(State or other jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||

Description | Page Number | |

Fiscal Years | 2019 | 2018 | ||||||||||

Quarter | Net Sales | Net Earnings | Net Sales | Net Earnings | ||||||||

First | 19 | % | 22 | % | 21 | % | 8 | % | ||||

Second1,2 | 31 | % | 42 | % | 33 | % | 48 | % | ||||

Third1,2 | 27 | % | 22 | % | 25 | % | 29 | % | ||||

Fourth1 | 23 | % | 14 | % | 21 | % | 15 | % | ||||

1 | Fiscal 2019 net sales and net earnings were impacted by our acquisition of CMW. Refer to Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," and Note 2, Business Combinations, of the Notes to Consolidated Financial Statements included in Part II, Item 8, "Financial Statements and Supplementary Data" of this Annual Report on Form 10-K for additional information regarding CMW and its impact to our fiscal 2019 Results of Operations. |

2 | During fiscal 2019, CMW's financial position, results of operations, and cash flows were reported on a calendar month end. Accordingly, April 30, 2019 and July 31, 2019 were the quarterly period end dates closest to our quarterly fiscal periods ended May 3, 2019 and August 2, 2019, respectively. This reporting period difference did not have material impact on our Consolidated Results of Operations during our second and third fiscal quarters. For our fiscal 2019 fourth quarter, the reporting period end for both CMW and Toro was October 31, 2019. |

• | The U.S. EPA, the California Air Resources Board, and similar regulators in other U.S. states and foreign jurisdictions in which we sell our products have phased in, or are phasing in, emission regulations setting maximum emission standards for certain equipment. Specifically, these agencies from time to time adopt increasingly stringent engine emission regulations. Following the EPA implementation of Tier 4 emission requirements applicable to diesel engines several years ago, China and the European Union ("EU") also have adopted similar regulations, and similar emission regulations are also being considered in other markets in which we sell our products. |

• | The U.S. federal government, several U.S. states, and certain international jurisdictions in which we sell our products, including the EU and each of its member states, have implemented one or more of the following: (i) product life-cycle laws, rules, or regulations, which are intended to reduce waste and environmental and human health impact, and require manufacturers to label, collect, dispose, and recycle certain products, including some of our products, at the end of their useful life, including the Waste Electrical and Electronic Equipment directive, which mandates the labeling, collection, and disposal of specified waste electrical and electronic equipment; (ii) the Restriction on the use of Hazardous Substances directive or similar substance level laws, rules, or regulations, which restrict the use of several specified hazardous materials in the manufacture of specific types of electrical and electronic equipment; (iii) the Registration, Evaluation, Authorization and Restriction of Chemicals directive or similar substance level laws, rules, or regulations that require notification of use of certain chemicals, or ban or restrict the use of certain chemicals; (iv) country of origin |

• | Our products, when used by residential users, may be subject to various federal, state, and international laws, rules, and regulations that are designed to protect consumers, including rules and regulations of the U.S. Consumer Product Safety Commission. |

• | reduced levels of investment in golf course renovations and improvements and new golf course development; reduced revenue for golf courses resulting from a decrease in rounds played and/or memberships, as applicable; and increased number of golf course closures; |

• | reduced consumer and business spending on property maintenance, such as lawn care and snow and ice removal activities, and/or unfavorable weather conditions, causing property owners and landscape contractor professionals to forego or postpone purchases of our products; |

• | low or reduced levels of residential, commercial, and/or municipal construction projects and/or infrastructure improvements; |

• | a decline in acceptance of and demand for ag-irrigation solutions for agricultural production; |

• | availability of cash or credit on acceptable terms to finance new product purchases; and |

• | customer and/or government budgetary constraints resulting in reduced spending for grounds maintenance or construction equipment. |

• | diversion of management's attention; |

• | disruption to our existing operations and plans; |

• | inability to effectively manage our expanded operations; |

• | difficulties or delays in integrating and assimilating information and financial systems, operations, manufacturing processes and products of an acquired business or other business venture or in realizing projected efficiencies, growth prospects, cost savings, and synergies; |

• | inability to successfully integrate or develop a distribution channel for acquired product lines; |

• | potential loss of key employees, customers, distributors, or dealers of the acquired businesses or adverse effects on existing business relationships with suppliers, customers, distributors, and dealers; |

• | write-off of significant amounts of goodwill, other intangible assets, and/or long-lived assets as a result of deterioration in the performance of an acquired business or product line, adverse market conditions, changes in the competitive landscape, changes in laws or regulations that restrict activities of an acquired business or product line, or as a result of a variety of other circumstances; |

• | delays or challenges in transitioning distributors and dealers of acquired businesses to available floor plan financing arrangements; |

• | violation of confidentiality, intellectual property, and non-compete obligations or agreements by employees of an acquired business or lack of or inadequate formal intellectual property protection mechanisms in place at an acquired business; |

• | adverse impact on overall profitability if our expanded operations do not achieve the financial results projected in our valuation models; |

• | reallocation of amounts of capital from other operating initiatives and/or an increase in our leverage and debt service requirements to pay acquisition purchase prices or other business venture investment costs, which could in turn restrict our ability to access additional capital when needed or pursue other important elements of our business strategy; |

• | failure by acquired businesses or other business ventures to comply with applicable international, federal, and state product safety or other regulatory standards; |

• | infringement by acquired businesses or other business ventures of intellectual property rights of others; |

• | inaccurate assessment of additional post-acquisition or business venture investments, undisclosed, contingent or other liabilities or problems, unanticipated costs associated with an acquisition or other business venture, and an inability to recover or manage such liabilities and costs; and |

• | incorrect estimates made in the accounting for acquisitions and incurrence of non-recurring charges. |

• | diversion of management's attention to manage the CMW businesses and integrate CMW’s operations; |

• | disruption to our existing operations and plans or inability to effectively manage our expanded operations; |

• | failure, difficulties or delays in securing, integrating and assimilating information, financial systems, internal controls, operations, manufacturing processes and products, or the distribution channel for CMW’s businesses and product lines; |

• | potential loss of key employees, customers, distributors, dealers, or suppliers or other adverse effects on existing business relationships with customers, distributors, dealers, and suppliers; |

• | adverse impact on overall profitability if our expanded operations do not achieve the growth prospects, net sales, earnings, cost or revenue synergies, or other financial results projected in our valuation models, delays in the realization thereof or costs or charges incurred to achieve any revenue or cost synergies, including as a result of the Toro underground wind down or otherwise; |

• | the increase in our leverage and debt service requirements to fund the purchase price of the acquisition could restrict our ability to access additional capital when needed, result in a decrease in our credit rating, or limit our ability to pursue other important elements of our business strategy; |

• | inaccurate assessment of undisclosed, contingent or other liabilities, unanticipated costs associated with the acquisition, and despite the existence of representations, warranties and indemnities in the merger agreement and a |

• | impacts as a result of purchase accounting adjustments, incorrect estimates made in the accounting for the acquisition, or the potential future write-off of significant amounts of goodwill, intangible assets and/or other tangible long-lived assets if the CMW business does not perform in the future as expected, or other potential financial accounting or reporting impacts. |

• | increased costs of customizing products for foreign countries; |

• | difficulties in managing and staffing international operations and increases in infrastructure costs including legal, tax, accounting, and information technology; |

• | the imposition of additional U.S. and foreign governmental controls or regulations; |

• | new or enhanced trade restrictions and restrictions on the activities of foreign agents, representatives, and distribution channel customers; |

• | withdrawal from or revisions to international trade policies or agreements and the imposition or increases in import and export licensing and other compliance requirements, customs duties and tariffs, import and export quotas and other trade restrictions, license obligations, and other non-tariff barriers to trade; |

• | the imposition of U.S. and/or international sanctions against a country, company, person, or entity with whom we do business that would restrict or prohibit our business with the sanctioned country, company, person, or entity; |

• | international pricing pressures; |

• | laws and business practices favoring local companies; |

• | adverse currency exchange rate fluctuations; |

• | longer payment cycles and difficulties in enforcing agreements and collecting receivables through certain foreign legal systems; |

• | higher tax rates and potentially adverse tax consequences, including restrictions on repatriating cash and/or earnings to the U.S.; |

• | fluctuations in our operating performance based on our geographic mix of sales; |

• | transportation delays and interruptions; |

• | national and international conflicts, including foreign policy changes, acts of war or terrorist acts; |

• | difficulties in protecting, enforcing or defending intellectual property rights; and |

• | multiple, changing, and often inconsistent enforcement of laws, rules, regulations and standards, including rules relating to taxes, environmental, health and safety matters. |

• | create liens or other encumbrances on our assets; |

• | dispose of assets; |

• | engage in mergers or consolidations; and |

• | pay dividends that are significantly higher than those currently being paid, make other distributions to our shareholders, or redeem shares of our common stock. |

