Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| |

[X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2017

OR

| |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-15103

INVACARE CORPORATION

(Exact name of registrant as specified in its charter)

|

| |

| |

Ohio | 95-2680965 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| |

One Invacare Way, Elyria, Ohio | 44035 |

(Address of principal executive offices) | (Zip Code) |

(440) 329-6000

(Registrant's telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 (the “Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act. (Check One): Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller reporting company ¨ Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of May 5, 2017, the registrant had 32,060,839 Common Shares and 722,269 Class B Common Shares outstanding.

Table of Contents

|

| | |

| Item | Page |

PART I: FINANCIAL INFORMATION |

| 2 | |

| 1 | |

| | |

| | |

| | |

| | |

| 3 | |

| 4 | |

| | |

PART II: OTHER INFORMATION |

| 1 | |

| 1A | |

| 2 | |

| 6 | |

| | |

About Invacare Corporation

Invacare Corporation (NYSE: IVC) is a leading manufacturer and distributor in its markets for medical equipment used in non-acute care settings. At its core, the company designs, manufactures and distributes medical devices that help people to move, breathe, rest and perform essential hygiene. The company provides medical device solutions for congenital (e.g., cerebral palsy, muscular dystrophy, spina bifida), acquired (e.g., stroke, spinal cord injury, traumatic brain injury, post-acute recovery, pressure ulcers) and degenerative (e.g., ALS, multiple sclerosis, chronic obstructive pulmonary disease (COPD), elderly, bariatric) ailments. The company's products are important parts of care for people with a wide range of challenges, from those who are active and heading to work or school each day and may need additional mobility or respiratory support, to those who are cared for in residential care settings, at home and in rehabilitation centers. The company sells its products principally to home medical equipment providers with retail and e-commerce channels, residential care operators, dealers and government health services in North America, Europe and Asia/Pacific. For more information about the company and its products, visit Invacare's website at www.invacare.com.

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

The discussion and analysis presented below is concerned with material changes in financial condition and results of operations between the periods specified in the condensed consolidated balance sheet at March 31, 2017 and December 31, 2016, and in the condensed consolidated statement of comprehensive income (loss) for the three months ended March 31, 2017 and March 31, 2016. All comparisons presented are with respect to the same period last year, unless otherwise stated. This discussion and analysis should be read in conjunction with the consolidated financial statements and accompanying notes that appear elsewhere in this quarterly report on Form 10-Q and the MD&A included in the company's annual report on Form 10-K for the year ended December 31, 2016.

OVERVIEW

Strategy

The company had a strategy to be a leading provider of durable medical equipment to providers in global markets by providing the broadest portfolio available. This strategy has not kept pace with certain reimbursement changes, competitive dynamics and company-specific challenges. Since 2015, the company has made a major shift in its strategy to align its resources to produce products and solutions that assist customers and end-users with their most clinically complex needs. By focusing the company’s efforts to provide the best possible assistance and outcomes to the people and caregivers who use its products, the company aims to improve its financial condition for sustainable profit and growth. To execute this transformation, the company is undertaking a substantial three-phase, multi-year transformation plan.

Transformation

The company is executing a multi-year transformation to shift to its new strategy, especially in North America. This is expected to yield better financial results from the application of the company’s resources to products and solutions that provide greater healthcare value in clinically complex rehabilitation and post-acute care. The transformation is divided into the following three phases:

Phase One - Assess and Reorient

| |

• | Increase commercial effectiveness; |

| |

• | Shift and narrow the product portfolio; |

| |

• | Align innovation resources to clinically complex solutions; |

| |

• | Accelerate quality efforts with culture of quality excellence; and |

| |

• | Develop and expand talent. |

Phase One is an investment phase with significant shifts in the mix of the company's business. Reductions in less-accretive product sales, gross margin improvements, SG&A increases and cash consumption are all indicators of the transformative work underway.

Phase Two - Build and Align

| |

• | Leverage commercial improvements; |

| |

• | Optimize the business for cost and efficiency; |

| |

• | Continue to improve quality systems; |

| |

• | Launch new clinical product platforms; and |

| |

• | Expand talent management and culture. |

By the end of phase two, the company expects growth in sales and gross profit dollars, as well as an improvement in operating income and free cash flow results.

Phase Three - Grow

| |

• | Lead in quality culture and operations excellence; and |

By the end of phase three, the company expects continued improvements in net sales, operating margin, operating income and free cash flow.

In 2016, the company made significant progress on its Phase One work, most notably in North America, where some of the greatest improvement is needed. As expected, the 2016 financial results showed the near-term impact of investments in commercial resources, new product development, and quality systems, ahead of accretion. The company will continue to make investments in this transformation, reduce sales in certain areas, refocus resources away from less accretive activities, and look at its global infrastructure for opportunities to drive efficiency.

This progress continued in the first quarter of 2017. Net sales of basic aids for daily living continued to decline, while mobility and seating sales, excluding discontinued consumer power products, increased in the North America Home Medical Equipment (NA/HME) segment, where the transformation is most significant. Gross margin as a percentage of net sales grew compared to the first quarter 2016, primarily due to the company's more favorable mix of products. Through the first half of 2017, the company expects continued lower net sales offset by favorable sales mix shift and increased gross margin as a percentage of net sales.

The company expects to take advantage of opportunities for growth across its many product lines and businesses by providing clinical solutions to the growing demographic in need of the company’s products. The company also remains focused on building an enterprise-wide quality culture, which it believes will ultimately be a competitive advantage. The company intends to move forward with its transformation, while managing through external uncertainty, including foreign currency fluctuations and changes in payor reimbursement policies. The company has demonstrated some improvements in the key short-term metrics as a result of its strategic shift. However, in spite of this, there may be interim periods where the company’s investments do not fully yield expected financial improvements, particularly in light of various external factors.

STATUS OF THE CONSENT DECREE

For a complete description of the consent decree, see the “Contingencies” note to the financial statements contained in Item 1 of this Quarterly Report on Form 10-Q and “Forward-Looking Statements” contained below in this Item.

The company's continued focus on a quality culture and specific actions at its Corporate and Taylor Street facilities resulted in passing three recent milestones related to the consent decree with the United States Food and Drug Administration (FDA). In April 2017, FDA reinstated Certification-2 relating to design controls and accepted the company's third-party expert's Certification-3 report. And as a result, the company submitted its next required report ("the 5H report") to FDA. The 5H report was written by the company detailing its actions to improve its quality systems and overall compliance status together with its written responses to any observations in the independent expert's certification report and prior FDA inspection observations. Upon receipt of the 5H report, FDA has 30 days to initiate reinspection of the company's Corporate and Taylor Street facilities.

The company cannot predict the timing of the inspection, nor any remaining work that may be needed to meet FDA's requirements for resuming full operations at the impacted facilities.

OUTLOOK

The company is focused on transforming its business, especially in North America. Through the first half of 2017, the company expects lower net sales, favorable sales mix and increased gross margin as a percentage of net sales. As the company progresses in the next phase of transformation, it will shift toward growing sales, reducing cost and improving efficiency. The company's priorities remain: emphasizing a culture of quality excellence and achieving its long-term earnings potential. Because of the scope and magnitude of changes being undertaken and the realized and potential changes affecting the business, the company expects some variation in the timing of these results.

|

| | |

MD&A | Results of Operations | |

| | |

RESULTS OF OPERATIONS

On September 30, 2016, the company completed the sale of its subsidiary, Garden City Medical Inc. ("GCM"), to Compass Health Brands. GCM, doing business as PMI and Pinnacle Medsource, sourced and distributed primarily single-use products under the brand ProBasics™ by PMI. GCM was part of the North America/Home Medical Equipment (NA/HME) segment. This divestiture further refined the company’s focus on other lines of business where the company’s resources can best generate returns in areas of complex rehabilitation and post-acute care. CGM was not deemed a discontinued operation for financial reporting purposes, and therefore is included in the results below unless otherwise noted. For more information, see the condensed consolidated financial statements included in this Quarterly Report on Form 10-Q.

