UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

☑ Filed by the Registrant | ☐ Filed by a Party other than the Registrant | |

Check the appropriate box: | ||

⬜ | Preliminary Proxy Statement | |

⬜ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |

☑ | Definitive Proxy Statement | |

⬜ | Definitive Additional Materials | |

⬜ | Soliciting Material Pursuant to §240.14a-12 | |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply): | ||

☑ | No fee required. | |

⬜ | Fee paid previously with preliminary materials. | |

⬜ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

UDR At A Glance | ||||

UDR is a full-cycle investment | 51+ Years | |||

that consistently generates | ||||

strong total shareholder return | History | |||

(“TSR”) through innovation, | ||||

best-in-class operations, and | S&P 500 | |||

disciplined capital allocation. | ||||

| Multifamily REIT | |||

~$20 Billion | ||||

Enterprise Value (1) | ||||

~60,000 | ||||

Apartment Homes (2) | ||||

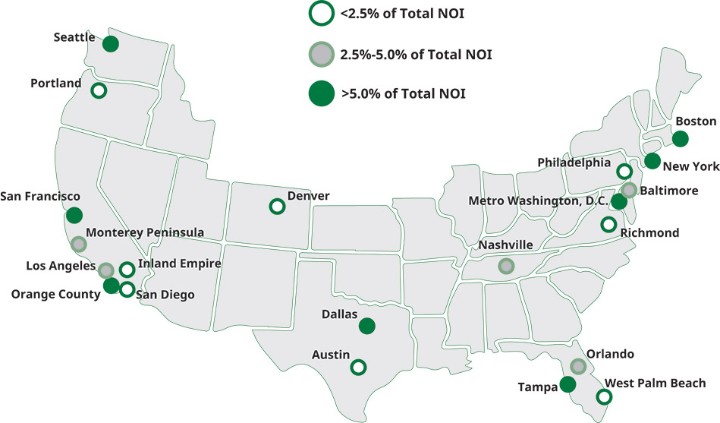

21 | ||||

Markets | ||||

4.4% | ||||

Dividend Yield (1) | ||||

(1) Enterprise Value and Dividend Yield as of December 31, | ||||

2023 | ||||

(2) As of December 31, 2023; includes homes held by | ||||

unconsolidated joint ventures | ||||

Properties on the Cover | ||||

Outside Front Cover: Columbus Square, New York City (Top-Left), | ||||

The Whitmore, Arlington, VA (Top-Center), Waterside Towers, Washington, DC (Top-Right), Signal Hill, Woodbridge, VA (Middle), Andover House, Washington, DC (Bottom) | ||||

Inside Front Cover: Waterside Towers, Washington, DC | ||||

Outside Back Cover: The Courts at Huntington Station, | ||||

Alexandria, VA | ||||

UDR Values UDR has a strong, inclusive culture that promotes innovation, engagement, and good corporate responsibility. We expect our associates will continue to cultivate this culture in alignment with our values for many years to come. |

| Respect |

|

| Integrity |

|

| Teamwork |

We will treat each other with courtesy and fairness. We will learn from a diversity of perspectives and accept that doing so is the way to a greater balance in our lives. | We will be honest and sincere in both words and our actions, striving to do the right thing, the right way, every time. | As we work together, we share ideas to find better ways to develop effective solutions, challenge our thinking, and overcome obstacles. | |||||

|

| Ownership |

|

| Growth |

Our Company's success will be the result of holding ourselves accountable to meet our goals and proudly share in our victories. | We will "be our best" when we increase our skills, gain more knowledge, try new things, learn from our mistakes, and focus on the positive as we shape our future. | ||||

Highlights, Culture, and Values

Our approach to social responsibility ensures we have a strategy and initiatives in place that address aspects across the employee lifecycle, including attracting, recruiting, developing, engaging and retaining talent. Our ultimate goal is to build a better Company by maintaining a diverse, engaged workforce to grow and retain talent, as there is a positive correlation between culture and values with engagement, productivity, and the bottom line. In furtherance of this goal, in 2023 we hired a Vice President - Organizational Development to concentrate on our succession and talent development efforts. Our commitment to social responsibility also prioritizes resident engagement and their experience with UDR. In 2023 we published our fifth ESG report, and we have received a 5 star designation from GRESB.

What Is New in this Proxy Statement? ● Expanded human capital disclosure including new benefit programs and associate communication methods ● Expanded disclosure regarding our efforts with respect to cybersecurity ● Added Independence Realty Trust (“IRT”) to our apartment peer group for 2024 ● Expanded disclosure regarding our board overboarding policy ● Added disclosure regarding actual compensation ● Additional disclosure regarding shareholder engagement ● Expanded disclosure regarding our sustainability efforts | ||||

x

| I welcome you to join me and the entire Board of Directors at our 2024 Annual Meeting of Shareholders, which will be held at 10:00am local time in Denver, CO, May 23, 2024, at the Four Seasons Hotel. Thomas W. Toomey Chairman and Chief Executive Officer | |||||

|

|

|

| |||

To My Fellow Shareholders:

Over the course of my 23 years at UDR, Inc. (“UDR” or the “Company”) and more than 30 years in the multifamily industry, I have seen firsthand the evolution of our business and how we communicate with stakeholders. Given the hundreds of investor interactions we conduct and the multitude of documents we publish annually which inform UDR’s stakeholders on our strategy and results in detail, this letter, which was once a primary communication vehicle, now seems more akin to a reflective piece. As such, I am using this platform to comment on the year that was, reflect on the progress we have made on our fourth strategic plan which we launched five years ago, and opine on where we see our business heading.

To that end, 2023 was a strong year for UDR. Among our many accomplishments, the Company:

| ● | Generated Funds From Operations as Adjusted (“FFOA”) per share growth of 6%. |

| ● | Produced same-store NOI growth of 6.8%, the second highest among our apartment peer group1 and the fourth highest annual growth rate over my 23 years at UDR. I would like to thank Mike Lacy, Matt Cozad, Kristin Nicholson, Cesar Armendariz, and our approximately 1,400 associates across the country for your continued passion to deliver success. |

| ● | Increased our dividend by a robust 10.5%, a near-record high for the Company, enhancing our already strong total return profile. |

| ● | Advanced our innovation efforts to deliver greater resident satisfaction, reduce resident turnover, and enhance associate resources, thereby positioning the Company well for years to come. I thank Scott Wesson, Josh Gampp, Chris Johnson, and our Innovation Team for continually finding creative solutions to advance the way we conduct business. |

| ● | Adhered to capital market signals and maintained disciplined capital allocation. We opportunistically executed approximately $1 billion of accretive deals through joint venture and Operating Partnership Unit transactions in 2023. I thank Harry Alcock, Andrew Cantor, Dan Campbell, and their teams for their tireless efforts to uncover attractive investment opportunities. |

| ● | Maintained a solid BBB+/Baa1 investment grade rating. I am grateful for Joe Fisher, Abe Claude, and their teams for positioning our balance sheet with minimal debt maturities through 2026 while enhancing liquidity to approximately $1 billion. |

| ● | Expanded our commitment to environmental, social, and governance (“ESG”) goals, as evidenced by a Sector Leader designation by GRESB2 and again being named to Newsweek’s list of America’s Most Responsible Companies. Chris Van Ens, Stephanie Marlin, Justin Rychlick, and our Sustainability team rightfully deserve credit for advancing our long-term environmental strategy. |

| ● | Received accolades from Institutional Investor3, who recognized UDR’s Board, Chairman and CEO, President and CFO, and Investor Relations team as being top-3 in their respective categories among more than 150 companies in the U.S. REITs industry. |

1 Apartment peer group includes AIRC, AVB, CPT, EQR, ESS, and MAA.

2 GRESB is a leading global ESG benchmark for real assets including real estate.

3 Institutional Investor offers annual rankings on corporates, buy-side and sell-side research, hedge funds, fixed income and asset management. These rankings have become known as the benchmark for excellence and a published position is confirmation directly from investors and/or sell-side analysts of the quality and reliability of a company’s efforts.

