UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

|

Investment Company Act file number |

811- 03940 | |||||

|

|

| |||||

|

|

Strategic Funds, Inc. |

| ||||

|

|

(Exact name of Registrant as specified in charter) |

| ||||

|

|

|

| ||||

|

|

c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 |

| ||||

|

|

(Address of principal executive offices) (Zip code) |

| ||||

|

|

|

| ||||

|

|

Bennett A. MacDougall, Esq. 200 Park Avenue New York, New York 10166 |

| ||||

|

|

(Name and address of agent for service) |

| ||||

|

| ||||||

|

Registrant's telephone number, including area code: |

(212) 922-6400 | |||||

|

|

| |||||

|

Date of fiscal year end:

|

05/31 |

| ||||

|

Date of reporting period: |

05/31/2017 |

| ||||

|

|

|

| ||||

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

Dreyfus Select Managers Small Cap Growth Fund

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus Select Managers Small Cap Growth Fund

|

|

ANNUAL REPORT |

|

|

|

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes. |

|

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

|

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

|

With Those of Other Funds |

|

|

Public Accounting Firm |

|

|

the Fund’s Additional |

|

|

Sub-Investment Adviser |

|

F O R M O R E I N F O R M AT I O N

Back Cover

|

|

The Fund |

A LETTER FROM THE CEO OF DREYFUS

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Select Managers Small Cap Growth Fund, covering the 12-month period from June 1, 2016 through May 31, 2017. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Stocks advanced solidly over the past year while bonds produced mixed returns in response to various economic and political developments. Equities began the reporting period in the midst of a sustained rebound from previous weakness as global economic data improved, commodity prices recovered, and U.S. monetary policymakers delayed additional rate hikes. After a bout of volatility in late June 2016, stocks continued to climb over the summer. The unexpected outcome of U.S. elections in November sent stocks sharply higher in anticipation of new fiscal, regulatory, and tax policies. Generally strong economic data and corporate earnings continued to support stock prices over the first five months of 2017.

In the bond market, yields of high-quality government bonds declined to historical lows early in the reporting period due to robust investor demand for current income. Yields moved higher in late 2016 in anticipation of short-term interest-rate hikes and more stimulative U.S. fiscal policies, but they receded in early 2017 when political uncertainty caused some of those expectations to moderate. In contrast, lower-rated corporate-backed bonds generally fared well throughout the reporting period in a more business-friendly market environment.

Some asset classes and industry groups seem likely to benefit from a changing economic and geopolitical landscape, while others probably will face challenges as conditions evolve. Consequently, selectivity may be key to investment success in the months ahead. As always, we encourage you to discuss the implications of our observations with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

Mark D. Santero

Chief Executive Officer

The Dreyfus Corporation

June 15, 2017

2

DISCUSSION OF FUND PERFORMANCE

For the period from June 1, 2016 through May 31, 2017, as provided by Keith L. Stransky and Robert B. Mayerick of EACM Advisors LLC, the fund’s portfolio allocation managers

Market and Fund Performance Overview

For the 12-month period ended May 31, 2017, Dreyfus Select Managers Small Cap Growth Fund’s Class A, Class C, Class I, and Class Y shares at NAV produced total returns of 20.24%, 19.29%, 20.54%, and 20.60%, respectively.1 In comparison, the Russell 2000® Growth Index (the “Index”), the fund’s benchmark, returned 19.71% for the same period.2

Small-cap growth stocks gained ground amid better-than-expected corporate earnings, improving domestic growth prospects, and positive investor sentiment in the wake of the U.S. presidential election. The fund produced higher returns than its benchmark, primarily due to strong stock selections by its underlying portfolio managers in 8 of the Index’s 11 economic sectors.

The Fund’s Investment Approach

The fund seeks long-term capital appreciation. To pursue its goal, the fund normally invests at least 80% of its assets in the stocks of small-cap companies.

The fund uses a “multi-manager” approach by selecting various subadvisers to manage its assets. As the fund’s portfolio allocation managers, we seek subadvisers that complement one another’s style of investing, consistent with the fund’s investment goal. We monitor and evaluate the performance of the subadvisers and will advise and recommend to Dreyfus and the fund’s board any changes to the fund’s subadvisers.

The fund’s assets are currently allocated to six subadvisers, each acting independently of one another and using their own methodology to select portfolio investments. At the end of the reporting period: 9% of the fund’s assets were under the management of Redwood Investments, LLC, which employs a blend of quantitative and qualitative research to build growth and core equity portfolios; approximately 21% of the fund’s assets were under the management of Henderson Geneva Capital Management, which employs bottom-up fundamental analysis supplemented by top-down considerations to identify companies with a consistent, sustainable record of growth; approximately 15% of the fund’s assets were under the management of Nicholas Investment Partners, L.P., which uses a bottom-up approach to security selection, combining rigorous fundamental analysis with the discipline and objectivity of quantitative analytics; EAM Investors, LLC, which managed 21% of the fund’s assets, chooses investments through bottom-up fundamental analysis using a blend of a quantitative discovery process and a qualitative analysis process; approximately 10% of the fund’s assets were managed by Granite Investment Partners, LLC, which seeks attractively valued small-cap companies with catalysts for growth; and 24% of the fund’s assets were managed by Rice Hall James & Associates LLC, which seeks growing companies with high earnings growth, high or improving returns on invested capital, and sustainable competitive advantages. The percentages of the fund’s assets allocated to the various subadvisers can change over time, within ranges described in the prospectus.

Post-Election Optimism Drove Markets Higher

The reporting period began in the midst of a market rally as economic growth improved, labor markets strengthened and commodity prices rebounded. While political uncertainties caused U.S. stocks to dip in the days leading up the 2016 presidential election, equity markets were reenergized in November and December when investors began to anticipate lower corporate taxes, reduced regulatory constraints on business, and increased infrastructure spending from a new presidential administration.

Equities continued to gain value in early 2017, with strong corporate earnings and encouraging economic data driving several broad market indices to record highs. Concerns about the new

3

DISCUSSION OF FUND PERFORMANCE (continued)

administration’s ability to implement its business-friendly policies slowed the market’s advance in March and April, but the Index ended the reporting period with double-digit gains.

Security Selections Buoyed Fund Results

The fund achieved particularly strong relative results in the information technology sector, where Internet development platform Wix.com more than doubled in value after reporting impressive user growth. Likewise, laser specialist Coherent raised its revenue forecast as demand intensified for flat-panel displays. In the health care sector, Aerie Pharmaceuticals saw favorable results in clinical trials of a new glaucoma treatment, and Supernus Pharmaceuticals reported better-than-expected prescription growth for its epilepsy and migraine drugs.

Although disappointments were relatively mild over the reporting period, the fund’s relative results in the consumer staples sector were constrained by natural foods supplier Hain Celestial, which came under regulatory scrutiny after delaying a quarterly financial report. Grocery retailer Smart & Final was hurt by lower food prices and cannibalization of existing customers by new store openings. In other areas, specialty retailer Hibbett Sports encountered reduced store traffic in a generally challenging retail environment.

Adjustments to the Roster of Subadvisers

Late in the reporting period, we welcomed a new subadviser, Redwood Investments, LLC, an independent manager of small-cap growth stocks with a strong track record. Conversely, we eliminated the fund’s positions in Riverbridge Partners, LLC, and Advisory Research, Inc.

Looking forward, we believe that an emphasis on fast-growing, small-cap companies positions the fund well for an environment of moderate economic growth, gradually rising interest rates, and robust business and consumer confidence.

June 15, 2017

Equities are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The prices of small company stocks tend to be more volatile than the prices of large company stocks, mainly because these companies have less established and more volatile earnings histories. They also tend to be less liquid than larger company stocks.

