UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03919

Name of Registrant: Vanguard STAR Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: October 31

Date of reporting period: November 1, 2012 – October 31, 2013

Item 1: Reports to Shareholders

|

|

| Annual Report | October 31, 2013 |

| Vanguard STAR® Fund |

|

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles,

grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds.

Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Fund Profile. | 8 |

| Performance Summary. | 9 |

| Financial Statements. | 11 |

| Your Fund’s After-Tax Returns. | 19 |

| About Your Fund’s Expenses. | 20 |

| Glossary. | 22 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: The ship's wheel represents leadership and guidance, essential qualities in navigating difficult seas. This one is a replica based on an 18th-century British vessel. The HMS Vanguard, another ship of that era, served as the flagship for Admiral Horatio Nelson when he defeated a French fleet at the Battle of the Nile.

Your Fund’s Total Returns

| Fiscal Year Ended October 31, 2013 | |

| Total | |

| Returns | |

| Vanguard STAR Fund | 17.36% |

| STAR Composite Index | 15.87 |

| STAR Composite Average | 17.16 |

| For a benchmark description, see the Glossary. | |

| STAR Composite Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| Your Fund’s Performance at a Glance | ||||

| October 31, 2012, Through October 31, 2013 | ||||

| Distributions Per Share | ||||

| Starting | Ending | |||

| Share | Share | Income | Capital | |

| Price | Price | Dividends | Gains | |

| Vanguard STAR Fund | $20.62 | $23.66 | $0.453 | $0.024 |

1

Chairman’s Letter

Dear Shareholder,

For the 12 months ended October 31, 2013, Vanguard STAR Fund returned 17.36%, propelled by the robust performance of its underlying equity funds. The fund’s return was ahead of its benchmark—the STAR Composite Index, a static mix of about 44% U.S. stocks, 19% international stocks, and 37% U.S. bonds—and on par with a composite of the average returns of peer groups for its underlying funds.

The STAR Fund is a “fund of funds” that consists of 11 actively managed Vanguard funds: eight stock funds and three bond funds. All the stock funds posted returns of more than 25% for the 12 months. Vanguard Explorer™ Fund had the highest result, surging 42.89%, as small-capitalization growth stocks led the U.S. stock market’s impressive advance. (Fund returns cited in this letter are for Investor Shares.)

The STAR Fund’s underlying bond funds fared considerably worse than their stock counterparts. Reflecting an especially challenging environment for long-term bonds, Vanguard Long-Term Investment-Grade Fund had the worst result, returning –6.06%.

Despite uncertainties, U.S. stocks found a path to strong returns

U.S. stocks faced several challenges en route to an impressive return of about 29% for the 12 months ended October 31.

2

Investors’ growing appetite for risk drove the rise in stocks, as corporate profit growth, on the whole, wasn’t particularly tantalizing.

Although the end of the fiscal year was notable for the budget impasse that resulted in October’s 16-day partial federal government shutdown, the period as a whole was marked by uncertainty about Federal Reserve monetary policy and concern about the economy’s patchy growth. Vanguard’s chief economist, Joe Davis, recently noted that “as was the case at the start of the year, the U.S. economy continues to expand at a modest and uneven pace.”

The disparity between the performance of the U.S. economy and that of U.S. stocks may seem surprising—but Vanguard research has shown a weak relationship over the long term between a nation’s economic growth and its stock returns. (You can read more in The Outlook for Emerging Market Stocks in a Lower-Growth World, available at vanguard.com/research.)

Outside the United States, stocks returned about 20%. The developed markets of Europe and the Pacific region delivered sizable gains; emerging-market stocks failed to keep pace.

| Market Barometer | |||

| Average Annual Total Returns | |||

| Periods Ended October 31, 2013 | |||

| One | Three | Five | |

| Year | Years | Years | |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 28.40% | 16.83% | 15.84% |

| Russell 2000 Index (Small-caps) | 36.28 | 17.69 | 17.04 |

| Russell 3000 Index (Broad U.S. market) | 28.99 | 16.89 | 15.94 |

| MSCI All Country World Index ex USA (International) | 20.29 | 6.04 | 12.48 |

| Bonds | |||

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | -1.08% | 3.02% | 6.09% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | -1.72 | 3.60 | 6.37 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.06 | 0.07 | 0.12 |

| CPI | |||

| Consumer Price Index | 0.96% | 2.21% | 1.52% |

3

Bond returns sagged as investors kept a close eye on the Fed

With investors fretting over the Fed’s next move in its stimulative bond-buying program, bonds recorded negative results for the 12 months. The broad U.S. taxable bond market returned –1.08%. The yield of the 10-year Treasury note closed at 2.54%, down from 2.63% at September’s close but up from 1.69% at the end of the previous fiscal year. (Bond yields and prices move in opposite directions.)

Municipal bonds returned –1.72%. Outside the United States, bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned–1.95%.

The Fed’s target for short-term interest rates remained between 0% and 0.25%, severely limiting returns of money market funds and savings accounts.

Diverging stock and bond results highlight the wisdom of balance

As I mentioned, the STAR Fund’s underlying equity funds soared over the 12 months, while its bond funds lagged. In an ideal world, one could identify and own only the best-performing investments in all periods. But we investors know that which investment comes out ahead varies

| Expense Ratios | ||

| Your Fund Compared With Its Peer Group | ||

| Acquired Fund Fees | Peer Group | |

| and Expenses | Average | |

| STAR Fund | 0.34% | 1.14% |

The acquired fund fees and expenses—drawn from the prospectus dated February 28, 2013—represent an estimate of the weighted average of the expense ratios and any transaction fees charged by the underlying mutual funds (the ”acquired” funds) in which the STAR Fund invests. The STAR Fund does not charge any expenses or fees of its own. For the fiscal year ended October 31, 2013, the annualized acquired fund fees and expenses were 0.34%.

The peer group is the STAR Composite Average, which is derived by weighting the average expense ratios of the following mutual fund groups: general equity funds (43.75%), fixed income funds (25%), 1–5 year investment-grade funds (12.5%), and international funds (18.75%). Average expense ratios for these groups are derived from data provided by Lipper, a Thomson Reuters Company, and capture information through year-end 2012.

4

from year to year in unpredictable ways, so we think it’s wise to take a balanced and diversified approach. Vanguard STAR Fund embodies just that.

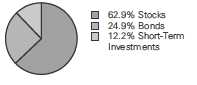

At the end of the period, about 63% of the STAR Fund’s assets were in stock funds, with the balance in bond funds. The advantage of exposure to both stocks and bonds is that when one zigs, the other can zag. In fiscal year 2011, for example, STAR’s bond funds provided stability when international stock markets tumbled amid concerns about the European debt crisis. (International stock funds account for about 30% of the STAR Fund’s equity holdings.)

In the most recent fiscal year, those international stock funds turned in healthy results, with Vanguard International Value Fund returning 27.94% and Vanguard International Growth Fund gaining 25.57%. Strong as those performances were, they paled next to the nearly 43% return of Vanguard Explorer Fund, one of STAR’s six domestic equity funds. Keep in mind that the Explorer Fund specializes in a volatile market segment, small-cap growth stocks, and that the fund has had steep declines along with

| Total Returns | |

| Ten Years Ended October 31, 2013 | |

| Average | |

| Annual Return | |

| STAR Fund | 7.43% |

| STAR Composite Index | 7.19 |

| STAR Composite Average | 6.17 |

| For a benchmark description, see the Glossary. | |

| STAR Composite Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

5

impressive advances in its 45-year history. As of October 31, Explorer accounted for less than 4% of the STAR Fund’s assets.

