| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| -------- |

| FORM N-CSR |

| -------- |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| INVESTMENT COMPANY ACT FILE NUMBER 811-3967 |

FIRST INVESTORS INCOME FUNDS

(Exact name of registrant as specified in charter)

40 Wall Street

New York, NY 10005

(Address of principal executive offices) (Zip code)

Joseph I. Benedek

Foresters Investment Management Company, Inc.

Raritan Plaza I

Edison, NJ 08837-3620

(Name and address of agent for service)

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE:

1-212-858-8000

DATE OF FISCAL YEAR END: SEPTEMBER 30

DATE OF REPORTING PERIOD: MARCH 31, 2017

Item 1. Reports to Stockholders

| The semi-annual report to stockholders follows |

| FOREWORD |

This report is for the information of the shareholders of the Funds. It is the policy of each Fund described in this report to mail only one copy of a Fund’s prospectus, annual report, semi-annual report and proxy statements to all shareholders who share the same mailing address and share the same last name and have invested in a Fund covered by the same document. You are deemed to consent to this policy unless you specifically revoke this policy and request that separate copies of such documents be mailed to you. In such case, you will begin to receive your own copies within 30 days after our receipt of the revocation. You may request that separate copies of these disclosure documents be mailed to you by writing to us at: Foresters Investor Services, Inc., Raritan Plaza I, Edison, NJ 08837-3620 or calling us at 1-800-423-4026.

You may obtain a free prospectus for any of the Funds by contacting your representative, calling 1-800-423-4026, writing to us at the following address: Foresters Financial Services, Inc., 40 Wall Street, New York, NY 10005, or by visiting our website at www.foresters.com. You should consider the investment objectives, risks, charges and expenses of a Fund carefully before investing. The prospectus contains this and other information about the Fund, and should be read carefully before investing.

An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the Government Cash Management Fund* seeks to preserve a net asset value at $1.00 per share, it is possible to lose money by investing in it, just as it is possible to lose money by investing in any of the other Funds. Past performance is no guarantee of future results. There is no guarantee that a Fund’s investment objective will be achieved.

A Statement of Additional Information (“SAI”) for any of the Funds may also be obtained, without charge, upon request by calling 1-800-423-4026, writing to us at our address or by visiting our website listed above. The SAI contains more detailed information about the Funds, including information about its Trustees.

* Effective October 3, 2016, the Cash Management Fund changed its name to the Government Cash Management Fund.

Foresters FinancialTM and ForestersTM are the trade names and trademarks of The Independent Order of Foresters (Foresters), a fraternal benefit society, 789 Don Mills Road, Toronto, Canada M3C 1T9 and its subsidiaries.

Market Overview

FIRST INVESTORS INCOME FUNDS

FIRST INVESTORS EQUITY FUNDS

Dear Investor:

We are pleased to provide you with our report for the six-month period ended March 31, 2017.

Market and Economic Overview

One of the largest impacts on the markets during the review period was the U.S. presidential election. The beginning of the period was dominated by risk-off sentiment ahead of the election. Donald Trump’s unexpected win resulted in a strong rally in U.S. equity markets, dollar appreciation, and a substantial rise in interest rates. In this rally, investors turned to investments that would benefit from Trump’s pro-growth agenda, such as tax reform, increased public spending and regulatory reforms. Toward the end of the review period, the post-election optimism paused as markets started to question the new administration’s ability to deliver on its agenda.

Another dominant factor that influenced markets was both the anticipation and actual timing of the Federal Reserve’s (“the Fed’s”) interest rate hikes. The Fed increased its target rate in December 2016 and March 2017, following the December 2015 hike when it started its path toward interest rate normalization. Reflecting increased optimism regarding the U.S. economy, the Fed is considering two additional hikes this year. The Labor Market Conditions Index, which tracks changes in the labor market, has been on the rise and the unemployment rate has fallen below 5%, both of which are signs of an improving economy. Inflation has been climbing steadily since July of 2016, and has moved towards the Fed’s target of 2%.

There have been additional signs of an improving U.S. and global economic outlook. The U.S. economy grew at an annualized rate of 2.1% during the fourth quarter of 2016, stronger than the previous estimate of 1.9%. U.S. consumers and businesses are significantly more positive regarding their outlook than they were at this time last year. U.S. consumer confidence is at a 17-year high. In Europe, business surveys have risen to their highest levels in over five years and consumer confidence has also recovered. There are also signs of improvement in emerging market growth.

Bond Markets

Most of the fixed income markets had negative performances during the review period. The U.S. bond market (measured by the BofA Merrill Lynch U.S. Broad Market Index) lost 2.23%. The market lost 3.08% in the fourth quarter, which was the worst quarterly loss in more than 20 years, as interest rates moved sharply higher in reaction to Trump’s victory.

| 1 |

Market Overview (continued)

FIRST INVESTORS INCOME FUNDS

FIRST INVESTORS EQUITY FUNDS

Treasury yields rose across all maturities during the review period. The 2-year Treasury yield, which is very sensitive to changes in Fed policy, rose 50 basis points from 0.76% to 1.26%. The benchmark 10-year Treasury yield rose 79 basis points from 1.60% to 2.39%. The Fed increased interest rates twice during this period, in mid-December and mid-March. Yields moved up ahead of these widely anticipated interest rate hikes, only to fall slightly later.

Despite recovering in the first quarter, Treasuries (measured by the BofA ML US Treasury Index) were the weakest domestic fixed income market during the review period, down 3.30%. Trump’s victory resulted in a massive sell-off of government bonds as investors reassessed the impact of the new administration on inflation and economic growth. Longer-dated Treasuries (15+ Years) had the worst performance at –10.45% while shorter-dated Treasuries (1–5 Year) held up better at –0.72%.

Investment grade corporate bonds (measured by the BofA ML Corporate Master Index) held up better than Treasuries, down 1.50% for the period under review, as tighter spreads offset some of the negative impact of rising interest rates. The sector continued to benefit from strong foreign demand due to its relatively attractive yields.

High yield bonds (measured by the BofA ML HY Cash Pay Constrained Index) and leveraged loans (measured by the Credit Suisse Leveraged Loan Index) were the best performing bond market sectors, gaining 4.61% and 3.48%, respectively. High yield bonds benefited from investors searching for income and the generally positive performance of riskier assets. The lowest quality bonds (CCC-rated) within high yield continued to outperform, returning 11.04%. Leveraged loans benefited from investors looking for bond investments that would perform well in a rising interest rate environment.

Many international fixed income markets underperformed U.S. fixed income markets, experiencing additional stress due to an appreciating U.S. dollar. Non-U.S. sovereign bonds (measured by the Citigroup World Government Bond ex-U.S., USD) lost 9.03%. Emerging market bonds (measured by the BofA ML Global Emerging Markets Sovereign, USD) performed better with a return of 0.35%. Emerging markets bond funds recovered during the first quarter, receiving about $20 billion of net flows as initial fears about U.S. post-election protectionism subsided. Money market rates increased 0.5% as a result of the Fed’s two interest rate increases during the review period.

| 2 |

Equity Markets

U.S. equities posted double-digit returns for the review period. The S&P 500 Index and the Dow Jones Industrial Average (DJIA) gained 10.12% and 14.30%, respectively. Many equity indices reached new record heights. For example, the DJIA hit three major psychological milestones of 19,000 (on November 22nd), 20,000 (on January 25th) and 21,000 (on March 1st).

Equity market volatility was very low for most of this time period with the only spike occurring after the U.S. election. The VIX Index, which measures equity market volatility, posted its second lowest quarterly average on record during the first quarter.

Equities began October with losses as investors became risk averse ahead of the U.S. presidential election in November, and in anticipation of potential tighter monetary policy around the globe. The Trump victory resulted in a rally of risky assets. The equity rally continued through February. However, there was a rotation of market leaders during the first quarter of 2017 as the rally was driven primarily by an improving economic outlook while the “Trump” trade faded. Small-caps, Financials, Industrials and Value stocks had the best performance during the post-election rally, while Technology and Growth stocks came into favor during the first quarter.

Overall, mid-cap stocks (measured by the S&P Midcap 400 Index) and small-cap stocks (measured by the Russell 2000 Index) posted similar returns to large-cap stocks, returning 11.65% and 11.52%, respectively, for the period. However, the major drivers of these returns and their trajectories differed. Small-cap stocks were the largest beneficiaries of the post-election rally, returning 11.15% in November, while large-cap stocks lagged at 3.70%. However, in the first quarter of 2017, large-cap stocks had the best return of 6.07% while small-cap stocks gained only 1.06%, on the belief that any new trade restrictions would not be as harsh as previously thought.

Ten of the S&P 500 Index’s 11 sectors were positive. Financials, which was one of the biggest beneficiaries of Trump’s victory and higher interest rates, was the strongest sector, returning 24.16% for the period. The majority of this return occurred in the fourth quarter of 2016. Technology, which benefits most from improved economic growth, was the second strongest sector, returning 13.92%. The majority of this return happened in the first quarter of 2017. Real Estate was the weakest sector, down 1.02%, despite having strong performances in December and February. Real estate investor sentiment oscillated between optimism regarding Trump’s proposed economic policies and pessimism due to the interest rate increases.

| 3 |

Market Overview (continued)

FIRST INVESTORS INCOME FUNDS

FIRST INVESTORS EQUITY FUNDS

International equities were positive as well, but most of the regions lagged behind U.S. equities. Developed markets outside the U.S. and Canada (measured by the MSCI EAFE Index) finished the review period up 6.66% as their U.S. dollar-denominated returns were hurt by an appreciating dollar. Europe (measured by the MSCI EURO Index) was one of the strongest regions, returning 10.80%. It benefited from a pick-up in growth throughout Europe and fading concerns that the anti-Euro candidate, Marine Le Pen, would prevail in the upcoming French presidential election.

Overall, emerging markets (MSCI EM Index) had similar returns as developed markets, gaining 6.93% for the period. However, they had larger quarter-over-quarter swings. They lost 4.08% during the fourth quarter, negatively influenced by Trump’s victory. However, those same markets were up 11.49% during the first quarter, rebounding off of post-election lows, led by Latin America.

Thank you for placing your trust in Foresters Financial. As always, we appreciate the opportunity to serve your investment needs.

This Market Overview is not part of the Funds’ financial report and is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors in the Funds, unless preceded or accompanied by an effective prospectus. The Market Overview reflects conditions through the end of the period as stated on the cover. Market conditions are subject to change. This Market Overview may not be relied upon as investment advice or as an indication of current or future trading intent on behalf of any Fund.

