How To Get More Information

Northwestern Mutual Express:

1-800-519-4665

Get up-to-date information about your Variable CompLife policy at your convenience with your policy number and your Personal Identification Number (PIN). Call toll-free to review policy values, fund performance information, and request a change to the allocations of your existing assets or future premiums/dividends.

Information on the Internet:

Northwestern Mutual Financial Network

WWW.NMFN.COM

To obtain current performance information and information about Northwestern Mutual, visit us on our website. You can also visit us at our customer service section from our Web site for information on Policy values and current fund performance. This site also allows you to view past confirmation and policy statements, as well as transfer funds online.

To sign up for this service please call 1-866-424-2609 between 7 a.m. – 6 p.m. Central Time Monday – Friday. As always, your Investment Services representative of the Northwestern Mutual Financial Network is available to answer any questions you have about your variable life insurance policy or any of our products.

For Variable Executive Life and Variable Joint Life inforce policy service questions please call 1-866-464-3800 between 7:30 a.m. –

5 p.m. Central Time Monday – Friday.

Contents

| Performance Summary for the Northwestern Mutual Variable Life Account |

| Northwestern Mutual Series Fund, Inc. - Annual Report |

| Fidelity VIP Mid Cap Portfolio - Annual Report (This report follows the end of the Northwestern Mutual Series Fund, Inc.) |

| Russell Investment Funds - Annual Report (This report follows the end of the Fidelity VIP Mid Cap Portfolio.) |

| Northwestern Mutual Variable Life Account |

| Prospectus Supplements |

The performance data quoted represents past performance. Past performance is historical and does not guarantee future performance. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Current performances may be lower or higher than the performance data quoted. For the most recent month-end performance information visit www.nmfn.com.

i

Performance Summary as of December 31, 2006

Variable Life — Policies Issued Before October 11, 1995

| Total return(j) (as of 12/31/06) |

Small Cap Growth Stock Division |

T. Rowe Price Small Cap Value Division |

Aggressive Growth Stock Division |

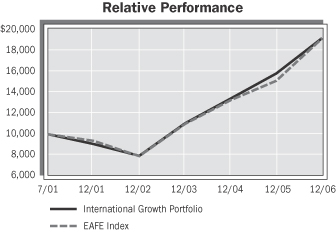

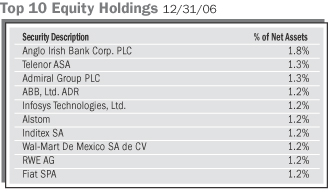

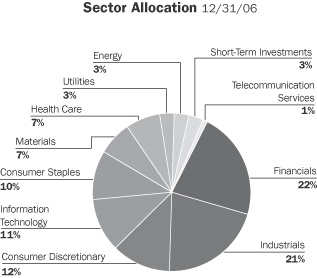

International Growth Division |

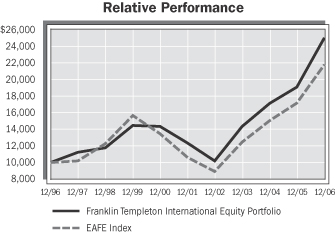

Franklin Templeton International Equity Division |

AllianceBernstein Mid Cap Value Division |

Index 400 Stock Division |

||||||||||||||

| 1 year |

6.10 | % | 15.92 | % | 3.83 | % | 20.81 | % | 30.18 | % | 13.87 | % | 9.44 | % | |||||||

| 5 years |

47.93 | % | 92.13 | % | 20.35 | % | 105.39 | % | 95.47 | % | — | 60.44 | % | ||||||||

| Annualized |

8.15 | % | 13.95 | % | 3.77 | % | 15.48 | % | 14.34 | % | — | 9.92 | % | ||||||||

| 10 years(g) |

— | — | 74.08 | % | — | 132.91 | % | — | — | ||||||||||||

| Annualized |

— | — | 5.70 | % | — | 8.82 | % | — | — | ||||||||||||

| Since division inception in Variable Life Account |

129.78 | %(b) | 94.93 | %(c) | — | 85.54 | %(c) | — | 86.25 | %(d) | 96.32 | %(b) | |||||||||

| Annualized |

11.72 | % | 13.11 | % | — | 12.08 | % | — | 18.48 | % | 9.41 | % | |||||||||

| Since portfolio inception(a) |

177.48 | %(b) | — | — | — | — | — | 106.88 | %(b) | ||||||||||||

| Annualized |

14.23 | % | — | — | — | — | — | 9.94 | % | ||||||||||||

| Current Yield(h) |

|||||||||||||||||||||

| Variable Complife — Polices Issued On or After October 11, 1995** | |||||||||||||||||||||

| 1 year |

6.21 | % | 16.03 | % | 3.93 | % | 20.93 | % | 30.31 | % | 13.98 | % | 9.55 | % | |||||||

| 5 years |

48.67 | % | 93.08 | % | 20.95 | % | 106.42 | % | 96.44 | % | — | 61.24 | % | ||||||||

| Annualized |

8.25 | % | 14.06 | % | 3.88 | % | 15.60 | % | 14.46 | % | — | 10.03 | % | ||||||||

| 10 years(g) |

— | — | 75.85 | % | — | 135.27 | % | — | — | ||||||||||||

| Annualized |

— | — | 5.81 | % | — | 8.93 | % | — | — | ||||||||||||

| Since division inception in Variable Life Account |

131.52 | %(b) | 95.98 | %(c) | — | 86.54 | %(c) | — | 86.93 | %(d) | 97.81 | %(b) | |||||||||

| Annualized |

11.84 | % | 13.22 | % | — | 12.19 | % | — | 18.59 | % | 9.52 | % | |||||||||

| Since portfolio inception(a) |

179.63 | %(b) | — | — | — | — | — | 108.48 | %(b) | ||||||||||||

| Annualized |

14.34 | % | — | — | — | — | — | 10.05 | % | ||||||||||||

| Current Yield(h) |

|||||||||||||||||||||

All total return figures shown above reflect the deduction of portfolio expenses, as well as mortality and expense risk charges for each product. Returns do not reflect deductions such as sales charges or premium taxes, administrative charges, surrender charges or cost of insurance charges. These deductions would significantly impact the returns if they were included.

| (a) | Returns stated are as of the inception date of the portfolio which preceeds availability in the Variable Life Account. See the following footnotes for portfolio inception dates. |

| (b) | Inception date of this division in the Variable Life Account was 6/30/99. Actual fund inception was 4/30/99. Performance quoted prior to 6/30/99 is based on actual investment experience, adjusted for expenses of the product and premium charges. |

| (c) | Inception date of 7/31/01. |

| (d) | Inception date of 5/1/03. |

| (e) | Inception date of this division in the Variable Life Account was 5/1/03. Actual fund inception was 12/28/98. Performance quoted prior to 5/1/03 is based on actual investment experience, adjusted for expenses of the product and premium charges. |

| (f) | Inception date of this division in the Variable Life Account was 6/30/99. Actual fund inception was 1/2/97. Performance quoted prior to 6/30/99 is based on actual investment experience, adjusted for expenses of the product and premium charges. |

| (g) | 10 year return for this division in the Variable Life Account. |

| (h) | For the seven-day period ended December 31, 2006, the Money Market Portfolio’s yield was 5.05% and was equivalent to a compound effective yield of 5.17%. The seven-day yield does not include deductions that are included in the separate accounts. The yield quotation more closely reflects the current earnings of the Money Market Portfolio than the total return quotation. |

| (j) | Returns shown include any fee waivers in effect and deductions for all Fund expenses. In the absence of fee waivers, total return would be reduced. For the Money Market Division, total returns include the effect of a fee waiver from December 2, 2002 through December 31, 2004. For the Franklin Templeton International Equity Division, total returns include the effect of a fee waiver that began November 15, 2006. |

| ** | Product inception date of 10/11/95. Returns prior to 10/11/95 were reflected using the actual investment experience of each division, adjusted for the expenses of the product and premium charges. |

| *** | Product inception date of 3/2/98. (For use with non-tax qualified executive benefit plans.) Returns prior to 3/2/98 were reflected using the actual investment experience of each division adjusted for expenses of the product and premium charges. |

| **** | Product inception date of December 28, 1998. (For use primarily in estate planning, provides coverage on two insureds with a death benefit payable on the second death). Returns prior to 12/28/98 were reflected using the actual investment experience of each division adjusted for expenses of the product and premium charges. |

ii

| Janus Capital Appreciation Division |

Growth Stock Division |

Large Cap Core Stock Division |

Capital Guardian Domestic Equity Division |

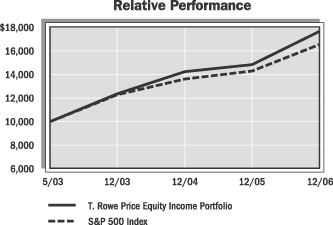

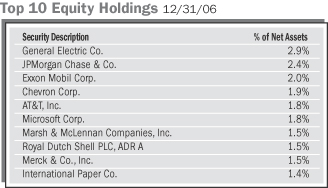

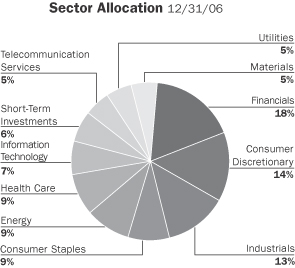

T. Rowe Price Equity Income Division |

Index 500 Stock Division |

Asset Allocation Division |

Balanced Division |

High Yield Bond Division |

Select Bond Division |

|||||||||||||||||||

| 4.31 | % | 8.97 | % | 10.89 | % | 15.93 | % | 18.50 | % | 14.99 | % | 9.32 | % | 9.82 | % | 9.18 | % | 3.18 | % | |||||||||

| — | 14.66 | % | 12.68 | % | 50.67 | % | — | 29.76 | % | 35.47 | % | 30.23 | % | 52.13 | % | 27.03 | % | |||||||||||

| — | 2.77 | % | 2.42 | % | 8.54 | % | — | 5.35 | % | 6.26 | % | 5.42 | % | 8.75 | % | 4.90 | % | |||||||||||

| — | 86.62 | % | 60.64 | % | — | — | 108.84 | % | — | 95.30 | % | 66.65 | % | 73.07 | % | |||||||||||||

| — | 6.44 | % | 4.85 | % | — | — | 7.64 | % | — | 6.92 | % | 5.24 | % | 5.64 | % | |||||||||||||

| 71.89 | %(d) | — | — | 46.94 | %(c) | 72.54 | %(d) | — | 32.23 | %(c) | — | — | — | |||||||||||||||

| 15.91 | % | — | — | 7.36 | % | 16.03 | % | — | 5.29 | % | — | — | — | |||||||||||||||

| — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||

| — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||

| 4.41 | % | 9.08 | % | 11.00 | % | 16.04 | % | 18.62 | % | 15.11 | % | 9.42 | % | 9.93 | % | 9.28 | % | 3.28 | % | |||||||||

| — | 15.23 | % | 13.24 | % | 51.42 | % | — | 30.40 | % | 36.15 | % | 30.88 | % | 52.88 | % | 27.66 | % | |||||||||||