Vanguard Windsor™ II Fund, the STAR Fund’s largest holding at about 14% of assets, produced strong absolute results, climbing 26.26%. But it was a few steps behind its benchmark index and the average return of peers.

As I noted, the bond market was unsettled during the period by perceived mixed signals from the Fed about when it might start scaling back its bond-buying program. Vanguard Long-Term Investment-Grade Fund was buffeted the most, but Vanguard GNMA Fund also declined (–0.75%). The STAR Fund’s third bond holding, Vanguard Short-Term Investment-Grade Fund, managed a modest 1.23% return.

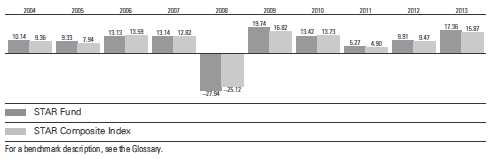

The fund’s record was solid during a challenging decade

Except for 2008, a year marked by financial turmoil, Vanguard STAR Fund recorded solid results in each of the last ten fiscal years. Its average annual return was 7.43% for the decade ended October 31. As you can see in the table on page 5, the fund outpaced a composite of the average annual returns of peer groups for its underlying funds, and it was modestly ahead of its composite benchmark index.

| Underlying Funds: Allocations and Returns | ||

| Twelve Months Ended October 31, 2013 | ||

| Percentage of | ||

| Vanguard Fund | STAR Fund Assets | Total Returns |

| Vanguard Windsor II Fund Investor Shares | 14.2% | 26.26% |

| Vanguard Long-Term Investment-Grade Fund | ||

| Investor Shares | 12.5 | -6.06 |

| Vanguard GNMA Fund Investor Shares | 12.4 | -0.75 |

| Vanguard Short-Term Investment-Grade Fund | ||

| Investor Shares | 12.2 | 1.23 |

| Vanguard International Value Fund | 9.5 | 27.94 |

| Vanguard International Growth Fund Investor | ||

| Shares | 9.4 | 25.57 |

| Vanguard Windsor Fund Investor Shares | 7.7 | 35.17 |

| Vanguard PRIMECAP Fund Investor Shares | 6.1 | 36.72 |

| Vanguard Morgan Growth Fund Investor Shares | 6.1 | 30.02 |

| Vanguard U.S. Growth Fund Investor Shares | 6.1 | 30.80 |

| Vanguard Explorer Fund Investor Shares | 3.8 | 42.89 |

| Combined | 100.0% | 17.36% |

6

This admirable track record during a decade that included the worst global recession since the Great Depression is a tribute to the discipline and expertise of the advisors who oversee the underlying stock and bond funds.

Combining diversity of thought with low costs brings benefits

Investors sometimes ask why Vanguard uses a multi-advisor approach for many of its actively managed equity funds, such as those included in the STAR Fund. (With the exception of Vanguard PRIMECAP Fund, all the underlying equity funds have more than one advisor.)

Just as we recommend diversification within and across asset classes for an investor’s overall portfolio, we think significant benefits can accrue from using multiple advisory firms for a single fund: diversity of investment process and style, thought, and holdings. These elements can lead to less risk and better results. Because not all investment managers invest the same way, their returns relative to the benchmark don’t move in lockstep.

As with many investment topics, however, there are some misconceptions about the benefits of a multi-manager approach. For example, it is often suggested that the best ideas of the advisors are diluted when combined in one portfolio. Recent Vanguard research has found otherwise.

Conventional wisdom also suggests that multi-manager funds tend to be expensive. At Vanguard, this is not the case: Low costs are a hallmark of all our offerings. And Vanguard research indicates that low costs can contribute greatly to investing success, helping investors keep more of a portfolio’s return. (You can read more in Analyzing Multi-Manager Funds: Does Management Structure Affect Performance?, available at vanguard.com/research.)

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

November 13, 2013

7

STAR Fund

Fund Profile

As of October 31, 2013

| Total Fund Characteristics | |

| Ticker Symbol | VGSTX |

| 30-Day SEC Yield | 2.01% |

| Acquired Fund Fees and Expenses1 | 0.34% |

| Allocation to Underlying Vanguard Funds | |

| Vanguard Windsor II Fund Investor Shares | 14.2% |

| Vanguard Long-Term Investment-Grade | |

| Fund Investor Shares | 12.5 |

| Vanguard GNMA Fund Investor Shares | 12.4 |

| Vanguard Short-Term Investment-Grade | |

| Fund Investor Shares | 12.2 |

| Vanguard International Value Fund | 9.5 |

| Vanguard International Growth Fund | |

| Investor Shares | 9.4 |

| Vanguard Windsor Fund Investor Shares | 7.7 |

| Vanguard PRIMECAP Fund Investor | |

| Shares | 6.1 |

| Vanguard Morgan Growth Fund Investor | |

| Shares | 6.1 |

| Vanguard U.S. Growth Fund Investor | |

| Shares | 6.1 |

| Vanguard Explorer Fund Investor Shares | 3.8 |

| Total Fund Volatility Measures | ||

| STAR | DJ U.S. | |

| Composite | Total Market | |

| Index | FA Index | |

| R-Squared | 0.99 | 0.93 |

| Beta | 1.05 | 0.68 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

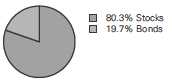

Fund Asset Allocation

1 This figure—drawn from the prospectus dated February 28, 2013—represents an estimate of the weighted average of the expense ratios and any transaction fees charged by the underlying mutual funds (the ”acquired” funds) in which the STAR Fund invests. The STAR Fund does not charge any expenses or fees of its own. For the fiscal year ended October 31, 2013, the annualized acquired fund fees and expenses were 0.34%.

8

STAR Fund

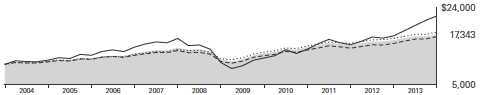

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

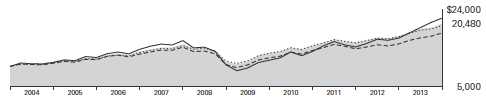

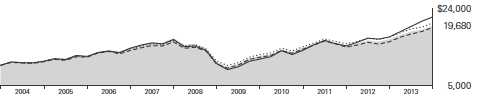

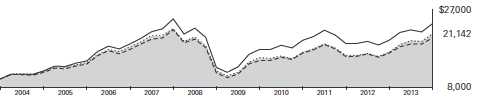

Cumulative Performance: October 31, 2003, Through October 31, 2013

Initial Investment of $10,000

| Average Annual Total Returns | ||||

| Periods Ended October 31, 2013 | ||||

| Final Value | ||||

| One | Five | Ten | of a $10,000 | |

| Year | Years | Years | Investment | |

| STAR Fund | 17.36% | 13.02% | 7.43% | $20,480 |

| STAR Composite Index | 15.87 | 12.07 | 7.19 | 20,027 |

| STAR Composite Average | 17.16 | 11.77 | 6.17 | 18,190 |

| Dow Jones U.S. Total Stock Market | ||||

| Float Adjusted Index | 28.86 | 16.01 | 8.13 | 21,850 |

For a benchmark description, see the Glossary.

STAR Composite Average: Derived from data provided by Lipper, a Thomson Reuters Company.

See Financial Highlights for dividend and capital gains information.

