UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-03931

CLIPPER FUND, INC.

(Exact name of registrant as specified in charter)

2949 East Elvira Road, Suite 101

Tucson, AZ 85756

(Address of principal executive offices)

Thomas D. Tays

Davis Selected Advisers, L.P.

2949 East Elvira Road, Suite 101

Tucson, AZ 85756

(Name and address of agent for service)

Registrant’s telephone number, including area code: 520-806-7600

Date of fiscal year end: December 31, 2011

Date of reporting period: June 30, 2011

____________________

ITEM 1. REPORT TO STOCKHOLDERS

|

CLIPPER FUNDSM

|

Cautionary Statement

Davis Advisors is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy and approach. Our views and opinions regarding the investment prospects of our portfolio holdings include “forward looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate. These opinions are current as of the date of this report, but are subject to change. The information provided in this report should not be considered a recommendation to buy, sell, or hold any particular security.

You can identify forward looking statements by words like “believe,” “expect,” “anticipate,” or similar expressions when discussing prospects for particular portfolio holdings and/or of the Fund. We cannot assure future results and achievements. You should not place undue reliance on forward looking statements, which speak only as of the date of this report. We disclaim any obligation to update or alter any forward looking statements, whether as a result of new information, future events, or otherwise. This material must be preceded or accompanied by a prospectus. Please read the prospectus carefully for a discussion of investment objectives, risks, fees, and expenses. Current performance may be lower or higher than the performance quoted herein. You may obtain a current copy of the Fund’s Prospectus or more current performance information by calling Investor Services at 1-800-432-2504 or on Clipper Fund’s website (www.clipperfund.com).

|

CLIPPER FUNDSM

|

Table of Contents

|

|

Shareholder Letter

|

2

|

|

Management’s Discussion of Fund Performance

|

16

|

|

Fund Overview

|

18

|

|

Expense Example

|

19

|

|

Schedule of Investments

|

20

|

|

Statement of Assets and Liabilities

|

23

|

|

Statement of Operations

|

24

|

|

Statements of Changes in Net Assets

|

25

|

|

Notes to Financial Statements

|

26

|

|

Financial Highlights

|

31

|

|

Director Approval of Advisory Agreements

|

32

|

|

Fund Information

|

34

|

|

Privacy Notice and Householding

|

35

|

|

Directors and Officers

|

36

|

This Semi-Annual Report is authorized for use by existing shareholders. Prospective shareholders must receive a current Clipper Fund Prospectus, which contains more information about investment strategies, risks, fees, and expenses. Please read the prospectus carefully before investing or sending money.

Shares of the Clipper Fund are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including possible loss of the principal amount invested.

|

CLIPPER FUNDSM

|

Shareholder Letter

|

The chart below summarizes results through June 30, 2011 for the Clipper Fund. The credit for the Fund’s satisfactory results since inception belong to our predecessor. The 10 year results combine four and a half years of our predecessor’s management during which returns were very good and five and a half years of our management during which returns have been poor, as reflected in the unsatisfactory five year results. On both a relative and absolute basis, these results are the worst my partner Ken Charles Feinberg and I have had to report in our careers.

|

Average Annual Total Returns as of June 30, 2011

|

||||

|

1 Year

|

5 Years

|

10 Years

|

Since Inception

(2/29/84)

|

|

|

Clipper Fund

|

28.95%

|

(0.41)%

|

2.28%

|

11.58%

|

|

S&P 500® Index

|

30.69%

|

2.94%

|

2.72%

|

10.81%

|

The performance presented represents past performance and is not a guarantee of future results. Total return assumes reinvestment of dividends and capital gain distributions. Investment return and principal value will vary so that, when redeemed, an investor’s shares may be worth more or less than their original cost. The total annual operating expense ratio as of the most recent prospectus was 0.76%. The total annual operating expense ratio may vary in future years. Current performance may be higher or lower than the performance quoted. For most recent month-end performance, visit clipperfund.com or call 800-432-2504. The Fund received favorable class action settlements from companies which it no longer owns. These settlements had a material impact on the investment performance of the Fund in 2009. This was a one-time event that is unlikely to be repeated. Clipper Fund was managed from inception, February 29, 1984, until December 31, 2005 by another Adviser. Davis Selected Advisers, L.P. took over management of the Fund on January 1, 2006.

With more than $70 million of our own money invested in Clipper Fund alongside shareholders, we, our colleagues and our families share the cost of these unsatisfactory results and have every incentive to fix them.1 To this end, while longer term results signify more, it is heartening that results have improved in more recent periods. Clipper Fund’s returns have almost caught up with the market’s over the last three years and, since the March 2009 lows reached during the financial crisis, the Fund has risen more than 130% versus the 105% rise of the S&P 500® Index.2 But we still have a long way to go. Nothing we say in the pages ahead is meant to excuse or minimize the poor results under our stewardship. We are committed to Clipper Fund and believe over a long period of time the fact that it is concentrated and, as a relatively small fund, opportunistic should be advantages.3

Our goal in this report is to provide some longer term context for our results and, more importantly, explain why we remain committed to the investment discipline that has served us well for more than four decades. We will also outline our rationale for believing returns in the years ahead should be substantially better.

While we generally do not emphasize very short-term results, we would note the Fund’s one year results convey a mixed message. On an absolute basis, our return of almost 29%, is more than satisfactory and may even seem a bit surprising given the pessimistic mood of the nation.2 We will explain later in this report why such a combination is not so unusual given that investment returns and investor sentiment often move in opposite directions. On a relative basis, however, our 29% return lagged the more than 30% return of the S&P 500® Index.2 While a portion of this relative underperformance stems from our deliberate attempt to reduce the Portfolio’s business and financial risk given the shakiness of the U.S. and global economy, a portion also stems from investment mistakes we have made. In the pages that follow, we will discuss in detail both our relatively conservative portfolio positioning as well as our investment mistakes.

Turning from past results to future outlook, we strongly believe that despite or even because of the pervasive sense of gloom and negativity, the stock market as a whole should produce improved returns in the decade ahead. Furthermore, if history is

___________________________

3 Clipper Fund is non-diversified and, therefore, is allowed to focus its investments in fewer companies than a fund that is required to diversify its portfolio. The Fund may be subject to greater volatility and risk, as the Fund’s investment performance, both good and bad, is expected to reflect the economic performance of the few companies on which the Fund focuses.

Not a part of Semi-Annual Report to Fund shareholders

2

|

CLIPPER FUNDSM

|

Shareholder Letter – (Continued)

|

any guide, we will be long into a stock market recovery before the press, pundits and public feel more confident. For example, we often hear commentators describe the stock market as depressed or mired in a bear market even though the S&P 500® Index is now within 10% of its all-time high on a total return basis and is up more than 100% from its low.4 There is a lot of truth in the old saying that the stock market climbs a wall of worry.

Finally, based on the strong fundamentals and attractive valuations of the specific companies that make up Clipper Fund, we believe our Portfolio is well positioned to generate returns above the market averages. Although the prices of the stocks we own have been disappointing in recent years, the values of a number of the underlying businesses have continued to make progress, resulting in one of the largest gaps between price and value that we have experienced in our careers. If we are correct in our appraisals, then prices should rise to reflect these values. While the timing may be uncertain, the narrowing of the difference between price and value should result in improved relative returns. Although we cannot promise such an outcome, the combination of higher stock prices and improved relative results could produce very satisfactory returns in the decade ahead. We will outline in the pages that follow the reasons why we are optimistic about the outlook for equities in general and Clipper Fund in particular.

