UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. ___ )

Filed by the Registrant ⌧

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| F & M BANK CORP. |

| (Name of Registrant as Specified in its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

F & M BANK CORP.

Timberville, Virginia

Notice of Annual Meeting of Shareholders

To the Shareholders of F & M Bank Corp.

The 2023 Annual Meeting of Shareholders of F & M Bank Corp. (the “Company”) will be held on Saturday, July 29, 2023, at 5:00 p.m., Eastern Time, at The Barn at Kline’s Mill, 5379 Klines Mill Road, Linville, Virginia 22834.

At the meeting, you will be asked to consider and vote on the following proposals:

|

| 1. | Election of four (4) directors, Hannah W. Hutman, Aubrey Michael (Mike) Wilkerson, John A. Willingham and Dean W. Withers, each for a three-year term expiring in 2026. |

|

|

|

|

|

| 2. | Ratification of the appointment of Yount, Hyde & Barbour, P.C. as the Company’s independent registered public accounting firm for 2023. |

|

|

|

|

|

| 3. | An advisory vote to approve the compensation of the Company’s named executive officers, as disclosed in the accompanying Proxy Statement. |

Only shareholders of record at the close of business on May 30, 2023, are entitled to notice of and to vote at the annual meeting or any adjournments thereof.

Whether or not you plan to attend the Annual Meeting, it is important that your shares are represented and voted. Please complete, date, and sign the enclosed proxy card and return it as soon as possible in the enclosed postage prepaid envelope. You may also vote by Internet or telephone by following the instructions on the enclosed proxy card. You may amend your proxy at any time prior to the closing of the polls at the meeting.

|

|

| By Order of the Board of Directors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stephanie E. Shillingburg, Secretary |

|

June 29, 2023

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD ON JULY 29, 2023

The proxy statement and the Company’s annual report on Form 10-K for the year ended December 31, 2022

are available at fmbankva.com/investor-relations.

| 2 |

F & M BANK CORP.

205 South Main Street

Timberville, Virginia 22853

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of F & M Bank Corp. (the “Company”) to be used at the annual meeting of shareholders of the Company to be held on Saturday, July 29, 2023 at 5:00 p.m., Eastern Time, at The Barn at Kline’s Mill, 5379 Klines Mill Road, Linville, Virginia 22834 and any adjournment thereof (the “Annual Meeting”). The principal executive offices of the Company are located at 205 South Main Street, P.O. Box 1111, Timberville, Virginia 22853. The approximate mailing date of this Proxy Statement and the accompanying proxy is June 29, 2023.

The Company’s Annual Report to shareholders, including audited financial statements for the year ended December 31, 2022, is being mailed to the Company’s shareholders concurrently with this Proxy Statement, but is not part of the proxy solicitation materials.

Interested shareholders may obtain, without charge, a copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 as filed with the Securities and Exchange Commission (“SEC”), upon written request to Stephanie Shillingburg, Secretary, F & M Bank Corp., P.O. Box 1111, Timberville, Virginia 22853.

In this Proxy Statement, we refer to F & M Bank Corp. and its subsidiaries as a combined entity as the “Company,” unless the context requires otherwise or unless otherwise noted, and we refer to Farmers & Merchants Bank as the “Bank.”

OUTSTANDING SHARES AND VOTING RIGHTS

Only common shareholders of record at the close of business on May 30, 2023 will be entitled to vote at the Annual Meeting. As of May 30, 2023, the Company had outstanding 3,479,181 shares of its common stock, $5.00 par value per share (the “Common Stock”), each of which is entitled to one vote at the Annual Meeting.

Shareholders are encouraged to vote using any of the methods available to our shareholders. The Company is pleased to offer its shareholders the convenience of voting by Internet or telephone, or you may mark, sign, date and mail the enclosed proxy card in the postage-paid envelope provided. If you are a registered shareholder, you also may attend and vote in person during the Annual Meeting. “Street name” shareholders who hold their shares through a bank, broker or other nominee who wish to attend and vote during the meeting will need to contact their broker or agent to obtain a legal proxy from the institution that holds their shares.

A majority of the shares of Common Stock entitled to vote, represented at the Annual Meeting in person or by proxy, constitutes a quorum for the transaction of business at the Annual Meeting. If a share is represented for any purpose at the Annual Meeting, it is deemed to be present for purposes of establishing a quorum. Abstentions and shares held of record by a broker or its nominees on behalf of beneficial owners (Broker Shares) that are voted on any matter are included in determining the number of votes present or represented at the Annual Meeting. Conversely, Broker Shares that are not voted on any matter will not be included in determining whether a quorum is present.

If a quorum is established, directors will be elected by a plurality of the votes cast by shareholders at the Annual Meeting, and the auditors will be ratified and the advisory vote to approve the compensation of our named executive officers will be approved by a majority of the votes cast by shareholders at the Annual Meeting. Broker shares may not be cast in the election of directors or the advisory vote on executive compensation without instructions from the beneficial owner of the shares. Votes that are withheld or abstentions and Broker Shares that are not voted will not be included in determining the number of votes cast and will not have any effect on the outcome of any of the matters at the Annual Meeting.

| 3 |

All properly executed proxies delivered pursuant to this solicitation will be voted at the Annual Meeting in accordance with any instructions thereon. If you are a shareholder whose shares are registered in your name, you may revoke your proxy at any time prior to the actual voting thereof by (i) filing written notice thereof with the Secretary of the Company (Stephanie Shillingburg, Secretary, F & M Bank Corp., P.O. Box 1111, Timberville, Virginia 22853); (ii) sending in a signed proxy card with a later date or providing subsequent telephone or Internet voting instructions; or (iii) attending the Annual Meeting or any adjournment thereof and voting in person. If your shares are held by a brokerage house or nominee, please follow the instructions delivered with the notice from your broker or nominee or contact your broker or nominee for instructions on how to change or revoke your vote.

The cost of the solicitation of proxies will be borne by the Company. Solicitations will be made only by the use of mail, except that, if necessary, officers, directors and regular employees of the Company, or its affiliates, may make solicitations of proxies by telephone or email. Brokerage houses and nominees may be requested to forward the proxy solicitation material to the beneficial owners of the stock held of record by such persons, and the Company may reimburse them for their charges and expenses in this regard.

| 4 |

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth information as of May 30, 2023 regarding the number of shares of Common Stock beneficially owned by each director, each named executive officer (see “Executive Compensation”) and by all directors and executive officers as a group. Unless otherwise indicated, all shares are owned directly, and the named person possesses sole voting and sole investment power with respect to all such shares.

| Name of Beneficial Owner |

| Amount and Nature of Beneficial Ownership (1) |

|

| Percent of Class |

| ||

| Edward Ray Burkholder |

|

| 3,180 |

|

| * |

| |

| Larry A. Caplinger |

|

| 188,517 | (2) |

|

| 5.42 | % |

| Mark C. Hanna |

|

| 12,251 |

|

| * |

| |

| Hannah W. Hutman |

|

| 1,572 |

|

| * |

| |

| Anne B. Keeler |

|

| 606 |

|

| * |

| |

| Michael W. Pugh |

|

| 12,480 | (3) |

| * |

| |

| Christopher S. Runion |

|

| 6,370 | (4) |

| * |

| |

| Daphyne Thomas |

|

| 384 |

|

| * |

| |

| John A. Willingham |

|

| 9,914 |

|

| * |

| |

| Dean W. Withers |

|

| 41,355 | (5) |

|

| 1.19 | % |

| Peter H. Wray |

|

| 175,896 | (6) |

|

| 5.06 | % |

| Barton E. Black |

|

| 177,374 | (7) |

|

| 5.10 | % |

| Aubrey Michael Wilkerson |

|

| 5,190 | (8) |

| * |

| |

| Directors and executive officers as a group (18 individuals) |

|

| 299,311 | (9) |

|

| 8.60 | % |

* Represents less than 1% of the Common Stock.