| — | 2.88 | % | 2.52 | % | 8.65 | % | — | 5.45 | % | 6.37 | % | 5.53 | % | 8.86 | % | 5.01 | % | |||||||||||

| — | 88.51 | % | 62.28 | % | — | — | 110.96 | % | — | 97.28 | % | 68.33 | % | 74.83 | % | |||||||||||||

| — | 6.54 | % | 4.96 | % | — | — | 7.75 | % | — | 7.03 | % | 5.35 | % | 5.75 | % | |||||||||||||

| 72.52 | %(d) | — | — | 47.74 | %(c) | 73.17 | %(d) | — | 32.95 | %(c) | — | — | — | |||||||||||||||

| 16.03 | % | — | — | 7.47 | % | 16.15 | % | — | 5.40 | % | — | — | — | |||||||||||||||

| — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||

| — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||

iii

Performance Summary, continued

Variable Life — Policies Issued Before October 11, 1995

| Total return(j) (as of 12/31/06) |

Money Market Division |

Fidelity VIP Mid Cap Division |

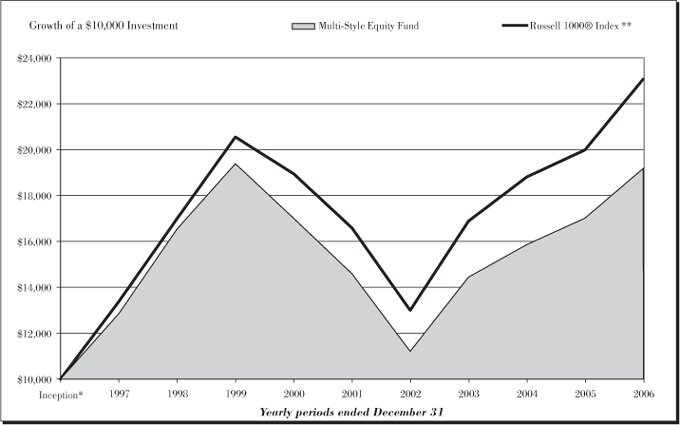

Russell |

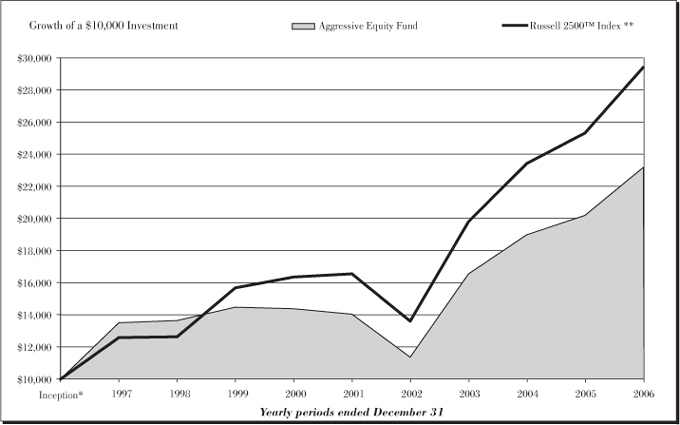

Russell Aggressive Equity Division |

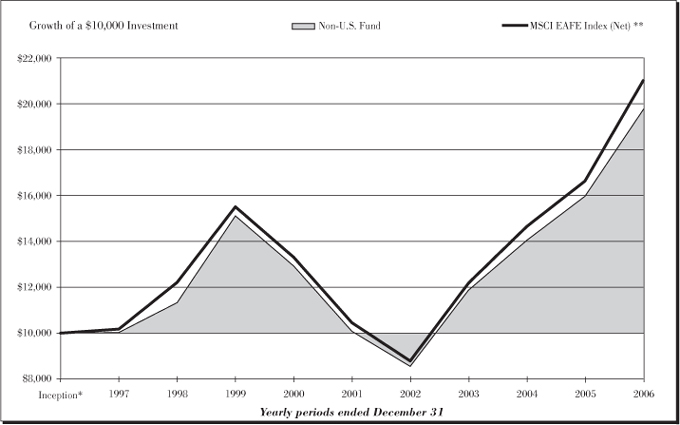

Russell Non-U.S. Division |

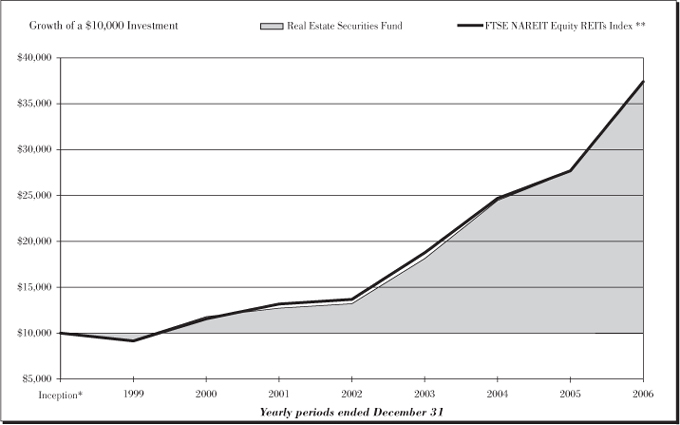

Russell Real Estate Securities Division |

Russell Core Bond Division |

||||||||||||||

| 1 year |

4.29 | % | 11.79 | % | 12.13 | % | 14.16 | % | 22.97 | % | 35.10 | % | 3.15 | % | |||||||

| 5 years |

9.02 | % | 98.94 | %(e) | 27.13 | % | 59.67 | % | 89.40 | % | 185.08 | % | 23.74 | % | |||||||

| Annualized |

1.74 | % | 14.75 | % | 4.92 | % | 9.81 | % | 13.63 | % | 23.31 | % | 4.35 | % | |||||||

| 10 years(g) |

35.84 | % | — | — | — | — | — | — | |||||||||||||

| Annualized |

3.11 | % | — | — | — | — | — | — | |||||||||||||

| Since division inception in Variable Life Account |

— | 127.08 | %(e) | (1.74 | %)(f) | 59.79 | %(f) | 54.70 | %(f) | 261.88 | %(b) | 44.39 | %(f) | ||||||||

| Annualized |

— | 25.05 | % | (0.23 | %) | 6.45 | % | 5.99 | % | 18.70 | % | 5.02 | % | ||||||||

| Since portfolio inception(a) |

— | 284.81 | %(e) | 79.11 | %(f) | 116.43 | %(f) | 84.35 | %(f) | 256.03 | %(b) | 65.33 | %(f) | ||||||||

| Annualized |

— | 18.33 | % | 6.01 | % | 8.03 | % | 6.31 | % | 18.00 | % | 5.16 | % | ||||||||

| Current Yield(h) |

5.17 | % | |||||||||||||||||||

| Variable Complife — Polices Issued On or After October 11, 1995** | |||||||||||||||||||||

| 1 year |

4.39 | % | 11.90 | % | 12.24 | % | 14.28 | % | 23.09 | % | 35.23 | % | 3.26 | % | |||||||

| 5 years |

9.56 | % | 99.93 | %(e) | 27.77 | % | 60.46 | % | 90.34 | % | 186.50 | % | 24.35 | % | |||||||

| Annualized |

1.84 | % | 14.86 | % | 5.02 | % | 9.92 | % | 13.74 | % | 23.43 | % | 4.46 | % | |||||||

| 10 years(g) |

37.22 | % | — | — | — | — | — | — | |||||||||||||

| Annualized |

3.21 | % | — | — | — | — | — | — | |||||||||||||

| Since division inception in Variable Life Account |

— | 127.91 | %(e) | (1.00 | %)(f) | 61.01 | %(f) | 55.86 | %(f) | 264.61 | %(b) | 45.48 | %(f) | ||||||||

| Annualized |

— | 25.18 | % | (0.13 | %) | 6.55 | % | 6.09 | % | 18.81 | % | 5.12 | % | ||||||||

| Since portfolio inception(a) |

— | 287.93 | %(e) | 80.93 | %(f) | 118.63 | %(f) | 86.21 | %(f) | 258.79 | %(b) | 67.00 | %(f) | ||||||||

| Annualized |

— | 18.45 | % | 6.11 | % | 8.14 | % | 6.42 | % | 18.12 | % | 5.27 | % | ||||||||

| Current Yield(h) |

5.17 | % | |||||||||||||||||||

All total return figures shown above reflect the deduction of portfolio expenses, as well as mortality and expense risk charges for each product. Returns do not reflect deductions such as sales charges or premium taxes, administrative charges, surrender charges or cost of insurance charges. These deductions would significantly impact the returns if they were included.

| (a) | Returns stated are as of the inception date of the portfolio which preceeds availability in the Variable Life Account. See the following footnotes for portfolio inception dates. |

| (b) | Inception date of this division in the Variable Life Account was 6/30/99. Actual fund inception was 4/30/99. Performance quoted prior to 6/30/99 is based on actual investment experience, adjusted for expenses of the product and premium charges. |

| (c) | Inception date of 7/31/01. |

| (d) | Inception date of 5/1/03. |

| (e) | Inception date of this division in the Variable Life Account was 5/1/03. Actual fund inception was 12/28/98. Performance quoted prior to 5/1/03 is based on actual investment experience, adjusted for expenses of the product and premium charges. |

| (f) | Inception date of this division in the Variable Life Account was 6/30/99. Actual fund inception was 1/2/97. Performance quoted prior to 6/30/99 is based on actual investment experience, adjusted for expenses of the product and premium charges. |

| (g) | 10 year return for this division in the Variable Life Account. |

| (h) | For the seven-day period ended December 31, 2006, the Money Market Portfolio’s yield was 5.05% and was equivalent to a compound effective yield of 5.17%. The seven-day yield does not include deductions that are included in the separate accounts. The yield quotation more closely reflects the current earnings of the Money Market Portfolio than the total return quotation. |

| (j) | Returns shown include any fee waivers in effect and deductions for all Fund expenses. In the absence of fee waivers, total return would be reduced. For the Money Market Division, total returns include the effect of a fee waiver from December 2, 2002 through December 31, 2004. For the Franklin Templeton International Equity Division, total returns include the effect of a fee waiver that began November 15, 2006. |

| ** | Product inception date of 10/11/95. Returns prior to 10/11/95 were reflected using the actual investment experience of each division, adjusted for the expenses of the product and premium charges. |

| *** | Product inception date of 3/2/98. (For use with non-tax qualified executive benefit plans.) Returns prior to 3/2/98 were reflected using the actual investment experience of each division adjusted for expenses of the product and premium charges. |

| **** | Product inception date of December 28, 1998. (For use primarily in estate planning, provides coverage on two insureds with a death benefit payable on the second death). Returns prior to 12/28/98 were reflected using the actual investment experience of each division adjusted for expenses of the product and premium charges. |