There are a variety of risks associated with investing in mutual funds. For all fund’s, there is the risk that securities selected by the portfolio manager may perform differently than the overall market or may not meet a portfolio manager’s

| 4 |

expectations. For stock funds, the risks include market risk (the risk that the entire stock market will decline because of an event such as deterioration in the economy or a rise in interest rates), as well as special risks associated with investing in certain types of stock funds, such as small-cap, global and international funds. For bond funds, the risks include interest rate risk and credit risk. Interest rate risk is the risk that bonds will decrease in value as interest rates rise. As a general matter, longer-term bonds fluctuate more than shorter-term bonds in reaction to changes in interest rates. Credit risk is the risk that bonds will decline in value as the result of a decline in the credit rating of the bonds or the economy as a whole, or that the issuer will be unable to pay interest and/or principal when due. There are also special risks associated with investing in certain types of bond funds, including liquidity risk and prepayment and extension risk. To the extent a fund uses derivatives, it will have risks associated with such use. You should consult your prospectus for a precise explanation of the risks associated with your Fund.

| 5 |

Understanding Your Fund’s Expenses (unaudited)

FIRST INVESTORS INCOME FUNDS

FIRST INVESTORS EQUITY FUNDS

As a mutual fund shareholder, you incur two types of costs: (1) transaction costs, including a sales charge (load) on purchase payments (on Class A shares only) and a contingent deferred sales charge on redemptions (on Class B shares only); and (2) ongoing costs, including advisory fees; distribution and service fees (12b-1) (on Class A and Class B shares only); and other expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 in each Fund at the beginning of the period, October 1, 2016, and held for the entire six-month period ended March 31, 2017. The calculations assume that no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expenses Example:

These amounts help you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To estimate the expenses you paid on your account during this period, simply divide your ending account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period”.

Hypothetical Expenses Example:

These amounts provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares of a Fund, and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transaction costs, such as front-end or contingent deferred sales charges (loads) or account fees that are charged to certain types of accounts, such as an annual custodial fee of $15 for certain IRA accounts and certain other retirement accounts or an annual custodial fee of $30 for 403(b) custodial accounts (subject to exceptions and certain waivers as described in the Funds’ Statement of Additional Information). Therefore, the hypothetical expenses example is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these costs were included, your costs would have been higher.

| 6 |

Fund Expenses (unaudited)

BALANCED INCOME FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 6 for a detailed explanation of the information presented in these examples.

| Annualized | Beginning | Ending | Expenses Paid | |

| Expense | Account Value | Account Value | During Period | |

| Expense Example | Ratio | (10/1/16) | (3/31/17) | (10/1/16–3/31/17)* |

| Class A Shares | 1.15% | |||

| Actual | $1,000.00 | $1,013.87 | $5.77 | |

| Hypothetical** | $1,000.00 | $1,019.20 | $5.79 | |

| Advisor Class Shares | 0.82% | |||

| Actual | $1,000.00 | $1,014.39 | $4.12 | |

| Hypothetical** | $1,000.00 | $1,020.84 | $4.13 | |

| Institutional Class Shares | 0.69% | |||

| Actual | $1,000.00 | $1,015.92 | $3.47 | |

| Hypothetical** | $1,000.00 | $1,021.49 | $3.48 |

| * | Expenses are equal to the annualized expense ratio, multiplied by the average account value over |

| the period, multiplied by 182/365 (to reflect the one-half year period). Expenses paid during the | |

| period are net of expenses waived and/or assumed. | |

| ** | Assumed rate of return of 5% before expenses |

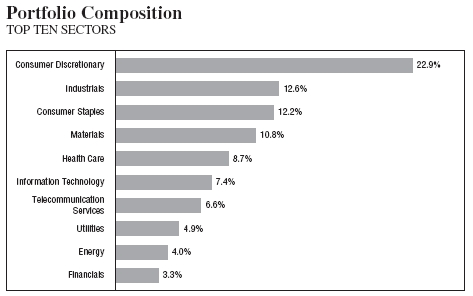

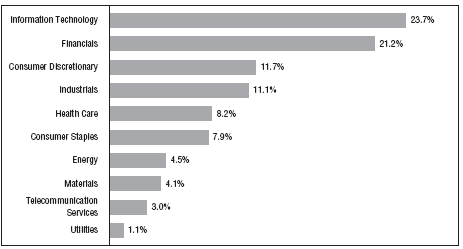

| Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2017, and |

| are based on the total market value of investments. |

|

7 |

Portfolio of Investments (continued)

BALANCED INCOME FUND

March 31, 2017

| Principal | |||

| Amount | Security | Value | |

| CORPORATE BONDS—40.1% | |||

| Aerospace/Defense—.5% | |||

| $ 200M | Rolls-Royce, PLC, 3.625%, 10/14/2025 (a) | $ 201,535 | |

| Automotive—.7% | |||

| 300M | O’Reilly Automotive, Inc., 3.55%, 3/15/2026 | 299,518 | |

| Chemicals—1.1% | |||

| 200M | Agrium, Inc., 3.375%, 3/15/2025 | 197,722 | |

| 300M | Dow Chemical Co., 3.5%, 10/1/2024 | 305,410 | |

| 503,132 | |||

| Consumer Non-Durables—.9% | |||

| 400M | Newell Brands, Inc., 4.2%, 4/1/2026 | 416,754 | |

| Energy—2.9% | |||

| 500M | BP Capital Markets, PLC, 3.216%, 11/28/2023 | 503,001 | |

| 300M | Magellan Midstream Partners, LP, 5%, 3/1/2026 | 330,827 | |

| 465M | Marathon Oil Corp., 3.85%, 6/1/2025 | 457,953 | |

| 1,291,781 | |||

| Financial Services—6.5% | |||

| 500M | American Express Co., 1.6401%, 5/22/2018 † | 501,980 | |

| 300M | American International Group, Inc., 3.75%, 7/10/2025 | 298,853 | |

| 200M | Assured Guaranty U.S. Holding, Inc., 5%, 7/1/2024 | 215,552 | |

| 200M | ERAC USA Finance Co., 7%, 10/15/2037 (a) | 253,534 | |

| Ford Motor Credit Co., LLC: | |||

| 500M | 2.875%, 10/1/2018 | 506,101 | |

| 300M | 1.9496%, 3/12/2019 † | 301,338 | |

| General Electric Capital Corp.: | |||

| 200M | 3.1%, 1/9/2023 | 205,729 | |

| 100M | 6.75%, 3/15/2032 | 135,045 | |

| 250M | Key Bank NA, 3.4%, 5/20/2026 | 243,594 | |

| 200M | State Street Corp., 3.55%, 8/18/2025 | 205,757 | |

| 2,867,483 | |||

| Financials—8.3% | |||

| 400M | Bank of America Corp., 5.875%, 2/7/2042 | 482,756 | |

| 400M | Capital One Financial Corp., 3.75%, 4/24/2024 | 407,419 | |

| 500M | Citigroup, Inc., 3.7%, 1/12/2026 | 501,395 | |

| 200M | Deutsche Bank AG, 3.7%, 5/30/2024 | 196,892 | |

| 300M | General Motors Financial Co., 5.25%, 3/1/2026 | 322,887 |

| 8 |

| Principal | |||

| Amount | Security | Value | |

| $ 200M | Goldman Sachs Group, Inc., 3.625%, 1/22/2023 | $ 205,295 | |

| JPMorgan Chase & Co.: | |||

| 300M | 3.625%, 12/1/2027 | 291,688 | |

| 100M | 6.4%, 5/15/2038 | 129,408 | |

| 100M | Morgan Stanley, 5.5%, 7/28/2021 | 111,003 | |

| U.S. Bancorp: | |||

| 200M | 3.6%, 9/11/2024 | 206,159 | |

| 200M | 3.1%, 4/27/2026 | 196,860 | |

| 300M | Visa, Inc., 3.15%, 12/14/2025 | 301,370 | |

| Wells Fargo & Co.: | |||

| 100M | 5.606%, 1/15/2044 | 114,811 | |

| 200M | 3.9%, 5/1/2045 | 191,971 | |

| 3,659,914 | |||

| Food/Beverage/Tobacco—1.0% | |||

| Anheuser-Busch InBev Finance, Inc.: | |||

| 100M | 3.65%, 2/1/2026 | 101,305 | |

| 200M | 4.7%, 2/1/2036 | 212,249 | |

| 100M | 4.9%, 2/1/2046 | 108,499 | |

| 422,053 | |||

| Food/Drug—.9% | |||

| 400M | CVS Health Corp., 3.875%, 7/20/2025 | 412,849 | |

| Information Technology—2.1% | |||

| 200M | Apple, Inc., 2.5%, 2/9/2025 | 193,693 | |

| 300M | Microsoft Corp., 3.7%, 8/8/2046 | 282,349 | |

| Oracle Corp.: | |||

| 100M | 2.95%, 5/15/2025 | 98,813 | |

| 350M | 2.65%, 7/15/2026 | 333,679 | |

| 908,534 | |||

| Media-Broadcasting—.7% | |||

| 300M | Comcast Corp., 4.25%, 1/15/2033 | 309,406 | |

| Media-Diversified—.5% | |||

| 200M | Time Warner, Inc., 3.6%, 7/15/2025 | 198,103 | |

| Real Estate—6.4% | |||

| 500M | Alexandria Real Estate Equities, Inc., 3.95%, 1/15/2028 | 499,700 | |

| 300M | AvalonBay Communities, Inc., 3.5%, 11/15/2024 | 303,834 | |

| 450M | Boston Properties, LP, 2.75%, 10/1/2026 | 415,044 |

| 9 |

Portfolio of Investments (continued)

