| Exhibit 99.1 | |||

Press Release | ||||

DENVER, CO—April 25, 2016 | Contact: Shelby Noble | |||

Phone: 720.922.6082 | ||||

UDR ANNOUNCES FIRST QUARTER 2016 RESULTS LED BY STRONG SAME-STORE GROWTH

UDR (the “Company”) First Quarter 2016 Highlights:

• | Funds from Operations (“FFO”) per share was $0.43, FFO as Adjusted per share was $0.43 (+8% year-over-year), and AFFO per share was $0.41 (+11%). |

• | Year-over-year same-store revenue and net operating income (“NOI”) growth for the quarter were 6.4 percent and 8.0 percent, respectively. |

• | Commenced the construction of 345 Harrison Street, a 585-home development in Boston’s South End, with an estimated cost of $367 million. |

• | Sold two land parcels located in Santa Monica, CA for $24 million. |

• | Issued $174 million of common equity in conjunction with S&P 500 Inclusion. |

• | The Company increased its annualized dividend by 6 percent to $1.18 per share versus $1.11 in 2015. |

• | Reaffirmed full-year 2016 earnings and same-store guidance ranges. |

Q1 2016 | Q1 2015 | |

FFO per common share and unit, diluted | $0.43 | $0.43 |

Acquisition-related costs/(fees), including joint ventures | — | 0.001 |

Texas Joint Venture promote and disposition fee income | — | (0.036) |

Long-term incentive plan transition costs | 0.001 | 0.003 |

Net gain on the sale of non-depreciable real estate owned | (0.006) | — |

Casualty-related (recoveries)/charges, including joint ventures, net | 0.004 | 0.004 |

FFO as Adjusted per common share and unit, diluted | $0.43 | $0.4 |

Recurring capital expenditures | (0.024) | (0.027) |

AFFO per common share and unit, diluted | $0.41 | $0.37 |

1

Operations

Same-store NOI increased 8.0 percent year-over-year in the first quarter of 2016 driven by same-store revenue growth of 6.4 percent against a 2.7 percent increase in same-store expenses. Same-store physical occupancy was 96.5 percent as compared to 96.7 percent in the prior year period. The annualized rate of turnover increased 110 basis points year-over-year to 42.2 percent in the quarter.

Summary of Same-Store Results First Quarter 2016 versus First Quarter 2015

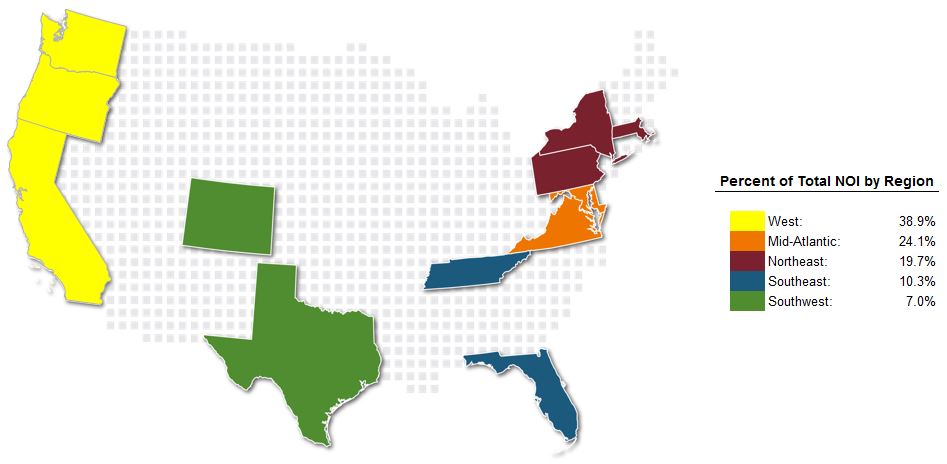

Region | Revenue Growth | Expense Growth/(Decline) | NOI Growth | % of Same- Store Portfolio(1) | Same-Store Occupancy(2) | Number of Same-Store Homes(3) | ||||||

