odc-2023073100000740467/312023FYFALSE5,108,7342,170,415186,610,921P3YP2Y00000740462022-08-012023-07-3100000740462023-01-31iso4217:USD0000074046us-gaap:CommonStockMember2023-09-30xbrli:shares0000074046us-gaap:CommonClassBMember2023-09-300000074046us-gaap:CommonClassAMember2023-09-3000000740462023-07-3100000740462022-07-310000074046us-gaap:CommonStockMember2022-07-31iso4217:USDxbrli:shares0000074046us-gaap:CommonStockMember2023-07-310000074046us-gaap:CommonClassBMember2022-07-310000074046us-gaap:CommonClassBMember2023-07-3100000740462021-08-012022-07-310000074046us-gaap:CommonStockMember2022-08-012023-07-310000074046us-gaap:CommonStockMember2021-08-012022-07-310000074046us-gaap:CommonClassBMember2022-08-012023-07-310000074046us-gaap:CommonClassBMember2021-08-012022-07-310000074046us-gaap:RetainedEarningsMember2022-08-012023-07-310000074046us-gaap:CommonStockMember2021-07-310000074046us-gaap:TreasuryStockMember2021-07-310000074046us-gaap:AdditionalPaidInCapitalMember2021-07-310000074046us-gaap:RetainedEarningsMember2021-07-310000074046us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-310000074046us-gaap:NoncontrollingInterestMember2021-07-3100000740462021-07-310000074046us-gaap:CommonStockMember2021-08-012022-07-310000074046us-gaap:AdditionalPaidInCapitalMember2021-08-012022-07-310000074046us-gaap:RetainedEarningsMember2021-08-012022-07-310000074046us-gaap:TreasuryStockMember2021-08-012022-07-310000074046us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-08-012022-07-310000074046us-gaap:NoncontrollingInterestMember2021-08-012022-07-310000074046us-gaap:CommonStockMember2022-07-310000074046us-gaap:TreasuryStockMember2022-07-310000074046us-gaap:AdditionalPaidInCapitalMember2022-07-310000074046us-gaap:RetainedEarningsMember2022-07-310000074046us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-310000074046us-gaap:NoncontrollingInterestMember2022-07-310000074046us-gaap:CommonStockMember2022-08-012023-07-310000074046us-gaap:AdditionalPaidInCapitalMember2022-08-012023-07-310000074046us-gaap:TreasuryStockMember2022-08-012023-07-310000074046us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-08-012023-07-310000074046us-gaap:NoncontrollingInterestMember2022-08-012023-07-310000074046us-gaap:CommonStockMember2023-07-310000074046us-gaap:TreasuryStockMember2023-07-310000074046us-gaap:AdditionalPaidInCapitalMember2023-07-310000074046us-gaap:RetainedEarningsMember2023-07-310000074046us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-310000074046us-gaap:NoncontrollingInterestMember2023-07-310000074046srt:MinimumMember2022-08-012023-07-310000074046srt:MaximumMember2022-08-012023-07-310000074046odc:TrademarksandPatentsMember2022-08-012023-07-310000074046us-gaap:CustomerListsMember2022-08-012023-07-310000074046odc:RetailAndWholesaleSegmentMember2021-08-012022-07-310000074046odc:BusinesstoBusinessSegmentMember2021-08-012022-07-310000074046odc:BuildingsAndLeaseholdImprovementsMembersrt:MinimumMember2022-08-012023-07-310000074046odc:BuildingsAndLeaseholdImprovementsMembersrt:MaximumMember2022-08-012023-07-310000074046srt:MinimumMemberus-gaap:EquipmentMember2022-08-012023-07-310000074046srt:MaximumMemberus-gaap:EquipmentMember2022-08-012023-07-310000074046us-gaap:OtherMachineryAndEquipmentMembersrt:MinimumMember2022-08-012023-07-310000074046us-gaap:OtherMachineryAndEquipmentMembersrt:MaximumMember2022-08-012023-07-310000074046odc:MiningAndOtherMembersrt:MinimumMember2022-08-012023-07-310000074046odc:MiningAndOtherMembersrt:MaximumMember2022-08-012023-07-310000074046odc:OfficeFurnitureComputersAndEquipmentMembersrt:MinimumMember2022-08-012023-07-310000074046odc:OfficeFurnitureComputersAndEquipmentMembersrt:MaximumMember2022-08-012023-07-310000074046srt:MinimumMemberus-gaap:VehiclesMember2022-08-012023-07-310000074046us-gaap:VehiclesMembersrt:MaximumMember2022-08-012023-07-310000074046us-gaap:UpFrontPaymentArrangementMember2022-07-310000074046us-gaap:UpFrontPaymentArrangementMember2023-07-310000074046us-gaap:UpFrontPaymentArrangementMember2022-08-012023-07-31xbrli:pureodc:segment0000074046odc:CatLitterMemberodc:BusinesstoBusinessSegmentMember2022-08-012023-07-310000074046odc:CatLitterMemberodc:BusinesstoBusinessSegmentMember2021-08-012022-07-310000074046odc:CatLitterMemberodc:RetailAndWholesaleSegmentMember2022-08-012023-07-310000074046odc:CatLitterMemberodc:RetailAndWholesaleSegmentMember2021-08-012022-07-310000074046odc:IndustrialandSportsMemberodc:BusinesstoBusinessSegmentMember2022-08-012023-07-310000074046odc:IndustrialandSportsMemberodc:BusinesstoBusinessSegmentMember2021-08-012022-07-310000074046odc:IndustrialandSportsMemberodc:RetailAndWholesaleSegmentMember2022-08-012023-07-310000074046odc:IndustrialandSportsMemberodc:RetailAndWholesaleSegmentMember2021-08-012022-07-310000074046odc:BusinesstoBusinessSegmentMemberodc:AgriculturalandHorticulturalMember2022-08-012023-07-310000074046odc:BusinesstoBusinessSegmentMemberodc:AgriculturalandHorticulturalMember2021-08-012022-07-310000074046odc:RetailAndWholesaleSegmentMemberodc:AgriculturalandHorticulturalMember2022-08-012023-07-310000074046odc:RetailAndWholesaleSegmentMemberodc:AgriculturalandHorticulturalMember2021-08-012022-07-310000074046odc:BleachingClayandFluidsPurificationMemberodc:BusinesstoBusinessSegmentMember2022-08-012023-07-310000074046odc:BleachingClayandFluidsPurificationMemberodc:BusinesstoBusinessSegmentMember2021-08-012022-07-310000074046odc:BleachingClayandFluidsPurificationMemberodc:RetailAndWholesaleSegmentMember2022-08-012023-07-310000074046odc:BleachingClayandFluidsPurificationMemberodc:RetailAndWholesaleSegmentMember2021-08-012022-07-310000074046odc:AnimalHealthandNutritionMemberodc:BusinesstoBusinessSegmentMember2022-08-012023-07-310000074046odc:AnimalHealthandNutritionMemberodc:BusinesstoBusinessSegmentMember2021-08-012022-07-310000074046odc:AnimalHealthandNutritionMemberodc:RetailAndWholesaleSegmentMember2022-08-012023-07-310000074046odc:AnimalHealthandNutritionMemberodc:RetailAndWholesaleSegmentMember2021-08-012022-07-310000074046odc:BusinesstoBusinessSegmentMember2022-08-012023-07-310000074046odc:RetailAndWholesaleSegmentMember2022-08-012023-07-310000074046odc:BusinesstoBusinessSegmentMember2023-07-310000074046odc:BusinesstoBusinessSegmentMember2022-07-310000074046odc:RetailAndWholesaleSegmentMember2023-07-310000074046odc:RetailAndWholesaleSegmentMember2022-07-310000074046us-gaap:CorporateAndOtherMember2023-07-310000074046us-gaap:CorporateAndOtherMember2022-07-310000074046odc:DomesticOperationsMember2022-08-012023-07-310000074046odc:DomesticOperationsMember2021-08-012022-07-310000074046odc:ForeignOperationsMember2022-08-012023-07-310000074046odc:ForeignOperationsMember2021-08-012022-07-310000074046odc:DomesticOperationsMember2023-07-310000074046odc:DomesticOperationsMember2022-07-310000074046odc:ForeignOperationsMember2023-07-310000074046odc:ForeignOperationsMember2022-07-310000074046us-gaap:CustomerConcentrationRiskMemberodc:RetailAndWholesaleSegmentMemberus-gaap:SalesRevenueNetMember2022-08-012023-07-310000074046us-gaap:CustomerConcentrationRiskMemberodc:RetailAndWholesaleSegmentMemberus-gaap:SalesRevenueNetMember2021-08-012022-07-310000074046us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberodc:RetailAndWholesaleSegmentMember2022-08-012023-07-310000074046us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberodc:RetailAndWholesaleSegmentMember2021-08-012022-07-310000074046odc:SeriesBSeniorNotesMember2022-08-012023-07-310000074046odc:SeriesBSeniorNotesMember2023-07-310000074046odc:SeriesBSeniorNotesMember2022-07-310000074046odc:SeriesCSeniorNotesMember2022-08-012023-07-310000074046odc:SeriesCSeniorNotesMember2023-07-310000074046odc:SeriesCSeniorNotesMember2022-07-310000074046us-gaap:LineOfCreditMember2023-07-310000074046us-gaap:LineOfCreditMember2022-08-012023-07-310000074046us-gaap:LineOfCreditMember2022-07-310000074046us-gaap:PrimeRateMemberus-gaap:LineOfCreditMember2023-07-310000074046us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:LineOfCreditMember2023-07-310000074046us-