(1) Based on 3,479,181 shares of Common Stock issued and outstanding on May 30, 2023. For purposes of this table, beneficial ownership has been determined in accordance with the provisions of Rule 13d-3 of the Securities Exchange Act of 1934 under which, in general, a person is deemed to be the beneficial owner of a security if he has, or shares, the power to vote, or direct the voting, of the security or the power to dispose of, or direct, the disposition of the security, or if he has the right to acquire beneficial ownership of the security within 60 days.

(2) Includes 6,443 shares owned jointly with his spouse, 6,114 shares in Mr. Caplinger’s Traditional IRA, 558 shares indirectly held for Mr. Caplinger’ s grandchildren, 361 shares in Mr. Caplinger’s Deferred Compensation Plan, and 170,905 shares owned by the Company’s Employee Stock Ownership Plan over which Mr. Caplinger has voting power in his capacity as plan trustee.

(3) Includes 10,212 shares owned jointly with his spouse, and 1,877 shares held by a simplified employee plan for Mr. Pugh’s benefit.

(4) Includes 500 shares owned jointly with his spouse, 500 shares held by Mr. Runion’s Non-Qualified Deferred Compensation Plan, 2,452 shares held in Mr. Runion’s Traditional IRA, 2,000 shares held in Mr. Runion’s Simple IRA, and 512 shares held in Heifer Investments LLC.

(5) Includes 15,441 shares held in Mr. Withers’ Traditional IRA, 704 shares held in Mr. Withers’ Roth IRA, 10,412 shares held by Mr. Withers’ Non-Qualified Deferred Compensation Plan, and 2,470 shares owned by his spouse.

(6) Includes 170,905 shares owned by the Company’s Employee Stock Ownership Plan over which Mr. Wray has voting power in his capacity as plan trustee.

(7) Includes 3,647 shares of unvested restricted stock and 170,905 shares owned by the Company’s Employee Stock Ownership Plan over which Mr. Black has voting power in his capacity as plan trustee.

(8) Includes 2,876 shares of unvested restricted stock.

(9) Includes 170,905 shares owned by the Company’s Employee Stock Ownership Plan over which Larry A. Caplinger, Barton E. Black and Peter Wray have voting power in their capacity as plan trustees, and 11,558 shares of unvested restricted stock.

| 5 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth information, as of May 30, 2023, unless otherwise noted, regarding the number of shares of Common Stock beneficially owned by all persons known by us who own, or will own under certain conditions, five percent or more of our outstanding shares of Common Stock.

| Name and Address of Beneficial Owner |

| Amount and Nature of Beneficial Ownership |

|

| Percent of Class (1) |

| ||

| Larry A. Caplinger P. O. Box 1111 Timberville, VA 22853 |

|

| 188,517 | (2) |

|

| 5.42 | % |

|

|

|

|

|

|

|

|

|

|

| Barton E. Black P. O. Box 1111 Timberville, VA 22853 |

|

| 177,374 | (3) |

|

| 5.10 | % |

| Peter H. Wray P. O. Box 1111 Timberville, VA 22853 |

|

| 175,896 | (4) |

|

| 5.06 | % |

(1) Based on 3,479,181 shares of Common Stock issued and outstanding on May 30, 2023.

(2) Includes 6,443 shares owned jointly with his spouse, 6,114 shares in Mr. Caplinger’s Traditional IRA, 558 shares indirectly held for Mr. Caplinger’ s grandchildren, 361 shares in Mr. Caplinger’s Deferred Compensation Plan, and 170,905 shares owned by the Company’s Employee Stock Ownership Plan over which Mr. Caplinger has voting power in his capacity as plan trustee.

(3) Includes 3,647 shares of unvested restricted stock and 170,905 shares owned by the Company’s Employee Stock Ownership Plan over which Mr. Black has voting power in his capacity as plan trustee.

(4) Includes 170,905 shares owned by the Company’s Employee Stock Ownership Plan over which Mr. Wray has voting power in his capacity as plan trustee.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s directors and executive officers, and any persons who own more than 10% of the Common Stock, to file with the SEC reports of ownership and changes in ownership of Common Stock. Officers and directors are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. Based solely on review of the copies of such reports furnished to the Company or written representation that no other reports were required, the Company believes that, during 2022, all filing requirements applicable to its officers and directors were timely satisfied other than one report reporting one transaction for each of Mr. Hanna, Mr. Willingham and Mr. Withers; one report reporting four transactions for Mr. Wilkerson; and one report reporting five transactions for Mr. Wray.

| 6 |

PROPOSAL ONE - ELECTION OF DIRECTORS

The Board is divided into three classes, with directors to be apportioned as evenly as possible among the classes and serving staggered three-year terms. The term of office for the Class C directors expires at the Annual Meeting. The Board has nominated such directors, namely Hannah W. Hutman, John A. Willingham, and Dean W. Withers, for re-election at the Annual Meeting. In addition, the Board has nominated Aubrey Michael (Mike) Wilkerson, who was appointed to the Board on April 10, 2023, for election as a Class C director. If elected, the Class C nominees will serve for a three-year term until the annual meeting of shareholders in 2026, or each in case until their respective successors have been duly elected and qualified.

The persons named as proxies in the accompanying form of proxy, unless instructed otherwise, intend to vote for the election of each of these nominees for directors. If any nominee should become unavailable to serve, the proxy may be voted for the election of a substitute nominee designated by the Board. The Board has no reason to believe that any of the nominees will be unable to serve if elected.

The Board of Directors recommends a vote FOR the Director nominees set forth below.

INFORMATION CONCERNING DIRECTORS AND NOMINEES

The following information, including the principal occupation during the past five years, is given with respect to the nominees, all of whom are current directors, for election to the Board at the Annual Meeting, as well as all directors continuing in office.

| 7 |

Director Nominees

Class C Directors to serve until the 2026 annual meeting of shareholders.

| Name and Age |

| Director Since |

| Principal Occupation During the Last Five Years |

| Hannah W. Hutman (42) |

| 2021 |

| Attorney, Partner at Hoover Penrod PLC, since 2015.

Ms. Hutman is a graduate of Columbia Union College and Marshall-Wythe School of Law, College of William and Mary. She has been an attorney practicing in Dayton, Ohio and Harrisonburg with experience in representing creditors, trustees and debtors in bankruptcy proceedings and insolvency matters. She has represented national and regional banks in all aspects of commercial loan transactions and collections, including restructuring obligations, asset liquidations and dispositions, and foreclosure. She is a member of the panel of Chapter 7 trustees for the Western District of Virginia. In addition, she provides legal counsel and services in entity formation and governance matters, financing transactions, contracts, and business asset transfers. She is a former Chair of the Board of Governors of the Bankruptcy Law Section for the Virginia State Bar. She is “AV” rated by Martindale-Hubbell, has routinely been listed in Super Lawyers as a Rising Star, selected as a member of Virginia’s “Legal Elite,” and included in the American Bankruptcy Institute’s 2018 class of “40 under 40.” Ms. Hutman’s skills and experience in commercial loan transactions, asset liquidations and foreclosures benefit the Company in evaluating problem loan management, bankruptcy proceedings, and governance matters.

|

| Aubrey Michael (Mike) Wilkerson (65) |

| 2023 |

| Chief Executive Officer of the Company and the Bank since April 2023; Executive Vice President/Chief Lending Officer from January 2022 to April 2023, and Executive Vice President/Chief Strategy Officer and Northern Shenandoah Valley Market Executive from January 2021 to January 2022.

A graduate of Elon University, Mr. Wilkerson began his banking career at Wachovia Bank on January 4, 1982. Mr. Wilkerson’s banking includes experience in Dealer Financial Services, Retail Banking, Private Banking, Commercial Banking, and senior strategic leadership positions. From 2012 to 2018, Mr. Wilkerson was the Business Banking Division Executive for Virginia, Maryland & Washington DC at Wachovia. More recently, Mr. Wilkerson served as the Commercial Banking Market Executive from 2018 through 2020 for the Western Mid-Atlantic Region at Wells Fargo.

|

| John A. Willingham (45) |

| 2021 |

| President of Stoneridge Companies, a real estate development and realty company based in Winchester, Virginia, since 2012, and Chief Executive Officer of Stoneridge Outdoor Living, a regional sunroom and outdoor living contractor, since 2021.