9

STAR Fund

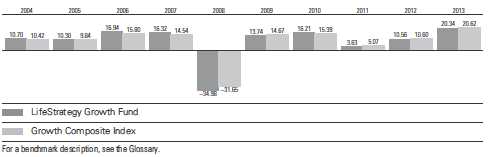

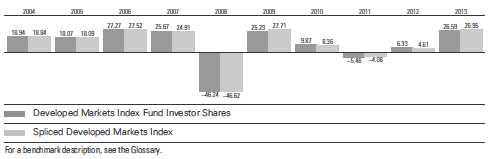

Fiscal-Year Total Returns (%): October 31, 2003, Through October 31, 2013

Average Annual Total Returns: Periods Ended September 30, 2013

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| Ten Years | ||||||

| Inception Date | One Year | Five Years | Income | Capital | Total | |

| STAR Fund | 3/29/1985 | 13.76% | 9.29% | 2.77% | 4.74% | 7.51% |

10

STAR Fund

Financial Statements

Statement of Net Assets

As of October 31, 2013

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| Market | ||

| Value• | ||

| Shares | ($000) | |

| Investment Companies (100.0%) | ||

| U.S. Stock Funds (44.1%) | ||

| Vanguard Windsor II Fund Investor Shares | 67,496,047 | 2,442,007 |

| Vanguard Windsor Fund Investor Shares | 68,149,999 | 1,328,925 |

| Vanguard PRIMECAP Fund Investor Shares | 11,500,745 | 1,055,423 |

| Vanguard Morgan Growth Fund Investor Shares | 41,565,231 | 1,046,197 |

| Vanguard U.S. Growth Fund Investor Shares | 38,861,899 | 1,043,442 |

| Vanguard Explorer Fund Investor Shares | 6,055,007 | 653,699 |

| 7,569,693 | ||

| International Stock Funds (18.9%) | ||

| Vanguard International Value Fund | 43,892,763 | 1,629,300 |

| Vanguard International Growth Fund Investor Shares | 70,938,433 | 1,620,943 |

| 3,250,243 | ||

| U.S. Bond Funds (37.0%) | ||

| Vanguard Long-Term Investment-Grade Fund Investor Shares | 216,697,181 | 2,138,801 |

| Vanguard GNMA Fund Investor Shares | 200,492,128 | 2,127,222 |

| Vanguard Short-Term Investment-Grade Fund Investor Shares | 194,665,633 | 2,092,655 |

| 6,358,678 | ||

| Total Investment Companies (Cost $11,535,491) | 17,178,614 | |

| Temporary Cash Investment (0.0%) | ||

| Money Market Fund (0.0%) | ||

| 1 Vanguard Market Liquidity Fund, 0.120% (Cost $581) | 581,383 | 581 |

| Total Investments (100.0%) (Cost $11,536,072) | 17,179,195 | |

| Other Assets and Liabilities (0.0%) | ||

| Other Assets | 21,753 | |

| Liabilities | (21,132) | |

| 621 | ||

| Net Assets (100%) | ||

| Applicable to 726,044,522 outstanding $.001 par value shares of | ||

| beneficial interest (unlimited authorization) | 17,179,816 | |

| Net Asset Value Per Share | $23.66 |

11

STAR Fund

| At October 31, 2013, net assets consisted of: | |

| Amount | |

| ($000) | |

| Paid-in Capital | 11,370,472 |

| Undistributed Net Investment Income | 64,254 |

| Accumulated Net Realized Gains | 101,967 |

| Unrealized Appreciation (Depreciation) | 5,643,123 |

| Net Assets | 17,179,816 |

See Note A in Notes to Financial Statements.

1 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the

7-day yield.

See accompanying Notes, which are an integral part of the Financial Statements.

12

STAR Fund

| Statement of Operations | |

| Year Ended | |

| October 31, 2013 | |

| ($000) | |

| Investment Income | |

| Income | |

| Income Distributions Received | 330,506 |

| Net Investment Income—Note B | 330,506 |

| Realized Net Gain (Loss) | |

| Capital Gain Distributions Received | 77,200 |

| Investment Securities Sold | 256,253 |

| Realized Net Gain (Loss) | 333,453 |

| Change in Unrealized Appreciation (Depreciation) | |

| of Investment Securities | 1,890,845 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 2,554,804 |

See accompanying Notes, which are an integral part of the Financial Statements.

13

STAR Fund

| Statement of Changes in Net Assets | ||

| Year Ended October 31, | ||

| 2013 | 2012 | |

| ($000) | ($000) | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net Investment Income | 330,506 | 325,689 |

| Realized Net Gain (Loss) | 333,453 | 161,543 |

| Change in Unrealized Appreciation (Depreciation) | 1,890,845 | 852,820 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 2,554,804 | 1,340,052 |

| Distributions | ||

| Net Investment Income | (324,431) | (333,955) |

| Realized Capital Gain1 | (17,087) | (17,863) |

| Total Distributions | (341,518) | (351,818) |

| Capital Share Transactions | ||

| Issued | 1,501,826 | 995,655 |

| Issued in Lieu of Cash Distributions | 328,541 | 338,746 |

| Redeemed | (1,622,340) | (1,447,256) |

| Net Increase (Decrease) from Capital Share Transactions | 208,027 | (112,855) |

| Total Increase (Decrease) | 2,421,313 | 875,379 |

| Net Assets | ||

| Beginning of Period | 14,758,503 | 13,883,124 |

| End of Period2 | 17,179,816 | 14,758,503 |

1 Includes fiscal 2013 and 2012 short-term gain distributions totaling $17,087,000 and $17,863,000, respectively. Short-term gain distributions

are treated as ordinary income dividends for tax purposes.

2 Net Assets—End of Period includes undistributed net investment income of $64,254,000 and $58,179,000.

See accompanying Notes, which are an integral part of the Financial Statements.

14

STAR Fund

| Financial Highlights | |||||

| For a Share Outstanding | Year Ended October 31, | ||||

| Throughout Each Period | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $20.62 | $19.25 | $18.76 | $16.96 | $15.33 |

| Investment Operations | |||||

| Net Investment Income | . 460 | .455 | .445 | .429 | .516 |

| Capital Gain Distributions Received | .106 | .097 | .073 | .024 | .142 |

| Net Realized and Unrealized Gain (Loss) | |||||

| on Investments | 2.951 | 1.309 | .468 | 1.788 | 2.150 |

| Total from Investment Operations | 3.517 | 1.861 | . 986 | 2.241 | 2.808 |

| Distributions | |||||

| Dividends from Net Investment Income | (.453) | (.466) | (.448) | (.430) | (.552) |

| Distributions from Realized Capital Gains | (.024) | (. 025) | (. 048) | (. 011) | (. 626) |

| Total Distributions | (.477) | (.491) | (. 496) | (.441) | (1.178) |

| Net Asset Value, End of Period | $23.66 | $20.62 | $19.25 | $18.76 | $16.96 |

| Total Return1 | 17.36% | 9.91% | 5.27% | 13.42% | 19.74% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $17,180 | $14,759 | $13,883 | $13,521 | $12,076 |

| Ratio of Total Expenses to Average Net Assets | — | — | — | — | — |

| Acquired Fund Fees and Expenses | 0.34% | 0.34% | 0.34% | 0.34% | 0.37% |

| Ratio of Net Investment Income to | |||||

| Average Net Assets | 2.08% | 2.28% | 2.29% | 2.40% | 3.35% |

| Portfolio Turnover Rate | 9% | 12% | 24% | 22% | 21% |

1 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about

any applicable account service fees.

See accompanying Notes, which are an integral part of the Financial Statements.