1 Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Return figures provided reflect the absorption of certain fund expenses by The Dreyfus Corporation pursuant to an undertaking in effect through October 1, 2017, at which time it may be extended, terminated, or modified. Had these expenses not been absorbed, the fund’s returns would have been lower.

2 Source: Lipper Inc. — The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher growth earning potential as defined by Russell's leading style methodology. The Russell 2000® Growth Index is constructed to provide a comprehensive and unbiased barometer for the small-cap growth segment. The index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set and that the represented companies continue to reflect growth characteristics. Investors cannot invest directly in any index.

4

FUND PERFORMANCE

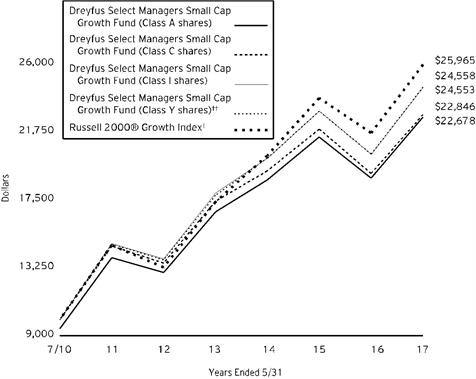

Comparison of change in value of $10,000 investment in Dreyfus Select Managers Small Cap Growth Fund Class A shares, Class C shares, Class I shares and Class Y shares and the Russell 2000® Growth Index (the “Index”)

† Source: Lipper Inc.

†† The total return figures presented for Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 7/1/13 (the inception date for Class Y shares), not reflecting the applicable sales load for Class A shares.

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in each of the Class A, Class C, Class I and Class Y shares of Dreyfus Select Managers Small Cap Growth Fund on 7/1/10 (inception date) to a $10,000 investment made in the Index. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher growth earning potential as defined by Russell's leading style methodology. The Index is constructed to provide a comprehensive and unbiased barometer for the small-cap growth segment. The Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set and that the represented companies continue to reflect growth characteristics. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

5

FUND PERFORMANCE (continued)

|

Average Annual Total Returns as of 5/31/17 | ||||

|

Inception Date |

1 Year |

5 Years |

From | |

|

Class A shares |

||||

|

with maximum sales charge (5.75%) |

7/1/10 |

13.30% |

10.52% |

12.56% |

|

without sales charge |

7/1/10 |

20.24% |

11.85% |

13.53% |

|

Class C shares |

||||

|

with applicable redemption charge† |

7/1/10 |

18.29% |

11.01% |

12.68% |

|

without redemption |

7/1/10 |

19.29% |

11.01% |

12.68% |

|

Class I shares |

7/1/10 |

20.54% |

12.19% |

13.86% |

|

Class Y shares |

7/1/13 |

20.60% |

12.31%†† |

13.86%†† |

|

Russell 2000® Growth Index |

6/30/10 |

19.71% |

14.36% |

14.79%††† |

Past performance is not predictive of future performance. The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

†† The total return performance figures presented for Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 7/1/13 (the inception date for Class Y shares), not reflecting the applicable sales load for Class A shares.

††† For comparative purposes, the value of the Index as of 6/30/10 is used as the beginning value on 7/1/10.

6

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Select Managers Small Cap Growth Fund from December 1, 2016 to May 31, 2017. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

|

Expenses and Value of a $1,000 Investment | ||||||||

|

assuming actual returns for the six months ended May 31, 2017 | ||||||||

|

Class A |

Class C |

Class I |

Class Y | |||||

|

Expenses paid per $1,000† |

|

$6.57 |

|

$10.67 |

|

$5.32 |

|

$4.96 |

|

Ending value (after expenses) |

|

$1,092.60 |

|

$1,088.00 |

|

$1,093.60 |

|

$1,094.10 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

|

Expenses and Value of a $1,000 Investment | ||||||||

|

assuming a hypothetical 5% annualized return for the six months ended May 31, 2017 | ||||||||

|

Class A |

Class C |

Class I |

Class Y | |||||

|

Expenses paid per $1,000† |

|

$6.34 |

|

$10.30 |

|

$5.14 |

|

$4.78 |

|

Ending value (after expenses) |

|

$1,018.65 |

|

$1,014.71 |

|

$1,019.85 |

|

$1,020.19 |

† Expenses are equal to the fund’s annualized expense ratio of 1.26% for Class A, 2.05% for Class C, 1.02% for Class I and .95% for Class Y, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

