ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

(State or other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) |

Title of each class | Trading Symbol | Name of exchange on which registered |

Large Accelerated filer | ☐ | ☒ | Emerging growth company | ||

Non-accelerated filer | ☐ | Smaller reporting company | |||

Item | Page | |

PART I: | ||

1 | ||

1A. | ||

1B. | ||

2 | ||

3 | ||

4 | ||

PART II: | ||

5 | ||

6 | ||

7 | ||

7A. | ||

8 | ||

9 | ||

9A. | ||

9B. | ||

PART III: | ||

10 | ||

11 | ||

12 | ||

13 | ||

14 | ||

PART IV: | ||

15 | ||

16 | ||

Part I | ||

Item 1. Business | ||

Part I | ||

Item 1. Business | ||

• | Power Wheelchairs. This product category includes complex power wheelchairs for individuals who require powered mobility. The company's power wheelchair product offerings include products that can be highly customized to meet an individual end-user's needs, as well as products that are inherently versatile and designed to meet a broad range of requirements. Center-wheel drive power wheelchair lines include the Invacare® TDX® (Total Driving eXperience) product line and the ROVI® X3 and A3 power base product line, |

Part I | ||

Item 1. Business | ||

• | Custom Manual Wheelchairs. This product category includes products for independent everyday use, outdoor recreation, and casual and competitive sports, such as basketball, racing and tennis. These products are marketed under the Invacare® and Invacare® Top End® brand names. The company markets a premiere line of lightweight, aesthetically-stylish custom manual wheelchairs under the Küschall® brand name. These custom manual wheelchairs feature precision components and outstanding driving performance. The company provides a wide range of mobility solutions for everyday activities. The company's competitive advantages include a wide range of features and functionality and the ability to build purposeful custom |

• | Seating and Positioning Products. At the core of care for seated end-users is the need for proper seating and positioning. Invacare designs, manufactures and markets some of the industry's best custom seating and positioning systems, custom molded and modular seat cushions, back supports and accessories to enable care givers to optimize the posture of their patients in mobility products. The Invacare® Seating and Positioning series provides seating solutions for less complex end-user needs. The Invacare® Matrx® Series offers versatile modular seating components with unique proprietary designs and materials designed to optimize pressure management and to help ensure long-term proper posture. The company's PinDot® series provides custom molded seat modules that can accommodate the most unique anatomic needs, and that can be adapted to fit with a wide range of mobility products. The company's ability to rapidly produce highly-customized products is highly specialized in the market, and is valued by therapists who need timely solutions for their patient's most complex clinical needs. |

• | Pressure Relieving Sleep Surfaces. This product category includes a complete line of therapeutic pressure relieving overlays and mattress systems. The Invacare® Softform and microAIR® brand names feature a broad range of pressure relieving foam mattresses and powered mattresses with alternating pressure, low-air-loss, or rotational design features, which redistribute weight and assist with moisture management. These mattresses are designed to provide comfort, support and relief to those patients who are immobile or have limited mobility; who may have fragile skin or be susceptible to skin breakdown; and who spend long periods in bed. |

• | Safe Resident Handling. This product category includes products needed to assist caregivers in transferring individuals from surface to surface (e.g., bed to chair). Designed for use in the home or in institutional settings, these products include ceiling and floor lifts, sit-to-stand devices and a comprehensive line of slings. |

• | Beds. This product category includes wide variety of Invacare® branded semi-electric and fully-electric bed systems designed for both residential and institutional care for a range of patient sizes. The company's offering includes bed accessories, such as bedside rails, overbed tables and trapeze bars. The company's bed systems introduced the split-spring bed design, which is easier |

Part I | ||

Item 1. Business | ||

• | Manual Wheelchairs. This product category includes a complete line of manual wheelchairs. The company's manual wheelchairs are sold for use in the home and in institutional care settings. Consumers include people who are chronically or temporarily-disabled, require basic mobility with little or no frame modification, and may propel themselves or be moved by a caregiver. The company's manual wheelchairs are marketed under the Invacare® brand name. Examples include the 9000 and Tracer® wheelchair product lines. |

• | Personal Care. This product category includes a full line of personal care products, including ambulatory aids such as rollators, walkers, and wheeled walkers. The company also distributes bathing safety aids, such as tub transfer benches and shower chairs, as well as patient care products, such as commodes and other toileting aids. In markets where payors value durable long-lasting devices, especially those markets outside of the U.S., personal care products continue to be an important part of the company's lifestyles product business. In certain other markets, and in the U.S. in particular, this product area is focused on residential care. |

• | Stationary Oxygen Concentrators. Invacare oxygen concentrators are manufactured under the Platinum® and Perfecto2™ brand names and are available in five-, nine-, and ten-liter models. All Invacare stationary oxygen concentrators are designed to provide patients with durable equipment that reliably concentrates |

• | Portable Oxygen Concentrators. One of two primary modalities for non-delivery supplementary ambulatory oxygen is the battery-powered portable category. Invacare's Platinum® Mobile Oxygen Concentrator has among the most competitive features in the five-liter equivalent category, including the industry's first wireless informatics platform in the five-pound category. The informatics platform includes a user centric app which now allows remote flow control of the portable concentrator from up to 25ft and a provider facing portal for remote fleet monitoring to help reduce unplanned dispatches and total operating costs. |

• | Oxygen Refilling Devices. The Invacare® HomeFill® Oxygen System is an alternative source of ambulatory oxygen that allows patients to fill their own convenient small portable oxygen cylinders from a stationary oxygen concentrator at home. This enables users to access high-flow stationary oxygen while at home and provides an easy-to-use form of mobile oxygen while away. As a result, medical equipment providers can significantly reduce time-consuming and costly service calls associated with cylinder and/or liquid oxygen deliveries, limit recurring high maintenance expenses and total cost of ownership while at the same time enhancing the lifestyle of the patient. |

Part I | ||

Item 1. Business | ||

Part I | ||

Item 1. Business | ||

Part I | ||

Item 1. Business | ||

• | The new Motion Concepts 407 seating system utilizes a simple design to optimize the stability of the base of the wheelchair, while providing up to 40º of tilt. This allows the end user to achieve a unique position where the head is below the feet, and the feet are above the heart, to assist with respiratory and circulatory conditions. |

• | The Motion Concepts UpFront thoughtfully combines a fully functioning power positioning system with 5.5” of forward shift, allowing the end user to access previously difficult to reach surfaces and objects. |

• | The Motion Concepts HD Series is a seating system which meets the individual needs of today’s larger end users. The HD Series is designed to allow for exceptional driving performance, elegant design and maximum comfort and can accommodate higher weight capacities. |

• | In the category of custom manual wheelchairs, the company introduced the new Kuschall 2.0 line of manual wheelchairs. This new line utilizes a new technology (hydroforming) to increase the stiffness of the chair, while at the same time reducing the weight. The result of these features adds to the driving performance of the wheelchair. The new design can be |

• | In the category of power add-on drives, the company's Alber division launched the new SMOOV one O10. This small, light and portable add-on is easy to use and has a separate, wireless and ergonomic control unit and an app for further adjustments and functions. |

• | In the Lifestyles product line, the company launched new products such as the Etude and NordBed. This new range of beds offers enhanced ergonomics (due to the new patented Ergo Move Technology), effective risk management and single-handed care with features like “Up & Out”, “low lowest height” and “RememberMe”. It has modern aesthetics and can be easily detachable in pieces below 20kg without any tools. |

• | In the Respiratory product line, the company launched another first with the addition of remote flow control to the existing portable oxygen concentrator app. The app enables an even more active and autonomous lifestyle for patients on oxygen. Using the app, a patient can change between prescribed rest and activity settings while the concentrator is worn on their back or from a distance of 25 feet when the concentrator is used with a longer cannula. This reduces activity interruption or the need to return to the concentrator to change between settings. |

Part I | ||

Item 1. Business | ||

• | Continue to drive all business segments and product lines based on their potential to achieve a leading market position and support profitability goals; |

• | In Europe, leverage centralized innovation and supply chain capabilities while reducing the cost and complexity of a legacy infrastructure; |

• | In North America, adjust the portfolio to consistently grow profitability amid cost increases by adding new products, reducing costs and continuing to improve customers' experience; |

• | In Asia Pacific, remain focused on sustainable growth and expansion in the southeast Asia region; and |

• | Globally, take actions to reduce working capital and improve free cash flow. |

Part I | ||

Item 1. Business | ||

Part I | ||

Item 1. Business | ||

Part I | ||

Item 1. Business | ||

Part I | ||

Item 1. Business | ||

Part I | ||

Item 1A. Risk Factors | ||

Part I | ||

Item 1A. Risk Factors | ||

Part I | ||

Item 1A. Risk Factors | ||

• | different regulatory environments and reimbursement systems; |

• | difficulties in enforcing agreements and collecting receivables through certain foreign legal systems; |

• | foreign customers who may have longer payment cycles than customers in the United States; |

• | fluctuations in foreign currency exchange rates; |

• | tax rates in certain foreign countries that may exceed those in the United States and foreign earnings that may be subject to withholding requirements; |

• | the imposition of tariffs, exchange controls or other trade restrictions including transfer pricing restrictions when products produced in one country are sold to an affiliated entity in another country; |

• | potential adverse changes in trade agreements between the United States and foreign countries, including the North America Free Trade Agreement (NAFTA) among the United States, Canada and Mexico; |

• | potential adverse changes in economic and political conditions in countries where the company operates or where end-users of the company's products reside, or in their diplomatic relations with the United States; |

• | government control of capital transactions, including the borrowing of funds for operations or the expatriation of cash; |