Specific to the Company’s fourth strategic plan that we prepared in conjunction with our Board and launched in 2018, we have achieved various accomplishments in transforming our business to a self-service model with a focus on an improved customer experience and higher associate engagement. Over the last five years, we have:

| ● | Grown the Enterprise Value of our Company by nearly 6%, the second highest rate among our peer group. This is a reflection of both our ability to source and deploy capital accretively and expand the operating margin on acquired communities through our industry-leading operating platform. |

| ● | Generated cumulative same-store NOI and FFOA per share growth of nearly 20%, each the third highest among our apartment peer group, trailing only our Sunbelt-oriented peers who disproportionately benefitted from increased demand due to effects of the COVID pandemic. |

| ● | Enhanced our controllable operating margin to a peer-leading 84%, helping drive higher cash flow growth. |

| ● | Delivered Total Shareholder Return of 15%, a testament to our ability to navigate through a wide range of challenges including the COVID pandemic, a capital markets recession, and interest rate volatility, among others. |

| ● | Increased the frequency, depth, and breadth of associate engagement. Similar to establishing a culture, improving engagement takes time and requires attentively listening and responding to our associates. We have made concerted efforts to enhance dialogue through frequent discussions, surveys, and townhall-style forums. Nearly 90% of our associates participate in these engagements, and approximately 80% of UDR associates express satisfaction in their job; both results are well above their respective benchmarks for high-performing companies. While there remains room for improvement, I am encouraged by our industry-leading response rate and feedback that shows an overwhelming majority of our associates enjoy working for, and believe they can succeed at, UDR. This is best evidenced by achieving an all-time Company low associate turnover rate of 22% in 2023, which is nearly half of the industry average of 40%. |

While the team and I are proud of our accomplishments, we continue to build the Company for the future and are excited for what lies ahead. Namely, our primary goals remain to innovate and drive durable competitive advantages across our diversified portfolio. Over time, these should generate attractive risk-adjusted returns for our stakeholders irrespective of the economic cycle. To accomplish this, we remain laser focused on executing in areas that we can control. These include continuous innovation, the quality of our customer service, growing the skill set of our associates, solidifying our balance sheet and improving liquidity, and actively engaging investors.

We start 2024 with fewer “knowns” than in 2023 due to ongoing interest rate volatility, economic uncertainty, geopolitical risks, and historically high levels of new multifamily supply, all of which could impact customer behavior. While the macro backdrop remains fluid, we remain confident in our abilities to navigate through a wide range of outcomes. Our success over time can be directly linked to four core attributes:

| 1. | Always listening to associates, customers, and other stakeholders to guide long-term strategy and short-term tactics. |

| 2. | Continually evolving how we conduct our business through ongoing innovation. |

| 3. | Fostering an inclusive culture that empowers teams and associates to innovate while simultaneously affording opportunities for career growth and work-life balance. |

| 4. | Focusing on what we can control and creating strategies that mitigate risk from drivers of our business that are out of our control. |

Looking to 2024, we have strategically positioned ourselves with high occupancy of over 97% to begin the year, with the intent of pushing rent growth as the peak leasing season unfolds. Also in our favor are several underlying fundamental factors including:

| 1. | Our consumer remains resilient, with rent-to-income ratios approximating the long-term average. |

| 2. | Relative affordability versus alternative housing options remains decidedly in our favor at roughly 60% less expensive to rent than own, a 25% improvement from pre-COVID, and supportive of a stable to declining homeownership rate. |

| 3. | The largest U.S. age cohorts remain in their prime renter years, according to the latest U.S. Census data, providing continued support for long-term rental demand. |

| 4. | Multifamily development starts activity has retreated by 70% from recent highs and is now well below historical norms, which should benefit future rent growth. |

What is missed in the numbers we report and the macro outlook that drives our business is how we are structurally enhancing UDR to better capitalize on what should be improved operating conditions post 2024. These enhancements include our Customer Experience Project, which helps to improve our residents’ UDR experience, reduce resident turnover over time, and better capture the lifetime value of a UDR resident. This initiative will continue to be rolled out in the coming years, but the upside potential is vast. For every 1% decrease in resident turnover our NOI increases by approximately $3 million. Since implementing our Customer Experience Project in mid-2023, initial results have been positive with annualized resident turnover approximately 3.5% to 4% lower versus the prior year. To facilitate the implementation of the Customer Experience

2024 Proxy Statement |

| 3 |

Project and other future innovations, we have reorganized the reporting structure of some of our business lines. Specifically, we combined our Operations and Technology Systems teams to streamline the process of advancing ideas into actions and outcomes. I am excited about what this collaboration will yield.

Management Team Update

On a bittersweet note, UDR’s Chief Investment Officer Harry Alcock announced his retirement effective July 31, 2024. Harry, who has been with UDR for 13 years and with whom I have had the pleasure of working for approximately 30 years during our careers, has been a long-time trusted partner. His contributions to the Company have helped UDR thoughtfully and accretively grow from an $8 billion enterprise in 2010 to a $20 billion enterprise today. I am thankful that UDR and its investors have benefitted from Harry’s expertise, and wish him well in his retirement.

With change comes opportunity. Our broader investment teams are in good hands under the guidance of Andrew Cantor, Bob McCullough, Doug Fee, and Andrew Lavaux. All have proven their value to the Company time and again, and I look forward to working with them more closely moving forward.

Reflection

When considering our long-term growth trajectory, we will continue to focus on our customers, associates, and stakeholders.

| 1. | Customers. Our residents have healthy rent-to-income ratios and relative affordability continues to favor apartments over other forms of housing. So, we view the near-term effect of elevated multifamily supply as transitory and expect that the demand versus supply dynamic will eventually revert to our favor. |

| 2. | Associates. Through frequent discussions, surveys, and townhall meetings, we have created a strong and engaging culture that empowers our associates to constantly innovate and help grow the Company. |

| 3. | Stakeholders. We are highly engaged and understand what stakeholders believe we are doing well and where we can and will improve. |

From these interactions, we have created a company that we believe is a full cycle investment and maximizes value creation for our stakeholders regardless of the economic environment. In 2024 and beyond, we plan to lean into what we can control and execute on. This means continuing to leverage our operating platform and innovation, nimbly adjusting our tactics to combat the ever-changing economic landscape, taking a capital light approach to maintain liquidity and balance sheet flexibility, and continuing to invest in our associates and culture. Taken together, I believe these tactics will continue UDR’s long tenure of success.

Finally, my and Senior Management’s thanks go out to our associates, the Company’s trusted partners, and our Board. These groups are a big reason why UDR continues to succeed, and I look forward to seeing how our innovation will propel UDR forward in the years to come.

Best,

Thomas W. Toomey

Chairman and Chief Executive Officer

2024 Proxy Statement |

| 4 |

Voting Items

01 | Election of 10 Directors |

Date and Time

Location

Who Can Vote Important Notice: Availability of Proxy Materials for UDR, Inc.’s Annual Meeting of Shareholders to be held on May 23, 2024. This Notice of Annual Meeting and Proxy Statement and UDR, Inc.’s Annual Report/Form 10-K for the year ended December 31, 2023 are available on the Internet at the following website: www.proxyvote.com. | ||||

| The Board recommends a vote “FOR” each director nominee | Page 24 |

| |||

02 | Advisory Vote on Executive Compensation | |||||

| The Board recommends a vote “FOR” | Page 61 |

| |||

03 | Ratification of Ernst & Young LLP as Independent Registered Public Accounting Firm | |||||

| The Board recommends a vote “FOR” | Page 104 |

| |||

Shareholders will also transact such other business as may properly come before the Meeting or any adjournment(s) thereof. How to Vote in Advance Your vote is important. Whether or not you plan to attend the meeting, we urge you to vote your shares electronically through the following: | ||||||

|

|

| ||||

By Telephone 1-800-690-6903 | By Internet www.proxyvote.com | By Mail Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided | ||||

2024 Proxy Statement |

| 5 |

On or about April 4, 2024, we intend to mail to our shareholders of record a notice containing instructions on how to access our 2024 proxy statement (“Proxy Statement”) and our Annual Report on Form 10-K for the year ended December 31, 2023 (“Annual Report”), and how to vote online. The notice also provides instructions on how you can request a paper copy of these documents if you desire, and how you can enroll in e-delivery. If you received your annual meeting materials via email, the email contains voting instructions and links to our Annual Report and Proxy Statement on the Internet. If you would like to reduce the costs incurred by UDR in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions on the Proxy Card to vote using the Internet and, when prompted, indicate that you agree to receive or access shareholder communications electronically in future years. We want to thank you for helping make UDR an environmentally friendly company and for your continued support of UDR.

