |

24,805 | 1,812 | ||

| Hess Corp. |

38,165 | 2,250 | ||

| Occidental Petroleum Corp. |

40,250 | 2,330 | ||

| Suncor Energy, Inc. |

57,655 | 5,184 | ||

| Valero Energy Corp. |

31,185 | 2,303 | ||

| Total |

24,261 | |||

| Financials (17.5%) |

||||

| The Bear Stearns Companies, Inc. |

24,610 | 3,445 | ||

| The Goldman Sachs Group, Inc. |

31,510 | 6,830 | ||

| KKR Private Equity Investors LP |

24,936 | 561 | ||

| Lehman Brothers Holdings, Inc. |

49,775 | 3,709 | ||

| Merrill Lynch & Co., Inc. |

42,590 | 3,560 | ||

| Moody’s Corp. |

70,410 | 4,380 | ||

| Wells Fargo & Co. |

222,450 | 7,823 | ||

| Total |

30,308 | |||

| Health Care (10.0%) |

||||

| Alcon, Inc. |

28,535 | 3,850 | ||

| *Amylin Pharmaceuticals, Inc. |

5,775 | 238 | ||

| *Celgene Corp. |

80,330 | 4,605 | ||

| *Genentech, Inc. |

36,440 | 2,757 | ||

| *Gilead Sciences, Inc. |

150,010 | 5,816 | ||

| Total |

17,266 | |||

| Industrials (2.5%) |

||||

| Precision Castparts Corp. |

35,580 | 4,318 | ||

| Total |

4,318 | |||

| Information Technology (19.9%) |

||||

| *Akamai Technologies, Inc. |

70,105 | 3,410 | ||

| Common Stocks (85.0%) | Shares/ $ Par |

Value $ (000’s) | ||

| Information Technology continued |

||||

| *Apple, Inc. |

136,425 | 16,649 | ||

| *Electronic Arts, Inc. |

29,695 | 1,405 | ||

| *Google, Inc. — Class A |

9,805 | 5,132 | ||

| QUALCOMM, Inc. |

57,970 | 2,515 | ||

| *Research in Motion, Ltd. |

25,250 | 5,050 | ||

| Total |

34,161 | |||

| Materials (6.3%) |

||||

| Monsanto Co. |

51,355 | 3,469 | ||

| Potash Corp. of Saskatchewan, Inc. |

96,000 | 7,485 | ||

| Total |

10,954 | |||

| Telecommunication Services (1.5%) |

||||

| *Time Warner Telecom, Inc. — Class A |

130,410 | 2,621 | ||

| Total |

2,621 | |||

| Total Common Stocks |

146,900 | |||

| Money Market Investments (11.3%) | ||||

| Federal Government & Agencies (10.7%) | ||||

| Federal Home Loan Bank, 5.16%, 7/13/07 |

5,400,000 | 5,390 | ||

| Federal Home Loan Bank, 5.15%, 7/18/07 |

13,100,000 | 13,066 | ||

| Total |

18,456 | |||

| National Commercial Banks (0.6%) |

||||

| UBS Finance LLC, 5.35%, 7/2/07 |

1,100,000 | 1,100 | ||

| Total |

1,100 | |||

| Total Money Market Investments (Cost: $19,556) |

19,556 | |||

| Total Investments (96.3%) (Cost $132,758)(a) |

166,456 | |||

| Other Assets, Less Liabilities (3.7%) |

6,386 | |||

| Net Assets (100.0%) |

172,842 | |||

| * | Non-Income Producing |

ADR after the name of a security represents — American Depositary Receipt.

| (a) | At June 30, 2007 the aggregate cost of securities for federal tax purposes (in thousands) was $132,758 and the net unrealized appreciation of investments based on that cost was $33,698 which is comprised of $35,732 aggregate gross unrealized appreciation and $2,034 aggregate gross unrealized depreciation. |

The Accompanying Notes are an Integral Part of the Financial Statements.

Janus Capital Appreciation Portfolio

5

Table of Contents

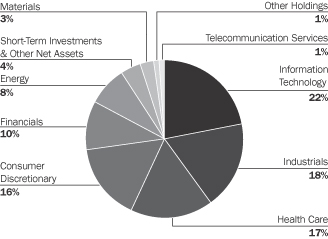

Large Cap Core Stock Portfolio

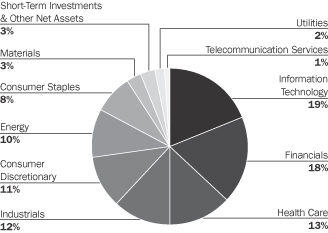

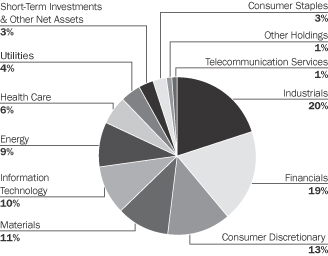

Sector Allocation 6/30/07

Sector Allocation is based on Net Assets.

Sector Allocation is subject to change.

Expense Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Portfolio expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2007 to June 30, 2007).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs or separate account charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs or separate account charges were included, your costs would have been higher.

| Beginning Account Value January 1, 2007 |

Ending Account Value June 30, 2007 |

Expenses Paid During Period January 1, 2007 to June 30, 2007* | |||||||

| Actual |

$ | 1,000.00 | $ | 1,069.70 | $ | 2.21 | |||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.66 | $ | 2.16 | |||

| * | Expenses are equal to the Portfolio’s annualized expense ratio of 0.43%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

6

Large Cap Core Stock Portfolio

Table of Contents

Large Cap Core Stock Portfolio

Northwestern Mutual Series Fund, Inc.

Schedule of Investments

June 30, 2007 (unaudited)

