CNB FINANCIAL CORP/PA0000736772DEF 14Afalse00007367722022-01-012022-12-310000736772ccne:MichaelDPeduzziMember2022-01-012022-12-31iso4217:USD0000736772ccne:JosephBBowerJrMember2022-01-012022-12-31iso4217:USDxbrli:shares0000736772ccne:JosephBBowerJrMember2021-01-012021-12-3100007367722021-01-012021-12-310000736772ccne:JosephBBowerJrMember2020-01-012020-12-3100007367722020-01-012020-12-3100007367722022-01-012022-12-300000736772ccne:SCTRestrictedStockAwardsMemberccne:MichaelDPeduzziMemberecd:PeoMember2022-01-012022-12-310000736772ccne:FairValueOfNewUnvestedEquityAwardsMemberccne:MichaelDPeduzziMemberecd:PeoMember2022-01-012022-12-310000736772ccne:ChangeInFairValueOfExistingUnvestedEquityAwardsMemberccne:MichaelDPeduzziMemberecd:PeoMember2022-01-012022-12-310000736772ccne:ChangeInFairValueOfVestingEquityAwardsMemberccne:MichaelDPeduzziMemberecd:PeoMember2022-01-012022-12-310000736772ccne:MichaelDPeduzziMemberccne:DividendsOnUnvestedEquityAwardsMemberecd:PeoMember2022-01-012022-12-310000736772ccne:SCTChangeInPensionValueNonqualifiedDeferredCompensationEarningsMemberccne:MichaelDPeduzziMemberecd:PeoMember2022-01-012022-12-310000736772ccne:ServiceCostPriorServiceCostMemberccne:MichaelDPeduzziMemberecd:PeoMember2022-01-012022-12-310000736772ccne:SCTRestrictedStockAwardsMemberccne:JosephBBowerJrMemberecd:PeoMember2022-01-012022-12-310000736772ccne:SCTRestrictedStockAwardsMemberccne:JosephBBowerJrMemberecd:PeoMember2021-01-012021-12-310000736772ccne:SCTRestrictedStockAwardsMemberccne:JosephBBowerJrMemberecd:PeoMember2020-01-012020-12-310000736772ccne:JosephBBowerJrMemberccne:FairValueOfNewUnvestedEquityAwardsMemberecd:PeoMember2022-01-012022-12-310000736772ccne:JosephBBowerJrMemberccne:FairValueOfNewUnvestedEquityAwardsMemberecd:PeoMember2021-01-012021-12-310000736772ccne:JosephBBowerJrMemberccne:FairValueOfNewUnvestedEquityAwardsMemberecd:PeoMember2020-01-012020-12-310000736772ccne:ChangeInFairValueOfExistingUnvestedEquityAwardsMemberccne:JosephBBowerJrMemberecd:PeoMember2022-01-012022-12-310000736772ccne:ChangeInFairValueOfExistingUnvestedEquityAwardsMemberccne:JosephBBowerJrMemberecd:PeoMember2021-01-012021-12-310000736772ccne:ChangeInFairValueOfExistingUnvestedEquityAwardsMemberccne:JosephBBowerJrMemberecd:PeoMember2020-01-012020-12-310000736772ccne:ChangeInFairValueOfVestingEquityAwardsMemberccne:JosephBBowerJrMemberecd:PeoMember2022-01-012022-12-310000736772ccne:ChangeInFairValueOfVestingEquityAwardsMemberccne:JosephBBowerJrMemberecd:PeoMember2021-01-012021-12-310000736772ccne:ChangeInFairValueOfVestingEquityAwardsMemberccne:JosephBBowerJrMemberecd:PeoMember2020-01-012020-12-310000736772ccne:JosephBBowerJrMemberccne:FairValueOfNewVestedEquityAwardsMemberecd:PeoMember2022-01-012022-12-310000736772ccne:JosephBBowerJrMemberccne:FairValueOfNewVestedEquityAwardsMemberecd:PeoMember2021-01-012021-12-310000736772ccne:JosephBBowerJrMemberccne:FairValueOfNewVestedEquityAwardsMemberecd:PeoMember2020-01-012020-12-310000736772ccne:FairValueAsOfPriorYearEndOfEquityAwardsForfeitedMemberccne:JosephBBowerJrMemberecd:PeoMember2022-01-012022-12-310000736772ccne:FairValueAsOfPriorYearEndOfEquityAwardsForfeitedMemberccne:JosephBBowerJrMemberecd:PeoMember2021-01-012021-12-310000736772ccne:FairValueAsOfPriorYearEndOfEquityAwardsForfeitedMemberccne:JosephBBowerJrMemberecd:PeoMember2020-01-012020-12-310000736772ccne:JosephBBowerJrMemberccne:DividendsOnUnvestedEquityAwardsMemberecd:PeoMember2022-01-012022-12-310000736772ccne:JosephBBowerJrMemberccne:DividendsOnUnvestedEquityAwardsMemberecd:PeoMember2021-01-012021-12-310000736772ccne:JosephBBowerJrMemberccne:DividendsOnUnvestedEquityAwardsMemberecd:PeoMember2020-01-012020-12-310000736772ccne:SCTChangeInPensionValueNonqualifiedDeferredCompensationEarningsMemberccne:JosephBBowerJrMemberecd:PeoMember2022-01-012022-12-310000736772ccne:SCTChangeInPensionValueNonqualifiedDeferredCompensationEarningsMemberccne:JosephBBowerJrMemberecd:PeoMember2021-01-012021-12-310000736772ccne:SCTChangeInPensionValueNonqualifiedDeferredCompensationEarningsMemberccne:JosephBBowerJrMemberecd:PeoMember2020-01-012020-12-310000736772ccne:JosephBBowerJrMemberccne:ServiceCostPriorServiceCostMemberecd:PeoMember2022-01-012022-12-310000736772ccne:JosephBBowerJrMemberccne:ServiceCostPriorServiceCostMemberecd:PeoMember2021-01-012021-12-310000736772ccne:JosephBBowerJrMemberccne:ServiceCostPriorServiceCostMemberecd:PeoMember2020-01-012020-12-310000736772ccne:SCTRestrictedStockAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000736772ccne:SCTRestrictedStockAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000736772ccne:SCTRestrictedStockAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000736772ccne:FairValueOfNewUnvestedEquityAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000736772ccne:FairValueOfNewUnvestedEquityAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000736772ccne:FairValueOfNewUnvestedEquityAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000736772ccne:ChangeInFairValueOfExistingUnvestedEquityAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000736772ccne:ChangeInFairValueOfExistingUnvestedEquityAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000736772ccne:ChangeInFairValueOfExistingUnvestedEquityAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000736772ccne:ChangeInFairValueOfVestingEquityAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000736772ccne:ChangeInFairValueOfVestingEquityAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000736772ccne:ChangeInFairValueOfVestingEquityAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000736772ecd:NonPeoNeoMemberccne:DividendsOnUnvestedEquityAwardsMember2022-01-012022-12-310000736772ecd:NonPeoNeoMemberccne:DividendsOnUnvestedEquityAwardsMember2021-01-012021-12-310000736772ecd:NonPeoNeoMemberccne:DividendsOnUnvestedEquityAwardsMember2020-01-012020-12-310000736772ccne:SCTChangeInPensionValueNonqualifiedDeferredCompensationEarningsMemberecd:NonPeoNeoMember2022-01-012022-12-310000736772ccne:SCTChangeInPensionValueNonqualifiedDeferredCompensationEarningsMemberecd:NonPeoNeoMember2021-01-012021-12-310000736772ccne:SCTChangeInPensionValueNonqualifiedDeferredCompensationEarningsMemberecd:NonPeoNeoMember2020-01-012020-12-310000736772ccne:ServiceCostPriorServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310000736772ccne:ServiceCostPriorServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310000736772ccne:ServiceCostPriorServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-31000073677212022-01-012022-12-31000073677222022-01-012022-12-31000073677232022-01-012022-12-31000073677242022-01-012022-12-31000073677252022-01-012022-12-31000073677262022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | | | | |

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14(a)-6(e)(2)) |

| |

| ☒ | Definitive Proxy Statement |

| |

| ☐ | Definitive Additional Materials |

| |

| ☐ | Soliciting Material under §240.14a-12 |

CNB Financial Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| ☒ | No fee required |

| |

| ☐ | Fee paid previously with preliminary materials. |

| |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14-a6(i)(1) and 0-11. |

1 South Second Street

P.O. Box 42

Clearfield, PA 16830

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO OUR SHAREHOLDERS:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of CNB FINANCIAL CORPORATION will be held virtually only via a live webcast exclusively at http://www.viewproxy.com/CNBFinancial/2023/vm. Please register in advance of the virtual meeting by visiting www.viewproxy.com/CNBFinancial/2023. For procedures on attending the virtual meeting, please refer to the section titled “About the Meeting” beginning on page 1. The virtual meeting will be held on Tuesday, April 18, 2023, beginning at 2:00 p.m. (EDT) for the following purposes:

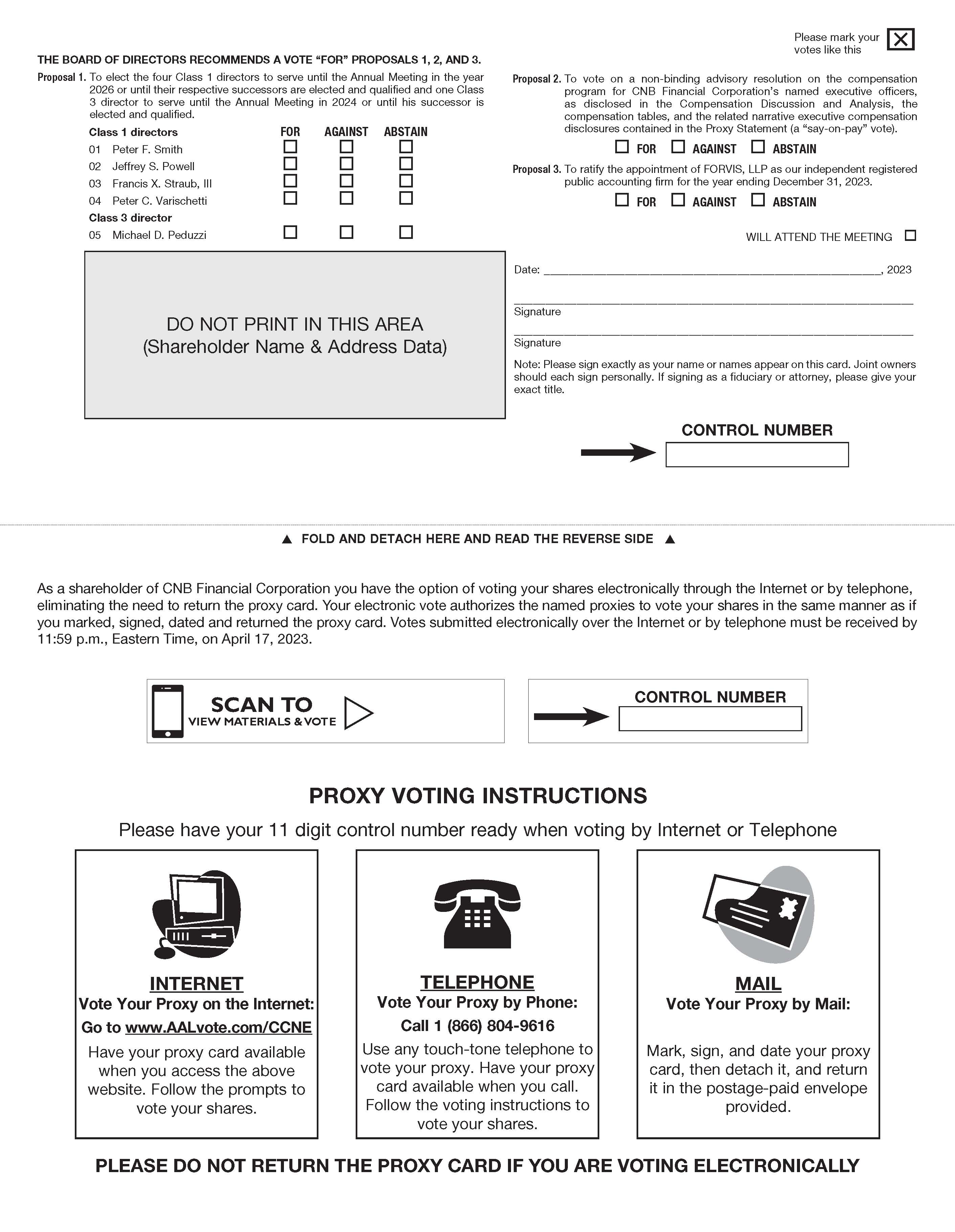

1.ELECTION OF DIRECTORS: To elect the four Class 1 directors to serve until the Annual Meeting in the year 2026 or until their respective successors are elected and qualified and one Class 3 director to serve until the Annual Meeting in 2024 or until his successor is elected and qualified.

2.SAY-ON-PAY VOTE: To vote on a non-binding advisory resolution on the compensation program for CNB Financial Corporation’s Named Executive Officers, as disclosed in the Compensation Discussion and Analysis, and compensation tables, and related narrative executive compensation disclosures contained in the Proxy Statement (a “say-on-pay” vote).

3.RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM: To ratify the appointment of FORVIS, LLP as our independent registered public accounting firm for the year ending December 31, 2023.

4.TRANSACTION OF OTHER BUSINESS: To transact such other business as may properly come before the meeting or any adjournment thereof.

The Board of Directors of CNB Financial Corporation fixed February 21, 2023, as the record date for the determination of shareholders entitled to notice of and to vote at the meeting. Only shareholders of record at the close of business on that date will be entitled to notice of and to vote at the Annual Meeting or any adjournments thereof.

The Annual Report on Form 10-K for the year ended December 31, 2022, the 2022 Annual Report, and the Proxy Statement and form of proxy for the meeting are enclosed.

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE ANNUAL MEETING. YOU ARE URGED TO SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD WHETHER OR NOT YOU PLAN TO VIRTUALLY ATTEND THE MEETING. PLEASE RETURN THE PROXY CARD AS PROMPTLY AS POSSIBLE. THE BOARD RECOMMENDS A VOTE “FOR” EACH OF PROPOSALS ONE, TWO AND THREE DESCRIBED ABOVE. YOU MAY WITHDRAW OR CHANGE YOUR PROXY AT ANY TIME BEFORE IT IS OFFICIALLY REGISTERED AS VOTED BY SO NOTIFYING THE SECRETARY AND VOTING YOUR SHARES WHILE THE POLLS ARE OPEN DURING THE VIRTUAL ANNUAL MEETING.

By Order of the Board,

Richard L. Greslick, Jr., Secretary

Clearfield, Pennsylvania

March 9, 2023

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held virtually only on April 18, 2023. This Proxy Statement, along with our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and our separate 2022 Annual Report document which includes, among other information, listings of the Directors and Officers of CNB Financial Corporation and its subsidiaries, are available free of charge on the Investor Relations section of our website (www.cnbbank.bank).

TABLE OF CONTENTS

CNB FINANCIAL CORPORATION

1 SOUTH SECOND STREET

CLEARFIELD, PA 16830-0042

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD VIRTUALLY

TUESDAY, APRIL 18, 2023, 2:00 p.m. (EDT)

ABOUT THE MEETING

General Information

This Proxy Statement is furnished to shareholders of CNB Financial Corporation (the “Corporation”) in connection with the solicitation of proxies on behalf of the Board of Directors of the Corporation (the “Board”) for use at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Tuesday, April 18, 2023 at 2:00 p.m. (EDT).

The Corporation is a Pennsylvania business corporation and a financial holding company registered with the Federal Reserve Board and has its principal offices at CNB Bank, 1 South Second Street, Clearfield, Pennsylvania 16830. The subsidiaries of the Corporation are CNB Bank (“CNB Bank” or the “Bank”), CNB Securities Corporation, CNB Risk Management, Inc., Holiday Financial Services Corporation and CNB Insurance Agency.

Unless otherwise directed, proxies solicited hereby will be voted FOR the election as directors of the nominees named under the caption: “Proposal 1. Election of Directors;” FOR approval of the non-binding advisory resolution on the compensation program for our NEOs (as defined below) under the caption: “Proposal 2. Advisory Vote on Executive Compensation;” and FOR ratification of the appointment of our independent registered public accounting firm for the year 2023 under the caption: “Proposal 3. Ratification of Appointment of Independent Registered Public Accounting Firm.” The Board is not aware of any other matters which will be presented for action at the meeting, but the persons named in the proxies intend to vote or act according to their discretion with respect to any other proposal which may be presented for shareholder action at the Annual Meeting.