Location | Ownership | Products Manufactured / Use | ||

Abilene, TX | Leased | Office, professional products, and service center | ||

Albany, GA | Owned | Professional service area and office | ||

Albis, France | Leased | Professional service area and office | ||

Althengstett, Germany | Owned | Professional products, distribution facility, and office | ||

Ankeny, IA | Leased | Professional and residential distribution center | ||

Baraboo, WI | Leased | Professional and residential distribution center | ||

Barcelona, Spain | Leased | Professional products warehouse and office | ||

Beatrice, NE | Owned/Leased | Professional products, test facility, and office | ||

Beijing, China | Leased | Professional products manufacturing, distribution facility, and office | ||

Beverley, Australia | Owned | Professional products, distribution facility, service area, and office | ||

Bloomington, MN | Owned/Leased | Corporate headquarters, warehouse, and test facility | ||

Boulder, CO | Leased | Professional office | ||

Braeside, Australia | Leased | Distribution facility, service area, and office | ||

Branchburg, NJ | Owned | Distribution facility, service area, and office | ||

Brooklyn Center, MN | Leased | Distribution facility, service area, and office | ||

Capena, Italy | Leased | Distribution center | ||

Corpus Christi, TX | Owned | Professional service area and office | ||

El Cajon, CA | Owned/Leased | Professional products, distribution facility, test site, and office | ||

El Paso, TX | Owned/Leased | Residential component parts and professional products manufacturing, and distribution facility | ||

Fiano Romano, Italy | Owned/Leased | Professional products, distribution facility, and office | ||

Forest Park, GA | Leased | Professional service area and office | ||

Fresno, CA | Leased | Professional products warehouse | ||

Grandville, MI | Leased | Professional service area and office | ||

Harlingen, TX | Leased | Professional service area and office | ||

Hertfordshire, United Kingdom | Owned | Professional and residential products, distribution facility, test lab, and office | ||

Howell, MI | Owned | Professional service area and office | ||

Iron Mountain, MI | Owned/Leased | Professional products, distribution facility, and office | ||

Juarez, Mexico | Leased | Professional and residential products and warehouse | ||

Lake Mills, WI | Owned | Professional products manufacturing and distribution facility and office | ||

Oevel, Belgium | Owned | Distribution center, service area, and office | ||

Perry, OK | Owned/Leased | Professional products, test facility, warehouse, distribution facility, and office | ||

Petaluma, CA | Leased | Professional products manufacturing and distribution facility, service area, and office | ||

Ploiesti, Romania | Owned | Professional products, distribution facility, test facility, and office | ||

Plymouth, WI | Owned | Professional and residential parts distribution center | ||

Pune, India | Leased | Corporate service center | ||

Riverside, CA | Owned/Leased | Professional products, test facility, distribution facility, and office | ||

Ronkonkoma, NY | Owned | Distribution facility, service area, and office | ||

Sanford, FL | Leased | Professional products and distribution center | ||

Savannah, GA | Leased | Professional service area and office | ||

Shakopee, MN | Owned | Components for professional and residential products | ||

St. Louis, MO | Leased | Distribution facility, service area, and office | ||

Sterling, KY | Leased | Professional products manufacturing and distribution facility, service area, and office | ||

Tomah, WI | Owned/Leased | Professional products and distribution center | ||

Traverse City, MI | Leased | Professional and warehouse | ||

Ustron, Poland | Owned | Professional products, distribution facility, and office | ||

Weatherford, TX | Owned | Professional products manufacturing and distribution facility and office | ||

West Salem, OH | Owned | Professional products manufacturing and distribution facility and office | ||

Windom, MN | Owned/Leased | Residential and professional products and warehouses | ||

Xiamen City, China | Leased | Professional and residential products and related components, distribution facility, and office | ||

Name, Age, and Position | Business Experience during the Last Five or More Years | |

Richard M. Olson 55, Chairman of the Board, President and Chief Executive Officer | Chairman of the Board since November 2017 and President and Chief Executive Officer since November 2016. From September 2015 through October 2016, he served as President and Chief Operating Officer. From June 2014 through August 2015, he served as Group Vice President, International Business, Global Ag-Irrigation Business, and Distributor Development. From March 2013 through May 2014, he served as Vice President, International Business. From March 2012 to February 2013, he served as Vice President, Exmark. | |

Jody M. Christy 51, Vice President, BOSS | Vice President, BOSS since December 2018. From June 2016 to November 2018, he served as General Manager, BOSS. At the time of the acquisition of BOSS in November 2014 to May 2016, he served as Director, Engineering for BOSS. Prior to the acquisition of BOSS in November 2014, from January 2012 to October 2014, he served as the Head of Engineering for BOSS. | |

Amy E. Dahl 45, Vice President, Human Resources and Distributor Development | Vice President, Human Resources since April 2015, and in December 2016 she assumed responsibility for our distributor development activity. From June 2013 through March 2015, she served as Managing Director, Corporate Communications and Investor Relations. From July 2012 to May 2013, she served as Assistant General Counsel and Assistant Secretary. Effective January 10, 2020, she will become the company's Vice President, Human Resources, Distributor Development and General Counsel, as well as its Corporate Secretary. | |

Timothy P. Dordell 57, Vice President, Secretary and General Counsel | Vice President, Secretary and General Counsel since May 2007. On November 8, 2019, Mr. Dordell notified the company of his decision to retire, which is effective January 10, 2020. | |

Blake M. Grams 52, Vice President, Global Operations | Vice President, Global Operations since June 2013. From December 2008 to May 2013, he served as Vice President, Corporate Controller. | |

Bradley A. Hamilton 55, Group Vice President, Commercial, International, and Irrigation Businesses | Group Vice President, Commercial, International, and Irrigation Businesses since October 2018. From November 2017 to September 2018, he served as Group Vice President, Commercial and International Businesses. From October 2016 to November 2017, he served as Vice President, Commercial Business. From April 2015 to October 2016, he served as General Manager, Commercial Business. From June 2014 through March 2015, he served as Managing Director, Distributor Development and Financial Services. From March 2012 through May 2014, he served as Director, Distributor Development. | |

Gregory S. Janey 41, Vice President, Residential and Landscape Contractor Businesses | Vice President, Residential and Landscape Contractor Businesses since November 2019. From November 2017 to October 2019, he served as General Manager, Residential and Landscape Contractor Businesses. From April 2015 to October 2017, he served as Director, Marketing International Business. From January 2013 through March 2015, he served as Director, Residential Mass Sales and National Accounts in our Residential Business. | |

Peter D. Moeller 42, Vice President, Sitework Systems Business | Vice President, Sitework Systems Business since November 2019. From November 2017 to October 2019, he served as General Manager, Sitework Systems Business. From April 2015 to October 2017, he served as Managing Director, Business Development and Strategic Planning. From September 2010 to March 2015, he served as Director, Marketing for Irrigation Business. | |

Renee J. Peterson 58, Vice President, Treasurer and Chief Financial Officer | Vice President, Treasurer and Chief Financial Officer since July 2013. From August 2011 to July 2013, she served as Vice President, Finance and Chief Financial Officer. | |

Darren L. Redetzke 55, Vice President, International Business | Vice President, International Business since April 2015. From August 2010 to April 2015, he served as Vice President, Commercial Business. | |

Richard W. Rodier 59, Group Vice President, Construction Businesses | Group Vice President, Construction Businesses since April 2019. From November 2017 to April 2019, he served as Vice President, Commercial Business. From October 2016 to November 2017, he served as Vice President, Sitework Systems. From February 2009 to October 2016, he served as General Manager, Sitework Systems. | |

Kurt D. Svendsen 53, Vice President, Information Services | Vice President, Information Services since June 2013. From September 2011 to June 2013, he served as Managing Director, Corporate Communications and Investor Relations. | |

Period | Total Number of Shares (or Units) Purchased1, 2 | Average Price Paid per Share (or Unit) | Total Number of Shares (or Units) Purchased As Part of Publicly Announced Plans or Programs1 | Maximum Number of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs1 | |||||||||

August 3, 2019 through August 30, 2019 | — | $ | — | — | 7,042,256 | ||||||||

August 31, 2019 through September 27, 2019 | — | — | — | 7,042,256 | |||||||||

September 28, 2019 through October 31, 2019 | 1,172 | 73.93 | — | 7,042,256 | |||||||||

Total | 1,172 | $ | 73.93 | — | |||||||||

1 | On December 3, 2015, the company's Board of Directors authorized the repurchase of 8,000,000 shares of the company's common stock in open-market or in privately negotiated transactions. On December 4, 2018, the company’s Board of Directors authorized the repurchase of up to an additional 5,000,000 shares of the company’s common stock in open-market or privately negotiated transactions. This authorized stock repurchase program has no expiration date but may be terminated by the company's Board of Directors at any time. No shares were repurchased under this authorized stock repurchase program during the fourth quarter of fiscal 2019 and 7,042,256 shares remained available to repurchase under this authorized stock repurchase program as of October 31, 2019. |

