Table of Contents

As filed with the Securities and Exchange Commission on June 30, 2015.

Registration No. 333-203383

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

IHEARTCOMMUNICATIONS, INC.*

(Exact name of registrant as specified in its charter)

| Texas | 4832 | 74-1787539 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Number) |

(I.R.S. Employer Identification No.) |

200 East Basse Road

San Antonio, Texas 78209

Telephone: (210) 822-2828

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Robert H. Walls, Jr.

Executive Vice President, General Counsel and Secretary

iHeartCommunications, Inc.

200 East Basse Road

San Antonio, Texas 78209

Telephone: (210) 822-2828

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

James S. Rowe

Brian D. Wolfe

Kirkland & Ellis LLP

300 North LaSalle

Chicago, Illinois 60654

Telephone: (312) 862-2000

* The co-registrants listed on the next page are also included in this Form S-4 Registration Statement as additional registrants.

Approximate date of commencement of proposed sale of the securities to the public: The exchange will occur as soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

TABLE OF ADDITIONAL REGISTRANTS

| Exact Name of Additional Registrants* |

Primary Standard Industrial Classification Number |

Jurisdiction of Formation |

I.R.S. Employer Identification No. | |||

| iHeartMedia Capital I, LLC |

4899 | Delaware | 27-0263715 | |||

| AMFM Broadcasting, Inc. |

4832 | Delaware | 95-4068583 | |||

| AMFM Operating Inc. |

4899 | Delaware | 13-3649750 | |||

| Citicasters Licenses, Inc. |

4832 | Texas | 90-0183894 | |||

| Capstar Radio Operating Company |

4832 | Delaware | 13-3922738 | |||

| CC Broadcast Holdings, Inc. |

4899 | Nevada | 20-2302507 | |||

| Christal Radio Sales, Inc. |

7311 | Delaware | 13-2618663 | |||

| Cine Guarantors II, Inc. |

4899 | California | 95-2960196 | |||

| Citicasters Co. |

4832 | Ohio | 31-1081002 | |||

| Clear Channel Broadcasting Licenses, Inc. |

4832 | Nevada | 88-0309517 | |||

| iHeartMedia+Entertainment, Inc. |

4832 | Nevada | 74-2722883 | |||

| iHM Identity, Inc. |

4899 | Texas | 27-1992018 | |||

| Clear Channel Holdings, Inc. |

4899 | Nevada | 88-0318078 | |||

| Clear Channel Investments, Inc. |

6799 | Nevada | 91-1883551 | |||

| iHeartMedia Management Services, Inc. |

8741 | Texas | 02-0619566 | |||

| Clear Channel Mexico Holdings, Inc. |

4899 | Nevada | 20-2303205 | |||

| Critical Mass Media, Inc. |

4899 | Ohio | 31-1228174 | |||

| Katz Communications, Inc. |

7311 | Delaware | 13-0904500 | |||

| Katz Media Group, Inc. |

7311 | Delaware | 13-3779266 | |||

| Katz Millennium Sales & Marketing Inc. |

7311 | Delaware | 06-0963166 | |||

| Katz Net Radio Sales, Inc. |

7311 | Delaware | 74-3221051 | |||

| M Street Corporation |

2741 | Washington | 54-1526578 | |||

| Premiere Networks, Inc. |

4832 | Delaware | 95-4083971 | |||

| Terrestrial RF Licensing, Inc. |

4832 | Nevada | 55-0858211 | |||

| CC Licenses, LLC |

4832 | Delaware | 20-3498527 | |||

| Clear Channel Real Estate, LLC |

4899 | Delaware | 74-2745435 | |||

| AMFM Broadcasting Licenses, LLC |

4832 | Delaware | 01-0824545 | |||

| AMFM Radio Licenses, LLC |

4832 | Delaware | 75-2779594 | |||

| AMFM Texas, LLC |

4832 | Delaware | 74-2939082 | |||

| AMFM Texas Broadcasting, LP |

4832 | Delaware | 75-2486577 | |||

| AMFM Texas Licenses, LLC |

4832 | Texas | 75-2486580 | |||

| Capstar TX, LLC |

4832 | Texas | 13-3933048 | |||

| CC Finco Holdings, LLC |

4899 | Delaware | 26-3757034 |

| * | The address and agent for service of process for each of the additional registrants are the same as for iHeartCommunications, Inc. |

Table of Contents

The information in this prospectus is not complete and may be changed. These notes may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor is it an offer to buy these notes in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 30, 2015

| PROSPECTUS |

|

IHEARTCOMMUNICATIONS, INC.

Exchange Offer for

$950,000,000 10.625% Priority Guarantee Notes due 2023

We are offering (the “exchange offer”) to exchange up to $950,000,000 aggregate principal amount of our new 10.625% Priority Guarantee Notes due 2023 (the “exchange notes”), which will be registered under the Securities Act of 1933, as amended (the “Securities Act”), for up to $950,000,000 aggregate principal amount of our outstanding 10.625% Priority Guarantee Notes due 2023, which we issued on February 26, 2015 (collectively, the “outstanding notes”). We refer to the outstanding notes and the exchange notes collectively as the “notes.” We refer to the notes and our other outstanding priority guarantee notes collectively as the “priority guarantee notes.”

Material Terms of the Exchange Offer

We are not asking you for a proxy and you are not requested to send us a proxy.

For a discussion of certain factors that you should consider before participating in the exchange offer, see “Risk Factors” beginning on page 16 of this prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the exchange notes to be distributed in the exchange offer, nor have any of these organizations determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We have filed a registration statement on Form S-4 to register with the SEC the exchange notes to be issued in the exchange offer. This prospectus is part of that registration statement.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, starting on the expiration date (as defined herein) and ending on the close of business 180 days after the expiration date, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

THE DATE OF THIS PROSPECTUS IS , 2015.

Table of Contents

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. You should assume that the information contained in this prospectus is accurate as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since then. We are not making an offer to sell the exchange notes offered by this prospectus in any jurisdiction where the offer or sale is not permitted.

i

Table of Contents

The financial statements and related footnotes included in this prospectus are those of iHeartMedia Capital I, LLC (“iHeart Capital”), the direct parent of iHeartCommunications, Inc. (“iHeartCommunications”), which is a guarantor of the notes. The financial statements included in this prospectus contain certain footnote disclosures regarding the financial information of iHeartCommunications and iHeartCommunications’ domestic wholly-owned subsidiaries that guarantee certain of iHeartCommunications’ outstanding indebtedness. iHeart Capital does not have any operations of its own, and, as a result, the financial statements of iHeart Capital reflect the financial condition and results of iHeartCommunications. All other data and information in this prospectus are that of iHeartCommunications and its subsidiaries, unless otherwise indicated.

iHeart Capital and iHeartCommunications are indirect wholly-owned subsidiaries of iHeartMedia, Inc. (formerly known as CC Media Holdings, Inc.) (“Parent”), which was formed in May 2007 by private equity funds managed by Thomas H. Lee Partners, L.P. (“THL”) and Bain Capital Partners, LLC (“Bain Capital” and together with THL, the “Sponsors”) for the purpose of acquiring the business of iHeartCommunications. On July 30, 2008, Parent acquired iHeartCommunications. The acquisition was effected by the merger of an entity formed by the Sponsors, then an indirect, wholly-owned subsidiary of Parent, with and into iHeartCommunications.

ii

Table of Contents

This prospectus contains certain statements that are, or may be deemed to be, “forward-looking statements.” These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Actual outcomes and results may differ materially from those expressed in, or implied by, our forward-looking statements. Words such as “expects,” “anticipates,” “believes,” “estimates” and other similar expressions or future or conditional verbs such as “will,” “should,” “would” and “could” are intended to identify such forward-looking statements. Readers should not rely solely on the forward-looking statements and should consider all uncertainties and risks throughout this prospectus, including those set forth under “Risk Factors.” The statements are representative only as of the date they are made, and we undertake no obligation to update any forward-looking statement.