Solicitation

The enclosed proxy is being solicited by the Board. The cost of preparing, assembling and mailing the notice of annual meeting, proxy statement and form of proxy is to be borne by the Corporation. In addition to the solicitation of proxies by use of mail, directors, officers or other employees of the Corporation may solicit proxies personally or by telephone and the Corporation may request certain persons holding stock in their names or in the names of their nominees to obtain proxies from and send proxy material to the principals and will reimburse such persons for their expenses in so doing. Directors, officers, or other employees so utilized will not receive special compensation for such efforts. The date on which this Proxy Statement and the accompanying form of proxy was first mailed to shareholders was on or around March 9, 2023.

Quorum; Voting

A quorum for the transaction of business at the Annual Meeting will require the presence, through virtual confirmed attendance, or by proxy, of shareholders entitled to cast at least a majority of the votes that all shareholders are entitled to cast on a particular matter to be acted upon at the meeting. Abstentions are counted as shares present for determination of a quorum but are not counted as affirmative or negative votes and are not counted in determining the number of votes cast on any matter. The affirmative vote of a majority of the votes cast by all shareholders entitled to vote on the matter is required for the approval of all matters under consideration at the Annual Meeting. Shareholders have one vote for each share held.

Revocation of Proxies

The enclosed proxy is revocable at any time prior to the actual voting of such proxy by the filing of a written notice revoking it, or a duly executed proxy bearing a later date, with Richard L. Greslick, Jr., the Secretary of the Corporation. In the event your proxy is mailed and you virtually attend the meeting, you have the right to revoke your proxy and cast your vote personally using the instructions included under the section titled “Attending the Virtual Annual Meeting” which begins on page 2 of this Proxy Statement. All properly executed proxies delivered to us pursuant to this solicitation will be voted at the meeting in accordance with your instructions, if any.

Eligibility to Vote; Record Date

The securities that can be voted at the Annual Meeting consist of shares of common stock of the Corporation with each share entitling its owner to one vote on all matters properly presented at the meeting. There is no cumulative voting of shares. The Board has fixed the close of business on February 21, 2023, as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting. On the record date, there were 21,217,777 shares of common stock then outstanding and eligible to be voted at the Annual Meeting. As of that date, all executive officers and directors of the Corporation as a group (22 persons) beneficially owned 599,690 shares, or 2.83%, of the total number of outstanding shares.

Voting Procedures

Whether you hold shares directly as a registered shareholder of record or beneficially in street name, you may vote without virtually attending the Annual Meeting. You may vote by granting a proxy or, for shares held beneficially in street name, by submitting voting instructions to your broker, bank or other trustee or nominee. In most cases, you will be able to do this by using the internet, by telephone or by mail.

•Voting by internet or telephone - You may submit your proxy over the internet or by telephone by following the instructions for internet or telephone voting provided with your proxy materials and on your proxy card or voter instruction form.

•Voting by mail - You may submit your proxy by mail by completing, signing, dating and returning your proxy card or, for shares held beneficially in street name, by following the voting instructions included by your broker or other intermediary. If you provide specific voting instructions, your shares will be voted as you have instructed.

The proposal to ratify the appointment of independent auditors (Proposal 3) is considered a “discretionary” item. This means that brokerage firms may vote in their discretion on this matter on behalf of clients who have not furnished voting instructions. In contrast, the proposals with respect to the election of directors (Proposal 1) and “say-on-pay” (Proposal 2) are “non-discretionary” items. This means brokerage firms that have not received voting instructions from their clients on these matters may not vote on these proposals. These so-called “broker non-votes” will not be considered in determining the number of votes necessary for approval and, therefore, will have no effect on the outcome of the vote for these proposals.

Attending the Virtual Annual Meeting

Shareholders at the virtual Annual Meeting will have the same rights as at an in-person meeting, including the rights to vote and ask questions at the virtual meeting. Both shareholders of record and street name shareholders who wish to virtually attend the Annual Meeting will need to register to be able to attend the Annual Meeting via live webcast, submit their questions during the meeting and vote their shares electronically at the Annual Meeting by following the instructions below.

If you are a shareholder of record, you must:

•Follow the instructions provided on your Notice or proxy card to first register at www.viewproxy.com/CNBFinancial/2023 by 11:59 p.m. (EDT) on April 17, 2023. You will need to enter your name, phone number, virtual control number (included on your Notice or proxy card) and email address as part of the registration, following which, you will receive an email confirmation of your registration, as well as a password to virtually attend the Annual Meeting.

•On the day of the Annual Meeting, if you have properly registered, you may enter the Annual Meeting by logging in using the password you received via email registration confirmation at http://www.viewproxy.com/CNBFinancial/2023/VM (you will need the password provided to you after you have registered to attend).

•If you wish to vote your shares electronically during the virtual Annual Meeting, you will need to visit http://www.AALvote.com/CCNE during the Annual Meeting while the polls are open (you will need the 16 digit virtual control number included on your Notice or proxy card).

If you are a street name shareholder, you must:

•Obtain a legal proxy from your broker, bank or other nominee.

•Register at www.viewproxy.com/CNBFinancial/2023 by 11:59 p.m. (EDT) on April 17, 2023. You will need to enter your name, phone number and email address, and provide a copy of the legal proxy (which may be uploaded to the registration website or sent via email to VirtualMeeting@viewproxy.com) as part of the registration, following which, you will receive an email confirming your registration, your virtual control number, as well as the password to virtually attend the Annual Meeting. Please note, if you do not provide a copy of the legal proxy, you may still attend the Annual Meeting but you will be unable to vote your shares electronically at the Annual Meeting.

•On the day of the Annual Meeting, if you have properly registered, you may enter the Annual Meeting by logging in using the password you received via email in your registration confirmation at http://www.viewproxy.com/CNBFinancial/2023/VM (you will need the virtual control number assigned to you in your registration confirmation email).

•If you wish to vote your shares electronically at the virtual Annual Meeting, you will need to visit http://www.AALvote.com/CCNE during the Annual Meeting while the polls are open (you will need the virtual control number assigned to you in your registration confirmation email). Further instructions on how to attend the Annual Meeting via live audio webcast, including how to vote your shares electronically at the Annual Meeting are posted on www.viewproxy.com/CNBFinancial/2023 under Frequently Asked Questions (FAQ). The Annual Meeting live webcast will begin promptly at 2:00 p.m. (EDT) on April 18, 2023. We encourage you to access the meeting prior to the start time. Online check-in will begin at 1:30 p.m. (EDT), and you should allow ample time for the check-in procedures.

Live Q&A

You may ask questions during the virtual meeting by following the instructions that will be available on the virtual meeting website during the meeting. We will answer questions as they come in and address those asked in advance, to the extent relevant to the business of the Annual Meeting, as time permits. Off-topic, personal or other inappropriate questions will not be answered.

Technical Assistance

We will have technicians ready to assist you with any technical difficulties you may have accessing the Annual Meeting live webcast. Please be sure to check in by 1:30 p.m. (EDT) on April 18, 2023, the day of the Annual Meeting, so we may address any technical difficulties before the Annual Meeting live audio webcast begins. If you encounter any difficulties accessing the Annual Meeting live webcast during the check-in or meeting time, please email VirtualMeeting@viewproxy.com or call 1-866-612-8937.

The platform we are using for the Annual Meeting live webcast will require you to install a software or have the ability to run a temporary application in order for you to join the Annual Meeting live webcast. If you have not registered to attend the meeting, but would like to listen in only on the day of the meeting at 2:00 p.m. the toll-free number and access code will be displayed on the site www.viewproxy.com/CNBFinancial/2023.

Obtaining an Annual Report on Form 10-K

The Corporation is required to file an Annual Report on Form 10-K (the “Form 10-K”) for the 2022 fiscal year with the U.S. Securities and Exchange Commission (“SEC”). Shareholders may obtain, free of charge, a copy of the Form 10-K by writing to Richard L. Greslick, Jr., Secretary, CNB Financial Corporation, P.O. Box 42, Clearfield, Pennsylvania 16830. Our 2022 Annual Report is also available free of charge on the Investor Relations section of our website (www.cnbbank.bank).

PROPOSAL 1. ELECTION OF DIRECTORS

The Bylaws of the Corporation (the “Bylaws”) provide that the Board shall consist of not less than nine nor more than twenty-four persons. The Board has acted to fix the number of directors for the ensuing year at twelve, including ten independent directors and two directors who are also members of the Corporation’s management team.

