0000737468DEF 14Afalse00007374682022-01-012022-12-31iso4217:USDxbrli:pure00007374682021-01-012021-12-3100007374682020-01-012020-12-310000737468wash:EquityAwardsReportedValueMemberecd:PeoMember2022-01-012022-12-310000737468wash:EquityAwardAdjustmentsMemberecd:PeoMember2022-01-012022-12-310000737468ecd:PeoMemberwash:AdjustmentChangeInActuarialPresentValueOfReportedPensionBenefitsAdjustmentsMember2022-01-012022-12-310000737468ecd:PeoMemberwash:AdjustmentPensionBenefitAdjustmentsMember2022-01-012022-12-310000737468wash:EquityAwardsReportedValueMemberecd:PeoMember2021-01-012021-12-310000737468wash:EquityAwardAdjustmentsMemberecd:PeoMember2021-01-012021-12-310000737468ecd:PeoMemberwash:AdjustmentChangeInActuarialPresentValueOfReportedPensionBenefitsAdjustmentsMember2021-01-012021-12-310000737468ecd:PeoMemberwash:AdjustmentPensionBenefitAdjustmentsMember2021-01-012021-12-310000737468wash:EquityAwardsReportedValueMemberecd:PeoMember2020-01-012020-12-310000737468wash:EquityAwardAdjustmentsMemberecd:PeoMember2020-01-012020-12-310000737468ecd:PeoMemberwash:AdjustmentChangeInActuarialPresentValueOfReportedPensionBenefitsAdjustmentsMember2020-01-012020-12-310000737468ecd:PeoMemberwash:AdjustmentPensionBenefitAdjustmentsMember2020-01-012020-12-310000737468wash:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2022-01-012022-12-310000737468ecd:PeoMemberwash:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310000737468ecd:PeoMemberwash:EquityAwardsGrantedDuringTheYearVestedMember2022-01-012022-12-310000737468wash:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2022-01-012022-12-310000737468ecd:PeoMemberwash:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310000737468wash:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:PeoMember2022-01-012022-12-310000737468wash:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2021-01-012021-12-310000737468ecd:PeoMemberwash:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310000737468ecd:PeoMemberwash:EquityAwardsGrantedDuringTheYearVestedMember2021-01-012021-12-310000737468wash:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-01-012021-12-310000737468ecd:PeoMemberwash:EquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310000737468wash:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:PeoMember2021-01-012021-12-310000737468wash:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2020-01-012020-12-310000737468ecd:PeoMemberwash:EquityAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310000737468ecd:PeoMemberwash:EquityAwardsGrantedDuringTheYearVestedMember2020-01-012020-12-310000737468wash:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2020-01-012020-12-310000737468ecd:PeoMemberwash:EquityAwardsThatFailedToMeetVestingConditionsMember2020-01-012020-12-310000737468wash:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:PeoMember2020-01-012020-12-310000737468wash:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2022-01-012022-12-310000737468wash:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000737468ecd:NonPeoNeoMemberwash:AdjustmentChangeInActuarialPresentValueOfReportedPensionBenefitsAdjustmentsMember2022-01-012022-12-310000737468ecd:NonPeoNeoMemberwash:AdjustmentPensionBenefitAdjustmentsMember2022-01-012022-12-310000737468wash:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2021-01-012021-12-310000737468wash:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000737468ecd:NonPeoNeoMemberwash:AdjustmentChangeInActuarialPresentValueOfReportedPensionBenefitsAdjustmentsMember2021-01-012021-12-310000737468ecd:NonPeoNeoMemberwash:AdjustmentPensionBenefitAdjustmentsMember2021-01-012021-12-310000737468wash:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2020-01-012020-12-310000737468wash:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000737468ecd:NonPeoNeoMemberwash:AdjustmentChangeInActuarialPresentValueOfReportedPensionBenefitsAdjustmentsMember2020-01-012020-12-310000737468ecd:NonPeoNeoMemberwash:AdjustmentPensionBenefitAdjustmentsMember2020-01-012020-12-310000737468wash:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000737468ecd:NonPeoNeoMemberwash:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310000737468ecd:NonPeoNeoMemberwash:EquityAwardsGrantedDuringTheYearVestedMember2022-01-012022-12-310000737468wash:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000737468ecd:NonPeoNeoMemberwash:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310000737468wash:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2022-01-012022-12-310000737468wash:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000737468ecd:NonPeoNeoMemberwash:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310000737468ecd:NonPeoNeoMemberwash:EquityAwardsGrantedDuringTheYearVestedMember2021-01-012021-12-310000737468wash:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000737468ecd:NonPeoNeoMemberwash:EquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310000737468wash:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2021-01-012021-12-310000737468wash:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000737468ecd:NonPeoNeoMemberwash:EquityAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310000737468ecd:NonPeoNeoMemberwash:EquityAwardsGrantedDuringTheYearVestedMember2020-01-012020-12-310000737468wash:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000737468ecd:NonPeoNeoMemberwash:EquityAwardsThatFailedToMeetVestingConditionsMember2020-01-012020-12-310000737468wash:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2020-01-012020-12-31000073746812022-01-012022-12-31000073746822022-01-012022-12-31000073746832022-01-012022-12-31000073746842022-01-012022-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| | | | | |

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

|

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only, (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under Rule 14a-12 |

WASHINGTON TRUST BANCORP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| | | | | | | | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Dear Fellow Shareholders:

On behalf of the Washington Trust Bancorp, Inc. Board of Directors, it is my pleasure to invite you to the 2023 Annual Meeting of Shareholders. This year’s Annual Meeting will be held in a virtual only format via live webcast. The accompanying Notice of Annual Meeting of Shareholders and Proxy Statement will serve as your guide to the business to be conducted at the meeting. A copy of these materials, as well as our Annual Report to Shareholders, is available on our Investor Relations website at https://ir.washtrust.com/proxy.

I’m pleased to report Washington Trust once again delivered solid financial results and consistent returns to shareholders in 2022, a year marked by significant economic challenges brought about by the lingering effects of the global pandemic, inflationary pressures, changes in the interest rate environment, and more. We remained committed to offering a high level of personal service, digital solutions, and trusted advice, while ensuring we were intentionally engaged and supportive of our employees, customers, and communities to help them through these turbulent times. Our strong capital position, disciplined credit culture, and diverse business model sustained us through previous economic cycles and contributed to our success.

Financial highlights for the year ended December 31, 2022, included:

▪$71.7 million in net income, or $4.11 diluted earnings per share, consistent profitability

▪14.49% return on average equity and 1.17% return on average assets, solid returns

▪$6.7 billion in total assets, a record level

▪$5.1 billion in total loans, an all-time high

▪$5.0 billion in total deposits, with solid in-market deposit growth

▪$6.0 billion in wealth management assets under administration, a key source of noninterest income

▪$2.18 cash dividends per share, the twelfth consecutive year of dividend increases

Growth is a key strategic initiative, and we take a disciplined approach to market expansion. Over the past decade, de novo branching provided a source of new deposits and helped us retain our position as the top state-chartered bank for FDIC-insured deposits in Rhode Island. In 2022 we opened a branch in Cumberland, Rhode Island and identified future branch locations in Providence, Barrington, and Smithfield. Over the years, we have successfully expanded our mortgage lending, commercial banking, and wealth management operations outside of our core Rhode Island market area. Our key business line performances reflect the continued challenges of financial market volatility, intense competition, increased regulation, and other environmental factors. Our wealth management division withstood client attrition late in the year, but we remain committed to growing this key line of business for the long-term. In 2022, we expanded our team of local commercial banking professionals and opened a commercial lending office in New Haven, Connecticut. We look forward to building and deepening customer relationships and enhancing our brand presence in the Connecticut market. We believe there are additional growth opportunities for a bank like Washington Trust in these attractive markets.

Community banking is about people, and we are committed to providing the right solutions to meet our employee and customer needs. We quickly adapted to the new work and lifestyle preferences and behaviors brought about by the pandemic. We made investments in technology, introduced digital solutions, and employed new processes across business lines to improve employee and customer experiences. We

successfully blended high-touch customer service, for which we are well-known, with access to high-tech tools, providing the speed, security, and convenience many consumers desire. We welcomed employees “back to the office,” post-pandemic, offering a hybrid work environment and providing secure tools to enable them to perform efficiently, and serve customers effectively, while affording them the desired work-life balance.

Washington Trust has a strong and distinctive corporate culture, and we remain committed to fostering a supportive and inclusive work environment, attracting a highly talented and diverse workforce, and supporting and empowering our team to achieve their personal and professional goals. We have a formalized strategy that guides our diversity, equity & inclusion (“DE&I”) efforts, focusing on four pillars – culture and employee experience; recruitment, development, and retention; leadership and workforce engagement; and impactful community relationships. To assist us in implementing our DE&I strategy, we have established the Washington Trust DE&I Council, a cross functional group of colleagues representing different perspectives, backgrounds, and experiences. We are excited by the Council’s passion and look forward to their contributions in ensuring Washington Trust continues to offer a welcoming environment and remains an employer of choice.