iv

Performance Summary, continued as of December 31, 2006

Variable Executive Life — Policies First Offered on March 2, 1998***

| Total return(j) (as of 12/31/06) |

Small Cap Growth Stock Division |

T. Rowe Price Small Cap Value Division |

Aggressive Growth Stock Division |

International Growth Division |

Franklin Templeton International Equity Division |

AllianceBernstein Mid Cap Value Division |

Index 400 Stock Division |

||||||||||||||

| 1 year |

6.68 | % | 16.55 | % | 4.40 | % | 21.48 | % | 30.90 | % | 14.49 | % | 10.04 | % | |||||||

| 5 years |

52.95 | % | 98.64 | % | 24.43 | % | 112.36 | % | 102.09 | % | — | 65.88 | % | ||||||||

| Annualized |

8.87 | % | 14.71 | % | 4.47 | % | 16.26 | % | 15.11 | % | — | 10.65 | % | ||||||||

| 10 years(g) |

— | — | 86.41 | % | — | 149.40 | % | — | — | ||||||||||||

| Annualized |

— | — | 6.43 | % | — | 9.57 | % | — | — | ||||||||||||

| Since division inception in Variable Life Account |

141.79 | %(b) | 102.13 | %(c) | — | 92.40 | %(c) | — | 90.79 | %(d) | 106.58 | %(b) | |||||||||

| Annualized |

12.49 | % | 13.87 | % | — | 12.84 | % | — | 19.25 | % | 10.15 | % | |||||||||

| Since portfolio inception(a) |

192.33 | %(b) | — | — | — | — | — | 117.94 | %(b) | ||||||||||||

| Annualized |

15.01 | % | — | — | — | — | — | 10.69 | % | ||||||||||||

| Current Yield(h) |

|||||||||||||||||||||

| Variable Joint Life — Policies First Offered on December 28, 1998**** | |||||||||||||||||||||

| 1 year |

6.68 | % | 16.55 | % | 4.40 | % | 21.48 | % | 30.90 | % | 14.49 | % | 10.04 | % | |||||||

| 5 years |

52.95 | % | 98.64 | % | 24.43 | % | 112.36 | % | 102.09 | % | — | 65.88 | % | ||||||||

| Annualized |

8.87 | % | 14.71 | % | 4.47 | % | 16.26 | % | 15.11 | % | — | 10.65 | % | ||||||||

| 10 years(g) |

— | — | 86.41 | % | — | 149.40 | % | — | — | ||||||||||||

| Annualized |

— | — | 6.43 | % | — | 9.57 | % | — | — | ||||||||||||

| Since division inception in Variable Life Account |

141.79 | %(b) | 102.13 | %(c) | — | 92.40 | %(c) | — | 90.79 | %(d) | 106.58 | %(b) | |||||||||

| Annualized |

12.49 | % | 13.87 | % | — | 12.84 | % | — | 19.25 | % | 10.15 | % | |||||||||

| Since portfolio inception(a) |

192.33 | %(b) | — | — | — | — | — | 117.94 | %(b) | ||||||||||||

| Annualized |

15.01 | % | — | — | — | — | — | 10.69 | % | ||||||||||||

| Current Yield(h) |

|||||||||||||||||||||

All total return figures shown above reflect the deduction of portfolio expenses, as well as mortality and expense risk charges for each product. Returns do not reflect deductions such as sales charges or premium taxes, administrative charges, surrender charges or cost of insurance charges. These deductions would significantly impact the returns if they were included.

| (a) | Returns stated are as of the inception date of the portfolio which preceeds availability in the Variable Life Account. See the following footnotes for portfolio inception dates. |

| (b) | Inception date of this division in the Variable Life Account was 6/30/99. Actual fund inception was 4/30/99. Performance quoted prior to 6/30/99 is based on actual investment experience, adjusted for expenses of the product and premium charges. |

| (c) | Inception date of 7/31/01. |

| (d) | Inception date of 5/1/03. |

| (e) | Inception date of this division in the Variable Life Account was 5/1/03. Actual fund inception was 12/28/98. Performance quoted prior to 5/1/03 is based on actual investment experience, adjusted for expenses of the product and premium charges. |

| (f) | Inception date of this division in the Variable Life Account was 6/30/99. Actual fund inception was 1/2/97. Performance quoted prior to 6/30/99 is based on actual investment experience, adjusted for expenses of the product and premium charges. |

| (g) | 10 year return for this division in the Variable Life Account. |

| (h) | For the seven-day period ended December 31, 2006, the Money Market Portfolio’s yield was 5.05% and was equivalent to a compound effective yield of 5.17%. The seven-day yield does not include deductions that are included in the separate accounts. The yield quotation more closely reflects the current earnings of the Money Market Portfolio than the total return quotation. |

| (j) | Returns shown include any fee waivers in effect and deductions for all Fund expenses. In the absence of fee waivers, total return would be reduced. |

For the Money Market Division, total returns include the effect of a fee waiver from December 2, 2002 through December 31, 2004.

For the Franklin Templeton International Equity Division, total returns include the effect of a fee waiver that began November 15, 2006.

| ** | Product inception date of 10/11/95. Returns prior to 10/11/95 were reflected using the actual investment experience of each division, adjusted for the expenses of the product and premium charges. |

| *** | Product inception date of 3/2/98. (For use with non-tax qualified executive benefit plans.) Returns prior to 3/2/98 were reflected using the actual investment experience of each division adjusted for expenses of the product and premium charges. |

| **** | Product inception date of December 28, 1998. (For use primarily in estate planning, provides coverage on two insureds with a death benefit payable on the second death). Returns prior to 12/28/98 were reflected using the actual investment experience of each division adjusted for expenses of the product and premium charges. |

v

Performance Summary, continued as of December 31, 2006

Variable Executive Life — Policies First Offered on March 2, 1998***

| Total return(j) (as of 12/31/06) |

Janus Capital Appreciation Division |

Growth Stock Division |

Large Cap Core Stock Division |

Capital Guardian Domestic Equity Division |

T. Rowe Price Equity Income Division |

Index 500 Stock Division |

Asset Allocation Division |

||||||||||||||

| 1 year |

4.88 | % | 9.57 | % | 11.49 | % | 16.56 | % | 19.15 | % | 15.62 | % | 9.91 | % | |||||||

| 5 years |

— | 18.55 | % | 16.50 | % | 55.79 | % | — | 34.16 | % | 40.07 | % | |||||||||

| Annualized |

— | 3.46 | % | 3.10 | % | 9.27 | % | — | 6.05 | % | 6.97 | % | |||||||||

| 10 years(g) |

— | 99.83 | % | 72.02 | % | — | — | 123.63 | % | — | |||||||||||

| Annualized |

— | 7.17 | % | 5.57 | % | — | — | 8.38 | % | — | |||||||||||

| Since division inception in Variable Life Account |

76.08 | %(d) | — | — | 52.38 | %(c) | 76.75 | %(d) | — | 37.12 | %(c) | ||||||||||

| Annualized |

16.67 | % | — | — | 8.08 | % | 16.80 | % | — | 6.00 | % | ||||||||||

| Since portfolio inception(a) |

— | — | — | — | — | — | — | ||||||||||||||

| Annualized |

— | — | — | — | — | — | — | ||||||||||||||

| Current Yield(h) |

|||||||||||||||||||||

| Variable Joint Life—Policies First Offered on December 28, 1998**** | |||||||||||||||||||||

| 1 year |

4.88 | % | 9.57 | % | 11.49 | % | 16.56 | % | 19.15 | % | 15.62 | % | 9.91 | % | |||||||

| 5 years |

— | 18.55 | % | 16.50 | % | 55.79 | % | — | 34.16 | % | 40.07 | % | |||||||||

| Annualized |

— | 3.46 | % | 3.10 | % | 9.27 | % | — | 6.05 | % | 6.97 | % | |||||||||

| 10 years(g) |

— | 99.83 | % | 72.02 | % | — | — | 123.63 | % | — | |||||||||||

| Annualized |

— | 7.17 | % | 5.57 | % | — | — | 8.38 | % | — | |||||||||||

| Since division inception in Variable Life Account |

76.08 | %(d) | — | — | 52.38 | %(c) | 76.75 | %(d) | — | 37.12 | %(c) | ||||||||||

| Annualized |

16.67 | % | — | — | 8.08 | % | 16.80 | % | — | 6.00 | % | ||||||||||

| Since portfolio inception(a) |

— | — | — | — | — | — | — | ||||||||||||||

| Annualized |

— | — | — | — | — | — | — | ||||||||||||||

| Current Yield(h) |

|||||||||||||||||||||

All total return figures shown above reflect the deduction of portfolio expenses, as well as mortality and expense risk charges for each product. Returns do not reflect deductions such as sales charges or premium taxes, administrative charges, surrender charges or cost of insurance charges. These deductions would significantly impact the returns if they were included.

| (a) | Returns stated are as of the inception date of the portfolio which preceeds availability in the Variable Life Account. See the following footnotes for portfolio inception dates. |

| (b) | Inception date of this division in the Variable Life Account was 6/30/99. Actual fund inception was 4/30/99. Performance quoted prior to 6/30/99 is based on actual investment experience, adjusted for expenses of the product and premium charges. |

| (c) | Inception date of 7/31/01. |

| (d) | Inception date of 5/1/03. |

| (e) | Inception date of this division in the Variable Life Account was 5/1/03. Actual fund inception was 12/28/98. Performance quoted prior to 5/1/03 is based on actual investment experience, adjusted for expenses of the product and premium charges. |

| (f) | Inception date of this division in the Variable Life Account was 6/30/99. Actual fund inception was 1/2/97. Performance quoted prior to 6/30/99 is based on actual investment experience, adjusted for expenses of the product and premium charges. |

| (g) | 10 year return for this division in the Variable Life Account. |

| (h) | For the seven-day period ended December 31, 2006, the Money Market Portfolio’s yield was 5.05% and was equivalent to a compound effective yield of 5.17%. The seven-day yield does not include deductions that are included in the separate accounts. The yield quotation more closely reflects the current earnings of the Money Market Portfolio than the total return quotation. |

| (j) | Returns shown include any fee waivers in effect and deductions for all Fund expenses. In the absence of fee waivers, total return would be reduced. |

For the Money Market Division, total returns include the effect of a fee waiver from December 2, 2002 through December 31, 2004.