Mr. Willingham is a graduate of the Pamplin College of Business at Virginia Tech and holds a current CPA license and real estate agent license. He previously has served as a Market President and Senior Commercial Lender with Wells Fargo, Chief Financial Officer of Premier Community Bankshares Inc., and practiced in public accounting with Yount, Hyde & Barbour, P.C., and PricewaterhouseCoopers. Mr. Willingham currently serves as Chairman for the Frederick Winchester Service Authority and is a member of the Board for Grafton Integrated Health Network. He has previously served on the F&M Advisory Board for Winchester/Northern Shenandoah Valley and as a City Councilor for the City of Winchester. Mr. Willingham’s experience and expertise benefits the Company in his understanding of accounting and the Winchester real estate market.

|

| Dean W. Withers (66) |

| 2004 |

| Vice Chairman of the Company since December 2018; Chief Executive Officer of the Company and the Bank from December 2017 to June 2018; President and Chief Executive Officer of the Company and the Bank from May 2004 to December 2017; Executive Vice President of the Bank from January 2003 to May 2004; Vice President of the Bank from 1993 to 2003.

Mr. Withers has 39 years of banking experience, including 14 years as President and CEO of the Company and the Bank. He graduated from James Madison University and Graduate School of Banking at LSU. He also serves as a director of Valley Southern Title. In the past, he has served as a director in the Virginia Association of Community Banks, Virginia Bankers Association Benefits Corporation and Rockingham Memorial Hospital Foundation. Mr. Withers’ education, experience and skills as President and Chief Executive Officer and a former commercial lender benefit the Company through his understanding of bank operations, corporate governance, and lending. |

| 8 |

Directors Continuing in Office

Class A Directors to serve until the 2024 annual meeting of shareholders.

| Name and Age |

| Director Since |

| Principal Occupation During the Last Five Years |

| Anne B. Keeler (60) |

| 2019 |

| Anne Keeler is the principal of Clover Lane Advisory Services, a financial services advisory practice she launched in 2021. From 1998 to 2021, Ms. Keeler served as the Vice President for Finance and Treasurer of Bridgewater College (Bridgewater, VA), with responsibility for financial reporting, treasury and debt management, information technology, human resources, auxiliary services, and real estate.

Ms. Keeler began her career in financial services, beginning with Farm Credit as a lender and later leading a statewide agribusiness banking unit in Harrisonburg, VA for First Union Bank. She also has experience in the public higher education sector, having worked in the procurement office of James Madison University as a buyer specialist. Ms. Keeler holds a master’s degree in accounting from James Madison University and a Bachelor of Science degree from the College of Agriculture at Virginia Tech. She is a licensed Certified Public Accountant and completed the College Business Management Institute (CBMI), a continuing education certificate program for higher education administrators at the University of Kentucky. Ms. Keeler has served on the board of directors for Rockingham Insurance, a regional personal and specialty lines insurance company, since 2003; she is currently chair of the audit committee and was board chair from 2008-2010. She was a founding board member of both the Virginia Private Colleges Benefits Consortium (VPCBC) and the “Section 403(b) Defined Contribution Plan for Tax-Exempt Colleges and Universities in Virginia”. |

| Daphyne S. Thomas (69) |

| 2021 |

| Professor Emeritus, Finance & Business Law, James Madison University.

Ms. Thomas is a graduate of Virginia Tech, Washington and Lee School of Law, and James Madison University. She was a professor at JMU from 1981 to 2020 and served as the endowed Adolph Coors Professor of Business Administration chair until her retirement. She currently teaches graduate classes for James Madison University’s Executive Leadership MBA and for the Master of Accounting programs. She was a co-founder and co-director of the CyberCity Summer Program, a nationally award-winning summer technology program for middle and high school students from underrepresented populations. Ms. Thomas is a former chair of the Harrisonburg Electric Commission and the Harrisonburg Rockingham Community Services Board. She currently serves on the boards of Sunnyside Communities, The Explore More Children’s Museum, The Community Services Board Halfway House, The JMU College of Visual and Performing Arts Advisory Board, The Harrisonburg Rockingham Child Daycare Center and The Community Foundation of Harrisonburg Rockingham Grants and Scholarship committee. Ms. Thomas’ education and experience in business law and accounting and previous board service uniquely benefits the Company. |

| Peter H. Wray (54) |

| 2017 |

| President of Wray Realty, Inc., and Principal Broker of Triangle Realtors since 2002. Owner/Partner in multiple commercial real estate developments throughout central and western Virginia.

Mr. Wray specializes in commercial and investment real estate. He holds a Bachelor of Arts in Environmental Science from the University of Virginia. Mr. Wray is a licensed Broker in Virginia and North Carolina. He is a member of multiple professional organizations including the National Association of Realtors (NAR), the Virginia Association of Realtors (VAR), Shenandoah Valley Economic Partnership (SVEP), International Council of Shopping Centers (ICSC) and the Certified Commercial Investment Members (CCIM). He is a member of the Board of Directors for the Shenandoah Valley First Tee Program. Mr. Wray has assisted with some of the region’s most successful commercial real estate projects. He has represented many local, regional, and national companies with their purchasing, sales, leasing, and development requirements. Mr. Wray has completed a wide array of commercial real estate transactions from office, industrial, and multifamily to shopping centers, self-storage, and hotels. He has considerable experience with every aspect of new construction, rezoning, transportation issues, and commercial real estate financing. Mr. Wray’s experience in the commercial real estate industry benefits the company in evaluating commercial loan requests and identifying new areas for loan portfolio growth. |

| 9 |

Directors Continuing in Office

Class B Directors to serve until the 2025 annual meeting of shareholders.

| Name and Age |

| Director Since |

| Principal Occupation During the Last Five Years |

| Edward Ray Burkholder (49) |

| 2015 |

| Executive Senior Vice President of Balzer and Associates, Inc. since 2012.

Mr. Burkholder holds a Bachelor of Landscape Architecture from Virginia Tech and acquired his Virginia State Professional Certification in Landscape Architecture in 2000. Mr. Burkholder has held many positions within Balzer and Associates since 1997. In 2003, he opened a branch office in Staunton after working in the Richmond market for seven years. His key roles have involved master planning, land development consulting, rezoning, highest and best use land analysis and studies, overseeing local and regional land development projects, and corporate management as a director of the board. For the past six years, he either has served or is serving as a director for Victory Worship Center, Staunton Rotary, and Augusta Home Builders Association. Other memberships included the Virginia Economic Development Association, Shenandoah Valley Partnership, and Augusta Chamber of Commerce. Mr. Burkholder’s experience benefits the Company due to his vast diversity of land development projects and understanding of local and state land use regulatory requirements.

|

| Larry A. Caplinger (70) |

| 2012 |

| Executive Vice President of the Company from November 2007 until his retirement in December 2018. Mr. Caplinger has held several positions with the Company and the Bank over his 46-year career, including as Corporate Secretary from January 1992 to January 2019; Executive Vice President and Chief Projects Officer from January 2018 to December 2018; Executive Vice President and Chief Lending Officer of the Company and the Bank from November 2007 to January 2018; Senior Vice President of the Company from April 2002 until November 2007; and Senior Vice President of the Bank from May 1990 to November 2007.

Mr. Caplinger graduated from Blue Ridge Community College with an Associate Degree in Accounting. Mr. Caplinger is also a graduate of Virginia Bankers Association School of Bank Management and the ABA Agricultural Lending School. He has completed various classes from American Institute of Banking. He serves as a director of F&M Mortgage and Valley Southern Title. Mr. Caplinger is a Life Member of the Timberville Volunteer Fire Department. His education, skills, and experience as Executive Vice President and Chief Lending Officer continue to benefit the Company through his understanding of the agri-business industry, lending, and bank operations.

|

| Michael W. Pugh (68) |

| 1994 |

| Chairman of the Board of the the Company and the Bank since December 2018.