West | 9.1 | % | 4.2 | % | 10.9 | % | 41.3 | % | 96.1 | % | 11,298 | |

Mid-Atlantic | 2.0 | % | 2.4 | % | 1.9 | % | 21.1 | % | 96.6 | % | 8,304 | |

Northeast | 5.9 | % | 4.6 | % | 6.5 | % | 17.3 | % | 96.8 | % | 3,124 | |

Southeast | 7.3 | % | (0.6 | )% | 11.3 | % | 14.1 | % | 96.0 | % | 7,683 | |

Southwest | 5.4 | % | 1.4 | % | 7.9 | % | 6.2 | % | 97.0 | % | 3,608 | |

Total | 6.4 | % | 2.7 | % | 8.0 | % | 100.0 | % | 96.5 | % | 34,017 | |

(1) | Based on Q1 2016 NOI. |

(2) | Average same-store occupancy for the quarter. |

(3) | During the first quarter, 34,017 apartment homes, or approximately 84 percent of 40,728 total consolidated apartment homes (versus 51,231 apartment homes inclusive of joint ventures and development pipeline homes upon completion), were classified as same-store. The Company defines QTD SS Communities as those communities stabilized for five full consecutive quarters. These communities were owned and had stabilized occupancy and operating expenses as of the beginning of the quarter in the prior year, were not in process of any substantial redevelopment activities, and not held for disposition. |

Sequentially, same-store NOI increased by 2.0 percent on revenue growth of 1.7 percent against a 1.1 percent increase in expenses in the first quarter of 2016.

Development Activity

At the end of the first quarter, the Company had an under-construction development pipeline for which its pro rata share totaled $1 billion. The development projects will be delivered over the next three years, with $162 million expected to be completed in 2016, $166 million in 2017, $342 million in 2018 and the balance in early 2019. The development pipeline is currently expected to produce a weighted average spread between estimated stabilized yields and current market cap rates above the upper end of the Company’s 150 to 200 basis point targeted range.

During the quarter, the Company commenced one new development project. 345 Harrison Street, a 585-home community located in the South End neighborhood of Boston, MA, is being developed for a budgeted cost of $367 million. The project is expected to be completed in early 2019.

In addition, the Company had preferred equity and participating loan investments for which its pro rata share totaled $364 million with 100 percent of the equity commitment funded. The $364 million consisted of a $93 million completed, non-stabilized project and $271 million of under construction projects. Of the $271 million in development projects left to complete, $215 million is expected to be completed in 2016 and the balance in 2017.

2

Transactions

During the first quarter, the Company sold its 95 percent ownership interest in two land parcels located in Santa Monica, CA for $24 million. This resulted in a gain of $1.7 million to FFO, but was excluded from FFO as Adjusted.

Capital Markets

During the first quarter, in conjunction with the Company’s inclusion in the S&P 500 Index, the Company issued 5 million common shares, at a net price of $34.73, for total net proceeds of $174 million.

In addition, the Company paid down $83.3 million of 5.25% Medium Term Notes on January 15, 2016.

Balance Sheet

At March 31, 2016, the Company had $1.1 billion in availability through a combination of cash and undrawn capacity on its credit facilities.

The Company’s total indebtedness at March 31, 2016 was $3.4 billion. The Company ended the quarter with fixed-rate debt representing 84.3 percent of its total debt, a total blended interest rate of 3.95 percent and a weighted average term to maturity of 4.9 years. The Company’s leverage was 33.0 percent versus 37.5 percent a year ago, net debt-to-EBITDA was 5.4x versus 6.4x a year ago and fixed charge coverage was 4.4x versus 4.0x a year ago.

Dividend

As previously announced, the Company’s Board of Directors declared a regular quarterly dividend on its common stock for the first quarter of 2016 in the amount of $0.295 per share. The dividend will be paid in cash on May 2, 2016 to UDR common stock shareholders of record as of April 11, 2016. The first quarter 2016 dividend will represent the 174th consecutive quarterly dividend paid by the Company on its common stock.

On an annualized basis, the Company’s 2016 dividend per share of $1.18 represents a 6 percent increase versus 2015.