2 | Includes 1,172 units ("shares") of the company's common stock purchased in open-market transactions at an average price of $73.93 per share on behalf of a rabbi trust formed to pay benefit obligations of the company to participants in deferred compensation plans. These 1,172 shares were not repurchased under the company's repurchase programs described in footnote 1 above. |

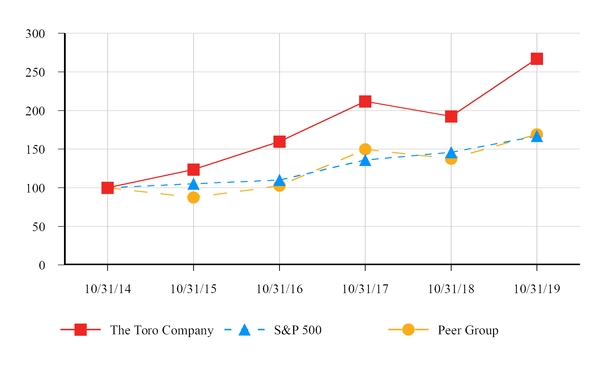

Fiscal Years Ended October 31 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | ||||||||||||||||||

The Toro Company | $ | 100.00 | $ | 123.75 | $ | 159.70 | $ | 212.00 | $ | 192.49 | $ | 267.18 | ||||||||||||

S&P 500 | 100.00 | 105.20 | 109.94 | 135.93 | 145.91 | 166.81 | ||||||||||||||||||

Peer Group | $ | 100.00 | $ | 87.42 | $ | 102.45 | $ | 149.67 | $ | 137.51 | $ | 169.20 | ||||||||||||

(Dollars in thousands, except per share data) Fiscal Years Ended October 31 | 2019 3 | 2018 2 | 2017 | 2016 | 2015 1 | |||||||||||||||

Consolidated Statements of Earnings data: | ||||||||||||||||||||

Net sales | $ | 3,138,084 | $ | 2,618,650 | $ | 2,505,176 | $ | 2,392,175 | $ | 2,390,875 | ||||||||||

Net earnings | 273,983 | 271,939 | 267,717 | 230,994 | 201,591 | |||||||||||||||

Basic net earnings per share | 2.57 | 2.56 | 2.47 | 2.10 | 1.81 | |||||||||||||||

Diluted net earnings per share | $ | 2.53 | $ | 2.50 | $ | 2.41 | $ | 2.06 | $ | 1.78 | ||||||||||

Consolidated Balance Sheets data: | ||||||||||||||||||||

Total assets | $ | 2,330,547 | $ | 1,570,984 | $ | 1,493,787 | $ | 1,384,572 | $ | 1,300,429 | ||||||||||

Long-term debt, including current portion | $ | 700,813 | $ | 312,549 | $ | 331,887 | $ | 350,961 | $ | 374,723 | ||||||||||

Consolidated Statements of Cash Flows data: | ||||||||||||||||||||

Cash dividends per share of Toro common stock | $ | 0.90 | $ | 0.80 | $ | 0.70 | $ | 0.60 | $ | 0.50 | ||||||||||

1 | Basic and diluted net earnings per share have been adjusted for prior periods presented to reflect the impact of our two-for-one stock split effective September 16, 2016. |

2 | Net earnings and basic and diluted net earnings per share were significantly impacted by the enactment of Public Law No. 115-97 ("Tax Act" or "U.S. Tax Reform"), originally introduced as the Tax Cuts and Jobs Act, during fiscal 2018. Refer to the section entitled "Results of Operations" included in Part I, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and Note 8, Income Taxes, of the Notes to Consolidated Financial Statements included in Part II, Item 8, "Financial Statements and Supplementary Data" of this Annual Report on Form 10-K, as well as our Annual Report on Form 10-K for the fiscal year ended October 31, 2018, for additional information regarding U.S. Tax Reform and its impact to our fiscal 2018 Results of Operations. |

3 | The company's Consolidated Financial Statements include results of the CMW business from April 1, 2019, the date of acquisition, including charges incurred for acquisition-related purchase accounting adjustments and transaction and integration costs. Refer to the section entitled "Results of Operations" included in Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," and Note 2, Business Combinations, of the Notes to Consolidated Financial Statements included in Part II, Item 8, "Financial Statements and Supplementary Data" of this Annual Report on Form 10-K for additional information regarding our acquisition of CMW and its impact to our fiscal 2019 Results of Operations. |

• | Company Overview |

• | Results of Operations |

• | Business Segments |

• | Financial Position |

• | Non-GAAP Financial Measures |

• | Critical Accounting Policies and Estimates |

• | Net sales for fiscal 2019 increased by 19.8 percent to $3,138.1 million when compared to fiscal 2018. The sales increase was primarily driven by incremental sales as a result of our acquisition of CMW, the year-over-year impact of price increases across our Professional and Residential segment product lines, strong channel demand for our Professional segment snow and ice management products and Residential snow thrower products, incremental sales as a result of our acquisition of a Northeastern U.S. distribution company, as well as the successful introduction of innovative new products in the Professional and Residential segments. |

• | Professional segment net sales grew 25.5 percent in fiscal 2019 compared to fiscal 2018. |

• | Residential segment net sales increased 1.0 percent in fiscal 2019 compared to fiscal 2018. |

• | International net sales for fiscal 2019 increased by 12.7 percent compared to fiscal 2018, primarily driven by incremental sales as a result of our acquisition of CMW. Foreign currency exchange rates unfavorably impacted our international net sales by approximately $14.1 million in fiscal 2019. International net sales comprised 23.1 percent of our total consolidated net sales in fiscal 2019 compared to 24.6 percent and 24.4 percent in fiscal 2018 and 2017, respectively. |

• | Gross margin was 33.4 percent in fiscal 2019, a decrease of 250 basis points from 35.9 percent in fiscal 2018. Non-GAAP adjusted gross margin was 35.1 percent in fiscal 2019, a decrease of 80 basis points from 35.9 percent in fiscal 2018. |

• | Selling, general, and administrative ("SG&A") expense was 23.0 percent as a percentage of net sales in fiscal 2019, |

• | Fiscal 2019 net earnings of $274.0 million increased 0.8 percent compared to fiscal 2018, and diluted net earnings per share increased 1.2 percent to $2.53 in fiscal 2019 compared to $2.50 in fiscal 2018. Fiscal 2019 non-GAAP adjusted net earnings were $324.3 million, an increase of 11.8 percent compared to fiscal 2018, and non-GAAP adjusted diluted net earnings per share increased 12.4 percent to $3.00 in fiscal 2019 compared to $2.67 in fiscal 2018. |

• | Our receivables and inventories increased by 39.1 percent and 81.9 percent, respectively, as of the end of fiscal 2019 compared to the end of fiscal 2018, primarily due to incremental receivables and inventories as a result of our acquisition of CMW. |

• | Our field inventory levels were up as of the end of fiscal 2019 compared to the end of fiscal 2018, primarily as a result of higher Professional segment field inventory that was primarily due to incremental field inventory as a result of our acquisition of CMW and higher field inventory for our Professional segment zero-turn riding mowers due to soft retail demand. |

• | We continued our history of paying quarterly cash dividends in fiscal 2019. We increased our fiscal 2019 quarterly cash dividend by 12.5 percent to $0.225 per share compared to our quarterly cash dividend in fiscal 2018 of $0.20 per share. |

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | ||||||

Net sales | 100.0 | % | 100.0 | % | 100.0 | % | |||

Cost of sales | (66.6 | ) | (64.1 | ) | (63.2 | ) | |||

Gross margin | 33.4 | 35.9 | 36.8 | ||||||

SG&A expense | (23.0 | ) | (21.7 | ) | (22.6 | ) | |||

Operating earnings | 10.4 | 14.2 | 14.2 | ||||||

Interest expense | (0.9 | ) | (0.7 | ) | (0.8 | ) | |||

Other income, net | 0.8 | 0.7 | 0.7 | ||||||

Provision for income taxes | (1.6 | ) | (3.8 | ) | (3.4 | ) | |||

Net earnings | 8.7 | % | 10.4 | % | 10.7 | % | |||

• | Increased worldwide sales of Professional segment products, which were primarily driven by incremental sales as a result of our acquisition of CMW, the year-over-year impact of price increases across our Professional segment product lines, and strong channel demand for our snow and ice management, landscape contractor, and Toro-branded rental and specialty construction equipment, partially offset by fewer shipments of our irrigation products due to unfavorable weather in key regions. |

• | Increased sales for our Other activities were primarily due to increased shipments of our golf and grounds equipment through our wholly-owned domestic distribution companies driven by our acquisition of a Northeastern U.S. distribution company. |

• | Increased worldwide sales of Residential segment products were primarily due to the year-over-year impact of price increases across our Residential segment product lines, strong retail demand for snow throwers, the successful introduction of new products, and increased parts sales, partially offset by soft retail demand for zero-turn riding mowers and reduced sales of our Pope-branded irrigation products by unfavorable weather conditions. |