For the Franklin Templeton International Equity Division, total returns include the effect of a fee waiver that began November 15, 2006.

| ** | Product inception date of 10/11/95. Returns prior to 10/11/95 were reflected using the actual investment experience of each division, adjusted for the expenses of the product and premium charges. |

| *** | Product inception date of 3/2/98. (For use with non-tax qualified executive benefit plans.) Returns prior to 3/2/98 were reflected using the actual investment experience of each division adjusted for expenses of the product and premium charges. |

| **** | Product inception date of December 28, 1998. (For use primarily in estate planning, provides coverage on two insureds with a death benefit payable on the second death). Returns prior to 12/28/98 were reflected using the actual investment experience of each division adjusted for expenses of the product and premium charges. |

vi

| Balanced Division |

High Yield Bond Division |

Select Bond Division |

Money Market Division |

Fidelity VIP Mid Cap Division |

Russell Multi-Style Equity Division |

Russell Aggressive Equity Division |

Russell Non-U.S. Division |

Russell Real Estate Securities Division |

Russell Core Bond Division |

|||||||||||||||||||

| 10.42 | % | 9.77 | % | 3.74 | % | 4.86 | % | 12.40 | % | 12.75 | % | 14.79 | % | 23.64 | % | 35.84 | % | 3.72 | % | |||||||||

| 34.65 | % | 57.29 | % | 31.34 | % | 12.72 | % | 105.69 | %(e) | 31.45 | % | 65.08 | % | 95.82 | % | 194.75 | % | 27.94 | % | |||||||||

| 6.13 | % | 9.48 | % | 5.60 | % | 2.42 | % | 15.52 | % | 5.62 | % | 10.55 | % | 14.39 | % | 24.13 | % | 5.05 | % | |||||||||

| 109.12 | % | 78.44 | % | 85.32 | % | 45.45 | % | — | — | — | — | — | — | |||||||||||||||

| 7.66 | % | 5.96 | % | 6.36 | % | 3.82 | % | — | — | — | — | — | — | |||||||||||||||

| — | — | — | — | 132.61 | %(e) | 3.39 | %(f) | 68.15 | %(f) | 62.78 | %(f) | 280.78 | %(b) | 51.93 | %(f) | |||||||||||||

| — | — | — | — | 25.87 | % | 0.45 | % | 7.17 | % | 6.71 | % | 19.50 | % | 5.73 | % | |||||||||||||

| — | — | — | — | 306.36 | %(e) | 91.79 | %(f) | 131.75 | %(f) | 97.40 | %(f) | 275.07 | %(b) | 77.03 | %(f) | |||||||||||||

| — | — | — | — | 19.13 | % | 6.73 | % | 8.77 | % | 7.04 | % | 18.81 | % | 5.88 | % | |||||||||||||

| 5.17 | % | |||||||||||||||||||||||||||

| 10.42 | % | 9.77 | % | 3.74 | % | 4.86 | % | 12.40 | % | 12.75 | % | 14.79 | % | 23.64 | % | 35.84 | % | 3.72 | % | |||||||||

| 34.65 | % | 57.29 | % | 31.34 | % | 12.72 | % | 105.69 | %(e) | 31.45 | % | 65.08 | % | 95.82 | % | 194.75 | % | 27.94 | % | |||||||||

| 6.13 | % | 9.48 | % | 5.60 | % | 2.42 | % | 15.52 | % | 5.62 | % | 10.55 | % | 14.39 | % | 24.13 | % | 5.05 | % | |||||||||

| 109.12 | % | 78.44 | % | 85.32 | % | 45.45 | % | — | — | — | — | — | — | |||||||||||||||

| 7.66 | % | 5.96 | % | 6.36 | % | 3.82 | % | — | — | — | — | — | — | |||||||||||||||

| — | — | — | — | 132.61 | %(e) | 3.39 | %(f) | 68.15 | %(f) | 62.78 | %(f) | 280.78 | %(b) | 51.93 | %(f) | |||||||||||||

| — | — | — | — | 25.87 | % | 0.45 | % | 7.17 | % | 6.71 | % | 19.50 | % | 5.73 | % | |||||||||||||

| — | — | — | — | 306.36 | %(e) | 91.79 | %(f) | 131.75 | %(f) | 97.40 | %(f) | 275.07 | %(b) | 77.03 | %(f) | |||||||||||||

| — | — | — | — | 19.13 | % | 6.73 | % | 8.77 | % | 7.04 | % | 18.81 | % | 5.88 | % | |||||||||||||

| 5.17 | % | |||||||||||||||||||||||||||

vii

Annual Report December 31, 2006

Northwestern Mutual Series Fund, Inc.

A Series Fund Offering Eighteen Portfolios

| • | Small Cap Growth Stock Portfolio |

| • | T. Rowe Price Small Cap Value Portfolio |

| • | Aggressive Growth Stock Portfolio |

| • | International Growth Portfolio |

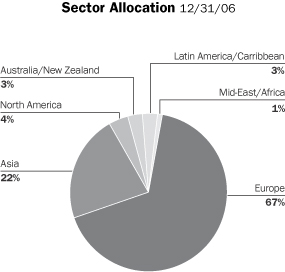

| • | Franklin Templeton International Equity Portfolio |

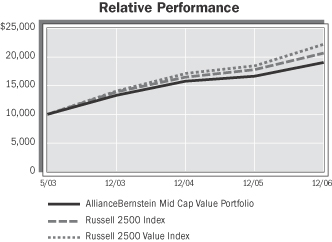

| • | AllianceBernstein Mid Cap Value Portfolio |

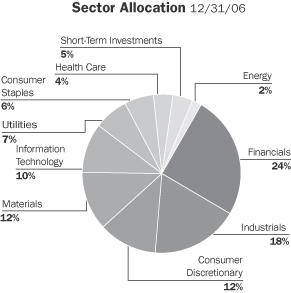

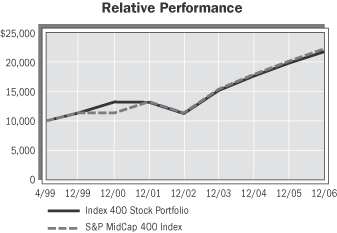

| • | Index 400 Stock Portfolio |

| • | Janus Capital Appreciation Portfolio |

| • | Growth Stock Portfolio |

| • | Large Cap Core Stock Portfolio |

| • | Capital Guardian Domestic Equity Portfolio |

| • | T. Rowe Price Equity Income Portfolio |

| • | Index 500 Stock Portfolio |

| • | Asset Allocation Portfolio |

| • | Balanced Portfolio |

| • | High Yield Bond Portfolio |

| • | Select Bond Portfolio |

| • | Money Market Portfolio |

Letter to Policyowners

December 31, 2006

The headlines for 2006 are fairly straightforward — stocks performed well; bonds managed a seventh straight year of gains; and economic growth remained surprisingly healthy and inflation tame. However, the underlying story is more complicated. The slowdown in housing, muted job and wage gains, and higher energy prices and interest rates were all negatives for consumers.

Did the economy transcend these problems, or should we expect a delayed reaction? The answer may well be “yes” on both counts, depending upon your economic perspective. Middle- and lower-income Americans did indeed feel a pinch in their pocketbooks, while those in higher tax brackets continued to spend. Perhaps this sums it up best — it was a tough year for Wal-Mart, but Tiffany’s posted record profits.

Another important trend that helps explain performance across capital markets is this: risk assets reigned supreme in 2006, reflecting an increase in liquidity and the changing face of investors in the marketplace. 2006 witnessed a surge in mergers and acquisitions, companies going private, and share buybacks by public firms. Indeed, we saw hundreds of billions of dollars in net stock taken out of the market last year, when cash acquisitions of companies ran at twice the pace of 2005. Other things being equal, less supply translates into higher prices, and that was exactly what we got in the stock market in 2006.

Just as important, the face of the market is changing — hedge funds and private equity investors became increasingly influential in the global financial markets in 2006. These “sophisticated” investors accept high levels of risk in pursuit of excess return, using leverage to enhance performance (borrowing money in one market to deploy it in another, or borrowing against a company’s assets to increase their pool of available capital). In addition, some long-time market participants increased the risks in their portfolios, as many pension funds allocated a portion of their asset mix to private equity transactions.

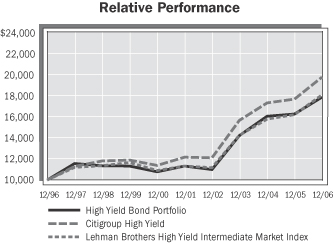

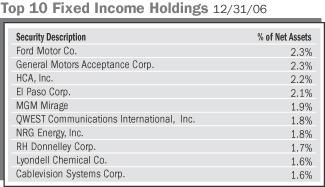

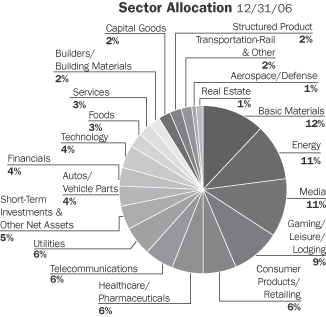

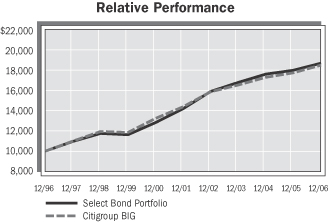

These two trends met in the marketplace and helped propel risk assets to the top of the return tables for 2006. For example, high yield bonds outperformed higher quality, investment grade securities by a wide margin. For all of 2006, the Citigroup U.S. Broad Investment Grade Bond Index returned 4.33%, while the Citigroup High Yield Cash Pay Index returned 11.71%. The effect of this risk-seeking investment behavior has been to push the spread, or difference in yield, between riskier assets and Treasury securities to historic lows. In other words, the risk premium — your compensation for taking on additional risk — is being wrung out of the market.

It was a similar story in equities, where “value” stocks outperformed growth-oriented stocks for a seventh consecutive year. Private equity firms have been targeting lower quality, turnaround stories, as well as firms whose stock prices are lower than their asset-rich value, such as auto parts suppliers, utilities, and so on. These classic examples of “deep value” companies are convenient targets for buyouts — their prices are depressed, and if you are going to use leverage, you need hard assets to borrow against. For all of 2006, the S&P 500® Index was up 15.79%, but consider that its value and growth components returned 20.80% and 11.01%, respectively.

This phenomenon was not limited to the United States. The riskiest, emerging market stocks performed best in 2006, with the MSCI Emerging Market Index returning 32.17%. By comparison, the MSCI EAFE Index, a measure of performance in developed foreign markets, returned 26.86%.

The side effect of ramping up risk throughout financial markets is that it leaves both stocks and bonds priced for perfection. For example, the performance of stocks and high yield bonds suggests investors see a “Goldilocks” economy — not too hot, not too cold, but just right. Meanwhile, perhaps the best measure of the bond market’s view on the direction of the economy is the slope of the yield curve, which is currently pointing down. Reconciling these two views could be painful.

That said, the party looks set to continue until there is some event that tips the scales away from risk assets. These corrections — or if you like, a “re-pricing of risk” — occur from time to time. The 1980’s Mexican currency crisis and late ‘90s meltdown of hedge fund Long-Term Capital Management are a few high profile examples. But predicting when or if such an event will occur is impossible.

Precisely because the economic view is uncertain, it makes sense to take a prudent, measured approach to investing. I encourage you to meet with your financial representative on a regular basis to review your investment goals and risk tolerances and to help determine whether the mix of assets in your portfolio is appropriate for your current stage in life.