15

STAR Fund

Notes to Financial Statements

Vanguard STAR Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund follows a balanced investment strategy by investing in selected Vanguard funds. The fund invests 60% to 70% of its net assets in stock funds (predominantly large-capitalization U.S. stock funds), 20% to 30% in intermediate- to long-term bond funds, and 10% to 20% in a short-term bond fund. Financial statements and other information about each underlying fund are available on vanguard.com.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Investments are valued at the net asset value of each underlying Vanguard fund determined as of the close of the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date.

2. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (October 31, 2010–2013), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

3. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

4. Other: Income and capital gain distributions received are recorded on the ex-dividend date. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. Under a service agreement, The Vanguard Group furnishes investment advisory, corporate management, administrative, marketing, and distribution services to the fund. The service agreement provides that the fund’s expenses may be reduced or eliminated to the extent of savings realized by the Vanguard funds by the operation of the fund. Accordingly, all incremental expenses for services provided by Vanguard and all other expenses incurred by the fund during the year ended October 31, 2013, were borne by the funds in which the fund invests. The fund’s trustees and officers are also directors and officers of Vanguard and the funds in which the fund invests.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

At October 31, 2013, 100% of the market value of the fund’s investments was determined based on Level 1 inputs.

D. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss

16

STAR Fund

are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

The fund used a tax accounting practice to treat a portion of the price of capital shares redeemed during the year as distributions from realized capital gains. Accordingly, the fund has reclassified $3,577,000 from accumulated net realized gains to paid-in capital.

The fund used capital loss carryforwards of $214,599,000 to offset taxable capital gains realized during the year ended October 31, 2013, reducing the amount of capital gains that would otherwise be available to distribute to shareholders. For tax purposes, at October 31, 2013, the fund had $65,155,000 of ordinary income and $101,954,000 of long-term capital gains available for distribution. Short-term capital gain distributions received are treated as ordinary income for tax purposes, and cannot be offset by capital losses. Capital gain distributions paid during the year ended October 31, 2013, were from short-term gain distributions received from Vanguard Long-Term Investment-Grade Fund, Vanguard GNMA Fund, and Vanguard Short-Term Investment-Grade Fund.

At October 31, 2013, the cost of investment securities for tax purposes was $11,536,959,000. Net unrealized appreciation of investment securities for tax purposes was $5,642,236,000, consisting entirely of unrealized gains on securities that had risen in value since their purchase.

E. During the year ended October 31, 2013, the fund purchased $1,677,096,000 of investment securities and sold $1,409,258,000 of investment securities, other than temporary cash investments.

F. Capital shares issued and redeemed were:

| Year Ended October 31, | ||

| 2013 | 2012 | |

| Shares | Shares | |

| (000) | (000) | |

| Issued | 68,385 | 50,059 |

| Issued in Lieu of Cash Distributions | 15,650 | 17,868 |

| Redeemed | (73,891) | (73,097) |

| Net Increase (Decrease) in Shares Outstanding | 10,144 | (5,170) |

G. Management has determined that no material events or transactions occurred subsequent to October 31, 2013, that would require recognition or disclosure in these financial statements.

17

Report of Independent Registered Public Accounting Firm

To the Trustees of Vanguard STAR Funds and the Shareholders of Vanguard STAR Fund:

In our opinion, the accompanying statement of net assets and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard STAR Fund (constituting a separate portfolio of Vanguard STAR Funds, hereafter referred to as the “Fund”) at October 31, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2013 by agreement to the underlying ownership records of the transfer agent, provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

December 12, 2013

Special 2013 tax information (unaudited) for Vanguard STAR Fund

This information for the fiscal year ended October 31, 2013, is included pursuant to provisions of the Internal Revenue Code.

The fund distributed $3,577,000 as capital gain dividends (from net long-term capital gains) to shareholders during the fiscal year.

The fund distributed $145,493,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 27.5% of investment income (dividend income plus short-term gains, if any) qualifies for the dividends-received deduction.

The fund designates to shareholders foreign source income of $62,313,000 and foreign taxes paid of $3,174,000. Shareholders will receive more detailed information with their Form 1099-DIV in January 2014 to determine the calendar-year amounts to be included on their 2013 tax returns.

18

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income, using actual prior-year figures and estimates for 2013. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.)

Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

| Average Annual Total Returns: STAR Fund | |||

| Periods Ended October 31, 2013 | |||

| One | Five | Ten | |

| Year | Years | Years | |

| Returns Before Taxes | 17.36% | 13.02% | 7.43% |

| Returns After Taxes on Distributions | 16.61 | 12.03 | 6.43 |

| Returns After Taxes on Distributions and Sale of Fund Shares | 10.12 | 10.13 | 5.70 |

19

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A typical fund’s expenses are expressed as a percentage of its average net assets. The STAR Fund has no direct expenses, but bears its proportionate share of the costs for the underlying funds in which it invests. These indirect expenses make up the acquired fund fees and expenses, also expressed as a percentage of average net assets.

The following examples are intended to help you understand the ongoing cost (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period. The costs were calculated using the acquired fund fees and expenses for the STAR Fund.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

20

| Six Months Ended October 31, 2013 | |||

| Beginning | Ending | Expenses | |

| Account Value | Account Value | Paid During | |

| STAR Fund | 4/30/2013 | 10/31/2013 | Period |

| Based on Actual Fund Return | $1,000.00 | $1,067.33 | $1.77 |

| Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,023.49 | 1.73 |

The calculations are based on acquired fund fees and expenses charged by the underlying mutual funds in which the STAR Fund invests. The STAR Fund’s annualized expense figure for the period is 0.34%. The dollar amounts shown as ”Expenses Paid” are equal to the annualized average weighted expense ratio for the underlying funds multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

21

Glossary

30-Day SEC Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (for bonds), its actual income (for asset-backed securities), or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Acquired Fund Fees and Expenses. Funds that invest in other Vanguard funds incur no direct expenses, but they do bear proportionate shares of the operating, administrative, and advisory expenses of the underlying funds, and they must pay any fees charged by those funds. The figure for acquired fund fees and expenses represents a weighted average of these underlying costs. Acquired is a term that the Securities and Exchange Commission applies to any mutual fund whose shares are owned by another fund.

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Expense Ratio. A fund’s total annual operating expenses expressed as a percentage of the fund’s average net assets. The expense ratio includes management and administrative expenses, but does not include the transaction costs of buying and selling portfolio securities.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the fund and the index.

22

Benchmark Information

STAR Composite Average: 62.5% general equity funds average, 25% fixed income funds average, and 12.5% money market funds average through December 31, 2002; 50% general equity funds average, 25% fixed income funds average, 12.5% 1–5 year investment-grade funds average, and 12.5% international funds average through September 30, 2010; and 43.75% general equity funds average, 25% fixed income funds average, 12.5% 1–5 year investment-grade funds average, and 18.75% international funds average thereafter. Derived from data provided by Lipper, a Thomson Reuters Company.

STAR Composite Index: 62.5% Dow Jones U.S. Total Stock Market Index, 25% Barclays U.S. Aggregate Bond Index, and 12.5% Citigroup Three-Month U.S. Treasury Bill Index through December 31, 2002; 50% Dow Jones U.S. Total Stock Market Index, 25% Barclays U.S. Aggregate Bond Index, 12.5% Barclays U.S. 1–5 Year Credit Bond Index, and 12.5% MSCI EAFE Index through April 22, 2005; 50% MSCI US Broad Market Index, 25% Barclays U.S. Aggregate Bond Index, 12.5% Barclays U.S. 1–5 Year Credit Bond Index, and 12.5% MSCI EAFE Index through September 30, 2010; and 43.75% MSCI US Broad Market Index, 25% Barclays U.S. Aggregate Bond Index, 12.5% Barclays U.S. 1–5 Year Credit Bond Index, and 18.75% MSCI All Country World Index ex USA thereafter. MSCI international benchmark returns are adjusted for withholding taxes.