BALANCED INCOME FUND

March 31, 2017

| Principal | |||

| Amount | |||

| or Shares | Security | Value | |

| Real Estate (continued) | |||

| $ 200M | ERP Operating, LP, 3.375%, 6/1/2025 | $ 198,450 | |

| 300M | Prologis, LP, 3.75%, 11/1/2025 | 307,118 | |

| 500M | Realty Income Corp., 3.25%, 10/15/2022 | 505,437 | |

| 200M | Simon Property Group, LP, 3.375%, 10/1/2024 | 201,793 | |

| 400M | Welltower, Inc., 4%, 6/1/2025 | 406,121 | |

| 2,837,497 | |||

| Retail-General Merchandise—1.9% | |||

| 200M | Amazon.com, Inc., 4.8%, 12/5/2034 | 222,125 | |

| 500M | Home Depot, Inc., 5.875%, 12/16/2036 | 633,763 | |

| 855,888 | |||

| Telecommunications—1.6% | |||

| 200M | AT&T, Inc., 5.15%, 3/15/2042 | 199,123 | |

| Verizon Communications, Inc.: | |||

| 400M | 3.65%, 9/14/2018 | 410,984 | |

| 100M | 4.272%, 1/15/2036 | 92,892 | |

| 702,999 | |||

| Transportation—2.2% | |||

| 400M | Burlington North Santa Fe, LLC, 5.15%, 9/1/2043 | 457,424 | |

| 200M | Cummins, Inc., 4.875%, 10/1/2043 | 222,966 | |

| 300M | Southwest Airlines Co., 3%, 11/15/2026 | 283,799 | |

| 964,189 | |||

| Utilities—1.9% | |||

| 200M | Dominion Resources, Inc., 3.9%, 10/1/2025 | 203,997 | |

| 200M | Duke Energy Progress, Inc., 4.15%, 12/1/2044 | 203,592 | |

| 100M | Entergy Arkansas, Inc., 4.95%, 12/15/2044 | 102,245 | |

| 100M | Oklahoma Gas & Electric Co., 4%, 12/15/2044 | 96,226 | |

| 200M | South Carolina Electric & Gas Co., 5.45%, 2/1/2041 | 225,343 | |

| 831,403 | |||

| Total Value of Corporate Bonds (cost $18,023,517) | 17,683,038 | ||

| COMMON STOCKS—37.6% | |||

| Consumer Discretionary—4.6% | |||

| 100 | * | Acushnet Holdings Corporation | 1,728 |

| 341 | Adient, PLC | 24,780 | |

| 4,300 | American Eagle Outfitters, Inc. | 60,329 | |

| 10 |

| Shares | Security | Value | |

| Consumer Discretionary (continued) | |||

| 2,600 | Coach, Inc. | $ 107,458 | |

| 6,900 | DSW, Inc. – Class “A” | 142,692 | |

| 8,100 | Ford Motor Company | 94,284 | |

| 2,400 | HSN, Inc. | 89,040 | |

| 4,964 | Johnson Controls International, PLC | 209,084 | |

| 3,500 | L Brands, Inc. | 164,850 | |

| 4,600 | Newell Brands, Inc. | 216,982 | |

| 3,600 | Nordstrom, Inc. | 167,652 | |

| 4,600 | Regal Entertainment Group – Class “A” | 103,868 | |

| 3,800 | Tupperware Brands Corporation | 238,336 | |

| 650 | Whirlpool Corporation | 111,365 | |

| 2,100 | Williams-Sonoma, Inc. | 112,602 | |

| 2,000 | Wyndham Worldwide Corporation | 168,580 | |

| 2,013,630 | |||

| Consumer Staples—5.8% | |||

| 6,600 | Altria Group, Inc. | 471,372 | |

| 5,400 | B&G Foods, Inc. | 217,350 | |

| 4,200 | Coca-Cola Company | 178,248 | |

| 7,500 | Koninklijke Ahold Delhaize NV (ADR) | 160,800 | |

| 2,400 | Nu Skin Enterprises, Inc. – Class “A” | 133,296 | |

| 3,100 | PepsiCo, Inc. | 346,766 | |

| 4,600 | Philip Morris International, Inc. | 519,340 | |

| 1,600 | Procter & Gamble Company | 143,760 | |

| 3,300 | Sysco Corporation | 171,336 | |

| 2,900 | Wal-Mart Stores, Inc. | 209,032 | |

| 2,551,300 | |||

| Energy—1.7% | |||

| 700 | Chevron Corporation | 75,159 | |

| 1,400 | ExxonMobil Corporation | 114,814 | |

| 2,900 | Marathon Petroleum Corporation | 146,566 | |

| 750 | Occidental Petroleum Corporation | 47,520 | |

| 3,600 | PBF Energy, Inc. – Class “A” | 79,812 | |

| 700 | Phillips 66 | 55,454 | |

| 2,000 | Royal Dutch Shell, PLC – Class “A” (ADR) | 105,460 | |

| 650 | Schlumberger, Ltd. | 50,765 | |

| 3,200 | Suncor Energy, Inc. | 98,400 | |

| 773,950 |

| 11 |

Portfolio of Investments (continued)

BALANCED INCOME FUND

March 31, 2017

| Shares | Security | Value | |

| Financials—4.3% | |||

| 2,000 | Ameriprise Financial, Inc. | $ 259,360 | |

| 3,100 | Berkshire Hills Bancorp, Inc. | 111,755 | |

| 1,100 | Chubb, Ltd. | 149,875 | |

| 3,600 | Discover Financial Services | 246,204 | |

| 100 | * | Hamilton Lane, Inc. – Class “A” | 1,867 |

| 3,000 | JPMorgan Chase & Company | 263,520 | |

| 3,600 | MetLife, Inc. | 190,152 | |

| 1,600 | PNC Financial Services Group, Inc. | 192,384 | |

| 4,100 | U.S. Bancorp | 211,150 | |

| 8,600 | Waddell & Reed Financial, Inc. – Class “A” | 146,200 | |

| 2,500 | Wells Fargo & Company | 139,150 | |

| 1,911,617 | |||

| Health Care—4.3% | |||

| 5,500 | Abbott Laboratories | 244,255 | |

| 5,100 | AbbVie, Inc. | 332,316 | |

| 6,600 | GlaxoSmithKline, PLC (ADR) | 278,256 | |

| 3,100 | Johnson & Johnson | 386,105 | |

| 3,900 | Merck & Company, Inc. | 247,806 | |

| 11,400 | Pfizer, Inc. | 389,994 | |

| 1,878,732 | |||

| Industrials—4.5% | |||

| 2,000 | 3M Company | 382,660 | |

| 6,800 | General Electric Company | 202,640 | |

| 2,000 | Honeywell International, Inc. | 249,740 | |

| 5,900 | Koninklijke Philips NV (ADR) | 189,449 | |

| 1,400 | Lockheed Martin Corporation | 374,640 | |

| 4,000 | Mobile Mini, Inc. | 122,000 | |

| 1,700 | Textainer Group Holdings, Ltd. | 26,010 | |

| 11,100 | Triton International, Ltd. | 286,269 | |

| 1,200 | United Technologies Corporation | 134,652 | |

| 1,968,060 | |||

| Information Technology—5.8% | |||

| 3,300 | Apple, Inc. | 474,078 | |

| 9,100 | Cisco Systems, Inc. | 307,580 | |

| 4,600 | Intel Corporation | 165,922 | |

| 1,200 | International Business Machines Corporation | 208,968 | |

| 5,800 | Maxim Integrated Products, Inc. | 260,768 | |

| 6,800 | Microsoft Corporation | 447,848 |

| 12 |

| Shares | Security | Value | |

| Information Technology (continued) | |||

| 4,600 | QUALCOMM, Inc. | $ 263,764 | |

| 2,400 | Symantec Corporation | 73,632 | |

| 8,000 | Travelport Worldwide, Ltd. | 94,160 | |

| 3,200 | Western Digital Corporation | 264,096 | |

| 2,560,816 | |||

| Materials—.9% | |||

| 3,100 | International Paper Company | 157,418 | |

| 1,150 | Praxair, Inc. | 136,390 | |

| 1,950 | RPM International, Inc. | 107,308 | |

| 401,116 | |||

| Real Estate—1.8% | |||

| 10,000 | Brixmor Property Group, Inc. (REIT) | 214,600 | |

| 4,400 | Chesapeake Lodging Trust (REIT) | 105,424 | |

| 14,400 | FelCor Lodging Trust, Inc. (REIT) | 108,144 | |

| 5,600 | Sunstone Hotel Investors, Inc. (REIT) | 85,848 | |

| 6,200 | Tanger Factory Outlet Centers, Inc. (REIT) | 203,174 | |

| 4,500 | Urstadt Biddle Properties, Inc. – Class “A” (REIT) | 92,520 | |

| 809,710 | |||

| Telecommunication Services—1.4% | |||

| 8,300 | AT&T, Inc. | 344,865 | |

| 5,500 | Verizon Communications, Inc. | 268,125 | |

| 612,990 | |||

| Utilities—2.5% | |||

| 3,000 | Black Hills Corporation | 199,410 | |

| 3,400 | Duke Energy Corporation | 278,834 | |

| 4,200 | Exelon Corporation | 151,116 | |

| 5,800 | NiSource, Inc. | 137,982 | |

| 3,000 | SCANA Corporation | 196,050 | |

| 2,400 | WEC Energy Group, Inc. | 145,512 | |

| 1,108,904 | |||

| Total Value of Common Stocks (cost $15,137,252) | 16,590,825 | ||

| 13 |

Portfolio of Investments (continued)

BALANCED INCOME FUND

March 31, 2017

| Principal | |||||

| Amount | |||||

| or Shares | Security | Value | |||

| RESIDENTIAL MORTGAGE-BACKED | |||||

| SECURITIES—7.3% | |||||

| Fannie Mae: | |||||

| $ 663M | 3%, 4/1/2046 – 6/1/2046 | $ 658,188 | |||

| 1,027M | 3.5%, 9/1/2045 – 11/1/2046 | 1,052,203 | |||

| 1,053M | 4%, 11/1/2045 – 7/1/2046 | 1,107,564 | |||

| 297M | 4.5%, 1/1/2047 | 319,038 | |||

| 72M | 5%, 8/1/2039 | 79,306 | |||

| Total Value of Residential Mortgage-Backed Securities (cost $3,261,805) | 3,216,299 | ||||

| U.S. GOVERNMENT OBLIGATIONS—3.6% | |||||

| U.S. Treasury Notes: | |||||

| 700M | 0.9515%, 10/31/2018 † | 701,120 | |||

| 875M | 1.0535%, 1/31/2018 † | 877,042 | |||

| Total Value of U.S. Government Obligations (cost $1,577,119) | 1,578,162 | ||||

| VARIABLE AND FLOATING RATE NOTES—2.7% | |||||

| Municipal Bonds | |||||

| 1,200M | Illinois St. Fin. Auth. Rev., 0.9%, 7/1/2038 (cost $1,199,798) † | 1,200,000 | |||

| EXCHANGE TRADED FUNDS—1.9% | |||||

| 9,500 | ishares iBoxx USD High Yield Corporate Bond ETF (ETF) | ||||

| (cost $794,601) | 833,910 | ||||

| SHORT-TERM U.S. GOVERNMENT AGENCY | |||||

| OBLIGATIONS—5.1% | |||||

| Federal Home Loan Bank: | |||||

| $ 750M | 0.71%, 4/21/2017 | 749,745 | |||

| 1,500M | 0.74%, 4/26/2017 | 1,499,349 | |||

| Total Value of Short-Term U.S. Government | |||||

| Agency Obligations (cost $2,248,933) | 2,249,094 | ||||

| Total Value of Investments (cost $42,243,025) | 98.3 | % | 43,351,328 | ||

| Other Assets, Less Liabilities | 1.7 | 759,905 | |||

| Net Assets | 100.0 | % | $44,111,233 | ||

| * | Non-income producing |

| (a) | Security exempt from registration under Rule 144A of the Securities Act of 1933 (see Note 4). |

| † | Interest rates are determined and reset periodically. The interest rates above are the rates in effect |

| at March 31, 2017 |

| 14 |

| Summary of Abbreviations: | |

| ADR | American Depositary Receipts |

| ETF | Exchange Traded Fund |

| REIT | Real Estate Investment Trust |

| USD | United States Dollar |

Futures contracts outstanding at March 31, 2017:

| Value at | |||||||||

| Number of | Value at | March 31, | Unrealized | ||||||

| Contracts | Type | Expiration | Trade Date | 2017 | Appreciation | ||||

| 5 | 5 Year U.S. | Jun. 2017 | $ 588,984 | $ 589,272 | $ 288 | ||||

| Treasury Note | |||||||||

| 19 | 10 Year U.S. | Jun. 2017 | 2,367,133 | 2,367,336 | 203 | ||||

| Treasury Note | |||||||||

| 7 | U.S. Treasury | Jun. 2017 | 1,059,516 | 1,063,036 | 3,520 | ||||

| Long Bond | |||||||||

| (Premium received $396) | $4,011 | ||||||||

| 15 |

Portfolio of Investments (continued)