With the implementation during 2016 of ASU 2015-03, “Simplifying the Presentation of Debt Issuance Costs”, the company re-assessed the classification of amortization of debt fees. Historically, these costs were reflected in Selling, General and Administrative (SG&A) expenses, however, the company has determined it is more appropriate to classify the costs as interest expense. The amounts now classified as interest expense versus SG&A expense is $379,000 for the three months ended March 31, 2016.

NET SALES

|

| | | | | | | | | | |

($ in thousands USD) | Q1 17 | Q1 16 | Reported % Change | Foreign Exchange % Impact | Constant Currency % Change |

Europe | 119,508 |

| 122,031 |

| (2.1 | ) | (5.3 | ) | 3.2 |

|

NA/HME | 84,262 |

| 107,672 |

| (21.7 | ) | 0.3 |

| (22.0 | ) |

IPG | 16,373 |

| 18,244 |

| (10.3 | ) | — |

| (10.3 | ) |

Asia/Pacific | 11,580 |

| 9,605 |

| 20.6 |

| 4.7 |

| 15.9 |

|

Consolidated | 231,723 |

| 257,552 |

| (10.0 | ) | (2.2 | ) | (7.8 | ) |

| | | | | |

NA/HME less divested GCM | 84,262 |

| 98,513 |

| (14.5 | ) | 0.2 |

| (14.7 | ) |

Consolidated less divested GCM | 231,723 |

| 248,393 |

| (6.7 | ) | (2.3 | ) | (4.4 | ) |

Constant currency net sales increased in the European and Asia/Pacific segments, but were more than offset by declines in the NA/HME and IPG segments. Excluding the divestiture of the GCM business, consolidated net sales declined 4.4% for the quarter compared to the same period last year with net sales declines in lifestyle and respiratory products partially offset by increases in mobility and seating products.

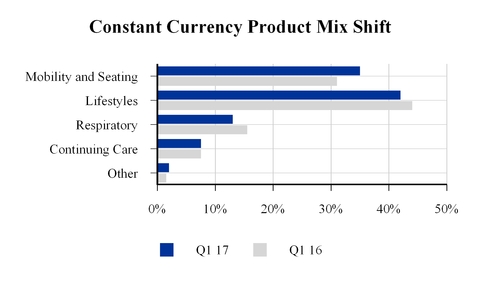

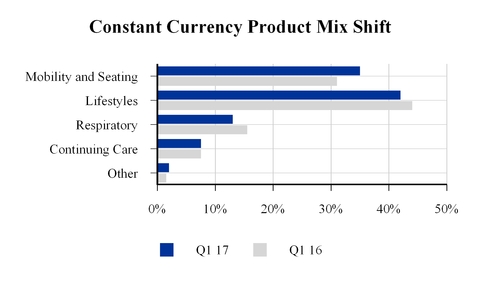

The company realized a favorable impact from sales mix attributable to mobility and seating products, which comprise a majority of the company's clinically complex product portfolio, which increased to 35% from 31% of the constant currency net sales by product for the first quarter of 2017 as compared to same period last year.

The table above provides net sales change as reported and as adjusted to exclude the impact of foreign exchange translation (constant currency net sales) as well as net sales further adjusted to exclude the impact of the sale of GCM, which was sold in September 2016 and not deemed a discontinued operation from an external reporting perspective. “Constant currency net sales" is a non-GAAP financial measure, which is defined as net sales excluding the impact of foreign currency translation. The current year's functional currency net sales are translated using the prior year's foreign exchange rates. These amounts are then compared to the prior year's sales to calculate the constant currency net sales change.

This favorable net sales mix shift is the result of the company's transformation and, in particular, the implementation of Phase One of the transformation, where the company focused on shifting and narrowing the product portfolio and alignment of resources to focus on clinically complex solutions.

The decline in lifestyle products was partially impacted by the divestiture of GCM. The decline in respiratory products was primarily the result of reduced net sales to national customers for both stationary concentrators and the HomeFill® refilling system product.

Constant currency net sales performance drivers by segment:

Europe - The improvement in constant currency net sales was driven by mobility and seating products partially offset by declines in respiratory and lifestyle products.

North America/Home Medical Equipment (NA/HME) - Excluding the divestiture of the GCM business, constant currency net sales declined 14.7% for the quarter compared to the same period last year. The decrease in constant currency net sales was driven by lifestyle and respiratory products, and to a lesser extent, mobility and seating products. In the fourth quarter of 2016, the company discontinued its consumer power wheelchair products. Excluding consumer power wheelchair net sales from the first quarter of 2016, constant currency net sales of mobility and seating products would have increased for the quarter compared to the same period last year.

Institutional Products Group (IPG) - The decrease in constant currency net sales was driven by all major product categories. As previously disclosed, the company is transforming its go-to-market strategy in the post-acute care (PAC) channel. As part of this transformation, the IPG segment has launched robust clinical training programs for its PAC salesforce, and continues to hire new sales associates to complete its North America footprint.

Asia/Pacific - The improvement in constant currency net sales was driven by the Australia and New Zealand distribution businesses as well as the company's subsidiary that produces microprocessor controllers.

GROSS PROFIT

Last year's gross profit was impacted by a charge of $1,220,000 or 0.5 of a percentage point related to a product recall recorded in the NA/HME segment. Excluding this charge, gross margin as a percentage of net sales increased by 1.3 percentage points in the quarter as compared to the same period last year. The increase in gross margin as a percentage of net sales was driven by a favorable sales mix and reduced freight costs partially offset by unfavorable foreign exchange and increased research and development expense related to new products. Gross margin as a percentage of net sales increased for all the segments. Gross profit dollars declined principally in the NA/HME and Europe segments, with increases in Asia/Pacific and IPG segments.

Gross profit drivers by segment:

Europe - Gross margin as a percentage of net sales increased 0.2 of a percentage point, while gross profit dollars decreased $196,000, compared to the same period last year. The decrease in gross profit dollars was driven by unfavorable foreign currency and increased research and development expense partially offset by reduced warranty and freight costs.

NA/HME - Gross margin as a percentage of net sales increased by 2.2 percentage points, while gross profit dollars decreased $3,079,000, compared to the same period last year. Excluding the impact of the divested GCM business, gross margin as a percentage of net sales increased by 2.0 percentage points, while gross profit dollars decreased by $1,030,000. The decrease in gross profit dollars was primarily as a result of sales volume declines partially offset by favorable sales mix and reduced warranty and freight costs. Warranty expense in the first quarter last year included a charge of $1,220,000 related to a product recall.

IPG - Gross margin as a percentage of net sales increased 2.7 percentage points, or $96,000, compared to the same period last year. The slight increase in gross profit dollars was driven by reduced freight and warranty costs partially offset by volume declines.

Asia/Pacific - Gross margin as a percentage of net sales increased by 0.6 of a percentage point, or $231,000, compared to the same period last year. The increase in gross profit dollars was primarily as a result of volume increases and favorable sales mix partially offset by increased research and development expense.

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

|

| | | | | | | | | | |

($ in thousands USD) | Q1 17 | Q1 16 | Reported Change | Foreign Exchange Impact | Constant Currency Change |

SG&A Expenses - $ | 72,513 |

| 72,834 |

| (321 | ) | (974 | ) | 653 |

|

SG&A Expenses - % change | | | (0.4 | ) | (1.3 | ) | 0.9 |

|

% to net sales | 31.3 |

| 28.3 |

| | | |

Consolidated less divested GCM - $ | 72,513 |

| 71,567 |

| 946 |

| (974 | ) | 1,920 |

|

Consolidated less divested GCM - % change | | | 1.3 |

| (1.4 | ) | 2.7 |

|

% to net sales | 31.3 |

| 28.8 |

| | | |

The increase in SG&A expense, excluding the sale of GCM and foreign exchange, was primarily driven by unfavorable foreign currency transactions and increased legal and bad debt expense.

SG&A expense drivers by segment:

Europe - SG&A expenses increased by 2.3%, or $666,000, compared to the same period last year with foreign currency translation decreasing SG&A expenses by approximately $1,211,000, or 4.2 percentage points. Constant currency SG&A expenses increased by $1,877,000, or 6.5%, primarily attributable to increased employment costs and foreign currency transactions.