Let us hope then that when the investing headlines are written for 2007, they will include progress toward financial goals, regardless of economic or market trends.

|

| ||

| Mark G. Doll Senior Vice President Investments | ||

| The Northwestern Mutual Life Insurance Company | ||

| (Northwestern Mutual) | ||

Northwestern Mutual Series Fund, Inc.

| Series Fund Objectives and Schedules of Investments: |

||

| 1 | ||

| 6 | ||

| 13 | ||

| 18 | ||

| 24 | ||

| 30 | ||

| 35 | ||

| 43 | ||

| 48 | ||

| 53 | ||

| 58 | ||

| 63 | ||

| 68 | ||

| 77 | ||

| 96 | ||

| 112 | ||

| 120 | ||

| 131 | ||

| 136 | ||

| 138 | ||

| 140 | ||

| 149 | ||

| 158 | ||

| 164 | ||

| 165 | ||

| 166 | ||

| 168 | ||

The views expressed in the portfolio manager commentaries set forth in the following pages reflect those of the portfolio managers only through the end of the period covered by this report and do not necessarily represent the views of any affiliated organization. These views are subject to change at any time based upon market conditions or other events and should not be relied upon as investment advice. Mason Street Advisors, LLC, disclaims any responsibility to update these views.

Small Cap Growth Stock Portfolio

| Objective: | Portfolio Strategy: | Net Assets: | ||

| Long-term growth of capital. | Strive for the highest possible rate of capital appreciation by investing in small companies with potential for above-average growth. | $529 million |

The Small Cap Growth Stock Portfolio seeks long-term growth of capital. The Portfolio seeks to achieve this objective by investing at least 80% of net assets (plus any borrowings for investment purposes) in common stocks of companies in the United States with market capitalizations that do not exceed the maximum market capitalization of any security in the S&P SmallCap 600® Index. Securities are selected for their above-average growth potential giving consideration to factors such as, for example, company management, growth rate of revenues and earnings, opportunities for margin expansion and strong financial characteristics. The Portfolio may also invest in the equity securities of micro cap companies (defined as companies with stock market capitalizations less than $500 million at the time of investment.)

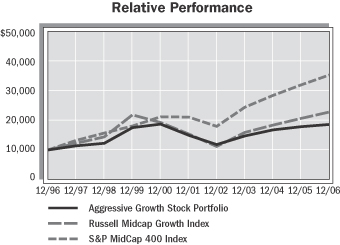

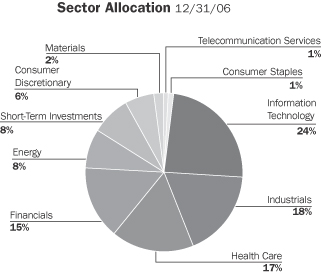

Stocks performed well in 2006, but in contrast to recent years, large company stocks performed best. For the year, the S&P 500® Index (a gauge of large-cap stock performance) returned 15.79%, while small-cap stocks returned 15.12%, as measured by the S&P 600® SmallCap Index. Mid-cap stocks lagged, as the S&P 400® MidCap Index returned 10.32% in 2006. Looking at performance by style, value stocks outperformed growth stocks by a wide margin yet again in 2006. Mid- and small-cap growth stocks — such as those in which the Small Cap Growth Stock Portfolio invests — were the poorest performing segments of the market.

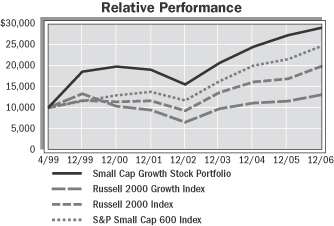

For the year ended December 31, 2006, the Small Cap Growth Stock Portfolio returned 6.68%, trailing the Russell 2000 Index, which had a return of 18.37%, the Russell 2000 Growth Index, which had a return of 13.35%, and the S&P SmallCap 600® Index, which returned 15.12% for the same period. (These Indices are unmanaged, cannot be invested in directly, and do not include expenses.) The Portfolio also trailed its Lipper Small-Cap Growth Funds peer group, which had an average return of 11.12%.

The Portfolio’s underperformance in 2006 was largely the result of holding in the Health Care and Energy sectors. Holdings in the Industrials and Consumer Discretionary sectors contributed most to performance. Sector weightings in 2006 had no material impact on overall performance.

The Portfolio’s results were limited by disappointing performance from some of our Health Care holdings, including LCA-Vision, The Providence Service Corp., Symbion, and Horizon Health. These shares were plagued by company-specific issues, as well as worry over Medicare reimbursement rates and potential negative effects in the form of additional oversight or legislation from a Democratic Congress. Health Care device maker, FoxHollow, also detracted from performance after reporting slower-than-expected sales for one of its key products, and we have eliminated this position.

The Portfolio’s Energy holdings also disappointed in 2006. One of our leading detractors for the year was Energy Equipment and Services firm, Hydril. This firm had exposure to the volatile North American natural gas market and was vulnerable to a sell-off after performing very well in recent years. It was a similar story for James River Coal, where strong performance in 2005 turned negative in 2006. We have eliminated both positions. Coal is seen as a cheaper alternative to natural gas, so when natural gas prices weakened in 2006, coal’s pricing advantage decreased. On a positive note, we were able to take our profits from one of our leading contributors for the year, Energy Oil Services firm, FMC Technologies. The company consistently beat earnings estimates in 2006, enjoying strength in its business units outside of the Energy sector.

Looking at other positives, the Industrials sector was home to many of our leading contributors to performance. A good example is Corrections Corp. of America, which runs correctional facilities across the United States. This stock benefited from expanding business and a favorable municipal funding environment, making it the top contributor to performance. Other leading contributors were business support outsourcing firm ICT Group, and the Huron Consulting Group. Huron is a financial consulting firm with expertise in issues around stock option grants and executive compensation — this during a period when several high profile firms were hit with questions about the timing of option grants.

The Portfolio also enjoyed significant contributions to return from Consumer Discretionary companies, which was home to Specialty Retailer Golf Galaxy. This long-time Portfolio holding announced its intentions to be acquired by Dick’s Sporting Goods at a significant premium to its existing share price. Elsewhere in the Consumer Discretionary sector, global hotelier Orient-Express Hotels was a leading contributor, reporting better-than-expected earnings and experiencing positive financial results as a result of their expansion through the acquisition of several Asian properties.

Looking ahead to 2007, we will continue to look for companies that we believe are well managed, have solid growth in revenue and earnings, and have strong financial characteristics. We believe this bottom-up investment approach, based on holding what we feel are the best individual stocks we can find, is key to seeking solid performance over time. In addition, we believe the relative valuations of small-cap growth shares are more attractive now, after underperforming small-company value stocks in recent years, and these factors should help drive relative performance going forward.

Small Cap Growth Stock Portfolio

1

Small Cap Growth Stock Portfolio

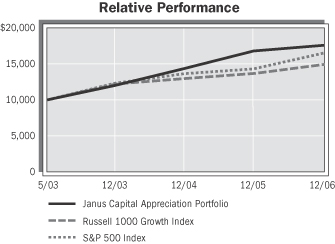

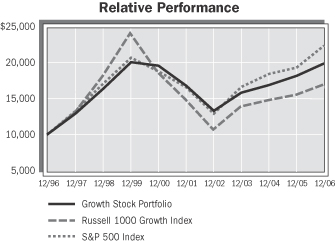

| Average Annual Total Return | ||||||

| For Periods Ended December 31, 2006 | ||||||

| 1 Year | 5 Years | Since Inception* | ||||

| Small Cap Growth Stock Portfolio |

6.68% | 8.87% | 15.01% | |||

| Russell 2000 Growth Index |

13.35% | 6.93% | 3.65% | |||

| Russell 2000 Index |

18.37% | 11.39% | 9.49% | |||

| S&P SmallCap 600 Index |

15.12% | 12.49% | 12.61% | |||

| Small Cap Growth Funds Lipper Average |

11.12% | 5.75% | - | |||

| *Inception | date of 4/30/99 |

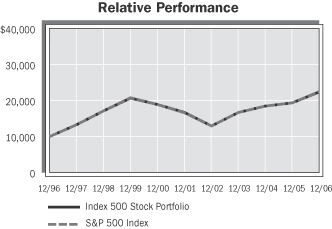

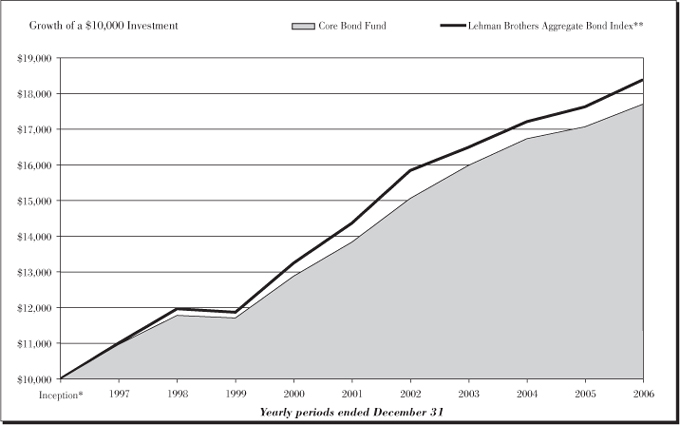

This chart assumes an initial investment of $10,000 made on 4/30/99 (commencement of the Portfolio’s operations). Returns shown reflect fee waivers, deductions for management and other portfolio expenses, and reinvestment of all dividends. In the absence of fee waivers, total return would be reduced. Returns exclude deductions for separate account sales loads and account fees. Total returns, which reflect deduction of charges for the separate account, are shown beginning on page ii of the Performance Summary of the Separate Account report.

Stocks of smaller or newer companies, such as those held in this Portfolio, are more likely to realize more substantial growth as well as suffer more significant losses than larger or more established issuers. Investments in such companies can be both more volatile and more speculative. Investing in small company stocks involves a greater degree of risk than investing in medium or large company stocks.

Since the Portfolio invests primarily in small capitalization issues, the indices that best reflect the portfolio’s performance are the Russell 2000 Growth Index and Standard and Poor’s (S&P) SmallCap 600 Index. The indices cannot be invested in directly and do not include sales charges.

The Russell 2000 Growth Index measures the performance of those companies in the Russell 2000 Index with higher price-to-book ratios and higher forecasted growth values. As of December 31, 2006, the average market capitalization of companies in the Index was $1.206 billion; the median market capitalization was $643 million; and the largest company in the Index had a market capitalization of $3.045 billion and a smallest of $68 million.

The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. As of the latest reconstitution, the average market capitalization of companies in the Russell 3000 was approximately $5.1 billion; the median market capitalization was approximately $1.09 billion. Market capitalization of companies in the Index ranged from $368.5 billion to $218.4 million.

The Russell 2000 Index represents approximately 8% of the total market capitalization of the Russell 3000 Index. As of the latest reconstitution, the average market capitalization of companies in the Russell 2000 was approximately $762.8 million; the median market capitalization was approximately $613.5 million. The largest company in the Index had an approximate market capitalization of $1.9 billion and a smallest of $218.4 million.

The Standard & Poor’s SmallCap 600 Index is an unmanaged index of 600 selected common stocks of smaller U.S.-based companies compiled by Standard & Poor’s Corporation. As of December 31, 2006, the 600 companies in the composite had a median market capitalization of $878.0 million and total market value of $615.4 billion. The SmallCap 600 represents approximately 2.9% of the market value of Compustat’s database of over 9,653 equities.

The Portfolio is changing from the Russell 2000 Index to the Russell 2000 Growth Index because of the Russell 2000 Growth Index’s greater emphasis on small cap growth companies. This emphasis more closely aligns with the Portfolio’s investment objective and strategy.