BALANCED INCOME FUND

March 31, 2017

The Fund’s assets and liabilities are classified into the following three levels based on the inputs used to value the assets or liabilities:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, U.S. Government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of March 31, 2017:

| Level 1 | Level 2 | Level 3 | Total | |||||||||

| Corporate Bonds | $ | — | $ | 17,683,038 | $ | — | $ | 17,683,038 | ||||

| Common Stocks | 16,590,825 | — | — | 16,590,825 | ||||||||

| Residential Mortgage-Backed | ||||||||||||

| Securities | — | 3,216,299 | — | 3,216,299 | ||||||||

| U.S. Government Obligations | — | 1,578,162 | — | 1,578,162 | ||||||||

| Variable and Floating Rate Notes | — | 1,200,000 | — | 1,200,000 | ||||||||

| Exchange Traded Funds | 833,910 | — | — | 833,910 | ||||||||

| Short-Term U.S. Government | ||||||||||||

| Agency Obligations | — | 2,249,094 | — | 2,249,094 | ||||||||

| Total Investments in Securities* | $ | 17,424,735 | $ | 25,926,593 | $ | — | $ | 43,351,328 | ||||

| Other Assets | ||||||||||||

| Futures Contracts | $ | 4,407 | $ | — | $ | — | $ | 4,407 |

| * | The Portfolio of Investments provides information on the industry categorization for corporate bonds, |

| common stocks and variable and floating rate notes. | |

| There were no transfers into or from Level 1 and Level 2 by the Fund for the period ended March 31, | |

| 2017. Transfers, if any, between Levels are recognized at the end of the reporting period. |

| 16 | See notes to financial statements |

Fund Expenses (unaudited)

FLOATING RATE FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 6 for a detailed explanation of the information presented in these examples.

| Annualized | Beginning | Ending | Expenses Paid | |

| Expense | Account Value | Account Value | During Period | |

| Expense Example | Ratio | (10/1/16) | (3/31/17) | (10/1/16–3/31/17)* |

| Class A Shares | 1.10% | |||

| Actual | $1,000.00 | $1,018.63 | $5.54 | |

| Hypothetical** | $1,000.00 | $1,019.45 | $5.54 | |

| Advisor Class Shares | 0.90% | |||

| Actual | $1,000.00 | $1,019.57 | $4.53 | |

| Hypothetical** | $1,000.00 | $1,020.44 | $4.53 | |

| Institutional Class Shares | 0.70% | |||

| Actual | $1,000.00 | $1,020.54 | $3.53 | |

| Hypothetical** | $1,000.00 | $1,021.44 | $3.53 |

| * | Expenses are equal to the annualized expense ratio, multiplied by the average account value over |

| the period, multiplied by 182/365 (to reflect the one-half year period). Expenses paid during the | |

| period are net of expenses waived and/or assumed. | |

| ** | Assumed rate of return of 5% before expenses. |

| Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2017, and |

| are based on the total market value of investments. |

| 17 |

Portfolio of Investments

FLOATING RATE FUND

March 31, 2017

| Principal | |||

| Amount | Security | Value | |

| LOAN PARTICIPATIONS†—87.8% | |||

| Aerospace/Defense—1.9% | |||

| $ 1,164M | B/E Aerospace, Inc., 4.0333%, 12/16/2021 | $ 1,167,609 | |

| TransDigm, Inc.: | |||

| 348M | 4.0367%, 5/14/2022 | 347,516 | |

| 1,356M | 4.1169%, 2/28/2020 | 1,357,912 | |

| 2,873,037 | |||

| Automotive—4.2% | |||

| 775M | Cooper-Standard Automotive, Inc., 3.89678%, 11/2/2023 | 783,527 | |

| 1,095M | Federal-Mogul Holdings, LLC, 4%, 4/15/2018 | 1,095,196 | |

| 1,468M | Hertz Corp., 3.73222%, 6/30/2023 | 1,471,654 | |

| 977M | KAR Auction Services, Inc., 4.1875%, 3/11/2021 | 985,913 | |

| 836M | Key Safety Systems, Inc., 5.54%, 8/29/2021 | 846,901 | |

| 623M | Tectum Holdings, Inc., 5.8226%, 8/24/2023 | 631,620 | |

| 665M | TI Group Automotive Systems, LLC, 3.73222%, 6/30/2022 | 668,199 | |

| 6,483,010 | |||

| Building Materials—.9% | |||

| 934M | Builders FirstSource, Inc., 4%, 2/29/2024 | 934,301 | |

| 484M | Headwaters, Inc., 4%, 3/24/2022 | 485,856 | |

| 1,420,157 | |||

| Chemicals—2.6% | |||

| 868M | A. Schulman, Inc., 4.0556%, 6/1/2022 | 871,470 | |

| 969M | Chemours Co., 6%, 5/12/2022 | 971,034 | |

| 495M | Huntsman International, LLC, 3.98222%, 4/1/2023 | 500,224 | |

| 663M | Methanol Holdings Trinidad, Ltd., 4.48222%, 6/30/2022 | 663,188 | |

| 915M | Univar USA, Inc., 3.73222%, 7/1/2022 | 923,825 | |

| 3,929,741 | |||

| Consumer Non-Durables—2.0% | |||

| 896M | Revlon Consumer Products Corp., 4.48222%, 9/7/2023 | 897,515 | |

| 1,233M | Reynolds Group Holdings, Inc., 3.98222%, 2/5/2023 | 1,239,102 | |

| 945M | Spectrum Brands Canada, Inc., 3.3989%, 6/23/2022 | 951,874 | |

| 3,088,491 |

| 18 |

| Principal | |||

| Amount | Security | Value | |

| Energy—2.1% | |||

| $ 881M | Granite Acquisition, Inc., 5.14678%, 12/17/2021 | $ 889,272 | |

| 925M | Jonah Energy, LLC, 7.5%, 5/12/2021 | 878,750 | |

| 775M | MEG Energy Corp., 4.54%, 12/31/2023 | 775,161 | |

| 625M | Summit Midstream Partners Holdings, LLC, 7.02167%, 5/13/2022 | 636,719 | |

| 3,179,902 | |||

| Financial Services—1.6% | |||

| 1,728M | Delos Finance Sarl, 3.39678%, 10/6/2023 | 1,751,221 | |

| 644M | Ineos U.S. Finance, LLC, 3.73222%, 3/31/2022 (b) | 647,942 | |

| 2,399,163 | |||

| Financials—1.4% | |||

| 800M | Avolon TLB Borrower 1 U.S., LLC, 3.745%, 3/21/2022 (b) | 809,000 | |

| 250M | Helix Generation Funding, LLC, 3.75%, 3/9/2024 (b) | 253,750 | |

| 1,024M | Lightstone Holding Co., LLC, 5.539%, 1/30/2024 | 1,030,999 | |

| 2,093,749 | |||

| Food/Beverage/Tobacco—2.0% | |||

| 533M | B&G Foods, Inc., 3.81056%, 11/2/2022 | 536,425 | |

| 1,073M | Chobani, LLC, 5.25%, 10/9/2023 (b) | 1,084,629 | |

| 1,471M | Pinnacle Foods Finance, LLC, 2.81056%, 2/2/2024 | 1,479,274 | |

| 3,100,328 | |||

| Forest Products/Containers—2.1% | |||

| 1,207M | Berry Plastics Corp., 3.5009%, 10/1/2022 | 1,216,083 | |

| 650M | BWay Holding Co., 3.25%, 4/3/2024 (b) | 650,203 | |

| 713M | BWay Intermediate Co., Inc., 4.75%, 8/14/2020 | 714,404 | |

| 706M | Exopack Holdings SA, 4.64678%, 5/8/2019 | 707,910 | |

| 3,288,600 | |||

| Gaming/Leisure—4.9% | |||

| AMC Entertainment Holdings, Inc.: | |||

| 876M | 3.6622%, 12/15/2022 | 884,734 | |

| 375M | 3.73278%, 12/15/2023 | 378,574 | |

| 300M | Delta 2 Lux Sarl, 4.245%, 2/1/2024 (b) | 300,141 | |

| 1,237M | Hilton Worldwide Finance, LLC, 2.9817%, 10/25/2023 | 1,246,592 | |

| 1,316M | La Quinta Intermediate Holdings, LLC, 3.77178%, 4/14/2021 | 1,325,994 | |

| 840M | Lions Gate Entertainment Corp., 3.98222%, 12/8/2023 | 846,038 |

| 19 |

Portfolio of Investments (continued)

FLOATING RATE FUND

March 31, 2017

| Principal | |||

| Amount | Security | Value | |

| Gaming/Leisure (continued) | |||

| $ 1,469M | Live Nation Entertainment, Inc., 3.5%, 10/31/2023 | $ 1,485,144 | |

| 230M | Pinnacle Entertainment, Inc., 3.99%, 4/28/2023 | 233,060 | |

| 871M | Seminole Hard Rock Entertainment, Inc., 3.89678%, 5/14/2020 | 877,397 | |

| 7,577,674 | |||

| Health Care—7.9% | |||

| CHS/Community Health Systems, Inc.: | |||

| 219M | 3.7976%, 12/31/2019 | 217,917 | |

| 739M | 4.0477%, 1/27/2021 | 730,717 | |

| 523M | Cotiviti Corp., 3.9%, 9/28/2023 | 527,575 | |

| 565M | DaVita, Inc., 3.73222%, 6/24/2021 | 571,808 | |

| 1,075M | Envision Healthcare Corp., 4.15%, 12/1/2023 | 1,085,303 | |

| 444M | ExamWorks Group, Inc., 3.5%, 7/27/2023 | 447,217 | |

| 566M | Kindred Healthcare, Inc., 4.5625%, 4/9/2021 | 565,584 | |

| 531M | Mallinckrodt International Finance SA, 3.89678%, 9/24/2024 | 532,030 | |