All forward-looking statements, by their nature, are subject to risks and uncertainties. Our actual future results may differ materially from those set forth in our forward-looking statements. We face risks that are inherent in the businesses and the market places in which we operate. While management believes these forward-looking statements are accurate and reasonable, uncertainties, risks and factors, including those described below and under “Risk Factors,” could cause actual results to differ materially from those reflected in the forward-looking statements.

Factors that may cause the actual outcome and results to differ materially from those expressed in, or implied by, these forward-looking statements include, but are not necessarily limited to:

| — | the impact of our substantial indebtedness, including the effect of our leverage on our financial position and earnings; |

| — | our ability to generate sufficient cash from operations or other liquidity-generating transactions and our need to allocate significant amounts of our cash to make payments on our indebtedness, which in turn could reduce our financial flexibility and ability to fund other activities; |

| — | risks associated with weak or uncertain global economic conditions and their impact on the capital markets; |

| — | other general economic and political conditions in the United States and in other countries in which we currently do business, including those resulting from recessions, political events and acts or threats of terrorism or military conflicts; |

| — | industry conditions, including competition; |

| — | the level of expenditures on advertising; |

| — | legislative or regulatory requirements; |

| — | fluctuations in operating costs; |

| — | technological changes and innovations; |

| — | changes in labor conditions, including on-air talent, program hosts and management; |

| — | capital expenditure requirements; |

| — | risks of doing business in foreign countries; |

| — | fluctuations in exchange rates and currency values; |

| — | the outcome of pending and future litigation; |

| — | taxes and tax disputes; |

| — | changes in interest rates; |

| — | shifts in population and other demographics; |

| — | access to capital markets and borrowed indebtedness; |

| — | our ability to implement our business strategies; |

iii

Table of Contents

| — | the risk that we may not be able to integrate the operations of acquired businesses successfully; |

| — | the risk that our cost savings initiatives may not be entirely successful or that any cost savings achieved from those initiatives may not persist; and |

| — | the other factors described in this prospectus under the heading “Risk Factors.” |

Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations and also could cause actual results to differ materially from those included, contemplated or implied by the forward-looking statements made in this prospectus, and the reader should not consider the above list of factors to be a complete set of all potential risks or uncertainties.

iv

Table of Contents

Market and industry data throughout this prospectus was obtained from a combination of our own internal company surveys, the good faith estimates of management, various trade associations and publications, Arbitron Inc. (“Arbitron”) and Nielsen Media Research, Inc. rankings, comScore, Inc., the Veronis Suhler Stevenson Industry Forecast, SNL Kagan, the Radio Advertising Bureau, Media Dynamics, Ando Media, Omniture, BIA Financial Network Inc., eMarketer Inc., the Outdoor Advertising Association of America and Universal McCann. While we believe our internal surveys, third-party information, estimates of management and data from trade associations are reliable, we have not verified this data with any independent sources. Accordingly, we do not make any representations as to the accuracy or completeness of that data.

This prospectus includes trademarks, such as “iHeartMedia,” which are protected under applicable intellectual property laws and are the property of iHeartCommunications, Inc. (“iHeartCommunications” or the “Company”). This prospectus also contains trademarks, service marks, trade names and copyrights, of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

v

Table of Contents

This summary highlights key information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether or not to participate in the exchange offer. You should read this entire prospectus, including the information set forth under “Risk Factors” and the financial statements and related notes, before making any investment decision.

Unless otherwise indicated or required by the context, as used in this prospectus, the terms the “Company,” “we,” “our” and “us” refer to iHeartCommunications and all of its subsidiaries that are consolidated under GAAP, and the term “iHeartCommunications” refers to iHeartCommunications, Inc. and not to any of its subsidiaries. iHeartCommunications is a direct, wholly-owned subsidiary of iHeartMedia Capital I, LLC, one of the guarantors of the notes. All references in this prospectus to “iHeart Capital” refer to iHeartMedia Capital I, LLC and not to any of its subsidiaries.

Overview

We are a diversified media and entertainment company with leading market positions in each of our operating segments: iHeartMedia (“iHM”), Americas Outdoor Advertising and International Outdoor Advertising.

| — | iHM. Our iHM operations include radio broadcasting, online and mobile services and products, program syndication, entertainment, traffic and weather data distribution and music research services. Our radio stations and content can be heard on AM/FM stations, HD digital radio stations, satellite radio, at iHeartRadio.com and our radio stations’ websites, and through our iHeartRadio mobile application on smart phones and tablets, on gaming consoles, via in-home entertainment, in enhanced automotive platforms, as well as in-vehicle entertainment and navigation systems. As of December 31, 2014, we owned 858 domestic radio stations servicing more than 150 U.S. markets, including 44 of the top 50 markets and 84 of the top 100 markets. In addition, we provide programming and sell air time on one radio station owned by a third-party under a local marketing agreement. We are also the beneficiary of Aloha Station Trust, LLC, which owns and operates 16 radio stations, and the Brunswick Trust, which owns and operates 1 radio station, all of which we were required to divest in order to comply with Federal Communication Commission (“FCC”) media ownership rules, and which are being marketed for sale. In addition to our local radio programming, we also operate Premiere Networks (“Premiere”), a national radio network that produces, distributes or represents more than 90 syndicated radio programs and serves more than 5,500 radio station affiliates, reaching approximately 245 million listeners monthly. We also deliver real-time traffic information via navigation systems, radio and television broadcast media and wireless and Internet-based services through our traffic business, Total Traffic & Weather Network. We also promote, produce and curate special nationally recognized events for our listeners, including the iHeartRadio Music Festival, the iHeartRadio Ultimate Pool Party, the iHeartRadio Jingle Ball Concert Tour, the iHeartRadio Country Festival, the iHeartRadio Ultimate Valentine’s Escape and the iHeartRadio Fiesta Latina. For each of the years ended December 31, 2014 and 2013, our iHM segment represented approximately 50% of our revenue. For the three months ended March 31, 2015 and 2014, our iHM segment represented approximately 52% and 50%, respectively, of our revenue. |

| — | Americas Outdoor Advertising. We are one of the largest outdoor advertising companies in the Americas (based on revenues), which includes the United States, Canada and Latin America. Approximately 89% of our revenue in our Americas outdoor advertising segment was derived from the United States in each of the years ended December 31, 2014, 2013 and 2012. We own or operate approximately 114,000 display structures in our Americas outdoor segment with operations in 45 of the 50 largest markets in the United States, including all of the 20 largest markets. Our Americas outdoor assets consist of traditional and digital billboards, street furniture and transit displays, airport displays and wallscapes and other spectaculars, which we own or operate under lease management agreements. Our Americas outdoor advertising business is focused on metropolitan areas with dense populations. For the years ended December 31, 2014 and 2013, our Americas Outdoor Advertising segment represented approximately 21% and 22%, respectively, of our revenue. For each of the three months ended March 31, 2015 and 2014, our Americas Outdoor Advertising segment represented approximately 22% of our revenue. |