7

STATEMENT OF INVESTMENTS

May 31, 2017

|

Common Stocks - 96.8% |

Shares |

Value ($) |

|||

|

Automobiles & Components - 1.9% |

|||||

|

Dorman Products |

29,204 |

a,b |

2,435,614 |

||

|

Fox Factory Holding |

15,330 |

b |

503,591 |

||

|

LCI Industries |

61,204 |

5,447,156 |

|||

|

Standard Motor Products |

20,408 |

993,053 |

|||

|

Visteon |

29,647 |

b |

2,973,298 |

||

|

12,352,712 |

|||||

|

Banks - 4.1% |

|||||

|

Ameris Bancorp |

26,804 |

1,161,953 |

|||

|

BancFirst |

8,590 |

a |

811,326 |

||

|

Bank of the Ozarks |

145,574 |

6,434,371 |

|||

|

BofI Holding |

173,888 |

a,b |

3,860,314 |

||

|

Boston Private Financial Holdings |

48,205 |

698,973 |

|||

|

Central Pacific Financial |

25,405 |

768,501 |

|||

|

Columbia Banking System |

17,371 |

637,689 |

|||

|

Eagle Bancorp |

14,262 |

b |

813,647 |

||

|

First Hawaiian |

16,087 |

443,358 |

|||

|

Franklin Financial Network |

20,912 |

b |

815,568 |

||

|

IBERIABANK |

9,575 |

739,190 |

|||

|

LendingTree |

9,029 |

b |

1,404,912 |

||

|

Preferred Bank |

16,137 |

805,398 |

|||

|

Synovus Financial |

24,068 |

983,900 |

|||

|

Texas Capital Bancshares |

43,053 |

b |

3,160,090 |

||

|

Walker & Dunlop |

17,101 |

a,b |

798,788 |

||

|

Western Alliance Bancorp |

20,299 |

b |

928,070 |

||

|

Wintrust Financial |

9,539 |

655,902 |

|||

|

25,921,950 |

|||||

|

Capital Goods - 9.5% |

|||||

|

AAON |

43,733 |

a |

1,582,041 |

||

|

Aerovironment |

30,419 |

b |

944,206 |

||

|

Albany International, Cl. A |

25,945 |

1,253,143 |

|||

|

Altra Industrial Motion |

20,565 |

888,408 |

|||

|

American Woodmark |

13,067 |

b |

1,212,618 |

||

|

Apogee Enterprises |

36,807 |

a |

1,961,077 |

||

|

Astec Industries |

15,952 |

892,833 |

|||

|

Barnes Group |

50,161 |

2,838,611 |

|||

|

Beacon Roofing Supply |

66,647 |

b |

3,214,385 |

||

|

Builders FirstSource |

57,374 |

b |

783,729 |

||

8

|

Common Stocks - 96.8% (continued) |

Shares |

Value ($) |

|||

|

Capital Goods - 9.5% (continued) |

|||||

|

BWX Technologies |

17,972 |

873,439 |

|||

|

Chart Industries |

23,628 |

b |

811,622 |

||

|

Cubic |

19,751 |

915,459 |

|||

|

Donaldson |

50,889 |

2,440,636 |

|||

|

DXP Enterprises |

22,160 |

b |

793,993 |

||

|

Encore Wire |

23,999 |

a |

992,359 |

||

|

EnPro Industries |

15,843 |

1,058,471 |

|||

|

Esterline Technologies |

10,878 |

b |

1,060,061 |

||

|

H&E Equipment Services |

41,849 |

832,377 |

|||

|

John Bean Technologies |

25,557 |

2,205,569 |

|||

|

Kadant |

874 |

67,167 |

|||

|

Kennametal |

49,472 |

1,903,188 |

|||

|

KLX |

37,156 |

a,b |

1,797,979 |

||

|

Kratos Defense & Security Solutions |

100,911 |

b |

1,091,857 |

||

|

Masonite International |

34,448 |

b |

2,537,095 |

||

|

MasTec |

55,568 |

b |

2,356,083 |

||

|

Mercury Systems |

58,244 |

a,b |

2,316,364 |

||

|

Middleby |

21,830 |

b |

2,802,099 |

||

|

MRC Global |

64,922 |

a,b |

1,171,842 |

||

|

Nordson |

5,540 |

641,975 |

|||

|

Proto Labs |

23,092 |

b |

1,477,888 |

||

|

Quanta Services |

47,124 |

b |

1,444,822 |

||

|

Raven Industries |

36,833 |

a |

1,246,797 |

||

|

RBC Bearings |

28,646 |

a,b |

2,902,413 |

||

|

Rush Enterprises, Cl. A |

30,765 |

b |

1,102,925 |

||

|

SiteOne Landscape Supply |

28,267 |

a |

1,503,239 |

||

|

The Greenbrier Companies |

17,641 |

a |

780,614 |

||

|

Timken |

40,136 |

1,852,276 |

|||

|

Trex |

18,042 |

b |

1,159,559 |

||

|

Triton International |

29,861 |

a |

836,705 |

||

|

Tutor Perini |

26,806 |

a,b |

695,616 |

||

|

Woodward |

17,889 |

1,218,599 |

|||

|

60,462,139 |

|||||

|

Commercial & Professional Services - 3.6% |

|||||

|

Advisory Board |

86,935 |

b |

4,494,539 |

||

|

CBIZ |

62,488 |

b |

943,569 |

||

|

Exponent |

30,296 |

1,796,553 |

|||

|

Franklin Covey |

28,470 |

a,b |

562,283 |

||

|

Healthcare Services Group |

69,178 |

a |

3,311,551 |

||

9

STATEMENT OF INVESTMENTS (continued)

|

Common Stocks - 96.8% (continued) |

Shares |

Value ($) |

|||

|

Commercial & Professional Services - 3.6% (continued) |

|||||

|

Huron Consulting Group |

49,338 |

b |

2,049,994 |

||

|

Insperity |

14,375 |

1,084,594 |

|||

|

On Assignment |

16,731 |

b |

876,704 |

||

|

Tetra Tech |

125,461 |

5,764,933 |

|||

|

The Brink's Company |

16,817 |

1,061,153 |

|||

|

TransUnion |

16,518 |

b |

722,002 |

||

|

WageWorks |

9,066 |

b |

641,420 |

||

|

23,309,295 |

|||||

|

Consumer Durables & Apparel - 1.9% |

|||||

|

Callaway Golf |

86,396 |

1,100,685 |

|||

|

Hooker Furniture |

22,728 |

975,031 |

|||

|

LGI Homes |

34,725 |

b |

1,125,090 |

||

|

Nautilus |

85,114 |

a,b |

1,544,819 |

||

|

Oxford Industries |

25,347 |

a |

1,362,148 |

||

|

Steven Madden |

18,435 |

b |

723,574 |

||

|

TopBuild |

45,322 |

b |

2,426,993 |

||

|

Universal Electronics |

16,752 |

b |

1,082,179 |

||

|

Wolverine World Wide |

57,947 |

1,506,622 |

|||

|

11,847,141 |

|||||

|

Consumer Services - 5.8% |

|||||

|

Bravo Brio Restaurant Group |

31,533 |

b |

148,205 |

||

|

Bright Horizons Family Solutions |

40,774 |

b |

3,128,181 |

||

|

Buffalo Wild Wings |

20,932 |

a,b |

3,007,928 |

||

|

Century Casinos |

87,221 |

b |

681,196 |

||

|

Cheesecake Factory |

60,618 |

a |

3,575,250 |

||

|

Chuy's Holdings |

47,105 |

b |

1,267,124 |

||

|

ClubCorp Holdings |

49,840 |

662,872 |

|||

|

Dave & Buster's Entertainment |

76,681 |

a,b |

5,114,623 |

||

|

Grand Canyon Education |

21,918 |

b |

1,718,371 |

||

|

Hilton Grand Vacations |

25,685 |

918,752 |

|||

|

Panera Bread, Cl. A |

10,673 |

b |

3,356,552 |

||

|

Red Robin Gourmet Burgers |

12,656 |

a,b |

912,181 |

||

|

Strayer Education |

18,231 |

1,612,532 |

|||

|

Texas Roadhouse |

68,853 |

3,368,289 |

|||

|

Vail Resorts |

19,765 |

4,227,733 |

|||

|

Weight Watchers International |

48,495 |

a,b |

1,275,418 |

||

|

Wendy's |

82,798 |

a |

1,338,844 |

||

|

Wingstop |

31,680 |

a |

903,197 |

||

|

37,217,248 |

|||||

10

|

Common Stocks - 96.8% (continued) |

Shares |

Value ($) |

|||

|

Diversified Financials - 2.3% |

|||||

|

Associated Capital Group, Cl. A |

12,716 |

431,072 |

|||

|

CBOE Holdings |

8,068 |

696,833 |

|||

|

Evercore Partners, Cl. A |

24,751 |

1,678,118 |

|||

|

FactSet Research Systems |

10,357 |

a |

1,716,051 |

||

|

GAMCO Investors, Cl. A |

12,858 |

372,882 |

|||

|

Hercules Capital |

56,381 |

a |

734,644 |

||

|

LPL Financial Holdings |

20,745 |

807,603 |

|||

|

MarketAxess Holdings |

22,437 |

4,276,043 |

|||

|

Moelis & Co., Cl. A |

54,429 |

1,910,458 |

|||

|

PJT Partners, Cl. A |

22,060 |

853,060 |

|||

|

WisdomTree Investments |

124,190 |

a |

1,181,047 |

||

|

14,657,811 |

|||||

|

Energy - 1.0% |

|||||

|

Callon Petroleum |

146,362 |

b |

1,656,818 |

||

|

Dril-Quip |

15,669 |

a,b |

777,182 |

||

|

Forum Energy Technologies |

43,022 |

a,b |

699,108 |

||

|

Green Plains |

44,709 |

954,537 |

|||

|

Matador Resources |

27,924 |

a,b |

636,388 |

||

|

Patterson-UTI Energy |

20,609 |

439,384 |

|||

|

US Silica Holdings |

31,407 |

1,193,466 |

|||

|

6,356,883 |

|||||

|

Exchange-Traded Funds - 1.1% |

|||||

|

iShares Russell 2000 ETF |

51,235 |

a |

6,984,355 |

||

|

Food & Staples Retailing - .2% |

|||||

|

Natural Grocers by Vitamin Cottage |

20,846 |

a,b |

206,584 |

||

|

Smart & Final Stores |

94,039 |

a,b |

1,231,911 |

||

|

1,438,495 |

|||||

|

Food, Beverage & Tobacco - 1.5% |

|||||

|

Farmer Brothers |

26,774 |

b |

803,220 |

||

|

Hain Celestial Group |

61,726 |

b |

2,156,089 |

||

|

Hostess Brands |

74,859 |

b |

1,178,281 |

||

|

J&J Snack Foods |

17,610 |

2,291,061 |

|||

|

Nomad Foods |

69,527 |

b |

983,807 |

||

|

Sanderson Farms |

7,468 |

886,452 |

|||

|

SunOpta |

132,763 |

b |

1,234,696 |

||

|

9,533,606 |

|||||

|

Health Care Equipment & Services - 9.3% |

|||||

|

ABIOMED |

43,715 |

b |

6,007,752 |

||

|

AMN Healthcare Services |

24,479 |

b |

887,364 |

||

11

STATEMENT OF INVESTMENTS (continued)