• | potential adverse tax consequences, including those that may result from new United States tax laws, rules, regulations or policies; |

• | security concerns and potential business interruption risks associated with political and/or social unrest, or public health crisis, in foreign countries where the company's facilities or assets are located; |

• | difficulties associated with managing a large organization spread throughout various countries; |

• | difficulties in enforcing intellectual property rights and weaker intellectual property rights protection in some countries; |

• | required compliance with a variety of foreign laws and regulations; and |

• | differing consumer product preferences. |

Part I | ||

Item 1A. Risk Factors | ||

Part I | ||

Item 1A. Risk Factors | ||

Part I | ||

Item 1A. Risk Factors | ||

Part I | ||

Item 1A. Risk Factors | ||

Part I | ||

Item 1A. Risk Factors | ||

Part I | ||

Item 1A. Risk Factors | ||

• | reduced availability of cash for the company's operations and other business activities after satisfying interest payments and other requirements under the terms of its debt instruments; |

• | less flexibility to plan for or react to competitive challenges, and suffer a competitive disadvantage relative to competitors that do not have as much indebtedness; |

• | difficulty in obtaining additional financing in the future; |

• | inability to comply with covenants in, and potential for default under, the company's debt instruments; and |

• | challenges to refinancing any of the company's debt. |

Part I | ||

Item 1A. Risk Factors | ||

Part I | ||

Item 1A. Risk Factors | ||

Part I | ||

Item 1A. Risk Factors | ||

Part I | ||

Item 1A. Risk Factors | ||

Part I | ||

Item 1A. Risk Factors | ||

Part I | ||

Item 1A. Risk Factors | ||

Part I | ||

Item 2. Properties | ||

Owned | Leased | ||||||||

Number | Square Feet | Number | Square Feet | ||||||

Manufacturing Facilities | |||||||||

Europe | 3 | 349,612 | 6 | 513,601 | |||||

North America | 1 | 152,256 | 10 | 481,656 | |||||

4 | 501,868 | 16 | 995,257 | ||||||

Warehouse and Office Facilities | |||||||||

Europe | 2 | 37,674 | 45 | 412,183 | |||||

North America | — | — | 9 | 319,486 | |||||

All Other (Asia Pacific) | — | — | 5 | 104,728 | |||||

2 | 37,674 | 59 | 836,397 | ||||||

Part I | ||

Item 3. Legal Proceedings | ||

Part I | ||

Executive Officers of the Registrant | ||

Name | Age | Position |

Matthew E. Monaghan | 52 | Chairman, President and Chief Executive Officer |

Kathleen P. Leneghan | 56 | Senior Vice President and Chief Financial Officer |

Anthony C. LaPlaca | 61 | Senior Vice President, General Counsel and Secretary |

Ralf A. Ledda | 52 | Senior Vice President and General Manager, Europe, Middle East & Africa |

Darcie L. Karol | 53 | Senior Vice President, Human Resources |

* | The description of executive officers is included pursuant to the instructions to Item 401 of Regulation S-K. |

Part II | ||

Items 5 - 6 | ||

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

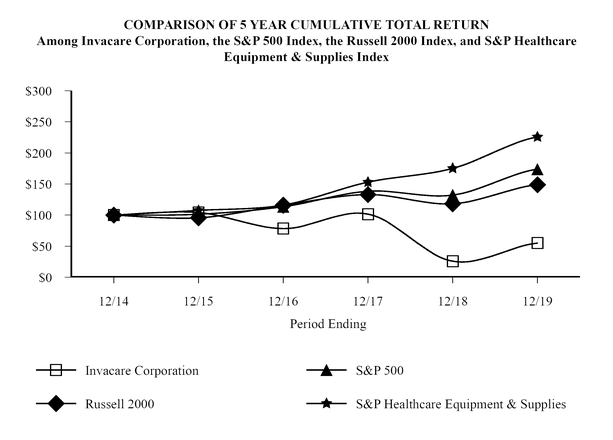

12/14 | 12/15 | 12/16 | 12/17 | 12/18 | 12/19 | ||||||||||||||||||

Invacare Corporation | $ | 100.00 | $ | 104.05 | $ | 78.40 | $ | 101.51 | $ | 25.98 | $ | 54.98 | |||||||||||

S&P 500 | 100.00 | 101.38 | 113.51 | 138.29 | 132.23 | 173.86 | |||||||||||||||||

Russell 2000 | 100.00 | 95.59 | 115.95 | 132.94 | 118.30 | 148.89 | |||||||||||||||||

S&P Healthcare Equipment & Supplies | 100.00 | 107.57 | 116.14 | 152.94 | 175.13 | 225.62 | |||||||||||||||||

Part II | ||

Items 5 - 6 | ||

Period | Total Number of Shares Purchased (1) | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares That May Yet Be Purchased Under the Plans or Programs (2) | |||||

10/1/2019 | - | 10/31/19 | — | $ __ | — | 2,453,978 | |||

11/1/2019 | - | 11/30/19 | 3,387 | 10.02 | — | 2,453,978 | |||

12/1/2019 | - | 12/31/19 | — | — | — | 2,453,978 | |||

Total | 3,387 | $10.02 | — | 2,453,978 | |||||

(1) | All 3,387 shares repurchased between October 1, 2019 and December 31, 2019 were surrendered to the company by employees for minimum tax withholding purposes in conjunction with the vesting of restricted shares awarded to the employees or exercise of non-qualified options under the company's equity compensation plans. |

(2) | In 2001, the Board of Directors authorized the company to purchase up to 2,000,000 Common Shares, excluding any shares acquired from employees or directors as a result of the exercise of options or vesting of restricted shares pursuant to the company's performance plans. The Board of Directors reaffirmed its authorization of this repurchase program on November 5, 2010, and on August 17, 2011 authorized an additional 2,046,500 shares for repurchase under the plan. To date, the company has purchased 1,592,522 shares under this program, with authorization remaining to purchase 2,453,978 shares. The company purchased no shares pursuant to this Board authorized program during 2019. |

Part II | ||

Items 5 - 6 | ||

2019 * | 2018 ** | 2017 *** | 2016 **** | 2015 ***** | |||||||||||||||

(In thousands, except per share and ratio data) | |||||||||||||||||||

Earnings (Loss) | |||||||||||||||||||

Net sales from continuing operations | $ | 927,964 | $ | 972,347 | $ | 966,497 | $ | 1,047,474 | $ | 1,142,338 | |||||||||

Loss from continuing operations | (53,327 | ) | (43,922 | ) | (76,541 | ) | (42,856 | ) | (26,450 | ) | |||||||||

Net earnings from discontinued operations | — | — | — | — | 260 | ||||||||||||||

Net Loss | (53,327 | ) | (43,922 | ) | (76,541 | ) | (42,856 | ) | (26,190 | ) | |||||||||

Net Earnings (Loss) per Share—Basic: | |||||||||||||||||||

Net loss from continuing operations | (1.59 | ) | (1.33 | ) | (2.34 | ) | (1.32 | ) | (0.82 | ) | |||||||||

Net earnings from discontinued operations | — | — | — | — | 0.01 | ||||||||||||||

Net Loss per Share—Basic | (1.59 | ) | (1.33 | ) | (2.34 | ) | (1.32 | ) | (0.81 | ) | |||||||||

Net Earnings (Loss) per Share—Assuming Dilution: | |||||||||||||||||||

Net loss from continuing operations | (1.59 | ) | (1.33 | ) | (2.34 | ) | (1.32 | ) | (0.82 | ) | |||||||||

Net earnings from discontinued operations | — | — | — | — | 0.01 | ||||||||||||||

Net Loss per Share—Assuming Dilution | (1.59 | ) | (1.33 | ) | (2.34 | ) | (1.32 | ) | (0.81 | ) | |||||||||

Dividends per Common Share | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | ||||||||||||||

Dividends per Class B Common Share | — | 0.02273 | 0.04545 | 0.04545 | 0.04545 | ||||||||||||||

Balance Sheet | |||||||||||||||||||

Current Assets | $ | 355,877 | $ | 397,410 | $ | 456,914 | $ | 409,072 | $ | 362,299 | |||||||||

Total Assets | 852,126 | 885,855 | 1,066,033 | 903,743 | 838,143 | ||||||||||||||

Current Liabilities | 218,657 | 198,208 | 218,064 | 220,861 | 247,644 | ||||||||||||||

Working Capital | 137,220 | 199,202 | 238,850 | 188,211 | 114,655 | ||||||||||||||

Long-Term Debt | 258,004 | 253,535 | 241,405 | 146,088 | 45,092 | ||||||||||||||

Other Long-Term Obligations | 66,949 | 74,965 | 183,270 | 114,407 | 82,589 | ||||||||||||||

Shareholders' Equity | 308,516 | 359,147 | 423,294 | 422,387 | 462,818 | ||||||||||||||

Other Data | |||||||||||||||||||

Research and Development Expenditures | $ | 15,836 | $ | 17,377 | $ | 17,796 | $ | 17,123 | $ | 18,677 | |||||||||

Capital Expenditures | 10,874 | 9,823 | 14,569 | 10,151 | 7,522 | ||||||||||||||

Depreciation and Amortization | 15,563 | 15,556 | 14,631 | 14,635 | 18,204 | ||||||||||||||

Key Ratios | |||||||||||||||||||

Return on Sales % from continuing operations | (5.7 | ) | (4.5 | ) | (7.9 | ) | (4.1 | ) | (2.3 | ) | |||||||||

Return on Average Assets % | (6.1 | ) | (4.5 | ) | (7.8 | ) | (4.9 | ) | (2.9 | ) | |||||||||