| Common Stocks (96.8%) | Shares/ $ Par |

Value $ (000’s) | ||

| Consumer Discretionary (11.3%) | ||||

| Abercrombie & Fitch Co. — Class A |

13,200 | 963 | ||

| *Comcast Corp. |

211,500 | 5,947 | ||

| Hilton Hotels Corp. |

158,900 | 5,318 | ||

| International Game Technology |

116,600 | 4,629 | ||

| J.C. Penney Co., Inc. |

63,300 | 4,582 | ||

| Johnson Controls, Inc. |

71,700 | 8,301 | ||

| News Corp. — Class A |

317,200 | 6,728 | ||

| NIKE, Inc. — Class B |

60,800 | 3,544 | ||

| Omnicom Group, Inc. |

72,600 | 3,842 | ||

| Staples, Inc. |

199,800 | 4,741 | ||

| Starwood Hotels & Resorts Worldwide, Inc. |

61,200 | 4,105 | ||

| Target Corp. |

87,800 | 5,584 | ||

| Time Warner, Inc. |

237,600 | 4,999 | ||

| Total |

63,283 | |||

| Consumer Staples (7.9%) | ||||

| Altria Group, Inc. |

80,600 | 5,653 | ||

| Avon Products, Inc. |

170,300 | 6,259 | ||

| CVS/Caremark Corp. |

225,222 | 8,209 | ||

| Loews Corp. — Carolina Group |

56,200 | 4,343 | ||

| PepsiCo, Inc. |

110,200 | 7,146 | ||

| The Procter & Gamble Co. |

140,662 | 8,607 | ||

| Walgreen Co. |

85,000 | 3,701 | ||

| Total |

43,918 | |||

| Energy (9.5%) | ||||

| Baker Hughes, Inc. |

74,400 | 6,259 | ||

| ConocoPhillips |

54,888 | 4,309 | ||

| Diamond Offshore Drilling, Inc. |

37,400 | 3,798 | ||

| EOG Resources, Inc. |

68,100 | 4,975 | ||

| Exxon Mobil Corp. |

215,300 | 18,060 | ||

| Schlumberger, Ltd. |

76,700 | 6,515 | ||

| Valero Energy Corp. |

71,000 | 5,244 | ||

| XTO Energy, Inc. |

65,800 | 3,955 | ||

| Total |

53,115 | |||

| Financials (17.5%) | ||||

| American Express Co. |

88,500 | 5,414 | ||

| American International Group, Inc. |

105,200 | 7,367 | ||

| Bank of America Corp. |

175,400 | 8,576 | ||

| *The Blackstone Group LP |

18,800 | 550 | ||

| Chicago Mercantile Exchange Holdings, Inc. |

5,000 | 2,672 | ||

| Citigroup, Inc. |

96,700 | 4,960 | ||

| Genworth Financial, Inc. |

52,900 | 1,820 | ||

| The Goldman Sachs Group, Inc. |

31,500 | 6,828 | ||

| Host Hotels & Resorts, Inc. |

177,102 | 4,095 | ||

| JPMorgan Chase & Co. |

153,296 | 7,427 | ||

| Legg Mason, Inc. |

49,200 | 4,840 | ||

| Lehman Brothers Holdings, Inc. |

74,200 | 5,529 | ||

| Common Stocks (96.8%) | Shares/ $ Par |

Value $ (000’s) | ||

| Financials continued | ||||

| Prudential Financial, Inc. |

87,100 | 8,469 | ||

| State Street Corp. |

77,500 | 5,301 | ||

| The Travelers Companies, Inc. |

107,800 | 5,767 | ||

| U.S. Bancorp |

115,300 | 3,799 | ||

| UBS AG |

81,900 | 4,915 | ||

| Wachovia Corp. |

90,600 | 4,643 | ||

| Wells Fargo & Co. |

139,900 | 4,920 | ||

| Total |

97,892 | |||

| Health Care (12.5%) | ||||

| Abbott Laboratories |

98,700 | 5,285 | ||

| Baxter International, Inc. |

81,800 | 4,609 | ||

| Bristol-Myers Squibb Co. |

84,700 | 2,673 | ||

| Cardinal Health, Inc. |

38,300 | 2,706 | ||

| *Celgene Corp. |

98,100 | 5,624 | ||

| *Express Scripts, Inc. |

53,500 | 2,676 | ||

| *Genentech, Inc. |

45,500 | 3,443 | ||

| *Gilead Sciences, Inc. |

112,000 | 4,342 | ||

| *Hospira, Inc. |

41,600 | 1,624 | ||

| Johnson & Johnson |

74,400 | 4,585 | ||

| Medtronic, Inc. |

77,500 | 4,019 | ||

| Merck & Co., Inc. |

152,400 | 7,589 | ||

| Pfizer, Inc. |

169,500 | 4,334 | ||

| *St. Jude Medical, Inc. |

86,600 | 3,593 | ||

| *Thermo Fisher Scientific, Inc. |

133,600 | 6,909 | ||

| Wyeth |

96,600 | 5,539 | ||

| Total |

69,550 | |||

| Industrials (12.4%) | ||||

| The Boeing Co. |

88,500 | 8,510 | ||

| Canadian National Railway Co. |

102,100 | 5,200 | ||

| Danaher Corp. |

74,000 | 5,587 | ||

| FedEx Corp. |

44,400 | 4,927 | ||

| General Electric Co. |

329,000 | 12,594 | ||

| Honeywell International, Inc. |

124,890 | 7,029 | ||

| Roper Industries, Inc. |

99,700 | 5,693 | ||

| *Spirit AeroSystems Holdings, Inc. |

120,000 | 4,326 | ||

| Textron, Inc. |

62,400 | 6,871 | ||

| United Technologies Corp. |

120,400 | 8,540 | ||

| Total |

69,277 | |||

| Information Technology (19.1%) | ||||

| Accenture, Ltd. |

135,400 | 5,807 | ||

| *Adobe Systems, Inc. |

76,000 | 3,051 | ||

| *Amdocs, Ltd. |

146,000 | 5,814 | ||

| *Autodesk, Inc. |

71,500 | 3,366 | ||

| *BEA Systems, Inc. |

182,700 | 2,501 | ||

| *Broadcom Corp. |

217,250 | 6,355 | ||

| *Cisco Systems, Inc. |

285,700 | 7,957 | ||

| *Corning, Inc. |

204,700 | 5,230 | ||

| *Electronic Arts, Inc. |

98,300 | 4,652 | ||

| *Google, Inc. — Class A |

13,600 | 7,118 | ||

| Hewlett-Packard Co. |

193,100 | 8,615 | ||

| Common Stocks (96.8%) | Shares/ $ Par |

Value $ (000’s) | ||

| Information Technology continued | ||||

| Intel Corp. |

81,000 | 1,925 | ||

| International Business Machines Corp. |

50,500 | 5,315 | ||

| KLA-Tencor Corp. |

100,800 | 5,539 | ||

| Maxim Integrated Products, Inc. |

129,200 | 4,317 | ||

| Microsoft Corp. |

279,300 | 8,231 | ||

| *Oracle Corp. |

293,500 | 5,785 | ||

| QUALCOMM, Inc. |

157,100 | 6,817 | ||

| Texas Instruments, Inc. |

170,100 | 6,401 | ||

| *Yahoo!, Inc. |

46,900 | 1,272 | ||

| Total |

106,068 | |||

| Materials (3.2%) | ||||

| International Paper Co. |

70,500 | 2,753 | ||

| Monsanto Co. |

150,600 | 10,171 | ||

| Praxair, Inc. |

69,800 | 5,025 | ||

| Total |

17,949 | |||

| Telecommunication Services (1.2%) | ||||

| AT&T, Inc. |

164,000 | 6,806 | ||

| Total |

6,806 | |||

| Utilities (2.2%) | ||||

| Exelon Corp. |

87,900 | 6,382 | ||

| PG&E Corp. |

132,300 | 5,993 | ||

| Total |

12,375 | |||

| Total Common Stocks |

540,233 | |||

| Money Market Investments (3.1%) | ||||

| Autos (1.7%) | ||||

| (b)Fcar Owner Trust 1, 5.30%, 7/16/07 |

10,000,000 | 9,977 | ||

| Total |

9,977 | |||

| Federal Government & Agencies (0.3%) | ||||

| Fannie Mae, 5.13%, 9/19/07 |

1,500,000 | 1,483 | ||

| Total |

1,483 | |||

| National Commercial Banks (1.1%) | ||||

| UBS Finance LLC, 5.35%, 7/2/07 |

5,900,000 | 5,898 | ||

| Total |

5,898 | |||

| Total Money Market |

17,358 | |||

| Total Investments (99.9%) |

557,591 | |||

| Other Assets, Less Liabilities |

755 | |||

| Net Assets (100.0%) |

558,346 | |||

The Accompanying Notes are an Integral Part of the Financial Statements.