President of Old Dominion Realty, Inc.

Mr. Pugh has been President of Old Dominion Realty, Inc. for 43 years. He was issued a Virginia Certified General Appraisal license in 1992, a Virginia real estate broker’s license in 1976 and a West Virginia real estate broker’s license in 1982. He has completed numerous classes and certifications related to the real estate field. He has served as a director in the following entities: Bankers Title Shenandoah, F&M Mortgage, Valley Southern Title, Old Dominion Realty, Inc., and Sunnyside Retirement Communities. Mr. Pugh’s skills and experience relating to real estate sales, development and appraisals benefit the Company in evaluating real estate investments and collateral values for real estate loans.

|

| Christopher S. Runion (64) |

| 2010 |

| President of Eddie Edwards Signs, Inc. and managing member of Heifer Investments, L.L.C.

Mr. Runion has served in these capacities for over 25 years. In 2019, Mr. Runion was elected to the Virginia House of Delegates, serving the 25th District representing portions of Rockingham, Augusta, and Albemarle counties. He holds a Bachelor of Science – Accounting from Virginia Tech and a Masters – Business Administration from James Madison University. He is serving or has served as a director in the following entities during the past five years: Shenandoah Valley Economic Education, Inc., Rotary Club of Harrisonburg, Lantz Construction Company, Rockingham Mutual Insurance Companies, and Rockingham Development Corporation. Mr. Runion is a former member of the Rockingham County Planning Commission. He has also been involved in farming his entire life. Mr. Runion’s education, skills and experience relating to commercial and institutional business activity benefit the Company in evaluating various business opportunities and scenarios. |

| 10 |

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS

General

The business and affairs of the Company are managed under the direction of the Board of Directors in accordance with the Virginia Stock Corporation Act and the Company’s Articles of Incorporation and Bylaws. Members of the Board are kept informed of the Company’s business through discussions with the Chairman of the Board, the Chief Executive Officer, and other officers, by reviewing materials provided to them and by participating in meetings of the Board and its committees.

Board Leadership

The Board of Directors is currently made up of eleven members, including eight outside directors and three current or former officers of the Company. The Board leadership structure includes the Chairman of the Board and Vice Chairman of the Board, neither of whom currently serve as the principal executive officer of the Company. The Board does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board, as the Board believes it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. The Board has determined that having an independent director serve as Chairman is in the best interest of the Company’s shareholders at this time. This structure encourages a greater role for the independent directors in the oversight of the Company and active participation of the independent directors in setting agendas and establishing Board priorities and procedures. Further, this structure permits the Chief Executive Officer to focus on the management of the Company’s day-to-day operations.

Risk Oversight

The Board has appointed several committees of the Company and the Bank, including Audit, Asset/Liability (ALCO), Compensation, Operational Risk, and Corporate Governance. In addition to the Board’s overall policy making authority and risk management responsibilities, these committees are delegated authority with respect to their various areas of operation. One area of significant risk to financial institutions revolves around the risks associated with the monitoring of existing and proposed loan relationships. The Board receives a number of monthly and quarterly reports that assist in tracking and mitigating lending risk. The Board has also established an Executive Loan Committee which convenes periodically, either in person or virtually, to consider new loan requests. In addition, the Compensation Committee is responsible for reviewing the Bank’s compensation policies and practices as they relate to risk-taking and risk management.

Code of Ethics

The Company has adopted a broad-based code of ethics for all employees and directors. The Company has also adopted a code of ethics tailored to senior officers who have financial responsibilities. A copy of the codes may be obtained without charge by request from the corporate secretary.

Independence of Directors

The Board of Directors in its business judgment has determined that the following nine of its 12 members during 2022 are independent as defined by the listing standards of the Nasdaq Stock Market (“Nasdaq”): Edward Ray Burkholder, Daniel J. Harshman, Anne B. Keeler, Hannah W. Hutman, Michael W. Pugh, Christopher S. Runion, Daphyne S. Thomas, John A. Willingham, and Peter H. Wray.

In determining that the above directors are independent within Nasdaq listing standards, the Board considered that the Bank conducts business with several of our directors from time to time, including Edward Ray Burkholder (engineering expertise), Michael Pugh (real estate appraisal services, sales and leasing), Christopher Runion (signage), Peter Wray (real estate sales and leasing), Hannah Hutman (legal services), Daphyne Thomas (education), and John Willingham (real estate services and sales). Mr. Caplinger, Mr. Hanna, and Mr. Withers are not considered independent due to their recent employment relationships with the Company. Mr. Wilkerson was appointed to the Board in April 2023 and is not considered independent due to his current employment by the Company. Other than those described above and under “Certain Relationships and Related Transactions,” the Board of Directors did not consider any transactions, relationships, or arrangements in determining director independence.

| 11 |

Board and Committee Meeting Attendance

There were twelve meetings of the Board of Directors of the Company in 2022. Each director attended greater than 75% of the aggregate number of meetings of the Board of Directors and meetings of committees of which the director was a member in 2022. The Board of the Bank, which met twelve times in 2022, primarily manages all matters for the Bank. All the directors of the Company are also directors of the Bank.

Committees of the Board

The Company has an Audit Committee. The Company does not have a standing Compensation Committee; however, the Bank has a Compensation Committee. Since compensation is paid through the Bank, the Bank’s Compensation Committee evaluates compensation policies and makes recommendations to the Company’s Board. These recommendations are considered for approval by the independent directors of the Company.

The Company does not have a standing nominating committee. Other standing committees for the Bank include the ALCO Committee, Operational Risk Committee, Corporate Governance Committee, and Building Committee.

Audit Committee

The Audit Committee assists the Board of Directors in fulfilling the Board’s oversight responsibility to the shareholders relating to the integrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements, the qualifications, independence and performance of the Company’s independent auditors and the performance of the internal audit function. The Audit Committee is responsible for the appointment, compensation, retention, and oversight of the work of the independent auditors engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attestation services for the Company. The Board of Directors has adopted a written charter for the Audit Committee which can be found on our website at www.fmbankva.com/About/Investor-Relations.

The members of the Audit Committee are Anne B. Keeler, Christopher S. Runion, Daphyne S. Thomas, John A. Willingham, and Peter H. Wray, each of whom the Board in its business judgment has determined are independent as defined by Securities and Exchange Commission (“SEC”) regulations and the listing standards of Nasdaq. The Board of Directors also has determined that all the members of the Audit Committee have sufficient knowledge in financial and auditing matters to serve on the Audit Committee and that Mr. Runion qualifies as an audit committee financial expert as defined by SEC regulations.

The Audit Committee met five times in 2022. For additional information regarding the Audit Committee, see “Audit Information-Audit Committee Report” on page 31 of this Proxy Statement.

Compensation Committee

The Bank’s Compensation Committee reviews executive officers’ performance and compensation, reviews and sets guidelines for compensation of all employees and makes compensation recommendations to the Board. All recommendations of the Bank’s Compensation Committee relating to the compensation of our executive officers are reported to the Company’s Board of Directors for approval by the independent directors. The Board of Directors has adopted a written charter for the Compensation Committee which can be found on our website at www.fmbankva.com/About/Investor-Relations.

The members of the Bank’s Compensation Committee during 2022 were Edward Ray Burkholder, Daniel J. Harshman, Anne B. Keeler, Michael W. Pugh, and Peter H. Wray. Each of the members are independent as defined by the SEC regulations and the listing standards of Nasdaq. The Compensation Committee met four times in 2022.

| 12 |

Corporate Governance Committee

The Bank’s Corporate Governance Committee assists the Board of Directors in its oversight of matters of corporate governance, including (i) identifying individuals qualified to become Board members, recommending director nominees to the Board, and development of advisory board groups, (ii) oversight of board succession planning and board committee assignments, (iii) development and administration of CEO performance evaluation, and (iv) reviewing and reporting to the Board on matters of corporate governance and developing and recommending to the Board corporate governance principles applicable to the Company. The Board of Directors has adopted a written charter for the Corporate Governance Committee which can be found on our website at www.fmbankva.com/About/Investor-Relations.