gaap:FairValueInputsLevel1Member2023-07-310000074046us-gaap:FairValueInputsLevel1Member2022-07-310000074046us-gaap:FairValueInputsLevel2Member2023-07-310000074046us-gaap:FairValueInputsLevel2Member2022-07-310000074046odc:DeferredTaxAssetMember2023-07-310000074046odc:DeferredTaxLiabilityMember2023-07-310000074046odc:DeferredTaxAssetMember2022-07-310000074046odc:DeferredTaxLiabilityMember2022-07-310000074046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2021-07-310000074046us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2021-07-310000074046us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-07-310000074046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2021-08-012022-07-310000074046us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2021-08-012022-07-310000074046us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-08-012022-07-310000074046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-07-310000074046us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-07-310000074046us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-07-310000074046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-08-012023-07-310000074046us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-08-012023-07-310000074046us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-08-012023-07-310000074046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-07-310000074046us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-07-310000074046us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-07-310000074046odc:A2006PlanMember2023-07-310000074046odc:A2006PlanRestrictedStockMembersrt:MinimumMember2022-08-012023-07-310000074046odc:A2006PlanRestrictedStockMembersrt:MaximumMember2022-08-012023-07-310000074046us-gaap:RestrictedStockMember2022-08-012023-07-310000074046us-gaap:RestrictedStockMember2021-08-012022-07-310000074046us-gaap:RestrictedStockMember2021-07-310000074046us-gaap:RestrictedStockMember2020-08-012021-07-310000074046us-gaap:RestrictedStockMember2022-07-310000074046us-gaap:RestrictedStockMember2023-07-310000074046us-gaap:PensionPlansDefinedBenefitMemberodc:AnnuityPurchaseMember2022-08-012023-07-310000074046us-gaap:PensionPlansDefinedBenefitMemberodc:LumpSumPaymentMember2022-08-012023-07-310000074046us-gaap:PensionPlansDefinedBenefitMember2022-08-012023-07-310000074046us-gaap:PensionPlansDefinedBenefitMember2023-07-310000074046us-gaap:QualifiedPlanMember2022-08-012023-07-310000074046us-gaap:QualifiedPlanMember2021-08-012022-07-310000074046us-gaap:PensionPlansDefinedBenefitMember2022-07-310000074046us-gaap:PensionPlansDefinedBenefitMember2021-07-310000074046us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-07-310000074046us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-07-310000074046us-gaap:PensionPlansDefinedBenefitMember2021-08-012022-07-310000074046us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-08-012023-07-310000074046us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-08-012022-07-310000074046us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-07-310000074046us-gaap:CashAndCashEquivalentsMember2023-07-310000074046us-gaap:CashAndCashEquivalentsMember2022-07-310000074046us-gaap:FixedIncomeFundsMember2023-07-310000074046us-gaap:FixedIncomeFundsMember2022-07-310000074046us-gaap:EquitySecuritiesMember2023-07-310000074046us-gaap:EquitySecuritiesMember2022-07-310000074046us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2022-07-310000074046us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2022-07-310000074046us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2022-07-310000074046us-gaap:PensionPlansDefinedBenefitMemberodc:EquitySecuritiesUSCompaniesMember2022-07-310000074046us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberodc:EquitySecuritiesUSCompaniesMember2022-07-310000074046us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberodc:EquitySecuritiesUSCompaniesMember2022-07-310000074046us-gaap:PensionPlansDefinedBenefitMemberodc:EquitySecuritiesInternationalCompaniesMember2022-07-310000074046us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberodc:EquitySecuritiesInternationalCompaniesMember2022-07-310000074046us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberodc:EquitySecuritiesInternationalCompaniesMember2022-07-310000074046us-gaap:PensionPlansDefinedBenefitMemberodc:InternationalEquityMutualFundsDevelopedMarketsMember2022-07-310000074046us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberodc:InternationalEquityMutualFundsDevelopedMarketsMember2022-07-310000074046us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberodc:InternationalEquityMutualFundsDevelopedMarketsMember2022-07-310000074046us-gaap:PensionPlansDefinedBenefitMemberodc:InternationalEquityMutualFundsEmergingMarketsMember2022-07-310000074046us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberodc:InternationalEquityMutualFundsEmergingMarketsMember2022-07-310000074046us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberodc:InternationalEquityMutualFundsEmergingMarketsMember2022-07-310000074046us-gaap:PensionPlansDefinedBenefitMemberodc:CommodityBasedInvestmentsMember2022-07-310000074046us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberodc:CommodityBasedInvestmentsMember2022-07-310000074046us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberodc:CommodityBasedInvestmentsMember2022-07-310000074046us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasurySecuritiesMember2022-07-310000074046us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasurySecuritiesMember2022-07-310000074046us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasurySecuritiesMember2022-07-310000074046us-gaap:CorporateDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-07-310000074046us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2022-07-310000074046us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-07-310000074046us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:PensionPlansDefinedBenefitMember2022-07-310000074046us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2022-07-310000074046us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:PensionPlansDefinedBenefitMember2022-07-310000074046us-gaap:PensionPlansDefinedBenefitMemberodc:FixedIncomeMultistrategybondfundMember2022-07-310000074046us-gaap:FairValueInputsLevel1Memberodc:FixedIncomeMultistrategybondfundMember2022-07-310000074046us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberodc:FixedIncomeMultistrategybondfundMember2022-07-310000074046us-gaap:PensionPlansDefinedBenefitMemberus-gaap:MoneyMarketFundsMember2022-07-310000074046us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:MoneyMarketFundsMember2022-07-310000074046us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:MoneyMarketFundsMember2022-07-310000074046us-gaap:PensionPlansDefinedBenefitMemberodc:OtherInvestmentMember2022-07-310000074046us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberodc:OtherInvestmentMember2022-07-310000074046us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberodc:OtherInvestmentMember2022-07-310000074046us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2022-07-310000074046us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2022-07-310000074046odc:InternationalEquityMutualFundsDevelopedMarketsMember2021-08-012022-07-310000074046us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2022-07-310000074046odc:DeferredCompensationMember2022-08-012023-07-310000074046odc:DeferredCompensationMember2021-08-012022-07-310000074046odc:DeferredCompensationMember2023-07-310000074046odc:DeferredCompensationMember2022-07-310000074046us-gaap:DeferredBonusMember2022-08-012023-07-310000074046us-gaap:DeferredBonusMember2021-08-012022-07-310000074046srt:DirectorMember2022-08-012023-07-310000074046srt:DirectorMember2021-08-012022-07-310000074046srt:DirectorMember2023-07-310000074046srt:DirectorMember2022-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended July 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from _____ to _____