We are proud of the recognition we received in 2022, which include being:

▪Listed as one of the nation’s “Best Banks to Work For” by American Banker® magazine, for the fourth consecutive year

▪Selected as one of the “Healthiest Employers in Rhode Island” by Providence Business News, for the second consecutive year

▪Given outstanding recognition by Newsweek as “Best Small Bank in Rhode Island”

▪Recognized as one of “Rhode Island’s Best Places to Work” by Providence Business News, for the twelfth consecutive year

In 2022 we celebrated our 222nd Anniversary and are proud to be the oldest community bank in the nation. With this mantle we bear great responsibility to ensure our actions are authentic and we continue to do what’s right for our employees, our customers, our communities, and our shareholders. Our 2022 Environmental, Social, and Governance (“ESG”) Report will share the many ways we provide “those little assistances,” as our original charter states. In honor of our 222nd Anniversary, our employees committed more than 222 “Acts of Kindness,” serving as community leaders and volunteers to make a difference in the lives of their family, neighbors, and friends. I’m immensely proud of our team and the work they do every day to make Washington Trust the “Best Place to Work”.

We are confident in our business model and our team and believe we are well-positioned to meet the challenges ahead. We remain committed to enhancing long-term value for our shareholders and thank you for your continued support.

Sincerely,

Edward O. Handy III

Chairman and Chief Executive Officer

| | | | | |

| Notice of Annual Meeting of Shareholders |

Date and Time: Tuesday, the 25th of April, 2023, at 11:00 a.m. ET

Location: The Washington Trust Bancorp, Inc. 2023 Annual Meeting of Shareholders (the “Annual Meeting”) will be held solely by remote communication via live webcast at www.virtualshareholdermeeting.com/WASH2023. To join the meeting, be sure to have the control number provided to you on the proxy card or Notice of Internet Availability of Proxy Materials. You will not be able to attend the Annual Meeting in person.

| | | | | | | | |

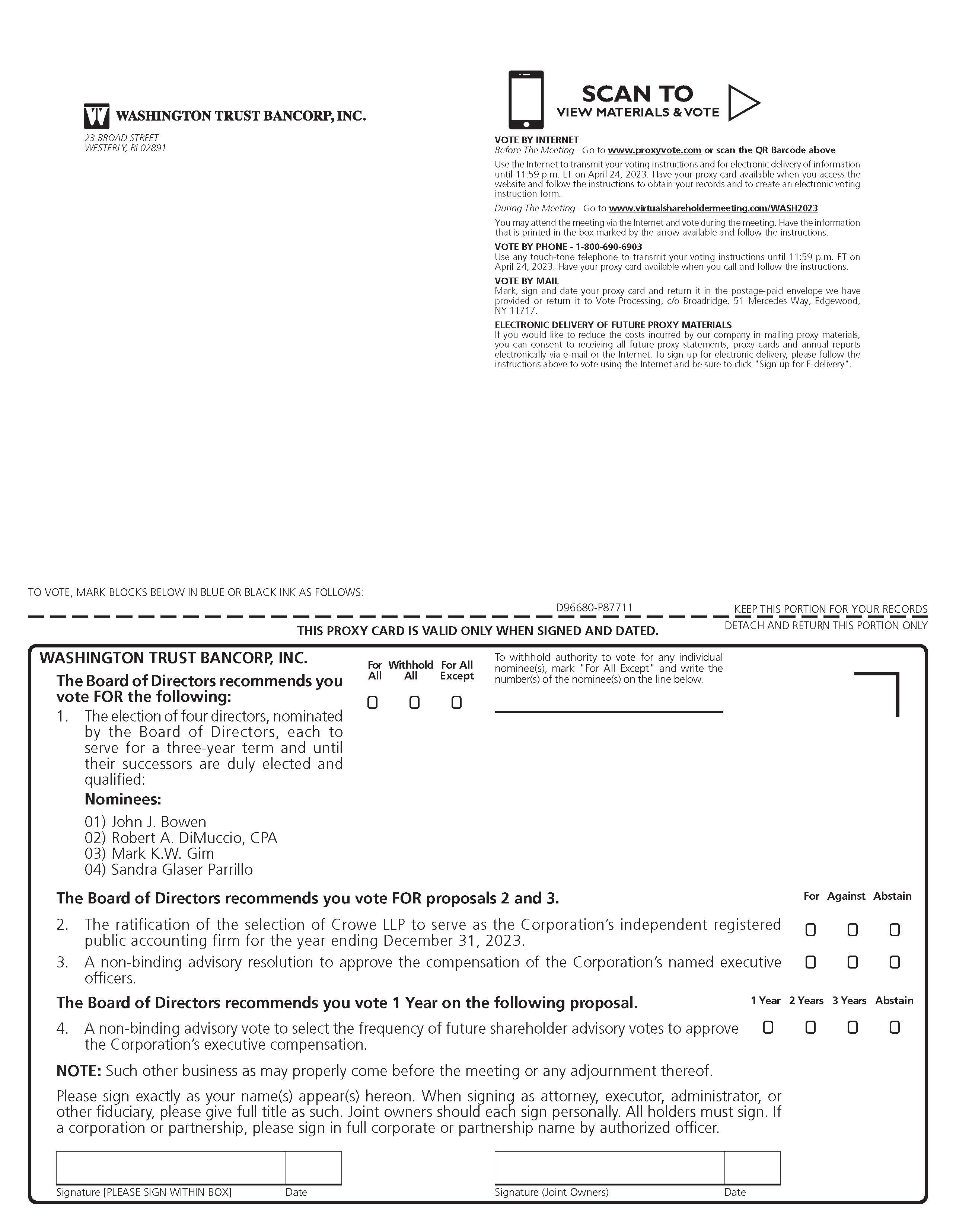

| Agenda: | 1. | The election of four directors, nominated by the Board of Directors and named in the Proxy Statement, each to serve for a three-year term and until their successors are duly elected and qualified; |

| 2. | The ratification of the selection of Crowe LLP to serve as the Corporation’s independent registered public accounting firm for the year ending December 31, 2023; |

| 3. | A non-binding advisory resolution to approve the compensation of the Corporation’s named executive officers; |

| 4. | A non-binding advisory vote to select the frequency of future shareholder advisory votes to approve the Corporation’s executive compensation; and |

| 5. | Such other business as may properly come before the meeting, or any postponement or adjournment thereof. |

Record Date: Shareholders of record at the close of business on February 28, 2023 will be entitled to notice of and to vote at the Annual Meeting.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, please promptly submit your proxy by telephone, Internet or by signing and returning the proxy card by mail. Please refer to this Proxy Statement for additional information.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Shareholder Meeting To Be Held on April 25, 2023

On or about March 14, 2023, we mailed a Notice of Internet Availability of Proxy Materials (the "Notice") to all shareholders of record as of February 28, 2023, containing instructions on how to access our Proxy Statement and Annual Report on Form 10-K and vote your shares. The Notice also contains instructions on how you can (i) receive a paper copy of the proxy materials, if you only received the Notice by mail, or (ii) elect to receive your proxy materials over the Internet.

By Order of the Board of Directors,

Kristen L. DiSanto

Corporate Secretary

March 14, 2023

| | | | | |

| Table of Contents |

| |

| |

| |

| |

| |

| |

Director Independence | |

| |

Director Nominations | |

| |

| |

| Environmental, Social and Governance Issues at Washington Trust | |

Communications with the Board | |

| |

Board Members | |

Board Composition, Qualifications and Diversity | |

Committee Membership and Meetings | |

| Ownership of Certain Beneficial Owners and Management | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

CEO Pay Ratio | |

| Pay Versus Performance | |

| |

| |

| |

| |

The accompanying proxy is solicited by and on behalf of the Board of Directors of Washington Trust Bancorp, Inc. (the “Corporation” or “Washington Trust”) for use at the Annual Meeting of Shareholders to be held by remote communication via live webcast on Tuesday, the 25th of April, 2023 at 11:00 a.m. ET, and any postponement or adjournment thereof.

As of February 28, 2023, the record date for determining shareholders entitled to notice of and to vote at the Annual Meeting, there were 16,984,872 shares of our common stock, $0.0625 par value, outstanding. Each share of common stock is entitled to one vote per share on all matters to be voted upon at the Annual Meeting, with all holders of common stock voting as one class.

On or about March 14, 2023, we mailed a Notice of Internet Availability of Proxy Materials (the "Notice") to all shareholders of record as of February 28, 2023. The Notice included instructions on how to access this Proxy Statement and our Annual Report on Form 10-K. You may access the proxy materials at

https://ir.washtrust.com/proxy. Printed copies may be obtained at no charge by contacting the Corporation by phone at (800) 475-2265 or by email at investor.relations@washtrust.com.

Required Votes and Board Recommendations

| | | | | | | | | | | |

| Proposal | Required Vote (a) | Board of Directors Recommendation |

| 1. | Elect the following nominees as director: | As required by Rhode Island law, a plurality of votes cast by holders of common stock entitled to vote at the Annual Meeting. | FOR ALL |

| John J. Bowen;

Robert A. DiMuccio, CPA;

Mark K. W. Gim; and

Sandra Glaser Parrillo |

| 2. | Ratify the selection of Crowe LLP as the Corporation’s independent registered public accounting firm for the year ending December 31, 2023. | A majority vote of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting. | FOR |

| 3. | Approve, on a non-binding, advisory basis, the compensation of the Corporation’s named executive officers. | A majority vote of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting. | FOR |

| 4. | Approve, on a non-binding, advisory basis, the frequency of future votes to approve the Corporation’s executive compensation. | A majority vote of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting. | EVERY ONE YEAR |

(a)Abstentions, broker non-votes, and votes withheld with respect to Proposal 1 will have no effect on the election of directors. Broker non-votes will have the same effect as a vote "against" Proposals 2, 3 and 4. Abstentions will have the same effect as a vote “against” Proposal 2, 3 and 4.