The members of the Bank’s Corporate Governance Committee during 2022 were Larry A. Caplinger, Daniel J. Harshman, Michael W. Pugh, Dean W. Withers, Mark Hanna, Anne B. Keeler, and Hannah W. Hutman. The Corporate Governance Committee met four times in 2022.

Director Nomination Process

The Bank’s Corporate Governance Committee, among other things, is responsible for seeking and identifying individuals qualified to become Board members, overseeing the evaluation of Board candidates, and recommending director nominees to the Board for election.

Should the Board or Corporate Governance Committee decide to fill a board position, the Committee would look to the following list of director qualifications and consider these qualifications in developing a pool of potential nominees from the communities served by the Company. The Corporate Governance Committee is responsible for evaluating the background and qualifications of any candidates for the Board and recommending candidates to the Board. The Corporate Governance Committee and the Board also consider potential nominees submitted by shareholders.

The Corporate Governance Committee considers, at a minimum, the following factors in evaluating new candidates for election to the Board, as well as the continued service of existing directors:

|

| · | The ability of the prospective nominee to represent the interests of the shareholders of the Company; |

|

| · | The prospective nominee’s standards of integrity, commitment, and independence of thought and judgment; |

|

| · | The prospective nominee’s ability to dedicate sufficient time, energy, and attention to the diligent performance of his or her duties, including the prospective nominee’s service on other public company boards; and |

|

| · | The extent to which the prospective nominee contributes to the range of talent, skill, and expertise appropriate for the Board of Directors. |

Shareholders entitled to vote for the election of directors may submit candidates for formal consideration by the Company in connection with an annual meeting of shareholders by providing the Company with timely written notice, in proper form, for each such recommended director nominee. If the notice is not timely and in proper form, the nominee will not be considered by the Company. To be timely for the 2024 annual meeting, the notice must be received within the time frame set forth in “Shareholder Proposals” on page 32 of this Proxy Statement. To be in proper form, the notice must include each nominee’s written consent to be named as a nominee and to serve, if elected, and information about the shareholder making the nomination and the person nominated for election. These requirements are more fully described in Section 2.5 of the Company’s Bylaws, a copy of which will be provided, without charge, to any shareholder upon written request to the Secretary of the Company, whose address is P. O. Box 1111, Timberville, Virginia 22853.

While the Company does not have a diversity policy, we consider the diversity of the Board based on a number of factors including the geographic locations of potential directors within our branch network, educational background, and work experience.

| 13 |

Annual Meeting Attendance

The Company encourages members of the Board of Directors to attend the annual meeting of shareholders. All the directors attended the 2022 virtual annual meeting.

Communications with Directors

Any director may be contacted by writing to him or her c/o P. O. Box 1111, Timberville, Virginia 22853. Communications to the non-management directors as a group may be sent to the same address, c/o the Secretary of the Company. The Company promptly forwards, without screening, all such correspondence to the indicated directors.

Anti-Hedging Policy

The Company currently does not have any policies with respect to financial instruments or transactions in derivative securities or otherwise that hedge or offset any decrease in the market value of the Common Stock.

Director Compensation

The following table provides compensation information for the year ended December 31, 2022 for each non-employee director of the Company’s Board of Directors:

|

|

| Fees Earned or Paid in Cash ($) |

|

| Stock Awards(1) ($) |

|

| Total ($) |

| |||

| Edward Ray Burkholder |

| $ | 44,235 |

|

| $ | 3,825 |

|

| $ | 48,060 |

|

| Larry A. Caplinger |

|

| 44,735 |

|

|

| 3,825 |

|

|

| 48,650 |

|

| Daniel J. Harshman |

|

| 43,435 |

|

|

| 3,825 |

|

|

| 47,260 |

|

| Hannah W. Hutman |

|

| 39,998 |

|

|

| 1,573 |

|

|

| 41,571 |

|

| Anne B. Keeler |

|

| 43,785 |

|

|

| 3,825 |

|

|

| 47,610 |

|

| Michael W. Pugh |

|

| 50,535 |

|

|

| 3,825 |

|

|

| 54,360 |

|

| Christopher S. Runion |

|

| 41,885 |

|

|

| 3,825 |

|

|

| 45,710 |

|

| Daphyne Thomas |

|

| 41,298 |

|

|

| 1,573 |

|

|

| 42,871 |

|

| John A. Willingham |

|

| 40,798 |

|

|

| 1,573 |

|

|

| 42,371 |

|

| Dean W. Withers |

|

| 43,835 |

|

|

| 3,825 |

|

|

| 47,660 |

|

| Peter H. Wray |

|

| 43,835 |

|

|

| 3,825 |

|

|

| 47,660 |

|

(1) The amounts represent the grant date fair value of the awards calculated in accordance with the Financial Accounting Standards Board’s Accounting Standards Codification Topic 718, Compensation – Stock Compensation. Assumptions used in the calculation of these amounts are included in Note 12 of the Company’s audited financial statements contained in the Annual Report on Form 10-K for the year ended December 31, 2022.

All non-employee directors of the Company, who are also directors of the Bank, received $1,200 for each Board meeting attended, $400 for each ALCO, Operational Risk, Compensation, and Corporate Governance Committee meeting attended and $500 for each Audit Committee meeting attended. Since the Company and Bank board meetings are held on the same day, members are only paid one fee of $1,200 for their attendance at the combined meeting. In addition to meeting fees, each non-employee director received a quarterly retainer of $5,000 to compensate for time spent on bank-related activities outside the normal meeting structure.

| 14 |

In addition to cash compensation, non-employee members of the Board of Directors received stock awards in accordance with the Company’s 2020 Stock Incentive Plan.

Mark C. Hanna, the Company’s former President and Chief Executive Officer, is not included in the table above as he received no compensation for his services as a director. The compensation received by Mr. Hanna as an employee is shown in the Summary Compensation Table.

Executive Officers Who Are Not Directors

Barton E. Black, 52, has served as the President of the Bank and the Company since April 2023. Prior to that he served as the Executive Vice President/Chief Operating Officer of the Bank and the Company from June 2020 to April 2023 and as Executive Vice President/Chief Strategy & Risk Officer March 2019 to May 2020. Prior to joining the Company, he served as Managing Director at Strategic Risk Associates, a financial services consulting company based in Virginia, from August 2012 through February 2019.

Lisa F. Campbell, 55, has served as Executive Vice President/Chief Financial Officer of the Company and the Bank since October 2022. Prior to joining the Company, she served as Group Vice President and Chief Financial Officer for Fidelity Bancshares N.C., Inc. in Fuquay-Varina, North Carolina from August 2014 to October 2022. Previously, she served as Executive Vice President, Chief Operating Officer and Chief Financial Officer for New Century Bancorp, Inc. in Dunn, North Carolina from March 2000 to August 2014 and as Senior Vice President and Controller for Triangle Bancorp, Inc. in Raleigh, North Carolina from September 1997 to March 2000. Ms. Campbell also worked in public accounting from September 1990 through September 1997.

Charles C. Driest, 45, has served as Executive Vice President, Chief Experience Officer since April 2023. Prior to that he served as Senior Vice President, Director of Digital Banking of the Bank and the Company from January 2022 to April 2023. Prior to joining the company, he served as Senior Vice President, Director of Digital Banking at Essex Bank from July 2017 to January 2022. Charles holds a Master of Business Administration (MBA) – Finance from St. John’s University.

Paul E. Eberly, 41, has served as Executive Vice President/Chief Development Officer since September 2022. Executive Vice President/Chief Credit Officer from September 2020 to August 2022, Senior Vice President/Agricultural & Rural Programs Leader from January 2020 until September 2020, and Vice President/Agricultural & Rural Programs Leader from January 2019 until January 2020. He also served in various sales, lending, credit, risk management and other leadership roles within the Farm Credit System from June 2005 until January 2019. Mr. Eberly has been in the banking and finance industry since 2005.