1

Table of Contents

| — | International Outdoor Advertising. Our International outdoor business segment includes our operations in Asia, Australia and Europe, with approximately 35% of our revenue in this segment derived from France and the United Kingdom for each of the years ended December 31, 2014, 2013 and 2012. As of December 31, 2014, we owned or operated more than 529,000 displays across 22 countries. Our International outdoor assets consist of street furniture and transit displays, billboards, mall displays, Smartbike programs, wallscapes and other spectaculars, which we own or operate under lease agreements. Our International business is focused on metropolitan areas with dense populations. For each of the years ended December 31, 2014 and 2013, our International Outdoor Advertising segment represented approximately 25% of our revenue. For the three months ended March 31, 2015 and 2014, our International Outdoor Advertising segment represented approximately 24% and 26%, respectively, of our revenue. |

| — | Other. Our Other category includes our media representation firm, Katz Media, as well as other general support services and initiatives which are ancillary to our other businesses. Katz Media, a leading media representation firm in the U.S. for radio and television stations, sells national spot advertising time for clients in the radio and television industries throughout the United States. As of December 31, 2014, Katz Media represented more than 4,000 radio stations, approximately one-fifth of which are owned by us. Katz Media also represents more than 700 television and digital multicast stations. Katz Media generates revenue primarily through contractual commissions realized from the sale of national spot and online advertising. National spot advertising is commercial airtime sold to advertisers on behalf of radio and television stations. Katz Media represents its media clients pursuant to media representation contracts, which typically have terms of up to ten years in length. For each of the years ended December 31, 2014 and 2013 and the three months ended March 31, 2015 and 2014, our Other category represented approximately 3% of our revenue. |

For the year ended December 31, 2014, we generated consolidated revenues of $6,319 million, operating income of $1,082 million and consolidated net loss of $762 million. For the three months ended March 31, 2015, we generated consolidated revenues of $1,345 million, operating income of $93 million and consolidated net loss of $385 million.

Our Strengths

Leading Positions in the U.S. Media and Entertainment and Global Outdoor Market. We are a leading global media and entertainment company.

| — | We own the number one or number two ranked radio station clusters in nine of the top 10 and in 21 of the top 25 markets in the United States as of December 2014 and have a total weekly listening base of almost 139 million individuals based on NielsenAudio figures for the Fall 2014 ratings period. |

| — | In the United States outdoor market, we believe we hold the number one market share in eight of the top 10 markets and are either number one or number two in 16 of the top 20 markets. Internationally, we believe we hold one of the leading positions in France, the United Kingdom, Australia, Finland, Ireland, Switzerland, Sweden, Belgium, Italy and Norway. In addition, we hold positions in several countries where we have experienced strong growth, including Latin America, China and Singapore. |

Global Scale in Media and Entertainment and Outdoor Advertising. As of December 31, 2014, we owned 858 domestic radio stations servicing more than 150 U.S. markets, including 44 of the top 50 markets and 84 of the top 100 markets. We also operated more than 640,000 outdoor advertising displays worldwide in metropolitan and densely populated locations, providing advertisers with both a global and a local reach. We believe that our scale provides us with the flexibility and resources to introduce new products and solutions in a cost effective manner.

| — | Our scale has enabled cost-effective investment in new technologies, such as digital billboards and streaming technology, which we believe will continue to support future growth. Digital billboards, for example, enable us to transition from selling space on a display to a single advertiser to selling time on that display to multiple advertisers, creating new revenue opportunities from both new and existing clients. |

2

Table of Contents

| — | Our large distribution platform in our iHM segment allows us to attract top talent and more effectively utilize programming, sharing the best and most compelling talent and programming across many stations throughout the United States. |

| — | We have sales people in local markets across the globe. Our scale has facilitated cost-effective investment in systems that allow us to maximize yield management and systems that improve the ability of our local salespeople to increase revenue. Additionally, our scale has allowed us to implement initiatives that we believe differentiate us from the rest of the media industry and position us to outperform our competitors across our markets. |

Diversification Across Business Lines, Geographies, Markets and Format. Approximately half of our revenue is generated by our iHM segment, with the remaining half generated by our Americas Outdoor Advertising and International Outdoor Advertising segments, as well as other support services and initiatives. We offer advertisers a diverse platform of media assets across geographies, outdoor products and programming formats. Due to our multiple business units, we are not dependent upon any single source of revenue.

Strong Collection of Unique Assets. Through acquisitions and organic growth, we have aggregated a unique portfolio of assets. We believe the combination of our assets cannot be replicated.

| — | Ownership and operation of radio broadcast stations is governed by the FCC’s licensing process, which limits the number of radio licenses available in any market. Any party seeking to acquire or transfer radio licenses must go through a detailed review process with the FCC. Over several decades, we have aggregated multiple licenses in local market clusters across the United States. A cluster of multiple radio stations in a market allows us to provide listeners with more diverse programming and advertisers with a more efficient means to reach those listeners. In addition, we are able to increase our efficiency by operating in clusters, which allows us to eliminate duplicative operating expenses and realize economies of scale. |

| — | The domestic outdoor industry is regulated by the federal government as well as state and municipal governments. Statutes and regulations govern the construction, repair, maintenance, lighting, height, size, spacing and placement and permitting of outdoor advertising structures. Due to these regulations, it has become increasingly difficult to develop new outdoor advertising locations. Further, for many of our existing billboards, a competitor or landlord could not obtain a permit for replacement under existing laws and regulations due to their non-conforming status. |

Attractive Businesses with High Margins and Low Capital Expenditure Requirements. Our global scale has enabled us to make productive and cost effective investments across our portfolio. As a result of our strong margins and low capital expenditure requirements, we have been able to convert a significant portion of our operating income into cash flow that can be utilized for debt service.

| — | We have strong operating margins, driven by our significant scale and leading market share in both radio broadcasting and outdoor advertising. For the year ended December 31, 2014, our consolidated operating margin was 17% with strong operating margins in our iHM segment of 31%, and Americas Outdoor Advertising segment of 23%. |

| — | In addition, both our media and entertainment and our outdoor businesses are low capital intensity businesses. For the years ended December 31, 2014 and 2013, our total capital expenditures were 5% of total revenue. |

Highly Effective Advertising Medium. We believe both our media and entertainment and our outdoor advertising businesses offer compelling value propositions to advertisers and valuable access to consumers when they are out of the home and therefore closer to purchase decisions. We also believe both industries are well positioned to benefit from the fragmentation of audiences of other media as they are able to reach mass audiences on a local market basis.

| — | Radio broadcasting and outdoor media offer compelling value propositions to advertisers by providing cost effective media advertising outlets. |

| — | Our media and entertainment and our outdoor businesses reach potential consumers outside of the home, a valuable position as it is closer to the purchase decision. Today, consumers spend a significant portion of their day out-of-home, while out-of-home media (radio and outdoor) currently garner a disproportionately smaller share of media spending than in-home media. We believe this discrepancy represents an opportunity for growth. |

3

Table of Contents

| — | Additionally, radio programming reaches 91% of all consumers in the United States in a given week, with the average consumer listening for approximately 14 hours per week. On a weekly basis, this represents approximately 243 million unique listeners. |

| — | According to Nielsen’s December 2014 Total Audience Report, consumers in the United States listen to a significant amount of radio per day. In 2013, broadcast radio captured 164 minutes of user consumption per day as compared to the Internet at 159 minutes according to comScore, Inc. and newspapers at 26 minutes according to eMarketer Inc. |

| — | According to Scarborough, in 2014, 91% of U.S. residents traveled in a car each month, with an average of 170 miles traveled per week. The captive in-car audience is protected from media fragmentation and is subject to increasing out-of-home advertiser exposure as time and distance of commutes increase. |

| — | According to a single-source advertising return on investment (“ROI”) study in the radio sector conducted by NielsenAudio and Nielsen Catalina Solutions in 2014, radio delivered a sales lift of more than $6 per dollar spent on radio, an ROI which Advertising Age reported doubled that of even the best results from recent studies of digital or TV media, with one retail brand recording a sales lift of more than $23 per dollar invested in radio. |

Significant Operating Leverage with Flexibility to Manage Cost Base As Necessary. We benefit from significant operating leverage, which leads to operating margin increases in a growth environment. Conversely, we have demonstrated our flexibility to effectively manage our cost base in a low growth or recessionary environment.