NA/HME - SG&A expenses decreased 0.2%, or $63,000, compared to the same period last year with foreign currency translation having an immaterial impact. Constant currency SG&A expenses decreased $115,000, or 0.4%. Excluding the impact of the divested GCM business, constant currency SG&A expense increased by $1,152,000 or 3.7 percentage points driven primarily by increased employment costs and bad debt expense.

IPG - SG&A expenses for IPG decreased by 11.8%, or $377,000, compared to the same period last year with foreign currency translation having an immaterial impact. Constant currency SG&A expenses decreased by $384,000 or 12.1 percentage points primarily related to employment costs.

Asia/Pacific - SG&A expenses decreased 1.1%, or $41,000, compared to the same period last year with foreign currency translation increasing SG&A expenses by $178,000, or 4.7 percentage points. Constant currency SG&A expenses decreased by $219,000, or 5.8%, primarily driven by employment costs.

Other - SG&A expenses decreased by 10.4%, or $506,000, compared to the same period last year primarily driven by lower employment costs primarily related to equity compensation expense.

|

| | |

MD&A | Operating Income (Loss) | |

| | |

OPERATING INCOME (LOSS)

|

| | | | | | | | |

($ in thousands USD) | Q1 17 | Q1 16 | $ Change | % Change |

Europe | 5,100 |

| 5,963 |

| (863 | ) | (14.5 | ) |

NA/HME | (9,426 | ) | (6,409 | ) | (3,017 | ) | 47.1 |

|

IPG | 1,898 |

| 1,424 |

| 474 |

| 33.3 |

|

Asia/Pacific | (430 | ) | (703 | ) | 273 |

| (38.8 | ) |

All Other | (4,510 | ) | (5,249 | ) | 739 |

| (14.1 | ) |

Charges related to restructuring activities | (3,283 | ) | (102 | ) | (3,181 | ) | 3,118.6 |

|

Consolidated Operating Loss | (10,651 | ) | (5,076 | ) | (5,575 | ) | 109.8 |

|

| | | | |

The increase in consolidated operating loss was significantly impacted by an increase in restructuring charges and increased segment operating losses primarily related to volume declines, unfavorable foreign currency and increased research and development costs partially offset by reduced warranty expense.

Operating income (loss) by segment:

Europe - Operating income decreased for the first three months of 2017 as compared to the same period last year primarily related to unfavorable foreign exchange and increased SG&A expense partially offset by increased net sales and reduced warranty and freight costs.

NA/HME - Operating loss increased for the first three months of 2017 as compared to the same period last year primarily related to net sales declines partially offset by favorable sales mix and reduced warranty and freight expense. In addition, the first three months of 2016 included $0.8 million in operating income for GCM.

IPG - Operating income increased for the first three months of 2017 as compared to the same period last year primarily related to reduced SG&A expense and warranty and freight costs partially offset by net sales declines.

Asia/Pacific - Operating loss decreased for the first three months of 2017 as compared to the same period last year primarily related to increased net sales and favorable sales mix partially offset by increased research and development costs.

All Other - Operating loss decrease was primarily impacted by reduced SG&A expense.

Charge Related to Restructuring Activities

Restructuring charges totaled $3,283,000 in the first three months of 2017 related to severance and contract terminations in the NA/HME segment ($2,242,000) and severance in the Europe ($690,000) and Asia/Pacific ($351,000) segments. In the first three months of 2016, the company incurred restructuring charges of $102,000 related principally to severance costs incurred in the NA/HME segment ($61,000) and the Asia/Pacific segment ($41,000). The majority of the outstanding restructuring accruals at March 31, 2017 are expected to be paid out in the next twelve months other than certain executive payments which will be paid out over the next few years.

OTHER ITEMS

Net Gain on Convertible Debt Derivatives

|

| | | | | | |

($ in thousands USD) | March 31, 2017 | December 31, 2016 | Change in Fair Value - Gain (Loss) |

| | | |

Three Months Ended March 31, 2017 | | | |

Convertible Note Hedge Asset | 19,641 |

| 25,471 |

| (5,830 | ) |

Convertible Debt Conversion Liability | (23,977 | ) | (30,708 | ) | 6,731 |

|

Net gain on convertible debt derivatives | | 901 |

|

| | | |

| March 31, 2016 | Debt Issuance Date | Change in Fair Value - Gain (Loss) |

Three Months Ended March 31, 2016 | | | |

Convertible Note Hedge Asset | 29,297 |

| 27,975 |

| 1,322 |

|

Convertible Debt Conversion Liability | (35,198 | ) | (34,480 | ) | (718 | ) |

Net gain on convertible debt derivatives | | 604 |

|

| | | |

The company recognized net gains of $901,000 and $604,000 for the three months ended March 31, 2017 and March 31, 2016, respectively, related to the fair value of the convertible debt derivatives. See "Long-Term Debt" in the notes to the Consolidated Financial Statements included elsewhere in this report for more detail.

Interest

|

| | | | | | | |

($ in thousands USD) | Q1 17 | Q1 16 | $ Change | % Change |

Interest Expense | 4,518 |

| 2,373 |

| 2,145 |

| 90.4 |

Interest Income | (88 | ) | (54 | ) | (34 | ) | 63.0 |

The increase in interest expense for the first quarter as compared to the same period last year was primarily due to the convertible notes issuance in the first quarter of 2016.

Income Taxes

The company had an effective tax rate of 18.3% on losses before tax for the three months ended March 31, 2017 compared to an expected benefit at the U.S. statutory rate of 35.0% on the pre-tax losses for each period. The company's effective tax rate for the three months ended March 31, 2017 was unfavorable as compared to the U.S. federal statutory rate expected benefit, principally due to the negative impact of the company not being able to record tax benefits related to the significant losses in countries which had tax valuation allowances. The effective tax rate was reduced by certain taxes outside the United States, excluding countries with tax valuation allowances, that were at an effective rate lower than the U.S. statutory rate.

The company had an effective tax rate of 26.9% on losses before tax for the three months ended March 31, 2016 compared to an expected benefit at the U.S. statutory rate of 35.0% on the pre-tax losses for each period. The company's effective tax rate for the three months ended March 31, 2016 was unfavorable as compared to the U.S. federal statutory rate expected benefit, principally due to the negative impact of the company not being able to record tax benefits related to the significant losses in countries which had tax valuation allowances. The effective tax rate was reduced by certain taxes outside the United States, excluding countries with tax valuation allowances, that were at an effective rate lower than the U.S. statutory rate.

Installment payments were made in the first half of 2016 related to a previously disclosed liability for uncertain tax positions and current taxes payable, and during the second quarter of 2016, the company accelerated and paid the balance of the installment obligation, in order to reduce interest costs.

|

| | |

MD&A | Liquidity and Capital Resources | |

| | |

LIQUIDITY AND CAPITAL RESOURCES

The company continues to maintain an adequate liquidity position through its unused bank lines of credit (see Long-Term Debt in the Notes to Condensed Consolidated Financial Statements included in this report).

Key balances on the company's balance sheet and related metrics:

|

| | | | | | | | |

($ in thousands USD) | March 31, 2017 | December 31, 2016 | $ Change | % Change |

Cash and cash equivalents | 76,836 |

| 124,234 |

| (47,398 | ) | (38.2 | ) |

Working capital (1) | 171,211 |

| 188,211 |

| (17,000 | ) | (9.0 | ) |

Total debt (2) | 182,590 |

| 196,501 |

| (13,911 | ) | (7.1 | ) |

Long-term debt (2) | 180,392 |

| 181,240 |

| (848 | ) | (0.5 | ) |

Total shareholders' equity | 407,160 |

| 422,387 |

| (15,227 | ) | (3.6 | ) |

Credit agreement borrowing availability (3) | 41,990 |

| 44,260 |

| (2,270 | ) | (5.1 | ) |

| |

(1) | Current assets less current liabilities. |

| |

(2) | Long-term debt and Total debt exclude debt issuance costs recognized as a deduction from the carrying amount of that debt liability and debt discounts classified as equity. |

| |

(3) | The change in borrowing capacity is due to changes in the calculated borrowing base and is not the result of borrowings. |

The company's total debt outstanding, inclusive of the debt discount related to the convertible senior subordinated debentures due 2027 included in equity in accordance with FSB APB 14-1 as well as the debt discount and fees associated with the convertible senior notes due 2021, decreased by $13,911,000 to $182,590,000 at March 31, 2017 from $196,501,000 as of December 31, 2016. The debt decrease during first three months of 2017 was principally a result of the company's repurchase of all of the outstanding $13,350,000 principal amount of 4.125% Convertible Senior Subordinated Debentures due 2027 (the "2027 Debentures") as the holders exercised their February 1, 2017 right to require the company to repurchase their 2027 Debentures (see Long-Term Debt in the notes to Condensed Consolidated Financial Statements included in this report).