| 506M | MPH Acquisition Holdings, LLC, 4.89678%, 6/7/2023 | 513,020 | |

| 1,146M | Nature’s Bounty Co., 4.64678%, 5/5/2023 | 1,154,233 | |

| 388M | Onex Carestream Finance, LP, 5.14678%, 6/7/2019 | 376,101 | |

| 300M | Prestige Brands Holdings, Inc., 3.7322%, 1/26/2024 | 303,375 | |

| 716M | Quintiles IMS, Inc., 2.9746%, 3/7/2024 | 721,567 | |

| RPI Finance Trust: | |||

| 60M | 3.15289%, 3/23/2023 (b) | 60,337 | |

| 1,204M | 3.64678%, 10/14/2022 | 1,210,730 | |

| 1,500M | Sterigenics-Nordion Holdings, LLC, 3%, 5/15/2022 (b) | 1,502,345 | |

| 1,558M | Valeant Pharma International, Inc., 5.57%, 4/1/2022 | 1,565,383 | |

| 12,085,242 | |||

| Industrials—.7% | |||

| 1,147M | SIG Combibloc Holdings SCA, 4%, 3/11/2022 | 1,155,844 | |

| Information Technology—7.2% | |||

| 331M | ARRIS Group, Inc., 3.73222%, 4/17/2020 | 333,931 | |

| 1,580M | Avast Holdings BV, 5%, 9/30/2022 | 1,591,850 | |

| 875M | Change Heathcare Holdings, 3.75%, 3/1/2024 | 877,187 | |

| 878M | Dell International, LLC, 3.49%, 9/7/2023 | 882,737 | |

| 225M | Gartner Group, Inc., 2.99875%, 3/15/2024 (b) | 226,828 | |

| 658M | Global Payments, Inc., 3.48222%, 4/21/2023 | 663,394 | |

| Go Daddy Operating Co., LLC: | |||

| 809M | 3.41222%, 2/15/2024 (b) | 810,521 | |

| 1,067M | 3.4975%, 2/15/2024 (b) | 1,069,166 | |

| 678M | Match Group, Inc., 4.09667%, 11/16/2022 | 680,668 |

| 20 |

| Principal | |||

| Amount | Security | Value | |

| Information Technology (continued) | |||

| $ 399M | Micron Technology, Inc., 4.74%, 4/26/2022 | $ 404,234 | |

| 403M | Microsemi Corp., 3.22611%, 1/15/2023 (b) | 405,708 | |

| 1,563M | Quest Software U.S., 7%, 10/31/2022 | 1,588,482 | |

| 736M | Western Digital Corp., 3.73222%, 4/29/2023 | 741,362 | |

| 714M | Zebra Technologies Corp., 3.6%, 10/27/2021 | 720,096 | |

| 10,996,164 | |||

| Manufacturing—6.8% | |||

| 1,870M | Brand Energy & Infrastructure, 4.772%, 11/26/2020 (b) | 1,877,455 | |

| 1,450M | Columbus McKinnon Corp., 4.1468%, 1/31/2024 | 1,464,500 | |

| 625M | Douglas Dynamics, LLC, 4.5%, 12/31/2021 | 628,125 | |

| 977M | Filtration Group, Inc., 4.304%, 11/23/2020 | 985,323 | |

| 1,178M | Gardner Denver, Inc., 4.5588%, 7/30/2020 | 1,175,247 | |

| 1,147M | Gates Global, LLC, 4.39678%, 7/6/2021 | 1,150,122 | |

| 939M | Husky Injection Molding System, 4.25%, 6/30/2021 | 944,858 | |

| 1,045M | RBS Global, Inc., 3.8371%, 8/21/2023 | 1,050,510 | |

| 1,204M | U.S. Farathane, LLC, 5.1468%, 12/23/2021 | 1,220,156 | |

| 10,496,296 | |||

| Media-Broadcasting—4.5% | |||

| 2,575M | Altice Financing SA, 3.7475%, 7/28/2025 (b) | 2,573,699 | |

| 1,340M | Altice France SA, 5.289%, 1/15/2024 | 1,349,226 | |

| 2,250M | Altice U.S. Finance I, 4.2475%, 7/28/2025 (b) | 2,256,750 | |

| CBS Radio, Inc.: | |||

| 125M | 4.495%, 11/1/2023 (b) | 125,625 | |

| 557M | 4.5%, 10/17/2023 | 563,721 | |

| 6,869,021 | |||

| Media-Cable TV—4.7% | |||

| 1,361M | Charter Communications, 3.23222%, 1/15/2024 | 1,369,475 | |

| CSC Holdings, LLC : | |||

| 500M | 3.245%, 7/15/2025 (b) | 500,000 | |

| 1,371M | 3.94278%, 10/11/2024 | 1,380,616 | |

| 748M | Gray Television, Inc., 3.33444%, 2/7/2024 | 753,736 | |

| 823M | Midcontinent Communications, Inc., 3.3344%, 12/31/2023 | 831,681 | |

| 102M | Mission Broadcasting, Inc., 3.9428%, 1/17/2024 | 102,744 | |

| 1,086M | Nexstar Broadcasting, Inc., 3.94278%, 1/17/2024 | 1,095,915 | |

| 614M | Raycom TV Broadcasting, LLC, 3.98222%, 8/4/2021 | 615,786 | |

| 600M | Ziggo Secured Finance BV, 3.41222%, 4/15/2025 | 599,625 | |

| 7,249,578 |

| 21 |

Portfolio of Investments (continued)

FLOATING RATE FUND

March 31, 2017

| Principal | |||

| Amount | Security | Value | |

| Media-Diversified—.8% | |||

| $ 489M | Tribune Media Co., 3.98222%, 1/26/2024 | $ 492,169 | |

| 801M | Virgin Media Bristol, LLC, 3.66222%, 1/31/2025 | 803,836 | |

| 1,296,005 | |||

| Metals/Mining—4.1% | |||

| 1,250M | Arch Coal, Inc., 5%, 3/7/2024 | 1,250,781 | |

| 401M | FMG Resources Property, 3.75%, 6/30/2019 | 404,206 | |

| 1,300M | Foresight Energy, LLC, 6.735%, 3/28/2022 (b) | 1,272,375 | |

| 1,381M | MRC Global U.S., Inc., 5%, 11/8/2019 | 1,394,722 | |

| 225M | Peabody Energy Corp., 5.495%, 2/8/2022 (b) | 226,125 | |

| 882M | TMS International Corp., 4.5565%, 10/16/2020 | 886,166 | |

| 845M | Zekelman Industries, Inc., 4.90622%, 6/14/2021 | 856,120 | |

| 6,290,495 | |||

| Real Estate—.4% | |||

| 579M | Realogy Group, LLC, 3.23167%, 7/20/2022 | 581,594 | |

| Retail-General Merchandise—8.8% | |||

| 1011778 B.C. Unlimited: | |||

| 250M | 3.25%, 2/16/2024 (b) | 251,094 | |

| 1,079M | 3.3093%, 2/16/2024 | 1,088,229 | |

| 950M | 84 Lumber Co., 6.75%, 10/25/2023 | 961,875 | |

| 1,375M | Bass Pro Group, LLC, 5.97039%, 12/15/2023 | 1,323,437 | |

| 1,300M | BJ’s Wholesale Club, Inc., 4.75%, 2/3/2024 | 1,271,292 | |

| 916M | CNT Holdings III Corp., 4.28%, 1/22/2023 | 922,636 | |

| 521M | General Nutrition Centers, Inc., 3.49%, 3/4/2019 | 445,705 | |

| 750M | Hanesbrands, Inc., 3.4822%, 4/29/2022 | 756,578 | |

| 1,542M | Harbor Freight Tools USA, Inc., 4.23222%, 8/18/2023 | 1,542,250 | |

| 1,020M | KFC Holding Co., 2.9761%, 6/16/2023 | 1,028,587 | |

| 1,125M | Landry’s, Inc., 4.0410%, 10/4/2023 | 1,136,250 | |

| 871M | Neiman Marcus Group, Inc., 4.25%, 10/25/2020 | 701,190 | |

| 1,050M | Party City Holdings, Inc., 3.8718%, 8/19/2022 | 1,049,333 | |

| 995M | Planet Fitness Holdings, LLC, 4.5269%, 3/31/2021 | 996,244 | |

| 13,474,700 |

| 22 |

| Principal | |||

| Amount | Security | Value | |

| Services—3.8% | |||

| $ 500M | Aramark Services, Inc., 2.98287%, 3/28/2024 (b) | $ 503,750 | |

| 1,437M | Brickman Group, Ltd., LLC, 4.0008%, 12/18/2020 | 1,444,410 | |

| 790M | Doosan Bobcat, Inc., 4.5%, 5/28/2021 | 799,465 | |

| 948M | Monitronics International, Inc., 6.6468%, 9/30/2022 | 960,569 | |

| 1,546M | Safway Group Holding, LLC, 5.75%, 8/21/2023 | 1,565,452 | |

| 525M | TKC Holdings, Inc., 4.75%, 2/1/2023 | 529,266 | |

| 5,802,912 | |||

| Telecommunications—3.3% | |||

| 1,009M | CommScope, Inc., 3.48222%, 12/29/2022 | 1,018,005 | |

| 1,081M | GCI Holdings, Inc., 3.98222%, 2/2/2022 | 1,091,897 | |

| 1,200M | Level 3 Financing, Inc., 3.2272%, 2/22/2024 | 1,202,626 | |

| 1,250M | Telenet International Finance Sarl, 3.91222%, 1/31/2025 | 1,250,000 | |

| 435M | Zayo Group, LLC, 3.5%, 1/19/2024 | 437,719 | |

| 5,000,247 | |||

| Transportation—.3% | |||

| 454M | XPO Logistics, Inc., 3.1078%, 11/1/2021 | 455,835 | |

| Utilities—4.3% | |||

| 961M | Calpine Corp., 3.9%, 1/15/2024 | 966,398 | |

| 425M | Dayton Power & Light Co., 4.24%, 8/24/2022 | 429,250 | |

| 475M | Dynegy, Inc., 4.25%, 6/27/2023 | 476,979 | |

| HD Supply, Inc.: | |||

| 750M | 3.73222%, 8/13/2021 | 756,551 | |

| 549M | 3.73222%, 10/17/2023 | 553,254 | |

| 995M | NRG Energy, Inc., 3.23222%, 6/30/2023 | 1,000,182 | |

| 1,075M | Talen Energy Supply, LLC, 6.06%, 12/6/2023 | 1,091,125 | |

| 1,272M | Vistra Operations Co., LLC, 3.7222%, 8/4/2023 | 1,270,550 | |

| 6,544,289 | |||

| Waste Management—1.4% | |||

| 950M | Advanced Disposal Services, 3.69778%, 11/10/2023 | 957,139 | |

| 1,119M | GFL Environmental, Inc., 3.89678%, 9/29/2023 | 1,126,022 | |

| 2,083,161 |

| 23 |

Portfolio of Investments (continued)

FLOATING RATE FUND

March 31, 2017

| Principal | |||

| Amount | Security | Value | |

| Wireless Communications—3.1% | |||

| $ 1,600M | Intelsat Jackson Holdings SA, 3.88733%, 6/30/2019 | $ 1,571,501 | |

| 1,450M | Sprint Communications, Inc., 3.5%, 2/2/2024 | 1,451,812 | |

| 1,747M | Telesat Canada, 4.15%, 11/17/2023 | 1,770,899 | |

| 4,794,212 | |||

| Total Value of Loan Participations (cost $133,769,384) | 134,609,447 | ||

| CORPORATE BONDS—7.5% | |||

| Aerospace/Defense—.2% | |||

| 325M | Bombardier, Inc., 8.75%, 12/1/2021 (a) | 356,687 | |

| Building Materials—.5% | |||

| 750M | Griffon Corp., 5.25%, 3/1/2022 | 752,813 | |

| Energy—2.0% | |||

| 750M | Murphy Oil USA, Inc., 6%, 8/15/2023 | 789,375 | |

| 400M | Precision Drilling Corp., 6.5%, 12/15/2021 | 401,088 | |

| 1,000M | Targa Resources Partners, LP, 4.125%, 11/15/2019 | 1,021,250 | |

| 800M | Tesoro Logistics, LP, 6.25%, 10/15/2022 | 849,000 | |

| 3,060,713 | |||

| Financials—.4% | |||

| 626M | Consolidated Energy Finance SA, 6.75%, 10/15/2019 (a) | 633,825 | |

| Forest Products/Container—.5% | |||

| 700M | Ardagh Holdings USA, Inc., 4.289%, 5/15/2021 (a) | 718,375 | |

| Health Care—.9% | |||

| 800M | Centene Corp., 5.625%, 2/15/2021 | 839,280 | |

| 150M | Endo Finance, LLC, 7.25%, 1/15/2022 (a) | 142,500 | |

| 450M | Molina Healthcare, Inc., 5.375%, 11/15/2022 | 468,842 | |

| 1,450,622 | |||

| Manufacturing—.5% | |||

| 700M | H&E Equipment Services, Inc., 7%, 9/1/2022 | 737,625 | |

| Media-Cable TV—.4% | |||

| 500M | DISH DBS Corp., 7.875%, 9/1/2019 | 552,500 | |

| 24 |

| Principal | |||||

| Amount | Security | Value | |||

| Metals/Mining—.9% | |||||

| $ 275M | Aleris International, Inc., 9.5%, 4/1/2021 (a) | $ 297,000 | |||

| 650M | Barminco Holdings Property, Ltd., 9%, 6/1/2018 (a) | 685,750 | |||

| 325M | Teck Resources, Ltd., 8.5%, 6/1/2024 (a) | 375,781 | |||

| 1,358,531 | |||||

| Services—.3% | |||||

| 450M | Cimpress NV, 7%, 4/1/2022 (a) | 468,000 | |||

| Telecommunications—.1% | |||||

| 225M | Wind Acquisition Finance SA, 4.75%, 7/15/2020 (a) | 229,781 | |||

| Utilities—.6% | |||||

| 430M | Calpine Corp., 6%, 1/15/2022 (a) | 449,887 | |||

| 500M | Dynegy, Inc., 6.75%, 11/1/2019 | 516,250 | |||

| 966,137 | |||||

| Wireless Communications—.2% | |||||

| 250M | T-Mobile USA, Inc., 6.125%, 1/15/2022 | 264,688 | |||

| Total Value of Corporate Bonds (cost $11,412,514) | 11,550,297 | ||||

| VARIABLE AND FLOATING RATE NOTES—.1% | |||||

| Utilities | |||||

| 219M | AES Corp., 4.05456%, 6/1/2019 (cost $214,827) † | 219,548 | |||

| SHORT-TERM U.S. GOVERNMENT AGENCY | |||||

| OBLIGATIONS—6.5% | |||||

| 10,000M | Federal Home Loan Bank, 0.7%, 4/11/2017 (cost $9,998,055) | 9,998,490 | |||