Our Strategy

Our goal is to strengthen our position as a leading global media and entertainment company specializing in radio, digital, out-of-home, mobile and on-demand entertainment and information services for national audiences and local communities and providing premiere opportunities for advertisers. We plan to achieve this objective by capitalizing on our competitive strengths and pursuing the following strategies.

iHM

Our iHM strategy centers on delivering entertaining and informative content across multiple platforms, including broadcast, mobile and digital as well as events. We strive to serve our listeners by providing the content they desire on the platform they prefer, while supporting advertisers, strategic partners, music labels and artists with a diverse platform of creative marketing opportunities designed to effectively reach and engage target audiences. Our iHM strategy also focuses on continuing to improve the operations of our stations by providing valuable programming and promotions, as well as sharing best practices across our stations in marketing, distribution, sales and cost management.

Promote Broadcast Radio Media Spending. Given the attractive reach and metrics of both the broadcast radio industry in general and iHM in particular, as well as our depth and breadth of relationships with both media agencies and national and local advertisers, we believe we can drive broadcast radio’s share of total media spending by using our dedicated national sales team to highlight the value of broadcast radio relative to other media. We have made and continue to make significant investments in research to enable our clients to better understand how our assets can successfully reach their target audiences and promote their advertising campaigns; broadened our national sales teams and initiatives to better develop, create and promote their advertising campaigns; invested in technology to enhance our platform and capabilities; and continue to seek opportunities to deploy our iHeartRadio digital radio service across both existing and emerging devices and platforms. We are also working closely with advertisers, marketers and agencies to meet their needs through new products, events and services developed through optimization of our current portfolio of assets, as well as to develop tools to determine how effective broadcast radio is in reaching their desired audiences.

4

Table of Contents

Promote Local and National Advertising. We intend to grow our iHM businesses by continuing to develop effective programming, creating new solutions for our advertisers and agencies, fostering key relationships with advertisers and improving our local and national sales team. We intend to leverage our diverse collection of assets, our programming and creative strengths, and our consumer relationships to create special events, such as one-of-a-kind local and national promotions for our listeners, and develop new, innovative technologies and products to promote our advertisers. We seek to maximize revenue by closely managing our advertising opportunities and pricing to compete effectively in local markets. We operate price and yield information systems, which provide detailed inventory information. These systems enable our station managers and sales directors to adjust commercial inventory and pricing based on local market demand, as well as to manage and monitor different commercial durations (60 second, 30 second, 15 second and five second) in order to provide more effective advertising for our customers at what we believe are optimal prices given market conditions.

Continue to Enhance the Listener Experience. We intend to continue enhancing the listener experience by offering a wide variety of compelling content and methods of delivery. We will continue to provide the content our listeners desire on their preferred platforms. Our investments have created a collection of leading on-air talent. For example, Premiere offers more than 90 syndicated radio programs and services for more than 5,500 radio station affiliates across the United States, including popular programs such as Rush Limbaugh, Sean Hannity, Glenn Beck, Ryan Seacrest, Steve Harvey, Elvis Duran, Bobby Bones and Delilah. Our distribution capabilities allow us to attract top talent and more effectively utilize programming, sharing our best and most compelling content across many stations.

Deliver Content via Multiple Distribution Technologies. We continue to expand the choices for our listeners. We deliver music, news, talk, sports, traffic and other content using an array of distribution technologies, including broadcast radio and HD radio channels, satellite radio, digitally via iHeartRadio.com and our stations’ websites, and through our iHeartRadio mobile application on smart phones and tablets, on gaming consoles, via in-home entertainment, in enhanced automotive platforms, as well as in-vehicle entertainment and navigation systems. Some examples of our recent initiatives are as follows:

| — | Streaming. We provide streaming content via the Internet, mobile and other digital platforms. We rank among the top streaming networks in the U.S. with regards to Average Active Sessions (“AAS”), Session Starts (“SS”) and Average Time Spent Listening (“ATSL”). AAS and SS measure the level of activity while ATSL measures the ability to keep the audience engaged. |

| — | Websites and Mobile Applications. We have developed mobile and Internet applications such as the iHeartRadio smart phone application and website and websites for our stations and personalities. These mobile and Internet applications allow listeners to use their smart phones, tablets or other digital devices to interact directly with stations, find titles/artists, request songs and create custom and personalized stations while providing an additional method for advertisers to reach consumers. As of December 31, 2014, our iHeartRadio mobile application has been downloaded approximately 500 million times (including updates). iHeartRadio provides a unique digital music experience by offering access to more than 1,900 live broadcast and digital-only radio stations, plus user-created custom stations with broad social media integration and our on demand content from our premium talk partnerships and user generated talk shows. Through our digital platforms, we estimate that we had more than 81 million unique digital visitors for the month of December 2014. |

5

Table of Contents

Outdoor

We seek to capitalize on our Americas outdoor network and diversified product mix to maximize revenue. In addition, by sharing best practices among our business segments, we believe we can quickly and effectively replicate our successes in our other markets. Our outdoor strategy focuses on leveraging our diversified product mix and long-standing presence in many of our existing markets, which provides us with the ability to launch new products and test new initiatives in a reliable and cost-effective manner.

Promote Overall Outdoor Media Spending. Given the attractive industry fundamentals of outdoor media and our depth and breadth of relationships with both local and national advertisers, we believe we can drive outdoor advertising’s share of total media spending by using our dedicated national sales team to highlight the value of outdoor advertising relative to other media. Outdoor advertising only represented 4% of total dollars spent on advertising in the United States in 2014. We have made and continue to make significant investments in research tools that enable our clients to better understand how our displays can successfully reach their target audiences and promote their advertising campaigns. Also, we are working closely with clients, advertising agencies and other diversified media companies to develop more sophisticated systems that will provide improved audience metrics for outdoor advertising. For example, we have implemented the TAB Out of Home Ratings audience measurement system which: (1) separately reports audiences for billboards, posters, junior posters, transit shelters and phone kiosks, (2) reports for geographically sensitive reach and frequency, (3) provides granular detail, reporting individual out of home units in over 200 designated market areas, (4) provides detailed demographic data comparable to other media, and (5) provides true commercial ratings based on people who see the advertising.