The company's cash balances were utilized for normal operations and debt repayment during the three-month period ended March 31, 2017. Debt repayments, acquisitions, divestitures, the timing of vendor payments, the timing of customer rebate payments, the granting of extended payment terms to significant national accounts and other activity can have a significant impact on the company's cash flow and borrowings outstanding such that the debt reported at the end of a given period may be materially different than debt levels during a given period. While the company has cash balances in various jurisdictions around the world, there are no material restrictions regarding the use of such cash for dividends within the company, loans or other purposes, except in China where the cash balance as of March 31, 2017 was approximately $6,396,000.

Based on the company's current expectations, the company believes that its cash balances, available borrowing capacity under its credit facilities should be sufficient to meet working capital needs, capital requirements, and commitments for at least the next twelve months. Notwithstanding the company's expectations, if the company's operating results decline as the result of pressures on the business due to, for example, currency fluctuations or regulatory issues or the company's failure to execute its business plans or if the company's transformation takes longer than expected, the company may be unable to comply with its obligations under the credit facilities, and its lenders could demand repayment of any amounts outstanding under the company's credit facilities.

The company also has an agreement with De Lage Landen, Inc. (“DLL”), a third-party financing company, to provide lease financing to the company's U.S. customers. Either party could terminate this agreement with 180 days' notice or 90 days' notice by DLL upon the occurrence of certain events. Should this agreement be terminated, the company's borrowing needs under its credit facilities could increase.

While there is general concern about the potential for rising interest rates, the company expects that it will be able to absorb modest rate increases in the months ahead without any material impact on its liquidity or capital resources. As of March 31, 2017, the weighted average floating interest rate on revolving credit borrowings, excluding capital leases, was 4.97% compared to 4.85% as of December 31, 2016.

See Long-Term Debt in the Notes to the Consolidated Financial Statements for more details regarding the company's credit facilities.

|

| | |

MD&A | Liquidity and Capital Resources | |

| | |

CAPITAL EXPENDITURES

The company estimates that capital investments for 2017 could approximate between $15,000,000 and $18,000,000, compared to actual capital expenditures of $10,151,000 in 2016. The anticipated increase considers the company's investments to transform the company. The terms of the company's credit facilities limit the company's annual capital expenditures to $35,000,000. As of March 31, 2017, the company has material capital expenditure commitments outstanding, consisting primarily of computer systems contracts. See Item 7. Contractual Obligations of the company's Annual Report on Form 10-K for the year ended December 31, 2016.

DIVIDEND POLICY

On February 21, 2017, the company's Board of Directors declared a quarterly cash dividend of $0.0125 per Common Share and $0.011364 per Class B Common Share to shareholders of record as of April 3, 2017, which was paid on April 13, 2017. At the current rate, the cash dividend will amount to $0.05 per Common Share and $0.045 per Class B Common Share on an annual basis, subject to Board of Directors approval of future dividend payments.

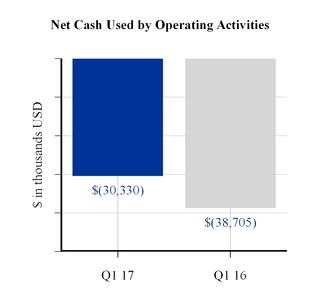

CASH FLOWS

The cash used by operating activities in the first three months of 2017 was driven by net loss and increases in inventory and accounts receivable and reductions in accrued expenses. The decrease in cash used by operating activities in the first three months of 2017 compared to the same period last year was principally due to timing of bonus payments which were paid in the first quarter of 2016 and installment tax payments in the first quarter of 2016 related to a previously disclosed liability for uncertain tax positions, which was incremental when compared to tax payments during the first three months of 2017.

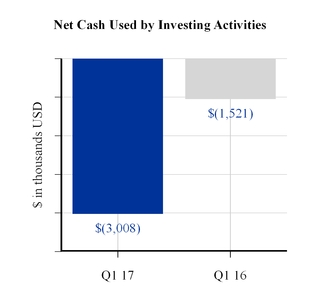

The increase in cash flows used by investing activities for the first three months of 2017 as compared to the same period last year was primarily related to an increase in capital expenditures.

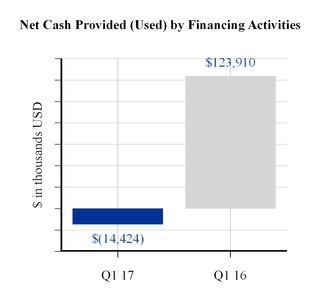

Cash flows used by financing activities in the first three months of 2017 were driven principally by the repayment of $13,350,000 in aggregate principal amount of the 2027 Debentures. Cash flows provided by financing activities in the first three months of 2016 reflect net proceeds received as a result of the issuance of Convertible Senior Notes due 2021, including the net proceeds used for the related convertible note hedge transactions, repurchase of common shares and payment of financing costs.

Free cash flow is a non-GAAP financial measure and is reconciled to the corresponding GAAP measure as follows (in thousands):

|

| | | | | |

($ in thousands USD) | Three Months Ended |

| 2017 | | 2016 |

Net cash used by operating activities | (30,330 | ) | | (38,705 | ) |

Plus: Sales or property and equipment | 10 |

| | 4 |

|

Less: Purchases of property and equipment | (3,034 | ) | | (1,464 | ) |

Free Cash Flow | (33,354 | ) | | (40,165 | ) |

| | | |

The first three months 2017 and 2016 free cash flow was negatively impacted by the same items that affected cash flows used by operating activities. Free cash flow is a non-GAAP financial measure that is comprised of net cash used by operating activities less purchases of property and equipment plus proceeds from sales of property and equipment. Management believes that this financial measure provides meaningful information for evaluating the overall financial performance of the company and its ability to repay debt or make future investments (including acquisitions, etc.).

The company's approximate cash conversion days at March 31, 2017, December 31, 2016 and March 31, 2016 are as follows:

Days in receivables are equal to current quarter net current receivables divided by trailing four quarters of net sales multiplied by 365 days. Days in inventory and accounts payable are equal to current quarter net inventory and accounts payable, respectively, divided by trailing four quarters of cost of sales multiplied by 365 days. Total cash conversion days are equal to days in receivables plus days in inventory less days in accounts payable.

|

| | |

MD&A | Accounting Estimates and Pronouncements | |

| | |

ACCOUNTING ESTIMATES AND PRONOUNCEMENTS

CRITICAL ACCOUNTING ESTIMATES

The Consolidated Financial Statements included in the report include accounts of the company and all majority-owned subsidiaries. The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions in certain circumstances that affect amounts reported in the accompanying Consolidated Financial Statements and related footnotes. In preparing the financial statements, management has made its best estimates and judgments of certain amounts included in the financial statements, giving due consideration to materiality. However, application of these accounting policies involves the exercise of judgment and use of assumptions as to future uncertainties and, as a result, actual results could differ from these estimates. Please refer to the Critical Accounting Estimates section within MD&A of company's Annual Report on Form 10-K for the period ending December 31, 2016.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

For the company’s disclosure regarding recently issued accounting pronouncements, see Accounting Policies - Recent Accounting Pronouncements in the Notes to the Consolidated Financial Statements contained in this Quarterly Report on Form 10-Q.