The Bylaws further provide that the Board shall be classified into three classes with each class consisting of not less than three nor more than eight directors. The Board has elected to fix the number of each class of directors at four. One class of directors is to be elected annually for a three-year term and until their successors are elected and qualified, or until their earlier death, resignation, removal or achievement of the mandatory retirement age of 70. The four Class 1 nominees named below are nominated to serve as Class 1 directors to hold office for a three-year term expiring at the third succeeding annual meeting (in the year 2026). The one Class 3 nominee named below is nominated to serve as a Class 3 director to hold office for a one-year term expiring at the next annual meeting (in the year 2024). The Class 3 nominee replaces a previously elected Class 3 director who retired from the Board as of December 31, 2022. Each nominee has consented to be named as a nominee and has agreed to serve if elected. If, for any reason, any of the nominees named below should become unavailable to serve, the enclosed proxy will be voted for the remaining nominees and such other person or persons as the Board may select among those recommended by the Corporate Governance/Nominating Committee.

Information as to Nominees and Other Directors

The following tables set forth the names of the nominees for election as directors and the current directors of the Corporation. Also set forth in the tables is certain other information with respect to each such person’s age at December 31, 2022, the periods during which such person has served as a director of the Corporation and positions currently held with the Corporation.

Following the tables are biographies of each of the nominees and continuing directors which contain information regarding each such person’s business experience, director positions held currently or at any time during the last five years, information regarding involvement in certain legal or administrative proceedings, if applicable, and the experiences, qualifications, attributes or skills that caused the Corporate Governance/Nominating Committee and the Board to determine that such person should serve as a director as of the time of filing of this Proxy Statement. The Corporate Governance/Nominating Committee believes that each director brings a strong and unique background and set of skills to the Board, giving the Board as a whole competence and experience in a wide variety of areas, including corporate governance, board service, executive management, business, finance and marketing. “Independent” directors are those who, in the Board’s judgment, meet the standards for independence as required by NASDAQ.

NOMINEES:

The following Class 1 directors for a three-year term expiring at the time of the annual meeting in 2026.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age at

December 31,

2022 | | Business Experience (Past Five Years) | | Positions Held at CNB | | Director

Since |

| Peter F. Smith Independent Director | | 68 | | Chairperson of the Board

Attorney at Law | | — | | 9/12/1989 |

Jeffrey S. Powell

Independent Director | | 58 | | President, J.J. Powell, Inc. (Petroleum Distributor) | | — | | 12/27/1994 |

Francis X. Straub, III

Independent Director | | 62 | | President/CEO of U.S. Complete Care Inc. | | — | | 4/19/2015 |

Peter C. Varischetti

Independent Director | | 53 | | President, Varischetti Holdings, LP | | — | | 8/11/2015 |

.

The following Class 3 director for a one-year term expiring at the time of the annual meeting in 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age at

December 31,

2022 | | Business Experience (Past Five Years) | | Positions Held at CNB | | Director

Since |

| Michael D. Peduzzi | | 57 | | President and Chief Executive Officer, CNB Financial Corp. and CNB Bank President & Chief Operating Officer, CNB Bank Senior Vice President and Chief Financial Officer, Mid Penn Bancorp, Inc | | President and Chief Executive Officer, CNB Financial Corp. and CNB Bank President & Chief Operating Officer, CNB Bank | | 1/1/2023 |

Peter F. Smith obtained his Bachelor of Arts from Williams College in 1976 and later graduated from the Dickinson School of Law in 1981. He joined his late father, William U. Smith, in the general practice of law in Clearfield after graduation. Mr. Smith has continued in the practice, representing a diverse group of businesses and their owners. He concentrates his practice on commercial transactions, real estate, mineral law, estate planning and related litigation. Mr. Smith has served on the Ethics Committee of the Pennsylvania Bar Association since 1994 and has authored numerous written opinions to assist other lawyers with ethical issues, and has been invited to speak as a panelist by the Pennsylvania Bar Institute. Mr. Smith has served and continues to serve numerous charitable and public services organizations. Mr. Smith’s legal experience provides the Board with valuable insight into legal matters affecting it and its markets. Mr. Smith has strong corporate governance, lending and financial experience resulting from serving on the Board for over thirty years.

Michael D. Peduzzi joined CNB Financial Corporation as the President and Chief Operating Officer of CNB Bank in August 2021. He became CEO of CNB Bank on July 1, 2022, and became President and CEO of CNB Financial Corporation on December 31, 2022. Mr. Peduzzi has over 30 years of experience working for companies in the banking and financial services industry while maintaining his Certified Public Accounting license continuously throughout that same period. Prior to joining the Bank, Mr. Peduzzi served as an executive at other publicly-held financial institutions, including as the Senior Vice President and Chief Financial Officer of Mid Penn Bancorp, Inc. from 2016 through August 2021. He has also held Executive and Chief Financial Officer roles at Codorus Valley Bancorp and Union National Financial Corp, and was the Corporate Audit Executive for Keystone Financial Inc. Mr. Peduzzi graduated from The Pennsylvania State University with a Bachelor of Science degree in Accounting. He is a Pennsylvania-licensed Certified Public Accountant and a member of both the American Institute of Certified Public Accountants and the Pennsylvania Institute of Certified Public Accountants.

Jeffrey S. Powell serves as Audit Committee Chairperson. He is a graduate of The Pennsylvania State University where he earned a degree in Business Administration. He is currently the President of J.J. Powell Inc., a petroleum marketer, as well as Snappy’s Convenience Stores. Mr. Powell’s extensive executive experience in the petroleum marketing and retail convenience industry provide strong knowledge regarding finance, operations compliance and planning to the Board.

Francis X. Straub, III is President/CEO of U.S. Complete Care Inc. Mr. Straub brings a diverse background in healthcare and entrepreneurial culture, which began in his family’s pharmacy over 40 years ago. Mr. Straub holds a Bachelor of Science degree in the field of pharmacy from Duquesne University and is a licensed pharmacist. He has served on numerous charitable and public service boards and currently serves as Chairman of the Board of Directors at Value Drug Company, board member on the Penn Highlands Northern Regional board and board member of Straub Brewery Inc. Additionally, Mr. Straub is involved with industrial manufacturing, oil and gas production, medical services and commercial real estate development.

Peter C. Varischetti is the President of Varischetti Holdings, LP, a privately held holding company that includes businesses in the manufacturing industry, gas field services, fabrication, electrical contracting, automation & control systems, and real estate. Mr. Varischetti is also a director and officer of Guardian Healthcare Holdings, Inc., a healthcare services company providing skilled nursing, rehabilitation, pharmacy, and healthcare staffing services to communities in Pennsylvania and West Virginia. Additionally, Mr. Varischetti is the President of Varischetti Sports, LLC, which owns a minority interest in the Pittsburgh Steelers. A member of the Board of Trustees for the University of Pittsburgh, Mr. Varischetti is chairman of the Property and Facilities Committee and the School of Health and Rehabilitation Sciences Board of Visitors, and also serves on their Governance and Nominating Committee. Mr. Varischetti has served on numerous charitable and public service boards and currently serves as chairman of the Brockway Center for Arts and Technology. Additionally, he serves on the Erie Diocesan Finance Council, the Parish Finance Council of St. Tobias Church, and the Finance Committee of DuBois Central Catholic. Mr. Varischetti also serves on the Board of Directors for the Frank Varischetti Foundation. He holds a Bachelor of Science degree in Business Administration and Psychology from the University of Pittsburgh.

There are no arrangements or understandings between any director and any other person pursuant to which he or she was selected as a director.

Vote Required

Under our Bylaws, to be elected in an uncontested election, director nominees must receive the affirmative vote of a majority of the votes cast (the number of shares voted FOR a director nominee must exceed the number of votes cast AGAINST that director nominee). For purposes of the election of directors, abstentions and other shares not voted (whether by broker non-vote or otherwise) will not be counted as votes cast for or against a nominee’s election and will have no effect on the result of the vote. There is no cumulative voting with respect to the election of directors.

If an incumbent director fails to be reelected by a majority of votes cast, that director is required under our Bylaws to promptly deliver to the Board his or her irrevocable offer to resign from the Board. The Board will consider such director’s offer to resign, taking into consideration any such factors that the Board deems relevant in deciding whether to accept such director’s resignation, including any recommendation of the Corporate Governance/Nominating Committee. The Board is required to act on such director’s resignation within 90 days after the election results are certified.