Large Cap Core Stock Portfolio

7

Table of Contents

Large Cap Core Stock Portfolio

| * | Non-Income Producing |

| (a) | At June 30, 2007 the aggregate cost of securities for federal tax purposes (in thousands) was $429,408 and the net unrealized appreciation of investments based on that cost was $128,183 which is comprised of $131,768 aggregate gross unrealized appreciation and $3,585 aggregate gross unrealized depreciation. |

| (b) | All or a portion of the securities have been committed as collateral for open futures positions or when-issued securities. Information regarding open futures contracts as of period end is summarized below. |

| Issuer (000’s) | Number of Contracts |

Expiration Date |

Unrealized Appreciation/ (Depreciation) (000’s) |

|||||

| S&P 500 Index Futures (Long) |

16 | 9/07 | $ | (39 | ) | |||

| (Total Notional Value at June 30, 2007, $6,100) |

||||||||

The Accompanying Notes are an Integral Part of the Financial Statements.

8

Large Cap Core Stock Portfolio

Table of Contents

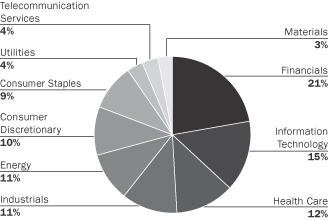

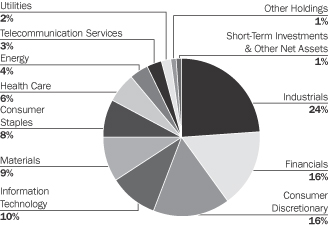

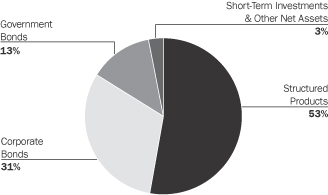

Sector Allocation 6/30/07

Sector Allocation is based on equities.

Sector Allocation is subject to change.

Expense Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Portfolio expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2007 to June 30, 2007).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs or separate account charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs or separate account charges were included, your costs would have been higher.

| Beginning Account Value January 1, 2007 |

Ending Account Value June 30, 2007 |

Expenses June 30, | |||||||

| Actual |

$ | 1,000.00 | $ | 1,069.60 | $ | 1.03 | |||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,023.80 | $ | 1.00 | |||

| * | Expenses are equal to the Portfolio’s annualized expense ratio of 0.20%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

Index 500 Stock Portfolio

9

Table of Contents

Index 500 Stock Portfolio

Northwestern Mutual Series Fund, Inc.

Schedule of Investments

June 30, 2007 (unaudited)

| Common Stocks (98.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Consumer Discretionary (10.0%) |

||||

| Abercrombie & Fitch Co. — Class A |

14,100 | 1,029 | ||

| *Amazon.com, Inc. |

49,800 | 3,407 | ||

| *Apollo Group, Inc. —Class A |

22,400 | 1,309 | ||

| *AutoNation, Inc. |

24,229 | 544 | ||

| *AutoZone, Inc. |

7,625 | 1,042 | ||

| *Bed Bath & Beyond, Inc. |

43,900 | 1,580 | ||

| Best Buy Co., Inc. |

64,875 | 3,028 | ||

| *Big Lots, Inc. |

17,500 | 515 | ||

| The Black & Decker Corp. |

10,600 | 936 | ||

| Brunswick Corp. |

14,500 | 473 | ||

| Carnival Corp. |

70,909 | 3,458 | ||

| CBS Corp. — Class B |

117,424 | 3,913 | ||

| Centex Corp. |

19,100 | 766 | ||

| Circuit City Stores, Inc. |

22,200 | 335 | ||

| Clear Channel Communications, Inc. |

79,550 | 3,009 | ||

| *Coach, Inc. |

59,500 | 2,820 | ||

| *Comcast Corp. — Class A |

498,705 | 14,023 | ||

| D.R. Horton, Inc. |

43,800 | 873 | ||

| Darden Restaurants, Inc. |

22,650 | 996 | ||

| Dillard’s, Inc. — Class A |

9,764 | 351 | ||

| *The DIRECTV Group, Inc. |

123,500 | 2,854 | ||

| Dollar General Corp. |

50,448 | 1,106 | ||

| Dow Jones & Co., Inc. |

10,520 | 604 | ||

| The E.W. Scripps Co. — Class A |

13,400 | 612 | ||

| Eastman Kodak Co. |

46,083 | 1,282 | ||

| Family Dollar Stores, Inc. |

24,200 | 831 | ||

| *Ford Motor Co. |

301,294 | 2,838 | ||

| Fortune Brands, Inc. |

24,467 | 2,015 | ||

| Gannett Co., Inc. |

37,650 | 2,069 | ||

| The Gap, Inc. |

84,975 | 1,623 | ||

| General Motors Corp. |

90,627 | 3,426 | ||

| Genuine Parts Co. |

27,300 | 1,354 | ||

| *The Goodyear Tire & Rubber Co. |

33,100 | 1,151 | ||

| H&R Block, Inc. |

51,700 | 1,208 | ||

| Harley-Davidson, Inc. |

41,300 | 2,462 | ||

| Harman International Industries, Inc. |

10,400 | 1,215 | ||

| Harrah’s Entertainment, Inc. |

29,950 | 2,554 | ||

| Hasbro, Inc. |

25,525 | 802 | ||

| Hilton Hotels Corp. |

62,450 | 2,090 | ||

| The Home Depot, Inc. |

316,294 | 12,445 | ||

| *IAC/InterActiveCorp |

35,000 | 1,211 | ||

| International Game Technology |

53,300 | 2,116 | ||

| *The Interpublic Group of Companies, Inc. |

75,100 | 856 | ||

| J.C. Penney Co., Inc. |

36,050 | 2,609 | ||

| Johnson Controls, Inc. |

31,600 | 3,658 | ||

| Jones Apparel Group, Inc. |

17,400 | 492 | ||

| KB HOME |

12,300 | 484 | ||

| *Kohl’s Corp. |

51,667 | 3,670 | ||

| Leggett & Platt, Inc. |

28,433 | 627 | ||

| Common Stocks (98.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Consumer Discretionary continued |