| Total Value of Investments (cost $155,394,780) | 101.9 | % | 156,377,782 | ||

| Excess of Liabilities Over Other Assets | (1.9 | ) | (2,850,398) | ||

| Net Assets | 100.0 | % | $153,527,384 | ||

| (a) | Security exempt from registration under Rule 144A of the Securities Act of 1933 (see Note 4). |

| (b) | A portion or all of the security purchased on a when-issued or delayed delivery basis. |

| † | Interest rates are determined and reset periodically. The interest rates above are the rates in effect |

| at March 31, 2017. |

| 25 |

Portfolio of Investments (continued)

FLOATING RATE FUND

March 31, 2017

The Fund’s assets and liabilities are classified into the following three levels based on the inputs used to value the assets or liabilities:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, U.S. Government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of March 31, 2017:

| Level 1 | Level 2 | Level 3 | Total | |||||||||

| Loan Participations | $ | — | $ | 134,609,447 | $ | — | $ | 134,609,447 | ||||

| Corporate Bonds | — | 11,550,297 | — | 11,550,297 | ||||||||

| Variable & Floating Rate Notes | — | 219,548 | — | 219,548 | ||||||||

| Short-Term U.S. Government | ||||||||||||

| Agency Obligations | — | 9,998,490 | — | 9,998,490 | ||||||||

| Total Investments in Securities* | $ | — | $ | 156,377,782 | $ | — | $ | 156,377,782 |

| * | The Portfolio of Investments provides information on the industry categorization of loan |

| participations, corporate bonds and variable and floating rate notes. | |

| There were no transfers into or from Level 1 and Level 2 by the Fund for the period ended March 31, | |

| 2017. Transfers, if any, between Levels are recognized at the end of the reporting period. |

| 26 | See notes to financial statements |

Fund Expenses (unaudited)

FUND FOR INCOME

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 6 for a detailed explanation of the information presented in these examples.

| Annualized | Beginning | Ending | Expenses Paid | |

| Expense | Account Value | Account Value | During Period | |

| Expense Example | Ratio | (10/1/16) | (3/31/17) | (10/1/16–3/31/17)* |

| Class A Shares | 1.21% | |||

| Actual | $1,000.00 | $1,028.59 | $6.12 | |

| Hypothetical** | $1,000.00 | $1,018.90 | $6.04 | |

| Class B Shares | 1.96% | |||

| Actual | $1,000.00 | $1,023.65 | $9.89 | |

| Hypothetical** | $1,000.00 | $1,015.16 | $9.80 | |

| Advisor Class Shares | 0.94% | |||

| Actual | $1,000.00 | $1,029.86 | $4.76 | |

| Hypothetical** | $1,000.00 | $1,020.24 | $4.73 | |

| Institutional Class Shares | 0.79% | |||

| Actual | $1,000.00 | $1,031.00 | $4.00 | |

| Hypothetical** | $1,000.00 | $1,020.99 | $3.93 |

| * | Expenses are equal to the annualized expense ratio, multiplied by the average account value over |

| the period, multiplied by 182/365 (to reflect the one-half year period). Expenses paid during the | |

| period are net of expenses waived. | |

| ** | Assumed rate of return of 5% before expenses. |

| Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2017, and |

| are based on the total market value of investments. |

| 27 |

Portfolio of Investments

FUND FOR INCOME

March 31, 2017

| Principal | |||

| Amount | Security | Value | |

| CORPORATE BONDS—91.7% | |||

| Aerospace/Defense—1.3% | |||

| Bombardier, Inc.: | |||

| $2,600M | 8.75%, 12/1/2021 (a) | $ 2,853,500 | |

| 1,675M | 7.5%, 3/15/2025 (a) | 1,721,062 | |

| Meccanica Holdings USA, Inc.: | |||

| 1,871M | 7.375%, 7/15/2039 (a) | 2,132,940 | |

| 750M | 6.25%, 1/15/2040 (a) | 796,875 | |

| 1,725M | Transdigm, Inc., 6.375%, 6/15/2026 | 1,730,330 | |

| 9,234,707 | |||

| Automotive—4.9% | |||

| American Axle & Manufacturing, Inc.: | |||

| 125M | 6.625%, 10/15/2022 | 129,375 | |

| 1,475M | 6.25%, 4/1/2025 (a) | 1,480,531 | |

| 1,175M | 6.5%, 4/1/2027 (a) | 1,174,260 | |

| 1,725M | Asbury Automotive Group, Inc., 6%, 12/15/2024 | 1,789,687 | |

| 1,700M | Avis Budget Car Rental, 6.375%, 4/1/2024 (a) | 1,710,625 | |

| 1,900M | Cooper-Standard Automotive, Inc., 5.625%, 11/15/2026 (a) | 1,904,750 | |

| Dana Holding Corp.: | |||

| 2,000M | 6%, 9/15/2023 | 2,095,000 | |

| 700M | 5.5%, 12/15/2024 | 712,250 | |

| 2,350M | Fiat Chrysler Automobiles NV, 5.25%, 4/15/2023 | 2,428,725 | |

| Group 1 Automotive, Inc.: | |||

| 2,375M | 5%, 6/1/2022 | 2,404,687 | |

| 1,425M | 5.25%, 12/15/2023 (a) | 1,446,375 | |

| 1,975M | Hertz Corp., 5.5%, 10/15/2024 (a) | 1,725,656 | |

| IHO Verwaltungs GmbH: | |||

| 1,075M | 4.125%, 9/15/2021 (a) | 1,083,063 | |

| 550M | 4.5%, 9/15/2023 (a) | 545,188 | |

| 3,650M | LKQ Corp., 4.75%, 5/15/2023 | 3,650,000 | |

| 3,725M | Meritor, Inc., 6.25%, 2/15/2024 | 3,836,750 | |

| 3,050M | Omega U.S. Sub, LLC, 8.75%, 7/15/2023 (a) | 3,250,782 | |

| 2,550M | ZF North America Capital, Inc., 4.75%, 4/29/2025 (a) | 2,648,813 | |

| 34,016,517 | |||

| Building Materials—1.0% | |||

| 2,600M | Building Materials Corp., 5.375%, 11/15/2024 (a) | 2,647,112 | |

| 4,200M | Griffon Corp., 5.25%, 3/1/2022 | 4,215,750 | |

| 6,862,862 |

| 28 |

| Principal | |||

| Amount | Security | Value | |

| Chemicals—4.4% | |||

| $2,000M | A. Schulman, Inc., 6.875%, 6/1/2023 | $ 2,085,000 | |

| 2,700M | Blue Cube Spinco, Inc., 10%, 10/15/2025 | 3,273,750 | |

| 1,900M | Koppers, Inc., 6%, 2/15/2025 (a) | 1,966,500 | |

| 3,100M | Platform Specialty Products Corp., 10.375%, 5/1/2021 (a) | 3,456,500 | |