Return on Beginning Shareholders' Equity % | (14.8 | ) | (10.4 | ) | (18.1 | ) | (9.3 | ) | (4.6 | ) | |||||||||

Current Ratio | 1.6:1 | 2.0:1 | 2.1:1 | 1.9:1 | 1.5:1 | ||||||||||||||

Debt-to-Equity Ratio | 0.87:1 | 0.71:1 | 0.58:1 | 0.38:1 | 0.10:1 | ||||||||||||||

Part II | ||

Items 5 - 6 | ||

* | Reflects charges related to restructuring from continuing operations of $11,829,000 ($9,003,000 after-tax expense or $0.27 per share assuming dilution), loss on debt extinguishment including debt finance charges and fees of $6,165,000 ($6,165,000 after-tax expense or $0.18 per share assuming dilution), net gains on convertible debt derivatives of $1,197,000 ($1,197,000 after-tax income or $0.04 per share assuming dilution) and an intangible asset impairment of $587,000 ($435,000 after-tax expense or $0.01 per share assuming dilution). |

** | Reflects charges related to restructuring from continuing operations of $3,481,000 ($3,249,000 after-tax expense or $0.10 per share assuming dilution), net loss on convertible debt derivatives of $11,994,000 ($11,994,000 after-tax income or $0.36 per share assuming dilution), an intangible asset impairment of $583,000 ($431,000 after-tax expense or $0.01 per share assuming dilution) and a non-cash tax benefit of $2,023,000 ($0.06 per share assuming dilution) related to U.S. tax reform legislation. |

*** | Reflects charges related to restructuring from continuing operations of $12,274,000 ($11,872,000 after-tax expense or $0.36 per share assuming dilution), net loss on convertible debt derivatives of $3,657,000 ($3,657,000 after-tax income or $0.11 per share assuming dilution), an intangible asset impairment of $320,000 ($237,000 after-tax expense or $0.01 per share assuming dilution) and a non-cash tax benefit of $1,580,000 ($0.05 per share assuming dilution) related to the revaluation of net deferred tax liabilities as a result of the new U.S. tax reform legislation. |

**** | Reflects gain on sale of Garden City Medical, Inc. of $7,386,000 ($7,386,000 after-tax income or $0.23 per share assuming dilution), charges related to restructuring from continuing operations of $2,447,000 ($2,447,000 after-tax expense or $0.08 per share assuming dilution), incremental warranty expense of $2,856,000 ($2,856,000 after-tax expense or $0.09 per share assuming dilution related to three product recalls) and net gain on convertible debt derivatives of $1,268,000 ($1,268,000 after-tax income or $0.04 per share assuming dilution). |

***** | Reflects charges related to restructuring from continuing operations of $1,971,000 ($1,843,000 after-tax expense or $0.06 per share assuming dilution), net warranty reversals of $2,325,000 ($2,325,000 after-tax income or $0.07 per share assuming dilution related to three product recalls) and the positive impact of an intraperiod tax allocation associated with discontinued operations of $140,000 or $0.00 per share assuming dilution. |

Part II | ||

Management Discussion & Analysis - Overview | ||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations. |

Part II | ||

Management Discussion & Analysis - Overview | ||

• | Globally, continue to drive all business segments and product lines based on their potential to achieve a leading market position and to support profitability goals; |

• | In Europe, leverage centralized innovation and supply chain capabilities while reducing the cost and complexity of a legacy infrastructure; |

• | In North America, adjust the portfolio to consistently grow profitability amid cost increases by adding new products, reducing costs and continuing to improve customers' experience; |

• | In Asia Pacific, remain focused on sustainable growth and expansion in the southeast Asia region; and |

• | Take actions globally to reduce working capital and improve free cash flow. |

• | Significantly reduced constant currency SG&A; |

• | Substantially mitigated the majority of tariffs which impacted North America; |

• | Completed the transfer of manual wheelchair production to France; |

• | Announced the consolidation of two German facilities by the end of 2020 and; |

• | Engaged in strategic long-term program to modernize IT infrastructure at no incremental in-period expense. |

Part II | ||

MD&A - Results of Operations | ||

Part II | ||

MD&A - Net Sales | ||

($ in thousands USD) | 2019 | 2018 | % Change Fav/(Unfav) | Foreign Exchange % Impact | Constant Currency % Change Fav/(Unfav) | ||||||||||

Europe | 533,048 | 558,518 | (4.6 | ) | (5.8 | ) | 1.2 | ||||||||

North America | 348,201 | 364,590 | (4.5 | ) | (0.2 | ) | (4.3 | ) | |||||||

All Other (Asia Pacific) | 46,715 | 49,239 | (5.1 | ) | (5.5 | ) | 0.4 | ||||||||

Consolidated | 927,964 | 972,347 | (4.6 | ) | (3.7 | ) | (0.9 | ) | |||||||

Part II | ||

MD&A - Net Sales | ||

Q4 19 at Reported Foreign Exchange Rates | Foreign Exchange Translation Impact | Q4 19 at Q1 19 Foreign Exchange Rates | Q3 19 at Q1 19 Foreign Exchange Rates | Sequential Growth $ | Sequential Growth % | |||||||||||||||||

Europe | $ | 136,842 | $ | 4,577 | $ | 141,419 | $ | 140,155 | $ | 1,264 | 0.9 | % | ||||||||||

North America | 85,286 | (52 | ) | 85,234 | 87,062 | (1,828 | ) | (2.1 | ) | |||||||||||||

All Other (Asia Pacific) | 10,785 | 485 | 11,270 | 11,795 | (525 | ) | (4.5 | ) | ||||||||||||||

Consolidated | $ | 232,913 | $ | 5,010 | $ | 237,923 | $ | 239,012 | $ | (1,089 | ) | (0.5 | )% | |||||||||

Q3 19 at Reported Foreign Exchange Rates | Foreign Exchange Translation Impact | Q3 19 at Q1 19 Foreign Exchange Rates | Q2 19 at Q1 19 Foreign Exchange Rates | Sequential Growth $ | Sequential Growth % | |||||||||||||||||

Europe | $ | 137,371 | $ | 2,784 | $ | 140,155 | $ | 135,385 | $ | 4,770 | 3.5 | % | ||||||||||

North America | 87,118 | (56 | ) | 87,062 | 89,610 | (2,548 | ) | (2.8 | ) | |||||||||||||

All Other (Asia Pacific) | 11,285 | 510 | 11,795 | 12,604 | (809 | ) | (6.4 | ) | ||||||||||||||

Consolidated | $ | 235,774 | $ | 3,238 | $ | 239,012 | $ | 237,599 | $ | 1,413 | 0.6 | % | ||||||||||

Q2 19 at Reported Foreign Exchange Rates | Foreign Exchange Translation Impact | Q2 19 at Q1 19 Foreign Exchange Rates | Q1 19 at Q1 19 Foreign Exchange Rates | Sequential Growth $ | Sequential Growth % | |||||||||||||||||

Europe | $ | 133,991 | $ | 1,394 | $ | 135,385 | $ | 124,844 | $ | 10,541 | 8.4 | % | ||||||||||

North America | 89,553 | 57 | 89,610 | 86,243 | 3,367 | 3.9 | ||||||||||||||||

All Other (Asia Pacific) | 12,314 | 290 | 12,604 | 12,332 | 272 | 2.2 | ||||||||||||||||

Consolidated | $ | 235,858 | $ | 1,741 | $ | 237,599 | $ | 223,419 | $ | 14,180 | 6.3 | % | ||||||||||

Part II | ||

MD&A - Net Sales | ||

Part II | ||

MD&A - Net Sales | ||

($ in thousands USD) | 2018 | 2017 | Reported % Change | Foreign Exchange % Impact | Constant Currency % Change | ||||||||||

Europe | 558,518 | 535,326 | 4.3 | 4.5 | (0.2 | ) | |||||||||

North America | 364,590 | 380,290 | (4.1 | ) | 0.1 | (4.1 | ) | ||||||||

All Other (Asia Pacific) | 49,239 | 50,881 | (3.2 | ) | (2.1 | ) | (1.1 | ) | |||||||

Consolidated | 972,347 | 966,497 | 0.6 | 2.4 | (1.8 | ) | |||||||||

Part II | ||

MD&A - Gross Profit | ||

Part II | ||

MD&A - Gross Profit | ||

Part II | ||

MD&A - SG&A | ||

($ in thousands USD) | 2019 | 2018 | Reported Change | Foreign Exchange Impact | Constant Currency Change | |||||

SG&A Expenses - $ | 260,061 | 281,906 | (21,845 | ) | (7,228 | ) | (14,617 | ) | ||

SG&A Expenses - % change | (7.7 | ) | (2.5 | ) | (5.2 | ) | ||||

% to net sales | 28.0 | 29.0 | ||||||||

Part II | ||

MD&A - SG&A | ||

($ in thousands USD) | 2018 | 2017 | Reported Change | Foreign Exchange Impact | Constant Currency Change | |||||

SG&A Expenses - $ | 281,906 | 296,816 | (14,910 | ) | 5,014 | (19,924 | ) | |||

SG&A Expenses - % change | (5.0 | ) | 1.7 | (6.7 | ) | |||||

% to net sales | 29.0 | 30.7 | ||||||||

Part II | ||

MD&A - Operating Income | ||

2019 vs. 2018 | 2018 vs. 2017 | |||||||||||||

($ in thousands USD) | 2019 | 2018 | 2017 | $ Change | % Change | $ Change | % Change | |||||||

Europe | 36,174 | 32,673 | 33,160 | 3,501 | 10.7 | (487 | ) | (1.5 | ) | |||||

North America | (7,592 | ) | (32,506 | ) | (36,992 | ) | 24,914 | 76.6 | 4,486 | 12.1 | ||||