We intend to hold our annual meeting in person; however, in the event it is not possible or advisable to hold our annual meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting by means of remote communication. Please monitor our annual meeting website at https://www.udr.com/2024annualmeeting for updated information. If you are planning to attend our meeting, please check the website one week prior to the meeting date.

Whether or not you expect to be at the meeting, please vote as soon as possible to ensure that your shares are represented.

By Order of the Board of Directors

Warren L. Troupe

Corporate secretary

April 4, 2024

2024 Proxy Statement |

| 6 |

This summary highlights selected information about UDR and the items to be voted on at the annual meeting. This summary does not contain all of the information that you should consider in deciding how to vote. You should read the entire proxy statement carefully before voting.

Company Overview

About UDR, Inc.

UDR is a $20 billion enterprise value multifamily REIT that owns, operates, develops and redevelops a diversified portfolio of apartment homes across top-tier U.S. markets. Founded in 1972, UDR is an S&P 500 company that consistently generates strong total shareholder return through innovation, best-in-class operations and disciplined capital allocation across a wide range of opportunities. UDR’s strategy is founded on diversification across markets, price points, and product types which coupled with our best-in-class operations delivers a full-cycle investment that generates both growth and stability. As of December 31, 2023, we owned 188 communities including 60,336 homes and had 1,397 full-time and 13 part-time associates who worked to generate in excess of $1.6 billion of revenue in 2023.

2024 Proxy Statement |

| 7 |

Proxy Overview

UDR’s Business Strategy

Why UDR?

Strategy

Our primary goal is to consistently generate above-peer (our apartment peers include AIRC, AVB, CPT, EQR, ESS, and MAA) average total shareholder return (“TSR”) while considering our stakeholders and the environments in which we operate. The following attributes aid us in executing this goal through growth in Funds from Operations as Adjusted (“FFOA”), Net Asset Value (“NAV”), and the Dividend per share combined with being a strong Corporate Citizen.

► Operating Excellence | ► Culture and ESG | |

● Generate above-peer median same-store growth. ● Enhance controllable operating margin via innovative technological solutions. ● Increase resident satisfaction through self-service enablement. | ● Promote an innovative, inclusive culture where associate engagement is high, sustainability is more than a catch phrase, and top-notch customer service is a central focus. ● Reduce our environmental footprint through accretive capital investments in energy, water, and waste initiatives. | |

► Portfolio Diversification | ► Accretive Capital Allocation | |

● Reduce metropolitan statistical area concentration risk and same-store growth volatility and appeal to a wide renter/investor audience. ● Implement our best-in-class operating and capital allocation platforms. | ● Invest in and pivot to the best risk-adjusted return opportunities. ● Apply predictive analytics that influence investments and capital deployment. | |

► Balance Sheet Strength | ||

● Maintain a safe, liquid and flexible balance sheet that can fully fund our needs throughout real estate cycles. ● Sustain a diverse, efficient set of capital sources. | ||

These efforts contribute to creating above-peer average TSR:

2024 Proxy Statement |

| 8 |

Proxy Overview

2023 Performance Highlights

In 2023, UDR achieved a variety of successes, which include:

► Earnings and Growth Highlights | ||

● Generating above-peer-average earnings growth of 6%, marking the seventh time in the last ten years UDR has outperformed the peer group. ● Accretively growing the Company through $402 million of wholly owned acquisitions. ● Formed the LaSalle joint venture, contributed $507 million of properties and acquired one property for $114 million. ● Our dividend paid in January 2024 (for the fourth quarter of 2023) was our 206th consecutive dividend paid and our annualized dividend for 2024 increased by 1.2% over 2023, while our 2023 annualized dividend increased by 10.5% over the annualized dividend for 2022. | ||

► Operational Highlights | ||

● Implementing the Company’s Next Generation Operating Platform to improve the customer experience and our operating efficiency through a self-service model. Since 2018, UDR has reduced onsite staffing by approximately 40% mostly through natural attrition, resulting in UDR having the best controllable operating margin in the multifamily peer group at approximately 300 basis points above what would be expected for a company with UDR’s average rent. We are continuing our innovation efforts and have identified future projects which we estimate will increase net operating income by as much as $40 million while at the same time enhancing our residents’ experience. ● Second highest same-store net operating income growth among our apartment peers for 2023. | ||

► ESG Highlights | ||

● Enhanced our ESG related disclosure resulting in receiving a GRESB Sector Leader designation, being named one of America’s Most Responsible Companies by Newsweek for the third consecutive year, and we have committed to invest $30 million (including $10 million in early 2024) in strategic ESG and climate focused venture capital funds. ● We were an inaugural donor to the NAREIT Foundation’s Dividends through Diversity, Equity and Inclusion campaign. ● Achieved 80% participation by our associates in our quarterly Associate Engagement Pulse Survey. ● Introduced quarterly pulse surveys to promptly examine and consider the needs and perceptions of our associates. ● Associate turnover of 22% in 2023 outperforming the industry average of 40%. ● Updated our Scope 1, 2, and 3 emissions intensity goals to align with science-based targets. | ||

► Investment/Balance Sheet | ||

● Invested in ~$1 billion of joint venture and operating partnership unit transactions. ● Maintained our investment-grade balance sheet and have the lowest cost of debt in our sector and the best liquidity profile – only 12% of debt (apartment peer group average is 25%) maturing through 2026. | ||

2024 Proxy Statement |

| 9 |

Proxy Overview

Innovation Accomplishments

UDR’s history of innovation has delivered better SS NOI growth and controllable operating margin versus peers.

Long-Term Same-Store UDR vs. Peer Median(1) SS NOI Growth (2013-2023) | Controllable Operating Margin (“COM”) COM vs. Avg. Monthly Rent(2) (TTM THROUGH 4Q 2023) |

|

|

| (1) | Peer group includes AIRC (AIV prior to 2021), AVB, CPT, EQR, ESS, and MAA; 2Q 2020 through 4Q 2023 UDR same-store NOI results have been adjusted where appropriate to reflect concessions on a straight-line basis for peer comparability. |

| (2) | Based on disclosures across the peer group, Average Monthly Rent is defined as average monthly rental rates for EQR, ESS, and MAA and is defined as average monthly revenue per occupied home for AIRC, AVB, CPT, and UDR. |

Source: Company and peer documents.

~300 bps controllable operating margin advantage vs. peer average |

| Same-Store EBITDA margin (including G&A and property management) is ~100 bps higher than the peer average |

| Higher Same-Store EBITDA margin in 9 of 14 primary UDR markets in which we compete with our apartment peers |

2024 Proxy Statement |

| 10 |

Proxy Overview

Human Capital Management

Our associates are critical to our success and, in recognition of that fact, below we describe some of the tools and initiatives we utilize to attract, develop, and retain our associates as well as to measure the results of our efforts. Our goal is to build a culture that results in high associate satisfaction and retention, which in turn should help us to achieve results for our other stakeholders, including our shareholders. Our efforts in 2023 resulted in a turnover rate of 22%, a 4% decrease from 2022, as compared to an industry average turnover rate of 40%.

Board Oversight

The board believes that it is critical to our success that we continue to attract, develop and retain high quality associates in all areas of our business. Through its oversight function, the board sets the “tone at the top,” and holds senior management accountable for creating a culture that embodies our values and that allows us to attract and retain the high-quality associates that we need. Each year in its annual report to the board, the human resources team furnishes a thorough overview of our human capital initiatives, encompassing the evaluation process and results, workforce analysis, and strategic planning components.

In 2018, in connection with our belief as to the importance of our associates to our success, a “Health of the Workforce” performance metric was added to our short-term incentive compensation program for our named executive officers and certain other senior officers, which has been retained for subsequent years. In 2023, we continued to track the Rooney Rule metric as part of the “Health of the Workforce” scorecard, which ties compensation to performance with respect to an initiative to consider all candidates for all open positions across the entire company. A new ESG metric was added to our 2021 short term incentive compensation program and retained for 2022 and 2023, although for 2023 such metric was revised to be determined based on the percentile of our overall GRESB score as opposed to an absolute score. In addition, for 2022 and 2023 we expanded our Health of the Workforce and ESG metrics so that they impact associate compensation for many associates beginning at the vice president level and in 2024 we expanded this concept to many associates at the director and senior director level.