• | incremental sales as a result of our acquisition of CMW, |

• | strong channel demand for our golf and grounds equipment, and |

• | strong retail demand for Residential snow thrower products. |

• | decreased sales of Residential and Professional segment zero-turn riding mowers due to soft retail demand, |

• | lower sales of Pope-branded products due to unfavorable weather in key regions, and |

• | changes in foreign currency exchange rates unfavorably impacted our international net sales by approximately $14.1 million in fiscal 2019. |

• | the unfavorable impact of higher commodity and tariff costs on purchased raw materials and component parts, |

• | the impact of purchase accounting adjustments related to our acquisition of CMW, |

• | unfavorable product mix, |

• | charges related to the Toro underground wind down, and |

• | supply chain challenges and inclement weather resulting in manufacturing inefficiencies within our Professional segment. |

• | improved net price realization driven by price increases across our product lines, |

• | productivity initiatives related to commodities, components, parts, and accessories sourcing, and |

• | lower freight costs due to cost reduction initiatives. |

• | the unfavorable impact of higher commodity and tariff costs on purchased raw materials and component parts, |

• | unfavorable product mix, and |

• | supply chain challenges and inclement weather resulting in manufacturing inefficiencies within our Professional segment. |

• | improved net price realization driven by price increases across our product lines, |

• | productivity initiatives related to commodities, components, parts, and accessories sourcing, and |

• | lower freight costs due to cost reduction initiatives. |

• | the acquisition of CMW, which resulted in incremental administrative, indirect sales and marketing, engineering, warranty, and service expense; integration and acquisition-related expenditures, and higher amortization of other intangible assets; |

• | increased warranty costs in certain of our legacy businesses; and |

• | increased engineering expense for new product development in our legacy businesses. |

• | realized gain on actuarial valuation changes for our pension and post-retirement plans of $6.8 million and |

• | higher earnings from our equity investment in Red Iron of $0.8 million. |

• | increased legal expense, net of litigation recoveries, of $1.0 million and |

• | the loss on the sale of a used underground construction equipment business of $0.9 million. |

• | the significant impact of the one-time charges as a result of the Tax Act on our fiscal 2018 net earnings, |

• | incremental earnings as a result of our acquisition of CMW, |

• | improved net price realization driven by price increases across our product lines, |

• | the reduction in the U.S federal corporate tax rate from a blended rate of 23.3 percent in fiscal 2018 to a rate of 21.0 percent in fiscal 2019, |

• | productivity initiatives related to commodities and component parts sourcing, and |

• | the realized gain on actuarial valuation changes for our pension and post-retirement plans. |

• | the unfavorable impact of purchase accounting adjustments and integration and acquisition-related expenditures from our CMW acquisition, |

• | higher commodity and tariff costs on purchased raw materials and component parts, |

• | unfavorable product mix, |

• | charges related to the Toro underground wind down, |

• | higher interest expense incurred on outstanding indebtedness, and |

• | charges related to our corporate restructuring event. |

• | incremental earnings as a result of our acquisition of CMW, |

• | improved net price realization driven by price increases across our product lines, |

• | the reduction in the U.S federal corporate tax rate from blended rate of 23.3 percent in fiscal 2018 to a rate of 21.0 percent in fiscal 2019, |

• | productivity initiatives related to commodities and component parts sourcing, and |

• | the realized gain on actuarial valuation changes for our pension and post-retirement plans. |

• | higher commodity and tariff costs on purchased raw materials and component parts, |

• | unfavorable product mix, and |

• | higher interest expense incurred on outstanding indebtedness. |

(Dollars in millions) | ||||||||||||

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | |||||||||

Net sales | $ | 2,443.4 | $ | 1,947.0 | $ | 1,811.7 | ||||||

% change from prior year | 25.5 | % | 7.5 | % | 6.2 | % | ||||||

Operating earnings | $ | 380.9 | $ | 399.8 | $ | 379.5 | ||||||

As a percent of net sales | 15.6 | % | 20.5 | % | 20.9 | % | ||||||

• | incremental sales as a result of our acquisition of CMW; |

• | the year-over-year impact of price increases across our Professional segment product lines; |

• | higher shipments of our snow and ice management products due to strong channel and retail demand driven by late snowfalls in key regions during the Spring of 2019, as well as strong sales of the redesigned stand-on Snowrator; |

• | continued growth in our landscape contractor business driven by the successful introduction of the new eXmark-branded Staris stand-on zero-turn riding mower, incremental sales of lawn solution products as a result of our acquisition of L.T. Rich Products, Inc. ("L.T. Rich"), higher parts sales, and strong channel demand for walk-behind and walk-power mowers; and |

• | increased shipments of our rental and specialty construction equipment due to the successful new product |

• | our acquisition of CMW resulting in charges incurred for purchase accounting adjustments and acquisition-related and integration expenditures; incremental administrative, indirect sales and marketing, engineering, warranty, and service expense; and higher amortization of other intangible assets; |

• | the unfavorable impact of higher commodity and tariff costs on purchased raw materials and component parts; |

• | supply chain challenges and inclement weather resulting in manufacturing inefficiencies; |

• | charges related to the Toro underground wind down; |

• | unfavorable product mix; |

• | increased warranty costs in certain of our legacy businesses; and |

• | increased engineering expense for new product development. |

• | improved net price realization driven by pricing increases across our Professional segment product lines, |

• | productivity initiatives related to commodities and component parts sourcing, |

• | lower freight costs due to cost reduction initiatives, and |

• | decreased direct marketing expense in our legacy businesses. |

(Dollars in millions) | ||||||||||||

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | |||||||||

Net sales | $ | 661.3 | $ | 654.4 | $ | 673.2 | ||||||

% change from prior year | 1.0 | % | (2.8 | )% | 0.6 | % | ||||||

Operating earnings | $ | 65.2 | $ | 64.8 | $ | 74.7 | ||||||

As a percent of net sales | 9.9 | % | 9.9 | % | 11.1 | % | ||||||

• | the year-over-year impact of price increases across our Residential segment product lines, |

• | strong retail demand for our snow throwers, including the successful introduction of our line of 60V lithium-ion powered single-stage snow thrower products, |

• | higher shipments of walk power mowers driven by the launch of our 60V lithium-ion powered walk power mowers, and |

• | increased parts sales driven by channel demand. |

• | fewer shipments of zero-turn riding mowers driven by soft retail demand and |

• | reduced sales of our Pope-branded irrigation products driven by unfavorable weather conditions in key regions. |

• | improved net price realization as a result of pricing increases across our Residential segment product lines, |

• | favorable manufacturing variance, and |

• | lower direct marketing costs. |

• | the unfavorable impact of higher commodity and tariff costs on purchased raw materials and component parts, |

• | unfavorable product mix, |

• | increased warranty cost, and |

• | higher engineering expense for new product development. |

(Dollars in millions) | ||||||||||||

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | |||||||||

Net sales | $ | 33.4 | $ | 17.2 | $ | 20.2 | ||||||

% change from prior year | 93.5 | % | (14.8 | )% | 14.1 | % | ||||||

Operating losses | $ | (123.9 | ) | $ | (92.2 | ) | $ | (101.0 | ) | |||

(Dollars in millions) | ||||||||

Fiscal Years Ended October 31 | 2019 | 2018 | ||||||

Average cash and cash equivalents | $ | 180.0 | $ | 237.6 | ||||

Average receivables, net | $ | 265.4 | $ | 214.7 | ||||

Average inventories, net | $ | 560.5 | $ | 404.5 | ||||

Average accounts payable | $ | 315.5 | $ | 259.3 | ||||

Average days outstanding for receivables | 30.9 | 29.9 | ||||||

Average inventory turnover (times) | 3.7 | 4.2 | ||||||

• | Average net receivables increased by 23.6 percent in fiscal 2019 compared to fiscal 2018, primarily due to incremental net receivables as a result of our acquisition of CMW. Our average days outstanding for receivables increased to 30.9 days in fiscal 2019 compared to 29.9 days in fiscal 2018. |

• | Average net inventories increased by 38.6 percent in fiscal 2019 compared to fiscal 2018. Inventory levels as of the end of fiscal 2019 compared to the end of fiscal 2018 were up by $293.4 million, or 81.9 percent, primarily due to incremental net inventory as a result of our acquisition of CMW, as well as higher net inventory balances in our legacy businesses due to lower than forecasted sales in our Professional segment driven by soft retail demand and build-ahead for fiscal 2020 new product introductions in our Residential segment. |

• | Average accounts payable increased by 21.7 percent in fiscal 2019 compared to fiscal 2018, mainly due to incremental accounts payable as a result of our acquisition of CMW and negotiating more favorable payment terms with suppliers as a component of our working capital initiatives. |