|

| | |

MD&A | Forward-Looking Statements | |

| | |

FORWARD-LOOKING STATEMENTS

This Form 10-Q contains forward-looking statements within the meaning of the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995. Terms such as “will,” “should,” “could,” “plan,” “intend,” “expect,” “continue,” “believe” and “anticipate,” as well as similar comments, denote forward-looking statements that are subject to inherent uncertainties that are difficult to predict. Actual results and events may differ significantly from those expressed or anticipated as a result of risks and uncertainties, which include, but are not limited to, the following: adverse effects of the company’s consent decree of injunction with the U.S. Food and Drug Administration (FDA), including but not limited to, compliance costs, limitations on the production and/or distribution of the company's products, inability to bid on or win certain contracts, unabsorbed capacity utilization, including fixed costs and overhead, or limitations on the company’s ability to design new power wheelchairs at its Corporate and Taylor Street facilities; any circumstances or developments that might delay or adversely impact FDA's inspection of the company's quality systems at the Elyria, Ohio, facilities impacted by the consent decree, including any possible failure to comply with the consent decree or FDA regulations, any requirement to perform additional remediation activities or further resultant delays in receipt of FDA's written notification to resume operations; regulatory proceedings or the company's failure to comply with regulatory requirements or receive regulatory clearance or approval for the company's products or operations in the United States or abroad; adverse effects of regulatory or governmental inspections of company facilities at any time and governmental enforcement actions; circumstances or developments that may make the company unable to implement or realize the anticipated benefits, or that may increase the costs, of its current business initiatives; possible adverse effects on the company's liquidity that may result from delays in the implementation or realization of benefits of its current business initiatives; product liability or warranty claims; product recalls, including more extensive warranty or recall experience than expected; the failure or refusal of customers or healthcare professionals to sign verification of medical necessity (VMN) documentation or other certification forms required by the exceptions to FDA consent decree; possible adverse effects of being leveraged, including interest rate or event of default risks; exchange rate fluctuations, particularly in light of the relative importance of the company's foreign operations to its overall financial performance and including the existing and potential impacts from the Brexit referendum; potential impacts of the new United States administration’s policies, and any legislation or regulations that may result from those policies, such as possible border-adjusted taxes on imported goods; legal actions, including adverse judgments or settlements of litigation or claims in excess of available insurance limits; adverse changes in government and other third-party payor reimbursement levels and practices both in the U.S. and in other countries (such as, for example, more extensive pre-payment reviews and post-payment audits by payors, or the continuing impact of the Medicare National Competitive

Bidding program); ineffective cost reduction and restructuring efforts or inability to realize anticipated cost savings or achieve desired efficiencies from such efforts; delays, disruptions or excessive costs incurred in facility closures or consolidations; tax rate fluctuations; additional tax expense or additional tax exposures, which could affect the company's future profitability and cash flow; inability to design, manufacture, distribute and achieve market acceptance of new products with greater functionality or new product platforms that deliver the anticipated benefits; consolidation of health care providers; lower cost imports; uncollectible accounts receivable; difficulties in implementing/upgrading Enterprise Resource Planning systems; risk of cybersecurity attack, data breach or data loss and/or delays in or inability to recover or restore data and IT systems; risks inherent in managing and operating businesses in many different foreign jurisdictions; decreased availability or increased costs of materials which could increase the company's costs of producing or acquiring the company's products, including possible increases in commodity costs or freight costs; heightened vulnerability to a hostile takeover attempt or other shareholder activism; provisions of Ohio law or in the company's debt agreements, charter documents or other agreements that may prevent or delay a change in control, as well as the risks described from time to time in the company's reports as filed with the Securities and Exchange Commission. Except to the extent required by law, the company does not undertake and specifically declines any obligation to review or update any forward-looking statements or to publicly announce the results of any revisions to any of such statements to reflect future events or developments or otherwise.

Part I. FINANCIAL INFORMATION

Item 1. Financial Statements.

INVACARE CORPORATION AND SUBSIDIARIES

Condensed Consolidated Statement of Comprehensive Income (Loss) (unaudited)

|

| | | | | | | |

(In thousands, except per share data) | Three Months Ended March 31, |

| 2017 | | 2016 |

Net sales | $ | 231,723 |

| | $ | 257,552 |

|

Cost of products sold | 166,578 |

| | 189,692 |

|

Gross Profit | 65,145 |

| | 67,860 |

|

Selling, general and administrative expenses | 72,513 |

| | 72,834 |

|

Charges related to restructuring activities | 3,283 |

| | 102 |

|

Operating Loss | (10,651 | ) | | (5,076 | ) |

Net gain on convertible debt derivatives | (901 | ) | | (604 | ) |

Interest expense | 4,518 |

| | 2,373 |

|

Interest income | (88 | ) | | (54 | ) |

Loss Before Income Taxes | (14,180 | ) | | (6,791 | ) |

Income tax provision | 2,600 |

| | 1,825 |

|

Net Loss | $ | (16,780 | ) | | $ | (8,616 | ) |

| | | |

Dividends Declared per Common Share | $ | 0.0125 |

| | $ | 0.0125 |

|

| | | |

Net Loss per Share—Basic | $ | (0.52 | ) | | $ | (0.27 | ) |

Weighted Average Shares Outstanding—Basic | 32,475 |

| | 32,371 |

|

Net Loss per Share—Assuming Dilution | $ | (0.52 | ) | | $ | (0.27 | ) |

Weighted Average Shares Outstanding—Assuming Dilution | 32,704 |

| | 32,600 |

|

| | | |

Net Loss | $ | (16,780 | ) | | $ | (8,616 | ) |

Other comprehensive income (loss): | | | |

Foreign currency translation adjustments | 949 |

| | 10,769 |

|

Defined Benefit Plans: | | | |

Amortization of prior service costs and unrecognized gains | (295 | ) | | (190 | ) |

Deferred tax adjustment resulting from defined benefit plan activity | (3 | ) | | (16 | ) |

Valuation reserve associated with defined benefit plan activity | 3 |

| | 16 |

|

Current period unrealized gain on cash flow hedges | 631 |

| | 1,165 |

|

Deferred tax loss related to unrealized gain on cash flow hedges | (166 | ) | | (203 | ) |

Other Comprehensive Income | 1,119 |

| | 11,541 |

|

Comprehensive Income (Loss) | $ | (15,661 | ) | | $ | 2,925 |

|

See notes to condensed consolidated financial statements.

INVACARE CORPORATION AND SUBSIDIARIES

Condensed Consolidated Balance Sheets (unaudited)

|

| | | | | | | |

| March 31,

2017 | | December 31,

2016 |

| (In thousands) |

Assets | | | |

Current Assets | | | |

Cash and cash equivalents | $ | 76,836 |

| | $ | 124,234 |

|

Trade receivables, net | 122,604 |

| | 116,307 |

|

Installment receivables, net | 1,655 |

| | 1,368 |

|

Inventories, net | 144,758 |

| | 135,644 |

|

Other current assets | 34,835 |

| | 31,519 |

|

Total Current Assets | 380,688 |

| | 409,072 |

|

Other Assets | 23,380 |

| | 29,687 |

|

Intangibles | 28,636 |

| | 29,023 |

|

Property and Equipment, net | 75,450 |

| | 75,359 |

|

Goodwill | 360,596 |

| | 360,602 |

|

Total Assets | $ | 868,750 |

| | $ | 903,743 |

|

Liabilities and Shareholders’ Equity | | | |

Current Liabilities | | | |

Accounts payable | $ | 92,483 |

| | $ | 88,236 |

|

Accrued expenses | 107,215 |

| | 110,095 |

|

Current taxes payable | 7,581 |

| | 7,269 |

|

Short-term debt and current maturities of long-term obligations | 2,198 |

| | 15,261 |

|

Total Current Liabilities | 209,477 |

| | 220,861 |

|

Long-Term Debt | 147,288 |

| | 146,088 |

|

Other Long-Term Obligations | 104,825 |

| | 114,407 |

|

Shareholders’ Equity | | | |

Preferred Shares (Authorized 300 shares; none outstanding) | — |

| | — |

|

Common Shares (Authorized 100,000 shares; 35,652 and 35,318 issued and outstanding in 2017 and 2016, respectively)—no par | 9,064 |

| | 8,974 |

|

Class B Common Shares (Authorized 12,000 shares; 729 issued and outstanding in 2017 and 2016, respectively)—no par | 183 |

| | 183 |

|

Additional paid-in-capital | 266,892 |

| | 266,151 |

|

Retained earnings | 248,967 |

| | 266,144 |

|

Accumulated other comprehensive income | (18,216 | ) | | (19,335 | ) |

Treasury shares (3,616 shares in 2017 and 2016, respectively) | (99,730 | ) | | (99,730 | ) |

Total Shareholders’ Equity | 407,160 |

| | 422,387 |

|

Total Liabilities and Shareholders’ Equity | $ | 868,750 |

| | $ | 903,743 |

|

See notes to condensed consolidated financial statements.