Commission File Number 001-12622

OIL-DRI CORPORATION OF AMERICA

(Exact name of the registrant as specified in its charter)

Delaware 36-2048898

(State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.)

410 North Michigan Avenue, Suite 400 60611-4213

Chicago, Illinois (Zip Code)

Registrant's telephone number, including area code (312) 321-1515

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.10 per share | ODC | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Smaller reporting company | ☒ |

| Accelerated filer | ☒ | | Emerging growth company | ☐ |

| Non-accelerated filer | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

The aggregate market value of Oil-Dri’s Common Stock owned by non-affiliates as of January 31, 2023 was $186,610,921.

Number of shares of each class of Oil-Dri’s capital stock outstanding as of September 30, 2023:

Common Stock – 5,108,734 shares Class B Stock – 2,170,415 shares Class A Common Stock – 0 shares

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Oil-Dri’s Proxy Statement for its 2023 Annual Meeting of Stockholders (“Proxy Statement”), which will be filed with the Securities and Exchange Commission (“SEC”) not later than November 28, 2023 (120 days after the end of Oil-Dri’s fiscal year ended July 31, 2023), are incorporated into Part III of this Annual Report on Form 10-K, as indicated herein.

CONTENTS | | | | | | | | | | | | | | |

| Item | | | | Page |

|

| |

| 1 | | | | |

| | | | | |

| 1A. | | | | |

| | | | | |

| 1B. | | | | |

| | | | | |

| 2 | | | | |

| | | | | |

| 3 | | | | |

| | | | | |

| 4 | | Mine Safety Disclosure | | |

| | | | | |

|

| |

| 5 | | | | |

| | | | | |

| 6 | | [Reserved] | | |

| | | | | |

| 7 | | | | |

| | | | | |

| | | | |

| | | | |

| 8 | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| 9 | | | | |

| | | | | |

| 9A. | | | | |

| | | | | |

| 9B. | | | | |

| | | | |

| 9C. | | | | |

| | | | | |

|

| |

| 10 | | | | |

| | | | | |

| 11 | | | | |

| | | | | |

| 12 | | | | |

| | | | | |

| 13 | | | | |

| | | | | |

| 14 | | | | |

CONTENTS (CONTINUED)

FORWARD-LOOKING STATEMENTS

Certain statements in this report, including those under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and those statements elsewhere in this report and other documents we file with the SEC, contain forward-looking statements that are based on current expectations, estimates, forecasts and projections about our future performance, our business, our beliefs and our management’s assumptions. In addition, we, or others on our behalf, may make forward-looking statements in press releases or written statements, or in our communications and discussions with investors and analysts in the normal course of business through meetings, webcasts, phone calls and conference calls. Words such as “expect,” “outlook,” “forecast,” “would,” “could,” “should,” “project,” “intend,” “plan,” “continue,” “believe,” “seek,” “estimate,” “anticipate,” “may,” “assume,” “foresee,” “predict,” “possible,” “commit,” “design,” “strive,” and variations of such words and similar expressions are intended to identify such forward-looking statements, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Such statements are subject to certain risks, uncertainties and assumptions that could cause actual results to differ materially, including those described in Item 1A “Risk Factors” below and other documents we file with the SEC. Should one or more of these or other risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, intended, expected, believed, estimated, projected or planned. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except to the extent required by law, we do not have any intention or obligation to update publicly any forward-looking statements after the distribution of this report, whether as a result of new information, future events, changes in assumptions or otherwise.

TRADEMARK NOTICE

Agsorb, Ambio, Amlan, Calibrin, Cat’s Pride, ConditionAde, Flo-Fre, Fresh & Light, Jonny Cat, KatKit, MD-09, Metal-X, Metal-Z, NeoPrime, Oil-Dri, Pel-Unite, Perform, Pro Mound, Pro's Choice Sports Field Products, Pure-Flo, Rapid Dry, Saular, Select, Sorbiam, Terra-Green, Ultra-Clear, Varium and Verge, as well as other registered or common law trade names, trademarks or service marks appearing in this Annual Report on Form 10-K are the property of Oil-Dri Corporation of America or of its subsidiaries. Fresh Step is a registered trademark of The Clorox Pet Products Company.

PART I

ITEM 1 – BUSINESS

OVERVIEW OF BUSINESS

Except as otherwise indicated herein or as the context otherwise requires, references to “Oil-Dri,” the “Company,” “we,” “us” or “our” refer to Oil-Dri Corporation of America and its subsidiaries.

Oil-Dri is a leader in developing, manufacturing and/or marketing sorbent products. Our sorbent products are principally produced from hydrated aluminosilicate minerals, primarily consisting of calcium bentonite, attapulgite and diatomaceous shale, which we refer to collectively as our “clay,” our “minerals,” or “Fuller's Earth.” We surface mine our clay on leased or owned land near our manufacturing facilities in Mississippi, Georgia, Illinois and California. We produce both absorbent and adsorbent products from our clay. Absorbents, like sponges, draw liquids up into their many pores. Examples of our absorbent clay products are Cat’s Pride and Jonny Cat branded premium cat litter, as well as other private label cat litters. Additional examples are our Oil-Dri branded floor absorbents, Amlan branded animal health and nutrition solutions for livestock, and Agsorb and Verge agricultural chemical carriers. Adsorbent products attract impurities in liquids, such as metals and surfactants, and form low-level chemical bonds. Examples of our adsorbent products include Ultra-Clear, Pure-Flo, Supreme, Perform, Select, Metal-X and Metal-Z which act as purification mediums for edible and non-edible oils. We also sell nonclay-based products, such as our Oil-Dri synthetic sorbents used for automotive, industrial and marine cleanup as well as plastic cat litter box liners. Our principal products are described in more detail below.

Oil-Dri Corporation of America was incorporated in 1969 in Delaware as the successor to an Illinois corporation incorporated in 1946 (which was the successor to a partnership that commenced business in 1941). For additional information on recent business developments, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in Part II, Item 7, incorporated herein by reference.

PRINCIPAL PRODUCTS

Agricultural and Horticultural Products

We produce a wide range of granules and powders used to enhance agricultural and horticultural products. Our mineral-based absorbent products serve as carriers for biological and chemical active ingredients, drying agents, and growing media. Our brands include: Agsorb, an agricultural and horticultural carrier and drying agent; Verge, an engineered granule used as a carrier and drying agent; and Flo-Fre, a highly absorbent microgranule used as a flowability aid.

Agsorb and Verge carriers are used in products that are alternatives to liquid sprays. These products are sold for lawn and garden and row crop applications. The clay granules absorb active ingredients and are then delivered directly into, or on top of the ground, providing a more precise application than liquid sprays. Verge carriers are spherical, uniform-sized granules with very low dust. Agsorb drying agent is blended into fertilizer-pesticide blends applied to absorb moisture and improve flowability. Flo-Fre microgranules are used by grain processors and other large handlers of bulk products to soak up excess moisture, which prevents caking. These products are sold primarily in the United States by our technical sales force.

Animal Health and Nutrition Solutions

We produce, or use contract processors to produce, Amlan brand name and private label products that support good health and productivity of species in livestock industries. For example, our products, including our Calibrin, Varium and NeoPrime products in our international markets, and Sorbiam, Ambio P and Ambio S products to customers in North America, provide a number of solutions for swine, poultry and dairy cattle livestock production. In addition, our MD-09 moisture manager product is a feed additive for the reduction of wet droppings in poultry and our Pel-Unite and Pel-Unite Plus products are specialized animal feed pellet binders.

Our animal health and nutrition products are sold both directly and through a network of distributors to livestock producers, feed mill operators, nutritionists and veterinarians in the United States, Latin America, Africa, Mexico, the Middle East and Asia. The sales force for our subsidiaries located in China, Mexico and Indonesia also sells these products, as further described in Foreign Operations below.