Melody Emswiler, 49, has served as Executive Vice President/Chief Human Resources Officer since January 2022, Senior Vice President/Human Resources Director from January 2019 to December 2021, Vice President/Director of Human Resources from February 2015 to December 2018, and Assistant Vice President/Human Resources Manager from February 2011 to January 2015. Ms. Emswiler has been in the human resources profession since 1997.

Kevin Russell, 46, has served as the Executive Vice President/President of Mortgage, Title and Financial Services at the Bank and the Company since June 16, 2020. Prior to that he served as the President of F&M Mortgage since 2000.

Jason C. Withers, 40, has served as Executive Vice President/Chief Credit Officer since September 2022, and Senior Vice President/Credit Manager since March 2021. Prior to joining the Company, he served as a Senior Credit Analyst at Blue Ridge Bank from April 2017 to March 2021, and as a Credit Analyst for CresCom Bank from March 2010 to March 2017.

| 15 |

EXECUTIVE COMPENSATION

Summary Compensation

The Summary Compensation Table below sets forth the compensation of the Company’s named executive officers for all services rendered to the Company and the Bank for 2022. See the Summary of Compensation Policies beginning on page 22 of this Proxy Statement for further information regarding our compensation program, including summaries of the Company’s employment agreements and other compensation arrangements.

SUMMARY COMPENSATION TABLE

| Name and Principal Position |

| Year |

| Salary ($) |

|

| Stock Awards ($) (1) |

|

| Non-Equity Incentive Plan Compensation ($) (2) |

|

| All Other Compensation ($) (3) |

|

| Total ($) |

| |||||

| Mark C. Hanna |

| 2022 |

|

| 427,359 |

|

|

| 81,999 |

|

|

| 86,547 |

|

|

| 61,790 |

|

|

| 657,695 |

|

| Former President and CEO |

| 2021 |

|

| 414,853 |

|

|

| 78,110 |

|

|

| 106,210 |

|

|

| 58,352 |

|

|

| 657,525 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Barton E. Black (4) |

| 2022 |

|

| 285,388 |

|

|

| 40,938 |

|

|

| 57,617 |

|

|

| 51,526 |

|

|

| 435,469 |

|

| President |

| 2021 |

|

| 275,414 |

|

|

| 38,975 |

|

|

| 70,707 |

|

|

| 55,066 |

|

|

| 440,162 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aubrey M. (Mike) Wilkerson (5) |

| 2022 |

|

| 263,440 |

|

|

| 37,483 |

|

|

| 56,445 |

|

|

| 45,638 |

|

|

| 403,006 |

|

| Chief Executive Officer |

| 2021 |

|

| 241,416 |

|

|

| 8,640 |

|

|

| 64,750 |

|

|

| 29,945 |

|

|

| 344,751 |

|

____________

| (1) | The amounts represent the grant date fair value of the awards calculated in accordance with the Financial Accounting Standards Board’s Accounting Standards Codification Topic 718, Compensation – Stock Compensation. Awards consist of time-based restricted stock that vest over a period of four years. Assumptions used in the calculation of these amounts are included in Note 12 of the Company’s audited financial statements contained in the Annual Report on Form 10-K for the year ended December 31, 2022. |

| (2) | The amounts in this column represent non-equity incentive plan compensation pursuant to the Executive Incentive Plan approved for the year listed; however, the actual payments were not made until after the end of each year. |

| (3) | The amounts in this column are detailed in the table titled “All Other Compensation” below. |

| (4) | Mr. Black served as Executive Vice President/Chief Operating Officer during 2022 and was appointed President in April 2023. |

| (5) | Mr. Wilkerson served as Executive Vice President/Chief Lending Officer during 2022 and was appointed Chief Executive Officer in April 2023. |

ALL OTHER COMPENSATION

FISCAL YEAR 2022

| Name |

| 401(k) Company Contribution ($) |

|

| Company ESOP Contribution ($) (1) |

|

| Company Deferred Compensation Contribution ($) (2) |

|

| Life Insurance Premiums ($) (3) |

|

| Restricted Stock Dividends ($) (4) |

|

| Personal and Other Benefits ($) (5) |

|

| Total ($) |

| |||||||

| Mark C. Hanna |

|

| 7,059 |

|

|

| 10,150 |

|

|

| 25,835 |

|

|

| 1,448 |

|

|

| 3,781 |

|

|

| 13,516 |

|

|

| 61,790 |

|

| Barton E. Black |

|

| 9,418 |

|

|

| 10,150 |

|

|

| 17,199 |

|

|

| 963 |

|

|

| 1,888 |

|

|

| 11,908 |

|

|

| 51,526 |

|

| Aubrey M. (Mike) Wilkerson |

|

| 7,880 |

|

|

| 10,150 |

|

|

| 15,900 |

|

|

| 588 |

|

|

| 1,166 |

|

|

| 9,954 |

|

|

| 45,638 |

|

____________

| (1) | The Company has established an Employee Stock Ownership Plan that covers all eligible full and part-time employees, including the executive officers. The plan serves as a long-term incentive for employees to promote the achievement of goals which create value for our shareholders. See Employee Stock Ownership Plan on page 26 of this Proxy Statement for further details. |

| (2) | The Company has established a nonqualified deferred compensation plan for the benefit of our directors and certain employees, including the executive officers, to defer receipt of salary or bonus payments. See Deferred Compensation Plan on page 25 of this Proxy Statement for further details. |

| (3) | The amounts in this column represent the annual premium of group term life insurance with a death benefit equal to three times annual compensation. |

| (4) | The amounts in this column represent dividends received during 2022 on unvested shares of restricted stock. Under the 2020 Stock Incentive Plan, holders are entitled to dividends from the grant date through the vesting period. |

| (5) | The amounts in this column include personal use of a company vehicle, bank-owned life insurance premiums and country club dues. |

| 16 |

Holdings of Stock Awards

The following table contains certain information regarding the value of restricted stock awards for each of the Company’s named executive officers as of December 31, 2022.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

|

|

|

| Stock Awards |

| ||||||

| Name |

| Grant Date |

| Number of Shares or Units of Stock that Have Not Vested (#) (1) |

|

| Market Value of Shares or Units of Stock that Have Not Vested ($) (2) |

| ||

| Mark C. Hanna |

| 3/5/2021 |

|

| 2,190 |

|

|

| 50,085 |

|

|

|

| 3/7/2022 |

|

| 2,658 |

|

|

| 60,788 |

|

|

|

|

|

|

|

|

|

|

| ||

| Barton E. Black |

| 3/5/2021 |

|

| 1,093 |

|

|

| 24,997 |

|

|

|

| 3/7/2022 |

|

| 1,327 |

|

|

| 30,348 |

|

|

|

|

|

|

|

|

|

|

| ||

| Aubrey M. (Mike) Wilkerson |

| 3/5/2021 |

|

| 280 |

|

|

| 6,404 |

|

|

|

| 3/7/2022 |

|

| 1,215 |

|

|

| 27,787 |

|

|

| (1) | These amounts are comprised of unvested shares of time-based restricted stock at December 31, 2022. All shares granted vest over a four-year period whereby the executive receives one-fourth of the shares on the anniversary of the grant date if that executive is employed on the anniversary date. |

|

| (2) | These amounts represent the fair market value of the restricted stock awards on December 31, 2022. The closing price of the Common Stock was $22.87 on that date. |

Equity Compensation Plan Information

The following table summarizes information, as of December 31, 2022, relating to the Company’s stock-based compensation plans under which shares of Common Stock are authorized for issuance.

| Plan Category | Number of Shares to Be Issued Upon Exercise of Outstanding Options, Warrants and Rights |

| Weighted Average Exercise Price of Outstanding Options, Warrants and Rights |

| Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans |

|

| Equity Compensation Plans |

|

|

|

|

|

|

| Approved by Shareholders: |

|

|

|

|

|

|

| 2020 Stock Incentive Plan | - |

| - |

| 161,231 |

|

|

|

|

|

|

|

|

|

| Equity Compensation Plans Not Approved by Shareholders: (1) | - |

| - |

| - |

|

|

|

|

|

|

|

|

|

| Total | - |

| - |

| 161,231 |

|

| (1) | The Company does not have any equity compensation plans that have not been approved by shareholders. |

| 17 |

Summary of Compensation Policies

Overview. This section provides information regarding the compensation program in place during 2022 for Mark Hanna, our former President/CEO, Aubrey M. (Mike) Wilkerson, our current Chief Executive Officer, and Barton E. Black, our current President, collectively referred to as our “named executive officers.” This section includes information regarding the overall objectives of our compensation program and each element of compensation that we provide.