|

Common Stocks - 96.8% (continued) |

Shares |

Value ($) |

|||

|

Health Care Equipment & Services - 9.3% (continued) |

|||||

|

AxoGen |

60,892 |

b |

904,246 |

||

|

BioTelemetry |

67,052 |

b |

1,934,450 |

||

|

Cantel Medical |

43,758 |

3,405,248 |

|||

|

Cardiovascular Systems |

60,088 |

b |

1,804,443 |

||

|

Cotiviti Holdings |

18,408 |

701,897 |

|||

|

Cutera |

39,865 |

b |

908,922 |

||

|

Glaukos |

16,834 |

a,b |

685,312 |

||

|

Globus Medical, Cl. A |

94,526 |

a,b |

2,906,674 |

||

|

Haemonetics |

13,212 |

a,b |

538,785 |

||

|

HealthEquity |

81,095 |

a,b |

3,714,151 |

||

|

HealthSouth |

30,220 |

1,369,873 |

|||

|

Hill-Rom Holdings |

9,354 |

723,625 |

|||

|

K2M Group Holdings |

30,844 |

b |

701,701 |

||

|

Masimo |

52,304 |

b |

4,552,540 |

||

|

Medidata Solutions |

64,659 |

b |

4,602,428 |

||

|

Merit Medical Systems |

28,905 |

b |

1,026,127 |

||

|

Natus Medical |

43,127 |

a,b |

1,462,005 |

||

|

Neogen |

43,952 |

b |

2,781,722 |

||

|

Nevro |

9,212 |

a,b |

634,062 |

||

|

NuVasive |

14,657 |

b |

1,099,715 |

||

|

NxStage Medical |

42,981 |

b |

930,968 |

||

|

Omnicell |

48,682 |

b |

1,942,412 |

||

|

OraSure Technologies |

78,509 |

b |

1,183,131 |

||

|

Penumbra |

18,425 |

a,b |

1,526,511 |

||

|

Spectranetics |

17,082 |

b |

461,214 |

||

|

Tactile Systems Technology |

3,886 |

b |

94,546 |

||

|

Teladoc |

85,058 |

a,b |

2,602,775 |

||

|

Teleflex |

16,457 |

3,291,729 |

|||

|

Tivity Health |

26,993 |

a,b |

916,412 |

||

|

Vocera Communications |

70,536 |

b |

1,885,427 |

||

|

Wright Medical Group |

38,593 |

a,b |

1,031,205 |

||

|

59,219,372 |

|||||

|

Household & Personal Products - .2% |

|||||

|

e.l.f. Beauty |

18,249 |

446,553 |

|||

|

Inter Parfums |

25,699 |

a |

894,325 |

||

|

Medifast |

6,006 |

249,910 |

|||

|

1,590,788 |

|||||

|

Insurance - .7% |

|||||

|

AMERISAFE |

15,476 |

801,657 |

|||

12

|

Common Stocks - 96.8% (continued) |

Shares |

Value ($) |

|||

|

Insurance - .7% (continued) |

|||||

|

Infinity Property & Casualty |

10,719 |

1,026,344 |

|||

|

James River Group Holdings |

20,319 |

805,445 |

|||

|

Kinsale Captial Group |

27,398 |

992,904 |

|||

|

Primerica |

13,657 |

986,035 |

|||

|

4,612,385 |

|||||

|

Materials - 2.5% |

|||||

|

Balchem |

31,266 |

2,461,260 |

|||

|

Berry Plastics Group |

15,928 |

b |

923,665 |

||

|

Chemours |

23,024 |

920,730 |

|||

|

Ferro |

65,807 |

b |

1,102,925 |

||

|

GCP Applied Technologies |

21,156 |

b |

636,796 |

||

|

Kaiser Aluminum |

12,609 |

1,038,477 |

|||

|

KMG Chemicals |

17,652 |

987,276 |

|||

|

Koppers Holdings |

31,823 |

b |

1,147,219 |

||

|

Louisiana-Pacific |

29,879 |

b |

665,704 |

||

|

Platform Specialty Products |

84,379 |

b |

1,053,050 |

||

|

Rayonier Advanced Materials |

52,241 |

908,471 |

|||

|

Sensient Technologies |

34,080 |

2,736,283 |

|||

|

Summit Materials, Cl. A |

62,599 |

b |

1,681,409 |

||

|

16,263,265 |

|||||

|

Media - .4% |

|||||

|

MDC Partners, Cl. A |

114,206 |

947,910 |

|||

|

New York Times, Cl. A |

88,380 |

1,555,488 |

|||

|

2,503,398 |

|||||

|

Pharmaceuticals, Biotechnology & Life Sciences - 12.3% |

|||||

|

Accelerate Diagnostics |

31,008 |

a,b |

865,123 |

||

|

Achaogen |

80,745 |

a,b |

1,629,434 |

||

|

Aclaris Therapeutics |

33,091 |

a,b |

786,904 |

||

|

Aerie Pharmaceuticals |

65,208 |

a,b |

3,615,784 |

||

|

Argenx, ADR |

5,554 |

a |

115,801 |

||

|

Aurinia Pharmaceuticals |

81,019 |

a,b |

505,559 |

||

|

Avexis |

13,806 |

a,b |

976,774 |

||

|

Biohaven Pharmaceutical Holding |

24,901 |

627,754 |

|||

|

Bio-Rad Laboratories, Cl. A |

3,081 |

b |

688,542 |

||

|

BioSpecifics Technologies |

23,599 |

b |

1,223,136 |

||

|

Bio-Techne |

23,795 |

2,666,944 |

|||

|

Bluebird Bio |

10,413 |

a,b |

784,620 |

||

|

Blueprint Medicines |

9,473 |

b |

339,891 |

||

|

Cambrex |

44,903 |

b |

2,415,781 |

||

13

STATEMENT OF INVESTMENTS (continued)