We know of no matters to be brought before the Annual Meeting other than those referred to in this Proxy Statement. If any other matters not described in this Proxy Statement are properly presented at the meeting, any proxies received by us will be voted in the discretion of the proxy holder.

Quorum

A majority of the outstanding shares of common stock entitled to vote, represented in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be counted for purposes of determining if a quorum is present.

Broker Non-votes

If you are a beneficial owner of shares held in a brokerage account and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. There are rules prescribed under the New York Stock Exchange, which in this matter also apply to Nasdaq-listed companies like Washington Trust. Under these rules, brokers, banks and other securities intermediaries may use their discretion to vote your uninstructed shares on matters considered to be “routine” (as defined under these rules) but not with respect to “non-routine” matters. A broker non-vote occurs when a broker, bank or other agent has not received voting instructions from the beneficial owner of the shares and the broker, bank, or other agent cannot vote the shares because the matter is considered “non-routine”. Proposals 1, 3 and 4 are considered to be “non-routine” such that your broker, bank or other agent may not vote your shares on those proposals in the absence of your voting instructions. Conversely, Proposal 2 is considered to be a “routine” matter so that if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on Proposal 2.

Revocation of Proxies

The presence of a shareholder at the Annual Meeting will not automatically revoke a proxy previously delivered by that shareholder. A shareholder may revoke his or her proxy at any time before it is exercised by: (1) submitting another proxy bearing a later date, by mail, Internet or telephone, (2) by attending the Annual Meeting and voting at the Annual Meeting, or (3) by notifying the Corporation of the revocation in writing to the Corporate Secretary of the Corporation, 23 Broad Street, Westerly, RI 02891. If not revoked, the proxy will be voted at the Annual Meeting in accordance with the instructions indicated by the shareholder or, if no instructions are indicated, all shares represented by valid proxies received pursuant to this solicitation (and not revoked before such shares are voted) will be voted “for” all of the nominees in Proposal 1; “for” Proposals 2 and 3; and for a frequency of every “1 year” for Proposal 4.

| | |

| Proposal 1: Election of Directors |

Our Board of Directors is divided into three classes, with one class elected at each annual meeting. The Corporation’s Restated Articles of Incorporation, as amended (the “Articles of Incorporation”), require that the three classes be as nearly equal in number as possible.

There are presently 13 directors, divided into three classes. The Corporation’s By-laws require any director who attains age 72 to resign from the Board of Directors as of the Annual Meeting of Shareholders following such director’s 72nd birthday. There is no exception or waiver process for this requirement. Kathleen E. McKeough, a member of the class of directors with a term expiring at the 2025 Annual Meeting of Shareholders, has reached age 72, and will resign as of the 2023 Annual Meeting, after which the Board will be reduced to 12 directors. Ms. McKeough currently serves as Lead Director and the Board of Directors has appointed Robert A. DiMuccio to serve as Lead Director effective upon Ms. McKeough’s retirement.

Four individuals will be elected to the Board of Directors, each to serve until the 2026 Annual Meeting of Shareholders and until his or her respective successor is elected and qualified. Based on the recommendation of the Nominating and Corporate Governance Committee (“Nominating Committee”), the Board of Directors has nominated John J. Bowen; Robert A. DiMuccio, CPA; Mark K.W. Gim; and Sandra Glaser Parrillo for election at the Annual Meeting. Each of the nominees for director is presently a director of the Corporation. Each of the nominees has consented to being named as a nominee in this Proxy Statement and has agreed to serve as a director if elected at the Annual Meeting. In the event that any nominee is unable to serve, the persons named in the proxy have discretion to vote for other persons if the Board of Directors designates such other persons. The Board of Directors has no reason to believe that any of the nominees will be unavailable for election.

Recommendation: The Board of Directors unanimously recommends that shareholders vote “FOR” each of the nominees in this proposal.

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 2

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines, which are available on our website at

https://ir.washtrust.com/govdocs. The Corporate Governance Guidelines describe our corporate governance practices and address issues such as Board composition and responsibilities, Board leadership structure, the Board’s relationship with management and executive succession planning.

Please note that the information contained on our website is not incorporated by reference in, or considered to be a part of, this Proxy Statement.

Board Leadership Structure

The Board believes that the Corporation’s Chief Executive Officer is best positioned to serve as Chairman because he is the director most familiar with the Corporation’s business and industry, and most capable of effectively identifying and executing strategy priorities. The Corporation’s independent directors bring experience, oversight and expertise from outside of the Corporation, while the Chief Executive Officer brings Corporation-specific experience and expertise. The Board recognizes its responsibility to hold management accountable for the execution of strategy once it is developed. The Board believes the combined role of Chairman and Chief Executive Officer, together with an independent Lead Director having the duties described below, is in the best interest of shareholders because it fosters effective decision-making and strategy development while providing for independent oversight of management.

Independent Lead Director

The Corporation’s Corporate Governance Guidelines provide that the Chair of the Nominating Committee of the Board serves as Lead Director. The Lead Director has the responsibility of presiding at all executive sessions of the Board, consulting with the Chairman and Chief Executive Officer on meeting agendas, and acting as a liaison between management and the non-management directors, including maintaining frequent contact with the Chairman and Chief Executive Officer and advising him on the efficiency of the Board meetings and the facilitation of communication between the non-management directors and management.

Director Independence

The Corporation’s Board has determined that each of current directors John J. Bowen, Steven J. Crandall, Robert A. DiMuccio, CPA, Joseph P. Gencarella, CPA, Constance A. Howes, Esq., Kathleen E. McKeough, Sandra Glaser Parrillo, John T. Ruggieri, Edwin J. Santos and Lisa M. Stanton is considered independent under the Nasdaq Listing Rules.

Any shareholder who wishes to make their concerns known to the independent directors may avail themselves of the procedures described under the heading “Communications With the Board of Directors” later in this Proxy Statement.

Executive Sessions

The Board believes that executive sessions consisting solely of independent directors are part of good governance practices. The Board conducts executive sessions as deemed necessary from time to time and at least twice a year as required by the Nasdaq Listing Rules.

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 3

Director Nominations

The Corporation is committed to strong Board recruitment practices that align with the Corporation’s long-term strategic needs. We seek to select directors who reflect a diverse set of skills, professional and personal backgrounds, perspectives and experiences.

The Nominating Committee is responsible for identifying, evaluating and recommending director candidates to the Board. We consider a variety of factors including diversity, independence, experience, existing and desired skill sets, and anticipated retirements to identify gaps and establish priorities for Board refreshment.

While we do not have a specific diversity policy, we are proud to have a diverse board. Board diversity continues to be a priority, and we seek representation across a range of attributes including gender, race, ethnicity, industry and professional experience.

At a minimum, each nominee to become a Board member, whether proposed by a shareholder or any other party, must:

1.have the highest personal and professional integrity, demonstrate sound judgment, and effectively interact with other members of the Board to serve the long-term interests of the Corporation and our shareholders;

2.have experience at a strategic or policy-making level in a business, government, not-for-profit or academic organization of high standing;

3.have a record of distinguished accomplishment in his or her field;

4.be well regarded in the community and have a long-term reputation for the highest ethical and moral standards;

5.have sufficient time and availability to devote to the affairs of the Corporation, particularly in light of the number of boards on which the nominee may serve; and

6.to the extent such nominee serves or has previously served on other boards, have a demonstrated history of actively contributing at board meetings.

The Nominating Committee evaluates all such proposed nominees in the same manner, without regard to the source of the initial recommendation of such proposed nominee. In seeking candidates to consider for nomination to fill a vacancy on the Corporation’s Board, the Nominating Committee may solicit recommendations from a variety of sources, including current directors, our Chief Executive Officer and other executive officers. The Nominating Committee may also engage a search firm to assist in identifying or evaluating candidates.

The Nominating Committee will consider nominees recommended by shareholders. Shareholders who wish to submit recommendations for candidates to the Nominating Committee must submit their recommendations in writing to the Corporate Secretary of the Corporation at 23 Broad Street, Westerly, RI 02891, who will forward all recommendations to the Nominating Committee. For a shareholder recommendation to be considered by the Nominating Committee for election at the 2024 Annual Meeting of Shareholders, it must be submitted to the Corporation by November 15, 2023. All shareholder recommendations for nominees must include the following information:

1.the name and address of record of the shareholder;

2.a representation that the shareholder is a record holder of our securities, or if the shareholder is not a record holder, evidence of ownership in accordance with Rule 14a-8(b)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”);

3.the name, age, business and residential address, educational background, current principal occupation or employment, and principal occupation or employment for the preceding five full fiscal years of the proposed nominee;

4.a description of the qualifications and background of the proposed nominee that addresses the minimum qualifications and other criteria for board membership approved by the Corporation’s Board;

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 4

5.a description of all arrangements or understandings between the shareholder and the proposed nominee;

6.the consent of the proposed nominee to (a) be named in the proxy statement relating to our 2024 Annual Meeting of Shareholders, and (b) serve as a director if elected at the 2024 Annual Meeting of Shareholders; and

7.any other information regarding the proposed nominee that is required to be included in a proxy statement filed pursuant to the rules of the Securities and Exchange Commission (“SEC”).