Our Recommendation

The Board unanimously recommends that shareholders vote FOR each of the foregoing nominees

The following Class 3 directors’ terms expire at the time of the annual meeting in 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age at

December 31,

2022 | | Business Experience (Past Five Years) | | Positions Held at CNB | | Director

Since |

Joel E. Peterson

Independent Director | | 64 | | President, Clearfield Wholesale Paper (Wholesaler) | | — | | 9/13/2011 |

Richard B. Seager

Independent Director | | 65 | | Owner, Ritri Holdings, LLC

President and CEO, Journey Health System (Mental Health) | | — | | 12/14/2010 |

Michael Obi

Independent Director | | 55 | | President, UBIZ Venture Capital;

Chief Executive Officer, Spectrum Global Solutions | | — | | 9/14/2021 |

Joel E. Peterson is a graduate of The Pennsylvania State University with a major in Accounting and Marketing. He is the Chairman/CEO of Clearfield Wholesale Paper Company, a fourth-generation 100 year old business that serves suppliers in several states. His previous employment was in banking for several years as a credit and loan origination analyst. Currently, he serves on the DuBois Educational Foundation as the Development Committee Chair and previously served as the Chairman of the Clearfield Jefferson Regional Airport Authority with duties that included working with state and federal agencies. He has also served as President of the Bucktail Council of the Boy Scouts of America and President of the Clearfield YMCA. Mr. Peterson, by virtue of his executive service and business and community involvement in our CNB market, brings meaningful corporate governance experience to the Board.

Richard B. Seager has over 30 years of experience in health care administration, consulting, and finance. Mr. Seager is actively involved in small business and community development activities throughout northwestern Pennsylvania, including service on various non-profit boards. He obtained his Bachelor of Science degree from Gannon University. Mr. Seager provides the Board with knowledge of the market area and strong governance experience as a result of his executive experience as President and Chief Executive Officer of multiple companies.

Michael Obi is President of UBIZ Venture Capital and Chief Executive Officer of Spectrum Global Holdings, LLC, in Cleveland, Ohio. He has seventeen years of experience working in banking and financial services including executive leadership positions at KeyBank, Bank of America, Wells Fargo and SunTrust. Prior to launching Spectrum Global Holdings, LLC, he served as Senior Vice President for KeyBank’s Retail and Business Banking Segments. Mr. Obi obtained both his Bachelor of Science degree in Accounting and Master of Business Administration from the Coggins School of Business at the University of North Florida in Jacksonville, Florida. Mr. Obi has served and continues to serve on various boards within the Cleveland community. He is also an economic development advisor for the Urban League of Greater Cleveland. The Board

believes that Mr. Obi, through his extensive experience in all areas of banking, including retail, commercial, operations and finance, provides a significant depth of knowledge of the industry to the Board.

The following Class 2 directors’ terms expire at the time of the annual meeting in 2025.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age at

December 31,

2022 | | Business Experience (Past Five Years) | | Positions Held at CNB | | Director

Since |

| Richard L. Greslick, Jr. | | 46 | | Senior Executive Vice President,

Chief Operational Officer and

Secretary, CNB Financial Corp.

and CNB Bank | | Senior Executive Vice President, Chief Operational Officer and Secretary, CNB Financial Corp. and CNB Bank | | 1/1/2012 |

Deborah Dick Pontzer

Independent Director | | 62 | | President of Grow Rural PA Economic & Workforce Specialist for Congressman Glenn Thompson | | — | | 6/10/2003 |

Nicholas N. Scott

Independent Director | | 50 | | Vice President/Owner Scott

Enterprises (Hospitality Industry) | | — | | 5/14/2013 |

Julie M. Young

Independent Director | | 49 | | Employment Attorney, JMY Law, LLC | | — | | 5/14/2019 |

Richard L. Greslick, Jr., has been with the Corporation since 1998 and serves as the Senior Executive Vice President & Chief Operating Officer of CNB Bank. Mr. Greslick has served as a director and Secretary of CNB Financial Corporation and director and Senior Executive Vice President of CNB Bank since January 2012. He previously held roles as the Chief Support Officer and Senior Vice President of Administration. Mr. Greslick holds a Bachelor of Science in Accounting from Indiana University of Pennsylvania and is a 2009 graduate of the American Bankers Association’s Stonier National Graduate School of Banking in Philadelphia, Pennsylvania. Mr. Greslick has served and continues to serve on various boards within the community and on the board of the Pennsylvania Banking Industry. Mr. Greslick’s experience as an executive of the Corporation provides him with a thorough knowledge of the Corporation’s opportunities, challenges, and operations.

Deborah Dick Pontzer is the President of Grow Rural PA, specializing in economic and community development. In her current capacity, she works with business, industry, and communities doing strategic planning, identifying and obtaining the resources for impactful, equitable economic growth through infrastructure development, capacity building, job creation, retention and recruitment. Her prior experience includes serving as an economic development and workforce specialist for U.S. Congressmen, John E. Peterson and Glenn Thompson, and as a senior associate for Coopers & Lybrand in the Business Investigation Services unit. She is active in her community, serving on various boards. Ms. Pontzer earned a Bachelor of Arts degree from Mount Holyoke College and a Masters of Business Administration from the American Graduate School of International Management, a division of Arizona State University. Ms. Pontzer’s experience delivering meaningful economic outcomes enables her to provide a valuable perspective to the Board.

Nicholas N. Scott is Vice President/Owner of Scott Enterprises, a family owned-hospitality enterprise based in Erie, Pennsylvania, focused on restaurants and hotels, including two resorts. Mr. Scott has served in this role since 1995. As a business leader responsible for operations and development of the third-generation family owned hospitality business, Mr. Scott applies his expertise in strategic planning and provides leadership and guidance to the Board. Mr. Scott also has a degree in Hotel, Restaurant, and Institutional Management from The Pennsylvania State University. Mr. Scott also serves on numerous boards in his community.

Julie M. Young is an attorney specializing in employment law and human resources at JMY Law, LLC. Ms. Young has served in this role since 2016. With over two decades of experience navigating federal and state employment laws, Ms. Young works closely with small and mid-sized businesses to provide comprehensive employment law services. Prior to her current position, Ms. Young practiced employment law at Worley Law, LLC. Ms. Young is a frequent speaker on employment law and human resource topics, from structuring employment agreements, to federal and state compliance considerations and advising on anti-harassment and anti-discrimination policies and practices. Ms. Young is active in her community and also serves as a member of the board of advisors of FCBank, a division of CNB Bank, headquartered in Worthington, Ohio. Ms. Young received a Bachelor of Arts degree from Miami University of Ohio and a Juris Doctorate from The Ohio State University Mortiz College of Law. The Board believes that Ms. Young’s qualifications, including her broad human resources and employment law experience, will provide critical support to the Corporation’s business and strategic goals.

PROPOSAL 2. ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”) added Section 14A to the Securities Exchange Act of 1934 (the “Exchange Act”), which requires that the Corporation provide its shareholders with the opportunity to approve, on a non-binding advisory basis, the compensation of its named executive officers (the “NEOs”) as disclosed in this Proxy Statement in accordance with the compensation disclosure rules of the SEC.

As described in greater detail under the heading “Compensation Discussion and Analysis,” we seek to align the interests of our NEOs with the interests of our shareholders. Our compensation programs are designed to reward our NEOs for the achievement of short-term results and long-term growth that are consistent with enhancing shareholder value, while at the same time avoiding the encouragement of unnecessary or excessive risk-taking.

The Corporation is presenting the following proposal, which gives you as a shareholder the opportunity to endorse or not endorse our compensation program for NEOs by voting for or against the following resolution (a “say-on-pay” vote). While the vote on the resolution is advisory in nature and therefore will not bind us to take any particular action, our Board intends to carefully consider the shareholder vote resulting from the proposal in making future decisions regarding our compensation program.

“RESOLVED, that the shareholders approve, on an advisory basis, the compensation of the Corporation’s NEOs, as disclosed in the Compensation Discussion and Analysis, the compensation tables, and the related narrative executive compensation disclosures contained in this Proxy Statement.”

Vote Required

The affirmative vote of a majority of the votes cast by all shareholders entitled to vote on this proposal is required to approve (on a non-binding advisory basis) the compensation of the Corporation’s named executive officers. For purposes of the vote on this proposal, abstentions and other shares not voted (whether by broker non-vote or otherwise) will not be counted as votes cast and will have no effect on the result of the vote.

Our Recommendation

The Board unanimously recommends that shareholders vote FOR the resolution approving on a non-binding advisory basis the compensation of the Corporation’s named executive officers.

PROPOSAL 3. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board is responsible for selecting the Corporation’s independent registered public accounting firm. At its meeting held on March 1, 2023, the Audit Committee appointed FORVIS, LLP as the independent registered public accounting firm for the fiscal year ending December 31, 2023. Although shareholder approval for this appointment is not required, the Board is submitting the selection of FORVIS, LLP for ratification to obtain the views of shareholders. If the appointment is not ratified, the Audit Committee will reconsider its selection.