|

Common Stocks - 96.8% (continued) |

Shares |

Value ($) |

|||

|

Pharmaceuticals, Biotechnology & Life Sciences - 12.3% (continued) |

|||||

|

Cara Therapeutics |

57,168 |

a,b |

946,702 |

||

|

Clovis Oncology |

37,737 |

b |

1,949,493 |

||

|

Dermira |

39,606 |

b |

1,085,997 |

||

|

Emergent BioSolutions |

110,145 |

a,b |

3,516,930 |

||

|

Esperion Therapeutics |

25,031 |

a,b |

801,493 |

||

|

Exact Sciences |

78,756 |

a,b |

2,872,231 |

||

|

Exelixis |

87,692 |

a,b |

1,640,717 |

||

|

Flexion Therapeutics |

31,787 |

a,b |

543,240 |

||

|

Global Blood Therapeutics |

35,330 |

a,b |

953,910 |

||

|

GlycoMimetics |

70,060 |

a,b |

889,061 |

||

|

Halozyme Therapeutics |

50,262 |

a,b |

593,092 |

||

|

Heska |

14,092 |

b |

1,390,317 |

||

|

Horizon Pharma |

71,598 |

b |

715,980 |

||

|

Immunomedics |

127,950 |

a,b |

966,022 |

||

|

Intersect ENT |

39,602 |

b |

1,001,931 |

||

|

Keryx Biopharmaceuticals |

249,825 |

a,b |

1,596,382 |

||

|

Kite Pharma |

14,875 |

a,b |

1,075,760 |

||

|

Ligand Pharmaceuticals |

65,196 |

a,b |

7,059,423 |

||

|

Loxo Oncology |

23,487 |

a,b |

1,072,182 |

||

|

MiMedx Group |

50,467 |

a,b |

690,389 |

||

|

Nektar Therapeutics |

303,764 |

a,b |

6,038,828 |

||

|

NeoGenomics |

138,536 |

b |

1,047,332 |

||

|

Pacira Pharmaceuticals |

24,947 |

a,b |

1,107,647 |

||

|

Paratek Pharmaceuticals |

75,451 |

a,b |

1,512,793 |

||

|

PAREXEL International |

40,903 |

b |

3,305,780 |

||

|

Portola Pharmaceuticals |

16,774 |

b |

618,122 |

||

|

PRA Health Sciences |

13,486 |

b |

974,363 |

||

|

Progenics Pharmaceuticals |

207,861 |

a,b |

1,324,075 |

||

|

Puma Biotechnology |

4,293 |

a,b |

328,415 |

||

|

REGENXBIO |

37,267 |

b |

637,266 |

||

|

Repligen |

33,293 |

a,b |

1,306,417 |

||

|

Sage Therapeutics |

14,171 |

a,b |

936,845 |

||

|

Supernus Pharmaceuticals |

202,441 |

b |

7,611,782 |

||

|

TESARO |

15,554 |

a,b |

2,322,368 |

||

|

TG Therapeutics |

79,465 |

a,b |

893,981 |

||

|

78,569,313 |

|||||

|

Real Estate - .4% |

|||||

|

RE/MAX Holdings, Cl. A |

14,764 |

784,707 |

|||

|

Terreno Realty |

34,103 |

c |

1,114,486 |

||

14

|

Common Stocks - 96.8% (continued) |

Shares |

Value ($) |

|||

|

Real Estate - .4% (continued) |

|||||

|

UMH Properties |

52,768 |

c |

881,226 |

||

|

2,780,419 |

|||||

|

Retailing - 4.8% |

|||||

|

Burlington Stores |

26,309 |

b |

2,574,336 |

||

|

Conn's |

53,949 |

a,b |

922,528 |

||

|

Core-Mark Holding |

31,057 |

1,057,491 |

|||

|

Hibbett Sports |

25,760 |

a,b |

597,632 |

||

|

Lithia Motors, Cl. A |

10,830 |

983,905 |

|||

|

LKQ |

34,419 |

b |

1,083,854 |

||

|

Lumber Liquidators Holdings |

30,058 |

a,b |

871,081 |

||

|

MakeMyTrip |

29,521 |

a,b |

944,672 |

||

|

Monro Muffler Brake |

58,723 |

2,912,661 |

|||

|

Nutrisystem |

49,292 |

a |

2,565,649 |

||

|

Ollie's Bargain Outlet Holdings |

24,100 |

a,b |

991,715 |

||

|

PetMed Express |

30,898 |

a |

1,084,211 |

||

|

Pool |

55,560 |

6,618,863 |

|||

|

Shutterfly |

78,202 |

b |

3,870,217 |

||

|

The Children's Place |

16,340 |

1,767,988 |

|||

|

Tile Shop Holdings |

37,051 |

728,052 |

|||

|

Wayfair, Cl. A |

13,965 |

a,b |

879,097 |

||

|

30,453,952 |

|||||

|

Semiconductors & Semiconductor Equipment - 7.3% |

|||||

|

Ambarella |

27,660 |

a,b |

1,619,216 |

||

|

Axcelis Technologies |

48,026 |

b |

1,044,565 |

||

|

AXT |

131,277 |

a,b |

872,992 |

||

|

Brooks Automation |

31,648 |

871,902 |

|||

|

Cabot Microelectronics |

11,833 |

893,273 |

|||

|

Cavium |

12,324 |

b |

899,282 |

||

|

CEVA |

120,728 |

a,b |

5,100,758 |

||

|

Cirrus Logic |

31,257 |

b |

2,061,399 |

||

|

Cypress Semiconductor |

276,904 |

a |

3,873,887 |

||

|

Entegris |

50,894 |

b |

1,257,082 |

||

|

FormFactor |

65,605 |

b |

964,393 |

||

|

Ichor Holdings |

62,072 |

1,457,451 |

|||

|

Impinj |

50,184 |

a |

2,190,532 |

||

|

Inphi |

70,505 |

a,b |

2,797,638 |

||

|

Integrated Device Technology |

104,501 |

b |

2,673,136 |

||

|

Kulicke & Soffa Industries |

43,406 |

b |

961,443 |

||

|

MACOM Technology Solutions Holdings |

21,295 |

b |

1,298,356 |

||

15

STATEMENT OF INVESTMENTS (continued)