Shareholder nominations that are not submitted to the Nominating Committee for consideration may be made at an Annual Meeting of Shareholders in accordance with the procedures set forth in clause (e) of Article Eighth of our Articles of Incorporation. Specifically, advanced written notice of any nominations must be received by the Corporate Secretary not less than 14 days nor more than 60 days prior to any meeting of shareholders called for the election of directors (provided that if fewer than 21 days’ notice of the meeting is given to shareholders, notice of the proposed nomination must be received by the Corporate Secretary not later than the close of the 10th day following the day on which notice of the meeting was mailed to shareholders). For this Annual Meeting, such proposals must be received by the Corporation not earlier than February 24, 2023 and not later than April 11, 2023. Proxies solicited by our Board of Directors will confer discretionary voting authority with respect to these proposals, subject to SEC rules and regulations governing the exercise of this authority.

To comply with the universal proxy rules, shareholders who intend to solicit proxies in support of director nominees other than the Corporation’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than February 23, 2024.

Shareholder Proposals

Any shareholder who wishes to submit a proposal for presentation to the 2024 Annual Meeting of Shareholders must submit the proposal to the Corporation, 23 Broad Street, Westerly, RI 02891, Attention: Corporate Secretary, not later than November 15, 2023 for inclusion, if appropriate, in our proxy statement and the form of proxy relating to the 2024 Annual Meeting of Shareholders. Any proposal submitted after November 15, 2023 will be considered untimely. Such a proposal must also comply with the requirements as to form and substance established by the SEC for such a proposal to be included in the proxy statement. For deadlines related to shareholder director nominations, see “Director Nominations” above.

The Board’s Role in Risk Oversight

The Board’s role in the Corporation’s risk oversight process includes receiving regular reports from members of senior management on areas of material risk to the Corporation, including operational, credit, interest rate, liquidity, fiduciary, legal, regulatory, compensation, strategic and reputational risks. The full Board of the Corporation or of our subsidiary bank, The Washington Trust Company, of Westerly (the “Bank”) (or the appropriate committee in the case of risks that are under the purview of a particular committee) receives these reports from the appropriate “risk owner” within the Corporation’s management to enable it to understand and determine the adequacy of our risk identification, risk management and risk mitigation strategies. When a committee receives a report, the Chair of the relevant committee reports on the discussion to the full Board of the Corporation or the Bank at the next Board meeting. This enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships. As part of its charter, the Audit Committee is responsible for review and oversight of the Corporation’s Enterprise Risk Management Program.

Environmental, Social and Governance Report

Since our founding in 1800, Washington Trust has been guided by strong core values and operated in a manner which exemplifies good governance, ethics, and an overriding commitment to people. We recognize that much has changed over the past two centuries and understand our shareholders’ desire for additional transparency regarding environmental, social and governance (“ESG”) issues. We have issued

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 5

an Environmental, Social and Governance Report, which addresses how we view, manage, and perform in specific areas such as corporate governance; employee engagement; diversity, inclusion and equity; data security and privacy; environmental responsibility; and community involvement and investment. This report can be found at https://ir.washtrust.com/govdocs.

Communications With the Board of Directors

Any shareholder desiring to send communications to the Corporation’s Board, or any individual director, may forward such communication to our Corporate Secretary at our offices at 23 Broad Street, Westerly, RI 02891. The Corporate Secretary will collect all such communications and forward them to the Corporation’s Board and any such individual director.

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 6

The following is biographical information as of March 14, 2023 for each member of and nominee for the Board of Directors, including positions held, principal occupation and business experience for the past five years or more. The description includes the specific experience, qualifications, attributes and skills that, in the case of each nominee for director, led to the conclusion by the Board of Directors that such person should serve as a director of the Corporation; and in the case of each director who is not standing for election at the Annual Meeting, that the Board of Directors would expect to consider if it were making a conclusion currently as to whether such person should serve as a director. Additionally, we believe each has a reputation for honesty, integrity and adherence to high ethical standards, and has demonstrated business acumen and sound judgment, as well as a commitment to the Corporation and its shareholders. All current directors of the Corporation also serve on the board of directors of the Bank.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

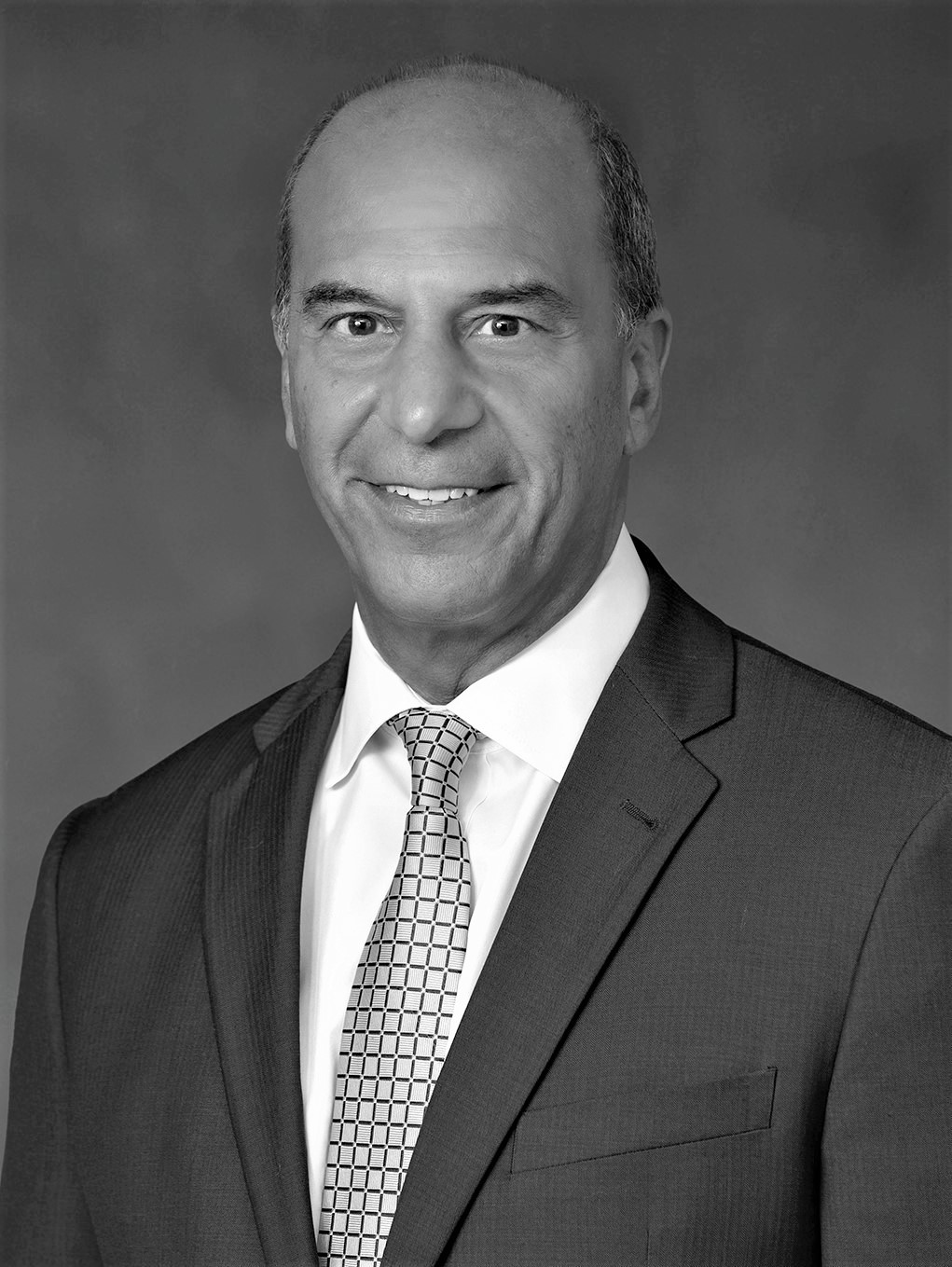

| John J. Bowen |

Age: | 71 | Director Since: | 2011 | Term in Office Expires: | 2023 | |

Business Experience: Mr. Bowen retired from Johnson & Wales University in 2018 and was elected Chancellor Emeritus. He served as Chancellor, President and Chief Executive Officer of the University from 2010 until his retirement, and as President and Chief Executive Officer from 2004 to 2010. He serves as a board member for Newport Restaurant Corporation, and has previously served as a director of a large regional bank. Mr. Bowen’s qualifications to serve on the Board of Directors include his experience leading a large, successful institution; experience on governing boards of nonprofit and for-profit corporations; and previous experience in the banking industry. |

| | | | | | | | |

| Steven J. Crandall |

Age: | 71 | Director Since: | 1983 | Term in Office Expires: | 2025 | |

Business Experience: Mr. Crandall has served as Vice President of Ashaway Line & Twine Manufacturing Co., a manufacturer of sporting goods products and medical threads, for more than 40 years. His experience and responsibilities include domestic and international sales and marketing, corporate finance and financial analysis, and human resources management. Mr. Crandall’s qualifications to serve on the Board of Directors include his extensive experience in sales and marketing, as well as the management of a successful commercial and industrial business. |