||||

| Lennar Corp. — Class A |

22,300 | 815 | ||

| Limited Brands, Inc. |

54,887 | 1,507 | ||

| Liz Claiborne, Inc. |

16,800 | 627 | ||

| Lowe’s Companies, Inc. |

241,200 | 7,402 | ||

| Macy’s Inc. |

73,646 | 2,930 | ||

| Marriott International, Inc. — Class A |

52,600 | 2,274 | ||

| Mattel, Inc. |

62,988 | 1,593 | ||

| McDonald’s Corp. |

191,278 | 9,709 | ||

| The McGraw-Hill Companies, Inc. |

55,020 | 3,746 | ||

| Meredith Corp. |

6,200 | 382 | ||

| The New York Times Co. — Class A |

23,070 | 586 | ||

| Newell Rubbermaid, Inc. |

44,692 | 1,315 | ||

| News Corp. — Class A |

373,200 | 7,916 | ||

| NIKE, Inc. — Class B |

60,800 | 3,544 | ||

| Nordstrom, Inc. |

35,934 | 1,837 | ||

| *Office Depot, Inc. |

44,257 | 1,341 | ||

| OfficeMax, Inc. |

12,100 | 476 | ||

| Omnicom Group, Inc. |

53,000 | 2,805 | ||

| Polo Ralph Lauren Corp. |

9,800 | 961 | ||

| Pulte Homes, Inc. |

34,000 | 763 | ||

| RadioShack Corp. |

21,700 | 719 | ||

| *Sears Holdings Corp. |

13,180 | 2,234 | ||

| The Sherwin-Williams Co. |

17,513 | 1,164 | ||

| Snap-on, Inc. |

9,317 | 471 | ||

| The Stanley Works |

13,350 | 810 | ||

| Staples, Inc. |

114,650 | 2,721 | ||

| *Starbucks Corp. |

118,700 | 3,115 | ||

| Starwood Hotels & Resorts Worldwide, Inc. |

34,500 | 2,314 | ||

| Target Corp. |

136,457 | 8,679 | ||

| Tiffany & Co. |

21,867 | 1,160 | ||

| Time Warner, Inc. |

606,600 | 12,762 | ||

| The TJX Companies, Inc. |

72,900 | 2,005 | ||

| Tribune Co. |

13,525 | 398 | ||

| VF Corp. |

14,257 | 1,306 | ||

| *Viacom, Inc. — Class B |

110,424 | 4,597 | ||

| The Walt Disney Co. |

317,557 | 10,841 | ||

| Wendy’s International, Inc. |

13,950 | 513 | ||

| Whirlpool Corp. |

12,644 | 1,406 | ||

| *Wyndham Worldwide Corp. |

29,186 | 1,058 | ||

| Yum! Brands, Inc. |

83,960 | 2,747 | ||

| Total |

218,220 | |||

| Consumer Staples (9.1%) |

||||

| Altria Group, Inc. |

337,022 | 23,639 | ||

| Anheuser-Busch Companies, Inc. |

121,749 | 6,350 | ||

| Archer-Daniels-Midland Co. |

104,603 | 3,461 | ||

| Avon Products, Inc. |

70,300 | 2,584 | ||

| Brown-Forman Corp. — Class B |

12,618 | 922 | ||

| Campbell Soup Co. |

34,722 | 1,348 | ||

| The Clorox Co. |

24,350 | 1,512 | ||

| The Coca-Cola Co. |

321,975 | 16,843 | ||

| Common Stocks (98.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Consumer Staples continued |

||||

| Coca-Cola Enterprises, Inc. |

44,700 | 1,073 | ||

| Colgate-Palmolive Co. |

81,922 | 5,313 | ||

| ConAgra Foods, Inc. |

79,767 | 2,143 | ||

| *Constellation Brands, Inc. — Class A |

31,000 | 753 | ||

| Costco Wholesale Corp. |

71,564 | 4,188 | ||

| CVS/Caremark Corp. |

247,361 | 9,016 | ||

| Dean Foods Co. |

20,800 | 663 | ||

| The Estee Lauder Companies, Inc. — Class A |

18,900 | 860 | ||

| General Mills, Inc. |

55,467 | 3,240 | ||

| H.J. Heinz Co. |

52,017 | 2,469 | ||

| The Hershey Co. |

27,500 | 1,392 | ||

| Kellogg Co. |

40,157 | 2,080 | ||

| Kimberly-Clark Corp. |

73,056 | 4,887 | ||

| Kraft Foods, Inc. — Class A |

256,996 | 9,059 | ||

| The Kroger Co. |

113,405 | 3,190 | ||

| McCormick & Co., Inc. |

20,900 | 798 | ||

| Molson Coors Brewing Co. — Class B |

7,600 | 703 | ||

| The Pepsi Bottling Group, Inc. |

21,100 | 711 | ||

| PepsiCo, Inc. |

261,030 | 16,928 | ||

| The Procter & Gamble Co. |

504,564 | 30,873 | ||

| Reynolds American, Inc. |

27,400 | 1,786 | ||

| Safeway, Inc. |

70,800 | 2,409 | ||

| Sara Lee Corp. |

117,735 | 2,049 | ||

| SUPERVALU, Inc. |

33,270 | 1,541 | ||

| Sysco Corp. |

99,025 | 3,267 | ||

| Tyson Foods, Inc. — Class A |

40,500 | 933 | ||

| UST, Inc. |

25,667 | 1,379 | ||

| Walgreen Co. |

160,346 | 6,981 | ||

| Wal-Mart Stores, Inc. |

388,500 | 18,691 | ||

| Whole Foods Market, Inc. |

22,700 | 869 | ||

| Wm. Wrigley Jr. Co. |

34,558 | 1,911 | ||

| Total |

198,814 | |||

| Energy (10.6%) |

||||

| Anadarko Petroleum Corp. |

74,324 | 3,864 | ||

| Apache Corp. |

53,046 | 4,328 | ||

| Baker Hughes, Inc. |

51,330 | 4,318 | ||

| BJ Services Co. |

47,000 | 1,337 | ||

| Chesapeake Energy Corp. |

65,600 | 2,270 | ||

| Chevron Corp. |

344,414 | 29,013 | ||

| ConocoPhillips |

261,938 | 20,562 | ||

| CONSOL Energy, Inc. |

29,200 | 1,346 | ||

| Devon Energy Corp. |

71,300 | 5,582 | ||

| El Paso Corp. |

112,171 | 1,933 | ||

| ENSCO International, Inc. |

23,900 | 1,458 | ||

| EOG Resources, Inc. |

39,220 | 2,865 | ||

| Exxon Mobil Corp. |

902,656 | 75,715 | ||

| Halliburton Co. |

146,438 | 5,052 | ||

| Hess Corp. |

43,700 | 2,577 | ||

| Marathon Oil Corp. |

109,966 | 6,594 | ||

| Murphy Oil Corp. |

30,100 | 1,789 | ||

| *Nabors Industries, Ltd. |

45,100 | 1,505 | ||

The Accompanying Notes are an Integral Part of the Financial Statements.