Continue to Deploy Digital Displays. Digital outdoor advertising provides significant advantages over traditional outdoor media. Our electronic displays are linked through centralized computer systems to instantaneously and simultaneously change advertising copy on a large number of displays, allowing us to sell more advertising opportunities to advertisers. The ability to change copy by time of day and quickly change messaging based on advertisers’ needs creates additional flexibility for our customers. Although digital displays require more capital to construct compared to traditional bulletins, the advantages of digital allow us to penetrate new accounts and categories of advertisers, as well as serve a broader set of needs for existing advertisers. Digital displays allow for high-frequency, 24-hour advertising changes in high-traffic locations and allow us to offer our clients optimal flexibility, distribution, circulation and visibility. We expect this trend to continue as we increase our quantity of digital inventory. As of December 31, 2014, we have deployed more than 1,100 digital billboards in 37 markets in the United States.

Capitalize on Product and Geographic Opportunities. We are also focused on growing our business internationally by working closely with our advertising customers and agencies in meeting their needs, and through new product offerings, optimization of our current display portfolio and selective investments targeting promising growth markets. We have continued to innovate and introduce new products in international markets based on local demands. Our core business is our street furniture business and that is where we plan to focus much of our investment. We plan to continue to evaluate municipal contracts that may come up for bid and will make prudent investments where we believe we can receive attractive returns. We will also continue to invest in markets such as China and Latin America where we believe there is high growth potential.

6

Table of Contents

Corporate Structure

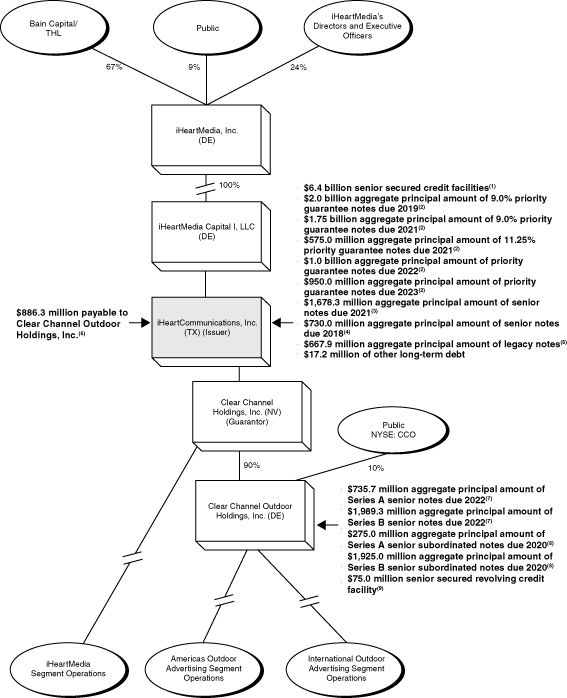

The following chart summarizes our corporate structure and principal indebtedness as of March 31, 2015.

7

Table of Contents

| (1) | Our senior secured credit facilities and receivables based credit facility are guaranteed on a senior secured basis by iHeart Capital and by our material wholly-owned domestic restricted subsidiaries. Our foreign subsidiaries and Clear Channel Outdoor Holdings, Inc. (“CCOH”) and its subsidiaries have not guaranteed any of our obligations under the senior secured credit facilities or receivables based credit facility. As of March 31, 2015, our senior secured credit facilities consisted of a $5,000.0 million Term Loan D facility which matures in January 2019 and a $1,300.0 million Term Loan E facility which matures in July 2019. As of March 31, 2015, we had outstanding $120.0 million aggregate principal amount under our receivables based credit facility. |

| (2) | Our 9.0% priority guarantee notes due 2019, 9.0% priority guarantee notes due 2021, 11.25% priority guarantee notes due 2021, 9.0% priority guarantee notes due 2022 and 10.625% priority guarantee notes due 2023 (collectively, the “priority guarantee notes”) are, and the exchange notes will be, guaranteed on a senior basis by iHeart Capital and by our wholly-owned domestic restricted subsidiaries that guarantee our senior secured credit facilities. Our foreign subsidiaries and CCOH and its subsidiaries have not guaranteed any of our obligations under the priority guarantee notes. As of March 31, 2015, we had outstanding $1,999.8 million aggregate principal amount of 9.0% priority guarantee notes due 2019, $1,716.8 million aggregate principal amount of 9.0% priority guarantee notes due 2021, net of discounts of $33.2 million, $575.0 million aggregate principal amount of 11.25% priority guarantee notes due 2021, $1,002.4 million aggregate principal amount of 9.0% priority guarantee notes due 2022, net of premiums of $2.4 million, and $950.0 million aggregate principal amount of 10.625% priority guarantee notes due 2023. |

| (3) | Our senior notes due 2021 are guaranteed on a senior basis by iHeart Capital and by our wholly-owned domestic restricted subsidiaries that guarantee our senior secured credit facilities, except that those guarantees by our subsidiaries are subordinated to each such guarantor’s guarantee of the senior credit facilities and the priority guarantee notes. As of March 31, 2015, we had outstanding $1,663.1 million aggregate principal amount of the senior notes due 2021, net of unamortized discounts of $15.2 million. Amount in chart above does not include $427.6 million of senior notes due 2021 held by a subsidiary of ours as of March 31, 2015. |

| (4) | Our senior notes due 2018 are not guaranteed by iHeart Capital or any of our subsidiaries. Amount in chart above does not include $120.0 million of senior notes due 2018 held by a subsidiary of ours as of March 31, 2015. |

| (5) | As of March 31, 2015, we had $492.7 million aggregate principal amount of legacy notes outstanding (the “legacy notes”), net of discounts of $175.2 million. Our legacy notes bear interest at fixed rates ranging from 5.5% to 7.25%, have maturities through 2027 and contain provisions, including limitations on certain liens and sale and leaseback transactions, customary for investment grade debt securities. The legacy notes are not guaranteed by iHeart Capital or any of our subsidiaries. Amount in chart above does not include $57.1 million of legacy notes held by a subsidiary of ours as of March 31, 2015. |

| (6) | As part of the day-to-day cash management services we provide to CCOH, we maintain accounts that represent amounts payable to or due from CCOH, and the net amount is recorded as “Due from/to iHeartCommunications” on CCOH’s consolidated balance sheet. As of March 31, 2015, the amount “Due from iHeartCommunications” was $886.3 million, as reflected in an intercompany revolving promissory note payable by us to CCOH (the “Due from iHeartCommunications Note”). |

| (7) | Clear Channel Worldwide Holdings, Inc.’s (“CCWH”) Series A senior notes due 2022 and Series B senior notes due 2022 are guaranteed by CCOH, Clear Channel Outdoor, Inc. (“CCOI”) and certain subsidiaries of CCOH. As of March 31, 2015, CCWH had outstanding $729.7 million aggregate principal amount of Series A senior notes due 2022, net of discounts of $6.0 million, and $1,989.3 million of Series B senior notes due 2022. |

| (8) | CCWH Series A senior subordinated notes due 2020 and Series B senior subordinated notes due 2020 are guaranteed by CCOH, CCOI and certain subsidiaries of CCOH. |

| (9) | The CCOH revolving credit facility is a five-year senior secured revolving credit facility with an aggregate principal amount of $75.0 million. As of March 31, 2015, there were no amounts outstanding under the CCOH revolving credit facility, and $61.3 million of letters of credit issued under the revolving credit facility, which reduce availability under the facility. |

8

Table of Contents

Equity Sponsors

Bain Capital, LLC

Bain Capital is a global private investment firm that manages several pools of capital including private equity, venture capital, public equity, credit products and absolute return with over $75 billion of assets under management. Bain Capital has a team of over 400 professionals dedicated to investing and to supporting its portfolio companies. Since its inception in 1984, Bain Capital has made private equity, growth, and venture capital investments in approximately 400 companies around the world. The firm has offices in Boston, New York, Chicago, Palo Alto, London, Munich, Tokyo, Shanghai, Melbourne, Hong Kong and Mumbai.