23

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals. The independent board members have distinguished backgrounds in business, academia, and public service. Each of the trustees and executive officers oversees 181 Vanguard funds.

The following table provides information for each trustee and executive officer of the fund. More information about the trustees is in the Statement of Additional Information, which can be obtained, without charge, by contacting Vanguard at 800-662-7447, or online at vanguard.com.

| InterestedTrustee1 | and Delphi Automotive LLP (automotive components); |

| Senior Advisor at New Mountain Capital; Trustee of | |

| F. William McNabb III | The Conference Board. |

| Born 1957. Trustee Since July 2009. Chairman of the | |

| Board. Principal Occupation(s) During the Past Five | Amy Gutmann |

| Years: Chairman of the Board of The Vanguard Group, | Born 1949. Trustee Since June 2006. Principal |

| Inc., and of each of the investment companies served | Occupation(s) During the Past Five Years: President |

| by The Vanguard Group, since January 2010; Director | of the University of Pennsylvania; Christopher H. |

| of The Vanguard Group since 2008; Chief Executive | Browne Distinguished Professor of Political Science |

| Officer and President of The Vanguard Group and of | in the School of Arts and Sciences with secondary |

| each of the investment companies served by The | appointments at the Annenberg School for |

| Vanguard Group since 2008; Director of Vanguard | Communication and the Graduate School of Education |

| Marketing Corporation; Managing Director of The | of the University of Pennsylvania; Member of the |

| Vanguard Group (1995–2008). | National Commission on the Humanities and Social |

| Sciences; Trustee of Carnegie Corporation of New | |

| IndependentTrustees | York and of the National Constitution Center; Chair |

| of the U.S. Presidential Commission for the Study | |

| Emerson U. Fullwood | of Bioethical Issues. |

| Born 1948. Trustee Since January 2008. Principal | |

| Occupation(s) During the Past Five Years: Executive | JoAnn Heffernan Heisen |

| Chief Staff and Marketing Officer for North America | Born 1950. Trustee Since July 1998. Principal |

| and Corporate Vice President (retired 2008) of Xerox | Occupation(s) During the Past Five Years: Corporate |

| Corporation (document management products and | Vice President and Chief Global Diversity Officer |

| services); Executive in Residence and 2010 | (retired 2008) and Member of the Executive |

| Distinguished Minett Professor at the Rochester | Committee (1997–2008) of Johnson & Johnson |

| Institute of Technology; Director of SPX Corporation | (pharmaceuticals/medical devices/consumer |

| (multi-industry manufacturing), the United Way of | products); Director of Skytop Lodge Corporation |

| Rochester, Amerigroup Corporation (managed health | (hotels), the University Medical Center at Princeton, |

| care), the University of Rochester Medical Center, | the Robert Wood Johnson Foundation, and the Center |

| Monroe Community College Foundation, and North | for Talent Innovation; Member of the Advisory Board |

| Carolina A&T University. | of the Maxwell School of Citizenship and Public Affairs |

| at Syracuse University. | |

| Rajiv L. Gupta | F. Joseph Loughrey |

| Born 1945. Trustee Since December 2001.2 | Born 1949. Trustee Since October 2009. Principal |

| Principal Occupation(s) During the Past Five Years: | Occupation(s) During the Past Five Years: President |

| Chairman and Chief Executive Officer (retired 2009) | and Chief Operating Officer (retired 2009) of Cummins |

| and President (2006–2008) of Rohm and Haas Co. | Inc. (industrial machinery); Chairman of the Board of |

| (chemicals); Director of Tyco International, Ltd. | Hillenbrand, Inc. (specialized consumer services) and |

| (diversified manufacturing and services), Hewlett- | of Oxfam America; Director of SKF AB (industrial |

| Packard Co. (electronic computer manufacturing), | |

| machinery), Hyster-Yale Materials Handling, Inc. | Executive Officers | |

| (forklift trucks), and the Lumina Foundation for | ||

| Education; Member of the Advisory Council for the | Glenn Booraem | |

| College of Arts and Letters and of the Advisory Board | Born 1967. Controller Since July 2010. Principal | |

| to the Kellogg Institute for International Studies, both | Occupation(s) During the Past Five Years: Principal | |

| at the University of Notre Dame. | of The Vanguard Group, Inc.; Controller of each of | |

| the investment companies served by The Vanguard | ||

| Mark Loughridge | Group; Assistant Controller of each of the investment | |

| Born 1953. Trustee Since March 2012. Principal | companies served by The Vanguard Group (2001–2010). | |

| Occupation(s) During the Past Five Years: Senior Vice | ||

| President and Chief Financial Officer at IBM (information | Thomas J. Higgins | |

| technology services); Fiduciary Member of IBM’s | Born 1957. Chief Financial Officer Since September | |

| Retirement Plan Committee. | 2008. Principal Occupation(s) During the Past Five | |

| Years: Principal of The Vanguard Group, Inc.; Chief | ||

| Scott C. Malpass | Financial Officer of each of the investment companies | |

| Born 1962. Trustee Since March 2012. Principal | served by The Vanguard Group; Treasurer of each of | |

| Occupation(s) During the Past Five Years: Chief | the investment companies served by The Vanguard | |

| Investment Officer and Vice President at the University | Group (1998–2008). | |

| of Notre Dame; Assistant Professor of Finance at the | ||

| Mendoza College of Business at Notre Dame; Member | Kathryn J. Hyatt | |

| of the Notre Dame 403(b) Investment Committee; | Born 1955. Treasurer Since November 2008. Principal | |

| Director of TIFF Advisory Services, Inc. (investment | Occupation(s) During the Past Five Years: Principal of | |

| advisor); Member of the Investment Advisory | The Vanguard Group, Inc.; Treasurer of each of the | |

| Committees of the Financial Industry Regulatory | investment companies served by The Vanguard | |

| Authority (FINRA) and of Major League Baseball. | Group; Assistant Treasurer of each of the investment | |

| companies served by The Vanguard Group (1988–2008). | ||

| André F. Perold | ||

| Born 1952. Trustee Since December 2004. Principal | Heidi Stam | |

| Occupation(s) During the Past Five Years: George | Born 1956. Secretary Since July 2005. Principal | |

| Gund Professor of Finance and Banking at the Harvard | Occupation(s) During the Past Five Years: Managing | |

| Business School (retired 2011); Chief Investment | Director of The Vanguard Group, Inc.; General Counsel | |

| Officer and Managing Partner of HighVista Strategies | of The Vanguard Group; Secretary of The Vanguard | |

| LLC (private investment firm); Director of Rand | Group and of each of the investment companies | |

| Merchant Bank; Overseer of the Museum of Fine | served by The Vanguard Group; Director and Senior | |

| Arts Boston. | Vice President of Vanguard Marketing Corporation. | |

| Alfred M. Rankin, Jr. | ||

| Vanguard Senior ManagementTeam | ||

| Born 1941. Trustee Since January 1993. Principal | ||

| Occupation(s) During the Past Five Years: Chairman, | Mortimer J. Buckley | Chris D. McIsaac |

| President, and Chief Executive Officer of NACCO | Kathleen C. Gubanich | Michael S. Miller |

| Industries, Inc. (housewares/lignite) and of Hyster-Yale | Paul A. Heller | James M. Norris |