Fluids Purification Products

We produce an array of adsorbent products for bleaching, purification and filtration applications that are used around the world by edible oil processors, as well as by refiners of renewable diesel, jet fuel and other petroleum-based products. Bleaching clays are used by edible oil processors to adsorb soluble contaminants that promote oxidation problems. Our Pure-Flo and Perform bleaching clays remove impurities, such as trace metals, chlorophyll and color bodies, in various types of edible oils. Perform products provide increased activity for hard-to-bleach oils. Our Select adsorbents are used in a pre-treatment process to remove metals and trace soap in vegetable oil processing. Our Select adsorbents can also be used to pre-treat oil in the processing of biodiesel. Metal-X and Metal-Z are highly efficient adsorbents for the renewable diesel market. Our Ultra-Clear product is used as a purification and filtration medium for jet fuel and other petroleum-based products. These products are sold in the United States and in international markets by our team of technical sales employees, distributors and sales agents.

Cat Litter Products

We produce two types of mineral-based cat litter products, scoopable and coarse non-clumping litters, both of which have absorbent and odor controlling characteristics. Scoopable litters have the additional characteristic of clumping when exposed to moisture, allowing the consumer to selectively dispose of the used portion of the litter. Scoopable litter products are further differentiated between lightweight and heavyweight. Lightweight scoopable litters offer high performance with the added convenience of being lighter to carry and pour.

Branded products. Our scoopable and non-clumping litters are sold under our Cat’s Pride and Jonny Cat brand names. Our Cat's Pride litters created the lightweight segment of the scoopable litter market. Late this fiscal year, we launched Cat’s Pride Antibacterial Clumping Litter which is the first and only Environmental Protection Agency (“EPA”) approved antibacterial cat litter in the United States. In addition, we offer our non-clumping litter in a pre-packaged, disposable tray under the Cat’s Pride KatKit brand. Moreover, we offer litter box liners under the Cat's Pride and Jonny Cat product lines. These products are sold through independent food brokers and by our sales force to major grocery, drug, dollar store, mass-merchandiser and pet outlets, as well as through online retailers.

Private label products. We produce private label scoopable and non-clumping cat litters. Our lightweight scoopable litters lead our private label cat litter offerings.

Co-packaged products. We have a long-term supply arrangement with A&M Products Manufacturing Company, a subsidiary of The Clorox Company ("Clorox"), under which we manufacture branded non-clumping litters. Under this co-manufacturing relationship, the marketer controls all aspects of sales, marketing, and distribution, as well as the odor control formula, and we are responsible for manufacturing. Under the long-term supply agreement with Clorox we have the exclusive right to supply Clorox’s requirements for Fresh Step coarse cat litter up to certain levels.

Industrial and Automotive Products

We manufacture and/or sell products made from clay, polypropylene and recycled materials that absorb oil, acid, paint, ink, water and other liquids. These products have industrial, automotive, marine and home applications. Our clay-based sorbent products, such as Oil-Dri branded and private label floor absorbents, are used for floor maintenance in industrial applications to provide a non-slip and non-flammable surface for workers. These floor absorbents are also used in automotive repair facilities, car dealerships and other industrial applications, as well as for home use in garages and driveways. Our Oil-Dri branded polypropylene-based and recycled products are sold in various forms, such as pads, rolls, socks, booms and spill kits.

Industrial and automotive sorbent products are sold through distribution networks that includes industrial, auto parts, safety, sanitary supply, chemical and paper distributors. These products are also sold through environmental service companies, mass-merchandisers, catalogs and through e-commerce.

Sports Products

We manufacture and sell both branded and private label sports products. Pro’s Choice Sports Field Products are used on baseball, softball, football, cricket, and soccer fields. Pro’s Choice soil conditioners are used in field construction or as top dressing to improve drainage, suppress dust and improve field performance. Pro Mound packing clay is used to construct pitcher’s mounds, catcher's stations and batter’s boxes. Rapid Dry drying agent is used to wick away excess water from the

infield. Sports products are used at all levels of play, including professional, college and high school and on municipal fields. These products are sold through distributors of sport turf materials as well as to sports field product users.

BUSINESS SEGMENTS

We have two reportable operating segments for financial reporting derived from the different characteristics of our two major customer groups: the Retail and Wholesale Products Group and the Business to Business Products Group. The Retail and Wholesale Products Group customers include mass merchandisers, the farm and fleet channel, drugstore chains, pet specialty retail outlets, dollar stores, retail grocery stores, online retailers, co-packaged products customers, distributors of industrial cleanup and automotive products, environmental service companies and users of sports field products and sports turf materials. The Business to Business Products Group customers include processors and refiners of edible oils, renewable diesel, petroleum-based oils and biodiesel fuel; manufacturers of animal feed and agricultural chemicals; distributors of animal health and nutrition products. Certain financial information on both segments is contained in Note 2 of the Notes to the Consolidated Financial Statements and is incorporated herein by reference.

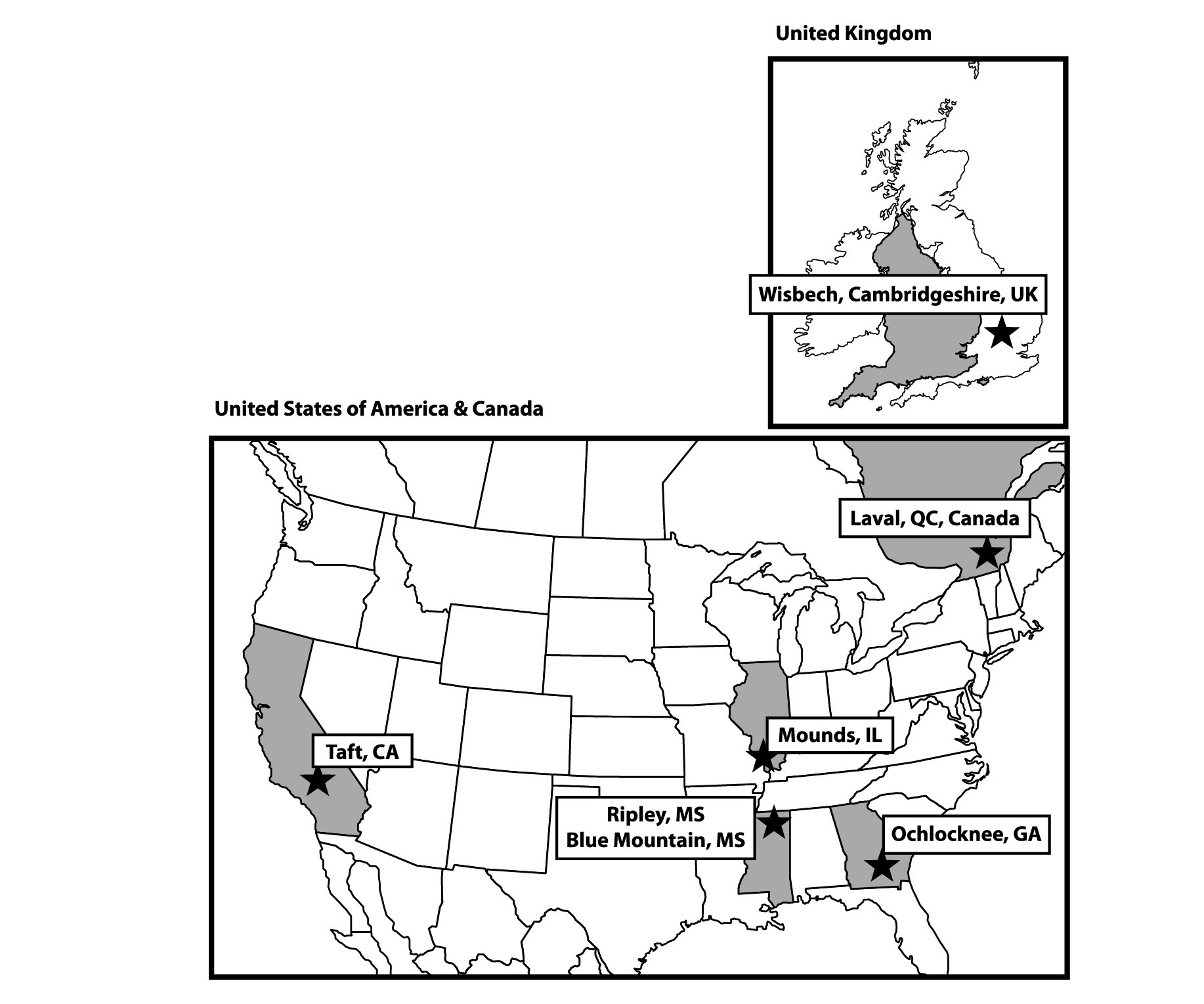

FOREIGN OPERATIONS

Our foreign operations are located in Canada, which is included in the Retail and Wholesale Products Group, and the United Kingdom, China, Switzerland, Mexico and Indonesia, which are included in the Business to Business Products Group.