Thomas H. Lee Partners, L.P.

THL is a leading private equity firm based in Boston, Massachusetts. The firm focuses on identifying and obtaining substantial ownership positions in growth-oriented companies, headquartered primarily in North America, where it implements operational and strategic improvements to accelerate sustainable revenue and profit growth. As one of the oldest and most experienced private equity firms, THL has raised approximately $20 billion of equity capital and invested in more than 100 businesses with an aggregate purchase price of more than $150 billion. THL strives to build great companies of lasting value and to generate superior investment returns.

Corporate Information

iHeartCommunications is a Texas corporation that was incorporated in 1974. Our corporate headquarters are in San Antonio, Texas and we have executive offices in New York, New York. Our corporate headquarters are located at 200 East Basse Road, San Antonio, Texas 78209 (telephone: 210-822-2828). Our website is http://www.iheartmedia.com. The information on our website is not incorporated by reference or deemed to be part of this prospectus, and you should not rely on it in connection with your decision whether to participate in the exchange offer.

9

Table of Contents

Exchange Offer

On February 26, 2015, we issued $950,000,000 aggregate principal amount of outstanding notes. In connection therewith, we entered into a registration rights agreement with the initial purchasers (the “Initial Purchasers”) and for the benefit of the holders of such notes, in which we agreed, among other things, to file the registration statement of which this prospectus is a part. The following is a summary of the exchange offer. For more information, please see “Exchange Offer.”

| The Outstanding Notes | We issued $950,000,000 aggregate principal amount of outstanding notes on February 26, 2015 and the Initial Purchasers subsequently resold the outstanding notes (i) to qualified institutional buyers pursuant to Rule 144A under the Securities Act and (ii) outside the United States to non-U.S. persons in offshore transactions in reliance on Regulation S under the Securities Act. | |

| Registration Rights Agreement | Simultaneously with the issuance of the outstanding notes, we entered into a registration rights agreement with the Initial Purchasers, pursuant to which we have agreed, among other things, to use commercially reasonable efforts to file with the SEC and cause to become effective a registration statement relating to an offer to exchange the outstanding notes for an issue of SEC-registered notes with terms identical to the outstanding notes. The exchange offer for the outstanding notes is intended to satisfy your rights under the registration rights agreement. After the exchange offer for the outstanding notes is completed, you will no longer be entitled to any exchange or registration rights with respect to your outstanding notes. | |

| The Exchange Offer | We are offering to exchange the exchange notes, which have been registered under the Securities Act, for your outstanding notes, which were issued in the private offering. In order to be exchanged, outstanding notes must be properly tendered and accepted. All outstanding notes that are validly tendered and not validly withdrawn will be exchanged. We will issue the exchange notes promptly after the expiration of the exchange offer. | |

| Resales | Based on interpretations by the staff of the SEC set forth in no-action letters issued to unrelated parties, we believe that the exchange notes issued in the exchange offer may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act provided that: | |

| — the exchange notes are being acquired in the ordinary course of your business;

— you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the exchange notes issued to you in the exchange offer; and

— you are not an affiliate of ours. | ||

| If any of these conditions are not satisfied and you transfer any exchange notes issued to you in the exchange offer without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from registration of your exchange notes from these requirements, you may incur liability under the Securities Act. We will not assume, nor will we indemnify you against, any such liability. | ||

10

Table of Contents

| Each broker-dealer that is issued exchange notes in the exchange offer for its own account in exchange for outstanding notes that were acquired by that broker-dealer as a result of market-making or other trading activities, must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the exchange notes. A broker-dealer may use this prospectus for an offer to resell, resale or other retransfer of the exchange notes issued to it in the exchange offer. | ||

| Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, , 2015 unless we decide to extend it. | |

| Conditions to the Exchange Offer | The exchange offer is not subject to any condition, other than that the exchange offer does not violate applicable law or any applicable interpretation of the staff of the SEC. | |

| Special Procedures for Beneficial Owners | If you are the beneficial owner of book-entry interests and your name does not appear on a security position listing of DTC as the holder of the book-entry interests or if you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender the book-entry interest or outstanding notes in the exchange offer, you should contact the person in whose name your book-entry interests or outstanding notes are registered promptly and instruct that person to tender on your behalf. | |

| Withdrawal Rights | You may withdraw the tender of your outstanding notes from the exchange offer at any time prior to the expiration date. | |

| U.S. Federal Income Tax Consequences | We believe that the exchange of outstanding notes should not be a taxable event for United States federal income tax purposes. | |

| Use of Proceeds; Fees and Expenses | We will not receive any proceeds from the issuance of exchange notes pursuant to the exchange offer. We will pay all of our expenses incident to the exchange offer. | |

| Exchange Agent | U.S. Bank National Association is serving as the exchange agent in connection with the exchange offer. | |

11

Table of Contents

Summary of the Terms of the Exchange Notes

The form and terms of the exchange notes are the same as the form and terms of the outstanding notes, except that the exchange notes will be registered under the Securities Act. As a result, the exchange notes will not bear legends restricting their transfer and will not contain the registration rights and liquidated damage provisions contained in the outstanding notes.

| Issuer | iHeartCommunications, Inc., a Texas corporation. | |

| Notes Offered | $950,000,000 aggregate principal amount of priority guarantee notes due 2023. | |

| Maturity | March 15, 2023 | |

| Interest | The exchange notes will bear interest at a rate of 10.625% per annum. | |

| Ranking | The exchange notes:

— will be our senior obligations;

— will rank equally in right of payment with all of our existing and future indebtedness that is not by its terms expressly subordinated in right of payment to the exchange notes;

— will rank senior in right of payment to all of our existing and future indebtedness that is by its terms expressly subordinated in right of payment to the exchange notes;

— will be effectively subordinated in right of payment to all of our existing and future indebtedness that is secured by assets that are not part of the collateral securing the exchange notes, to the extent of such assets; and

— will be structurally subordinated in right of payment to all existing and future indebtedness and other liabilities of any subsidiary of ours that is not a guarantor of the exchange notes. | |

| As of March 31, 2015, we had approximately $20.5 billion of total indebtedness outstanding, net of unamortized discounts. As of March 31, 2015, our nonguarantor subsidiaries held approximately 51% of our consolidated assets and had $4.9 billion in outstanding indebtedness, excluding intercompany obligations. For the year ended December 31, 2014 and the three months ended March 31, 2015, our non-guarantor subsidiaries generated 47% and 46%, respectively, of our revenue and 26% and (3)%, respectively, of our operating income. | ||

| Guarantors | The exchange notes will be fully and unconditionally guaranteed on a senior basis by iHeart Capital and each of our existing and future wholly-owned domestic restricted subsidiaries. CCOH, which is not a wholly-owned subsidiary of ours, and its subsidiaries will not guarantee the exchange notes. The guarantee of the exchange notes by iHeart Capital will rank equally in right of payment to all existing and future indebtedness of iHeart Capital that is not expressly subordinated in right of payment to such guarantee. Each subsidiary guarantee: | |

| — will rank senior in right of payment to all existing and future indebtedness of the applicable subsidiary guarantor that is by its terms expressly subordinated in right of payment to such subsidiary guarantee;