INVACARE CORPORATION AND SUBSIDIARIES

Condensed Consolidated Statement of Cash Flows (unaudited)

|

| | | | | | | |

| For the Three Months Ended March 31, |

| 2017 | | 2016 |

Operating Activities | (In thousands) |

Net loss | $ | (16,780 | ) | | $ | (8,616 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

Depreciation and amortization | 3,593 |

| | 3,653 |

|

Provision for losses on trade and installment receivables | 176 |

| | 47 |

|

Benefit for deferred income taxes | (728 | ) | | (29 | ) |

Provision for other deferred liabilities | 283 |

| | 79 |

|

Provision for stock-based compensation | 838 |

| | 2,089 |

|

Loss on disposals of property and equipment | 9 |

| | 19 |

|

Amortization of convertible debt discount | 1,749 |

| | 664 |

|

Amortization of debt fees | 521 |

| | 379 |

|

Gain on convertible debt derivatives | (901 | ) | | (604 | ) |

Changes in operating assets and liabilities: | | | |

Trade receivables | (6,386 | ) | | (6,938 | ) |

Installment sales contracts, net | (161 | ) | | (674 | ) |

Inventories | (8,603 | ) | | (9,480 | ) |

Other current assets | (1,714 | ) | | (2,495 | ) |

Accounts payable | 4,028 |

| | (2,529 | ) |

Accrued expenses | (4,322 | ) | | (12,108 | ) |

Other long-term liabilities | (1,932 | ) | | (2,162 | ) |

Net Cash Used by Operating Activities | (30,330 | ) | | (38,705 | ) |

Investing Activities | | | |

Purchases of property and equipment | (3,034 | ) | | (1,464 | ) |

Proceeds from sale of property and equipment | 10 |

| | 4 |

|

Change in other long-term assets | 19 |

| | (103 | ) |

Other | (3 | ) | | 42 |

|

Net Cash Used by Investing Activities | (3,008 | ) | | (1,521 | ) |

Financing Activities | | | |

Proceeds from revolving lines of credit and long-term borrowings | — |

| | 122,025 |

|

Payments on revolving lines of credit and long-term borrowings | (14,027 | ) | | (546 | ) |

Proceeds from exercise of stock options | — |

| | 17 |

|

Payment of financing costs | — |

| | (4,562 | ) |

Payment of dividends | (397 | ) | | (400 | ) |

Issuance of warrants | — |

| | 12,376 |

|

Purchase of treasury stock | — |

| | (5,000 | ) |

Net Cash Provided (Used) by Financing Activities | (14,424 | ) | | 123,910 |

|

Effect of exchange rate changes on cash | 364 |

| | 965 |

|

Increase (Decrease) in cash and cash equivalents | (47,398 | ) | | 84,649 |

|

Cash and cash equivalents at beginning of year | 124,234 |

| | 60,055 |

|

Cash and cash equivalents at end of period | $ | 76,836 |

| | $ | 144,704 |

|

See notes to condensed consolidated financial statements.

|

| | |

Notes to Financial Statements | Accounting Policies | |

| | |

Accounting Policies

Principles of Consolidation:

The consolidated financial statements include the accounts of the company and its wholly owned subsidiaries and include all adjustments, which were of a normal recurring nature, necessary to present fairly the financial position of the company as of March 31, 2017 and the results of its operations and changes in its cash flow for the three months ended March 31, 2017 and 2016, respectively. Certain foreign subsidiaries, represented by the European segment, are consolidated using a February 28 quarter end in order to meet filing deadlines. No material subsequent events have occurred related to the European segment, which would require disclosure or adjustment to the company's financial statements. All significant intercompany transactions are eliminated. The results of operations for the three months ended March 31, 2017 are not necessarily indicative of the results to be expected for the full year.

Use of Estimates:

The consolidated financial statements are prepared in conformity with accounting principles generally accepted in the United States, which require management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results may differ from these estimates.

Recent Accounting Pronouncements (Already Adopted):

In March 2016, the FASB issued ASU 2016-09, "Compensation – Stock Compensation: Topic 718: Improvements to Employee Share-Based Payment Accounting." ASU 2016-09 is intended to simplify several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. The company adopted ASU 2016-09, effective January 1, 2017, which did not have a material impact on the company's financial statements.

In July 2015, the FASB issued ASU 2015-11, “Inventory (Topic 330): Simplifying the Measurement of Inventory,” to simplify the subsequent measurement of inventory. With effectiveness of this update, entities are required to subsequently measure inventory at the lower of cost or net realizable value rather than at the lower of cost or market. The company adopted ASU 2015-11, effective January 1, 2017, which did not have a material impact on the company's financial statements.

Recent Accounting Pronouncements (Not Yet Adopted):

In May 2014, the FASB issued ASU 2014-09, "Revenue from Contracts with Customers." ASU 2014-09 requires a company to recognize revenue when promised goods or services are transferred to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods and services. The guidance requires five steps to be applied: 1) identify the contract(s) with customers, 2) identify the performance obligations in the contract, 3) determine the transaction price, 4) allocate the transaction price to the performance obligation in the contract and 5) recognize revenue when (or as) the entity satisfies a performance obligation. The guidance also requires both quantitative and qualitative disclosures, which are more comprehensive than existing revenue standards. The disclosures are intended to enable financial statement users to understand the nature, timing and uncertainty of revenue and the related cash flow. An entity can apply the new revenue standard retrospectively to each prior reporting period presented or retrospective with the cumulative effect of initially applying the standard recognized at the date of initial application in retained earnings. The new accounting guidance is effective for annual periods beginning after December 15, 2017, due to an approved one-year deferral, and early adoption is permitted. During 2016, the company completed a preliminary assessment of its contracts and is currently continuing its review of contracts and related accounting. Based on this review, the company does not expect this standard will have a material impact on the company's results of operations or cash flows in the periods after adoption. Pursuant to ASU 2014-09, revenues are recognized as control transfers to the customers, which is consistent with the current revenue recognition model and the current accounting for the majority of the company's contracts. The company will continue to evaluate the impact of ASU 2014-09, as well as any subsequent updates and clarifications, the possible impact of the standard on any new contracts entered into by the company through the date of adoption and determine the transition method of retrospective or cumulative effect transition method.

In February 2016, the FASB issued ASU 2016-02, "Leases." ASU 2016-02 requires lessees to put most leases on their balance sheet while recognizing expense in a manner similar to existing accounting. The new accounting guidance is effective for fiscal periods beginning after December 15, 2018 and early adoption is permitted. The company is currently reviewing the impact of the adoption of ASU 2016-02 on the company's financial statements.

|

| | |

Notes to Financial Statements | Accounting Policies | |

| | |

In June 2016, the FASB issued ASU 2016-13, "Measurement of Credit Losses on Financial Statements." ASU 2016-13 requires a new credit loss standard for most financial assets and certain other instruments. For example, entities will be required to use an "expected loss" model that will generally require earlier recognition of allowances for losses for trade receivables. The standard also requires additional disclosures, including disclosures regarding how an entity tracks credit quality. The amendments in the pronouncement are effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. Entities may early adopt the amendments as of fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. The company is currently reviewing the impact of the adoption of ASU 2016-09 on the company's financial statements.

In January 2017, the FASB issued ASU 2017-04, "Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment". The guidance in ASU 2017-04 eliminates the requirement to determine the fair value of individual assets and liabilities of a reporting unit to measure goodwill impairment. Under the amendments in the new ASU, goodwill impairment testing will be performed by comparing the fair value of the reporting unit with its carrying amount and recognizing an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value. The new standard is effective for annual and interim goodwill impairment tests in fiscal years beginning after December 15, 2019, and should be applied on a prospective basis. Early adoption is permitted for annual or interim goodwill impairment testing performed after January 1, 2017. The company is currently reviewing the impact of the adoption of ASU 2017-04 on the company's financial statements.