All Other | (26,576 | ) | (14,397 | ) | (23,733 | ) | (12,179 | ) | (84.6 | ) | 9,336 | 39.3 | ||

Charges related to restructuring | (11,829 | ) | (3,481 | ) | (12,274 | ) | (8,348 | ) | (239.8 | ) | 8,793 | 71.6 | ||

Impairment of an intangible asset | (587 | ) | (583 | ) | (320 | ) | (4 | ) | 0.7 | (263 | ) | 82.2 | ||

Consolidated Operating Loss | (10,410 | ) | (18,294 | ) | (40,159 | ) | 7,884 | 43.1 | 21,865 | 54.4 | ||||

Part II | ||

MD&A - Operating Income | ||

Part II | ||

MD&A - Other Items | ||

($ in thousands USD) | Change in Fair Value - Gain (Loss) | |||

2019 | 2018 | |||

Convertible Note Hedge Assets | 9,600 | (90,505 | ) | |

Convertible Debt Conversion Liabilities | (8,403 | ) | 102,499 | |

Net gain on convertible debt derivatives | 1,197 | 11,994 | ||

($ in thousands USD) | 2019 | 2018 | $ Change | % Change | |||

Interest Expense | 29,076 | 28,336 | 740 | 2.6 | |||

Interest Income | (429 | ) | (534 | ) | 105 | 19.7 | |

($ in thousands USD) | Change in Fair Value - Gain (Loss) | |||

2018 | 2017 | |||

Convertible Note Hedge Assets | (90,505 | ) | 43,344 | |

Convertible Debt Conversion Liabilities | 102,499 | (47,001 | ) | |

Net gain on convertible debt derivatives | 11,994 | (3,657 | ) | |

($ in thousands USD) | 2018 | 2017 | $ Change | % Change | ||||

Interest Expense | 28,336 | 22,907 | 5,429 | 23.7 | ||||

Interest Income | (534 | ) | (473 | ) | (61 | ) | (12.9 | ) |

Part II | ||

MD&A - Liquidity and Capital Resources | ||

($ in thousands USD) | December 31, 2019 | December 31, 2018 | $ Change | % Change | ||||

Cash and cash equivalents | 80,063 | 116,907 | (36,844 | ) | (31.5 | ) | ||

Working capital (1) | 137,220 | 199,202 | (61,982 | ) | (31.1 | ) | ||

Total debt (2) | 302,106 | 299,912 | 2,194 | 0.7 | ||||

Long-term debt (2) | 292,744 | 297,802 | (5,058 | ) | (1.7 | ) | ||

Total shareholders' equity | 308,516 | 359,147 | (50,631 | ) | (14.1 | ) | ||

Credit agreement borrowing availability (3) | 34,516 | 33,362 | 1,154 | 3.5 | ||||

(1) | Current assets less current liabilities. |

(2) | Long-term debt and Total debt exclude debt issuance costs recognized as a deduction from the carrying amount of debt liability and debt discounts classified as debt or equity. |

(3) | Reflects the combined availability of the company's North American and European asset-based revolving credit facilities. The change is borrowing availability is due to changes in the calculated borrowing base. |

Part II | ||

MD&A - Liquidity and Capital Resources | ||

Part II | ||

MD&A - Liquidity and Capital Resources | ||

Part II | ||

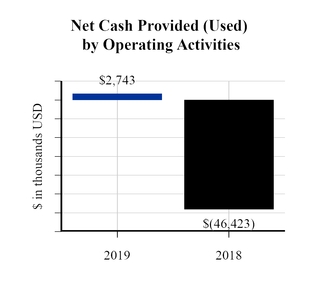

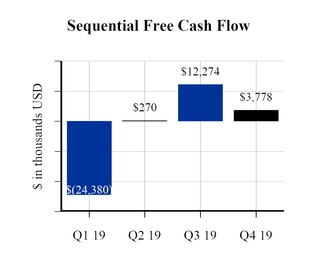

MD&A - Cash Flows | ||

($ in thousands USD) | Twelve Months Ended December 31, | ||||||

2019 | 2018 | ||||||

Net cash provided (used) by operating activities | $ | 2,743 | $ | (46,423 | ) | ||

Plus: Sales of property and equipment | 73 | 40 | |||||

Plus: Advance payment from sale of property | — | 3,524 | |||||

Less: Purchases of property and equipment | (10,874 | ) | (9,823 | ) | |||

Free Cash Flow | $ | (8,058 | ) | $ | (52,682 | ) | |

Part II | ||

MD&A - Cash Flows | ||

Part II | ||

MD&A - Accounting Estimates and Pronouncements | ||

Part II | ||

MD&A - Accounting Estimates and Pronouncements | ||

Part II | ||

MD&A - Accounting Estimates and Pronouncements | ||

Part II | ||

MD&A - Accounting Estimates and Pronouncements | ||

Part II | ||

MD&A - Accounting Estimates and Pronouncements | ||

Part II | ||

MD&A - Contractual Obligations | ||

Payments due by period | |||||||||||||||||||

Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years | |||||||||||||||

Purchase obligations (primarily computer systems contracts) (1) | $ | 235,138 | $ | 27,598 | $ | 59,240 | $ | 56,840 | $ | 91,460 | |||||||||

4.500% Convertible Senior Subordinated Notes due 2022 | 133,050 | 5,400 | 127,650 | — | — | ||||||||||||||

4.500% Convertible Senior Subordinated Notes due 2024 | 90,680 | 3,645 | 7,291 | 79,744 | — | ||||||||||||||

5.00% Convertible Senior Subordinated Notes due 2021 | 64,528 | 3,055 | 61,473 | — | — | ||||||||||||||

Future lease obligations (2) | 67,931 | 2,264 | 6,793 | 6,793 | 52,081 | ||||||||||||||

Capital lease obligations | 39,753 | 3,785 | 6,017 | 4,897 | 25,054 | ||||||||||||||

Operating lease obligations | 21,625 | 8,063 | 9,919 | 2,532 | 1,111 | ||||||||||||||

Product liability | 16,150 | 2,736 | 6,414 | 3,019 | 3,981 | ||||||||||||||

Supplemental Executive Retirement Plan | 5,824 | 391 | 782 | 782 | 3,869 | ||||||||||||||

Other, principally deferred compensation | 5,354 | — | — | — | 5,354 | ||||||||||||||

Total | $ | 680,033 | $ | 56,937 | $ | 285,579 | $ | 154,607 | $ | 182,910 | |||||||||

Part II | ||

Items 7 - 9 | ||

Item 7A. | Quantitative and Qualitative Disclosures about Market Risk. |

Item 8. | Financial Statements and Supplementary Data. |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. |

Part II | ||

Items 7 - 9 | ||

Part III | ||

Items 10 - 14 | ||

Item 10. | Directors, Executive Officers and Corporate Governance. |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters. |

Item 13. | Certain Relationships and Related Transactions, and Director Independence. |

Item 14. | Principal Accountant Fees and Services. |

Part IV | ||

Items 15 - 16 | ||

INVACARE CORPORATION | ||

By: | /s/ MATTHEW E. MONAGHAN | |

Matthew E. Monaghan | ||

Chairman of the Board of Directors, President and Chief Executive Officer | ||

Exhibit Index | ||

Official Exhibit No. | Description | Sequential Page No. | |

Membership Interest Purchase Agreement among Invacare Continuing Care, Inc., Invacare Corporation and Joerns Healthcare Parent, LLC, dated July 2, 2015. (Pursuant to Item 601(b)(2) of Regulation S-K, the registrant hereby agrees to supplementally furnish to the Securities and Exchange Commission upon request any omitted schedule or exhibit to the agreement.) | (A) | ||

Share Purchase Agreement among Invacare Corporation, Garden City Medical Inc. and Compass Health Brands Corp., dated September 30, 2016. (Pursuant to Item 601(b)(2) of Regulation S-K, the registrant hereby agrees to supplementally furnish to the Securities and Exchange Commission upon request any omitted schedule or exhibit to the agreement.) | (B) | ||

Securities Purchase Agreement among Allied Motion Christchurch Limited, Invacare Holdings New Zealand and Invacare Corporation, dated March 6, 2020. (Pursuant to Item 601(b)(2) of Regulation S-K, the registrant hereby agrees to supplementally furnish to the Securities and Exchange Commission upon request any omitted schedule or exhibit to the agreement.) | (OO) | ||

Second Amended and Restated Articles of Incorporation | (C) | ||

Second Amended and Restated Code of Regulations, as amended | (D) | ||

Amendment No. 1 to the Second Amended and Restated Articles of Incorporation | (E) | ||

Specimen Share Certificate for Common Shares | (F) | ||

Specimen Share Certificate for Class B Common Shares | (F) | ||

Indenture, dated as of February 23, 2016, by and between Invacare Corporation and Wells Fargo Bank, National Association (including the form of the 5.00% Convertible Senior Notes due 2021). | (G) | ||

Indenture, dated as of June 14, 2017, by and between Invacare Corporation and Wells Fargo Bank, National Association (including the form of the 4.50% Convertible Senior Notes due 2022). | (H) | ||

Indenture, dated as of November 19, 2019, by and between Invacare Corporation and Wells Fargo Bank, N.A., as Trustee (including the form of the 5.00% Convertible Senior Exchange Notes due 2024). | (I) | ||

Description of Securities Registered Under the Exchange Act. | |||

Invacare Retirement Savings Plan, effective January 1, 2001, as amended | (J)* | ||

Invacare Corporation 401(K) Plus Benefit Equalization Plan, effective January 1, 2003, as amended and restated | (J)* | ||