Helping Our Associates Thrive

At UDR, our culture is defined by choice, transparency, and trust. We seek to empower our associates to make decisions that align with their individual interests and benefit the company as a whole. Our approach to human capital has resulted in high levels of associate engagement as shown by our associate surveys, leading to increased associate retention (turnover in 2023 of 22% outperforming the industry average of 40%) and better performance outcomes. To continue this success, our human resources team continues to evaluate and adjust our strategies to create alignment between the needs and expectations of our business and our associates.

To further enhance our commitment to human capital development, in 2023, we hired a Vice President of Organizational Development, a new position that will focus on career development and succession for associates throughout the organization. These efforts will play a pivotal role in ensuring that UDR cultivates and retains the right talent in the right positions.

In 2022, as part of our ongoing commitment to optimizing our human resources strategy, our human resources team spearheaded an HR Priority Ranking Assessment involving approximately 50 UDR leaders, including Senior Vice Presidents and Vice Presidents. The objective was to synchronize our strategic direction with the specific needs of our business, allowing the creation of tailored and impactful solutions. Based on the insights gleaned from this assessment, five key HR Goals for 2023 were identified and subsequently approved by the senior executive team. In addition, drawing upon feedback garnered from quarterly pulse surveys begun in 2023, our objectives were adjusted for 2024. For 2024, our five core objectives are as follows: (1) enhance the associate experience to drive engagement and elevate customer satisfaction; (2) strengthen our approach to learning, development, and succession planning; (3) pursue excellence in associate health, wellness, and compensation to maintain competitive standing in the market; (4) optimize our talent acquisition function to attract and retain top talent effectively, and (5) advance our DEI programs and expand opportunities for community engagement among associates.

Following up on the comprehensive benefits survey of our associates conducted in 2022, and the changes we made to our benefits program in 2022 based on the results of the survey, we dedicated our third quarter 2023 associate engagement pulse survey to benefits. That survey revealed that 88% of associates have a clear understanding of their benefits, with a strong favorability rating of 77% across our UDR benefit offerings. Drawing from the survey and additional feedback from associates we further enhanced our benefit package for 2024 by reducing the benefit waiting period from 60 to 30 days, instituting a 401(k) auto-enrollment for new hires at 3% of salary, introducing Teen Support to our Associate Resource Program, and launching a new Annual Virtual Health & Wellness Fair.

For a number of years, we have worked in our recruitment endeavors to attract qualified candidates including candidates from underrepresented groups. In connection with that effort, we have implemented various strategies such as integrating our Human Resources Information System with job board platforms, including those most used by potential candidates from underrepresented groups, collaborating with organizations such as the National Diversity Council, actively participating in military job fairs, and making other concerted efforts to recruit from diverse candidate pools. These efforts have been successful, in 2023, 61% of our newly hired associates were from ethnic groups other than white, and 42% were female. In addition to recruiting efforts, we continue to furnish resources on DEI-related topics, offering a range of avenues, including webinars, training, workshops, and other tools. These efforts are complemented by our ongoing initiatives to promote community engagement, exemplified through activities such as food drives and volunteer opportunities. We measure our efforts in this area through our quarterly pulse surveys with a survey in 2023 showing that 80% of associates believe that everyone can succeed at UDR irrespective of age, cultural background, gender, or race.

2024 Proxy Statement |

| 11 |

Proxy Overview

Compensation programs are also important to recruiting, attracting and retaining talent and along with our surveys we use tools to measure our compensation across a variety of metric including a compensation market data tool we began using in 2022, that provides near real-time market data, which we use to measure and update our salary ranges.

Set forth below are graphs that show the average salary by gender and ethnicity versus the average salary company wide, in each case by job title:

by gender: | |||||||

Salaries | Workforce | Management | Management Promotions | ||||

100% | 100% | 40% | 60% | 43% | 57% | 48% | 52% |

Female | Male | Female | Male | Female | Male | Female | Male |

by ethnicity: | |||||||

SALARIES BY ETHNIC GROUP | Workforce | Management | Management Promotions | ||||

Asian | 106% | Asian | 2% | Non-white | 39% | Asian | 5% |

Black | 101% | Black | 13% | White | 61% | Black | 18% |

White | 100% | White | 53% | White | 52% | ||

Hispanic/ | 99% | Hispanic/ | 26% | Hispanic/ | 21% | ||

Other | 102% | Other | 6% | Other | 4% | ||

* | Data as of or for the period ending December 31, 2023. |

** | Management is defined as Resident Services Manager and more senior job classifications. |

Other includes: American Indian, Alaska Native, Native Hawaiian, Pacific Islander, Not Specified or two or more races.

2024 Proxy Statement |

| 12 |

Proxy Overview

While we believe the metrics with respect to our workplace and workforce set forth above are more useful to us in managing our business, the data from our EEO-1 report for 2022, filed in May 2023 (the most recent report available), is below.

Job | Hispanic | Non-Hispanic or Latino | Overall Total | ||||||||||||

Male | Female | ||||||||||||||

Male | Female | White | Black or African | Native Hawaiian or | Asian | American Indian | Two or More Races | White | Black or African | Native Hawaiian or | Asian | American Indian | Two or More Races | ||

Exec/Sr. | 3 | 0 | 35 | 0 | 0 | 0 | 0 | 0 | 13 | 0 | 0 | 0 | 0 | 0 | 51 |

First/Mid | 39 | 11 | 84 | 9 | 0 | 4 | 1 | 4 | 113 | 12 | 0 | 8 | 0 | 4 | 289 |

Professionals | 15 | 25 | 91 | 11 | 1 | 3 | 0 | 5 | 77 | 17 | 2 | 7 | 2 | 7 | 263 |

Technicians | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Sales Workers | 2 | 6 | 6 | 2 | 0 | 0 | 0 | 1 | 21 | 4 | 0 | 0 | 0 | 2 | 44 |

Administrative Support | 13 | 40 | 41 | 15 | 1 | 6 | 0 | 3 | 85 | 29 | 1 | 4 | 0 | 14 | 252 |

Craft Workers | 156 | 1 | 92 | 42 | 1 | 1 | 1 | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 297 |

Operatives | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Laborers & Helpers | 14 | 0 | 23 | 4 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 42 |

Service Workers | 15 | 6 | 28 | 10 | 1 | 0 | 0 | 3 | 8 | 3 | 0 | 1 | 0 | 1 | 76 |

Total | 257 | 89 | 400 | 93 | 4 | 14 | 2 | 20 | 317 | 65 | 3 | 20 | 2 | 28 | 1314 |

Previous | 245 | 78 | 376 | 79 | 4 | 12 | 3 | 15 | 312 | 50 | 2 | 20 | 0 | 31 | 1227 |

We believe that a critical component of human capital is training, which is a cornerstone for enhancing associate job satisfaction, effectiveness, career progression, and retention. We have a comprehensive two-day onboarding process for new associates during which we prioritize instilling our culture, values, mission, and administrative procedures, providing our associates with the groundwork for success. In addition, we have mandatory annual regulatory training covering areas such as harassment, cybersecurity, and fair housing for all associates. Further, associates can participate in management development programs such as ULEAD and Level Up! Career Mobility Programs. Through these programs we intend to equip associates with the essential skills required for career advancement. Our extensive training catalog boasts over 6,000 courses encompassing leasing skills, property maintenance, customer service, project management, and system applications. In 2023, our associates collectively dedicated 13,924 hours to training, averaging 10 hours per full-time associate. In addition, with respect to required training, we implemented enhanced controls to ensure timely completion of courses, resulting in a 95% completion rate by year end 2023.

Certifications are widely recognized as key elements in career progression within the apartment industry. To support our associates' professional growth, we actively encourage them to pursue certifications aligned with their interests, offering partial tuition reimbursement. Additionally, we require annual performance reviews, providing valuable feedback on career development and engagement levels, thereby integrating robust human capital management strategies into our practices.

We also believe in actively engaging with our communities and facilitating our associates' involvement in meaningful community initiatives. To this end, each associate receives 8 hours of paid volunteer time per year. In 2023, UDR associates collectively contributed 1,041 hours of paid time off for volunteer work, collaborating with over 20 local organizations. Additionally, we organized various drives and initiatives, including food, clothing, and blood drives, to support non-profit organizations and causes, fostering a culture of giving back.

Throughout 2023, in addition to our quarterly pulse survey program we also implemented various measures focused on improving communication in order to foster data-driven decisions and promote collaboration between operations and corporate teams. These initiatives included: centralizing information, creating an HR Monthly Newsletter, and establishing internal publications and recognition programs.