Reclassifications:

In 2016, the company redefined the measure by which it evaluates segment profit or loss to be segment operating profit (loss). The previous performance measure was earnings before income taxes. All prior periods presented were restated to reflect the new measure. During the first quarter of 2017, a subsidiary, formerly included in the Europe segment transferred to the NA/HME segment as it is managed by the NA/HME segment manager effective January 1, 2017. This restatement increased revenues from external customers by $1,301,000 and operating loss by $107,000 for NA/HME with an offsetting impact for Europe. For the year 2016, this restatement will increase revenues from external customers by $5,211,000 and operating loss by $128,000 for NA/HME with an offsetting impact for Europe.

The company has historically classified the amortization of debt issuance costs as a component of Selling, General and Administrative (SG&A) Expenses. During the second quarter of 2016, the company determined that it is more appropriate to classify this amortization as a component of Interest Expense. Therefore, interest expense for the three months ended March 31, 2016 was increased by $379,000 with a corresponding decrease to SG&A expenses. There was no change to Loss Before Income Taxes for any period presented.

|

| | |

Notes to Financial Statements | Divested Businesses | |

| | |

Divested Businesses

Operations Held For Sale

On September 30, 2016, the company completed the sale of its subsidiary, Garden City Medical Inc, a Delaware corporation and wholly-owned subsidiary (“GCM”), dba PMI and Pinnacle Medsource, to Compass Health Brands Corp., a Delaware corporation (the “Purchaser”), pursuant to a Share Purchase Agreement. GCM sourced and distributed primarily lifestyle products under the brand ProBasics™ by PMI. GCM was part of the NA/HME segment of the company. The price paid to the company for GCM was $13,829,000 in cash, and net proceeds from the transaction were $12,729,000, net of expenses. The company recorded a pre-tax gain of $7,386,000 in the third quarter of 2016, which represented the excess of the net sales price over the book value of the assets and liabilities of GCM. The sale of GCM was dilutive to the company's results. The company utilized the net proceeds to fund operations. The company determined that the sale of GCM did not meet the criteria for classification as a discontinued operation in accordance with ASU 2014-08 but the "held for sale" criteria of ASC 360-10-45-9 were met and thus GCM was treated as held for sale for purposes of the Condensed Consolidated Balance Sheet as of December 31, 2015.

With the sale of GCM, the company entered into an agreement with the Purchaser for the Purchaser to buy, at cost, all ProBasics™ inventory capitalized on the balance sheets of certain Invacare subsidiaries which was not sold as part of the GCM sale on September 30, 2016. The value of the inventory sold was approximately $2,400,000 which was transferred to the Purchaser in the fourth quarter of 2016. Under the agreement, depending on certain conditions, the Purchaser may have until September 30, 2017 to pay for the inventory.

Prior to 2017, the company had recorded expenses related to the sale of all operations held for sale, including GCM, totaling $2,892,000, of which $1,512,000 has been paid out as of March 31, 2017.

Discontinued Operations

From 2012 through 2014, the company sold three businesses which were classified as discontinued operations. Prior to 2017, the company had recorded cumulative expenses related to the sale of discontinued operations totaling $8,801,000, of which $8,405,000 have been paid as of March 31, 2017.

|

| | |

Notes to Financial Statements | Current Assets | |

| | |

Current Assets

Receivables

Accounts receivable are reduced by an allowance for amounts that may become uncollectible in the future. Substantially all of the company’s receivables are due from health care, medical equipment providers and long term care facilities located throughout the United States, Australia, Canada, New Zealand, China and Europe. A significant portion of products sold to providers, both foreign and domestic, are ultimately funded through government reimbursement programs such as Medicare and Medicaid in the U.S. As a consequence, changes in these programs can have an adverse impact on dealer liquidity and profitability.

The estimated allowance for uncollectible amounts ($7,140,000 at March 31, 2017 and $6,916,000 at December 31, 2016) is based primarily on management’s evaluation of the financial condition of specific customers. In addition, as a result of the company's financing arrangement with De Lage Landen, Inc. ("DLL"), a third-party financing company with which the company has worked since 2000, management monitors the collection status of these contracts in accordance with the company’s limited recourse obligations and provides amounts necessary for estimated losses in the allowance for doubtful accounts and establishes reserves for specific customers as needed. The company writes off uncollectible trade accounts receivable after such receivables are moved to collection status and legal remedies are exhausted. See Concentration of Credit Risk in the Notes to the Consolidated Financial Statements for a description of the financing arrangement. Long-term installment receivables are included in “Other Assets” on the consolidated balance sheet.

The company’s U.S. customers electing to finance their purchases can do so using DLL. In addition, the company often provides financing directly for its Canadian customers for which DLL is not an option, as DLL typically provides financing to Canadian customers only on a limited basis. The installment receivables recorded on the books of the company represent a single portfolio segment of finance receivables to the independent provider channel and long-term care customers. The portfolio segment is comprised of two classes of receivables distinguished by geography and credit quality. The U.S. installment receivables are the first class and represent installment receivables re-purchased from DLL because the customers were in default. Default with DLL is defined as a customer being delinquent by three payments. The Canadian installment receivables represent the second class of installment receivables which were originally financed by the company because third party financing was not available to the HME providers. The Canadian installment receivables are typically

financed for twelve months and historically have had a very low risk of default.

The estimated allowance for uncollectible amounts and evaluation for impairment for both classes of installment receivables is based on the company’s quarterly review of the financial condition of each individual customer with the allowance for doubtful accounts adjusted accordingly. Installments are individually and not collectively reviewed for impairment. The company assesses the bad debt reserve levels based upon the status of the customer’s adherence to legally negotiated payment schedule and the company’s ability to enforce judgments, liens, etc.

For purposes of granting or extending credit, the company utilizes a scoring model to generate a composite score that considers each customer’s consumer credit score and/or D&B credit rating, payment history, security collateral and time in business. Additional analysis is performed for most customers desiring credit greater than $250,000, which generally includes a detailed review of the customer’s financial statements as well as consideration of other factors such as exposure to changing reimbursement laws.

Interest income is recognized on installment receivables based on the terms of the installment agreements. Installment accounts are monitored and if a customer defaults on payments and is moved to collection, interest income is no longer recognized. Subsequent payments received once an account is put on non-accrual status are generally first applied to the principal balance and then to the interest. Accruing of interest on collection accounts would only be restarted if the account became current again.

All installment accounts are accounted for using the same methodology regardless of the duration of the installment agreements. When an account is placed in collection status, the company goes through a legal process for pursuing collection of outstanding amounts, the length of which typically approximates eighteen months. Any write-offs are made after the legal process has been completed. The company has not made any changes to either its accounting policies or methodology to estimate allowances for doubtful accounts in the last twelve months.

|

| | |

Notes to Financial Statements | Current Assets | |

| | |

Installment receivables consist of the following (in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2017 | | December 31, 2016 |

| Current | | Long- Term | | Total | | Current | | Long- Term | | Total |

Installment receivables | $ | 2,285 |

| | $ | 2,601 |

| | $ | 4,886 |

| | $ | 2,027 |

| | $ | 2,685 |

| | $ | 4,712 |

|

Less: Unearned interest | (42 | ) | | — |

| | (42 | ) | | (40 | ) | | — |

| | (40 | ) |

| 2,243 |

| | 2,601 |

| | 4,844 |

| | 1,987 |

| | 2,685 |

| | 4,672 |

|

Allowance for doubtful accounts | (588 | ) | | (2,073 | ) | | (2,661 | ) | | (619 | ) | | (2,219 | ) | | (2,838 | ) |

Installment receivables, net | $ | 1,655 |

| | $ | 528 |

| | $ | 2,183 |

| | $ | 1,368 |

| | $ | 466 |

| | $ | 1,834 |

|

Installment receivables purchased from DLL during the three months ended March 31, 2017 increased the gross installment receivables balance by $345,000. No sales of installment receivables were made by the company during the quarter.