3

Outlook

For the second quarter of 2016, the Company has established the following earnings guidance ranges:

FFO per share | $0.43 to $0.45 | ||||

FFO as Adjusted per share | $0.43 to $0.45 | ||||

AFFO per share | $0.39 to $0.41 | ||||

For the full-year 2016, the Company has reaffirmed its previously provided guidance ranges:

FFO per share | $1.75 to $1.81 | ||||

FFO as Adjusted per share | $1.75 to $1.81 | ||||

AFFO per share | $1.59 to $1.65 | ||||

For the full-year 2016, the Company has reaffirmed its previously provided same-store growth guidance ranges:

Revenue | 5.50% to 6.00% | ||||

Expense | 3.00% to 3.50% | ||||

Net operating income | 6.50% to 7.00% | ||||

Additional assumptions for the Company’s second quarter and full-year 2016 guidance can be found on Attachment 15 of the Company’s first quarter Supplemental Financial Information.

4

Supplemental Information

The Company offers Supplemental Financial Information that provides details on the financial position and operating results of the Company which is available on the Company's website at ir.udr.com.

Conference Call and Webcast Information

UDR will host a webcast and conference call at 1:00 p.m. Eastern Time on April 26, 2016 to discuss first quarter results. The webcast will be available on UDR's website at ir.udr.com. To listen to a live broadcast, access the site at least 15 minutes prior to the scheduled start time in order to register, download and install any necessary audio software.

To participate in the teleconference dial 877-723-9517 for domestic and 719-325-4745 for international and provide the following conference ID number: 7493963.

A replay of the conference call will be available through May 26, 2016, by dialing 888-203-1112 for domestic and 719-457-0820 for international and entering the confirmation number, 7493963, when prompted for the pass code.

A replay of the call will be available for 30 days on UDR's website at ir.udr.com.

Full Text of the Earnings Report and Supplemental Data

Internet -- The full text of the earnings report and Supplemental Financial Information will be available on the Company’s website at ir.udr.com.

Mail -- For those without Internet access, the first quarter 2016 earnings report and Supplemental Financial Information will be available by mail or fax, on request. To receive a copy, please call UDR Investor Relations at 720-922-6082.

5

Forward Looking Statements

Certain statements made in this press release may constitute “forward-looking statements.” Words such as “expects,” “intends,” “believes,” “anticipates,” “plans,” “likely,” “will,” “seeks,” “estimates” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements, by their nature, involve estimates, projections, goals, forecasts and assumptions and are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those expressed in a forward-looking statement, due to a number of factors, which include, but are not limited to, unfavorable changes in the apartment market, changing economic conditions, the impact of inflation/deflation on rental rates and property operating expenses, expectations concerning availability of capital and the stabilization of the capital markets, the impact of competition and competitive pricing, acquisitions, developments and redevelopments not achieving anticipated results, delays in completing developments, redevelopments and lease-ups on schedule, expectations on job growth, home affordability and demand/supply ratio for multifamily housing, expectations concerning development and redevelopment activities, expectations on occupancy levels, expectations concerning the joint ventures with third parties, expectations that automation will help grow net operating income, expectations on annualized net operating income and other risk factors discussed in documents filed by the Company with the Securities and Exchange Commission from time to time, including the Company's Annual Report on Form 10-K and the Company's Quarterly Reports on Form 10-Q. Actual results may differ materially from those described in the forward-looking statements. These forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this press release, and the Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statement contained herein, to reflect any change in the Company's expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required under the U.S. securities laws.

This press release and these forward-looking statements include UDR’s analysis and conclusions and reflect UDR’s judgment as of the date of these materials. UDR assumes no obligation to revise or update to reflect future events or circumstances.

About UDR, Inc.

UDR, Inc. (NYSE:UDR), an S&P 500 company, is a leading multifamily real estate investment trust with a demonstrated performance history of delivering superior and dependable returns by successfully managing, buying, selling, developing and redeveloping attractive real estate properties in targeted U.S. markets. As of March 31, 2016, UDR owned or had an ownership position in 51,231 apartment homes including 3,556 homes under development. For 44 years, UDR has delivered long-term value to shareholders, the best standard of service to residents and the highest quality experience for associates. Additional information can be found on the Company's website at ir.udr.com.

6