| 3,425M | PolyOne Corp., 5.25%, 3/15/2023 | 3,467,813 | |

| Rain CII Carbon, LLC: | |||

| 3,225M | 8.25%, 1/15/2021 (a) | 3,341,906 | |

| 6,725M | 7.25%, 4/1/2025 (a) | 6,674,563 | |

| 1,350M | Rayonier AM Products, Inc., 5.5%, 6/1/2024 (a) | 1,221,750 | |

| 1,350M | TPC Group, Inc., 8.75%, 12/15/2020 (a) | 1,235,520 | |

| Tronox Finance, LLC: | |||

| 2,200M | 6.375%, 8/15/2020 | 2,219,250 | |

| 1,000M | 7.5%, 3/15/2022 (a) | 1,040,000 | |

| 525M | W.R. Grace & Co., 5.625%, 10/1/2024 (a) | 555,187 | |

| 30,537,739 | |||

| Consumer Non-Durables—.9% | |||

| Reynolds Group Issuer, Inc.: | |||

| 1,800M | 5.75%, 10/15/2020 | 1,854,018 | |

| 850M | 5.125%, 7/15/2023 (a) | 874,438 | |

| 1,375M | Standard Industries, Inc., 5.5%, 2/15/2023 (a) | 1,409,375 | |

| 2,275M | Wolverine World Wide, Inc., 5%, 9/1/2026 (a) | 2,144,188 | |

| 6,282,019 | |||

| Energy—11.3% | |||

| 1,425M | Alta Mesa Holdings, LP, 7.875%, 12/15/2024 (a) | 1,492,687 | |

| Antero Resources Corp.: | |||

| 950M | 5.375%, 11/1/2021 | 979,298 | |

| 475M | 5.125%, 12/1/2022 | 483,609 | |

| 400M | 5%, 3/1/2025 (a) | 394,248 | |

| 1,725M | Baytex Energy Corp., 5.125%, 6/1/2021 (a) | 1,565,437 | |

| 1,375M | Blue Racer Midstream, LLC, 6.125%, 11/15/2022 (a) | 1,399,062 | |

| 425M | Callon Petroleum Co., 6.125%, 10/1/2024 (a) | 444,125 | |

| 1,600M | Carrizo Oil & Gas, Inc., 6.25%, 4/15/2023 | 1,612,000 | |

| 1,425M | Cheniere Corpus Christi Holdings, 7%, 6/30/2024 (a) | 1,576,406 | |

| Continental Resources, Inc.: | |||

| 1,150M | 4.5%, 4/15/2023 | 1,124,838 | |

| 3,575M | 3.8%, 6/1/2024 | 3,342,625 | |

| 475M | 4.9%, 6/1/2044 | 410,875 |

| 29 |

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2017

| Principal | |||

| Amount | Security | Value | |

| Energy (continued) | |||

| Crestwood Midstream Partners, LP: | |||

| $2,175M | 6.25%, 4/1/2023 | $ 2,267,437 | |

| 1,375M | 5.75%, 4/1/2025 (a) | 1,407,656 | |

| 500M | Diamondback Energy, Inc., 4.75%, 11/1/2024 (a) | 505,450 | |

| 2,767M | Exterran Partners, LP, 6%, 10/1/2022 | 2,739,330 | |

| 1,950M | Forum Energy Technologies, Inc., 6.25%, 10/1/2021 | 1,930,500 | |

| Genesis Energy, LP: | |||

| 1,400M | 6.75%, 8/1/2022 | 1,450,400 | |

| 225M | 6%, 5/15/2023 | 227,250 | |

| 500M | 5.625%, 6/15/2024 | 491,250 | |

| 1,150M | Gulfport Energy Corp., 6.375%, 5/15/2025 (a) | 1,134,187 | |

| 2,125M | Hilcorp Energy I, 5.75%, 10/1/2025 (a) | 2,061,250 | |

| 2,600M | Laredo Petroleum, Inc., 5.625%, 1/15/2022 | 2,606,500 | |

| 1,400M | Matador Resources Co., 6.875%, 4/15/2023 | 1,470,000 | |

| 1,900M | MEG Energy Corp., 6.5%, 1/15/2025 (a) | 1,907,125 | |

| Murphy Oil Corp.: | |||

| 1,425M | 4.7%, 12/1/2022 | 1,389,375 | |

| 1,225M | 6.875%, 8/15/2024 | 1,301,563 | |

| 3,300M | Newfield Exploration Co., 5.375%, 1/1/2026 | 3,463,020 | |

| 325M | NuStar Logistics, LP, 4.8%, 9/1/2020 | 330,493 | |

| 1,750M | Oasis Petroleum, Inc., 6.5%, 11/1/2021 | 1,763,125 | |

| 425M | Parsley Energy, LLC, 6.25%, 6/1/2024 (a) | 452,625 | |

| 1,400M | Pattern Energy Group, Inc., 5.875%, 2/1/2024 (a) | 1,424,500 | |

| 575M | PDC Energy, Inc., 6.125%, 9/15/2024 (a) | 592,250 | |

| 1,700M | Precision Drilling Corp., 6.5%, 12/15/2021 | 1,704,624 | |

| 2,075M | QEP Resources, Inc., 6.875%, 3/1/2021 | 2,215,063 | |

| 1,651M | Range Resources Corp., 5%, 8/15/2022 (a) | 1,642,745 | |

| 1,650M | Rice Energy, Inc., 6.25%, 5/1/2022 | 1,707,750 | |

| 1,250M | Rowan Companies, Inc., 4.875%, 6/1/2022 | 1,200,000 | |

| 700M | RSP Permian, Inc., 5.25%, 1/15/2025 (a) | 708,750 | |

| Sabine Pass Liquefaction, LLC: | |||

| 1,600M | 6.25%, 3/15/2022 | 1,777,467 | |

| 925M | 5.625%, 4/15/2023 | 1,004,778 | |

| 2,625M | 5.75%, 5/15/2024 | 2,864,807 | |

| 650M | 5.875%, 6/30/2026 (a) | 717,920 | |

| 425M | 5%, 3/15/2027 (a) | 445,139 | |

| Southwestern Energy Co.: | |||

| 775M | 5.8%, 1/23/2020 | 786,141 | |

| 1,025M | 6.7%, 1/23/2025 | 1,014,750 | |

| 700M | Suburban Propane Partners, LP, 5.875%, 3/1/2027 | 693,000 |

| 30 |

| Principal | |||

| Amount | Security | Value | |

| Energy (continued) | |||

| Sunoco, LP: | |||

| $1,100M | 6.25%, 4/15/2021 | $ 1,124,750 | |

| 900M | 6.375%, 4/1/2023 | 918,000 | |

| Targa Resources Partners, LP: | |||

| 900M | 5.25%, 5/1/2023 | 924,750 | |

| 2,800M | 4.25%, 11/15/2023 | 2,751,000 | |

| 1,150M | 5.125%, 2/1/2025 (a) | 1,188,813 | |

| Tesoro Logistics, LP: | |||

| 1,650M | 6.25%, 10/15/2022 | 1,751,063 | |

| 825M | 6.375%, 5/1/2024 | 897,188 | |

| 1,550M | Unit Corp., 6.625%, 5/15/2021 | 1,534,500 | |

| Weatherford Bermuda, PLC: | |||

| 600M | 4.5%, 4/15/2022 | 577,500 | |

| 625M | 6.5%, 8/1/2036 | 593,750 | |

| 1,725M | WPX Energy, Inc., 6%, 1/15/2022 | 1,763,813 | |

| 78,248,557 | |||

| Financials—3.9% | |||

| Ally Financials, Inc.: | |||

| 1,300M | 8%, 12/31/2018 | 1,407,250 | |

| 3,100M | 8%, 3/15/2020 | 3,487,500 | |

| 4,250M | 8%, 11/1/2031 | 5,068,125 | |

| 1,875M | Argos Merger Sub, Inc., 7.125%, 3/15/2023 (a) | 1,785,937 | |

| 1,200M | BCD Acquisition, Inc., 9.625%, 9/15/2023 (a) | 1,302,000 | |

| 525M | CDW, LLC, 5%, 9/1/2025 | 538,125 | |

| 3,466M | Consolidated Energy Finance SA, 6.75%, 10/15/2019 (a) | 3,509,325 | |

| 1,700M | CVR Partners, LP, 9.25%, 6/15/2023 (a) | 1,751,000 | |

| 1,000M | Dana Financing Luxembourg Sarl, 6.5%, 6/1/2026 (a) | 1,045,000 | |

| Icahn Enterprises, LP: | |||

| 250M | 6%, 8/1/2020 | 260,000 | |

| 1,325M | 6.25%, 2/1/2022 (a) | 1,348,187 | |

| 2,700M | 6.75%, 2/1/2024 (a) | 2,791,125 | |

| 1,350M | Ladder Capital Finance Holdings, 5.25%, 3/15/2022 (a) | 1,363,500 | |

| Park Aerospace Holdings, Ltd.: | |||

| 600M | 5.25%, 8/15/2022 (a) | 626,250 | |

| 725M | 5.5%, 2/15/2024 (a) | 755,813 | |

| 27,039,137 |

| 31 |

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2017

| Principal | |||

| Amount | Security | Value | |

| Food/Beverage/Tobacco—1.2% | |||

| $1,225M | Barry Callebaut Services SA, 5.5%, 6/15/2023 (a) | $ 1,318,411 | |

| Lamb Weston Holdings, Inc.: | |||

| 875M | 4.625%, 11/1/2024 (a) | 894,687 | |

| 625M | 4.875%, 11/1/2026 (a) | 639,062 | |

| Post Holdings, Inc.: | |||

| 1,575M | 7.75%, 3/15/2024 (a) | 1,744,643 | |

| 1,725M | 5.5%, 3/1/2025 (a) | 1,742,250 | |

| 1,700M | Vector Group, Ltd., 6.125%, 2/1/2025 (a) | 1,740,375 | |

| 8,079,428 | |||

| Food/Drug—.6% | |||

| 1,000M | AdvancePierre Foods Holdings, 5.5%, 12/15/2024 (a) | 1,013,750 | |

| 1,350M | Albertson Cos., LLC, 5.75%, 3/15/2025 (a) | 1,312,875 | |

| 2,025M | Rite Aid Corp., 6.125%, 4/1/2023 (a) | 2,014,875 | |

| 4,341,500 | |||

| Forest Products/Containers—2.5% | |||

| Ardagh Packaging Finance, PLC: | |||

| 2,175M | 6%, 6/30/2021 (a) | 2,248,406 | |

| 525M | 4.625%, 5/15/2023 (a) | 530,906 | |

| 1,850M | Berry Plastics Group, 5.125%, 7/15/2023 | 1,903,187 | |

| 425M | Flex Acquisition Co., Inc., 6.875%, 1/15/2025 (a) | 434,977 | |

| 775M | Louisiana-Pacific Corp., 4.875%, 9/15/2024 | 780,813 | |

| Mercer International, Inc.: | |||

| 1,400M | 7.75%, 12/1/2022 | 1,505,420 | |

| 1,175M | 6.5%, 2/1/2024 (a) | 1,180,875 | |

| Owens-Brockway Glass Container, Inc.: | |||

| 450M | 5%, 1/15/2022 (a) | 464,625 | |

| 625M | 5.875%, 8/15/2023 (a) | 662,500 | |

| 1,875M | 5.375%, 1/15/2025 (a) | 1,910,156 | |

| 450M | 6.375%, 8/15/2025 (a) | 481,781 | |

| Sealed Air Corp.: | |||

| 875M | 4.875%, 12/1/2022 (a) | 914,918 | |

| 2,025M | 5.25%, 4/1/2023 (a) | 2,136,375 | |

| 2,175M | 6.875%, 7/15/2033 (a) | 2,376,188 | |

| 17,531,127 |

| 32 |

| Principal | |||

| Amount | Security | Value | |

| Gaming/Leisure—2.6% | |||

| $ 775M | GLP Capital, LP, 5.375%, 4/15/2026 | $ 802,125 | |

| International Game Technology, PLC: | |||

| 225M | 5.625%, 2/15/2020 (a) | 236,250 | |

| 900M | 6.25%, 2/15/2022 (a) | 965,250 | |

| 1,350M | 6.5%, 2/15/2025 (a) | 1,444,500 | |

| 525M | Lions Gate Entertainment Corp., 5.875%, 11/1/2024 (a) | 547,313 | |

| 1,800M | NCL Corp., Ltd., 4.625%, 11/15/2020 (a) | 1,847,250 | |

| 1,775M | Regal Entertainment Group, 5.75%, 3/15/2022 | 1,857,094 | |

| 1,900M | Scientific Games International, Inc., 7%, 1/1/2022 (a) | 2,033,000 | |