— will rank equally in right of payment with all existing and future indebtedness of the applicable subsidiary guarantor that is not by its terms expressly subordinated in right of payment to such subsidiary guarantee; and | ||

12

Table of Contents

| — will be effectively subordinated in right of payment to all existing and future indebtedness of the applicable subsidiary guarantor that is secured by assets that are not part of the collateral securing such subsidiary guarantee, to the extent of such assets. | ||

| Each guarantee will be structurally subordinated in right of payment to all existing and future indebtedness and other liabilities of any subsidiary of the applicable guarantor that is not also a guarantor of the exchange notes. | ||

| Security | Initially, our obligations under the exchange notes and the guarantors’ obligations under the guarantees will be secured, subject to prior liens permitted by the indenture governing the legacy notes, by (1) a lien on (a) the capital stock of iHeartCommunications and (b) certain property and related assets that do not constitute “principal property” (as defined in the indenture governing the legacy notes), in each case equal in priority to the liens securing the obligations under our senior secured credit facilities and our priority guarantee notes (collectively, “certain collateral securing our senior secured credit facilities and our priority guarantee notes”) and (2) a lien on the accounts receivable and related assets securing our receivables based credit facility junior in priority to the lien securing our obligations under such receivables based credit facility (the “receivables-based collateral” and, together with certain collateral securing our senior secured credit facilities and our priority guarantee notes, the “collateral”). The collateral will also include (x) 100% of the capital stock of our wholly-owned domestic restricted subsidiaries and intercompany loans between iHeartCommunications and its restricted subsidiaries or between any restricted subsidiaries and (y) our assets that constitute “principal property” under the indenture governing the legacy notes if (A) the aggregate amount of legacy notes outstanding is $500 million or less, (B) the indenture governing the legacy notes has been amended or otherwise modified to remove or limit the applicability of the negative pledge covenant set forth in the indenture governing the legacy notes, (C) any legacy notes are secured or become required to be secured by a lien on any collateral with respect to the springing lien or (D) our senior secured credit facilities and our priority guarantee notes are secured by a lien on the assets described in this sentence (other than certain liens securing our senior secured credit facilities permitted under the indenture governing the legacy notes in effect on the issue date). See “Description of the Exchange Notes—Security.” The value of the collateral at any time will depend on market and other economic conditions, including the availability of suitable buyers for the collateral. See “Risk Factors—Risks Related to the Notes.” | |

| Intercreditor Agreements | The notes are subject to (i) an intercreditor agreement that establishes the relative priority of the liens securing our senior secured credit facilities, our priority guarantee notes and the notes and (ii) an intercreditor agreement that establishes the relative rights of the lenders under our senior secured credit facilities, our receivables based credit facility, our priority guarantee notes and the notes in the collateral securing our receivables based credit facility. See “Description of the Exchange Notes—Intercreditor Agreements.” | |

| Optional Redemption | The notes will be redeemable, in whole or in part, at any time on or after March 15, 2018, at the redemption prices specified under “Description of the Exchange Notes—Optional Redemption.” At any time prior to March 15, 2018, we may redeem up to 40% of the aggregate principal amount of the notes with the net cash proceeds from certain equity offerings at a price equal to 110.625% of the principal amount thereof, together with accrued and unpaid interest, if any, to the redemption date. In addition, at any time prior to March 15, 2018, we may redeem the notes, in whole or in part, at a price equal to 100% of the principal amount of the notes plus a “make-whole” premium, together with accrued and unpaid interest, if any, to the redemption date. | |

13

Table of Contents

| Mandatory Repurchase Offers | If we or our restricted subsidiaries engage in asset sales or sales of collateral under certain circumstances and do not use the proceeds for certain specified purposes, we must use all or a portion of such proceeds to offer to repurchase the notes at 100% of their principal amount, plus accrued and unpaid interest, if any, to the date of purchase. | |

| Additionally, upon the occurrence of a change of control, we must offer to purchase the notes at 101% of their principal amount, plus accrued and unpaid interest, if any, thereon. For more details, you should read “Description of the Exchange Notes—Repurchase of the Option of Holders—Change of Control.” | ||

| Certain Covenants | The indenture governing the notes contains covenants that limit, among other things, our ability and the ability of our restricted subsidiaries to:

— incur additional indebtedness or issue certain preferred stock;

— pay dividends on, or make distributions in respect of, their capital stock

— or repurchase their capital stock;

— make certain investments or other restricted payments;

— sell certain assets;

— create liens or use assets as security in other transactions;

— merge, consolidate or transfer or dispose of substantially all of their assets;

— engage in transactions with affiliates; and

— designate their subsidiaries as unrestricted subsidiaries. | |

| The covenants are subject to a number of important limitations and exceptions. See “Description of the Exchange Notes.” | ||

| Risk Factors | In evaluating whether to participate in the exchange offer, you should carefully consider, along with the other information set forth in this prospectus, the specific factors set forth under “Risk Factors.” | |

14

Table of Contents

Summary Historical Consolidated Financial Data

The following table sets forth summary historical consolidated financial data as of the dates and for the periods indicated. The summary historical consolidated financial data for the years ended December 31, 2014, 2013, and 2012, and as of December 31, 2014 and 2013, are derived from iHeart Capital’s audited consolidated financial statements included elsewhere in this prospectus. The summary historical consolidated financial data as of December 31, 2012 is derived from iHeart Capital’s audited consolidated financial statements and related notes not included herein. The summary historical consolidated financial data as of March 31, 2015 and for the three months ended March 31, 2015 and 2014 are derived from iHeart Capital’s unaudited consolidated financial statements and related notes included elsewhere in this prospectus. The summary historical consolidated financial data as of March 31, 2014 are derived from iHeart Capital’s unaudited consolidated financial statements and related notes not included herein. Historical results are not necessarily indicative of the results to be expected for future periods.

The summary historical consolidated financial data should be read in conjunction with “Risk Factors,” “Selected Historical Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto appearing elsewhere in this prospectus. The amounts in the tables may not add due to rounding.

| (in millions) | Three Months Ended March 31, |

Year Ended December 31, | ||||||||||||||||||

| 2015 | 2014 | 2014 | 2013 | 2012 | ||||||||||||||||

| Results of Operations Data: |

||||||||||||||||||||

| Revenue |

$ | 1,345 | $ | 1,343 | $ | 6,319 | $ | 6,243 | $ | 6,247 | ||||||||||

| Operating Expenses: |

||||||||||||||||||||

| Direct operating expenses |

579 | 598 | 2,541 | 2,565 | 2,505 | |||||||||||||||

| Selling, general and administrative expenses |

416 | 415 | 1,680 | 1,639 | 1,660 | |||||||||||||||

| Corporate expenses(1) |

77 | 73 | 320 | 313 | 293 | |||||||||||||||

| Depreciation and amortization |

171 | 174 | 711 | 731 | 729 | |||||||||||||||

| Impairment charges |

— | — | 24 | 17 | 38 | |||||||||||||||

| Other operating (expense) income, net |

(9 | ) | — | 40 | 23 | 48 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income |