Following our practice, we have structured this report as a series of responses to the questions we are most frequently asked by shareholders, with a particular emphasis on our results and outlook.

Q: Why should the relative performance of Clipper Fund improve?

A: During a period of such disappointing relative results, any attempt to put these results in context risks sounding evasive or defensive. Our goal is not to avoid taking responsibility for the fact that Clipper Fund’s results fall short of our standards and expectations. Instead, we want to provide our fellow shareholders with the reasons why we remain committed to our investment discipline and believe results in the years ahead should be much better.

A useful way to begin the analysis is by reviewing the longer term investment record of another more diversified mutual fund managed by our firm and asking whether periods such as this are unprecedented. Before addressing this question, however, we must point out that because we have only managed Clipper Fund since January 1, 2006 and because the other fund we have managed longer is more diversified their records may not be directly comparable. We present this data here as an illustration of past periods of poor results rather than as a statement of how Clipper Fund would have fared during those periods. With that caveat, the Davis New York Venture Fund, a diversified mutual fund that our firm has managed since 1969 and that Ken and I have overseen for well over a decade, has returned 11.81% per year after expenses since its inception versus 9.61% for the S&P 500® Index during that same time period, a result we consider satisfactory on both a relative and absolute basis.5

|

Average Annual Total Returns as of June 30, 2011

|

|||

|

1 Year

|

5 Years

|

10 Years

|

|

|

Davis New York Venture Fund Class A

|

|||

|

with a maximum 4.75% sales charge

|

18.29%

|

0.29%

|

3.16%

|

The performance presented represents past performance and is not a guarantee of future results. Total return assumes reinvestment of dividends and capital gain distributions. Investment return and principal value will vary so that, when redeemed, an investor’s shares may be worth more or less than their original cost. The total annual operating expense ratio for Class A shares as of the most recent prospectus was 0.89%. The total annual operating expense ratio may vary in future years. Returns and expenses for other classes of shares will vary. Current performance may be higher or lower than the performance quoted. For most recent month-end performance, visit davisfunds.com or call 800-279-0279.

___________________________

5 Class A shares, not including a sales charge. Inception was 2/17/69. Past performance is not a guarantee of future results.

Not a part of Semi-Annual Report to Fund shareholders

3

|

CLIPPER FUNDSM

|

Shareholder Letter – (Continued)

|

Over this time, the Fund outperformed the market in 100% of all 10 year periods.6 In addition, the Fund outperformed in 78% of all five year periods and, while this is a strong percentage, it also means the Fund underperformed in 22% of all five year periods.6 Bearing in mind the Davis New York Venture Fund is a diversified fund and thus not directly comparable to Clipper Fund, we would note that five years of lagging results, while disappointing, are not unprecedented or inconsistent with our long-term history. Also, although we do not know if this would have been true for Clipper Fund, in every case in which our more diversified fund trailed the market for a five year period, it exceeded the market in the following five years.6

If we extend this analysis of our own history to the record of other managers that have generated good long-term results, a similar pattern emerges. For example, almost 60% of the top-performing large cap equity managers over the past decade underperformed for at least a five year stretch during that decade of outperformance.7 To use an example closer to home, our predecessors in managing Clipper Fund built an outstanding long-term record from the time they started the Fund in 1984 until they stepped down in 2005, outperforming the market by almost 2% per year for more than 20 years. However, even under their excellent management, the Fund still underperformed in roughly half of all five year periods since its inception.

While this has been a very difficult and disappointing period, from these statistics it would seem such a stretch of underperformance is not unprecedented for us as managers, unexpected in comparison with other managers we admire or unusual in Clipper Fund’s own history.

Finally, while it is no solace to Clipper shareholders and while Clipper Fund as a more concentrated fund would have been run differently, our management team did outperform the market in 10 of the last 12 five year periods with the other more diversified equity fund mentioned above.6 It is difficult to put into words how frustrating it is to us that none of those periods of outperformance were enjoyed by Clipper shareholders.

Q: Why do you believe this is a good time to invest in Clipper Fund?

A: In managing Clipper Fund, our investment approach is grounded in the recognition that stocks are not just pieces of paper or numbers that move up and down daily but instead are certificates of ownership of real businesses. As a result, our research focuses first on the task of assessing the intrinsic value of those underlying businesses. Then we compare our appraisal of each business’s value to the market price of its stock. Our goal is to construct a portfolio of companies in which value significantly exceeds price. Although executing this task can be both imprecise and difficult, the underlying principle is a straightforward understanding of the fundamental difference between price and value.

Unfortunately, in modern financial theory price and value are often treated as synonyms. It is almost a matter of faith, not to mention new accounting standards, that the most appropriate measure of an asset’s value is its current market price. In the real world, however, the difference between price and value is well understood and best captured by the wise saying, “Price is what you pay. Value is what you get.” More specifically, the price of an asset is whatever people are willing to buy and sell it for at a given instant. Because price is set by people who are necessarily fallible and emotional, it can be subject to all sorts of influences beyond the pure economic characteristics of the underlying asset. In certain cases, the influence of emotions like euphoria and panic can become so dominant that prices become irrational—just consider the bubble prices of Internet stocks in 2000 or the panic prices of many stocks during the depths of the financial crisis.

On the other hand, the value of an asset is simply the total amount of cash it will generate over its life, discounted to the present. This amount is determined by reality not emotion. To consider a simple example, imagine a rental property that reliably produces income of $50,000 after all expenses each year. At the peak of the real estate bubble, a buyer might have paid more than $1 million for such a property, accepting a return of only 5%. In the depths of the crisis that followed, it might have been difficult to get $500,000, which would give a buyer more than a 10% return. Although the price of the property in this example may have dropped in half reflecting the changing mood of buyer and seller, the value of the property remains unchanged reflecting the stability of the underlying cash flows. Similarly, because stock prices at any given time are

___________________________

7 Source: eVestment Alliance; 193 managers from eVestment Alliance’s large cap universe whose 10 year average annualized performance ranked in the top quartile from January 1, 2001-December 31, 2010. Past performance is not a guarantee of future results.

Not a part of Semi-Annual Report to Fund shareholders

4

|

CLIPPER FUNDSM

|

Shareholder Letter – (Continued)

|

determined by fallible and emotional human beings, they also tend to reflect the mood of buyers and sellers. On the other hand, because stock values are determined by the cash flows of real operating businesses, they are unaffected by changing sentiments.

This understanding of the essential difference between price and value drives our confidence in the prospects for our Portfolio. Put simply, although the prices of many of the stocks we own have lagged for a number of years, the values of the businesses we own—as measured by sales, earnings, shareholders’ equity, dividends, and so on—have continued to build. As a result our appraisals of the value of the businesses that make up Clipper Fund now meaningfully exceed their prices. Although such a divergence can persist for long periods, as it has for the last five years, we do not believe it can persist forever. As Ben Graham famously said, “In the short run, the market is a voting machine [with prices reflecting psychology and emotion]. In the long run, it is a weighing machine [reflecting the value of the underlying businesses].” This is the most important reason we believe that patient investors who can stay the course should be rewarded in the years ahead.