2024 Proxy Statement |

| 13 |

Proxy Overview

Sustainability

HIGHLIGHTS OF OUR SUSTAINABILITY EFFORTS OVER RECENT YEARS INCLUDE:

1M kWh | SCOPE 1, 2, AND 3 EMISSIONS INTENSITY REDUCTION GOALS | ESG and Climate Tech Funds | ||||||||

Over 300 Sustainability Projects | United Nations Sustainable Development Goals | 32,071,000 kWh in RECs | ||||||||

More than 420 Electric Vehicle Charging Ports | Paperless | 11,000 kW | ||||||||

Physical Climate Change Risk | 15,978,000 Gallons Reclaimed | Carbon Footprint and Climate Related Risk | ||||||||

41,700 Metric Tons CO2e Avoided | Resident Communication | |||||||||

Sustainable Building Certification | Compensation Tied to ESG | |||||||||

2024 Proxy Statement |

| 14 |

Proxy Overview

Commitment to Corporate Responsibility Reporting

In 2023, we published our fifth ESG Report covering calendar year 2022, which is available on the investor relations page of our website under the heading ESGà2023 ESG Report. Our Report aligns with SASB and TCFD standards and we updated our GRI disclosures to reflect the GRI Universal Standards (2021). Highlights of our report include:

| ● | Our updated long-term Sustainability Strategy which positions UDR well to navigate the still-evolving sustainability environment, including the adoption of science-based Scope 1, 2, and 3 GHG emissions intensity reduction targets and revised sub-goals related to reduced energy, water, and waste usage as well as greater renewable energy procurement. |

| ● | The expansion of our Environmental Metrics table to include Scope 3 emissions as we work towards our Scope 3 emissions intensity reduction goal. |

| ● | The introduction of our top five people goals, intended to help shape the direction of our future people initiatives, which are: |

| o | Monitor and enhance the associate experience; |

| o | Enhance our approach to learning, development, and succession planning; |

| o | Improve associate health and wellness; |

| o | Strengthen our talent acquisition function; and |

| o | Advance Diversity, Equity, and Inclusion (“DEI”) and community engagement programs. |

| ● | Additional disclosures related to associate engagement, including quarterly pulse survey results and the addition of “Associate Compensation and Benefits” to our ESG Report Materiality Assessment, which prioritizes ESG topics to include in our disclosures based on rankings periodically performed by senior leadership through a survey to reflect current ESG initiatives and relevant ESG engagement across our stakeholder groups. |

We will continue to evaluate our ESG strategy through consistent reviews of our ESG processes and initiatives to ensure that they (1) remain aligned with and enhance our strategic and sustainability goals, (2) address the evolving needs and expectations of our stakeholders, and (3) continue to provide useful and actionable ESG data metrics. Continued ESG improvement is critical to our long-term success, the results and the TSR we generate over time, enhancing our culture, and improving our residents’ experience.

Awards and Leadership

UDR’s ongoing commitment to enhancing its comprehensive ESG program resulted in the Company earning a variety of honors from widely recognized institutions as a leader in ESG and sustainability in 2023.

|

| GRESB Score of 87 Sustainalytics Climate Tech Funds | SDG Alignment Responsibility Green Bonds | Sustainable Building Certifications DEI Commitment | |||||

|

| ||||||||

|

|

| 2020 |

| 2021 |

| 2022 |

| 2023 | |

GRESB |

| 83 |

| 86 |

| 87 |

| 87 |

Sustainalytics |

| 13 |

| 13 |

| 12 |

| 14 |

MSCI |

| A |

| BB |

| BB |

| BB |

2024 Proxy Statement |

| 15 |

Proxy Overview

Protecting the Environment and Our Stakeholders

We understand the impact our business can have on the environment and our stakeholders. When appropriate, we undertake initiatives designed to improve our operational quality, improve quality of life for and retention of our associates and residents, and reduce our environmental footprint. Examples of efforts completed over the past couple of years include having third parties assess climate-change risks for each of our assets (the results of which are reported to the board and are used to inform future decision making), conducting environmental assessments of each UDR asset that we acquire, investing in ESG and Climate Technology Funds that are on the cutting edge of sustainability technology, including “green lease” addendums in all our leases to better educate our residents on their environmental impact, improving our employee benefits packages based on extensive internal feedback, and enhancing our resident experience through self-service and leading technologies. Over the past nine years we have completed 240 energy conservation projects which have resulted in estimated avoided emissions of more than 41,700 metric tons of carbon dioxide equivalent (CO2e) since 2015 and have also provided a strong financial return. In 2023, we updated our Sustainability Strategy to (1) reinforce our long-standing commitment to being a sustainability leader in the REIT space, and (2) better address the evolution that the sustainability space has undergone over the past 5+ years by layering on more programmatic sustainability actions and capital investment to our already best-in-class compliance and reporting framework. This updated strategy is governed by our Environmental Policy, which states that UDR is committed to incorporating efforts towards the protection of the environment within the Company’s environmental governance, risk management, and business strategy in order to operate more sustainably and create long-term value for our stakeholders.

2024 Proxy Statement |

| 16 |

Proxy Overview

proposal 1 highlights

01 | Election of 10 Directors |

| The Board recommends a vote “FOR” each director nominee |

● Diverse slate of directors (40% of our directors are diverse) with broad leadership experience. ● All candidates are highly successful executives with relevant skills and expertise. ● Average director tenure of 13.7 years with 9 of 10 directors to be voted upon independent of management. ● Board ranked number 3 in the 2023 Institutional Investor All-America Executive Team Rankings out of approximately 150 companies. | |

Our Existing Board

|

|

| |||||

Katherine A. Cattanach Former General Partner of INVESCO Private Capital, Inc. | Jon A. Grove Former Chairman, President and Chief Executive Officer of ASR Investments Corporation | Mary Ann King Co-Head of Berkadia Institutional Solutions | |||||

Independent Tenure: 18 years Other Current Public Company Boards: 0 Committee(s): AC, GC (Chair), NC | Independent Tenure: 26 years Other Current Public Company Boards: 0 Committee(s): CC | Independent Tenure: 9 years Other Current Public Company Boards: 0 Committee(s): CC, GC | |||||

|

|

| |||||

James D. Klingbeil Chairman and CEO of Klingbeil Capital Management and The Klingbeil Company | Clint D. McDonnough Managing Partner of McDonnough Consulting LLC; Former Office Managing Partner for Ernst & Young LLP’s Dallas office | Robert A. McNamara Former Group Chief Risk Officer of Lend Lease Corporation | |||||

Lead Independent Director Tenure: 26 years Other Current Public Company Boards: 0 Committee(s): NC (Chair), EC (Chair) | Independent Tenure: 8 years Other Current Public Company Boards: 0 Committee(s): AC, EC | Independent Tenure: 10 years Other Current Public Company Boards: 1 Committee(s): CC (Chair), GC, NC | |||||

|

|

| |||||

Diane M. Morefield Former Executive Vice President, Chief Financial Officer of CyrusOne | Kevin C. Nickelberry Managing Director and | Mark R. Patterson President of MRP Holdings LLC | |||||

Independent Tenure: 4 years Other Current Public Company Boards: 1 Committee(s): AC (Chair), GC, NC | Independent Tenure: 3 years Other Current Public Company Boards: 0 Committee(s): AC, GC | Independent Tenure: 10 years Other Current Public Company Boards: 3 Committee(s): CC | |||||

AC = Audit and Risk Management Committee CC = Compensation and Management Development Committee GC = Governance Committee NC = Nominating Committee EC = Executive Committee |

| |||||

Thomas W. Toomey Chairman and CEO of UDR, Inc. | ||||||

Tenure: 23 years Other Current Public Company Boards: 0 Committee(s): EC | ||||||

2024 Proxy Statement |

| 17 |

Proxy Overview

Board Snapshot

Skills and Attributes

|

|

|

|

|

|

|

Accounting/Financial | C-Level Management | Capital Market | Corporate | |||

10/10 | 8/10 | 9/10 | 10/10 |

|

|

|

|

|

|

|

Multifamily | Non-UDR Board | Property Mangement | Public Company CEO | |||

4/10 | 6/10 | 5/10 | 2/10 |

|

|

|

|

| ||||

Real Estate | Sales and | Stakeholder | Strategic | Technology, | ||||

9/10 | 8/10 | 10/10 | 10/10 | 6/10 |

2024 Proxy Statement |

| 18 |

Proxy Overview

Shareholder Engagement

85.0% | In 2023 and early 2024, we had 708 interactions with our investors through meetings and property tours, representing ownership of approximately 85.0% of our outstanding common stock. |

| 43.1% | In addition, we proactively contacted the governance or stewardship departments of 119 of our investors and received responses from and had engagement meetings with representatives of 17 of such departments, representing ownership of approximately 43.1% of our outstanding common stock. |

Governance Highlights

UDR has a history of strong corporate governance guided by three primary principles – dialogue, transparency and responsiveness. The board has adjusted our governance approach over time to align with evolving best practices, drive sustained shareholder value, and serve the interests of shareholders.