| Materials Handling, Inc. (forklift trucks); Director of | Martha G. King | Glenn W. Reed |

| the National Association of Manufacturers; Chairman | John T. Marcante | |

| of the Board of University Hospitals of Cleveland; | ||

| Advisory Chairman of the Board of The Cleveland | ||

| Museum of Art. | Chairman Emeritus and Senior Advisor | |

| Peter F. Volanakis | John J. Brennan | |

| Born 1955. Trustee Since July 2009. Principal | Chairman, 1996–2009 | |

| Occupation(s) During the Past Five Years: President | Chief Executive Officer and President, 1996–2008 | |

| and Chief Operating Officer (retired 2010) of Corning | ||

| Incorporated (communications equipment); Director | Founder | |

| of SPX Corporation (multi-industry manufacturing); | ||

| Overseer of the Amos Tuck School of Business | John C. Bogle | |

| Administration at Dartmouth College; Advisor to the | Chairman and Chief Executive Officer, 1974–1996 | |

| Norris Cotton Cancer Center. | ||

1 Mr. McNabb is considered an “interested person,” as defined in the Investment Company Act of 1940, because he is an officer of the Vanguard funds.

2 December 2002 for Vanguard Equity Income Fund, Vanguard Growth Equity Fund, the Vanguard Municipal Bond Funds, and the Vanguard State Tax-Exempt Funds.

| |

| P.O. Box 2600 | |

| Valley Forge, PA 19482-2600 |

Connect with Vanguard® > vanguard.com

| Fund Information > 800-662-7447 | |

| Direct Investor Account Services > 800-662-2739 | |

| Institutional Investor Services > 800-523-1036 | |

| Text Telephone for People | |

| With Hearing Impairment > 800-749-7273 | |

| This material may be used in conjunction | |

| with the offering of shares of any Vanguard | |

| fund only if preceded or accompanied by | |

| the fund’s current prospectus. | |

| All comparative mutual fund data are from Lipper, a | |

| Thomson Reuters Company, or Morningstar, Inc., unless | |

| otherwise noted. | |

| You can obtain a free copy of Vanguard’s proxy voting | |

| guidelines by visiting vanguard.com/proxyreporting or by | |

| calling Vanguard at 800-662-2739. The guidelines are | |

| also available from the SEC’s website, sec.gov. In | |

| addition, you may obtain a free report on how your fund | |

| voted the proxies for securities it owned during the 12 | |

| months ended June 30. To get the report, visit either | |

| vanguard.com/proxyreporting or sec.gov. | |

| You can review and copy information about your fund at | |

| the SEC’s Public Reference Room in Washington, D.C. To | |

| find out more about this public service, call the SEC at | |

| 202-551-8090. Information about your fund is also | |

| available on the SEC’s website, and you can receive | |

| copies of this information, for a fee, by sending a | |

| request in either of two ways: via e-mail addressed to | |

| publicinfo@sec.gov or via regular mail addressed to the | |

| Public Reference Section, Securities and Exchange | |

| Commission, Washington, DC 20549-1520. | |

| © 2013 The Vanguard Group, Inc. | |

| All rights reserved. | |

| Vanguard Marketing Corporation, Distributor. | |

| Q560 122013 | |

|

|

| Annual Report | October 31, 2013 |

| Vanguard LifeStrategy® Funds |

|

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles,

grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds.

Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| LifeStrategy Income Fund. | 9 |

| LifeStrategy Conservative Growth Fund. | 18 |

| LifeStrategy Moderate Growth Fund. | 27 |

| LifeStrategy Growth Fund. | 36 |

| Your Fund’s After-Tax Returns. | 47 |

| About Your Fund’s Expenses. | 49 |

| Glossary. | 51 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: The ship's wheel represents leadership and guidance, essential qualities in navigating difficult seas. This one is a replica based on an 18th-century British vessel. The HMS Vanguard, another ship of that era, served as the flagship for Admiral Horatio Nelson when he defeated a French fleet at the Battle of the Nile.

Your Fund’s Total Returns

| Fiscal Year Ended October 31, 2013 | |

| Total | |

| Returns | |

| Vanguard LifeStrategy Income Fund | 3.88% |

| Income Composite Index | 4.12 |

| Income Composite Average | 5.82 |

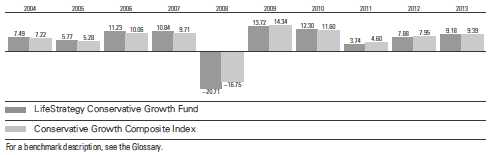

| Vanguard LifeStrategy Conservative Growth Fund | 9.18% |

| Conservative Growth Composite Index | 9.39 |

| Conservative Growth Composite Average | 11.05 |

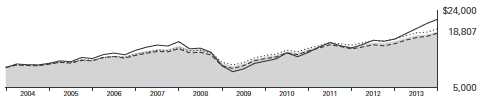

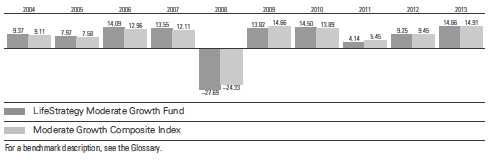

| Vanguard LifeStrategy Moderate Growth Fund | 14.66% |

| Moderate Growth Composite Index | 14.91 |

| Moderate Growth Composite Average | 16.49 |

| Vanguard LifeStrategy Growth Fund | 20.34% |

| Growth Composite Index | 20.62 |

| Growth Composite Average | 22.15 |

| For a benchmark description, see the Glossary. | |

| Composite Averages: Derived from data provided by Lipper, a Thomson Reuters Company. | |

1

Chairman’s Letter

Dear Shareholder,

U.S. and international stock markets produced exceptionally strong gains for the fiscal year ended October 31, 2013. Bonds were another story, with many fixed income categories finishing in negative territory.

Despite weakness in global bond markets, the four Vanguard LifeStrategy Funds produced positive returns ranging from about 4% to about 20%. The funds’ results were generally on par with their composite indexes but trailed the average return of their composite peer groups.

As you would expect, the funds with the heaviest allocation to stocks performed best in this environment. Short-term challenges notwithstanding, we continue to believe that bonds are a good cushion to equity market volatility, and that a higher allocation to bonds can reduce the total risk in your portfolio over the long term.

Amid uncertainty, U.S. stocks found a path to strong returns

U.S. stocks faced several challenges en route to an impressive return of about 29% for the 12 months ended October 31. Investors’ growing appetite for risk drove the rise in stocks, as corporate profit growth, on the whole, wasn’t particularly tantalizing.

Although the end of the fiscal year was notable for the budget impasse that resulted in October’s 16-day partial federal government shutdown, the period as a whole was marked by uncertainty about

2

Federal Reserve monetary policy and concern about the economy’s patchy growth. Vanguard’s chief economist, Joe Davis, recently noted that “as was the case at the start of the year, the U.S. economy continues to expand at a modest and uneven pace.”

The disparity between the performance of the U.S. economy and that of U.S. stocks may seem surprising—but Vanguard research has shown a weak relationship over the long term between a nation’s economic growth and its stock returns. (You can read more in The Outlook for Emerging Market Stocks in a Lower-Growth World, available at vanguard.com/research.)

Outside the United States, stocks returned about 20%. The developed markets of Europe and the Pacific region delivered robust gains; emerging-market stocks failed to keep pace.