Invacare Corporation Deferred Compensation Plus Plan, effective January 1, 2005, as amended August 19, 2009 and on November 23, 2010 | (K)* | ||

Amendment No. 3 to Invacare Corporation Deferred Compensation Plus Plan, effective January 1, 2005 | (L)* | ||

Invacare Corporation Death Benefit Only Plan, effective January 1, 2005, as amended | (J)* | ||

Supplemental Executive Retirement Plan, as amended and restated effective February 1, 2000 | (M)* | ||

Cash Balance Supplemental Executive Retirement Plan, as amended and restated, effective December 31, 2008 | (N)* | ||

Amendment No. 1 to the Cash Balance Supplemental Executive Retirement Plan, effective August 19, 2009 | (O)* | ||

Form of Participation Agreement, for current participants in the Cash Balance Supplemental Executive Retirement Plan, as of December 31, 2008, entered into by and between the company and certain participants and a schedule of all such agreements with participants | (P)* | ||

Invacare Corporation Amended and Restated 2003 Performance Plan | (O)* | ||

Form of Director Stock Option Award under Invacare Corporation 2003 Performance Plan | (J)* | ||

Exhibit Index | ||

Official Exhibit No. | Description | Sequential Page No. | |

Form of Director Deferred Option Award under Invacare Corporation 2003 Performance Plan | (K)* | ||

Form of Restricted Stock Award under Invacare Corporation 2003 Performance Plan | (L) | ||

Form of Stock Option Award under Invacare Corporation 2003 Performance Plan | (J)* | ||

Form of Executive Stock Option Award under Invacare Corporation 2003 Performance Plan | (J)* | ||

Form of Switzerland Stock Option Award under Invacare Corporation 2003 Performance Plan | (J)* | ||

Form of Switzerland Executive Stock Option Award under Invacare Corporation 2003 Performance Plan | (J)* | ||

Invacare Corporation 2013 Equity Compensation Plan | (Q) | ||

Amendment No. 1 to the Invacare Corporation 2013 Equity Compensation Plan | (R)* | ||

Form of Executive Stock Option Award under the Invacare Corporation 2013 Equity Compensation Plan | (S) | ||

Form of Stock Option Award under the Invacare Corporation 2013 Equity Compensation Plan | (S) | ||

Form of Executive Stock Option Award for Swiss Employees under the Invacare Corporation 2013 Equity Compensation Plan | (S) | ||

Form of Stock Option Award for Swiss Employees under the Invacare Corporation 2013 Equity Compensation Plan | (S) | ||

Form of Director Restricted Stock Award under the Invacare Corporation 2013 Equity Compensation Plan | (S) | ||

Form of Restricted Stock Award under the Invacare Corporation 2013 Equity Compensation Plan | (S) | ||

Form of Performance Share Award Agreement under the Invacare Corporation 2013 Equity Compensation Plan | (T) | ||

Form of Restricted Stock Award Agreement for Employees under the Invacare Corporation 2013 Equity Compensation Plan | (U) | ||

Form of Director Restricted Stock Unit under the Invacare Corporation 2013 Equity Compensation Plan | (V) | ||

Invacare Corporation Executive Incentive Bonus Plan, as amended and restated | (R)* | ||

Employment Agreement, dated as of January 21, 2015, by and between the company and Matthew E. Monaghan. | (W)* | ||

Letter Agreement, dated as of February 20, 2018, by and between Invacare Corporation and Kathleen P. Leneghan. | (X)* | ||

Letter agreement, dated as of July 31, 2008, by and between the company and Anthony C. LaPlaca. | (P)* | ||

Employment Agreement, dated as of October 21, 2016, by and between the company and Ralf Ledda. | (V) | ||

Change of Control Agreement, dated as of December 31, 2008, by and between the company and Anthony C. LaPlaca | (Y) | ||

Form of Change of Control Agreement entered into by and between the company and certain of its executive officers and schedule of all such agreements with certain executive officers | (Z)* | ||

Technical Information & Non-Competition Agreement, dated April 1, 2015, entered into by and between the company and Matthew E. Monaghan | (P)* | ||

Technical Information & Non-Competition Agreement, dated April 6, 2008, entered into by and between the company and Robert K. Gudbranson | (P)* | ||

Technical Information & Non-Competition Agreement entered into by and between the company and certain of its executive officers and schedule of all such agreements with executive officers | (Z)* | ||

Exhibit Index | ||

Official Exhibit No. | Description | Sequential Page No. | |

Indemnity Agreement, dated April 1, 2015, entered into by and between the company and Matthew E. Monaghan. | (P)* | ||

Form of Indemnity Agreement entered into by and between the company and its directors and certain of its executive officers and schedule of all such agreements with directors and executive officers | (Z)* | ||

Form of Rule 10b5-1 Sales Plan entered into between the company and certain of its executive officers and other employees and a schedule of all such agreements with executive officers and other employees | (K) | ||

Director Compensation Schedule | * | ||

2012 Non-employee Directors Deferred Compensation Plan, effective January 1, 2012, Amended and Restated as of November 17, 2016 | (V) | ||

Retirement Agreement and Release, dated as of November 14, 2014, by and between Invacare Corporation and A. Malachi Mixon, III. | (AA)* | ||

Purchase and Sale Agreement, dated as of February 24, 2015, by and between the company and Industrial Realty Group, LLC. | (BB) | ||

Form of Lease Agreement by and among the company and the affiliates of Industrial Realty Group, LLC named therein. | (BB) | ||

Amended and Restated Revolving Credit and Security Agreement, dated as of September 30, 2015, by and among the company, the other Borrowers party thereto, the Guarantors party thereto, the Lenders party thereto, PNC Bank, National Association, as administrative agent, JP Morgan Chase Bank, N.A. and J.P. Morgan Europe Limited, as European agent. | (CC) | ||

First Amendment to Amended and Restated Revolving Credit and Security Agreement, dated as of February 16, 2016, by and among the company, the other borrowers party thereto, the guarantors party thereto, the lenders party thereto, PNC Bank, National Association, as administrative agent, and J.P. Morgan Europe Limited, as European agent. | (DD) | ||

Second Amendment to Amended and Restated Revolving Credit and Security Agreement, dated as of May 3, 2016 by and among the company, the other borrowers party thereto, the guarantors party thereto, the lenders party thereto, PNC Bank, National Association, as administrative agent, and J.P. Morgan Europe Limited, as European agent. | (V) | ||

Third Amendment to Amended and Restated Revolving Credit and Security Agreement, dated as of September 30, 2016, by and among the company, the other borrowers party thereto, the guarantors party thereto, the lenders party thereto, PNC Bank, National Association, as administrative agent, and J.P. Morgan Europe Limited, as European agent. | (V) | ||

Fourth Amendment to Amended and Restated Revolving Credit and Security Agreement, dated as of November 30, 2016, by and among the company, the other borrowers party thereto, the guarantors party thereto, the lenders party thereto, PNC Bank, National Association, as agent for the lenders, and J.P. Morgan Europe Limited, as European agent for the lenders. | (EE) | ||

Waiver and Fifth Amendment to Amended and Restated Revolving Credit and Security Agreement, dated as of November 30, 2016, by and among the company, the other borrowers party thereto, the guarantors party thereto, the lenders party thereto, PNC Bank, National Association, as agent for the lenders, and J.P. Morgan Europe Limited, as European agent for the lenders. | 10(FF) | ||

Sixth Amendment to Amended and Restated Revolving Credit and Security Agreement, dated as of November 13, 2019, by and among the company, the other borrowers party thereto, the guarantors party thereto, the lenders party thereto, PNC Bank, National Association, as agent for the lenders, and J.P. Morgan Europe Limited, as European agent for the lenders. | 10(I) | ||

Call Option Transaction Confirmation entered into between JPMorgan Chase Bank, National Association, London Branch and Invacare Corporation as of February 17, 2016 | (G) | ||

Call Option Transaction Confirmation entered into between Wells Fargo Bank, National Association and Invacare Corporation as of February 17, 2016 | (G) | ||

Warrants Confirmation between Invacare Corporation to JPMorgan Chase Bank, National Association, London Branch as of February 17, 2016 | (G) | ||

Warrants Confirmation between Invacare Corporation to Wells Fargo Bank, National Association as of February 17, 2016 | (G) | ||

Exhibit Index | ||

Official Exhibit No. | Description | Sequential Page No. | |

Additional Call Option Transaction Confirmation, dated March 4, 2016, between JPMorgan Chase Bank, National Association, London Branch and Invacare Corporation. | (GG) | ||

Additional Call Option Transaction Confirmation, dated March 4, 2016, between Wells Fargo Bank, National Association and Invacare Corporation. | (GG) | ||

Additional Warrants Confirmation, dated March 4, 2016, between JPMorgan Chase Bank, National Association, London Branch and Invacare Corporation. | (GG) | ||

Additional Warrants Confirmation, dated March 4, 2016, between Wells Fargo Bank, National Association and Invacare Corporation. | (GG) | ||

Partial Unwind Agreement, dated as of November 26, 2019, between Invacare Corporation and JPMorgan Chase Bank, National Association, London Branch. | |||

Partial Unwind Agreement, dated as of November 22, 2019, between Invacare Corporation and Wells Fargo Bank, National Association. | |||

Form of Performance-Based Stock Option Award under Invacare Corporation 2013 Equity Compensation Plan. | (HH) | ||

Base Call Option Transaction Confirmation, dated June 8, 2017, between Goldman Sachs & Co. LLC and Invacare Corporation. | 10(H) | ||

Base Warrants Confirmation, dated June 8, 2017, between Goldman Sachs & Co. LLC and Invacare Corporation. | 10(H) | ||