Crowe LLP was previously the principal accountants for the Corporation. Following a competitive process commenced at the direction of the Audit Committee, on March 4, 2022, the Corporation engaged FORVIS, LLP (formerly BKD, LLP) as the Corporation’s principal accountants for the year ending December 31, 2022. As a result of the engagement of FORVIS, LLP, on March 4, 2022, the Corporation dismissed Crowe LLP as the Corporation’s principal accountants. The decision to change accountants was approved by the Audit Committee on March 4, 2022.

During the two fiscal years ended December 31, 2021, and the subsequent interim period through March 3, 2022, there were no: (1) disagreements (as that term is used in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K) with Crowe LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements if not resolved to their satisfaction would have cause them to make reference to the subject matter of the disagreements in connection with their reports, or (2) reportable events (as described in Item 304(a)(1)(v) of Regulation S-K).

The audit reports of Crowe LLP on the consolidated financial statements of the Corporation and its subsidiaries as of and for the years ended December 31, 2021 and 2020 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principles. During the years ended December 31, 2021 and 2020, and through March 3, 2022, the Corporation did not consult with FORVIS, LLP with respect to (1) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might have been rendered on the Corporation’s consolidated financial statements, or (2) any matters that were either the subject of a disagreement (as that term is used in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K) or a reportable event (as described in Item 304(a)(1)(v) of Regulation S-K).

In making the appointment of FORVIS, LLP as the Corporation’s independent registered public accounting firm for the fiscal year ending December 31, 2023, the Audit Committee considered whether FORVIS, LLP’s provision of services other than audit services is compatible with maintaining independence as our independent auditors and decided that the provision of such services is compatible with maintaining independence.

Vote Required

The affirmative vote of a majority of the votes cast by all shareholders entitled to vote on this proposal is required to approve the ratification of the appointment of FORVIS, LLP as the Corporation’s independent registered public accounting firm. For purposes of approving Proposal 3, abstentions and other shares not voted will not be counted as votes cast and will have no effect on the result of the vote. Even if the appointment of FORVIS, LLP as the Corporation’s independent registered public accounting firm is ratified, the Audit Committee may, in its discretion, change that appointment at any time during the year should it determine such a change would be in our and our shareholders’ best interests.

Our Recommendation

The Board unanimously recommends that shareholders vote FOR ratification of the appointment of independent auditors.

CONCERNING THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Corporation’s independent registered public accounting firm for the fiscal year ended December 31, 2022 was FORVIS, LLP. The Audit Committee had selected FORVIS, LLP to be the independent registered public accounting firm for the fiscal year ending December 31, 2022. Representatives of FORVIS, LLP are expected to be present at the Annual Meeting to respond to appropriate questions and to make such statements as they may desire, including comments on the financial statements of the Corporation.

Audit Fees

The following table shows the fees paid or accrued by the Corporation for professional services provided by FORVIS, LLP during the fiscal year ended December 31, 2022 and by Crowe LLP during the fiscal year ended December 31, 2021:

| | | | | | | | | | | |

| | December 31, |

| | 2022 | | 2021 |

| Audit Fees | $ | 415,000 | | | $ | 365,000 | |

| Audit-Related Fees | — | | | 15,200 | |

| Tax Fees | 28,000 | | | 7,500 | |

| All Other Fees | 75,000 | | | 7,500 | |

| $ | 518,000 | | | $ | 395,200 | |

Audit fees represent fees for professional services rendered by FORVIS, LLP in connection with the audit of the Corporation’s consolidated financial statements and internal control over financial reporting and reviews of the consolidated financial statements included in the Corporation’s quarterly reports on Form 10-Q. Tax fees relate to the Corporation’s Federal and State income tax compliance. All other fees for 2022 represent fees related to the Corporation’s common equity capital raise in 2022.

Audit fees represent fees for professional services rendered by Crowe LLP in connection with the audit of the Corporation’s consolidated financial statements and internal control over financial reporting and reviews of the consolidated financial statements included in the Corporation’s quarterly reports on Form 10-Q. Audit-related fees for 2021 represent audit fees for the captive insurance company. Tax fees in 2021 reflect tax compliance services for the captive insurance company. All other fees in 2021 represent fees related to the Corporation’s issuance of subordinated debt in a private placement to certain qualified institutional buyers and accredited investors.

In 2021, the Corporation paid FORVIS, LLP fees totaling $68,293 related to services regarding the Corporation’s allowance for credit losses model valuation and certain tax services.

Auditor Independence

The Audit Committee of the Board believes that the non-audit services provided by FORVIS, LLP were compatible with maintaining the auditor’s independence. None of the time devoted by FORVIS, LLP on its engagement to audit the financial statements for the year ended December 31, 2022 is attributable to work performed by persons other than full-time, permanent employees of FORVIS, LLP. The Audit Committee is responsible for approving any service provided by the Corporation’s independent registered public accounting firm. The Audit Committee pre-approved all services performed by FORVIS, LLP during 2022 and by Crowe LLP during 2021, including those listed in the table above

CORPORATE GOVERNANCE

General

The business and affairs of the Corporation are managed under the direction of the Board. Members of the Board are kept informed of the Corporation’s business through discussions with the Chairperson of the Board and the Corporation’s executive officers, by reviewing materials provided to them and by participating in meetings and strategic planning sessions of the Board and its various committees. The Board is also kept apprised by the Chairperson of the Board and management of continuing educational programs on corporate governance and fiduciary duties and responsibilities.

The Corporation believes in the importance of sound and effective corporate governance and has adopted policies and promoted practices which it believes enhance corporate governance of the Corporation.

Board Leadership Structure

The Corporation has elected to have two separate individuals as Chief Executive Officer (“CEO”) and Chairperson. The Board believes that this separation facilitates the independence of the Board and is appropriate for the size and structure of the Corporation. In addition, this structure allows us to draw upon the skills and experiences of both our Chairperson and our CEO, while allowing our CEO to focus on overseeing the Corporation’s day-to-day operations and long-term strategic planning. If in the future the Board, after considering facts and circumstances at that time, appoints the CEO as Chairperson of the Board, we will promptly publicly disclose the appointment.

The Chairperson’s duties and responsibilities include: (1) developing and establishing Board meeting agendas and the appropriate schedule of Board meetings, in consultation with the CEO and the other directors; (2) along with other Board members, engaging in communications with shareholders and other stakeholders, including at our annual meetings; (3) engaging with the CEO, chairs of Board committees, and other members of the Board regarding Board structure; and (4) encouraging professional development of the Board members and executive officers.

Risk Oversight

Risk identification and management are essential elements for the successful management of the Corporation. In the normal course of business, the Corporation is subject to various types of risk. These risks are controlled through policies and procedures established throughout the Corporation, which are monitored and reviewed by the Board. Our Board is responsible for overseeing our company-wide approach to the identification, assessment, and management of short-term, intermediate-term, and long-term risks facing the Corporation. The Board recognizes its responsibility for overseeing the assessment and management of risks that may threaten successful execution of our long-term strategies, and the Board consults with outside advisors and experts when necessary

The Corporation’s Enterprise Risk Management (“ERM”) program includes measurement and monitoring of the following risks: credit, market, liquidity, operational, compliance, strategic and reputation. An ERM Risk Assessment Team evaluates, analyzes, and reports annual risk assessment(s) and provides quarterly updates to the ERM Risk Steering Committee, comprised of the Executive Management Team. The Board of Directors has established an ERM Policy, Risk Philosophy Statements and Risk Appetite Statements that summarize the risk appetite of the Corporation as well as the expected reward for the risks.

In addition to the ERM program, the following risks are specifically addressed as outlined below: market, credit, and liquidity risk.

Market risk is the sensitivity of net interest income and the market value of financial instruments to the direction and frequency of changes in interest rates. Market risk results from various repricing frequencies and the maturity structure of the financial instruments owned by the Corporation. The Corporation uses its asset/liability management policy and systems to control, monitor, and manage market risk. Such policies and systems are monitored by the Management Asset/Liability Committee, which generally meets monthly, and by the Asset/Liability Committee of the Board, which meets four times per year.