► Good Governance | |

● Extensive board and committee dialogue with formal processes for shareholder engagement ● Annual board and committee self-evaluations ● Annual individual director evaluation process ● Periodic continuing education for directors ● All directors attended at least 75% of meetings held ● Policies, incorporated in our Statement on Corporate Governance and Nominating Committee Charter, requiring the initial pools of candidates for the board and external searches for a Chief Executive Officer to include diverse candidates. This concept has been expanded to cover associates at all levels ● Annual advisory approval of named executive officer compensation ● Robust Code of Business Conduct and Ethics, and Code of Ethics for Senior Financial Officers ● Stock ownership guidelines for executive officers and directors ● Board Overboarding Policy | ● Prohibition on hedging transactions ● Pledging transactions prohibited without prior approval ● Recoupment Policy (updated in 2023) ● Charitable Donations and Political Contributions Policy ● Annual ESG reporting ● Double-trigger acceleration of vesting in the event of a change in control ● Twelve-month minimum vesting on equity awards generally ● Board and committee oversight of material short-term and long-term risks (including climate change and cybersecurity risk), ESG and human capital management |

► Shareholder Rights | |

● Annual election of all directors ● Majority voting in uncontested director elections ● Proxy access for eligible director candidates nominated by eligible shareholders ● No shareholder rights plan (poison pill) ● Confidential voting | ● No material restrictions on shareholders’ right to call a special meeting ● Active shareholder engagement ● Ability for shareholders to propose binding bylaw amendments ● No issued and outstanding shares of capital stock that have no voting rights and no treasury stock |

► Independent Oversight | |

● Strong Lead Independent Director role with clearly articulated responsibilities ● Audit, Compensation, Governance and Nominating Committees consist entirely of Independent Directors | ● All directors are independent, except the Chairman and Chief Executive Officer ● Independent directors and committees meet regularly in executive session |

2024 Proxy Statement |

| 19 |

Proxy Overview

Proposal 2 highlights

02 | Say-on-Pay: Advisory Vote on the Compensation of the Named Executive Officers |

| The Board recommends a vote “FOR” this proposal |

● Independent oversight by our Compensation and Management Development Committee, with the assistance of an independent compensation consultant. ● Executive compensation that is competitive with our peers and that is structured to be aligned with our strategy and is measured against both absolute and relative to our peers total return to shareholders. ● Executive compensation comprised of a mix of base salary, short-term incentive compensation and long-term incentive compensation, and is determined based on the consideration of a number of factors described in more detail in “Executive Compensation — Compensation Discussion and Analysis.” ● Our TSR over time compares favorably to the peer group. | |

Components of 2023 Compensation

| component |

| Fixed/ |

| objective | performance metrics | |

| Base Salary |

| Fixed |

| Designed to reward individual effort associated with job-related duties and to attract and retain talented executive officers for our Company. | ||

| Short-Term Incentive Compensation (STI) |

| Variable |

| Designed to encourage outstanding individual and Company performance by motivating the named executive officers to achieve short-term Company and individual goals by rewarding performance measured against key annual strategic objectives and, for the CEO, using the independent directors’ evaluation of the CEO’s performance towards achieving short-term goals. | ● FFO as Adjusted per share ● Transactions Index ● Operations Index ● GRESB Percentile ● Associate Engagement & DEI ● Individual and Department Goals | |

| Long-Term Incentive Compensation (LTI) |

| Variable |

| Our LTI compensation is designed to closely align the interests of our management with the creation of shareholder value, to motivate our management to achieve long-term growth and success of our Company and to foster significant ownership of our common stock by our management. LTI compensation is the most significant component of the named executive officers’ compensation. | ● 3-Year Relative TSR vs. Apartment Peers ● 3-Year Relative TSR vs. NAREIT Equity REITs Total Return Index ● 3-Year Relative FFO as Adjusted Growth Rate vs. Apartment Peers ● Annual FFO as Adjusted per share |

Say-on-Pay/Shareholder Engagement

While we have consistently had strong shareholder support for our executive compensation program, we continue to engage in dialogue with shareholders on executive compensation issues. We will consider the outcome of future advisory votes and the input we receive from shareholder engagement when establishing the Company’s compensation programs and policies and making compensation decisions regarding our named executive officers.

Our shareholders have consistently supported our executive compensation program and over the last five years, shareholder support for our advisory vote on executive compensation has averaged 85.86%.

2024 Proxy Statement |

| 20 |

Proxy Overview

Compensation Earned

Total compensation, as reported in the Summary Compensation Table and calculated as required by applicable rules and regulations, includes items driven by accounting rules and assumptions with respect to incentive compensation that has not yet been earned and may in the future not be earned. Therefore, it is not reflective of the compensation our named executive officers actually earned in a given year. Accordingly, to supplement the disclosure contained in the Summary Compensation Table and the narrative disclosure accompanying the table starting on page 89, we are providing the table below to compare the compensation earned by our named executive officers in 2023, 2022, and 2021 to the total compensation shown by the Summary Compensation Table.

The amounts set forth below for “Earned Compensation” differ materially from the amounts reported as total compensation in the Summary Compensation Table and are not a substitute for those amounts.

|

|

| ||||

Total | Earned | |||||

(from Summary | Compensation | |||||

Name and | Compensation Table) | Total | ||||

Principal Position | Year | ($) | ($) | |||

Thomas W. |

| 2023 | 11,755,015 | 6,727,096 | ||

Toomey |

| 2022 | 8,149,435 | 9,852,300 | ||

Chief Executive Officer |

| 2021 | 14,228,383 | 11,040,952 | ||

Joseph D. Fisher |

| 2023 | 4,855,745 | 3,701,277 | ||

President - Chief |

| 2022 | 8,191,454 | 4,288,540 | ||

Financial Officer |

| 2021 | 3,068,246 | 4,668,698 | ||

Harry G. Alcock |

| 2023 | 3,601,319 | 2,916,140 | ||

Senior Vice |

| 2022 | 3,236,130 | 4,332,375 | ||

President - Chief Investment Officer | 2021 | 2,963,709 | 5,004,658 | |||

Michael D. Lacy | 2023 | 2,765,854 | 2,478,862 | |||

Senior Vice |

| 2022 | 1,815,398 | 2,395,045 | ||

President - Property Operations |

| 2021 | 1,711,463 | 1,857,987 |

Earned Compensation for 2023 includes 2023 salary, any bonus earned in 2023, short-term incentive compensation earned for 2023, the portion of the long-term incentive programs with respect to which the performance period ended on December 31, 2023 and the “All Other Compensation” from the Summary Compensation Table for 2023.

Earned Compensation for 2022 includes 2022 salary, any bonus earned in 2022, short-term incentive compensation earned for 2022, the portion of the long-term incentive programs with respect to which the performance period ended on December 31, 2022 and the “All Other Compensation” from the Summary Compensation Table for 2022.

Earned Compensation for 2021 includes 2021 salary, any bonus earned in 2021, short-term incentive compensation earned for 2021, the portion of the long-term incentive programs with respect to which the performance period ended on December 31, 2021, and the “All Other Compensation” from the Summary Compensation Table for 2021.