(Dollars in millions) | Cash Provided by/(Used in) | |||||||||||

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | |||||||||

Operating activities | $ | 337.4 | $ | 364.8 | $ | 360.7 | ||||||

Investing activities | (772.9 | ) | (127.9 | ) | (83.8 | ) | ||||||

Financing activities | 299.5 | (252.1 | ) | (245.3 | ) | |||||||

Effect of exchange rates on cash | (1.2 | ) | (5.9 | ) | 5.0 | |||||||

Net increase/(decrease) in cash and cash equivalents | (137.3 | ) | (21.1 | ) | 36.7 | |||||||

Cash and cash equivalents as of fiscal year end | $ | 151.8 | $ | 289.1 | $ | 310.3 | ||||||

(Dollars in millions) | ||||||||

Fiscal Years Ended October 31 | 2019 | 2018 | ||||||

Long-term debt, including current portion | $ | 700.8 | $ | 312.5 | ||||

Stockholders' equity | $ | 859.6 | $ | 668.9 | ||||

Debt-to-capitalization ratio | 44.9 | % | 31.8 | % | ||||

(Dollars in millions, except share and per share data) | ||||||||||||

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | |||||||||

Shares of Board authorized common stock purchased | 359,758 | 2,579,864 | 2,710,837 | |||||||||

Cost to repurchase common stock | $ | 20.0 | $ | 160.4 | $ | 159.4 | ||||||

Average price paid per share | $ | 55.71 | $ | 62.19 | $ | 58.78 | ||||||

(Dollars in millions) | Payments Due by Period | |||||||||||||||||||

Contractual Obligations | Total | Less Than 1 Year | 1-3 Years | 3-5 Years | More Than 5 Years | |||||||||||||||

Long-term debt1 | $ | 705.0 | $ | — | $ | 115.0 | $ | 165.0 | $ | 425.0 | ||||||||||

Interest payments2 | 309.2 | 31.9 | 62.6 | 53.8 | 160.9 | |||||||||||||||

Purchase obligations3 | 24.8 | 24.5 | 0.3 | — | — | |||||||||||||||

Operating leases4 | 83.0 | 17.1 | 28.6 | 18.6 | 18.7 | |||||||||||||||

Other5 | 15.3 | 6.0 | 8.1 | 0.6 | 0.6 | |||||||||||||||

Total | $ | 1,137.3 | $ | 79.5 | $ | 214.6 | $ | 238.0 | $ | 605.2 | ||||||||||

1 | Principal payments based on the maturity dates defined in our long-term debt agreements. |

2 | Interest payments for outstanding long-term debt obligations. Interest on variable rate debt was calculated using the interest rate as of October 31, 2019. |

3 | Purchase obligations represent contracts or firm commitments for the purchase of commodities, components, parts, and accessories, as well as contracts or firm commitments to purchase property, plant, and equipment, as applicable. |

4 | Operating lease obligations represent contracts that convey our right to use certain property, plant, or equipment assets in exchange for consideration and do not include payments to property owners covering real estate taxes and common area maintenance. |

5 | Payment obligations for corporate information technology software and services, as well as other miscellaneous contractual obligations. |

(Dollars in thousands, except per share data) Fiscal Years Ended | October 31, 2019 | October 31, 2018 | ||||||

Gross profit | $ | 1,047,963 | $ | 941,011 | ||||

Acquisition-related costs1 | 42,958 | — | ||||||

Management actions2 | 10,316 | — | ||||||

Adjusted non-GAAP gross profit | $ | 1,101,237 | $ | 941,011 | ||||

Operating earnings | $ | 325,029 | $ | 373,085 | ||||

Acquisition-related costs1 | 62,333 | — | ||||||

Management actions2 | 16,311 | — | ||||||

Adjusted non-GAAP operating earnings | $ | 403,673 | $ | 373,085 | ||||

Earnings before income taxes | $ | 322,133 | $ | 372,397 | ||||

Acquisition-related costs1 | 62,333 | — | ||||||

Management actions2 | 17,167 | — | ||||||

Adjusted non-GAAP earnings before income taxes | $ | 401,633 | $ | 372,397 | ||||

Net earnings | $ | 273,983 | $ | 271,939 | ||||

Acquisition-related costs1 | 51,149 | — | ||||||

Management actions2 | 13,817 | — | ||||||

Tax impact of share-based compensation3 | (13,677 | ) | (14,555 | ) | ||||

U.S. Tax Reform4 | (1,012 | ) | 32,702 | |||||

Adjusted non-GAAP net earnings | $ | 324,260 | $ | 290,086 | ||||

Diluted EPS | $ | 2.53 | $ | 2.50 | ||||

Acquisition-related costs1 | 0.47 | — | ||||||

Management actions2 | 0.13 | — | ||||||

Tax impact of share-based compensation3 | (0.12 | ) | (0.13 | ) | ||||

U.S. Tax Reform4 | (0.01 | ) | 0.30 | |||||

Adjusted non-GAAP diluted EPS | $ | 3.00 | $ | 2.67 | ||||

Fiscal Years Ended | October 31, 2019 | October 31, 2018 | ||||

Effective tax rate | 14.9 | % | 27.0 | % | ||

Acquisition-related costs1 | (0.3 | )% | — | % | ||

Management actions2 | 0.1 | % | — | % | ||

Tax impact of share-based compensation3 | 4.3 | % | 3.9 | % | ||

U.S. Tax Reform4 | 0.3 | % | (8.8 | )% | ||

Adjusted non-GAAP effective tax rate | 19.3 | % | 22.1 | % | ||

1 | During the second quarter of fiscal 2019, we acquired CMW. Acquisition-related costs represent integration and transaction costs incurred, as well as charges incurred for the take-down of the inventory fair value step-up amount and amortization of the backlog intangible asset resulting from purchase accounting adjustments, related to our acquisition of CMW during the fiscal year ended October 31, 2019. Refer to Note 2, Business Combinations, of the Notes to Consolidated Financial Statements included in Part II, Item 8, "Financial Statements and Supplementary Data" of this Annual Report on Form 10-K for additional information regarding our acquisition of CMW. |

2 | During the third quarter of fiscal 2019, we announced the wind down our Toro-branded large horizontal directional drill and riding trencher product line. Additionally, during the fourth quarter of fiscal 2019, we incurred charges for a corporate restructuring event and a loss on the divestiture of a used underground construction equipment business. Management actions represent charges incurred during the fiscal year ended October 31, 2019 for the Toro underground wind down, including charges related to the write-down of inventory, anticipated inventory retail support activities, and accelerated depreciation on fixed assets; the corporate restructuring event, including employee severance charges; and the divestiture of a used underground construction equipment business, including the loss on the sale of the business. Refer to Note 7, Management Actions, of the Notes to Consolidated Financial Statements included in Part II, Item 8, "Financial Statements and Supplementary Data" of this Annual Report on Form 10-K for additional information regarding our these management actions. |

3 | In the first quarter of fiscal 2017, we adopted Accounting Standards Update No. 2016-09, Stock-based Compensation: Improvements to Employee Share-based Payment Accounting, which requires that any excess tax deduction for share-based compensation be immediately recorded within income tax expense. These amounts represent the discrete tax benefits recorded as excess tax deductions for share-based compensation during the fiscal years ended October 31, 2019 and October 31, 2018. |

4 | Signed into law on December 22, 2017, the Tax Act, reduced the U.S. federal corporate tax rate from 35.0 percent to 21.0 percent, effective January 1, 2018, resulting in a blended U.S. federal statutory tax rate of 23.3 percent for the fiscal year ended October 31, 2018. This reduction in rate required the re-measurement of our net deferred taxes as of the date of enactment. The Tax Act also imposed a one-time deemed repatriation tax on our historical undistributed earnings and profits of foreign affiliates. During the fiscal year ended October 31, 2019, we recorded a tax benefit of $1.0 million related to a prior year true-up of the Tax Act. During the fiscal year ended October 31, 2018, the remeasurement of our net deferred taxes and the one-time deemed repatriation tax resulted in a combined charge of $32.7 million. |

• | Off-Invoice Discounts: Our costs for off-invoice discounts represent a reduction in the selling price of our products given at the time of sale. |

• | Rebate Programs: Our rebate programs are generally based on claims submitted from either our direct customers or end-users of our products, depending upon the program. The amount of the rebate varies based on the specific program and is either a dollar amount or a percentage of the purchase price and can also be based on actual retail price as compared to our selling price. |

• | Incentive Discounts: Our costs for incentive discount programs are based on our customers’ purchase or retail sales goals of certain quantities or mixes of product during a specified time period, which are tracked on an annual or quarterly basis depending on the program. |

• | Financing Programs: Our financing programs, consist of wholesale floor plan financing and end-user retail financing. Costs incurred for wholesale floor plan financing programs represent financing costs associated with programs under which we pay a portion of the interest cost to finance distributor and dealer inventories through third-party financing arrangements for a specific period of time. End-user retail financing is similar to floor planning with the difference being that retail financing programs are offered to end-user customers under which we pay a portion of interest costs on behalf of end-users for financing purchases of our equipment. |