|

Common Stocks - 96.8% (continued) |

Shares |

Value ($) |

|||

|

Semiconductors & Semiconductor Equipment - 7.3% (continued) |

|||||

|

MaxLinear |

49,010 |

a,b |

1,526,661 |

||

|

Microsemi |

15,349 |

b |

753,789 |

||

|

MKS Instruments |

30,204 |

2,469,177 |

|||

|

Monolithic Power Systems |

34,647 |

3,402,335 |

|||

|

Nanometrics |

46,508 |

b |

1,292,922 |

||

|

ON Semiconductor |

92,270 |

b |

1,428,340 |

||

|

PDF Solutions |

39,665 |

b |

644,160 |

||

|

Semtech |

27,455 |

b |

1,048,781 |

||

|

Silicon Laboratories |

12,012 |

b |

898,498 |

||

|

Ultra Clean Holdings |

64,356 |

b |

1,469,891 |

||

|

Veeco Instruments |

27,254 |

b |

857,138 |

||

|

46,628,997 |

|||||

|

Software & Services - 17.8% |

|||||

|

2U |

21,759 |

a,b |

930,197 |

||

|

ACI Worldwide |

74,272 |

b |

1,697,858 |

||

|

Actua |

117,405 |

b |

1,643,670 |

||

|

Acxiom |

96,524 |

b |

2,528,929 |

||

|

Alarm.com Holdings |

74,839 |

b |

2,436,009 |

||

|

Aspen Technology |

13,459 |

b |

823,152 |

||

|

Blackbaud |

42,375 |

a |

3,505,684 |

||

|

Blucora |

48,960 |

b |

1,003,680 |

||

|

Bottomline Technologies |

49,482 |

b |

1,237,545 |

||

|

Callidus Software |

108,283 |

b |

2,587,964 |

||

|

Cimpress |

40,228 |

a,b |

3,553,742 |

||

|

Criteo, ADR |

133,816 |

a,b |

7,015,973 |

||

|

CyberArk Software |

22,822 |

b |

1,118,506 |

||

|

Descartes Systems Group |

62,840 |

b |

1,574,142 |

||

|

Ellie Mae |

25,357 |

b |

2,778,113 |

||

|

Envestnet |

55,279 |

b |

1,981,752 |

||

|

Euronet Worldwide |

7,581 |

b |

661,291 |

||

|

Everbridge |

131,775 |

3,407,701 |

|||

|

ExlService Holdings |

43,297 |

b |

2,267,464 |

||

|

Fair Isaac |

18,847 |

a |

2,500,243 |

||

|

Five9 |

62,242 |

b |

1,398,578 |

||

|

Gartner |

13,132 |

b |

1,570,587 |

||

|

GrubHub |

21,000 |

a,b |

912,870 |

||

|

GTT Communications |

45,142 |

b |

1,455,829 |

||

|

Guidewire Software |

13,029 |

b |

865,386 |

||

|

IAC/InterActiveCorp |

6,854 |

b |

728,854 |

||

16

|

Common Stocks - 96.8% (continued) |

Shares |

Value ($) |

|||

|

Software & Services - 17.8% (continued) |

|||||

|

Instructure |

35,266 |

a,b |

941,602 |

||

|

j2 Global |

37,562 |

a |

3,178,496 |

||

|

Leidos Holdings |

17,021 |

945,687 |

|||

|

LivePerson |

91,818 |

b |

876,862 |

||

|

LogMeIn |

8,771 |

973,581 |

|||

|

MAXIMUS |

48,818 |

3,030,621 |

|||

|

MINDBODY, Cl. A |

92,400 |

b |

2,591,820 |

||

|

MiX Telematics, ADR |

58,292 |

392,888 |

|||

|

Monotype Imaging Holdings |

21,603 |

422,339 |

|||

|

MuleSoft, Cl. A |

40,333 |

1,049,465 |

|||

|

New Relic |

56,700 |

b |

2,476,089 |

||

|

Nuance Communications |

44,983 |

b |

832,635 |

||

|

Paycom Software |

58,040 |

a,b |

3,798,138 |

||

|

Pegasystems |

16,407 |

958,989 |

|||

|

Points International |

53,023 |

b |

513,263 |

||

|

Proofpoint |

22,385 |

a,b |

1,925,110 |

||

|

PROS Holdings |

33,474 |

b |

999,868 |

||

|

Q2 Holdings |

23,118 |

b |

915,473 |

||

|

Quotient Technology |

127,395 |

a,b |

1,401,345 |

||

|

RealPage |

23,428 |

b |

810,609 |

||

|

RingCentral, Cl. A |

27,578 |

b |

940,410 |

||

|

Shutterstock |

70,439 |

a,b |

3,279,640 |

||

|

Square, Cl. A |

52,663 |

b |

1,210,722 |

||

|

Stamps.com |

61,918 |

a,b |

8,538,492 |

||

|

Take-Two Interactive Software |

24,040 |

b |

1,844,830 |

||

|

Talend, ADR |

13,960 |

457,469 |

|||

|

Trade Desk, Cl. A |

17,862 |

982,410 |

|||

|

TrueCar |

97,948 |

a,b |

1,721,926 |

||

|

Tyler Technologies |

22,097 |

b |

3,775,935 |

||

|

Ultimate Software Group |

11,813 |

a,b |

2,607,602 |

||

|

Varonis Systems |

25,098 |

b |

912,312 |

||

|

Web.com Group |

38,753 |

b |

881,631 |

||

|

Wix.com |

19,186 |

b |

1,414,008 |

||

|

WNS Holdings, ADR |

89,678 |

b |

2,986,277 |

||

|

Zix |

162,622 |

b |

938,329 |

||

|

113,712,592 |

|||||

|

Technology Hardware & Equipment - 5.0% |

|||||

|

ADTRAN |

46,473 |

894,605 |

|||

|

Applied Optoelectronics |

23,965 |

a,b |

1,673,236 |

||

17

STATEMENT OF INVESTMENTS (continued)

|

Common Stocks - 96.8% (continued) |

Shares |

Value ($) |

|||

|

Technology Hardware & Equipment - 5.0% (continued) |

|||||

|

CalAmp |

83,768 |

b |

1,583,215 |

||

|

Celestica |

95,109 |

b |

1,306,798 |

||

|

Cognex |

44,637 |

4,084,732 |

|||

|

Coherent |

6,285 |

b |

1,559,623 |

||

|

EchoStar, Cl. A |

11,619 |

b |

686,102 |

||

|

Electronics For Imaging |

43,539 |

b |

2,064,619 |

||

|

ePlus |

32,163 |

b |

2,532,836 |

||

|

Extreme Networks |

249,840 |

b |

2,405,959 |

||

|

II-VI |

9,351 |

b |

280,530 |

||

|

Infinera |

115,407 |

b |

1,121,756 |

||

|

IPG Photonics |

6,284 |

b |

873,727 |

||

|

Itron |

17,376 |

b |

1,175,486 |

||

|

Ituran Location and Control |

20,059 |

645,900 |

|||

|

Littelfuse |

5,888 |

953,562 |

|||

|

Lumentum Holdings |

28,013 |

b |

1,598,142 |

||

|

Orbotech |

14,117 |

b |

503,695 |

||

|

OSI Systems |

19,094 |

b |

1,512,054 |

||

|

Quantenna Communications |

36,761 |

a |

702,870 |

||

|

Rogers |

6,302 |

b |

669,335 |

||

|

Silicom |

16,834 |

858,029 |

|||

|

Universal Display |

10,131 |

a |

1,148,855 |

||

|

Viavi Solutions |

92,572 |

b |

1,039,584 |

||

|

31,875,250 |

|||||

|

Telecommunication Services - .8% |

|||||

|

Boingo Wireless |

188,443 |

b |

3,028,279 |

||

|

ORBCOMM |

124,260 |

a,b |

1,217,748 |

||

|

Vonage Holdings |

80,510 |

b |

556,324 |

||

|

Zayo Group Holdings |

18,591 |

b |

597,887 |

||

|

5,400,238 |

|||||

|

Transportation - 2.2% |

|||||

|

Air Transport Services Group |

39,062 |

b |

931,629 |

||

|

Allegiant Travel |

16,640 |

2,279,680 |

|||

|

Echo Global Logistics |

109,069 |

b |

2,034,137 |

||

|

Genesee & Wyoming, Cl. A |

19,041 |

a,b |

1,247,185 |

||

|

Hawaiian Holdings |

23,269 |

b |

1,165,777 |

||

|

Hub Group, Cl. A |

13,516 |

b |

484,549 |

||

|

Knight Transportation |

26,726 |

a |

891,312 |

||

|

Marten Transport |

106,695 |

2,640,701 |

|||

|

Old Dominion Freight Line |

9,221 |

823,620 |

|||

18

|

Common Stocks - 96.8% (continued) |

Shares |

Value ($) |

|||

|

Transportation - 2.2% (continued) |

|||||

|

SkyWest |

21,123 |

724,519 |

|||

|

XPO Logistics |

21,732 |

b |

1,143,103 |

||

|

14,366,212 |

|||||

|

Utilities - .2% |

|||||

|

American States Water |

26,383 |

a |

1,208,078 |

||

|

Total Common Stocks (cost $500,156,633) |

619,265,894 |

||||

|

Investment of Cash Collateral for Securities Loaned - 11.7% |

|||||

|

Registered Investment Company; |

|||||

|

Dreyfus Institutional Preferred Money Market Fund, Hamilton Shares |

74,990,232 |

d |

74,990,232 |

||

|

Total Investments (cost $575,146,865) |

108.5% |

694,256,126 |

|||

|

Liabilities, Less Cash and Receivables |

(8.5%) |

(54,390,447) |

|||

|

Net Assets |

100.0% |

639,865,679 |

|||

ADR—American Depository Receipt

ETF—Exchange-Traded Fund

a Security, or portion thereof, on loan. At May 31, 2017, the value of the fund’s securities on loan was $141,423,649 and the value of the collateral held by the fund was $144,760,047, consisting of cash collateral of $74,990,232 and U.S. Government & Agency securities valued at $69,769,815.

b Non-income producing security.

c Investment in real estate investment trust.

d Investment in affiliated money market mutual fund.