Additional Call Option Transaction Confirmation, dated June 9, 2017, between Goldman Sachs & Co. LLC and Invacare Corporation. | 10(H) | ||

Additional Warrants Confirmation, dated June 9, 2017, between Goldman Sachs & Co. LLC and Invacare Corporation. | 10(H) | ||

Separation Agreement and Release by and between Invacare Corporation and Patricia A. Stumpp. | 10(II)* | ||

Invacare Corporation 2018 Equity Compensation Plan | 10(JJ) | ||

Amendment No. 1 to Invacare Corporation 2018 Equity Compensation Plan | 10(E)* | ||

Form of Restricted Stock Award under Invacare Corporation 2018 Equity Compensation Plan | 10(KK) | ||

Form of Restricted Stock Unit Award under Invacare Corporation 2018 Equity Compensation Plan | 10(KK) | ||

Form of Director Restricted Stock Unit Award under Invacare Corporation 2018 Equity Compensation Plan | 10(KK) | ||

Form of Performance Award under Invacare Corporation 2018 Equity Compensation Plan | 10(KK) | ||

Form of Performance Unit Award under Invacare Corporation 2018 Equity Compensation Plan | 10(KK) | ||

Letter agreement, dated as of May 9, 2018, by and between the company and Darcie L. Karol | 10(KK)* | ||

Separation Agreement and Release by and between Invacare Corporation and Dean J. Childers | 10(LL)* | ||

Omnibus Amendment | 10(Z) | ||

Master Information Technology Services Agreement by and between Invacare Corporation and Birlasoft Solutions, Inc. effective October 1, 2019. | 10(MM) | ||

Subsidiaries of the company | |||

Consent of Independent Registered Public Accounting Firm | |||

Certification of the Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |||

Certification of the Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |||

Certification of the Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |||

Exhibit Index | ||

Official Exhibit No. | Description | Sequential Page No. | |

Certification of the Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |||

Consent Decree of Permanent Injunction, as filed with the U.S. District Court for the Northern District of Ohio on December 20, 2012. | (NN) | ||

101.INS** | Inline XBRL instance document | ||

101.SCH** | Inline XBRL taxonomy extension schema | ||

101.CAL** | Inline XBRL taxonomy extension calculation linkbase | ||

101.DEF** | Inline XBRL taxonomy extension definition linkbase | ||

101.LAB** | Inline XBRL taxonomy extension label linkbase | ||

101.PRE** | Inline XBRL taxonomy extension presentation linkbase | ||

104 | Cover Page Interactive Data File - The cover page from the company's Annual Report on Form 10-K for the year ended December 31, 2019, formatted in Inline XBRL (included in Exhibit 101). | ||

* | Management contract, compensatory plan or arrangement |

** | Filed herewith |

(A) | Reference is made to Exhibit 2.1 of the company report on Form 8-K, dated July 2, 2015, which Exhibit is incorporated herein by reference. |

(B) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated October 3, 2016, which Exhibit is incorporated herein by reference. |

(C) | Reference is made to Exhibit 3(a) of the company report on Form 10-K for the fiscal year ended December 31, 2008, which Exhibit is incorporated herein by reference. |

(D) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated February 13, 2014, which Exhibit is incorporated herein by reference. |

(E) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated May 16, 2019, which Exhibit is incorporated herein by reference. |

(F) | Reference is made to the appropriate Exhibit of the company report on Form 10-K for the fiscal year ended December 31, 2005, which Exhibit is incorporated herein by reference. |

(G) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated February 23, 2016, which Exhibit is incorporated herein by reference. |

(H) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated June 8, 2017, which Exhibit is incorporated herein by reference. |

(I) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated November 13, 2019, which Exhibit is incorporated herein by reference. |

(J) | Reference is made to the appropriate Exhibit of the company report on Form 10-K for the fiscal year ended December 31, 2007, which Exhibit is incorporated herein by reference. |

(K) | Reference is made to the appropriate Exhibit of the company report on Form 10-K for the fiscal year ended December 31, 2010, which Exhibit is incorporated herein by reference. |

(L) | Reference is made to the appropriate Exhibit of the company report on Form 10-K for the fiscal year ended December 31, 2011, which Exhibit is incorporated herein by reference. |

(M) | Reference is made to the appropriate Exhibit of the company report on Form 10-K for the fiscal year ended December 31, 2004, which Exhibit is incorporated herein by reference. |

(N) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated December 31, 2008, which Exhibit is incorporated herein by reference. |

(O) | Reference is made to Exhibit 10.1 of the company report on Form 8-K, dated May 21, 2009, which Exhibit is incorporated herein by reference. |

Exhibit Index | ||

(P) | Reference is made to the appropriate Exhibit of the company report on Form 10-K for the fiscal year ended December 31, 2015, which Exhibit is incorporated herein by reference. |

(Q) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated May 16, 2013, which Exhibit is incorporated herein by reference. |

(R) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated May 14, 2015, which Exhibit is incorporated herein by reference. |

(S) | Reference is made to the appropriate Exhibit of the company report on Form 10-Q, for the fiscal quarter ended September 30, 2013, which Exhibit is incorporated herein by reference. |

(T) | Reference is made to Exhibit 10.1 of the company report on Form 8-K, dated March 7, 2014, which Exhibit is incorporated herein by reference. |

(U) | Reference is made to Exhibit 10.2 of the company report on Form 8-K, dated March 7, 2014, which Exhibit is incorporated herein by reference. |

(V) | Reference is made to the appropriate Exhibit of the company report on Form 10-K for the fiscal year ended December 31, 2016, which Exhibit is incorporated herein by reference. |

(W) | Reference is made to Exhibit 10.1 of the company report on Form 8-K, dated January 21, 2015, which Exhibit is incorporated herein by reference. |

(X) | Reference is made to Exhibit 10.1 of the company report on Form 8-K, dated February 22, 2018, which Exhibit is incorporated herein by reference. |

(Y) | Reference is made to the appropriate Exhibit of the company report on Form 10-K for the fiscal year ended December 31, 2017, which Exhibit is incorporated herein by reference. |

(Z) | Reference is made to the appropriate Exhibit of the company report on Form 10-K for the fiscal year ended December 31, 2018, which Exhibit is incorporated herein by reference. |

(AA) | Reference is made to Exhibit 10.1 of the company report on Form 8-K, dated November 14, 2014, which Exhibit is incorporated herein by reference. |

(BB) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated April 23, 2015, which Exhibit is incorporated herein by reference. |

(CC) | Reference is made to Exhibit 10.1 of the company report on Form 8-K, dated September 30, 2015, which Exhibit is incorporated herein by reference. |

(DD) | Reference is made to Exhibit 10.1 of the company report on Form 8-K, dated February 16, 2016, which Exhibit is incorporated herein by reference. |

(EE) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated November 30, 2016, which Exhibit is incorporated herein by reference. |

(FF) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated June 7, 2017, which Exhibit is incorporated herein by reference. |

(GG) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated March 7, 2016, which Exhibit is incorporated herein by reference. |

(HH) | Reference is made to the appropriate Exhibit of the company report on Form 10-Q, for the fiscal quarter ended March 31, 2017, which Exhibit is incorporated herein by reference. |

(II) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated December 14, 2017, which Exhibit is incorporated herein by reference. |

(JJ) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated May 18, 2018, which Exhibit is incorporated herein by reference. |

(KK) | Reference is made to the appropriate Exhibit of the company report on Form 10-Q, for the fiscal quarter ended June 30, 2018, which Exhibit is incorporated herein by reference. |

(LL) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated October 10, 2018, which Exhibit is incorporated herein by reference. |

(MM) | Reference is made to the appropriate Exhibit of the company report on Form 10-Q, for the fiscal quarter ended September 30, 2019, which Exhibit is incorporated herein by reference. |

(NN) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated December 20, 2012, which Exhibit is incorporated herein by reference. |

(OO) | Reference is made to the appropriate Exhibit of the company report on Form 8-K, dated March 9, 2020, which Exhibit is incorporated herein by reference. |

Signatures | ||

Signature | Title | |

/s/ MATTHEW E. MONAGHAN | Chairman of the Board of Directors, President and Chief Executive Officer (Principal Executive Officer) | |

Matthew E. Monaghan | ||

/s/ KATHLEEN P. LENEGHAN | Senior Vice President and Chief Financial Officer (Principal Financial and Accounting Officer) | |

Kathleen P. Leneghan | ||

/s/ SUSAN H. ALEXANDER | Director | |

Susan H. Alexander | ||

/s/ JULIE A. BECK | Director | |

Julie A. Beck | ||

/s/ PETRA DANIELSOHN-WEIL, PhD | Director | |

Petra Danielsohn-Weil, PhD | ||

/s/ DIANA S. FERGUSON | Director | |

Diana S. Ferguson | ||

/s/ MARC M. GIBELEY | Director | |

Marc M. Gibeley | ||

/s/ C. MARTIN HARRIS, M.D. | Director | |

C. Martin Harris, M.D. | ||

/s/ CLIFFORD D. NASTAS | Director | |

Clifford D. Nastas | ||

/s/ BAIJU R. SHAH | Director | |

Baiju R. Shah | ||

Reports of Independent Registered Public Accounting Firm | ||

Reports of Independent Registered Public Accounting Firm | ||

Financial Statements | ||

Consolidated Statements of Comprehensive Loss | ||

Years Ended December 31, | |||||||||||

2019 | 2018 | 2017 | |||||||||

(In thousands, except per share data) | |||||||||||

Net sales | $ | $ | $ | ||||||||

Cost of products sold | |||||||||||

Gross Profit | |||||||||||

Selling, general and administrative expenses | |||||||||||

Charges related to restructuring activities | |||||||||||

Impairment of an intangible asset | |||||||||||

Operating Loss | ( | ) | ( | ) | ( | ) | |||||

Net loss (gain) on convertible debt derivatives | ( | ) | ( | ) | |||||||

Loss on debt extinguishment including debt finance charges and fees | |||||||||||