| | | | | | | | |

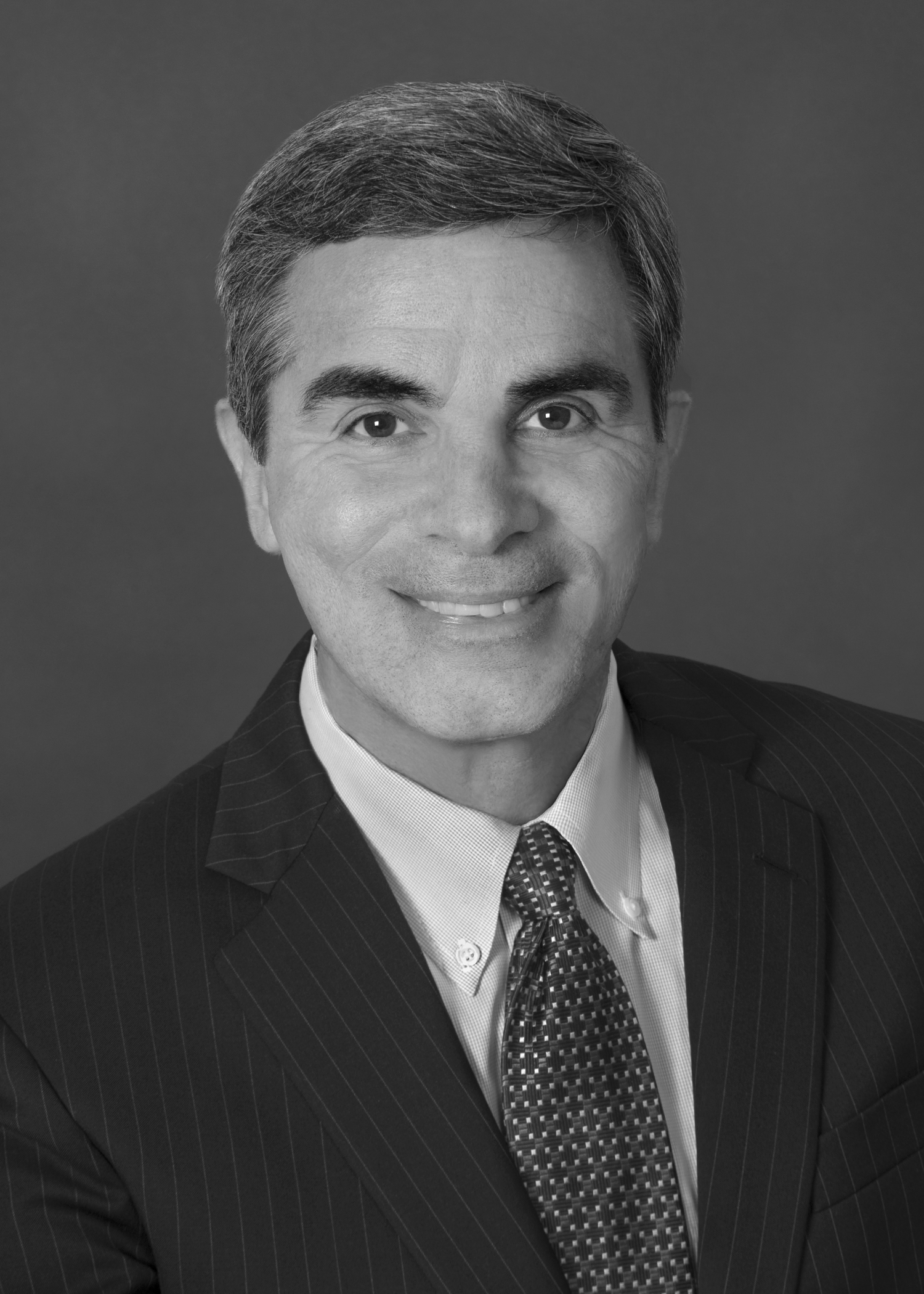

| Robert A. DiMuccio, CPA |

Age: | 65 | Director Since: | 2010 | Term in Office Expires: | 2023 | |

Business Experience: Mr. DiMuccio retired as President and Chief Executive Officer of Amica Mutual Insurance Company on September 30, 2022. He had served as President and Chief Executive Officer since 2005, and also served as Chairman from 2009 until retiring on December 31, 2022. He joined Amica in 1991 as a Vice President and served in various positions of progressive responsibility, including Chief Financial Officer and Treasurer. Prior to joining Amica, he served as an Audit Partner with the public accounting firm of KPMG LLP, with public and non-public company audit experience, including banking and insurance companies. He is also a director and past Chair of the American Property Casualty Insurance Association and has earned the Chartered Property Casualty Underwriter (CPCU) designation. Mr. DiMuccio’s qualifications to serve on the Board of Directors include his extensive experience in the areas of audit, accounting and financial reporting, as well as his record of leadership in the financial services industry. |

| | | | | | | | |

| | | | | | | | |

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 7

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Joseph P. Gencarella, CPA | |

Age: | 60 | Director Since: | 2022 | Term in Office Expires: | 2025 | |

Business Experience: Mr. Gencarella served as an Audit Partner with public accounting firm KPMG LLP before his retirement in 2021. He joined KPMG in 1985 and served in various positions of progressive responsibility throughout the years. He has extensive experience with public and non-public company audits, including banking and insurance companies; SEC and regulatory reporting; and internal controls and risk management. He served as a trustee for the Rhode Island Public Expenditure Council from 2012 to 2020 and was a member of Providence College President’s Council from 2013 to 2020. Mr. Gencarella’s qualifications to serve on the Board of Directors include his extensive experience in the areas of audit, accounting and financial reporting. |

| | | | | | | | |

| Mark K. W. Gim | |

Age: | 56 | Director Since: | 2022 | Term in Office Expires: | 2023 | |

Business Experience: Mr. Gim assumed the role of President and Chief Operating Officer of the Corporation and the Bank in 2018. Mr. Gim joined the Bank in 1993 and held various positions of increasing responsibility in financial planning and asset/liability management. In 2000, he was promoted to Senior Vice President – Financial Planning and Asset/Liability Management of the Bank. He was named Executive Vice President and Treasurer of the Corporation and the Bank in 2008, and had the added responsibility of oversight of the Retail Banking Division from 2011 through 2013. He was promoted to Executive Vice President, Wealth Management and Treasurer in 2013, and to Senior Executive Vice President, Wealth Management and Treasurer in 2015. In 2017, he was named Senior Executive Vice President, Wealth Management and Chief Strategy Officer. Mr. Gim’s qualifications to serve on the Board of Directors include his global view of the financial industry and markets, with deep institutional knowledge and strategic acumen. |

| | | | | | | | |

| Edward O. Handy III | | |

Age: | 61 | Director Since: | 2016 | Term in Office Expires: | 2025 | |

Business Experience: Mr. Handy assumed the role of Chairman and Chief Executive Officer of the Corporation and the Bank in 2018, after serving as President and Chief Operating Officer of the Corporation and the Bank since 2013. Prior to joining Washington Trust, he served as President of Citizens Bank in Rhode Island and Connecticut from 2009 to 2013; Executive Vice President, Head of Commercial Real Estate from 2007 to 2009; President / Chief Executive Officer of Charter One Bank of Ohio, an affiliate of Citizens Bank, from 2005 to 2008; and various positions of senior leadership at Citizens Bank and related companies, primarily in commercial real estate lending, from 1995 to 2005. Prior to that, he held positions at Fleet National Bank with concentration in commercial lending and credit analysis. Mr. Handy’s qualifications to serve on the Board of Directors include his extensive banking and leadership experience, with particular emphasis on his extensive background in the area of commercial lending. |

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 8

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Constance A. Howes, Esq. |

Age: | 69 | Director Since: | 2018 | Term in Office Expires: | 2024 | |

Business Experience: Ms. Howes served as President and CEO of Women & Infants Hospital of Rhode Island from October 2002 through October 2013. She served at Care New England Health System as EVP of Women’s Health from October 2013 through October 2015, and Women’s Health Advisor from November 2015 through July 2016. Prior to working in healthcare, she practiced business law in Providence, RI. She served as an Adjunct Professor at Roger Williams School of Law, teaching Health Law and Policy in 2017 and 2019, and was a Faculty Advisor for the Brown University Executive Master of Healthcare Leadership program from 2014 through 2020. She previously served on the Board of Trustees of the American Hospital Association and as the Chair of the RI Governor’s Workforce Board. She also served on the RI Board of Education, as well as on the boards of numerous community organizations. Ms. Howes’ qualifications to serve on the Board of Directors include her extensive legal expertise; her experience as an executive of several large healthcare organizations; and her experience on governing boards of various non-profit, industry and government entities. |

| | | | | | | | |

| Joseph J. MarcAurele | |

Age: | 71 | Director Since: | 2009 | Term in Office Expires: | 2024 | |

Business Experience: Mr. MarcAurele served as Chairman and Chief Executive Officer of the Corporation and the Bank from April 2010 until his retirement in 2018. He held the additional title of President of the Corporation and the Bank from 2010 to 2013. Prior to joining Washington Trust in 2009 as President and Chief Operating Officer of the Corporation and the Bank, he served as President of Citizens Bank from 2007 to 2009. He held positions of President and Chief Executive Officer of Citizens Bank entities in Rhode Island and Connecticut from 2001 to 2007, and held a series of positions of executive leadership at Citizens Bank from 1993 to 2001 in the areas of commercial lending, wealth management and private banking. Prior to that, Mr. MarcAurele held positions at Fleet National Bank with concentration in commercial lending and credit analysis and also held the position of Senior Vice President, Director of Human Resources. Mr. MarcAurele’s qualifications to serve on the Board of Directors include his extensive experience in banking and financial services, experience in positions of executive leadership, and knowledge of the business community in our market area. |

| | | | | | | | |

| Kathleen E. McKeough | | |

Age: | 72 | Director Since: | 2003 | Term in Office Expires: | 2025 |

Business Experience: Ms. McKeough is retired and previously served as Senior Vice President, Human Resources, of GTECH Holdings Corporation, a lottery industry and financial transaction processing company, from 2000 to 2004. From 1991 to 1999, she served with the U.S. division of Allied Domecq, PLC, a manufacturer and franchiser for 6,500 franchised stores, in positions including Treasurer, Chief Financial Officer and Senior Vice President, Human Resources. Previously, she held positions in commercial lending and credit administration with Bank of Boston. Ms. McKeough’s qualifications to serve on the Board of Directors include her extensive experience in human resources matters, as well as her experience in finance and banking. |