• | Commissions Paid to Service Home Centers: We pay commissions to representative agencies to service home centers to ensure appropriate store sets for all Toro product. This estimated expense is recorded at point of sale. In addition, Toro dealers are paid a commission to set up and deliver riding product purchased at certain home centers. |

• | Commissions Paid to Distributors and Dealers: For certain products, we use a distribution network of dealers and distributors that purchase and take possession of products for sale to the end customer. In addition, we have dealers and distributors that act as sales agents for us on certain products using a direct-selling type model. Under this direct-selling type model, our network of distributors and dealers facilitates a sale directly to the dealer or end-user customer on our behalf. Commissions to distributors and dealers in these instances represent commission payments to sales agents that are also our customers. |

• | Cooperative Advertising: Cooperative advertising programs are based on advertising costs incurred by distributors and dealers for promoting our products. We support a portion of those advertising costs in which claims are submitted by the distributor or dealer along with evidence of the advertising material procured/produced and evidence of the cost incurred in the form of third-party invoices or receipts. |

Average Contracted Rate | Notional Amount | Fair Value | Gain (Loss) at Fair Value | ||||||||||||

Buy U.S. dollar/Sell Australian dollar | 0.7208 | $ | 95,937.9 | $ | 99,559.6 | $ | 3,621.7 | ||||||||

Buy U.S. dollar/Sell Canadian dollar | 1.3136 | 32,026.1 | 32,099.1 | 73.0 | |||||||||||

Buy U.S. dollar/Sell Euro | 1.2025 | 119,825.0 | 125,997.1 | 6,172.1 | |||||||||||

Buy U.S. dollar/Sell British pound | 1.3376 | 43,925.5 | 44,957.1 | 1,031.6 | |||||||||||

Buy Mexican peso/Sell U.S. dollar | 20.1367 | $ | 1,489.8 | $ | 1,480.3 | $ | (9.5 | ) | |||||||

/s/ Richard M. Olson | ||

Chairman of the Board, President and Chief Executive Officer | ||

/s/ Renee J. Peterson | ||

Vice President, Treasurer and Chief Financial Officer | ||

December 20, 2019 | ||

• | Evaluating the Company’s discount rates, by comparing them against a discount rate range that was independently developed using publicly available market data for comparable entities; and |

• | Developing an estimate of the fair values of the customer-related and trade name intangible assets acquired using the Company’s cash flow and revenue forecasts, respectively, and an independently developed discount rate and compared the results of our estimates to the Company’s fair value estimates. |

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | |||||||||

Net sales | $ | $ | $ | |||||||||

Cost of sales | ||||||||||||

Gross profit | ||||||||||||

Selling, general and administrative expense | ||||||||||||

Operating earnings | ||||||||||||

Interest expense | ( | ) | ( | ) | ( | ) | ||||||

Other income, net | ||||||||||||

Earnings before income taxes | ||||||||||||

Provision for income taxes | ||||||||||||

Net earnings | $ | $ | $ | |||||||||

Basic net earnings per share of common stock | $ | $ | $ | |||||||||

Diluted net earnings per share of common stock | $ | $ | $ | |||||||||

Weighted-average number of shares of common stock outstanding – Basic | ||||||||||||

Weighted-average number of shares of common stock outstanding – Diluted | ||||||||||||

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | |||||||||

Net earnings | $ | $ | $ | |||||||||

Other comprehensive income (loss), net of tax: | ||||||||||||

Foreign currency translation adjustments, net of tax of $(16), $(222), and $0, respectively | ( | ) | ( | ) | ||||||||

Derivative instruments, net of tax of $(862), $2,899, and $(1,123), respectively | ( | ) | ( | ) | ||||||||

Pension and retiree medical benefits, net of tax of $(1,305), $254, and $2,536, respectively | ( | ) | ||||||||||

Other comprehensive income (loss), net of tax | ( | ) | ||||||||||

Comprehensive income | $ | $ | $ | |||||||||

October 31 | 2019 | 2018 | ||||||

ASSETS | ||||||||

Cash and cash equivalents | $ | $ | ||||||

Receivables, net: | ||||||||

Customers, net of allowances (2019 - $3,270; 2018 - $2,228) | ||||||||

Other | ||||||||

Total receivables, net | ||||||||

Inventories, net | ||||||||

Prepaid expenses and other current assets | ||||||||

Total current assets | ||||||||

Property, plant and equipment, net | ||||||||

Deferred income taxes | ||||||||

Goodwill | ||||||||

Other intangible assets, net | ||||||||

Other assets | ||||||||

Total assets | $ | $ | ||||||

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

Current portion of long-term debt | $ | $ | ||||||

Accounts payable | ||||||||

Accrued liabilities: | ||||||||

Warranty | ||||||||

Advertising and marketing programs | ||||||||

Compensation and benefit costs | ||||||||

Insurance | ||||||||

Interest | ||||||||

Other | ||||||||

Total current liabilities | ||||||||

Long-term debt, less current portion | ||||||||

Deferred income taxes | ||||||||

Other long-term liabilities | ||||||||

Stockholders' equity: | ||||||||

Preferred stock, par value $1.00 per share, authorized 1,000,000 voting and 850,000 non-voting shares, none issued and outstanding | ||||||||

Common stock, par value $1.00 per share, authorized 175,000,000 shares; issued and outstanding 106,742,082 shares as of October 31, 2019 and 105,600,652 shares as of October 31, 2018 | ||||||||

Retained earnings | ||||||||

Accumulated other comprehensive loss | ( | ) | ( | ) | ||||

Total stockholders' equity | ||||||||

Total liabilities and stockholders' equity | $ | $ | ||||||

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | |||||||||

Cash flows from operating activities: | ||||||||||||

Net earnings | $ | $ | $ | |||||||||

Adjustments to reconcile net earnings to net cash provided by operating activities: | ||||||||||||

Non-cash income from finance affiliate | ( | ) | ( | ) | ( | ) | ||||||

Distributions from finance affiliate, net | ||||||||||||

Depreciation of property, plant and equipment | ||||||||||||

Amortization of other intangible assets | ||||||||||||

Fair value step-up adjustment to acquired inventory | ||||||||||||

Stock-based compensation expense | ||||||||||||

Deferred income taxes | ( | ) | ( | ) | ||||||||

Other | ||||||||||||

Changes in operating assets and liabilities, net of effect of acquisitions: | ||||||||||||

Receivables, net | ( | ) | ( | ) | ( | ) | ||||||

Inventories, net | ( | ) | ( | ) | ( | ) | ||||||

Prepaid expenses and other assets | ( | ) | ( | ) | ||||||||

Accounts payable, accrued liabilities, deferred revenue and other long-term liabilities | ||||||||||||

Net cash provided by operating activities | ||||||||||||

Cash flows from investing activities: | ||||||||||||

Purchases of property, plant and equipment | ( | ) | ( | ) | ( | ) | ||||||

Proceeds from asset disposals | ||||||||||||

Proceeds from sale of a business | ||||||||||||

Investments in unconsolidated entities | ( | ) | ( | ) | ( | ) | ||||||

Acquisitions, net of cash acquired | ( | ) | ( | ) | ( | ) | ||||||

Net cash used in investing activities | ( | ) | ( | ) | ( | ) | ||||||

Cash flows from financing activities: | ||||||||||||

Borrowings under debt arrangements | ||||||||||||

Repayments under debt arrangements | ( | ) | ( | ) | ( | ) | ||||||

Proceeds from exercise of stock options | ||||||||||||

Payments of withholding taxes for stock awards | ( | ) | ( | ) | ( | ) | ||||||

Purchases of Toro common stock | ( | ) | ( | ) | ( | ) | ||||||

Dividends paid on Toro common stock | ( | ) | ( | ) | ( | ) | ||||||

Net cash provided by (used in) financing activities | ( | ) | ( | ) | ||||||||

Effect of exchange rates on cash and cash equivalents | ( | ) | ( | ) | ||||||||

Net (decrease) increase in cash and cash equivalents | ( | ) | ( | ) | ||||||||

Cash and cash equivalents as of the beginning of the fiscal period | ||||||||||||

Cash and cash equivalents as of the end of the fiscal period | $ | $ | $ | |||||||||

Supplemental disclosures of cash flow information: | ||||||||||||

Cash paid during the fiscal year for: | ||||||||||||

Interest | $ | $ | $ | |||||||||

Income taxes | $ | $ | $ | |||||||||

Common Stock | Retained Earnings | Accumulated Other Comprehensive Loss | Total Stockholders' Equity | |||||||||||||

Balance as of October 31, 2016 | $ | $ | $ | ( | ) | $ | ||||||||||

Cash dividends paid on common stock - $0.70 per share | — | ( | ) | — | ( | ) | ||||||||||

Issuance of 1,185,601 shares for stock options exercised and restricted stock units vested | — | |||||||||||||||