Interest expense | |||||||||||

Interest income | ( | ) | ( | ) | ( | ) | |||||

Loss Before Income Taxes | ( | ) | ( | ) | ( | ) | |||||

Income tax provision | |||||||||||

Net Loss | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||

Net Loss per Share—Basic | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||

Weighted Average Shares Outstanding—Basic | |||||||||||

Net Loss per Share—Assuming Dilution | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||

Weighted Average Shares Outstanding—Assuming Dilution | |||||||||||

Net Loss | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||

Other comprehensive income (loss): | |||||||||||

Foreign currency translation adjustments | ( | ) | ( | ) | |||||||

Defined benefit plans: | |||||||||||

Amortization of prior service costs and unrecognized losses | ( | ) | |||||||||

Deferred tax adjustment resulting from defined benefit plan activity | ( | ) | ( | ) | |||||||

Valuation reserve associated with defined benefit plan activity | ( | ) | |||||||||

Current period gain (loss) on cash flow hedges | ( | ) | ( | ) | |||||||

Deferred tax benefit (loss) related to gain (loss) on cash flow hedges | ( | ) | |||||||||

Other Comprehensive Income (Loss) | ( | ) | ( | ) | |||||||

Comprehensive Loss | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||

Financial Statements | ||

Consolidated Balance Sheets | ||

December 31, 2019 | December 31, 2018 | ||||||

Assets | (In thousands) | ||||||

Current Assets | |||||||

Cash and cash equivalents | $ | $ | |||||

Trade receivables, net | |||||||

Installment receivables, net | |||||||

Inventories, net | |||||||

Other current assets | |||||||

Total Current Assets | |||||||

Other Assets | |||||||

Intangibles | |||||||

Property and Equipment, net | |||||||

Financing Lease Assets, net | |||||||

Operating Lease Assets, net | |||||||

Goodwill | |||||||

Total Assets | $ | $ | |||||

Liabilities and Shareholders' Equity | |||||||

Current Liabilities | |||||||

Accounts payable | $ | $ | |||||

Accrued expenses | |||||||

Current taxes payable | |||||||

Short-term debt and current maturities of long-term obligations | |||||||

Current portion of financing lease obligations | |||||||

Current portion of operating lease obligations | |||||||

Total Current Liabilities | |||||||

Long-Term Debt | |||||||

Finance Lease Long-term Obligations | |||||||

Operating Leases Long-term Obligations | |||||||

Other Long-Term Obligations | |||||||

Shareholders' Equity | |||||||

Preferred Shares (Authorized 300 shares; none outstanding) | |||||||

Common Shares (Authorized 150,000 shares; 37,609 and 37,010 issued and outstanding in 2019 and 2018, respectively)—no par | |||||||

Class B Common Shares (Authorized 12,000 shares; 6 issued and outstanding in 2019 and 2018)—no par | |||||||

Additional paid-in-capital | |||||||

Retained earnings | |||||||

Accumulated other comprehensive income | |||||||

Treasury shares (3,953 and 3,841 shares in 2019 and 2018, respectively) | ( | ) | ( | ) | |||

Total Shareholders' Equity | |||||||

Total Liabilities and Shareholders' Equity | $ | $ | |||||

Financial Statements | ||

Consolidated Statements of Cash Flows | ||

Years Ended December 31, | |||||||||||

2019 | 2018 | 2017 | |||||||||

Operating Activities | (In thousands) | ||||||||||

Net loss | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||

Adjustments to reconcile net earnings to net cash used by operating activities: | |||||||||||

Depreciation and amortization | |||||||||||

Amortization operating lease right of use assets | |||||||||||

Provision for losses on trade and installment receivables | |||||||||||

Benefit for deferred income taxes | ( | ) | ( | ) | ( | ) | |||||

Provision (benefit) for other deferred liabilities | ( | ) | |||||||||

Provision for equity compensation | |||||||||||

Loss (gain) on disposals of property and equipment | ( | ) | |||||||||

Loss on debt extinguishment including debt finance charges and associated fees | |||||||||||

Impairment of an intangible asset | |||||||||||

Amortization of convertible debt discount | |||||||||||

Amortization of debt fees | |||||||||||

Net loss (gain) on convertible debt derivatives | ( | ) | ( | ) | |||||||

Changes in operating assets and liabilities: | |||||||||||

Trade receivables | ( | ) | |||||||||

Installment sales contracts, net | ( | ) | ( | ) | |||||||

Inventories | ( | ) | |||||||||

Other current assets | ( | ) | ( | ) | |||||||

Accounts payable | ( | ) | ( | ) | |||||||

Accrued expenses | ( | ) | ( | ) | |||||||

Other long-term liabilities | ( | ) | ( | ) | |||||||

Net Cash Provided (Used) by Operating Activities | ( | ) | ( | ) | |||||||

Investing Activities | |||||||||||

Purchases of property and equipment | ( | ) | ( | ) | ( | ) | |||||

Proceeds from sale of property and equipment | |||||||||||

Advance Payment from Sale of Property | |||||||||||

Decrease in other long-term assets | ( | ) | ( | ) | ( | ) | |||||

Other | ( | ) | ( | ) | |||||||

Net Cash Used by Investing Activities | ( | ) | ( | ) | ( | ) | |||||

Financing Activities | |||||||||||

Proceeds from revolving lines of credit and long-term borrowings | |||||||||||

Repurchases of convertible debt and capital lease payments | ( | ) | ( | ) | ( | ) | |||||

Proceeds from exercise of stock options | |||||||||||

Payment of financing costs | ( | ) | ( | ) | |||||||

Payment of dividends | ( | ) | ( | ) | ( | ) | |||||

Issuance of warrants | |||||||||||

Payments to debt holders | ( | ) | |||||||||

Purchases of treasury shares | ( | ) | ( | ) | ( | ) | |||||

Net Cash Provided (Used) by Financing Activities | ( | ) | ( | ) | |||||||

Effect of exchange rate changes on cash | ( | ) | ( | ) | |||||||

Increase (decrease) in cash and cash equivalents | ( | ) | ( | ) | |||||||

Cash and cash equivalents at beginning of year | |||||||||||

Cash and cash equivalents at end of year | $ | $ | $ | ||||||||

Financial Statements | ||

Consolidated Statements of Shareholders' Equity | ||

(In thousands) | Common Stock | Class B Stock | Additional Paid-in- Capital | Retained Earnings | Accumulated Other Comprehensive Earnings | Treasury Stock | Total | ||||||||||||||||||||

January 1, 2017 Balance | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||

Exercise of stock options | — | — | — | ( | ) | ||||||||||||||||||||||

Performance awards | — | — | — | — | — | ||||||||||||||||||||||

Non-qualified stock options | — | — | — | — | — | ||||||||||||||||||||||

Restricted stock awards | — | — | — | ( | ) | ||||||||||||||||||||||

Conversion from Class B to Common Stock | ( | ) | — | — | — | — | |||||||||||||||||||||

Net loss | — | — | — | ( | ) | — | — | ( | ) | ||||||||||||||||||

Foreign currency translation adjustments | — | — | — | — | — | ||||||||||||||||||||||

Unrealized loss on cash flow hedges | — | — | — | — | ( | ) | — | ( | ) | ||||||||||||||||||

Defined benefit plans: | |||||||||||||||||||||||||||

Amortization of prior service costs and unrecognized losses and credits | — | — | — | — | — | ||||||||||||||||||||||

Total comprehensive loss | — | — | — | — | — | — | ( | ) | |||||||||||||||||||

Issuance of warrants | — | — | — | — | — | ||||||||||||||||||||||

Dividends | — | — | — | ( | ) | — | — | ( | ) | ||||||||||||||||||

December 31, 2017 Balance | ( | ) | |||||||||||||||||||||||||

Exercise of stock options | — | — | — | ( | ) | ||||||||||||||||||||||

Performance awards | — | — | — | — | — | ||||||||||||||||||||||

Non-qualified stock options | — | — | — | — | — | ||||||||||||||||||||||

Restricted stock awards | — | — | — | ( | ) | ||||||||||||||||||||||

Net loss | — | — | — | ( | ) | — | — | ( | ) | ||||||||||||||||||

Foreign currency translation adjustments | — | — | — | — | ( | ) | — | ( | ) | ||||||||||||||||||

Unrealized loss on cash flow hedges | — | — | — | — | — | ||||||||||||||||||||||

Defined benefit plans: | |||||||||||||||||||||||||||

Amortization of prior service costs and unrecognized losses and credits | — | — | — | — | — | ||||||||||||||||||||||

Total comprehensive loss | — | — | — | — | — | — | ( | ) | |||||||||||||||||||

Dividends | — | — | — | ( | ) | — | — | ( | ) | ||||||||||||||||||

December 31, 2018 Balance | ( | ) | |||||||||||||||||||||||||

Performance awards | — | — | — | ( | ) | ||||||||||||||||||||||

Non-qualified stock options | — | — | — | — | — | ||||||||||||||||||||||

Restricted stock awards | — | — | — | ( | ) | ||||||||||||||||||||||

Net loss | — | — | — | ( | ) | — | — | ( | ) | ||||||||||||||||||

Foreign currency translation adjustments | — | — | — | — | ( | ) | — | ( | ) | ||||||||||||||||||