The independent members of our Board of Directors administer the Company’s executive compensation program based on the recommendations of the Bank’s Compensation Committee, which the Company’s independent directors review and approve. The Bank’s Compensation Committee operates under a written charter approved by the Board.

General Compensation Objectives. The overall objectives of our executive compensation program are to provide a compensation package intended to attract, motivate, and retain qualified executives and to provide them with incentives to achieve our annual goals and to increase shareholder value. We recognize the need to implement sound principles to develop and administer compensation and benefit programs that appropriately align executive pay, the achievement of Company goals and objectives and the best interests of our shareholders.

To assist in its review, the Compensation Committee obtains and reviews certain industry data, including a Janney Montgomery Scott, LLC report of peer banks in Virginia and adjoining states that met certain asset and performance characteristics (the “peer group”).

We rely upon our judgment in making sound compensation decisions, after reviewing the performance of the Company and carefully evaluating the executive’s performance during the year against established goals, leadership qualities, operational performance, business responsibilities, career with the Company, current compensation arrangements and long-term potential to enhance shareholder value. Specific factors affecting compensation decisions for the named executive officers include:

|

| · | Financial measures, such as net profit, return on equity, return on assets and efficiency ratio, relative to the peer group; |

|

| · | Strategic objectives, such as the establishment of new branch offices; |

|

| · | Launching new or improved products that help us reach our goals of being a market leader and attracting and retaining customers; |

|

| · | Achievement of specific operational goals for the Company, including improved productivity, risk management or portfolio management goals; |

|

| · | Achieving excellence in their organizational structure and among their employees; and |

|

| · | Supporting our corporate values by promoting integrity through compliance with laws and regulations. |

We generally do not strive for rigid formulas or react to short-term changes in business performance in determining the amount or mix of compensation and benefits. The mix of compensation elements is based on the review of the factors outlined above to provide the executive with a combination of salary, non-equity incentives and long-term equity and other compensation commensurate with responsibilities and competitive with other banks of comparable size and characteristics.

While we consider the compensation paid by others, we do not attempt to maintain a certain target percentile within those peer groups.

Consideration of Say on Pay Vote Results. At the Company’s 2022 annual meeting of shareholders, the Company’s shareholders overwhelmingly approved the annual non-binding advisory vote on executive compensation, receiving approximately 94% support. We believe that these results reinforce shareholder support for our compensation philosophy and the appropriateness of our compensation structure.

| 18 |

Base Salaries. Our policy is to provide salaries that we believe are necessary to attract and retain qualified executives. The objective of the base salary is to reflect job responsibilities, value to the Company and individual performance with respect to the Company’s goals and objectives. The salaries of the executive officers are reviewed on an annual basis, as well as at the time of a promotion or other change in responsibilities. Increases in salary are based on an evaluation of the individual’s performance and level of pay compared to industry peers. With regard to discussion and determination of named executive officers’ compensation, we exclude the Chief Executive Officer from discussion of his compensation.

Executive Incentive Plan. Executive officers may earn an annual incentive award that is a predetermined percentage of total base salary. The components of the Executive Incentive Plan as approved by the Compensation Committee during 2022 were: percentage of non-performing assets to strategic goal, percentage 30+ days delinquent to strategic goal excluding nonaccrual, net income, total demand deposit growth, total deposit growth, total loan growth, and a discretionary component around personal, department, and corporate performance. Achievement levels for the components are predetermined around the annual budget amounts considering achievements that are above, below, and on budget. The maximum opportunity an executive could earn in 2022 was 35% of base salary.

Equity Compensation. The Compensation Committee may provide equity compensation to employees, directors, and consultants pursuant to the 2020 Stock Incentive Plan. The plan makes available up to 200,000 shares of Common Stock for the granting of stock options, restricted stock and other stock awards, restricted stock units, and stock appreciation rights.

Equity compensation has been made to executive officers in the form of restricted stock, which is vested over a four-year period whereby the executive receives one-fourth of the shares on each anniversary of the grant date if that executive is employed on such anniversary date. The goal of the Compensation Committee in granting equity compensation is to stimulate the efforts of employees, directors and consultants upon whose judgment, interest, and efforts the Company depends for the successful conduct of its businesses and to further align those persons’ interests with the interests of the Company’s shareholders. Further, these restricted stock awards represent long-term compensation designed to enhance retention of the named executive officers.

On March 7, 2022, the Company granted restricted stock awards with respect to 2,658, 1,215 and 1,327 shares to Mr. Hanna, Mr. Wilkerson, and Mr. Black, respectively.

Employment Agreements. The Company has entered into employment agreements with its named executive officers, as summarized below.

Mark C. Hanna. The Company entered into an employment agreement on December 30, 2020. Mr. Hanna’s separation from the Company and the Bank was effective April 10, 2023.

Mr. Hanna’s employment agreement provides for payment of: (i) his then-current base salary for the greater of the remainder of the term or 12 months, (ii) any bonus or other short-term incentive compensation earned in connection with certain termination events, but not yet paid, for prior years and (iii) a welfare continuance benefit in an amount equal to 12 times the excess of COBRA premiums that would apply as of Mr. Hanna’s date of termination for continued health, dental and vision coverage, if COBRA continuation were elected for such coverage, over the amount that he paid for such coverage immediately before his termination of employment.

Mr. Hanna’s employment agreement contains restrictive covenants relating to the protection of confidential information, non-disclosure, non-competition and non-solicitation. The non-compete and non-solicitation covenants generally continue for a period of 18 months following the last day of Mr. Hanna’s employment.

Barton E. Black. The term of Mr. Black’s employment agreement began on December 30, 2020 and initially continued until December 31, 2021. On December 31, 2020, and each December 31 thereafter, the term of the agreement shall be renewed and extended by one year, such that the extended term of his agreement on such anniversary is two years, unless either Mr. Black or the Company gives advance notice to the other in writing.

| 19 |

Mr. Black’s employment agreement provides for the termination of Mr. Black’s employment by the Company without “Cause” or by him for “Good Reason” in the absence of a “Change of Control” (as those terms are defined in the agreement). In such cases, Mr. Black will be entitled to receive (i) his then-current base salary for the greater of the remainder of the term or 12 months, (ii) any bonus or other short-term incentive compensation earned, but not yet paid, for prior years and (iii) a welfare continuance benefit in an amount equal to 12 times the excess of COBRA premiums that would apply as of Mr. Black’s date of termination for continued health, dental and vision coverage, if COBRA continuation were elected for such coverage, over the amount that he paid for such coverage immediately before his termination of employment. Mr. Black’s employment agreement also provides for the termination of Mr. Black’s employment by the Company following a “Change of Control” or by him for “Good Reason” following a “Change of Control.” In such cases, Mr. Black will be entitled to receive, among other things, a lump sum amount equal to (i) the welfare continuance benefit described above, substituting 24 for 12 and (ii) 2.99 times the sum of his base salary and the greater of his target annual bonus or actual annual bonus for the most recent year. Mr. Black’s entitlement to the foregoing severance payments is subject to Mr. Black’s release and waiver of claims against the Company and his compliance with certain restrictive covenants as provided in the employment agreement.

Mr. Black will not be entitled to any compensation or other benefits under his employment agreement if his employment is terminated upon his death, by the Company for “Cause,” or by him in the absence of “Good Reason.”