| 1,125M | Silversea Cruise Finance Ltd., 7.25%, 2/1/2025 (a) | 1,186,875 | |

| 4,125M | Six Flags Entertainment Corp., 5.25%, 1/15/2021 (a) | 4,242,356 | |

| 2,900M | Viking Cruises, Ltd., 6.25%, 5/15/2025 (a) | 2,784,000 | |

| 17,946,013 | |||

| Health Care—8.2% | |||

| 1,775M | Centene Corp., 6.125%, 2/15/2024 | 1,910,344 | |

| CHS/Community Health Systems, Inc.: | |||

| 1,125M | 7.125%, 7/15/2020 | 1,035,000 | |

| 950M | 5.125%, 8/1/2021 | 942,875 | |

| 2,450M | 6.25%, 3/31/2023 | 2,502,062 | |

| DaVita HealthCare Partners, Inc.: | |||

| 1,875M | 5.75%, 8/15/2022 | 1,947,656 | |

| 1,775M | 5.125%, 7/15/2024 | 1,796,078 | |

| Endo Finance, LLC: | |||

| 1,350M | 7.25%, 1/15/2022 (a) | 1,282,500 | |

| 1,575M | 6%, 7/15/2023 (a) | 1,386,000 | |

| 375M | 6%, 2/1/2025 (a) | 321,562 | |

| Fresenius Medical Care U.S. Finance II, Inc.: | |||

| 1,150M | 5.625%, 7/31/2019 (a) | 1,220,437 | |

| 675M | 4.75%, 10/15/2024 (a) | 688,500 | |

| HCA, Inc.: | |||

| 3,025M | 6.5%, 2/15/2020 | 3,318,062 | |

| 3,300M | 6.25%, 2/15/2021 | 3,570,188 | |

| 175M | 7.5%, 2/15/2022 | 200,594 | |

| 2,425M | 5.875%, 5/1/2023 | 2,625,062 | |

| 375M | 5.375%, 2/1/2025 | 391,875 | |

| 2,400M | 5.875%, 2/15/2026 | 2,538,000 | |

| HealthSouth Corp.: | |||

| 1,150M | 5.125%, 3/15/2023 | 1,155,750 | |

| 1,325M | 5.75%, 11/1/2024 | 1,341,562 | |

| 1,225M | Kindred Healthcare, Inc., 8.75%, 1/15/2023 | 1,232,656 |

| 33 |

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2017

| Principal | |||

| Amount | Security | Value | |

| Health Care (continued) | |||

| LifePoint Health, Inc.: | |||

| $2,900M | 5.875%, 12/1/2023 | $ 2,994,250 | |

| 1,175M | 5.375%, 5/1/2024 (a) | 1,197,913 | |

| Mallinckrodt Finance SB: | |||

| 1,125M | 5.75%, 8/1/2022 (a) | 1,114,313 | |

| 1,025M | 5.5%, 4/15/2025 (a) | 948,125 | |

| 2,925M | Molina Healthcare, Inc., 5.375%, 11/15/2022 | 3,047,470 | |

| 775M | MPH Acquisition Holdings, 7.125%, 6/1/2024 (a) | 835,159 | |

| 700M | RegionalCare Hospital Partners, 8.25%, 5/1/2023 (a) | 750,400 | |

| 2,275M | Tenet Healthcare Corp., 6%, 10/1/2020 | 2,411,500 | |

| 575M | Universal Health Services, Inc., 5%, 6/1/2026 (a) | 593,688 | |

| 675M | Universal Hospital Services, Inc., 7.625%, 8/15/2020 | 675,000 | |

| Valeant Pharmaceuticals International, Inc.: | |||

| 5,200M | 6.375%, 10/15/2020 (a) | 4,732,000 | |

| 1,100M | 5.625%, 12/1/2021 (a) | 891,000 | |

| 400M | 6.5%, 3/15/2022 (a) | 412,500 | |

| 1,125M | 7%, 3/15/2024 (a) | 1,157,344 | |

| 4,600M | 6.125%, 4/15/2025 (a) | 3,559,250 | |

| 56,726,675 | |||

| Information Technology—4.4% | |||

| 1,350M | Alliance Data Systems Corp., 5.375%, 8/1/2022 (a) | 1,366,875 | |

| 2,892M | Belden, Inc., 5.5%, 9/1/2022 (a) | 2,964,300 | |

| 975M | CEB, Inc., 5.625%, 6/15/2023 (a) | 1,061,531 | |

| 2,200M | CommScope Technologies Finance, LLC, 6%, 6/15/2025 (a) | 2,315,500 | |

| 2,625M | Equinix, Inc., 5.875%, 1/15/2026 | 2,798,906 | |

| 2,414M | IAC/InterActiveCorp, 4.875%, 11/30/2018 | 2,448,399 | |

| Match Group, Inc.: | |||

| 350M | 6.75%, 12/15/2022 | 367,938 | |

| 825M | 6.375%, 6/1/2024 | 895,637 | |

| 1,850M | Micron Technology, Inc., 7.5%, 9/15/2023 (a) | 2,069,688 | |

| 1,050M | Microsemi Corp., 9.125%, 4/15/2023 (a) | 1,211,438 | |

| 1,250M | MSCI, Inc., 5.75%, 8/15/2025 (a) | 1,334,375 | |

| 1,375M | Nuance Communications, Inc., 6%, 7/1/2024 (a) | 1,426,563 | |

| NXP BV: | |||

| 675M | 4.125%, 6/1/2021 (a) | 702,000 | |

| 2,650M | 3.875%, 9/1/2022 (a) | 2,716,250 | |

| 1,300M | Open Text Corp., 5.625%, 1/15/2023 (a) | 1,358,500 |

| 34 |

| Principal | |||

| Amount | Security | Value | |

| Information Technology (continued) | |||

| $1,800M | Radiate Holdco, LLC, 6.625%, 2/15/2025 (a) | $ 1,780,875 | |

| 1,225M | Sensata Technologies BV, 6.25%, 2/15/2026 (a) | 1,304,625 | |

| 2,075M | Western Digital Corp., 10.5%, 4/1/2024 | 2,451,094 | |

| 30,574,494 | |||

| Manufacturing—3.7% | |||

| 1,225M | American Greetings Corp., 7.875%, 2/15/2025 (a) | 1,292,375 | |

| 2,300M | Amkor Technology, Inc., 6.375%, 10/1/2022 | 2,383,375 | |

| 2,450M | ATS Automation Tooling Systems, Inc., 6.5%, 6/15/2023 (a) | 2,566,375 | |

| 700M | Boise Cascade Co., 5.625%, 9/1/2024 (a) | 714,000 | |

| 2,775M | Brand Energy & Infrastructure Services, Inc., 8.5%, 12/1/2021 (a) | 2,934,562 | |

| 1,575M | Cloud Crane, LLC, 10.125%, 8/1/2024 (a) | 1,685,250 | |

| 2,550M | Gates Global, LLC, 6%, 7/15/2022 (a) | 2,607,375 | |

| 2,775M | Grinding Media, Inc., 7.375%, 12/15/2023 (a) | 2,920,687 | |

| 3,075M | H&E Equipment Services, Inc., 7%, 9/1/2022 | 3,240,281 | |

| United Rentals, Inc.: | |||

| 1,675M | 5.875%, 9/15/2026 | 1,752,469 | |

| 1,475M | 5.5%, 5/15/2027 | 1,493,438 | |

| 2,050M | Zekelman Industries, Inc., 9.875%, 6/15/2023 (a) | 2,296,000 | |

| 25,886,187 | |||

| Media-Broadcasting—2.3% | |||

| Belo Corp.: | |||

| 725M | 7.75%, 6/1/2027 | 788,437 | |

| 150M | 7.25%, 9/15/2027 | 159,750 | |

| 2,225M | LIN Television Corp., 5.875%, 11/15/2022 | 2,314,000 | |

| 3,250M | Nexstar Broadcasting, Inc., 6.125%, 2/15/2022 (a) | 3,396,250 | |

| 1,350M | Nexstar Escrow Corp., 5.625%, 8/1/2024 (a) | 1,373,625 | |

| Sinclair Television Group, Inc.: | |||

| 4,075M | 5.375%, 4/1/2021 | 4,176,875 | |

| 1,575M | 5.125%, 2/15/2027 (a) | 1,527,750 | |

| Sirius XM Radio, Inc.: | |||

| 1,425M | 5.75%, 8/1/2021 (a) | 1,482,369 | |

| 625M | 6%, 7/15/2024 (a) | 671,094 | |

| 15,890,150 |

| 35 |

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2017

| Principal | |||

| Amount | Security | Value | |

| Media-Cable TV—9.4% | |||

| Altice Financing SA: | |||

| $2,525M | 6.625%, 2/15/2023 (a) | $ 2,634,837 | |

| 2,300M | 5.375%, 7/15/2023 (a) | 2,380,500 | |

| 970M | 8.125%, 1/15/2024 (a) | 1,042,750 | |

| 900M | 7.625%, 2/15/2025 (a) | 928,125 | |

| 1,000M | 5.5%, 5/15/2026 (a) | 1,030,000 | |

| 1,150M | 7.5%, 5/15/2026 (a) | 1,224,750 | |

| 1,250M | Block Communications, Inc., 6.875%, 2/15/2025 (a) | 1,328,125 | |

| 1,625M | Cable One, Inc., 5.75%, 6/15/2022 (a) | 1,694,062 | |

| CCO Holdings, LLC: | |||

| 2,950M | 5.125%, 2/15/2023 | 3,038,500 | |

| 3,675M | 5.875%, 4/1/2024 (a) | 3,886,312 | |

| 1,350M | 5.125%, 5/1/2027 (a)(b) | 1,360,125 | |

| 2,250M | 5.875%, 5/1/2027 (a) | 2,368,125 | |

| Cequel Communications Holdings I, LLC: | |||

| 4,525M | 6.375%, 9/15/2020 (a) | 4,672,062 | |

| 1,700M | 7.75%, 7/15/2025 (a) | 1,888,062 | |

| Clear Channel Worldwide Holdings, Inc. (Class “A”): | |||

| 200M | 7.625%, 3/15/2020 | 199,500 | |

| 750M | 6.5%, 11/15/2022 | 765,000 | |

| Clear Channel Worldwide Holdings, Inc. (Class “B”): | |||

| 2,250M | 7.625%, 3/15/2020 | 2,275,312 | |

| 2,375M | 6.5%, 11/15/2022 | 2,481,875 | |

| CSC Holdings, LLC: | |||

| 1,525M | 6.75%, 11/15/2021 | 1,657,484 | |

| 4,950M | 10.125%, 1/15/2023 (a) | 5,754,375 | |

| 1,250M | 6.625%, 10/15/2025 (a) | 1,362,500 | |

| 650M | 10.875%, 10/15/2025 (a) | 783,250 | |

| DISH DBS Corp.: | |||

| 4,125M | 7.875%, 9/1/2019 | 4,558,125 | |

| 950M | 5%, 3/15/2023 | 957,125 | |

| 1,750M | 5.875%, 11/15/2024 | 1,844,500 | |

| 725M | 7.75%, 7/1/2026 | 844,625 | |

| 2,400M | Gray Television, Inc., 5.875%, 7/15/2026 (a) | 2,448,000 | |

| 2,375M | Lynx II Corp., 6.375%, 4/15/2023 (a) | 2,487,813 | |

| Midcontinent Communications & Finance Corp.: | |||

| 1,000M | 6.25%, 8/1/2021 (a) | 1,045,000 | |

| 2,775M | 6.875%, 8/15/2023 (a) | 2,965,781 |

| 36 |

| Principal | |||

| Amount | Security | Value | |

| Media-Cable TV (continued) | |||

| Numericable Group SA: | |||

| $1,575M | 6%, 5/15/2022 (a) | $ 1,638,000 | |

| 1,800M | 6.25%, 5/15/2024 (a) | 1,818,000 | |

| 65,362,600 | |||

| Media-Diversified—1.4% | |||

| 1,675M | CBS Outdoor Americas Capital, 5.875%, 3/15/2025 | 1,760,844 | |

| 1,700M | Clearwater Paper Corp., 4.5%, 2/1/2023 | 1,657,500 | |

| 1,700M | Gannett Co., Inc., 5.125%, 7/15/2020 | 1,759,500 | |

| 625M | Lamar Media Corp., 5.75%, 2/1/2026 | 671,094 | |

| 975M | LSC Communication, Inc., 8.75%, 10/15/2023 (a) | 1,004,250 | |

| 2,775M | Tribune Co., 5.875%, 7/15/2022 | 2,906,813 | |

| 9,760,001 | |||

| Metals/Mining—5.7% | |||