2024 Proxy Statement |

| 21 |

Proxy Overview

Our Compensation Best Practices

Our compensation policies and programs are built upon a strong foundation of corporate governance and compensation best practices, including:

| WHAT WE DO |

|

| WHAT WE DON’T DO |

● Provide a significant portion of our named executive officers’ total compensation in the form of awards tied to executing our long-term strategy, performance relative to key business and individual objectives, and performance versus our peers as measured by a diverse set of metrics. ● Require compliance with our Executive Stock Ownership Guidelines, which require that our executive officers own a specified number of shares of the Company’s common stock or equivalent (110,000 shares for the Chairman and Chief Executive Officer and President, 50,000 shares for any Executive Vice President, and 20,000 for any Senior Vice President). ● Have a Recoupment Policy that applies to certain of our executive officers, including all our named executive officers, and their performance-based incentive compensation. This policy was updated in 2023 to satisfy rules adopted by the SEC and the NYSE in 2023. ● Have a Compensation Committee comprised entirely of independent directors. The Compensation Committee has retained its own independent compensation advisor. ● Have a Compensation Committee that reviews external market considerations, internal considerations, and the long-term interests of our shareholders, when making compensation decisions. ● Have the ongoing consideration and oversight by the Compensation Committee with respect to any potential risks associated with our incentive compensation programs. ● Have a “double trigger” change of control provision and no awards outstanding that are subject to the legacy “single trigger” provision. | ● Permit any Company personnel, which includes directors, officers and all other employees of the Company, to engage in any short-term, speculative securities transactions, engage in short sales, buying or selling put or call options, trading in options (other than those granted by the Company) or engaging in hedging transactions, in each case with respect to our securities. ● Permit purchasing securities on margin or pledging our securities as collateral without prior approval. ● Provide tax gross-ups for our named executive officers. ● Grant only time-vested restricted stock units, LTIP Units (including Performance LTIP Units), options, or other equity awards to our named executive officers as part of our long-term incentive compensation program other than in limited circumstances such as the appointment of a new executive officer or to recognize extraordinary achievements. ● Time the grants of restricted stock, restricted stock units, LTIP Units, options or other equity awards to coordinate with the release of material non-public information, or time the release of material non-public information for the purpose of affecting the value of any named executive officer compensation. ● Make one-time or special awards to our named executive officers other than in connection with the appointment of a new named executive officer or other special circumstance. | |||

Compensation Changes Made in Response to Stakeholder Feedback

Minimum Vesting Period Beginning with grants made in 2021 and thereafter, all equity grants will have a minimum vesting period of 12 months subject to certain limited exclusions. | Double Trigger Provision All grants made in 2021 and thereafter are subject to a double-trigger change in control provision. | |||||||

Specific ESG and DEI Metrics We have added both ESG and DEI specific metrics to our short-term incentive compensation program for both our named executive officers and, when appropriate, for other officers | “Rooney Rule” Metrics We modified the associate engagement metric for 2022 and subsequent years that is part of our short-term incentive compensation program, and is applicable to all our named executive officers, to incorporate in our compensation programs performance with respect to our “Rooney Rule” initiative. This expands the Rooney Rule concept to all job openings across the Company regardless of the position we are seeking to fill. | |||||||

2024 Proxy Statement |

| 22 |

Proxy Overview

Proposal 3 highlights

03 | Independent Registered Public Accounting Firm |

| The Board recommends a vote “FOR” ratification of Ernst & Young LLP for 2024. |

● Independent firm with few ancillary services and reasonable fees. ● Significant industry and financial reporting expertise. | |

Ernst & Young LLP, an independent registered public accounting firm, served as our auditors for fiscal 2023. Our Audit Committee again selected Ernst & Young LLP to audit our financial statements for fiscal 2024. Although it is not required to do so, the board is submitting the Audit Committee’s selection of our independent registered public accounting firm for ratification by the shareholders at the annual meeting in order to ascertain the view of our shareholders regarding such selection. Below is summary information about Ernst & Young’s fees for services during fiscal years 2023 and 2022:

Description of Services |

| 2023 |

| 2022 | ||

Audit Fees | $ | 1,341,609 | $ | 1,476,705 | ||

Audit-Related Fees |

| — |

| — | ||

Tax Fees | $ | 68,170 | $ | 209,896 | ||

All Other Fees |

| — |

| — | ||

TOTAL | $ | 1,409,779 | $ | 1,686,601 | ||

2024 Proxy Statement |

| 23 |

The ten individuals listed below, each of whom is currently a member of the board, have been nominated for election to the board at the 2024 annual meeting of shareholders.

| KATHERINE A. |

| JON A. |

| MARY ANN | ||

| JAMES D. |

| CLINT D. |

| ROBERT A. | ||

| DIANE M. |

| KEVIN C. |

| MARK R. | ||

| THOMAS W. Chairman and CEO of UDR, Inc. |

If any of the nominees is unable or declines to serve as a director at the time of the meeting, the proxies will be voted for any nominee who is designated by the present board to fill the vacancy. It is not expected that any nominee will be unable or will decline to serve as a director. The directors elected will hold their respective offices until the next annual meeting of shareholders or until their successors are elected and qualified.

Each nominee brings a strong and unique background and set of skills to our board, giving the board as a whole competence and experience in a wide variety of areas of value to the Company, including corporate governance and board service, executive management, corporate finance and financial markets, real estate investment and the real estate industry and civic leadership. For each of our director nominees, set forth below are the specific experience, qualifications, attributes or skills that led the board to conclude that the person should serve as a director for the Company. There is no family relationship between any of our directors or executive officers.

| Our board recommends that the shareholders vote “FOR” the director nominees listed above. |

VOTE REQUIRED AND BOARD OF DIRECTORS’ RECOMMENDATION

The affirmative vote of a majority of the votes cast is required for the election of a director in an uncontested election. A majority of the votes cast means that the number of shares voted “for” a director’s election exceeds fifty percent of the total number of votes cast with respect to that director’s election. If an incumbent director does not receive a majority of the votes cast for his or her election, the director is required to tender his or her resignation for the consideration of the board. See “Corporate Governance Matters – Majority Voting Standard for Uncontested Director Elections.”

Proposal 1 Election of Directors

Director Skills and Experience

Board Skills Matrix

Skill/Attribute | Cattanach | Grove | King | Klingbeil | McDonnough | McNamara | Morefield | Nickelberry | Patterson | Toomey | |

| Accounting/Financial Literacy | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| C-Level Management Experience | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Public Company CEO Experience | ● | ● | ||||||||

| Corporate Governance | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Stakeholder Advocacy | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Real Estate Industry Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Multifamily Experience | ● | ● | ● | ● | ||||||

| Capital Market Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Sales and Marketing Experience | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Non-UDR Public Board Experience | ● | ● | ● | ● | ● | ● | ||||

| Property Management and Operations | ● | ● | ● | ● | ● | |||||

| Technology, Cybersecurity, and Innovation | ● | ● | ● | ● | ● | ● | ||||

| Strategic Oversight | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Diversity | ● | ● | ● | ● | ||||||

Proposal 1 Election of Directors

Diversity Matrix

Cattanach | Grove | King | Klingbeil | McDonnough | McNamara | Morefield | Nickelberry | Patterson | Toomey | |

Board Tenure | ||||||||||

Completed Years | 18 | 26 | 9 | 26 | 8 | 10 | 4 | 3 | 10 | 23 |

Gender | ||||||||||

Male | ● | ● | ● | ● | ● | ● | ● | |||

Female | ● | ● | ● | |||||||

Race/Ethnicity | ||||||||||

African American/Black | ● | |||||||||

White/Caucasian | ● | ● | ● | ● | ● | ● | ● | ● | ● |

Selection of Directors

At UDR, we believe that diversity of background and perspective is an important attribute of a well-functioning board. Collectively, the members of our board standing for election embody a range of viewpoints, backgrounds and expertise. Currently, 30% of the members of our board are women and 40% of the members of our board are diverse. All recent board searches have included ethnically diverse candidates (utilizing search firms with specific expertise with underrepresented groups) and, consistent with our other company initiatives, we adopted a “Rooney Rule” for all board searches. The diversity of our board will continue to be a point of focus in connection with board refreshment efforts.