Mr. Black’s employment agreement contains restrictive covenants relating to the protection of confidential information, non-disclosure, non-competition and non-solicitation. The non-compete and non-solicitation covenants generally continue for a period of 18 months following the last day of Mr. Black’s employment.

Aubrey M. (Mike) Wilkerson. The term of Mr. Wilkerson’s employment agreement began on January 4, 2021, and initially continued until December 31, 2022. On December 31, 2021, and each December 31 thereafter, the term of the agreement shall be renewed and extended by one year, such that the extended term of his agreement on such anniversary is two years, unless either Mr. Wilkerson or the Company gives advance notice to the other in writing.

Mr. Wilkerson’s employment agreement provides for the termination of Mr. Wilkerson’s employment by the Company without “Cause” or by him for “Good Reason” in the absence of a “Change of Control” (as those terms are defined in the agreement). In such cases, Mr. Wilkerson will be entitled to receive (i) his then-current base salary for the greater of the remainder of the term or 12 months, (ii) any bonus or other short-term incentive compensation earned, but not yet paid, for prior years and (iii) a welfare continuance benefit in an amount equal to 12 times the excess of COBRA premiums that would apply as of Mr. Wilkerson’s date of termination for continued health, dental and vision coverage, if COBRA continuation were elected for such coverage, over the amount that he paid for such coverage immediately before his termination of employment. Mr. Wilkerson’s employment agreement also provides for the termination of Mr. Wilkerson’s employment by the Company following a “Change of Control” or by him for “Good Reason” following a “Change of Control.” In such cases, Mr. Wilkerson will be entitled to receive, among other things, a lump sum amount equal to (i) the welfare continuance benefit described above, substituting 24 for 12 and (ii) 2.99 times the sum of his base salary and the greater of his target annual bonus or actual annual bonus for the most recent year. Mr. Wilkerson’s entitlement to the foregoing severance payments is subject to Mr. Wilkerson’s release and waiver of claims against the Company and his compliance with certain restrictive covenants as provided in the employment agreement.

Mr. Wilkerson will not be entitled to any compensation or other benefits under his employment agreement if his employment is terminated upon his death, by the Company for “Cause,” or by him in the absence of “Good Reason.”

Mr. Wilkerson’s employment agreement contains restrictive covenants relating to the protection of confidential information, non-disclosure, non-competition and non-solicitation. The non-compete and non-solicitation covenants generally continue for a period of 18 months following the last day of Mr. Wilkerson’s employment.

| 20 |

Retirement Benefits. An important retention tool is the Company’s various retirement plans. We balance the effectiveness of these plans as a compensation and retention tool with the cost to the Company of providing them.

Pension Plan. The Company has a noncontributory pension plan that covers all full-time employees and executive officers hired prior to April 1, 2012. This plan conforms to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The amount of benefits payable under the plan is determined by an employee’s period of credited service. The amount of normal retirement benefit will be determined based on a participant’s credited service, earnings and the benefit formula as described in the plan’s adoption agreement. The plan provides for early retirement for participants with 10 years of vesting service and the attainment of age 55. A participant who terminates employment with five or more years of vesting service will be entitled to a benefit. The benefits are payable in single or joint/survivor annuities, as well as a lump sum payment option upon retirement or separation of service (subject to limitations as described in the plan’s adoption agreement). As of February 15, 2023, the plan was amended to stop the accrual of future benefits.

Deferred Compensation Plan. Our deferred compensation plan allows certain employees, including the executive officers and directors to defer receipt of salary and or bonus payments. The initial decision to create the deferred compensation plan included an evaluation of our total benefits package for our senior management team, compared to the benefits package available to all employees and to other comparable companies. The plan was created as a means of attracting and retaining qualified members of the management team. At the present time, participation in the plan is limited to our directors, the senior management team, consisting of twenty employees, including the eight executive officers. Deferred amounts are deposited in separate accounts and are credited with earnings or losses based on the rate of return of mutual funds selected by the plan participants. Distributions are paid either upon termination or returned at a specific date in the future, as elected by the employee. The employee may elect to receive payments in either a lump sum or a series of installments. Participants may defer up to 100% of their salary and bonus payments.

Each year we consider whether to make a discretionary Company contribution to the plan for the benefit of the participants, including the executive officers. Contributions to the plan are based on several factors including an evaluation of overall bank performance and an evaluation of the total contributions to the bank’s other retirement plans, including the ESOP and 401(k) plans. This contribution is shared on a pro-rated basis by the participants in the plan based on each participant’s salary as a percentage of the total salaries of the participants in the plan. For 2022 and 2021, the total contributions to the plan were $198,000 and $187,000, respectively.

401(k) Savings Plan. Employees, including the executive officers, may contribute up to 96% of regular earnings on a before-tax basis into their Savings Plan (subject to IRS limits). We match dollar for dollar the first 1% of compensation that an employee contributes. Then we match one dollar for each two dollars the employee contributes up to 6% of compensation. Amounts held in the Savings Plan accounts may not be withdrawn prior to the employee’s termination of employment (subject to certain exceptions as directed by the IRS).

The Savings Plan limits the “annual additions” that can be made to an employee’s account to $61,000 per year for 2022. “Annual additions” include our matching contributions, before-tax contributions made by our employee under Section 401(k) of the Internal Revenue Code and employee after-tax contributions. Of those annual additions, the maximum before-tax contribution was $20,500 per year in 2022. Participants aged 50 and over could also contribute, on a before-tax basis, and without regard to the $66,000 limitation on annual additions or the $20,500 general limitation on before-tax contributions, catch-up contributions of up to $6,500 per year in 2022. The Company’s matching contribution for each of the named executive officers is contained in the Summary Compensation Table.

Employee Stock Ownership Plan (“ESOP”). This plan is a long-term incentive for our employees that promotes the achievement of goals which create value for our shareholders. This noncontributory plan covers all eligible full and part-time employees, including the executive officers. This plan conforms to the ERISA. An employee becomes a participant in the plan as of October 1st of the plan year in which the employee completes one full year of service. A participant who terminates employment with three or more years of vesting service will be vested in their benefit. Cash dividends paid by the Company are passed through to the participants on an annual basis. In 2022 and 2021, the Company contributed $496,000 and $472,000 respectively, to the plan. All eligible employees, including the executive officers, share in this contribution on a pro-rated basis based on each participant’s eligible compensation as a percentage of the total eligible compensation of all the participants in the plan. The allocation to each of the named executive officers is contained in the Summary Compensation Table.

| 21 |

Potential Payments upon Termination of Employment or Change in Control

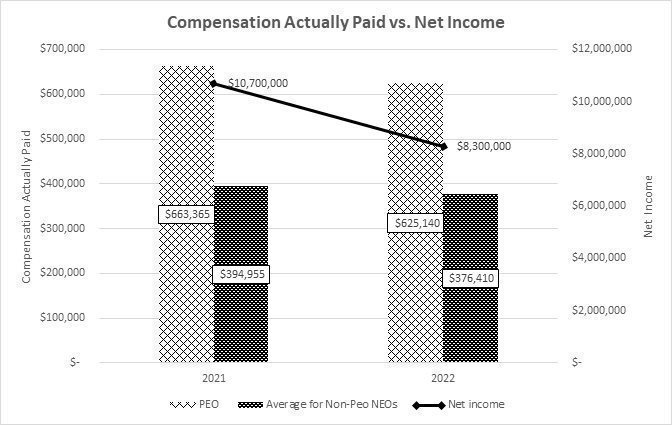

Potential Payments Upon Termination Following Change in Control. In the event of termination without “Cause” or resignation for “Good Reason” following a “Change of Control” (as those terms are defined in their agreements), the Company’s employment agreements with Mr. Hanna, Mr. Wilkerson, and Mr. Black provide for payments described under “Employment Agreements” above. Additionally, under the terms of the Company’s 2020 Stock Incentive Plan, accelerated vesting of restricted stock grants will occur in the event of a change in control.