Our wholly-owned subsidiary, Oil-Dri Canada ULC, is a manufacturer, distributor and marketer of branded and private label cat litter in the Canadian marketplace. Among its leading brands are Saular, Cat’s Pride and Jonny Cat. Our Canadian business also manufactures or purchases and sells industrial granule floor absorbents, synthetic polypropylene sorbent materials and agricultural chemical carriers.

Our wholly-owned subsidiary, Oil-Dri (U.K.) Limited, is a manufacturer, distributor and marketer of industrial floor absorbents, bleaching earth and cat litter. These products are marketed in the United Kingdom and Western Europe. Oil-Dri (U.K.) Limited also sells synthetic polypropylene sorbent materials and plastic containment products.

Our wholly-owned subsidiary, Amlan Trading (Shenzhen) Company, Ltd., located in Shenzhen, China, is dedicated to animal health and provides natural disease management solutions for livestock. This subsidiary sells animal health and nutrition products under our Amlan brand name and under private label arrangements.

Our wholly-owned subsidiary, PT Amlan Perdagangan Internasional, located in Indonesia also distributes our animal health and nutrition products.

Our wholly-owned subsidiary, Oil-Dri SARL, is a Swiss company that performs various management, customer service and administrative functions for some of the international customers of our domestic operations.

Effective May 12, 2023 we acquired the remaining equity of Agromex Importaciones, S.A de C.V, which is now a wholly-owned subsidiary. Previously we owned 78.4% of the equity of this entity. This Mexican subsidiary sells our international animal health and nutrition products.

Our foreign operations are subject to the normal risks of doing business in non-U.S. countries, such as currency fluctuations, restrictions on the transfer of funds and import/export duties; however, historically our operating results have not been materially impacted by these factors. Incorporated herein by reference are Item 1A "Risk Factors", which describes other risks that could impact our foreign operations, and Note 2 of the Notes to the Consolidated Financial Statements, which contains certain financial information about our foreign operations.

CUSTOMERS

Sales to Wal-Mart Stores, Inc. (“Walmart”) and its affiliates accounted for approximately 19% and 16% of our total net sales for fiscal years 2023 and 2022, respectively. Walmart is a customer in our Retail and Wholesale Products Group. There are no customers in the Business to Business Products Group with sales equal to or greater than 10% of our total sales. The degree of margin contribution of our significant customers in the Business to Business Products Group varies, with certain customers having a greater effect on our operating results. The loss of any customer other than those described in this paragraph would not be expected to have a material adverse effect on our business.

COMPETITION

Product performance, price, brand recognition, customer service, technical support, and distribution resources are the principal methods of competition in our markets and competition historically has been very vigorous. Advertising, promotion, merchandising and packaging also have a significant impact on retail consumer purchasing decisions, which primarily affects our Retail and Wholesale Products Group. Most of the principal competitors for our Retail and Wholesale Products Group have substantially greater financial resources or market presence than we do and have established brands. These competitors may be able to spend more aggressively on advertising and promotional activities, introduce competing products more quickly and respond more effectively to changing business and economic conditions than us.

We have six principal competitors in our Retail and Wholesale Products Group, one of which is also our customer. Two of the principal competitors relate to our Industrial and Sports products. The overall cat litter market has grown in recent years, with market share of both scoopable cat litter and coarse non-clumping litter increasing in fiscal year 2023. The overwhelming majority of all cat litter is mineral based, including both scoopable and coarse non-clumping litters. Cat litters based on alternative strata such as paper, various agricultural waste products and silica gels have niche positions. Scoopable products have a majority of the cat litter market share followed by coarse non-clumping litters.

There is significant competition to attract cat litter consumers across multi-outlet channels, including grocery, mass-merchandiser, dollar, pet and drug stores, as well as through online retailers. Competition for the scoopable litter market continues to be impacted by new product offerings and increased advertising and promotions by our competitors and by us. We provide our customers with product innovation, a nation-wide distribution network and strong customer service. Our exceptional sales and research and development teams, as well as vertical integration give us a further advantage over smaller and regional manufacturers.

We have six principal competitors in our Business to Business Products Group. Our bleaching clay and fluid purification products are sold in a highly cost competitive global marketplace. Performance is a primary competitive factor for these products. The animal health portion of this segment also operates in a global marketplace with price and performance competition from multi-national and local competitors. Competition for our crop protection products is primarily based on price, but competitor differentiation also exists in the ability to meet customer product specifications and enhancements in engineered granule technologies.

RESEARCH AND DEVELOPMENT

We develop new products and applications and improve existing products at our research and development center in Vernon Hills, Illinois. The center includes a pilot plant that simulates the production processes of our customers and our manufacturing plants. In addition, our microbiology lab is within walking distance of our existing research and development center and is dedicated primarily to the development of our animal health products. Our staff (and various consultants they engage from time to time) have experience in disciplines such as biology, microbiology, chemistry, physics, mathematics, geological and earth science, material science, geochemistry, physical catalysis, animal nutrition, and the animal sciences. In the past several years, our research efforts have resulted in a number of new sorbent products and processes. The research and development center produces prototype samples and tests new products for customer trial and evaluation. No significant research and development was customer sponsored, and all research and development costs are expensed in the period in which incurred. See Note 1 of the Notes to the Consolidated Financial Statements for further information about research and development expenses.

BACKLOG; SEASONALITY

As of July 31, 2023 and 2022, the value of our backlog of orders were approximately $3.6 million and $6.6 million respectively. Certain customers place orders for a full year of orders with future requested ship dates. Accordingly, we define backlog as purchase orders that we have received from customers and that we have accepted, but that have not shipped by the customers’ requested ship dates. This value was determined by the number of tons on backlog order and the net selling prices. By increasing personnel, expanding production shifts, optimizing equipment, and utilizing alternative modes of transportation, we have been able to reduce our backlog over fiscal year 2023.

We consider our business, taken as a whole, to be moderately seasonal; however, business activities of certain customers (such as agricultural chemical manufacturers and edible oil producers) are subject to such seasonal factors as crop acreage planted, product formulation cycles and weather conditions.

EFFECTS OF INFLATION

Inflation generally affects us by increasing the cost of employee wages and benefits, transportation, processing equipment, purchased raw materials and packaging, energy and borrowings under our credit facility. See Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further discussion of these costs.

RESOURCES

Patents

We have obtained or applied for patents for certain of our processes and products sold to customers in both the Retail and Wholesale Products Group and the Business to Business Products Group. U.S. patents are currently granted for a term of 20 years from the date the patent application is filed and durations of patents issued outside of the United States vary from country to country. Our patents, particularly our U.S. patents, are highly important to our business and we assert our patent rights and vigorously protect our patents from apparent infringement where appropriate, although no single patent is considered material to the business as a whole. The risks associated with our patents (and intellectual property, generally), are discussed in Item 1A "Risk Factors".