Credit risk represents the possibility that a customer may not perform in accordance with contractual terms. Credit risk results from loans with customers and the purchase of investment securities. The Corporation manages credit risk by following an established credit policy and through a disciplined evaluation of the adequacy of the allowance for loan losses. Also, the investment policy limits the amount of credit risk that may be taken in the securities portfolio. Such policies and systems are monitored by both the Asset/Liability Committee of the Board and the Loan Committee of the Board, both of which meet four times per year.

Liquidity risk represents the inability to generate or otherwise obtain funds at reasonable rates to satisfy commitments to borrowers and obligations to depositors. The Corporation has established guidelines within its asset liability management policy

to manage liquidity risk. These guidelines include contingent funding alternatives. Such guidelines are monitored by the Management Asset/Liability Committee, which generally meets monthly, and by the Asset/Liability Committee of the Board, which meets four times per year.

Meetings and Committees of the Board

The Board held eleven meetings during 2022. Each incumbent director attended at least 75% of the aggregate of (i) the total number of meetings held by the Board during the period that the individual served and (ii) the total number of meetings held by all committees of the Board on which the individual served during the period that the individual served. All directors attended the 2022 Annual Meeting of Shareholders.

The Board of the Corporation and the Board of the Bank have three standing joint committees that serve both the Corporation and the Bank, including the Audit, Executive Compensation and Corporate Governance/Nominating Committees. Directors Peter F. Smith, Michael D. Peduzzi, and Richard L. Greslick, Jr. are ex-officio members of all committees if not otherwise named, except for the Audit, Corporate Governance/Nominating and Executive Compensation Committees as to Mr. Peduzzi and Mr. Greslick.

Audit Committee

The Audit Committee met four times in 2022. The Audit Committee appoints the Corporation’s independent registered public accounting firm, reviews and approves the audit plan and fee estimate of the independent registered public accounting firm, appraises the effectiveness of the internal and external audit efforts, evaluates the adequacy and effectiveness of accounting policies and financial and accounting management, approves and evaluates the internal audit function, pre-approves all audit and any non-audit services, and reviews and approves the annual and quarterly financial statements. The Audit Committee also is responsible for reviewing and overseeing the Corporation’s privacy, information technology security and cybersecurity risk exposures. The Audit Committee has the authority to engage legal counsel or other experts or consultants as it deems appropriate to carry out its responsibilities, at the Corporation’s expense. The members of the Audit Committee are Jeffrey S. Powell, Chairperson, Peter F. Smith, Michael Obi, Joel E. Peterson, Deborah Dick Pontzer, Richard B. Seager and Peter C. Varischetti. The Corporation’s Board has a written charter for the Audit Committee, which is reviewed annually by the Audit Committee. The charter is available on the Corporation’s website at www.cnbbank.bank.

In the opinion of the Corporation’s Board, the members of the Audit Committee do not have a relationship with the Corporation or any of its affiliates that would interfere with the exercise of independent judgment in carrying out their responsibilities as directors. None of them is or has for the past three years been an employee of the Corporation or any of its affiliates; no immediate family members of any of them is or has for the past three years been an executive officer of the Corporation or any of its affiliates; and they otherwise meet the standards for independence required by NASDAQ.

The Board has also determined that Mr. Obi qualifies as an “audit committee financial expert” as such term is currently defined in Item 407(d)(5) of Regulation S-K. Mr. Obi is also an independent director.

The Audit Committee must pre-approve all permitted non-audit services performed by the Corporation’s external audit firm. The Audit Committee may delegate such authority to a subcommittee, provided that any decisions of the subcommittee are presented to the full Audit Committee at its next scheduled meeting.

The Audit Committee has submitted the following report (the “Audit Committee Report”) for inclusion in this Proxy Statement:

The Audit Committee has reviewed the audited financial statements for the year ended December 31, 2022 and has discussed them with management. The Audit Committee has also discussed with FORVIS, LLP the matters required to be discussed by the Public Company Accounting Oversight Board’s Auditing Standard No. 16 and by SEC rules. The Audit Committee has received the written disclosures and the letter from FORVIS, LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding FORVIS, LLP’s communications with the Audit Committee, and has discussed with FORVIS, LLP their independence. Based on this, the Audit Committee recommended to the Board that the audited financial statements be included in CNB Financial Corporation’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 for filing with the SEC.

Submitted by the Audit Committee:

| | | | | | | | |

| Jeffrey S. Powell, Chairperson | Peter F. Smith | Michael Obi |

| Joel E. Peterson | Deborah Dick Pontzer | Richard B. Seager |

| Peter C. Varischetti | | |

This report of the Audit Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Exchange Act and shall not be deemed filed under the Exchange Act.

Executive Compensation Committee

The Executive Compensation Committee (the “ECC”) consists of the following independent directors as defined by NASDAQ rules: Michael Obi, Chairperson, Peter F. Smith, Deborah Dick Pontzer, Jeffrey S. Powell, Julie Young and Nicholas N. Scott. The ECC met six times during 2022. See “Compensation Determination Process” for more information about the ECC.

Corporate Governance/Nominating Committee

The Corporate Governance/Nominating Committee (the “CGN Committee”) met two times during 2022. The CGN Committee consists of the following independent directors as defined by NASDAQ rules: Peter F. Smith, Chairperson, Michael Obi, Joel E. Peterson, Deborah Dick Pontzer, and Jeffrey S. Powell. The CGN Committee was established by resolution of the Board and recommends to the Board candidates for nomination for election to the Board. Any shareholder who wishes to have the CGN Committee consider a candidate should submit the name of the candidate, along with any biographical or other relevant information that the shareholder wishes the CGN Committee to consider and the consent of such candidate evidencing his or her willingness to serve as a director, to the President of the Corporation at the address appearing on the Notice of Annual Meeting no later than November 10, 2023 if the shareholder proposes that such candidate be included in the Corporation’s proxy statement. All recommendations are subject to the process described below.

We believe that the quality, focus and diversity of skills, experience, and perspective of the Board have been a key driver of the Corporation’s success and that the strength of the Board is a competitive advantage. The CGN Committee has the responsibility of reviewing and evaluating candidates for election or appointment to the Board, strategically thinking about board refreshment and succession planning, rather than simply reacting to isolated retirements. The CGN Committee evaluates, among other things, the current Board’s range of skills, education and experience to assess any needs, including increasing the racial, ethnic and gender diversity of the Board and anticipating Board vacancies. In identifying candidates to join the Board, the CGN Committee solicits input from a variety of sources, including existing directors, senior management and formal expressions of interest by individuals that have been communicated to the CGN Committee.

Utilizing the selection criteria set forth below, the CGN Committee selects a prospective candidate and then conducts an interview in order to further evaluate the individual. Subsequent to the interview the CGN Committee meets to determine whether to recommend the candidate to the Board for election or appointment. The Board, excluding all non-independent directors, either accepts or rejects the CGN Committee’s recommendation.

The CGN Committee utilizes various selection criteria to evaluate a candidate for election or appointment to the Board including, among others, the following minimum criteria:

1.Residency within the market area of CNB Bank.

2.Ability and willingness to commit time necessary to fulfill Board and committee duties.

3.Strong interest in or familiarity with the financial services industry.

4.Successful career in a business or profession, or valuable community knowledge and perspective, suitable to our business and community service plans within the Bank’s market area.

5.Character and reputation.

6.Whether the candidate is “independent” under SEC and NASDAQ rules.

7.Provide expertise in an area needed for the Board.

No incumbent director may be nominated without approval of at least 25% of the existing directors and no person not then a director may be proposed for nomination without approval of at least two-thirds of the directors. The Bylaws provide that any director, upon first being appointed or elected to serve as a director, must own the lesser of 1,000 unencumbered shares of common stock of the Corporation or the number of shares equivalent to $15,000 of market value as of the date of the appointment or election. Further, on or before the third anniversary of the director’s first election to the Board, the director must own at least the lesser of 2,500 unencumbered shares of common stock of the Corporation or the number of shares equal to $25,000 of market value.

The Corporate Governance/Nominating Committee has a charter, a copy of which is available on the Corporation’s website at www.cnbbank.bank.

Communications with Directors

Any shareholder who wishes to communicate with the directors (or with any individual director) should send a letter to the directors as follows: ATTN: Corporate Secretary - Communication to Directors, CNB Financial Corp., P.O. Box 42, Clearfield, PA 16830. The Corporate Secretary will regularly forward all such correspondence to the directors.

Director Attendance at Annual Meetings

The Corporation typically schedules a meeting of the Board in conjunction with the annual meeting and expects that the members of the Board will attend the annual meeting, absent a valid reason, such as a previously scheduled conflict. All of the individuals then serving as directors attended the 2022 Annual Meeting of Shareholders in April 2022.