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 9

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Sandra Glaser Parrillo | |

Age: | 66 | Director Since: | 2020 | Term in Office Expires: | 2023 | |

Business Experience: Ms. Parrillo served as President and Chief Executive Officer of Providence Mutual Fire Insurance Company from 2000 until her retirement in February 2021. She joined the property-casualty mutual insurance company in 1977 as an underwriter and has served in various positions of progressive responsibility. She was awarded the designation of Chartered Property Casualty Underwriter (CPCU) and Certified Insurance Counselor. She is also a past director and Chair of the National Association of Mutual Insurance Companies and past director of the Rhode Island Public Expenditure Council. Her qualifications to serve on the Board of Directors include her extensive experience in leading a successful financial service company, as well as her experience on governing boards of nonprofit and for-profit corporations. |

| | | | | | | | |

| John T. Ruggieri | | |

Age: | 66 | Director Since: | 2019 | Term in Office Expires: | 2025 | |

Business Experience: Mr. Ruggieri served as Senior Vice President and Chief Financial Officer for Gilbane Building Company, a global integrated construction and facility management services firm, and as Vice President and Chief Financial Officer for Gilbane, Inc., a global construction and real estate development firm from 2005 until his retirement in April 2022. Prior to joining the Gilbane companies, he served as Executive Vice President and Chief Financial Officer for Emissive Energy Corporation, a manufacturer of lighting electronics and equipment. From 1980 through 2004, he worked for A.T. Cross Company, an international manufacturer of fine writing instruments, timepieces and personal accessories, holding various positions of increasing responsibility, ultimately being named Senior Vice President and Chief Financial Officer in 1997 and assuming the additional responsibility of President, Pen Computing Group in 2001. Mr. Ruggieri is a former certified public accountant. His qualifications to serve on the Board of Directors include his expertise in audit, finance, accounting and taxation, as well his experience as an executive of several large companies and knowledge of real estate development, facilities management and construction matters. |

| | | | | | | | |

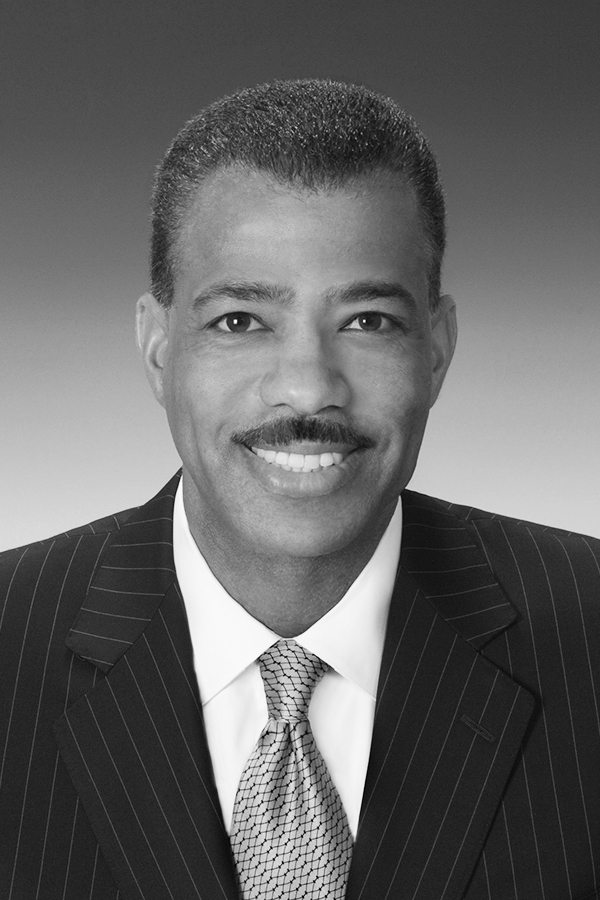

| Edwin J. Santos | | |

Age: | 63 | Director Since: | 2012 | Term in Office Expires: | 2024 | |

Business Experience: Mr. Santos has had a distinguished career in banking, with experience in risk management, corporate governance, management advisory services, acquisitions, and reengineering efforts. He served for many years in various positions of significant responsibility with FleetBoston Financial Group, and more recently served as Group Executive Vice President and General Auditor for Citizens Financial Group prior to his retirement in 2009. Mr. Santos currently serves as a member of the board and chairperson of the audit committee of Flywire Corporation (Nasdaq symbol: FLYW). He is also a member of the boards of Providence Mutual Fire Insurance Company, Fidelity Institutional Asset Management, a Fidelity Investments company, and is a member of the Bryant University Board of Trustees. He is Past Chairperson of the Board of Prospect CharterCARE, LLC and President of the Board of Trustees of Rocky Hill School. Mr. Santos’ professional competency, broad experience in the financial services industry and strong reputation in the Rhode Island community qualify him to serve on the Board of Directors. |

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 10

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Lisa M. Stanton | | |

| Age: | 59 | Director Since: | 2021 | Term in Office Expires: | 2024 | |

Business Experience: Ms. Stanton has served on the Board of Directors of Red Violet, Inc. (Nasdaq symbol: RDVT), a data information company, since August 2021. She served on the board of Trulioo, an on-demand global identity verification company based in Vancouver, Canada, from January 2020 to June 2021. Additionally, she served as a member of the Venture Investments Board and as an Advisor to the IT Resilience and Strategy Committee of the Board of Directors of Nationwide Building Society, a financial institution in London, England from September 2016 through December 2019. She has more than 25 years of financial services, technology and data security experience, most recently serving as General Manager, Enterprise Strategy for American Express from December 2018 through her retirement in April 2020. From 2014 through 2016, she served as Chief Executive Officer for InAuth, a digital security platform deployed by financial institutions globally to protect their mobile and online banking capabilities. Following the acquisition of InAuth by American Express in 2016, she continued serving as InAuth’s President through 2018. She was the founder of the U.S. division of Monitise, a technology company that hosted a mobile banking and payments platform for banks and credit unions, where she served as Chief Executive Officer from 2007 to 2009, General Manager of the London-based Monitise Group from 2009 to 2013 and President, Americas from 2013 to 2014. She also served as a Senior Vice President for Citizens Financial Group from 1996 to 2007 and First New Hampshire Bank from 1991 to 1996, holding leadership roles in real estate; venture capital; retail distribution; digital, mobile and online channels; and card and payments products. She began her career as a commercial real estate broker, attaining the designation of Certified Commercial Investment Member (CCIM). Ms. Stanton’s qualifications to serve on the Board of Directors include extensive experience as a financial services executive and as a board member; deep expertise in risk management, data security, digital and technology matters; and her knowledge of commercial real estate matters. |

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 11

Board Composition, Qualifications and Diversity

We believe the Board is comprised of an effective mix of experience, skills and perspectives. The following charts and graphs highlight the current composition of our Board.

| | | | | | | | | | | | | | |

| Board Diversity Matrix (as of the date of this Proxy Statement) |

| Total Number of Directors | 13 | | | |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity |

| Directors | 4 | | 9 | | — | | — | |

| Part II: Demographic Background |

| African American or Black | — | | 1 | | — | | — | |

| Alaskan Native or Native American | — | | — | | — | | — | |

| Asian | — | | — | | — | | — | |

| Hispanic or Latinx | — | | — | | — | | — | |

| Native Hawaiian or Pacific Islander | — | | — | | — | | — | |

| White | 4 | | 7 | | — | | — | |

| Two or More Races or Ethnicities | — | | 1 | | — | | — | |

| LGBTQ+ | — | | — | | — | | — | |

| Did Not Disclose Demographic Background | — | | — | | — | | — | |

As part of the Nominating & Governance Committee’s commitment to achieving and maintaining a diverse Board, the Committee is actively looking for opportunities to maintain a Board composition comprised of at least 30% gender diverse directors. The Committee is engaged in an ongoing process to identify and evaluate qualified candidates that best serve the needs of the Corporation and contribute to the overall diversity of the Board, including the Board’s 30% gender diversity objective. The Corporation plans to continue to meet its 30% gender diversity objective by the 2024 Annual Meeting of Stockholders.