Stock-based compensation expense | — | — | ||||||||||||||

Contribution of stock to a deferred compensation trust | — | — | ||||||||||||||

Purchase of 2,730,022 shares of common stock | ( | ) | ( | ) | — | ( | ) | |||||||||

Cumulative effect adjustment ASU 2016-16 | — | ( | ) | — | ( | ) | ||||||||||

Other comprehensive income | — | — | ||||||||||||||

Net earnings | — | — | ||||||||||||||

Balance as of October 31, 2017 | ( | ) | ||||||||||||||

Cash dividends paid on common stock - $0.80 per share | — | ( | ) | — | ( | ) | ||||||||||

Issuance of 1,495,367 shares for stock options exercised and restricted stock units vested | — | |||||||||||||||

Stock-based compensation expense | — | — | ||||||||||||||

Contribution of stock to a deferred compensation trust | — | — | ||||||||||||||

Purchase of 2,777,687 shares of common stock | ( | ) | ( | ) | — | ( | ) | |||||||||

Reclassification due to the adoption of ASU 2018-02 | — | ( | ) | |||||||||||||

Other comprehensive income | — | — | ||||||||||||||

Net earnings | — | — | ||||||||||||||

Balance as of October 31, 2018 | ( | ) | ||||||||||||||

Cash dividends paid on common stock - $0.90 per share | — | ( | ) | — | ( | ) | ||||||||||

Issuance of 1,544,962 shares for stock options exercised and restricted stock units vested | — | |||||||||||||||

Stock-based compensation expense | — | — | ||||||||||||||

Contribution of stock to a deferred compensation trust | — | — | ||||||||||||||

Purchase of 403,532 shares of common stock | ( | ) | ( | ) | — | ( | ) | |||||||||

Cumulative transition adjustment due to the adoption of ASU 2014-09 | — | — | ||||||||||||||

Other comprehensive loss | — | — | ( | ) | ( | ) | ||||||||||

Net earnings | — | — | ||||||||||||||

Balance as of October 31, 2019 | $ | $ | $ | ( | ) | $ | ||||||||||

1 | Summary of Significant Accounting Policies and Related Data |

October 31 | 2019 | 2018 | ||||||

Raw materials and work in process | $ | $ | ||||||

Finished goods and service parts | ||||||||

Total FIFO value | ||||||||

Less: adjustment to LIFO value | ||||||||

Total inventories, net | $ | $ | ||||||

October 31 | 2019 | 2018 | ||||||

Land and land improvements | $ | $ | ||||||

Buildings and leasehold improvements | ||||||||

Machinery and equipment | ||||||||

Tooling | ||||||||

Computer hardware and software | ||||||||

Construction in process | ||||||||

Subtotal | ||||||||

Less: accumulated depreciation | ||||||||

Total property, plant, and equipment, net | $ | $ | ||||||

Fiscal Years Ended October 31 | 2019 | 2018 | ||||||

Beginning balance | $ | $ | ||||||

Warranty provisions | ||||||||

Acquisitions | ||||||||

Warranty claims | ( | ) | ( | ) | ||||

Changes in estimates | ( | ) | ||||||

Ending balance | $ | $ | ||||||

• | Off-Invoice Discounts: The company's costs for off-invoice discounts represent a reduction in the selling price of its products given at the time of sale. |

• | Rebate Programs: The company's rebate programs are generally based on claims submitted from either its direct customers or end-users of its products, depending upon the |

• | Incentive Discounts: The company's costs for incentive discount programs are based on its customers’ purchase or retail sales goals of certain quantities or mixes of product during a specified time period, which are tracked on an annual or quarterly basis depending on the program. |

• | Financing Programs: The company's financing programs, consist of wholesale floor plan financing and end-user retail financing. Costs incurred for wholesale floor plan financing programs represent financing costs associated with programs under which the company pays a portion of the interest cost to finance distributor and dealer inventories through third-party financing arrangements for a specific period of time. End-user retail financing is similar to floor planning with the difference being that retail financing programs are offered to end-user customers under which the company pays a portion of interest costs on behalf of end-users for financing purchases of the company's equipment. |

• | Commissions Paid to Service Home Centers: The company pays commissions to representative agencies to service home center customers to ensure appropriate store sets for all Toro product. This estimated expense is recorded at point of sale. In addition, Toro dealers are paid a commission to set up and deliver riding product purchased at certain home centers. |

• | Commissions Paid to Distributors and Dealers: For certain products, the company uses a distribution network of dealers and distributors that purchase and take possession of products for sale to the end customer. In addition, the company has dealers and distributors that act as sales agents for it on certain products using a direct-selling type model. Under this direct-selling type model, the company's network of distributors and dealers facilitates a sale directly to the dealer or end-user customer on its behalf. Commissions to distributors and dealers in these instances represent commission payments to sales agents that are also its customers. |

• | Cooperative Advertising: Cooperative advertising programs are based on advertising costs incurred by distributors and dealers for promoting the company's products. The company supports a portion of those advertising costs in which claims are submitted by the distributor or dealer along with evidence of the advertising material procured/produced and evidence of the cost incurred in the form of third-party invoices or receipts. |

2019 | 2018 | 2017 | |||||||

Basic | |||||||||

Weighted-average number of shares of common stock | |||||||||

Assumed issuance of contingent shares | |||||||||

Weighted-average number of shares of common stock and assumed issuance of contingent shares | |||||||||

Diluted | |||||||||

Weighted-average number of shares of common stock and assumed issuance of contingent shares | |||||||||

Effect of dilutive securities | |||||||||

Weighted-average number of shares of common stock, assumed issuance of contingent shares, and effect of dilutive securities | |||||||||

• | Portfolio approach practical expedient relative to the estimation of variable consideration. |

• | Shipping and handling practical expedient to account for shipping and handling activities that occur after control of the related good transfers as fulfillment activities. |

• | Costs of obtaining a contract practical expedient to recognize the incremental costs of obtaining a contract as |

• | Immaterial goods or services practical expedient to not assess whether promised goods or services are performance obligations if they are immaterial in the context of the contract with the customer. |

• | Sales taxes practical expedient to exclude sales taxes and other similar taxes from the transaction price. |

• | Exemption to not disclose the unfulfilled performance obligation balance for contracts with an original length of one year or less. |

2 | Business Combinations |

April 1, 2019 | ||||

Cash and cash equivalents | $ | |||

Receivables | ||||

Inventories | ||||

Prepaid expenses and other current assets | ||||

Property, plant and equipment | ||||

Goodwill | ||||

Other intangible assets | ||||

Other long-term assets | ||||

Accounts payable | ( | ) | ||

Accrued liabilities | ( | ) | ||

Deferred income tax liabilities | ( | ) | ||

Other long-term liabilities | ( | ) | ||

Total fair value of net assets acquired | ||||

Less: cash and cash equivalents acquired | ( | ) | ||

Total purchase price | $ | |||

Weighted-Average Useful Life | Gross Carrying Amount | Accumulated Amortization | Net | |||||||||||

Customer-related | $ | $ | ( | ) | $ | |||||||||

Developed technology | ( | ) | ||||||||||||

Trade names | ( | ) | ||||||||||||

Backlog | ( | ) | ||||||||||||

Total amortizable | ( | ) | ||||||||||||

Non-amortizable - trade names | — | |||||||||||||

Total other intangible assets, net | $ | $ | ( | ) | $ | |||||||||

October 31, 2019 | October 31, 2018 | |||||||

Net sales | $ | $ | ||||||

Net earnings1 | ||||||||

Basic net earnings per share of common stock | ||||||||

Diluted net earnings per share of common stock1 | $ | $ | ||||||

1 | On January 1, 2019, CMW amended its retiree medical plans so that no employee hired, or rehired, after that date would be eligible for such retiree medical plans. CMW further amended its retiree medical plans on February 14, 2019 so that no employee who terminates employment after February 14, 2019 is eligible to participate in the retiree medical plans and to terminate its retiree medical plans effective December 31, 2019. The amendments and resulting termination of CMW's retiree medical plans resulted in a gain of approximately $ |

3 | Segment Data |

Fiscal Year Ended October 31, 2019 | Professional | Residential | Other | Total | ||||||||||||

Net sales | $ | $ | $ | $ | ||||||||||||

Intersegment gross sales (eliminations) | ( | ) | — | |||||||||||||

Earnings (loss) before income taxes | ( | ) | ||||||||||||||

Total assets | ||||||||||||||||

Capital expenditures | ||||||||||||||||

Depreciation and amortization | $ | $ | $ | $ | ||||||||||||

Fiscal Year Ended October 31, 2018 | Professional | Residential | Other | Total | ||||||||||||

Net sales | $ | $ | $ | $ | ||||||||||||

Intersegment gross sales (eliminations) | ( | ) | — | |||||||||||||

Earnings (loss) before income taxes | ( | ) | ||||||||||||||

Total assets | ||||||||||||||||

Capital expenditures | ||||||||||||||||

Depreciation and amortization | $ | $ | $ | $ | ||||||||||||

Fiscal Year Ended October 31, 2017 | Professional | Residential | Other | Total | ||||||||||||