93 | 83 | 1,082 | 1,001 | 1,070 | |||||||||||||||

| Interest expense |

442 | 431 | 1,742 | 1,649 | 1,549 | |||||||||||||||

| Gain (loss) on marketable securities |

1 | — | — | 131 | (5 | ) | ||||||||||||||

| Equity in earnings (loss) of nonconsolidated affiliates |

— | (13 | ) | (9 | ) | (78 | ) | 19 | ||||||||||||

| Loss on extinguishment of debt |

(2 | ) | (4 | ) | (43 | ) | (88 | ) | (255 | ) | ||||||||||

| Other income (expense), net |

20 | 1 | 9 | (22 | ) | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before income taxes |

(330 | ) | (364 | ) | (704 | ) | (705 | ) | (719 | ) | ||||||||||

| Income tax benefit (expense) |

(57 | ) | (68 | ) | (58 | ) | 122 | 308 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Consolidated net loss |

(387 | ) | (432 | ) | (762 | ) | (584 | ) | (411 | ) | ||||||||||

| Amount attributable to noncontrolling interest |

(2 | ) | (8 | ) | 32 | 23 | 13 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss attributable to the Company |

$ | (385 | ) | $ | (424 | ) | $ | (794 | ) | $ | (607 | ) | $ | (424 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash Flow Data: |

||||||||||||||||||||

| Cash interest expense(2) |

$ | 495 | $ | 413 | $ | 1,541 | $ | 1,543 | $ | 1,381 | ||||||||||

| Capital expenditures(3) |

(56 | ) | (67 | ) | 318 | 325 | 390 | |||||||||||||

| Net cash flows used by operating activities |

(236 | ) | (92 | ) | 245 | 213 | 485 | |||||||||||||

| Net cash flows provided by (used for) investing activities |

(31 | ) | 153 | (89 | ) | (133 | ) | (397 | ) | |||||||||||

| Net cash flows provided by (used for) financing activities |

(105 | ) | (106 | ) | (398 | ) | (596 | ) | (95 | ) | ||||||||||

| Balance Sheet Data (at period end): |

||||||||||||||||||||

| Current assets |

$ | 1,918 | $ | 2,350 | $ | 2,180 | $ | 2,513 | $ | 2,988 | ||||||||||

| Property, plant and equipment, net |

2,586 | 2,855 | 2,699 | 2,898 | 3,037 | |||||||||||||||

| Total assets |

13,582 | 14,597 | 14,040 | 15,097 | 16,293 | |||||||||||||||

| Current liabilities |

1,234 | 1,707 | 1,364 | 1,764 | 1,782 | |||||||||||||||

| Long-term debt, net of current maturities |

20,483 | 20,010 | 20,322 | 20,030 | 20,365 | |||||||||||||||

| Member’s deficit |

(10,154 | ) | (9,128 | ) | (9,665 | ) | (8,697 | ) | (7,995 | ) | ||||||||||

| (1) | Includes non-cash compensation expense. |

| (2) | Cash interest expense, a non-GAAP financial measure, includes cash paid for interest expense and excludes amortization of deferred financing costs and original issue discount. The most directly comparable GAAP financial measure is interest expense, as presented in our Results of Operations data above. |

| (3) | Capital expenditures include additions to our property, plant and equipment and do not include any proceeds from disposal of assets, nor any expenditures for business combinations. |

15

Table of Contents

You should carefully consider the following risk factors as well as the other information and data included in this prospectus before participating in the exchange offer. Any of the following risks related to our business could materially and adversely affect our business, cash flows, financial condition or results of operations. In such a case, you may lose all or part of your original investment in your notes.

Risk Factors Related to the Exchange Offer

Because there is no public market for the exchange notes, you may not be able to resell your exchange notes

The exchange notes will be registered under the Securities Act, but will constitute new issues of securities with no established trading market, and there can be no assurance as to:

| • | the liquidity of any trading market that may develop; |

| • | the ability of holders to sell their exchange notes; or |

| • | the price at which the holders would be able to sell their exchange notes. |

If a trading market were to develop, the exchange notes might trade at higher or lower prices than their respective principal amount or purchase price, depending on many factors, including prevailing interest rates, the market for similar securities and our financial performance.

Your outstanding notes will not be accepted for exchange if you fail to follow the exchange offer procedures

We will not accept your outstanding notes for exchange in the exchange offer if you do not follow the exchange offer procedures. We will issue exchange notes as part of the exchange offer only after a timely receipt of your outstanding notes and all other required documents. Therefore, if you want to tender your outstanding notes, please allow sufficient time to ensure timely delivery. If we do not receive your outstanding notes and other required documents by the expiration date of the exchange offer, we will not accept your outstanding notes for exchange. We are under no duty to give notification of defects or irregularities with respect to the tenders of outstanding notes for exchange. If there are defects or irregularities with respect to your tender of outstanding notes, we may not accept your outstanding notes for exchange. For more information, see “Exchange Offer.”

In addition, any holder of outstanding notes who tenders in the exchange offer for the purpose of participating in a distribution of the exchange notes may be deemed to have received restricted securities, and if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction. For a description of these requirements, see “Exchange Offer.”

If you do not exchange your outstanding notes, your outstanding notes will continue to be subject to the existing transfer restrictions and you may not be able to sell your outstanding notes

We did not register the outstanding notes, nor do we intend to do so following the exchange offer. Outstanding notes that are not tendered will therefore continue to be subject to the existing transfer restrictions and may be transferred only in limited circumstances under the securities laws. If you do not exchange your outstanding notes, you will lose your right to have your outstanding notes registered under the federal securities laws. As a result, if you hold outstanding notes after the exchange offer, you may not be able to sell your outstanding notes.

Risks Related to Our Business

Our results have been in the past, and could be in the future, adversely affected by economic uncertainty or deteriorations in economic conditions

We derive revenues from the sale of advertising. Expenditures by advertisers tend to be cyclical, reflecting economic conditions and budgeting and buying patterns. Periods of a slowing economy or recession, or periods of economic uncertainty, may be accompanied by a decrease in advertising. For example, the global economic downturn that began in 2008 resulted in a decline in advertising and marketing by our customers, which resulted in a decline in advertising revenues across our businesses. This reduction in advertising revenues had an adverse effect on our revenue, profit margins, cash flow and liquidity. Global economic conditions have been slow to recover and remain uncertain. If economic conditions do not continue to improve, economic uncertainty increases or economic conditions deteriorate again, global economic conditions may once again adversely impact our revenue, profit margins,

16

Table of Contents

cash flow and liquidity. Furthermore, because a significant portion of our revenue is derived from local advertisers, our ability to generate revenues in specific markets is directly affected by local and regional conditions, and unfavorable regional economic conditions also may adversely impact our results. In addition, even in the absence of a downturn in general economic conditions, an individual business sector or market may experience a downturn, causing it to reduce its advertising expenditures, which also may adversely impact our results.

We performed impairment tests on our goodwill and other intangible assets during the fourth quarter of 2014, 2013 and 2012 and recorded non-cash impairment charges of $19.2 million, $17.0 million and $37.7 million, respectively. Although we believe we have made reasonable estimates and used appropriate assumptions to calculate the fair value of our licenses, billboard permits and reporting units, it is possible a material change could occur. If actual market conditions and operational performance for the respective reporting units underlying the intangible assets were to deteriorate, or if facts and circumstances change that would more likely than not reduce the estimated fair value of the indefinite-lived assets or goodwill for these reporting units below their adjusted carrying amounts, we may also be required to recognize additional impairment charges in future periods, which could have a material impact on our financial condition and results of operations.

To service our debt obligations and to fund capital expenditures, we will require a significant amount of cash to meet our needs, which depends on many factors beyond our control