The Lipper Variable Insurance Products (VIP) Small Cap Growth Funds Average is calculated by Lipper Analytical Services, Inc. and reflects the average investment return of portfolios underlying variable life and annuity products. The category consists of funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three–year weighted basis) less than 250% of the dollar–weighted median of the smallest 500 of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Small–cap growth funds typically have an above–average price–to–earnings ratio, price–to–book ratio, and three–year sales–per–share growth value, compared to the S&P SmallCap 600 Index. Source: Lipper, Inc.

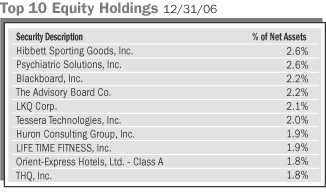

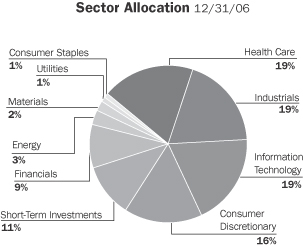

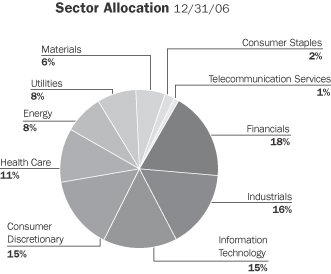

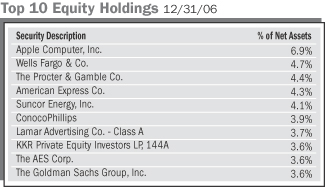

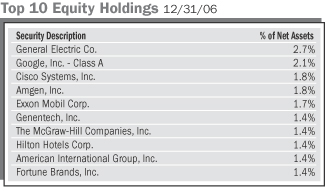

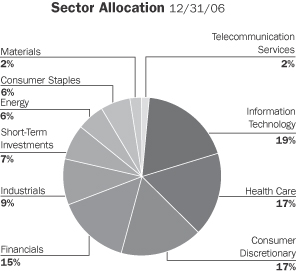

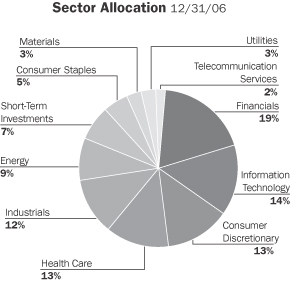

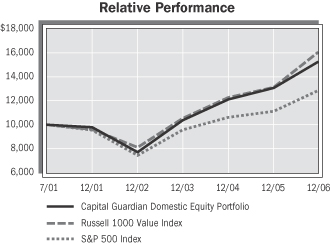

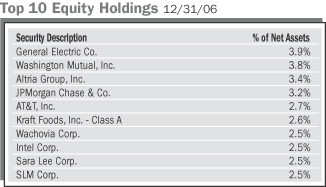

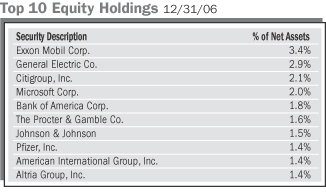

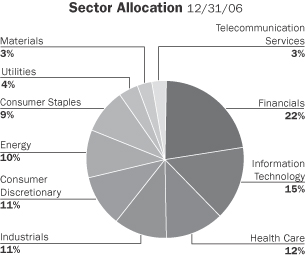

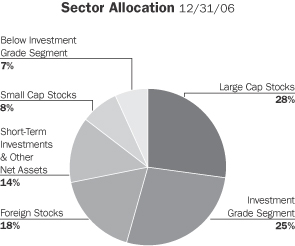

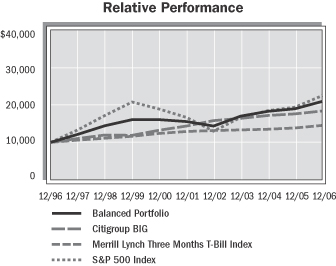

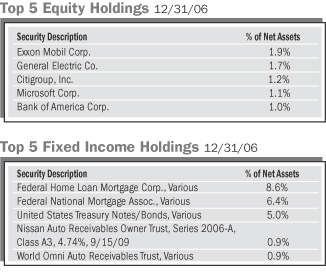

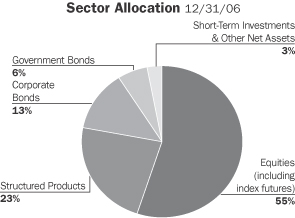

Sector Allocation is based on Net Assets.

Sector Allocation and Top 10 Holdings are subject to change.

Investing in small company stocks involves a greater degree of risk than investing in medium or large company stocks.

2

Small Cap Growth Stock Portfolio

Small Cap Growth Stock Portfolio

Expense Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Portfolio expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2006 to December 31, 2006).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs or separate account charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs or separate account charges were included, your costs would have been higher.

| Beginning Account Value July 1, 2006 |

Ending Account Value December 31, 2006 |

Expenses Paid During Period July 1, 2006 to December 31, 2006* | |||||||

| Actual |

$ | 1,000.00 | $ | 1,029.40 | $ | 2.84 | |||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.10 | $ | 2.83 | |||

| * | Expenses are equal to the Portfolio’s annualized expense ratio of 0.55%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

Small Cap Growth Stock Portfolio

3

Small Cap Growth Stock Portfolio

Northwestern Mutual Series Fund, Inc.