Q: Can you describe the characteristics of the companies that make up the Portfolio?

A: Our conviction about Clipper Fund’s improved prospects is based on the economic characteristics and valuations of the companies that make up the Fund. Because each of these companies is selected based on its individual merits and because the Fund can be both opportunistic and flexible, the portfolio defies easy categorization.

Bearing in mind the risk of overgeneralizing, especially given John Train’s observation that “investing is the art of the specific,” the Portfolio today can roughly be divided into three categories. The first is made up of companies that are under a cloud and whose reputations and valuations have suffered because of management missteps, lackluster execution or worse than expected results. Although subjective, this category would include companies such as Harley-Davidson, Bank of New York Mellon, Hewlett-Packard, and CVS Caremark. Because these companies are currently unpopular, their shares can be purchased at low valuations. Moreover, in each case, we have reason to believe the fundamentals will improve and the companies will regain some of their lost luster. If this happens, shareholders can benefit from both improved earnings and an improved multiple of earnings, a compounding effect my grandfather referred to as “the double play.”

A second category is made up of companies whose relatively small size, complexity or illiquidity means their stocks are poorly understood or followed by relatively few. In this subjective category, we would include companies like Oaktree Capital, RHJ International, SKBHC Holdings, and even Loews Corporation. Although each of these companies is run by owner operators with proven records of success, they tend to be relatively illiquid or not well known and thus not attractive to many large investors. In the years ahead, we hope to show that one of the advantages of Clipper Fund’s relatively small size is the opportunity to take meaningful positions in such companies.

The third category makes up the majority of Fund assets. Companies in this largest and most important category might well be characterized as world leaders. This category includes some of the highest quality companies we have ever owned. We believe a significant percentage of them are best-of-breed across a range of different industries. Think of Wells Fargo, American Express and Goldman Sachs in financial services; Costco and Bed Bath & Beyond in retailing; Procter & Gamble in consumer products; Merck and Roche in health care; Diageo in beverages; Canadian Natural Resources in energy; Berkshire Hathaway in insurance (and many other industries); and Microsoft and Texas Instruments in technology. These companies tend to have deeper moats, stronger balance sheets and often more pricing power or lower costs than their competitors. Many also have broad product portfolios and wide geographic diversity that give them exposure to higher growth economies around the world. These attributes helped many of these companies deliver strong business results straight through the worst economic downturn since the Great Depression. A number of our holdings, including Merck, Wells Fargo and Berkshire Hathaway, actually took advantage of the financial crisis by making opportunistic acquisitions and others such as Texas Instruments and Microsoft repurchased a meaningful amount of their outstanding shares at distressed prices.

However, the economic characteristics of these leading companies are only half the reason we are so optimistic about future returns. The other half of the equation is valuation. Because the stock market works like a pari-mutuel system, businesses with such wonderful characteristics will tend to trade at high valuations, which in turn can make them poor investments. While above average valuations may be appropriate for above average businesses, they decrease the likelihood investors will earn an excess return. As a result, during most periods, investors who wanted the safety and security of owning some of the world’s most durable businesses had to give up some return by paying higher than average valuations. Such valuations

Not a part of Semi-Annual Report to Fund shareholders

5

|

CLIPPER FUNDSM

|

Shareholder Letter – (Continued)

|

reached bubble levels in the Nifty Fifty era of the early 1970s and again in the late 1990s when many such global leaders had dividend yields of less than 1% and traded at more than 30 times earnings.

Since then, there has been a dramatic reversal. Today, we estimate the individually selected companies that make up this portion of the Clipper Fund are currently priced at around 13 times our estimate of this year’s owner earnings. Owner earnings is a measure of earnings that differs somewhat from generally accepted accounting principles (GAAP) in ways that we believe make it a more accurate measure of economic versus accounting reality. For example, in determining owner earnings, we normalize tax rates and credit costs as well as including the costs of adequately funding pension liabilities, adding back depreciation, and deducting maintenance capital spending and so on.

With low valuation as the final piece of the puzzle, we would conclude that this largest portion of Clipper Fund’s portfolio currently exhibits a rare combination of 1) lower than average risk, as measured by our companies’ balance sheet strength, competitive position and low risk of obsolescence, 2) durable, long-term growth prospects as indicated by their product portfolios, geographic diversity and attractive returns on retained equity; and 3) low valuations as indicated by the fact they are priced at a substantial discount to our estimated range of fair value. In our view, this is the perfect combination in an uncertain environment that may include anything from a robust economic recovery to another economic or financial crisis.

Putting all three categories together, Ken and I feel the gap between the prices of companies held in Clipper Fund and their relative value is as wide as we have seen. In aggregate, based on our analysis and projections, we estimate our companies on average are currently priced at somewhere between 9.5-11.5 times our estimate of the owner earnings they should generate two to three years from now. Looked at another way, we estimate the companies held in Clipper Fund on average should generate an earnings yield of 8.5%-10.5% by 2013. In a world where corporate bonds of such companies yield between 3%-6% we find the gap between the price and value of the companies that make up Clipper Fund especially compelling. This above all else strengthens our belief that Clipper Fund’s relative results over the next five years should be more than satisfactory.

If our confidence proves justified, then the combination of higher stock market returns and better relative results could well make the next decade a very good one for our investors. Although we cannot promise this outcome, we are certainly committed to it and will do everything in our power to achieve it.

Q: Can you give specific examples from the Portfolio that show the difference between stock prices and business values?

A: Having given a general description of the types of companies we own and why we believe the value of these companies is well above their current stock prices, it may be useful to look at some specific examples. Although future value is the most important investment consideration, the process of estimating future value requires forecasts that are open to conjecture. As a result, a better starting point may be to look back over the last five years for examples in which solid growth in value was not fully reflected in comparable price appreciation. In doing so, we will not only provide specific data about the companies we own but also point out how a period of poor relative results may be an indication of deferred gratification rather than mistaken analysis.

A useful first example is our longtime holding Costco, the warehouse club retailer often considered a paradise for value shoppers. Over the last five years, this outstanding company has added significantly to its value, growing its sales from around $60 billion in 2006 to more than $80 billion today. With a membership-based business model, the company generates more than $1.8 billion in annual fees from its loyal customer base, almost 90% of whom renew their membership each year. Over the last five years, the company has expanded its fast growing international operations, particularly in Asia, to 25% of sales and has grown overall earnings by more than 80%. If we consider this earnings growth as a proxy for value, it would seem the 42% increase in Costco’s share price has lagged its 80% increase in value.8

In the financial sector, contrary to common perception, the earnings of two of our largest holdings have made progress in the last five years even in the face of the financial crisis. However, in this controversial sector filled with headline risk, misperception is quite common. For example, despite having the word bank in its name, the Bank of New York Mellon, one

___________________________

Not a part of Semi-Annual Report to Fund shareholders

6

|

CLIPPER FUNDSM

|

Shareholder Letter – (Continued)

|

of our largest holdings, is not really a bank in the traditional sense as more than 90% of its profits come from securities processing, custody and asset management. Founded in the 18th century, this stalwart institution now has more than $25 trillion of assets under custody and is a market leader in most of its businesses. However, even with these impressive characteristics let alone the fact the company’s earnings have grown more than 30% in the last five years, its stock price is 25% below where it was then.9