Reserves

We mine our clay on leased or owned land near our manufacturing facilities in Mississippi, Georgia, Illinois and California; we also have reserves in Nevada and Tennessee. We estimate that our proven mineral reserves as of July 31, 2023 were approximately 92.1 million tons in aggregate and our probable reserves were approximately 138.5 million tons in aggregate, for a total of 230.6 million tons of mineral reserves. Based on our rate of consumption during fiscal year 2023, and without regard to any of our reserves in Nevada or Tennessee, we consider our proven and probable reserves adequate to supply our needs for over 40 years. Although we consider these reserves to be extremely valuable to our business, only a small portion of the reserves, those which were acquired in acquisitions, are reflected at cost on our balance sheet.

It is our policy to attempt to maintain a minimum of forty years of proven and probable reserves of each type of clay at each location. We have an ongoing program of exploration for additional reserves but we cannot assure that additional reserves will continue to become available. Our use of these reserves, and our ability to explore for additional reserves, are subject to compliance with existing and future federal and state statutes and regulations regarding mining and environmental compliance. During fiscal year 2023, we utilized these reserves to produce substantially all of the sorbent products that we sold.

Proven reserves are those reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from results of detailed sampling, and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well established. Probable reserves are computed from information similar to that used for proven reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. We use certified professional geologists and mineral specialists who estimate and evaluate existing and potential reserves in terms of quality, quantity and availability.

Mining Operations

We have continuously conducted mining operations in Ripley, Mississippi since 1963, in Ochlocknee, Georgia since 1968, in Blue Mountain, Mississippi since 1989, in Mounds, Illinois since 1998 and in Taft, California since 2002. Our clay is surface mined on a year-round basis, using large earth moving scrapers, bulldozers, or excavators and off-road trucks to strip off overburden (non-usable material atop desired clay). The desired clay is then loaded into dump trucks and transported to the processing facilities. The stripping, mining and hauling of our clay is performed in-house as well as by independent contractors. Our current operating mines range in distance from immediately adjacent to approximately 11 miles from the related processing plants. Processing facilities are generally accessed from the mining areas by private and public roads and in some instances by public highways. Each of our processing facilities maintains inventories of unprocessed clay of approximately one week of production requirements. All key permits have either been obtained by us, or approval is expected to be received in the normal course of business. See Item 2 “Properties” below for additional information regarding our mining properties and operations.

The following schedule summarizes the net book value of land and other plant and equipment for each of our manufacturing facilities as of July 31, 2023 (in thousands). Of the land and mineral rights, $2.2 million relates to mineral rights. Mineral rights as of July 31, 2023 were $1.2 million, $0.8 million and $0.1 million for our properties in Illinois, California, and Georgia, respectively.

| | | | | | | | | | | | | | |

| | Land & Mineral Rights | | Plant and

Equipment |

| Ochlocknee, Georgia | | $ | 13,636 | | | $ | 37,078 | |

| Ripley, Mississippi | | $ | 2,893 | | | $ | 17,485 | |

| Mounds, Illinois | | $ | 1,637 | | | $ | 9,484 | |

| Blue Mountain, Mississippi | | $ | 939 | | | $ | 9,930 | |

| Taft, California | | $ | 1,854 | | | $ | 12,590 | |

Energy

We primarily used natural gas in the processing kilns to dry our clay products during fiscal year 2023. We monitor gas market trends and we may contract for a portion of our anticipated fuel needs using forward purchase contracts to mitigate the volatility of our kiln fuel prices. During fiscal year ended July 31, 2023, we purchased several forward fuel contracts to cover a portion of our fuel needs in Georgia and California.

HUMAN CAPITAL MANAGEMENT

Overview

During fiscal year 2023, we had approximately 884 employees, who we refer to as our teammates of which 121, 18, and 704 of our U.S. teammates work in our corporate functions, research and development and manufacturing, respectively. In addition, 41 of our teammates are employed by our foreign subsidiaries in corporate and manufacturing functions. We believe our corporate offices, research and development center and manufacturing facilities are currently adequately staffed but there is no guarantee that this will always be possible. Approximately 71 of our teammates in the U.S. and approximately 12 of our teammates in Canada are represented by labor unions, with whom we have entered into separate collective bargaining agreements. We consider our employee relations to be satisfactory.

Culture

Oil-Dri’s culture and values, along with its teammates, are our most valuable assets. We take pride in building a culture that emphasizes high moral and ethical values and conducts business with honesty, integrity and a passion for excellence. Our approach is centered on collaboration, communication, and transparency, and we believe in the value of an open and accessible corporate structure. We expect all our teammates to conduct business in an ethical and fair manner using our “WE CARE” values framework.

Oil-Dri's culture and the objectives that we focus on in managing our business are based on our “WE CARE” values. “WE CARE” is an acronym for remembering our core values, which is the moral standard that we endeavor to apply to our teammates, customers, vendors, and other stakeholders. We continuously work to reinforce these values through leading by example, training, and rewarding positive behaviors. We use “WE CARE” values as a moral compass to constantly strive for continuous improvement. These values are embedded into everything we do and are reflected in our Code of Ethics and Business Conduct, formal policies and procedures, annual training including training on workplace harassment, and a strong governance structure. Our "WE CARE" values are also the basis of our formal teammate recognition process.

Our Code of Ethics and Business Conduct details how we act in accordance with these fundamental standards. The first “E” in "WE CARE" represents Ethics. Oil-Dri’s ethical culture is one of our greatest strengths and areas of emphasis by our Board of Directors and management team. Our CEO is asked to speak on this topic at local business schools, including the Kellogg School of Management at Northwestern, and Marquette University. Our CEO’s continued messaging to all Oil-Dri teammates about the importance of our ethical culture helps maintain a strong tone at the top for our entire organization.

We have codified our compliance and ethics requirements through the Code of Ethics and Business Conduct, the Human Rights Policy, and the Whistleblower Response Policy.

Our Compliance Committee meets quarterly and is comprised of members of Oil-Dri leadership as well as the owners of our three compliance functions: Trade, Regulatory, and Anti-Corruption. Our Trade compliance function works to make sure we are in alignment with all applicable export laws and regulations, and screens all new international customers, distributors and/or agents against the various restricted and denied party lists before they can do business with Oil-Dri. Our Regulatory compliance team ensures our product registrations meet the complex and multiple requirements of the various countries, as well as U.S. states, in which we do business. Our Anti-Corruption compliance team works with Human Resources to address potential risks related to compliance with anti-corruption regulations in various jurisdictions, including by ensuring that teammates attest to Oil-Dri’s Code of Ethics and Business Conduct, which was updated in fiscal year 2021, and that the Company’s Code of Ethics and Business Conduct provides appropriate tools and guidance to the Company’s teammates. These two groups also work together to make sure teammates understand the specific requirements around conflicts of interest, including any disclosures where relevant. As part of the focus on addressing potential risks and ensuring a global understanding of the various applicable policies and requirements, we have also translated our Code of Ethics and Business Conduct into Mandarin and Spanish. Our Board of Directors also annually attests to Oil-Dri’s Code of Ethics and Business Conduct. The Anti-Corruption team also conducts a thorough Third-Party Due Diligence process that includes the use of compliance software. Third parties are selected for this process based on a risk analysis that includes potential interaction with government officials as well as the Corruption Perception Index published by Transparency International (an international non-profit) of the countries in which they do business. In addition, distributor and agent agreements include a mandatory anti-corruption regulatory compliance section.

Oil-Dri has strong policies and procedures in place for anti-corruption and conflicts of interest. This includes training and attestation requirements where appropriate. Oil-Dri is committed to whistleblower protection and uses a third-party anonymous hotline available on our website, where teammates or third parties across the globe can reach out via phone or internet with any concerns they may have and be ensured of anonymity in reporting if they so desire. The Company has documented and implemented procedures to ensure the protection of whistleblowers' employment status as well as protection from harassment in the workplace. Our anti-corruption training emphasizes the necessity of whistleblower procedures, protection, and zero tolerance for retaliation. This training is given within the first few months of hire to new teammates with sales and/or leadership roles that interact with customers and/or teammates outside the U.S. Additionally, anti-corruption training is repeated annually at our Global Sales Meeting for all attending teammates; these are sales teams across the globe as well as all Oil-Dri leadership personnel.