10

Index 500 Stock Portfolio

Table of Contents

Index 500 Stock Portfolio

| Common Stocks (98.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Energy continued |

||||

| *National-Oilwell Varco, Inc. |

28,500 | 2,971 | ||

| Noble Corp. |

21,450 | 2,092 | ||

| Occidental Petroleum Corp. |

133,640 | 7,735 | ||

| Peabody Energy Corp. |

42,500 | 2,056 | ||

| Rowan Companies, Inc. |

17,750 | 727 | ||

| Schlumberger, Ltd. |

188,834 | 16,040 | ||

| Smith International, Inc. |

32,100 | 1,882 | ||

| Spectra Energy Corp. |

101,236 | 2,628 | ||

| Sunoco, Inc. |

19,500 | 1,554 | ||

| *Transocean, Inc. |

46,151 | 4,891 | ||

| Valero Energy Corp. |

88,000 | 6,500 | ||

| *Weatherford International, Ltd. |

54,000 | 2,983 | ||

| The Williams Companies, Inc. |

96,000 | 3,036 | ||

| XTO Energy, Inc. |

61,399 | 3,690 | ||

| Total |

230,893 | |||

| Financials (20.4%) |

||||

| ACE, Ltd. |

52,200 | 3,264 | ||

| AFLAC, Inc. |

78,350 | 4,027 | ||

| The Allstate Corp. |

97,328 | 5,987 | ||

| Ambac Financial Group, Inc. |

16,300 | 1,421 | ||

| American Express Co. |

190,475 | 11,653 | ||

| American International Group, Inc. |

415,730 | 29,113 | ||

| Ameriprise Financial, Inc. |

37,655 | 2,394 | ||

| Aon Corp. |

47,000 | 2,003 | ||

| Apartment Investment & Management Co. — Class A |

15,600 | 787 | ||

| Archstone-Smith Trust |

35,700 | 2,110 | ||

| Assurant, Inc. |

15,900 | 937 | ||

| AvalonBay Communities, Inc. |

12,800 | 1,522 | ||

| Bank of America Corp. |

711,067 | 34,763 | ||

| The Bank of New York Co., Inc. |

121,153 | 5,021 | ||

| BB&T Corp. |

86,900 | 3,535 | ||

| The Bear Stearns Companies, Inc. |

19,095 | 2,673 | ||

| Boston Properties, Inc. |

19,100 | 1,951 | ||

| Capital One Financial Corp. |

66,229 | 5,195 | ||

| *CB Richard Ellis Group, Inc. |

30,000 | 1,095 | ||

| The Charles Schwab Corp. |

162,139 | 3,327 | ||

| Chicago Mercantile Exchange Holdings, Inc. |

5,700 | 3,046 | ||

| The Chubb Corp. |

64,300 | 3,481 | ||

| Cincinnati Financial Corp. |

27,475 | 1,192 | ||

| CIT Group, Inc. |

30,700 | 1,683 | ||

| Citigroup, Inc. |

792,648 | 40,654 | ||

| Comerica, Inc. |

24,950 | 1,484 | ||

| Commerce Bancorp, Inc. |

30,700 | 1,136 | ||

| Compass Bancshares, Inc. |

21,100 | 1,455 | ||

| Countrywide Financial Corp. |

95,100 | 3,457 | ||

| Developers Diversified Realty Corp. |

20,000 | 1,054 | ||

| *E*TRADE Financial Corp. |

68,400 | 1,511 | ||

| Equity Residential |

46,600 | 2,126 | ||

| Fannie Mae |

155,948 | 10,188 | ||

| Common Stocks (98.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Financials continued |

||||

| Federated Investors, Inc. — Class B |

14,200 | 544 | ||

| Fifth Third Bancorp |

88,134 | 3,505 | ||

| First Horizon National Corp. |

20,200 | 788 | ||

| Franklin Resources, Inc. |

26,450 | 3,504 | ||

| Freddie Mac |

105,986 | 6,433 | ||

| Genworth Financial, Inc. |

67,000 | 2,305 | ||

| The Goldman Sachs Group, Inc. |

65,500 | 14,197 | ||

| The Hartford Financial Services Group, Inc. |

50,750 | 4,999 | ||

| Host Hotels & Resorts, Inc. |

83,700 | 1,935 | ||

| Hudson City Bancorp, Inc. |

77,600 | 948 | ||

| Huntington Bancshares, Inc. |

37,842 | 861 | ||

| Janus Capital Group, Inc. |

29,729 | 828 | ||

| JPMorgan Chase & Co. |

547,397 | 26,520 | ||

| KeyCorp |

62,875 | 2,158 | ||

| Kimco Realty Corp. |

36,300 | 1,382 | ||

| Legg Mason, Inc. |

21,100 | 2,076 | ||

| Lehman Brothers Holdings, Inc. |

85,344 | 6,360 | ||

| Lincoln National Corp. |

43,430 | 3,081 | ||

| Loews Corp. |

71,401 | 3,640 | ||

| M&T Bank Corp. |

12,100 | 1,293 | ||

| Marsh & McLennan Companies, Inc. |

88,980 | 2,748 | ||

| Marshall & Ilsley Corp. |

41,500 | 1,977 | ||

| MBIA, Inc. |

20,950 | 1,304 | ||

| Mellon Financial Corp. |

66,668 | 2,933 | ||

| Merrill Lynch & Co., Inc. |

139,500 | 11,659 | ||

| MetLife, Inc. |

118,836 | 7,663 | ||

| MGIC Investment Corp. |

13,300 | 756 | ||

| Moody’s Corp. |

36,850 | 2,292 | ||

| Morgan Stanley |

168,913 | 14,168 | ||

| National City Corp. |

92,297 | 3,075 | ||

| Northern Trust Corp. |

30,250 | 1,943 | ||

| Plum Creek Timber Co., Inc. |

28,300 | 1,179 | ||

| PNC Financial Services Group, Inc. |

55,267 | 3,956 | ||

| Principal Financial Group, Inc. |

42,900 | 2,501 | ||

| The Progressive Corp. |

118,000 | 2,824 | ||

| ProLogis |

41,100 | 2,339 | ||

| Prudential Financial, Inc. |

74,900 | 7,283 | ||

| Public Storage, Inc. |

19,700 | 1,513 | ||

| Regions Financial Corp. |

112,890 | 3,737 | ||

| SAFECO Corp. |

17,050 | 1,062 | ||

| Simon Property Group, Inc. |

35,800 | 3,331 | ||

| SLM Corp. |

65,942 | 3,797 | ||

| Sovereign Bancorp, Inc. |

57,880 | 1,224 | ||

| State Street Corp. |

53,900 | 3,687 | ||

| SunTrust Banks, Inc. |

57,133 | 4,899 | ||

| Synovus Financial Corp. |

52,350 | 1,607 | ||

| T. Rowe Price Group, Inc. |

42,600 | 2,211 | ||

| Torchmark Corp. |

15,350 | 1,028 | ||

| The Travelers Companies, Inc. |

106,410 | 5,693 | ||

| U.S. Bancorp |

278,621 | 9,181 | ||

| Unum Group |

54,931 | 1,434 | ||

| Vornado Realty Trust |

20,900 | 2,296 | ||

| Wachovia Corp. |

306,647 | 15,716 | ||

| Common Stocks (98.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Financials continued |