The story is similar at Wells Fargo where superior management and conservative lending allowed the company to acquire its large rival Wachovia at the depths of the financial crisis. The combined company now generates earnings of about $36 billion per year before taxes and provisions for bad loans. Although the weak economy and loan charge-offs may persist for several more years, the underlying earnings power of this well-run bank has significantly increased and may now be almost 50% higher than the earnings it is currently reporting. Over the last five years, though, Wells Fargo’s progress in earnings power has been ignored in its stock price, which is still below its level of five years ago.9

Turning from finance to pharmacies, leading companies like CVS Caremark stand to benefit as a huge number of the world’s most well-known and widely used prescription drugs will be coming off patent. As patents expire and patients switch to cheaper generic drugs, prices fall as much as 90%. This coming wave of generic substitution is a positive not just for patients and entities like insurance companies and Medicare that cover prescription drug charges but also for pharmacies and pharmacy benefit managers like CVS Caremark. CVS actually makes more money filling a generic prescription than the far more expensive original brand name prescription. This trend combined with a generally aging population that consumes more drugs has enabled CVS Caremark to grow earnings per share 90% over the past five years. However, despite these good results and solid growth prospects, the share price during the same period rose only 22%.9

In the important technology sector, Microsoft has grown its sales from $44 billion to approximately $70 billion in the last five years. Significantly, because of expense discipline and share repurchase, its earnings per share have grown at an even faster clip, more than doubling from $1.21 to $2.73 per share. Although the company competes in a sector full of obsolescence risk, its most important businesses are more entrenched than many realize. For example, we estimate that more than two-thirds of Microsoft’s profits come from corporate software licenses and from the specialized software that runs behind the scenes on the millions of computer servers that power the Internet. Amazingly though, Microsoft’s share price has barely changed in five years, rising a paltry 2% per year while earnings have grown 17% per year.9

Finally, in the energy sector we also believe the value of our holding in Canadian Natural Resources has also increased more than its stock price. In this field though appraisals can be a bit more complicated as our investment focus is not based on trying to predict the direction of oil and gas prices but rather on trying to identify those individual companies that have been able to grow their reserves on a per share basis over long periods of time. While changes in commodity prices may have a larger influence on stock prices for some period of time, we believe growth in reserves will be the more important determinate of long-term value creation. With this in mind, it is amazing to consider that over the last five years Canadian Natural Resources has increased its reserves per share (debt adjusted) a staggering 136%, more than twice the 51% increase in its stock price.9

While our files on each of the companies mentioned above are thick with research data and analysis, these cursory examples and summaries are simply intended to give some indication of the manner in which changes in a company’s stock price can lag growth in its value. At a time when stock prices have been disappointing, it is reassuring to remind ourselves of the progress, strength and growth of the underlying businesses we own. Furthermore, in an uncertain world in which prices can fluctuate wildly with each day’s headlines, the reminder that the Portfolio is made up of businesses that are not just attractively valued but also durable, profitable and resilient can help steady investors’ nerves and allow them to stay the course.

Q: Has long-term investing become obsolete in this new world of high-velocity and technical trading strategies, ETFs, alternative investments, and hedge funds?

A: Before turning to the new products and approaches that are currently in favor, we should be clear about our background assumptions and definitions. First, investing has always been a competitive enterprise in which investors are barraged with

___________________________

Not a part of Semi-Annual Report to Fund shareholders

7

|

CLIPPER FUNDSM

|

Shareholder Letter – (Continued)

|

new information that must be considered and evaluated. Without question, long-term success requires constant learning and adaptation. Any firm that refuses to learn and adapt will fail. However, the fact that successful investors are constantly adapting to new information does not mean that the underlying principles of economics and investing are called into question or that common sense has been repealed. While we have our biases, it seems to us that many of today’s “innovations” are simply ways for promoters of one type or another to generate more transactions, charge higher fees or simply make more money at the expense of the investing public. There is a lot of wisdom in the old saying that “the four most expensive words on Wall Street are ‘this time is different.’”

A brief look at some of the more popular new investment fashions may illustrate the point. A good place to start is with the current conventional wisdom that increased trading somehow adds value. Two types of trading strategies have become particularly popular. The first trading strategy is practiced by very sophisticated quantitative hedge funds that use computers to execute high velocity trading strategies in nanoseconds based on so-called algorithms. While some of these strategies may be legitimate, many are based on practices that, if executed in slower motion by conventional traders, would look a lot like front running, bid fishing or other practices that have long been banned by leading stock exchanges. The SEC is currently reviewing these practices and we are hopeful they will be rightly prohibited. Any investors wishing to understand the unethical and abusive nature of this type of high-frequency trading should read the outstanding letter to the SEC written by O. Mason Hawkins and his colleagues at Southeastern Asset Management. Please visit the Literature section of clipperfund.com to read this letter.

The second type of trading strategy is best illustrated by watching advertisements on the financial television networks, not that this is a practice we would recommend. In these ads, hucksters market so-called “tools” and “strategies” for trading stocks, options, ETFs, commodities, and more. What these tools and strategies have in common is that the people selling them will get paid whether the buyer makes or loses money. Get-rich-quick schemes and day trading strategies in which promoters capitalize on hopes, dreams and greed are nothing new. Investors would do well to remember Charlie Munger’s wonderful story in which he says “I think the reason that there is such idiocy is best illustrated by a story I tell about the guy who sold fishing tackle. I asked him, ‘My God, they’re purple and green. Do fish really take these lures?’ And he said, ‘Mister, I don’t sell to fish.’”

Aside from these promoter risks, the idea that trading adds value contains an economic fallacy that can be seen using a simple exercise described by Jack Bogle in a 2009 interview with The Motley Fool.10 In this exercise, he suggests imagining that half the shares outstanding of all the stocks in the S&P 500® Index are owned by long-term investors and the other half by traders. By definition, the long-term holders who own half the shares and do not trade them will earn the market return. The traders on the other hand are trading with each other because the long-term investors are not trading with them. As Jack concludes, “It follows as the night to the day that the traders will lose by the amount of money paid to the intermediaries, the croupiers in the middle [as well as to the IRS!]. It therefore follows logically and mathematically that buying and holding is a winner's game and buying and trading is a loser's game. Simple as that. No way around it.”11 The cost of this economic fallacy shows up in long-term returns. For example, over the last 15 years, mutual funds that had the highest amount of trading underperformed mutual funds that had the lowest amount of trading by about 1% per year.12

Another popular “innovation” is investing in ETFs, of which there are two primary categories. The first and largest category includes those that are based on broad stock indexes. Index-based ETFs, unlike the trading strategies described above, have both good and bad aspects. On the positive side, these ETFs can offer an extremely low-cost, tax-efficient way to own a broad index of stocks if investors are planning on holding the ETFs for the long term. In this way, they are no different than index funds, which have existed for decades. While investors in these ETFs, like investors in index funds, are likely to underperform the index every year because of expenses, this underperformance will be predictable and relatively small. Furthermore, while investors are giving up the opportunity to outperform over the long term, they are also avoiding the inevitable periods of underperformance that even strong managers will experience. While investing with a superior manager

___________________________

12 Source: Morningstar as of December 31, 2010. 155 Large Cap Funds Class A shares (excluding index funds) with at least a 15 year track record were included in this study and grouped by reported portfolio turnover. Past performance is not a guarantee of future results. There is no guarantee that in future periods low turnover funds will have higher returns than those funds with higher turnover.