As individual hotline cases are investigated, the Company's Compliance Department works with Human Resources and any other teammates involved in the investigation to ensure confidentiality is maintained and whistleblowers are protected; our compliance training emphasizes that this is not only required by law, but clearly fits with our "WE CARE" values. All cases are investigated to conclusion, with follow up provided, where possible, on an anonymous basis back to the whistleblower through the anonymous third-party hotline.

Diversity, Equity and Inclusion

"WE CARE" for all.

Our strength as a company comes from leveraging the uniqueness of all teammates and those in our communities. We strive to promote a diverse and inclusive workforce for all.

Oil-Dri’s success is enhanced by striving for a workforce that reflects the diversity of the communities and countries in which we live and work. We embrace all people, regardless of race, sex, gender identity, age, religion, nationality, physical ability or sexual orientation. Diverse perspectives are encouraged and needed in order to help our company achieve its vision and continue to grow. We are committed to cultivating and preserving a culture of inclusion. That is why we created a Diversity, Equity and Inclusion Committee to help us live up to our "WE CARE" core values. This committee represents a diverse group of colleagues across locations, functions and communities who are the Company’s champions for our diversity, equity, and inclusion initiatives. The committee strives to bring awareness and understanding of human diversity as a corporate imperative by engaging teammates in pertinent conversation, training, and education. As the committee evolves, additional programs will be introduced.

Compensation

We believe our success largely depends upon our continued ability to attract and retain highly skilled teammates. We have demonstrated a history of investing in our teammates by providing competitive salaries and bonuses at all levels of the Company, including a deferred compensation plan and executive deferred bonuses for our executives, and opportunities for equity ownership through our restricted stock program under our long-term incentive plan. We also provide access to training and development and an attractive employment package that promotes well-being, including health care, retirement plans, and paid time off. We support our employees’ desire to save for retirement by providing a 401(k) savings plan in which we contribute 100% of every employee dollar contributed, up to six percent (6%) of earnings and for which employees are fully vested after two (2) years of employment. The competitive compensation and benefit package have been key to the strong retention of our employees.

Teammate Health and Wellness

The success of our business is fundamentally connected to the well-being of our teammates. As such, the health and wellness of our teammates is a top priority. We offer robust and generous benefit programs to those who qualify, which include, but are not limited to, health, prescription drug, dental, life insurance and disability insurance. We also offer wellness programs to those who qualify, to help our teammates live healthy lives. Smoking cessation programs are offered to teammates at no cost. We also offer gym and weight loss reimbursement in order to encourage a healthy lifestyle. Our employee assistance program provides face-to-face, telephonic and online counseling services for a variety of potential needs that our teammates may have. Our commitment to the wellness of our teammates is further evidenced by our paid time off and sick days program, which are part of the work/life balance component of our "WE CARE" values framework.

Workplace Flexibility

During fiscal year 2023, Oil-Dri continued a hybrid work environment for non-manufacturing teammates with the option for some positions to be 100% remote. Oil-Dri offers a wide range of employment opportunities including full and part-time positions which support our Work/Life Balance values. By providing these flexible work options, among other initiatives, we are able to attract and retain diverse talent throughout the Company.

Continuous Teammate Development

We encourage our teammates to reach their potential with continuous learning and improvement. All teammates have access to our online training and development library for on-demand courses, webinars, books and podcasts. Teammates may attend conferences and programs and/or obtain certifications that relate to their positions at no cost. For teammates looking to further their education, we offer varying levels of tuition reimbursement programs after one year of employment. This is designed to provide financial support to help teammates reach their educational goals, while also providing a way to support academic activities that directly relate to the organization’s identified knowledge, skills, and behaviors which support the mission, vision, and values of the Company.

Teammate Engagement

Oil-Dri maintains an open-door policy that encourages conversations between teammates at all levels. Communication goes both ways - ideas are shared and feedback is encouraged. We engage with teammates on a regular basis through newsletters, townhalls, video announcements, meetings, and new hire luncheons with our CEO. On occasion, anonymous online surveys are issued to solicit feedback on various work-related topics. We come together to celebrate work anniversaries, birthdays, retirements and other special occasions.

Safety

We believe that safety must be the first and foremost consideration in the decisions made by and on behalf of the Company. We believe safety is everyone’s responsibility - from senior management to frontline workers. As part of our company-wide safety policies, it is expected that all teammates identify safety risks and take action by implementing interim controls, ensuring that controls are maintained, and recommending permanent solutions. Additionally, as part of our annual budget and capital planning process, our businesses identify additional safety investments required for training, education, equipment, and processes. We are committed to operating in a manner that protects the health and safety of our workforce and our communities and ensures decisions are consistent with a long-term view of sustainability and stewardship.

Through our corporate safety department, we implemented a safety auditing program for adherence to local, state and federal safety standards and regulations including those of the Mine Safety and Health Administration ("MSHA") and the Occupational Safety and Health Administration ("OSHA"). These audits are conducted annually for global operations by third-party consultants enforcing a rigorous assessment of regulatory standards, internal procedures and program performance. Audit assessments and inspections are scored and are currently indicating high levels of compliance in our operations. The auditing program confirms the Company’s commitment to best management practices and principles. We continually increase the rigor and level of scrutiny to drive continuous improvement in our operations.

GOVERNMENT AND ENVIRONMENTAL REGULATION AND COMPLIANCE

We are subject to a variety of federal, state, local and foreign laws and regulatory requirements relating to the environment and to health and safety matters. In particular, our mining and manufacturing operations and facilities in Georgia, Mississippi, California and Illinois are required to comply with state surface mining and environmental protection statutes as well as the workplace safety requirements of the MSHA. These domestic locations and our Canadian operations are subject to various federal, state, provincial and local statutes, regulations, ordinances, building codes, and permitting and licensing requirements which govern the discharge, storage and disposal of materials, water and waste into the environment, maintenance of our locations or otherwise regulate our operations. In recent years, regulation and enforcement have grown increasingly stringent, a trend that we expect will continue. We endeavor to be in compliance at all times and in all material respects with all applicable environmental, health and safety controls and regulations. As a result, compliance with the various statutes, regulations, ordinances, codes, and other requirements have required continuing management efforts and the expenditures relating to such compliance have varied over the years; however, these expenditures have not had a material adverse effect on our capital expenditures, earnings, or competitive position. As part of our ongoing environmental compliance activities, we incur expenses in connection with reclaiming mining sites. Historically, reclamation expenses have not had a material effect on our cost of goods sold.

In addition to the environmental, health and safety requirements related to our mining and manufacturing operations and facilities, there has been increased federal, state and international regulation with respect to the content, labeling, use, packaging, registration, trade compliance, advertising, and disposal of products that we sell. For example, in the United States, some of our operations, products, product claims, labeling and advertising are regulated by the Food and Drug Administration, the Consumer Product Safety Commission, the OSHA, the MSHA, the EPA and the Federal Trade Commission. Most states

have agencies that regulate in parallel to these federal agencies. In addition, our international sales and operations are subject to regulation in each of the foreign jurisdictions in which we manufacture, distribute or sell our products. There is increasing federal and state regulation with respect to the content, labeling, use, and disposal after use of various products we sell. Throughout the world, but particularly in the United States and Europe, there is also increasing government scrutiny and regulation of the food chain and products entering or affecting the food chain. We endeavor to be in compliance at all times and in all material respects with those regulations and to assist our customers in that compliance.

We cannot assure that, despite all commercially reasonable efforts, we will always be in compliance in all material respects with all applicable environmental laws and requirements nor can we assure that from time to time enforcement of such requirements will not have a material adverse effect on our business. The imposition of more stringent standards or requirements under such regulations could result in increased expenditures. Additionally, we could be required to alter our operations in order to comply with any new standards or requirements under environmental laws or regulations. See Item 1A “Risk Factors - Risks Related to Regulatory Compliance” below for a discussion of the impact of government regulations on our business and other risks to our business.