Bond returns sagged as investors kept a close eye on the Fed

With investors fretting over the Fed’s next move in its stimulative bond-buying program, bonds recorded negative results for the 12 months. The broad U.S. taxable bond market returned –1.08%. The yield of the 10-year U.S. Treasury note closed at 2.54%, down from 2.63% at September’s close but up from 1.69% at the end of the previous fiscal year. (Bond yields and prices move in opposite directions.) Municipal bonds returned –1.72%.

| Market Barometer | |||

| Average Annual Total Returns | |||

| Periods Ended October 31, 2013 | |||

| One | Three | Five | |

| Year | Years | Years | |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 28.40% | 16.83% | 15.84% |

| Russell 2000 Index (Small-caps) | 36.28 | 17.69 | 17.04 |

| Russell 3000 Index (Broad U.S. market) | 28.99 | 16.89 | 15.94 |

| MSCI All Country World Index ex USA (International) | 20.29 | 6.04 | 12.48 |

| Bonds | |||

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | -1.08% | 3.02% | 6.09% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | -1.72 | 3.60 | 6.37 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.06 | 0.07 | 0.12 |

| CPI | |||

| Consumer Price Index | 0.96% | 2.21% | 1.52% |

3

Outside the United States, bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned –1.95%.

The Fed’s target for short-term interest rates remained between 0% and 0.25%, severely limiting the returns of money market funds and savings accounts.

Underlying stock funds’ strength tempered bond funds’ decline

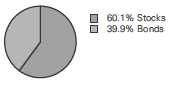

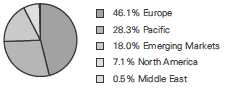

Each of the four LifeStrategy Funds consists of a broadly diversified, index-based portfolio of domestic and international stocks and bonds. Because each of these “funds of funds” has a different risk profile, investors can select the portfolio that best fits their risk tolerance and long-term investment goals.

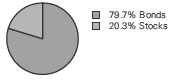

How each of the LifeStrategy Funds performed over the 12 months was largely influenced by its level of exposure to stocks. The LifeStrategy Growth Fund, with its allocation of about 80% stocks and 20% bonds, returned about 20%—its best fiscal year result in a decade. In contrast, the LifeStrategy Income Fund—the most conservative fund in the series, with about 20% stocks and 80% bonds—returned about 4%, compared with about 6% for the previous fiscal year. The results of the two other LifeStrategy Funds fell in between.

Each fund invests in four underlying funds—two stock index funds and two bond index funds. Among those, Vanguard Total Stock Market Index Fund was the

| Expense Ratios | ||

| Your Fund Compared With Its Peer Group | ||

| Acquired Fund Fees | Peer Group | |

| and Expenses | Average | |

| LifeStrategy Income Fund | 0.14% | 0.99% |

| LifeStrategy Conservative Growth Fund | 0.15 | 1.07 |

| LifeStrategy Moderate Growth Fund | 0.16 | 1.14 |

| LifeStrategy Growth Fund | 0.17 | 1.21 |

The fund expense figures shown—drawn from the prospectus dated August 12, 2013—represent an estimate of the weighted average of the expense ratios and any transaction fees charged by the underlying mutual funds (the ”acquired” funds) in which the LifeStrategy Funds invest. The LifeStrategy Funds do not charge any expenses or fees of their own. For the fiscal year ended October 31, 2013, the annualized acquired fund fees and expenses were 0.14% for the LifeStrategy Income Fund, 0.15% for the LifeStrategy Conservative Growth Fund, 0.16% for the LifeStrategy Moderate Growth Fund, and 0.17% for the LifeStrategy Growth Fund.

Peer groups are the composites listed on page 1. Their expense figures are derived by applying the appropriate allocations to average expense ratios of these mutual fund peer groups: fixed income funds, general equity funds, and international funds. Average expense ratios for these groups are derived from data provided by Lipper, a Thomson Reuters Company, and capture information through year-end 2012.

4

standout; its return of about 29% reflected the double-digit, across-the-board gains for U.S. stocks. (The returns of the underlying index funds in this letter are for Investor Shares.) Financials were particularly strong as slight improvements in the economy and investor confidence boosted the stocks of large banks and financial services companies.

Vanguard Total International Stock Index Fund produced a robust 20% return for the 12 months, buoyed largely by the strength of Europe’s developed markets.

The two underlying bond funds fared less well. That dampened returns for the more conservative LifeStrategy Funds—the Income Fund and the LifeStrategy Conservative Growth Fund, which have the largest allocations to bonds.

| Total Returns | |

| Ten Years Ended October 31, 2013 | |

| Average | |

| Annual Return | |

| LifeStrategy Income Fund | 4.89% |

| Income Composite Index | 5.29 |

| Income Composite Average | 4.64 |

| LifeStrategy Conservative Growth Fund | 5.66% |

| Conservative Growth Composite Index | 5.99 |

| Conservative Growth Composite Average | 5.31 |

| LifeStrategy Moderate Growth Fund | 6.52% |

| Moderate Growth Composite Index | 6.90 |

| Moderate Growth Composite Average | 6.30 |

| LifeStrategy Growth Fund | 7.00% |

| Growth Composite Index | 7.39 |

| Growth Composite Average | 6.78 |

| For a benchmark description, see the Glossary. | |

| Composite Averages: Derived from data provided by Lipper, a Thomson Reuters Company. | |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

5

Vanguard Total Bond Market II Index Fund returned –1.37% for the fiscal year. Although returns in the U.S. bond market were positive for the first half of the period, prices fell in the second half as interest rates rose amid concerns about the future of the Fed’s $85-billion-a-month bond-buying program. Vanguard Total International Bond Index Fund, which was added to the LifeStrategy Funds on May 31, 2013, did slightly better, though it lacked a full year’s result. For the partial period, it returned 0.50%.

The funds have kept evolving amid robust long-term results

For the decade ended October 31, 2013, the returns of the LifeStrategy Funds ranged from about 5% for the Income Fund to about 7% for the Growth Fund. Each fund’s average annual return exceeded that of its peer group.

The quality of the underlying index funds has been crucial to the LifeStrategy Funds’ strong records. Skilled portfolio construction and management by Vanguard’s Equity Investment Group and Fixed Income Group have enabled the underlying index funds to successfully track their benchmarks over the ten years while keeping the associated costs low. (The LifeStrategy Funds themselves do not charge any management expenses.)

These groups have also helped the LifeStrategy Funds keep evolving. Over the past two years, the funds have adopted an all-index approach and further diversified their portfolios by adding an international bond component. As I’ve mentioned in previous letters, these changes are intended to provide several benefits to investors: a simpler portfolio design, lower costs, more transparency, and a more predictable risk profile.

The case for adding non-U.S. bonds in a diversified portfolio

Vanguard’s investment principles, which you can see on the inside front cover, don’t change in response to the latest fads. Occasionally, however, we do adjust our asset allocation guidelines for long-term strategic reasons, but only after formal and thorough deliberation. A case in point is our decision to launch Vanguard Total International Bond Fund and include it in Vanguard’s all-in-one funds, including the LifeStrategy Funds.

Bonds issued by governments, corporations, and other entities outside the United States have long been a meaningful slice of worldwide capital markets. Consistent with Vanguard’s belief in balance, diversification, and broad market exposure, it would have been theoretically appropriate to offer an international bond fund before now. However, the many practical obstacles to buying non-U.S. bonds—including illiquidity, high trading and currency-hedging costs, and difficulties in navigating foreign credit markets—kept them absent from our fund lineup.

6

That changed with the recent growth and maturation of bond markets abroad, accompanied by lower currency-hedging costs, further globalization of businesses, greater capital flows, and better information access. In 2000, non-U.S. bonds constituted less than 20% of the world’s capital markets. By year-end 2012, they had grown to approximately 33%, the largest global asset class and well ahead of international stocks (24%), U.S. bonds (22%), and U.S. stocks (21%).