19

STATEMENT OF INVESTMENTS (continued)

|

Portfolio Summary (Unaudited) † |

Value (%) |

|

Software & Services |

17.8 |

|

Pharmaceuticals, Biotechnology & Life Sciences |

12.3 |

|

Money Market Investment |

11.7 |

|

Capital Goods |

9.5 |

|

Health Care Equipment & Services |

9.3 |

|

Semiconductors & Semiconductor Equipment |

7.3 |

|

Consumer Services |

5.8 |

|

Technology Hardware & Equipment |

5.0 |

|

Retailing |

4.8 |

|

Banks |

4.1 |

|

Commercial & Professional Services |

3.6 |

|

Materials |

2.5 |

|

Diversified Financials |

2.3 |

|

Transportation |

2.2 |

|

Automobiles & Components |

1.9 |

|

Consumer Durables & Apparel |

1.9 |

|

Food, Beverage & Tobacco |

1.5 |

|

Exchange-Traded Funds |

1.1 |

|

Energy |

1.0 |

|

Telecommunication Services |

.8 |

|

Insurance |

.7 |

|

Real Estate |

.4 |

|

Media |

.4 |

|

Household & Personal Products |

.2 |

|

Food & Staples Retailing |

.2 |

|

Utilities |

.2 |

|

108.5 |

† Based on net assets.

See notes to financial statements.

20

STATEMENT OF ASSETS AND LIABILITIES

May 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

Cost |

|

Value |

|

|

Assets ($): |

|

|

|

| ||

|

Investments in securities—See Statement of Investments |

|

|

|

| ||

|

Unaffiliated issuers |

|

500,156,633 |

|

619,265,894 |

| |

|

Affiliated issuers |

|

74,990,232 |

|

74,990,232 |

| |

|

Cash |

|

|

|

|

21,835,907 |

|

|

Receivable for investment securities sold |

|

|

|

|

8,800,125 |

|

|

Dividends and securities lending income receivable |

|

|

|

|

330,544 |

|

|

Receivable for shares of Common Stock subscribed |

|

|

|

|

220,952 |

|

|

Prepaid expenses |

|

|

|

|

42,588 |

|

|

|

|

|

|

|

725,486,242 |

|

|

Liabilities ($): |

|

|

|

| ||

|

Due to The Dreyfus Corporation and affiliates—Note 3(c) |

|

|

|

|

528,113 |

|

|

Liability for securities on loan—Note 1(b) |

|

|

|

|

74,990,232 |

|

|

Payable for investment securities purchased |

|

|

|

|

9,851,261 |

|

|

Payable for shares of Common Stock redeemed |

|

|

|

|

137,276 |

|

|

Accrued expenses |

|

|

|

|

113,681 |

|

|

|

|

|

|

|

85,620,563 |

|

|

Net Assets ($) |

|

|

639,865,679 |

| ||

|

Composition of Net Assets ($): |

|

|

|

| ||

|

Paid-in capital |

|

|

|

|

501,536,672 |

|

|

Accumulated investment (loss)—net |

|

|

|

|

(1,075,880) |

|

|

Accumulated net realized gain (loss) on investments |

|

|

|

|

20,295,626 |

|

|

Accumulated net unrealized appreciation (depreciation) |

|

|

|

119,109,261 |

| |

|

Net Assets ($) |

|

|

639,865,679 |

| ||

|

Net Asset Value Per Share |

Class A |

Class C |

Class I |

Class Y |

|

|

Net Assets ($) |

2,818,693 |

323,126 |

11,777,062 |

624,946,798 |

|

|

Shares Outstanding |

114,868 |

13,972 |

468,874 |

24,883,272 |

|

|

Net Asset Value Per Share ($) |

24.54 |

23.13 |

25.12 |

25.12 |

|

|

See notes to financial statements. |

21

STATEMENT OF OPERATIONS

Year Ended May 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Income ($): |

|

|

|

| ||

|

Income: |

|

|

|

| ||

|

Cash dividends (net of $9,700 foreign taxes |

|

|

3,415,406 |

| ||

|

Income from securities lending—Note 1(b) |

|

|

601,473 |

| ||

|

Total Income |

|

|

4,016,879 |

| ||

|

Expenses: |

|

|

|

| ||

|

Management fee—Note 3(a) |

|

|

5,380,027 |

| ||

|

Custodian fees—Note 3(c) |

|

|

102,926 |

| ||

|

Professional fees |

|

|

63,241 |

| ||

|

Registration fees |

|

|

60,574 |

| ||

|

Directors’ fees and expenses—Note 3(d) |

|

|

59,466 |

| ||

|

Prospectus and shareholders’ reports |

|

|

24,910 |

| ||

|

Shareholder servicing costs—Note 3(c) |

|

|

23,452 |

| ||

|

Loan commitment fees—Note 2 |

|

|

14,169 |

| ||

|

Distribution fees—Note 3(b) |

|

|

2,324 |

| ||

|

Miscellaneous |

|

|

44,517 |

| ||

|

Total Expenses |

|

|

5,775,606 |

| ||

|

Less—reduction in expenses due to undertaking—Note 3(a) |

|

|

(2,596) |

| ||

|

Less—reduction in fees due to earnings credits—Note 3(c) |

|

|

(33,684) |

| ||

|

Net Expenses |

|

|

5,739,326 |

| ||

|

Investment (Loss)—Net |

|

|

(1,722,447) |

| ||

|

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

|

| ||||

|

Net realized gain (loss) on investments |

66,465,001 |

| ||||

|

Net unrealized appreciation (depreciation) on investments |

|

|

46,361,475 |

| ||

|

Net Realized and Unrealized Gain (Loss) on Investments |

|

|

112,826,476 |

| ||

|

Net Increase in Net Assets Resulting from Operations |

|

111,104,029 |

| |||

|

See notes to financial statements. |

||||||

22

STATEMENT OF CHANGES IN NET ASSETS

|

|

|

|

|

Year Ended May 31, | |||||

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

Operations ($): |

|

|

|

|

|

|

|

| |

|

Investment (loss)—net |

|

|

(1,722,447) |

|

|

|

(1,913,592) |

| |

|

Net realized gain (loss) on investments |

|

66,465,001 |

|

|

|

(32,332,896) |

| ||

|

Net unrealized appreciation (depreciation) |

|

46,361,475 |

|

|

|

(36,965,710) |

| ||

|

Net Increase (Decrease) in Net Assets |

111,104,029 |

|

|

|

(71,212,198) |

| |||

|

Distributions to Shareholders from ($): |

|

|

|

|

|

|

|

| |

|

Net realized gain on investments: |

|

|

|

|

|

|

|

| |

|

Class A |

|

|

- |

|

|

|

(277,408) |

| |

|

Class C |

|

|

- |

|

|

|

(14,611) |

| |

|

Class I |

|

|

- |

|

|

|

(1,466,073) |

| |

|

Class Y |

|

|

- |

|

|

|

(36,396,471) |

| |

|

Total Distributions |

|

|

- |

|

|

|

(38,154,563) |

| |

|

Capital Stock Transactions ($): |

|

|

|

|

|

|

|

| |

|

Net proceeds from shares sold: |

|

|

|

|

|

|

|

| |

|

Class A |

|

|

111,993 |

|

|

|

406,187 |

| |

|

Class C |

|

|

99,495 |

|

|

|

101,238 |

| |

|

Class I |

|

|

21,438,749 |

|

|

|

7,203,985 |

| |

|

Class Y |

|

|

107,518,287 |

|

|

|

142,747,856 |

| |

|

Distributions reinvested: |

|

|

|

|

|

|

|

| |

|

Class A |

|

|

- |

|

|

|

276,552 |

| |

|

Class C |

|

|

- |

|

|

|

14,611 |

| |

|

Class I |

|

|

- |

|

|

|

1,202,280 |

| |

|

Class Y |

|

|

- |

|

|

|

17,291,983 |

| |

|

Cost of shares redeemed: |

|

|

|

|

|

|

|

| |

|

Class A |

|

|

(1,633,132) |

|

|

|

(957,487) |

| |

|

Class C |

|

|

(82,751) |

|

|

|

(82,977) |

| |

|

Class I |

|

|

(31,509,561) |

|

|

|

(8,486,644) |

| |

|

Class Y |

|

|

(122,029,408) |

|

|

|

(117,140,868) |

| |

|

Increase (Decrease) in Net Assets |

(26,086,328) |

|

|

|

42,576,716 |

| |||

|

Total Increase (Decrease) in Net Assets |

85,017,701 |

|

|

|

(66,790,045) |

| |||

|

Net Assets ($): |

|

|

|

|

|

|

|

| |

|

Beginning of Period |

|

|

554,847,978 |

|

|

|

621,638,023 |

| |

|

End of Period |

|

|

639,865,679 |

|

|

|

554,847,978 |

| |

|

Accumulated investment (loss)—net |

(1,075,880) |

|

|

|

(723,545) |

| |||

23

STATEMENT OF CHANGES IN NET ASSETS (continued)