Not a part of Semi-Annual Report to Fund shareholders

8

|

CLIPPER FUNDSM

|

Shareholder Letter – (Continued)

|

over the long term can generate results in excess of the index (as we have since our inception), investors who do not have the discipline or temperament to weather periods of underperformance could benefit from a long-term strategy of passive investing in either index funds or comparable ETFs.

Unfortunately, many if not most investors in this type of ETF are not using it as a passive long-term investment strategy, as they would index funds. Instead, they are attempting to take advantage of the only meaningful difference between index-based ETFs and traditional index funds—namely that ETFs are easily traded. As a result most ETFs have become what are known in Wall Street parlance as “trading sardines” rather than “eating sardines” or long-term investments. For example, the total size of the flagship Vanguard 500 Index Fund is $106 billion of which only a tiny fraction is exchanged in or out each day. Conversely, the largest ETF tracking the S&P 500® Index trades more than $100 billion each week! Put another way, the average “investor” in an S&P 500® ETF has a holding period of roughly 4 days. This is not a recipe for wealth creation. Once again, to quote Jack Bogle, “The idea that a bell rings to signal when investors should get into or out of the stock market is simply not credible. After nearly fifty years in this business, I do not know of anybody who has done it successfully and consistently. I don't even know anybody who knows anybody who has done it successfully and consistently.”

The second category of ETFs are those designed to track everything from specific asset classes, such as gold or Treasury bonds, to particular market sectors ranging from commodities to technology, to targeted geographic regions from Brazil to Canada. The idea is that rather than invest in specific assets or securities, investors can simply use ETFs to get quickly in and out of virtually any asset class in the world. Some of these ETFs have the added “attraction” of leverage. While it is difficult to generalize about such a broad category, what most of these ETFs have in common is that they were created to facilitate speculation and trading. As with the trading strategies described earlier, such sector rotation is doomed to be a loser’s game in aggregate, though there will of course be some winners. The fact that such trading strategies are often given more respectable sounding names such as sector rotation or dynamic asset allocation does not change their true nature anymore than calling a janitor a custodial engineer changes his job description. Furthermore, as with the man selling fishing tackle, the marketers of these ETFs are paid based on assets and transactions not outcomes. It does not matter to them if no value is created for the end investor provided volume and activity increase. Finally, by facilitating large scale speculation, particularly in less liquid asset classes and sectors, these sorts of ETFs are almost certain to lead to bubbles, busts and other sorts of unexpected dislocations as traders stampede in and out of whole sectors or classes of companies without analyzing the individual companies that are included in each index. While such a volatile and speculative environment is not easy on the nerves, it is likely to create enormous opportunities for those who can maintain a long-term perspective and can differentiate between price and value. We are highly confident that such dislocations will occur, though we are not sure when, and we are anxious to capitalize when they do.

Two other fashionable financial innovations include so-called alternative investment strategies and hedge funds. As with ETFs, these are broad categories about which it is difficult to generalize and there are certainly examples of success in each. However, both alternative investments and hedge funds tend to have high fees and most employ leverage, which increases risk. Furthermore, the nature of their incentive fee structures creates a peculiar asymmetry that can result in managers getting paid for volatility even if their investors lose money. For example, a stock that appreciates 20% per year for four years and then falls 50% in the fifth year would leave investors with a small net profit after five years. However, investors in a hedge fund with a typical fee structure (i.e., a 2% fixed fee plus 20% of the gains) that generated the same returns before fees (gains of 20% per year for four years and then a loss of 50% in the fifth year) would end up with a cumulative loss of about 20% after fees. Meanwhile, the manager of that hedge fund would have received cumulative fees of almost 33%.

More important than the high fee structures and dangerous incentives, however, is the fact investors tend to put a lot more money into a particular alternative strategy or hedge fund after long periods of good results and then get out after periods of bad results. For example, consider the money that poured into venture capital in the late 1990s based on the fact smaller funds that had been created years before had done well. Similarly, the largest private equity funds raised the most money in 2006 and 2007, just before the financial crisis wiped out many of these funds.

While we have often shared data about the destructive tendency of mutual fund investors to chase performance, it has been difficult to find data quantifying the long-term costs that investors in hedge funds incur from the same tendency to invest in funds after periods of good results and get out after periods of bad results. This year, however, professors at Harvard Business School and Emory University jointly published an explosive study concluding that from 1980-2008 this timing and

Not a part of Semi-Annual Report to Fund shareholders

9

|

CLIPPER FUNDSM

|

Shareholder Letter – (Continued)

|

selection penalty cost hedge fund investors 3%-7% per year.13 According to the study, “We find that the real alpha of hedge fund investors is close to zero. In absolute terms, dollar-weighted returns [earned by hedge-fund investors] are reliably lower than the return of the S&P 500® Index and are only marginally higher than the risk-free rate….”

While not currently fashionable, we think long-term investing in a carefully constructed portfolio of high quality equities is still the best way to build and protect wealth over decades. We would even argue that the very fact that it has become unfashionable increases the likelihood of a satisfactory outcome given that investment fads are a notoriously reliable contrary indicator.

Finally, we must reiterate our conviction that bonds, which have become the most popular asset class today, are enormously risky. As we have written in the past, during the same period in which stock values have improved while stock prices have fallen, bond values have fallen while their prices have risen. In fact, after nearly 30 years of rising prices, the cash flow bonds produce (i.e., their interest payments) now stands near historic lows. This is a risky combination and, though the timing may be uncertain, it seems certain that a significant amount of optimism and euphoria is incorporated in bond prices, presaging the likely demise of the long bull market in bonds. My grandfather Shelby Cullom Davis referred to bonds as “certificates of confiscation.” His dislike of bonds stemmed from the fact that for almost three decades ending in 1982, investors in bonds lost money on an inflation-adjusted basis. While it is impossible to predict the short-term direction of interest rates, the fact that they are close to their historic lows at a time when deficits and commodity prices are soaring makes it almost certain the long-term direction will be up. To use Jim Grant’s phrase, at today’s prices, bonds represent “return-free risk.”

Q: What were your biggest mistakes?

A: During the financial crisis, the mistakes of investors (including us) were dramatic and obvious. While we avoided a number of the biggest losers, including Fannie Mae, Freddie Mac, Lehman, Bear Stearns, Countrywide and Washington Mutual, we also made a number of important mistakes. Our loss in AIG in particular, was substantial and permanent and was responsible for a majority of our underperformance over the last five years. We have written at length about this mistake in earlier reports and commend them to your attention. (Please see the Commentaries section of clipperfund.com to read these reports.)

We are more than two years past the depths of the financial crisis. Since the lows in March of 2009 through June 30th of this year, the market is up about 105% and Clipper Fund about 130%.14 Despite this recovery, we still have ground to make up from 2008. Furthermore, while a 130% gain is gratifying, we could have done better. For example, as we have written in past reports, it is likely that the largest mistakes we made in recent years will never show up in our financial statements. This is not because we are glossing over them, but rather because they were mistakes of omission. In other words, our costliest mistakes during this financial crisis may well be the investments we failed to make when others were panicking. Wells Fargo, for example, traded roughly as low as $8 per share and American Express as low as $10. Had we added less than 2% of the Fund to each position, we would have more than made up the cumulative losses we suffered in AIG.15 Such mistakes of omission are rarely discussed and yet, as the example above shows, they can be just as costly to long-term returns.