||||

| Washington Mutual, Inc. |

142,454 | 6,074 | ||

| Wells Fargo & Co. |

535,160 | 18,822 | ||

| XL Capital, Ltd. — Class A |

29,800 | 2,512 | ||

| Zions Bancorporation |

17,600 | 1,354 | ||

| Total |

444,380 | |||

| Health Care (11.5%) | ||||

| Abbott Laboratories |

246,850 | 13,219 | ||

| Aetna, Inc. |

82,708 | 4,086 | ||

| Allergan, Inc. |

49,234 | 2,838 | ||

| AmerisourceBergen Corp. |

30,600 | 1,514 | ||

| *Amgen, Inc. |

185,817 | 10,274 | ||

| Applera Corp. — Applied Biosystems Group |

29,433 | 899 | ||

| *Barr Pharmaceuticals, Inc. |

17,600 | 884 | ||

| Bausch & Lomb, Inc. |

8,700 | 604 | ||

| Baxter International, Inc. |

104,400 | 5,882 | ||

| Becton, Dickinson and Co. |

39,250 | 2,924 | ||

| *Biogen Idec, Inc. |

54,790 | 2,931 | ||

| Biomet, Inc. |

39,345 | 1,799 | ||

| *Boston Scientific Corp. |

190,122 | 2,916 | ||

| Bristol-Myers Squibb Co. |

315,408 | 9,954 | ||

| C. R. Bard, Inc. |

16,500 | 1,363 | ||

| Cardinal Health, Inc. |

61,625 | 4,353 | ||

| *Celgene Corp. |

60,900 | 3,491 | ||

| CIGNA Corp. |

46,087 | 2,407 | ||

| *Coventry Health Care, Inc. |

25,100 | 1,447 | ||

| Eli Lilly and Co. |

158,106 | 8,835 | ||

| *Express Scripts, Inc. |

43,500 | 2,175 | ||

| *Forest Laboratories, Inc. |

50,966 | 2,327 | ||

| *Genzyme Corp. |

42,100 | 2,711 | ||

| *Gilead Sciences, Inc. |

149,600 | 5,800 | ||

| *Hospira, Inc. |

24,965 | 975 | ||

| *Humana, Inc. |

26,900 | 1,638 | ||

| IMS Health, Inc. |

31,467 | 1,011 | ||

| Johnson & Johnson |

464,137 | 28,601 | ||

| *King Pharmaceuticals, Inc. |

39,066 | 799 | ||

| *Laboratory Corp. of America Holdings |

18,800 | 1,471 | ||

| Manor Care, Inc. |

11,700 | 764 | ||

| McKesson Corp. |

47,305 | 2,821 | ||

| *Medco Health Solutions, Inc. |

44,872 | 3,500 | ||

| Medtronic, Inc. |

184,500 | 9,568 | ||

| Merck & Co., Inc. |

347,320 | 17,297 | ||

| *Millipore Corp. |

8,600 | 646 | ||

| Mylan Laboratories, Inc. |

39,800 | 724 | ||

| *Patterson Companies, Inc. |

22,300 | 831 | ||

| PerkinElmer, Inc. |

19,200 | 500 | ||

| Pfizer, Inc. |

1,124,634 | 28,758 | ||

| Quest Diagnostics, Inc. |

25,300 | 1,307 | ||

| Schering-Plough Corp. |

238,650 | 7,265 | ||

| *St. Jude Medical, Inc. |

54,200 | 2,249 | ||

| Stryker Corp. |

47,900 | 3,022 | ||

| *Tenet Healthcare Corp. |

75,750 | 493 | ||

| *Thermo Fisher Scientific, Inc. |

67,600 | 3,496 | ||

| UnitedHealth Group, Inc. |

214,744 | 10,982 | ||

| *Varian Medical Systems, Inc. |

20,400 | 867 | ||

The Accompanying Notes are an Integral Part of the Financial Statements.

Index 500 Stock Portfolio

11

Table of Contents

Index 500 Stock Portfolio

| Common Stocks (98.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Health Care continued | ||||

| *Waters Corp. |

16,200 | 962 | ||

| *Watson Pharmaceuticals, Inc. |

16,400 | 533 | ||

| *WellPoint, Inc. |

98,300 | 7,847 | ||

| Wyeth |

215,529 | 12,358 | ||

| *Zimmer Holdings, Inc. |

37,937 | 3,220 | ||

| Total |

250,138 | |||

| Industrials (11.2%) | ||||

| 3M Co. |

115,376 | 10,013 | ||

| *Allied Waste Industries, Inc. |

40,950 | 551 | ||

| American Standard Companies, Inc. |

28,200 | 1,663 | ||

| Avery Dennison Corp. |

14,650 | 974 | ||

| The Boeing Co. |

126,176 | 12,133 | ||

| Burlington Northern Santa Fe Corp. |

57,085 | 4,860 | ||

| C.H. Robinson Worldwide, Inc. |

27,400 | 1,439 | ||

| Caterpillar, Inc. |

102,576 | 8,032 | ||

| Cintas Corp. |

21,633 | 853 | ||

| Cooper Industries, Ltd. — Class A |

29,300 | 1,673 | ||

| CSX Corp. |

70,100 | 3,160 | ||

| Cummins, Inc. |

16,700 | 1,690 | ||

| Danaher Corp. |

38,200 | 2,884 | ||

| Deere & Co. |

36,060 | 4,354 | ||

| Dover Corp. |

32,767 | 1,676 | ||

| Eaton Corp. |

23,500 | 2,186 | ||

| Emerson Electric Co. |

127,400 | 5,962 | ||

| Equifax, Inc. |

23,300 | 1,035 | ||

| FedEx Corp. |

49,320 | 5,473 | ||

| Fluor Corp. |

14,100 | 1,570 | ||

| General Dynamics Corp. |

64,900 | 5,076 | ||

| General Electric Co. |

1,648,606 | 63,109 | ||

| Goodrich Corp. |

20,100 | 1,197 | ||

| Honeywell International, Inc. |

124,950 | 7,032 | ||

| Illinois Tool Works, Inc. |

66,000 | 3,577 | ||

| Ingersoll-Rand Co., Ltd. — Class A |

48,360 | 2,651 | ||

| ITT Corp. |

29,100 | 1,987 | ||

| L-3 Communications Holdings, Inc. |

20,000 | 1,948 | ||

| Lockheed Martin Corp. |

56,908 | 5,357 | ||

| Masco Corp. |

60,500 | 1,722 | ||

| *Monster Worldwide, Inc. |

20,967 | 862 | ||

| Norfolk Southern Corp. |

63,057 | 3,315 | ||

| Northrop Grumman Corp. |

55,320 | 4,308 | ||

| PACCAR, Inc. |

39,810 | 3,465 | ||

| Pall Corp. |

19,650 | 904 | ||

| Parker Hannifin Corp. |

18,575 | 1,819 | ||

| Pitney Bowes, Inc. |

35,237 | 1,650 | ||

| Precision Castparts Corp. |

22,000 | 2,670 | ||

| R. R. Donnelley & Sons Co. |

35,234 | 1,533 | ||

| Raytheon Co. |

71,100 | 3,832 | ||

| Robert Half International, Inc. |

26,640 | 972 | ||

| Rockwell Automation, Inc. |

25,250 | 1,753 | ||

| Common Stocks (98.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Industrials continued | ||||