Unrealized loss on cash flow hedges | — | — | — | — | ( | ) | — | ( | ) | ||||||||||||||||||

Defined benefit plans: | |||||||||||||||||||||||||||

Amortization of prior service costs and unrecognized losses and credits | — | — | — | — | ( | ) | — | ( | ) | ||||||||||||||||||

Total comprehensive loss | — | — | — | — | — | — | ( | ) | |||||||||||||||||||

Convertible debt derivative adjustments | ( | ) | ( | ) | |||||||||||||||||||||||

Exchange of convertible notes | |||||||||||||||||||||||||||

Dividends | — | — | — | ( | ) | — | — | ( | ) | ||||||||||||||||||

December 31, 2019 Balance | $ | $ | $ | $ | $ | $ | ( | ) | $ | ||||||||||||||||||

Notes to Financial Statements | ||

Accounting Policies | ||

Notes to Financial Statements | ||

Accounting Policies | ||

Notes to Financial Statements | ||

Accounting Policies | ||

Notes to Financial Statements | ||

Accounting Policies | ||

Notes to Financial Statements | ||

Accounting Policies | ||

Notes to Financial Statements | ||

Divested Businesses | ||

Notes to Financial Statements | ||

Current Assets | ||

2019 | 2018 | ||||||

Accounts receivable, gross | $ | $ | |||||

Customer rebate reserve | ( | ) | ( | ) | |||

Allowance for doubtful accounts | ( | ) | ( | ) | |||

Cash discount reserves | ( | ) | ( | ) | |||

Other, principally returns and allowances reserves | ( | ) | ( | ) | |||

Accounts receivable, net | $ | $ | |||||

Notes to Financial Statements | ||

Current Assets | ||

2019 | 2018 | ||||||||||||||||||||||

Current | Long- Term | Total | Current | Long- Term | Total | ||||||||||||||||||

Installment receivables | $ | $ | $ | $ | $ | $ | |||||||||||||||||

Less: Unearned interest | ( | ) | ( | ) | ( | ) | ( | ) | |||||||||||||||

Allowance for doubtful accounts | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | |||||||||||

$ | $ | $ | $ | $ | $ | ||||||||||||||||||

2019 | 2018 | ||||||

Balance as of beginning of period | $ | $ | |||||

Current period provision | |||||||

Direct write-offs charged against the allowance | ( | ) | ( | ) | |||

Balance as of end of period | $ | $ | |||||

Total Installment Receivables | Unpaid Principal Balance | Related Allowance for Doubtful Accounts | Interest Income Recognized | ||||||||||||

U.S. | |||||||||||||||

Impaired installment receivables with a related allowance recorded | $ | $ | $ | $ | |||||||||||

Canada | |||||||||||||||

Non-impaired installment receivables with no related allowance recorded | — | ||||||||||||||

Impaired installment receivables with a related allowance recorded | |||||||||||||||

Total Canadian installment receivables | |||||||||||||||

Total | |||||||||||||||

Non-impaired installment receivables with no related allowance recorded | — | ||||||||||||||

Impaired installment receivables with a related allowance recorded | |||||||||||||||

Total installment receivables | $ | $ | $ | $ | |||||||||||

Notes to Financial Statements | ||

Current Assets | ||

Total Installment Receivables | Unpaid Principal Balance | Related Allowance for Doubtful Accounts | Interest Income Recognized | ||||||||||||

U.S. | |||||||||||||||

Impaired installment receivables with a related allowance recorded | $ | $ | $ | $ | |||||||||||

Canada | |||||||||||||||

Non-impaired installment receivables with no related allowance recorded | — | ||||||||||||||

Impaired installment receivables with a related allowance recorded | |||||||||||||||

Total Canadian installment receivables | |||||||||||||||

Total | |||||||||||||||

Non-impaired installment receivables with no related allowance recorded | — | ||||||||||||||

Impaired installment receivables with a related allowance recorded | |||||||||||||||

Total installment receivables | $ | $ | $ | $ | |||||||||||

December 31, 2019 | December 31, 2018 | ||||||||||||||||||||||

Total | U.S. | Canada | Total | U.S. | Canada | ||||||||||||||||||

Current | $ | $ | $ | $ | $ | $ | |||||||||||||||||

0-30 days past due | |||||||||||||||||||||||

31-60 days past due | |||||||||||||||||||||||

61-90 days past due | |||||||||||||||||||||||

90+ days past due | |||||||||||||||||||||||

$ | $ | $ | $ | $ | $ | ||||||||||||||||||

Notes to Financial Statements | ||

Current Assets | ||

2019 | 2018 | ||||||

Finished goods | $ | $ | |||||

Raw materials | |||||||

Work in process | |||||||

Inventories, net | $ | $ | |||||

2019 | 2018 | ||||||

Tax receivables principally value added taxes | $ | $ | |||||

Receivable due from information technology provider | |||||||

Prepaid insurance | |||||||

Service contracts | |||||||

Prepaid social charges | |||||||

Derivatives (foreign currency forward contracts) | |||||||

Prepaid inventory | |||||||

Recoverable income taxes | |||||||

Prepaid debt fees | |||||||

Prepaid and other current assets | |||||||

Other Current Assets | $ | $ | |||||

Notes to Financial Statements | ||

Long-Term Assets | ||

2019 | 2018 | ||||||

Convertible 2021 note hedge asset | $ | $ | |||||

Convertible 2022 note hedge asset | |||||||

Cash surrender value of life insurance policies | |||||||

Deferred financing fees | |||||||

Investments | |||||||

Long-term installment receivables | |||||||

Long-term deferred taxes | |||||||

Other | |||||||

Other Long-Term Assets | $ | $ | |||||

2019 | 2018 | ||||||

Machinery and equipment | $ | $ | |||||

Land, buildings and improvements | |||||||

Furniture and fixtures | |||||||

Leasehold improvements | |||||||

Capitalized software | |||||||

Property and Equipment, gross | |||||||

Less allowance for depreciation | ( | ) | ( | ) | |||

Property and Equipment, net | $ | $ | |||||

Notes to Financial Statements | ||

Long-Term Assets | ||

Institutional Products Group | Europe | Consolidated | |||||||||

Balance at December 31, 2017 | $ | $ | $ | ||||||||

Foreign currency translation adjustments | ( | ) | ( | ) | ( | ) | |||||

Balance at December 31, 2018 | |||||||||||

Foreign currency translation adjustments | ( | ) | ( | ) | |||||||

Balance at December 31, 2019 | $ | $ | $ | ||||||||

Notes to Financial Statements | ||

Long-Term Assets | ||

December 31, 2019 | December 31, 2018 | ||||||||||||||

Historical Cost | Accumulated Amortization | Historical Cost | Accumulated Amortization | ||||||||||||

Customer lists | $ | $ | $ | $ | |||||||||||

Trademarks | — | — | |||||||||||||

License agreements | |||||||||||||||

Developed technology | |||||||||||||||

Patents | |||||||||||||||

Other | |||||||||||||||

Intangibles | $ | $ | $ | $ | |||||||||||

Notes to Financial Statements | ||

Current Liabilities | ||

2019 | 2018 | ||||||

Salaries and wages | $ | $ | |||||

Taxes other than income taxes, primarily Value Added Taxes | |||||||

Warranty | |||||||

Rebates | |||||||

Severance | |||||||

Professional | |||||||

IT service contracts | |||||||

Freight | |||||||

Interest | |||||||

Advance payment on sale of land & buildings | |||||||

Deferred revenue | |||||||

Product liability, current portion | |||||||

IT licenses | |||||||

Derivatives (foreign currency forward exchange contracts) | |||||||

Insurance | |||||||

Rent | |||||||

Supplemental Executive Retirement Program liability Plan (SERP) | |||||||

Other items, principally trade accruals | |||||||

Accrued Expenses | $ | $ | |||||

Notes to Financial Statements | ||

Current Liabilities | ||

2019 | 2018 | ||||||

Balance as of January 1 | $ | $ | |||||

Warranties provided during the period | |||||||

Settlements made during the period | ( | ) | ( | ) | |||

Changes in liability for pre-existing warranties during the period, including expirations | |||||||

Balance as of December 31 | $ | $ | |||||

Notes to Financial Statements | ||

Long-Term Debt | ||

2019 | 2018 | ||||||

Convertible senior notes at 5.00%, due in February 2021 | $ | $ | |||||

Convertible senior notes at 4.50%, due in June 2022 | |||||||

Convertible senior notes at 5.00%, due in November 2024 | |||||||

Other obligations | |||||||

Less current maturities of long-term debt | ( | ) | |||||

Long-Term Debt | $ | $ | |||||

Notes to Financial Statements | ||

Long-Term Debt | ||

Notes to Financial Statements | ||

Long-Term Debt | ||

Notes to Financial Statements | ||

Long-Term Debt | ||

December 31, 2019 | December 31, 2018 | ||||||

Principal amount of liability component | $ | $ | |||||

Unamortized discount | ( | ) | ( | ) | |||

Debt fees | ( | ) | ( | ) | |||

Net carrying amount of liability component | $ | $ | |||||

Notes to Financial Statements | ||

Long-Term Debt | ||

Notes to Financial Statements | ||

Long-Term Debt | ||

December 31, 2019 | December 31, 2018 | ||||||

Principal amount of liability component | $ | $ | |||||

Unamortized discount | ( | ) | ( | ) | |||

Debt fees | ( | ) | ( | ) | |||

Net carrying amount of liability component | $ | $ | |||||

Notes to Financial Statements | ||

Long-Term Debt | ||

December 31, 2019 | ||||