Although we do not usually comment on shorter term results, some have asked whether the fact the Fund did not own many of the more leveraged, speculative or cyclical companies that led the market in 2010 and thus far in 2011 was also a mistake of omission. The short answer is we do not believe so. As discussed earlier in this report, we strongly believe high quality companies with durable growth prospects and relatively low business and financial risk represent the most compelling opportunity in the market today. That does not mean the stocks of these companies will always outperform. In fact, it is likely these stocks could underperform those that are more leveraged or speculative in nature should the economic recovery gain steam and the world avoid major crises. However, the last several years should have taught all investors that portfolios should be built to weather downturns as well as participate in good times. Although the gyrations of this summer may be simply a bump on the road to recovery, they may also be early signs of another economic swoon. If so, although we cannot predict

___________________________

15 Period discussed is from 6/30/06-6/30/11.

Not a part of Semi-Annual Report to Fund shareholders

10

|

CLIPPER FUNDSM

|

Shareholder Letter – (Continued)

|

how our stocks will perform, we feel confident that the values of the underlying businesses we own are far less vulnerable than those we owned in 2008.

In short, while the companies we own or added to in recent years including Costco, CVS Caremark and Microsoft may lag more leveraged, cyclical or speculative companies in a robust recovery, we are confident they will prove to be satisfactory investments over the long term.

Concluding Thoughts

Each time we prepare a report for our clients and shareholders, our primary goal is to provide the information we would want if our roles were reversed, particularly with regard to portfolio results, individual holdings and investment mistakes. We feel a candid and thorough accounting is an essential component of our responsibility as stewards of investors’ savings, especially when short-term results are below our standards and expectations as they have been in the most recent periods.

A second goal is to share our outlook both for the stock market in general and for the portfolio of companies we own in particular. This outlook rests on the fundamental difference between price and value. Prices are determined by human beings and thus reflect emotions as well as economics. In times of fear and pessimism (like today), prices tend to be low. In times of optimism and confidence (like the 1990s), they tend to be high. Business values, however, are determined by the earnings and dividends of the underlying companies. As a result, value is independent of emotions. It is the relationship between subjective prices and objective value that drives our outlook at any given time. Today, after years of falling prices and rising business values, our outlook is especially positive. The S&P 500® Index currently has a dividend yield that is higher than the risk-free rate and an earnings yield that is more than twice the coupon on 10 year government bonds. In addition, the fact that earnings and dividends have some component of inflation protection makes stocks particularly attractive in comparison with bonds at today’s prices.

More important, based on the strength, growth prospects and valuations of the particular companies we own, we are especially bullish about the outlook for our Portfolio. These companies have both the durability and resilience to weather the inevitable shocks as well as a proven record of adapting and growing through all different economic and business environments. In our view, the gap between the growing value of the companies we own and their current market prices is as wide as we have seen in our careers. As mentioned earlier, we estimate our companies on average are currently priced at somewhere between 9.5-11.5 times our estimate of the owner earnings they should generate two to three years from now. Looked at another way, we estimate the companies held in Clipper Fund on average should generate an earnings yield of 8.5%-10.5% by 2013. Although predicting the short-term direction of stock prices is a fool’s game, we are confident this wide gap between price and value will eventually close resulting in stronger returns on both an absolute and relative basis in the years ahead.

One final goal of these reports is to demystify the fundamentals of investing and particularly highlight areas of the capital markets in which we think investors are behaving irrationally. We do so not to cast stones at others but because we recognize investor returns come from both the performance of the underlying asset they own as well as the timing of their decision to buy or sell that asset. In most cases, this timing decision is costly because of the persistent tendency of investors to want to do today what they wish they had done yesterday. As a result, investors buy what has already gone up and lose interest in what has already gone down. By reminding our shareholders that the fundamental laws of economics and the basic tenets of common sense are timeless, we hope to make an indirect contribution to their returns by giving them data that will help them stay the course when times are uncertain and resist the tendency to get caught up in the fads and manias being pushed by promoters and pundits.

Today, long-term investing in a portfolio of carefully selected companies is, to say the least, unfashionable. New trading strategies, asset allocation models, ETFs, fixed income securities, alternative investments, and hedge funds are all attracting more interest and more dollars. We could not disagree more strongly with this behavior. A decade of falling prices and rising values has made stocks a bargain. We want to do all we can to ensure that clients and shareholders who stayed with us through these difficult times can benefit from the bargain prices produced by the current disinterest in equities.

Not a part of Semi-Annual Report to Fund shareholders

11

|

CLIPPER FUNDSM

|

Shareholder Letter – (Continued)

|

Before ending this report, we want to thank our colleagues. We have the best team of analysts we have ever had in terms of character and capability. We are often given credit for their work and do not want to miss this chance to acknowledge their hard work and dedication.

On behalf of all of us at Davis Advisors, we thank you for your continued trust.

Sincerely,

Christopher C. Davis Kenneth Charles Feinberg

President & Portfolio Manager Portfolio Manager

August 5, 2011

Not a part of Semi-Annual Report to Fund shareholders

12

|

CLIPPER FUNDSM

|

Shareholder Letter – (Continued)

|

This material is authorized for use by existing Clipper Fund and Davis New York Venture Fund shareholders. A current Clipper Fund and Davis New York Venture Fund prospectus must accompany or precede this material if it is distributed to prospective shareholders. You should carefully consider the Funds’ investment objective, risks, charges, fees, and expenses before investing. Read the prospectus carefully before you invest or send money.

This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. These comments may also include the expression of opinions that are speculative in nature and should not be relied on as statements of fact. Equity markets are volatile and an investor may lose money.

Clipper Fund’s investment objective is long-term capital growth and capital preservation. Davis New York Venture Fund’s investment objective is long-term growth of capital. There can be no assurance that either Fund will achieve its objective. The Funds invest primarily in equity securities issued by large companies with market capitalizations of at least $10 billion. Some important risks of an investment in the Funds are: stock market risk (CF, DNYVF): stock markets tend to move in cycles, with periods of rising prices and periods of falling prices, including the possibility of sharp declines; manager risk (CF, DNYVF): poor security selection or focus on securities in a particular sector, category, or group of companies may cause the Fund to underperform relevant benchmarks or other funds with a similar investment objective; common stock risk (CF, DNYVF): common stock represents an ownership position in a company. An adverse event may have a negative impact on a company and could result in a decline in the price of its common stock. Common stock is generally subordinate to an issuer’s other securities, including preferred, convertible, and debt securities; focused portfolio risk (CF): funds that invest in a limited number of companies may have more risk because changes in the value of a single security may have a more significant effect, either negative or positive, on the value of the Fund’s total portfolio; financial services risk (CF, DNYVF): investing a significant portion of assets in the financial services sector may cause the Fund to be more sensitive to problem affecting financial companies; under $10 billion market capitalization risk (CF): small- and mid-size companies typically have more limited product lines, markets and financial resources than larger companies, and their securities may trade less frequently and in more limited volume than those of larger, more mature companies; headline risk (CF, DNYVF): the Fund may invest in a company when the company becomes the center of controversy after receiving adverse media attention concerning its operations, long-term prospects, or management or for other reasons. While Davis Advisors researches companies subject to such contingencies, it cannot be correct every time, and the company’s stock may never recover or may become worthless; fees and expenses risk (CF, DNYVF): the Fund may not earn enough through income and capital appreciation to offset the operating expenses of the Fund. All mutual funds incur operating fees and expenses. Fees and expenses reduce the return which a shareholder may earn by investing in a fund, even when a fund has favorable performance. A low return environment, or a bear market, increases the risk that a shareholder may lose money; and foreign country risk (CF, DNYVF): foreign companies may be subject to greater risk as foreign economies may not be as strong or diversified, foreign political systems may not be as stable, and foreign financial reporting standards may not be as rigorous as they are in the United States. As of June 30, 2011, the Clipper Fund had approximately 15.1% of assets invested in foreign companies. As of June 30, 2011, the Davis New York Venture Fund had approximately 18.3% of assets invested in foreign companies. See the prospectuses for complete listings of the principal risks.