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 12

Committee Membership and Meetings

Current committee membership and the number of meetings of the full Board and each committee held during 2022, are shown in the following table.

| | | | | | | | | | | | | | | | | | | | | | | |

| Independent Director | Board | Audit Committee | Compensation and Human Resources Committee | Executive Committee | Nominating Committee |

| John J. Bowen | n | n | | | n | | |

| Steven J. Crandall | n | n | | | | | |

| Robert A. DiMuccio, CPA | n | n | | t+ | n | n | n |

| Joseph P. Gencarella, CPA | n | n | | n+ | | | |

| Mark K.W. Gim | | n | | | | | |

| Edward O. Handy III | | ¬ | | | | n | |

| Constance A. Howes, Esq. | n | n | | | n | n | n |

| Joseph J. MarcAurele | | n | | | | n | |

| Kathleen E. McKeough | n | µ | | | n | t | t |

| Sandra Glaser Parrillo | n | n | | | n | | |

| John T. Ruggieri | n | n | | n+ | | | |

| Edwin J. Santos | n | n | | n | t | n | n |

| Lisa M. Stanton | n | n | | n | | | |

Number of Meetings in 2022 | | 10 | 9 | 7 | 1 | 5 |

¬ = Chair of the Board µ = Lead Director t = Committee Chair n = Member + = Financial Expert

Committee membership changes will occur following the Annual Meeting, including, but not limited to, the appointment of Mr. DiMuccio to the position of Lead Director and Mr. Ruggieri to the Nominating Committee and Chair of the Audit Committee.

During 2022, each member of the Corporation’s Board attended at least 75% of the aggregate number of meetings of the Corporation’s Board and the committees of the Corporation’s Board of which such person was a member. While we do not have a formal policy related to Board member attendance at annual meetings of shareholders, directors are encouraged to attend each annual meeting to the extent reasonably practicable. All directors attended the 2022 Annual Meeting of Shareholders.

Executive Committee

When the Corporation’s Board is not in session, the Executive Committee is entitled to exercise all the powers and duties of the Corporation’s Board, except for such business that by law only the full Board is authorized to perform.

Nominating Committee

The Nominating Committee has a written charter that is available on our website at https://ir.washtrust.com/govdocs. The Nominating Committee’s responsibilities and authorities, which are discussed in detail in its charter, include, among other things:

▪Establishing procedures for identifying and evaluating nominees for the Board.

▪Establishing procedures to be followed by shareholders in submitting recommendations for director candidates to the Nominating Committee.

▪Evaluating and recommending to the Board qualified individuals to serve as Board and/or committee members consistent with criteria set by the Board.

▪Reviewing and assessing succession plans for the Chief Executive Officer position.

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 13

▪Developing and recommending to the Corporation’s Board a set of Corporate Governance Guidelines and recommending any changes to such Guidelines.

▪Overseeing the Corporation’s ESG policies and initiatives.

▪Overseeing the evaluation of the Corporation’s Board and management.

The Nominating Committee recommended that John J. Bowen; Robert A. DiMuccio, CPA; Mark K.W. Gim; and Sandra Glaser Parrillo be nominated for election to serve as directors until the 2026 Annual Meeting of Shareholders and until their successors are duly elected and qualified.

Audit Committee

The Audit Committee has a written charter that is available on our website at https://ir.washtrust.com/govdocs. The charter is reviewed annually and amended as appropriate to reflect the evolving role of the Audit Committee. The responsibilities of the Audit Committee include, among other things:

▪Overseeing and reviewing our financial statements, accounting practices and related internal controls, as well as audits of the financial statements of the Corporation and its subsidiaries.

▪Overseeing our relationship with our independent registered public accounting firm, including having the sole authority and responsibility for all decisions related to appointing, compensating, evaluating, retaining, assessing the independence of, and, when appropriate, replacing the Corporation’s independent registered public accounting firm.

▪Overseeing our internal audit function.

▪Reviewing and approving all audit plans, including scope and staffing.

▪Establishing procedures for the submission, receipt and treatment of complaints or concerns regarding accounting or auditing matters.

▪Overseeing and reviewing the Corporation’s Code of Ethics and Standards of Personal Conduct (the “Code of Ethics”) and any related investigations.

▪Overseeing and reviewing the Corporation and the Bank’s compliance program and risk management efforts, as well as our credit review program and related results, asset quality and the adequacy of our allowance for credit losses.

Management is responsible for the financial reporting process, including the Corporation's system of internal controls, and the preparation of the Corporation's consolidated financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The Corporation's independent registered public accounting firm is responsible for performing an independent audit of the Corporation's consolidated financial statements and internal controls over financial reporting in accordance with the auditing standards of the Public Company Accounting Oversight Board (“PCAOB”) and to issue a report thereon. The Audit Committee's responsibility is to oversee and review these processes, and it relies on the expertise and knowledge of management, the internal auditor and the independent auditor in carrying out that role. The Audit Committee is not professionally engaged in the practice of accounting or auditing and does not provide any expert or other special assurance or professional opinion as to the sufficiency of internal and external audits, whether the Corporation's financial statements are complete and accurate and are in accordance with generally accepted accounting principles or on the effectiveness of the Corporation's system of internal controls.

In order to assure continuing auditor independence, the Audit Committee periodically considers whether there should be a regular rotation of the independent registered public accounting firm. Additionally, in conjunction with the mandated rotation of the audit firm’s lead engagement partner, the Audit Committee is directly involved in the selection of the new lead engagement partner.

The Board has determined that each member of the Audit Committee is an independent director under the Nasdaq Listing Rules and Rule 10A-3(b)(1) under the Exchange Act. In addition, the Board has determined

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 14

that Messrs. DiMuccio, Gencarella and Ruggieri each qualify as an “audit committee financial expert” under the Exchange Act.

The Audit Committee’s report on our audited financial statements for the fiscal year ended December 31, 2022 appears under the heading “Audit Committee Report” later in this Proxy Statement.

Compensation Committee

The Compensation Committee has a written charter that is available on our website at https://ir.washtrust.com/govdocs. Generally, the Compensation Committee is responsible for executive and director compensation decisions, and reports all actions to the members of the Corporation’s Board. The Compensation Committee’s responsibilities and authorities, which are discussed in detail in its charter, include, among other things:

▪Establishing our compensation philosophy, and reviewing compensation practices to ensure alignment with that philosophy.

▪Establishing annual compensation for the Chief Executive Officer and all other executive officers including salary, incentive and equity compensation.

▪Establishing incentive plans for all employees, and approving awards under such plans to the Chief Executive Officer and all other executive officers.

▪Annually reviewing the Succession and Talent Development Plan.

▪Establishing director compensation.

▪Approving equity compensation awards and the terms of such awards to employees and directors.

▪Reviewing the impact of our compensation practices in relation to the Corporation’s risk management objectives.

▪Administering our retirement, benefit and equity compensation plans, programs and policies.

A schedule of meetings and preliminary agenda is approved by the Compensation Committee at the end of each year for the coming fiscal year. The agenda for Compensation Committee meetings is determined by its Chair with the assistance of the Chief Human Resources Officer. The Compensation Committee regularly invites the Chief Executive Officer and other members of the senior management team to attend meetings, although these individuals are not voting members nor are they present during executive session deliberations regarding their own compensation. The Compensation Committee meets regularly in executive session without the presence of employee directors and management.

The Compensation Committee has authority under its charter to select, retain, terminate and approve the fees of advisers, counsel or other experts or consultants, as it deems appropriate. The Compensation Committee has engaged Meridian Compensation Partners, LLC (“Meridian”), an independent compensation consulting firm, to assist in fulfillment of its duties. Meridian was selected by the Compensation Committee after review of, among other things, the Compensation Committee’s needs, the qualifications of the firm’s personnel, the firm’s independence, the firm’s resources, past experience with the firm, and a good faith estimate of fees, and was not made pursuant to the recommendation of management. Meridian advises the Compensation Committee with respect to compensation and benefit trends, best practices, market analysis, plan design and establishing targets for individual compensation awards. The use of an independent compensation consultant provides additional assurance that our executive compensation programs are reasonable and consistent with our philosophy and objectives. Meridian reports directly to the Compensation Committee, and meets with members at least annually in executive session without the presence of employee directors and management. The Compensation Committee does not prohibit Meridian from providing services to management, but such engagement must be requested or approved by the Compensation Committee. The Compensation Committee has considered all relevant factors, including the six factors listed in Rule 10C-1(b)(4) of the Exchange Act and further included in the Compensation Committee’s charter, and determined that no conflict of interest exists with respect to Meridian.

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 15

During 2022, Meridian received total remuneration of $81,230 for consulting services on behalf of the Compensation Committee related to compensation analysis and planning. We did not engage Meridian for any services other than those related to executive and director compensation consulting on behalf of the Compensation Committee.

The Compensation Committee may delegate authority to fulfill certain administrative duties regarding the compensation and benefit programs to our management team. The Compensation Committee solicits the input and recommendations of the Chief Executive Officer for compensation awards to other executives, including the named executive officers. Such awards are further discussed in executive session, with decisions made by the Compensation Committee without the Chief Executive Officer’s involvement.