Director Education

The Corporation and the Board believe that continuing director education is essential to the Board’s performance and continued oversight of the Corporation and its business. On May 17, 2022, the Board attended a formal training session related to the Bank Secrecy Act of 1970, Office of Foreign Assets Control requirements and anti-money laundering. On October 25, 2022, the Board attended a formal training session related to the roles and responsibilities of the Board. In addition, periodic training sessions for the Board occur during regularly scheduled Board and committee meetings. Topics covered during these trainings in 2022 included information technology, information security, cybersecurity, bank owned life insurance policies and asset-liability management. Finally, individual Board members, at times, attend specialized industry conferences based on their committee assignments and training needs.

Director Skills Summary

Our Board brings diverse experience and perspectives to areas critical to our business. Their collective knowledge ensures appropriate management and risk oversight and supports our strategy of long-term sustainable shareholder value.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | INDEPENDENT DIRECTORS | | INSIDERS |

| | Smith | | Obi | | Peterson | | Pontzer | | Powell | | Scott | | Seager | | Straub | | Varischetti | | Young | | Peduzzi | | Greslick |

| Financial industry experience | X | | X | | | | | | | | | | | | | | | | | | X | | X |

| CEO/business head | | | X | | X | | | | X | | | | X | | X | | X | | | | X | | |

| Business ethics | X | | X | | | | X | | | | | | | | | | | | | | X | | |

| Technology/cybersecurity | | | | | | | | | | | | | X | | X | | | | | | X | | X |

| Human capital management/compensation | | | X | | | | | | X | | | | X | | | | | | X | | X | | X |

| Audit Committee financial expert | | | X | | | | | | | | | | | | | | | | | | | | |

| Mergers and acquisitions | X | | | | X | | | | | | X | | X | | X | | X | | | | X | | X |

| Public company governance | | | | | | | X | | | | | | | | | | | | | | X | | X |

| Sales and marketing | | | | | X | | | | X | | X | | | | | | | | | | X | | |

| Legal, legislative or regulatory | X | | | | | | X | | | | | | | | | | X | | X | | X | | X |

Board Diversity Matrix

Our Board views its diversity as an important strength, as our commitment to diversity of experience, gender, and ethnicity is a key driver of the Corporation’s success. The following matrix illustrates the diversity of the Board as of the date of the Annual Meeting of Shareholders.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Number of Directors | 12 | | | | | | | |

| | | | | | | | |

| | | Female | | Male | | Non-Binary | | Did Not Disclose

Gender |

| Part I: Gender Identity | | | | | | | | |

| Directors | | 2 | | 10 | | — | | — |

| Part II: Demographic Background | | | | | | | | |

| African American or Black | | — | | 1 | | — | | — |

| Alaskan or Native American | | — | | — | | — | | — |

| Asian | | — | | — | | — | | — |

| Hispanic or Latinx | | — | | — | | — | | — |

| Native Hawaiian or Pacific Islander | | — | | — | | — | | — |

| White | | 2 | | 9 | | — | | — |

| Two or More Races or Ethnicities | | — | | — | | — | | — |

| LGBTQ+ | | — | | — | | — | | — |

| Did Not Disclose Demographic Background | | — | | — | | — | | — |

In addition to the valuable perspectives resulting from the diversity of gender and ethnicity on the Board, the CGN Committee seeks to ensure that there is diversity of thought among directors, resulting in more thorough analysis of each issue and better decisions, which in the long-term results in greater shareholder value. The Board and CGN Committee believes that diversity of thought stems from many factors including professional experience, life experience, socio-economic background, gender, race, religion, skill set, and geographic representation. The Corporation believes that the backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of experience, knowledge, abilities, and shareholder and community representation that will allow the Board to fulfill its responsibilities.

The Board recognizes and values the importance of diversity and the beneficial impact it has on the long-term success of the Corporation. As such, the Board has commenced a search for qualified, independent directors that identify themselves as a gender other than male (“Qualified Directors”). The Board’s goal is to add such Qualified Directors during the 2023 calendar year so that the mix of Qualified Directors meets or exceeds 30% of the total number of directors, by the end of 2023.

Environmental, Social and Governance (ESG) Principles and Activities of the Corporation

The Corporation respects, values and promotes the realization of an increasing diversity and inclusivity profile in our team of Board members and employees, and our customers, reflective of the communities we serve. In addition to the above-described Board attributes, the Corporation emphasizes relevant governance and diversity and inclusion principles in strategic planning, human capital management and leadership development (which includes recruiting and retaining employees), and vendor management, as relationships with third parties represent critical connections to and extensions of the values and operating principles of the Corporation and Board.

Strategic Planning and Related Training

The Corporation has established a formal Strategic Plan, and the framework of the Strategic Plan establishes that principles of inclusion and diversity encompass and integrate with the other objectives of the Strategic Plan, including exceptional experiences, demonstrated leadership, adaptable technology, and long-term growth. In establishing these principles as the foundation upon which all other strategic objectives are anchored, the Corporation seeks to further develop and sustain a diverse, equitable, and inclusive culture, with sensitivity to the entirety of the Corporation’s footprint and environment in which it operates. The differences among the Board and employees, and its customers and community members, are respected and embraced to drive innovative products, services, and solutions that effectively meet the variety of needs among the Corporation’s diverse group of stakeholders.

To ensure that the Environmental, Social, and Governance principles are understood, implemented, and demonstrated by the Corporation’s employee team on a sustained basis, the Corporation developed a comprehensive diversity, equity, and inclusion (“DE&I”) communication processes and a training curriculum which was rolled out to all employees, including internal sessions delivered by a certified diversity and inclusion trainer, supplemented by relevant external training sources. Employee experience committees were also formed in 2022 to explore and evaluate how various DE&I topics impact our employees and how we can better address them. To monitor progress and solicit feedback, the Corporation conducted a company wide survey on DE&I. The results of this survey will be utilized for developing areas of focus for 2023. In 2023, the Corporation also plans to continue offering training to employees, including a module within the Corporation’s training program for new managers, monthly lunch and learn events, and develop employee resource groups, which are employee-led groups whose aim is to foster a diverse, inclusive workplace aligned within the organization.

Inclusion and Diversity Committee

In support of its strategic diversity and inclusion efforts, and to ensure that the diverse perspectives of the entire Corporation’s employee team is considered when developing and implementing its service and operating profile, the Corporation established a Diversity, Equity and Inclusion Committee (the “Diversity Committee”) in 2018. The Diversity Committee, which meets monthly, is comprised of over 10 employee members including underrepresented minorities, females, and those who identify as LGBTQ+, as well as two senior executive level members, with the following committee responsibilities and goals:

•Encourage an inclusive and engaged workforce culture through communications and training

•Demonstrate sustainability, commitment and accountability by tracking inclusion and diversity efforts bank wide

•Bring awareness to the importance of inclusion and diversity internally and externally

The Diversity Committee’s meeting minutes, activities and recommendations are provided regularly to the Corporation’s executive management team for consideration to promote the effective integration of diversity and inclusion principles into the respective facets of our business evaluated and addressed by the Diversity Committee.

Human Capital Management and Leadership Development

We seek to recognize the unique contribution each employee brings to the Corporation, and we are fully committed to supporting a workplace that understands, accepts and values the similarities and differences between individuals. The Corporation’s key human capital management objectives are to recruit, hire, develop and promote a deeply experienced and diverse employee team, supplemented by similarly inclusive and diversity-focused third-party vendors, that collectively translate into a strong workforce committed to fostering, promoting, and preserving the entire spectrum of our communities and culture, while successfully executing our business strategies and demonstrating our corporate values. To support these objectives, the Corporation’s Employee Experience processes and programs are designed and operated to:

•Attract and develop talented employees across the spectrum of professional experience, life experience, socio-economic background, gender, race, religion, skill set, and geographic representation;

•Prepare all members of our team for critical roles and leadership positions both now and the future, in serving as employees and valuable community members;

•Reward and support employees fairly and without discrimination based upon successful performance and through competitive pay and benefit programs;

•Enhance the Corporation’s culture through efforts to better understand, foster, promote, and preserve a culture of diversity and inclusion; and

•Evolve and invest in technology, tools, and resources to better support employees of varying skills and backgrounds at work.

Among the means we use to monitor our performance in employee diversity and inclusion management, we take recurring management and employee demographic measurements and engagement surveys, and utilize the results to identify progress made, as well as areas in need of more attention, in improving the diversity, equity, and inclusion of our leadership and workforce profile, and personnel management practices.