Davis Advisors is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy and approach. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. Forward-looking statements can be identified by words like “believe,” “expect,” “anticipate,” or similar expressions. You should not place undue reliance on forward-looking statements, which are current as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate.

13

|

CLIPPER FUNDSM

|

Shareholder Letter – (Continued)

|

The information provided in this material should not be considered a recommendation to buy, sell, or hold any particular security. As of June 30, 2011, Clipper Fund had invested the following percentages of its assets in the companies listed:

|

American Express

|

10.24%

|

Loews Corp.

|

6.15%

|

|

|

Bank of New York Mellon

|

4.61%

|

Merck

|

3.12%

|

|

|

Bed Bath and Beyond

|

1.27%

|

Microsoft

|

1.31%

|

|

|

Berkshire Hathaway

|

7.04%

|

Oaktree Capital

|

9.38%

|

|

|

Canadian Natural Resources

|

8.42%

|

Procter & Gamble

|

2.48%

|

|

|

Costco

|

10.22%

|

RHJ International

|

2.76%

|

|

|

CVS Caremark

|

5.37%

|

Roche

|

0.92%

|

|

|

Diageo

|

0.72%

|

SKBHC Holdings

|

0.29%

|

|

|

Goldman Sachs

|

0.81%

|

Texas Instruments

|

1.94%

|

|

|

Harley-Davidson

|

5.10%

|

Wells Fargo

|

1.11%

|

|

|

Hewlett-Packard

|

1.99%

|

The information provided in this material should not be considered a recommendation to buy, sell, or hold any particular security. As of June 30, 2011, Davis New York Venture Fund had invested the following percentages of its assets in the companies listed:

|

American Express

|

4.87%

|

Harley-Davidson

|

0.87%

|

|

|

Bank of New York Mellon

|

4.33%

|

Hewlett-Packard

|

0.75%

|

|

|

Bed Bath & Beyond

|

2.32%

|

Loews Corp.

|

3.34%

|

|

|

Berkshire Hathaway

|

1.88%

|

Merck

|

2.98%

|

|

|

Canadian Natural Resources

|

3.01%

|

Microsoft

|

1.13%

|

|

|

Costco Wholesale

|

4.53%

|

Procter & Gamble

|

0.75%

|

|

|

CVS Caremark

|

3.97%

|

Roche

|

2.08%

|

|

|

Diageo

|

1.13%

|

Texas Instruments

|

1.70%

|

|

|

Goldman Sachs

|

0.44%

|

Wells Fargo

|

4.12%

|

The Funds have adopted Portfolio Holdings Disclosure policies that govern the release of non-public portfolio holding information. These policies are described in the prospectuses. For Clipper Fund, visit clipperfund.com or call 800-432-2504 for the most current public portfolio holdings information. For Davis New York Venture Fund, visit davisfunds.com or call 800-279-0279 for the most current public portfolio holdings information.

Rolling Returns. Davis New York Venture Fund’s average annual total returns for Class A shares were compared against the returns earned by the S&P 500® Index as of December 31 of each of the rolling periods discussed from 1969 through 2010. The Fund’s returns assume an investment in Class A shares on January 1 of each year with all dividends and capital gain distributions reinvested for the periods indicated. The returns are not adjusted for any sales charge that may be imposed. If a sales charge were imposed, the reported figures would be lower. The figures shown reflect past results; past performance is not a guarantee of future results. There can be no guarantee that the Fund will continue to deliver consistent investment performance. The performance presented includes periods of bear markets when performance was negative. Equity markets are volatile and an investor may lose money. Returns for other share classes will vary.

Clipper Fund was managed from inception, February 29, 1984, until December 31, 2005 by another Adviser. Davis Selected Advisers, L.P. took over management of the Fund on January 1, 2006.

We gather our index data from a combination of reputable sources, including, but not limited to, Thomson Financial, Lipper, and index websites.

Broker-dealers and other financial intermediaries may charge Davis Advisors substantial fees for selling its funds and providing continuing support to clients and shareholders. For example, broker-dealers and other financial intermediaries may charge: sales commissions; distribution and service fees; and record-keeping fees. In addition, payments or reimbursements may be requested for: marketing support concerning Davis Advisors’ products; placement on a list of offered products;

Not a part of Semi-Annual Report to Fund shareholders

14

|

CLIPPER FUNDSM

|

Shareholder Letter – (Continued)

|

access to sales meetings, sales representatives and management representatives; and participation in conferences or seminars, sales or training programs for invited registered representatives and other employees, client and investor events, and other dealer-sponsored events. Financial advisors should not consider Davis Advisors’ payment(s) to a financial intermediary as a basis for recommending Davis Advisors.

The S&P 500® Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Index is adjusted for dividends, weighted towards stocks with large market capitalizations and represents approximately two-thirds of the total market value of all domestic common stocks. Investments cannot be made directly in an index.

Alpha is the incremental return of a manager when the market is stationary. This risk-adjusted factor takes into account both the performance of the market as a whole and the volatility of the manager. A positive alpha indicates that a manager has produced returns above the expected level at that risk level, and vice versa for a negative alpha.

This is not a solicitation for Vanguard 500 Index Fund.

After October 31, 2011, this material must be accompanied by a supplement containing performance data for the most recent quarter end.

Shares of the Clipper Fund and the Davis New York Venture Fund are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including possible loss of the principal amount invested.

06/11 Davis Distributors, LLC, 2949 East Elvira Road, Suite 101, Tucson, AZ 85756, 800-432-2504, clipperfund.com

Not a part of Semi-Annual Report to Fund shareholders

15

|

CLIPPER FUNDSM

|

Management’s Discussion of Fund Performance

|

Performance Overview

Clipper Fund delivered a total return on net asset value of 8.07% for the six-month period ended June 30, 2011. Over the same time period, the Standard & Poor’s 500® Index (“Index”) returned 6.02%. Every sector1 within the Index, except for financials, delivered positive returns over the six-month period. The sectors within the Index that turned in the strongest performance over the six-month period were health care and energy. The sectors within the Index that turned in the weakest performance over the six-month period were financials and information technology.

Factors Impacting the Fund’s Performance

The Fund continued to have more invested in financial companies than in any other sector and they were the most important contributor2 to performance, both on an absolute basis and relative to the Index. The Fund’s financial companies out-performed the corresponding sector within the Index (up 8% versus down 3% for the Index), but had a higher relative average weighting (48% versus 16% for the Index) in this weaker performing sector. Oaktree3 and American Express were among the most important contributors to performance. Bank of New York Mellon, RHJ International, and Berkshire Hathaway were among the most important detractors from performance.