2024 Proxy Statement |

| 26 |

Proposal 1 Election of Directors

Director Biographies

INDEPENDENT Age: Director Since: Committee Membership: | Katherine A. Cattanach, Ph.D. PROFESSIONAL EXPERIENCE ● Former General Partner of INVESCO Private Capital, Inc. (formerly Sovereign Financial Services, Inc., of which Dr. Cattanach was CEO), a company specializing in private equity investments, from 1987 to 2005. ● Former Secretary and a member of the Board of Trustees of Great Outdoors Colorado. She is active in, and serves as a member of, numerous charitable organizations. ● Member of the Board of Directors and chair of the audit committee of Empower Trust Company. ● Extensive civic leadership, including the Colorado Commission on Higher Education, the Governing Board for the Colorado State University System, the Foundation for Metropolitan State College, the Board of Trustees for the Colorado Chapter of the Nature Conservancy and the Board of Trustees for the Yellowstone Association. ● From 2005 to March 2006, she served as a director of Collect America, Ltd. ● Has served as a member of several corporate boards and board committees and on several partnership advisory boards. ● Ph.D. in Finance and has served on the faculty of the College of Business at the University of Denver and as an Associate Professor of Finance at the University of Denver’s Graduate School of Business. | |

SKILLS AND QUALIFICATIONS Dr. Cattanach brings to the board (1) corporate governance experience, (2) C-Suite level management experience, (3) civic leadership from her numerous philanthropic activities, and (4) capital markets, risk assessment and financial literacy. ● Current or Former CEO ● Current or Former Public Company Officer ● Strategic Oversight ● Stockholder Advocacy ● Corporate Governance ● Real Estate Experience ● Financial Expertise ● Risk Assessment and Management | ||

2024 Proxy Statement |

| 27 |

Proposal 1 Election of Directors

INDEPENDENT Age: Director Since: Committee Membership: | Jon A. Grove PROFESSIONAL EXPERIENCE ● Former Chairman, President and Chief Executive Officer of ASR Investments Corporation from its organization in 1987 until our acquisition of ASR in 1998. ● Former Chairman and director of American Southwest Holdings, LLC and SecurNet Mortgage Securities LLC. ● Longtime executive of multifamily companies and investor in multifamily REITs. | |

SKILLS AND QUALIFICATIONS Mr. Grove brings to the board (1) C-Suite level management experience, (2) property management and operations expertise that helps to drive value creation through our expanding array of operating platform initiatives, (3) strategic oversight, (4) stakeholder advocacy, and (5) capital markets and financial literacy. ● Current or Former CEO ● Strategic Oversight ● Stockholder Advocacy ● Corporate Governance ● Real Estate Experience ● Financial Expertise ● Risk Assessment and Management | ||

2024 Proxy Statement |

| 28 |

Proposal 1 Election of Directors

INDEPENDENT Age: Director Since: Committee Membership: | Mary Ann King PROFESSIONAL EXPERIENCE ● Co-Head of Berkadia Institutional Solutions for Berkadia, a privately held commercial real estate firm that provides clients with a suite of services that includes investment sales and mortgage banking. ● Former Co-Chairman of Moran & Company, a real estate brokerage firm focusing exclusively on multifamily assets and mixed-use assets with significant multifamily components, whose investment sales operations were purchased by Berkadia in January of 2021. ● Over the Rainbow Association – Member of the Board of Directors, Member of the Executive Committee and Development Committee and Member and Chairman of the Association’s LIFE Fund. ● Member of the Advisory Board of Sack Properties. ● Full Member of ULI and Member of MFC-Blue Product Council; former Trustee from 2012-2015 and former Product Council Counselor for all four Multifamily Product Councils. ● Member of the Executive Committee of the National Multi Housing, Chairperson from 2006 to 2008, and served on the leadership team from 2000 to 2008. | |

SKILLS AND QUALIFICATIONS Ms. King brings to the board (1) extensive real estate experience across a variety of property sectors, in particular multifamily, (2) C-Suite level management experience, (3) corporate governance experience, (4) technology, cybersecurity, and innovation, and (5) financial literacy. ● Construction and Development Expertise ● Strategic Oversight ● Stockholder Advocacy ● Corporate Governance ● Real Estate Experience ● Financial Expertise ● Risk Assessment and Management | ||

2024 Proxy Statement |

| 29 |

Proposal 1 Election of Directors

LEAD INDEPENDENT DIRECTOR Age: Director Since: Committee Membership: | James D. Klingbeil PROFESSIONAL EXPERIENCE ● Lead Independent Director since January 2018. ● Chairman of the Board of Directors from March 2010 to December 2017 and Vice Chairman of the Board from October 2000 until March 2010. ● Chairman of Klingbeil Capital Management and The Klingbeil Company, both of which acquire, develop and operate multifamily assets. ● Chairman and Chief Executive Officer of American Apartment Communities II from 1995 until its merger with the Company in December of 1998. ● Currently serves as a director of numerous private companies and on the Board of Trustees of The Ohio State University. He is also the past Chairman and a lifetime member of the Board of Trustees of the Urban Land Institute and a member of the ULI Foundation Board. | |

SKILLS AND QUALIFICATIONS Mr. Klingbeil brings to the board (1) over 60 years of experience in building, acquiring, managing, and selling multifamily communities, which help drive value across UDR’s development, investment, and operating activities, (2) corporate governance experience, (3) capital markets expertise, and (4) accounting and financial literacy. ● Current or Former CEO ● Construction and Development Expertise ● Strategic Oversight ● Stockholder Advocacy ● Corporate Governance ● Real Estate Experience ● Financial Expertise ● Risk Assessment and Management | ||

2024 Proxy Statement |

| 30 |

Proposal 1 Election of Directors

INDEPENDENT Age: Director Since: Committee Membership: | Clint D. McDonnough PROFESSIONAL EXPERIENCE ● Managing Partner of McDonnough Consulting LLC, a consulting firm, since May 2016. ● Served 38 years for Ernst & Young LLP before retiring in June, 2015. ● Former Office Managing Partner for the Dallas, Texas, office of Ernst & Young LLP, responsible for day-to-day practice operations. ● Prior to serving as the Office Managing Partner, Mr. McDonnough was the firm’s Managing Partner of Assurance & Advisory Business Services for the Southwest Area practice. He also served as Ernst & Young’s National Director of Real Estate Advisory Services. ● Mr. McDonnough previously served on the Board of Directors of Forterra (Nasdaq), a manufacturer of water and drainage pipe and products, and previously served on the Board of Directors of Orix USA, a diversified financial services company. ● Currently a board member of the Dallas City Council. ● Active in, and previously served on the boards of, several charitable, civic and educational organizations. | |

SKILLS AND QUALIFICATIONS Mr. McDonnough brings to the board (1) extensive accounting expertise and experience as well as financial literacy, (2) real estate industry experience, (3) technology, cybersecurity, and innovation experience and (4) corporate governance expertise. ● Strategic Oversight ● Stockholder Advocacy ● Corporate Governance ● Real Estate Experience ● Financial Expertise ● Risk Assessment and Management | ||

2024 Proxy Statement |

| 31 |

Proposal 1 Election of Directors

INDEPENDENT Age: Director Since: Committee Membership: | Robert A. McNamara PROFESSIONAL EXPERIENCE ● Former Group Chief Risk Officer of Lend Lease Corporation (ASX), an international property and infrastructure firm from 2014 to 2017. ● Former Chief Executive Officer Americas of Lend Lease Corporation (ASX) from 2010 to 2014. ● Former Chairman and Chief Executive Officer of Penhall/LVI International, an environmental remediation, concrete services and infrastructure repair firm, from 2006 to 2010. ● Mr. McNamara held various positions at Fluor Corporation, a global engineering and construction company, from 1996 to 2006, including Senior Executive and Group President. ● Mr. McNamara began his career at Marshall Contractors, Inc., a general contractor, where he held various positions from 1978 to 1996, including President and Chief Operating Officer. ● Member of the Board of Directors of Jacobs Solutions Inc. (f/k/a Jacobs Engineering Group, Inc.) (NYSE), a provider of technical, professional and construction services, and serves on the Audit Committee and as chair of the ESG and Risk Committee for Jacobs. ● Former board member of several privately-held firms. ● Mr. McNamara has also served on the board of the US China Business Council and as Chairman for the Construction Industry Institute’s Technology Implementation Task Force. | |

SKILLS AND QUALIFICATIONS Mr. McNamara brings to the board (1) corporate governance experience, (2) development and construction experience, (3) ESG knowledge and oversight, (4) C-Suite level management experience, (5) capital markets, accounting and financial literacy, and (6) expertise in new technologies, cybersecurity, and innovation. ● Current or Former CEO ● Current or Former Public Company Officer ● Construction and Development Expertise ● Strategic Oversight ● Stockholder Advocacy ● Corporate Governance ● Real Estate Experience ● Financial Expertise ● Risk Assessment and Management | ||

2024 Proxy Statement |

| 32 |

Proposal 1 Election of Directors