Greater market size and lower barriers to access aren’t sufficient to merit adding international bonds to a portfolio. To serve as a core asset class, they should demonstrate a beneficial role. Vanguard research has shown that international bonds—when currency exposure is appropriately hedged—have the potential to reduce the overall volatility of portfolio returns, providing a diversification benefit similar to that expected from international stocks. (You can read more in Global Fixed Income: Considerations for U.S. Investors, available at vanguard.com/research.)

Of course, an appropriate allocation to international bonds depends on each investor’s circumstances. We believe a suitable starting point is to consider allocating 20% of your fixed income holdings to foreign bonds.

Thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

November 12, 2013

7

| Your Fund’s Performance at a Glance | ||||

| October 31, 2012, Through October 31, 2013 | ||||

| Distributions Per Share | ||||

| Starting | Ending | Income | Capital | |

| Share Price | Share Price | Dividends | Gains | |

| Vanguard LifeStrategy Income Fund | $14.73 | $14.47 | $0.293 | $0.514 |

| Vanguard LifeStrategy Conservative Growth | ||||

| Fund | $17.21 | $18.04 | $0.367 | $0.336 |

| Vanguard LifeStrategy Moderate Growth Fund | $20.84 | $22.90 | $0.522 | $0.367 |

| Vanguard LifeStrategy Growth Fund | $23.36 | $27.07 | $0.631 | $0.266 |

8

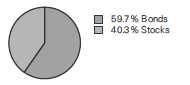

LifeStrategy Income Fund

Fund Profile

As of October 31, 2013

| Total Fund Characteristics | |

| Ticker Symbol | VASIX |

| 30-Day SEC Yield | 2.07% |

| Acquired Fund Fees and Expenses1 | 0.14% |

| Allocation to Underlying Vanguard Funds | |

| Vanguard Total Bond Market II Index Fund | |

| Investor Shares | 63.8% |

| Vanguard Total International Bond Index | |

| Fund Investor Shares | 15.9 |

| Vanguard Total Stock Market Index Fund | |

| Investor Shares | 14.2 |

| Vanguard Total International Stock Index | |

| Fund Investor Shares | 6.1 |

| Total Fund Volatility Measures | ||

| Barclays | ||

| Income | Aggregate | |

| Composite | Bond | |

| Index | Index | |

| R-Squared | 0.98 | 0.16 |

| Beta | 1.04 | 0.49 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

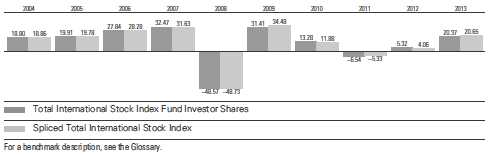

Fund Asset Allocation

1 This figure—drawn from the prospectus dated August 12, 2013—represents an estimate of the weighted average of the expense ratios and any transaction fees charged by the underlying mutual funds (the ”acquired” funds) in which the LifeStrategy Income Fund invests. The LifeStrategy Income Fund does not charge any expenses or fees of its own. For the fiscal year ended October 31, 2013, the annualized acquired fund fees and expenses were 0.14%.

9

LifeStrategy Income Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

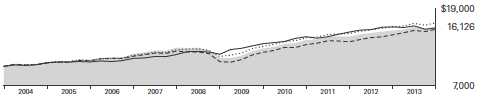

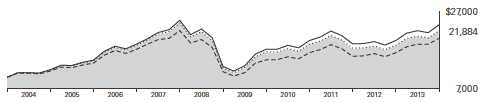

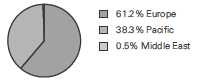

Cumulative Performance: October 31, 2003, Through October 31, 2013

Initial Investment of $10,000

| Average Annual Total Returns | ||||

| Periods Ended October 31, 2013 | ||||

| Final Value | ||||

| One | Five | Ten | of a $10,000 | |

| Year | Years | Years | Investment | |

| LifeStrategy Income Fund | 3.88% | 7.38% | 4.89% | $16,126 |

| Income Composite Index | 4.12 | 7.77 | 5.29 | 16,747 |

| Income Composite Average | 5.82 | 7.98 | 4.64 | 15,738 |

| Barclays U.S. Aggregate Bond Index | -1.08 | 6.09 | 4.78 | 15,945 |

For a benchmark description, see the Glossary.

Income Composite Average: Derived from data provided by Lipper, a Thomson Reuters Company.

See Financial Highlights for dividend and capital gains information.

10

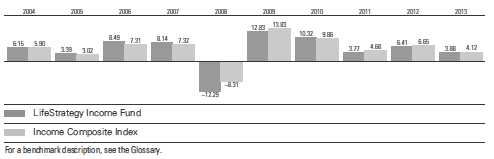

LifeStrategy Income Fund

Fiscal-Year Total Returns (%): October 31, 2003, Through October 31, 2013

Average Annual Total Returns: Periods Ended September 30, 2013

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| Ten Years | ||||||

| Inception Date | One Year | Five Years | Income | Capital | Total | |

| LifeStrategy Income Fund | 9/30/1994 | 2.31% | 5.59% | 3.32% | 1.52% | 4.84% |

11

LifeStrategy Income Fund

Financial Statements

Statement of Net Assets

As of October 31, 2013

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| Market | ||

| Value | ||

| Shares | ($000) | |

| Investment Companies (100.0%) | ||

| U.S. Stock Fund (14.2%) | ||

| Vanguard Total Stock Market Index Fund Investor Shares | 9,286,325 | 412,499 |

| International Stock Fund (6.1%) | ||

| Vanguard Total International Stock Index Fund Investor Shares | 10,670,912 | 177,884 |

| U.S. Bond Fund (63.8%) | ||

| 1 Vanguard Total Bond Market II Index Fund Investor Shares | 173,999,276 | 1,851,352 |

| International Bond Fund (15.9%) | ||

| Vanguard Total International Bond Index Fund Investor Shares | 46,311,189 | 462,649 |

| Total Investment Companies (Cost $2,719,785) | 2,904,384 | |

| Temporary Cash Investment (0.0%) | ||

| Money Market Fund (0.0%) | ||

| 1 Vanguard Market Liquidity Fund, 0.120% (Cost $341) | 341,355 | 341 |

| Total Investments (100.0%) (Cost $2,720,126) | 2,904,725 | |

| Other Assets and Liabilities (0.0%) | ||

| Other Assets | 18,652 | |

| Liabilities | (19,399) | |

| (747) | ||

| Net Assets (100%) | ||

| Applicable to 200,708,321 outstanding $.001 par value shares of | ||

| beneficial interest (unlimited authorization) | 2,903,978 | |

| Net Asset Value Per Share | $14.47 |

| At October 31, 2013, net assets consisted of: | |

| Amount | |

| ($000) | |

| Paid-in Capital | 2,698,235 |

| Undistributed Net Investment Income | 5,127 |

| Accumulated Net Realized Gains | 16,017 |

| Unrealized Appreciation (Depreciation) | 184,599 |

| Net Assets | 2,903,978 |

See Note A in Notes to Financial Statements.

1 Affiliated fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown for Vanguard Market Liquidity Fund is the 7-day yield.

See accompanying Notes, which are an integral part of the Financial Statements.

12

LifeStrategy Income Fund

| Statement of Operations | |

| Year Ended | |

| October 31, 2013 | |

| ($000) | |

| Investment Income | |

| Income | |