| Rockwell Collins, Inc. |

26,850 | 1,897 | ||

| Ryder System, Inc. |

9,800 | 527 | ||

| Southwest Airlines Co. |

125,167 | 1,866 | ||

| *Terex Corp. |

16,500 | 1,341 | ||

| Textron, Inc. |

20,150 | 2,219 | ||

| Tyco International, Ltd. |

317,708 | 10,735 | ||

| Union Pacific Corp. |

43,360 | 4,993 | ||

| United Parcel Service, Inc. — Class B |

169,700 | 12,388 | ||

| United Technologies Corp. |

159,334 | 11,302 | ||

| W.W. Grainger, Inc. |

11,400 | 1,061 | ||

| Waste Management, Inc. |

82,885 | 3,237 | ||

| Total |

244,486 | |||

| Information Technology (15.2%) | ||||

| *ADC Telecommunications, Inc. |

18,764 | 344 | ||

| *Adobe Systems, Inc. |

94,250 | 3,784 | ||

| *Advanced Micro Devices, Inc. |

88,200 | 1,261 | ||

| *Affiliated Computer Services, Inc. — Class A |

15,900 | 902 | ||

| *Agilent Technologies, Inc. |

63,437 | 2,439 | ||

| Altera Corp. |

56,911 | 1,259 | ||

| Analog Devices, Inc. |

52,457 | 1,974 | ||

| *Apple, Inc. |

138,600 | 16,915 | ||

| Applied Materials, Inc. |

221,400 | 4,399 | ||

| *Autodesk, Inc. |

37,068 | 1,745 | ||

| Automatic Data Processing, Inc. |

88,650 | 4,297 | ||

| *Avaya, Inc. |

72,116 | 1,214 | ||

| *BMC Software, Inc. |

32,660 | 990 | ||

| *Broadcom Corp. — Class A |

74,600 | 2,182 | ||

| CA, Inc. |

65,892 | 1,702 | ||

| *Ciena Corp. |

13,685 | 494 | ||

| *Cisco Systems, Inc. |

972,900 | 27,095 | ||

| *Citrix Systems, Inc. |

28,920 | 974 | ||

| *Cognizant Technology Solutions Corp. — Class A |

23,000 | 1,727 | ||

| *Computer Sciences Corp. |

27,750 | 1,641 | ||

| *Compuware Corp. |

48,257 | 572 | ||

| *Convergys Corp. |

21,950 | 532 | ||

| *Corning, Inc. |

252,000 | 6,439 | ||

| *Dell, Inc. |

364,033 | 10,393 | ||

| *eBay, Inc. |

181,400 | 5,837 | ||

| *Electronic Arts, Inc. |

49,700 | 2,352 | ||

| Electronic Data Systems Corp. |

81,567 | 2,262 | ||

| *EMC Corp. |

336,274 | 6,087 | ||

| Fidelity National Information Services, Inc. |

26,200 | 1,422 | ||

| First Data Corp. |

120,932 | 3,951 | ||

| *Fiserv, Inc. |

26,925 | 1,529 | ||

| *Google, Inc. — Class A |

34,900 | 18,266 | ||

| Hewlett-Packard Co. |

419,626 | 18,724 | ||

| Intel Corp. |

930,963 | 22,120 | ||

| International Business Machines Corp. |

218,939 | 23,043 | ||

| *Intuit, Inc. |

54,900 | 1,651 | ||

| Jabil Circuit, Inc. |

28,767 | 635 | ||

| *JDS Uniphase Corp. |

33,850 | 455 | ||

| Common Stocks (98.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Information Technology continued | ||||

| *Juniper Networks, Inc. |

90,700 | 2,283 | ||

| KLA-Tencor Corp. |

30,700 | 1,687 | ||

| *Lexmark International, Inc. — Class A |

15,200 | 750 | ||

| Linear Technology Corp. |

40,650 | 1,471 | ||

| *LSI Logic Corp. |

123,400 | 927 | ||

| Maxim Integrated Products, Inc. |

51,400 | 1,717 | ||

| *MEMC Electronic Materials, Inc. |

36,000 | 2,200 | ||

| *Micron Technology, Inc. |

121,150 | 1,518 | ||

| Microsoft Corp. |

1,348,992 | 39,755 | ||

| Molex, Inc. |

22,750 | 683 | ||

| Motorola, Inc. |

370,877 | 6,565 | ||

| National Semiconductor Corp. |

44,686 | 1,263 | ||

| *NCR Corp. |

28,800 | 1,513 | ||

| *Network Appliance, Inc. |

59,500 | 1,737 | ||

| *Novell, Inc. |

55,800 | 435 | ||

| *Novellus Systems, Inc. |

20,200 | 573 | ||

| *NVIDIA Corp. |

58,200 | 2,404 | ||

| *Oracle Corp. |

634,325 | 12,503 | ||

| Paychex, Inc. |

54,435 | 2,129 | ||

| *PMC-Sierra, Inc. |

34,200 | 264 | ||

| *QLogic Corp. |

25,500 | 425 | ||

| QUALCOMM, Inc. |

267,134 | 11,591 | ||

| *SanDisk Corp. |

36,600 | 1,791 | ||

| *Sanmina-SCI Corp. |

84,900 | 266 | ||

| *Solectron Corp. |

144,900 | 533 | ||

| *Sun Microsystems, Inc. |

572,097 | 3,009 | ||

| *Symantec Corp. |

144,354 | 2,916 | ||

| Tektronix, Inc. |

13,060 | 441 | ||

| *Tellabs, Inc. |

70,192 | 755 | ||

| *Teradyne, Inc. |

30,450 | 535 | ||

| Texas Instruments, Inc. |

229,700 | 8,644 | ||

| *Unisys Corp. |

55,750 | 510 | ||

| *VeriSign, Inc. |

39,300 | 1,247 | ||

| Western Union Co. |

123,832 | 2,579 | ||

| *Xerox Corp. |

150,200 | 2,776 | ||

| Xilinx, Inc. |

47,700 | 1,277 | ||

| *Yahoo!, Inc. |

193,800 | 5,258 | ||

| Total |

330,538 | |||

| Materials (3.1%) |

||||

| Air Products and Chemicals, Inc. |

34,667 | 2,786 | ||

| Alcoa, Inc. |

139,307 | 5,646 | ||

| Allegheny Technologies, Inc. |

16,417 | 1,722 | ||

| Ashland, Inc. |

9,000 | 576 | ||

| Ball Corp. |

16,332 | 868 | ||

| Bemis Co., Inc. |

16,800 | 557 | ||

| The Dow Chemical Co. |

152,709 | 6,753 | ||

| E. I. du Pont de Nemours and Co. |

148,028 | 7,525 | ||

| Eastman Chemical Co. |

13,525 | 870 | ||

| Ecolab, Inc. |

28,100 | 1,200 | ||

| Freeport-McMoRan Copper & Gold, Inc. |

60,188 | 4,985 | ||

| *Hercules, Inc. |

18,700 | 367 | ||

The Accompanying Notes are an Integral Part of the Financial Statements.