|

|

|

|

|

Year Ended May 31, | |||||

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

Capital Share Transactions (Shares): |

|

|

|

|

|

|

|

| |

|

Class Aa |

|

|

|

|

|

|

|

| |

|

Shares sold |

|

|

4,851 |

|

|

|

19,009 |

| |

|

Shares issued for distributions reinvested |

|

|

- |

|

|

|

12,941 |

| |

|

Shares redeemed |

|

|

(72,023) |

|

|

|

(44,496) |

| |

|

Net Increase (Decrease) in Shares Outstanding |

(67,172) |

|

|

|

(12,546) |

| |||

|

Class C |

|

|

|

|

|

|

|

| |

|

Shares sold |

|

|

4,821 |

|

|

|

4,857 |

| |

|

Shares issued for distributions reinvested |

|

|

- |

|

|

|

717 |

| |

|

Shares redeemed |

|

|

(3,894) |

|

|

|

(3,751) |

| |

|

Net Increase (Decrease) in Shares Outstanding |

927 |

|

|

|

1,823 |

| |||

|

Class Ia |

|

|

|

|

|

|

|

| |

|

Shares sold |

|

|

907,336 |

|

|

|

314,949 |

| |

|

Shares issued for distributions reinvested |

|

|

- |

|

|

|

55,176 |

| |

|

Shares redeemed |

|

|

(1,368,183) |

|

|

|

(386,158) |

| |

|

Net Increase (Decrease) in Shares Outstanding |

(460,847) |

|

|

|

(16,033) |

| |||

|

Class Ya |

|

|

|

|

|

|

|

| |

|

Shares sold |

|

|

4,680,876 |

|

|

|

6,589,584 |

| |

|

Shares issued for distributions reinvested |

|

|

- |

|

|

|

794,303 |

| |

|

Shares redeemed |

|

|

(5,319,266) |

|

|

|

(5,351,331) |

| |

|

Net Increase (Decrease) in Shares Outstanding |

(638,390) |

|

|

|

2,032,556 |

| |||

|

a |

During the period ended May 31, 2017, 12,411 Class A shares representing $289,719 were exchanged for 12,125 Class I shares, 94,740 Class I shares representing $1,530,178 were exchanged for 94,777 Class Y shares, and during the period ended May 31, 2016, 235,226 Class Y shares representing $5,438,913 were exchanged for 235,068 Class I shares. |

||||||||

|

See notes to financial statements. |

|||||||||

24

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. These figures have been derived from the fund’s financial statements.

|

Year Ended May 31, | ||||||

|

Class A Shares |

2017 |

2016 |

2015 |

2014 |

2013 | |

|

Per Share Data ($): |

||||||

|

Net asset value, beginning of period |

20.41 |

24.84 |

23.55 |

22.16 |

17.13 | |

|

Investment Operations: |

||||||

|

Investment (loss)—neta |

(.13) |

(.15) |

(.17) |

(.19) |

(.11) | |

|

Net realized and unrealized |

4.26 |

(2.76) |

3.42 |

2.90 |

5.14 | |

|

Total from Investment Operations |

4.13 |

(2.91) |

3.25 |

2.71 |

5.03 | |

|

Distributions: |

||||||

|

Dividends from net realized |

- |

(1.52) |

(1.96) |

(1.32) |

- | |

|

Net asset value, end of period |

24.54 |

20.41 |

24.84 |

23.55 |

22.16 | |

|

Total Return (%)b |

20.24 |

(11.99) |

14.30 |

11.87 |

29.36 | |

|

Ratios/Supplemental Data (%): |

||||||

|

Ratio of total expenses |

1.28 |

1.29 |

1.32 |

1.38 |

1.34 | |

|

Ratio of net expenses |

1.28 |

1.29 |

1.30 |

1.30 |

1.33 | |

|

Ratio of net investment (loss) |

(.60) |

(.66) |

(.71) |

(.75) |

(.56) | |

|

Portfolio Turnover Rate |

138.00 |

125.11 |

148.55 |

121.33 |

111.48 | |

|

Net Assets, end of period ($ x 1,000) |

2,819 |

3,716 |

4,834 |

4,742 |

668 | |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

25

FINANCIAL HIGHLIGHTS (continued)

|

Year Ended May 31, | ||||||

|

Class C Shares |

2017 |

2016 |

2015 |

2014 |

2013 | |

|

Per Share Data ($): |

||||||

|

Net asset value, beginning of period |

19.39 |

23.85 |

22.85 |

21.70 |

16.89 | |

|

Investment Operations: |

||||||

|

Investment (loss)—neta |

(.31) |

(.30) |

(.35) |

(.36) |

(.23) | |

|

Net realized and unrealized |

4.05 |

(2.64) |

3.31 |

2.83 |

5.04 | |

|

Total from Investment Operations |

3.74 |

(2.94) |

2.96 |

2.47 |

4.81 | |

|

Distributions: |

||||||

|

Dividends from net realized |

- |

(1.52) |

(1.96) |

(1.32) |

- | |

|

Net asset value, end of period |

23.13 |

19.39 |

23.85 |

22.85 |

21.70 | |

|

Total Return (%)b |

19.29 |

(12.67) |

13.49 |

10.99 |

28.48 | |

|

Ratios/Supplemental Data (%): |

||||||

|

Ratio of total expenses |

2.27 |

2.39 |

2.34 |

2.34 |

2.25 | |

|

Ratio of net expenses |

2.05 |

2.05 |

2.05 |

2.03 |

2.02 | |

|

Ratio of net investment (loss) |

(1.39) |

(1.42) |

(1.48) |

(1.48) |

(1.28) | |

|

Portfolio Turnover Rate |

138.00 |

125.11 |

148.55 |

121.33 |

111.48 | |

|

Net Assets, end of period ($ x 1,000) |

323 |

253 |

268 |

430 |

32 | |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

26

|

Year Ended May 31, | ||||||

|

Class I Shares |

2017 |

2016 |

2015 |

2014 |

2013 | |

|

Per Share Data ($): |

||||||

|

Net asset value, beginning of period |

20.84 |

25.25 |

23.83 |

22.35 |

17.22 | |

|

Investment Operations: |

||||||

|

Investment (loss)—neta |

(.08) |

(.08) |

(.10) |

(.12) |

(.05) | |

|

Net realized and unrealized |

4.36 |

(2.81) |

3.48 |

2.92 |

5.18 | |

|

Total from Investment Operations |

4.28 |

(2.89) |

3.38 |

2.80 |

5.13 | |

|

Distributions: |

||||||

|

Dividends from net realized |

- |

(1.52) |

(1.96) |

(1.32) |

- | |

|

Net asset value, end of period |

25.12 |

20.84 |

25.25 |

23.83 |

22.35 | |

|

Total Return (%) |

20.54 |

(11.71) |

14.69 |

12.18 |

29.79 | |

|

Ratios/Supplemental Data (%): |