Schedule of Investments

December 31, 2006

| Common Stocks (89.2%) | Shares/ $ Par |

Value $ (000’s) | ||

| Consumer Discretionary (15.5%) |

||||

| *Blue Nile, Inc. |

126,200 | 4,656 | ||

| *Coldwater Creek, Inc. |

93,900 | 2,302 | ||

| *Golf Galaxy, Inc. |

404,600 | 7,542 | ||

| *Heelys, Inc. |

2,736 | 88 | ||

| *Hibbett Sporting Goods, Inc. |

457,300 | 13,961 | ||

| *Interface, Inc. — Class A |

236,900 | 3,369 | ||

| *LIFE TIME FITNESS, Inc. |

203,500 | 9,872 | ||

| *LKQ Corp. |

483,800 | 11,123 | ||

| *Morton’s Restaurant Group, Inc. |

412,400 | 6,866 | ||

| Orient-Express Hotels, Ltd. — Class A |

205,437 | 9,721 | ||

| *Pinnacle Entertainment, Inc. |

249,500 | 8,268 | ||

| *Williams Scotsman International, Inc. |

210,400 | 4,128 | ||

| Total |

81,896 | |||

| Consumer Staples (1.3%) |

||||

| *United Natural Foods, Inc. |

191,200 | 6,868 | ||

| Total |

6,868 | |||

| Energy (2.7%) |

||||

| *Dril-Quip, Inc. |

106,900 | 4,186 | ||

| *Grant Prideco, Inc. |

120,000 | 4,772 | ||

| World Fuel Services Corp. |

123,100 | 5,474 | ||

| Total |

14,432 | |||

| Financials (9.2%) |

||||

| *Clayton Holdings, Inc. |

73,000 | 1,366 | ||

| *Evercore Partners, Inc. |

20,200 | 744 | ||

| First Republic Bank |

61,300 | 2,396 | ||

| *Global Cash Access Holdings, Inc. |

422,300 | 6,854 | ||

| Greater Bay Bancorp |

206,700 | 5,442 | ||

| Greenhill & Co., Inc. |

130,500 | 9,631 | ||

| Heartland Payment Systems, Inc. |

265,200 | 7,492 | ||

| International Securities Exchange Holdings, Inc. |

96,600 | 4,520 | ||

| *KBW, Inc. |

78,393 | 2,304 | ||

| *Nexity Financial Corp. |

127,900 | 1,535 | ||

| optionsXpress Holdings, Inc. |

114,000 | 2,587 | ||

| *Portfolio Recovery Associates, Inc. |

81,700 | 3,815 | ||

| Total |

48,686 | |||

| Health Care (19.1%) |

||||

| *Adams Respiratory Therapeutics, Inc. |

179,500 | 7,325 | ||

| *Allscripts Healthcare Solutions, Inc. |

335,900 | 9,066 | ||

| *Centene Corp. |

141,540 | 3,478 | ||

| *HealthExtras, Inc. |

66,600 | 1,605 | ||

| *ICON PLC, ADR |

221,700 | 8,358 | ||

| *Kyphon, Inc. |

89,100 | 3,600 | ||

| *Noven Pharmaceuticals, Inc. |

211,700 | 5,388 | ||

| *Pediatrix Medical Group, Inc. |

182,600 | 8,929 | ||

| PolyMedica Corp. |

150,800 | 6,094 | ||

| *The Providence Service Corp. |

341,985 | 8,594 | ||

| *PSS World Medical, Inc. |

357,700 | 6,986 | ||

| *Psychiatric Solutions, Inc. |

371,400 | 13,934 | ||

| Common Stocks (89.2%) | Shares/ $ Par |

Value $ (000’s) | ||

| Health Care continued |

||||

| *Radiation Therapy Services, Inc. |

218,400 | 6,884 | ||

| *ResMed, Inc. |

164,100 | 8,077 | ||

| *Ventana Medical Systems, Inc. |

61,454 | 2,644 | ||

| Total |

100,962 | |||

| Industrials (19.4%) |

||||

| *ACCO Brands Corp. |

214,800 | 5,686 | ||

| *The Advisory Board Co. |

212,000 | 11,349 | ||

| *Beacon Roofing Supply, Inc. |

243,250 | 4,578 | ||

| Brady Corp. — Class A |

146,300 | 5,454 | ||

| Bucyrus International, Inc. — Class A |

104,320 | 5,400 | ||

| C.H. Robinson Worldwide, Inc. |

70,080 | 2,866 | ||

| The Corporate Executive Board Co. |

64,800 | 5,683 | ||

| *Corrections Corp. of America |

172,075 | 7,783 | ||

| Forward Air Corp. |

98,464 | 2,849 | ||

| *Huron Consulting Group, Inc. |

221,600 | 10,046 | ||

| *ICT Group, Inc. |

277,100 | 8,754 | ||

| Knight Transportation, Inc. |

215,967 | 3,682 | ||

| Knoll, Inc. |

283,900 | 6,246 | ||

| *Marlin Business Services Corp. |

345,120 | 8,293 | ||

| *Marten Transport, Ltd. |

185,300 | 3,397 | ||

| *PeopleSupport, Inc. |

272,300 | 5,732 | ||

| *Resources Connection, Inc. |

13,500 | 430 | ||

| *VistaPrint, Ltd. |

138,100 | 4,572 | ||

| Total |

102,800 | |||

| Information Technology (18.6%) |

||||

| *Bankrate, Inc. |

134,668 | 5,111 | ||

| *Blackboard, Inc. |

387,000 | 11,626 | ||

| *Comtech Group, Inc. |

70,700 | 1,286 | ||

| *Cymer, Inc. |

82,200 | 3,613 | ||

| *DealerTrack Holdings, Inc. |

227,100 | 6,681 | ||

| *Diodes, Inc. |

33,700 | 1,196 | ||

| *Entegris, Inc. |

345,500 | 3,738 | ||

| *Euronet Worldwide, Inc. |

94,200 | 2,797 | ||

| *First Solar, Inc. |

5,562 | 166 | ||

| *Forrester Research, Inc. |

178,400 | 4,836 | ||

| *Isilon Systems, Inc. |

5,618 | 155 | ||

| *Kenexa Corp. |

260,489 | 8,664 | ||

| *The Knot, Inc. |

117,600 | 3,086 | ||

| *MKS Instruments, Inc. |

177,050 | 3,998 | ||

| *Netlogic Microsystems, Inc. |

219,260 | 4,756 | ||

| *Plexus Corp. |

143,900 | 3,436 | ||

| *RF Micro Devices, Inc. |

684,300 | 4,646 | ||

| *Silicon Image, Inc. |

249,800 | 3,177 | ||

| *Sonic Solutions |

195,600 | 3,188 | ||

| *Tessera Technologies, Inc. |

259,800 | 10,480 | ||

| *THQ, Inc. |

298,450 | 9,706 | ||

| *The Ultimate Software Group, Inc. |

95,267 | 2,216 | ||

| Total |

98,558 | |||

| Materials (2.2%) |

||||

| Airgas, Inc. |

182,350 | 7,389 | ||

| Silgan Holdings, Inc. |

93,700 | 4,115 | ||

| Total |

11,504 | |||

4

Small Cap Growth Stock Portfolio

Small Cap Growth Stock Portfolio

| Common Stocks (89.2%) | Shares/ $ Par |

Value $ (000’s) | ||

| Utilities (1.2%) |

||||

| ITC Holdings Corp. |

154,300 | 6,157 | ||

| Total |

6,157 | |||

| Total Common Stocks (Cost: $412,626) |

471,863 | |||

| Money Market Investments (10.7%) | ||||

| Autos (1.9%) |

||||

| Daimler Chrysler Auto, |

5,000,000 | 4,994 | ||

| Fcar Owner Trust 1, 5.32%, 1/17/07 |

5,000,000 | 4,988 | ||

| Total |

9,982 | |||

| Federal Government & Agencies (0.5%) |

||||

| (b)Federal Home Loan Mortgage Corp., 5.128%, 3/23/07 |

2,500,000 | 2,472 | ||

| Total |

2,472 | |||

| Finance Lessors (2.8%) |

||||

| (b)Thunder Bay Funding, Inc., |

5,000,000 | 4,995 | ||

| (b)Windmill Funding Corp., |

10,000,000 | 9,975 | ||

| Total |

14,970 | |||

| Finance Services (1.9%) |

||||

| Bryant Park Funding LLC, |

5,000,000 | 4,989 | ||

| Bryant Park Funding LLC, |

5,000,000 | 4,993 | ||

| Total |

9,982 | |||

| National Commercial Banks (0.8%) |

||||

| UBS Finance LLC, 5.27%, 1/2/07 |

4,000,000 | 3,999 | ||

| Total |

3,999 | |||

| Money Market Investments (10.7%) |

Shares/ $ Par |

Value $ (000’s) | ||

| Short Term Business Credit (2.8%) |

||||

| (b)Old Line Funding Corp., |

5,000,000 | 4,997 | ||

| Sheffield Receivables, |

5,000,000 | 4,979 | ||

| (b)Sheffield Receivables, 5.34%, 1/3/07 |

5,000,000 | 4,998 | ||

| Total |

14,974 | |||

| Total Money Market Investments (Cost: $56,378) |

56,379 | |||

| Total Investments (99.9%) |

528,242 | |||

| Other Assets, Less Liabilities (0.1%) |

370 | |||

| Net Assets (100.0%) |

528,612 | |||

| * | Non-Income Producing |

ADR after the name of a security represents — American Depositary Receipt.

| (a) | At December 31, 2006 the aggregate cost of securities for federal tax purposes (in thousands) was $469,589 and the net unrealized appreciation of investments based on that cost was $58,653 which is comprised of $66,322 aggregate gross unrealized appreciation and $7,669 aggregate gross unrealized depreciation. |

| (b) | All or a portion of the securities have been committed as collateral for open futures positions or when-issued securities. Information regarding open futures contracts as of period end is summarized below. |

| Issuer (000’s) | Number of Contracts |

Expiration Date |

Unrealized Appreciation/ (Depreciation) $ (000’s) |

||||

| Russell 2000 Index Futures (Long) |

68 | 3/07 | (269 | ) | |||

| (Total Notional Value at December 31, 2006, $27,295 ) |

The Accompanying Notes are an Integral Part of the Financial Statements.

Small Cap Growth Stock Portfolio

5

T. Rowe Price Small Cap Value Portfolio

| Objective: | Portfolio Strategy: | Net Assets: | ||

| Long-term growth of capital. | Invest in small companies whose common stocks are believed to be undervalued in relation to their prospects for growth. | $325 million |

The T. Rowe Price Small Cap Value Portfolio seeks long-term growth of capital. The Portfolio seeks to achieve this objective by investing at least 80% of net assets (plus any borrowings for investment purposes) in common stocks of companies with market capitalizations that do not exceed the maximum market capitalization of any security in the S&P SmallCap 600® Index. Equity securities of small companies are selected based on management’s belief that they are undervalued with good prospects for capital appreciation based on such measures as, for example, company book or asset values, earnings, cash flow and business franchises. The Portfolio may also invest in the equity securities of micro cap companies (defined as companies with stock market capitalizations less than $500 million at the time of investment).

For the year ended December 31, 2006, the Portfolio outpaced its benchmark, the small/mid-cap S&P SmallCap 600® Index. For the year, the T. Rowe Price Small Cap Value Portfolio returned 16.55%, compared with the 15.12% return of the Index. (The Index is unmanaged, cannot be invested in directly and does not include expenses.) The Portfolio’s return was also ahead of the 15.23% average return of its peer group, the Lipper Small Cap Core Funds. Sector positioning had much to do with the Portfolio’s relative strength, although stock selection was broadly positive as well. The Lipper Small Cap Value Fund peer group returned an average of 17.31% for the year ended December 31, 2006.

Small- and mid-cap stocks had an eventful 2006. After extending their multi-year trend of dominance over large-caps in the early months of the year, they took a step back in the summer. With interest rates elevated and economic growth slowing, investor sentiment appeared to shift away from riskier assets. But a late year market rally gave small-caps in particular a boost. Investors seemed to focus on areas that could take advantage of rising global economic growth, including Materials and Telecommunication Services companies. However, all sectors in the S&P SmallCap 600® Index had positive returns for the year.

By a large margin, the Portfolio’s most productive position relative to its Index was in the Health Care sector. Health Care was a notable laggard for the year in the Index, and a significant underweight in the group added value. Moreover, stock selection in the Biotechnology and Health Care Equipment and Supplies segments helped the Portfolio’s Health Care weighting outperform its benchmark counterpart.

Likewise, strong stock selection and an underweight position combined to make Information Technology the Portfolio’s second most productive contributor to relative returns. Stock selection in Software was a significant driver of outperformance. RSA, a leading provider of security authentication services, was the top contributor in this group as it was purchased by EMC at a premium price.

An underweight in the relatively weak Consumer Discretionary area proved effective during the period, and the Portfolio’s stock choices in this group added to performance. We have tread carefully in this sector, which has been harmed by elevated interest rates and energy prices as well as softness in the housing market. Limiting our stake in Household Durables was helpful.

These relatively beneficial positions were countered to a modest degree by weakness in Consumer Staples and Industrials and Business Services. While the Consumer Discretionary sector trailed the benchmark average in 2006, Consumer Staples fared significantly better. The Portfolio was underweighted in this area, and our stock choices did not keep pace with their benchmark counterparts.

In the Industrials and Business Services group, we were correctly overweighted as the sector posted above-average results. But stock selection was not productive during the period, particularly among Machinery and Commercial Services and Supplies stocks, which were hurt by concerns over slowing economic growth.

We expect 2007 to be a decent year for equities, although stocks will likely have to swim against the currents of a gradually slowing economy and moderating profit margins. A slowing economy should favor larger growth stocks, which, unlike cyclical companies, are not as heavily reliant on good economic growth to prosper. As always, the potential exists for external shocks in the form of an overseas financial crisis or another event. Should profits increase at a slower pace, investors would have to rely on expanding multiples, or increasing price-to-earnings ratios, for any major increase in stock prices.

6

T. Rowe Price Small Cap Value Portfolio

T. Rowe Price Small Cap Value Portfolio

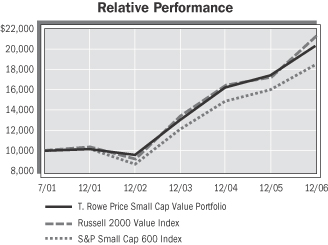

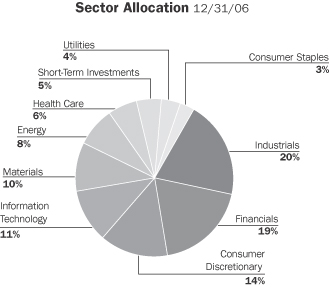

| Average Annual Total Return | ||||||

| For Periods Ended December 31, 2006 | ||||||

| 1 Year | 5 Years | Since Inception* | ||||

| T. Rowe Price Small Cap Value Portfolio |

16.55% | 14.71% | 13.87% | |||

| Russell 2000 Value Index |

23.48% | 15.37% | 14.83% | |||

| S&P SmallCap 600 Index |

15.12% | 12.49% | 11.89% | |||

| Small Cap Core Funds Lipper Average |

15.23% | 10.44% | - | |||

| Small Cap Value Funds Lipper Average |

17.31% | 13.78% | - | |||

| *Inception | date of 7/31/01 |

This chart assumes an initial investment of $10,000 made on 7/31/01 (commencement of the Portfolio’s operations). Returns shown reflect fee waivers, deductions for management and other portfolio expenses, and reinvestment of all dividends. In the absence of fee waivers, total return would be reduced. Returns exclude deductions for separate account sales loads and account fees. Total returns, which reflect deduction of charges for the separate account, are shown beginning on page ii of the Performance Summary of the Separate Account report.

The Russell 2000 Value Index measures the performance of those companies in the Russell 2000 Index with lower price-to-book ratios and lower forecasted growth values. As of December 31, 2006, the average market capitalization of companies in the Index was $1.198 billion; the median market capitalization was $662 million. The largest company in the Index had a market capitalization of $3.045 billion and a smallest of $92 million.

The Standard & Poor’s SmallCap 600 Index is an unmanaged index of 600 selected common stocks of smaller U.S. -based companies compiled by Standard & Poor’s Corporation. As of December 31, 2006, the 600 companies in the composite had a median market capitalization of $878.0 million and total market value of $615.4 billion. The SmallCap 600 represents approximately 2.9% of the market value of Compustat’s database of over 9,653 equities.