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 16

| | |

| Ownership of Certain Beneficial Owners and Management |

The following table sets forth certain information as of February 28, 2023 regarding (i) the beneficial ownership interest in our common stock of the directors and certain executive officers of the Corporation and the Bank, (ii) the beneficial ownership interest of all directors and executive officers of the Corporation, as a group, and (iii) the security holdings of each person, including any group of persons, known by the Corporation to be the beneficial owner of five percent (5%) or more of our common stock outstanding.

| | | | | | | | | | | | | | | | | | | | |

| | Common

Stock | Exercisable

Options (a) | Vested

Restricted

Stock

Units (b) | Total (c) | Percentage

Of

Class |

| Nominees and Directors: | | | | | | |

| John J. Bowen | | 9,840 | | — | | 860 | | 10,700 | | 0.06 | % |

| Steven J. Crandall | | 18,573 | | — | | 860 | | 19,433 | | 0.11 | % |

| Robert A. DiMuccio, CPA | | 11,706 | | — | | 860 | | 12,566 | | 0.07 | % |

| Joseph P. Gencarella, CPA | (d) | 250 | | — | | — | | 250 | | — | % |

| Mark K.W. Gim | | 28,481 | | — | | — | | 28,481 | | 0.17 | % |

| Edward O. Handy III | | 26,978 | | — | | — | | 26,978 | | 0.16 | % |

| Constance A. Howes, Esq. | | 2,870 | | — | | 860 | | 3,730 | | 0.02 | % |

| Joseph J. MarcAurele | | 44,354 | | — | | 860 | | 45,214 | | 0.27 | % |

| Kathleen E. McKeough | (e) | 14,460 | | — | | 2,070 | | 16,530 | | 0.10 | % |

| Sandra Glaser Parrillo | | — | | — | | 860 | | 860 | | 0.01 | % |

| John T. Ruggieri | | 1,192 | | — | | 860 | | 2,052 | | 0.01 | % |

| Edwin J. Santos | | 3,130 | | — | | 860 | | 3,990 | | 0.02 | % |

| Lisa M. Stanton | | 108 | | — | | — | | 108 | | — | % |

| Certain Executive Officers: | | | | | | |

| Ronald S. Ohsberg | | 5,093 | | — | | — | | 5,093 | | 0.03 | % |

| Kathleen A. Ryan | | 4,362 | | 3,800 | | — | | 8,162 | | 0.05 | % |

| James M. Hagerty | | 13,828 | | — | | — | | 13,828 | | 0.08 | % |

| All directors, nominees and executive officers as a group (22 persons) | 248,990 | | 23,175 | | 8,950 | | 281,115 | | 1.65 | % |

| Beneficial Owners: | | | | | | |

BlackRock, Inc. (f)

55 East 52nd St., New York, NY 10055 | 1,585,219 | | — | | — | | 1,585,219 | | 9.32 | % |

Franklin Mutual Advisers, LLC (g)

101 John F. Kennedy Pky., Short Hills, NJ 07078 | 940,281 | | — | | — | | 940,281 | | 5.53 | % |

FMR LLC (h)

245 Summer Street, Boston, MA 02210 | 1,253,511 | | — | | — | | 1,253,511 | | 7.37 | % |

The Vanguard Group (i)

100 Vanguard Blvd., Malvern, PA 19355 | 936,915 | | — | | — | | 936,915 | | 5.51 | % |

(a)Stock options that are or will become exercisable within 60 days of February 28, 2023.

(b)Restricted stock units that are or will become vested within 60 days of February 28, 2023.

(c)Total does not include a performance share unit award for Messrs. Handy, Gim, Ohsberg and Hagerty and Ms. Ryan and certain other executive officers that is based on the Corporation’s relative performance during the measurement period, which ended December 31, 2022 and was further subject to a time-based vesting period, which will end on March 16, 2023. Relative performance results were not available as of March 14, 2023, and therefore, the final awards have not been ascertained. Information regarding these grants including the current performance assumption is presented under the heading “Outstanding Equity Awards at Fiscal Year End” later in this Proxy Statement.

(d)Held by MidwayFour, LLC, of which Mr. Gencarella is a member. Mr. Gencarella disclaims beneficial ownership of the shares held by MidwayFour, LLC except to the extent of his pecuniary interest therein.

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 17

(e)Ms. McKeough will reach age 72 prior to the Annual Meeting and pursuant to our By-laws, will resign from the Board effective April 25, 2023.

(f)Based on information set forth in a Schedule 13G filed with the SEC on January 24, 2023.

(g)Based on information set forth in a Schedule 13G/A filed with the SEC on January 31, 2023.

(h)Based on information set forth in a Schedule 13G/A filed with the SEC on February 9, 2023.

(i)Based on information set forth in a Schedule 13G/A filed with the SEC on February 9, 2023.

The following is a list of all executive officers of the Corporation and the Bank with their titles, current ages and years of service, followed by certain biographical information.

| | | | | | | | | | | |

| Name | Title | Age | Years of Service |

| Edward O. Handy III | Chairman and Chief Executive Officer of the Corporation and the Bank | 61 | 9 |

| Mark K.W. Gim | President and Chief Operating Officer of the Corporation and the Bank | 56 | 29 |

| Ronald S. Ohsberg | Senior Executive Vice President, Chief Financial Officer and Treasurer of the Corporation and the Bank | 58 | 5 |

| Kristen L. DiSanto | Senior Executive Vice President, Chief Human Resources Officer and Corporate Secretary of the Corporation and the Bank | 53 | 28 |

| Mary E. Noons | Senior Executive Vice President and Chief Retail Lending Officer of the Bank | 61 | 30 |

| William K. Wray, Sr. | Senior Executive Vice President and Chief Risk Officer of the Bank | 64 | 7 |

| Dennis L. Algiere | Executive Vice President, Chief Compliance Officer & Director of Community Affairs of the Bank | 62 | 27 |

| Debra A. Gormley | Executive Vice President and Chief Retail Banking Officer of the Bank | 67 | 12 |

| James M. Hagerty | Executive Vice President and Chief Lending Officer of the Bank | 65 | 10 |

| Maria N. Janes, CPA | Executive Vice President, Chief Accounting Officer and Controller of the Corporation and the Bank | 52 | 25 |

| Kathleen A. Ryan, Esq. | Executive Vice President and Chief Wealth Management Officer of the Bank | 57 | 7 |

Biographical information for Messrs. Handy and Gim are provided under the heading “Board of Directors” earlier in this Proxy Statement.

Ronald S. Ohsberg, CPA joined the Bank in 2017 as Executive Vice President and Treasurer. In 2017, he was promoted to Senior Executive Vice President and Treasurer. He was promoted to Senior Executive Vice President, Chief Financial Officer and Treasurer in 2018. Prior to joining the Bank, he served as Executive Vice President, Finance for Linear Settlement Services from 2016 to 2017, where he was responsible for all finance and accounting matters for the company. He served as Executive Vice President, Corporate Controller and Chief Accounting Officer for Citizens Financial Group from 2009 to 2016, where he was responsible for financial operations and reporting.

Kristen L. DiSanto joined the Bank in 1994 and held positions of increasing responsibility within Human Resources. She was promoted to Senior Vice President, Human Resources in 2009, and to Executive Vice

Washington Trust Bancorp, Inc. | 2023 Proxy Statement | 18

President, Human Resources in 2012. She was promoted to Senior Executive Vice President, Chief Human Resources Officer and Assistant Secretary of the Corporation and the Bank in 2017. She was promoted to Senior Executive Vice President, Chief Human Resources Officer and Corporate Secretary of the Corporation and the Bank in 2018.

Mary E. Noons joined the Bank in 1992 and has held positions of increasing responsibility in managing lending support, loan operations, secondary market, consumer lending, mortgage operations and mortgage origination. She was promoted to Senior Vice President in 2011. In 2016, she was promoted to Retail Lending division head, assuming responsibility for all mortgage and consumer lending activities. She was promoted to Executive Vice President in 2016, appointed Executive Vice President and Chief Retail Lending Officer in 2018 and appointed Senior Executive Vice President and Chief Retail Lending Officer in 2022. The Corporation has previously announced that Ms. Noons will assume the position of President and Chief Operating Officer following Mr. Gim’s retirement.

William K. Wray, Sr. joined the Bank in 2015 as Senior Vice President, Risk Management. He was promoted to Executive Vice President and Chief Risk Officer in September 2015 and to Senior Executive Vice President and Chief Risk Officer in 2017. Prior to joining Washington Trust, he served as Chief Operating Officer for Blue Cross Blue Shield of Rhode Island from 2009 to 2015. From 1993 to 2008, he served in various executive leadership positions for Citizens Bank including Vice Chairman and Chief Information Officer, including responsibility for corporate risk and compliance programs.

Dennis L. Algiere joined the Bank in 1995 as Compliance Officer. He was promoted to Vice President, Compliance in 1996 and to Senior Vice President, Compliance and Community Affairs in 2001. He was named Senior Vice President, Chief Compliance Officer and Director of Community Affairs in 2004, and promoted to Executive Vice President, Chief Compliance Officer and Director of Community Affairs in 2019.

Debra A. Gormley joined the Bank in 2011 as Senior Vice President, Retail Banking. She was promoted to Executive Vice President, Retail Banking in 2014, and appointed Executive Vice President and Chief Retail Banking Officer in 2018. Prior to joining Washington Trust, she served in various leadership positions for Citizens Bank, including as Retail Director with responsibility for management of a 54-branch network in Rhode Island.

James M. Hagerty joined the Bank in 2012 as Executive Vice President and Chief Lending Officer. From December 2001 until he joined Washington Trust, he served as Senior Vice President, Rhode Island Market Manager, for Citizens Bank, responsible for middle market and not-for-profit commercial lending. On February 5, 2023, Mr. Hagerty retired from his role as Chief Lending Officer. He continues to work on a part-time basis in an advisory role for the Commercial Banking division.