12

Index 500 Stock Portfolio

Table of Contents

Index 500 Stock Portfolio

| Common Stocks (98.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Materials continued |

||||

| International Flavors & Fragrances, Inc. |

12,400 | 647 | ||

| International Paper Co. |

69,766 | 2,724 | ||

| MeadWestvaco Corp. |

29,579 | 1,045 | ||

| Monsanto Co. |

87,106 | 5,883 | ||

| Newmont Mining Corp. |

72,280 | 2,823 | ||

| Nucor Corp. |

48,332 | 2,835 | ||

| *Pactiv Corp. |

20,900 | 667 | ||

| PPG Industries, Inc. |

26,267 | 1,999 | ||

| Praxair, Inc. |

51,100 | 3,679 | ||

| Rohm and Haas Co. |

22,780 | 1,246 | ||

| Sealed Air Corp. |

25,842 | 802 | ||

| Sigma-Aldrich Corp. |

21,000 | 896 | ||

| Temple-Inland, Inc. |

17,000 | 1,046 | ||

| United States Steel Corp. |

18,950 | 2,061 | ||

| Vulcan Materials Co. |

15,300 | 1,752 | ||

| Weyerhaeuser Co. |

34,580 | 2,729 | ||

| Total |

66,689 | |||

| Telecommunication Services (3.7%) | ||||

| ALLTEL Corp. |

55,357 | 3,739 | ||

| AT&T, Inc. |

987,975 | 41,002 | ||

| CenturyTel, Inc. |

17,600 | 863 | ||

| Citizens Communications Co. |

54,900 | 838 | ||

| Embarq Corp. |

24,230 | 1,535 | ||

| *Qwest Communications International, Inc. |

248,935 | 2,415 | ||

| Sprint Nextel Corp. |

463,702 | 9,603 | ||

| Verizon Communications, Inc. |

465,242 | 19,154 | ||

| Windstream Corp. |

76,392 | 1,128 | ||

| Total |

80,277 | |||

| Utilities (3.5%) | ||||

| *The AES Corp. |

107,000 | 2,341 | ||

| *Allegheny Energy, Inc. |

26,600 | 1,376 | ||

| Ameren Corp. |

33,067 | 1,621 | ||

| Common Stocks (98.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Utilities continued | ||||

| American Electric Power Co., Inc. |

63,940 | 2,880 | ||

| CenterPoint Energy, Inc. |

51,362 | 894 | ||

| CMS Energy Corp. |

36,000 | 619 | ||

| Consolidated Edison, Inc. |

43,350 | 1,956 | ||

| Constellation Energy Group |

29,000 | 2,528 | ||

| Dominion Resources, Inc. |

56,095 | 4,842 | ||

| DTE Energy Co. |

28,250 | 1,362 | ||

| Duke Energy Corp. |

201,773 | 3,692 | ||

| *Dynegy, Inc. |

64,500 | 609 | ||

| Edison International |

52,220 | 2,931 | ||

| Entergy Corp. |

31,609 | 3,393 | ||

| Exelon Corp. |

107,824 | 7,827 | ||

| FirstEnergy Corp. |

48,865 | 3,163 | ||

| FPL Group, Inc. |

65,114 | 3,695 | ||

| Integrys Energy Group, Inc. |

12,132 | 615 | ||

| KeySpan Corp. |

28,200 | 1,184 | ||

| Nicor, Inc. |

7,250 | 311 | ||

| NiSource, Inc. |

43,873 | 909 | ||

| PG&E Corp. |

56,325 | 2,552 | ||

| Pinnacle West Capital Corp. |

16,100 | 642 | ||

| PPL Corp. |

61,668 | 2,885 | ||

| Progress Energy, Inc. |

40,692 | 1,855 | ||

| Public Service Enterprise Group, Inc. |

40,536 | 3,558 | ||

| Questar Corp. |

27,600 | 1,459 | ||

| Sempra Energy |

42,302 | 2,506 | ||

| The Southern Co. |

120,500 | 4,132 | ||

| TECO Energy, Inc. |

33,600 | 577 | ||

| TXU Corp. |

73,530 | 4,948 | ||

| Xcel Energy, Inc. |

65,520 | 1,341 | ||

| Total |

75,203 | |||

| Total Common Stocks |

2,139,638 | |||

| Money Market Investments (1.6%) |

Shares/ $ Par |

Value $ (000’s) | ||

| Federal Government & Agencies (0.1%) | ||||

| (b)Fannie Mae, |

3,300,000 | 3,261 | ||

| Total |

3,261 | |||

| Finance Lessors (0.5%) | ||||

| (b)Ranger Funding Co. LLC, 5.34%, 7/12/07 |

10,000,000 | 9,982 | ||

| Total |

9,982 | |||

| Finance Services (0.5%) | ||||

| (b)Ciesco LP, 5.28%, 8/16/07 |

10,000,000 | 9,931 | ||

| Total |

9,931 | |||

| National Commercial Banks (0.1%) | ||||

| (b)UBS Finance LLC, 5.35%, 7/2/07 |

1,400,000 | 1,400 | ||

| Total |

1,400 | |||

| Short Term Business Credit (0.4%) | ||||

| (b)Sheffield Receivables, 5.35%, 7/10/07 |

10,000,000 | 9,985 | ||

| Total |

9,985 | |||

| Total Money Market Investments (Cost: $34,558) |

34,559 | |||

| Total Investments (99.9%) (Cost $1,419,010)(a) |

2,174,197 | |||

| Other Assets, Less Liabilities (0.1%) |

2,009 | |||

| Net Assets (100.0%) |

2,176,206 | |||

| * | Non-Income Producing |

| (a) | At June 30, 2007 the aggregate cost of securities for federal tax purposes (in thousands) was $1,419,010 and the net unrealized appreciation of investments based on that cost was $755,187 which is comprised of $842,012 aggregate gross unrealized appreciation and $86,825 aggregate gross unrealized depreciation. |

| (b) | All or a portion of the securities have been committed as collateral for open futures positions or when-issued securities. Information regarding open futures contracts as of period end is summarized below. |

| Issuer (000’s) | Number of Contracts |

Expiration Date |

Unrealized Appreciation/ (Depreciation) (000’s) |

|||||

| S&P 500 Index Futures (Long) |

91 | 9/07 | $ | (173 | ) | |||

| (Total Notional Value at June 30, 2007, $34,475) |

||||||||

The Accompanying Notes are an Integral Part of the Financial Statements.

Index 500 Stock Portfolio

13

Table of Contents

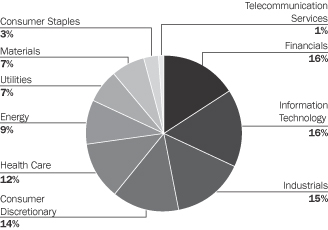

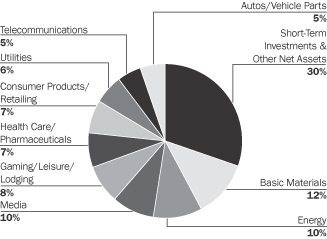

Capital Guardian Domestic Equity Portfolio

Sector Allocation 6/30/07

Sector Allocation is based on Net Assets.

Sector Allocation is subject to change.

Expense Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Portfolio expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2007 to June 30, 2007).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.