The Lipper Variable Insurance Products (VIP) Small Cap Core Funds Average is calculated by Lipper Analytical Services, Inc. and reflects the average investment return of portfolios underlying variable life and annuity products. The category consists of funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three–year weighted basis) less than 250% of the dollar–weighted median of the smallest 500 of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Small–cap core funds have more latitude in the companies in which they invest. These funds typically have an average price–to–earnings ratio, price–to–book ratio, and three–year sales–per–share growth value, compared to the S&P SmallCap 600 Index. Source: Lipper, Inc.

The Lipper Variable Insurance Products (VIP) Small Cap Value Funds Average is calculated by Lipper Analytical Services, Inc. and reflects the average investment return of portfolios underlying variable life and annuity products. The category consists of funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) less than 250% of the dollar-weighted median of the smallest 500 of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Small-cap value funds typically have a below-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P SmallCap 600 Index. Source: Lipper, Inc.

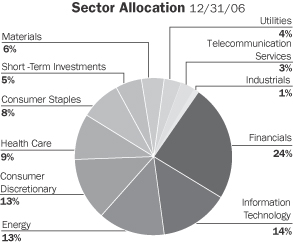

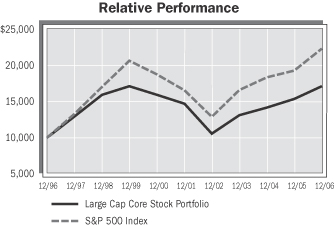

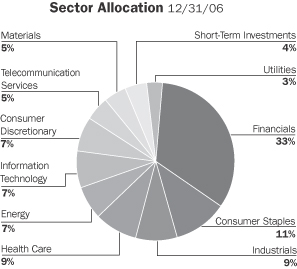

Sector Allocation is based on Net Assets.

Sector Allocation and Top 10 Holdings are subject to change.

T. Rowe Price Small Cap Value Portfolio

7

T. Rowe Price Small Cap Value Portfolio

Expense Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Portfolio expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2006 to December 31, 2006).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs or separate account charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs or separate account charges were included, your costs would have been higher.

| Beginning Account Value July 1, 2006 |

Ending Account Value December 31, 2006 |

Expenses Paid During Period July 1, 2006 to December 31, 2006* | |||||||

| Actual |

$ | 1,000.00 | $ | 1,063.70 | $ | 4.54 | |||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.50 | $ | 4.45 | |||

| * | Expenses are equal to the Portfolio’s annualized expense ratio of 0.87%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

8

T. Rowe Price Small Cap Value Portfolio

T. Rowe Price Small Cap Value Portfolio

Northwestern Mutual Series Fund, Inc.

Schedule of Investments

December 31, 2006

| Common Stocks (95.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Consumer Discretionary (13.9%) |

||||

| Aaron Rents, Inc. |

160,800 | 4,629 | ||

| Aaron Rents, Inc.— Class A |

4,725 | 125 | ||

| *Amazon.com, Inc. |

8,700 | 343 | ||

| *Apollo Group, Inc. — Class A |

8,500 | 331 | ||

| *Armstrong World Industries, Inc. |

4,000 | 170 | ||

| Belo Corp. — Class A |

18,100 | 332 | ||

| Brunswick Corp. |

13,400 | 427 | ||

| Building Materials Holding Corp. |

52,500 | 1,296 | ||

| *Career Education Corp. |

8,600 | 213 | ||

| *Cox Radio, Inc. — Class A |

17,400 | 284 | ||

| CSS Industries, Inc. |

46,600 | 1,648 | ||

| *Culp, Inc. |

32,600 | 168 | ||

| *Discovery Holding Co. |

34,400 | 553 | ||

| Dollar General Corp. |

17,200 | 276 | ||

| Dow Jones & Co., Inc. |

12,100 | 460 | ||

| *Drew Industries, Inc. |

12,400 | 323 | ||

| *Echostar Communications Corp. |

9,100 | 346 | ||

| Family Dollar Stores, Inc. |

21,700 | 636 | ||

| Fred’s, Inc. |

70,000 | 843 | ||

| The Gap, Inc. |

32,000 | 624 | ||

| *Gemstar-TV Guide International, Inc. |

41,500 | 166 | ||

| H&R Block, Inc. |

32,700 | 753 | ||

| *Hancock Fabrics, Inc. |

65,000 | 224 | ||

| Hasbro, Inc. |

5,100 | 139 | ||

| Haverty Furniture Companies, Inc. |

107,500 | 1,591 | ||

| Journal Register Co. |

77,000 | 562 | ||

| *Lamar Advertising Co. — Class A |

5,000 | 327 | ||

| *Liberty Media Holding Corp. |

3,400 | 333 | ||

| *Live Nation |

31,000 | 694 | ||

| M/I Homes, Inc. |

27,300 | 1,043 | ||

| Mattel, Inc. |

34,500 | 782 | ||

| Matthews International Corp. — Class A |

84,200 | 3,313 | ||

| Meredith Corp. |

5,700 | 321 | ||

| The New York Times Co. — Class A |

21,500 | 524 | ||

| Newell Rubbermaid, Inc. |

11,400 | 330 | ||

| OSI Restaurant Partners, Inc. |

13,500 | 529 | ||

| Pearson PLC, ADR |

35,500 | 536 | ||

| Pool Corp. |

73,325 | 2,872 | ||

| *RARE Hospitality International, Inc. |

93,250 | 3,071 | ||

| Reuters Group PLC, ADR |

3,000 | 157 | ||

| Ruby Tuesday, Inc. |

43,300 | 1,188 | ||

| *Saga Communications, Inc. — Class A |

84,600 | 813 | ||

| *Scholastic Corp. |

14,600 | 523 | ||

| Skyline Corp. |

34,500 | 1,388 | ||

| Stanley Furniture Co., Inc. |

61,000 | 1,308 | ||

| Stein Mart, Inc. |

150,000 | 1,989 | ||

| The TJX Companies, Inc. |

20,100 | 573 | ||

| Tribune Co. |

31,500 | 970 | ||

| *TRW Automotive Holdings Corp. |

18,000 | 466 | ||

| *Univision Communications, Inc. — Class A |

19,200 | 680 | ||

| Weight Watchers International, Inc. |

14,100 | 741 | ||

| Winnebago Industries, Inc. |

56,600 | 1,863 | ||

| *XM Satellite Radio Holdings, Inc. |

36,000 | 520 | ||

| Total |

45,316 | |||

| Common Stocks (95.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Consumer Staples (2.7%) |

||||

| Alberto-Culver Co. |

5,300 | 114 | ||

| *Alliance One International, Inc. |

109,300 | 772 | ||

| Campbell Soup Co. |

3,100 | 121 | ||

| Casey’s General Stores, Inc. |

71,500 | 1,683 | ||

| The Clorox Co. |

11,700 | 751 | ||

| Coca-Cola Enterprises, Inc. |

34,500 | 704 | ||

| ConAgra Foods, Inc. |

31,500 | 851 | ||

| H.J. Heinz Co. |

2,900 | 131 | ||

| McCormick & Co., Inc. |

5,200 | 201 | ||

| Nash Finch Co. |

38,500 | 1,050 | ||

| Sara Lee Corp. |

51,600 | 878 | ||

| *Wild Oats Markets, Inc. |

49,300 | 709 | ||

| *Winn-Dixie Stores, Inc. |

47,400 | 640 | ||

| Wm. Wrigley Jr. Co. |

2,200 | 114 | ||

| Total |

8,719 | |||

| Energy (7.7%) |

||||

| *Atwood Oceanics, Inc. |

35,200 | 1,724 | ||

| CARBO Ceramics, Inc. |

29,200 | 1,091 | ||

| *Forest Oil Corp. |

66,350 | 2,168 | ||

| *Geomet, Inc. |

22,400 | 233 | ||

| *Hanover Compressor Co. |

36,000 | 680 | ||

| Hess Corp. |

16,500 | 818 | ||

| *Lone Star Technologies, Inc. |

25,800 | 1,249 | ||

| *Mariner Energy, Inc. |

56,293 | 1,103 | ||

| Murphy Oil Corp. |

22,000 | 1,119 | ||

| Penn Virginia Corp. |

58,400 | 4,091 | ||

| *TETRA Technologies, Inc. |

151,300 | 3,870 | ||

| *Todco |

65,800 | 2,248 | ||

| *Union Drilling, Inc. |

23,700 | 334 | ||

| *W-H Energy Services, Inc. |

38,300 | 1,865 | ||

| *Whiting Petroleum Corp. |

52,400 | 2,442 | ||

| Total |

25,035 | |||

| Financials (18.7%) |

||||

| Allied Capital Corp. |

48,100 | 1,572 | ||

| Ares Capital Corp. |

47,900 | 915 | ||

| Aspen Insurance Holdings, Ltd. |

8,400 | 221 | ||

| Axis Capital Holdings, Ltd. |

19,500 | 651 | ||

| Boston Private Financial Holdings, Inc. |

45,200 | 1,275 | ||

| Commerce Bancshares, Inc. |

12,634 | 612 | ||

| *E*TRADE Financial Corp. |

7,800 | 175 | ||

| East West Bancorp, Inc. |

94,500 | 3,347 | ||

| First Financial Fund, Inc. |

114,913 | 1,737 | ||

| First Horizon National Corp. |

17,800 | 744 | ||

| First Niagara Financial Group, Inc. |

12,500 | 186 | ||

| First Potomac Realty Trust |

74,500 | 2,169 | ||

| First Republic Bank |

96,900 | 3,787 | ||

| Genworth Financial, Inc. |

10,500 | 359 | ||

| Hercules Technology Growth Capital, Inc. |

94,600 | 1,348 | ||

| Home Bancshares, Inc. |

10,200 | 245 | ||

| Innkeepers USA Trust |

53,200 | 825 | ||

| Investors Financial Services Corp. |

13,100 | 559 | ||

T. Rowe Price Small Cap Value Portfolio

9

T. Rowe Price Small Cap Value Portfolio

| Common Stocks (95.3%) | Shares/ $ Par |

Value $ (000’s) | ||

| Financials continued |

||||

| Janus Capital Group, Inc. |

22,100 | 477 | ||

| Kilroy Realty Corp. |

60,900 | 4,749 | ||

| *Kohlberg Capital Corp. |

103,000 | 1,782 | ||

| Lasalle Hotel Properties |

61,600 | 2,824 | ||

| Lazard, Ltd. — Class A |

2,700 | 128 | ||

| Lincoln National Corp. |

6,363 | 423 | ||

| *Markel Corp. |

4,900 | 2,352 | ||

| Marsh & McLennan Companies, Inc. |

52,800 | 1,619 | ||

| Max Re Capital, Ltd. |

72,100 | 1,790 | ||

| The Midland Co. |

48,800 | 2,047 | ||

| Netbank, Inc. |

83,000 | 385 | ||

| NewAlliance Bancshares, Inc. |

16,200 | 266 | ||

| Northern Trust Corp. |

9,900 | 601 | ||

| Ohio Casualty Corp. |

10,800 | 322 | ||

| *OneBeacon Insurance Group, Ltd. |

6,500 | 182 | ||

| Parkway Properties, Inc. |

2,500 | 128 | ||