Net sales | $ | $ | $ | $ | ||||||||||||

Intersegment gross sales (eliminations) | ( | ) | — | |||||||||||||

Earnings (loss) before income taxes | ( | ) | ||||||||||||||

Total assets | ||||||||||||||||

Capital expenditures | ||||||||||||||||

Depreciation and amortization | $ | $ | $ | $ | ||||||||||||

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | |||||||||

Corporate expenses | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||

Interest expense | ( | ) | ( | ) | ( | ) | ||||||

Other income | ||||||||||||

Total operating loss | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | |||||||||

Equipment | $ | $ | $ | |||||||||

Irrigation and lighting | ||||||||||||

Total net sales | $ | $ | $ | |||||||||

Fiscal Years Ended October 31 | United States | Foreign Countries | Total | |||||||||

2019 | ||||||||||||

Net sales | $ | $ | $ | |||||||||

Long-lived assets | $ | $ | $ | |||||||||

2018 | ||||||||||||

Net sales | $ | $ | $ | |||||||||

Long-lived assets | $ | $ | $ | |||||||||

2017 | ||||||||||||

Net sales | $ | $ | $ | |||||||||

Long-lived assets | $ | $ | $ | |||||||||

4 | Revenue |

Fiscal Year Ended October 31, 2019 | Professional | Residential | Other | Total | ||||||||||||

Revenue by product type: | ||||||||||||||||

Equipment | $ | $ | $ | $ | ||||||||||||

Irrigation | ||||||||||||||||

Total net sales | $ | $ | $ | $ | ||||||||||||

Revenue by geographic market: | ||||||||||||||||

United States | $ | $ | $ | $ | ||||||||||||

Foreign Countries | ||||||||||||||||

Total net sales | $ | $ | $ | $ | ||||||||||||

Fiscal Year Ended October 31, 2018 | Professional | Residential | Other | Total | ||||||||||||

Revenue by product type: | ||||||||||||||||

Equipment | $ | $ | $ | $ | ||||||||||||

Irrigation | ||||||||||||||||

Total net sales | $ | $ | $ | $ | ||||||||||||

Revenue by geographic market: | ||||||||||||||||

United States | $ | $ | $ | $ | ||||||||||||

Foreign Countries | ||||||||||||||||

Total net sales | $ | $ | $ | $ | ||||||||||||

5 | Goodwill and Other Intangible Assets |

Professional | Residential | Other | Total | |||||||||||||

Balance as of October 31, 2017 | $ | $ | $ | $ | ||||||||||||

Goodwill acquired | ||||||||||||||||

Translation adjustments | ( | ) | ( | ) | ( | ) | ||||||||||

Balance as of October 31, 2018 | ||||||||||||||||

Goodwill acquired | ||||||||||||||||

Translation adjustments | ( | ) | ( | ) | ||||||||||||

Balance as of October 31, 2019 | $ | $ | $ | $ | ||||||||||||

October 31, 2019 | Weighted-Average Useful Life | Gross Carrying Amount | Accumulated Amortization | Net | ||||||||||

Patents | $ | $ | ( | ) | $ | |||||||||

Non-compete agreements | ( | ) | ||||||||||||

Customer-related | ( | ) | ||||||||||||

Developed technology | ( | ) | ||||||||||||

Trade names | ( | ) | ||||||||||||

Backlog and other | ( | ) | ||||||||||||

Total amortizable | ( | ) | ||||||||||||

Non-amortizable - trade names | — | |||||||||||||

Total other intangible assets, net | $ | $ | ( | ) | $ | |||||||||

October 31, 2018 | Weighted-Average Useful Life | Gross Carrying Amount | Accumulated Amortization | Net | ||||||||||

Patents | $ | $ | ( | ) | $ | |||||||||

Non-compete agreements | ( | ) | ||||||||||||

Customer-related | ( | ) | ||||||||||||

Developed technology | ( | ) | ||||||||||||

Trade names | ( | ) | ||||||||||||

Other | ( | ) | ||||||||||||

Total amortizable | ( | ) | ||||||||||||

Non-amortizable - trade names | — | |||||||||||||

Total other intangible assets, net | $ | $ | ( | ) | $ | |||||||||

6 | Indebtedness |

October 31 | 2019 | 2018 | ||||||

Revolving credit facility | $ | $ | ||||||

$200 million term loan | — | |||||||

$300 million term loan | — | |||||||

3.81% series A senior notes | — | |||||||

3.91% series B senior notes | — | |||||||

7.800% debentures | ||||||||

6.625% senior notes | ||||||||

Less: unamortized discounts, debt issuance costs, and deferred charges | ( | ) | ( | ) | ||||

Total long-term debt | ||||||||

Less: current portion of long-term debt | ||||||||

Long-term debt, less current portion | $ | $ | ||||||

7 | Management Actions |

8 | Income Taxes |

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | |||||||||

Earnings before income taxes: | ||||||||||||

U.S. | $ | $ | $ | |||||||||

Foreign | ||||||||||||

Total earnings before income taxes | $ | $ | $ | |||||||||

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | ||||||

Statutory federal income tax rate | % | % | % | ||||||

Excess deduction for stock compensation | ( | ) | ( | ) | ( | ) | |||

Domestic manufacturer's deduction | ( | ) | ( | ) | |||||

State and local income taxes, net of federal benefit | |||||||||

Foreign operations | ( | ) | ( | ) | ( | ) | |||

Federal research tax credit | ( | ) | ( | ) | ( | ) | |||

Foreign-derived intangible income | ( | ) | |||||||

Remeasurement of deferred tax assets and liabilities | ( | ) | |||||||

Deemed repatriation tax | ( | ) | |||||||

Other, net | ( | ) | ( | ) | ( | ) | |||

Consolidated effective tax rate | % | % | % | ||||||

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | |||||||||

Current provision: | ||||||||||||

Federal | $ | $ | $ | |||||||||

State | ||||||||||||

Foreign | ||||||||||||

Total current provision | $ | $ | $ | |||||||||

Deferred provision (benefit): | ||||||||||||

Federal | $ | ( | ) | $ | $ | ( | ) | |||||

State | ( | ) | ( | ) | ||||||||

Foreign | ( | ) | ||||||||||

Total deferred provision (benefit) | ( | ) | ( | ) | ||||||||

Total provision for income taxes | $ | $ | $ | |||||||||

October 31 | 2019 | 2018 | ||||||

Deferred income tax assets: | ||||||||

Compensation and benefits | $ | $ | ||||||

Warranty and insurance | ||||||||

Advertising and sales allowance | ||||||||

Inventory | ||||||||

Other | ||||||||

Valuation allowance | ( | ) | ( | ) | ||||

Total deferred income tax assets | $ | $ | ||||||

Deferred income tax liabilities: | ||||||||

Depreciation | $ | ( | ) | $ | ( | ) | ||

Amortization | ( | ) | ( | ) | ||||

Total deferred income tax liabilities | ( | ) | ( | ) | ||||

Deferred income tax (liabilities) assets, net | $ | ( | ) | $ | ||||

Unrecognized tax benefits as of October 31, 2018 | $ | |||

Increase as a result of tax positions taken during a prior period | ||||

Increase as a result of tax positions taken during the current period | ||||

Decrease relating to settlements with taxing authorities | ( | ) | ||

Reductions as a result of statute of limitations lapses | ( | ) | ||

Unrecognized tax benefits as of October 31, 2019 | $ | |||

9 | Stock-Based Compensation Plans |

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | |||||||||

Unrestricted common stock awards | $ | $ | $ | |||||||||

Stock option awards | ||||||||||||

Restricted stock units | ||||||||||||

Performance share awards | ||||||||||||

Total compensation cost for stock-based awards | $ | $ | $ | |||||||||

Related tax benefit from stock-based awards | $ | $ | $ | |||||||||

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | |||||||||

Expected life of option in years | ||||||||||||

Expected stock price volatility | % | % | % | |||||||||

Risk-free interest rate | % | % | % | |||||||||

Expected dividend yield | % | % | % | |||||||||

Per share weighted-average fair value at date of grant | $ | $ | $ | |||||||||

Stock Option Awards | Weighted-Average Exercise Price | Weighted-Average Contractual Life (years) | Aggregate Intrinsic Value (in thousands) | ||||||||||

Outstanding as of October 31, 2018 | $ | $ | |||||||||||

Granted | |||||||||||||

Exercised | ( | ) | | ||||||||||

Canceled/forfeited | ( | ) | |||||||||||

Outstanding as of October 31, 2019 | $ | $ | |||||||||||

Exercisable as of October 31, 2019 | $ | $ | |||||||||||

Fiscal Years Ended October 31 | 2019 | 2018 | 2017 | |||||||||