AVAILABLE INFORMATION

This Annual Report on Form 10-K, as well as our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to all of the foregoing reports, are made available free of charge on or through the “Investors” section of our website at www.oildri.com as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC. Information related to corporate governance at Oil-Dri, including its Code of Ethics and Business Conduct, information concerning executive officers, directors and Board committees, and transactions in Oil-Dri securities by directors and executive officers, is available free of charge on or through the “Investors” section of our website at www.oildri.com. The information on our website in not included as a part of, nor incorporated by reference into, this Annual Report on Form 10-K.

ITEM 1A – RISK FACTORS

We seek to identify, manage and mitigate risks to our business, but risk and uncertainty cannot be eliminated or necessarily predicted. You should consider the following factors carefully, in addition to other information contained in this Annual Report on Form 10-K, before making an investment decision with respect to our securities. The risks described below are not the only risks we face. Our business operations could also be affected by additional factors that are not presently known to us or that we currently consider to be immaterial in our operations.

Risks Related to Our Business

Our future growth and financial performance is meaningfully impacted by successful new product introductions.

A significant portion of our net sales comes from the sale of products in mature categories, some of which have had, at times, experienced little or no volume growth or have had volume declines in recent fiscal years. A significant part of our future growth and financial performance will require that we successfully introduce new products or extend existing product offerings to meet emerging customer needs, technological trends and product market opportunities. We cannot be certain that we will achieve these goals. The development and introduction of new products generally require substantial and effective research, development and marketing expenditures, some or all of which may be unrecoverable if the new products do not gain market acceptance. New product development itself is inherently risky, as research failures, competitive barriers arising out of the intellectual property rights of others, launch and production difficulties, customer rejection and unexpectedly short product life cycles as well as other factors and events beyond our control may occur even after substantial effort and expense on our part. We may, at times, experience limitations on our ability to conduct plant tests with customers, which may impact our sales. Even in the case of a successful launch of a new product, the ultimate benefit we realize may be uncertain if the new product “cannibalizes” sales of our existing products beyond expected levels. See “Government regulation imposes significant costs on us, and future regulatory changes (or related customer responses to regulatory changes) could increase those costs or limit our ability to produce and sell our products” for a discussion of additional risks associated with new product development and launches.

We face intense competition in our markets.

Our markets are highly competitive and we expect that both direct and indirect competition will increase in the future. Our overall competitive position depends on a number of factors including price, customer service, marketing, advertising and trade spending, technical support, product quality and delivery. Some of our competitors, particularly in the sale of cat litter (the largest product in our Retail and Wholesale Products Group), have substantially greater financial resources and market presence with established brands. The competition in the future may, in some cases, lead to price reductions, increased promotional spending, or loss of market share or product distribution, any of which could materially and adversely affect our operating results and financial condition.

Our periodic results may be volatile.

Our operating results have varied on a quarterly basis during our operating history and are likely to fluctuate significantly in the future. Our expense levels are based, in part, on our expectations regarding future net sales, and many of our expenses are fixed, particularly in the short term. We may be unable to adjust spending in a timely manner to compensate for any unexpected revenue shortfall. Any significant shortfall of net sales in relation to our expectations could negatively affect our quarterly operating results. Our operating results may be below the expectations of our investors as a result of a variety of factors, many of which are outside our control. The Company has experienced growth in recent periods, which may not be sustainable or indicative of future growth. Factors that may affect our quarterly operating results include:

• fluctuating demand for our products and services, including as a result of changes in the level of pet ownership and spending on pets;

• size and timing of sales of our products and services;

• the mix of products with varying profitability sold in a given quarter;

• changes in our operating costs including raw materials, energy, transportation, packaging, overburden removal, trade spending and marketing, wages and other employee-related expenses such as health care costs, and other costs;

• our ability to anticipate and adapt to rapidly changing conditions;

• introduction of new products and services by us or our competitors;

• our ability to successfully implement price increases and surcharges, particularly in a timely manner that corresponds with cost increases, as well as other changes in our pricing policies;

• variations in purchasing patterns by our customers, including due to weather conditions, inventory planning, or other factors outside of our control;

• the ability of major customers and other debtors to meet their obligations to us as they come due;

• our ability to successfully manage regulatory, intellectual property, tax and legal matters;

• litigation and regulatory judgments and charges, settlements, or other litigation and regulatory-related costs;

• the overall tax rate of our business, which may be affected by a number of factors, including the use of tax attributes, the financial results of our international subsidiaries and the timing, size and integration of acquisitions we may make from time to time;

• the occurrence of a widespread outbreak of an illness or any other communicable disease, any other public health crisis, natural disaster, force majeure event or other catastrophic or unforeseen events;

• the incurrence of restructuring, impairment or other charges; and

• general economic conditions and specific economic conditions in our industry and the industries of our customers.

To the extent these factors slow or change, consumer demand for our products may not be sustained or may reverse, and our results could be adversely affected. Accordingly, we believe that quarter-to-quarter comparisons of our operating results are not necessarily meaningful. Investors should not rely on the results of one quarter as an indication of our future performance.

Uncertainties in economic conditions and their impact on consumer spending patterns could adversely impact our business, financial condition, and results of operations.

The United States has from time to time experienced challenging economic conditions and the global financial markets have recently undergone and may continue to experience significant volatility and disruption. Our business, financial condition and results of operations may be materially adversely affected by changes in consumer confidence, levels of unemployment, inflation, interest rates, tax rates and general uncertainty regarding the overall future economic environment. The keeping of pets and the purchase of pet-related products may constitute discretionary spending for some consumers and any material decline in the amount of consumer discretionary spending may reduce overall levels of pet ownership or spending on pets. As a result, a recession or slowdown in the economy may cause a decline in demand for our products. If economic conditions result in decreased spending on pets and have a negative impact on our retail customers and suppliers, our business, financial condition and results of operations may be materially adversely affected.

Acquisitions involve a number of risks, any of which could cause us not to realize the anticipated benefits.

We intend, from time to time, to strategically explore potential opportunities to expand our operations and reserves through acquisitions. Identification of good acquisition candidates is difficult and highly competitive. If we are unable to identify attractive acquisition candidates, complete acquisitions, and successfully integrate the companies, businesses or properties that we acquire, our profitability may decline and we could experience a material adverse effect on our business, financial condition, or operating results. Acquisitions involve a number of inherent risks, including:

• uncertainties in assessing the value, strengths, and potential profitability of acquisition candidates, and in identifying the extent of all weaknesses, risks, contingent and other liabilities (including environmental, legacy product or mining safety liabilities) of those candidates;

• the potential loss of key customers, management and employees of an acquired business;

• the ability to achieve identified operating and financial synergies anticipated to result from an acquisition;

• problems that could arise from the integration of the acquired business, its management or other unanticipated problems or liabilities; and

• unanticipated changes in business, industry or general economic conditions that affect the assumptions underlying our rationale for pursuing the acquisition.

Any one or more of these factors could cause us not to realize the benefits we anticipate to result from an acquisition. Moreover, acquisition opportunities we pursue could materially affect our liquidity and capital resources and may require us to incur indebtedness, seek equity capital or both and there can be no assurances that we can obtain indebtedness or equity capital on terms acceptable to the Company. Increased borrowings would correspondingly increase the Company's financial leverage and could result in lower credit ratings and increased future borrowing costs. These risks could also reduce the Company's flexibility to respond to changes in its industry or in general economic conditions. In addition, future acquisitions could result in our assuming more long-term liabilities relative to the value of the acquired assets than we have assumed in our previous acquisitions.

We depend on a limited number of customers for a large portion of our net sales.

A limited number of customers account for a large percentage of our net sales, as described in Item 1 “Business” above. The loss of, or a substantial decrease in the volume of, purchases by Walmart, or any of our other top customers could harm our sales and profitability. In addition, an adverse change in the terms of our dealings with, or in the financial wherewithal or viability of, one or more of our significant customers could harm our business, financial condition and results of operations.