Consumer staple companies were also an important contributor to performance. The Fund’s consumer staple companies out-performed the corresponding sector within the Index (up 10% versus up 8% for the Index) and had a higher relative average weighting (20% versus 10% for the Index). Costco Wholesale was among the most important contributors to performance.

Energy companies were the most important detractor from performance relative to the Index. The Fund’s energy companies under-performed the corresponding sector within the Index (down 3% versus up 11% for the Index) and had a lower relative average weighting (11% versus 13% for the Index) in this stronger performing sector. Canadian Natural Resources was among the most important detractors from performance.

Other important contributors to performance included Harley-Davidson and Iron Mountain. Another important detractor from performance was Hewlett-Packard.

The Fund had approximately 15% of its net assets invested in foreign companies at June 30, 2011. As a whole, those companies under-performed the domestic companies held by the Fund.

Clipper Fund’s investment objective is to seek long-term capital growth and capital preservation. There can be no assurance that the Fund will achieve its objective. Clipper Fund’s principal risks are: stock market risk, manager risk, common stock risk, focused portfolio risk, financial services risk, foreign country risk, under $10 billion market capitalization risk, headline risk, and fees and expenses risk. See the prospectus for a full description of each risk.

1 The companies included in the Standard & Poor’s 500® Index are divided into ten sectors. One or more industry groups make up a sector.

2 A company’s or sector’s contribution to or detraction from the Fund’s performance is a product both of its appreciation or depreciation and its weighting within the Fund. For example, a 5% holding that rises 20% has twice as much impact as a 1% holding that rises 50%.

3 This Management Discussion of Fund Performance discusses a number of individual companies. The information provided in this report does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular security. The Schedule of Investments lists the Fund’s holdings of each company discussed.

16

|

CLIPPER FUNDSM

|

Management’s Discussion of Fund Performance – (Continued)

|

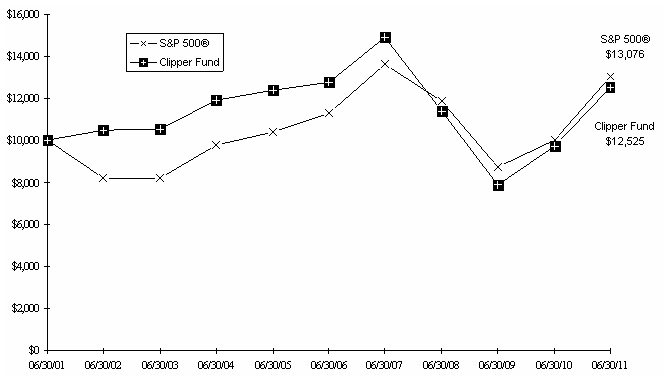

Comparison of a $10,000 investment in Clipper Fund versus the Standard & Poor’s 500® Index over 10 years for an investment made on June 30, 2001

Average Annual Total Return for periods ended June 30, 2011

|

Fund & Benchmark Index

|

1-Year

|

5-Year

|

10-Year

|

Since Fund’s Inception

(02/29/84)

|

Gross

Expense

Ratio

|

Net

Expense

Ratio

|

|

Clipper Fund

|

28.95%

|

(0.41)%

|

2.28%

|

11.58%

|

0.76%

|

0.76%

|

|

Standard & Poor’s 500® Index

|

30.69%

|

2.94%

|

2.72%

|

10.81%

|

In 2009, the Fund received favorable class action settlements from companies which it no longer owns. These settlements had a material impact on the investment performance of the Fund, adding approximately 5% to the Fund’s total return in 2009. This was a one time event that is unlikely to be repeated.

The Standard & Poor’s 500® Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Index is adjusted for dividends, weighted towards stocks with large market capitalizations, and represents approximately two-thirds of the total market value of all domestic common stocks. Investments cannot be made directly in the Index.

The performance data for Clipper Fund contained in this report represents past performance and assumes that all distributions were reinvested, and should not be considered as an indication of future performance from an investment in the Fund today. The investment return and principal value will fluctuate so that shares may be worth more or less than their original cost when redeemed. Fund performance changes over time and current performance may be higher or lower than stated. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The operating expense ratio may vary in future years. For more current information please call Clipper Fund Investor Services at 1-800-432-2504.

Davis Selected Advisers, L.P. began serving as investment adviser to Clipper Fund on January 1, 2006. A different investment adviser managed the Fund through December 31, 2005.

17

|

CLIPPER FUNDSM

|

Fund Overview

|

|

June 30, 2011 (Unaudited)

|

|

Portfolio Composition

|

Industry Weightings

|

|||||

|

(% of Fund’s 06/30/11 Net Assets)

|

(% of 06/30/11 Stock Holdings)

|

|||||

|

Fund

|

S&P 500®

|

|||||

|

Common Stock (U.S.)

|

84.01%

|

Diversified Financials

|

31.35%

|

6.89%

|

||

|

Common Stock (Foreign)

|

15.07%

|

Insurance

|

17.18%

|

3.75%

|

||

|

Short-Term Investments

|

0.87%

|

Food & Staples Retailing

|

16.47%

|

2.32%

|

||

|

Other Assets & Liabilities

|

0.05%

|

Energy

|

8.50%

|

12.78%

|

||

|

100.00%

|

Commercial & Professional Services

|

6.05%

|

0.58%

|

|||

|

Information Technology

|

5.29%

|

17.77%

|

||||

|

Automobiles & Components

|

5.15%

|

0.78%

|

||||

|

Health Care

|

4.08%

|

11.70%

|

||||

|

Household & Personal Products

|

2.50%

|

2.32%

|

||||

|

Banks

|

1.41%

|

2.76%

|

||||

|

Retailing

|

1.29%

|

3.57%

|

||||

|

Food, Beverage & Tobacco

|

0.73%

|

5.98%

|

||||

|

Other

|

−%

|

28.80%

|

||||

|

100.00%

|

100.00%

|

|||||

Top 10 Long-Term Holdings

(% of Fund’s 06/30/11 Net Assets)

|

American Express Co.

|

Consumer Finance

|

10.24%

|

|

|

Costco Wholesale Corp.

|

Food & Staples Retailing

|

10.22%

|

|

|

Oaktree Capital Group LLC, Class A, 144A

|

Diversified Financial Services

|

9.38%

|

|

|

Canadian Natural Resources Ltd.

|

Energy

|

8.42%

|

|

|

Berkshire Hathaway Inc., Class A

|

Property & Casualty Insurance

|

7.04%

|

|

|

Loews Corp.

|

Multi-line Insurance

|

6.15%

|

|

|

Iron Mountain Inc.

|

Commercial & Professional Services

|

6.00%

|

|

|

CVS Caremark Corp.

|

Food & Staples Retailing

|

5.37%

|

|

|

Harley-Davidson, Inc.

|

Automobiles & Components

|

5.10%

|

|

|

Bank of New York Mellon Corp.

|

Capital Markets

|

4.61%

|

18

|

CLIPPER FUNDSM

|

Expense Example (Unaudited)

|

Example

As a shareholder of the Fund, you incur ongoing costs only, including advisory and administrative fees and other Fund expenses. The Expense Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Expense Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated, which is for the six-month period ended June 30, 2011.

Actual Expenses