The movement in the installment receivables allowance for doubtful accounts was as follows (in thousands):

|

| | | | | | | |

| Three Months Ended March 31, 2017 | | Year Ended December 31, 2016 |

Balance as of beginning of period | $ | 2,838 |

| | $ | 2,792 |

|

Current period provision (benefit) | (177 | ) | | 1,220 |

|

Direct write-offs charged against the allowance | — |

| | (1,174 | ) |

Balance as of end of period | $ | 2,661 |

| | $ | 2,838 |

|

Installment receivables by class as of March 31, 2017 consist of the following (in thousands):

|

| | | | | | | | | | | | | | | |

| Total Installment Receivables | | Unpaid Principal Balance | | Related Allowance for Doubtful Accounts | | Interest Income Recognized |

U.S. | | | | | | | |

Impaired installment receivables with a related allowance recorded | $ | 3,947 |

| | $ | 3,947 |

| | $ | 2,529 |

| | $ | — |

|

Canada | | | | | | | |

Non-Impaired installment receivables with no related allowance recorded | 807 |

| | 765 |

| | — |

| | 23 |

|

Impaired installment receivables with a related allowance recorded | 132 |

| | 132 |

| | 132 |

| | — |

|

Total Canadian installment receivables | 939 |

| | 897 |

| | 132 |

| | 23 |

|

Total | | | | | | | |

Non-Impaired installment receivables with no related allowance recorded | 807 |

| | 765 |

| | — |

| | 23 |

|

Impaired installment receivables with a related allowance recorded | 4,079 |

| | 4,079 |

| | 2,661 |

| | — |

|

Total installment receivables | $ | 4,886 |

| | $ | 4,844 |

| | $ | 2,661 |

| | $ | 23 |

|

|

| | |

Notes to Financial Statements | Current Assets | |

| | |

Installment receivables by class as of December 31, 2016 consist of the following (in thousands):

|

| | | | | | | | | | | | | | | |

| Total Installment Receivables | | Unpaid Principal Balance | | Related

Allowance for

Doubtful

Accounts | | Interest Income Recognized |

U.S. | | | | | | | |

Impaired installment receivables with a related allowance recorded | $ | 3,762 |

| | $ | 3,762 |

| | $ | 2,706 |

| | $ | — |

|

Canada | | | | | | | |

Non-Impaired installment receivables with no related allowance recorded | 818 |

| | 778 |

| | — |

| | 65 |

|

Impaired installment receivables with a related allowance recorded | 132 |

| | 132 |

| | 132 |

| | — |

|

Total Canadian installment receivables | 950 |

| | 910 |

| | 132 |

| | 65 |

|

Total | | | | | | | |

Non-Impaired installment receivables with no related allowance recorded | 818 |

| | 778 |

| | — |

| | 65 |

|

Impaired installment receivables with a related allowance recorded | 3,894 |

| | 3,894 |

| | 2,838 |

| | — |

|

Total installment receivables | $ | 4,712 |

| | $ | 4,672 |

| | $ | 2,838 |

| | $ | 65 |

|

Installment receivables with a related allowance recorded as noted in the table above represent those installment receivables on a non-accrual basis in accordance with ASU 2010-20. As of March 31, 2017, the company had no U.S. installment receivables past due of 90 days or more for which the company is still accruing interest. Individually, all U.S. installment receivables are assigned a specific allowance for doubtful accounts based on management’s review when the

company does not expect to receive both the contractual principal and interest payments as specified in the loan agreement. In Canada, the company had an immaterial amount of Canadian installment receivables which were past due of 90 days or more as of March 31, 2017 and December 31, 2016 for which the company is still accruing interest.

The aging of the company’s installment receivables was as follows (in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2017 | | December 31, 2016 |

| Total | | U.S. | | Canada | | Total | | U.S. | | Canada |

Current | $ | 813 |

| | $ | — |

| | $ | 813 |

| | $ | 832 |

| | $ | — |

| | $ | 832 |

|

0-30 Days Past Due | 11 |

| | — |

| | 11 |

| | 18 |

| | — |

| | 18 |

|

31-60 Days Past Due | 7 |

| | — |

| | 7 |

| | 12 |

| | — |

| | 12 |

|

61-90 Days Past Due | 7 |

| | — |

| | 7 |

| | 2 |

| | — |

| | 2 |

|

90+ Days Past Due | 4,048 |

| | 3,947 |

| | 101 |

| | 3,848 |

| | 3,762 |

| | 86 |

|

| $ | 4,886 |

| | $ | 3,947 |

| | $ | 939 |

| | $ | 4,712 |

| | $ | 3,762 |

| | $ | 950 |

|

|

| | |

Notes to Financial Statements | Current Assets | |

| | |

Inventories

Inventories consist of the following (in thousands):

|

| | | | | | | |

| March 31, 2017 | | December 31, 2016 |

Finished goods | $ | 72,642 |

| | $ | 68,701 |

|

Raw materials | 61,570 |

| | 56,270 |

|

Work in process | 10,546 |

| | 10,673 |

|

Inventories, net | $ | 144,758 |

| | $ | 135,644 |

|

Other Current Assets

Other current assets consist of the following (in thousands):

|

| | | | | | | |

| March 31, 2017 | | December 31, 2016 |

Value added tax receivables | $ | 16,995 |

| | $ | 14,336 |

|

Service contracts | 2,809 |

| | 2,902 |

|

Derivatives (foreign currency forward contracts) | 2,497 |

| | 2,754 |

|

Prepaid insurance | 2,290 |

| | 2,761 |

|

Prepaid inventory | 462 |

| | 790 |

|

Recoverable income taxes | 422 |

| | 503 |

|

Prepaid debt fees | 294 |

| | 489 |

|

Prepaid and other current assets | 9,066 |

| | 6,984 |

|

Other Current Assets | $ | 34,835 |

| | $ | 31,519 |

|

|

| | |

Notes to Financial Statements | Long-Term Assets | |

| | |

Long-Term Assets

Other long-term assets consist of the following (in thousands):

|

| | | | | | | |

| March 31, 2017 | | December 31, 2016 |

Convertible note hedge asset | $ | 19,641 |

| | $ | 25,471 |

|

Cash surrender value of life insurance policies | 1,847 |

| | 1,824 |

|

Deferred financing fees | 820 |

| | 793 |

|

Installment receivables | 528 |

| | 466 |

|

Deferred taxes | 334 |

| | 837 |

|

Investments | 104 |

| | 108 |

|

Other | 106 |

| | 188 |

|

Other Long-Term Assets | $ | 23,380 |

| | $ | 29,687 |

|

During the quarter ended March 31, 2016, the company issued $150,000,000 principal amount of Convertible Senior Notes due 2021. As part of the transaction, the company entered into related convertible note hedge derivatives which are

included in Other Long-Term Assets, the value of which will be adjusted quarterly to reflect fair value. See "Long-Term Debt" in the notes to the Consolidated Financial Statements included elsewhere in this report for more detail.

Property and Equipment

Property and equipment consist of the following (in thousands):

|

| | | | | | | |

| March 31, 2017 | | December 31, 2016 |

Machinery and equipment | $ | 289,940 |

| | $ | 301,367 |

|

Land, buildings and improvements | 74,056 |

| | 73,709 |

|

Leasehold improvements | 12,040 |

| | 12,054 |

|

Furniture and fixtures | 9,705 |

| | 10,100 |

|

Property and Equipment, gross | 385,741 |

| | 397,230 |

|

Less allowance for depreciation | (310,291 | ) | | (321,871 | ) |

Property and Equipment, net | $ | 75,450 |

| | $ | 75,359 |

|

Goodwill

The change in goodwill from December 31, 2016 to March 31, 2017 was due to foreign currency translation.

|

| | |

Notes to Financial Statements | Long-Term Assets | |

| | |

The company's intangibles consist of the following (in thousands):

|

| | | | | | | | | | | | | | | |

| March 31, 2017 | | December 31, 2016 |

| Historical Cost | | Accumulated Amortization | | Historical Cost | | Accumulated Amortization |

Customer lists | $ | 49,351 |

| | $ | 46,110 |

| | $ | 49,362 |

| | $ | 45,797 |

|

Trademarks | 24,088 |

| | — |

| | 24,091 |

| | — |

|

Developed technology | 7,283 |

| | 6,009 |

| | 7,287 |